a073ff54eb2c9652f4e5394efe5bef90.ppt

- Количество слайдов: 75

24. VAT

24. VAT

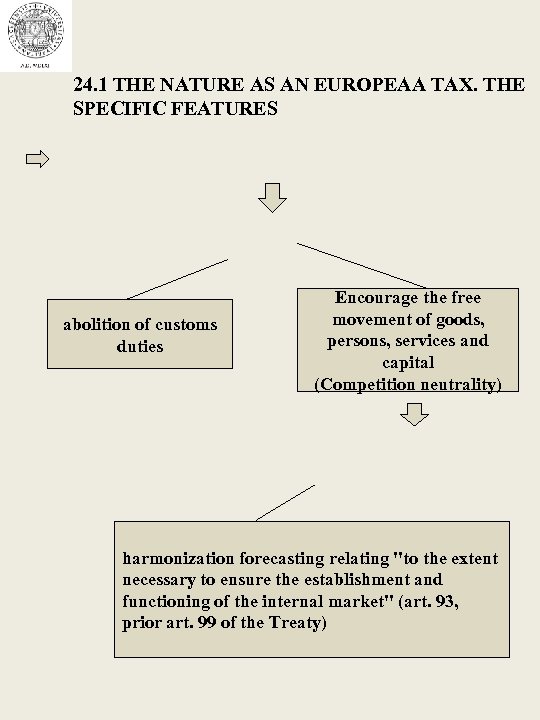

24. 1 THE NATURE AS AN EUROPEAA TAX. THE SPECIFIC FEATURES abolition of customs duties Encourage the free movement of goods, persons, services and capital (Competition neutrality) harmonization forecasting relating "to the extent necessary to ensure the establishment and functioning of the internal market" (art. 93, prior art. 99 of the Treaty)

24. 1 THE NATURE AS AN EUROPEAA TAX. THE SPECIFIC FEATURES abolition of customs duties Encourage the free movement of goods, persons, services and capital (Competition neutrality) harmonization forecasting relating "to the extent necessary to ensure the establishment and functioning of the internal market" (art. 93, prior art. 99 of the Treaty)

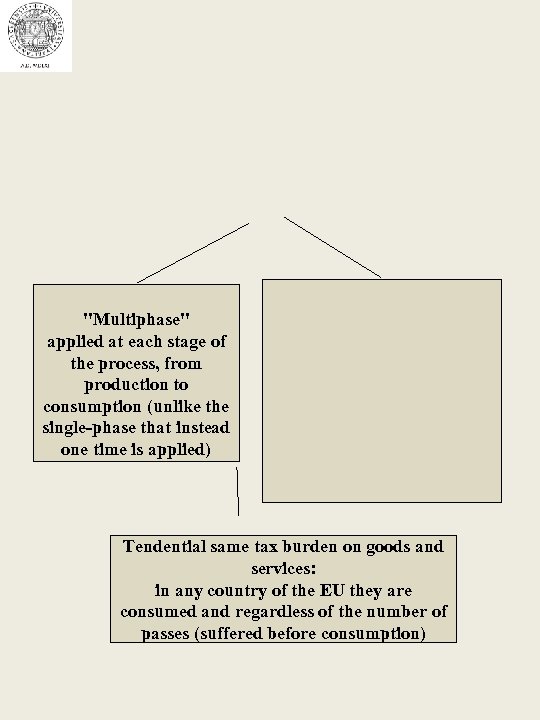

"Multiphase" applied at each stage of the process, from production to consumption (unlike the single-phase that instead one time is applied) Tendential same tax burden on goods and services: in any country of the EU they are consumed and regardless of the number of passes (suffered before consumption)

"Multiphase" applied at each stage of the process, from production to consumption (unlike the single-phase that instead one time is applied) Tendential same tax burden on goods and services: in any country of the EU they are consumed and regardless of the number of passes (suffered before consumption)

