314df8d569ef21b704c9f87378a4b2d1.ppt

- Количество слайдов: 46

2010 lessons from

2010 cross border

2010 “Europe’s largest clothing retailer, Spain’s Inditex, is taking its flagship Zara brand online, but it can expect stiff competition from other giants of high-street fashion already well-established in cyberspace. ” Madrid (AFP), 2 September 2010

2010 “We continue to move the focus of our international ambitions towards the internet and are now trading successfully online in 37 countries. Overseas sales on the internet (excluding Eire) have grown 250%. ” Results for the Half Year Ended July 2010 (RNS )

2010 “US retailer Gap, which has been online in the US since 1997, expanded the service to 55 countries on August 16. ” The Times 2010

2010 “In the seven weeks to November 15, ASOS enjoyed a 46 per cent increase in sales — with international sales soaring by 161 per cent and British takings rising by 23 per cent. ”. ” The Times 2010

2010 clothes are now the second most popular products online, after airline tickets but before books” “ Nielsen institute in 55 countries showed that

2010 lessons from

Lessons from the Leaders Expanding International e-Commerce Sales RBS World. Pay 2010

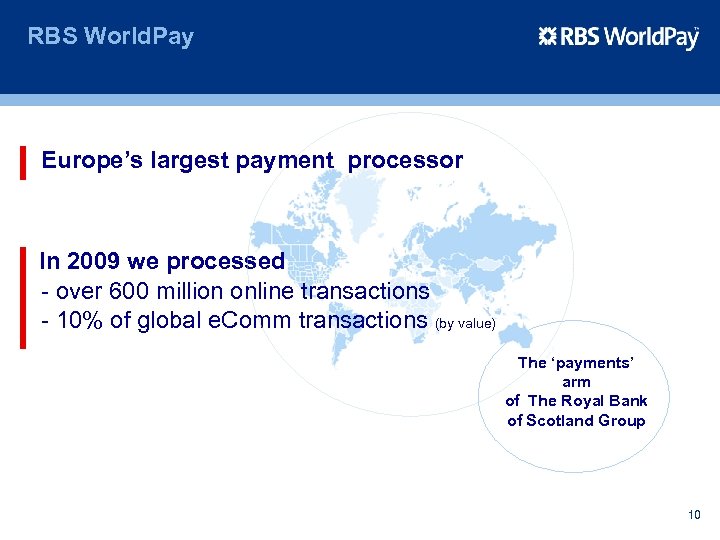

RBS World. Pay Europe’s largest payment processor In 2009 we processed - over 600 million online transactions - 10% of global e. Comm transactions (by value) The ‘payments’ arm of The Royal Bank of Scotland Group 10

RBS World. Pay 5% shoppers at German sites are overseas UK leads cross-border e. Comm in Europe 65% shoppers at UK sites are overseas “The largest cross border market in Europe is in and out of the UK” “UK web shops attracting a more international clientele than their continental counterpart” 11

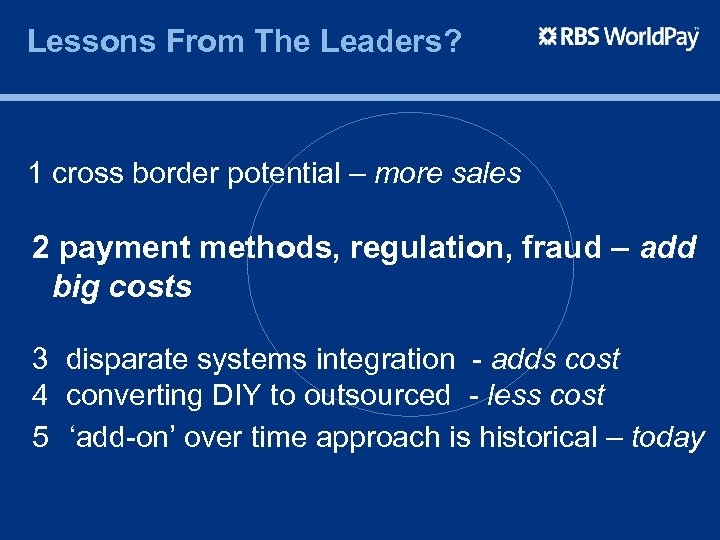

Lessons From The Leaders? 1 cross border potential – more sales 2 payments methods, regulation, fraud – adds cost 3 disparate systems integration - adds cost 4 expertise in payments provider – reduces cost 5 converting DIY to outsourced - less cost 6 ‘add-on’ over time approach is historical – today 12

