f15892e9def7a8a45da2d822233da2cc.ppt

- Количество слайдов: 51

2014 & Beyond: Are You Prepared? • Presented by: • Brad Pricer, JD, GBA & Carl Pilger, JD CUNA Mutual Group Proprietary Reproduction, Adaptation or Distribution Prohibited © CUNA Mutual Group 2013

Session Overview Today, we’ll cover: • Sharing responsibilities under ACA • Individual Responsibility • Employer Responsibilities • The Marketplace • Question & Answer Bradley Pricer, JD, GBA Senior Manager Employee Benefits CUNA Mutual Group Carl Pilger, JD Vice President, Legal Counsel Digital Benefits Advisors

Health Care Reform Patient Protection and Affordable Care Act of 2010 (PPACA) HOW DID WE GET HERE & WHERE DO WE GO NOW? 3

Where Do We Stand? • SCOTUS Ruling Ø 5 -4 vote Ø Chief Justice Roberts wrote majority opinion Rationale: Ø No Commerce Clause or Necessary and Proper clause authority Ø Authority to enact mandate comes from taxing power Ø Individuals can choose to obtain coverage or pay higher taxes Dissent Ø Would have overturned entire law • Election • Who was waiting? – Businesses – Government – look for a flurry of proposed rules and clarifications

What Does All This Mean to Credit Unions? Time to Act Broker/consultant and/or carrier must confirm you are in compliance Ø ACA changes already in effect will remain in effect Ø ACA’s provisions that are not currently in effect will continue to be implemented Continue to prepare and take stock of steps already taken

Act Now – Why? DOL is beginning to audit ACA compliance New development, ramifications still not clear…but concerning What has the DOL requested? Depends on “status” of plan – Grandfathered plans: • Records documenting the terms of the plan on March 23, 2010, and any additional documents to confirm the plan’s grandfathered status; and • The participant notice of grandfathered status included in materials that describe the benefits provided under the plan – Non- grandfathered plans • Documents related to preventive health services for each plan year beginning on or after 9/23/10; • The plan’s internal claims and appeals procedures; • Contracts or agreements with independent review organizations or TPAs providing external review • Notices regarding adverse benefit determinations and final external review determination notices; and • Documents relating to the plan’s emergency services benefit – All plans • A sample notice describing enrollment opportunities for children up to age 2 for plans with dependent coverage; • A list of participants who have had their coverage rescinded and the reasons for the rescissions; • Documents related to any lifetime limit that has been imposed under the plan since 9/23/10; and • Documents related to any annual limit that has been imposed under the plan since 9/23/10

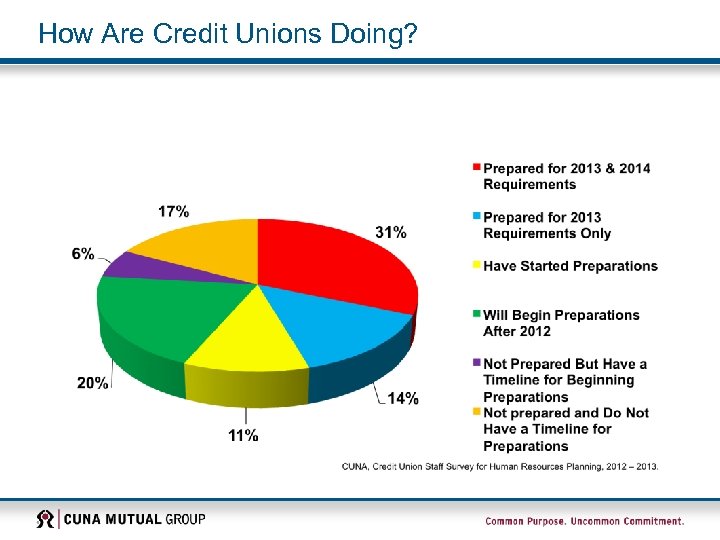

How Are Credit Unions Doing?

What Do I Need to Do? Requirements Already in Effect: Ø Coverage for dependent children up to age 26 Ø Removal of dollar maximums on essential benefits Ø Maintenance of 100% Preventive Care coverage for those that lost Grandfathered status Ø Maintenance of External Claims Review Process Ø Maintenance of Summary of Benefits and Coverage communication packages Ø Handling of options for Medicare Eligible retirees and dependents for prescription drugs Ø Benefit changes for Flexible Spending Accounts Ø Other provisions (pre-existing conditions, rescission, discrimination, etc. )

Requirements Going into Effect 2012 - 2013 Ø Annual limits Ø W-2 reporting requirements beginning with 2012 tax year Ø Women’s preventive care services Ø Medical loss ratio rebates Ø Summary of benefits and coverage Ø Comparative effectiveness research (CER) fees Ø FSA $2, 500 contribution limit Ø Elimination of retiree drug subsidy deduction Ø Additional Medicare tax withholding Ø Health insurance exchanges – notice of availability

Health Care Reform Patient Protection and Affordable Care Act of 2010 (PPACA) SHARING RESPONSIBILITIES – EMPLOYERS 10

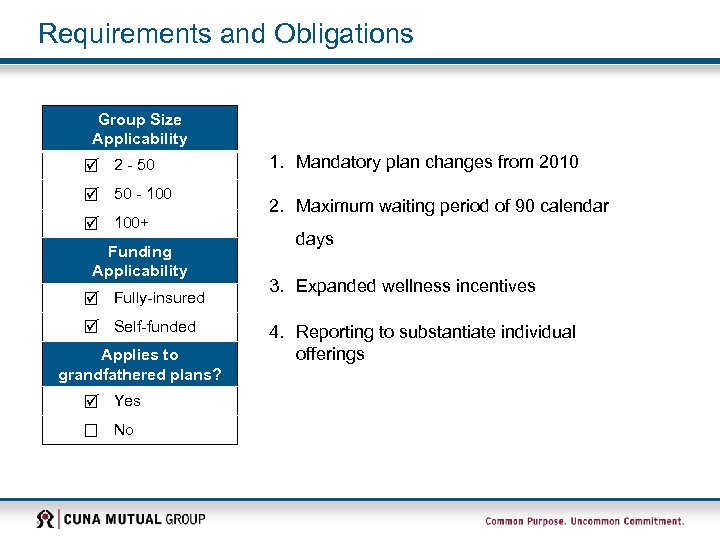

Requirements and Obligations Group Size Applicability 2 - 50 - 100+ Funding Applicability Fully-insured Self-funded Applies to grandfathered plans? Yes No 1. Mandatory plan changes from 2010 2. Maximum waiting period of 90 calendar days 3. Expanded wellness incentives 4. Reporting to substantiate individual offerings

