ca18eabbd345a428b91bd267af6a0b16.ppt

- Количество слайдов: 37

2010/2011 full business year EGIS Pharmaceuticals Public Limited Company Non-audited, consolidated, IFRS

Change! EGIS Group analyses export sales revenue in €, starting in 2010/2011 • Regulation in Russia changed – Prices of EDL products* are fixed in RUB – EDL products make up as much as 70% of EGIS local turnover • Distribution agreements modified to ruble invoicing, effective from January 1, 2011 • Weight of USD in the export of EGIS Group reduced – No 1. selling currency earlier, slipped to third rank (HUF, EUR) * EDL: Essential Drug List

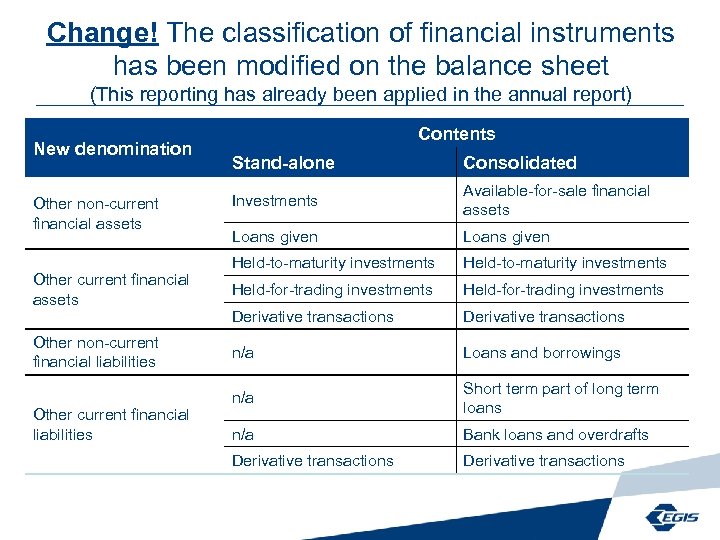

Change! The classification of financial instruments has been modified on the balance sheet (This reporting has already been applied in the annual report) New denomination Other non-current financial assets Other non-current financial liabilities Other current financial liabilities Contents Stand-alone Consolidated Investments Available-for-sale financial assets Loans given Held-to-maturity investments Held-for-trading investments Derivative transactions n/a Loans and borrowings n/a Short term part of long term loans n/a Bank loans and overdrafts Derivative transactions

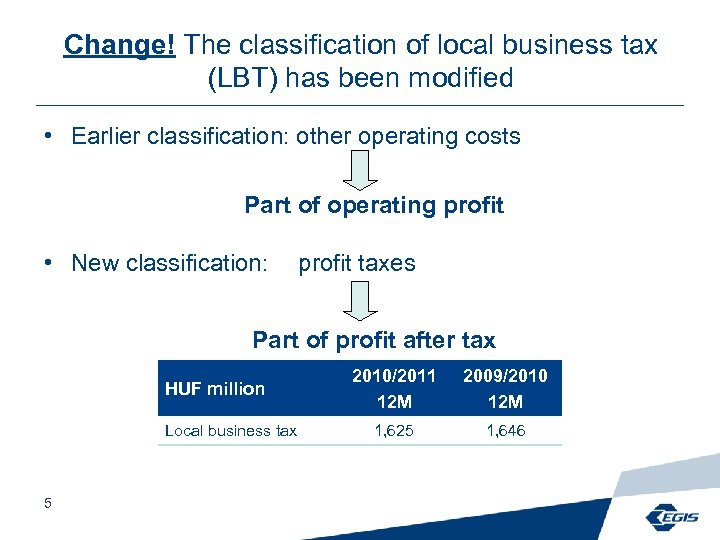

Change! The classification of local business tax (LBT) has been modified • Earlier classification: other operating costs Part of operating profit • New classification: profit taxes Part of profit after tax HUF million Local business tax 5 2010/2011 12 M 2009/2010 12 M 1, 625 1, 646

2010/2011 business year 4 th quarter EGIS Pharmaceuticals Public Limited Company Non-audited, consolidated, IFRS

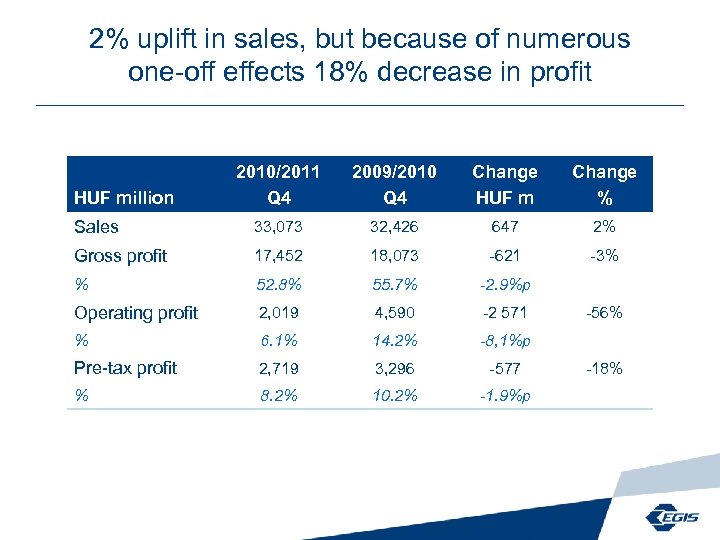

2% uplift in sales, but because of numerous one-off effects 18% decrease in profit 2010/2011 Q 4 2009/2010 Q 4 Change HUF m Change % Sales 33, 073 32, 426 647 2% Gross profit 17, 452 18, 073 -621 -3% % 52. 8% 55. 7% -2. 9%p Operating profit 2, 019 4, 590 -2 571 % 6. 1% 14. 2% -8, 1%p Pre-tax profit 2, 719 3, 296 -577 % 8. 2% 10. 2% -1. 9%p HUF million -56% -18%