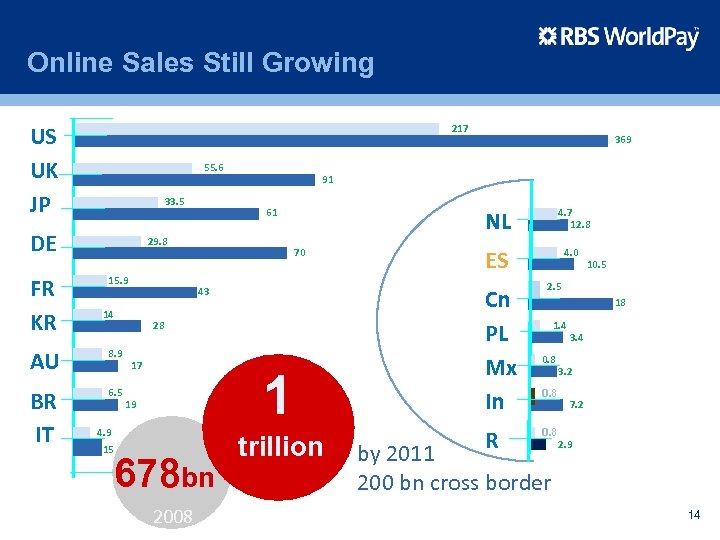

Online Sales Still Growing US UK JP 217 55. 6 33. 5 DE FR KR 29. 8 15. 9 14 AU 8. 9 BR IT 6. 5 4. 9 437 bn online spend 2006 NL 4. 7 ES Cn PL Mx In R 4. 0 2. 5 1. 4 0. 8 13

Online Sales Still Growing US UK JP 217 55. 6 33. 5 DE FR KR 91 70 43 14 28 AU 8. 9 BR IT 6. 5 17 1 19 4. 9 15 NL 61 29. 8 15. 9 678 bn 2008 369 trillion 4. 7 12. 8 ES 4. 0 Cn PL Mx In R 10. 5 2. 5 18 1. 4 0. 8 by 2011 200 bn cross border 3. 4 3. 2 7. 2 2. 9 14

Online Sales Travel Tickets 52% researched online 29 % bought online 45% bought online 71% bought offline 35 % 73% researched online bought offline Holidays RBS merchants 2009 15

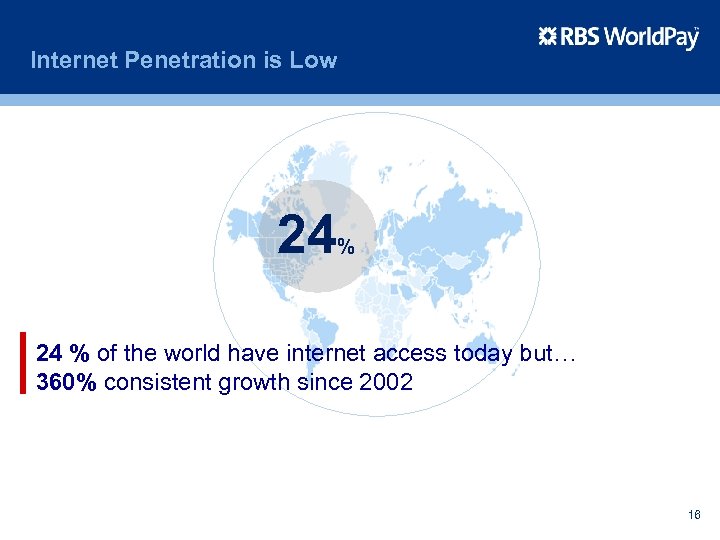

Internet Penetration is Low 24 % of the world have internet access today but… 360% consistent growth since 2002 16

