5503b1a296ef0fe5c07b66c11c349f4a.ppt

- Количество слайдов: 119

2010 Annual Fraud Awareness Training For Insurance Professionals What Every Insurance Professional Should Know About Insurance Fraud A Global Leader in Compliance and Investigation Solutions

2010 Annual Fraud Awareness Training For Insurance Professionals What Every Insurance Professional Should Know About Insurance Fraud A Global Leader in Compliance and Investigation Solutions

2010 Annual Fraud Awareness Training For Insurance Professionals Welcome to the Matrix Absence Management, Inc. , Special Investigative Unit’s online training course. This Power. Point presentation and 10 question test is designed to meet the various state requirements for Annual Anti-Fraud Training. Matrix Absence Management, Inc. , has contracted with the national investigative firm of G 4 S Compliance & Investigations to be the company’s Special Investigations Unit. The person in charge of the outsourced SIU is Cheryl Nordheim, Compliance Manager – Matrix Absence Management, Inc. (408) 361 -7219 cheryl. nordheim@matrixcos. com Your program administrator is Valerie Beebe, FCLS SIU Compliance Manager of G 4 S Compliance & Investigations. Should you have questions, please feel free to call Valerie at (704) 560 -6203 or via. email at valerie. beebe@cni. g 4 s. com A Global Leader in Compliance and Investigation Solutions

2010 Annual Fraud Awareness Training For Insurance Professionals Welcome to the Matrix Absence Management, Inc. , Special Investigative Unit’s online training course. This Power. Point presentation and 10 question test is designed to meet the various state requirements for Annual Anti-Fraud Training. Matrix Absence Management, Inc. , has contracted with the national investigative firm of G 4 S Compliance & Investigations to be the company’s Special Investigations Unit. The person in charge of the outsourced SIU is Cheryl Nordheim, Compliance Manager – Matrix Absence Management, Inc. (408) 361 -7219 cheryl. nordheim@matrixcos. com Your program administrator is Valerie Beebe, FCLS SIU Compliance Manager of G 4 S Compliance & Investigations. Should you have questions, please feel free to call Valerie at (704) 560 -6203 or via. email at valerie. beebe@cni. g 4 s. com A Global Leader in Compliance and Investigation Solutions

2010 Annual Fraud Awareness Training For Insurance Professionals IMPORTANT REMINDER FOR ALL MATRIX EMPLOYEES: It is critical that we maintain the confidentiality of business records, and the security of our corporate computer network. Login I. D. and password information is provided to employees so that you can access the network to perform the responsibilities of your position. Employees should never compromise the integrity of the network or the company by giving your login and/or password information to anyone else. This includes persons inside or outside of the company, including a colleague or manager. Additionally, in accordance with our Code of Conduct, if anyone asks you for password information, you should report it to your manager, any officer, Company Counsel or the Ethics Hotline immediately. A Global Leader in Compliance and Investigation Solutions

2010 Annual Fraud Awareness Training For Insurance Professionals IMPORTANT REMINDER FOR ALL MATRIX EMPLOYEES: It is critical that we maintain the confidentiality of business records, and the security of our corporate computer network. Login I. D. and password information is provided to employees so that you can access the network to perform the responsibilities of your position. Employees should never compromise the integrity of the network or the company by giving your login and/or password information to anyone else. This includes persons inside or outside of the company, including a colleague or manager. Additionally, in accordance with our Code of Conduct, if anyone asks you for password information, you should report it to your manager, any officer, Company Counsel or the Ethics Hotline immediately. A Global Leader in Compliance and Investigation Solutions

Training Overview • Part I – General Fraud Awareness A – Fraud Facts B – 2009 NICB Statistics • Part 2 – CA SIU Compliance Regulations • Part 3 - G 4 S SIU Successful Investigations • Part 4 – Defining Insurance Fraud • Part 5 – Emerging Fraud Trends • Part 6 - Insurance Fraud & Red Flag Indicators By Line of Business A – Workers’ Compensation Fraud B – General Liability Fraud C – Auto Fraud D – Property Fraud • Part 7 – SIU Org Chart • Part 8 – SIU Contact Information A Global Leader in Compliance and Investigation Solutions

Training Overview • Part I – General Fraud Awareness A – Fraud Facts B – 2009 NICB Statistics • Part 2 – CA SIU Compliance Regulations • Part 3 - G 4 S SIU Successful Investigations • Part 4 – Defining Insurance Fraud • Part 5 – Emerging Fraud Trends • Part 6 - Insurance Fraud & Red Flag Indicators By Line of Business A – Workers’ Compensation Fraud B – General Liability Fraud C – Auto Fraud D – Property Fraud • Part 7 – SIU Org Chart • Part 8 – SIU Contact Information A Global Leader in Compliance and Investigation Solutions

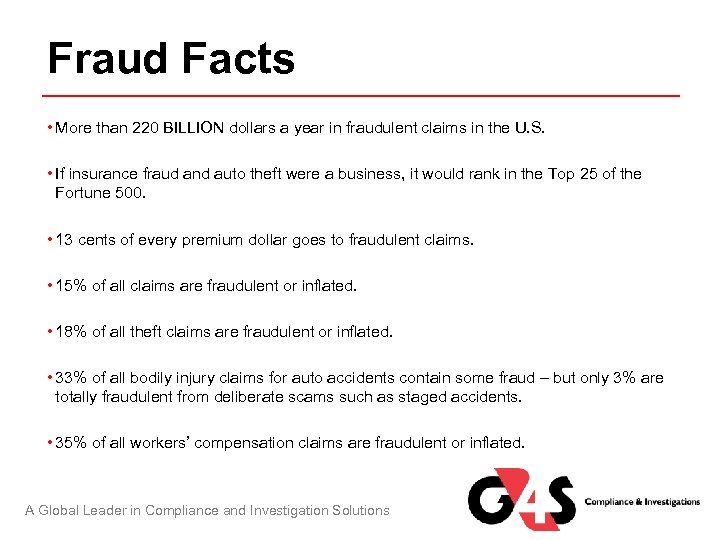

Fraud Facts • More than 220 BILLION dollars a year in fraudulent claims in the U. S. • If insurance fraud and auto theft were a business, it would rank in the Top 25 of the Fortune 500. • 13 cents of every premium dollar goes to fraudulent claims. • 15% of all claims are fraudulent or inflated. • 18% of all theft claims are fraudulent or inflated. • 33% of all bodily injury claims for auto accidents contain some fraud – but only 3% are totally fraudulent from deliberate scams such as staged accidents. • 35% of all workers’ compensation claims are fraudulent or inflated. A Global Leader in Compliance and Investigation Solutions

Fraud Facts • More than 220 BILLION dollars a year in fraudulent claims in the U. S. • If insurance fraud and auto theft were a business, it would rank in the Top 25 of the Fortune 500. • 13 cents of every premium dollar goes to fraudulent claims. • 15% of all claims are fraudulent or inflated. • 18% of all theft claims are fraudulent or inflated. • 33% of all bodily injury claims for auto accidents contain some fraud – but only 3% are totally fraudulent from deliberate scams such as staged accidents. • 35% of all workers’ compensation claims are fraudulent or inflated. A Global Leader in Compliance and Investigation Solutions

Fraud Facts These are conservative estimates! Think about your own claims inventory? A Global Leader in Compliance and Investigation Solutions

Fraud Facts These are conservative estimates! Think about your own claims inventory? A Global Leader in Compliance and Investigation Solutions

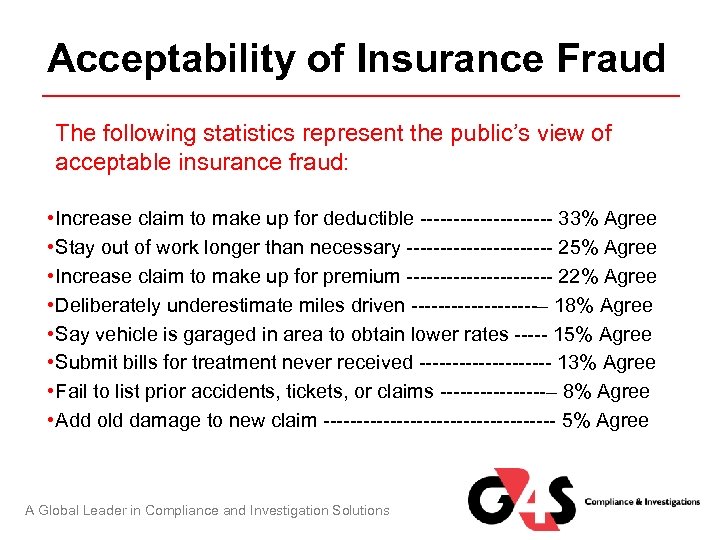

Acceptability of Insurance Fraud The following statistics represent the public’s view of acceptable insurance fraud: • Increase claim to make up for deductible ---------- 33% Agree • Stay out of work longer than necessary ----------- 25% Agree • Increase claim to make up for premium ----------- 22% Agree • Deliberately underestimate miles driven ----------– 18% Agree • Say vehicle is garaged in area to obtain lower rates ----- 15% Agree • Submit bills for treatment never received ---------- 13% Agree • Fail to list prior accidents, tickets, or claims --------– 8% Agree • Add old damage to new claim ------------------ 5% Agree A Global Leader in Compliance and Investigation Solutions

