21 - 1

21 - 1

21 - 2 How does preferred stock differ from common stock and debt?

21 - 2 How does preferred stock differ from common stock and debt?

21 - 3

21 - 3

21 - 4 What are the advantages and disadvantages of preferred stock financing?

21 - 4 What are the advantages and disadvantages of preferred stock financing?

21 - 5 What is a call option? A call option is a contract that gives the holder the right, but not the obligation, to buy some defined asset at a specified price within some specified period of time.

21 - 5 What is a call option? A call option is a contract that gives the holder the right, but not the obligation, to buy some defined asset at a specified price within some specified period of time.

21 - 6 What is the relationship between call options, warrants, and convertibles?

21 - 6 What is the relationship between call options, warrants, and convertibles?

21 - 7 Given the following facts, what coupon rate must be set on a bond with warrants if the total package is to sell for $1, 000?

21 - 7 Given the following facts, what coupon rate must be set on a bond with warrants if the total package is to sell for $1, 000?

21 - 8

21 - 8

21 - 9 Step 2: Find Coupon Payment and Rate N I/YR PV PMT FV Therefore, the required coupon rate is $100/$1, 000 = 10%.

21 - 9 Step 2: Find Coupon Payment and Rate N I/YR PV PMT FV Therefore, the required coupon rate is $100/$1, 000 = 10%.

21 - 10 If after issue the warrants immediately sell for $5 each, what would this imply about the value of the package?

21 - 10 If after issue the warrants immediately sell for $5 each, what would this imply about the value of the package?

21 - 11

21 - 11

21 - 12 Assume that the warrants expire 10 years after issue. When would you expect them to be exercised?

21 - 12 Assume that the warrants expire 10 years after issue. When would you expect them to be exercised?

21 - 13

21 - 13

21 - 14 Will the warrants bring in additional capital when exercised?

21 - 14 Will the warrants bring in additional capital when exercised?

21 - 15 What is the expected return to the bondwith-warrant holders (and cost to the issuer) if the warrants are expected to be exercised in 5 years when P = $36. 75?

21 - 15 What is the expected return to the bondwith-warrant holders (and cost to the issuer) if the warrants are expected to be exercised in 5 years when P = $36. 75?

21 - 16

21 - 16

21 - 17

21 - 17

21 - 18

21 - 18

21 - 19

21 - 19

21 - 20 Assume the following convertible bond data:

21 - 20 Assume the following convertible bond data:

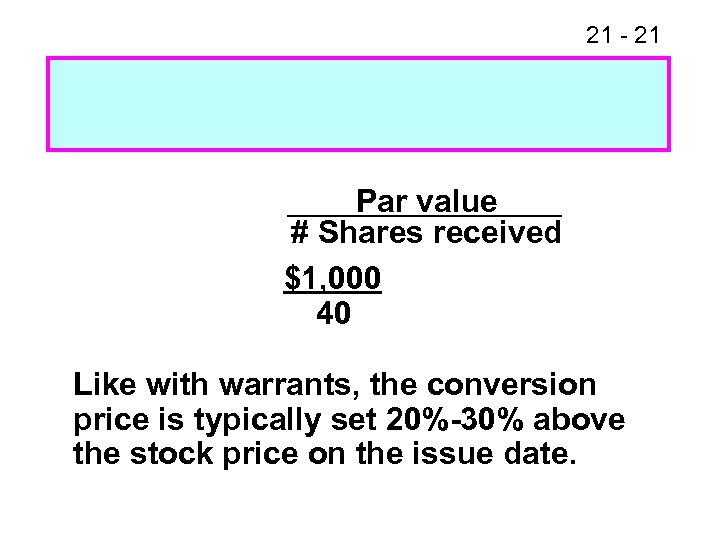

21 - 21 Par value # Shares received $1, 000 40 Like with warrants, the conversion price is typically set 20%-30% above the stock price on the issue date.

21 - 21 Par value # Shares received $1, 000 40 Like with warrants, the conversion price is typically set 20%-30% above the stock price on the issue date.

