ccced40f055cdced857d28ad150118e5.ppt

- Количество слайдов: 81

2010 Finance Forum 8 July 2010 Innovation Lecture Theatre

2010 Finance Forum 8 July 2010 Innovation Lecture Theatre

Agenda Welcome and Significant Current Issues David Sturgiss 10 minutes Transparent Cost of Research Peter Shipp 10 minutes HERDC Update Lorraine Piper 5 minutes FBT Return Review Callum Burke 10 minutes Vendor Record Management Wendy Fox 10 minutes Report Distribution Tool Ben Lees/Eric Li 10 minutes Receipting Project Pat Price Afternoon Tea 10 minutes 20 minutes Budget Template and Summary Code Mark Baker 10 minutes PCI-DSS Brigid Lever 10 minutes Student debtor policy/procedures Brigid Lever 10 minutes Update on other initiatives Brigid Lever 10 minutes F&BS training opportunities Amanda Walker 10 minutes

Agenda Welcome and Significant Current Issues David Sturgiss 10 minutes Transparent Cost of Research Peter Shipp 10 minutes HERDC Update Lorraine Piper 5 minutes FBT Return Review Callum Burke 10 minutes Vendor Record Management Wendy Fox 10 minutes Report Distribution Tool Ben Lees/Eric Li 10 minutes Receipting Project Pat Price Afternoon Tea 10 minutes 20 minutes Budget Template and Summary Code Mark Baker 10 minutes PCI-DSS Brigid Lever 10 minutes Student debtor policy/procedures Brigid Lever 10 minutes Update on other initiatives Brigid Lever 10 minutes F&BS training opportunities Amanda Walker 10 minutes

Welcome and Significant Current Issues David Sturgiss

Welcome and Significant Current Issues David Sturgiss

Transparent Cost of Research Peter Shipp

Transparent Cost of Research Peter Shipp

Background • First considered by the ANU in June 2008 • Participated in work undertaken by Allen Consulting Group in 2008 and 2009 on behalf of DIISR • Based on approaches identified under the UK Model to a degree • DIISR were seeking to identify an approach that could substantiate university claims regarding the indirect cost of research and a model to assist in driving a funding model within the Sustainable Research Excellence (SRE) context

Background • First considered by the ANU in June 2008 • Participated in work undertaken by Allen Consulting Group in 2008 and 2009 on behalf of DIISR • Based on approaches identified under the UK Model to a degree • DIISR were seeking to identify an approach that could substantiate university claims regarding the indirect cost of research and a model to assist in driving a funding model within the Sustainable Research Excellence (SRE) context

Background • SRE focus to support research excellence and secure longer term sustainability of quality research • SRE providing $510 million over 4 years 2009/10 to 2012/13 to : • Support indirect costs associated with Australian Competitive Grant Research (ACGR) • Increase transparency and accountability

Background • SRE focus to support research excellence and secure longer term sustainability of quality research • SRE providing $510 million over 4 years 2009/10 to 2012/13 to : • Support indirect costs associated with Australian Competitive Grant Research (ACGR) • Increase transparency and accountability

Background • 2010 a trial year for Transparent Costing exercise • Universities to provide: • Results of a ‘Staff time spent on ACG Research’ survey (Staff Time Survey) • Report on the University’s Indirect Costs (IDC) • Option of a Preferred and/or Alternate method of calculation given by DIISR

Background • 2010 a trial year for Transparent Costing exercise • Universities to provide: • Results of a ‘Staff time spent on ACG Research’ survey (Staff Time Survey) • Report on the University’s Indirect Costs (IDC) • Option of a Preferred and/or Alternate method of calculation given by DIISR

Promising Start • Open minded approach by DIISR in the development of a TC model • Option of 2 models to determine TC • Preferred and Alternate • Alternate model from high level data and all universities should be able to undertake • No disadvantage provision for those adopting the Preferred model if this resulted in a lower number

Promising Start • Open minded approach by DIISR in the development of a TC model • Option of 2 models to determine TC • Preferred and Alternate • Alternate model from high level data and all universities should be able to undertake • No disadvantage provision for those adopting the Preferred model if this resulted in a lower number

Promising Start • Use of a Trial Year approach to enable development of the model • TC outcomes used as a moderator NOT a determinator in the funding model • Not a true ABC model • Implementation funding for those participating in SRE and TC exercise

Promising Start • Use of a Trial Year approach to enable development of the model • TC outcomes used as a moderator NOT a determinator in the funding model • Not a true ABC model • Implementation funding for those participating in SRE and TC exercise

DIISR Methodology • Identify from Staff Time Survey the amount of time dedicated to ACG research as a proportion of Total Academic effort (Alternate method) or as a proportion of Total Research effort (Preferred method). Academic staff surveyed to determine time spent on: • Research ACG • Research Other • Teaching • Research Training • Other (includes grant application and preparation) • Leave

DIISR Methodology • Identify from Staff Time Survey the amount of time dedicated to ACG research as a proportion of Total Academic effort (Alternate method) or as a proportion of Total Research effort (Preferred method). Academic staff surveyed to determine time spent on: • Research ACG • Research Other • Teaching • Research Training • Other (includes grant application and preparation) • Leave

DIISR Methodology • Determine ‘Allowable Indirect Costs of Research’ – Preferred Method • Non academic salaries and on-costs related to supporting research activities • Maintenance of physical infrastructure used for research including most IT • Finance and Insurance costs related to research activities • Other costs indirectly associated with research

DIISR Methodology • Determine ‘Allowable Indirect Costs of Research’ – Preferred Method • Non academic salaries and on-costs related to supporting research activities • Maintenance of physical infrastructure used for research including most IT • Finance and Insurance costs related to research activities • Other costs indirectly associated with research