Acceptability of Insurance Fraud The following statistics represent the public’s view of acceptable insurance fraud: • Increase claim to make up for deductible ---------- 33% Agree • Stay out of work longer than necessary ----------- 25% Agree • Increase claim to make up for premium ----------- 22% Agree • Deliberately underestimate miles driven ----------– 18% Agree • Say vehicle is garaged in area to obtain lower rates ----- 15% Agree • Submit bills for treatment never received ---------- 13% Agree • Fail to list prior accidents, tickets, or claims --------– 8% Agree • Add old damage to new claim ------------------ 5% Agree A Global Leader in Compliance and Investigation Solutions

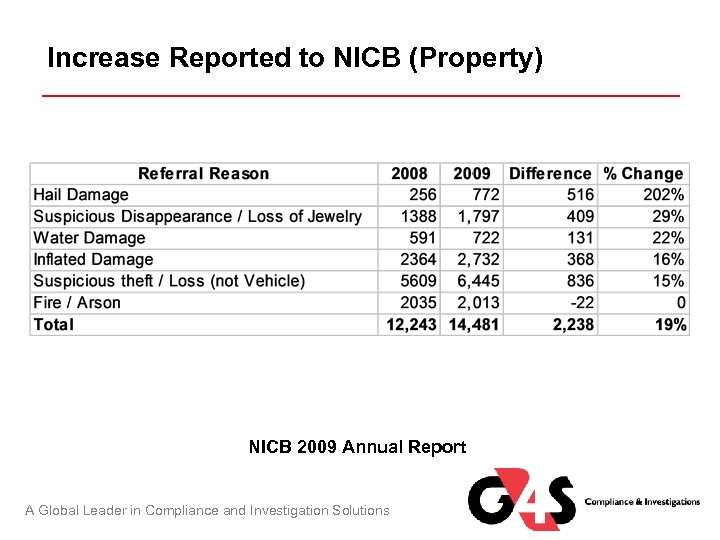

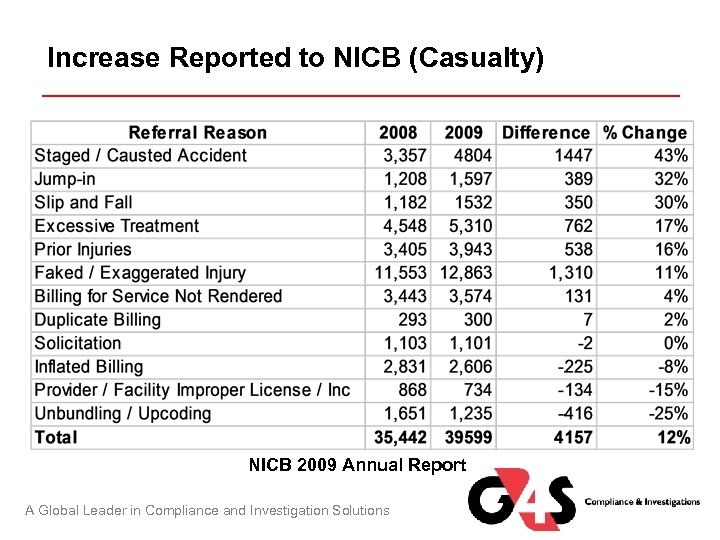

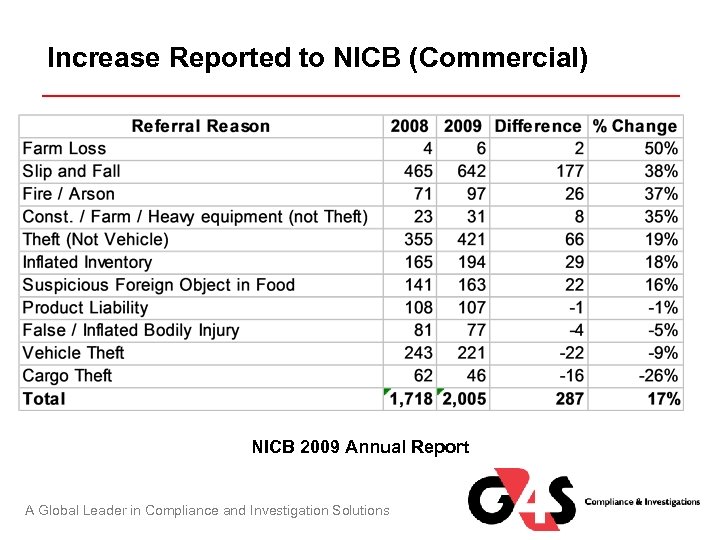

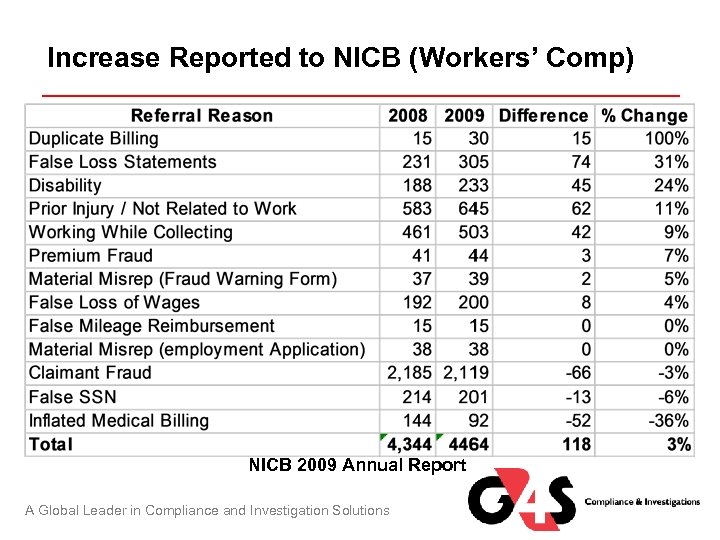

Acceptability of Insurance Fraud An analysis of the National Insurance Crime Bureau (NICB) 2008 and 2009 Questionable Claims (QCs) was performed to compare Property, Casualty, Commercial, Workers’ Compensation, Vehicle, and Miscellaneous referral categories. The 2008 Questionable Claims totaled 74, 902 while 2009 Questionable Claims totaled 85, 209. All categories showed an increase in referrals in 2009, even though some individual referral reasons showed a decrease. Also, similar to previous Questionable Claims analysis reports, an increase in referrals related to natural disasters can be seen in Property, Vehicle, and Miscellaneous categories. Tables and charts are organized by greatest percent change. NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Acceptability of Insurance Fraud An analysis of the National Insurance Crime Bureau (NICB) 2008 and 2009 Questionable Claims (QCs) was performed to compare Property, Casualty, Commercial, Workers’ Compensation, Vehicle, and Miscellaneous referral categories. The 2008 Questionable Claims totaled 74, 902 while 2009 Questionable Claims totaled 85, 209. All categories showed an increase in referrals in 2009, even though some individual referral reasons showed a decrease. Also, similar to previous Questionable Claims analysis reports, an increase in referrals related to natural disasters can be seen in Property, Vehicle, and Miscellaneous categories. Tables and charts are organized by greatest percent change. NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Property) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Property) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Casualty) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Casualty) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Commercial) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Commercial) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Workers’ Comp) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Workers’ Comp) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

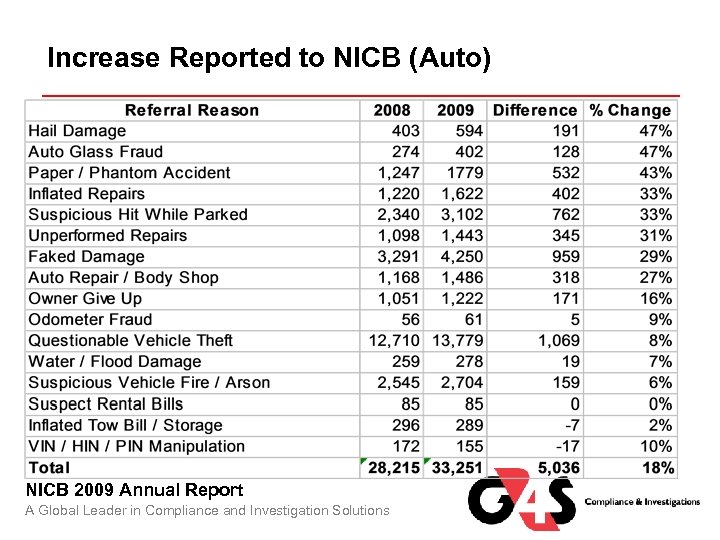

Increase Reported to NICB (Auto) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

Increase Reported to NICB (Auto) NICB 2009 Annual Report A Global Leader in Compliance and Investigation Solutions

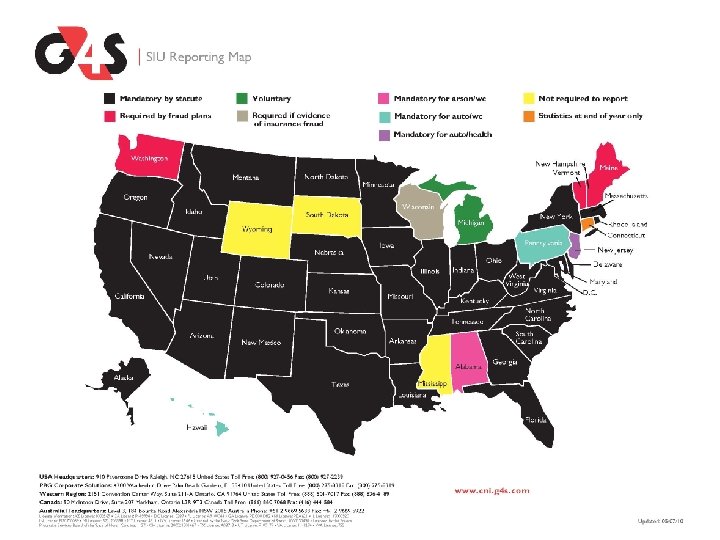

Anti-Fraud Compliance Components of Regulatory Compliance • • • 21 states have anti-fraud plan requirements 46 states have mandatory reporting of suspicious claims 16 states require annual reports 12 states require an SIU 27 jurisdictions have a state statute or regulation concerning “Fraud Warnings” which are required on documents used with consumers (i. e. claim forms, proofs of loss, applications for insurance and in some instances - benefit checks). A Global Leader in Compliance and Investigation Solutions

