d3347f516ac44c2c6d6d1026007eeb3b.ppt

- Количество слайдов: 31

2010 OGS State Purchasing Forum Navigating Proof of Coverage Required Proof of NYS Workers' Compensation and Disability Benefits Insurance for Government Permits, Licenses and/or Contracts Steve Carbone NYS Workers’ Compensation Board 518 -486 -6307 Steve. carbone@wcb. state. ny. us May 19 -20, 2010

2010 OGS State Purchasing Forum Navigating Proof of Coverage Required Proof of NYS Workers' Compensation and Disability Benefits Insurance for Government Permits, Licenses and/or Contracts Steve Carbone NYS Workers’ Compensation Board 518 -486 -6307 Steve. carbone@wcb. state. ny. us May 19 -20, 2010

What is Workers’ Compensation Insurance? Why Is It Important? May 19 -20, 2010

What is Workers’ Compensation Insurance? Why Is It Important? May 19 -20, 2010

Key NYS Workers’ Compensation Organizations n n NYS Insurance Department Compensation Insurance Rating Board NYS Workers’ Compensation Board Insurers -- Insurance Carriers Self-Insurers Group Self-Insurers May 19 -20, 2010

Key NYS Workers’ Compensation Organizations n n NYS Insurance Department Compensation Insurance Rating Board NYS Workers’ Compensation Board Insurers -- Insurance Carriers Self-Insurers Group Self-Insurers May 19 -20, 2010

Strategy for Enforcing Compensation Compliance n WCB Insurance Compliance Database n n n n Automated Penalty Process Appeal Process Outside Collection Agencies Judgments Investigators Educational Outreach External Enforcement (Section 57 of WCL) May 19 -20, 2010

Strategy for Enforcing Compensation Compliance n WCB Insurance Compliance Database n n n n Automated Penalty Process Appeal Process Outside Collection Agencies Judgments Investigators Educational Outreach External Enforcement (Section 57 of WCL) May 19 -20, 2010

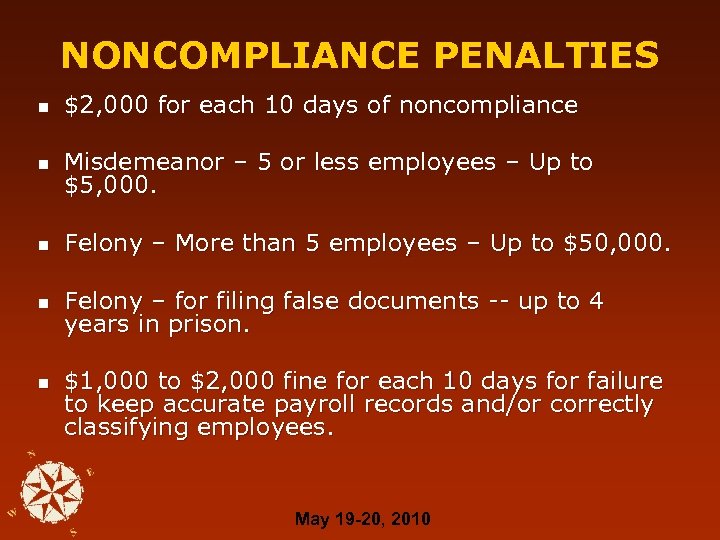

NONCOMPLIANCE PENALTIES n $2, 000 for each 10 days of noncompliance n Misdemeanor – 5 or less employees – Up to $5, 000. n Felony – More than 5 employees – Up to $50, 000. n Felony – for filing false documents -- up to 4 years in prison. n $1, 000 to $2, 000 fine for each 10 days for failure to keep accurate payroll records and/or correctly classifying employees. May 19 -20, 2010

NONCOMPLIANCE PENALTIES n $2, 000 for each 10 days of noncompliance n Misdemeanor – 5 or less employees – Up to $5, 000. n Felony – More than 5 employees – Up to $50, 000. n Felony – for filing false documents -- up to 4 years in prison. n $1, 000 to $2, 000 fine for each 10 days for failure to keep accurate payroll records and/or correctly classifying employees. May 19 -20, 2010

