9a903a2a641034312495056c7cea2bb3.ppt

- Количество слайдов: 45

2011 Fiscal and Compliance Monitoring Training February 1, 2011 Marissa M. Tirona Project Director

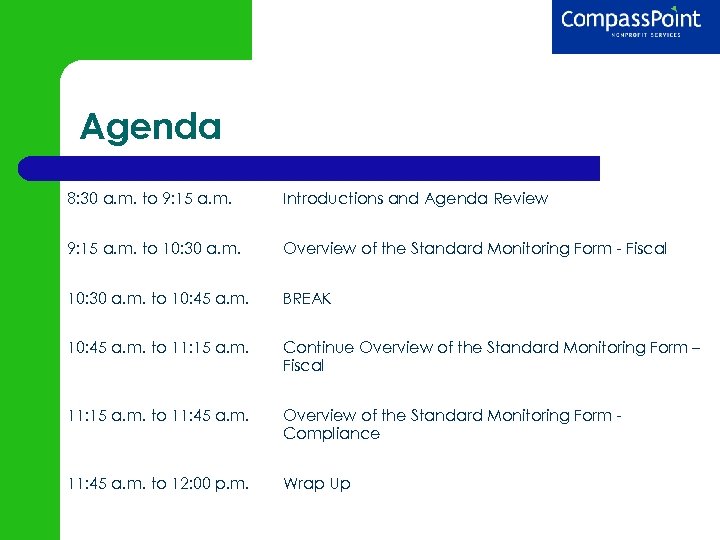

Agenda 8: 30 a. m. to 9: 15 a. m. Introductions and Agenda Review 9: 15 a. m. to 10: 30 a. m. Overview of the Standard Monitoring Form - Fiscal 10: 30 a. m. to 10: 45 a. m. BREAK 10: 45 a. m. to 11: 15 a. m. Continue Overview of the Standard Monitoring Form – Fiscal 11: 15 a. m. to 11: 45 a. m. Overview of the Standard Monitoring Form Compliance 11: 45 a. m. to 12: 00 p. m. Wrap Up

Compass. Point Nonprofit Services Compass. Point intensifies the impact of fellow nonprofit leaders, organizations, and networks as we achieve social equity together Our integrated practice offers the strongest teaching, consulting, and peer learning – all grounded in deep nonprofit leadership experience

Learning Objectives Understand context for fiscal and compliance monitoring program Review the fiscal and compliance standard monitoring form Learn more about what City monitors will be looking for during site visits

Context Organizations that invest in increasing their management capacities are poised to achieve greater mission impact. Leaders need to consider the mission impact and financial impact of all decisions. The City’s monitoring process is about supporting your organization’s ability to implement sustainable financial practices.

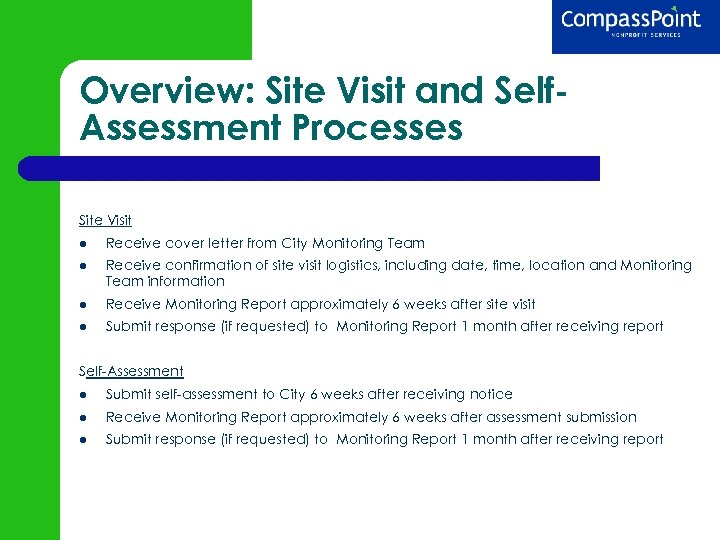

Overview: Site Visit and Self. Assessment Processes Site Visit Receive cover letter from City Monitoring Team Receive confirmation of site visit logistics, including date, time, location and Monitoring Team information Receive Monitoring Report approximately 6 weeks after site visit Submit response (if requested) to Monitoring Report 1 month after receiving report Self-Assessment Submit self-assessment to City 6 weeks after receiving notice Receive Monitoring Report approximately 6 weeks after assessment submission Submit response (if requested) to Monitoring Report 1 month after receiving report

