7193e621ed822974707c070cf7b72a80.ppt

- Количество слайдов: 60

295 Chapter 9 FINANCIAL INSTITUTIONS

295 Chapter 9 FINANCIAL INSTITUTIONS

297 I. OUR EVER-CHANGING ECONOMY (ECONOMIC CYCLES)

297 I. OUR EVER-CHANGING ECONOMY (ECONOMIC CYCLES)

297 n The economy shifts with every new election as taxing and spending policies change.

297 n The economy shifts with every new election as taxing and spending policies change.

A. Federal Reserve Banking System (The “Fed”) - 298 n Our national central banking authority. n Controls interest rates by controlling the availability of money to banks, and indirectly to other financial institutions. n Governed by the Federal Reserve Board: n n Seven-member committee. Appointed by the president.

A. Federal Reserve Banking System (The “Fed”) - 298 n Our national central banking authority. n Controls interest rates by controlling the availability of money to banks, and indirectly to other financial institutions. n Governed by the Federal Reserve Board: n n Seven-member committee. Appointed by the president.

299 B. Gross Domestic Product GDP)n The total value of all goods and services produced by an economy during a specific period of time.

299 B. Gross Domestic Product GDP)n The total value of all goods and services produced by an economy during a specific period of time.

299 C. Changing Interest Rates n Credit crunches of recent years have forced salespeople to be creative in the world of real property finance. n Salespeople must visualize all the ways a property can be financed before presenting it to a prospect. n Understanding the basic instruments and processes of real estate finance is essential. n REFINANCING – is the process of obtaining a new loan to pay off the old loan.

299 C. Changing Interest Rates n Credit crunches of recent years have forced salespeople to be creative in the world of real property finance. n Salespeople must visualize all the ways a property can be financed before presenting it to a prospect. n Understanding the basic instruments and processes of real estate finance is essential. n REFINANCING – is the process of obtaining a new loan to pay off the old loan.

299 II. SHOPPING FOR A LOAN

299 II. SHOPPING FOR A LOAN

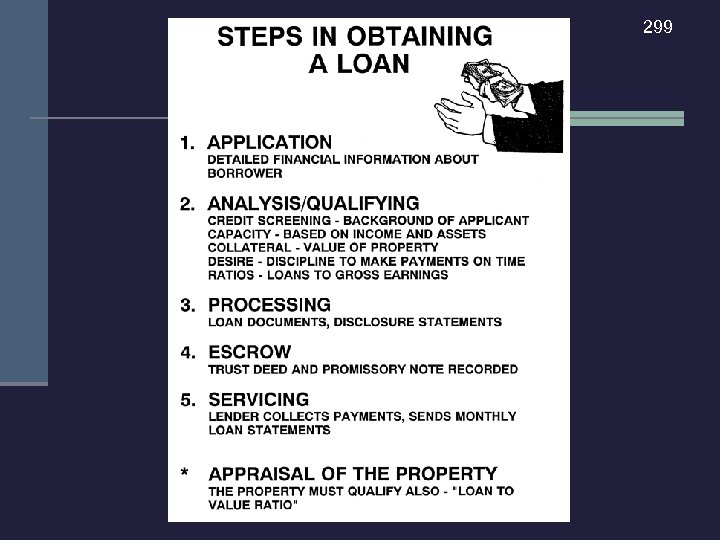

299

299

299 n Borrowing the money to buy a home is generally the largest financial obligation a person will assume in his or her lifetime. n Salesperson must advise caution and careful consideration before a promissory note is signed

299 n Borrowing the money to buy a home is generally the largest financial obligation a person will assume in his or her lifetime. n Salesperson must advise caution and careful consideration before a promissory note is signed

299 A. Loan To Value (L-T-V) n The percentage of appraised value the lender will loan the borrower to purchase the property.

299 A. Loan To Value (L-T-V) n The percentage of appraised value the lender will loan the borrower to purchase the property.

B. Estimate of Settlement Costs (RESPA) 302 n Before loan application is completed, lenders must provide a good faith estimate of the actual settlement costs to the borrower. n It must include: a. rate of interest. b. points to be charged. c. any additional loan fees and charges. d. escrow, title, and other allowable costs.