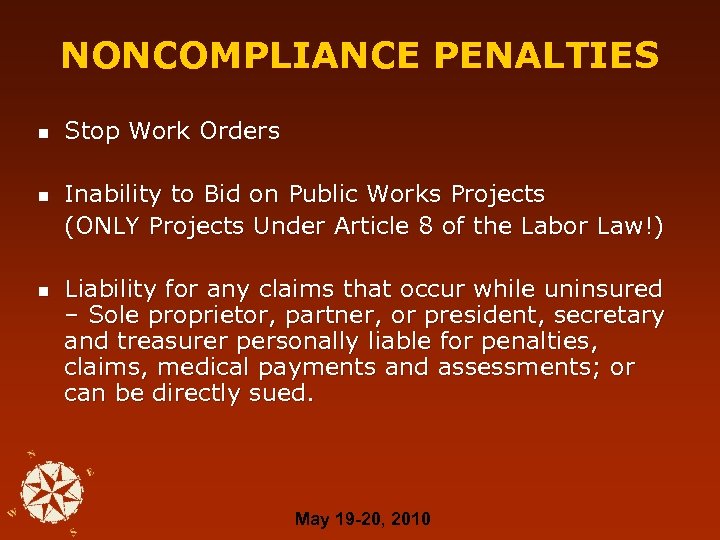

NONCOMPLIANCE PENALTIES n n n Stop Work Orders Inability to Bid on Public Works Projects (ONLY Projects Under Article 8 of the Labor Law!) Liability for any claims that occur while uninsured – Sole proprietor, partner, or president, secretary and treasurer personally liable for penalties, claims, medical payments and assessments; or can be directly sued. May 19 -20, 2010

NONCOMPLIANCE PENALTIES n n n Stop Work Orders Inability to Bid on Public Works Projects (ONLY Projects Under Article 8 of the Labor Law!) Liability for any claims that occur while uninsured – Sole proprietor, partner, or president, secretary and treasurer personally liable for penalties, claims, medical payments and assessments; or can be directly sued. May 19 -20, 2010

Who Needs to Be Covered? May 19 -20, 2010

Who Needs to Be Covered? May 19 -20, 2010

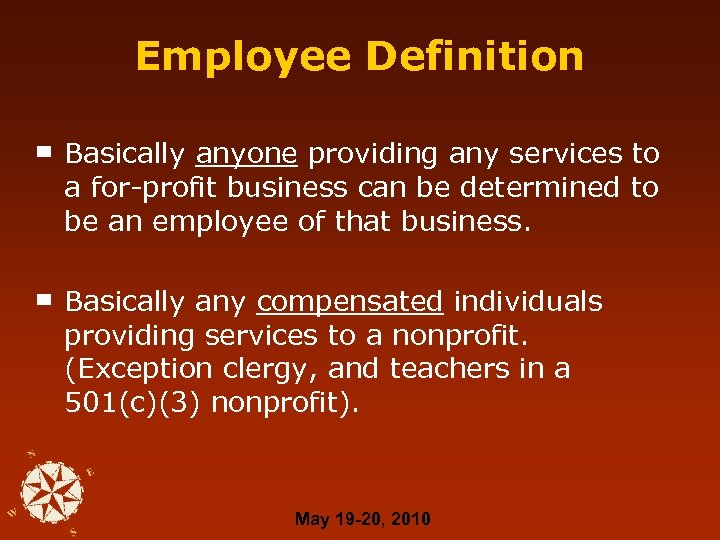

Employee Definition ▀ ▀ Basically anyone providing any services to a for-profit business can be determined to be an employee of that business. Basically any compensated individuals providing services to a nonprofit. (Exception clergy, and teachers in a 501(c)(3) nonprofit). May 19 -20, 2010