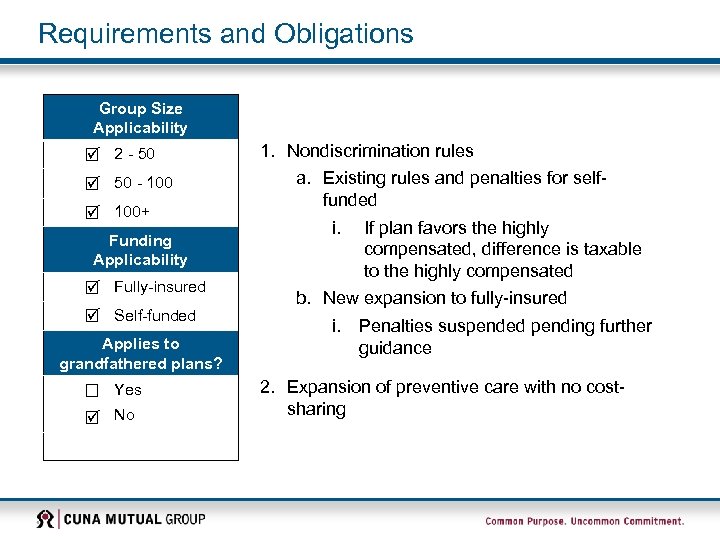

Requirements and Obligations Group Size Applicability 2 - 50 - 100+ Funding Applicability Fully-insured Self-funded Applies to grandfathered plans? Yes No 1. Nondiscrimination rules a. Existing rules and penalties for selffunded i. If plan favors the highly compensated, difference is taxable to the highly compensated b. New expansion to fully-insured i. Penalties suspended pending further guidance 2. Expansion of preventive care with no costsharing

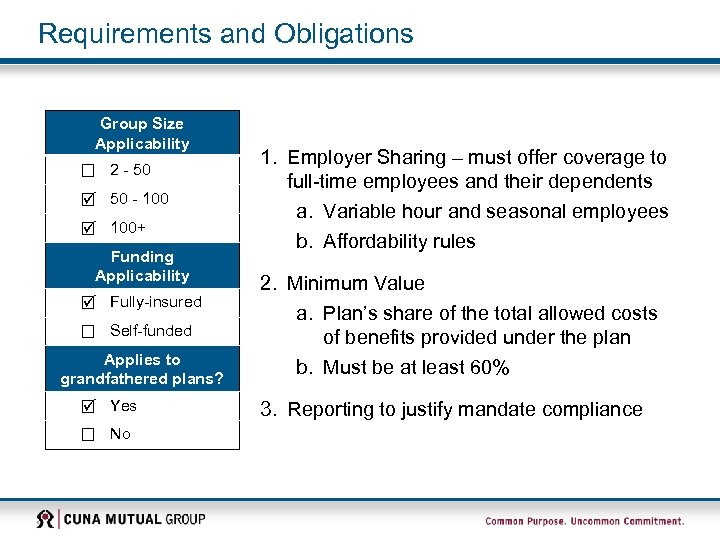

Requirements and Obligations Group Size Applicability 2 - 50 - 100+ Funding Applicability Fully-insured Self-funded Applies to grandfathered plans? Yes No 1. Employer Sharing – must offer coverage to full-time employees and their dependents a. Variable hour and seasonal employees b. Affordability rules 2. Minimum Value a. Plan’s share of the total allowed costs of benefits provided under the plan b. Must be at least 60% 3. Reporting to justify mandate compliance

Applicable Large Employer Review of Prior Rules • All employees, including seasonal, are counted to determine status Employer Sharing Responsibility • An employee is an individual who is an employee under common law standard Proposed Amendment • Leased employees are not crossreferenced under IRC § 4980 H • A sole proprietor or 2% S-corp. shareholder is typically not an employee • All full-time and full-time equivalent employees are counted REG-138006 -12 (CMS-9958 -P) 1/2/13

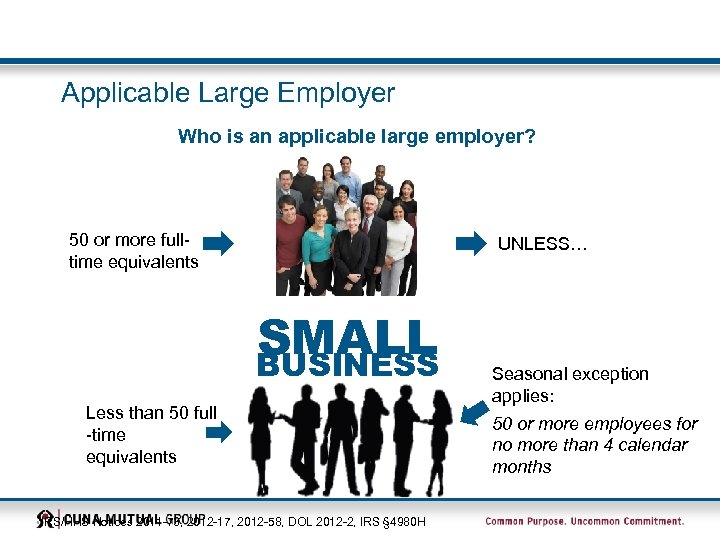

Applicable Large Employer Who is an applicable large employer? 50 or more fulltime equivalents UNLESS… SMALL BUSINESS Less than 50 full -time equivalents IRS/HHS Notices 2011 -73, 2012 -17, 2012 -58, DOL 2012 -2, IRS § 4980 H Seasonal exception applies: 50 or more employees for no more than 4 calendar months

Employer Definitions Employer Entity that is the employer of an employee under the common-law test. IRS § 4980 H, IRS § 414(b), (c), (m), or (o) Entities Counted as One Employer All entities treated as a single employer under § 414(b), (c), (m), or (o) are treated as a single employer for purposes of § 4980 H. IRS § 414 • 414(b) - all corporations of a controlled group of corporations • 414(c) - trades or businesses under common control • 414(m) - all employees of an affiliated service group • 414(o) – Discretionary regulations to prevent the avoidance of any employee benefit requirement