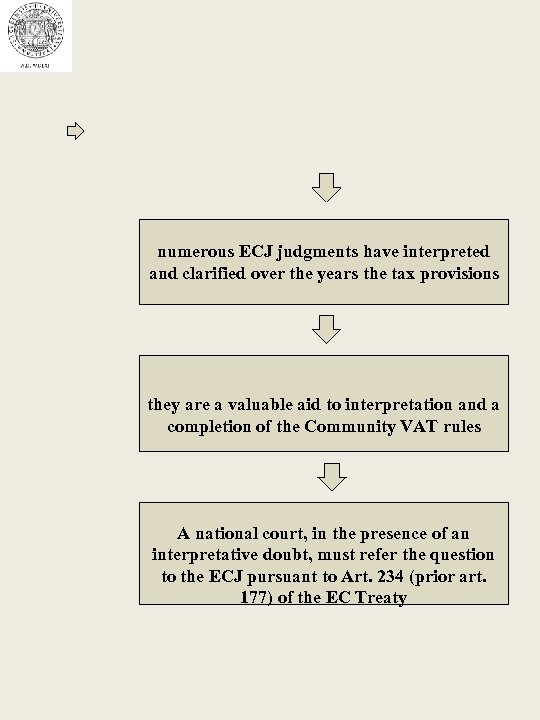

numerous ECJ judgments have interpreted and clarified over the years the tax provisions they are a valuable aid to interpretation and a completion of the Community VAT rules A national court, in the presence of an interpretative doubt, must refer the question to the ECJ pursuant to Art. 234 (prior art. 177) of the EC Treaty

numerous ECJ judgments have interpreted and clarified over the years the tax provisions they are a valuable aid to interpretation and a completion of the Community VAT rules A national court, in the presence of an interpretative doubt, must refer the question to the ECJ pursuant to Art. 234 (prior art. 177) of the EC Treaty

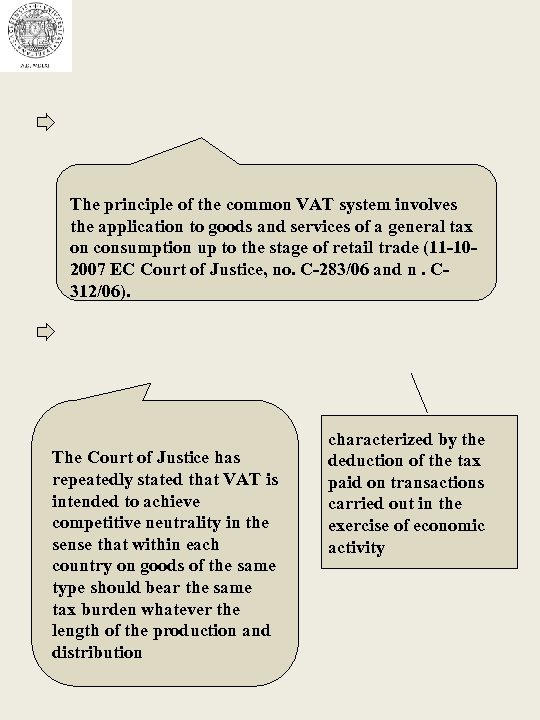

The principle of the common VAT system involves the application to goods and services of a general tax on consumption up to the stage of retail trade (11 -102007 EC Court of Justice, no. C-283/06 and n. C 312/06). The Court of Justice has repeatedly stated that VAT is intended to achieve competitive neutrality in the sense that within each country on goods of the same type should bear the same tax burden whatever the length of the production and distribution characterized by the deduction of the tax paid on transactions carried out in the exercise of economic activity

The principle of the common VAT system involves the application to goods and services of a general tax on consumption up to the stage of retail trade (11 -102007 EC Court of Justice, no. C-283/06 and n. C 312/06). The Court of Justice has repeatedly stated that VAT is intended to achieve competitive neutrality in the sense that within each country on goods of the same type should bear the same tax burden whatever the length of the production and distribution characterized by the deduction of the tax paid on transactions carried out in the exercise of economic activity

24. 2 The Vat subjects They are formally subject to VAT sono destinatari di obblighi formali e sostanziali non sono “tendenzialmente” incisi dal tributo

24. 2 The Vat subjects They are formally subject to VAT sono destinatari di obblighi formali e sostanziali non sono “tendenzialmente” incisi dal tributo

