0d251fa97965571e03721ab28781429b.ppt

- Количество слайдов: 71

2012 Financial Management in the Government of Canada • Winnipeg & Regina FMI Chapter • October 24 th and 25 th 2012 • Presented by: the Office of the Comptroller General, • Financial Management Sector, • Capacity Building and Community Development Team

2012 Financial Management in the Government of Canada • Winnipeg & Regina FMI Chapter • October 24 th and 25 th 2012 • Presented by: the Office of the Comptroller General, • Financial Management Sector, • Capacity Building and Community Development Team

Welcome • Introduction of the Office of the Comptroller General, Financial Management Sector – Juliet Woodfield, Senior Director, Capacity Building and Community Development (CBCD) Team 2

Welcome • Introduction of the Office of the Comptroller General, Financial Management Sector – Juliet Woodfield, Senior Director, Capacity Building and Community Development (CBCD) Team 2

Agenda – Financial Challenges • Current Environmental Overview • Financial Officer Training • Successful interviewing, resume preparation, and networking 3

Agenda – Financial Challenges • Current Environmental Overview • Financial Officer Training • Successful interviewing, resume preparation, and networking 3

Current Environmental Overview 4

Current Environmental Overview 4

Overview • Financial Management Environment & Context • Developments in Financial Management • Developments in Financial Reporting • Financial Management Transformation Initiatives 5

Overview • Financial Management Environment & Context • Developments in Financial Management • Developments in Financial Reporting • Financial Management Transformation Initiatives 5

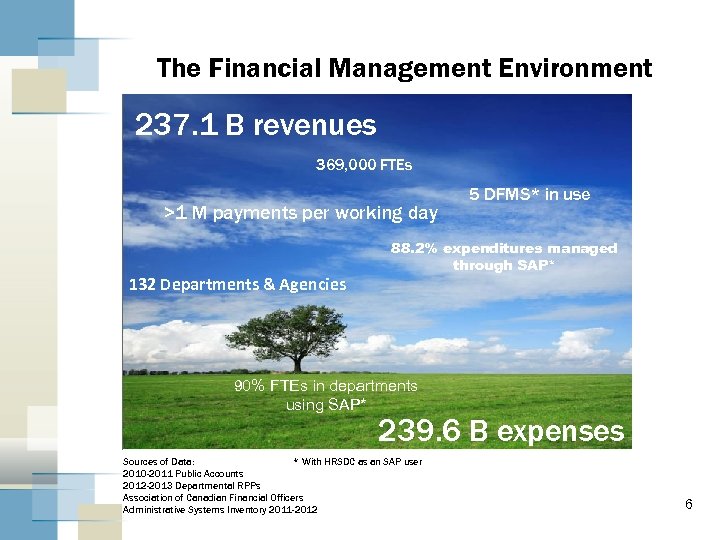

The Financial Management Environment 237. 1 B revenues 369, 000 FTEs >1 M payments per working day 132 Departments & Agencies 5 DFMS* in use 88. 2% expenditures managed through SAP* 90% FTEs in departments using SAP* 239. 6 B expenses Sources of Data: * With HRSDC as an SAP user 2010 -2011 Public Accounts 2012 -2013 Departmental RPPs Association of Canadian Financial Officers Administrative Systems Inventory 2011 -2012 6

The Financial Management Environment 237. 1 B revenues 369, 000 FTEs >1 M payments per working day 132 Departments & Agencies 5 DFMS* in use 88. 2% expenditures managed through SAP* 90% FTEs in departments using SAP* 239. 6 B expenses Sources of Data: * With HRSDC as an SAP user 2010 -2011 Public Accounts 2012 -2013 Departmental RPPs Association of Canadian Financial Officers Administrative Systems Inventory 2011 -2012 6

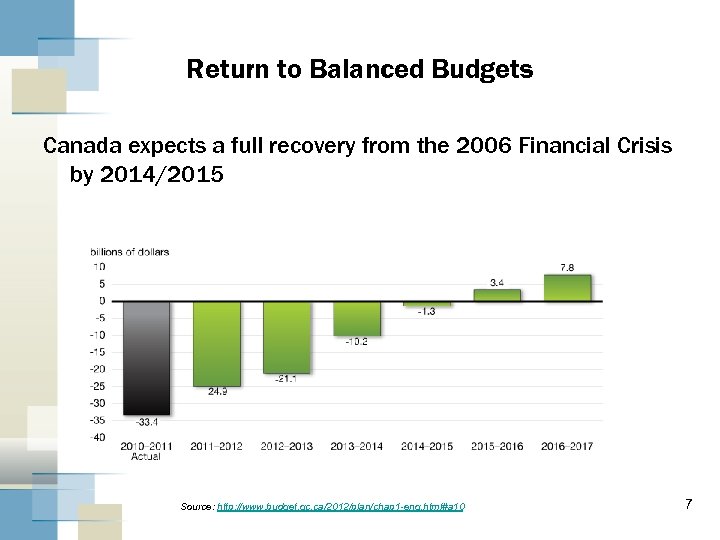

Return to Balanced Budgets Canada expects a full recovery from the 2006 Financial Crisis by 2014/2015 Source: http: //www. budget. gc. ca/2012/plan/chap 1 -eng. html#a 10 7

Return to Balanced Budgets Canada expects a full recovery from the 2006 Financial Crisis by 2014/2015 Source: http: //www. budget. gc. ca/2012/plan/chap 1 -eng. html#a 10 7

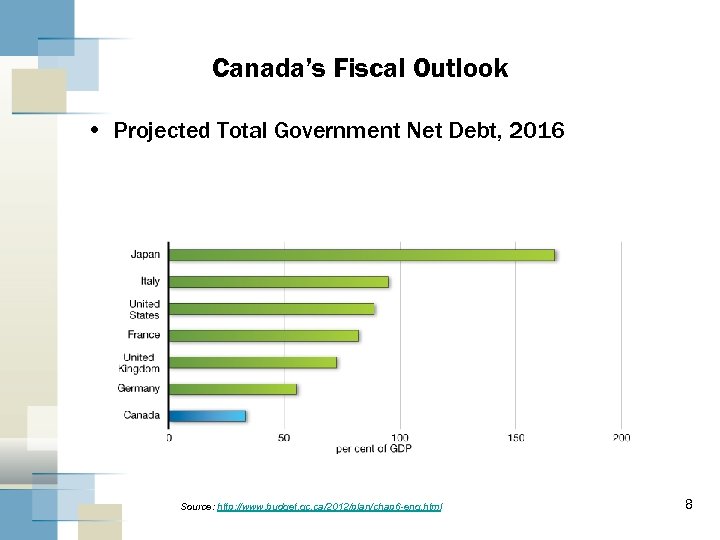

Canada’s Fiscal Outlook • Projected Total Government Net Debt, 2016 Source: http: //www. budget. gc. ca/2012/plan/chap 6 -eng. html 8

Canada’s Fiscal Outlook • Projected Total Government Net Debt, 2016 Source: http: //www. budget. gc. ca/2012/plan/chap 6 -eng. html 8

Current Environmental Context • Economic Recovery & Jobs • Cost Containment & Productivity • Standardized Business Processes & Service Consolidation • Supporting Enterprise-Level Decision Making 9

Current Environmental Context • Economic Recovery & Jobs • Cost Containment & Productivity • Standardized Business Processes & Service Consolidation • Supporting Enterprise-Level Decision Making 9

Developments in Financial Management • Internal Controls • Cost Containment • Attestation • Community Succession Planning, Talent management • E-Invoicing and Payment and Direct Deposit - Accomplishments and forward planning 10