Anti-Fraud Compliance Components of Regulatory Compliance • • • 21 states have anti-fraud plan requirements 46 states have mandatory reporting of suspicious claims 16 states require annual reports 12 states require an SIU 27 jurisdictions have a state statute or regulation concerning “Fraud Warnings” which are required on documents used with consumers (i. e. claim forms, proofs of loss, applications for insurance and in some instances - benefit checks). A Global Leader in Compliance and Investigation Solutions

Function/Purpose of Your SIU Surveillance International Investigations Fraud Reviews Clinic Inspections Examinations Under Oath Scene Diagrams Alive & Wellness Checks Fraud Awareness Training Auditing & Consulting Neighborhood Canvass Hospital Searches Driver’s License Searches Criminal Records Check And many more…. A Global Leader in Compliance and Investigation Solutions Claims / Fraud Investigations State Fraud Referrals Documented Fraud Packages Statements/Recorded Interviews Video Re-enactments of the loss Scene Photographs Continuance of Disability Checks SIU Compliance & Reporting Activity Checks Nationwide Background Investigation Pharmacy Searches Skip Tracing (locates) Civil Records Searches

Function/Purpose of Your SIU Surveillance International Investigations Fraud Reviews Clinic Inspections Examinations Under Oath Scene Diagrams Alive & Wellness Checks Fraud Awareness Training Auditing & Consulting Neighborhood Canvass Hospital Searches Driver’s License Searches Criminal Records Check And many more…. A Global Leader in Compliance and Investigation Solutions Claims / Fraud Investigations State Fraud Referrals Documented Fraud Packages Statements/Recorded Interviews Video Re-enactments of the loss Scene Photographs Continuance of Disability Checks SIU Compliance & Reporting Activity Checks Nationwide Background Investigation Pharmacy Searches Skip Tracing (locates) Civil Records Searches

Anti-Fraud Compliance CA Department of Insurance Fraud Division Regulatory Compliance A Global Leader in Compliance and Investigation Solutions

Anti-Fraud Compliance CA Department of Insurance Fraud Division Regulatory Compliance A Global Leader in Compliance and Investigation Solutions

CA Code of Regulations: Section 2698. 35 Detecting Suspected Insurance Fraud (a) An insurer’s integral anti-fraud personnel are responsible for identifying suspected insurance fraud during the handling of insurance transactions and referring it to the SIU as part of their regular duties. A Global Leader in Compliance and Investigation Solutions

CA Code of Regulations: Section 2698. 35 Detecting Suspected Insurance Fraud (a) An insurer’s integral anti-fraud personnel are responsible for identifying suspected insurance fraud during the handling of insurance transactions and referring it to the SIU as part of their regular duties. A Global Leader in Compliance and Investigation Solutions

Function/Purpose of Your SIU Investigating Suspected Insurance Fraud in Accordance with the California Regulations Section 2698. 36 As your SIU, we shall establish, maintain, distribute and adhere to written procedures for the investigation of possible suspected insurance fraud. An investigation of possible suspected insurance fraud shall include: (1) A thorough analysis of your claim file, application, or insurance transaction. (2) Identification and interviews of potential witnesses who may provide information on the accuracy of the claim or application. (3) Utilization of industry-recognized databases. (4) Preservation of documents and other evidence. (5) Writing a concise and complete summary of the investigation, including the investigator’s findings regarding the suspected insurance fraud and the basis for their findings. A Global Leader in Compliance and Investigation Solutions

Function/Purpose of Your SIU Investigating Suspected Insurance Fraud in Accordance with the California Regulations Section 2698. 36 As your SIU, we shall establish, maintain, distribute and adhere to written procedures for the investigation of possible suspected insurance fraud. An investigation of possible suspected insurance fraud shall include: (1) A thorough analysis of your claim file, application, or insurance transaction. (2) Identification and interviews of potential witnesses who may provide information on the accuracy of the claim or application. (3) Utilization of industry-recognized databases. (4) Preservation of documents and other evidence. (5) Writing a concise and complete summary of the investigation, including the investigator’s findings regarding the suspected insurance fraud and the basis for their findings. A Global Leader in Compliance and Investigation Solutions

Function/Purpose of Your SIU Referral of Suspected Insurance Fraud in Accordance with California Regulations Section 2698. 37 G 4 S Compliance & Investigations shall provide for the referral of acts of suspected insurance fraud to the Fraud Division and, as required, district attorneys. Referrals shall be submitted in any insurance transaction where the facts and circumstances create a reasonable belief that a person or entity may have committed or is committing insurance fraud. All incidents of suspected insurance fraud will be submitted to the Fraud Division within 60 days of reasonable belief. A Global Leader in Compliance and Investigation Solutions

Function/Purpose of Your SIU Referral of Suspected Insurance Fraud in Accordance with California Regulations Section 2698. 37 G 4 S Compliance & Investigations shall provide for the referral of acts of suspected insurance fraud to the Fraud Division and, as required, district attorneys. Referrals shall be submitted in any insurance transaction where the facts and circumstances create a reasonable belief that a person or entity may have committed or is committing insurance fraud. All incidents of suspected insurance fraud will be submitted to the Fraud Division within 60 days of reasonable belief. A Global Leader in Compliance and Investigation Solutions

What is Reasonable Suspicion? “Reasonable belief” is a level of belief that an act of insurance fraud may have or might be occurring for which there is an objective justification based on articulable fact(s) and rational inferences there from. California Statutes 2698. 30 A Global Leader in Compliance and Investigation Solutions

What is Reasonable Suspicion? “Reasonable belief” is a level of belief that an act of insurance fraud may have or might be occurring for which there is an objective justification based on articulable fact(s) and rational inferences there from. California Statutes 2698. 30 A Global Leader in Compliance and Investigation Solutions

Reasonable Suspicion To Report Fraud • In Mandatory State Fraud reporting, the claims professional or SIU member should be able to state objective justification based on articulable fact(s) and rational inferences to justify the report to the state or appropriate agency. • A claim meets this requirement if you can answer this question; • I believe this case is fraudulent because…… • If that question can be answered, then the claim meets the mandatory state fraud referral statutes. • Keep in mind that you do not need evidence of insurance fraud to trigger these regulations except in the State of Wisconsin. A Global Leader in Compliance and Investigation Solutions

Reasonable Suspicion To Report Fraud • In Mandatory State Fraud reporting, the claims professional or SIU member should be able to state objective justification based on articulable fact(s) and rational inferences to justify the report to the state or appropriate agency. • A claim meets this requirement if you can answer this question; • I believe this case is fraudulent because…… • If that question can be answered, then the claim meets the mandatory state fraud referral statutes. • Keep in mind that you do not need evidence of insurance fraud to trigger these regulations except in the State of Wisconsin. A Global Leader in Compliance and Investigation Solutions

What is Reasonable Suspicion? • Now that we have agreed on what % of your claims are fraudulent, and gone through what reasonable suspicion is, what % of your claims do you suspect to be fraudulent? • Obviously this number is going to be larger than the 15% we have already agreed were fraudulent or inflated. • Keep in mind the states that have Mandatory Reporting Requirements have set the threshold of “SUSPECTED TO BE FRAUDULENT”. • If you suspect a claim to be fraudulent, you must notify SIU so a State Fraud Referral can be filed and recorded on the Fraud Log. A Global Leader in Compliance and Investigation Solutions

What is Reasonable Suspicion? • Now that we have agreed on what % of your claims are fraudulent, and gone through what reasonable suspicion is, what % of your claims do you suspect to be fraudulent? • Obviously this number is going to be larger than the 15% we have already agreed were fraudulent or inflated. • Keep in mind the states that have Mandatory Reporting Requirements have set the threshold of “SUSPECTED TO BE FRAUDULENT”. • If you suspect a claim to be fraudulent, you must notify SIU so a State Fraud Referral can be filed and recorded on the Fraud Log. A Global Leader in Compliance and Investigation Solutions

Mandatory Fraud Reporting California Insurance Code 1874 “Any company licensed to write insurance in this state that believes that a fraudulent claim is being made shall, within 60 days after determination by the insurer that the claim appears to be a fraudulent claim, send to the Bureau of Fraudulent Claims, on a form prescribed by the Department, the information requested by the form and any additional information relative to the factual circumstances of the claims and parties claiming loss or damages that the commissioner may require. ” A Global Leader in Compliance and Investigation Solutions

Mandatory Fraud Reporting California Insurance Code 1874 “Any company licensed to write insurance in this state that believes that a fraudulent claim is being made shall, within 60 days after determination by the insurer that the claim appears to be a fraudulent claim, send to the Bureau of Fraudulent Claims, on a form prescribed by the Department, the information requested by the form and any additional information relative to the factual circumstances of the claims and parties claiming loss or damages that the commissioner may require. ” A Global Leader in Compliance and Investigation Solutions

