2ace08dbf80fcd50b66619a28f60edae.ppt

- Количество слайдов: 38

© 2011 Blue Cross and Blue Shield of Illinois. All rights reserved. An Independent Licensee of the Blue Cross and Blue Shield Association.

Welcome J. Todd Phillips Vice President, Middle Market and Sales Strategy 2

more than 1 in 3 Americans has a BCBS card 896, 000 providers 13. 1 million members in our 4 states more than 5, 300 hospitals 4

< 10% turnover Customer Service Reps WE RETAIN Members Are +6. 7% 98. 5% CUSTOMERS More Loyal team Average tenure of sales 14 years 5

Active producers online Is 18, 245 there an APP for that ? 10, 000340% Facebook fan channel views More Twitter increase in 2010 followers than all competitors 27, 000 fans 6

Moving Toward the Future Karen Atwood President 7

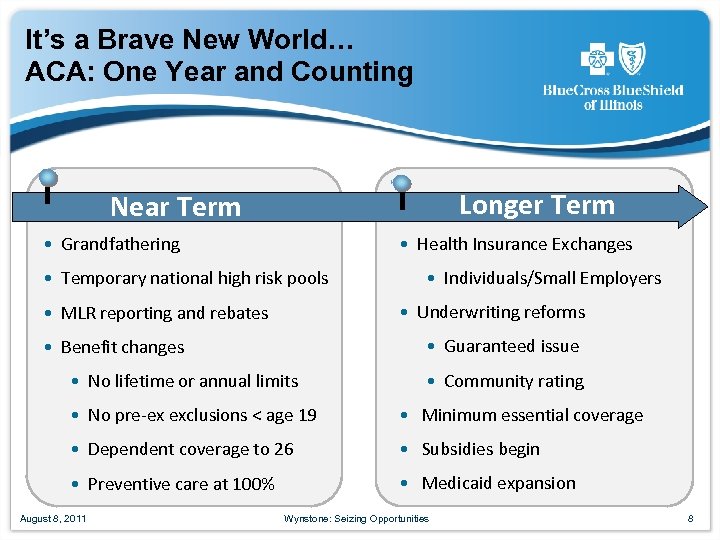

It’s a Brave New World… ACA: One Year and Counting Longer Term Near Term • Health Insurance Exchanges • Grandfathering • Temporary national high risk pools • Individuals/Small Employers • Underwriting reforms • MLR reporting and rebates • Guaranteed issue • Benefit changes • No lifetime or annual limits • Community rating • No pre-ex exclusions < age 19 • Minimum essential coverage • Dependent coverage to 26 • Subsidies begin • Preventive care at 100% • Medicaid expansion August 8, 2011 Wynstone: Seizing Opportunities 8

We Are Proceeding (Enthusiastically) – Despite Uncertainties Political Economic August 8, 2011 Judiciary Wynstone: Seizing Opportunities 9

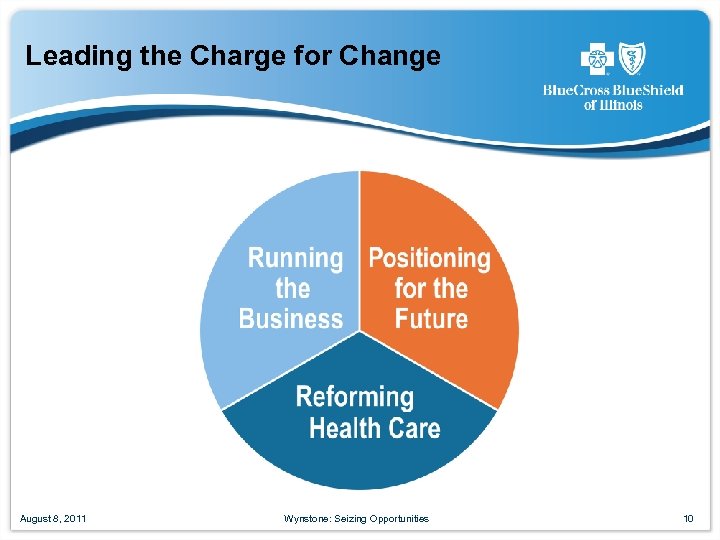

Leading the Charge for Change August 8, 2011 Wynstone: Seizing Opportunities 10

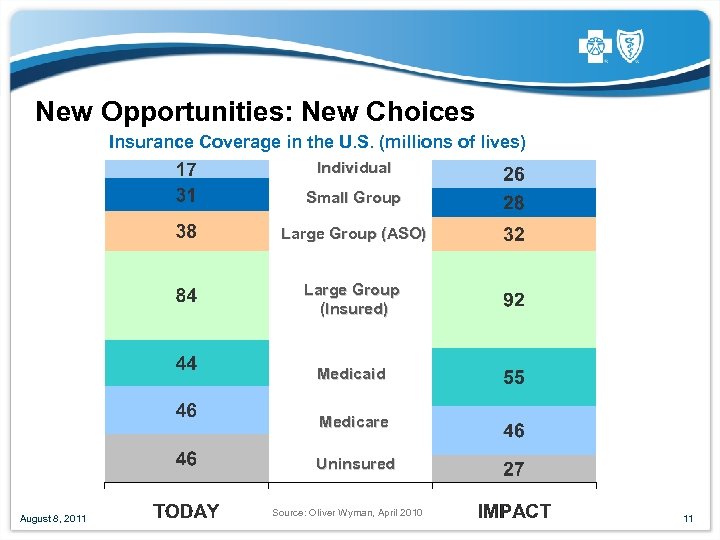

New Opportunities: New Choices Insurance Coverage in the U. S. (millions of lives) Individual Small Group Large Group (ASO) Large Group (Insured) Medicaid Medicare Uninsured August 8, 2011 Source: Oliver Wyman, April 2010 Wynstone : Seizing Opportunities 11

