b8f7a33b86d75b08689f43972ecc8842.ppt

- Количество слайдов: 57

2018 Developments in academic capitalism • Sheila Slaughter • Louise Mc. Bee Professor of Higher Education • University of Georgia • Institute for Higher Education

2018 Developments in academic capitalism • Sheila Slaughter • Louise Mc. Bee Professor of Higher Education • University of Georgia • Institute for Higher Education

Research • Slaughter, S. & Leslie, L. L. , 1997. Academic capitalism: politics policies & the entreprenurial university. Johns Hopkins. • Slaughter, S. & Rhoades, G. 2004. Academic capitalism: Markets State & Higher Education. Johns Hopkins. • Sheila Slaughter and Brendan Cantwell. 2012. Transatlantic moves to the market: Academic capitalism in the US & EU. ” Higher Education. 63, 5: 583 -606. • Slaughter, S. & Taylor, B. J. (eds. ) 2016. Stratification, Privatization and Vocationalization of Higher Education in the US and EU: Competitive advantage. Springer. • Series of current working papers on MIT exchanges

Research • Slaughter, S. & Leslie, L. L. , 1997. Academic capitalism: politics policies & the entreprenurial university. Johns Hopkins. • Slaughter, S. & Rhoades, G. 2004. Academic capitalism: Markets State & Higher Education. Johns Hopkins. • Sheila Slaughter and Brendan Cantwell. 2012. Transatlantic moves to the market: Academic capitalism in the US & EU. ” Higher Education. 63, 5: 583 -606. • Slaughter, S. & Taylor, B. J. (eds. ) 2016. Stratification, Privatization and Vocationalization of Higher Education in the US and EU: Competitive advantage. Springer. • Series of current working papers on MIT exchanges

THEMES • growth of market and market like activity in the sciences and engineering, as captured by patenting

THEMES • growth of market and market like activity in the sciences and engineering, as captured by patenting

THEMES • the recent aggressive commercialization of instruction, as practiced by University of Phoenix and as captured by copyrighting in public and private higher education.

THEMES • the recent aggressive commercialization of instruction, as practiced by University of Phoenix and as captured by copyrighting in public and private higher education.

THEMES • LARGE BUT RELATIVELY “INVISIBLE” PUBLIC SUBSIDIES TO MARKET ACTIVITY

THEMES • LARGE BUT RELATIVELY “INVISIBLE” PUBLIC SUBSIDIES TO MARKET ACTIVITY

THEMES: SHIFTS IN PRIVATE/PUBLIC BOUNDARIES Universities engage in profit-taking Equity positions in start up corporations IPO's Initial Public Offerings: moving to stock exchange Litigation in defense of intellectual property Administrators & faculty holding positions in private corporations

THEMES: SHIFTS IN PRIVATE/PUBLIC BOUNDARIES Universities engage in profit-taking Equity positions in start up corporations IPO's Initial Public Offerings: moving to stock exchange Litigation in defense of intellectual property Administrators & faculty holding positions in private corporations

THEMES • Shift of cost burden to students • • • Tuition Competition among students for places Marketing to captive student audiences

THEMES • Shift of cost burden to students • • • Tuition Competition among students for places Marketing to captive student audiences

The theory of academic capitalism • New economy: knowledge raw material • • • Global Knowledge Information • Biotechnology • ICT • Nanotechnology

The theory of academic capitalism • New economy: knowledge raw material • • • Global Knowledge Information • Biotechnology • ICT • Nanotechnology

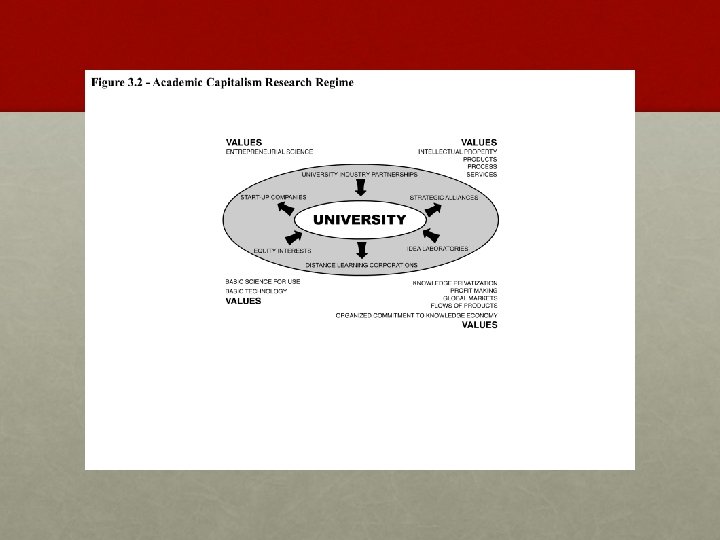

Networks link to new economy • new circuits of knowledge • interstitial organizational emergence • networks that intermediate between public and private sector • extended managerial capacity