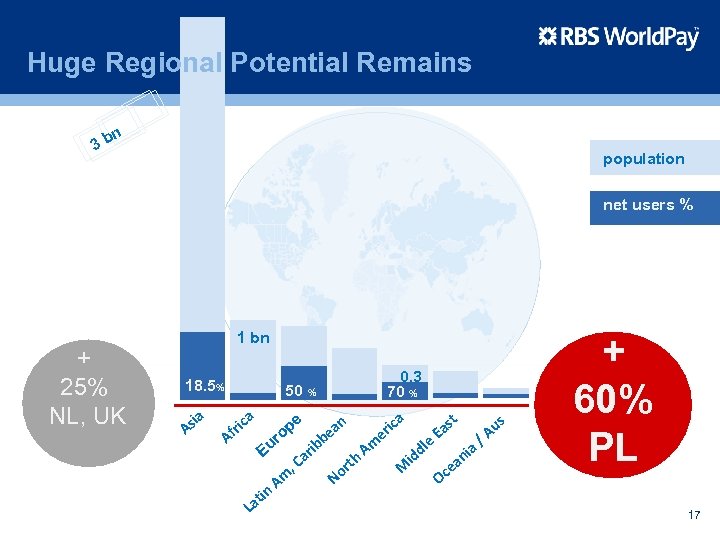

Huge Regional Potential Remains 3 b n population net users % + 25% NL, UK 1 bn 18. 5% ia As 0. 3 70 % 50 % a A c fri e op r Eu in t La Am , Ca n ea b rib th or N a st Am ic er M d id a e. E l s ia Oc n ea u /A + 60% PL 17

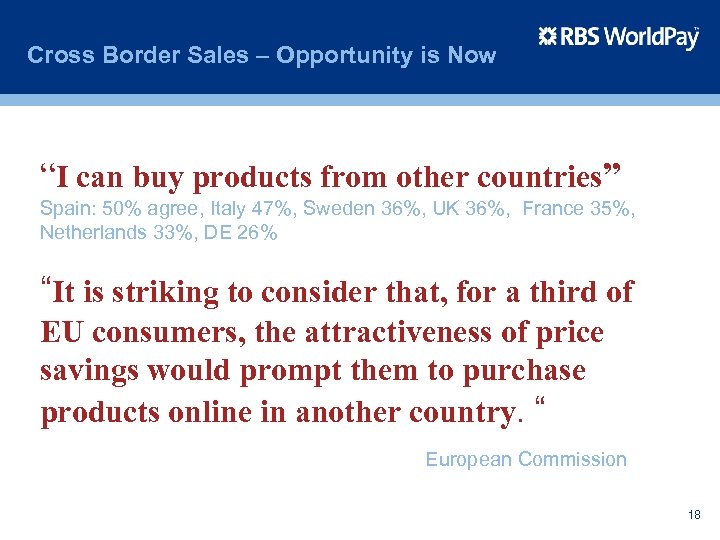

Cross Border Sales – Opportunity is Now “I can buy products from other countries” Spain: 50% agree, Italy 47%, Sweden 36%, UK 36%, France 35%, Netherlands 33%, DE 26% “It is striking to consider that, for a third of EU consumers, the attractiveness of price savings would prompt them to purchase products online in another country. “ European Commission 18

Lessons From The Leaders? 1 cross border potential – more sales 2 payment methods, regulation, fraud – add big costs 3 disparate systems integration - adds cost 4 converting DIY to outsourced - less cost 5 ‘add-on’ over time approach is historical – today 19

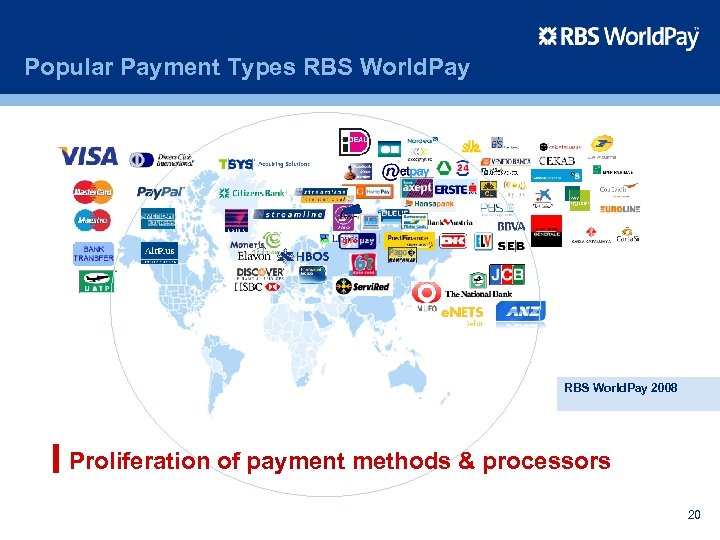

Popular Payment Types RBS World. Pay 2008 Proliferation of payment methods & processors 20

Regional Payment Trends Holland Bank transfer 2006/8 transactions 28 mil 5 mil The average Dutch merchant accepts 4 payment methods (Thuiswinkel. org) 15 mil +300% +87% 20% online spend 2007/2008 80% merchants offer it 40% shopper prefer it 21.