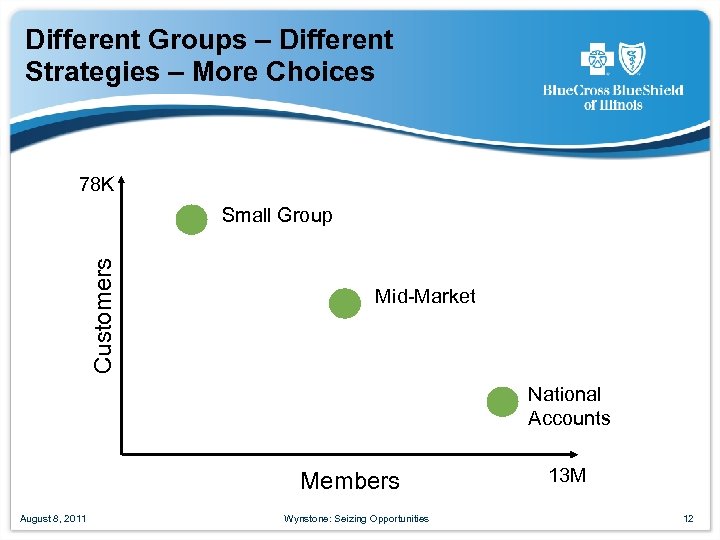

Different Groups – Different Strategies – More Choices 78 K Customers Small Group Mid-Market National Accounts Members August 8, 2011 Wynstone: Seizing Opportunities 13 M 12

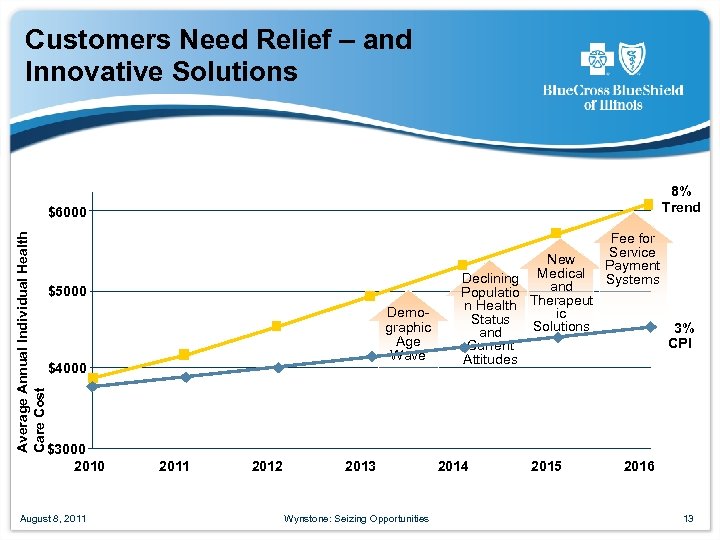

Customers Need Relief – and Innovative Solutions 8% Trend Average Annual Individual Health Care Cost $6000 $5000 Demographic Age Wave $4000 $3000 2010 August 8, 2011 2012 2013 Wynstone: Seizing Opportunities New Medical Declining and Populatio n Health Therapeut ic Status Solutions and Current Attitudes 2014 2015 Fee for Service Payment Systems 3% CPI 2016 13

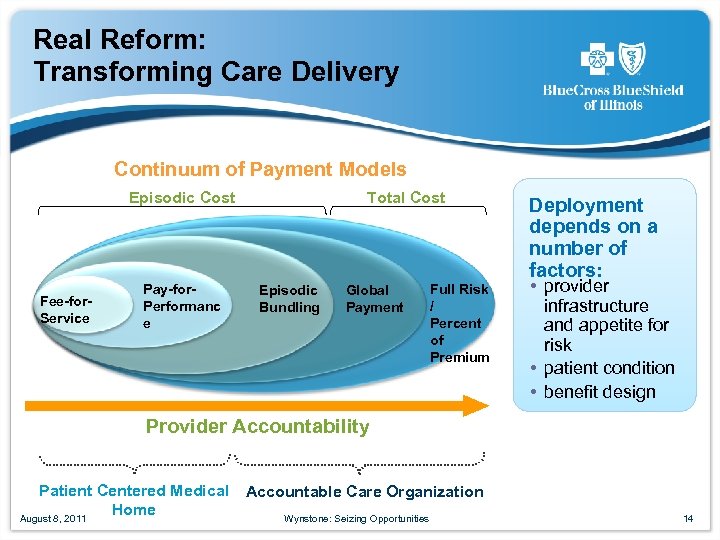

Real Reform: Transforming Care Delivery Continuum of Payment Models Episodic Cost Fee-for. Service Pay-for. Performanc e Total Cost Episodic Bundling Global Payment Full Risk / Percent of Premium Deployment depends on a number of factors: • provider infrastructure and appetite for risk • patient condition • benefit design Provider Accountability Patient Centered Medical Home August 8, 2011 Accountable Care Organization Wynstone: Seizing Opportunities 14