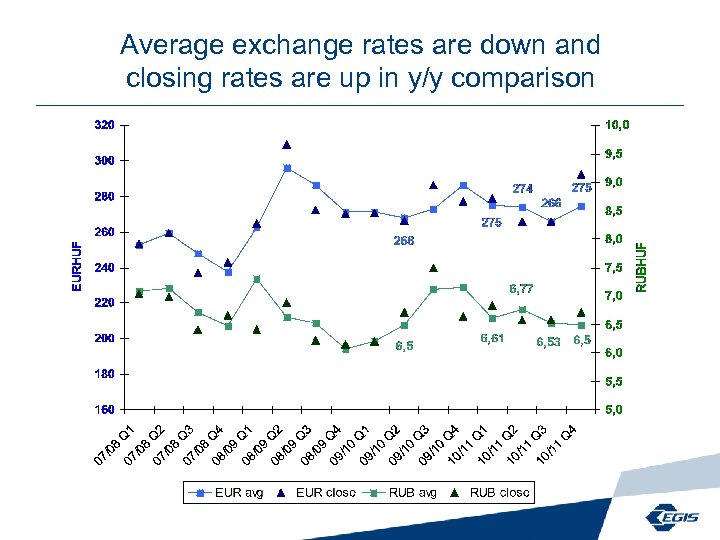

Average exchange rates are down and closing rates are up in y/y comparison

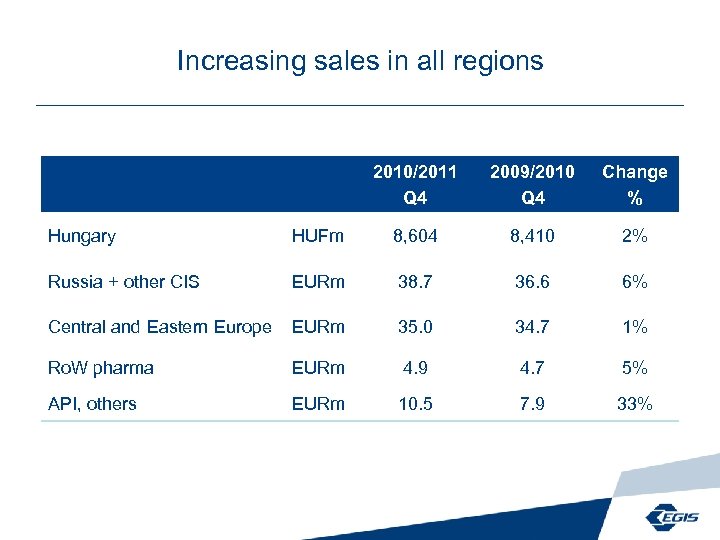

Increasing sales in all regions 2010/2011 Q 4 2009/2010 Q 4 Change % Hungary HUFm 8, 604 8, 410 2% Russia + other CIS EURm 38. 7 36. 6 6% Central and Eastern Europe EURm 35. 0 34. 7 1% Ro. W pharma EURm 4. 9 4. 7 5% API, others EURm 10. 5 7. 9 33%

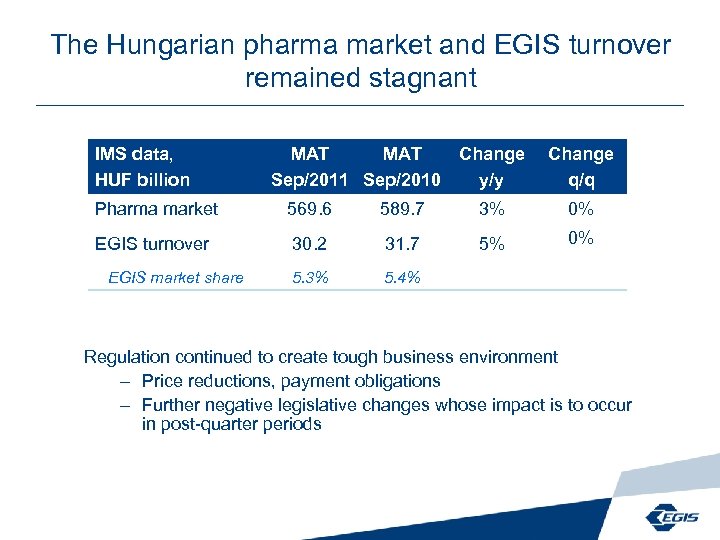

The Hungarian pharma market and EGIS turnover remained stagnant IMS data, HUF billion MAT Change Sep/2011 Sep/2010 y/y Change q/q Pharma market 569. 6 589. 7 3% 0% EGIS turnover 30. 2 31. 7 5% 0% 5. 3% 5. 4% EGIS market share Regulation continued to create tough business environment – Price reductions, payment obligations – Further negative legislative changes whose impact is to occur in post-quarter periods

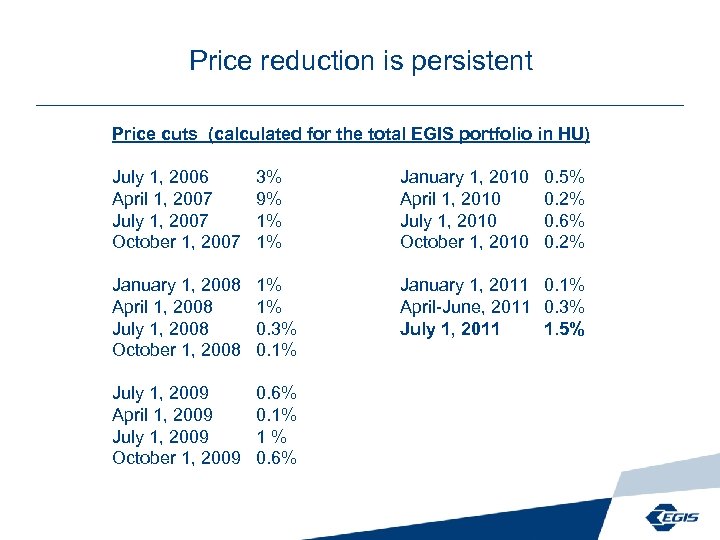

Price reduction is persistent Price cuts (calculated for the total EGIS portfolio in HU) July 1, 2006 April 1, 2007 July 1, 2007 October 1, 2007 3% 9% 1% 1% January 1, 2010 April 1, 2010 July 1, 2010 October 1, 2010 0. 5% 0. 2% 0. 6% 0. 2% January 1, 2008 April 1, 2008 July 1, 2008 October 1, 2008 1% 1% 0. 3% 0. 1% January 1, 2011 0. 1% April-June, 2011 0. 3% July 1, 2011 1. 5% July 1, 2009 April 1, 2009 July 1, 2009 October 1, 2009 0. 6% 0. 1% 1% 0. 6%

