e26a3a4936f02775e5349b9441ee952a.ppt

- Количество слайдов: 59

3. 0 Interdependent Choice and Market Coordination Chapter 3 Syracuse Economics

3. 0 Interdependent Choice and Market Coordination Chapter 3 Syracuse Economics

3. 1 Factors that give rise to complexity • Humans are interdependent by nature “No man island” • Finite initial endowment with increasing population we will eventually bump into each other • Complexity leads to greater productivity

3. 1 Factors that give rise to complexity • Humans are interdependent by nature “No man island” • Finite initial endowment with increasing population we will eventually bump into each other • Complexity leads to greater productivity

Adam Smith • The Wealth of Nations – 1776 • Invisible Hand • Smith - markets can coordinate the decisions of autonomous individuals without a central authority

Adam Smith • The Wealth of Nations – 1776 • Invisible Hand • Smith - markets can coordinate the decisions of autonomous individuals without a central authority

Greater productivity is possible with division of labor or specialization • 18 operations in making a pin • 1 person - 20/day • 10 people - 48, 000/day

Greater productivity is possible with division of labor or specialization • 18 operations in making a pin • 1 person - 20/day • 10 people - 48, 000/day

Reasons for Increased Productivity • Increase in dexterity - “practice makes perfect” • Switching operations takes time • New innovations - “build a better mousetrap” in your area of specialization

Reasons for Increased Productivity • Increase in dexterity - “practice makes perfect” • Switching operations takes time • New innovations - “build a better mousetrap” in your area of specialization

Surplus, Exchange, and Gains from trade • If we all produce 1 good, we will have a surplus of that good, but many unmet needs. • This leads to the need for exchange. • Through exchange, the benefits of division of labor are realized

Surplus, Exchange, and Gains from trade • If we all produce 1 good, we will have a surplus of that good, but many unmet needs. • This leads to the need for exchange. • Through exchange, the benefits of division of labor are realized

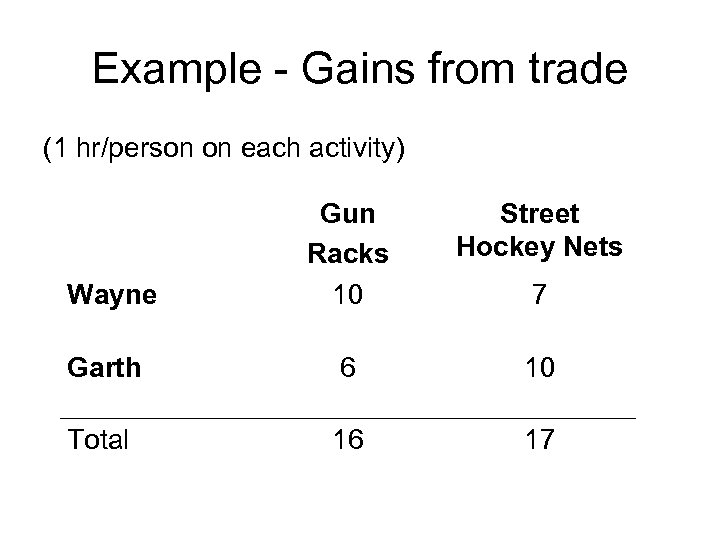

Example - Gains from trade (1 hr/person on each activity) Street Hockey Nets Wayne Gun Racks 10 Garth 6 10 Total 16 17 7

Example - Gains from trade (1 hr/person on each activity) Street Hockey Nets Wayne Gun Racks 10 Garth 6 10 Total 16 17 7

Absolute Advantage • Wayne is better at producing gun racks • Garth is better at producing street hockey nets • Each has an absolute advantage in that activity which they do best

Absolute Advantage • Wayne is better at producing gun racks • Garth is better at producing street hockey nets • Each has an absolute advantage in that activity which they do best

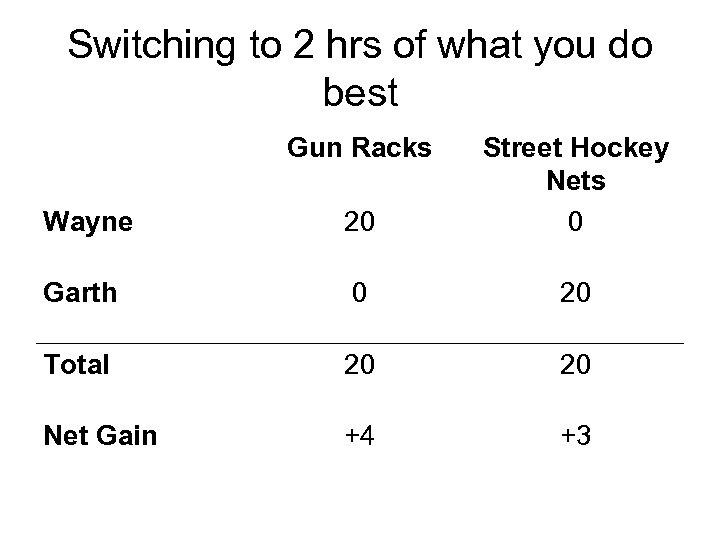

Switching to 2 hrs of what you do best Gun Racks Wayne 20 Street Hockey Nets 0 Garth 0 20 Total 20 20 Net Gain +4 +3

Switching to 2 hrs of what you do best Gun Racks Wayne 20 Street Hockey Nets 0 Garth 0 20 Total 20 20 Net Gain +4 +3