Networks link to new economy • new circuits of knowledge • interstitial organizational emergence • networks that intermediate between public and private sector • extended managerial capacity

GLOBAL ORGANIZATION • Neo liberal policies promote • • Global agreements (GATT, GATTS) Global trade adjudication offices (WTO) Strengthened protection for intellectual property Easy movement of highly educated workers

GLOBAL ORGANIZATION • Neo liberal policies promote • • Global agreements (GATT, GATTS) Global trade adjudication offices (WTO) Strengthened protection for intellectual property Easy movement of highly educated workers

INVESTMENT & CONSUMPTION • New investment, marketing and consumption behaviors on the part of members of the university community also link them to the new economy

INVESTMENT & CONSUMPTION • New investment, marketing and consumption behaviors on the part of members of the university community also link them to the new economy

CIRCUITS OF KNOWLEDGE • Knowledge no longer moves primarily within scientific/professional/scholarly networks • University-industry-government partnerships • review of scholarly papers include degree holders from industry as well as academics • The number of scholars from industry sitting on National Science Foundation (NSF) peer review programs has risen substantially • University research is judged not only by peers but also by patent officials & corporations • Although peer review is still important within scholarly disciplines, universities as institutions no longer judge their own performance • organizations like U. S. News and World Report

CIRCUITS OF KNOWLEDGE • Knowledge no longer moves primarily within scientific/professional/scholarly networks • University-industry-government partnerships • review of scholarly papers include degree holders from industry as well as academics • The number of scholars from industry sitting on National Science Foundation (NSF) peer review programs has risen substantially • University research is judged not only by peers but also by patent officials & corporations • Although peer review is still important within scholarly disciplines, universities as institutions no longer judge their own performance • organizations like U. S. News and World Report

Interstitial organizational emergence • new organizations emerge to manage new activities related to generation of external revenue • boundary spanning • • • Technology licensing offices Economic development offices Trademark licensing offices Copyright licensing, sales & marketing Distance education

Interstitial organizational emergence • new organizations emerge to manage new activities related to generation of external revenue • boundary spanning • • • Technology licensing offices Economic development offices Trademark licensing offices Copyright licensing, sales & marketing Distance education

Intermediating networks • intermediate between public, non-profit and private sectors • • • Business Higher Education Forum University-Industry-Government Research Roundtable Internet 2, Educause League for Innovation

Intermediating networks • intermediate between public, non-profit and private sectors • • • Business Higher Education Forum University-Industry-Government Research Roundtable Internet 2, Educause League for Innovation

Extended managerial capacity to engage markets • Technology transfer offices • Start up companies, venture capital, milestone shares, equity interests, material transfer agreements, mask work, tangible property sales

Extended managerial capacity to engage markets • Technology transfer offices • Start up companies, venture capital, milestone shares, equity interests, material transfer agreements, mask work, tangible property sales

Extended managerial capacity • Digitized courseware confers rights • • • intellectual property offices technology transfer and creative works offices Distance education

Extended managerial capacity • Digitized courseware confers rights • • • intellectual property offices technology transfer and creative works offices Distance education

Extended managerial capacity • Copyright: • video recordings, study guides, tests, syllabi, bibliographies, texts, film strips, charts, transparencies, other visual aids, programmed instructional materials, live video and audio broadcasts, and computer software including programs, program descriptions, and documentation of integrated circuit and databases

Extended managerial capacity • Copyright: • video recordings, study guides, tests, syllabi, bibliographies, texts, film strips, charts, transparencies, other visual aids, programmed instructional materials, live video and audio broadcasts, and computer software including programs, program descriptions, and documentation of integrated circuit and databases

Market behaviors • Fees • Stimulation of consumption • • • Luxury student dormitories Recreation centers Mini-malls Computing Facilities Wired port-to-pillow ratio • Stimulates • Increased tuition

Market behaviors • Fees • Stimulation of consumption • • • Luxury student dormitories Recreation centers Mini-malls Computing Facilities Wired port-to-pillow ratio • Stimulates • Increased tuition