B. Estimate of Settlement Costs (RESPA) 302 n Before loan application is completed, lenders must provide a good faith estimate of the actual settlement costs to the borrower. n It must include: a. rate of interest. b. points to be charged. c. any additional loan fees and charges. d. escrow, title, and other allowable costs.

C. Credit Scoring (Access to Credit Profile) - 302 n Gives lenders a fast, objective measurement of your ability to repay a loan or make timely credit payments.

C. Credit Scoring (Access to Credit Profile) - 302 n Gives lenders a fast, objective measurement of your ability to repay a loan or make timely credit payments.

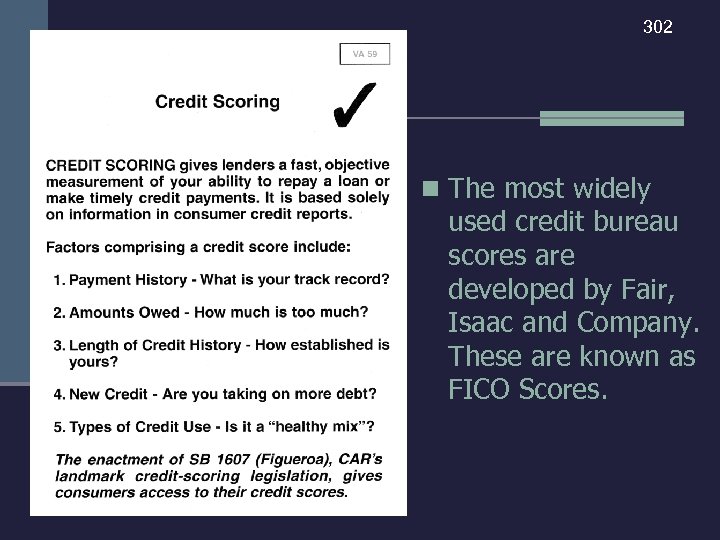

302 n The most widely used credit bureau scores are developed by Fair, Isaac and Company. These are known as FICO Scores.

302 n The most widely used credit bureau scores are developed by Fair, Isaac and Company. These are known as FICO Scores.

302 D. Loan Application – n Provides lender with: 1. 2. 3. 4. 5. 6. Information about property being financed Information about borrower (and co borrower, if any). Sources of income and analysis. Monthly housing expenses (present and proposed). Balance sheet. Other relevant information.

302 D. Loan Application – n Provides lender with: 1. 2. 3. 4. 5. 6. Information about property being financed Information about borrower (and co borrower, if any). Sources of income and analysis. Monthly housing expenses (present and proposed). Balance sheet. Other relevant information.

304 E. Equity – n Your net worth. It is the amount left after subtracting all that you owe from what you own. n Lenders want to see your equity on paper.

304 E. Equity – n Your net worth. It is the amount left after subtracting all that you owe from what you own. n Lenders want to see your equity on paper.

304 F. Liquidity – n The ability of a borrower to convert assets into cash so that debt obligation can be paid when due.

304 F. Liquidity – n The ability of a borrower to convert assets into cash so that debt obligation can be paid when due.

G. Opportunity Cost (Cost of Non-Liquidity) – n The lost profit one could have made by the alternative investment action not taken. 304

G. Opportunity Cost (Cost of Non-Liquidity) – n The lost profit one could have made by the alternative investment action not taken. 304

304 III. SOURCES OF REAL ESTATE FUNDS

304 III. SOURCES OF REAL ESTATE FUNDS

Three areas of demand for borrowing money are: n Construction funds to build. n To finance a purchase. n For refinancing. 307

Three areas of demand for borrowing money are: n Construction funds to build. n To finance a purchase. n For refinancing. 307

307 IV. INSTITUTIONAL LENDERS

307 IV. INSTITUTIONAL LENDERS

307 n INSTITUTIONAL LENDERS - Very large corporations which lend their depositors' funds to finance real estate transactions.

307 n INSTITUTIONAL LENDERS - Very large corporations which lend their depositors' funds to finance real estate transactions.

A. Federal Deposit Insurance Corporation (FDIC) n A government corporation that, for a fee, 307 insures each account of a depositor (savings banks and banks) up to $100, 000. www. fdic. gov Federal Deposit Insurance Corp.

A. Federal Deposit Insurance Corporation (FDIC) n A government corporation that, for a fee, 307 insures each account of a depositor (savings banks and banks) up to $100, 000. www. fdic. gov Federal Deposit Insurance Corp.

