2ae82c4d1119f8f873d0a09d763c36f9.ppt

- Количество слайдов: 22

24 Chapter The Residential Mortgage Market Money and Capital Markets Financial Institutions and Instruments in a Global Marketplace Eighth Edition Peter S. Rose Mc. Graw Hill / Irwin Slides by Yee-Tien (Ted) Fu

24 Chapter The Residential Mortgage Market Money and Capital Markets Financial Institutions and Instruments in a Global Marketplace Eighth Edition Peter S. Rose Mc. Graw Hill / Irwin Slides by Yee-Tien (Ted) Fu

24 - 2 Learning Objectives w To understand how the residential mortgage market supplies credit to build and buy homes. w To learn about the problems faced by families and individuals in finding credit to finance the purchase of their homes. w To see the problems faced by lenders in designing new home loan contracts that will protect them against inflation and other risks. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 2 Learning Objectives w To understand how the residential mortgage market supplies credit to build and buy homes. w To learn about the problems faced by families and individuals in finding credit to finance the purchase of their homes. w To see the problems faced by lenders in designing new home loan contracts that will protect them against inflation and other risks. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 3 Learning Objectives w To look at how federal government agencies and government-sponsored mortgage firms support the development of the market for mortgage loans. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 3 Learning Objectives w To look at how federal government agencies and government-sponsored mortgage firms support the development of the market for mortgage loans. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 4 Introduction w Among the fastest growing of all financial markets today is the residential mortgage market, where individuals and families fund their purchases of homes. w Originally a simple market that was primarily local and regional in character, the residential mortgage market has become an international capital market where home-mortgage-related instruments are traded around the globe. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 4 Introduction w Among the fastest growing of all financial markets today is the residential mortgage market, where individuals and families fund their purchases of homes. w Originally a simple market that was primarily local and regional in character, the residential mortgage market has become an international capital market where home-mortgage-related instruments are traded around the globe. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