Developments in Financial Management • Internal Controls • Cost Containment • Attestation • Community Succession Planning, Talent management • E-Invoicing and Payment and Direct Deposit - Accomplishments and forward planning 10

Internal Controls • Financial Management Policy Suite in place • Foundation of sound financial management - Effective I nternal Controls • Internal controls are integral to cost containment measures and reliability of financial information and reporting • Policy requires annual risk-based assessment of effectiveness of internal controls over financial reporting which is not yet requiring public attestations on effectiveness per Sarbanes–Oxley • Good progress is being made as demonstrated in the annual published departmental reports on results and action plans 11

Internal Controls • Financial Management Policy Suite in place • Foundation of sound financial management - Effective I nternal Controls • Internal controls are integral to cost containment measures and reliability of financial information and reporting • Policy requires annual risk-based assessment of effectiveness of internal controls over financial reporting which is not yet requiring public attestations on effectiveness per Sarbanes–Oxley • Good progress is being made as demonstrated in the annual published departmental reports on results and action plans 11

Cost Containment • Continued incentives to contain/reduce costs • Focus on productivity enhancements to systems, processes, data and performance management through, for example: – FM transformation will lead to efficiency gains in business processes and streamlining of service delivery hubs – Rigorous financial information to underpin decisions on proposals – CFO attestation – Measuring performance of grants and contributions and user fees 12

Cost Containment • Continued incentives to contain/reduce costs • Focus on productivity enhancements to systems, processes, data and performance management through, for example: – FM transformation will lead to efficiency gains in business processes and streamlining of service delivery hubs – Rigorous financial information to underpin decisions on proposals – CFO attestation – Measuring performance of grants and contributions and user fees 12

Attestation • Establishing a framework for consistent CFO due diligence on the financial aspects of Cabinet proposals • Six core financial management assertions and a CFO Representation Letter on conclusions and observations for each plus an overarching conclusion • Critical to meet heightened expectations of ministerial decision makers and to ensure rigour of financial information 13

Attestation • Establishing a framework for consistent CFO due diligence on the financial aspects of Cabinet proposals • Six core financial management assertions and a CFO Representation Letter on conclusions and observations for each plus an overarching conclusion • Critical to meet heightened expectations of ministerial decision makers and to ensure rigour of financial information 13

Community-Succession Planning, Talent management The Chief Financial Officer (CFO) position in the federal government of Canada: • exists in over 100 departments and agencies; • is a key role to the financial functioning of the federal government; • has been identified as being at risk due to changing demographic factors; and • requires incumbents to have an advanced level of both leadership and business skills. The Office of the Comptroller General has launched a CFO Talent Management initiative in the summer of 2012 with the objective of ensuring an adequate supply of qualified individuals in the community who are ready to assume the CFO role. 14

Community-Succession Planning, Talent management The Chief Financial Officer (CFO) position in the federal government of Canada: • exists in over 100 departments and agencies; • is a key role to the financial functioning of the federal government; • has been identified as being at risk due to changing demographic factors; and • requires incumbents to have an advanced level of both leadership and business skills. The Office of the Comptroller General has launched a CFO Talent Management initiative in the summer of 2012 with the objective of ensuring an adequate supply of qualified individuals in the community who are ready to assume the CFO role. 14

E-Invoicing and Payment and Direct Deposit Accomplishments and Challenges • Task Force for the Payments System Review Set-up by Minister of Finance in June 2010: – Compelling need for a payments system overhaul – Implementation of electronic invoicing and payments for all government suppliers and benefits recipients • Accomplishments: – Coding structures defined, procurement items being defined – E-invoicing data sets being reviewed with RG • Challenges: – Integration, training and complying with legislation such as FAA sect 32, 33 and 34 15

E-Invoicing and Payment and Direct Deposit Accomplishments and Challenges • Task Force for the Payments System Review Set-up by Minister of Finance in June 2010: – Compelling need for a payments system overhaul – Implementation of electronic invoicing and payments for all government suppliers and benefits recipients • Accomplishments: – Coding structures defined, procurement items being defined – E-invoicing data sets being reviewed with RG • Challenges: – Integration, training and complying with legislation such as FAA sect 32, 33 and 34 15

Community-Succession Planning, Talent management The CFO Talent Management Process has three key elements: 1. CFO community data collection: • Data collected through the Chief Human Resources Officer’s Executive talent management system will be used to build a CFO community profile. 2. CFO community analysis: • The CFO Community profile will help to identify potential CFO candidates and succession gaps. 3. CFO community development: • Results of the CFO community analysis will identify professional development needs as well as required key competencies for the CFO community. 16

Community-Succession Planning, Talent management The CFO Talent Management Process has three key elements: 1. CFO community data collection: • Data collected through the Chief Human Resources Officer’s Executive talent management system will be used to build a CFO community profile. 2. CFO community analysis: • The CFO Community profile will help to identify potential CFO candidates and succession gaps. 3. CFO community development: • Results of the CFO community analysis will identify professional development needs as well as required key competencies for the CFO community. 16

Developments in Financial Reporting • Quarterly financial reports (QFR’s) • Accounting Standards 17

Developments in Financial Reporting • Quarterly financial reports (QFR’s) • Accounting Standards 17

Quarterly financial reports (QFR’s) • First QFR’s prepared by departments and Crown corporations in June 2011 • QFR’s provide more timely, in year financial information at the organization level than had been previously available • QFR’s contain: – Departmental expenditures compared against the authorities – Comparative financial information for the preceding fiscal year – A narrative section • Increasingly will be used to report on the impact of Budget decisions 18

Quarterly financial reports (QFR’s) • First QFR’s prepared by departments and Crown corporations in June 2011 • QFR’s provide more timely, in year financial information at the organization level than had been previously available • QFR’s contain: – Departmental expenditures compared against the authorities – Comparative financial information for the preceding fiscal year – A narrative section • Increasingly will be used to report on the impact of Budget decisions 18

Accounting Standards • Employee termination benefits (Budget 2012 measures) • IFRS/PSAS conversion for certain government entities • Newly introduced concept of Net debt in departmental financial statements • New accounting standards: – Financial Instruments – Liabilities for contaminated sites – Government Transfers – Tax Revenue – Financial Statement Presentation 19

Accounting Standards • Employee termination benefits (Budget 2012 measures) • IFRS/PSAS conversion for certain government entities • Newly introduced concept of Net debt in departmental financial statements • New accounting standards: – Financial Instruments – Liabilities for contaminated sites – Government Transfers – Tax Revenue – Financial Statement Presentation 19

Financial Management Transformation Initiatives • Convergence of Financial Systems and Processes • Canada is converging their remaining 5 departmental financial management systems into one standard configuration; • Governance structures and times lines are now being developed for the government moving forwards; • Consolidation of Financial Services • Strategic information for decision making is of better quality and faster to produce (e. g. CEDI, Open. Gov, etc. ) • Improved stewardship of scarce resources • Better and more efficient containment costs and financial management resources (People, processes and information) 20

Financial Management Transformation Initiatives • Convergence of Financial Systems and Processes • Canada is converging their remaining 5 departmental financial management systems into one standard configuration; • Governance structures and times lines are now being developed for the government moving forwards; • Consolidation of Financial Services • Strategic information for decision making is of better quality and faster to produce (e. g. CEDI, Open. Gov, etc. ) • Improved stewardship of scarce resources • Better and more efficient containment costs and financial management resources (People, processes and information) 20