Why Should We Comply with Mandatory Reporting? • Several States have sanctions in their statutes that can be used to compel a carrier to comply with the Mandatory Reporting Statute. • The following states can sanction a carrier for not complying with this mandatory reporting statute; – California - $5, 000 per claim. – Pennsylvania - $10, 000 for not complying with the Anti-Fraud Plan on file with the state. – Florida - $2, 000 a day back to the first date the states decides the carrier should have been complying with the fraud regulations and an additional $100, 000 at the discretion of the commissioner. – New Jersey - $12, 500 per claim. – New York - left to the discretion of the commissioner. – Other states also have sanctions in their arsenal that can be used. A Global Leader in Compliance and Investigation Solutions

Why Should We Comply with Mandatory Reporting? • Several States have sanctions in their statutes that can be used to compel a carrier to comply with the Mandatory Reporting Statute. • The following states can sanction a carrier for not complying with this mandatory reporting statute; – California - $5, 000 per claim. – Pennsylvania - $10, 000 for not complying with the Anti-Fraud Plan on file with the state. – Florida - $2, 000 a day back to the first date the states decides the carrier should have been complying with the fraud regulations and an additional $100, 000 at the discretion of the commissioner. – New Jersey - $12, 500 per claim. – New York - left to the discretion of the commissioner. – Other states also have sanctions in their arsenal that can be used. A Global Leader in Compliance and Investigation Solutions

Example of Immunity For Reporting California Insurance Code 1872. 5 - “No insurer, or the employees or agents of any insurer, shall be subject to civil liability for libel, slander, or an other relevant tort cause of action. . . ” PROVIDED: • The investigation was conducted in good-faith • There was no malice of forethought • No willful misrepresentation was made • No intentional exclusions of relevant information • No violation of local, state or federal Privacy laws A Global Leader in Compliance and Investigation Solutions

Example of Immunity For Reporting California Insurance Code 1872. 5 - “No insurer, or the employees or agents of any insurer, shall be subject to civil liability for libel, slander, or an other relevant tort cause of action. . . ” PROVIDED: • The investigation was conducted in good-faith • There was no malice of forethought • No willful misrepresentation was made • No intentional exclusions of relevant information • No violation of local, state or federal Privacy laws A Global Leader in Compliance and Investigation Solutions

Example of Immunity For Reporting FLORIDA Insurance Code, Title XXXVII. Insurance, Chapter 626. 989 Insurance Field Representatives (d) In addition to the immunity granted in paragraph (c), persons identified as designated employees whose responsibilities include the investigation and disposition of claims relating to suspected fraudulent insurance acts may share information relating to persons suspected of committing fraudulent insurance acts with other designated employees employed by the same or other insurers whose responsibilities include the investigation and disposition of claims relating to fraudulent insurance acts, provided the department has been given written notice of the names and job titles of such designated employees prior to such designated employees sharing information… A Global Leader in Compliance and Investigation Solutions

Example of Immunity For Reporting FLORIDA Insurance Code, Title XXXVII. Insurance, Chapter 626. 989 Insurance Field Representatives (d) In addition to the immunity granted in paragraph (c), persons identified as designated employees whose responsibilities include the investigation and disposition of claims relating to suspected fraudulent insurance acts may share information relating to persons suspected of committing fraudulent insurance acts with other designated employees employed by the same or other insurers whose responsibilities include the investigation and disposition of claims relating to fraudulent insurance acts, provided the department has been given written notice of the names and job titles of such designated employees prior to such designated employees sharing information… A Global Leader in Compliance and Investigation Solutions

How Do I Report a Suspicious Claim? • Contact G 4 S Compliance & Investigations as your Special Investigations Unit (SIU) per your company’s written Anti-Fraud Procedures Manual. • G 4 S Case. Trak has a tab for submitting “State Fraud Referral Assignments”. • Select this tab and submit your assignment. G 4 S Compliance & Investigations will place your referral report on the proper state form and file with the appropriate State Fraud Bureau as required by regulation or statute. • Upon review, the SIU may contact you for determination of further investigation requirements. • G 4 S Compliance & Investigations SIU can also be reached at 1 -800 -927 -0456. A Global Leader in Compliance and Investigation Solutions

How Do I Report a Suspicious Claim? • Contact G 4 S Compliance & Investigations as your Special Investigations Unit (SIU) per your company’s written Anti-Fraud Procedures Manual. • G 4 S Case. Trak has a tab for submitting “State Fraud Referral Assignments”. • Select this tab and submit your assignment. G 4 S Compliance & Investigations will place your referral report on the proper state form and file with the appropriate State Fraud Bureau as required by regulation or statute. • Upon review, the SIU may contact you for determination of further investigation requirements. • G 4 S Compliance & Investigations SIU can also be reached at 1 -800 -927 -0456. A Global Leader in Compliance and Investigation Solutions

Insurer – SIU Training Responsibilities Anti-Fraud Training in Accordance with California Regulation Section 2698. 39 Requirements for training provided by and for the SIU shall include: (a) The insurer has established and maintained an ongoing anti-fraud training program, planned and conducted to develop and improve the anti-fraud awareness skills of the integral anti-fraud personnel. (b) The insurer has designated the SIU Compliance Manager to be responsible for coordinating the ongoing anti-fraud training program. (c) The anti-fraud training program shall consist of three (3) levels: (1) All newly- hired employees shall receive an anti-fraud orientation within ninety (90) days of commencing assigned duties. (2) Integral anti-fraud personnel shall receive annual anti-fraud in-service training. (3) The SIU personnel shall receive continuing anti-fraud training. A Global Leader in Compliance and Investigation Solutions

Insurer – SIU Training Responsibilities Anti-Fraud Training in Accordance with California Regulation Section 2698. 39 Requirements for training provided by and for the SIU shall include: (a) The insurer has established and maintained an ongoing anti-fraud training program, planned and conducted to develop and improve the anti-fraud awareness skills of the integral anti-fraud personnel. (b) The insurer has designated the SIU Compliance Manager to be responsible for coordinating the ongoing anti-fraud training program. (c) The anti-fraud training program shall consist of three (3) levels: (1) All newly- hired employees shall receive an anti-fraud orientation within ninety (90) days of commencing assigned duties. (2) Integral anti-fraud personnel shall receive annual anti-fraud in-service training. (3) The SIU personnel shall receive continuing anti-fraud training. A Global Leader in Compliance and Investigation Solutions

Fraud Warning Language Current research of the anti-fraud compliance laws of the fifty states and the District of Columbia reveals there are twentyseven [27] jurisdictions that have a state statute or regulations concerning “Fraud Warnings”. The fraud warning language in the statute MUST be used on all applicable documents in the states of Alaska, California [English & Spanish], Pennsylvania, and Rhode Island. The fraud warning language in the statute MUST be used on all applicable workers compensation documents in the states of Tennessee and Utah. A Global Leader in Compliance and Investigation Solutions

Fraud Warning Language Current research of the anti-fraud compliance laws of the fifty states and the District of Columbia reveals there are twentyseven [27] jurisdictions that have a state statute or regulations concerning “Fraud Warnings”. The fraud warning language in the statute MUST be used on all applicable documents in the states of Alaska, California [English & Spanish], Pennsylvania, and Rhode Island. The fraud warning language in the statute MUST be used on all applicable workers compensation documents in the states of Tennessee and Utah. A Global Leader in Compliance and Investigation Solutions

Fraud Warning Language The fraud warning language to be used in applicable documents can be substantially similar to the language in the statute, and does not have to be exact in the states of Arizona, Arkansas, Colorado, District of Columbia, Florida, Hawaii, Idaho, Indiana, Kentucky, Louisiana, Maine, Minnesota, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Tennessee [for non-work comp claims], and Virginia. Fraud warning must appear on the back of benefit checks in the states of Delaware, New York, Rhode Island, Utah, and in CA on TTD checks in both English and Spanish [or enclosed with ck]. Please make sure that you are using the appropriate fraud warning language in each state. If you wish to receive a complete breakdown by state, please contact the SIU Compliance Manager. A Global Leader in Compliance and Investigation Solutions

Fraud Warning Language The fraud warning language to be used in applicable documents can be substantially similar to the language in the statute, and does not have to be exact in the states of Arizona, Arkansas, Colorado, District of Columbia, Florida, Hawaii, Idaho, Indiana, Kentucky, Louisiana, Maine, Minnesota, New Hampshire, New Jersey, New Mexico, Ohio, Oklahoma, Tennessee [for non-work comp claims], and Virginia. Fraud warning must appear on the back of benefit checks in the states of Delaware, New York, Rhode Island, Utah, and in CA on TTD checks in both English and Spanish [or enclosed with ck]. Please make sure that you are using the appropriate fraud warning language in each state. If you wish to receive a complete breakdown by state, please contact the SIU Compliance Manager. A Global Leader in Compliance and Investigation Solutions

CA Code of Regulations: Section 2698. 42 - Penalties (a) If the Commissioner acts pursuant to the provisions of California Insurance Code Section 1875. 24( c) or (d) and finds that the insurer has failed to comply with the provisions of this article, the Commissioner shall impose a monetary penalty in an amount not to exceed $5, 000 for each act of non-compliance. Where the Commissioner determines that an insurer has willfully failed to comply with this article, the Commissioner may impose a monetary penalty in an amount not to exceed $ 10, 000 for each willful act of non -compliance. The Commissioner shall consider the factors enumerated at California Code of Regulations Title 10 Chapter 5, Subchapter 3, Section 2591. 3 (a)-(f) and determine if any of the enumerated factors are applicable to the insurer's conduct in the establishment and operation of its special investigative unit. If the Commissioner finds such factors are applicable to the insurer's conduct, the Commissioner may reduce the amount of the monetary penalty prescribed in subsection 2698. 42(a). A Global Leader in Compliance and Investigation Solutions