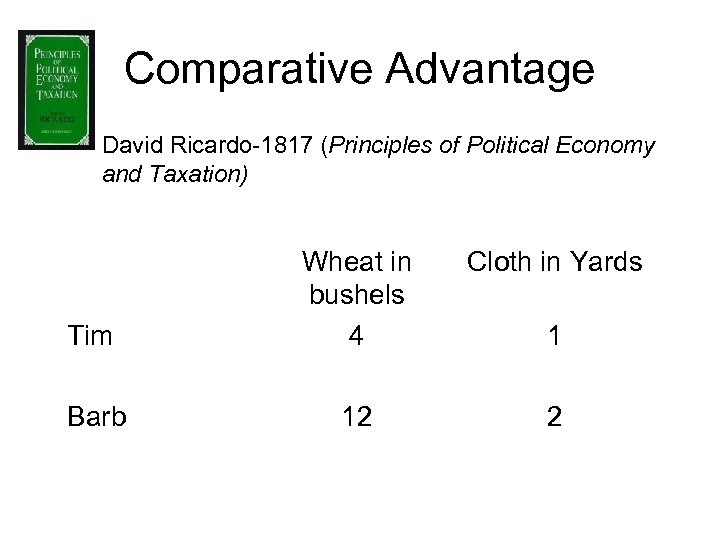

Comparative Advantage – David Ricardo-1817 (Principles of Political Economy and Taxation) Cloth in Yards Tim Wheat in bushels 4 Barb 12 2 1

Comparative Advantage – David Ricardo-1817 (Principles of Political Economy and Taxation) Cloth in Yards Tim Wheat in bushels 4 Barb 12 2 1

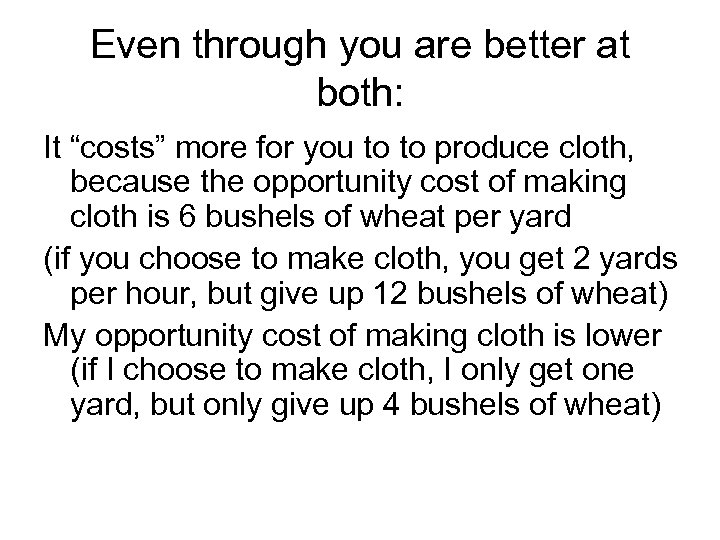

Even through you are better at both: It “costs” more for you to to produce cloth, because the opportunity cost of making cloth is 6 bushels of wheat per yard (if you choose to make cloth, you get 2 yards per hour, but give up 12 bushels of wheat) My opportunity cost of making cloth is lower (if I choose to make cloth, I only get one yard, but only give up 4 bushels of wheat)

Even through you are better at both: It “costs” more for you to to produce cloth, because the opportunity cost of making cloth is 6 bushels of wheat per yard (if you choose to make cloth, you get 2 yards per hour, but give up 12 bushels of wheat) My opportunity cost of making cloth is lower (if I choose to make cloth, I only get one yard, but only give up 4 bushels of wheat)

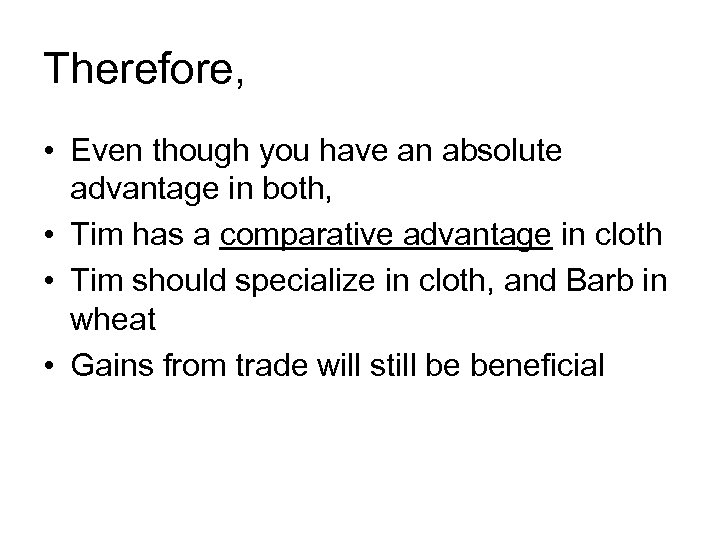

Therefore, • Even though you have an absolute advantage in both, • Tim has a comparative advantage in cloth • Tim should specialize in cloth, and Barb in wheat • Gains from trade will still be beneficial

Therefore, • Even though you have an absolute advantage in both, • Tim has a comparative advantage in cloth • Tim should specialize in cloth, and Barb in wheat • Gains from trade will still be beneficial

Extent of the market • • Limits division of labor No full-time taxi drivers in Milford No pro baseball players in Edmeston However, you need a mechanism for exchanging surpluses • Historically, there have been 3 major categories:

Extent of the market • • Limits division of labor No full-time taxi drivers in Milford No pro baseball players in Edmeston However, you need a mechanism for exchanging surpluses • Historically, there have been 3 major categories:

Tradition as a mechanism for Exchanging surpluses • follow previous generations patterns of saving and investing • Advantages - continuity, stability • Disadvantages - not flexible, fragile • Ex. Primitive societies

Tradition as a mechanism for Exchanging surpluses • follow previous generations patterns of saving and investing • Advantages - continuity, stability • Disadvantages - not flexible, fragile • Ex. Primitive societies