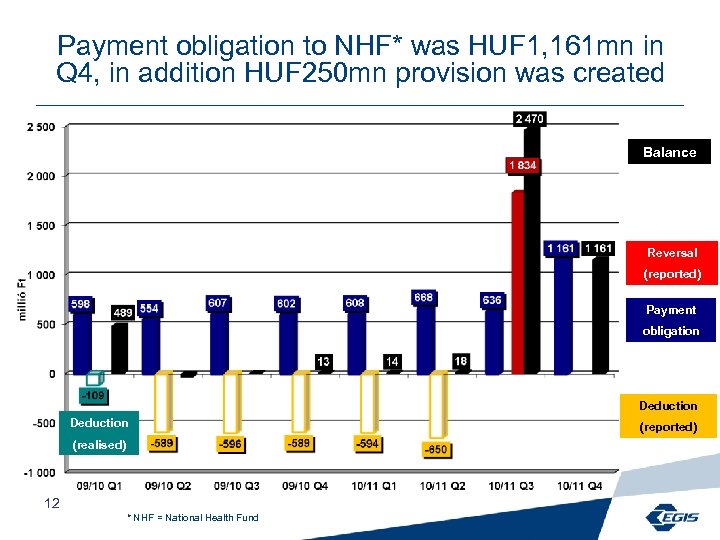

Payment obligation to NHF* was HUF 1, 161 mn in Q 4, in addition HUF 250 mn provision was created Balance Reversal (reported) Payment obligation Deduction (realised) 12 * NHF = National Health Fund (reported)

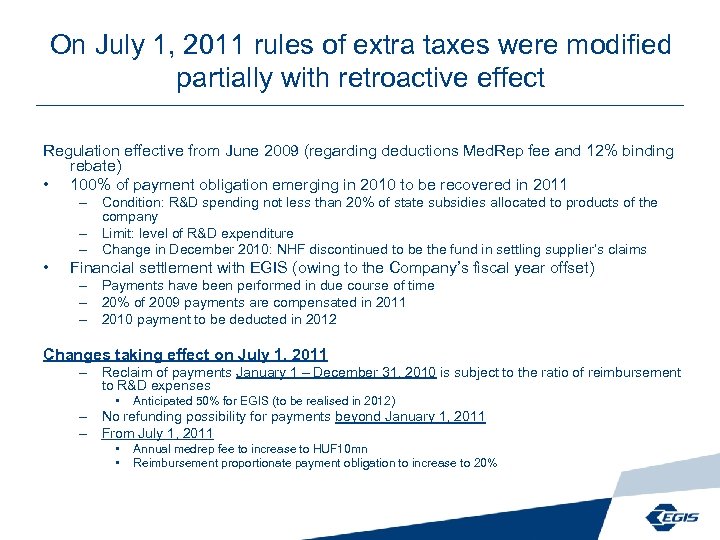

On July 1, 2011 rules of extra taxes were modified partially with retroactive effect Regulation effective from June 2009 (regarding deductions Med. Rep fee and 12% binding rebate) • 100% of payment obligation emerging in 2010 to be recovered in 2011 – Condition: R&D spending not less than 20% of state subsidies allocated to products of the company – Limit: level of R&D expenditure – Change in December 2010: NHF discontinued to be the fund in settling supplier’s claims • Financial settlement with EGIS (owing to the Company’s fiscal year offset) – Payments have been performed in due course of time – 20% of 2009 payments are compensated in 2011 – 2010 payment to be deducted in 2012 Changes taking effect on July 1, 2011 – Reclaim of payments January 1 – December 31, 2010 is subject to the ratio of reimbursement to R&D expenses • Anticipated 50% for EGIS (to be realised in 2012) – No refunding possibility for payments beyond January 1, 2011 – From July 1, 2011 • • Annual medrep fee to increase to HUF 10 mn Reimbursement proportionate payment obligation to increase to 20%

7% turnover rise in Russia, 3% aggregate growth in other CIS markets 2010/2011 Q 4 2009/2010 Q 4 Change % Russia 27, 134 25, 336 7% Ukraine 5, 490 3, 569 54% Kazakhstan 1, 813 2, 437 -26% Belarus 1, 403 2, 152 -35% Other CIS 2, 865 3, 114 -8% Russia and other CIS total 38, 705 36, 607 6% EUR thousand

1% sales increase alltogether in Central and Eastern Europe 2010/2011 Q 4 2009/2010 Q 4 Change % Poland 17, 097 16, 317 5% Czech Republic 5, 003 4, 491 11% Slovakia 4, 021 3, 797 6% Romania 4, 456 4, 743 -6% Other CEE 4, 436 5, 394 -18% CEE total 35, 013 34, 742 1% EUR thousand

Pharma export to other countries increased 5% EUR thousand Pharma export to other markets EGIS finished drugs Co-operation 2010/2011 Q 4 2009/2010 Q 4 Change % 4, 925 4, 708 5% 4, 273 4, 708 -9% 652 0