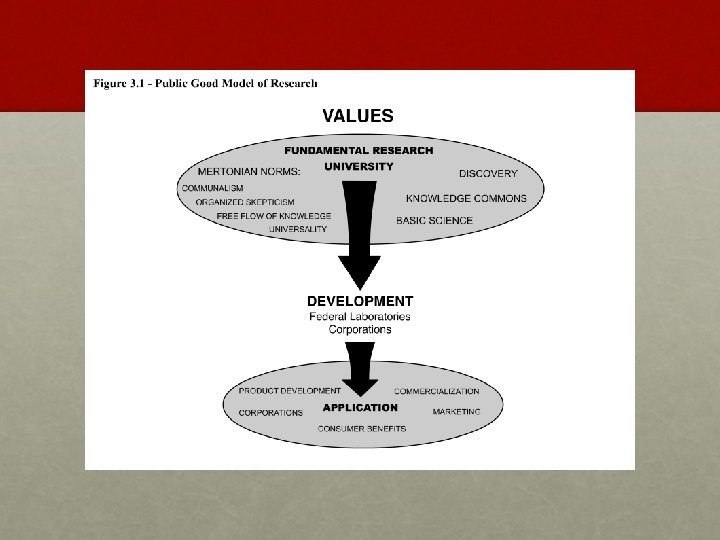

SHIFTING KNOWLEDGE/LEARNING REGIMES • Overall, we conceptualize colleges and universities as shifting from a public good knowledge/learning regime to an academic capitalist knowledge/learning regime. • The public good knowledge regime was characterized by Mertonian norms • communalism, universality, the free flow of knowledge, and organized skepticism--were associated with the public good model

SHIFTING KNOWLEDGE/LEARNING REGIMES • Overall, we conceptualize colleges and universities as shifting from a public good knowledge/learning regime to an academic capitalist knowledge/learning regime. • The public good knowledge regime was characterized by Mertonian norms • communalism, universality, the free flow of knowledge, and organized skepticism--were associated with the public good model

academic capitalism knowledge/learning regime • values knowledge privatization and profit taking in which institutions, inventor faculty • corporations have claims that come before those of the public • Public interest in science goods are subsumed in the increased growth expected from a strong knowledge economy.

academic capitalism knowledge/learning regime • values knowledge privatization and profit taking in which institutions, inventor faculty • corporations have claims that come before those of the public • Public interest in science goods are subsumed in the increased growth expected from a strong knowledge economy.

Academic capitalism • Professors are obligated to disclose discoveries to their institutions, which have the authority to determine how knowledge shall be used. • The cornerstones of the academic capitalism model are basic science for use and basic technology, models that make the case that science is embedded in commercial possibility • These models see little separation between science and commercial activity. • Discovery is valued because it leads to high-technology products for a knowledge economy.

Academic capitalism • Professors are obligated to disclose discoveries to their institutions, which have the authority to determine how knowledge shall be used. • The cornerstones of the academic capitalism model are basic science for use and basic technology, models that make the case that science is embedded in commercial possibility • These models see little separation between science and commercial activity. • Discovery is valued because it leads to high-technology products for a knowledge economy.

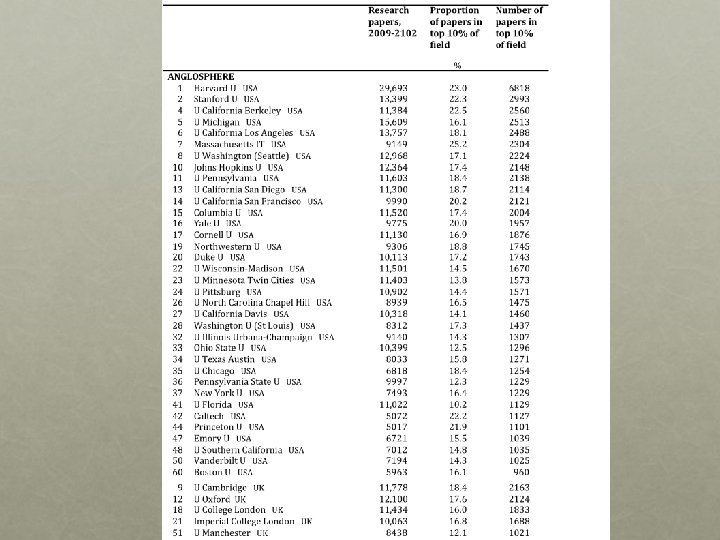

STRATIFICATION • Simon Marginson • National Level • Binary • The elite system & all the rest • Elite: great value • Non-elite: little or no value • US: Elite private universities, flagship state universities • France: Elite public, some elite privates, all the rest

STRATIFICATION • Simon Marginson • National Level • Binary • The elite system & all the rest • Elite: great value • Non-elite: little or no value • US: Elite private universities, flagship state universities • France: Elite public, some elite privates, all the rest