Section 1 Agency-wide Budget, Cost Allocation Procedures and Invoices

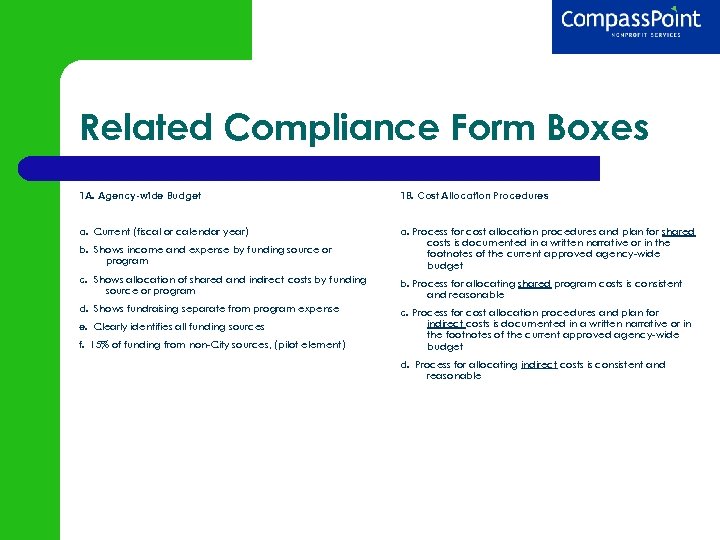

Related Compliance Form Boxes 1 A. Agency-wide Budget 1 B. Cost Allocation Procedures a. Current (fiscal or calendar year) b. Shows income and expense by funding source or program a. Process for cost allocation procedures and plan for shared costs is documented in a written narrative or in the footnotes of the current approved agency-wide budget c. Shows allocation of shared and indirect costs by funding source or program b. Process for allocating shared program costs is consistent and reasonable d. Shows fundraising separate from program expense c. Process for cost allocation procedures and plan for indirect costs is documented in a written narrative or in the footnotes of the current approved agency-wide budget e. Clearly identifies all funding sources f. 15% of funding from non-City sources, (pilot element) d. Process for allocating indirect costs is consistent and reasonable