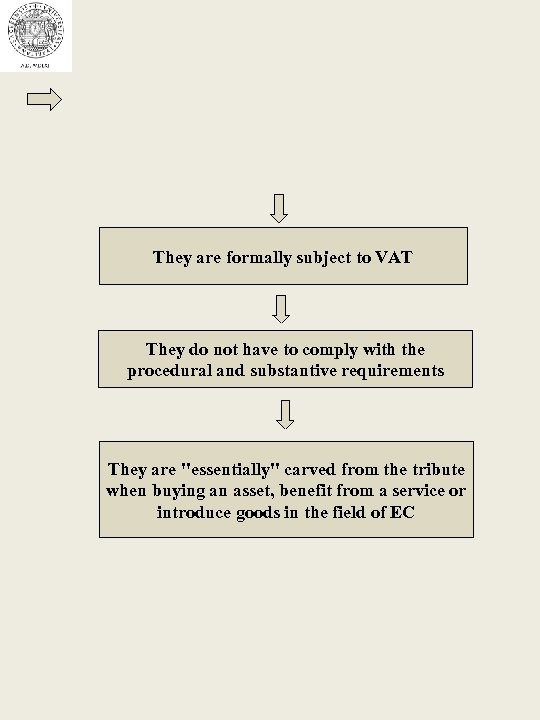

They are formally subject to VAT They do not have to comply with the procedural and substantive requirements They are "essentially" carved from the tribute when buying an asset, benefit from a service or introduce goods in the field of EC

They are formally subject to VAT They do not have to comply with the procedural and substantive requirements They are "essentially" carved from the tribute when buying an asset, benefit from a service or introduce goods in the field of EC

24. 3 The differenti theories (a) legal-formal theories that enhance the VAT regime (and thus the formal aspects of tax)

24. 3 The differenti theories (a) legal-formal theories that enhance the VAT regime (and thus the formal aspects of tax)

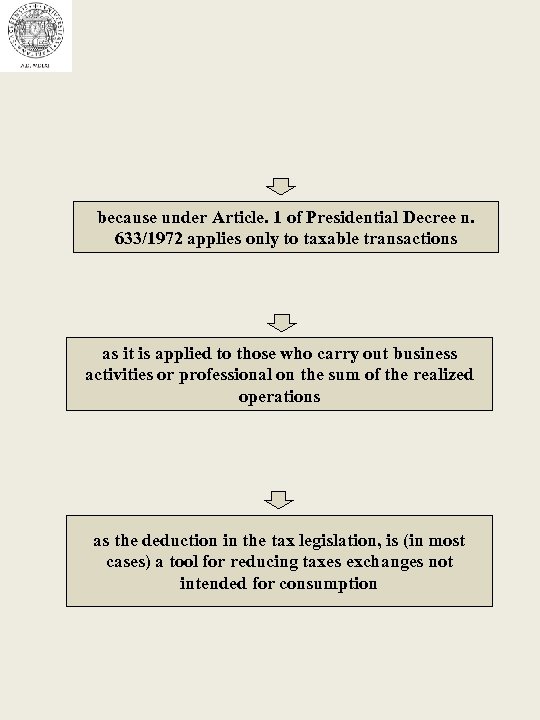

because under Article. 1 of Presidential Decree n. 633/1972 applies only to taxable transactions as it is applied to those who carry out business activities or professional on the sum of the realized operations as the deduction in the tax legislation, is (in most cases) a tool for reducing taxes exchanges not intended for consumption

because under Article. 1 of Presidential Decree n. 633/1972 applies only to taxable transactions as it is applied to those who carry out business activities or professional on the sum of the realized operations as the deduction in the tax legislation, is (in most cases) a tool for reducing taxes exchanges not intended for consumption

The tax only affects the end consumer and stands as "neutral" towards "VAT subjects", as there is a cost element in relation to such persons and for the principle of the deduction of input tax, both the right and duty of revenge.

The tax only affects the end consumer and stands as "neutral" towards "VAT subjects", as there is a cost element in relation to such persons and for the principle of the deduction of input tax, both the right and duty of revenge.