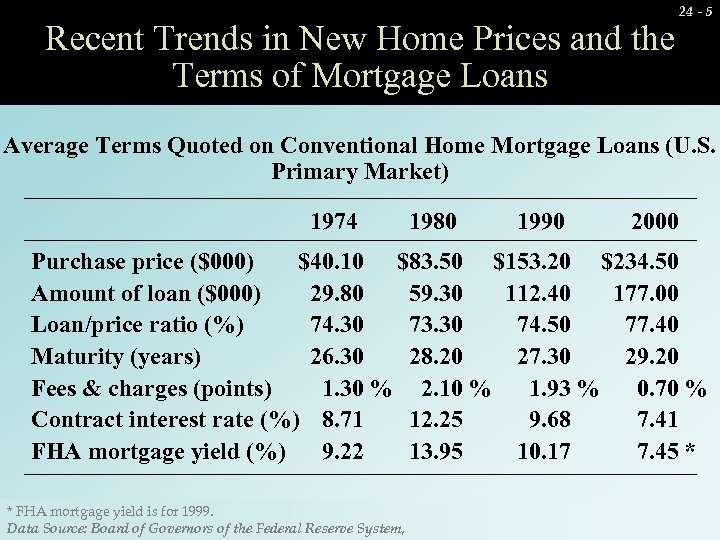

Recent Trends in New Home Prices and the Terms of Mortgage Loans 24 - 5 Average Terms Quoted on Conventional Home Mortgage Loans (U. S. Primary Market) 1974 1980 1990 2000 Purchase price ($000) $40. 10 $83. 50 $153. 20 $234. 50 Amount of loan ($000) 29. 80 59. 30 112. 40 177. 00 Loan/price ratio (%) 74. 30 73. 30 74. 50 77. 40 Maturity (years) 26. 30 28. 20 27. 30 29. 20 Fees & charges (points) 1. 30 % 2. 10 % 1. 93 % 0. 70 % Contract interest rate (%) 8. 71 12. 25 9. 68 7. 41 FHA mortgage yield (%) 9. 22 13. 95 10. 17 7. 45 * * FHA mortgage yield is for 1999. 2003 Mc. Graw Hill / Irwin Data Source: Board of Governors of the Federal Reserve System, by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Recent Trends in New Home Prices and the Terms of Mortgage Loans 24 - 5 Average Terms Quoted on Conventional Home Mortgage Loans (U. S. Primary Market) 1974 1980 1990 2000 Purchase price ($000) $40. 10 $83. 50 $153. 20 $234. 50 Amount of loan ($000) 29. 80 59. 30 112. 40 177. 00 Loan/price ratio (%) 74. 30 73. 30 74. 50 77. 40 Maturity (years) 26. 30 28. 20 27. 30 29. 20 Fees & charges (points) 1. 30 % 2. 10 % 1. 93 % 0. 70 % Contract interest rate (%) 8. 71 12. 25 9. 68 7. 41 FHA mortgage yield (%) 9. 22 13. 95 10. 17 7. 45 * * FHA mortgage yield is for 1999. 2003 Mc. Graw Hill / Irwin Data Source: Board of Governors of the Federal Reserve System, by The Mc. Graw-Hill Companies, Inc. All rights reserved.

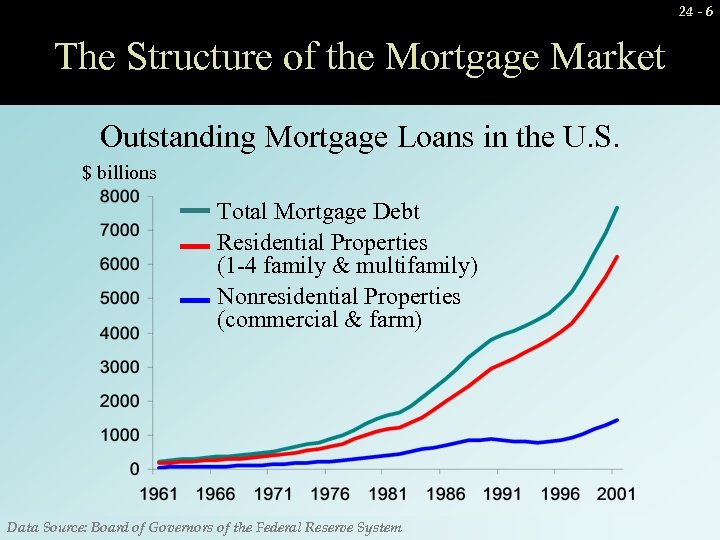

24 - 6 The Structure of the Mortgage Market Outstanding Mortgage Loans in the U. S. $ billions Total Mortgage Debt Residential Properties (1 -4 family & multifamily) Nonresidential Properties (commercial & farm) 2003 Data Source: Board of Governors of the Federal Reserve System by The Mc. Graw-Hill Companies, Inc. All rights reserved. Mc. Graw Hill / Irwin

24 - 6 The Structure of the Mortgage Market Outstanding Mortgage Loans in the U. S. $ billions Total Mortgage Debt Residential Properties (1 -4 family & multifamily) Nonresidential Properties (commercial & farm) 2003 Data Source: Board of Governors of the Federal Reserve System by The Mc. Graw-Hill Companies, Inc. All rights reserved. Mc. Graw Hill / Irwin