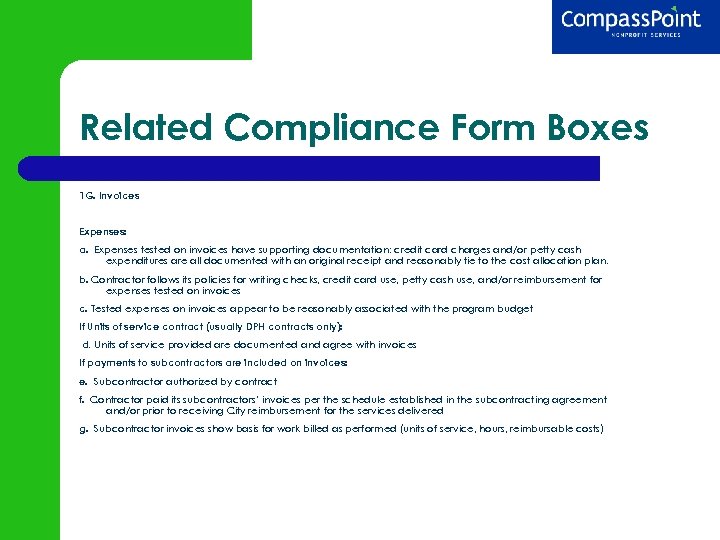

Related Compliance Form Boxes 1 G. Invoices Expenses: a. Expenses tested on invoices have supporting documentation: credit card charges and/or petty cash expenditures are all documented with an original receipt and reasonably tie to the cost allocation plan. b. Contractor follows its policies for writing checks, credit card use, petty cash use, and/or reimbursement for expenses tested on invoices c. Tested expenses on invoices appear to be reasonably associated with the program budget If Units of service contract (usually DPH contracts only): d. Units of service provided are documented and agree with invoices If payments to subcontractors are included on invoices: e. Subcontractor authorized by contract f. Contractor paid its subcontractors’ invoices per the schedule established in the subcontracting agreement and/or prior to receiving City reimbursement for the services delivered g. Subcontractor invoices show basis for work billed as performed (units of service, hours, reimbursable costs)

The Organizational Budget: Key Performance Points Current budget? Budgeted by cost centers? Includes projections and variances? Funding sources included? Appropriate cost allocations? 15% of funding from non-City sources?

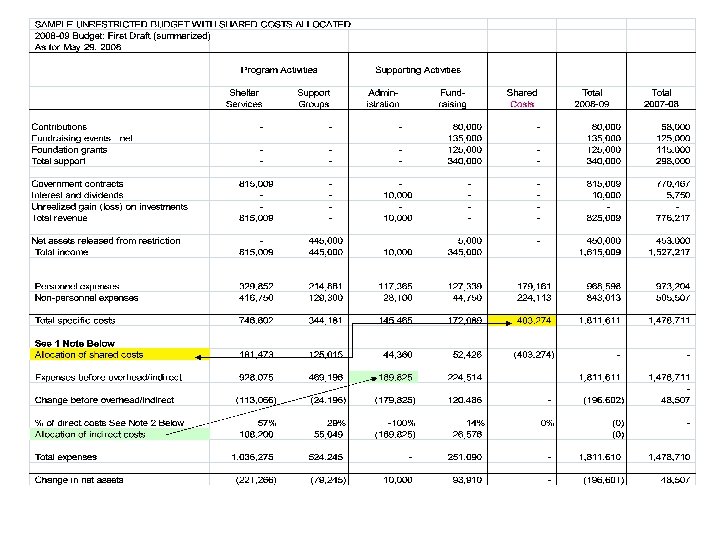

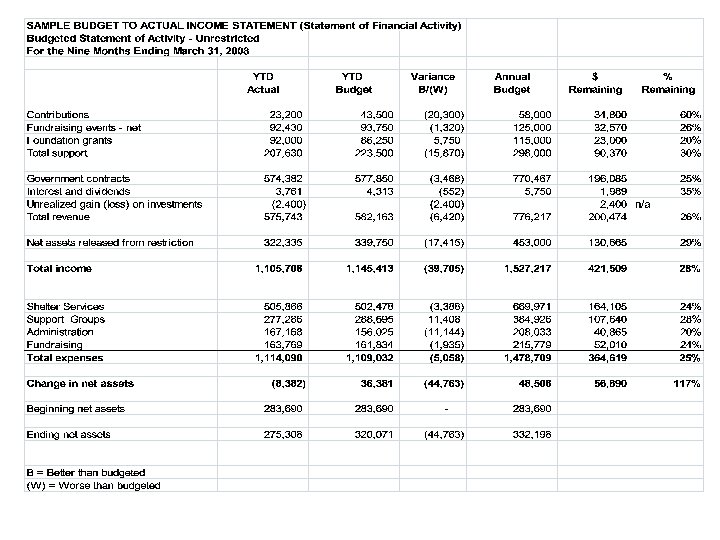

Sample Unrestricted Budget with Shared Costs Allocated This budget format is akin to a high-level “working” budget Often not the format presented to an organization’s board for final approval (generally, the board does not get involved in the details of an organization’s cost allocation methodology)