Employee Definition ▀ ▀ Basically anyone providing any services to a for-profit business can be determined to be an employee of that business. Basically any compensated individuals providing services to a nonprofit. (Exception clergy, and teachers in a 501(c)(3) nonprofit). May 19 -20, 2010

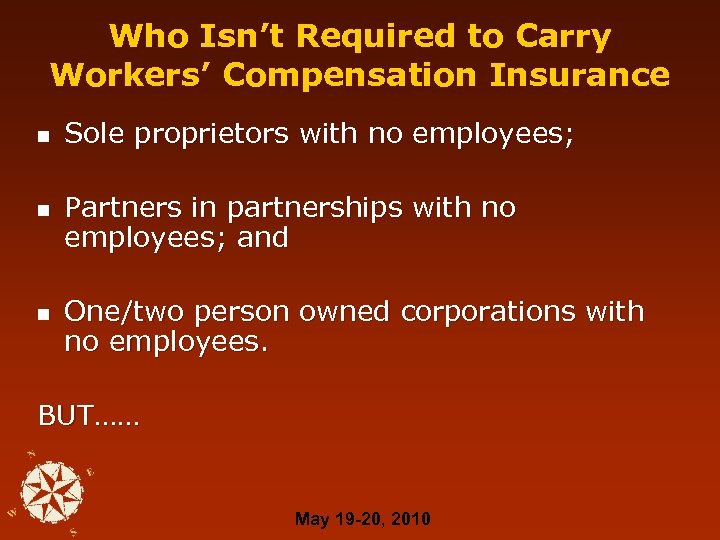

Who Isn’t Required to Carry Workers’ Compensation Insurance n n n Sole proprietors with no employees; Partners in partnerships with no employees; and One/two person owned corporations with no employees. BUT…… May 19 -20, 2010

Who Isn’t Required to Carry Workers’ Compensation Insurance n n n Sole proprietors with no employees; Partners in partnerships with no employees; and One/two person owned corporations with no employees. BUT…… May 19 -20, 2010

WCL Section 56 n n General contractors are liable for the workers’ compensation claims of all uninsured subcontractors. General contractors MUST obtain a workers’ compensation insurance policy if they have any subcontractors working on a job site and they are getting a government permit, license or contract. May 19 -20, 2010

WCL Section 56 n n General contractors are liable for the workers’ compensation claims of all uninsured subcontractors. General contractors MUST obtain a workers’ compensation insurance policy if they have any subcontractors working on a job site and they are getting a government permit, license or contract. May 19 -20, 2010

Out-of-state Companies Working in NYS Effective September 9, 2007, any out -of-state employer with employees working in NYS needs a full NYS workers’ compensation insurance policy. (NY must appear on Item 3 A on the information page of a policy. ) May 19 -20, 2010

Out-of-state Companies Working in NYS Effective September 9, 2007, any out -of-state employer with employees working in NYS needs a full NYS workers’ compensation insurance policy. (NY must appear on Item 3 A on the information page of a policy. ) May 19 -20, 2010

Independent Contractors The following are the indicators used to identify if an individual is an independent contractor , and thus not an employee: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Obtain a Federal Employer Identification Number from the Federal Internal Revenue Service (IRS) or have filed business or self-employment income tax returns with the IRS based on work or service performed the previous calendar year; Maintain a separate business establishment from the hiring business; Perform work that is different than the primary work of the hiring business and perform work for other businesses; Operate under a specific contract, and is responsible for satisfactory performance of work and is subject to profit or loss in performing the specific work under such contract, and be in a position to succeed or fail if the business’s expenses exceed income. Obtain a liability insurance policy (and if appropriate, workers’ compensation and disability benefits insurance policies) under its own legal business name and federal employer identification number; Have recurring business liabilities and obligations; If it has business cards or advertises, the materials must publicize itself, not another entity; Provide all equipment and materials necessary to fulfill the contract; Control the time and manner in which the work is to be done; and The individual works under his/her own operating permit, contract or authority. May 19 -20, 2010