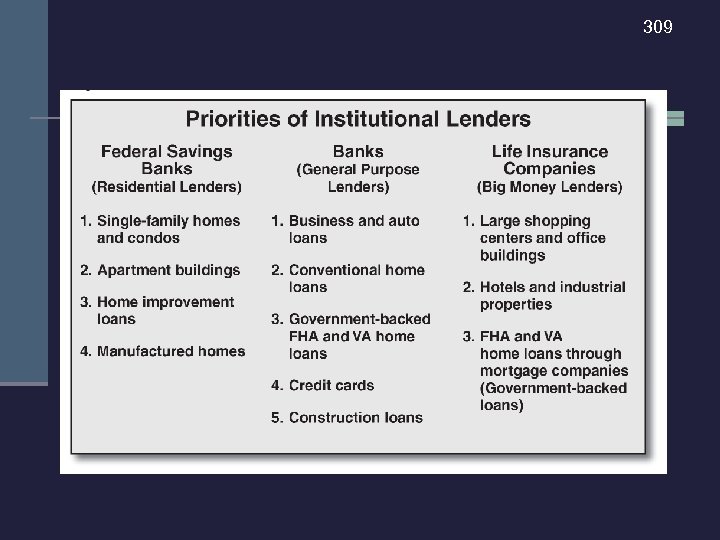

308 B. Federal Savings Banks n Provide more real estate loans than any other financial institution. n Either federally or state licensed. n Can loan 80% of value of property to be purchased. n Can loan 90 or 95% if loans are protected by Private Mortgage Insurance (PMI).

308 B. Federal Savings Banks n Provide more real estate loans than any other financial institution. n Either federally or state licensed. n Can loan 80% of value of property to be purchased. n Can loan 90 or 95% if loans are protected by Private Mortgage Insurance (PMI).

308 C. Banks n General purpose lenders. 1. National banks must be members of the Federal Reserve System. 2. State banks may be members of “the Fed” by choice.

308 C. Banks n General purpose lenders. 1. National banks must be members of the Federal Reserve System. 2. State banks may be members of “the Fed” by choice.

309 Banks will loan: a. First trust deed loans - for owners b. Construction loans (or interim loans) - for builders c. Take-out loans (repayment of interim loan) d. Home improvement loans - for owners

309 Banks will loan: a. First trust deed loans - for owners b. Construction loans (or interim loans) - for builders c. Take-out loans (repayment of interim loan) d. Home improvement loans - for owners

310 D. Life Insurance Companies n Conservative lenders specializing in large loans to commercial projects n Restricted to lending 75% of property value unless insured by the FHA or VA.

310 D. Life Insurance Companies n Conservative lenders specializing in large loans to commercial projects n Restricted to lending 75% of property value unless insured by the FHA or VA.

309

309

310 V. NONINSTITUTIONAL LENDERS

310 V. NONINSTITUTIONAL LENDERS

311 n NONINSTITUTIONAL LENDERS – are persons or organizations which make conventional loans on an individual basis. Conventional Loans are loans not insured or guaranteed by the United States government.

311 n NONINSTITUTIONAL LENDERS – are persons or organizations which make conventional loans on an individual basis. Conventional Loans are loans not insured or guaranteed by the United States government.

311 A. Private Individuals n usually second trust deeds taken back by the seller.

311 A. Private Individuals n usually second trust deeds taken back by the seller.

312 B. Credit Unions n Co-operative associations organized to promote thrift among members and provide them with a source of credit. n Playing an ever-increasing role in real estate finance. n Most are incorporated and gather funds by selling shares to members. n Loan rates are generally equal to or below current market rate. www. ncua. gov National Credit Union Administration

312 B. Credit Unions n Co-operative associations organized to promote thrift among members and provide them with a source of credit. n Playing an ever-increasing role in real estate finance. n Most are incorporated and gather funds by selling shares to members. n Loan rates are generally equal to or below current market rate. www. ncua. gov National Credit Union Administration

C. Real Estate Investment Trusts (REIT) - 312 n Companies that sell securities specializing in real estate ventures. n Equity Trust - an investment in real estate itself or in several real estate projects. n Mortgage Trust - an investment in mortgages and other loans or obligations.