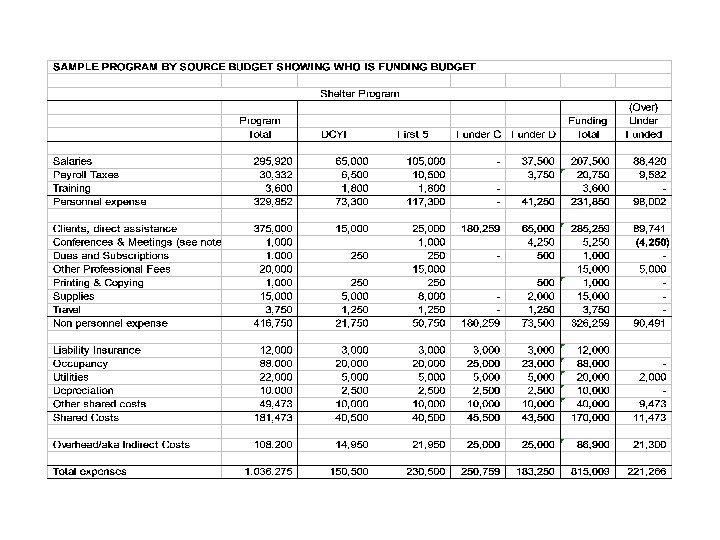

Sample Program by Source Budget Excellent supporting documentation for overall budget Helps in conversations you have with City staff regarding how the organizational budget was developed It’s another way to check invoicing – does the invoice accurately reflect the organizational budget and the program budget?

Possible Allocation Methodologies A percentage determined by dividing the number of FTEs of each activity by the total number of FTEs from all the activities (excluding any whose salaries are treated as common costs). A percentage determined by dividing the amount of the payroll expenses of each activity by the payroll expenses of all the activities (excluding common). A percentage determined by dividing the square footage used by each activity by the total agency square footage. A percentage determined by dividing the amount of the specific expenses of each activity by the total specific expenses of the organization.

Common Allocation Mistakes Failure to categorize Failure to document Failure to apply consistently

Section 2 Financial Reports, Audited Financial Statements and Tax Forms

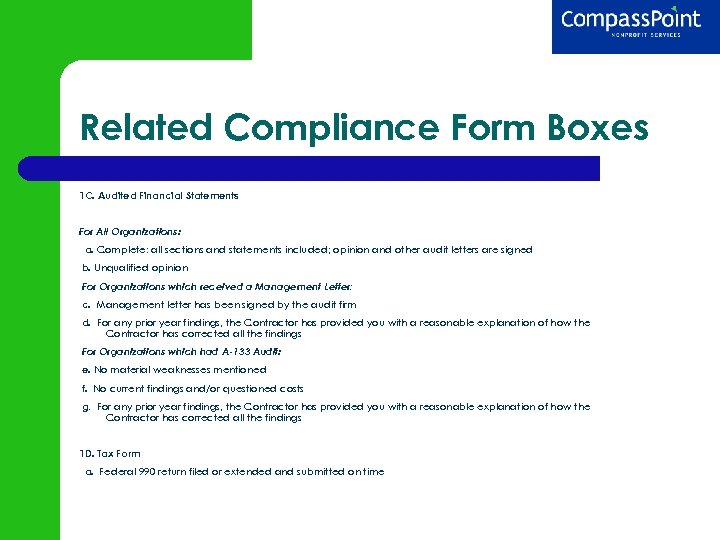

Related Compliance Form Boxes 1 C. Audited Financial Statements For All Organizations: a. Complete: all sections and statements included; opinion and other audit letters are signed b. Unqualified opinion For Organizations which received a Management Letter: c. Management letter has been signed by the audit firm d. For any prior year findings, the Contractor has provided you with a reasonable explanation of how the Contractor has corrected all the findings For Organizations which had A-133 Audit: e. No material weaknesses mentioned f. No current findings and/or questioned costs g. For any prior year findings, the Contractor has provided you with a reasonable explanation of how the Contractor has corrected all the findings 1 D. Tax Form a. Federal 990 return filed or extended and submitted on time