Independent Contractors The following are the indicators used to identify if an individual is an independent contractor , and thus not an employee: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Obtain a Federal Employer Identification Number from the Federal Internal Revenue Service (IRS) or have filed business or self-employment income tax returns with the IRS based on work or service performed the previous calendar year; Maintain a separate business establishment from the hiring business; Perform work that is different than the primary work of the hiring business and perform work for other businesses; Operate under a specific contract, and is responsible for satisfactory performance of work and is subject to profit or loss in performing the specific work under such contract, and be in a position to succeed or fail if the business’s expenses exceed income. Obtain a liability insurance policy (and if appropriate, workers’ compensation and disability benefits insurance policies) under its own legal business name and federal employer identification number; Have recurring business liabilities and obligations; If it has business cards or advertises, the materials must publicize itself, not another entity; Provide all equipment and materials necessary to fulfill the contract; Control the time and manner in which the work is to be done; and The individual works under his/her own operating permit, contract or authority. May 19 -20, 2010

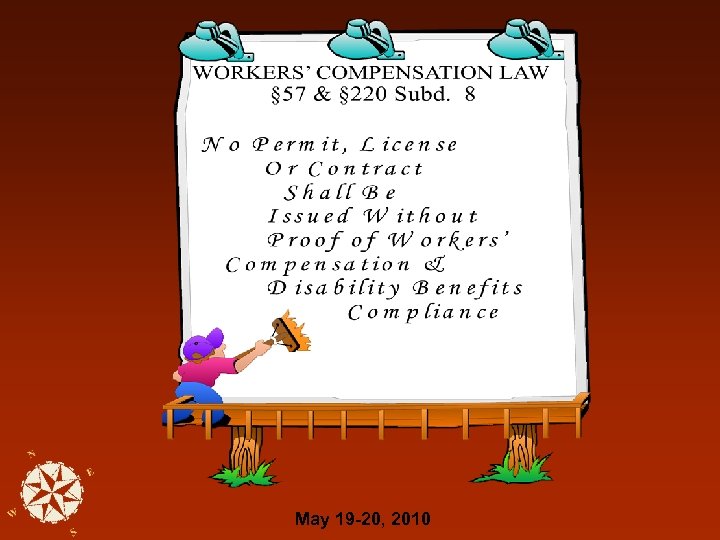

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

What Is A Legal Name Of An Employer And Why Is It Important? May 19 -20, 2010

What Is A Legal Name Of An Employer And Why Is It Important? May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

Title May 19 -20, 2010

Title May 19 -20, 2010

Proof of Workers’ Compensation Compliance (For Businesses) n CE-200 Business Does Not Require Workers’ Compensation and/or Disability Benefits Coverage n C-105. 2 Certificate of Workers’ Compensation Insurance Coverage n n U-26. 3 State Insurance Fund Version of Certificate of Workers’ Compensation Insurance Coverage SI-12 Certificate of Workers’ Compensation Self. Insurance or GSI-105. 2 Certificate of Workers’ Compensation Group Self-Insurance May 19 -20, 2010

Proof of Workers’ Compensation Compliance (For Businesses) n CE-200 Business Does Not Require Workers’ Compensation and/or Disability Benefits Coverage n C-105. 2 Certificate of Workers’ Compensation Insurance Coverage n n U-26. 3 State Insurance Fund Version of Certificate of Workers’ Compensation Insurance Coverage SI-12 Certificate of Workers’ Compensation Self. Insurance or GSI-105. 2 Certificate of Workers’ Compensation Group Self-Insurance May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

Proof of Workers’ Compensation Compliance (For Homeowners) n BP-1 Homeowner Does Not Require Workers’ Compensation Coverage n CE-200 Business Does Not Require Workers’ Compensation and/or Disability Benefits Coverage n C-105. 2 Certificate of Workers’ Compensation Insurance Coverage n U-26. 3 State Insurance Fund Version of Certificate of Workers’ Compensation Insurance Coverage May 19 -20, 2010