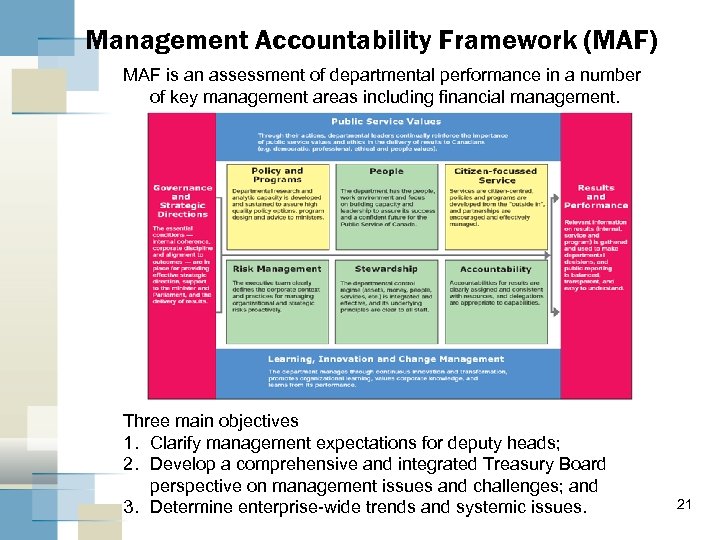

Management Accountability Framework (MAF) MAF is an assessment of departmental performance in a number of key management areas including financial management. Three main objectives 1. Clarify management expectations for deputy heads; 2. Develop a comprehensive and integrated Treasury Board perspective on management issues and challenges; and 3. Determine enterprise-wide trends and systemic issues. 21

Management Accountability Framework (MAF) MAF is an assessment of departmental performance in a number of key management areas including financial management. Three main objectives 1. Clarify management expectations for deputy heads; 2. Develop a comprehensive and integrated Treasury Board perspective on management issues and challenges; and 3. Determine enterprise-wide trends and systemic issues. 21

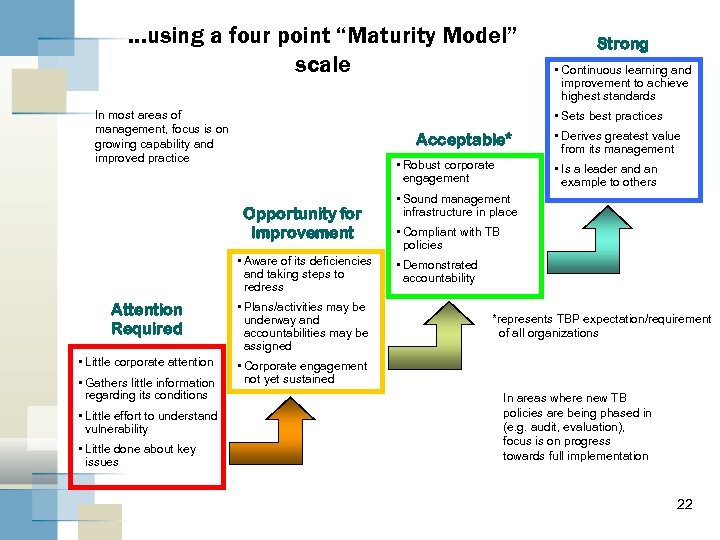

. . . using a four point “Maturity Model” scale In most areas of management, focus is on growing capability and improved practice Strong • Continuous learning and improvement to achieve highest standards • Sets best practices Acceptable* • Robust corporate engagement Opportunity for Improvement • Aware of its deficiencies and taking steps to redress Attention Required • Plans/activities may be underway and accountabilities may be assigned • Little corporate attention • Derives greatest value from its management • Is a leader and an example to others • Sound management infrastructure in place • Compliant with TB policies • Demonstrated accountability • Corporate engagement not yet sustained • Gathers little information regarding its conditions • Little effort to understand vulnerability • Little done about key issues *represents TBP expectation/requirement of all organizations In areas where new TB policies are being phased in (e. g. audit, evaluation), focus is on progress towards full implementation 22

. . . using a four point “Maturity Model” scale In most areas of management, focus is on growing capability and improved practice Strong • Continuous learning and improvement to achieve highest standards • Sets best practices Acceptable* • Robust corporate engagement Opportunity for Improvement • Aware of its deficiencies and taking steps to redress Attention Required • Plans/activities may be underway and accountabilities may be assigned • Little corporate attention • Derives greatest value from its management • Is a leader and an example to others • Sound management infrastructure in place • Compliant with TB policies • Demonstrated accountability • Corporate engagement not yet sustained • Gathers little information regarding its conditions • Little effort to understand vulnerability • Little done about key issues *represents TBP expectation/requirement of all organizations In areas where new TB policies are being phased in (e. g. audit, evaluation), focus is on progress towards full implementation 22

Convergence of Financial Systems and Processes • Canada is converging their remaining 5 departmental financial management systems into one standard configuration • SAP is the system of choice (ERP Standard) • Many concepts of operations are being reviewed – departmental clustering, outsourcing functions, hybrid solutions, shared services solutions, etc • Legislative frameworks already exist to allow this to happen • Governance structures and timelines are now being developed for the government moving forward • Convergence will not be organic – we will accelerate 23

Convergence of Financial Systems and Processes • Canada is converging their remaining 5 departmental financial management systems into one standard configuration • SAP is the system of choice (ERP Standard) • Many concepts of operations are being reviewed – departmental clustering, outsourcing functions, hybrid solutions, shared services solutions, etc • Legislative frameworks already exist to allow this to happen • Governance structures and timelines are now being developed for the government moving forward • Convergence will not be organic – we will accelerate 23

Consolidation of Financial Services? Enterprise • Differing concepts of operations can be contemplated • Administrative service delivery is improved and made more efficient • Strategic information for decision making is of better quality and faster to produce (e. g. CEDI, Open. Gov, etc. ) Departments and Agencies • Better information and analysis tools for organisations • Improved stewardship of scarce resources • Better and more efficient containment costs and financial management resources (People, processes and information) 24

Consolidation of Financial Services? Enterprise • Differing concepts of operations can be contemplated • Administrative service delivery is improved and made more efficient • Strategic information for decision making is of better quality and faster to produce (e. g. CEDI, Open. Gov, etc. ) Departments and Agencies • Better information and analysis tools for organisations • Improved stewardship of scarce resources • Better and more efficient containment costs and financial management resources (People, processes and information) 24

So what does this all mean to the financial officer community? 25

So what does this all mean to the financial officer community? 25

Accounting Profession – Landscape across Canada • The unification initiative is progressing quickly at the national and provincial levels • Some parties have left discussions • A three-way unification completed in Quebec • Proposals between CAs and Certified Management Accountants (CMAs) reached in many provinces except: (a) Alberta, where CMAs are poised to unify with the Certified General Accountants (CGAs), and (b) Ontario, where only the ICAO is supporting joining CPA Canada 26

Accounting Profession – Landscape across Canada • The unification initiative is progressing quickly at the national and provincial levels • Some parties have left discussions • A three-way unification completed in Quebec • Proposals between CAs and Certified Management Accountants (CMAs) reached in many provinces except: (a) Alberta, where CMAs are poised to unify with the Certified General Accountants (CGAs), and (b) Ontario, where only the ICAO is supporting joining CPA Canada 26

CA-CMA-CGA unification information • A Framework For Uniting The Canadian Accounting Profession • Professional Environment: Canadian and International • Four Unification objectives translated in benefits for members • Next Steps Unification Framework: – Canadian accounting profession is provincially regulated – Any decisions regarding merger proposals would be made provincially – Unification status interactive map: http: //cpacanada. ca 27

