Basic Macroeconomic Relationships.ppt

- Количество слайдов: 14

27 Basic Macroeconomic Relationships Mc. Graw-Hill/Irwin Copyright © 2012 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Income Consumption and Saving • Consumption and saving • Primarily determined by DI • Direct relationship • Consumption schedule • Planned household spending (in our • LO 1 model) Saving schedule • DI minus C • Dissaving can occur 27 -2

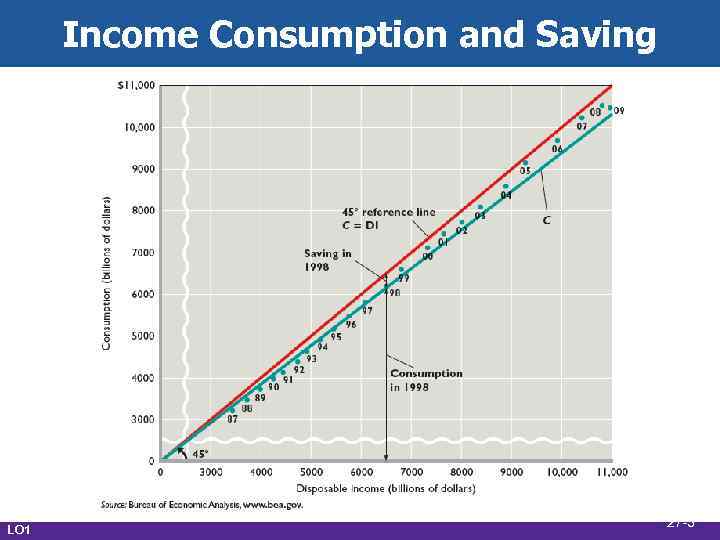

Income Consumption and Saving LO 1 27 -3

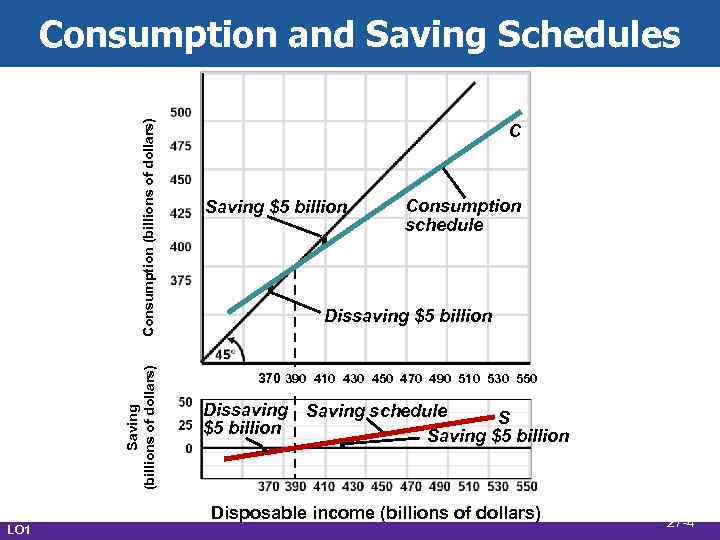

Saving (billions of dollars) Consumption and Saving Schedules LO 1 C Saving $5 billion Consumption schedule Dissaving $5 billion 370 390 410 430 450 470 490 510 530 550 Dissaving Saving schedule S $5 billion Saving $5 billion Disposable income (billions of dollars) 27 -4

