2a4d6c1945d9b1b692d1a0bf581eaba5.ppt

- Количество слайдов: 18

2010 Commercial Space Transportation Forecast for Non. Geosynchronous Orbits Presentation to COMSTAC May 19, 2010 Futron Corporation • 7315 Wisconsin Avenue, Suite 900 W • Bethesda, Maryland 20814 Phone 301 -913 -9372 • Fax 301 -913 -9475 • www. futron. com ISO 9001 Registered Better Decisions…Better Future

2010 Commercial Space Transportation Forecast for Non. Geosynchronous Orbits Presentation to COMSTAC May 19, 2010 Futron Corporation • 7315 Wisconsin Avenue, Suite 900 W • Bethesda, Maryland 20814 Phone 301 -913 -9372 • Fax 301 -913 -9475 • www. futron. com ISO 9001 Registered Better Decisions…Better Future

Contents and Purpose • Contents of the 2010 Commercial Space Transportation Forecast for Non. Geosynchronous Orbits (NGSO) Ø Ø Ø Developed by the FAA/AST with help from the Futron Corporation Projects global commercial launch demand for 2010 -2019 All nongeosynchronous orbits including • • Ø Low Earth orbit Medium Earth orbit Elliptical orbits External orbits such as to the Moon or other solar system destinations Commercial definition: • Internationally competed launches • Licensed by the FAA/AST • Purpose of the NGSO forecast Ø Ø To help the FAA/AST plan for its commercial launch licensing and promotional role To raise public awareness of the scope and trajectory of commercial spaceflight demand ISO 9001 Registered Better Decisions…Better Future • 2

Contents and Purpose • Contents of the 2010 Commercial Space Transportation Forecast for Non. Geosynchronous Orbits (NGSO) Ø Ø Ø Developed by the FAA/AST with help from the Futron Corporation Projects global commercial launch demand for 2010 -2019 All nongeosynchronous orbits including • • Ø Low Earth orbit Medium Earth orbit Elliptical orbits External orbits such as to the Moon or other solar system destinations Commercial definition: • Internationally competed launches • Licensed by the FAA/AST • Purpose of the NGSO forecast Ø Ø To help the FAA/AST plan for its commercial launch licensing and promotional role To raise public awareness of the scope and trajectory of commercial spaceflight demand ISO 9001 Registered Better Decisions…Better Future • 2

Basic Methodology • This report is based on research and discussions with: Ø Industry including: • Satellite service providers • Satellite manufacturers • Launch service providers Ø Ø Government offices Independent analysts • The forecast tracks progress for publicly-announced satellites and considers a number of factors, some examples: Ø Ø Ø Financing Regulatory developments Spacecraft manufacturing and launch services contracts Investor confidence Competition from space and terrestrial sectors Overall economic conditions ISO 9001 Registered Better Decisions…Better Future • 3

Basic Methodology • This report is based on research and discussions with: Ø Industry including: • Satellite service providers • Satellite manufacturers • Launch service providers Ø Ø Government offices Independent analysts • The forecast tracks progress for publicly-announced satellites and considers a number of factors, some examples: Ø Ø Ø Financing Regulatory developments Spacecraft manufacturing and launch services contracts Investor confidence Competition from space and terrestrial sectors Overall economic conditions ISO 9001 Registered Better Decisions…Better Future • 3