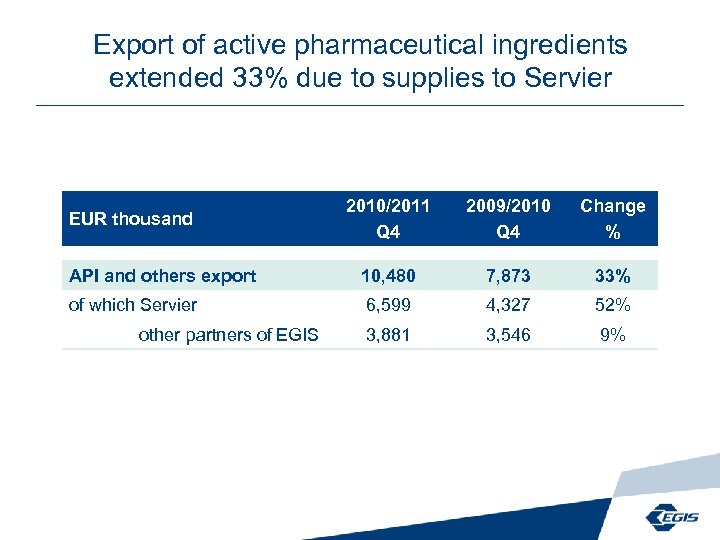

Export of active pharmaceutical ingredients extended 33% due to supplies to Servier 2010/2011 Q 4 2009/2010 Q 4 Change % API and others export 10, 480 7, 873 33% of which Servier 6, 599 4, 327 52% 3, 881 3, 546 9% EUR thousand other partners of EGIS

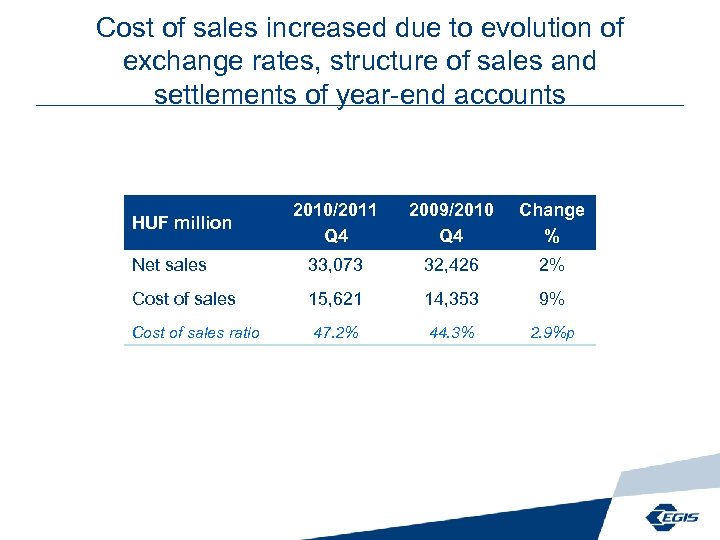

Cost of sales increased due to evolution of exchange rates, structure of sales and settlements of year-end accounts 2010/2011 Q 4 2009/2010 Q 4 Change % Net sales 33, 073 32, 426 2% Cost of sales 15, 621 14, 353 9% 47. 2% 44. 3% 2. 9%p HUF million Cost of sales ratio

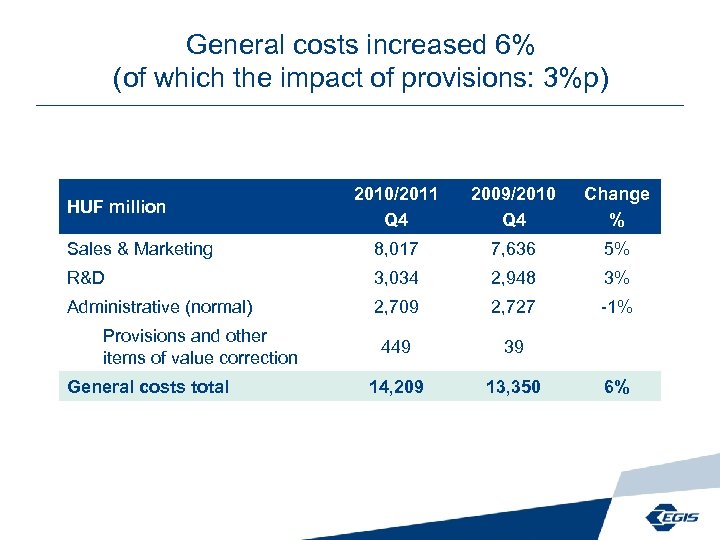

General costs increased 6% (of which the impact of provisions: 3%p) 2010/2011 Q 4 2009/2010 Q 4 Change % Sales & Marketing 8, 017 7, 636 5% R&D 3, 034 2, 948 3% Administrative (normal) 2, 709 2, 727 -1% 449 39 14, 209 13, 350 HUF million Provisions and other items of value correction General costs total 6%

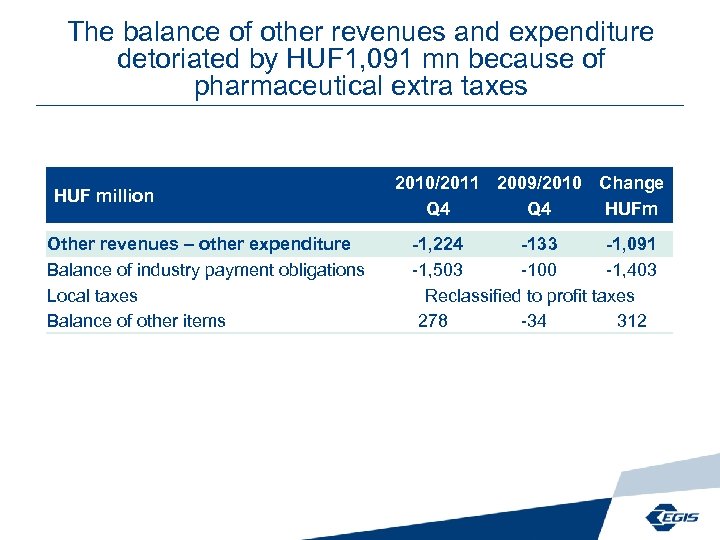

The balance of other revenues and expenditure detoriated by HUF 1, 091 mn because of pharmaceutical extra taxes HUF million Other revenues – other expenditure Balance of industry payment obligations Local taxes Balance of other items 2010/2011 2009/2010 Change Q 4 HUFm -1, 224 -133 -1, 091 -1, 503 -100 -1, 403 Reclassified to profit taxes 278 -34 312