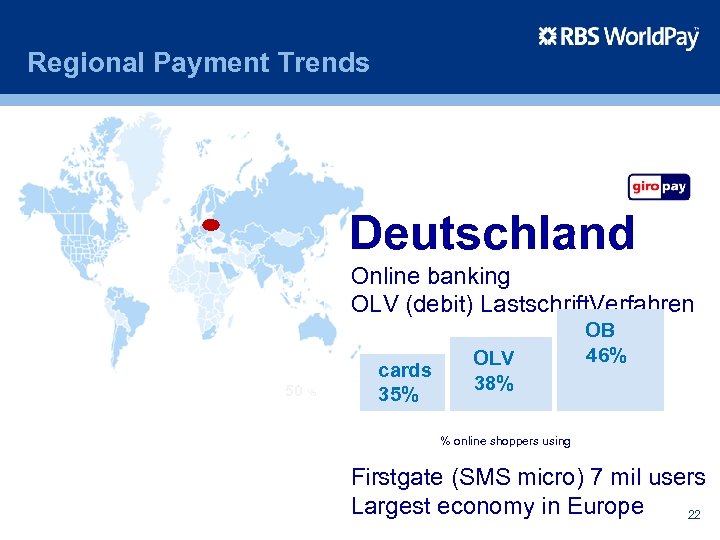

Regional Payment Trends Deutschland Online banking OLV (debit) Lastschrift. Verfahren 50 % cards 35% OLV 38% OB 46% % online shoppers using Firstgate (SMS micro) 7 mil users Largest economy in Europe 22

Regional Payment Trends España Credit cards dominate credit cards 65% 50 % % online shoppers using 23

Regional Payment Trends China cards 93. 7% of non-cash pymnts real-time bank transfers based on a debit card (40 banks) 50 % Alipay (ewallet) 200 mill accnts Union Mobile Pay launched 2008 24

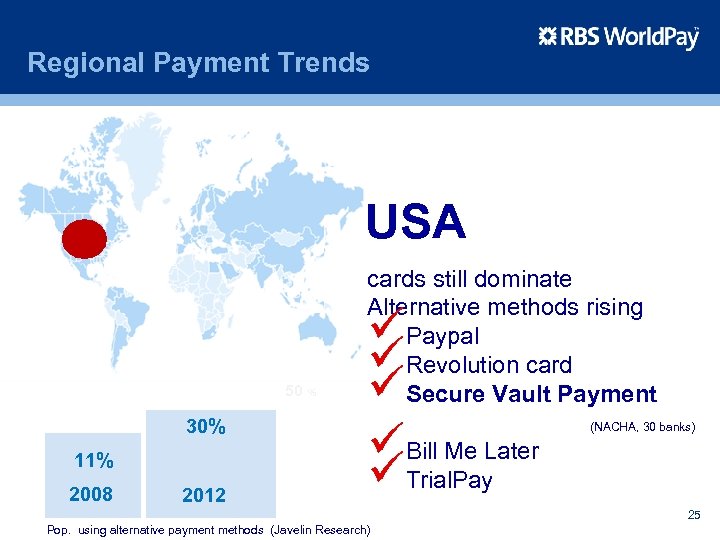

Regional Payment Trends USA 50 % 30% 11% 2008 2012 cards still dominate Alternative methods rising Paypal Revolution card Secure Vault Payment ü üBill Me Later üTrial. Pay (NACHA, 30 banks) 25 Pop. using alternative payment methods (Javelin Research)