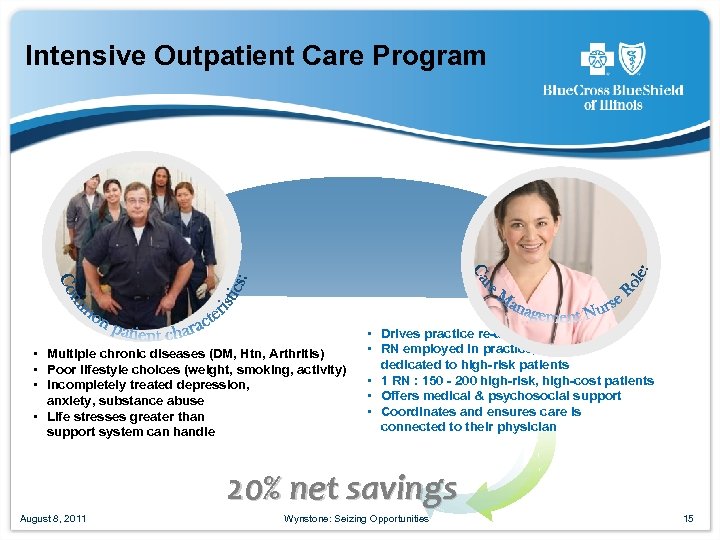

Intensive Outpatient Care Program • Multiple chronic diseases (DM, Htn, Arthritis) • Poor lifestyle choices (weight, smoking, activity) • Incompletely treated depression, anxiety, substance abuse • Life stresses greater than support system can handle • Drives practice re-design • RN employed in practice; dedicated to high-risk patients • 1 RN : 150 - 200 high-risk, high-cost patients • Offers medical & psychosocial support • Coordinates and ensures care is connected to their physician 20% net savings August 8, 2011 Wynstone: Seizing Opportunities 15

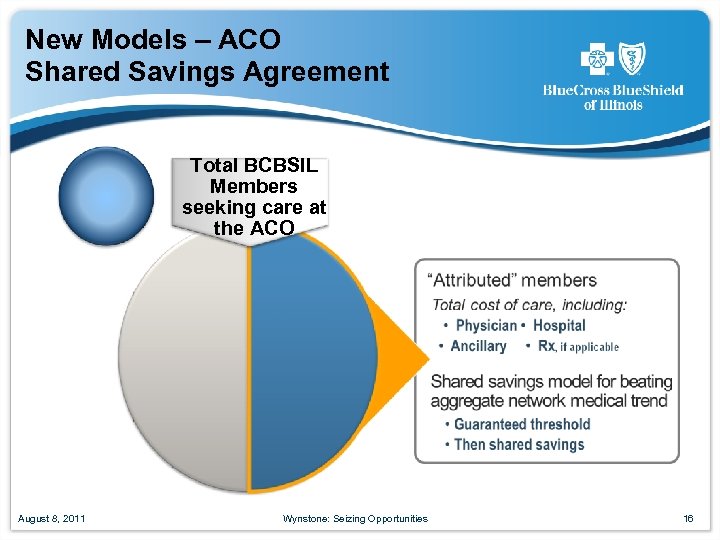

New Models – ACO Shared Savings Agreement Total BCBSIL Members seeking care at the ACO August 8, 2011 Wynstone: Seizing Opportunities 16

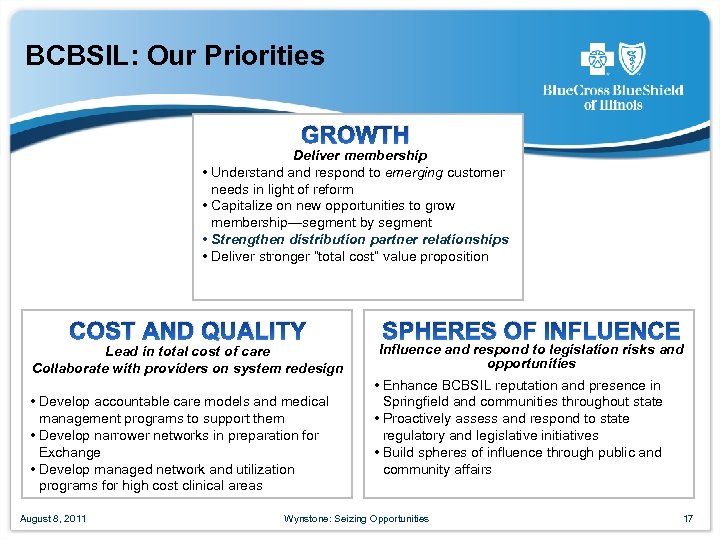

BCBSIL: Our Priorities GROWTH Deliver membership • Understand respond to emerging customer needs in light of reform • Capitalize on new opportunities to grow membership—segment by segment • Strengthen distribution partner relationships • Deliver stronger “total cost” value proposition COST AND QUALITY Lead in total cost of care Collaborate with providers on system redesign • Develop accountable care models and medical management programs to support them • Develop narrower networks in preparation for Exchange • Develop managed network and utilization programs for high cost clinical areas August 8, 2011 SPHERES OF INFLUENCE Influence and respond to legislation risks and opportunities • Enhance BCBSIL reputation and presence in Springfield and communities throughout state • Proactively assess and respond to state regulatory and legislative initiatives • Build spheres of influence through public and community affairs Wynstone: Seizing Opportunities 17