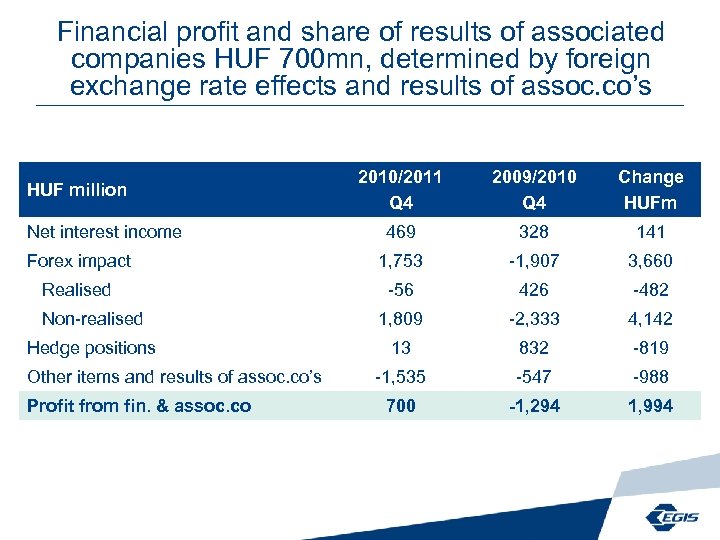

Financial profit and share of results of associated companies HUF 700 mn, determined by foreign exchange rate effects and results of assoc. co’s 2010/2011 Q 4 2009/2010 Q 4 Change HUFm 469 328 141 Forex impact 1, 753 -1, 907 3, 660 Realised -56 426 -482 Non-realised 1, 809 -2, 333 4, 142 Hedge positions 13 832 -819 -1, 535 -547 -988 700 -1, 294 1, 994 HUF million Net interest income Other items and results of assoc. co’s Profit from fin. & assoc. co

2010/2011 fiscal year 12 months

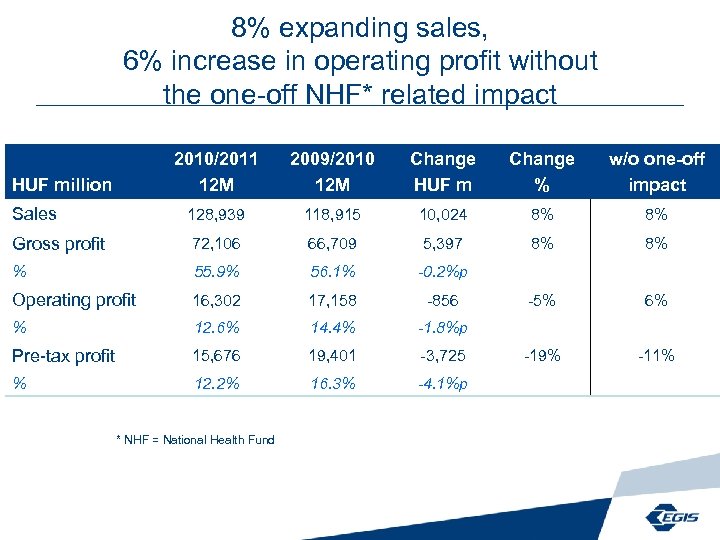

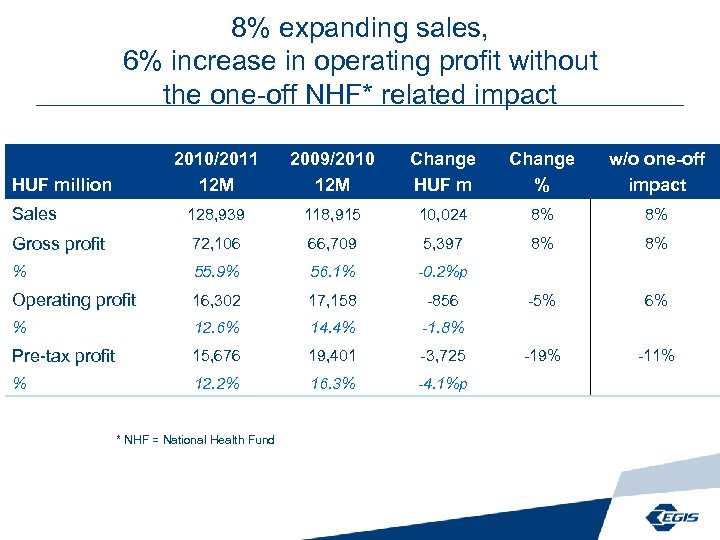

8% expanding sales, 6% increase in operating profit without the one-off NHF* related impact 2010/2011 12 M 2009/2010 12 M Change HUF m Change % w/o one-off impact Sales 128, 939 118, 915 10, 024 8% 8% Gross profit 72, 106 66, 709 5, 397 8% 8% % 55. 9% 56. 1% -0. 2%p Operating profit 16, 302 17, 158 -856 -5% 6% % 12. 6% 14. 4% -1. 8%p Pre-tax profit 15, 676 19, 401 -3, 725 -19% -11% % 12. 2% 16. 3% -4. 1%p HUF million * NHF = National Health Fund

Growing sales in all regions 2010/2011 12 M 2009/2010 12 M Change % Hungary HUFm 34, 871 32, 687 7% Russia + other CIS EURm 150. 9 138. 3 9% Central and Eastern Europe EURm 134. 2 130. 0 3% Ro. W pharma EURm 19. 6 17. 3 13% API, others EURm 40. 8 28. 3 45%