Employee Definitions Employees Included in Calculations • All full-time employees with, on average, 30 hours or more of service per week; (130 hours if using a monthly standard) • Part-time, variable, or seasonal employees • Hours for services performed outside the U. S. for which an individual receives U. S. source income Employer Sharing Responsibility REG-138006 -12 Proposed Amendment (CMS-9958 -P) 1/2/13

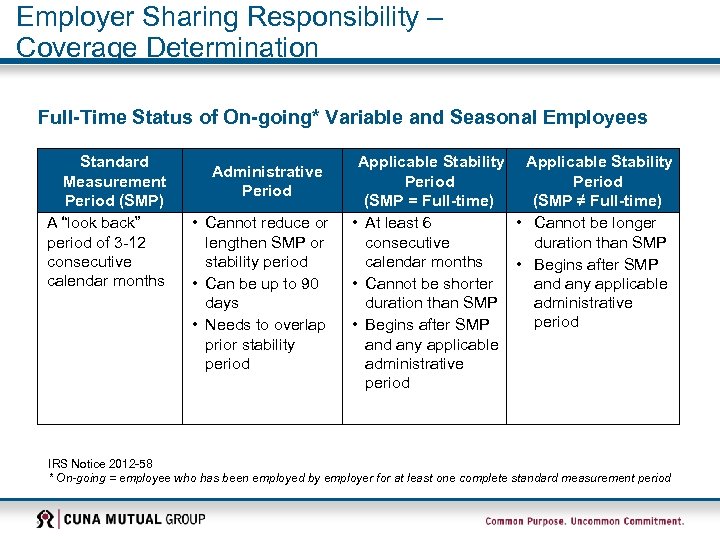

Employer Sharing Responsibility – Coverage Determination Full-Time Status of On-going* Variable and Seasonal Employees Standard Measurement Period (SMP) A “look back” period of 3 -12 consecutive calendar months Administrative Period • Cannot reduce or lengthen SMP or stability period • Can be up to 90 days • Needs to overlap prior stability period Applicable Stability Period (SMP = Full-time) (SMP ≠ Full-time) • At least 6 • Cannot be longer consecutive duration than SMP calendar months • Begins after SMP • Cannot be shorter and any applicable duration than SMP administrative period • Begins after SMP and any applicable administrative period IRS Notice 2012 -58 * On-going = employee who has been employed by employer for at least one complete standard measurement period

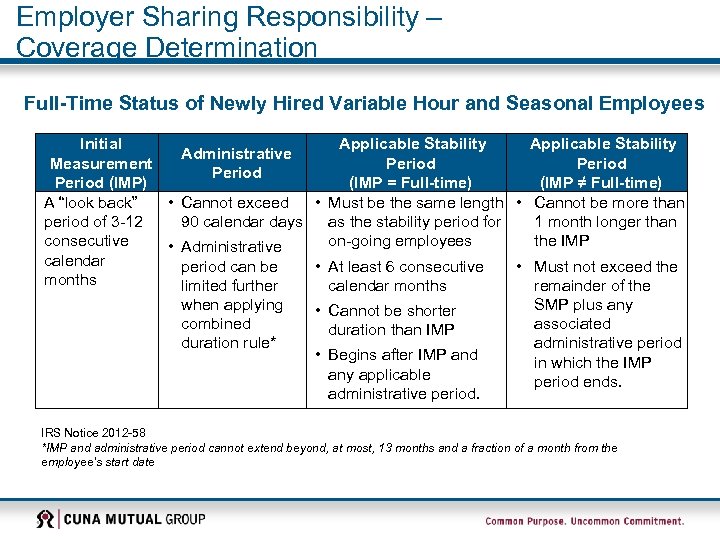

Employer Sharing Responsibility – Coverage Determination Full-Time Status of Newly Hired Variable Hour and Seasonal Employees Initial Applicable Stability Administrative Measurement Period (IMP) (IMP = Full-time) (IMP ≠ Full-time) A “look back” • Cannot exceed • Must be the same length • Cannot be more than period of 3 -12 90 calendar days as the stability period for 1 month longer than consecutive on-going employees the IMP • Administrative calendar period can be • At least 6 consecutive • Must not exceed the months limited further calendar months remainder of the when applying SMP plus any • Cannot be shorter combined associated duration than IMP duration rule* administrative period • Begins after IMP and in which the IMP any applicable period ends. administrative period. IRS Notice 2012 -58 *IMP and administrative period cannot extend beyond, at most, 13 months and a fraction of a month from the employee’s start date