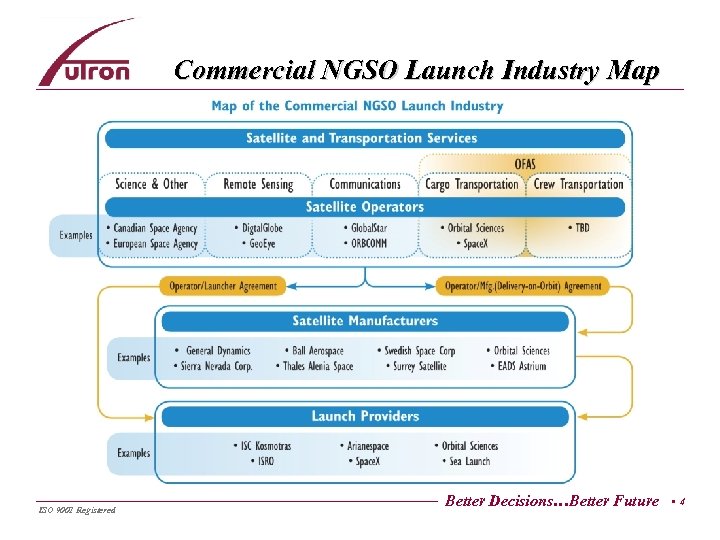

Commercial NGSO Launch Industry Map ISO 9001 Registered Better Decisions…Better Future • 4

Commercial NGSO Launch Industry Map ISO 9001 Registered Better Decisions…Better Future • 4

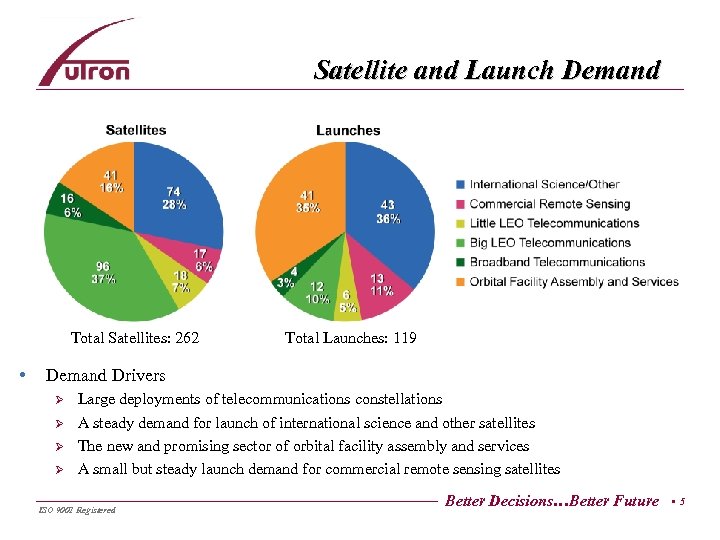

Satellite and Launch Demand Total Satellites: 262 Total Launches: 119 • Demand Drivers Ø Ø Large deployments of telecommunications constellations A steady demand for launch of international science and other satellites The new and promising sector of orbital facility assembly and services A small but steady launch demand for commercial remote sensing satellites ISO 9001 Registered Better Decisions…Better Future • 5

Satellite and Launch Demand Total Satellites: 262 Total Launches: 119 • Demand Drivers Ø Ø Large deployments of telecommunications constellations A steady demand for launch of international science and other satellites The new and promising sector of orbital facility assembly and services A small but steady launch demand for commercial remote sensing satellites ISO 9001 Registered Better Decisions…Better Future • 5

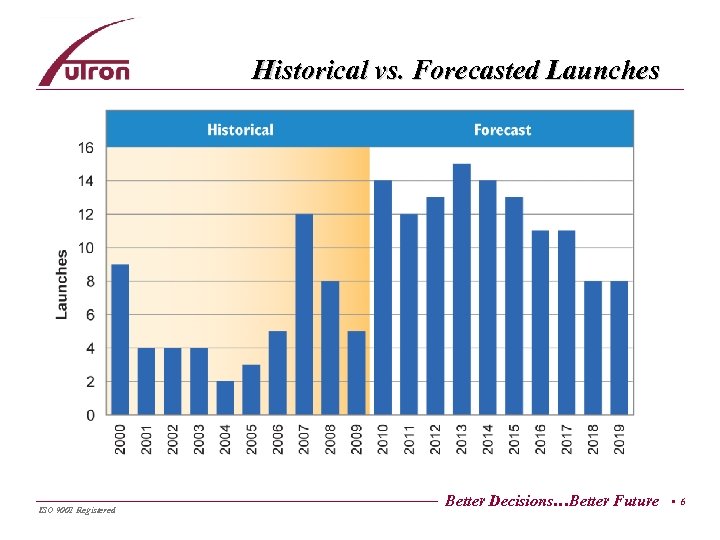

Historical vs. Forecasted Launches ISO 9001 Registered Better Decisions…Better Future • 6