12 % sales growth in Russia, 2% growth in other CIS markets alltogether 2010/2011 12 M 2009/2010 12 M Change % Russia 110, 244 98, 378 12% Ukraine 15, 582 14, 498 7% Kazakhstan 8, 021 7, 637 5% Belarus 6, 207 6, 618 -6% Other CIS 10, 839 11, 123 -3% Russia and other CIS total 150, 893 138, 254 9% EUR thousand

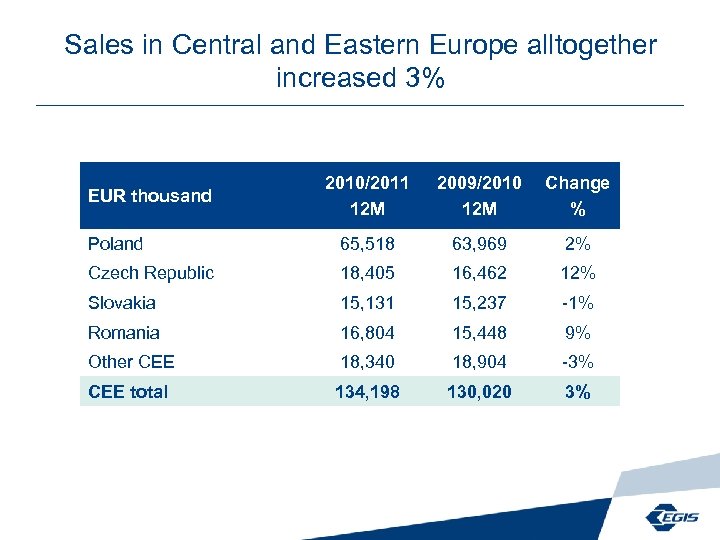

Sales in Central and Eastern Europe alltogether increased 3% 2010/2011 12 M 2009/2010 12 M Change % Poland 65, 518 63, 969 2% Czech Republic 18, 405 16, 462 12% Slovakia 15, 131 15, 237 -1% Romania 16, 804 15, 448 9% Other CEE 18, 340 18, 904 -3% CEE total 134, 198 130, 020 3% EUR thousand

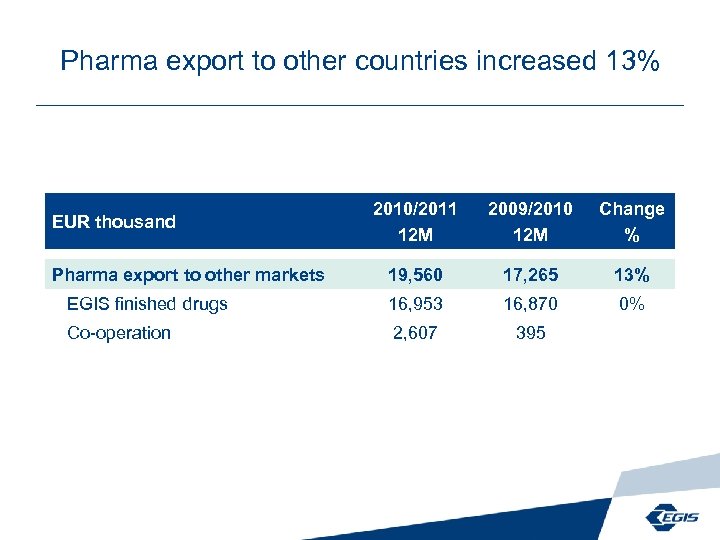

Pharma export to other countries increased 13% 2010/2011 12 M 2009/2010 12 M Change % 19, 560 17, 265 13% EGIS finished drugs 16, 953 16, 870 0% Co-operation 2, 607 395 EUR thousand Pharma export to other markets

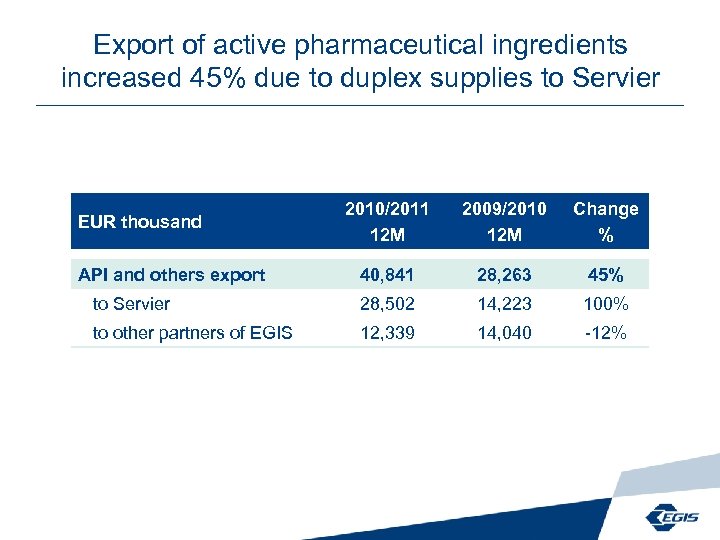

Export of active pharmaceutical ingredients increased 45% due to duplex supplies to Servier 2010/2011 12 M 2009/2010 12 M Change % 40, 841 28, 263 45% to Servier 28, 502 14, 223 100% to other partners of EGIS 12, 339 14, 040 -12% EUR thousand API and others export

