6e2c31ccb7648c671b7b806fa0441d2f.ppt

- Количество слайдов: 1

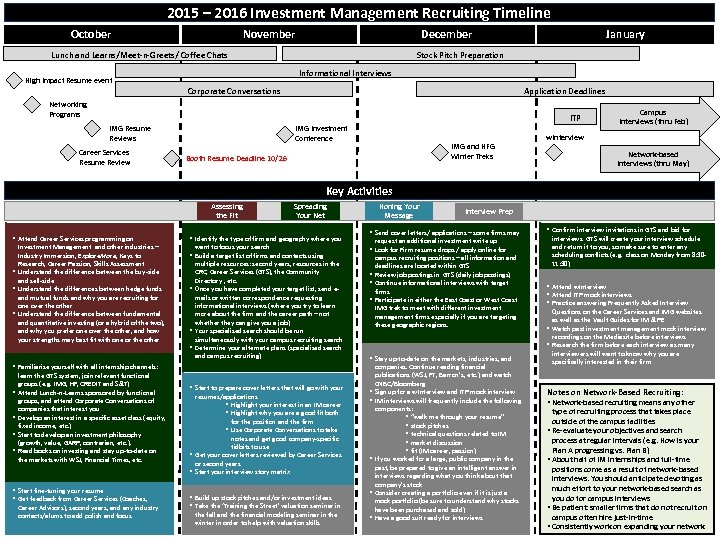

2015 – 2016 Investment Management Recruiting Timeline November October Lunch and Learns/Meet-n-Greets/ Coffee Chats High Impact Resume event January December Stock Pitch Preparation Informational Interviews Corporate Conversations Application Deadlines Networking Programs ITP IMG Resume Reviews Career Services Resume Review IMG Investment Conference IMG and HFG Winter Treks Booth Resume Deadline 10/26 Campus Interviews (thru Feb) w. Interview Network-based Interviews (thru May) Key Activities Assessing the Fit • Attend Career Services programming on Investment Management and other industries – Industry Immersion, Explore. More, Keys to Research, Career Passion, Skills Assessment • Understand the difference between the buy-side and sell-side • Understand the differences between hedge funds and mutual funds and why you are recruiting for one over the other • Understand the difference between fundamental and quantitative investing (or a hybrid of the two), and why you prefer one over the other, and how your strengths may best fit with one or the other Spreading Your Net • Identify the type of firm and geography where you • • want to focus your search Build a target list of firms and contacts using multiple resources: second years, resources in the CRC, Career Services (GTS), the Community Directory , etc. Once you have completed your target list, send emails or written correspondence requesting informational interviews (where you try to learn more about the firm and the career path – not whether they can give you a job) Your specialized search should be run simultaneously with your campus recruiting search Determine your alternate plans (specialized search and campus recruiting) Honing Your Message • Send cover letters/ applications – some firms may • • • Start fine-tuning your resume • Get feedback from Career Services (Coaches, Career Advisors), second years, and any industry contacts/alums to add polish and focus • Start to prepare cover letters that will go with your resumes/applications • Highlight your interest in an IM career • Highlight why you are a good fit both for the position and the firm • Use Corporate Conversations to take notes and get good company-specific tidbits to use • Get your cover letters reviewed by Career Services or second years • Start your interview story matrix • Build up stock pitches and/or investment ideas • Take the ‘Training the Street’ valuation seminar in the fall and the financial modeling seminar in the winter in order to help with valuation skills request an additional investment write up Look for Firm resume drops / apply online for campus recruiting positions – all information and deadlines are located within GTS Review job postings in GTS (daily job postings) Continue informational interviews with target firms Participate in either the East Coast or West Coast IMG trek to meet with different investment management firms especially if you are targeting these geographic regions. • Stay up-to-date on the markets, industries, and • Familiarize yourself with all internship channels: learn the GTS system, join relevant functional groups (e. g. IMG, HF, CREDIT and S&T) Attend Lunch-n-Learns sponsored by functional groups, and attend Corporate Conversations of companies that interest you Develop an interest in a specific asset class (equity, fixed income, etc. ) Start to develop an investment philosophy (growth, value, GARP, contrarian, etc. ). Read books on investing and stay up-to-date on the markets with WSJ, Financial Times, etc. Interview Prep • • • companies. Continue reading financial publications (WSJ, FT, Barron’s, etc. ) and watch CNBC/Bloomberg Sign up for a w. Interview and ITP mock interview IM interviews will frequently include the following components: • “walk me through your resume” • stock pitches • technical questions related to IM • market discussion • fit (IM career, passion) If you worked for a large, public company in the past, be prepared to give an intelligent answer in interviews regarding what you think about that company’s stock Consider creating a portfolio even if it is just a mock portfolio (be sure to understand why stocks have been purchased and sold) Have a good suit ready for interviews • Confirm interview invitations in GTS and bid for interviews. GTS will create your interview schedule and return it to you, so make sure to enter any scheduling conflicts (e. g. class on Monday from 8: 3011: 30) • Attend w. Interview • Attend ITP mock interviews • Practice answering Frequently Asked Interview Questions on the Career Services and IMG websites as well as the Vault Guides for IM & PE • Watch past investment management mock interview recordings on the Mediasite before interviews • Research the firm before each interview as many interviewers will want to know why you are specifically interested in their firm Notes on Network-Based Recruiting: • Network-based recruiting means any other type of recruiting process that takes place outside of the campus facilities • Re-evaluate your objectives and search process at regular intervals (e. g. How is your Plan A progressing vs. Plan B) • About half of IM internships and full-time positions come as a result of network-based interviews. You should anticipate devoting as much effort to your network-based search as you do for campus interviews • Be patient: smaller firms that do not recruit on campus often hire just-in-time • Consistently work on expanding your network

6e2c31ccb7648c671b7b806fa0441d2f.ppt