We’re Not Like All the Rest! • Committed to our communities for the long-term • Responsibility to lead positive, meaningful health care change • Largest non-investor owned health plan • We maximize access to care, not profits • We reinvest surpluses back into the health care system; not return it to shareholders • We maintain a longer-term planning and investment horizon that enables better decision-making • Unwavering commitment to provide as much affordable coverage to as many people as possible August 8, 2011 Wynstone: Seizing Opportunities 18 18

Creating the New World – Together • We want to continue be your business partner • The world is changing – and we both face the challenge of redefining roles and contributions in this new world • This includes the opportunity to define new ways of working together • We share a mutual client and our job is to create the new scenario: Client WIN • Producer WIN • BCBSIL WIN August 8, 2011 Wynstone: Seizing Opportunities 19

August 8, 2011 Wynstone: Seizing Opportunities 20

Legislative Update Harmony Harrington, BCBSIL Government Relations 21

View from Washington • While health care remains an important issue in Washington, lawmakers remain focused on the economy, jobs, FY 2012 appropriations and the federal budget / deficit ceiling. • Members continue to have a strong interest in health reform implementation. • Congressional hearings on key aspects of ACA • Several bills introduced to repeal, “defund” or otherwise change key ACA provisions • Regulatory Process is “overwhelming” 22

View from Springfield • While health care remains an important issue in Springfield, during the Spring Session, state lawmakers focused on the state budget, worker’s compensation reform and re-districting. Governor Quinn appointed Jack Messmore as Acting Director of Insurance to fill Mc. Raith vacancy. • Over 400 bills introduced during Spring Session impacting health insurance. • Legislature Returns to Springfield for Fall Veto Session in late October. 23

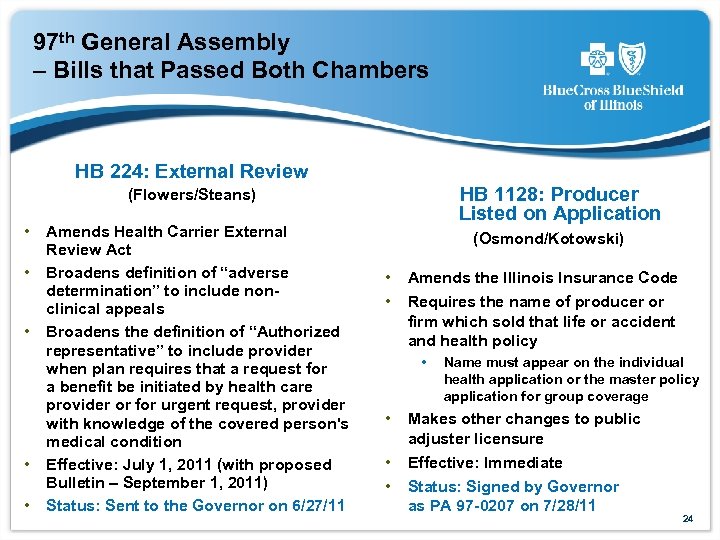

97 th General Assembly – Bills that Passed Both Chambers HB 224: External Review HB 1128: Producer Listed on Application (Flowers/Steans) • Amends Health Carrier External • • Review Act Broadens definition of “adverse determination” to include nonclinical appeals Broadens the definition of “Authorized representative” to include provider when plan requires that a request for a benefit be initiated by health care provider or for urgent request, provider with knowledge of the covered person's medical condition Effective: July 1, 2011 (with proposed Bulletin – September 1, 2011) Status: Sent to the Governor on 6/27/11 (Osmond/Kotowski) • Amends the Illinois Insurance Code • Requires the name of producer or firm which sold that life or accident and health policy • Name must appear on the individual health application or the master policy application for group coverage • Makes other changes to public • • adjuster licensure Effective: Immediate Status: Signed by Governor as PA 97 -0207 on 7/28/11 24

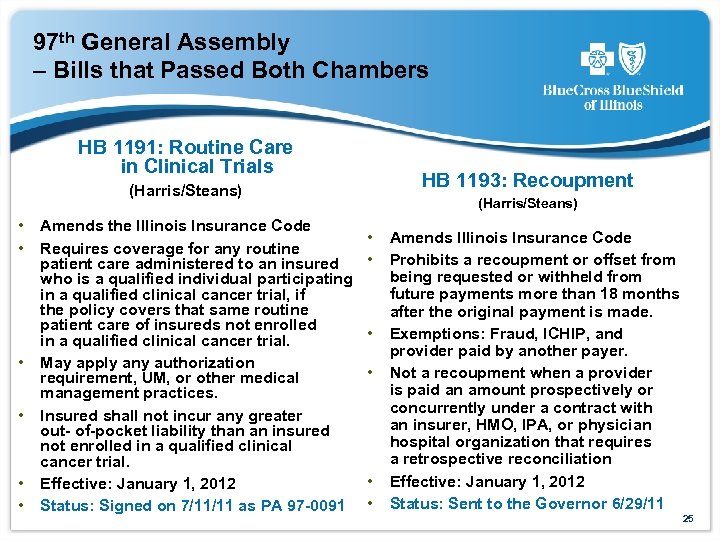

97 th General Assembly – Bills that Passed Both Chambers HB 1191: Routine Care in Clinical Trials HB 1193: Recoupment (Harris/Steans) • Amends the Illinois Insurance Code • Requires coverage for any routine • • patient care administered to an insured who is a qualified individual participating in a qualified clinical cancer trial, if the policy covers that same routine patient care of insureds not enrolled in a qualified clinical cancer trial. May apply any authorization requirement, UM, or other medical management practices. Insured shall not incur any greater out- of-pocket liability than an insured not enrolled in a qualified clinical cancer trial. Effective: January 1, 2012 Status: Signed on 7/11/11 as PA 97 -0091 (Harris/Steans) • Amends Illinois Insurance Code • Prohibits a recoupment or offset from • • being requested or withheld from future payments more than 18 months after the original payment is made. Exemptions: Fraud, ICHIP, and provider paid by another payer. Not a recoupment when a provider is paid an amount prospectively or concurrently under a contract with an insurer, HMO, IPA, or physician hospital organization that requires a retrospective reconciliation Effective: January 1, 2012 Status: Sent to the Governor 6/29/11 25