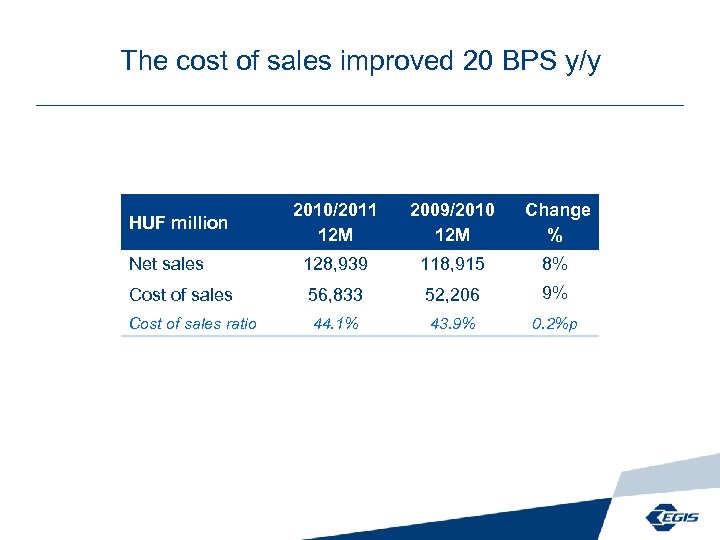

The cost of sales improved 20 BPS y/y 2010/2011 12 M 2009/2010 12 M Change % Net sales 128, 939 118, 915 8% Cost of sales 56, 833 52, 206 9% 44. 1% 43. 9% 0. 2%p HUF million Cost of sales ratio

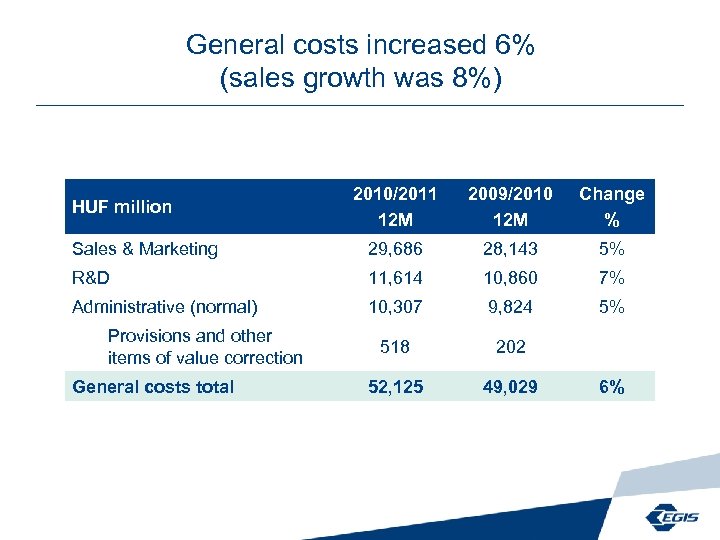

General costs increased 6% (sales growth was 8%) 2010/2011 12 M 2009/2010 12 M Change % Sales & Marketing 29, 686 28, 143 5% R&D 11, 614 10, 860 7% Administrative (normal) 10, 307 9, 824 5% 518 202 52, 125 49, 029 HUF million Provisions and other items of value correction General costs total 6%

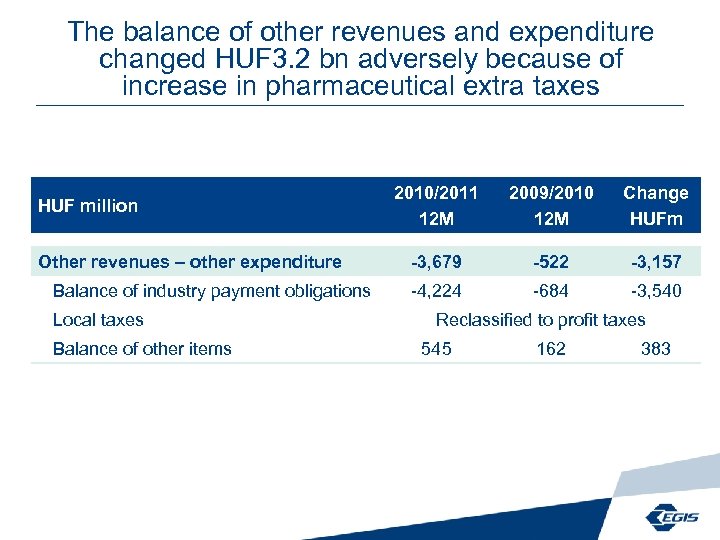

The balance of other revenues and expenditure changed HUF 3. 2 bn adversely because of increase in pharmaceutical extra taxes HUF million Other revenues – other expenditure Balance of industry payment obligations Local taxes Balance of other items 2010/2011 12 M 2009/2010 12 M Change HUFm -3, 679 -522 -3, 157 -4, 224 -684 -3, 540 Reclassified to profit taxes 545 162 383

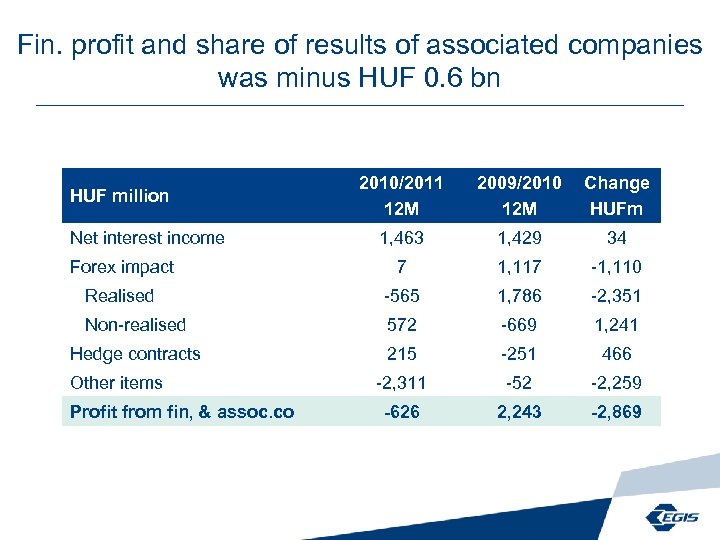

Fin. profit and share of results of associated companies was minus HUF 0. 6 bn 2010/2011 12 M 2009/2010 12 M Change HUFm 1, 463 1, 429 34 Forex impact 7 1, 117 -1, 110 Realised -565 1, 786 -2, 351 Non-realised 572 -669 1, 241 Hedge contracts 215 -251 466 -2, 311 -52 -2, 259 -626 2, 243 -2, 869 HUF million Net interest income Other items Profit from fin, & assoc. co