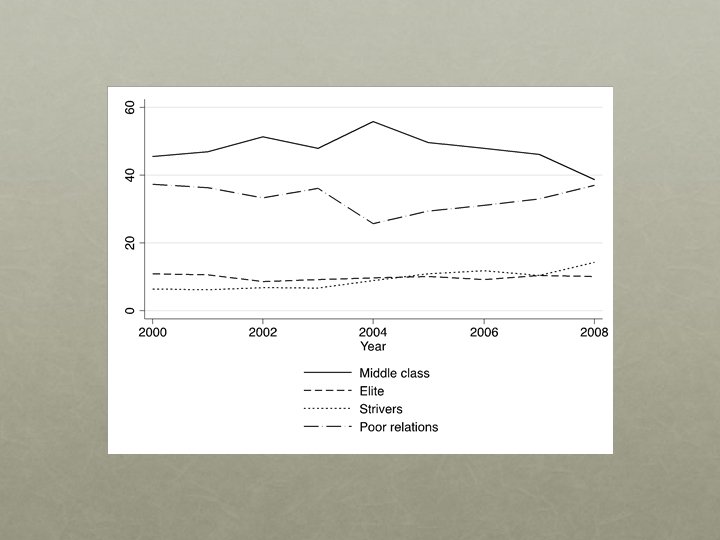

U. S. Research Universities Barrett Jay Taylor Stratification patterns among research universities in US Why some produce more research than others High & very high research intensive: 119 public, 48 private • Multilevel latent class analysis 2000 -2008 • Faculty members per 100 FTE students: Variables • BA degrees granted • selectivity • tuition $ • general subsidy per FTE • federally funded R&D • industry funded R&D • state funded R&D • Doctoral degrees granted

U. S. Research Universities Barrett Jay Taylor Stratification patterns among research universities in US Why some produce more research than others High & very high research intensive: 119 public, 48 private • Multilevel latent class analysis 2000 -2008 • Faculty members per 100 FTE students: Variables • BA degrees granted • selectivity • tuition $ • general subsidy per FTE • federally funded R&D • industry funded R&D • state funded R&D • Doctoral degrees granted

PUBLIC UNIVERSITIES • Elites: University of California-Berkeley, University of Wisconsin-Madison, Georgia Tech • Mainly flagships, but only 10 -12 • Strivers: those who want to be elites, 7 -17 • Penn State, U. of Pittsburgh • Middle Class: universities do some research, 46 -63 • Kansas State University, University of Tennessee, Oregon State • Poor relations: all the rest, 29 -43

PUBLIC UNIVERSITIES • Elites: University of California-Berkeley, University of Wisconsin-Madison, Georgia Tech • Mainly flagships, but only 10 -12 • Strivers: those who want to be elites, 7 -17 • Penn State, U. of Pittsburgh • Middle Class: universities do some research, 46 -63 • Kansas State University, University of Tennessee, Oregon State • Poor relations: all the rest, 29 -43

Elites • What differentiates • • Selective admissions More faculty members per 100 FTE Greater state subsidy (CA, GA, WI) Abundant federal research resources

Elites • What differentiates • • Selective admissions More faculty members per 100 FTE Greater state subsidy (CA, GA, WI) Abundant federal research resources

Private Universities • New variable: endowments • R&D super elite: JHU & CAL Tech, 2 • Private money + industry super elite: Duke & MIT, 2 • Elite with old endowment money: Harvard, Yale, Stanford, etc. 15 -19 • Tuition focused: Boston University, Vanderbilt, 25 -27

Private Universities • New variable: endowments • R&D super elite: JHU & CAL Tech, 2 • Private money + industry super elite: Duke & MIT, 2 • Elite with old endowment money: Harvard, Yale, Stanford, etc. 15 -19 • Tuition focused: Boston University, Vanderbilt, 25 -27

Elite private • Robust capacities for both instruction and research • employed more faculty members • admitted fewer applicants • spent more of their own funds on education • Elite privates collected significantly more research support from the federal and state governments • expended far more of their own funds on R&D • Largest numbers of doctorates per 100 FTE relative to the sample average • largest per-student endowments of any group

Elite private • Robust capacities for both instruction and research • employed more faculty members • admitted fewer applicants • spent more of their own funds on education • Elite privates collected significantly more research support from the federal and state governments • expended far more of their own funds on R&D • Largest numbers of doctorates per 100 FTE relative to the sample average • largest per-student endowments of any group

Private v Public Capacities of private universities extended on a scale that dwarfed what was found among elite publics This gap proved evident whether measured by faculty members per student, admission selectivity, non-tuition instructional spending, or doctorates produced. Nowhere was this “private advantage” more pronounced, however, than in federal R&D support. On average, elite privates collected about 180% of the per-student federal R&D expenditures of elite publics.

Private v Public Capacities of private universities extended on a scale that dwarfed what was found among elite publics This gap proved evident whether measured by faculty members per student, admission selectivity, non-tuition instructional spending, or doctorates produced. Nowhere was this “private advantage” more pronounced, however, than in federal R&D support. On average, elite privates collected about 180% of the per-student federal R&D expenditures of elite publics.