Proof of Workers’ Compensation Compliance (For Homeowners) n BP-1 Homeowner Does Not Require Workers’ Compensation Coverage n CE-200 Business Does Not Require Workers’ Compensation and/or Disability Benefits Coverage n C-105. 2 Certificate of Workers’ Compensation Insurance Coverage n U-26. 3 State Insurance Fund Version of Certificate of Workers’ Compensation Insurance Coverage May 19 -20, 2010

Title May 19 -20, 2010

Title May 19 -20, 2010

Proof of Disability Benefits Compliance n CE-200 Applicant Does Not Require Workers’ Compensation and/or Disability Benefits Coverage n DB-120. 1 Certificate of Disability Benefits Insurance Coverage n DB-155 Certificate of Disability Benefits Self. Insurance May 19 -20, 2010

Proof of Disability Benefits Compliance n CE-200 Applicant Does Not Require Workers’ Compensation and/or Disability Benefits Coverage n DB-120. 1 Certificate of Disability Benefits Insurance Coverage n DB-155 Certificate of Disability Benefits Self. Insurance May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

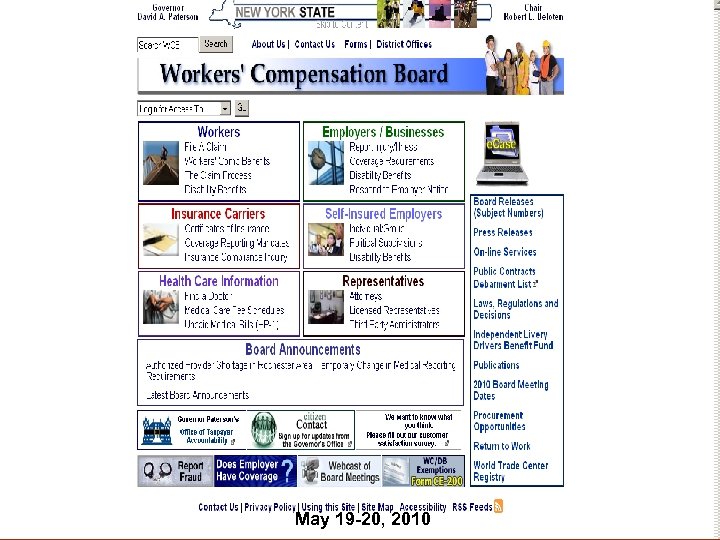

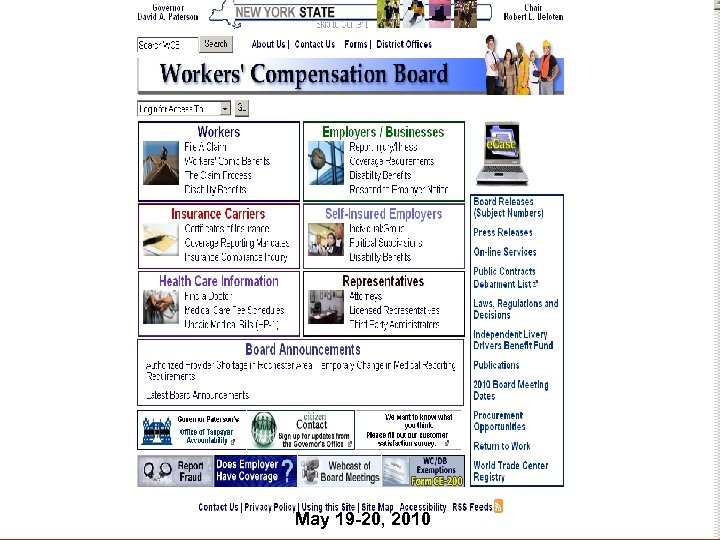

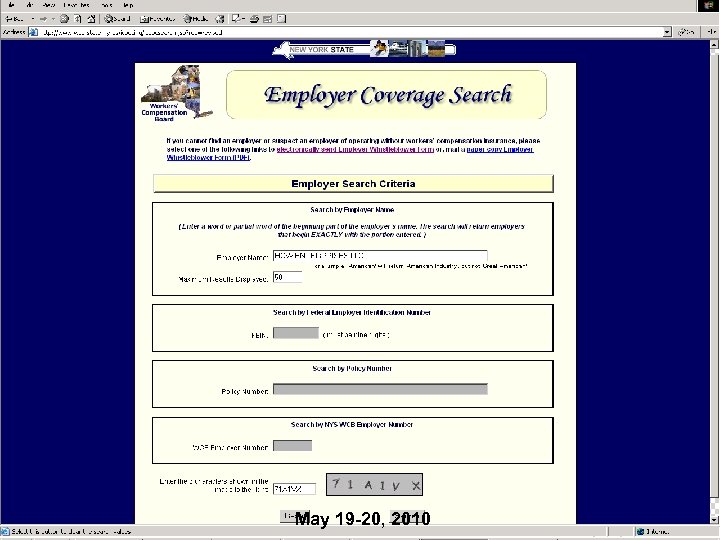

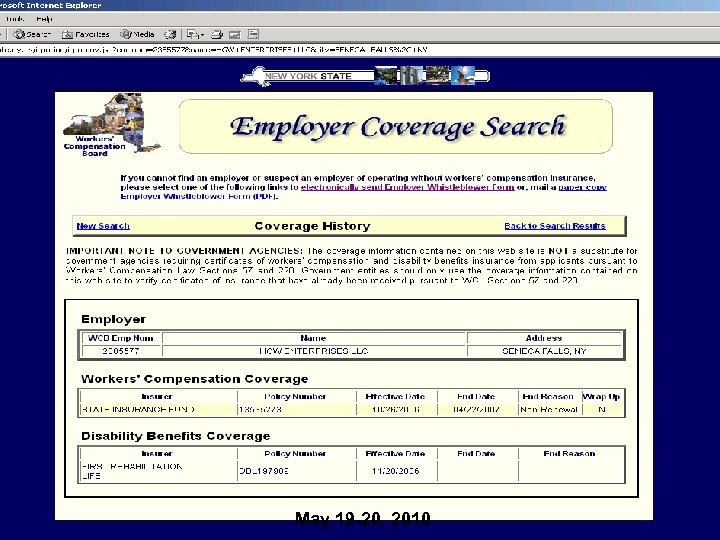

Verifying Workers’ Compensation Insurance Proof of Coverage n Ensure coverage is on Board’s website. n Go to www. wcb. state. ny. us May 19 -20, 2010