CA Code of Regulations: Section 2698. 42 - Penalties (a) If the Commissioner acts pursuant to the provisions of California Insurance Code Section 1875. 24( c) or (d) and finds that the insurer has failed to comply with the provisions of this article, the Commissioner shall impose a monetary penalty in an amount not to exceed $5, 000 for each act of non-compliance. Where the Commissioner determines that an insurer has willfully failed to comply with this article, the Commissioner may impose a monetary penalty in an amount not to exceed $ 10, 000 for each willful act of non -compliance. The Commissioner shall consider the factors enumerated at California Code of Regulations Title 10 Chapter 5, Subchapter 3, Section 2591. 3 (a)-(f) and determine if any of the enumerated factors are applicable to the insurer's conduct in the establishment and operation of its special investigative unit. If the Commissioner finds such factors are applicable to the insurer's conduct, the Commissioner may reduce the amount of the monetary penalty prescribed in subsection 2698. 42(a). A Global Leader in Compliance and Investigation Solutions

CA Code of Regulations: Section 2698. 42 - Penalties (b) If the Commissioner acts pursuant to the provisions of California Insurance Code Section 1875. 24(c) or (d) and determines that the acts of non-compliance are inadvertent and are solely relative to the maintenance and operation of the special investigative unit of the insurer, then the Commissioner shall consider such violations to be a single act for the purposes of imposition of a monetary penalty that is no greater than $5, 000 for that single act. For all other inadvertent acts, the Commissioner shall impose a penalty in the amount of up to $5, 000 per inadvertent act that is not in compliance with this article. A Global Leader in Compliance and Investigation Solutions

CA Code of Regulations: Section 2698. 42 - Penalties (b) If the Commissioner acts pursuant to the provisions of California Insurance Code Section 1875. 24(c) or (d) and determines that the acts of non-compliance are inadvertent and are solely relative to the maintenance and operation of the special investigative unit of the insurer, then the Commissioner shall consider such violations to be a single act for the purposes of imposition of a monetary penalty that is no greater than $5, 000 for that single act. For all other inadvertent acts, the Commissioner shall impose a penalty in the amount of up to $5, 000 per inadvertent act that is not in compliance with this article. A Global Leader in Compliance and Investigation Solutions

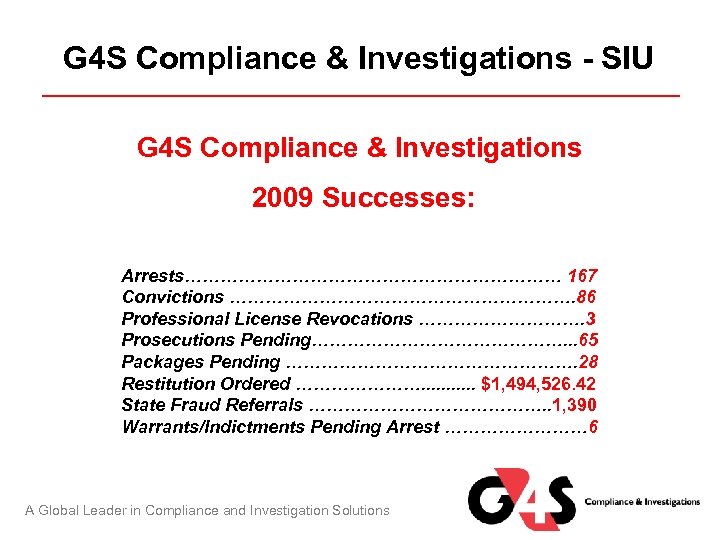

G 4 S Compliance & Investigations - SIU G 4 S Compliance & Investigations 2009 Successes: Arrests…………………………… 167 Convictions …………………………. 86 Professional License Revocations ……………. 3 Prosecutions Pending…………………. . . 65 Packages Pending ……………………. 28 Restitution Ordered …………………. . . $1, 494, 526. 42 State Fraud Referrals …………………. . 1, 390 Warrants/Indictments Pending Arrest ………… 6 A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU G 4 S Compliance & Investigations 2009 Successes: Arrests…………………………… 167 Convictions …………………………. 86 Professional License Revocations ……………. 3 Prosecutions Pending…………………. . . 65 Packages Pending ……………………. 28 Restitution Ordered …………………. . . $1, 494, 526. 42 State Fraud Referrals …………………. . 1, 390 Warrants/Indictments Pending Arrest ………… 6 A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU G 4 S Compliance & Investigations (SIU) conducted interviews with the contractors who provided estimates for the damages to the property to Pleasure Island Shrimp House. These interviews determined that the estimates provided by the insured, Mr. Tran, were fabricated by him. Tran presented a repair estimate in the amount of $119, 900. The SIU investigation revealed that there is no such company. This estimate was fabricated by Mr. Tran also presented an estimate for the repair of refrigeration equipment in the amount of $347, 600. SIU interviewed the owner of the company that supposedly wrote the estimate and learned they have not made any repairs to Mr. Tran since 2003. In addition, they do not install any refrigeration equipment. There would never be any labor costs on any of his estimates. His highest billing ever for equipment sold to Tran was under $3000. This estimate in the amount of $347, 600 was also fabricated by Mr. Tran. Continue on next slide A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU G 4 S Compliance & Investigations (SIU) conducted interviews with the contractors who provided estimates for the damages to the property to Pleasure Island Shrimp House. These interviews determined that the estimates provided by the insured, Mr. Tran, were fabricated by him. Tran presented a repair estimate in the amount of $119, 900. The SIU investigation revealed that there is no such company. This estimate was fabricated by Mr. Tran also presented an estimate for the repair of refrigeration equipment in the amount of $347, 600. SIU interviewed the owner of the company that supposedly wrote the estimate and learned they have not made any repairs to Mr. Tran since 2003. In addition, they do not install any refrigeration equipment. There would never be any labor costs on any of his estimates. His highest billing ever for equipment sold to Tran was under $3000. This estimate in the amount of $347, 600 was also fabricated by Mr. Tran. Continue on next slide A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Victor Tran pled guilty to 1 count of making a false statement and was ordered to pay XL Specialty Insurance Company $500, 000. 00 in restitution. Victor Tran reimbursed XL a total of $500, 000. 00 in restitution. A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Victor Tran pled guilty to 1 count of making a false statement and was ordered to pay XL Specialty Insurance Company $500, 000. 00 in restitution. Victor Tran reimbursed XL a total of $500, 000. 00 in restitution. A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Jose Diaz was hired in February 2006 as a laborer and filed a DWC-1 and an Application for Adjudication of Claim, alleging that sometime in May 2006, while working for the insured, he slipped on water and became injured when he fell landing on his left side. In addition, in June 2006, he filed a DWC-1 and an Application for Adjudication of Claim, alleging a cumulative trauma injury from February 2006 to June 2006. The Employer was not aware of any injury and the claim was delayed pending investigation. It was discovered that Jose Diaz’s attorney and physician were the same for a previous workers’ compensation claim with the State Compensation Insurance Fund. In that case this 1993 claim, Mr. Diaz reports to have been injured while lifting a 60 pound box. Jose Diaz, through his attorney, filed an Application for Adjudication of Claim in June 2003, and the claimant filed a DWC-1 in June 2003, for a cumulative trauma claim for injuries Jose Diaz and his attorney settled that claim on a Compromise and Release in September 2005. Jose Diaz was being treated for alleged injuries from a motor vehicle accident on March 26, 2006. Continue on next slide A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Jose Diaz was hired in February 2006 as a laborer and filed a DWC-1 and an Application for Adjudication of Claim, alleging that sometime in May 2006, while working for the insured, he slipped on water and became injured when he fell landing on his left side. In addition, in June 2006, he filed a DWC-1 and an Application for Adjudication of Claim, alleging a cumulative trauma injury from February 2006 to June 2006. The Employer was not aware of any injury and the claim was delayed pending investigation. It was discovered that Jose Diaz’s attorney and physician were the same for a previous workers’ compensation claim with the State Compensation Insurance Fund. In that case this 1993 claim, Mr. Diaz reports to have been injured while lifting a 60 pound box. Jose Diaz, through his attorney, filed an Application for Adjudication of Claim in June 2003, and the claimant filed a DWC-1 in June 2003, for a cumulative trauma claim for injuries Jose Diaz and his attorney settled that claim on a Compromise and Release in September 2005. Jose Diaz was being treated for alleged injuries from a motor vehicle accident on March 26, 2006. Continue on next slide A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Los Angeles CA - Jose Diaz pled guilty to one count of Insurance Fraud. At sentencing, per the plea agreement, Mr. Diaz paid restitution in the amount of $5, 000. This allowed him to have no prison time, but he will have 5 years formal probation and 300 hours of Community Service. It is during this 5 year period that Mr. Diaz is ordered to make full restitution of $20, 000. Mr. Diaz also agreed to withdraw and cancel his workers' compensation claim. A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Los Angeles CA - Jose Diaz pled guilty to one count of Insurance Fraud. At sentencing, per the plea agreement, Mr. Diaz paid restitution in the amount of $5, 000. This allowed him to have no prison time, but he will have 5 years formal probation and 300 hours of Community Service. It is during this 5 year period that Mr. Diaz is ordered to make full restitution of $20, 000. Mr. Diaz also agreed to withdraw and cancel his workers' compensation claim. A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Alfredo Wong Pizarro was employed by Costco Wholesale in Orlando, Florida as a seasonal temporary stocker from November 7, 2000. On December 9, 2000 at approximately 5: 00 pm, Mr. Pizarro tripped on a rope utilized to keep people out of a particular isle, and fell injuring his right foot and lower back. Mr. Pizarro received medical attention on December 9, 2000. He was released to return to work on light duty that day. Per the employer, they received first notice of injury on December 9, 2007 from Mr. Pizarro was later referred to a Wellness Center where he was treated for his right ankle, lower back and thoracic area. Over time, Mr. Pizarro’s complaints escalated to include his cervical spine, liver problems and pain in the right shoulder and lower extremities. Mr. Pizarro was placed under surveillance and was documented conducting activities he had been claiming to his physicians and in deposition that he specifically could not do. Continue on next slide A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Alfredo Wong Pizarro was employed by Costco Wholesale in Orlando, Florida as a seasonal temporary stocker from November 7, 2000. On December 9, 2000 at approximately 5: 00 pm, Mr. Pizarro tripped on a rope utilized to keep people out of a particular isle, and fell injuring his right foot and lower back. Mr. Pizarro received medical attention on December 9, 2000. He was released to return to work on light duty that day. Per the employer, they received first notice of injury on December 9, 2007 from Mr. Pizarro was later referred to a Wellness Center where he was treated for his right ankle, lower back and thoracic area. Over time, Mr. Pizarro’s complaints escalated to include his cervical spine, liver problems and pain in the right shoulder and lower extremities. Mr. Pizarro was placed under surveillance and was documented conducting activities he had been claiming to his physicians and in deposition that he specifically could not do. Continue on next slide A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Alfredo Pizarro pled guilty to 1 Count of Workers' Compensation Insurance Fraud and was sentenced to a withhold of adjudication with one year of reporting probation, with the special condition of 15 days in the Dade County Jail, 50 hours of community service to be completed at a minimum of 5 hours per month, restitution in the amount of $122, 644. 88 and investigative cost to the DOIF in the amount of $1, 135. 94. A Global Leader in Compliance and Investigation Solutions