RUB HUF hedge contracts (FRA) effective up to April 2012 November 2, 2011 RUBm Forward November 210 6. 78 December 210 6. 84 January 210 6. 87 February 180 6. 90 March 150 6. 93 April 90 6. 96

8% expanding sales, 6% increase in operating profit without the one-off NHF* related impact 2010/2011 12 M 2009/2010 12 M Change HUF m Change % w/o one-off impact Sales 128, 939 118, 915 10, 024 8% 8% Gross profit 72, 106 66, 709 5, 397 8% 8% % 55. 9% 56. 1% -0. 2%p Operating profit 16, 302 17, 158 -856 -5% 6% % 12. 6% 14. 4% -1. 8% Pre-tax profit 15, 676 19, 401 -3, 725 -19% -11% % 12. 2% 16. 3% -4. 1%p HUF million * NHF = National Health Fund

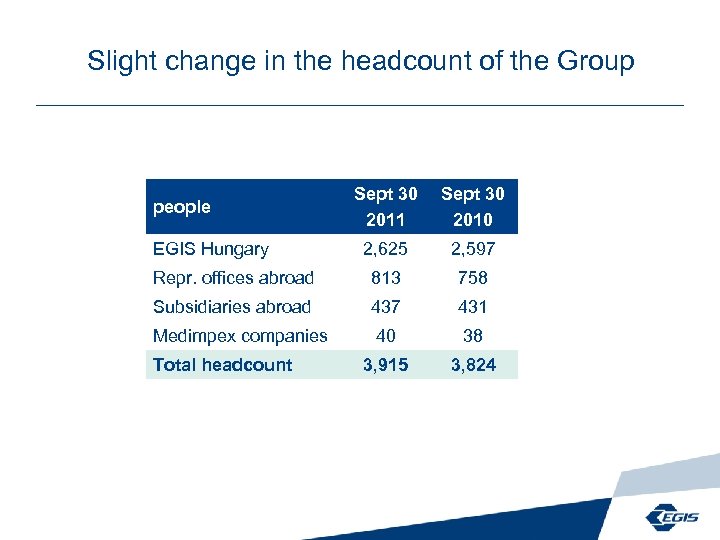

Slight change in the headcount of the Group Sept 30 2011 Sept 30 2010 2, 625 2, 597 Repr. offices abroad 813 758 Subsidiaries abroad 437 431 Medimpex companies 40 38 3, 915 3, 824 people EGIS Hungary Total headcount

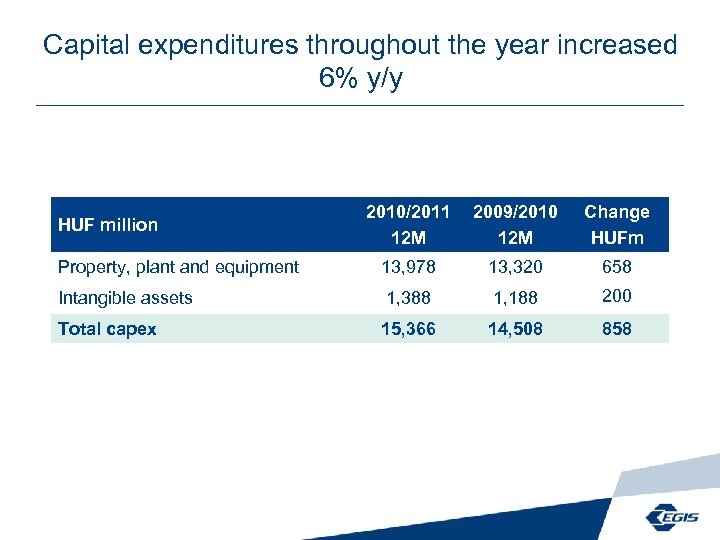

Capital expenditures throughout the year increased 6% y/y 2010/2011 12 M 2009/2010 12 M Change HUFm Property, plant and equipment 13, 978 13, 320 658 Intangible assets 1, 388 1, 188 200 Total capex 15, 366 14, 508 858 HUF million

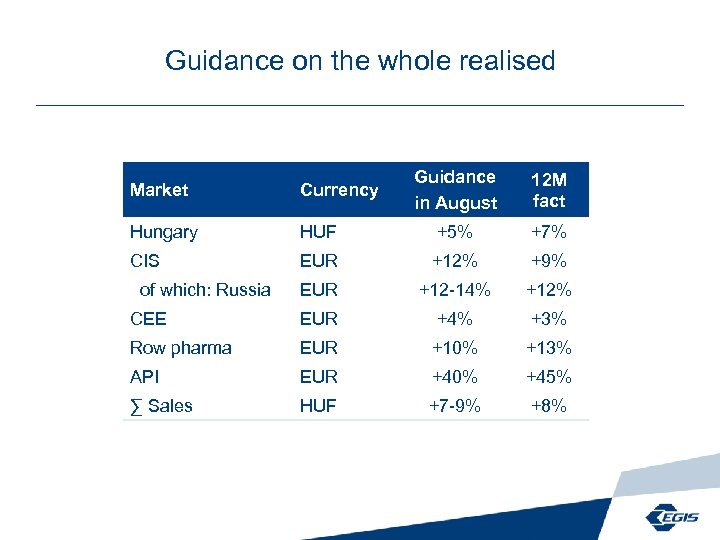

Guidance on the whole realised Guidance in August 12 M fact Market Currency Hungary HUF +5% +7% CIS EUR +12% +9% EUR +12 -14% +12% CEE EUR +4% +3% Row pharma EUR +10% +13% API EUR +40% +45% ∑ Sales HUF +7 -9% +8% of which: Russia

ca18eabbd345a428b91bd267af6a0b16.ppt