24. 4 the Vat assumptions

24. 4 the Vat assumptions

in domestic relations in international relations: in intra – CE exchenges:

in domestic relations in international relations: in intra – CE exchenges:

Objective assumption The notion of transfer of property does not refer to the transfer of the property in the manner prescribed by national law but covers any transfer of tangible property, carried out by one party which empowers the other to have made it as if it were the owner

Objective assumption The notion of transfer of property does not refer to the transfer of the property in the manner prescribed by national law but covers any transfer of tangible property, carried out by one party which empowers the other to have made it as if it were the owner

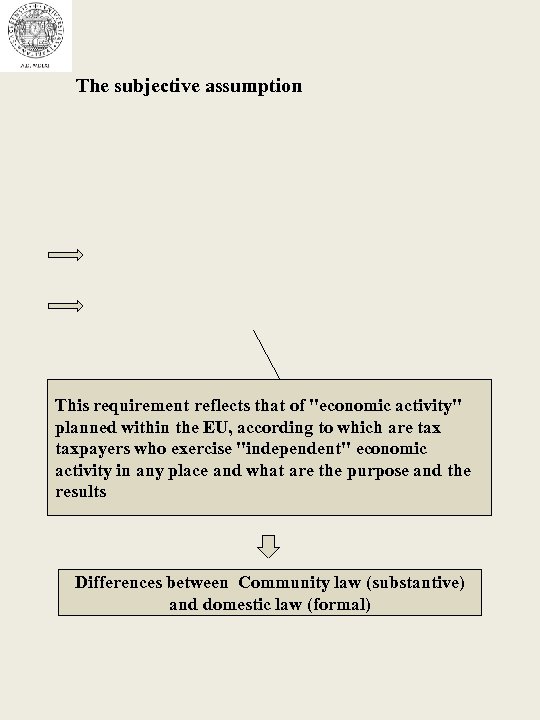

The subjective assumption This requirement reflects that of "economic activity" planned within the EU, according to which are taxpayers who exercise "independent" economic activity in any place and what are the purpose and the results Differences between Community law (substantive) and domestic law (formal)

The subjective assumption This requirement reflects that of "economic activity" planned within the EU, according to which are taxpayers who exercise "independent" economic activity in any place and what are the purpose and the results Differences between Community law (substantive) and domestic law (formal)

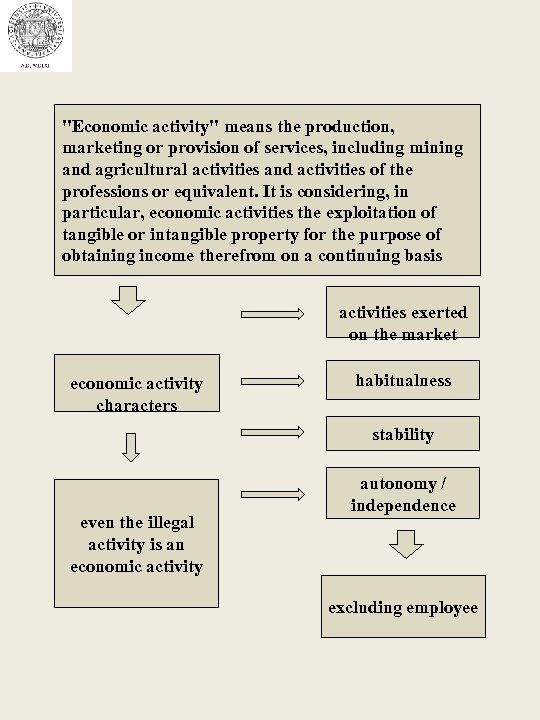

"Economic activity" means the production, marketing or provision of services, including mining and agricultural activities and activities of the professions or equivalent. It is considering, in particular, economic activities the exploitation of tangible or intangible property for the purpose of obtaining income therefrom on a continuing basis activities exerted on the market economic activity characters habitualness stability even the illegal activity is an economic activity autonomy / independence excluding employee