G 4 S Compliance & Investigations - SIU Alfredo Pizarro pled guilty to 1 Count of Workers' Compensation Insurance Fraud and was sentenced to a withhold of adjudication with one year of reporting probation, with the special condition of 15 days in the Dade County Jail, 50 hours of community service to be completed at a minimum of 5 hours per month, restitution in the amount of $122, 644. 88 and investigative cost to the DOIF in the amount of $1, 135. 94. A Global Leader in Compliance and Investigation Solutions

What is Insurance Fraud? A Global Leader in Compliance and Investigation Solutions

What is Insurance Fraud? A Global Leader in Compliance and Investigation Solutions

What is Insurance Fraud? Elements of the crime of insurance fraud are consistent: – Someone deliberately lies – (intent) – The intent of the lie is for someone else to rely on that lie, so that they may receive a benefit otherwise not entitled – The other person relies on that lie – As a result, the person who relied on that lie is harmed Each state has different thresholds an insurer must meet before the state will accept a case. – Texas requires that an insurer or self insurer pay at least $1, 500 on the claim before the DOI will accept a fraudulent claim for investigations. – Before the Federal authorities will accept a case, the loss must exceed $250, 000. A Global Leader in Compliance and Investigation Solutions

What is Insurance Fraud? Elements of the crime of insurance fraud are consistent: – Someone deliberately lies – (intent) – The intent of the lie is for someone else to rely on that lie, so that they may receive a benefit otherwise not entitled – The other person relies on that lie – As a result, the person who relied on that lie is harmed Each state has different thresholds an insurer must meet before the state will accept a case. – Texas requires that an insurer or self insurer pay at least $1, 500 on the claim before the DOI will accept a fraudulent claim for investigations. – Before the Federal authorities will accept a case, the loss must exceed $250, 000. A Global Leader in Compliance and Investigation Solutions

What Constitutes Insurance Fraud? Looking for the Lie In order to have Insurance Fraud, you must have a Lie. The lie does not have to be something that was told to the adjustor, doctor, investigator, attorney or other. It can be something that the individual should have said. GOT M. I. L. K. ? A Global Leader in Compliance and Investigation Solutions

What Constitutes Insurance Fraud? Looking for the Lie In order to have Insurance Fraud, you must have a Lie. The lie does not have to be something that was told to the adjustor, doctor, investigator, attorney or other. It can be something that the individual should have said. GOT M. I. L. K. ? A Global Leader in Compliance and Investigation Solutions

Fraud Defined – Got M. I. L. K. ? • Misrepresentations made must be Material to the case • The false information must have been presented Intentionally • A Lie must have been presented to prove, validate, affirm or deny a claim for injury or loss payment or to obtain insurance coverage • The information must have been presented Knowingly • The false information presented would have altered, changed or modified the manner the claim was handled, investigated, evaluated or settled A Global Leader in Compliance and Investigation Solutions

Fraud Defined – Got M. I. L. K. ? • Misrepresentations made must be Material to the case • The false information must have been presented Intentionally • A Lie must have been presented to prove, validate, affirm or deny a claim for injury or loss payment or to obtain insurance coverage • The information must have been presented Knowingly • The false information presented would have altered, changed or modified the manner the claim was handled, investigated, evaluated or settled A Global Leader in Compliance and Investigation Solutions

Emerging Fraud Trends Key Fraud Indicators A Global Leader in Compliance and Investigation Solutions

Emerging Fraud Trends Key Fraud Indicators A Global Leader in Compliance and Investigation Solutions

Three Main Types of External “Bad Guys” • Professional Fraud Perpetrators • Semi-Professional Fraud Perpetrators • Opportunistic Fraud Perpetrators A Global Leader in Compliance and Investigation Solutions

Three Main Types of External “Bad Guys” • Professional Fraud Perpetrators • Semi-Professional Fraud Perpetrators • Opportunistic Fraud Perpetrators A Global Leader in Compliance and Investigation Solutions

Professional Fraud Perpetrators • These are professional criminals who have made their livelihoods from insurance fraud schemes. In some cases, they have been doctors, lawyers, business owners and other professionals. The type of fraud that professional fraud perpetrators commit is sometimes referred to as “hard-core fraud” because it has involved fake theft claims, false bodily injury claims and staged accidents that have been repeated time and again and have had the potential to cost insurance companies many thousands of dollars. • General Liability – “Slip and fall” – Product Liability • Staged Accidents • Property Losses – Homeowner and Commercial A Global Leader in Compliance and Investigation Solutions

Professional Fraud Perpetrators • These are professional criminals who have made their livelihoods from insurance fraud schemes. In some cases, they have been doctors, lawyers, business owners and other professionals. The type of fraud that professional fraud perpetrators commit is sometimes referred to as “hard-core fraud” because it has involved fake theft claims, false bodily injury claims and staged accidents that have been repeated time and again and have had the potential to cost insurance companies many thousands of dollars. • General Liability – “Slip and fall” – Product Liability • Staged Accidents • Property Losses – Homeowner and Commercial A Global Leader in Compliance and Investigation Solutions

Professional Fraud Perpetrators • Auto Salvage Fraud – exchange VIN’s, rigged bidding, flood cars • Crime Rings – chop shops, trucking thefts, etc. • Arson-For-Profit Rings - Some rings were hired by policy owners for a fee, and some rings profited directly from the schemes • Staged Auto Accident rings A Global Leader in Compliance and Investigation Solutions

Professional Fraud Perpetrators • Auto Salvage Fraud – exchange VIN’s, rigged bidding, flood cars • Crime Rings – chop shops, trucking thefts, etc. • Arson-For-Profit Rings - Some rings were hired by policy owners for a fee, and some rings profited directly from the schemes • Staged Auto Accident rings A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators • Medical Build up Schemes • Rolling Labs • Medical Mills • Ambulance Chasing Rings • Police and EMS selling accident lists A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators • Medical Build up Schemes • Rolling Labs • Medical Mills • Ambulance Chasing Rings • Police and EMS selling accident lists A Global Leader in Compliance and Investigation Solutions

Medical Build-up Schemes Some professionals have committed opportunistic insurance fraud. Others have gone even further and have faked medical documents and committed “medical build-up. ” Examples of medical build-up cases are doctors who have taken advantage of the system by billing other employees’ group health insurance companies and employers’ workers compensation insurers by inflating both types of bills for what were actually minor injuries. In a recent case, employees of a Miami home health care agency were charged by federal authorities with cheating Medicare out of $15 million by billing for fictitious patient visits. Sometimes, insureds have been involved in these fraud schemes. Often, however, innocent insureds were unaware insurance fraud was taking place. The bill for their treatment were sent by the medical professionals directly to the insurance companies. The insureds usually never received treatment and never knew the bills existed. A Global Leader in Compliance and Investigation Solutions

Medical Build-up Schemes Some professionals have committed opportunistic insurance fraud. Others have gone even further and have faked medical documents and committed “medical build-up. ” Examples of medical build-up cases are doctors who have taken advantage of the system by billing other employees’ group health insurance companies and employers’ workers compensation insurers by inflating both types of bills for what were actually minor injuries. In a recent case, employees of a Miami home health care agency were charged by federal authorities with cheating Medicare out of $15 million by billing for fictitious patient visits. Sometimes, insureds have been involved in these fraud schemes. Often, however, innocent insureds were unaware insurance fraud was taking place. The bill for their treatment were sent by the medical professionals directly to the insurance companies. The insureds usually never received treatment and never knew the bills existed. A Global Leader in Compliance and Investigation Solutions