Why MORE Research $ • Not necessarily because that private (non-profit, foundations) are more autonomous, nimble, flexible, focused, etc. • All Public universities face declining funds from their states • • • Neo liberal state money is redistributes upward to wealthy, whether organizations or individuals Some non-profits are a vehicle for this no taxes • tuition support from several states (NY example), research support • • • Growth of rich who may donate: 1% Changes in rules re donations to encourage changes in investing practices Resources are necessary for research; resources and prestige are conflated • .

Why MORE Research $ • Not necessarily because that private (non-profit, foundations) are more autonomous, nimble, flexible, focused, etc. • All Public universities face declining funds from their states • • • Neo liberal state money is redistributes upward to wealthy, whether organizations or individuals Some non-profits are a vehicle for this no taxes • tuition support from several states (NY example), research support • • • Growth of rich who may donate: 1% Changes in rules re donations to encourage changes in investing practices Resources are necessary for research; resources and prestige are conflated • .

NEOliberal state • Neoliberal state: dominant philosophy underpinning economic policymaking • characterized by active deregulation and state-support for liberalized financial markets, and massive expansion in global financial exchange • Although the state is disfavored in neoliberal philosophy because it is seen as encumbering the free and efficient operation of markets, neoliberalism is, at least in part, a state-led project as the state dismantled its regulatory capacity while providing protection to financial risktakers (Harvey 2007)

NEOliberal state • Neoliberal state: dominant philosophy underpinning economic policymaking • characterized by active deregulation and state-support for liberalized financial markets, and massive expansion in global financial exchange • Although the state is disfavored in neoliberal philosophy because it is seen as encumbering the free and efficient operation of markets, neoliberalism is, at least in part, a state-led project as the state dismantled its regulatory capacity while providing protection to financial risktakers (Harvey 2007)

Submerged state Mettler 2011 • web of policies that utilize market-like mechanisms “the submerged state • Shapes competition in higher education markets for R&D • Quasi-markets for research • competitions between public and private providers to secure funds that will allow them to pursue public purposes • promise increases in efficiency because they borrow from the neoclassical economic logics that accompany neoliberal policies • mode of government channels wealth upward to alreadyadvantaged individuals, households, and organizations

Submerged state Mettler 2011 • web of policies that utilize market-like mechanisms “the submerged state • Shapes competition in higher education markets for R&D • Quasi-markets for research • competitions between public and private providers to secure funds that will allow them to pursue public purposes • promise increases in efficiency because they borrow from the neoclassical economic logics that accompany neoliberal policies • mode of government channels wealth upward to alreadyadvantaged individuals, households, and organizations

IMPLICATIONS OF PRIVATE ADVANTAGE • Advantage depends on small numbers of students & large endowments • Advantage depends on non-transparent government policies that redistribute resources upward • Public universities, which historically educated large numbers of students at all levels, are disadvantaged

IMPLICATIONS OF PRIVATE ADVANTAGE • Advantage depends on small numbers of students & large endowments • Advantage depends on non-transparent government policies that redistribute resources upward • Public universities, which historically educated large numbers of students at all levels, are disadvantaged

Slaughter & Barringer • Trustees of public & private universities • Illustrate mechanisms through which private universities redistribute upwards • Connection to firms • Private trustees connect to more firms, more in Fortune 500, more in knowledge intensive and high tech industries • Channels to industry & innovation • Almost all trustees donate

Slaughter & Barringer • Trustees of public & private universities • Illustrate mechanisms through which private universities redistribute upwards • Connection to firms • Private trustees connect to more firms, more in Fortune 500, more in knowledge intensive and high tech industries • Channels to industry & innovation • Almost all trustees donate