DIISR Methodology • Determine ‘Allowable Indirect Costs’ – Alternate Method • Identify all indirect costs associated with research and teaching which are all costs of operations EXCEPT • Academic salaries and on-costs • Depreciation • Borrowing costs • Commercial activity related costs • E-research/high performance computing costs • Joint venture and controlled entity costs • Costs of acquiring research animals

DIISR Methodology • Determine ‘Allowable Indirect Costs’ – Alternate Method • Identify all indirect costs associated with research and teaching which are all costs of operations EXCEPT • Academic salaries and on-costs • Depreciation • Borrowing costs • Commercial activity related costs • E-research/high performance computing costs • Joint venture and controlled entity costs • Costs of acquiring research animals

Alternate Method Approach • The simplest of the two methods • Requires: • Outcome from Staff Time Survey • Identification of ‘Allowable Indirect Cost’ at high level • Risk is that it is less accurate than the results from the Preferred Method • Predicated on the assumption that the non-research indirect costs are similar to those for research

Alternate Method Approach • The simplest of the two methods • Requires: • Outcome from Staff Time Survey • Identification of ‘Allowable Indirect Cost’ at high level • Risk is that it is less accurate than the results from the Preferred Method • Predicated on the assumption that the non-research indirect costs are similar to those for research

Preferred Method Approach • Requires recognition of the following allowable: • Indirect costs at the local research Business Unit level • Indirect costs at the College or Central level • Once the College/Central allowable non-local Indirect costs are identified they are to be reallocated to the research area on a relevant Cost Allocation Proxy (CAP) • The Indirect Cost at local research Business Unit + College/Central costs reallocated to research Business Unit = Indirect Cost of Research • The costs MUST be related to research activity

Preferred Method Approach • Requires recognition of the following allowable: • Indirect costs at the local research Business Unit level • Indirect costs at the College or Central level • Once the College/Central allowable non-local Indirect costs are identified they are to be reallocated to the research area on a relevant Cost Allocation Proxy (CAP) • The Indirect Cost at local research Business Unit + College/Central costs reallocated to research Business Unit = Indirect Cost of Research • The costs MUST be related to research activity

ANU Approach • ANU approach will not be applicable to ALL universities • Following principles should however be adaptable to most universities • Always view as a work in progress • Our operational structure and physical layout only allows us to adopt a ‘predominance use’ approach.

ANU Approach • ANU approach will not be applicable to ALL universities • Following principles should however be adaptable to most universities • Always view as a work in progress • Our operational structure and physical layout only allows us to adopt a ‘predominance use’ approach.

ANU Approach • Established a system generated report to identify contribution to P&L result by each Fund type* • Report can be run at whole-of-University or College or Business Unit level • Can be reconciled back to P&L values * Fund types R = Recurrent; S = Contract Research; Q = Consultancy; Other = Trading Areas, Endowment, and Investment returns etc.

ANU Approach • Established a system generated report to identify contribution to P&L result by each Fund type* • Report can be run at whole-of-University or College or Business Unit level • Can be reconciled back to P&L values * Fund types R = Recurrent; S = Contract Research; Q = Consultancy; Other = Trading Areas, Endowment, and Investment returns etc.

ANU Approach R S ACGR S Other Q ACGR Q Other Total 414, 466 87, 002 83, 174 131 53, 675 197, 021 835, 469 Acad Salary 128, 358 39, 574 10, 589 0 5, 892 298 184, 711 Non-Acad Sal 145, 025 12, 610 13, 700 2 3, 866 36, 571 211, 774 Services 143, 530 33, 508 32, 394 66 27, 769 26, 892 264, 159 Depreciation 44, 314 0 0 5, 232 49, 546 Other 46, 039 9 740 0 6, 335 5, 035 58, 158 Total Op Exp 507, 266 85, 701 57, 423 68 43, 862 74, 028 768, 348 AFS P&L (92, 800) 1, 301 25, 751 63 9, 813 122, 993 67, 121 Op Income Op Expense

ANU Approach R S ACGR S Other Q ACGR Q Other Total 414, 466 87, 002 83, 174 131 53, 675 197, 021 835, 469 Acad Salary 128, 358 39, 574 10, 589 0 5, 892 298 184, 711 Non-Acad Sal 145, 025 12, 610 13, 700 2 3, 866 36, 571 211, 774 Services 143, 530 33, 508 32, 394 66 27, 769 26, 892 264, 159 Depreciation 44, 314 0 0 5, 232 49, 546 Other 46, 039 9 740 0 6, 335 5, 035 58, 158 Total Op Exp 507, 266 85, 701 57, 423 68 43, 862 74, 028 768, 348 AFS P&L (92, 800) 1, 301 25, 751 63 9, 813 122, 993 67, 121 Op Income Op Expense

ANU Approach • Direct costs • Direct Costs funded by Projects PLUS Direct Costs that are met from University operational budgets e. g. Chief Investigator Salary and possibly other expenses of this nature • For the purpose of this exercise we have not identified these salaries as Direct Cost nor apportioned them in the allocation of Business Unit Indirect Costs (as they are excluded under DIISR Guidelines)

ANU Approach • Direct costs • Direct Costs funded by Projects PLUS Direct Costs that are met from University operational budgets e. g. Chief Investigator Salary and possibly other expenses of this nature • For the purpose of this exercise we have not identified these salaries as Direct Cost nor apportioned them in the allocation of Business Unit Indirect Costs (as they are excluded under DIISR Guidelines)

ANU Approach • Indirect Costs • Generally recognised as operational expenses recorded in the R Fund of the relevant Business Unit (Research School or Centre in this case) • Exceptions to the above are: Academic Salaries Depreciation

ANU Approach • Indirect Costs • Generally recognised as operational expenses recorded in the R Fund of the relevant Business Unit (Research School or Centre in this case) • Exceptions to the above are: Academic Salaries Depreciation