CA-CMA-CGA unification information • A Framework For Uniting The Canadian Accounting Profession • Professional Environment: Canadian and International • Four Unification objectives translated in benefits for members • Next Steps Unification Framework: – Canadian accounting profession is provincially regulated – Any decisions regarding merger proposals would be made provincially – Unification status interactive map: http: //cpacanada. ca 27

Canadian CPA Certification Program • Program Design • CPA Competencies • Program Details • Education • Examinations • Practical experience • Transition 28

Canadian CPA Certification Program • Program Design • CPA Competencies • Program Details • Education • Examinations • Practical experience • Transition 28

CPA Professional Education Program Anticipated Key Target Dates Fall 2013: • CPA Professional Education Program will be available Fall 2014: • Final full offering of the CA UFE Fall 2015: • The first CPA Common Final Examination will be written 29

CPA Professional Education Program Anticipated Key Target Dates Fall 2013: • CPA Professional Education Program will be available Fall 2014: • Final full offering of the CA UFE Fall 2015: • The first CPA Common Final Examination will be written 29

CPA Impact on Recruiting and Development in the Government of Canada • OCG is actively following the merger discussions. • OCG will be reviewing the implications of the CPA merger and professional program on the financial officer community and the current recruitment and development programs. 30

CPA Impact on Recruiting and Development in the Government of Canada • OCG is actively following the merger discussions. • OCG will be reviewing the implications of the CPA merger and professional program on the financial officer community and the current recruitment and development programs. 30

Financial Officer Training 31

Financial Officer Training 31

Managing your career during challenging times 32

Managing your career during challenging times 32

Financial Officer Career Management Tool Kit 33

Financial Officer Career Management Tool Kit 33

Financial Officer Career Management Tool Kit • FI to CFO Career Path • Competencies • FI core curriculum • Financial Management Community Strategic Plan • Current Environment of Fiscal Restraint 34

Financial Officer Career Management Tool Kit • FI to CFO Career Path • Competencies • FI core curriculum • Financial Management Community Strategic Plan • Current Environment of Fiscal Restraint 34

Financial Officer Training– FI to CFO Career Path – Developed by the DCFO Council to help Financial officers and financial executives map out their career objectives and goals against pre-determined criteria – Focus is on reaching a CFO position but can also be used for other specialized career paths within finance – Works on two dimensions: the number of levels before obtaining a CFO position and the specific requirements of each of these levels. • OCG working with FM community on revitalizing the FI to CFO Career Path (two distinct paths that interconnect). Will take into consideration requirements of CFO Talent Management Initiative. • New career path will include a “Welcome to the FM Community” page for each level in the career path (FI and EX) and will be housed on FM community GCPedia page: http: //www. gcpedia. gc. ca/wiki/Financial_management_community 35

Financial Officer Training– FI to CFO Career Path – Developed by the DCFO Council to help Financial officers and financial executives map out their career objectives and goals against pre-determined criteria – Focus is on reaching a CFO position but can also be used for other specialized career paths within finance – Works on two dimensions: the number of levels before obtaining a CFO position and the specific requirements of each of these levels. • OCG working with FM community on revitalizing the FI to CFO Career Path (two distinct paths that interconnect). Will take into consideration requirements of CFO Talent Management Initiative. • New career path will include a “Welcome to the FM Community” page for each level in the career path (FI and EX) and will be housed on FM community GCPedia page: http: //www. gcpedia. gc. ca/wiki/Financial_management_community 35

Financial Officer Training – FI Competencies • Competencies are defined by the Public Service Commission as being “the characteristics of an individual which underlie performance or behaviour at work”. • In order to remain relevant, competencies must evolve with the role or job. 36

Financial Officer Training – FI Competencies • Competencies are defined by the Public Service Commission as being “the characteristics of an individual which underlie performance or behaviour at work”. • In order to remain relevant, competencies must evolve with the role or job. 36

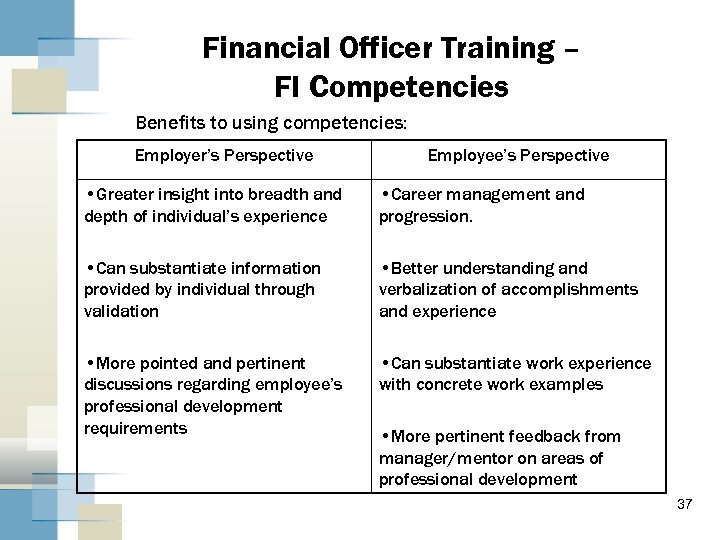

Financial Officer Training – FI Competencies Benefits to using competencies: Employer’s Perspective Employee’s Perspective • Greater insight into breadth and depth of individual’s experience • Career management and progression. • Can substantiate information provided by individual through validation • Better understanding and verbalization of accomplishments and experience • More pointed and pertinent discussions regarding employee’s professional development requirements • Can substantiate work experience with concrete work examples • More pertinent feedback from manager/mentor on areas of professional development 37

Financial Officer Training – FI Competencies Benefits to using competencies: Employer’s Perspective Employee’s Perspective • Greater insight into breadth and depth of individual’s experience • Career management and progression. • Can substantiate information provided by individual through validation • Better understanding and verbalization of accomplishments and experience • More pointed and pertinent discussions regarding employee’s professional development requirements • Can substantiate work experience with concrete work examples • More pertinent feedback from manager/mentor on areas of professional development 37

Financial Officer Training – FI Competencies FI Competency profiles Behavioural (includes the 7 key leadership competencies) • • Oral and written communications Risk Management Negotiation Values and Ethics Strategic Thinking: Analysis and Ideas Engagement Management Excellence: Action, People, Finance Functional (based on four FM functional areas) • • accounting and reporting planning and resource management Financial policy, Financial Systems 38

Financial Officer Training – FI Competencies FI Competency profiles Behavioural (includes the 7 key leadership competencies) • • Oral and written communications Risk Management Negotiation Values and Ethics Strategic Thinking: Analysis and Ideas Engagement Management Excellence: Action, People, Finance Functional (based on four FM functional areas) • • accounting and reporting planning and resource management Financial policy, Financial Systems 38

Financial Officer Training – FI Competencies • The FI Competency Profiles and the Employee guide on Competency-based Management have been approved by the Comptroller General • Guidelines and a Managers guide on Competency-based Management are being developed (anticipated completion date September 2012) • All competency documents will be posted on the FM community GCpedia site at: http: //www. gcpedia. gc. ca/wiki/Financial_management_community • Training will be provided for managers in October 2012 and for employees in January 2013 39

Financial Officer Training – FI Competencies • The FI Competency Profiles and the Employee guide on Competency-based Management have been approved by the Comptroller General • Guidelines and a Managers guide on Competency-based Management are being developed (anticipated completion date September 2012) • All competency documents will be posted on the FM community GCpedia site at: http: //www. gcpedia. gc. ca/wiki/Financial_management_community • Training will be provided for managers in October 2012 and for employees in January 2013 39