Command as a mechanism for Exchanging Surpluses • Centralized coordination systems directed by a dictator • also known as a command economy • Advantages - perfectly coordinated • Disadvantages - not fair, especially if dictator is not benevolent not efficient not much variety of goods • Ex. Old USSR

Command as a mechanism for Exchanging Surpluses • Centralized coordination systems directed by a dictator • also known as a command economy • Advantages - perfectly coordinated • Disadvantages - not fair, especially if dictator is not benevolent not efficient not much variety of goods • Ex. Old USSR

The Liberal System of Free Markets • Only a few hundred years old • People make their own choices based on their own preferences • Efficiency means people get the most utility out of their share of the social endowment • Agility of the market allows it to respond creatively to changing conditions

The Liberal System of Free Markets • Only a few hundred years old • People make their own choices based on their own preferences • Efficiency means people get the most utility out of their share of the social endowment • Agility of the market allows it to respond creatively to changing conditions

The liberal system of free markets and justice • Market system doesn’t create justice, it requires it • Smith – “Justice is the main pillar that upholds the whole edifice (of society) • ”Constructive participation of citizens is required for stability • If rules of fair play are not clear and commonly shared – stability of system is undermined

The liberal system of free markets and justice • Market system doesn’t create justice, it requires it • Smith – “Justice is the main pillar that upholds the whole edifice (of society) • ”Constructive participation of citizens is required for stability • If rules of fair play are not clear and commonly shared – stability of system is undermined

On Distributive and Commutative Justice • Distributive justice: How do we divide the social endowment so that all start the race fairly? • John Stuart Mill – 1848 – “not equality of outcomes that liberal society must assure…but eliminate laws of property… that have purposely fostered inequalities” and prevented all from starting the race fair • Commutative justice: How do we define and enforce rights, so that the race is fair for all?

On Distributive and Commutative Justice • Distributive justice: How do we divide the social endowment so that all start the race fairly? • John Stuart Mill – 1848 – “not equality of outcomes that liberal society must assure…but eliminate laws of property… that have purposely fostered inequalities” and prevented all from starting the race fair • Commutative justice: How do we define and enforce rights, so that the race is fair for all?

The Magic of Markets • The premise- each person gets a share of social endowment as your own private property • You can use that share as you please • Under ideal conditions known as perfect competition, • pursuing self-interest will also serve others • The more the market values what you bring to it, the more you will be rewarded

The Magic of Markets • The premise- each person gets a share of social endowment as your own private property • You can use that share as you please • Under ideal conditions known as perfect competition, • pursuing self-interest will also serve others • The more the market values what you bring to it, the more you will be rewarded

The Role of Money in Markets • Money is financial capital • Production capital is a “produced means of production” like machines • Whenever you hear the word capital, you need to figure out which way it is used

The Role of Money in Markets • Money is financial capital • Production capital is a “produced means of production” like machines • Whenever you hear the word capital, you need to figure out which way it is used

From Barter to Money Exchange • As division of labor leads to surpluses, exchange begins • Initially, all exchange is through barter exchange of equivalents - my good for your good

From Barter to Money Exchange • As division of labor leads to surpluses, exchange begins • Initially, all exchange is through barter exchange of equivalents - my good for your good

Problems with Barter • It requires matching - you must want what someone else has AND vice versa • Multi-person trade becomes tricky • Also, assume 1 horse = 4 chickens what if you only want 2 chickens?

Problems with Barter • It requires matching - you must want what someone else has AND vice versa • Multi-person trade becomes tricky • Also, assume 1 horse = 4 chickens what if you only want 2 chickens?

Gold • • Gold could be – a unit of account - measures value a medium of exchange - accepted a store of value - still valuable in future

Gold • • Gold could be – a unit of account - measures value a medium of exchange - accepted a store of value - still valuable in future

Characteristics of Good Money • • • Relatively fixed in supply Portable Continuously divisible Storable Commodity Money- Can be used as other things • Fiat Money- Has no other use it is money because we say so

Characteristics of Good Money • • • Relatively fixed in supply Portable Continuously divisible Storable Commodity Money- Can be used as other things • Fiat Money- Has no other use it is money because we say so

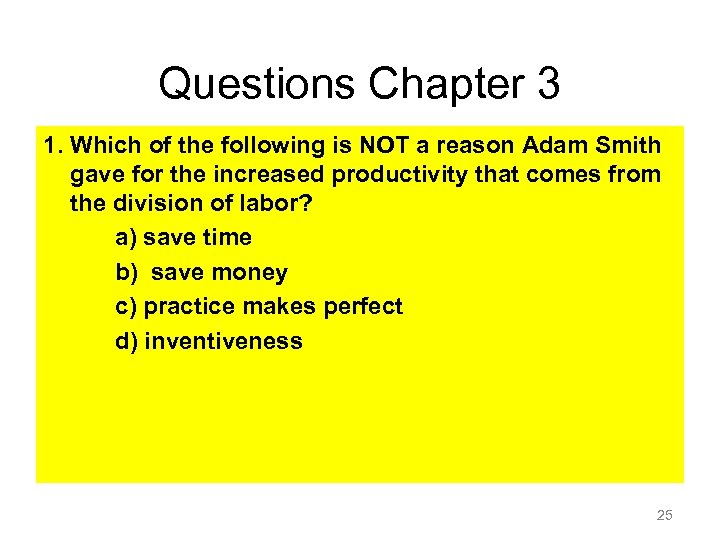

Questions Chapter 3 1. Which of the following is NOT a reason Adam Smith gave for the increased productivity that comes from the division of labor? a) save time b) save money c) practice makes perfect d) inventiveness 25

Questions Chapter 3 1. Which of the following is NOT a reason Adam Smith gave for the increased productivity that comes from the division of labor? a) save time b) save money c) practice makes perfect d) inventiveness 25