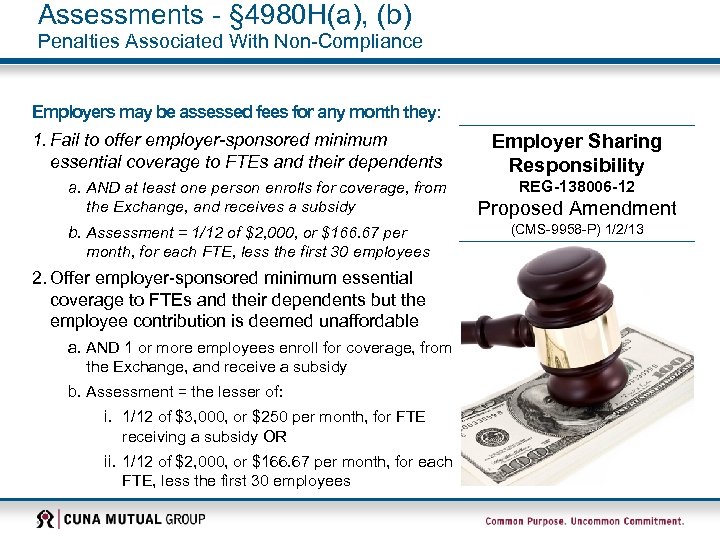

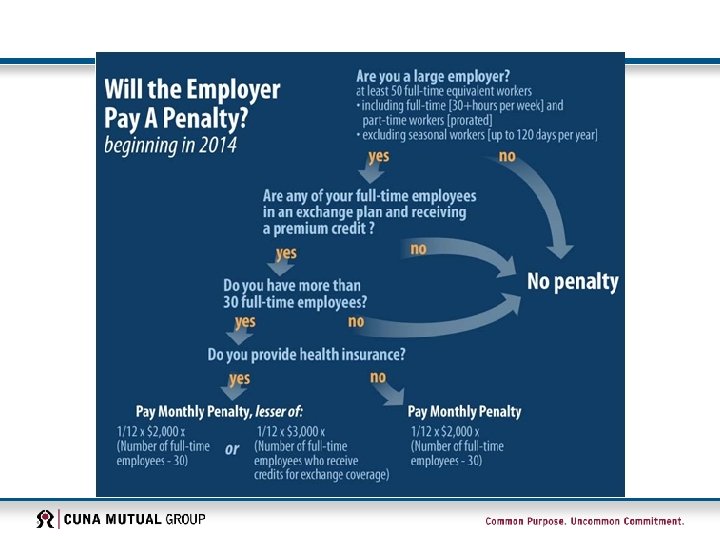

Assessments - § 4980 H(a), (b) Penalties Associated With Non-Compliance Employers may be assessed fees for any month they: 1. Fail to offer employer-sponsored minimum essential coverage to FTEs and their dependents a. AND at least one person enrolls for coverage, from the Exchange, and receives a subsidy b. Assessment = 1/12 of $2, 000, or $166. 67 per month, for each FTE, less the first 30 employees 2. Offer employer-sponsored minimum essential coverage to FTEs and their dependents but the employee contribution is deemed unaffordable a. AND 1 or more employees enroll for coverage, from the Exchange, and receive a subsidy b. Assessment = the lesser of: i. 1/12 of $3, 000, or $250 per month, for FTE receiving a subsidy OR ii. 1/12 of $2, 000, or $166. 67 per month, for each FTE, less the first 30 employees Employer Sharing Responsibility REG-138006 -12 Proposed Amendment (CMS-9958 -P) 1/2/13

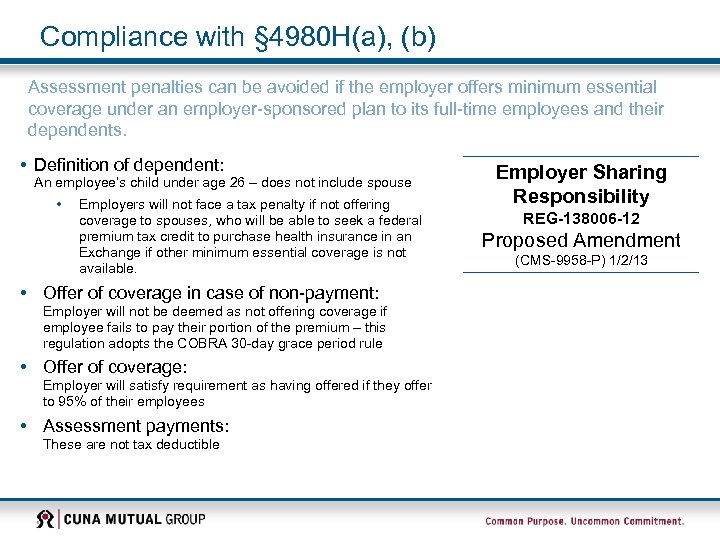

Compliance with § 4980 H(a), (b) Assessment penalties can be avoided if the employer offers minimum essential coverage under an employer-sponsored plan to its full-time employees and their dependents. • Definition of dependent: An employee’s child under age 26 – does not include spouse • Employers will not face a tax penalty if not offering coverage to spouses, who will be able to seek a federal premium tax credit to purchase health insurance in an Exchange if other minimum essential coverage is not available. • Offer of coverage in case of non-payment: Employer will not be deemed as not offering coverage if employee fails to pay their portion of the premium – this regulation adopts the COBRA 30 -day grace period rule • Offer of coverage: Employer will satisfy requirement as having offered if they offer to 95% of their employees • Assessment payments: These are not tax deductible Employer Sharing Responsibility REG-138006 -12 Proposed Amendment (CMS-9958 -P) 1/2/13

Compliance with § 4980 H(a), (b) Affordability Safe Harbors – applies only for purposes of whether the employer satisfies the 9. 5% affordability test 1. Form W 2 safe harbor – wages to be reported in Employer Sharing Box 1 of Form W 2 – – Must offer its full-time employees (and their dependents) AND Employee contribution toward self-only premium for not exceed 9. 5% of the employee’s Form W 2 wages for that calendar year. 2. Rate of pay safe harbor – – Take the hourly rate of pay for each hourly employee and multiply by 130 hours/month Use this monthly amount to compare to premium contributions 3. Federal poverty line safe harbor – – Employer can use FPL for a single to set premium contribution, i. e. set employee contribution for selfonly coverage of the lowest cost plan to ≤ 9. 5%. Can use the most recently published FPL guidelines as of the first day of the plan year. Responsibility REG-138006 -12 Proposed Amendment (CMS-9958 -P) 1/2/13

Transition Relief No assessments will be made in 2014, if an employer has a fiscal plan year as of 12/27/12 and an employee is offered affordable, minimum value coverage AND also satisfies 2 additional tests • Transition relief will allow employers, with fiscal plan years beginning in 2013, to update their plan documents • • • The right for an employee to revoke or change elections once during the plan year without regard to a change in status An employee who did not make the salary reduction election would be permitted to make a prospective election on or after the first day of the 2013 plan year without regard to a change in status Can use any six consecutive months to determine of applicable large employer Employer Sharing Responsibility REG-138006 -12 Proposed Amendment (CMS-9958 -P) 1/2/13

Health Care Reform Patient Protection and Affordable Care Act of 2010 (PPACA) SHARING RESPONSIBILITIES – THE MARKETPLACE 24