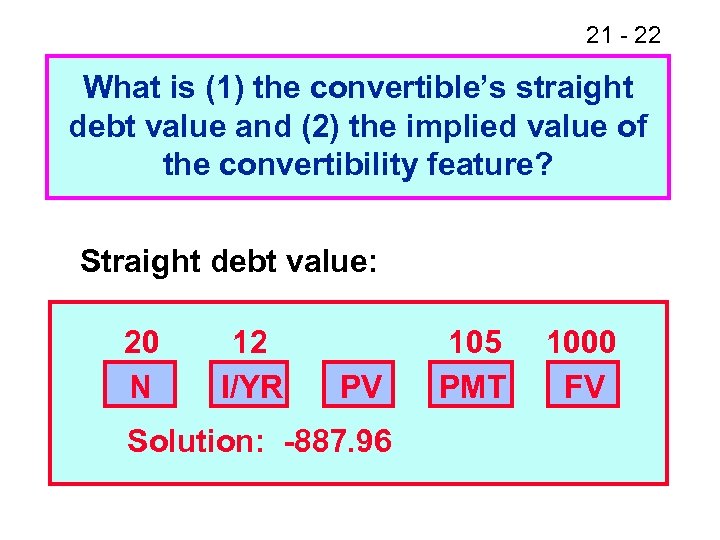

21 - 22 What is (1) the convertible’s straight debt value and (2) the implied value of the convertibility feature? Straight debt value: 20 N 12 I/YR PV Solution: -887. 96 105 PMT 1000 FV

21 - 22 What is (1) the convertible’s straight debt value and (2) the implied value of the convertibility feature? Straight debt value: 20 N 12 I/YR PV Solution: -887. 96 105 PMT 1000 FV

21 - 23 Implied Convertibility Value

21 - 23 Implied Convertibility Value

21 - 24 What is the formula for the bond’s expected conversion value in any year?

21 - 24 What is the formula for the bond’s expected conversion value in any year?

21 - 25 What is meant by the floor value of a convertible? What is the floor value at t = 0? At t = 10?

21 - 25 What is meant by the floor value of a convertible? What is the floor value at t = 0? At t = 10?

21 - 26

21 - 26

21 - 27 If the firm intends to force conversion on the first anniversary date after CV > $1, 200, when is the issue expected to be called? N I/YR PV PMT FV Solution: n = 5. 27 Bond would be called at t = 6 since call must occur on anniversary date.

21 - 27 If the firm intends to force conversion on the first anniversary date after CV > $1, 200, when is the issue expected to be called? N I/YR PV PMT FV Solution: n = 5. 27 Bond would be called at t = 6 since call must occur on anniversary date.

21 - 28 What is the convertible’s expected cost of capital to the firm? Input the cash flows in the calculator and solve for IRR = 13. 7%.

21 - 28 What is the convertible’s expected cost of capital to the firm? Input the cash flows in the calculator and solve for IRR = 13. 7%.

21 - 29 Does the cost of the convertible appear to be consistent with the costs of debt and equity?

21 - 29 Does the cost of the convertible appear to be consistent with the costs of debt and equity?

21 - 30 $1. 48(1. 08) $20

21 - 30 $1. 48(1. 08) $20

21 - 31 WACC Effects Assume the firm’s tax rate is 40% and its debt ratio is 50%. Now suppose the firm is considering either: (1) issuing convertibles, or (2) issuing bonds with warrants. Its new target capital structure will have 40% straight debt, 40% common equity and 20% convertibles or bonds with warrants. What effect will the two financing alternatives have on the firm’s WACC?

21 - 31 WACC Effects Assume the firm’s tax rate is 40% and its debt ratio is 50%. Now suppose the firm is considering either: (1) issuing convertibles, or (2) issuing bonds with warrants. Its new target capital structure will have 40% straight debt, 40% common equity and 20% convertibles or bonds with warrants. What effect will the two financing alternatives have on the firm’s WACC?

21 - 32 Convertibles Step 1: Find the after-tax cost of the convertibles.

21 - 32 Convertibles Step 1: Find the after-tax cost of the convertibles.

21 - 33 Convertibles Step 2: Find the after-tax cost of straight debt.

21 - 33 Convertibles Step 2: Find the after-tax cost of straight debt.