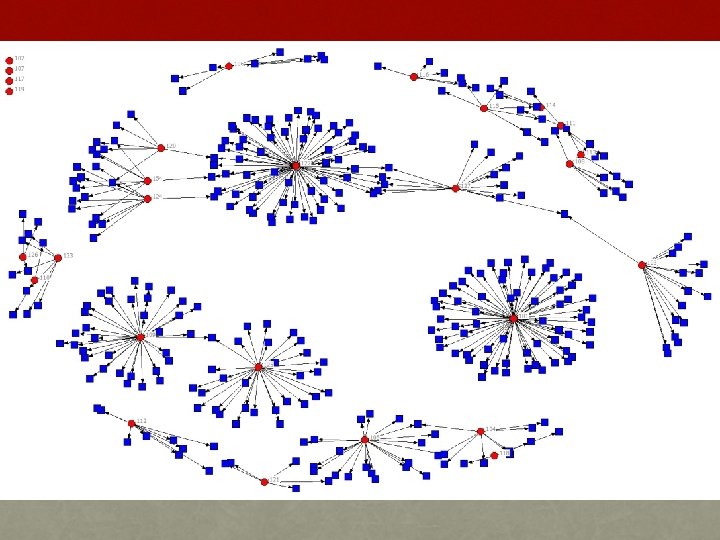

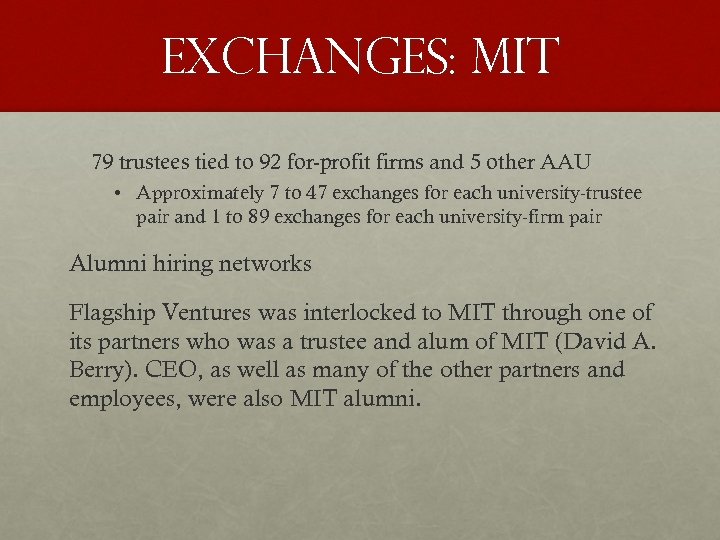

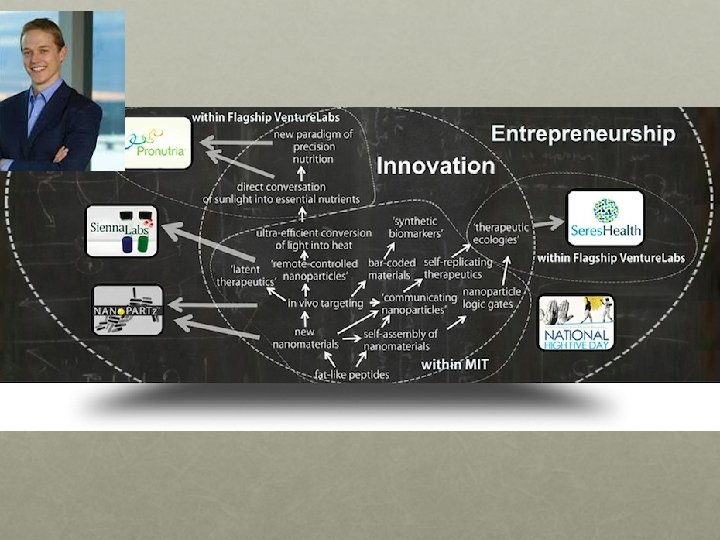

EXCHANGES: MIT 79 trustees tied to 92 for-profit firms and 5 other AAU • Approximately 7 to 47 exchanges for each university-trustee pair and 1 to 89 exchanges for each university-firm pair Alumni hiring networks Flagship Ventures was interlocked to MIT through one of its partners who was a trustee and alum of MIT (David A. Berry). CEO, as well as many of the other partners and employees, were also MIT alumni.

EXCHANGES: MIT 79 trustees tied to 92 for-profit firms and 5 other AAU • Approximately 7 to 47 exchanges for each university-trustee pair and 1 to 89 exchanges for each university-firm pair Alumni hiring networks Flagship Ventures was interlocked to MIT through one of its partners who was a trustee and alum of MIT (David A. Berry). CEO, as well as many of the other partners and employees, were also MIT alumni.

EXCHANGES Flagship invests in three principle business sectors: Therapeutics;

EXCHANGES Flagship invests in three principle business sectors: Therapeutics;

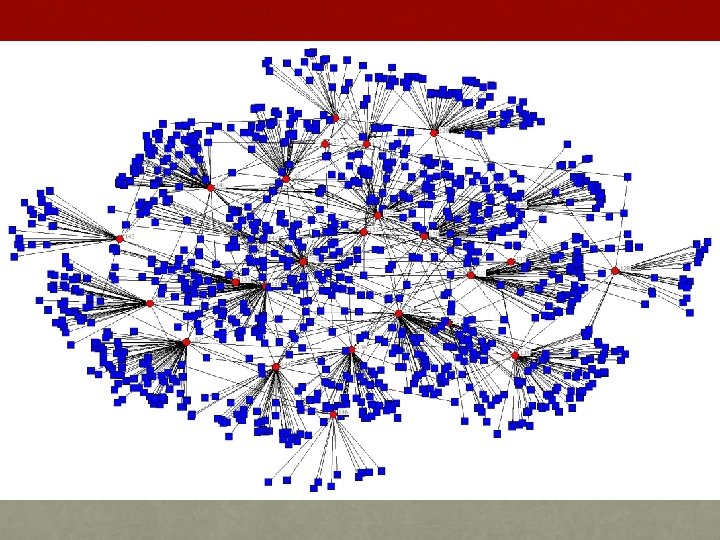

exchanges • Trustees were on visiting committees and advisory boards to schools & departments. This also worked in reverse, many MIT faculty were on corporate advisory boards & committees, or on boards of trustees of startups. • The exchanges also involved partnerships, collaborative research, sponsorship of departments, research initiatives, centers, and institutes, and the cosponsorship of startup firms