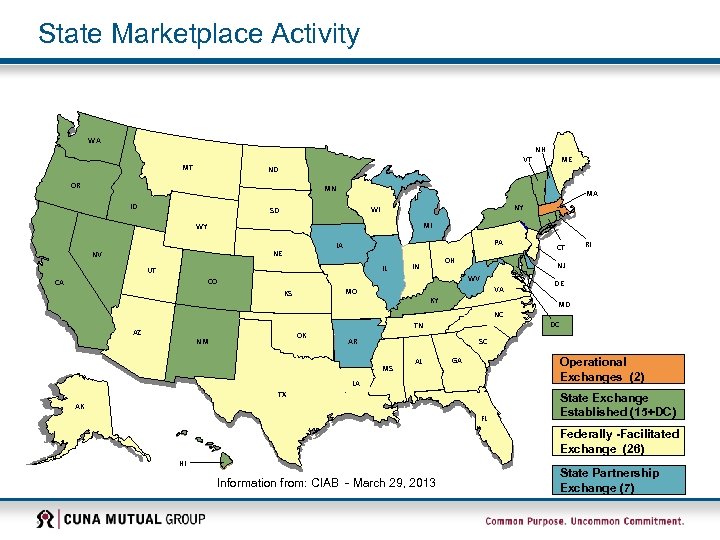

State Marketplace Activity WA NH VT MT ME ND OR MN ID MA NY WI SD MI WY PA IA NE NV IL UT OH IN VA MO KS KY OK NM DE MD NC AZ RI NJ WV CO CA CT TN AR DC SC MS AL GA Operational Exchanges (2) LA TX AK FL State Exchange Established (15+DC) Federally -Facilitated Exchange (26) HI Information from: CIAB - March 29, 2013 State Partnership Exchange (7)

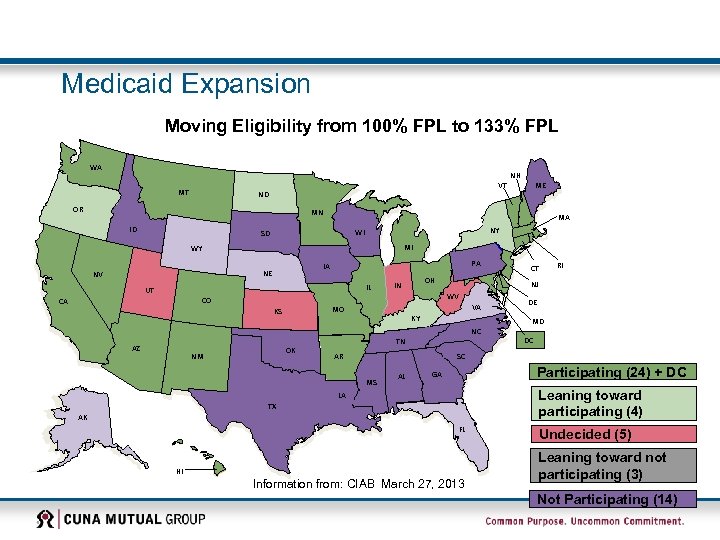

Medicaid Expansion Moving Eligibility from 100% FPL to 133% FPL WA MT VT ND OR NH ME MN ID MA NY WI SD MI WY PA IA NE NV IL UT CO CA NJ WV VA MO KS OH IN KY OK NM DE MD NC AZ RI CT TN AR DC SC MS AL Participating (24) + DC GA Leaning toward participating (4) LA TX AK FL HI Information from: CIAB March 27, 2013 Undecided (5) Leaning toward not participating (3) Not Participating (14)

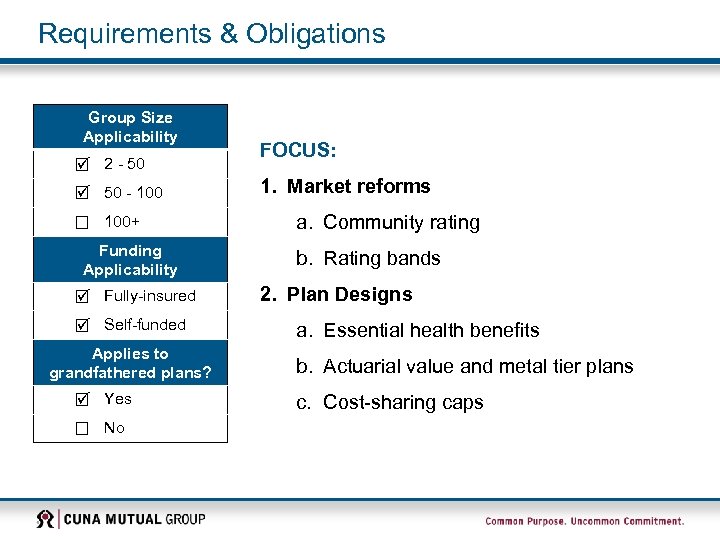

Requirements & Obligations Group Size Applicability 2 - 50 - 100+ Funding Applicability Fully-insured Self-funded Applies to grandfathered plans? Yes No FOCUS: 1. Market reforms a. Community rating b. Rating bands 2. Plan Designs a. Essential health benefits b. Actuarial value and metal tier plans c. Cost-sharing caps

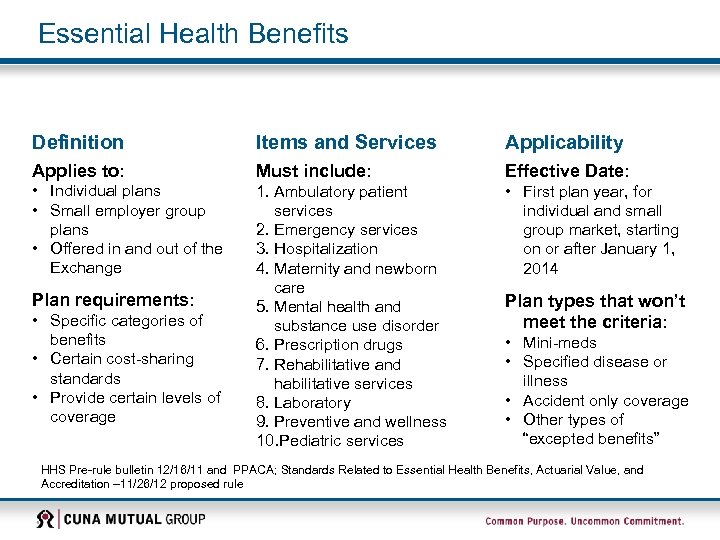

Essential Health Benefits Definition Items and Services Applicability Applies to: Must include: Effective Date: • Individual plans • Small employer group plans • Offered in and out of the Exchange 1. Ambulatory patient services 2. Emergency services 3. Hospitalization 4. Maternity and newborn care 5. Mental health and substance use disorder 6. Prescription drugs 7. Rehabilitative and habilitative services 8. Laboratory 9. Preventive and wellness 10. Pediatric services • First plan year, for individual and small group market, starting on or after January 1, 2014 Plan requirements: • Specific categories of benefits • Certain cost-sharing standards • Provide certain levels of coverage Plan types that won’t meet the criteria: • Mini-meds • Specified disease or illness • Accident only coverage • Other types of “excepted benefits” HHS Pre-rule bulletin 12/16/11 and PPACA; Standards Related to Essential Health Benefits, Actuarial Value, and Accreditation – 11/26/12 proposed rule