"Economic activity" means the production, marketing or provision of services, including mining and agricultural activities and activities of the professions or equivalent. It is considering, in particular, economic activities the exploitation of tangible or intangible property for the purpose of obtaining income therefrom on a continuing basis activities exerted on the market economic activity characters habitualness stability even the illegal activity is an economic activity autonomy / independence excluding employee

according to Community law, it does not constitute an economic activity

according to Community law, it does not constitute an economic activity

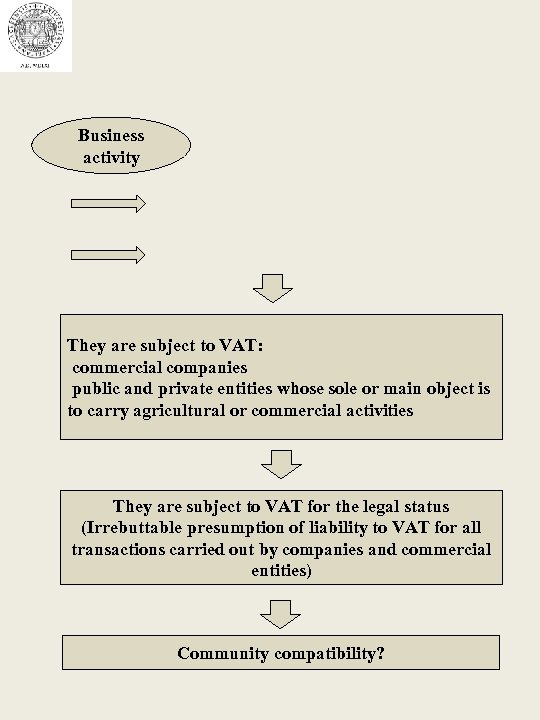

Business activity They are subject to VAT: commercial companies public and private entities whose sole or main object is to carry agricultural or commercial activities They are subject to VAT for the legal status (Irrebuttable presumption of liability to VAT for all transactions carried out by companies and commercial entities) Community compatibility?

Business activity They are subject to VAT: commercial companies public and private entities whose sole or main object is to carry agricultural or commercial activities They are subject to VAT for the legal status (Irrebuttable presumption of liability to VAT for all transactions carried out by companies and commercial entities) Community compatibility?

broader concept than that of civil law broader concept than that given in direct taxes as it also includes the agricultural enterprise

broader concept than that of civil law broader concept than that given in direct taxes as it also includes the agricultural enterprise

They are considered to be performed in the exercise of a business activity

They are considered to be performed in the exercise of a business activity

art or profession Exclusion of services provided by co. co. unless lattività underlying is subject to other occupation

art or profession Exclusion of services provided by co. co. unless lattività underlying is subject to other occupation

Public entities Not subject to VAT

Public entities Not subject to VAT

The territorial assumption rules

The territorial assumption rules

Territoriality in the supply of goods General criterion Specific criterion

Territoriality in the supply of goods General criterion Specific criterion

Territoriality of services general criterion

Territoriality of services general criterion

Territoriality of services Specific criteria that apply regardless of the recipient of the service

Territoriality of services Specific criteria that apply regardless of the recipient of the service

Specific criteria that apply regardless of the recipient of the service

Specific criteria that apply regardless of the recipient of the service

for the same assumptions relating to business transactions using the general criteria

for the same assumptions relating to business transactions using the general criteria

additional specific criteria

additional specific criteria

The import internationally import by any person Import notion: "goods imported into the territory of the State who originate from countries or territories not included in the Community or which have not been already released for free circulation in another member country of the EC or that they are from the territories excluded from the EC"

The import internationally import by any person Import notion: "goods imported into the territory of the State who originate from countries or territories not included in the Community or which have not been already released for free circulation in another member country of the EC or that they are from the territories excluded from the EC"