Financial Officer Training – FI Core Curriculum • Developed in conjunction with the Canada School of Public Service • Consists of courses and training events that address the knowledge and skills required of all financial professionals to meet their legal responsibilities 40

Financial Officer Training – FI Core Curriculum • Developed in conjunction with the Canada School of Public Service • Consists of courses and training events that address the knowledge and skills required of all financial professionals to meet their legal responsibilities 40

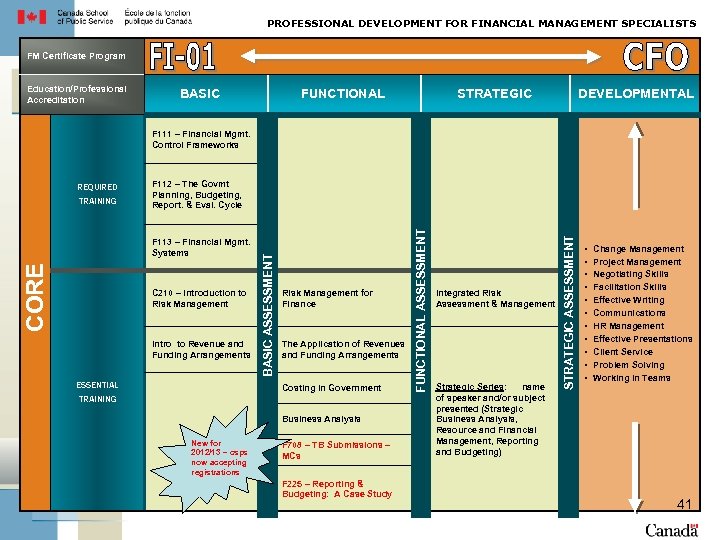

PROFESSIONAL DEVELOPMENT FOR FINANCIAL MANAGEMENT SPECIALISTS FM Certificate Program Education/Professional Accreditation BASIC FUNCTIONAL STRATEGIC DEVELOPMENTAL F 111 – Financial Mgmt. Control Frameworks C 210 – Introduction to Risk Management Intro to Revenue and Funding Arrangements ESSENTIAL Risk Management for Finance The Application of Revenues and Funding Arrangements Costing in Government TRAINING Business Analysis New for 2012/13 – csps now accepting registrations F 708 – TB Submissions – MCs F 225 – Reporting & Budgeting: A Case Study Integrated Risk Assessment & Management Strategic Series: name of speaker and/or subject presented (Strategic Business Analysis, Resource and Financial Management, Reporting and Budgeting) STRATEGIC ASSESSMENT CORE F 113 – Financial Mgmt. Systems FUNCTIONAL ASSESSMENT TRAINING F 112 – The Govmt Planning, Budgeting, Report. & Eval. Cycle BASIC ASSESSMENT REQUIRED • • • Change Management Project Management Negotiating Skills Facilitation Skills Effective Writing Communications HR Management Effective Presentations Client Service Problem Solving Working in Teams 41

PROFESSIONAL DEVELOPMENT FOR FINANCIAL MANAGEMENT SPECIALISTS FM Certificate Program Education/Professional Accreditation BASIC FUNCTIONAL STRATEGIC DEVELOPMENTAL F 111 – Financial Mgmt. Control Frameworks C 210 – Introduction to Risk Management Intro to Revenue and Funding Arrangements ESSENTIAL Risk Management for Finance The Application of Revenues and Funding Arrangements Costing in Government TRAINING Business Analysis New for 2012/13 – csps now accepting registrations F 708 – TB Submissions – MCs F 225 – Reporting & Budgeting: A Case Study Integrated Risk Assessment & Management Strategic Series: name of speaker and/or subject presented (Strategic Business Analysis, Resource and Financial Management, Reporting and Budgeting) STRATEGIC ASSESSMENT CORE F 113 – Financial Mgmt. Systems FUNCTIONAL ASSESSMENT TRAINING F 112 – The Govmt Planning, Budgeting, Report. & Eval. Cycle BASIC ASSESSMENT REQUIRED • • • Change Management Project Management Negotiating Skills Facilitation Skills Effective Writing Communications HR Management Effective Presentations Client Service Problem Solving Working in Teams 41

Financial Officer Training – FI Core Curriculum 2012 -2013 New Activities: • Strategic Series – Schedule of events: – Expectation seminar (Oct 19) – Strategic Relationships for Finance Managers (Dec 3) – Two minute briefings (Dec 14) – Managing sensitive conversations (Jan 15) – Seizing opportunities in a change environment (Jan 25) – Management and Leadership: Master both! – full day event (Feb 15) 42

Financial Officer Training – FI Core Curriculum 2012 -2013 New Activities: • Strategic Series – Schedule of events: – Expectation seminar (Oct 19) – Strategic Relationships for Finance Managers (Dec 3) – Two minute briefings (Dec 14) – Managing sensitive conversations (Jan 15) – Seizing opportunities in a change environment (Jan 25) – Management and Leadership: Master both! – full day event (Feb 15) 42

Financial Officer Training – FI Core Curriculum 2012 -2013 New Activities: • New courses update: – Risk Management for the Finance Professional – Course content under development – Introduction to Revenue and Funding Arrangements – Course Training Plan (CTP) to be approved 43

Financial Officer Training – FI Core Curriculum 2012 -2013 New Activities: • New courses update: – Risk Management for the Finance Professional – Course content under development – Introduction to Revenue and Funding Arrangements – Course Training Plan (CTP) to be approved 43

Financial Officer Training – FM Community Strategic Plan • The 5 year strategic plan will be developed to incorporate the needs and priorities of the financial officer community • FM Community Survey Questionnaire is under development and will seek input on demographics, mobility and learning and professional development priorities. Anticipated release date – late October, 2012. All FIs and EXs will be invited to participate • Focus groups or workshops will be conducted late fall 2012 to identify the community’s maturity against its proposed “ideal’ state and to develop key HR strategies and activities for the next 5 years 44

Financial Officer Training – FM Community Strategic Plan • The 5 year strategic plan will be developed to incorporate the needs and priorities of the financial officer community • FM Community Survey Questionnaire is under development and will seek input on demographics, mobility and learning and professional development priorities. Anticipated release date – late October, 2012. All FIs and EXs will be invited to participate • Focus groups or workshops will be conducted late fall 2012 to identify the community’s maturity against its proposed “ideal’ state and to develop key HR strategies and activities for the next 5 years 44

Financial Officer Training – Current Environment of Fiscal Restraint Training and Career Development • New and creative strategies required; increased emphasis on collaboration and in-house opportunities • Emphasizes the importance of learning plans • The responsibility for professional development is shared by both the employee and management 45

Financial Officer Training – Current Environment of Fiscal Restraint Training and Career Development • New and creative strategies required; increased emphasis on collaboration and in-house opportunities • Emphasizes the importance of learning plans • The responsibility for professional development is shared by both the employee and management 45

Successful Interviewing, Resume Preparation and Networking 46

Successful Interviewing, Resume Preparation and Networking 46

Managing your career • • • Preparation – useful questions Competition process Resume preparation Interviewing Networking 47

Managing your career • • • Preparation – useful questions Competition process Resume preparation Interviewing Networking 47

Career Planning - Useful Questions that can help you chart the right course: • • • Who are you? What are you looking for in an organization or job? What is important to you? What are you looking for? How do you learn best? What tools do you have at your disposal? (competency profiles, manager/peer feedback, evaluations, self-assessments, learning curriculum, career path, personal learning plan)? 48