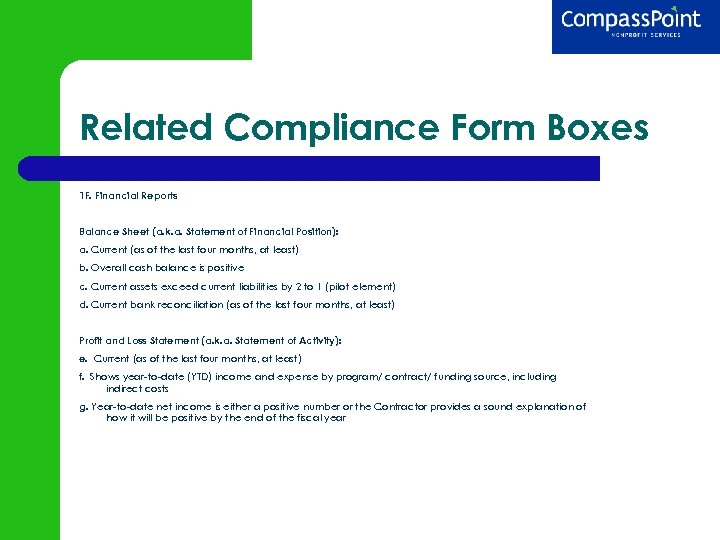

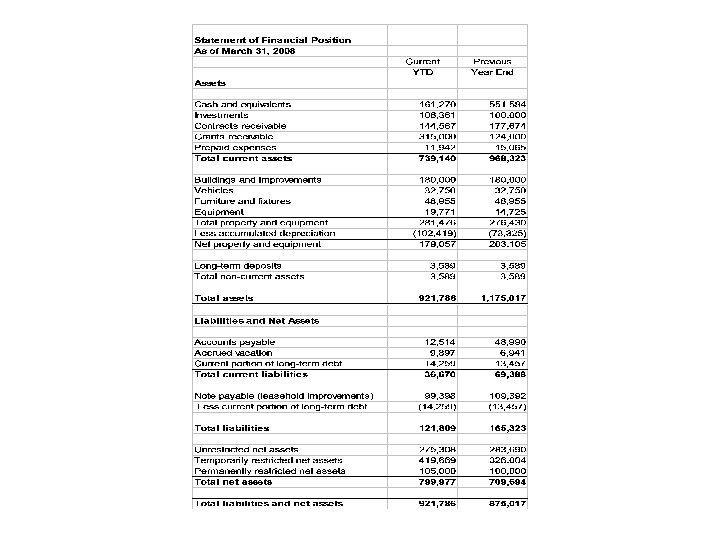

Related Compliance Form Boxes 1 F. Financial Reports Balance Sheet (a. k. a. Statement of Financial Position): a. Current (as of the last four months, at least) b. Overall cash balance is positive c. Current assets exceed current liabilities by 2 to 1 (pilot element) d. Current bank reconciliation (as of the last four months, at least) Profit and Loss Statement (a. k. a. Statement of Activity): e. Current (as of the last four months, at least) f. Shows year-to-date (YTD) income and expense by program/ contract/ funding source, including indirect costs g. Year-to-date net income is either a positive number or the Contractor provides a sound explanation of how it will be positive by the end of the fiscal year

Statement of Financial Position Commonly called “balance sheet” A snapshot as of date on top of report Never gets zeroed out: no “starting over” Assets = own/have title to Liabilities = owe Net Assets = the difference between the two Remember what “current” means: within a year