ANU Approach Overhead Cost recognition Generally located in the Recurrent Fund expenses associated with: • College General operations (primarily administration of the College or in some cases area in which utility charges are held if not distributed to Business Units of the College) • Central University Administration operations • To determine overhead costs related to Research ANU’s CAPS are applied to redistribute these costs to Teaching and Research Business Units

ANU Approach Overhead Cost recognition Generally located in the Recurrent Fund expenses associated with: • College General operations (primarily administration of the College or in some cases area in which utility charges are held if not distributed to Business Units of the College) • Central University Administration operations • To determine overhead costs related to Research ANU’s CAPS are applied to redistribute these costs to Teaching and Research Business Units

ANU Approach Overhead Cost recognition (cont’d) - College • College General Business Unit generally contains costs associated with administration and in some cases some other costs that the College does not distribute to Business Units. • Total College expenses allocated to Business Units (BU) of the College based on the ANU CAP • BU AFS Income/Total College AFS Income

ANU Approach Overhead Cost recognition (cont’d) - College • College General Business Unit generally contains costs associated with administration and in some cases some other costs that the College does not distribute to Business Units. • Total College expenses allocated to Business Units (BU) of the College based on the ANU CAP • BU AFS Income/Total College AFS Income

ANU Approach Overhead Cost recognition (cont’d) – Central Admin • The following Central Admin Areas Costs have been redistributed • Based on ANU CAP: Current Replacement Value BU Buildings/Total Current Replacement Value of Teaching & Research Buildings • Building Maintenance • Campus Wide Property Costs • Facilities and Services Division

ANU Approach Overhead Cost recognition (cont’d) – Central Admin • The following Central Admin Areas Costs have been redistributed • Based on ANU CAP: Current Replacement Value BU Buildings/Total Current Replacement Value of Teaching & Research Buildings • Building Maintenance • Campus Wide Property Costs • Facilities and Services Division

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP: BU AFS Income/Total Teaching & Research BU AFS Income • • • University Executive Finance & Business Services General University Activities Marketing and Communications Statistical Services Development Office

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP: BU AFS Income/Total Teaching & Research BU AFS Income • • • University Executive Finance & Business Services General University Activities Marketing and Communications Statistical Services Development Office

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP: BU Student EFTSL/Total Teaching & Research BU Student EFTSL • Division of Registrar and Student Services

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP: BU Student EFTSL/Total Teaching & Research BU Student EFTSL • Division of Registrar and Student Services

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP: BU Average of(Staff FTE + Student EFTSL)/Total Teaching & Research BU (Staff FTE + Student EFTSL) • Information Services (IT) • Based on ANU CAP BU Raw Staff Numbers/Teaching & Research Raw Staff Numbers • Human Resources Division

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP: BU Average of(Staff FTE + Student EFTSL)/Total Teaching & Research BU (Staff FTE + Student EFTSL) • Information Services (IT) • Based on ANU CAP BU Raw Staff Numbers/Teaching & Research Raw Staff Numbers • Human Resources Division

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP BU Number of S Accounts Held 31 Dec/ Total Teaching & Research BU S Accounts Held 31 Dec • Research Office

ANU Approach • Overhead Cost recognition (cont’d) – Central Admin • Based on ANU CAP BU Number of S Accounts Held 31 Dec/ Total Teaching & Research BU S Accounts Held 31 Dec • Research Office

Issues to be resolved in the future • How to address direct cost of academic salaries covered by universities not recognised as direct or indirect costs in the TC exercise • How to reflect depreciation • Current DIISR approach is that only function of universities is Teaching & Research – impact of this on redistributing College/Central costs where central costs associated with servicing non-eligible operations not recognised (eg commercial activities)

Issues to be resolved in the future • How to address direct cost of academic salaries covered by universities not recognised as direct or indirect costs in the TC exercise • How to reflect depreciation • Current DIISR approach is that only function of universities is Teaching & Research – impact of this on redistributing College/Central costs where central costs associated with servicing non-eligible operations not recognised (eg commercial activities)

Issues to be resolved in the future • Need for us to be more definitive in what is a Research and Teaching Department and associated costs to be recognised at that level • Move towards an ABC model methodology in the future • Determine cost drivers • Understand true cost of Research and Teaching deliverables • Look to identify costs associated with BOTH Research and Teaching

Issues to be resolved in the future • Need for us to be more definitive in what is a Research and Teaching Department and associated costs to be recognised at that level • Move towards an ABC model methodology in the future • Determine cost drivers • Understand true cost of Research and Teaching deliverables • Look to identify costs associated with BOTH Research and Teaching

Issues to be resolved in the future • Significant system and administrative practice changes likely to arise and need to be managed • Significant cost in both time and dollars will be involved in moving down this path and will require buy-in from university executive • The work, fun, and challenges for us in identifying the real cost of Research and Teaching in our universities begins!!!

Issues to be resolved in the future • Significant system and administrative practice changes likely to arise and need to be managed • Significant cost in both time and dollars will be involved in moving down this path and will require buy-in from university executive • The work, fun, and challenges for us in identifying the real cost of Research and Teaching in our universities begins!!!