Rolling Labs Another type of scam has involved rolling labs, vans or motor homes equipped with medical laboratories where unnecessary and sometimes fake medical tests have been conducted on unsuspecting patients and paid for by their insurers. Because these labs were on wheels, they were easily moved from location to location. A Global Leader in Compliance and Investigation Solutions

Rolling Labs Another type of scam has involved rolling labs, vans or motor homes equipped with medical laboratories where unnecessary and sometimes fake medical tests have been conducted on unsuspecting patients and paid for by their insurers. Because these labs were on wheels, they were easily moved from location to location. A Global Leader in Compliance and Investigation Solutions

Ambulance Chasing Rings Some corrupt lawyers use runners or cappers who are people hired by unscrupulous doctors or lawyers to recruit people for kickback or feesplitting schemes. The recruits have either been injured or agree to pretend to have been injured in an accident. Runners have also sometimes been hired to arrange “accidents” so they appear to be the fault of someone else. Runners often chase ambulances by using police-band radios to locate auto accidents. They would rush to the accident scenes and give one or both drivers the name of the ring’s doctor or lawyer. After the people were recruited and had contacted the ring’s doctor or lawyer, the runner received payment. The ring’s doctor performed needless medical treatments or simply billed the claimants for treatments that were never provided. The ring’s lawyer then built legal cases for the claimants in anticipation of taking those cases to court. A Global Leader in Compliance and Investigation Solutions

Ambulance Chasing Rings Some corrupt lawyers use runners or cappers who are people hired by unscrupulous doctors or lawyers to recruit people for kickback or feesplitting schemes. The recruits have either been injured or agree to pretend to have been injured in an accident. Runners have also sometimes been hired to arrange “accidents” so they appear to be the fault of someone else. Runners often chase ambulances by using police-band radios to locate auto accidents. They would rush to the accident scenes and give one or both drivers the name of the ring’s doctor or lawyer. After the people were recruited and had contacted the ring’s doctor or lawyer, the runner received payment. The ring’s doctor performed needless medical treatments or simply billed the claimants for treatments that were never provided. The ring’s lawyer then built legal cases for the claimants in anticipation of taking those cases to court. A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators • These are people who have committed insurance fraud more than once but have not relied on it as a major source of income. This category has also included certain unscrupulous doctors, lawyers and various types of business owners. • Most medical and legal professionals are honest and trustworthy. Some, however, are not. They have falsified and destroyed records and assisted others in fabricating injuries to collect large bodily injury insurance settlements or awards in lawsuits based on fraudulent claims. They have billed patients and clients excessively for medical and legal work, some of which they did not even do. • Unfortunately, the illegal activities of these relatively few corrupt medical and legal professionals can affect the reputation of integrity of the rest. A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators • These are people who have committed insurance fraud more than once but have not relied on it as a major source of income. This category has also included certain unscrupulous doctors, lawyers and various types of business owners. • Most medical and legal professionals are honest and trustworthy. Some, however, are not. They have falsified and destroyed records and assisted others in fabricating injuries to collect large bodily injury insurance settlements or awards in lawsuits based on fraudulent claims. They have billed patients and clients excessively for medical and legal work, some of which they did not even do. • Unfortunately, the illegal activities of these relatively few corrupt medical and legal professionals can affect the reputation of integrity of the rest. A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators • In addition to those previously described, many others have participated in fraud schemes for money or for kickbacks. Following are some examples: – Insurance professionals who took bribes or kickbacks for filing and processing fake claims – Contractors who were hired to repair or replace damaged property, who inflated the costs for work performed or charged for work they did not perform and for materials they did not use – Dentists who wrote claimants’ dental reports so their insurance would cover the costs of non-covered treatments or false treatments – Radiologists who falsified X-rays that were then used to support fraudulent claims A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators • In addition to those previously described, many others have participated in fraud schemes for money or for kickbacks. Following are some examples: – Insurance professionals who took bribes or kickbacks for filing and processing fake claims – Contractors who were hired to repair or replace damaged property, who inflated the costs for work performed or charged for work they did not perform and for materials they did not use – Dentists who wrote claimants’ dental reports so their insurance would cover the costs of non-covered treatments or false treatments – Radiologists who falsified X-rays that were then used to support fraudulent claims A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators – Employees of professionals and business owners whose employers were or were not also involved in the schemes and who falsified bills or claim forms – Real estate brokers who worked with arsonists in securing property and falsifying property values – Tow truck operators who notified corrupt professionals when accidents occurred and provided names of those who were injured A Global Leader in Compliance and Investigation Solutions

Semi-Professional Fraud Perpetrators – Employees of professionals and business owners whose employers were or were not also involved in the schemes and who falsified bills or claim forms – Real estate brokers who worked with arsonists in securing property and falsifying property values – Tow truck operators who notified corrupt professionals when accidents occurred and provided names of those who were injured A Global Leader in Compliance and Investigation Solutions

Opportunistic Insurance Fraud Perpetrators These are people who have taken the opportunity to squeeze extra money from the insurance companies. They usually do this only one or twice which is consider so called “soft fraud”. As an example, they have padded the amounts of their otherwise legitimate claims, have contended their injuries were worse than they really were or have added previously damaged property to their claims. Such people do not view their fraudulent acts as crimes and do not consider what they are doing as wrong. – Accident – Injury Claim – Clumsy slip and fall – Liability Claim – Homeowner Loss – Pad for deductible – WC – Never injured – WC – Malingering – Kitchen fire – to remodel the home – Commercial sales are down – Cash theft A Global Leader in Compliance and Investigation Solutions

Opportunistic Insurance Fraud Perpetrators These are people who have taken the opportunity to squeeze extra money from the insurance companies. They usually do this only one or twice which is consider so called “soft fraud”. As an example, they have padded the amounts of their otherwise legitimate claims, have contended their injuries were worse than they really were or have added previously damaged property to their claims. Such people do not view their fraudulent acts as crimes and do not consider what they are doing as wrong. – Accident – Injury Claim – Clumsy slip and fall – Liability Claim – Homeowner Loss – Pad for deductible – WC – Never injured – WC – Malingering – Kitchen fire – to remodel the home – Commercial sales are down – Cash theft A Global Leader in Compliance and Investigation Solutions

Con Artists These fraud perpetrators have frequently moved from place to place, pulling the same scams in city after city and town after town. “Slip and fall” accidents have been popular with many professional fraud perpetrators who have worked variations of this scheme in many different places. In some cases, they did not bother to stage actual falls rather they went directly to the storeowners and complained that falls have occurred on the premises. In both situations, other con artists acted as corroborative “witnesses”. The “injured” con artists usually insisted the stores were liable for the damages because of allegedly hazardous conditions, such as puddles or objects on the floor. The “injured” parties often complain of various other soft tissue or subjective injuries which rarely show up on x-rays and are therefore difficult to disprove. These people also often claim that they broke such items as eyeglasses, dentures and cameras. A Global Leader in Compliance and Investigation Solutions

Con Artists These fraud perpetrators have frequently moved from place to place, pulling the same scams in city after city and town after town. “Slip and fall” accidents have been popular with many professional fraud perpetrators who have worked variations of this scheme in many different places. In some cases, they did not bother to stage actual falls rather they went directly to the storeowners and complained that falls have occurred on the premises. In both situations, other con artists acted as corroborative “witnesses”. The “injured” con artists usually insisted the stores were liable for the damages because of allegedly hazardous conditions, such as puddles or objects on the floor. The “injured” parties often complain of various other soft tissue or subjective injuries which rarely show up on x-rays and are therefore difficult to disprove. These people also often claim that they broke such items as eyeglasses, dentures and cameras. A Global Leader in Compliance and Investigation Solutions

Auto Salvage Fraud The insurer becomes the vehicle owner after paying for a claim on a total loss of that vehicle. In most states, the insurer obtains a salvage title from the Department of Motor Vehicles. The vehicle’s title is stamped with the words, “salvage vehicle” or “junk” to show the vehicle was previously declared a total loss. The insurer puts the salvaged vehicle up for sale, usually either through auction or sealed bid. Legitimate salvage yards often purchase such vehicles, dismantle them and resell the usable parts. The buyer of the salvaged vehicle receives the salvage title and the plate from the vehicle that shows the manufacturer’s vehicle identification number (VIN), which is a combination of letters and numbers that were originally used for the manufacturer’s inventory purposes. One type of fraud scheme is called “body swing” where fraud perpetrators purchased a salvaged vehicle with extensive body damage but with other major parts in fairly good condition. Then, they stole a matching, undamaged vehicle. Instead of grinding the VIN off the vehicle and re-stamping it, they removed the entire undamaged body from its chassis and put it on the salvaged vehicle. Then, they transferred the VIN plate from the salvaged vehicle to the stolen vehicle. A Global Leader in Compliance and Investigation Solutions