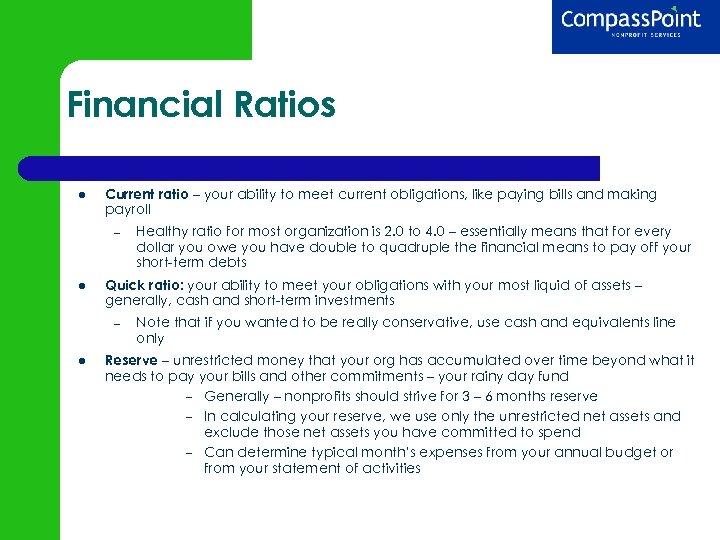

Financial Ratios Current ratio – your ability to meet current obligations, like paying bills and making payroll – Quick ratio: your ability to meet your obligations with your most liquid of assets – generally, cash and short-term investments – Healthy ratio for most organization is 2. 0 to 4. 0 – essentially means that for every dollar you owe you have double to quadruple the financial means to pay off your short-term debts Note that if you wanted to be really conservative, use cash and equivalents line only Reserve – unrestricted money that your org has accumulated over time beyond what it needs to pay your bills and other commitments – your rainy day fund – Generally – nonprofits should strive for 3 – 6 months reserve – In calculating your reserve, we use only the unrestricted net assets and exclude those net assets you have committed to spend – Can determine typical month’s expenses from your annual budget or from your statement of activities

Financial Ratios Current Ratio: Total Current Assets Total Current Liabilities Quick Ratio : Total Cash and Investments Total Current Liabilities Liquid Reserve Ratio: Unrestricted Net Assets - Total Fixed Assets Typical Monthly Expenses

Statement of Activities Commonly called “income statement” or “P&L” Reports on the fiscal year Does get zeroed out each new year Shows flows of restricted contributions in aggregate, not by funder

Section 3 Payroll and Timesheets

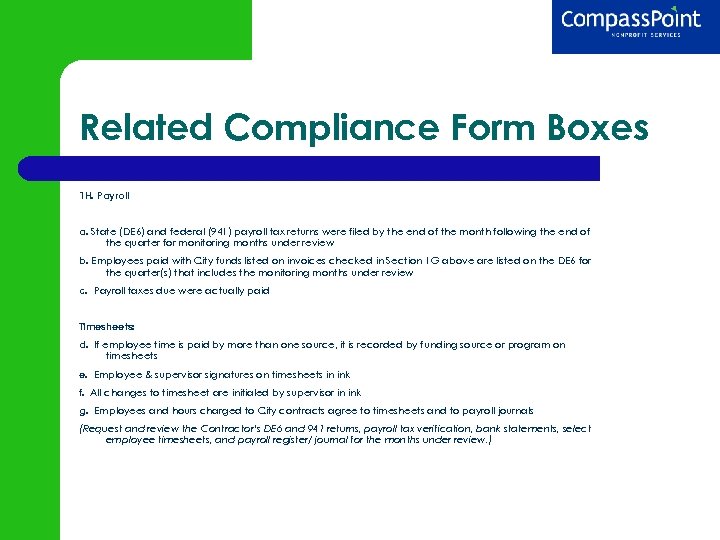

Related Compliance Form Boxes 1 H. Payroll a. State (DE 6) and federal (941) payroll tax returns were filed by the end of the month following the end of the quarter for monitoring months under review b. Employees paid with City funds listed on invoices checked in Section 1 G above are listed on the DE 6 for the quarter(s) that includes the monitoring months under review c. Payroll taxes due were actually paid Timesheets: d. If employee time is paid by more than one source, it is recorded by funding source or program on timesheets e. Employee & supervisor signatures on timesheets in ink f. All changes to timesheet are initialed by supervisor in ink g. Employees and hours charged to City contracts agree to timesheets and to payroll journals (Request and review the Contractor’s DE 6 and 941 returns, payroll tax verification, bank statements, select employee timesheets, and payroll register/ journal for the months under review. )