Useful Links • http: //www. innovation. gov. au/Section/Research/Document s/Indirect. Costs. Uni. Research. pdf • http: //www. innovation. gov. au/Section/Research/Document s/FAQs. SREFinance 100610. pdf • http: //www. innovation. gov. au/Section/Research/Document s/Guidelines. For. The. Assignment. Of. The. Indirect. Costs 100610. pdf • http: //www. innovation. gov. au/Section/Research/Document s/SRE 2010 Guidance. Paper. pdf

Useful Links • http: //www. innovation. gov. au/Section/Research/Document s/Indirect. Costs. Uni. Research. pdf • http: //www. innovation. gov. au/Section/Research/Document s/FAQs. SREFinance 100610. pdf • http: //www. innovation. gov. au/Section/Research/Document s/Guidelines. For. The. Assignment. Of. The. Indirect. Costs 100610. pdf • http: //www. innovation. gov. au/Section/Research/Document s/SRE 2010 Guidance. Paper. pdf

Useful Links • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/reviews/fecexecsum. pdf • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/reviews/fecreport. pdf • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/reviews/fecannex. pdf • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/documents /qavreport. pdf • RCUK website

Useful Links • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/reviews/fecexecsum. pdf • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/reviews/fecreport. pdf • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/reviews/fecannex. pdf • http: //www. rcuk. ac. uk/cmsweb/downloads/rcuk/documents /qavreport. pdf • RCUK website

Happy to take Questions

Happy to take Questions

HERDC Update Lorraine Piper

HERDC Update Lorraine Piper

SPECIAL PURPOSE FUNDS HERDC • Financial return submitted successfully 30 June • Increase of $2. 6 M over 2008 return • New & improved method of preparing return well received – further feedback will be sought prior to the preparation of the 2010 return

SPECIAL PURPOSE FUNDS HERDC • Financial return submitted successfully 30 June • Increase of $2. 6 M over 2008 return • New & improved method of preparing return well received – further feedback will be sought prior to the preparation of the 2010 return

30 June Statements • List of 122 statements due for preparation as at 30 June distributed to College Finance officers on Friday 2/7 • 18 require internal audit • 8 require external audit • Documentation to be returned to SPF by Wed 21/7 (at latest) to ensure timely conduct of audits

30 June Statements • List of 122 statements due for preparation as at 30 June distributed to College Finance officers on Friday 2/7 • 18 require internal audit • 8 require external audit • Documentation to be returned to SPF by Wed 21/7 (at latest) to ensure timely conduct of audits

FBT Return Review Callum Burke

FBT Return Review Callum Burke

Meal Entertainment - Overall increase in taxable value of approximately $75, 000. - Currently working strategies to reduce future FBT on ME. - Business areas need to encourage staff to reduce expenditure on ME. - FBT cost should be considered before ME takes place.

Meal Entertainment - Overall increase in taxable value of approximately $75, 000. - Currently working strategies to reduce future FBT on ME. - Business areas need to encourage staff to reduce expenditure on ME. - FBT cost should be considered before ME takes place.

Motor Vehicles -Increased taxable value of approximately $19, 000. -Make the most of exempt vehicles. -Reduce home garaging of non-exempt vehicles. -Reduce personal use. -Statutory percentages, Increased KM’s does unfortunately reduce FBT cost.

Motor Vehicles -Increased taxable value of approximately $19, 000. -Make the most of exempt vehicles. -Reduce home garaging of non-exempt vehicles. -Reduce personal use. -Statutory percentages, Increased KM’s does unfortunately reduce FBT cost.

2009 -10 FBT Return -FBT packs received from Colleges - Overall very high quality - Declarations -Individual area reports - Sent out in June for review -Reconciliation - Currently working on making adjustments for ‘actual FBT amounts’ v ‘System generated amounts’

2009 -10 FBT Return -FBT packs received from Colleges - Overall very high quality - Declarations -Individual area reports - Sent out in June for review -Reconciliation - Currently working on making adjustments for ‘actual FBT amounts’ v ‘System generated amounts’

Salary Sacrificing of i. Pads (e-readers) - ATO has confirmed that i. Pads can be defined as laptops or PDAs (section 58 X(2) FBTAA). - However to be exempt and therefore effective under a salary packaging arrangement: 1. The device must have been acquired for the primary purpose of use in your actual employment duties, and - 2. You must not have salary packaged any similar items earlier in the relevant FBT year. i. Pad is marketed primarily as an entertainment making it much harder to justify the primary - purpose is for work. Result = No i. Pads under salary packaging arrangements at this stage.

Salary Sacrificing of i. Pads (e-readers) - ATO has confirmed that i. Pads can be defined as laptops or PDAs (section 58 X(2) FBTAA). - However to be exempt and therefore effective under a salary packaging arrangement: 1. The device must have been acquired for the primary purpose of use in your actual employment duties, and - 2. You must not have salary packaged any similar items earlier in the relevant FBT year. i. Pad is marketed primarily as an entertainment making it much harder to justify the primary - purpose is for work. Result = No i. Pads under salary packaging arrangements at this stage.

Vendor Record Management Wendy Fox

Vendor Record Management Wendy Fox

Vendor Record Management Vendor request job logging in DOI Helpdesk • Email to vendor. maintenance@anu. edu. au with supporting documentation • Follow-up directly in DOI Helpdesk • Email from DOI Helpdesk when vendor approved Revised Web documentation: • POI – Get Employee/Student, default to cheque • 21 day payment terms default • Vendor reactivate – email vendor. maintenance@anu. edu. au with supporting documentation

Vendor Record Management Vendor request job logging in DOI Helpdesk • Email to vendor. maintenance@anu. edu. au with supporting documentation • Follow-up directly in DOI Helpdesk • Email from DOI Helpdesk when vendor approved Revised Web documentation: • POI – Get Employee/Student, default to cheque • 21 day payment terms default • Vendor reactivate – email vendor. maintenance@anu. edu. au with supporting documentation

Report Distribution Tool Ben Lees and Eric Li

Report Distribution Tool Ben Lees and Eric Li

Introduction • Approximately 10, 000 n. Vision reports produced each Period End • Significant time spent by Finance staff distributing reports to the right recipients • College of Science developed an email based distribution tool

Introduction • Approximately 10, 000 n. Vision reports produced each Period End • Significant time spent by Finance staff distributing reports to the right recipients • College of Science developed an email based distribution tool

Key Features • Distributes reports via Microsoft Outlook • Distribution template • Maintain recipient/report relationships • Map new reports at period end • Filtering by report id/recipient • Logs distribution history • Displays reports not yet distributed • Allows for adhoc usage • Multiple reports per recipient