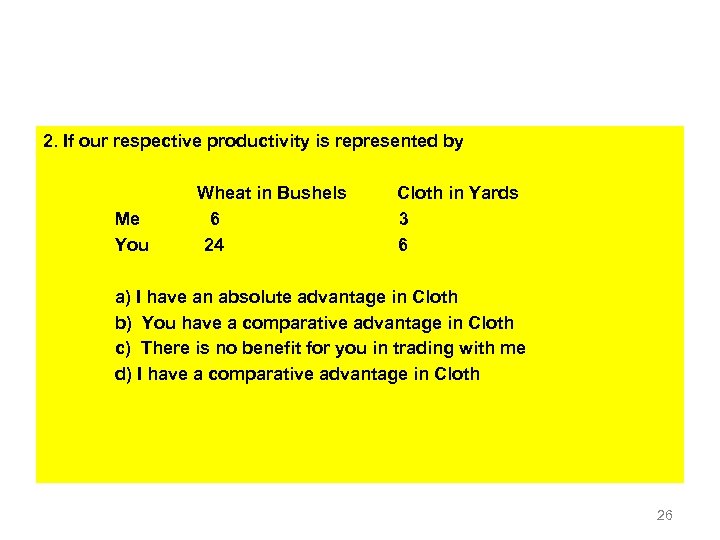

2. If our respective productivity is represented by Wheat in Bushels Cloth in Yards Me 6 3 You 24 6 a) I have an absolute advantage in Cloth b) You have a comparative advantage in Cloth c) There is no benefit for you in trading with me d) I have a comparative advantage in Cloth 26

2. If our respective productivity is represented by Wheat in Bushels Cloth in Yards Me 6 3 You 24 6 a) I have an absolute advantage in Cloth b) You have a comparative advantage in Cloth c) There is no benefit for you in trading with me d) I have a comparative advantage in Cloth 26

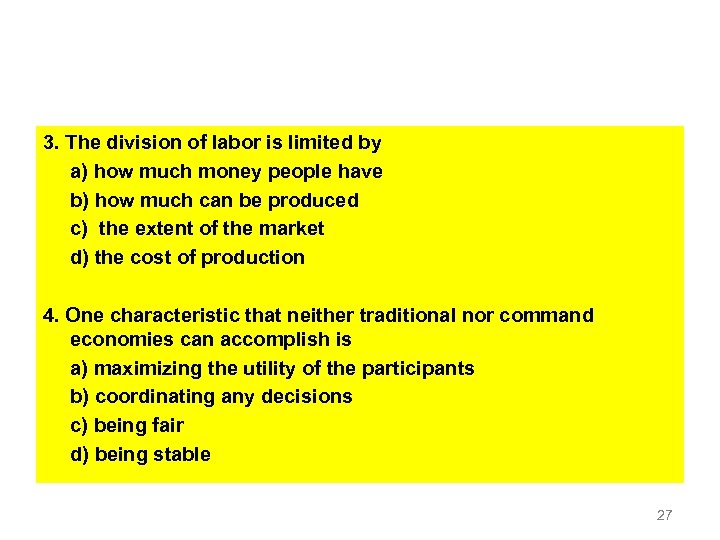

3. The division of labor is limited by a) how much money people have b) how much can be produced c) the extent of the market d) the cost of production 4. One characteristic that neither traditional nor command economies can accomplish is a) maximizing the utility of the participants b) coordinating any decisions c) being fair d) being stable 27

3. The division of labor is limited by a) how much money people have b) how much can be produced c) the extent of the market d) the cost of production 4. One characteristic that neither traditional nor command economies can accomplish is a) maximizing the utility of the participants b) coordinating any decisions c) being fair d) being stable 27

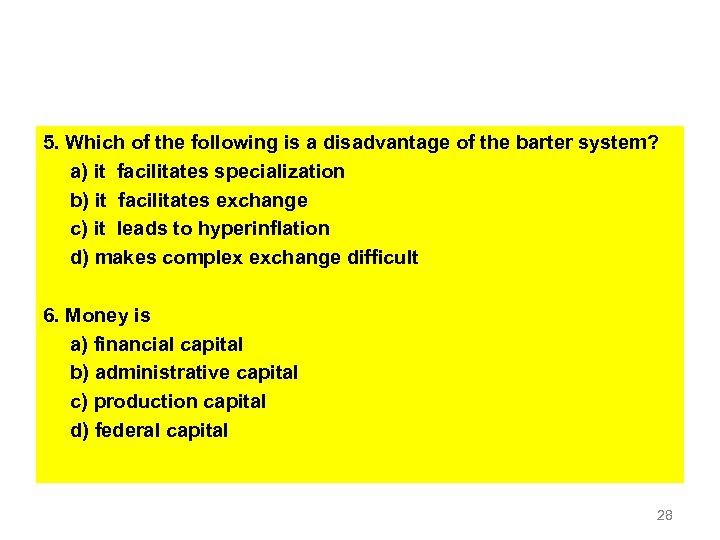

5. Which of the following is a disadvantage of the barter system? a) it facilitates specialization b) it facilitates exchange c) it leads to hyperinflation d) makes complex exchange difficult 6. Money is a) financial capital b) administrative capital c) production capital d) federal capital 28

5. Which of the following is a disadvantage of the barter system? a) it facilitates specialization b) it facilitates exchange c) it leads to hyperinflation d) makes complex exchange difficult 6. Money is a) financial capital b) administrative capital c) production capital d) federal capital 28