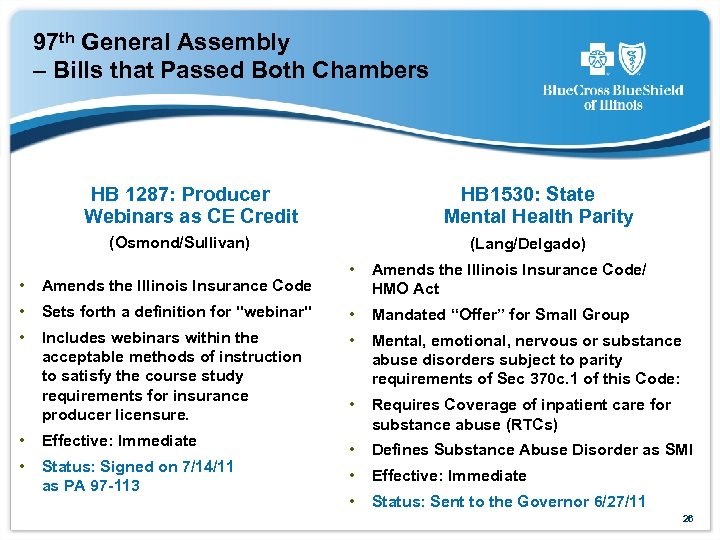

97 th General Assembly – Bills that Passed Both Chambers HB 1287: Producer Webinars as CE Credit HB 1530: State Mental Health Parity (Osmond/Sullivan) • Amends the Illinois Insurance Code • Sets forth a definition for "webinar" • Includes webinars within the acceptable methods of instruction to satisfy the course study requirements for insurance producer licensure. • Effective: Immediate • Status: Signed on 7/14/11 as PA 97 -113 (Lang/Delgado) • Amends the Illinois Insurance Code/ HMO Act • Mandated “Offer” for Small Group • Mental, emotional, nervous or substance abuse disorders subject to parity requirements of Sec 370 c. 1 of this Code: • Requires Coverage of inpatient care for substance abuse (RTCs) • Defines Substance Abuse Disorder as SMI • Effective: Immediate • Status: Sent to the Governor 6/27/11 26

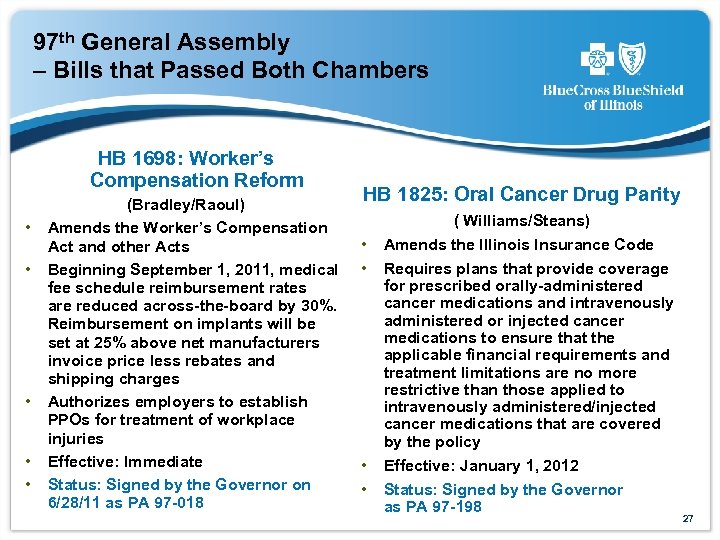

97 th General Assembly – Bills that Passed Both Chambers HB 1698: Worker’s Compensation Reform • • • (Bradley/Raoul) Amends the Worker’s Compensation Act and other Acts Beginning September 1, 2011, medical fee schedule reimbursement rates are reduced across-the-board by 30%. Reimbursement on implants will be set at 25% above net manufacturers invoice price less rebates and shipping charges Authorizes employers to establish PPOs for treatment of workplace injuries Effective: Immediate Status: Signed by the Governor on 6/28/11 as PA 97 -018 HB 1825: Oral Cancer Drug Parity ( Williams/Steans) • Amends the Illinois Insurance Code • Requires plans that provide coverage • • for prescribed orally-administered cancer medications and intravenously administered or injected cancer medications to ensure that the applicable financial requirements and treatment limitations are no more restrictive than those applied to intravenously administered/injected cancer medications that are covered by the policy Effective: January 1, 2012 Status: Signed by the Governor as PA 97 -198 27