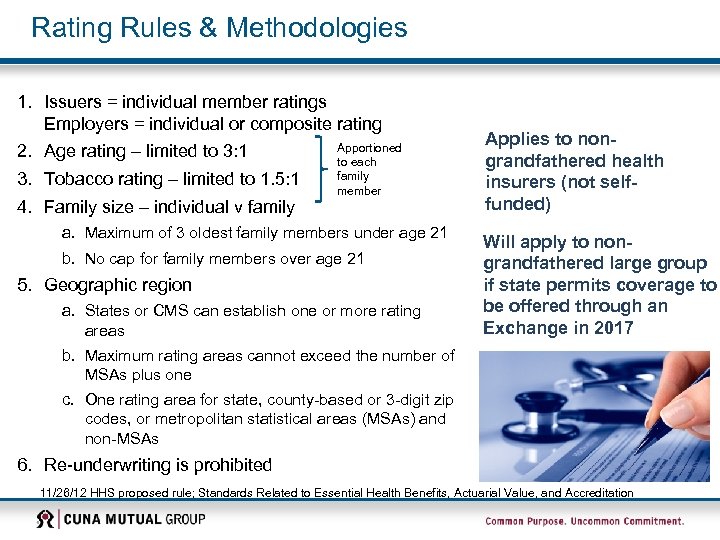

Rating Rules & Methodologies 1. Issuers = individual member ratings Employers = individual or composite rating Apportioned 2. Age rating – limited to 3: 1 to each family 3. Tobacco rating – limited to 1. 5: 1 member 4. Family size – individual v family a. Maximum of 3 oldest family members under age 21 b. No cap for family members over age 21 5. Geographic region a. States or CMS can establish one or more rating areas Applies to nongrandfathered health insurers (not selffunded) Will apply to nongrandfathered large group if state permits coverage to be offered through an Exchange in 2017 b. Maximum rating areas cannot exceed the number of MSAs plus one c. One rating area for state, county-based or 3 -digit zip codes, or metropolitan statistical areas (MSAs) and non-MSAs 6. Re-underwriting is prohibited 11/26/12 HHS proposed rule; Standards Related to Essential Health Benefits, Actuarial Value, and Accreditation

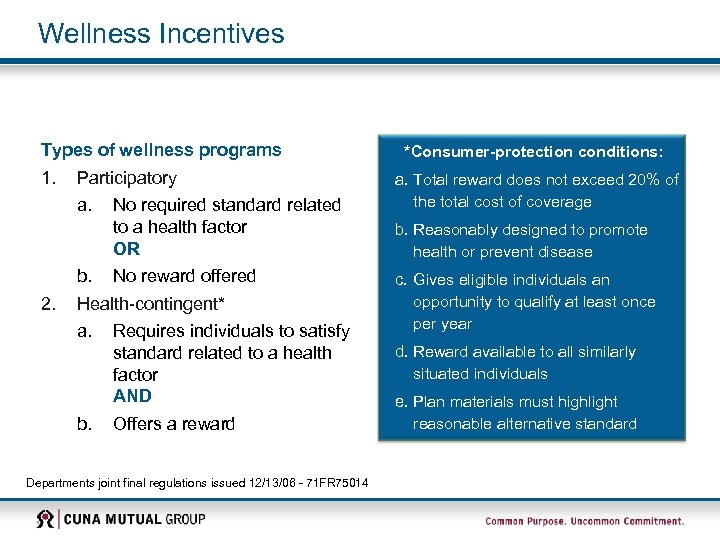

Wellness Incentives Types of wellness programs 1. Participatory a. 2. No required standard related to a health factor OR b. No reward offered Health-contingent* a. Requires individuals to satisfy standard related to a health factor AND b. Offers a reward Departments joint final regulations issued 12/13/06 - 71 FR 75014 *Consumer-protection conditions: a. Total reward does not exceed 20% of the total cost of coverage b. Reasonably designed to promote health or prevent disease c. Gives eligible individuals an opportunity to qualify at least once per year d. Reward available to all similarly situated individuals e. Plan materials must highlight reasonable alternative standard

Wellness Incentives ACA • Reflects the 2006 regulations • Extends nondiscrimination provisions to individual market Proposed Rules Applicability: • Grandfathered and non-grandfathered plans • Plan years on or after January 1, 2014 • Extension to individual market Increase in incentives: • 30% maximum program reward • 50% maximum tobacco prevention or reduction reward Affordable Care Act HHS Proposed Rule 11/26/12

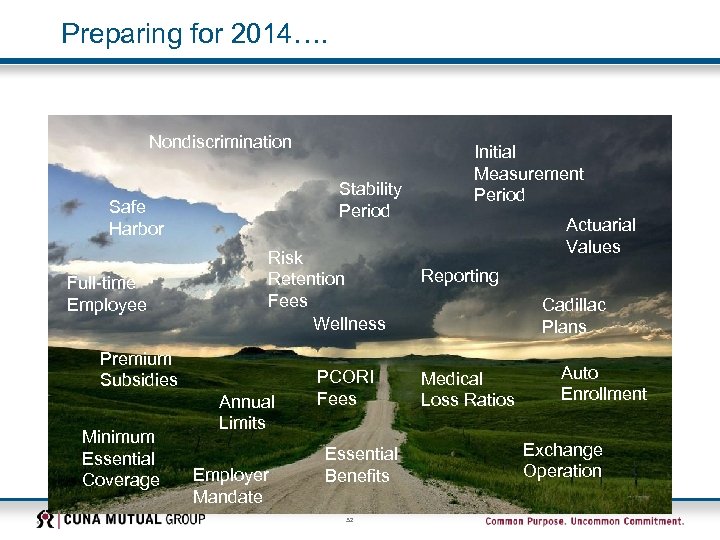

Preparing for 2014…. Nondiscrimination Stability Period Safe Harbor Full-time Employee Risk Retention Fees Wellness Premium Subsidies Minimum Essential Coverage Annual Limits Employer Mandate PCORI Fees Essential Benefits 32 Initial Measurement Period Actuarial Values Reporting Cadillac Plans Medical Loss Ratios Auto Enrollment Exchange Operation