Timesheets: What to Look Out For Time spent on activity is accurately reflected, including breaks Activity is clearly defined Time is recorded by program or funding source Employee’s and supervisor’s signatures Any changes are initialed by supervisor

Different ways to track time Daily timesheets Weekly timesheets Time studies

Section 4 Fiscal Policies and Procedures

Related Compliance Form Boxes 1 E. Fiscal Policies & Procedures a. Current (updated to reflect prior site visit or audit recommendations) In writing, contains at a minimum: b. Internal controls (safeguarding of assets, authorization of transactions, reconciliation of accounting records) c. Financial reporting d. Accounts payable e. Accounts receivable f. Petty cash g. Payroll

Key Elements of a Fiscal Policies and Procedures Manual Internal Controls (safeguarding of assets, authorization of transactions, reconciliation of accounting records) Financial Reporting (which reports are required, to whom, and when) Accounts Payable (processing of bills to the organization including credit cards) Accounts Receivable (process of money coming into the organization) Petty cash procedures Payroll (timesheets, time-studies, payroll process, paying and filing payroll taxes) Conflict of Interest Policies (if not included in the organization’s Personnel Manual)

Section 5 Board Minutes, Board Meetings, Public Access to Records and Community Representation on the Board

Related Compliance Form Boxes 2 A. Board Minutes a. Minutes show that if a paid City employee or City commission member is on the Board, he or she did not vote on items related to City contracts with their affiliated City department (excluding vote on Agency-Wide Budget) b. Minutes show that if the Executive Director is a member of the Board, he or she is a non-voting member c. Minutes show current agency-wide budget approved d. Minutes show that financial reports are shared with the Board on a regular basis 2 B. Board Meetings a. At least two meetings with quorum status are open to the public each year b. These two meetings are announced to the general public at least 30 days in advance through the SF Public Library and the Clerk of the Board

Related Compliance Form Boxes 2 C. Public Access to Records a. Procedures for responding to Sunshine Requests from the public within 10 days of request b. Policies for requests beyond what is “Sunshineable, ” including disputes about access to information 2 D. Community Representation on Board a. By-laws include requirements for community representation on Board, or, Contractor makes other efforts to ensure community representation

Section 6 Personnel Policies

Related Compliance Form Boxes 2 G. Personnel Policies a. Written and current personnel/employee manual b. Evidence that staff were trained regarding personnel policies c. Documentation of the following is maintained on file: - Job description - Employment application or résumé - Employment confirmation or letter of hire - Salary information including adjustments - Verification of employee orientation - Annual TB clearance (required for DPH contracts, meal, aging and dependent adult, and children’s services) - Fingerprinting (required for children’s services)

Evidence of Adequate Training on Personnel Policies Signed acknowledgment of receipt form Training calendar Memorandum documenting training

Section 7 Subcontracts and Licenses

Related Compliance Form Boxes 2 E. Subcontracts a. Procurement procedures in the Contractor’s fiscal policies and procedures were followed by Contractor to select subcontractors b. Legally binding agreements between Contractor and subcontractors are valid and current c. Contractor regularly monitors fiscal and programmatic performance of subcontractor 2 F. Licenses a. Site licenses required by City contracts are available, verified and current b. Staff licenses required by City contracts are available, verified and current