Auto Salvage Fraud The insurer becomes the vehicle owner after paying for a claim on a total loss of that vehicle. In most states, the insurer obtains a salvage title from the Department of Motor Vehicles. The vehicle’s title is stamped with the words, “salvage vehicle” or “junk” to show the vehicle was previously declared a total loss. The insurer puts the salvaged vehicle up for sale, usually either through auction or sealed bid. Legitimate salvage yards often purchase such vehicles, dismantle them and resell the usable parts. The buyer of the salvaged vehicle receives the salvage title and the plate from the vehicle that shows the manufacturer’s vehicle identification number (VIN), which is a combination of letters and numbers that were originally used for the manufacturer’s inventory purposes. One type of fraud scheme is called “body swing” where fraud perpetrators purchased a salvaged vehicle with extensive body damage but with other major parts in fairly good condition. Then, they stole a matching, undamaged vehicle. Instead of grinding the VIN off the vehicle and re-stamping it, they removed the entire undamaged body from its chassis and put it on the salvaged vehicle. Then, they transferred the VIN plate from the salvaged vehicle to the stolen vehicle. A Global Leader in Compliance and Investigation Solutions

Title Washing The objective of still another scheme, known as “title washing” or “title laundering, ” is to eliminate the designation “salvage vehicle” or “junk” from a legitimate salvage title. Fraud perpetrators have worked this scheme by purchasing expensive, late-model, salvaged vehicles and rebuilt and disguised them. Then, they register and re-title them in states where salvage brands on titles are not required. That way, there was no indication the vehicles were ever damaged, and the insurer’s names as owners were effectively removed from the titles. Many times, these previously damaged vehicles were sold to unsuspecting buyers for much more than the vehicles were worth, and the new owners usually obtained insurance on them. The result was the buyers purchased and the insurers insured previously salvaged vehicle that likely had some very serious defects. A Global Leader in Compliance and Investigation Solutions

Title Washing The objective of still another scheme, known as “title washing” or “title laundering, ” is to eliminate the designation “salvage vehicle” or “junk” from a legitimate salvage title. Fraud perpetrators have worked this scheme by purchasing expensive, late-model, salvaged vehicles and rebuilt and disguised them. Then, they register and re-title them in states where salvage brands on titles are not required. That way, there was no indication the vehicles were ever damaged, and the insurer’s names as owners were effectively removed from the titles. Many times, these previously damaged vehicles were sold to unsuspecting buyers for much more than the vehicles were worth, and the new owners usually obtained insurance on them. The result was the buyers purchased and the insurers insured previously salvaged vehicle that likely had some very serious defects. A Global Leader in Compliance and Investigation Solutions

TYPES OF INSURANCE FRAUD BEWARE!!!!

TYPES OF INSURANCE FRAUD BEWARE!!!!

When Fraud Has Been Committed • While many of the examples we’ve shared so far are of fraud that occurs when a claim is made, you should be aware that fraud can occur at any point in the insurance process. Fraud may also occur during the application process, be introduced by an agent or broker, be introduced by a third party administrator, or occur internally at the insurance company. • Generally, insurance fraud is categorized into three areas: – Application Fraud; – Claim Fraud; and – Internal Fraud A Global Leader in Compliance and Investigation Solutions

When Fraud Has Been Committed • While many of the examples we’ve shared so far are of fraud that occurs when a claim is made, you should be aware that fraud can occur at any point in the insurance process. Fraud may also occur during the application process, be introduced by an agent or broker, be introduced by a third party administrator, or occur internally at the insurance company. • Generally, insurance fraud is categorized into three areas: – Application Fraud; – Claim Fraud; and – Internal Fraud A Global Leader in Compliance and Investigation Solutions

At The Time Of Application fraud is fraud that occurs when the policy is purchased. Application fraud is generally categorized as either contract fraud or premium fraud. An application that is denied because of a material misrepresentation is attempted insurance fraud and requires reporting to the state. A Global Leader in Compliance and Investigation Solutions

At The Time Of Application fraud is fraud that occurs when the policy is purchased. Application fraud is generally categorized as either contract fraud or premium fraud. An application that is denied because of a material misrepresentation is attempted insurance fraud and requires reporting to the state. A Global Leader in Compliance and Investigation Solutions

Contract Fraud vs. Premium Fraud • Misstatements in a policy application that are made to convince an insurance company to enter into a contract are referred to as “contract fraud” • Misrepresentations that induce an insurance company to charge a lower premium are “premium fraud” or “rate evasion” A Global Leader in Compliance and Investigation Solutions

Contract Fraud vs. Premium Fraud • Misstatements in a policy application that are made to convince an insurance company to enter into a contract are referred to as “contract fraud” • Misrepresentations that induce an insurance company to charge a lower premium are “premium fraud” or “rate evasion” A Global Leader in Compliance and Investigation Solutions

Contract Fraud For example, answering no to questions about: – prior at fault accidents – issues of policy cancellation or non-renewals – issues of storage of explosives – issues about sky diving or pilot license – past company name to avoid WC modifier – ownership of pets on premises A Global Leader in Compliance and Investigation Solutions

Contract Fraud For example, answering no to questions about: – prior at fault accidents – issues of policy cancellation or non-renewals – issues of storage of explosives – issues about sky diving or pilot license – past company name to avoid WC modifier – ownership of pets on premises A Global Leader in Compliance and Investigation Solutions

Premium Fraud • An insured omits the fact he has teenager who drive his cars. • An insured lives in a city but uses someone else’s address in a suburb to reduce his auto premium. • An applicant requests non tobacco premium rates and denies tobacco use, even though he smokes. A Global Leader in Compliance and Investigation Solutions

Premium Fraud • An insured omits the fact he has teenager who drive his cars. • An insured lives in a city but uses someone else’s address in a suburb to reduce his auto premium. • An applicant requests non tobacco premium rates and denies tobacco use, even though he smokes. A Global Leader in Compliance and Investigation Solutions

WC Premium Fraud • Not reporting all employees. • Misclassification of employees; such as classifying roofers or tree trimmers as office workers. • Misidentifying your principal place of operation in a state that provides better rates. • Misreporting the number of job sites or workers. A Global Leader in Compliance and Investigation Solutions

WC Premium Fraud • Not reporting all employees. • Misclassification of employees; such as classifying roofers or tree trimmers as office workers. • Misidentifying your principal place of operation in a state that provides better rates. • Misreporting the number of job sites or workers. A Global Leader in Compliance and Investigation Solutions

Claim Fraud Creating a fraudulent claim may include: • • • Staged or caused auto accidents; Staged slip and fall accidents; False claim of foreign object in food or drink; Faking a death to collect benefits, or filing a phony death claim; Murder-for-profit; Phony burglary theft or vandalism; Arson; Staged auto thefts; Staged homeowner accident or burglary; “Fibbers" or “Padders" who overstate their insurance claims to make up for the deductible; • Claiming prior damage occurred in the current accident; A Global Leader in Compliance and Investigation Solutions

Claim Fraud Creating a fraudulent claim may include: • • • Staged or caused auto accidents; Staged slip and fall accidents; False claim of foreign object in food or drink; Faking a death to collect benefits, or filing a phony death claim; Murder-for-profit; Phony burglary theft or vandalism; Arson; Staged auto thefts; Staged homeowner accident or burglary; “Fibbers" or “Padders" who overstate their insurance claims to make up for the deductible; • Claiming prior damage occurred in the current accident; A Global Leader in Compliance and Investigation Solutions

Claim Fraud…Continued Creating a fraudulent claim may include: • Claiming a minor injury created a partial or total disability; • Receiving disability payments while working elsewhere conducting the same or similar work duties; • Claiming false disability; • Medical providers billing for services not rendered; • Providing unnecessary medical treatment; • Charging for non-provided medical tests; • Pharmacist "upcoding" for medicine by issuing generic pills and charging for name brand. • Multiple Policies for Profit -- A property or vehicle owner illegally buys numerous insurance policies for one property or vehicle and then damages or destroys it, collecting on all policies. A Global Leader in Compliance and Investigation Solutions

Claim Fraud…Continued Creating a fraudulent claim may include: • Claiming a minor injury created a partial or total disability; • Receiving disability payments while working elsewhere conducting the same or similar work duties; • Claiming false disability; • Medical providers billing for services not rendered; • Providing unnecessary medical treatment; • Charging for non-provided medical tests; • Pharmacist "upcoding" for medicine by issuing generic pills and charging for name brand. • Multiple Policies for Profit -- A property or vehicle owner illegally buys numerous insurance policies for one property or vehicle and then damages or destroys it, collecting on all policies. A Global Leader in Compliance and Investigation Solutions

Internal Fraud Internal fraud are those perpetrated against an insurance company or its policyholders by insurance agents, managers, executives, or other insurance employees. Examples include: Embezzlement – Employee stealing money from their employer. Agent, Adjuster or Personnel Claim Rings Fake/False/Forged Documents -- Agent or insurer issuing fake policies, certificates, insurance identification cards or binders. False Statements -- Agent or insurer making a false statement on a filing. Pocketing Premiums -- Agent or insurer pocketing premiums, then issuing a phony policy or none at all. A Global Leader in Compliance and Investigation Solutions

Internal Fraud Internal fraud are those perpetrated against an insurance company or its policyholders by insurance agents, managers, executives, or other insurance employees. Examples include: Embezzlement – Employee stealing money from their employer. Agent, Adjuster or Personnel Claim Rings Fake/False/Forged Documents -- Agent or insurer issuing fake policies, certificates, insurance identification cards or binders. False Statements -- Agent or insurer making a false statement on a filing. Pocketing Premiums -- Agent or insurer pocketing premiums, then issuing a phony policy or none at all. A Global Leader in Compliance and Investigation Solutions

Effective Utilization of Investigative Results What Does a Win Look Like? A Global Leader in Compliance and Investigation Solutions