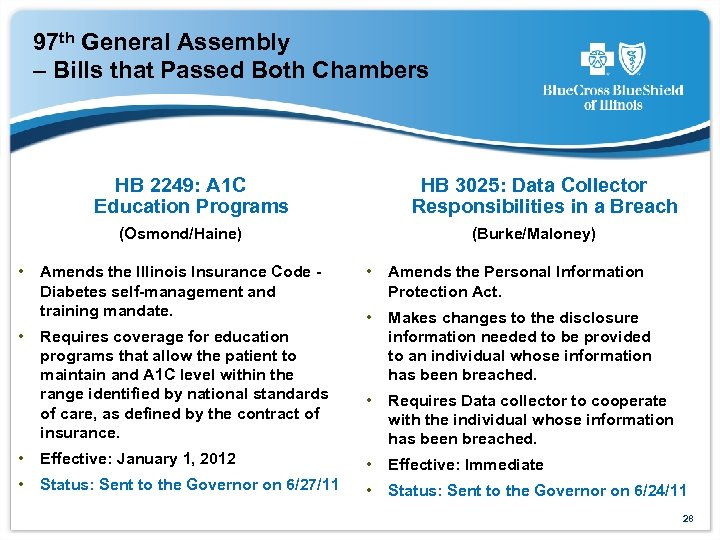

97 th General Assembly – Bills that Passed Both Chambers HB 2249: A 1 C Education Programs (Osmond/Haine) • Amends the Illinois Insurance Code Diabetes self-management and training mandate. • Requires coverage for education programs that allow the patient to maintain and A 1 C level within the range identified by national standards of care, as defined by the contract of insurance. • Effective: January 1, 2012 • Status: Sent to the Governor on 6/27/11 HB 3025: Data Collector Responsibilities in a Breach (Burke/Maloney) • Amends the Personal Information Protection Act. • Makes changes to the disclosure information needed to be provided to an individual whose information has been breached. • Requires Data collector to cooperate with the individual whose information has been breached. • Effective: Immediate • Status: Sent to the Governor on 6/24/11 28

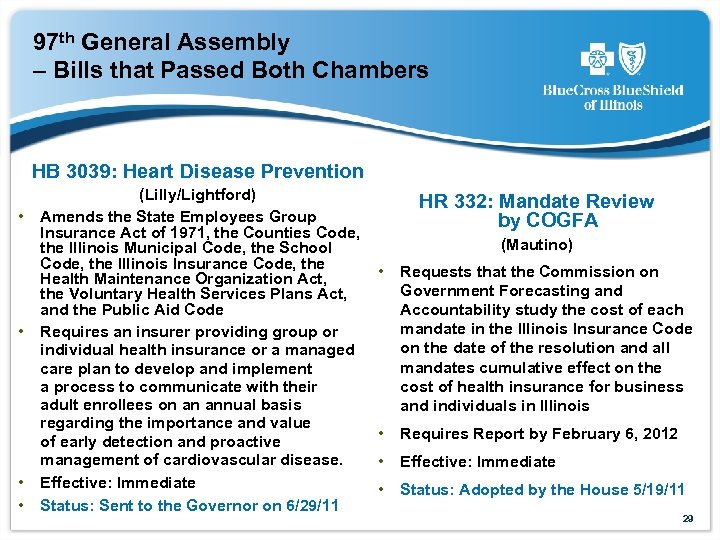

97 th General Assembly – Bills that Passed Both Chambers HB 3039: Heart Disease Prevention • • (Lilly/Lightford) Amends the State Employees Group Insurance Act of 1971, the Counties Code, the Illinois Municipal Code, the School Code, the Illinois Insurance Code, the Health Maintenance Organization Act, the Voluntary Health Services Plans Act, and the Public Aid Code Requires an insurer providing group or individual health insurance or a managed care plan to develop and implement a process to communicate with their adult enrollees on an annual basis regarding the importance and value of early detection and proactive management of cardiovascular disease. Effective: Immediate Status: Sent to the Governor on 6/29/11 HR 332: Mandate Review by COGFA (Mautino) • Requests that the Commission on Government Forecasting and Accountability study the cost of each mandate in the Illinois Insurance Code on the date of the resolution and all mandates cumulative effect on the cost of health insurance for business and individuals in Illinois • Requires Report by February 6, 2012 • Effective: Immediate • Status: Adopted by the House 5/19/11 29