C. Real Estate Investment Trusts (REIT) - 312 n Companies that sell securities specializing in real estate ventures. n Equity Trust - an investment in real estate itself or in several real estate projects. n Mortgage Trust - an investment in mortgages and other loans or obligations.

313 D. Pension Plans - n Are an investment organization that obtains funds from people before they retire and invests this money for their clients’ retirements.

313 D. Pension Plans - n Are an investment organization that obtains funds from people before they retire and invests this money for their clients’ retirements.

E. Mortgage Bankers (Companies) - 313 n Usually lend their own money or roll it over so they can originate, finance, and close first trust deeds or mortgages secured by real estate. n They then sell the loans to institutional investors and service the loans through a contractual relationship with the investors.

E. Mortgage Bankers (Companies) - 313 n Usually lend their own money or roll it over so they can originate, finance, and close first trust deeds or mortgages secured by real estate. n They then sell the loans to institutional investors and service the loans through a contractual relationship with the investors.

F. Private Mortgage Insurance (PMI) - 313 n A guarantee to lenders that the upper portion of a conventional loan will be repaid if a borrower defaults and a deficiency occurs at the foreclosure sale.

F. Private Mortgage Insurance (PMI) - 313 n A guarantee to lenders that the upper portion of a conventional loan will be repaid if a borrower defaults and a deficiency occurs at the foreclosure sale.

314 VI. GOVERNMENT-BACKED LOANS

314 VI. GOVERNMENT-BACKED LOANS

314 A. FHA Insured Loans 1. FHA Title I: Home Improvement Loans –the FHA can make home improvement loans to a maximum of $25, 000. The funds can be used only for home improvement purposes. 2. FHA Title II: Home Purchase or Build Loans – Section 203 b program: Insures home loans (1 -to-4 units) for anyone who is financially qualified. An FHA loan is based on the selling price when it is lower than the appraisal.

314 A. FHA Insured Loans 1. FHA Title I: Home Improvement Loans –the FHA can make home improvement loans to a maximum of $25, 000. The funds can be used only for home improvement purposes. 2. FHA Title II: Home Purchase or Build Loans – Section 203 b program: Insures home loans (1 -to-4 units) for anyone who is financially qualified. An FHA loan is based on the selling price when it is lower than the appraisal.

319 B. Veterans Administration (VA) – n Guarantees loans from institutional lenders. n A VA loan is not a loan, but rather a guarantee to an approved institutional lender.

319 B. Veterans Administration (VA) – n Guarantees loans from institutional lenders. n A VA loan is not a loan, but rather a guarantee to an approved institutional lender.

319 a. Eligibility n 90 days or of active military service (181 days during certain peacetime periods). a. Persons still in the military. b. Persons honorably discharged. c. American citizens who served in the armed forces of our allies during WWII. d. Spouses of eligible personnel who died without using their benefits. e. Persons receiving other than honorable discharges at the discretion of the VA.

319 a. Eligibility n 90 days or of active military service (181 days during certain peacetime periods). a. Persons still in the military. b. Persons honorably discharged. c. American citizens who served in the armed forces of our allies during WWII. d. Spouses of eligible personnel who died without using their benefits. e. Persons receiving other than honorable discharges at the discretion of the VA.

319 2. Certificate of Reasonable Valuen CRV is an appraisal of the property to be purchased by the veteran. n The amount of the down payment required for a VA loan is determined by the CRV.

319 2. Certificate of Reasonable Valuen CRV is an appraisal of the property to be purchased by the veteran. n The amount of the down payment required for a VA loan is determined by the CRV.

320 3. VA Loan Provisions: a. No limit to loans (generally California lenders will only loan up to $240, 000). b. Usually a 30 -year term. c. No down payment needed unless the purchase price exceeds the CRV appraisal or for some reason the lender requires one. www. va. org Department of Veterans Affairs

320 3. VA Loan Provisions: a. No limit to loans (generally California lenders will only loan up to $240, 000). b. Usually a 30 -year term. c. No down payment needed unless the purchase price exceeds the CRV appraisal or for some reason the lender requires one. www. va. org Department of Veterans Affairs

C. California Department of Veterans Affairs (Cal-Vet) - 321 n Makes direct loans to veterans in the form of Conditional Sales Contracts repaid in installments.

C. California Department of Veterans Affairs (Cal-Vet) - 321 n Makes direct loans to veterans in the form of Conditional Sales Contracts repaid in installments.