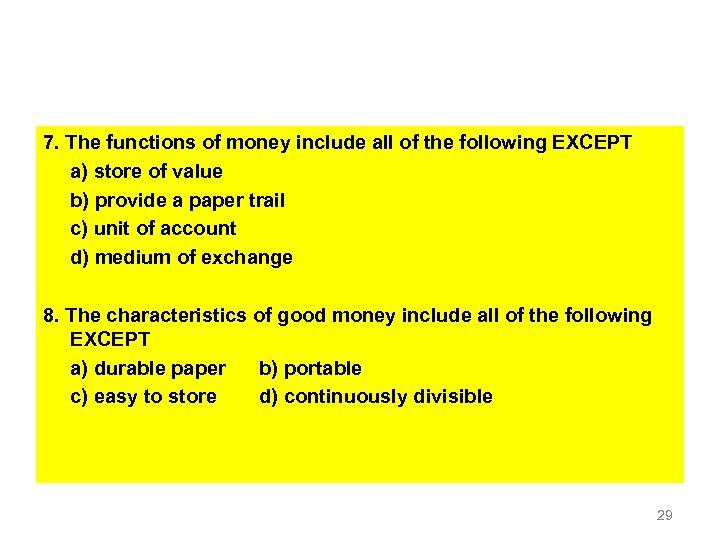

7. The functions of money include all of the following EXCEPT a) store of value b) provide a paper trail c) unit of account d) medium of exchange 8. The characteristics of good money include all of the following EXCEPT a) durable paper b) portable c) easy to store d) continuously divisible 29

7. The functions of money include all of the following EXCEPT a) store of value b) provide a paper trail c) unit of account d) medium of exchange 8. The characteristics of good money include all of the following EXCEPT a) durable paper b) portable c) easy to store d) continuously divisible 29

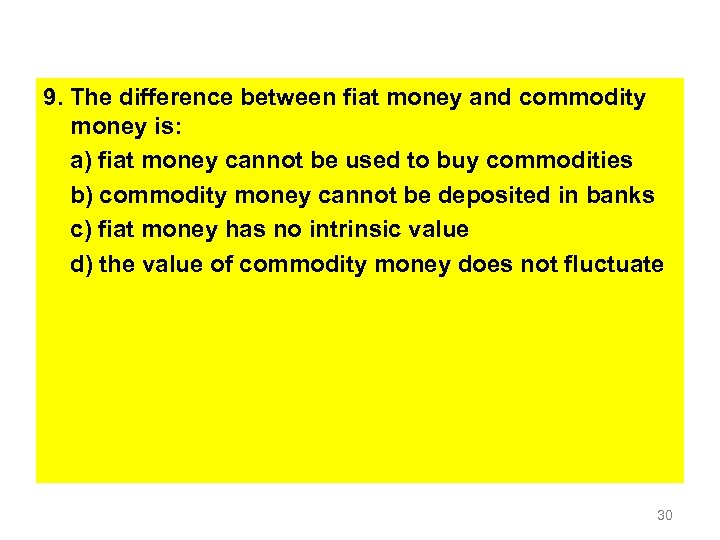

9. The difference between fiat money and commodity money is: a) fiat money cannot be used to buy commodities b) commodity money cannot be deposited in banks c) fiat money has no intrinsic value d) the value of commodity money does not fluctuate 30

9. The difference between fiat money and commodity money is: a) fiat money cannot be used to buy commodities b) commodity money cannot be deposited in banks c) fiat money has no intrinsic value d) the value of commodity money does not fluctuate 30

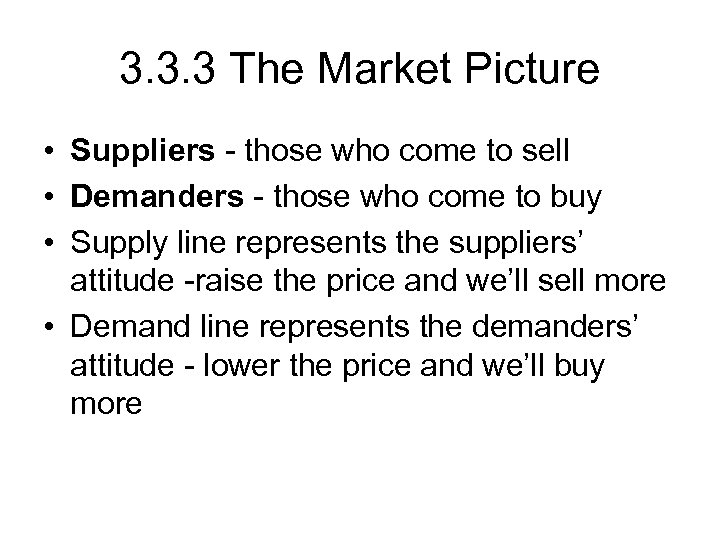

3. 3. 3 The Market Picture • Suppliers - those who come to sell • Demanders - those who come to buy • Supply line represents the suppliers’ attitude -raise the price and we’ll sell more • Demand line represents the demanders’ attitude - lower the price and we’ll buy more

3. 3. 3 The Market Picture • Suppliers - those who come to sell • Demanders - those who come to buy • Supply line represents the suppliers’ attitude -raise the price and we’ll sell more • Demand line represents the demanders’ attitude - lower the price and we’ll buy more

3. 3. 5 Functional Form • A way of describing a causal relationship between two variables: • G=f(E) grade in class is a function of effort you put in • QD = D(p) quantity demanded is a function D of the price p

3. 3. 5 Functional Form • A way of describing a causal relationship between two variables: • G=f(E) grade in class is a function of effort you put in • QD = D(p) quantity demanded is a function D of the price p

3. 3. 6 The terms of the demand relationship • Quantity demanded (QD) is a specific number • Demand (D) is not a number, it represents the current attitude of demanders

3. 3. 6 The terms of the demand relationship • Quantity demanded (QD) is a specific number • Demand (D) is not a number, it represents the current attitude of demanders

There is a difference between. . a movement along the line - Qd changing as price changes and a shift in the whole demand line- representing a changing attitude towards the item