Key Features • Distributes reports via Microsoft Outlook • Distribution template • Maintain recipient/report relationships • Map new reports at period end • Filtering by report id/recipient • Logs distribution history • Displays reports not yet distributed • Allows for adhoc usage • Multiple reports per recipient

Requirements • Microsoft Windows platform • 2003 or 2007 Microsoft Excel and Outlook

Requirements • Microsoft Windows platform • 2003 or 2007 Microsoft Excel and Outlook

Demonstration

Demonstration

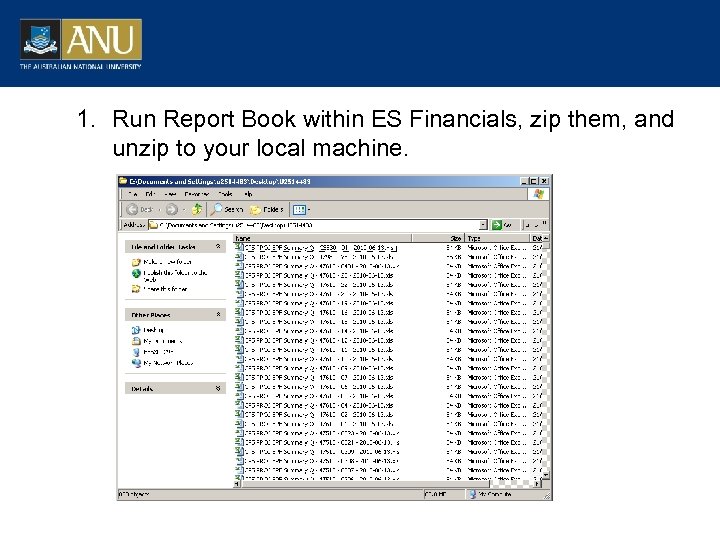

1. Run Report Book within ES Financials, zip them, and unzip to your local machine.

1. Run Report Book within ES Financials, zip them, and unzip to your local machine.

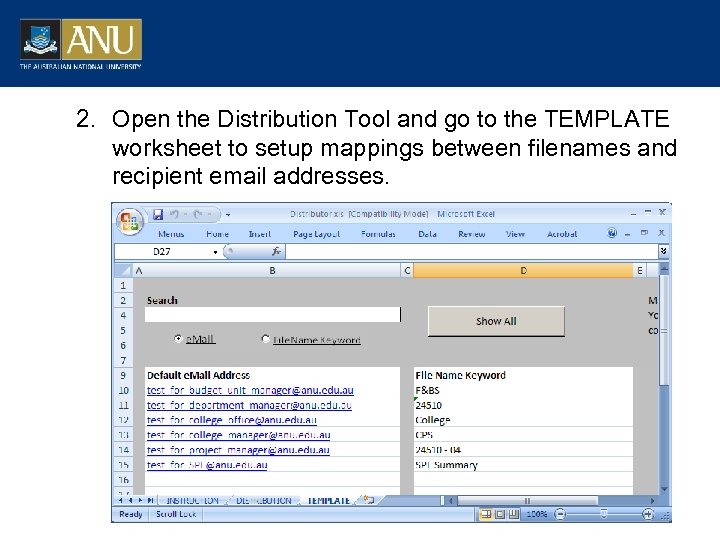

2. Open the Distribution Tool and go to the TEMPLATE worksheet to setup mappings between filenames and recipient email addresses.

2. Open the Distribution Tool and go to the TEMPLATE worksheet to setup mappings between filenames and recipient email addresses.

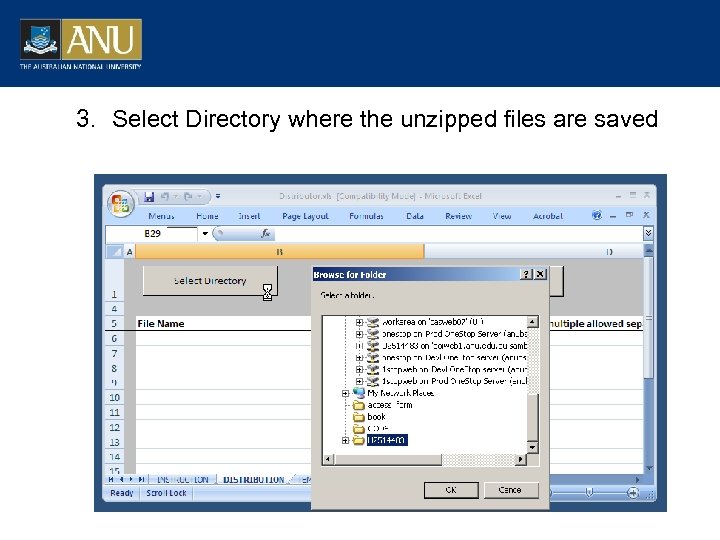

3. Select Directory where the unzipped files are saved

3. Select Directory where the unzipped files are saved

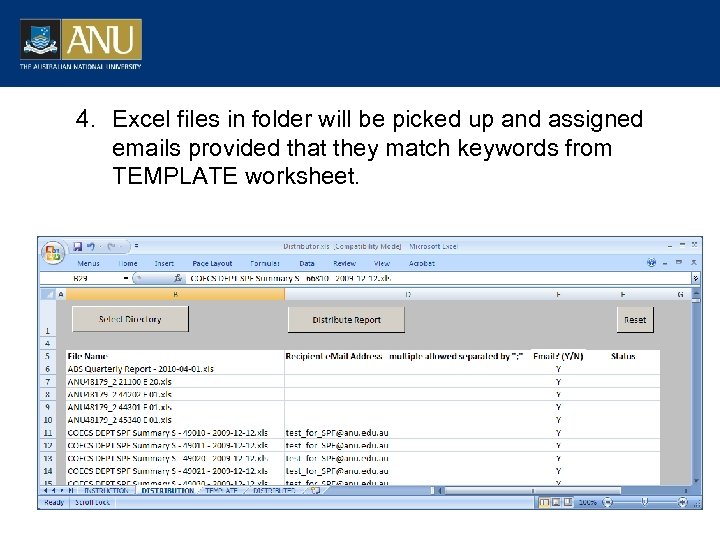

4. Excel files in folder will be picked up and assigned emails provided that they match keywords from TEMPLATE worksheet.