exchanges • Trustees were on visiting committees and advisory boards to schools & departments. This also worked in reverse, many MIT faculty were on corporate advisory boards & committees, or on boards of trustees of startups. • The exchanges also involved partnerships, collaborative research, sponsorship of departments, research initiatives, centers, and institutes, and the cosponsorship of startup firms

Exchanges • Finance • Some trustees represented financial corporations and acted on the investment committee of the university or as the director of the investment corporation • Government • Head US Department of Energy • Board of MIT Energy Initiative

Exchanges • Finance • Some trustees represented financial corporations and acted on the investment committee of the university or as the director of the investment corporation • Government • Head US Department of Energy • Board of MIT Energy Initiative

Endowment management • Brendan Cantwell • The death of the “Prudent Man” • 1969 Ford Foundation funded Barker Report • Growth of non-profits • Non-policy of no regulation

Endowment management • Brendan Cantwell • The death of the “Prudent Man” • 1969 Ford Foundation funded Barker Report • Growth of non-profits • Non-policy of no regulation

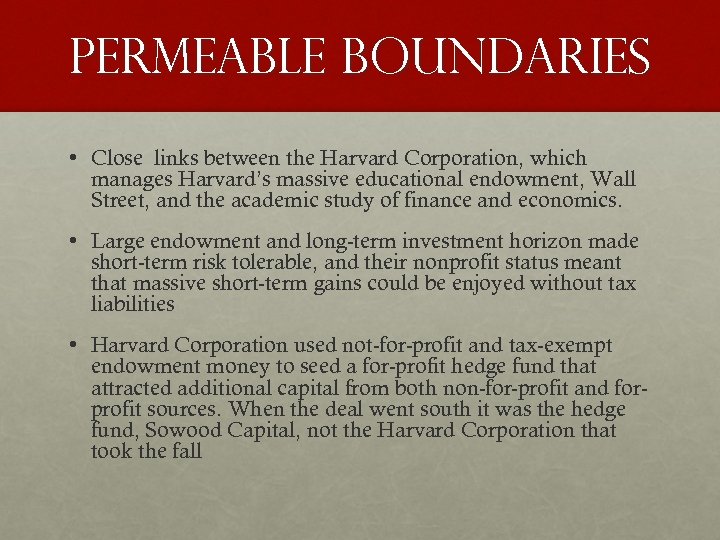

Permeable boundaries • Close links between the Harvard Corporation, which manages Harvard’s massive educational endowment, Wall Street, and the academic study of finance and economics. • Large endowment and long-term investment horizon made short-term risk tolerable, and their nonprofit status meant that massive short-term gains could be enjoyed without tax liabilities • Harvard Corporation used not-for-profit and tax-exempt endowment money to seed a for-profit hedge fund that attracted additional capital from both non-for-profit and forprofit sources. When the deal went south it was the hedge fund, Sowood Capital, not the Harvard Corporation that took the fall

Permeable boundaries • Close links between the Harvard Corporation, which manages Harvard’s massive educational endowment, Wall Street, and the academic study of finance and economics. • Large endowment and long-term investment horizon made short-term risk tolerable, and their nonprofit status meant that massive short-term gains could be enjoyed without tax liabilities • Harvard Corporation used not-for-profit and tax-exempt endowment money to seed a for-profit hedge fund that attracted additional capital from both non-for-profit and forprofit sources. When the deal went south it was the hedge fund, Sowood Capital, not the Harvard Corporation that took the fall