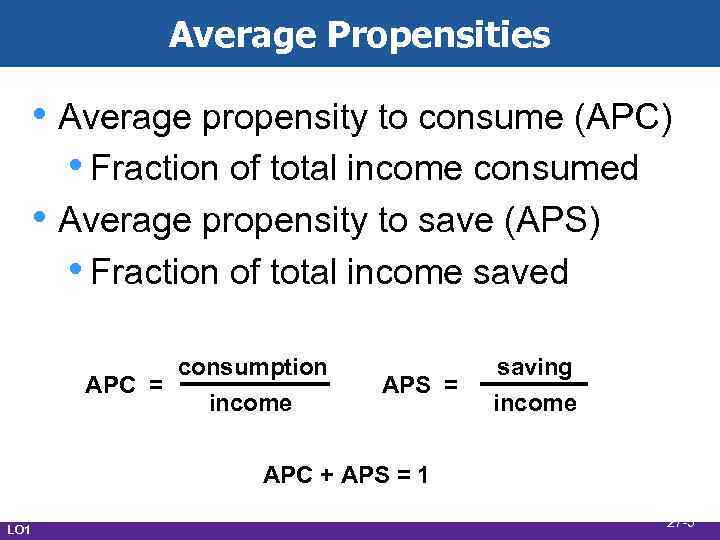

Average Propensities • Average propensity to consume (APC) • Fraction of total income consumed • Average propensity to save (APS) • Fraction of total income saved consumption APC = income APS = saving income APC + APS = 1 LO 1 27 -5

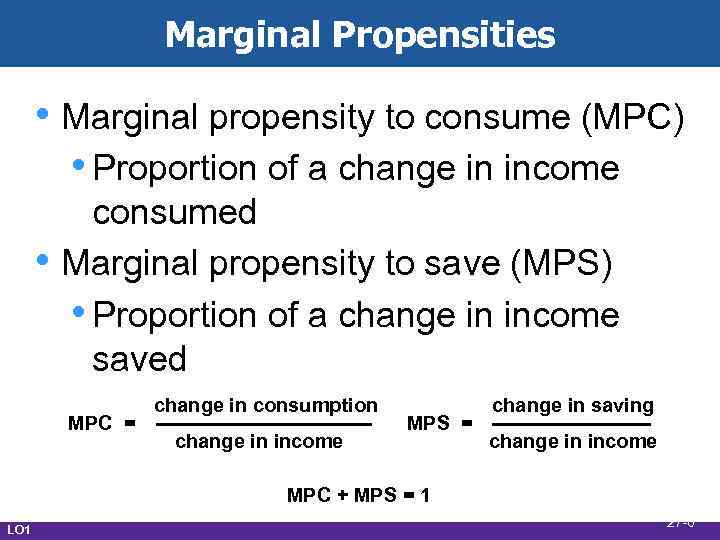

Marginal Propensities • Marginal propensity to consume (MPC) • Proportion of a change in income • consumed Marginal propensity to save (MPS) • Proportion of a change in income saved MPC = change in consumption change in income MPS = change in saving change in income MPC + MPS = 1 LO 1 27 -6

Nonincome Determinants • Amount of disposable income is the • LO 2 main determinant Other determinants • Wealth • Borrowing • Expectations • Real interest rates 27 -7