There is a difference between. . a movement along the line - Qd changing as price changes and a shift in the whole demand line- representing a changing attitude towards the item

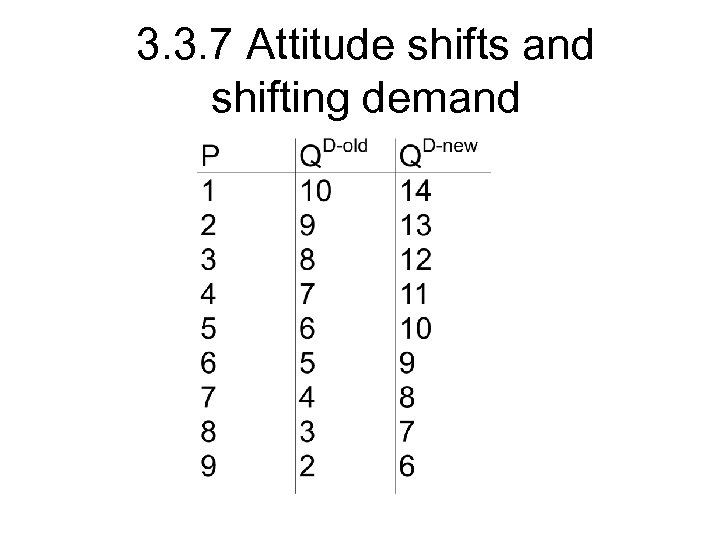

3. 3. 7 Attitude shifts and shifting demand

3. 3. 7 Attitude shifts and shifting demand

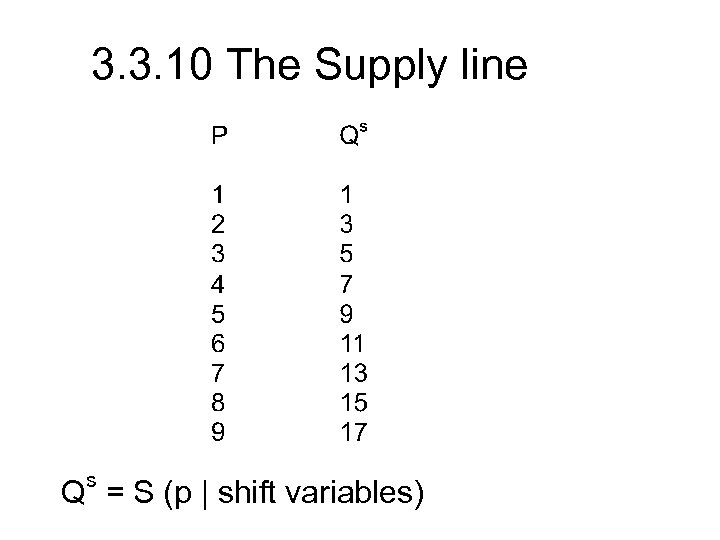

3. 3. 10 The Supply line s Q = S (p | shift variables)

3. 3. 10 The Supply line s Q = S (p | shift variables)

3. 3. 12 Market Signaling and Coordination • No one is in charge • The market coordinated the decisions of many through the invisible hand

3. 3. 12 Market Signaling and Coordination • No one is in charge • The market coordinated the decisions of many through the invisible hand

3. 3. 13 Excess Supply

3. 3. 13 Excess Supply

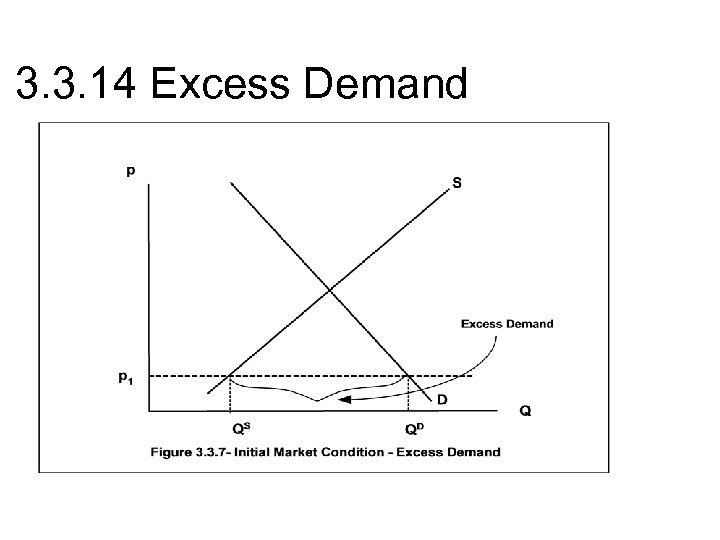

3. 3. 14 Excess Demand

3. 3. 14 Excess Demand

Some ? ? s • you ever really reach equilibrium ? • More important to know that there is always movement towards it • Don’t suppliers put the price on things? • They put the stickers on, but in perfect competition, the market sets the price and it is constantly changing

Some ? ? s • you ever really reach equilibrium ? • More important to know that there is always movement towards it • Don’t suppliers put the price on things? • They put the stickers on, but in perfect competition, the market sets the price and it is constantly changing

The signal on which the entire market system depends • The price!!! • People are not responding to each other The price is the signal by which people communicate their intentions

The signal on which the entire market system depends • The price!!! • People are not responding to each other The price is the signal by which people communicate their intentions

The General Market System • Division of labor increases productivity • A more complex world brings more interdependence • The greater the complexity, the more dependent we are on the health of the coordinating system

The General Market System • Division of labor increases productivity • A more complex world brings more interdependence • The greater the complexity, the more dependent we are on the health of the coordinating system

Perfect Competition • Situation where there is: - No market power Equal access to information Equal access to markets - No market failure Markets function smoothly Markets form quickly when needed • If we assume these things to be true, we will have a perfectly competitive economy that reaches Pareto Optimal General Competitive Equilibrium