Historical vs. Forecasted Launches ISO 9001 Registered Better Decisions…Better Future • 6

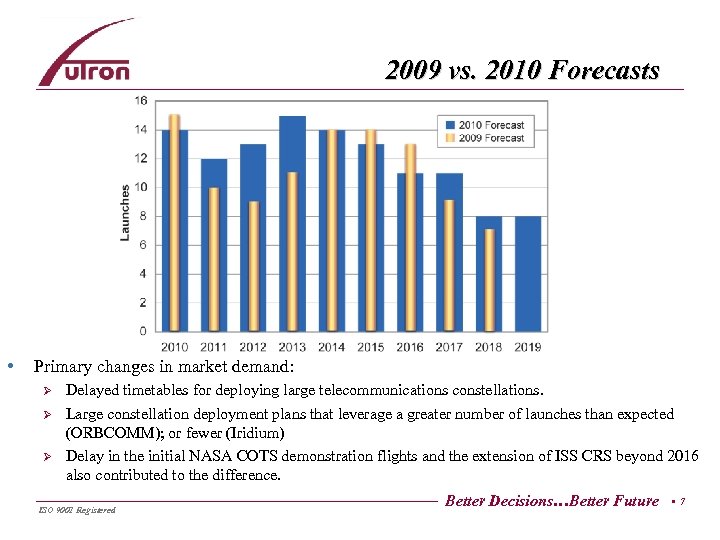

2009 vs. 2010 Forecasts • Primary changes in market demand: Ø Ø Ø Delayed timetables for deploying large telecommunications constellations. Large constellation deployment plans that leverage a greater number of launches than expected (ORBCOMM); or fewer (Iridium) Delay in the initial NASA COTS demonstration flights and the extension of ISS CRS beyond 2016 also contributed to the difference. ISO 9001 Registered Better Decisions…Better Future • 7

2009 vs. 2010 Forecasts • Primary changes in market demand: Ø Ø Ø Delayed timetables for deploying large telecommunications constellations. Large constellation deployment plans that leverage a greater number of launches than expected (ORBCOMM); or fewer (Iridium) Delay in the initial NASA COTS demonstration flights and the extension of ISS CRS beyond 2016 also contributed to the difference. ISO 9001 Registered Better Decisions…Better Future • 7

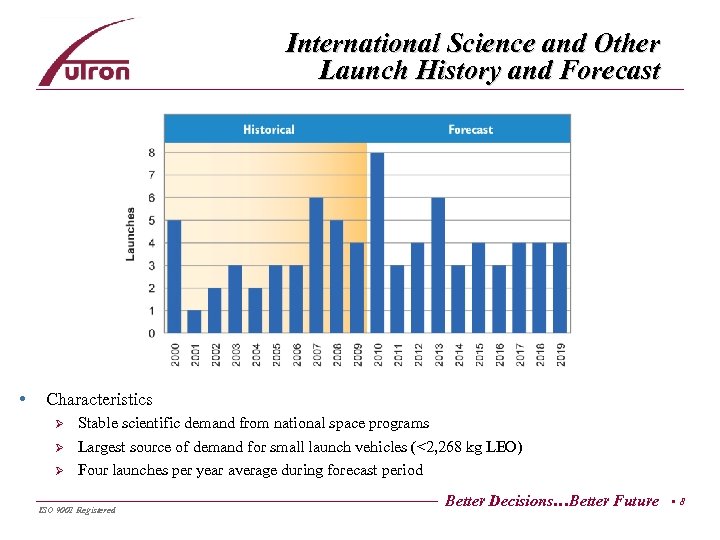

International Science and Other Launch History and Forecast • Characteristics Ø Ø Ø Stable scientific demand from national space programs Largest source of demand for small launch vehicles (<2, 268 kg LEO) Four launches per year average during forecast period ISO 9001 Registered Better Decisions…Better Future • 8