Vat applied on the imports

Vat applied on the imports

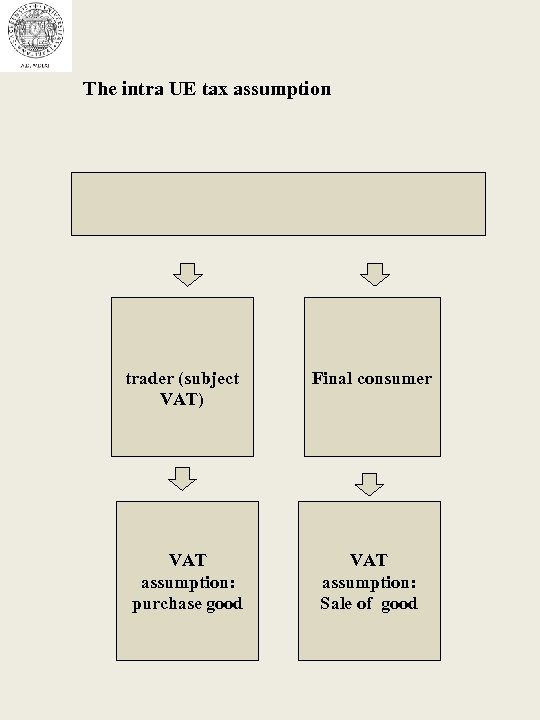

The intra UE tax assumption trader (subject VAT) VAT assumption: purchase good Final consumer VAT assumption: Sale of good

The intra UE tax assumption trader (subject VAT) VAT assumption: purchase good Final consumer VAT assumption: Sale of good

Sale to the final consumer

Sale to the final consumer

Sale to a vat subject

Sale to a vat subject

24. 4. the vat operations IVA operations Non Vat operations

24. 4. the vat operations IVA operations Non Vat operations

Vat taxable operations The carrying out of a taxable transaction involves the application of the ordinary workings of the VAT regime

Vat taxable operations The carrying out of a taxable transaction involves the application of the ordinary workings of the VAT regime

Vat non taxable operations Non taxable operations

Vat non taxable operations Non taxable operations

export

export

General rules Ratio of the discipline: Extra tax relief - EC goods consumed; Tax neutrality for economic operators that are engaged in export activities in the Community

General rules Ratio of the discipline: Extra tax relief - EC goods consumed; Tax neutrality for economic operators that are engaged in export activities in the Community

The extempt operations The exemptions

The extempt operations The exemptions

the ratio is not to distort competition even between lawful and unlawful activities

the ratio is not to distort competition even between lawful and unlawful activities

rules: Ratio of the discipline: engrave a person other than the final consumer, blocking the tax mechanism at one stage of production or of the front exchange for consumption

rules: Ratio of the discipline: engrave a person other than the final consumer, blocking the tax mechanism at one stage of production or of the front exchange for consumption

24. 5 THE APPLICATION OF VAT The time in wich the tax assumption is fulfilled when the economic operation reaches a degree of certainty as to set in motion the VAT system

24. 5 THE APPLICATION OF VAT The time in wich the tax assumption is fulfilled when the economic operation reaches a degree of certainty as to set in motion the VAT system

Sale of goods services intra - CE sales

Sale of goods services intra - CE sales

except art. 6, paragraph 5 (sale pharmaceuticals by pharmacists, services provided to the State - State bodies - Universities - Hospitals - USL) where the collectability is not connected at the time of the occurrence of tax but at the time of the payment

except art. 6, paragraph 5 (sale pharmaceuticals by pharmacists, services provided to the State - State bodies - Universities - Hospitals - USL) where the collectability is not connected at the time of the occurrence of tax but at the time of the payment

The transaction will be complete within the limits of the amount invoiced or paid

The transaction will be complete within the limits of the amount invoiced or paid

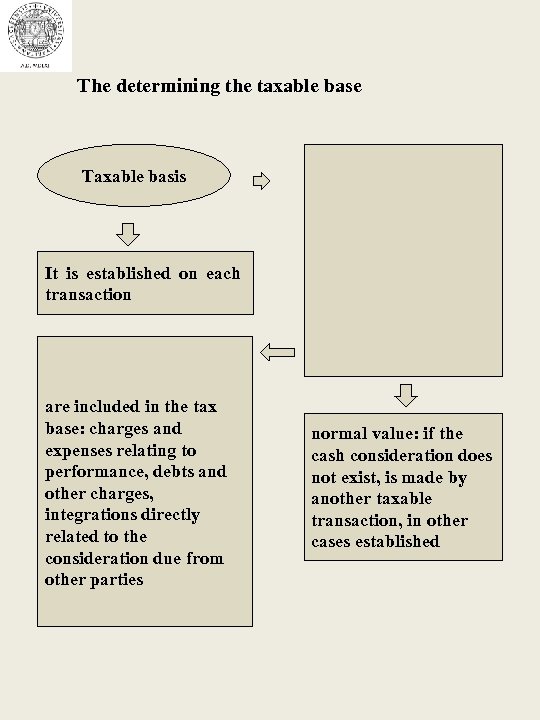

The determining the taxable base Taxable basis It is established on each transaction are included in the tax base: charges and expenses relating to performance, debts and other charges, integrations directly related to the consideration due from other parties normal value: if the cash consideration does not exist, is made by another taxable transaction, in other cases established