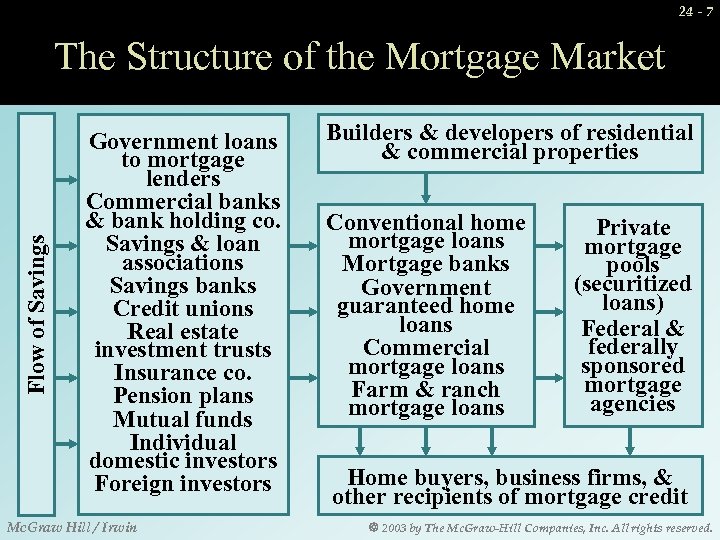

24 - 7 Flow of Savings The Structure of the Mortgage Market Government loans to mortgage lenders Commercial banks & bank holding co. Savings & loan associations Savings banks Credit unions Real estate investment trusts Insurance co. Pension plans Mutual funds Individual domestic investors Foreign investors Mc. Graw Hill / Irwin Builders & developers of residential & commercial properties Conventional home mortgage loans Mortgage banks Government guaranteed home loans Commercial mortgage loans Farm & ranch mortgage loans Private mortgage pools (securitized loans) Federal & federally sponsored mortgage agencies Home buyers, business firms, & other recipients of mortgage credit 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 7 Flow of Savings The Structure of the Mortgage Market Government loans to mortgage lenders Commercial banks & bank holding co. Savings & loan associations Savings banks Credit unions Real estate investment trusts Insurance co. Pension plans Mutual funds Individual domestic investors Foreign investors Mc. Graw Hill / Irwin Builders & developers of residential & commercial properties Conventional home mortgage loans Mortgage banks Government guaranteed home loans Commercial mortgage loans Farm & ranch mortgage loans Private mortgage pools (securitized loans) Federal & federally sponsored mortgage agencies Home buyers, business firms, & other recipients of mortgage credit 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

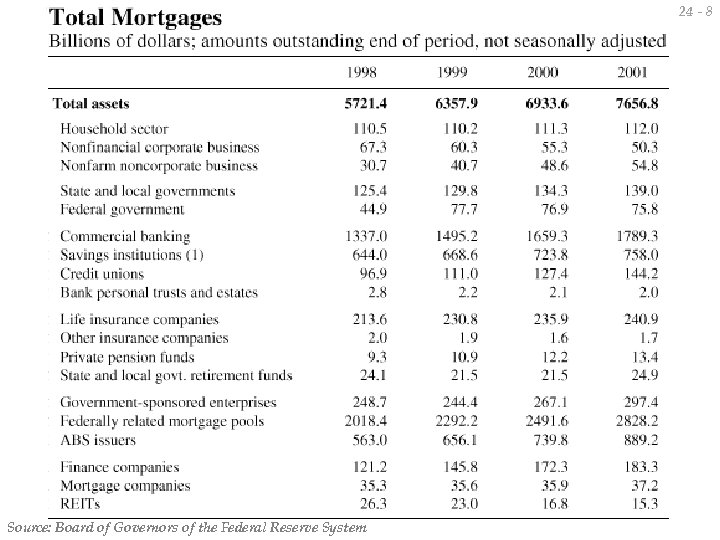

24 - 8 Mortgage Lending Institutions Source: Board of Governors of the Federal Reserve System

24 - 8 Mortgage Lending Institutions Source: Board of Governors of the Federal Reserve System

24 - 9 Mortgage Lending Institutions w Most mortgages generate multiple potential cash-flow streams: 1. 2. 3. 4. 5. origination & commitment fees (when a mortgage loan is first applied for) periodic loan repayments & loan interest compensation for prepayment & default risks service fees associated with collecting & recording amounts owed net returns & fees from the securitization of a pool of mortgage loans Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 9 Mortgage Lending Institutions w Most mortgages generate multiple potential cash-flow streams: 1. 2. 3. 4. 5. origination & commitment fees (when a mortgage loan is first applied for) periodic loan repayments & loan interest compensation for prepayment & default risks service fees associated with collecting & recording amounts owed net returns & fees from the securitization of a pool of mortgage loans Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 10 Mortgage Lending Institutions w A mortgage loan may be held in the originating lender’s portfolio for the promised interest and principal payments, sold to an investor at a discounted value (although the originating lender may retain servicing rights and charge the loan purchaser loan servicing fees), or packaged with other similar mortgage loans into a pool and securitized (the lender receives residual interest income and servicing fees). Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 10 Mortgage Lending Institutions w A mortgage loan may be held in the originating lender’s portfolio for the promised interest and principal payments, sold to an investor at a discounted value (although the originating lender may retain servicing rights and charge the loan purchaser loan servicing fees), or packaged with other similar mortgage loans into a pool and securitized (the lender receives residual interest income and servicing fees). Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