Perfect Competition • Situation where there is: - No market power Equal access to information Equal access to markets - No market failure Markets function smoothly Markets form quickly when needed • If we assume these things to be true, we will have a perfectly competitive economy that reaches Pareto Optimal General Competitive Equilibrium

Pareto Optimality • Ultimate efficiency • When no one can become better off without hurting someone else • Under our nice assumptions, a market system will reach a Pareto Optimal General Competitive Equilibrium

Pareto Optimality • Ultimate efficiency • When no one can become better off without hurting someone else • Under our nice assumptions, a market system will reach a Pareto Optimal General Competitive Equilibrium

10. ___ When supply and demand functions are represented as lines on a graph, a change in attitude _____ while a change in price ________ a )causes a move along the given line to a new quantity; shifts the line b) changes nothing; causes a move along the given line to a new quantity c) shifts the line; changes nothing d) shifts the line; causes a move along the given line to a new quantity 52

10. ___ When supply and demand functions are represented as lines on a graph, a change in attitude _____ while a change in price ________ a )causes a move along the given line to a new quantity; shifts the line b) changes nothing; causes a move along the given line to a new quantity c) shifts the line; changes nothing d) shifts the line; causes a move along the given line to a new quantity 52

11. In the equation G = F (E H) the shift variable is a) G b) F c) E d) H 53

11. In the equation G = F (E H) the shift variable is a) G b) F c) E d) H 53

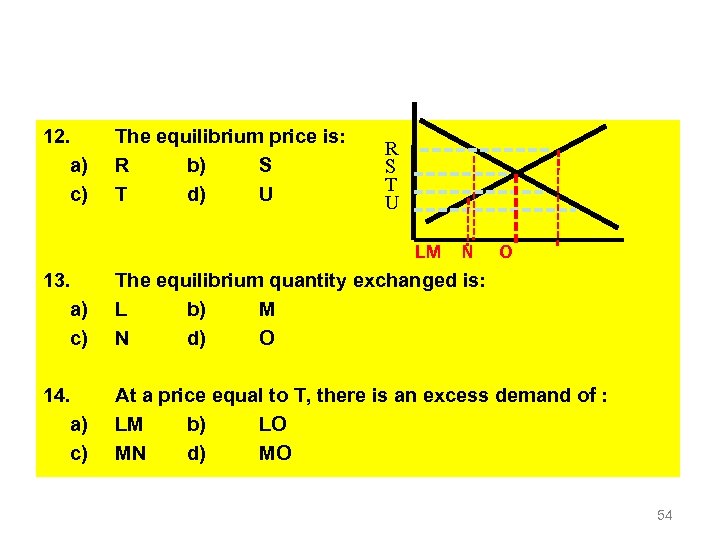

12. a) c) The equilibrium price is: R b) S T d) U R S T U LM N O 13. The equilibrium quantity exchanged is: a) L b) M c) N d) O 14. At a price equal to T, there is an excess demand of : a) LM b) LO c) MN d) MO 54

12. a) c) The equilibrium price is: R b) S T d) U R S T U LM N O 13. The equilibrium quantity exchanged is: a) L b) M c) N d) O 14. At a price equal to T, there is an excess demand of : a) LM b) LO c) MN d) MO 54

Suppose that there is an excess demand for concert tickets at the going price. As the market adjusts to equilibrium, we expect that: a) The price will rise, causing quantity demanded to decrease, and quantity supplied to increase b) The price will rise, causing demand to decrease, and supply to increase. c) The price will fall, causing quantity supplied to decrease and quantity demanded to increase. d) The price will rise, causing supply to decrease and demand to increase. 15. ___ 55

Suppose that there is an excess demand for concert tickets at the going price. As the market adjusts to equilibrium, we expect that: a) The price will rise, causing quantity demanded to decrease, and quantity supplied to increase b) The price will rise, causing demand to decrease, and supply to increase. c) The price will fall, causing quantity supplied to decrease and quantity demanded to increase. d) The price will rise, causing supply to decrease and demand to increase. 15. ___ 55

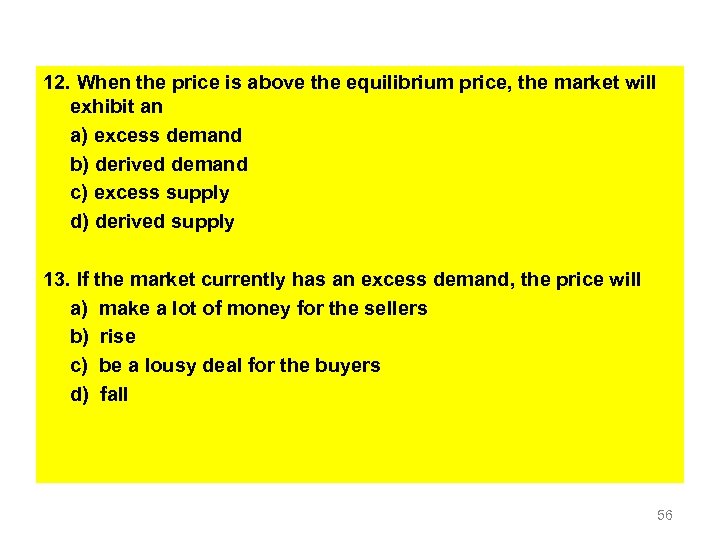

12. When the price is above the equilibrium price, the market will exhibit an a) excess demand b) derived demand c) excess supply d) derived supply 13. If the market currently has an excess demand, the price will a) make a lot of money for the sellers b) rise c) be a lousy deal for the buyers d) fall 56

12. When the price is above the equilibrium price, the market will exhibit an a) excess demand b) derived demand c) excess supply d) derived supply 13. If the market currently has an excess demand, the price will a) make a lot of money for the sellers b) rise c) be a lousy deal for the buyers d) fall 56