International Science and Other Launch History and Forecast • Characteristics Ø Ø Ø Stable scientific demand from national space programs Largest source of demand for small launch vehicles (<2, 268 kg LEO) Four launches per year average during forecast period ISO 9001 Registered Better Decisions…Better Future • 8

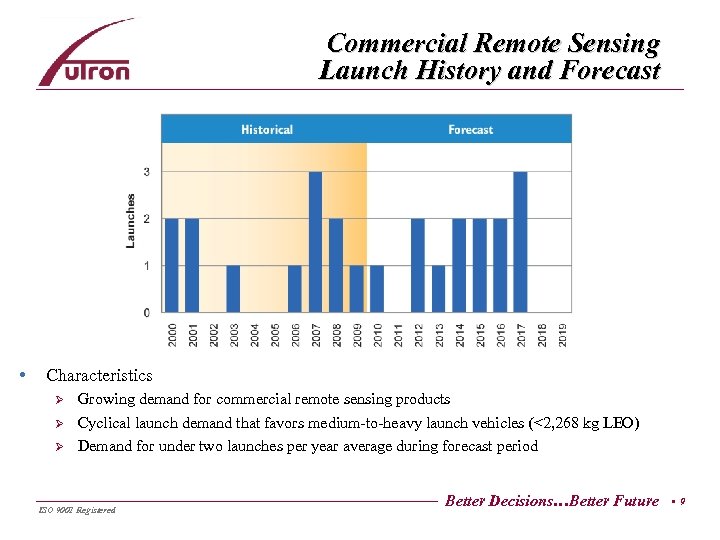

Commercial Remote Sensing Launch History and Forecast • Characteristics Ø Ø Ø Growing demand for commercial remote sensing products Cyclical launch demand that favors medium-to-heavy launch vehicles (<2, 268 kg LEO) Demand for under two launches per year average during forecast period ISO 9001 Registered Better Decisions…Better Future • 9

Commercial Remote Sensing Launch History and Forecast • Characteristics Ø Ø Ø Growing demand for commercial remote sensing products Cyclical launch demand that favors medium-to-heavy launch vehicles (<2, 268 kg LEO) Demand for under two launches per year average during forecast period ISO 9001 Registered Better Decisions…Better Future • 9

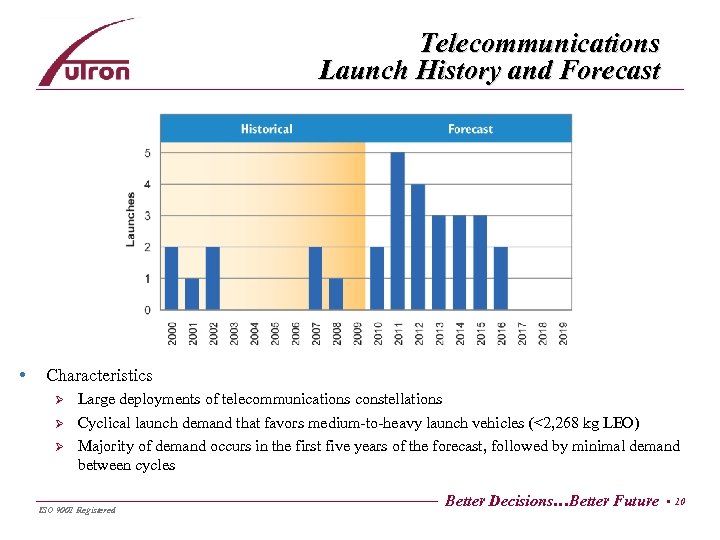

Telecommunications Launch History and Forecast • Characteristics Ø Ø Ø Large deployments of telecommunications constellations Cyclical launch demand that favors medium-to-heavy launch vehicles (<2, 268 kg LEO) Majority of demand occurs in the first five years of the forecast, followed by minimal demand between cycles ISO 9001 Registered Better Decisions…Better Future • 10