4. Excel files in folder will be picked up and assigned emails provided that they match keywords from TEMPLATE worksheet.

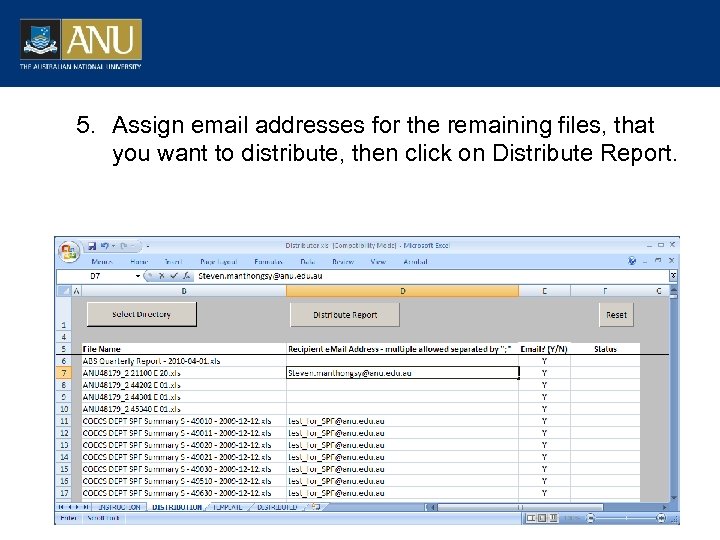

5. Assign email addresses for the remaining files, that you want to distribute, then click on Distribute Report.

5. Assign email addresses for the remaining files, that you want to distribute, then click on Distribute Report.

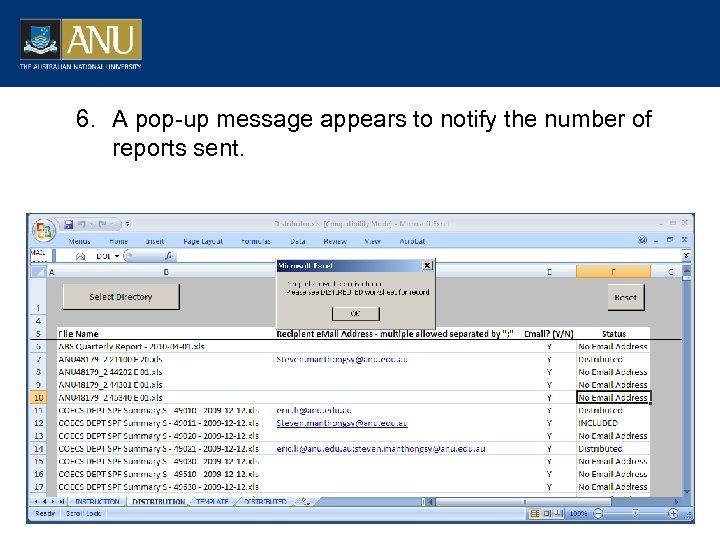

6. A pop-up message appears to notify the number of reports sent.

6. A pop-up message appears to notify the number of reports sent.

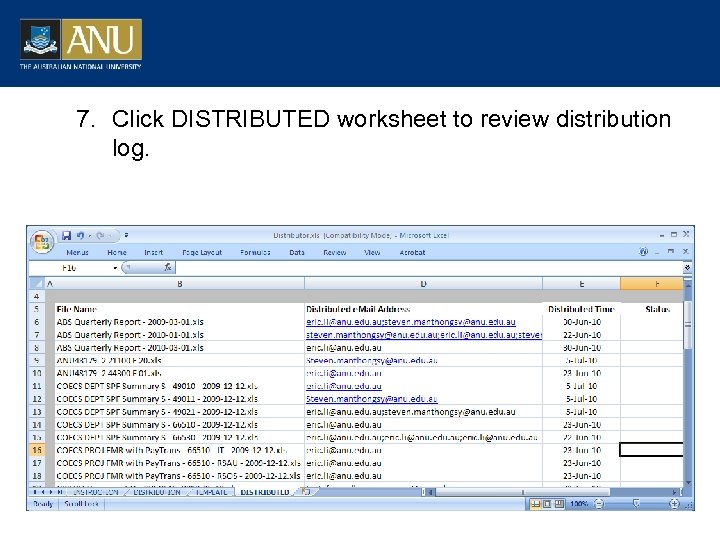

7. Click DISTRIBUTED worksheet to review distribution log.

7. Click DISTRIBUTED worksheet to review distribution log.

8. Sample Email from Outlook.

8. Sample Email from Outlook.

Questions?

Questions?