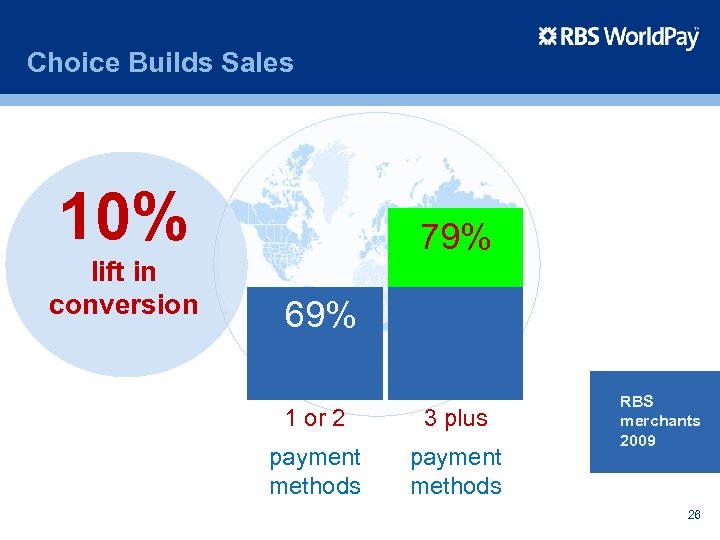

Choice Builds Sales 10% lift in conversion 79% 69% 1 or 2 3 plus payment methods RBS merchants 2009 26

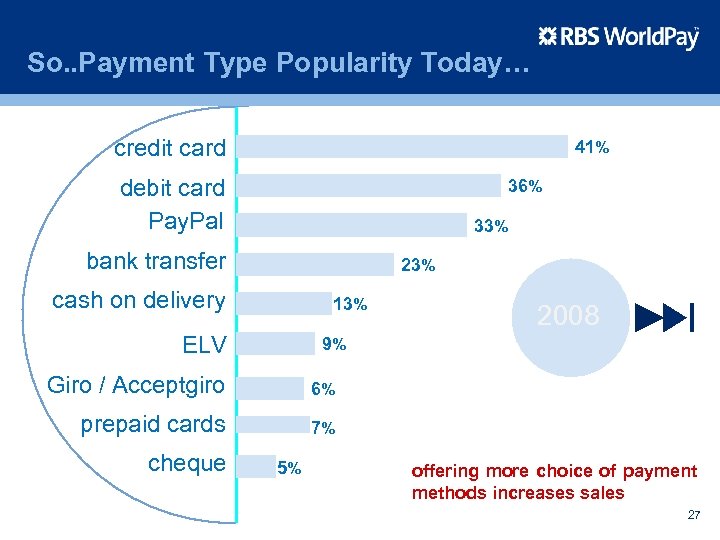

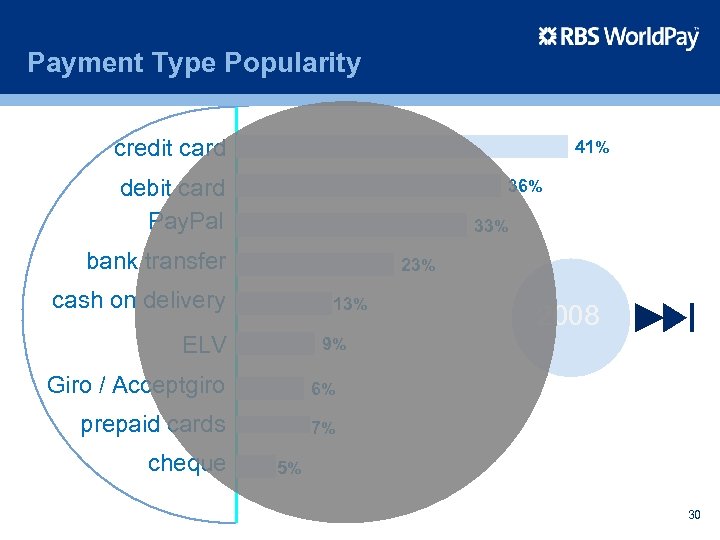

So. . Payment Type Popularity Today… credit card 41% debit card Pay. Pal 36% 33% bank transfer 23% cash on delivery 13% ELV 9% Giro / Acceptgiro 6% prepaid cards C cheque C 2008 7% 5% offering more choice of payment methods increases sales 27