Career Planning - Useful Questions that can help you chart the right course: • • • Who are you? What are you looking for in an organization or job? What is important to you? What are you looking for? How do you learn best? What tools do you have at your disposal? (competency profiles, manager/peer feedback, evaluations, self-assessments, learning curriculum, career path, personal learning plan)? 48

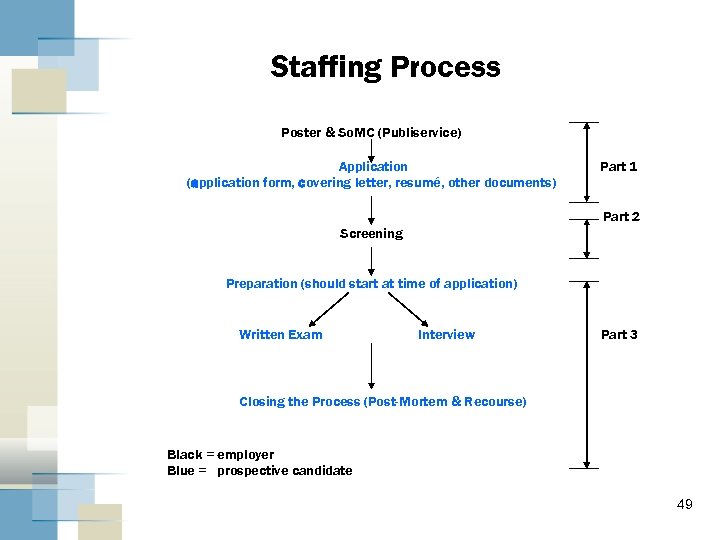

Staffing Process Poster & So. MC (Publiservice) Application (application form, covering letter, resumé, other documents) Part 1 Part 2 Screening Preparation (should start at time of application) Written Exam Interview Part 3 Closing the Process (Post-Mortem & Recourse) Black = employer Blue = prospective candidate 49

Staffing Process Poster & So. MC (Publiservice) Application (application form, covering letter, resumé, other documents) Part 1 Part 2 Screening Preparation (should start at time of application) Written Exam Interview Part 3 Closing the Process (Post-Mortem & Recourse) Black = employer Blue = prospective candidate 49

Poster - Actual job opportunity advertisement - Includes some of the information detailed on the Statement of Merit Criteria - Provides other information such as: • Area of selection – who and where* • Closing date* • General inquiries information (contact person) • Where and how to submit your application • Other information/requirements about the process: – Documents required and format* – Tools that may be used to assess candidates – Results expected (job offers, pool of candidates, etc. ) – Any other important information for the candidates It is important to submit all documents in the format requested and within the timeline indicated as failure to do so would affect your eligibility into the process * Part of selection criteria 50

Poster - Actual job opportunity advertisement - Includes some of the information detailed on the Statement of Merit Criteria - Provides other information such as: • Area of selection – who and where* • Closing date* • General inquiries information (contact person) • Where and how to submit your application • Other information/requirements about the process: – Documents required and format* – Tools that may be used to assess candidates – Results expected (job offers, pool of candidates, etc. ) – Any other important information for the candidates It is important to submit all documents in the format requested and within the timeline indicated as failure to do so would affect your eligibility into the process * Part of selection criteria 50

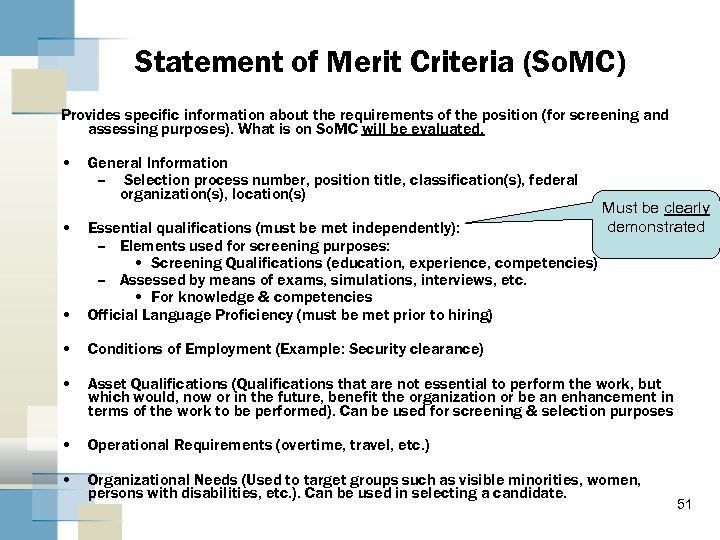

Statement of Merit Criteria (So. MC) Provides specific information about the requirements of the position (for screening and assessing purposes). What is on So. MC will be evaluated. • General Information – Selection process number, position title, classification(s), federal organization(s), location(s) • Essential qualifications (must be met independently): – Elements used for screening purposes: • Screening Qualifications (education, experience, competencies) – Assessed by means of exams, simulations, interviews, etc. • For knowledge & competencies • Official Language Proficiency (must be met prior to hiring) Must be clearly demonstrated • Conditions of Employment (Example: Security clearance) • Asset Qualifications (Qualifications that are not essential to perform the work, but which would, now or in the future, benefit the organization or be an enhancement in terms of the work to be performed). Can be used for screening & selection purposes • Operational Requirements (overtime, travel, etc. ) • Organizational Needs (Used to target groups such as visible minorities, women, persons with disabilities, etc. ). Can be used in selecting a candidate. 51

Statement of Merit Criteria (So. MC) Provides specific information about the requirements of the position (for screening and assessing purposes). What is on So. MC will be evaluated. • General Information – Selection process number, position title, classification(s), federal organization(s), location(s) • Essential qualifications (must be met independently): – Elements used for screening purposes: • Screening Qualifications (education, experience, competencies) – Assessed by means of exams, simulations, interviews, etc. • For knowledge & competencies • Official Language Proficiency (must be met prior to hiring) Must be clearly demonstrated • Conditions of Employment (Example: Security clearance) • Asset Qualifications (Qualifications that are not essential to perform the work, but which would, now or in the future, benefit the organization or be an enhancement in terms of the work to be performed). Can be used for screening & selection purposes • Operational Requirements (overtime, travel, etc. ) • Organizational Needs (Used to target groups such as visible minorities, women, persons with disabilities, etc. ). Can be used in selecting a candidate. 51

Values The guiding values of the Public Service Employment Act (PSEA) are: Fairness, Access, Representativeness and Transparency. 52

Values The guiding values of the Public Service Employment Act (PSEA) are: Fairness, Access, Representativeness and Transparency. 52

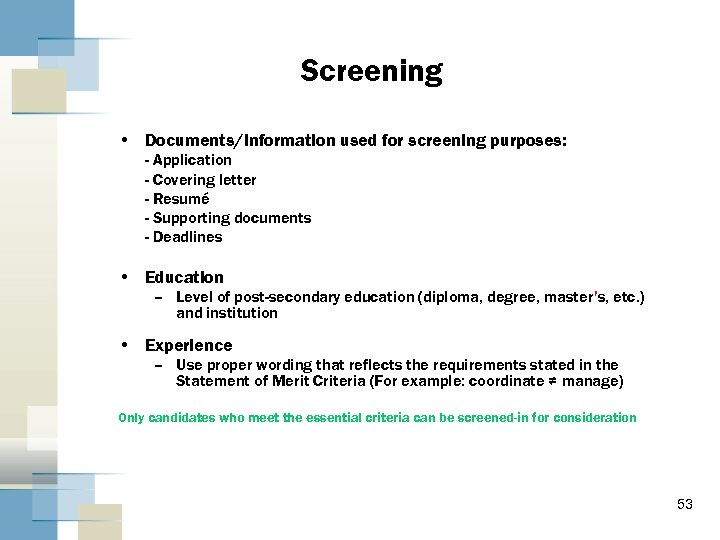

Screening • Documents/Information used for screening purposes: - Application - Covering letter - Resumé - Supporting documents - Deadlines • Education – Level of post-secondary education (diploma, degree, master’s, etc. ) and institution • Experience – Use proper wording that reflects the requirements stated in the Statement of Merit Criteria (For example: coordinate ≠ manage) Only candidates who meet the essential criteria can be screened-in for consideration 53