Receipting Project Pat Price

Receipting Project Pat Price

Receipting Project Purpose • review processes, tools and technology employed to collect funds (tuition fees, goods and services income, cost recoveries) • identify areas of inefficiency or risk; • review banking products available to assist; • propose implementation plans to deliver preferred solutions; and • provide the business information to support: • a reduction in manual processing and cash handling across the University; • improved processing of international receipts and reductions in the number of unidentified receipts; and • PCI-DSS compliance of customer payment card transactions (by 30/9/2010)

Receipting Project Purpose • review processes, tools and technology employed to collect funds (tuition fees, goods and services income, cost recoveries) • identify areas of inefficiency or risk; • review banking products available to assist; • propose implementation plans to deliver preferred solutions; and • provide the business information to support: • a reduction in manual processing and cash handling across the University; • improved processing of international receipts and reductions in the number of unidentified receipts; and • PCI-DSS compliance of customer payment card transactions (by 30/9/2010)

Receipting Project Execution • Review and document end-to-end process – customer to GL • In Scope – cash, EFTPOS, web payments, direct deposits • Out of scope – direct debits, BPay • Visit all receipting points and document current processes • Collate, analyse, process map and review • Recommendations for improvement future project(s) • Complete visits by end September, review and analysis through Sept-Nov

Receipting Project Execution • Review and document end-to-end process – customer to GL • In Scope – cash, EFTPOS, web payments, direct deposits • Out of scope – direct debits, BPay • Visit all receipting points and document current processes • Collate, analyse, process map and review • Recommendations for improvement future project(s) • Complete visits by end September, review and analysis through Sept-Nov

Afternoon Tea Everyone

Afternoon Tea Everyone

Budget Template and Summary Code Mark Baker

Budget Template and Summary Code Mark Baker

2011 Budget Website http: //info. anu. edu. au/fbs/Finance_Functions/2011 -Budget-2

2011 Budget Website http: //info. anu. edu. au/fbs/Finance_Functions/2011 -Budget-2

2011 Budget Website http: //info. anu. edu. au/fbs/Finance_Functions/2011 -Budget-2

2011 Budget Website http: //info. anu. edu. au/fbs/Finance_Functions/2011 -Budget-2

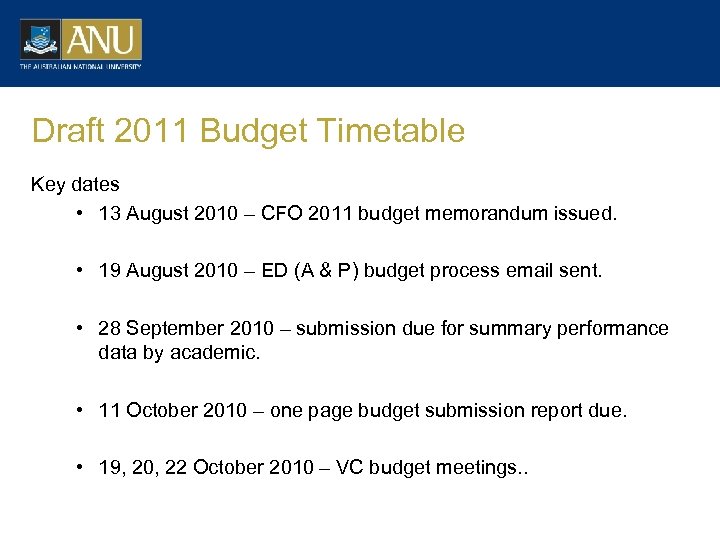

Draft 2011 Budget Timetable Key dates • 13 August 2010 – CFO 2011 budget memorandum issued. • 19 August 2010 – ED (A & P) budget process email sent. • 28 September 2010 – submission due for summary performance data by academic. • 11 October 2010 – one page budget submission report due. • 19, 20, 22 October 2010 – VC budget meetings. .

Draft 2011 Budget Timetable Key dates • 13 August 2010 – CFO 2011 budget memorandum issued. • 19 August 2010 – ED (A & P) budget process email sent. • 28 September 2010 – submission due for summary performance data by academic. • 11 October 2010 – one page budget submission report due. • 19, 20, 22 October 2010 – VC budget meetings. .

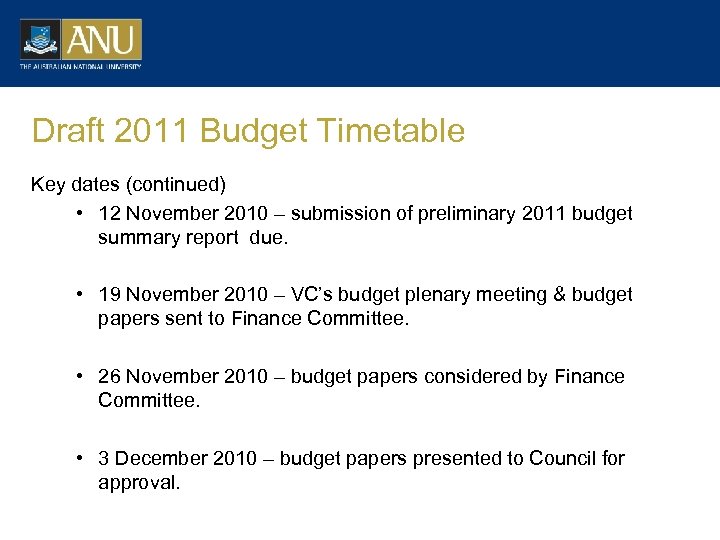

Draft 2011 Budget Timetable Key dates (continued) • 12 November 2010 – submission of preliminary 2011 budget summary report due. • 19 November 2010 – VC’s budget plenary meeting & budget papers sent to Finance Committee. • 26 November 2010 – budget papers considered by Finance Committee. • 3 December 2010 – budget papers presented to Council for approval.

Draft 2011 Budget Timetable Key dates (continued) • 12 November 2010 – submission of preliminary 2011 budget summary report due. • 19 November 2010 – VC’s budget plenary meeting & budget papers sent to Finance Committee. • 26 November 2010 – budget papers considered by Finance Committee. • 3 December 2010 – budget papers presented to Council for approval.

Questions?

Questions?