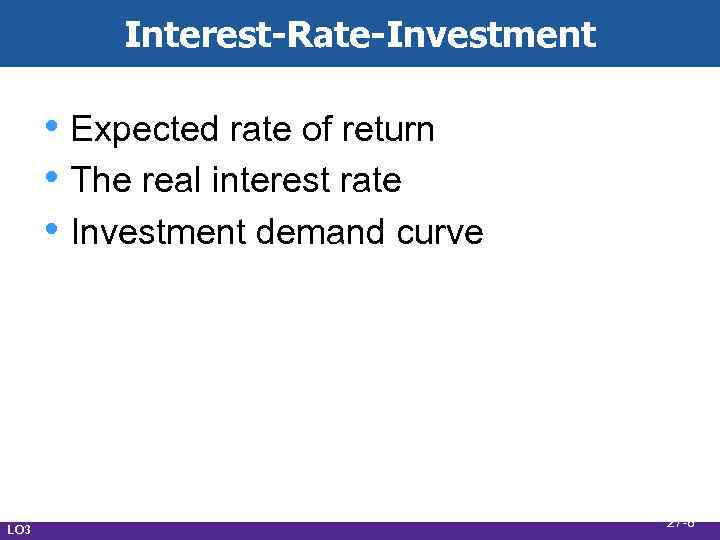

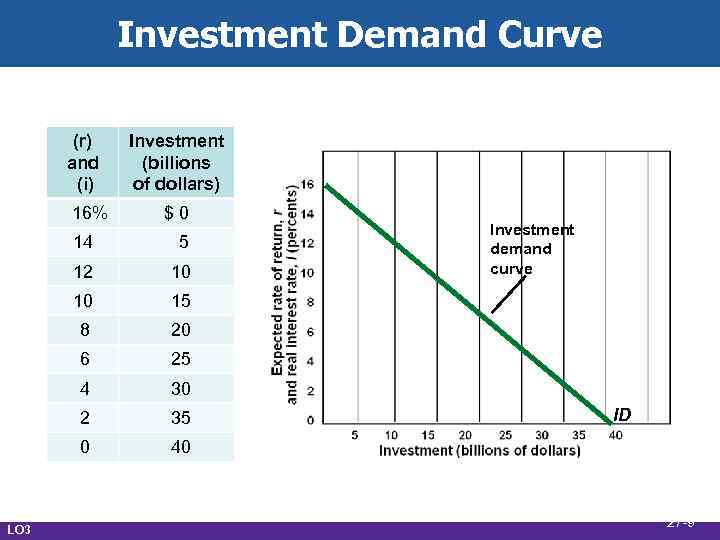

Interest-Rate-Investment • Expected rate of return • The real interest rate • Investment demand curve LO 3 27 -8

Investment Demand Curve (r) and (i) 16% Investment (billions of dollars) $0 14 12 10 10 15 8 20 6 25 4 30 2 35 0 LO 3 5 Investment demand curve 40 ID 27 -9

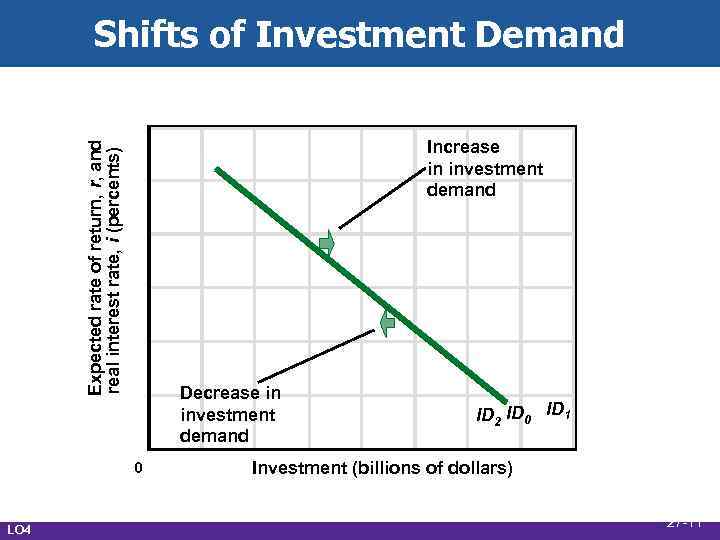

Shifts of Investment Demand • Acquisition, maintenance, and • • • LO 4 operating costs Business taxes Technological change Stock of capital goods on hand Planned inventory changes Expectations 27 -10

Shifts of Investment Demand Expected rate of return, r, and real interest rate, i (percents) Increase in investment demand Decrease in investment demand 0 LO 4 ID 2 ID 0 ID 1 Investment (billions of dollars) 27 -11