Verifying Workers’ Compensation Insurance Proof of Coverage n Ensure coverage is on Board’s website. n Go to www. wcb. state. ny. us May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

May 19 -20, 2010

Filing of Workers’ Compensation Insurance Proof of Coverage n n Accept only the approved forms. Make sure legal name on the approved form matches the legal name on the permit, license or contract. FEIN numbers — make sure FEIN on the approved form matches FEIN on the permit, license or contract. Ensure coverage is on Board’s website. May 19 -20, 2010

Filing of Workers’ Compensation Insurance Proof of Coverage n n Accept only the approved forms. Make sure legal name on the approved form matches the legal name on the permit, license or contract. FEIN numbers — make sure FEIN on the approved form matches FEIN on the permit, license or contract. Ensure coverage is on Board’s website. May 19 -20, 2010

Presenter Contact Information Steve Carbone Regulatory Affairs NYS Workers’ Compensation Board 20 Park Street – Room 200 Albany, New York 12207 Email: Steve. carbone@wcb. state. ny. us Phone: (518) 486 -6307 Workers’ Compensation Board’s Website: n www. wcb. state. ny. us May 19 -20, 2010

Presenter Contact Information Steve Carbone Regulatory Affairs NYS Workers’ Compensation Board 20 Park Street – Room 200 Albany, New York 12207 Email: Steve. carbone@wcb. state. ny. us Phone: (518) 486 -6307 Workers’ Compensation Board’s Website: n www. wcb. state. ny. us May 19 -20, 2010