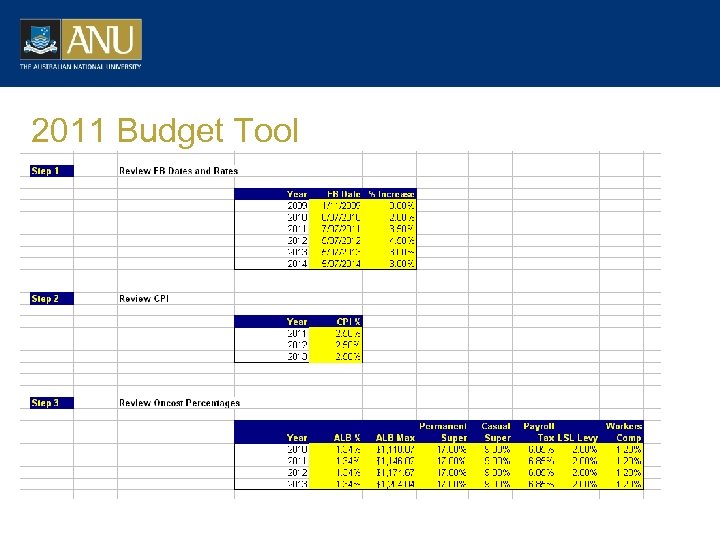

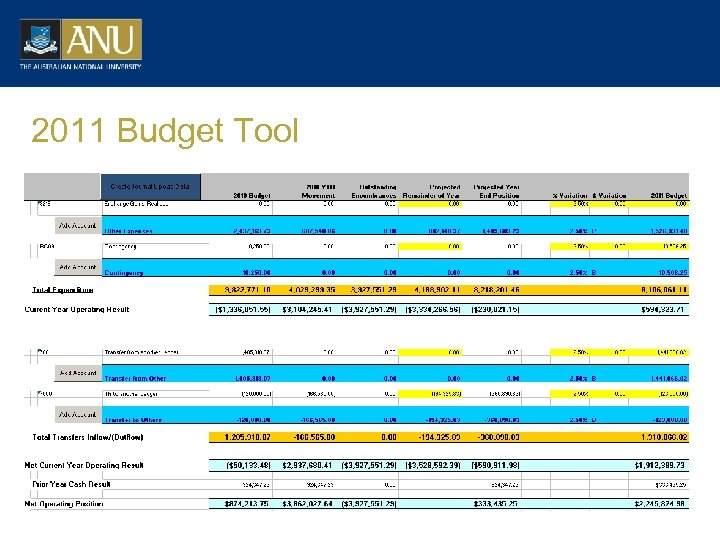

2011 Budget Tool What has changed for 2011? • Update EB dates and rates. • Review oncosts. • Review and update CPI. • Make sure salary increments are biannual, for those that are biannual. • Include employee ID on salary sheet. • Include 25% loading for casuals (bug from last year). • Update statement sheet to use new budget accounts tree layout. • Natural account codes retained. • Aim to release within the next month. • Additional explanatory notes added. • Any questions or suggested improvements email Trevor. Langtry@anu. edu. au

2011 Budget Tool What has changed for 2011? • Update EB dates and rates. • Review oncosts. • Review and update CPI. • Make sure salary increments are biannual, for those that are biannual. • Include employee ID on salary sheet. • Include 25% loading for casuals (bug from last year). • Update statement sheet to use new budget accounts tree layout. • Natural account codes retained. • Aim to release within the next month. • Additional explanatory notes added. • Any questions or suggested improvements email Trevor. Langtry@anu. edu. au

2011 Budget Tool

2011 Budget Tool

2011 Budget Tool

2011 Budget Tool

Questions?

Questions?

PCI-DSS Brigid Lever

PCI-DSS Brigid Lever

PCI-DSS • • • Purchase Card Industry Data Security Standards Costs of compliance – physical and electronic security Cost of non-compliance – fines $100 K plus Attest to level of compliance by 30/9/2010 PC data must be personally controlled by cardholder Only feasible response is to NOT record PC data anywhere, anytime within University

PCI-DSS • • • Purchase Card Industry Data Security Standards Costs of compliance – physical and electronic security Cost of non-compliance – fines $100 K plus Attest to level of compliance by 30/9/2010 PC data must be personally controlled by cardholder Only feasible response is to NOT record PC data anywhere, anytime within University

Student Debtor Policy/Procedure Brigid Lever

Student Debtor Policy/Procedure Brigid Lever

Student Debt Management • C’wealth-supported students - cancelled at census • DTF and ISF can be cancelled and still have a debt • DRSS liaise with student admin in Colleges • College SA liaise with College Finance • Write-off – College bears FULL fees • Pursue – College Finance to liaise with F&BS • MUST provide full evidence of enforceable debt • Subject to standard debt collection policy/cycle • Subsequent write-offs will bear FULL fee plus D&B costs

Student Debt Management • C’wealth-supported students - cancelled at census • DTF and ISF can be cancelled and still have a debt • DRSS liaise with student admin in Colleges • College SA liaise with College Finance • Write-off – College bears FULL fees • Pursue – College Finance to liaise with F&BS • MUST provide full evidence of enforceable debt • Subject to standard debt collection policy/cycle • Subsequent write-offs will bear FULL fee plus D&B costs

Updates on other initiatives Brigid Lever

Updates on other initiatives Brigid Lever

Updates • • OCR – development and testing underway Stipend advances (overpayments) Travelex 24/7 Visiting artists

Updates • • OCR – development and testing underway Stipend advances (overpayments) Travelex 24/7 Visiting artists

F&BS Training Opportunities Amanda Walker

F&BS Training Opportunities Amanda Walker

Training -Senior Leaders Guide to Finance @ ANU - Delegations - Structure of ledger - Budget process - How to read a financial report - Where to go with questions - Periodic mail out of finance “tips”: - SPF/FMR Guides - How to see if an invoice has been paid - Training info on web - Training page - Toolkits

Training -Senior Leaders Guide to Finance @ ANU - Delegations - Structure of ledger - Budget process - How to read a financial report - Where to go with questions - Periodic mail out of finance “tips”: - SPF/FMR Guides - How to see if an invoice has been paid - Training info on web - Training page - Toolkits

End

End