322 Eligibility n No residency requirement—all veterans eligible. Honorably discharged after at least 90 days active service in the following military actions: a. World War II — December 7, 1941 to December 31, 1946 b. Korean Conflict — June 27, 1950 to January 31, 1955 c. Vietnam Era — August 5, 1964 to May 7, 1975 d. Persian Gulf War — August 2, 1990 to date yet to be determined

322 Eligibility n No residency requirement—all veterans eligible. Honorably discharged after at least 90 days active service in the following military actions: a. World War II — December 7, 1941 to December 31, 1946 b. Korean Conflict — June 27, 1950 to January 31, 1955 c. Vietnam Era — August 5, 1964 to May 7, 1975 d. Persian Gulf War — August 2, 1990 to date yet to be determined

Also eligible is a California veteran who: 323 n Participated in a campaign or expedition for which a medal was awarded by the government of the United States. n Was discharged with less than 90 days’ active duty because of service connected disability incurred during his or her qualifying service period.

Also eligible is a California veteran who: 323 n Participated in a campaign or expedition for which a medal was awarded by the government of the United States. n Was discharged with less than 90 days’ active duty because of service connected disability incurred during his or her qualifying service period.

D. California Housing Finance Agency 323 n This is a state agency that sells bonds so that it can provide funds for low-income family housing on project or individual home basis.

D. California Housing Finance Agency 323 n This is a state agency that sells bonds so that it can provide funds for low-income family housing on project or individual home basis.

323 VII. LENDING CORPORATIONS AND THE SECONDARY MORTGAGE MARKET

323 VII. LENDING CORPORATIONS AND THE SECONDARY MORTGAGE MARKET

323 n Private and Quasi-Governmental Corporations n At one time, there were 3 federal corporations that used cash to buy and sell trust deeds between financial institutions. n These corporations are now either private or quasi-governmental.

323 n Private and Quasi-Governmental Corporations n At one time, there were 3 federal corporations that used cash to buy and sell trust deeds between financial institutions. n These corporations are now either private or quasi-governmental.

Secondary Mortgage (Trust Deed) Market n Provides an opportunity for financial institutions to buy from, and sell first mortgages (trust deeds) to, other financial institutions. 323

Secondary Mortgage (Trust Deed) Market n Provides an opportunity for financial institutions to buy from, and sell first mortgages (trust deeds) to, other financial institutions. 323

1. 325 Federal National Mortgage Association (FNMA) or “Fannie Mae” a. Private corporation b. Sells securities to raise funds c. Buys and sells conventional, FHA and VA loans

1. 325 Federal National Mortgage Association (FNMA) or “Fannie Mae” a. Private corporation b. Sells securities to raise funds c. Buys and sells conventional, FHA and VA loans

2. Government National Mortgage Association (GNMA) or “Ginnie Mae” a. Government corporation. b. Sells secondary mortgages to the public. c. Provides the federal government with cash. d. Sells federally insured shares on the stock exchange. 325

2. Government National Mortgage Association (GNMA) or “Ginnie Mae” a. Government corporation. b. Sells secondary mortgages to the public. c. Provides the federal government with cash. d. Sells federally insured shares on the stock exchange. 325

3. Federal Home Loan Mortgage Corporation (FHLMC) or “Freddie Mac” a. Government corporation. b. Supervised by the Federal Home Loan Bank Board. c. Buys home loan mortgages from savings banks to maintain their supply of money for loans to the public. d. Financed by the sale of stock. 325

3. Federal Home Loan Mortgage Corporation (FHLMC) or “Freddie Mac” a. Government corporation. b. Supervised by the Federal Home Loan Bank Board. c. Buys home loan mortgages from savings banks to maintain their supply of money for loans to the public. d. Financed by the sale of stock. 325

326 VIII. REAL ESTATE BROKER CAN MAKE LOANS

326 VIII. REAL ESTATE BROKER CAN MAKE LOANS

326 n Brokers and salespeople who arrange financing for buyers or invest in loans for their own profit.

326 n Brokers and salespeople who arrange financing for buyers or invest in loans for their own profit.

A. Mortgage Loan Disclosure Statement - 326 n A form which clearly states all the details and commission charges of a particular loan. n Mortgage loan brokers must provide this to the borrower before the note and instrument are signed. n Mortgage Loan Brokers need no special license other than their real estate license.