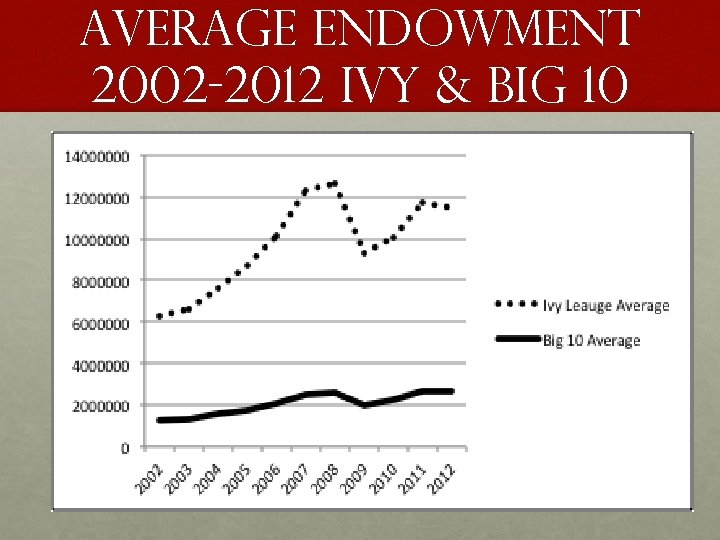

Average endowment 2002 -2012 IVY & BIG 10

Average endowment 2002 -2012 IVY & BIG 10

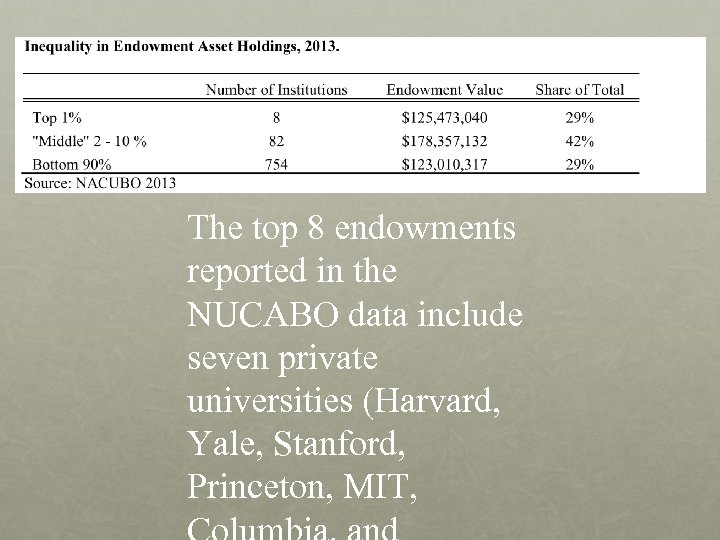

The top 8 endowments reported in the NUCABO data include seven private universities (Harvard, Yale, Stanford, Princeton, MIT,

The top 8 endowments reported in the NUCABO data include seven private universities (Harvard, Yale, Stanford, Princeton, MIT,

PUBLIC CATCH-UP • FOUNDATION CREATION • By mid 1990 s all AAU publics have endowment & research foundations • Member of these boards more closely resemble those of private boards in occupation and numbers • Some public foundations have made substantial gains

PUBLIC CATCH-UP • FOUNDATION CREATION • By mid 1990 s all AAU publics have endowment & research foundations • Member of these boards more closely resemble those of private boards in occupation and numbers • Some public foundations have made substantial gains

PRIVATE ADVANTAGE • Generally, we think segments of the non-profit sector are mechanisms through which the neoliberal state redistributes upward • • • Sector has expanded greatly since the 1990 s Expansion was unchecked by state regulation Yale endowment investment model Assets approach those of for-profit sector In many cases “clients” are no longer objects of charity • Private Universities are an example • Think tanks that promote the neo-liberal or submerged state along with conservative agendas • Hospitals

PRIVATE ADVANTAGE • Generally, we think segments of the non-profit sector are mechanisms through which the neoliberal state redistributes upward • • • Sector has expanded greatly since the 1990 s Expansion was unchecked by state regulation Yale endowment investment model Assets approach those of for-profit sector In many cases “clients” are no longer objects of charity • Private Universities are an example • Think tanks that promote the neo-liberal or submerged state along with conservative agendas • Hospitals

broaden study of postsecondary • Need to study broader structures of power • • Submerged state Agencies and field within that are crucial • • Research policy and agencies Economic stimulus Tax policy Regulatory polices

broaden study of postsecondary • Need to study broader structures of power • • Submerged state Agencies and field within that are crucial • • Research policy and agencies Economic stimulus Tax policy Regulatory polices

Public good • Who is the public? • Multiversities for the middle class • Move away from education and knowledge that redistribute benefits to the few • No frills, low tuition, high student-faculty ratios • Re-purpose mission agencies to research that benefits the citizenry as well as corporations • We have more social than technical problems, rebuild social sciences and humanities

Public good • Who is the public? • Multiversities for the middle class • Move away from education and knowledge that redistribute benefits to the few • No frills, low tuition, high student-faculty ratios • Re-purpose mission agencies to research that benefits the citizenry as well as corporations • We have more social than technical problems, rebuild social sciences and humanities

PUBLIC GOOD • Consider separating graduate from undergraduate education • Graduate education as federalized • Consider tax on endowments at certain limits

PUBLIC GOOD • Consider separating graduate from undergraduate education • Graduate education as federalized • Consider tax on endowments at certain limits