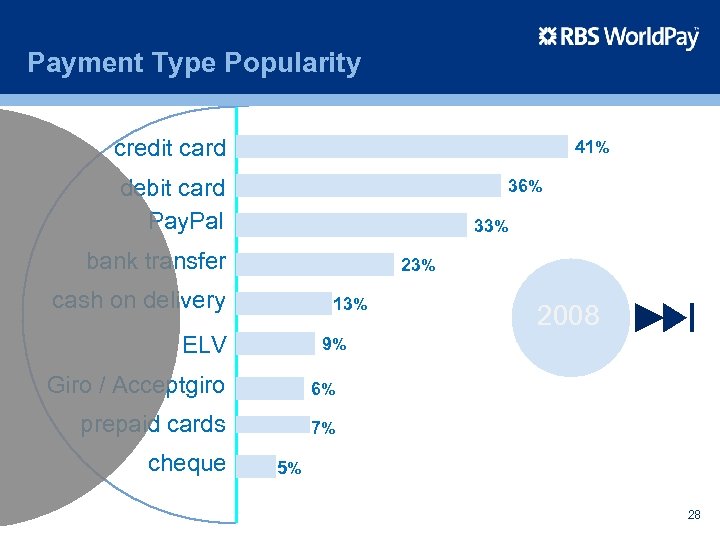

Payment Type Popularity credit card 41% debit card Pay. Pal 36% 33% bank transfer 23% cash on delivery 13% ELV 9% Giro / Acceptgiro 6% prepaid cards C cheque C 2008 7% 5% 28

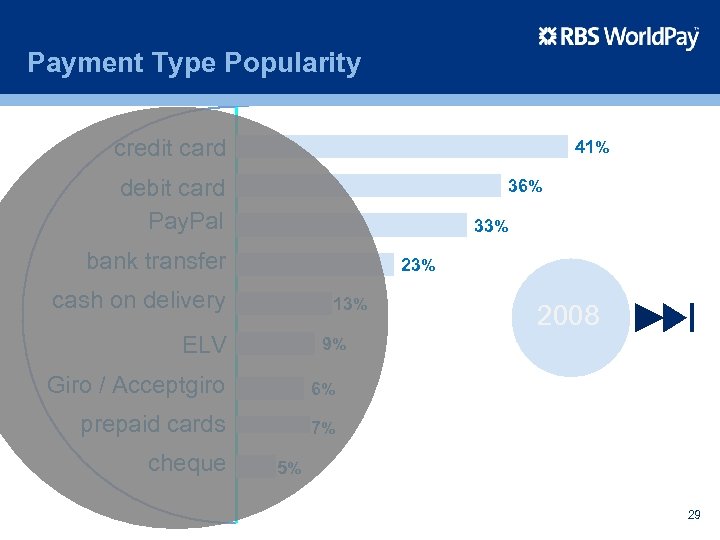

Payment Type Popularity credit card 41% debit card Pay. Pal 36% 33% bank transfer 23% cash on delivery 13% ELV 9% Giro / Acceptgiro 6% prepaid cards C cheque C 2008 7% 5% 29

Payment Type Popularity credit card 41% debit card Pay. Pal 36% 33% bank transfer 23% cash on delivery 13% ELV 9% Giro / Acceptgiro 6% prepaid cards C cheque C 2008 7% 5% 30