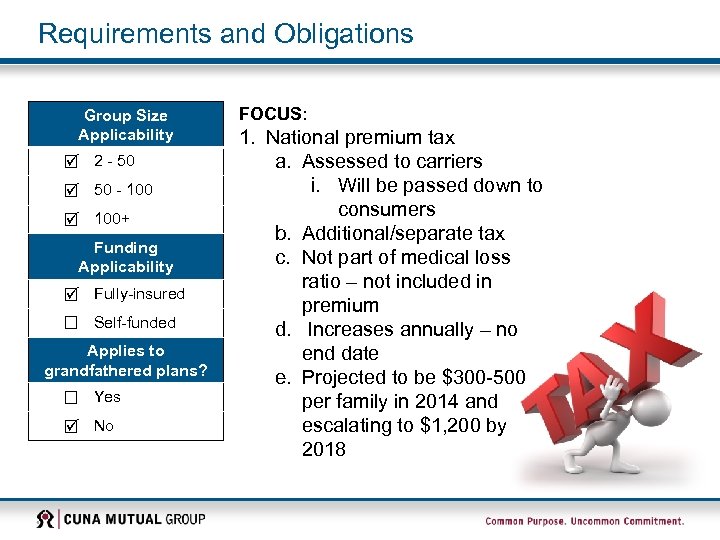

Requirements and Obligations Group Size Applicability 2 - 50 - 100+ Funding Applicability Fully-insured Self-funded Applies to grandfathered plans? Yes No FOCUS: 1. National premium tax a. Assessed to carriers i. Will be passed down to consumers b. Additional/separate tax c. Not part of medical loss ratio – not included in premium d. Increases annually – no end date e. Projected to be $300 -500 per family in 2014 and escalating to $1, 200 by 2018

Health Care Reform Patient Protection and Affordable Care Act of 2010 (PPACA) POTENTIAL OPPORTUNITIES? 34

Health Care Reform: State Exchanges Ø Exchange - An organized marketplace to help qualifying individuals and employer groups (initially small employers) buy health insurance in a way that permits easy comparison of available plan options based on price, benefits and quality. - Must be established by January 1, 2014 Ø Purpose - To facilitate the purchase of qualified health plans (QHPs) - To provide small employers a Small Business Health Options Program (SHOP Exchange)

Qualified Health Plans (Continued) Four Coverage Level Requirements for Essential Benefits Package Ø Bronze: designed to provide benefits actuarially equivalent to 60% of full value; Ø Silver: designed to provide benefits actuarially equivalent to 70% of full value; Ø Gold: designed to provide benefits actuarially equivalent to 80% of full value; and Ø Platinum: designed to provide benefits actuarially equivalent to 90% of full value.

Small Business Health Options Program (SHOP) Each state that chooses to operates an exchange must also establish insurance options for small business through a SHOP Ø States that choose to operate an Exchange may merge the SHOP with the individual market Exchange. The SHOP will allow employers to choose the level of coverage they will offer and offer the employees choices of all QHPs within that level of coverage. SHOP exchanges can also allow employers to select a single plan to offer its employees, like is typically done today.

Private Exchanges Most states are likely to have “bare bones” exchange approach due to late start, especially initially Ø Employers of choice will want to differentiate and simplify the process for their employees Ø Credit Unions will be looking for a simplified/customized process

Defined Contribution Health Plans Theory of gradual shift to defined contribution health plans Ø Shifting risk of incurring high health-care costs from employers to workers Ø Similar to previous shift for retirement plans Today, market is predominately “defined-benefit” plans Ø Employers determine a set of health-insurance benefits Move to “defined-contribution” where Ø Employers pay a fixed amount Ø Employees use money to buy or help pay for insurance they choose themselves

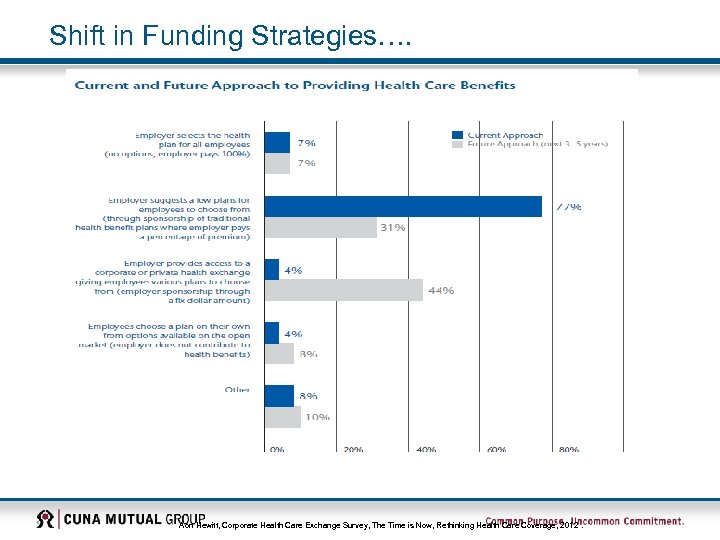

Shift in Funding Strategies…. Aon Hewitt, Corporate Health Care Exchange Survey, The Time is Now, Rethinking Health Care Coverage, 2012.

Do you have the answer? Should my Credit Union offer Coverage in light of Health Care Reform? Ø Have to consider “Play or Pay” Ø What will be offered through each state’s “Exchange”? Ø What will I need to do to remain competitive?