The Roles Played by Financial Institutions In the Mortgage Market 24 - 11 w Savings and loan associations (S&Ls) are predominantly local lenders. They often service the mortgage loans they made. w Commercial banks rank first as lenders for the purchase of homes, condominiums, and apartments, and in the commercial mortgage sector. w Savings banks invest in both governmentguaranteed and conventional mortgage loans. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

The Roles Played by Financial Institutions In the Mortgage Market 24 - 11 w Savings and loan associations (S&Ls) are predominantly local lenders. They often service the mortgage loans they made. w Commercial banks rank first as lenders for the purchase of homes, condominiums, and apartments, and in the commercial mortgage sector. w Savings banks invest in both governmentguaranteed and conventional mortgage loans. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

The Roles Played by Financial Institutions In the Mortgage Market 24 - 12 w Life insurance companies make substantial investments in commercial as well as residential mortgage properties, both nationally and internationally. w Mortgage banking houses act as a channel through which builders or contractors in need of long-term funds can find permanent mortgage financing. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

The Roles Played by Financial Institutions In the Mortgage Market 24 - 12 w Life insurance companies make substantial investments in commercial as well as residential mortgage properties, both nationally and internationally. w Mortgage banking houses act as a channel through which builders or contractors in need of long-term funds can find permanent mortgage financing. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 13 Government Activity w The Great Depression generated massive, unprecedented unemployment, such that there were thousands of foreclosures, property values fell, and many mortgage lenders faced liquidity crises. w So, the U. S. federal government had to move in to tackle the mortgage market’s problems, through government guarantees and the development of a secondary market. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 13 Government Activity w The Great Depression generated massive, unprecedented unemployment, such that there were thousands of foreclosures, property values fell, and many mortgage lenders faced liquidity crises. w So, the U. S. federal government had to move in to tackle the mortgage market’s problems, through government guarantees and the development of a secondary market. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 14 Government Activity w The major milestones include: 1932: Federal Home Loan Bank System è 1934: National Housing Act, Federal Housing Administration è 1938: Federal National Mortgage Association (Fannie Mae) è 1944: Servicemen’s Readjustment Act, Veterans Administration è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 14 Government Activity w The major milestones include: 1932: Federal Home Loan Bank System è 1934: National Housing Act, Federal Housing Administration è 1938: Federal National Mortgage Association (Fannie Mae) è 1944: Servicemen’s Readjustment Act, Veterans Administration è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 15 Government Activity 1968: Government National Mortgage Association (Ginnie Mae) (Its pass-throughs are popular with investors as safe, readily marketable securities with attractive rates of return. ) è 1970: Federal Home Loan Mortgage Corporation (Freddie Mac) (Its mortgage-backed securities include mortgage participation certificates (PCs), guaranteed mortgage certificates (GMCs), collateralized mortgage obligations (CMOs), and real estate mortgage investment conduits (REMICs). ) è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 15 Government Activity 1968: Government National Mortgage Association (Ginnie Mae) (Its pass-throughs are popular with investors as safe, readily marketable securities with attractive rates of return. ) è 1970: Federal Home Loan Mortgage Corporation (Freddie Mac) (Its mortgage-backed securities include mortgage participation certificates (PCs), guaranteed mortgage certificates (GMCs), collateralized mortgage obligations (CMOs), and real estate mortgage investment conduits (REMICs). ) è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 16 Innovations in Mortgage Instruments w The problems created by fixed-rate mortgages (FRMs) led to the development of variablerate mortgages (VRMs) and adjustable mortgage instruments (AMIs). w Volatile interest rates also led to the development of convertible mortgage instruments (CMIs) and balloon loans. w Reverse-annuity mortgages (RAMs) have also been developed to help older families. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 16 Innovations in Mortgage Instruments w The problems created by fixed-rate mortgages (FRMs) led to the development of variablerate mortgages (VRMs) and adjustable mortgage instruments (AMIs). w Volatile interest rates also led to the development of convertible mortgage instruments (CMIs) and balloon loans. w Reverse-annuity mortgages (RAMs) have also been developed to help older families. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 17 Innovations in Mortgage Instruments w Mortgage lock-ins protect borrowers from an increase in loan rates during the house-buying process, while loan modification agreements aid troubled borrowers in avoiding disclosure. w In recent years, as market interest rates fell, many homeowners have chosen to refinance their home mortgages. Some have also opted to take home equity loans. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 17 Innovations in Mortgage Instruments w Mortgage lock-ins protect borrowers from an increase in loan rates during the house-buying process, while loan modification agreements aid troubled borrowers in avoiding disclosure. w In recent years, as market interest rates fell, many homeowners have chosen to refinance their home mortgages. Some have also opted to take home equity loans. Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 18 Money and Capital Markets in Cyberspace w More information about the residential mortgage market can be found at: http: //www. cityresearch. com/ è http: //www. hsh. com/ è http: //www. wholesaleaccess. com/ è http: //mortgagesincanada. com/ è http: //www. hud. gov/ è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 18 Money and Capital Markets in Cyberspace w More information about the residential mortgage market can be found at: http: //www. cityresearch. com/ è http: //www. hsh. com/ è http: //www. wholesaleaccess. com/ è http: //mortgagesincanada. com/ è http: //www. hud. gov/ è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 19 Chapter Review w Introduction w Recent Trends in New Home Prices and the Terms of Mortgage Loans w The Structure of the Mortgage Market Volume of Mortgage Loans è Residential versus Nonresidential Mortgage Loans è w Mortgage Lending Institutions Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 19 Chapter Review w Introduction w Recent Trends in New Home Prices and the Terms of Mortgage Loans w The Structure of the Mortgage Market Volume of Mortgage Loans è Residential versus Nonresidential Mortgage Loans è w Mortgage Lending Institutions Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 20 Chapter Review w The Roles Played by Financial Institutions in the Mortgage Market Savings and Loan Associations è Commercial Banks è Life Insurance Companies è Savings Banks è Mortgage Bankers è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 20 Chapter Review w The Roles Played by Financial Institutions in the Mortgage Market Savings and Loan Associations è Commercial Banks è Life Insurance Companies è Savings Banks è Mortgage Bankers è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 21 Chapter Review w Government Activity The Impact of the Great Depression on Government Involvement in the Mortgage Market è The Creation of Fannie Mae (FNMA) è The Creation of Ginnie Mae (GNMA) è The Federal Home Loan Mortgage Corporation (FHLMC) è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 21 Chapter Review w Government Activity The Impact of the Great Depression on Government Involvement in the Mortgage Market è The Creation of Fannie Mae (FNMA) è The Creation of Ginnie Mae (GNMA) è The Federal Home Loan Mortgage Corporation (FHLMC) è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 22 Chapter Review w Innovations in Mortgage Instruments Variable-Rate and Adjustable Mortgage Instruments è Convertible Mortgages è Reverse-Annuity Mortgages è Mortgage Lock-ins è Refinancing Home Mortgages and Home Equity Loans è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

24 - 22 Chapter Review w Innovations in Mortgage Instruments Variable-Rate and Adjustable Mortgage Instruments è Convertible Mortgages è Reverse-Annuity Mortgages è Mortgage Lock-ins è Refinancing Home Mortgages and Home Equity Loans è Mc. Graw Hill / Irwin 2003 by The Mc. Graw-Hill Companies, Inc. All rights reserved.