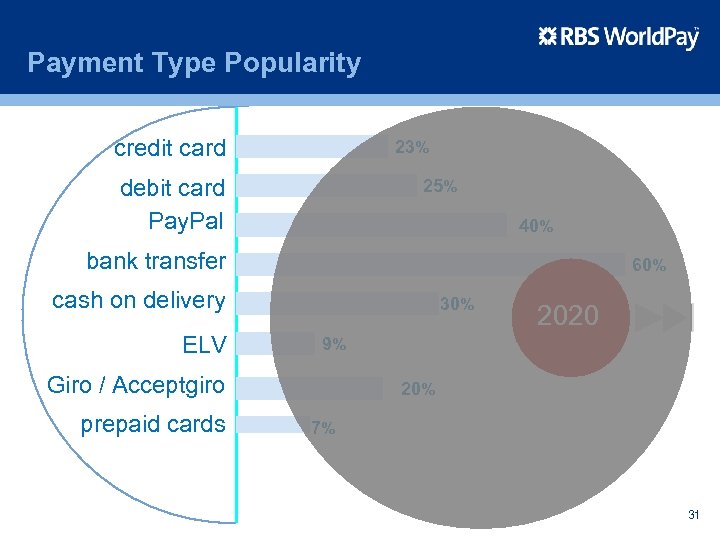

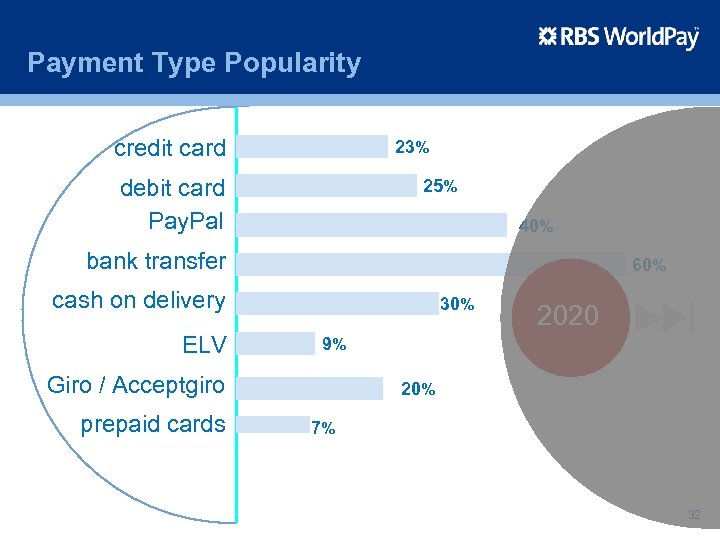

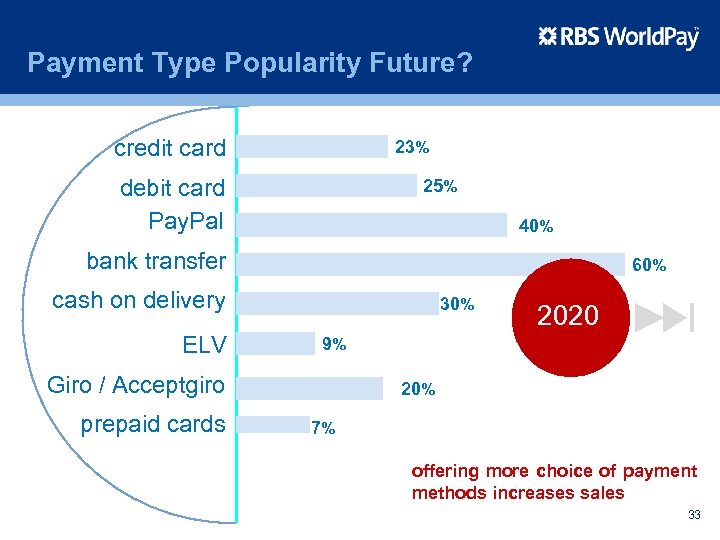

Payment Type Popularity credit card 23% debit card Pay. Pal 25% 40% bank transfer 60% cash on delivery ELV 30% 9% Giro / Acceptgiro prepaid cards C 2020 20% 7% 31

Payment Type Popularity credit card 23% debit card Pay. Pal 25% 40% bank transfer 60% cash on delivery ELV 30% 9% Giro / Acceptgiro prepaid cards C 2020 20% 7% 32

Payment Type Popularity Future? credit card 23% debit card Pay. Pal 25% 40% bank transfer 60% cash on delivery ELV 30% 9% Giro / Acceptgiro prepaid cards C 2020 20% 7% offering more choice of payment methods increases sales 33

Fraud ? The chances of you becoming a victim of card fraud are still low (fraudulent transactions make up 0. 12% of all transactions, by value). APACS UK Innopay “ “ Fraud for merchants can be completely avoided if merchants use only guaranteed payment methods combined with pre-payment. But… that will not lead to the highest sales 34