A. Mortgage Loan Disclosure Statement - 326 n A form which clearly states all the details and commission charges of a particular loan. n Mortgage loan brokers must provide this to the borrower before the note and instrument are signed. n Mortgage Loan Brokers need no special license other than their real estate license.

B. Business and Professions Code 330 1. Article 7 - Loan Broker Laws - On loans of $30, 000 and over for first trust deeds, and $20, 000 and over for junior deeds of trust, the broker may charge as much as the borrower will agree to pay.

B. Business and Professions Code 330 1. Article 7 - Loan Broker Laws - On loans of $30, 000 and over for first trust deeds, and $20, 000 and over for junior deeds of trust, the broker may charge as much as the borrower will agree to pay.

a. Threshold Reporting (Big Lending - $2, 000) n The requirement of reporting annual and 330 quarterly loan activity (review of trust fund) to the Department of Real Estate if, within the past 12 months, the broker has negotiated any combination of 20 or more loans to a subdivision or a total of more than $2, 000 in loans. In addition, advertising must be submitted to the DRE for review.

a. Threshold Reporting (Big Lending - $2, 000) n The requirement of reporting annual and 330 quarterly loan activity (review of trust fund) to the Department of Real Estate if, within the past 12 months, the broker has negotiated any combination of 20 or more loans to a subdivision or a total of more than $2, 000 in loans. In addition, advertising must be submitted to the DRE for review.

331 2. Article 5 - Broker Restrictions n The licensee is prohibited from pooling funds. n A broker may not accept funds except for a specifically identified loan transaction. n Before accepting a lender’s money, the broker must: a. b. Own the loan or have an unconditional written contract to purchase a specific note. Have the authorization from a prospective borrower to negotiate a secured loan.

331 2. Article 5 - Broker Restrictions n The licensee is prohibited from pooling funds. n A broker may not accept funds except for a specifically identified loan transaction. n Before accepting a lender’s money, the broker must: a. b. Own the loan or have an unconditional written contract to purchase a specific note. Have the authorization from a prospective borrower to negotiate a secured loan.

3. Article 6 - Real Property Securities Dealer n 331 A DRE broker’s license and endorsement are required: A $100 fee plus a $10, 000 surety bond. DRE permit is required to sell specific security. a. Commissioner’s Permit - the approval of the proposed real property security and plan of distribution. A commissioner’s permit requires a $10, 000 bond. b. Real Property Securities Dealer (RPSD) - any person acting as principal or agent who engages in the business of selling real property securities (such as promissory notes or sales contracts).

3. Article 6 - Real Property Securities Dealer n 331 A DRE broker’s license and endorsement are required: A $100 fee plus a $10, 000 surety bond. DRE permit is required to sell specific security. a. Commissioner’s Permit - the approval of the proposed real property security and plan of distribution. A commissioner’s permit requires a $10, 000 bond. b. Real Property Securities Dealer (RPSD) - any person acting as principal or agent who engages in the business of selling real property securities (such as promissory notes or sales contracts).

332 Chapter 9 - Summary n Inflation n Seller’s market n Buyer’s market n Federal Reserve n GDP n RESPA n Institutional Lenders n FDIC n General purpose lenders n Noninstitutional lenders n REITs n Equity trust n Mortgage Bankers n Secondary mortgage market n PMI n FHA n Title I & II n MIP

332 Chapter 9 - Summary n Inflation n Seller’s market n Buyer’s market n Federal Reserve n GDP n RESPA n Institutional Lenders n FDIC n General purpose lenders n Noninstitutional lenders n REITs n Equity trust n Mortgage Bankers n Secondary mortgage market n PMI n FHA n Title I & II n MIP

333 Chapter 9 - Summary n VA Loan n CRV n Cal - Vet n Mortgage Loan n Fannie Mae (FNMA) n Real Properties Disclosure Statement Securities Dealer n Ginnie Mae (GNMA) n Freddie Mac ( FHLMC)

333 Chapter 9 - Summary n VA Loan n CRV n Cal - Vet n Mortgage Loan n Fannie Mae (FNMA) n Real Properties Disclosure Statement Securities Dealer n Ginnie Mae (GNMA) n Freddie Mac ( FHLMC)