The determining the taxable base Taxable basis It is established on each transaction are included in the tax base: charges and expenses relating to performance, debts and other charges, integrations directly related to the consideration due from other parties normal value: if the cash consideration does not exist, is made by another taxable transaction, in other cases established

Italian Tax rate in force at the time when the transaction takes place

Italian Tax rate in force at the time when the transaction takes place

the application

the application

The retaliation is optional only in some cases fixed by law

The retaliation is optional only in some cases fixed by law

it is the operation with which the subject IVA subtracts from the tax related to the effected operations the acquitted tax or due or to him debited to title of retaliation it is a right of every subject instrumental IVA to the determination of the tax cannot be practiced over the declaration related to the second following year to that in which the right to the deduction has risen but to the existing conditions during the birth of the right

it is the operation with which the subject IVA subtracts from the tax related to the effected operations the acquitted tax or due or to him debited to title of retaliation it is a right of every subject instrumental IVA to the determination of the tax cannot be practiced over the declaration related to the second following year to that in which the right to the deduction has risen but to the existing conditions during the birth of the right

It relates only to the goods or services imported or purchased in a business, trade or profession You can not systematically deduct VAT, being necessary the existence of a direct and immediate link between a particular transaction and the overall activity of the taxable person

It relates only to the goods or services imported or purchased in a business, trade or profession You can not systematically deduct VAT, being necessary the existence of a direct and immediate link between a particular transaction and the overall activity of the taxable person

The right to deduct is the centerpiece of the tax legislation only the deduction can guarantee a perfect "fiscal neutrality" to tax all economic activities

The right to deduct is the centerpiece of the tax legislation only the deduction can guarantee a perfect "fiscal neutrality" to tax all economic activities

the Community system has regulated very strictly deducting VAT (arts. 17 and 18 of Directive VI), admitting restrictions on the right to deduct only in exceptional cases and in the presence of specific events

the Community system has regulated very strictly deducting VAT (arts. 17 and 18 of Directive VI), admitting restrictions on the right to deduct only in exceptional cases and in the presence of specific events

ogni norma nazionale che pone limitazioni non giustificate alla detrazione o che deroga ai principi comunitari sul diritto di detrazione deve essere disapplicata La norma italiana contenuta nell’art. 19 bis 1, lett. c) e d) del D. P. R. n. 633/1972 in base alla quale si inibiva la detrazione dell’imposta relativa all’acquisto o all’importazione di autoveicoli o di ciclomotori che non formano oggetto dell’impresa è contraria al sistema comunitario (Corte di Giustizia 14. 9. 2006, C-228/05).

ogni norma nazionale che pone limitazioni non giustificate alla detrazione o che deroga ai principi comunitari sul diritto di detrazione deve essere disapplicata La norma italiana contenuta nell’art. 19 bis 1, lett. c) e d) del D. P. R. n. 633/1972 in base alla quale si inibiva la detrazione dell’imposta relativa all’acquisto o all’importazione di autoveicoli o di ciclomotori che non formano oggetto dell’impresa è contraria al sistema comunitario (Corte di Giustizia 14. 9. 2006, C-228/05).