Screening • Documents/Information used for screening purposes: - Application - Covering letter - Resumé - Supporting documents - Deadlines • Education – Level of post-secondary education (diploma, degree, master’s, etc. ) and institution • Experience – Use proper wording that reflects the requirements stated in the Statement of Merit Criteria (For example: coordinate ≠ manage) Only candidates who meet the essential criteria can be screened-in for consideration 53

Screening (continued) • Supporting documents - - Attach all other requested documents (Proof of education, citizenship documents, performance assessments from previous employer (s), etc. ) If you do not provide them, you may be screened-out • Deadlines – Screening factor – must be met 54

Screening (continued) • Supporting documents - - Attach all other requested documents (Proof of education, citizenship documents, performance assessments from previous employer (s), etc. ) If you do not provide them, you may be screened-out • Deadlines – Screening factor – must be met 54

Application form & cover letter • Most applications must be submitted on-line through Publiservice • If paper applications are accepted, use the format required in the poster • Include ALL requested information & documentation • If some information/documentation is missing, you may be screened-out – The application form can be used as a screening tool • Cover Letter (often used as a screening tool): – This is the first impression you make on the employer and shows how well you communicate in writing – Shows the employer why they should consider your résumé – Opportunity to highlight how your skills and qualifications will benefit the employer – If indicated in the poster, make sure you follow the desired format • For example, if required, use headings or bullet format Trap: Some candidates fail to use the required format in the cover letter and are screened-out on this basis Tip 55

Application form & cover letter • Most applications must be submitted on-line through Publiservice • If paper applications are accepted, use the format required in the poster • Include ALL requested information & documentation • If some information/documentation is missing, you may be screened-out – The application form can be used as a screening tool • Cover Letter (often used as a screening tool): – This is the first impression you make on the employer and shows how well you communicate in writing – Shows the employer why they should consider your résumé – Opportunity to highlight how your skills and qualifications will benefit the employer – If indicated in the poster, make sure you follow the desired format • For example, if required, use headings or bullet format Trap: Some candidates fail to use the required format in the cover letter and are screened-out on this basis Tip 55

Resumé - Showcase yourself! - A "snapshot" of you - You must highlight: - Your education - level of post-secondary education (diploma, degree, master’s, etc. ) and institution - Your work history - Your work experience – remember to use proper wording (For example: coordinate ≠ manage) - Your acquired competencies & skills - Must be clear, concise and demonstrate that you meet all essential qualifications identified on the So. MC 56

Resumé - Showcase yourself! - A "snapshot" of you - You must highlight: - Your education - level of post-secondary education (diploma, degree, master’s, etc. ) and institution - Your work history - Your work experience – remember to use proper wording (For example: coordinate ≠ manage) - Your acquired competencies & skills - Must be clear, concise and demonstrate that you meet all essential qualifications identified on the So. MC 56

Resumé (continued) Resumé should be: Ø Ø Written with the employer’s interests in mind Professional in appearance Targeted for a particular job or organization “Letter-perfect” - spelling and grammar mistakes = bad impression on potential employer Ø Honest and clear demonstration of your skills, abilities and achievements Ø Clear indication of what you offer to the employer Note: When documents are submitted through online application forms, proper formatting is not always possible 57

Resumé (continued) Resumé should be: Ø Ø Written with the employer’s interests in mind Professional in appearance Targeted for a particular job or organization “Letter-perfect” - spelling and grammar mistakes = bad impression on potential employer Ø Honest and clear demonstration of your skills, abilities and achievements Ø Clear indication of what you offer to the employer Note: When documents are submitted through online application forms, proper formatting is not always possible 57

Tips and Tricks for a good Resumé • Useful link to help you prepare your resumé: – http: //www. youth. gc. ca/eng/topics/jobs/resume. shtml • You can find a resumé builder on the following Service Canada website: – http: //seekers. jobbank. gc. ca/commun-common/connection-login. aspx • Google can provide you with many “examples of resumés”. For example: – http: //jobsearch. about. com/od/sampleresumes/a/sampleresume 2. htm 58

Tips and Tricks for a good Resumé • Useful link to help you prepare your resumé: – http: //www. youth. gc. ca/eng/topics/jobs/resume. shtml • You can find a resumé builder on the following Service Canada website: – http: //seekers. jobbank. gc. ca/commun-common/connection-login. aspx • Google can provide you with many “examples of resumés”. For example: – http: //jobsearch. about. com/od/sampleresumes/a/sampleresume 2. htm 58

- Preparing for Exams and/or Interviews - Participating in Exams and/or Interviews - Closing the Process (Post-Mortem & Recourse) 59

- Preparing for Exams and/or Interviews - Participating in Exams and/or Interviews - Closing the Process (Post-Mortem & Recourse) 59

Preparing for exams/interviews Why is it important? – Increases your chances of obtaining what you are aiming for: • Prepares you to make a great first impression! – Demonstrates keen interest in the position – Demonstrates your professionalism and knowledge of the organization – Even if you are not successful, you will be better prepared for future competitions – Avoids wasting everyone’s time (reputation is everything) 60

Preparing for exams/interviews Why is it important? – Increases your chances of obtaining what you are aiming for: • Prepares you to make a great first impression! – Demonstrates keen interest in the position – Demonstrates your professionalism and knowledge of the organization – Even if you are not successful, you will be better prepared for future competitions – Avoids wasting everyone’s time (reputation is everything) 60

Preparing for exams and/or interview Ø Remember, an interview is a two-way exchange of information – The interviewer is interested in three things: ü Can you do the job? ü Will you fit the job? - You will need to be able to demonstrate this during the interview and/or exam - You want to know if the organization is right for you and your career goals Ø Review So. MC and make sure you understand all elements which will be assessed in the exam or during an interview (knowledge, competencies & skills) Ø Things to consider as you prepare yourself: Find out everything you can about the specific position Practice introductions - Practice responses to interview questions, but don't try to memorize them. Being yourself is essential to interview success. Responses need to feel and sound natural. To give a top-notch interview, you need to know the answers to three critical questions: ü Why do I want this job? ü What do I have to offer? ü What else do I need to know? 61

Preparing for exams and/or interview Ø Remember, an interview is a two-way exchange of information – The interviewer is interested in three things: ü Can you do the job? ü Will you fit the job? - You will need to be able to demonstrate this during the interview and/or exam - You want to know if the organization is right for you and your career goals Ø Review So. MC and make sure you understand all elements which will be assessed in the exam or during an interview (knowledge, competencies & skills) Ø Things to consider as you prepare yourself: Find out everything you can about the specific position Practice introductions - Practice responses to interview questions, but don't try to memorize them. Being yourself is essential to interview success. Responses need to feel and sound natural. To give a top-notch interview, you need to know the answers to three critical questions: ü Why do I want this job? ü What do I have to offer? ü What else do I need to know? 61

Preparing for exams and/or interview (continued) - Review appropriate documentation to prepare for questions - - Departmental website Central agencies’ websites General specialized documents Contact appropriate resources - Friends Colleagues Departmental contact(s), etc. 62