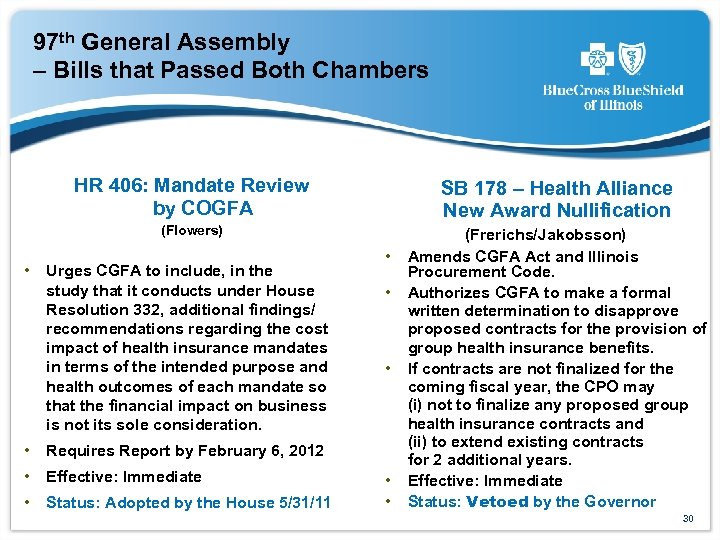

97 th General Assembly – Bills that Passed Both Chambers HR 406: Mandate Review by COGFA SB 178 – Health Alliance New Award Nullification (Flowers) (Frerichs/Jakobsson) Amends CGFA Act and Illinois Procurement Code. Authorizes CGFA to make a formal written determination to disapprove proposed contracts for the provision of group health insurance benefits. If contracts are not finalized for the coming fiscal year, the CPO may (i) not to finalize any proposed group health insurance contracts and (ii) to extend existing contracts for 2 additional years. Effective: Immediate Status: Vetoed by the Governor • Urges CGFA to include, in the study that it conducts under House Resolution 332, additional findings/ recommendations regarding the cost impact of health insurance mandates in terms of the intended purpose and health outcomes of each mandate so that the financial impact on business is not its sole consideration. • Requires Report by February 6, 2012 • Effective: Immediate • Status: Adopted by the House 5/31/11 • • • 30

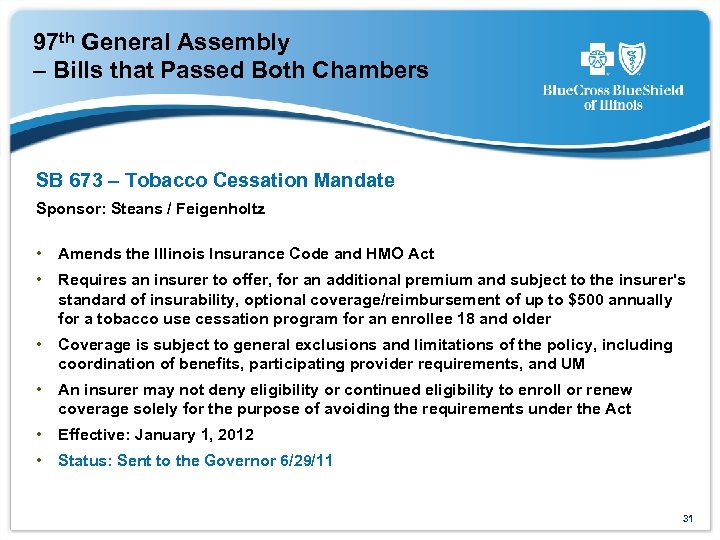

97 th General Assembly – Bills that Passed Both Chambers SB 673 – Tobacco Cessation Mandate Sponsor: Steans / Feigenholtz • Amends the Illinois Insurance Code and HMO Act • Requires an insurer to offer, for an additional premium and subject to the insurer's standard of insurability, optional coverage/reimbursement of up to $500 annually for a tobacco use cessation program for an enrollee 18 and older • Coverage is subject to general exclusions and limitations of the policy, including coordination of benefits, participating provider requirements, and UM • An insurer may not deny eligibility or continued eligibility to enroll or renew coverage solely for the purpose of avoiding the requirements under the Act • Effective: January 1, 2012 • Status: Sent to the Governor 6/29/11 31

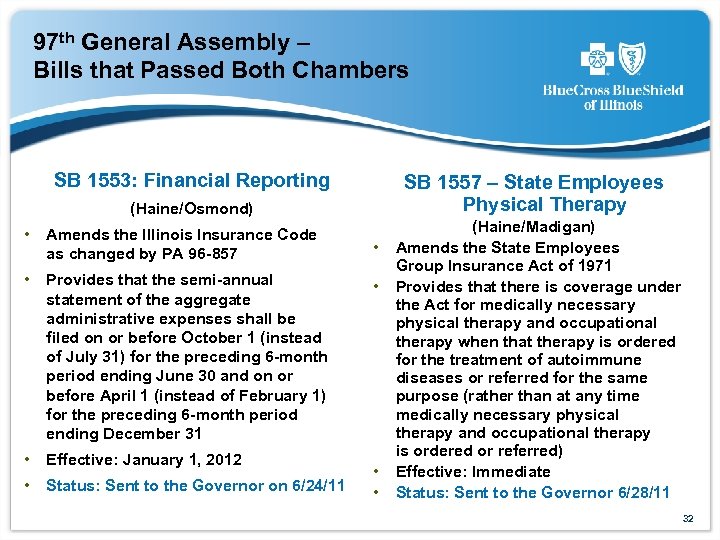

97 th General Assembly – Bills that Passed Both Chambers SB 1553: Financial Reporting SB 1557 – State Employees Physical Therapy (Haine/Osmond) • Amends the Illinois Insurance Code as changed by PA 96 -857 • Provides that the semi-annual statement of the aggregate administrative expenses shall be filed on or before October 1 (instead of July 31) for the preceding 6 -month period ending June 30 and on or before April 1 (instead of February 1) for the preceding 6 -month period ending December 31 • Effective: January 1, 2012 • Status: Sent to the Governor on 6/24/11 • • (Haine/Madigan) Amends the State Employees Group Insurance Act of 1971 Provides that there is coverage under the Act for medically necessary physical therapy and occupational therapy when that therapy is ordered for the treatment of autoimmune diseases or referred for the same purpose (rather than at any time medically necessary physical therapy and occupational therapy is ordered or referred) Effective: Immediate Status: Sent to the Governor 6/28/11 32