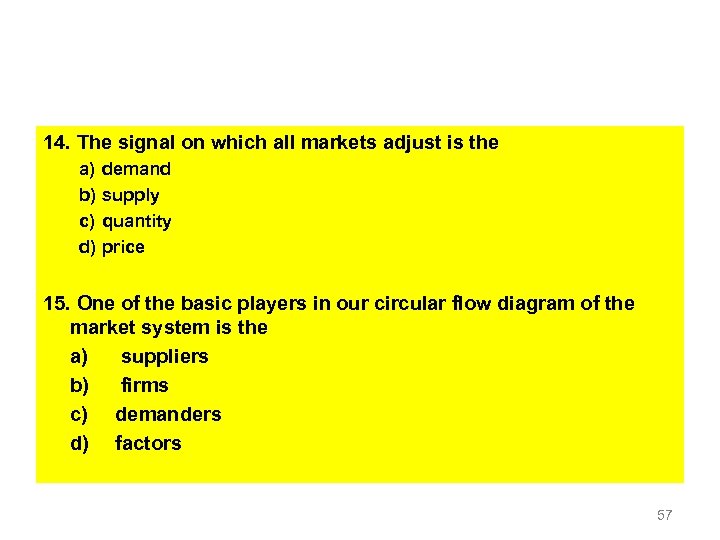

14. The signal on which all markets adjust is the a) demand b) supply c) quantity d) price 15. One of the basic players in our circular flow diagram of the market system is the a) suppliers b) firms c) demanders d) factors 57

14. The signal on which all markets adjust is the a) demand b) supply c) quantity d) price 15. One of the basic players in our circular flow diagram of the market system is the a) suppliers b) firms c) demanders d) factors 57

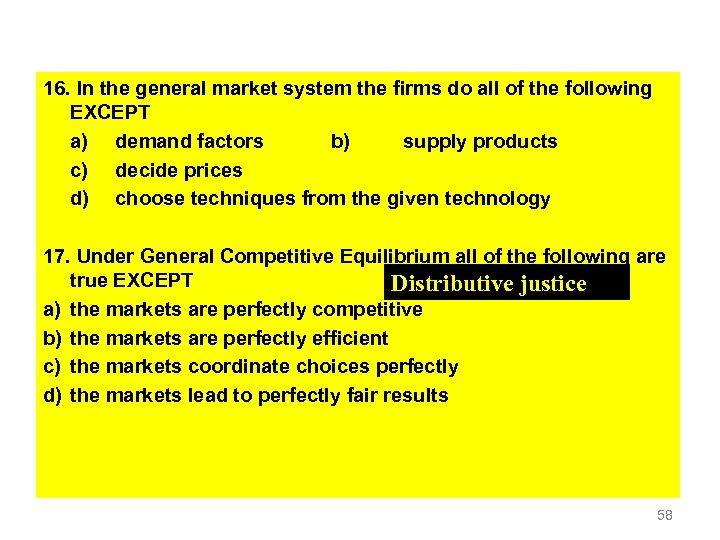

16. In the general market system the firms do all of the following EXCEPT a) demand factors b) supply products c) decide prices d) choose techniques from the given technology 17. Under General Competitive Equilibrium all of the following are true EXCEPT Distributive justice a) the markets are perfectly competitive b) the markets are perfectly efficient c) the markets coordinate choices perfectly d) the markets lead to perfectly fair results 58

16. In the general market system the firms do all of the following EXCEPT a) demand factors b) supply products c) decide prices d) choose techniques from the given technology 17. Under General Competitive Equilibrium all of the following are true EXCEPT Distributive justice a) the markets are perfectly competitive b) the markets are perfectly efficient c) the markets coordinate choices perfectly d) the markets lead to perfectly fair results 58

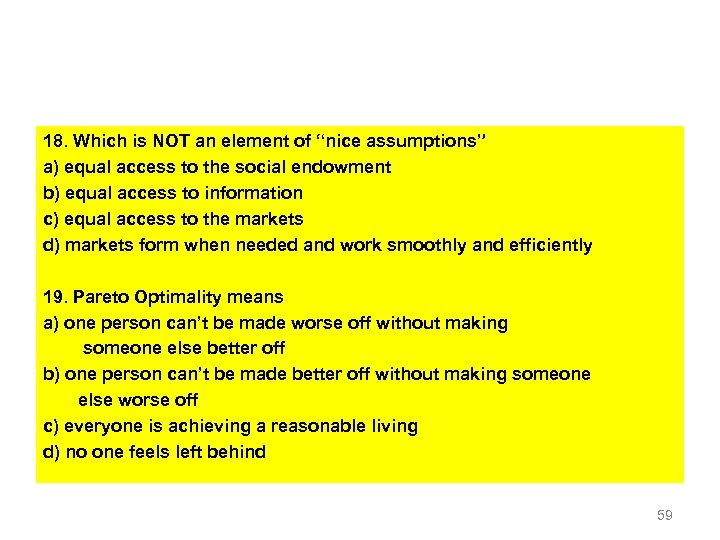

18. Which is NOT an element of “nice assumptions” a) equal access to the social endowment b) equal access to information c) equal access to the markets d) markets form when needed and work smoothly and efficiently 19. Pareto Optimality means a) one person can’t be made worse off without making someone else better off b) one person can’t be made better off without making someone else worse off c) everyone is achieving a reasonable living d) no one feels left behind 59

18. Which is NOT an element of “nice assumptions” a) equal access to the social endowment b) equal access to information c) equal access to the markets d) markets form when needed and work smoothly and efficiently 19. Pareto Optimality means a) one person can’t be made worse off without making someone else better off b) one person can’t be made better off without making someone else worse off c) everyone is achieving a reasonable living d) no one feels left behind 59