Section 8 Emergency Operations Plan and Americans with Disabilities Act

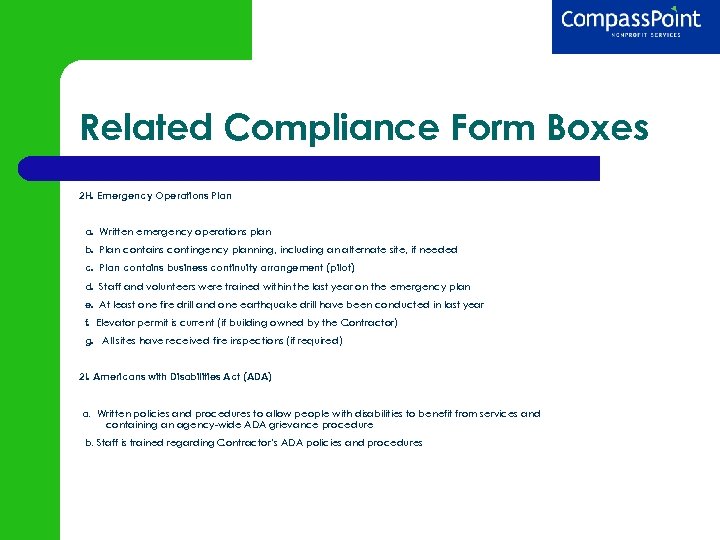

Related Compliance Form Boxes 2 H. Emergency Operations Plan a. Written emergency operations plan b. Plan contains contingency planning, including an alternate site, if needed c. Plan contains business continuity arrangement (pilot) d. Staff and volunteers were trained within the last year on the emergency plan e. At least one fire drill and one earthquake drill have been conducted in last year f. Elevator permit is current (if building owned by the Contractor) g. All sites have received fire inspections (if required) 2 I. Americans with Disabilities Act (ADA) a. Written policies and procedures to allow people with disabilities to benefit from services and containing an agency-wide ADA grievance procedure b. Staff is trained regarding Contractor’s ADA policies and procedures

Next Steps. . . What next steps will you take as a result of what you learned today? What resources do you need to support you in the monitoring process?

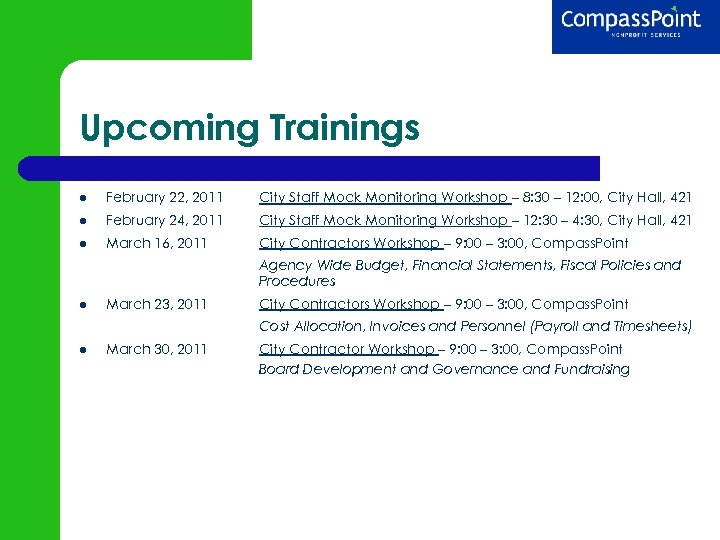

Upcoming Trainings February 22, 2011 City Staff Mock Monitoring Workshop – 8: 30 – 12: 00, City Hall, 421 February 24, 2011 City Staff Mock Monitoring Workshop – 12: 30 – 4: 30, City Hall, 421 March 16, 2011 City Contractors Workshop – 9: 00 – 3: 00, Compass. Point Agency Wide Budget, Financial Statements, Fiscal Policies and Procedures March 23, 2011 City Contractors Workshop – 9: 00 – 3: 00, Compass. Point Cost Allocation, Invoices and Personnel (Payroll and Timesheets) March 30, 2011 City Contractor Workshop – 9: 00 – 3: 00, Compass. Point Board Development and Governance and Fundraising

Contact Information Greg Asay Office of the Controller Greg. Asay@sfgov. org 415. 554. 7595 Marissa M. Tirona 415. 541. 9000 marissat@compasspoint. org www. compasspoint. org

9a903a2a641034312495056c7cea2bb3.ppt