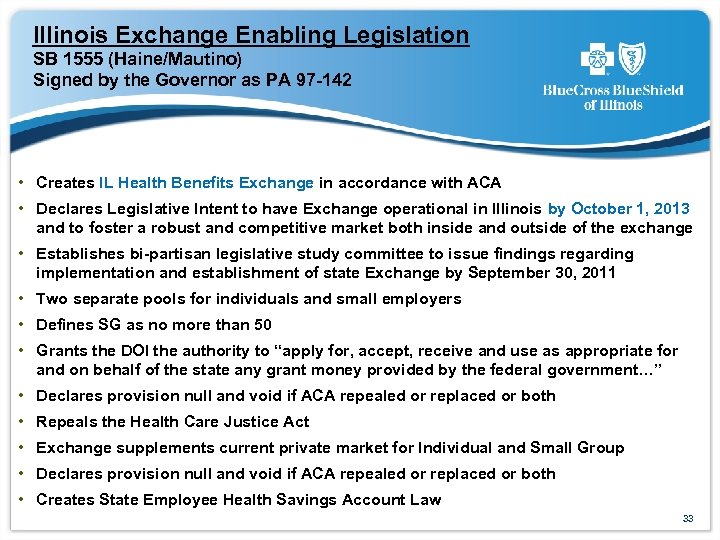

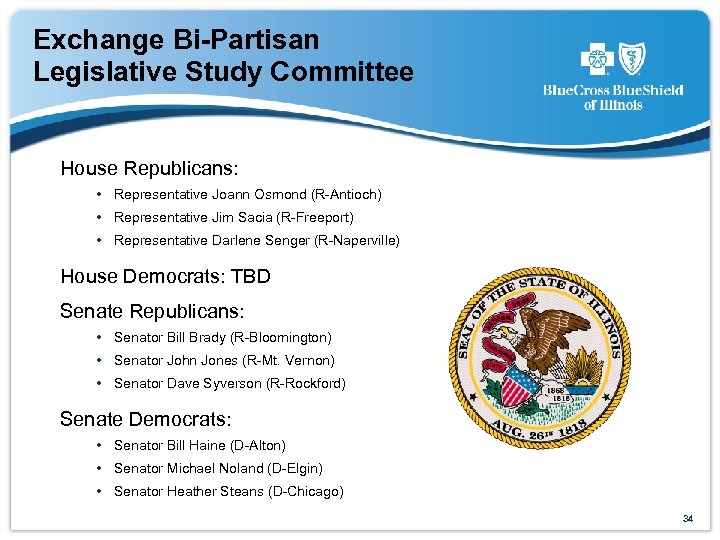

Illinois Exchange Enabling Legislation SB 1555 (Haine/Mautino) Signed by the Governor as PA 97 -142 • Creates IL Health Benefits Exchange in accordance with ACA • Declares Legislative Intent to have Exchange operational in Illinois by October 1, 2013 and to foster a robust and competitive market both inside and outside of the exchange • Establishes bi-partisan legislative study committee to issue findings regarding implementation and establishment of state Exchange by September 30, 2011 • Two separate pools for individuals and small employers • Defines SG as no more than 50 • Grants the DOI the authority to “apply for, accept, receive and use as appropriate for and on behalf of the state any grant money provided by the federal government…” • • • Declares provision null and void if ACA repealed or replaced or both Repeals the Health Care Justice Act Exchange supplements current private market for Individual and Small Group Declares provision null and void if ACA repealed or replaced or both Creates State Employee Health Savings Account Law 33

Exchange Bi-Partisan Legislative Study Committee House Republicans: • Representative Joann Osmond (R-Antioch) • Representative Jim Sacia (R-Freeport) • Representative Darlene Senger (R-Naperville) House Democrats: TBD Senate Republicans: • Senator Bill Brady (R-Bloomington) • Senator John Jones (R-Mt. Vernon) • Senator Dave Syverson (R-Rockford) Senate Democrats: • Senator Bill Haine (D-Alton) • Senator Michael Noland (D-Elgin) • Senator Heather Steans (D-Chicago) 34

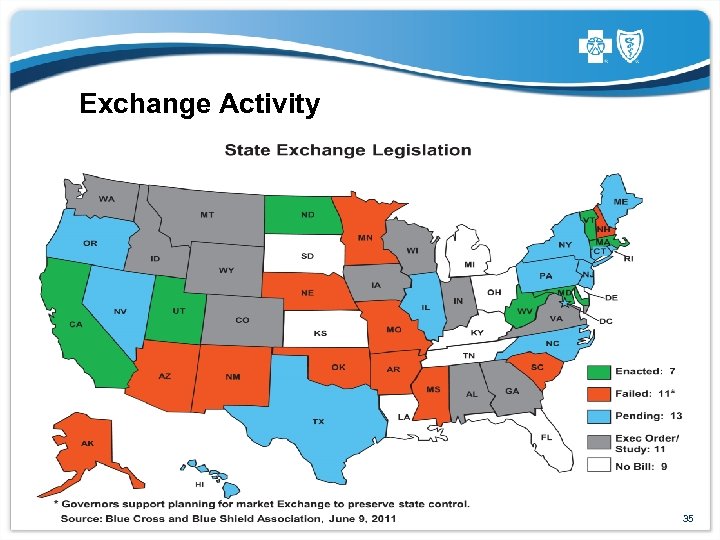

Exchange Activity 35

August 8, 2011 Wynstone: Seizing Opportunities 36

Health Care Reform: The New Skill Set You Need Joe Flower CEO, The Change Project 37

Lunch with Bill Rancic Entrepreneur and Donald Trump’s First Apprentice 38

2ace08dbf80fcd50b66619a28f60edae.ppt