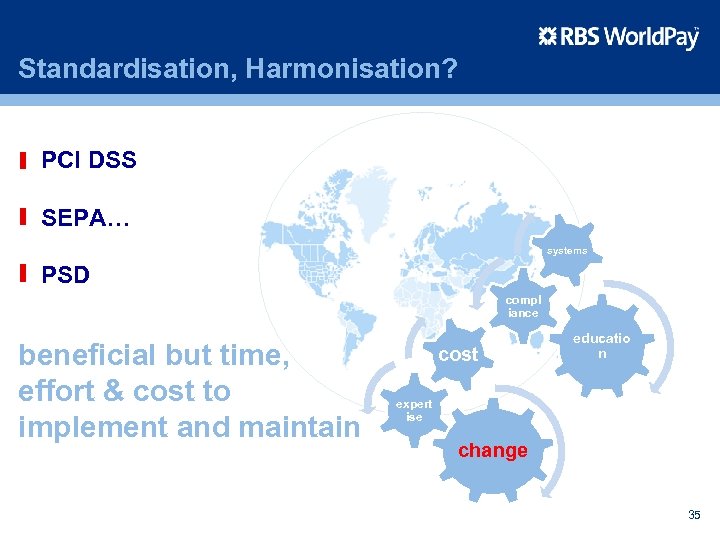

Standardisation, Harmonisation? PCI DSS SEPA… systems PSD compl iance beneficial but time, effort & cost to implement and maintain cost educatio n expert ise change 35

Payments & Fraud & Change Drivers est. 200 m online banking users Costs of card transactions & fraud Merchants want new markets Shoppers want to key less data Online Sales carry on growing Choice of method builds sales 36

Costs – Impact on bottom line - 2 : ¤ ¤ Payment choice/experience increases sales by 15% + Transaction Costs per method, domestic & international Expertise & Support – e. g. fraud config, market entry… Reconciliation, FX, cash flow, treasury…?

Costs – Impact on bottom line - 2 : ¤ Regulation & compliance (PCI, PSD…) - outsource costs ¤ Fraud – automate detection & rejection of bad payments ¤ Availability – ensure against loss of sales

Lessons From The Leaders? 1 cross border potential – more sales 2 payments methods, regulation, fraud – adds cost 3 disparate systems integration - adds cost 4 converting DIY to outsourced - less cost 5 ‘add-on’ over time approach is historical – today 39

Disparate Systems…Integrate? New channels, new systems and new regulations Systems almost as busy as their changing rooms! Typically new systems are “add-on”- poor integration Typical 2 or more payment processing services – costly, complex, no central view of customer behaviour inhibits more sophisticated targeted marketing …journey to core shared systems begun, but it’s going to cost and it’s going to … take time……………… 40

Lessons From The Leaders? 1 cross channel / border potential – more sales 2 payments methods, regulation, fraud – adds cost 3 disparate systems integration - adds cost 4 converting DIY to outsourced - less cost 5 ‘add-on’ over time approach is historical. Today companies can learn the lessons from the leaders / have the benefit of hindsight 41

Conclusions Business As Usual Πάντα ῥεῖ καὶ οὐδὲν μένει Everything flows, nothing stands still. Heraclitus 475 BC Opportunity is great Online sale still booming Domestic growth yes but World-wide potential is massive - early adopters realising Challenges are significant Domestic payment acceptance Fraud and lack of confidence in non-domestic online sellers Cross border support (delivery, reconciliation, cash management, regulator) Change is constant 42

The Lessons Benefit from the experiences of early adopters ¤ Assume X channel and X border expansion from start ¤ Choose outsourced payment service partner with… ü scale and reliability ü widest aggregation of channels and pay methods ü plug and play domestic acquiring routes ü interoperability built in ü sensible adoption of new payment trends. 43

The Lessons Benefit from the experiences of early adopters ¤ Assume X channel and X border expansion from start ¤ Choose outsourced payment service partner with… ü scale and reliability ü widest aggregation of channels and pay methods ü plug and play domestic acquiring routes ü interoperability built in ü sensible adoption of new payment trends. 44

Help Global Gateway RBS World. Pay is working with a number of international retailers supporting their expansion into overseas markets with integrated payment processing, acquiring and fraud management services 45

Conclusions World Payments Report World Non-cash Payments Markets and Trends Non-cash Payments Volumes Continue to Grow Payments Innovation in Asia is Taking Many Forms SEPA Update SEPA - Unresolved Issues and Practical Challenges Regulation, Client Needs and IT are Key Drivers What Does the Future Hold? Full report available on request comms@rbsworldpay. com 46

314df8d569ef21b704c9f87378a4b2d1.ppt