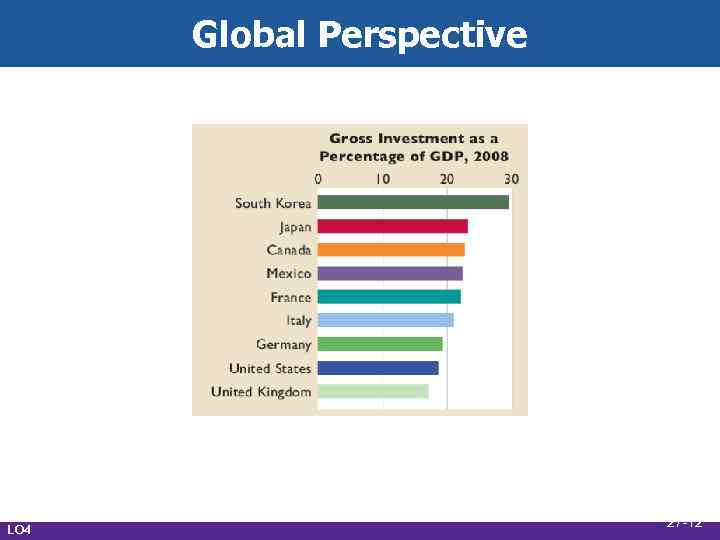

Global Perspective LO 4 27 -12

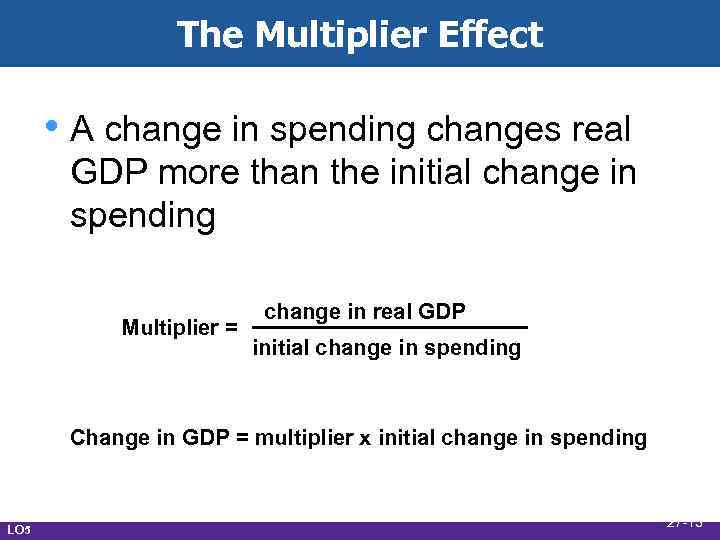

The Multiplier Effect • A change in spending changes real GDP more than the initial change in spending Multiplier = change in real GDP initial change in spending Change in GDP = multiplier x initial change in spending LO 5 27 -13

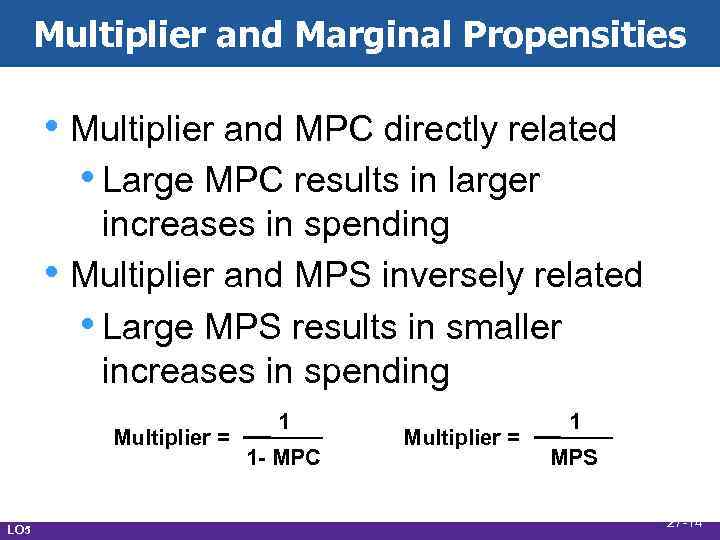

Multiplier and Marginal Propensities • Multiplier and MPC directly related • Large MPC results in larger • increases in spending Multiplier and MPS inversely related • Large MPS results in smaller increases in spending Multiplier = LO 5 1 1 - MPC Multiplier = 1 MPS 27 -14

Basic Macroeconomic Relationships.ppt