Telecommunications Launch History and Forecast • Characteristics Ø Ø Ø Large deployments of telecommunications constellations Cyclical launch demand that favors medium-to-heavy launch vehicles (<2, 268 kg LEO) Majority of demand occurs in the first five years of the forecast, followed by minimal demand between cycles ISO 9001 Registered Better Decisions…Better Future • 10

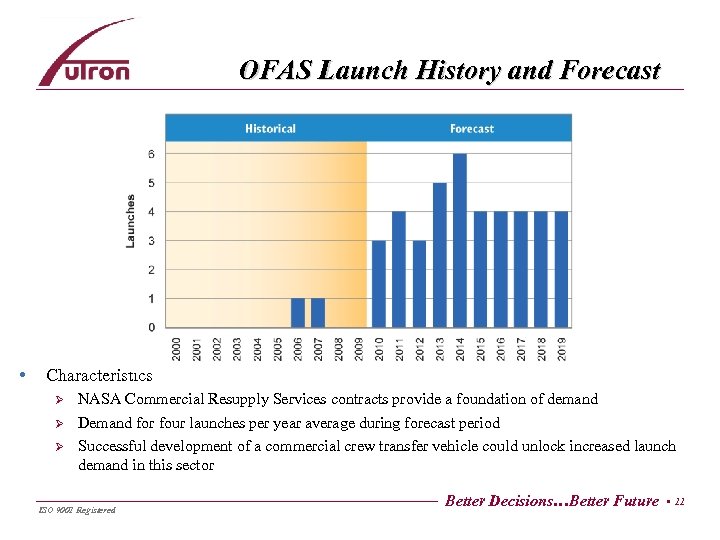

OFAS Launch History and Forecast • Characteristics Ø Ø Ø NASA Commercial Resupply Services contracts provide a foundation of demand Demand for four launches per year average during forecast period Successful development of a commercial crew transfer vehicle could unlock increased launch demand in this sector ISO 9001 Registered Better Decisions…Better Future • 11

OFAS Launch History and Forecast • Characteristics Ø Ø Ø NASA Commercial Resupply Services contracts provide a foundation of demand Demand for four launches per year average during forecast period Successful development of a commercial crew transfer vehicle could unlock increased launch demand in this sector ISO 9001 Registered Better Decisions…Better Future • 11

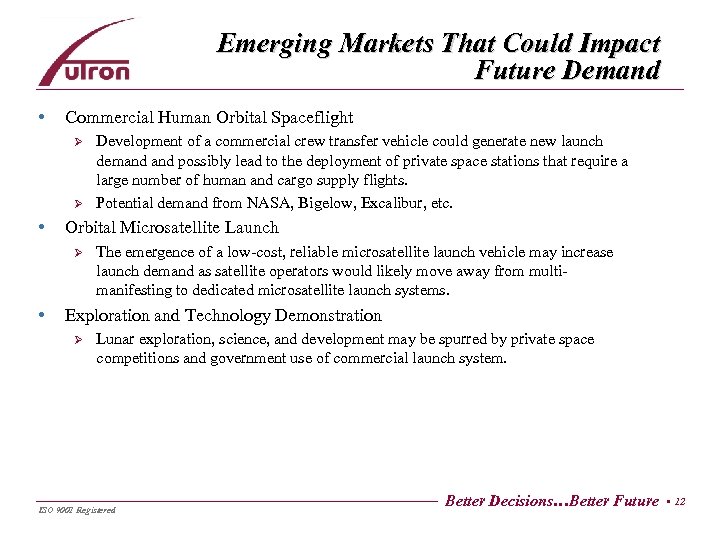

Emerging Markets That Could Impact Future Demand • Commercial Human Orbital Spaceflight Ø Ø Development of a commercial crew transfer vehicle could generate new launch demand possibly lead to the deployment of private space stations that require a large number of human and cargo supply flights. Potential demand from NASA, Bigelow, Excalibur, etc. • Orbital Microsatellite Launch Ø The emergence of a low-cost, reliable microsatellite launch vehicle may increase launch demand as satellite operators would likely move away from multimanifesting to dedicated microsatellite launch systems. • Exploration and Technology Demonstration Ø Lunar exploration, science, and development may be spurred by private space competitions and government use of commercial launch system. ISO 9001 Registered Better Decisions…Better Future • 12