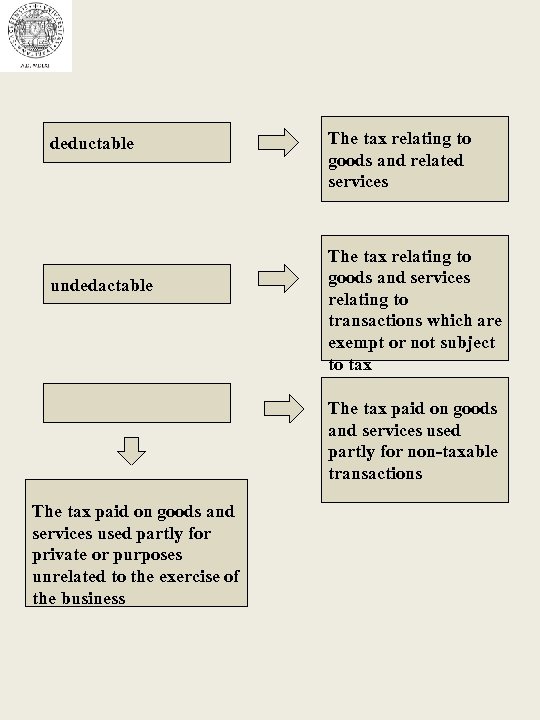

deductable undedactable The tax relating to goods and related services The tax relating to goods and services relating to transactions which are exempt or not subject to tax The tax paid on goods and services used partly for non-taxable transactions The tax paid on goods and services used partly for private or purposes unrelated to the exercise of the business

deductable undedactable The tax relating to goods and related services The tax relating to goods and services relating to transactions which are exempt or not subject to tax The tax paid on goods and services used partly for non-taxable transactions The tax paid on goods and services used partly for private or purposes unrelated to the exercise of the business

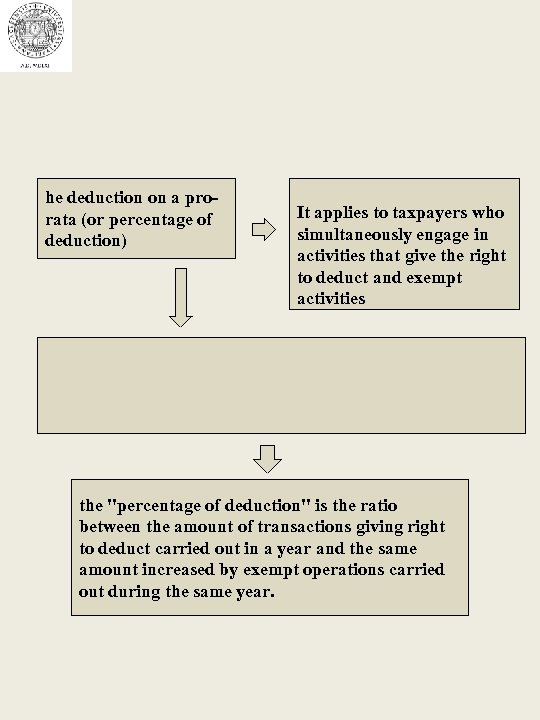

he deduction on a prorata (or percentage of deduction) It applies to taxpayers who simultaneously engage in activities that give the right to deduct and exempt activities the "percentage of deduction" is the ratio between the amount of transactions giving right to deduct carried out in a year and the same amount increased by exempt operations carried out during the same year.

he deduction on a prorata (or percentage of deduction) It applies to taxpayers who simultaneously engage in activities that give the right to deduct and exempt activities the "percentage of deduction" is the ratio between the amount of transactions giving right to deduct carried out in a year and the same amount increased by exempt operations carried out during the same year.

its use is subject to strong criticism as "perverts" the original VAT rules it is now used in many cases ( "carousel" fraud) and in some sectors (construction, sub contracts) in order to counter tax evasion

its use is subject to strong criticism as "perverts" the original VAT rules it is now used in many cases ( "carousel" fraud) and in some sectors (construction, sub contracts) in order to counter tax evasion

The assignee / the client emits un'auto-invoice, recording the transaction in the register of purchases and sales ledger simultaneously. This way no one pours and no deducts VAT.

The assignee / the client emits un'auto-invoice, recording the transaction in the register of purchases and sales ledger simultaneously. This way no one pours and no deducts VAT.

al fine di evitare che lo Stato in cui si effettua la detrazione sia differente da quello che incassa l’IVA

al fine di evitare che lo Stato in cui si effettua la detrazione sia differente da quello che incassa l’IVA