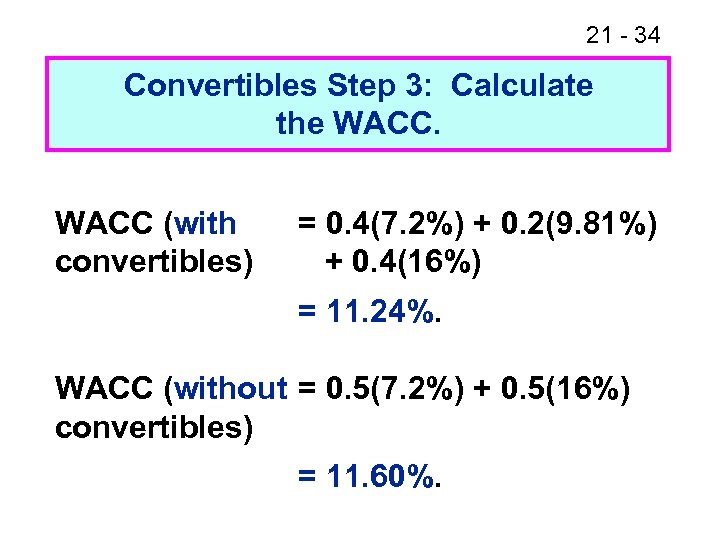

21 - 34 Convertibles Step 3: Calculate the WACC (with convertibles) = 0. 4(7. 2%) + 0. 2(9. 81%) + 0. 4(16%) = 11. 24%. WACC (without = 0. 5(7. 2%) + 0. 5(16%) convertibles) = 11. 60%.

21 - 34 Convertibles Step 3: Calculate the WACC (with convertibles) = 0. 4(7. 2%) + 0. 2(9. 81%) + 0. 4(16%) = 11. 24%. WACC (without = 0. 5(7. 2%) + 0. 5(16%) convertibles) = 11. 60%.

21 - 35

21 - 35

21 - 36 Warrants Step 1: Find the after-tax cost of the bond with warrants.

21 - 36 Warrants Step 1: Find the after-tax cost of the bond with warrants.

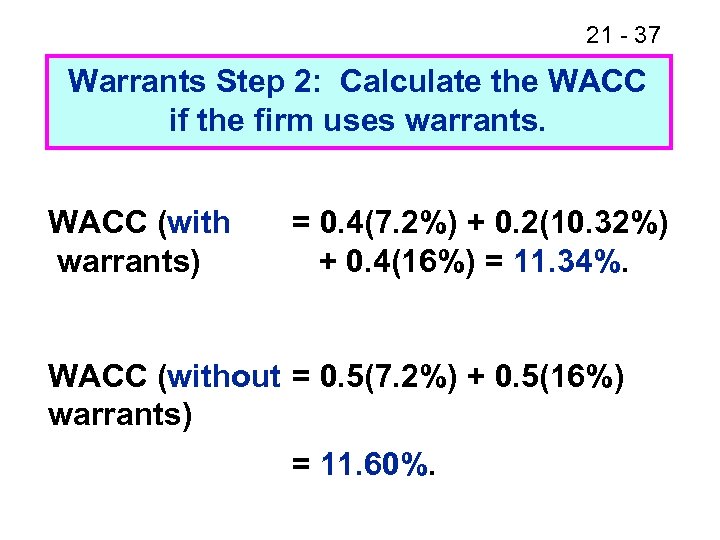

21 - 37 Warrants Step 2: Calculate the WACC if the firm uses warrants. WACC (with warrants) = 0. 4(7. 2%) + 0. 2(10. 32%) + 0. 4(16%) = 11. 34%. WACC (without = 0. 5(7. 2%) + 0. 5(16%) warrants) = 11. 60%.

21 - 37 Warrants Step 2: Calculate the WACC if the firm uses warrants. WACC (with warrants) = 0. 4(7. 2%) + 0. 2(10. 32%) + 0. 4(16%) = 11. 34%. WACC (without = 0. 5(7. 2%) + 0. 5(16%) warrants) = 11. 60%.

21 - 38 Besides cost, what other factors should be considered?

21 - 38 Besides cost, what other factors should be considered?

21 - 39

21 - 39

21 - 40 Recap the differences between warrants and convertibles.

21 - 40 Recap the differences between warrants and convertibles.

21 - 41

21 - 41

21 - 42 When should convertible issues be called?

21 - 42 When should convertible issues be called?

21 - 43

21 - 43

21 - 44 What new hybrid securities have recently been developed?

21 - 44 What new hybrid securities have recently been developed?

21 - 45

21 - 45