Emerging Markets That Could Impact Future Demand • Commercial Human Orbital Spaceflight Ø Ø Development of a commercial crew transfer vehicle could generate new launch demand possibly lead to the deployment of private space stations that require a large number of human and cargo supply flights. Potential demand from NASA, Bigelow, Excalibur, etc. • Orbital Microsatellite Launch Ø The emergence of a low-cost, reliable microsatellite launch vehicle may increase launch demand as satellite operators would likely move away from multimanifesting to dedicated microsatellite launch systems. • Exploration and Technology Demonstration Ø Lunar exploration, science, and development may be spurred by private space competitions and government use of commercial launch system. ISO 9001 Registered Better Decisions…Better Future • 12

Uncertainty • Fourteen sources of certainty examined, examples: Ø Financial uncertainty: • • Ø U. S. national and global economy Investor confidence Corporate mergers Terrestrial competition Political Uncertainty: • Policy and regulations • Increase/decrease in government purchase of commercial satellite services • Government missions open/closed to commercial launch competition Ø Technical Uncertainty: • • ISO 9001 Registered Launch failure Satellite manufacturing delay Satellite failure in orbit Introduction of innovative/disruptive technology Better Decisions…Better Future • 13

Uncertainty • Fourteen sources of certainty examined, examples: Ø Financial uncertainty: • • Ø U. S. national and global economy Investor confidence Corporate mergers Terrestrial competition Political Uncertainty: • Policy and regulations • Increase/decrease in government purchase of commercial satellite services • Government missions open/closed to commercial launch competition Ø Technical Uncertainty: • • ISO 9001 Registered Launch failure Satellite manufacturing delay Satellite failure in orbit Introduction of innovative/disruptive technology Better Decisions…Better Future • 13

End • Questions? ISO 9001 Registered Better Decisions…Better Future • 14

End • Questions? ISO 9001 Registered Better Decisions…Better Future • 14

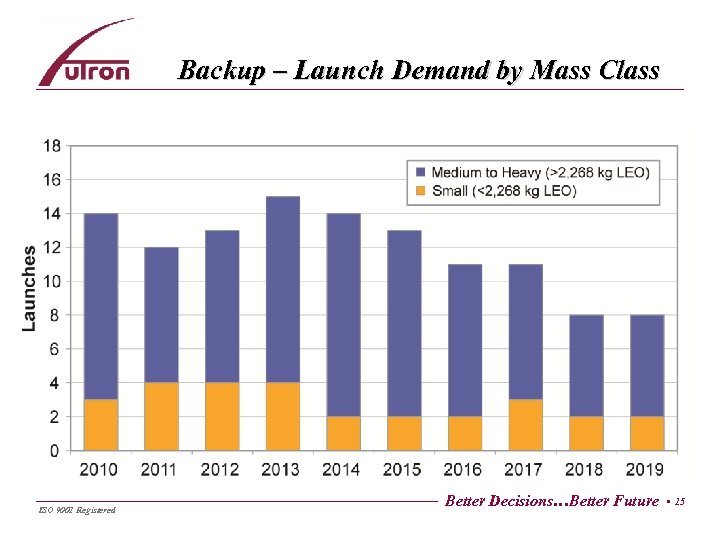

Backup – Launch Demand by Mass Class ISO 9001 Registered Better Decisions…Better Future • 15

Backup – Launch Demand by Mass Class ISO 9001 Registered Better Decisions…Better Future • 15