Preparing for exams and/or interview (continued) - Review appropriate documentation to prepare for questions - - Departmental website Central agencies’ websites General specialized documents Contact appropriate resources - Friends Colleagues Departmental contact(s), etc. 62

COMMON TYPES OF ORAL ASSESSMENT QUESTIONS • • • “ABOUT YOU” QUESTIONS SITUATIONAL QUESTIONS KNOWLEDGE QUESTIONS BEHAVIOUR BASED QUESTIONS ROLE PLAY 63

COMMON TYPES OF ORAL ASSESSMENT QUESTIONS • • • “ABOUT YOU” QUESTIONS SITUATIONAL QUESTIONS KNOWLEDGE QUESTIONS BEHAVIOUR BASED QUESTIONS ROLE PLAY 63

Participating in the interview/exam Be well-prepared Arrival: - Arrive 15 -20 minutes before the specified time - Bring requested documents (if any) - Dress for success * men: jacket, pants, shirt and ties women: jacket and pants or skirt and appropriate footwear (no flip flops) 64

Participating in the interview/exam Be well-prepared Arrival: - Arrive 15 -20 minutes before the specified time - Bring requested documents (if any) - Dress for success * men: jacket, pants, shirt and ties women: jacket and pants or skirt and appropriate footwear (no flip flops) 64

Participating in the interview/exam Be well-prepared Exam: - Come well prepared ü You've arrived a few minutes early, checked your appearance, are unfailingly polite and pleasant with reception ü Come well-prepared (well-rested, pen & paper, watch, snack, water, documentation if allowed, etc. ) - Read all questions first and allot your time accordingly - Answer questions you know first - If time permits, check your work - Neat and legible responses will assist the evaluator * Unless there is a cultural, religious or other personal reason for not doing so – in this case, you may wish to explain your custom at the interview 65

Participating in the interview/exam Be well-prepared Exam: - Come well prepared ü You've arrived a few minutes early, checked your appearance, are unfailingly polite and pleasant with reception ü Come well-prepared (well-rested, pen & paper, watch, snack, water, documentation if allowed, etc. ) - Read all questions first and allot your time accordingly - Answer questions you know first - If time permits, check your work - Neat and legible responses will assist the evaluator * Unless there is a cultural, religious or other personal reason for not doing so – in this case, you may wish to explain your custom at the interview 65

Participating in the interview/exam Be well-prepared (continued) At the interview: - Make your entrance (smile, firm handshake, confident demeanour, good eye contact and friendly, enthusiastic manner) * - Take notes - Present a detailed, specific and positive picture of what you can do, using concrete examples ü Listening, confidence, and quality of presentation are the keys to successful interviewing. ü Employers are looking for enthusiasm, some knowledge of the organization, confidence, and an ability to work well in their environment. ü The interview is also your opportunity to assess the organization. Do you want to work there? Can you contribute, get new skills, have a chance to advance, or will this position open doors for you? 66

Participating in the interview/exam Be well-prepared (continued) At the interview: - Make your entrance (smile, firm handshake, confident demeanour, good eye contact and friendly, enthusiastic manner) * - Take notes - Present a detailed, specific and positive picture of what you can do, using concrete examples ü Listening, confidence, and quality of presentation are the keys to successful interviewing. ü Employers are looking for enthusiasm, some knowledge of the organization, confidence, and an ability to work well in their environment. ü The interview is also your opportunity to assess the organization. Do you want to work there? Can you contribute, get new skills, have a chance to advance, or will this position open doors for you? 66

Participating in the interview/exam Be well-prepared (continued) Ending the interview: - ask questions that show your knowledge of the organization - ask when they anticipate a decision will be made and how candidates will be informed - Shake hands * and thank the interviewers for their time and for the opportunity to participate * Unless there is a cultural, religious or other personal reason for not doing so – in this case, you may wish to explain your custom at the interview 67

Participating in the interview/exam Be well-prepared (continued) Ending the interview: - ask questions that show your knowledge of the organization - ask when they anticipate a decision will be made and how candidates will be informed - Shake hands * and thank the interviewers for their time and for the opportunity to participate * Unless there is a cultural, religious or other personal reason for not doing so – in this case, you may wish to explain your custom at the interview 67

Interviews PREPARATION • “If you’re not practicing, somebody else is, somewhere, and he’ll be ready to take your job. ” ~Brooks Robinson • “Success depends upon previous preparation, and without such preparation there is sure to be failure” ~ Confucius 68

Interviews PREPARATION • “If you’re not practicing, somebody else is, somewhere, and he’ll be ready to take your job. ” ~Brooks Robinson • “Success depends upon previous preparation, and without such preparation there is sure to be failure” ~ Confucius 68

Interviews • Preparation is the key factor in ensuring success in a selection process. • Candidates should not leave their future to chance. • Candidates should take control of their future and ensure that they are both physically and mentally ready for assessment. 69

Interviews • Preparation is the key factor in ensuring success in a selection process. • Candidates should not leave their future to chance. • Candidates should take control of their future and ensure that they are both physically and mentally ready for assessment. 69

Thank you for the opportunity to speak with you today. 70

Thank you for the opportunity to speak with you today. 70

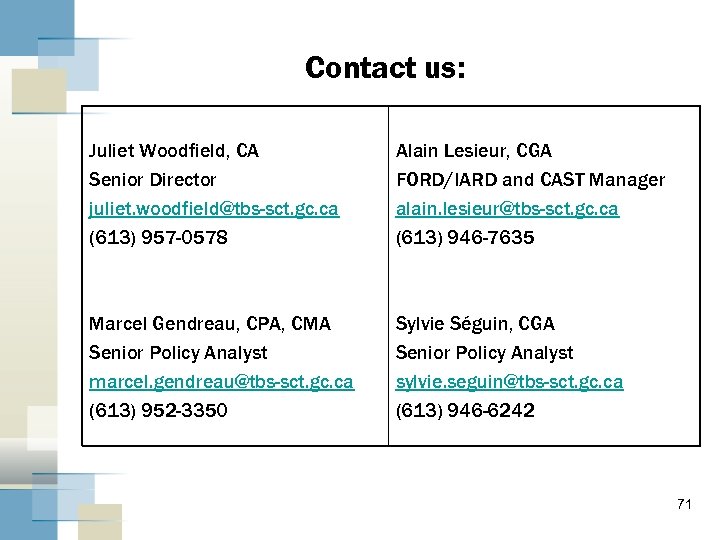

Contact us: Juliet Woodfield, CA Senior Director juliet. woodfield@tbs-sct. gc. ca (613) 957 -0578 Alain Lesieur, CGA FORD/IARD and CAST Manager alain. lesieur@tbs-sct. gc. ca (613) 946 -7635 Marcel Gendreau, CPA, CMA Senior Policy Analyst marcel. gendreau@tbs-sct. gc. ca (613) 952 -3350 Sylvie Séguin, CGA Senior Policy Analyst sylvie. seguin@tbs-sct. gc. ca (613) 946 -6242 71

Contact us: Juliet Woodfield, CA Senior Director juliet. woodfield@tbs-sct. gc. ca (613) 957 -0578 Alain Lesieur, CGA FORD/IARD and CAST Manager alain. lesieur@tbs-sct. gc. ca (613) 946 -7635 Marcel Gendreau, CPA, CMA Senior Policy Analyst marcel. gendreau@tbs-sct. gc. ca (613) 952 -3350 Sylvie Séguin, CGA Senior Policy Analyst sylvie. seguin@tbs-sct. gc. ca (613) 946 -6242 71