Strategic Inventory • Why do you offer health insurance as part of your current benefits package? a. Protection for employee and family b. Attract and retain talent c. Obligation d. Personal need e. Tax advantages f. Employee expectation • Why do your employees participate in your health insurance program? a. b. c. d. Lower cost Tax advantages Protection for family Transfer of responsibility

What if? • If you eliminate health insurance as part of your benefits package, would you replace it? With other benefits? With salary? • What would employee reaction be if you eliminated this benefit? • How might productivity be affected? • Will all your employees obtain health insurance coverage on their own? • What would you do personally for your own benefits?

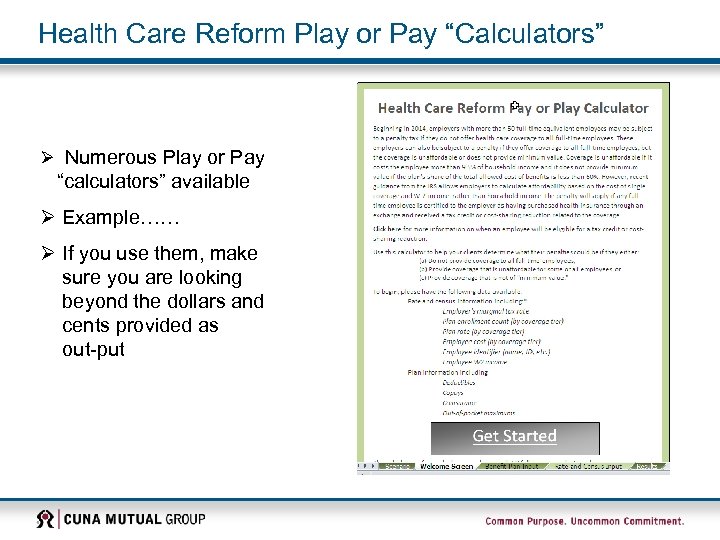

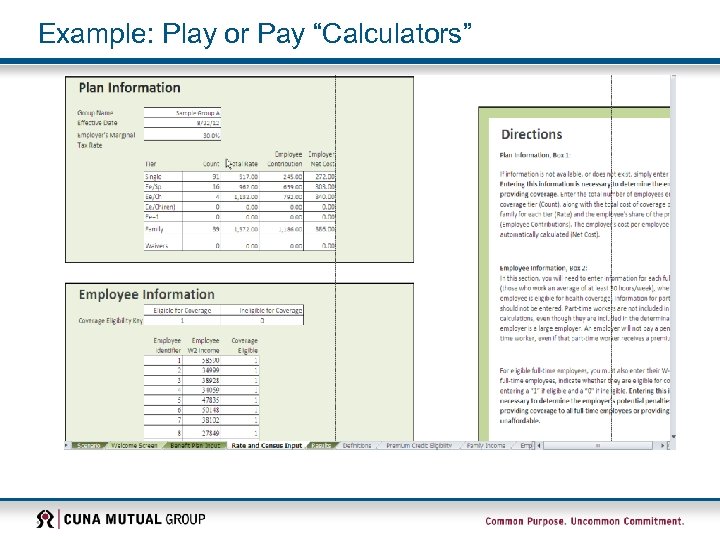

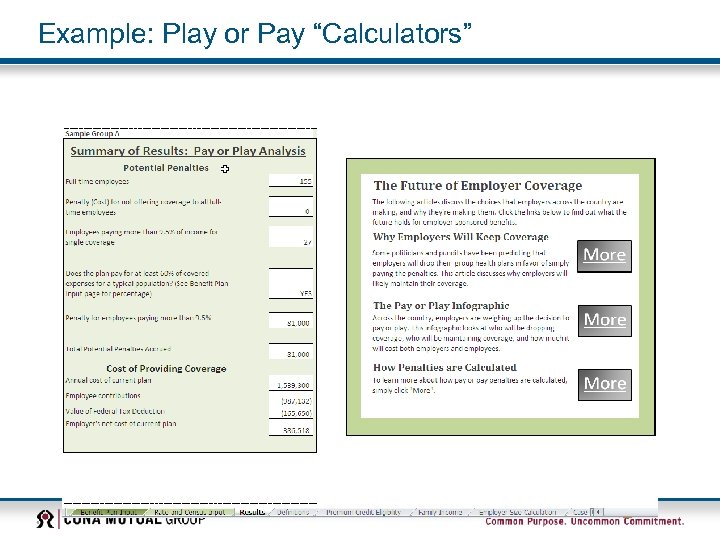

Health Care Reform Play or Pay “Calculators” Ø Numerous Play or Pay “calculators” available Ø Example…… Ø If you use them, make sure you are looking beyond the dollars and cents provided as out-put

Example: Play or Pay “Calculators”

Example: Play or Pay “Calculators”

Example: Play or Pay “Calculators” If you’d like a version of a calculator http: //www. cunamutual. com/portal/server. pt/ community/health_care_reform/543/health_c are_reform/685412 Disclaimer: This calculator is intended to provide estimates of possible penalties under current information available regarding the health care reform requirements. Results are dependent on entry of accurate plan and employee data and may change based on guidance issued by various regulatory agencies. Nothing in this calculator should be considered legal or tax advice. © 2012 Zywave, Inc. All rights reserved.

Summary HCR not likely to change substantially in the near future in wake of SCOTUS ruling and Presidential election Danger in waiting too long to ensure compliance Ø DOL Audits Ø Lack of time to create strategy Potential “opportunities” for credit unions thru HCR Ø Private Exchanges making shift to defined contribution funding easier Ø Public Exchanges Ø Possibility of dropping coverage if needed Ø “Employer of Choice” strategies

CUNA Mutual Group is the marketing name for CUNA Mutual Holding Company, a mutual insurance holding company, its subsidiaries and affiliates. CMFG Life Insurance Company underwrites Group Life Insurance, Shortterm Disability and Long-term Disability Income Insurance. CUNA Mutual Insurance Agency, Inc. , is a subsidiary of CMFG Life Insurance Company and is the marketing agent licensed to broker Employee Benefits products. This presentation was created by Digital Benefits Advisors and CUNA Mutual Group based on our experience in the credit union and Employee Benefits market. It is intended to be used only as a guide, not as legal advice. Digital Benefits Advisors and CUNA Mutual Group Proprietary Information. Further Reproduction, Adaptation or Distribution Prohibited. © CUNA Mutual Group, 2013 All Rights Reserved 10003693 -0513

f15892e9def7a8a45da2d822233da2cc.ppt