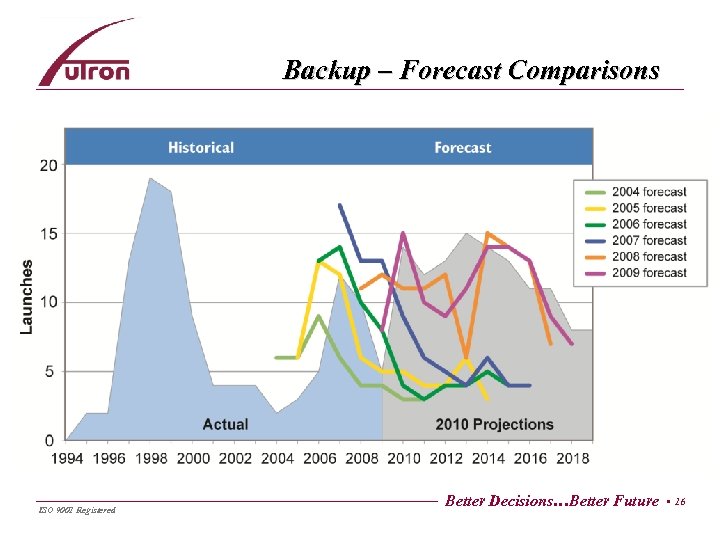

Backup – Forecast Comparisons ISO 9001 Registered Better Decisions…Better Future • 16

Backup – Forecast Comparisons ISO 9001 Registered Better Decisions…Better Future • 16

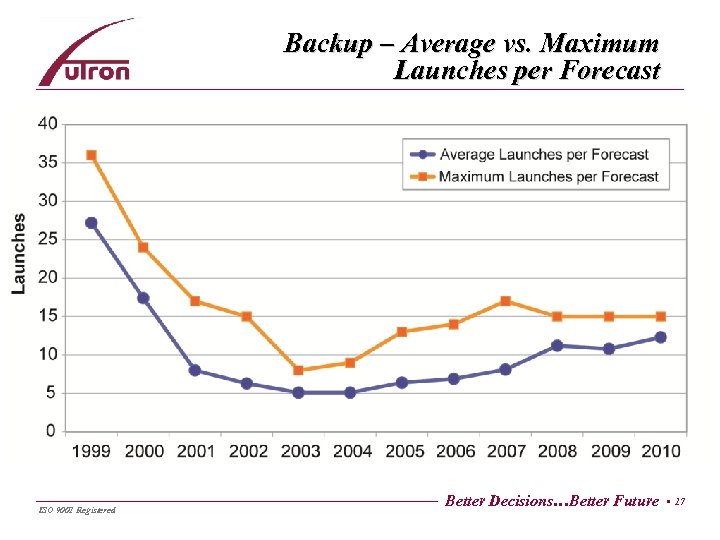

Backup – Average vs. Maximum Launches per Forecast ISO 9001 Registered Better Decisions…Better Future • 17

Backup – Average vs. Maximum Launches per Forecast ISO 9001 Registered Better Decisions…Better Future • 17

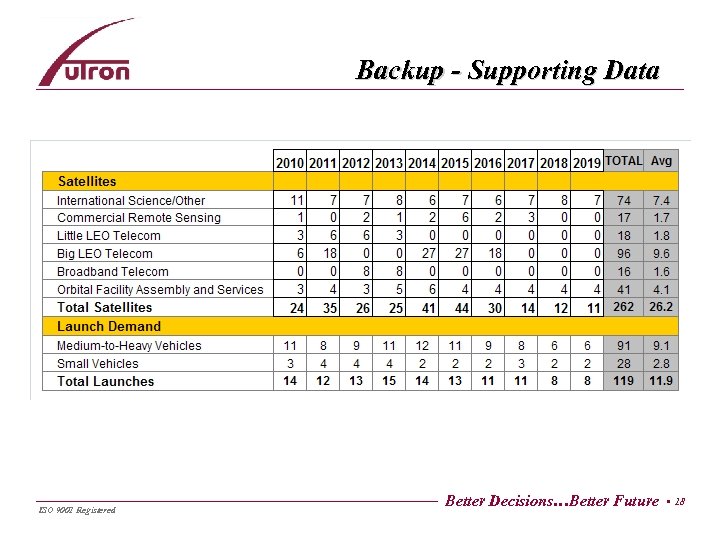

Backup - Supporting Data ISO 9001 Registered Better Decisions…Better Future • 18

Backup - Supporting Data ISO 9001 Registered Better Decisions…Better Future • 18