1de82fbaa7d6437ca7230ed0bcc778df.ppt

- Количество слайдов: 42

© 2009 The Mc. Graw-Hill Companies, Inc. Chapter 9 Long-Term Liabilities

© 2009 The Mc. Graw-Hill Companies, Inc. Chapter 9 Long-Term Liabilities

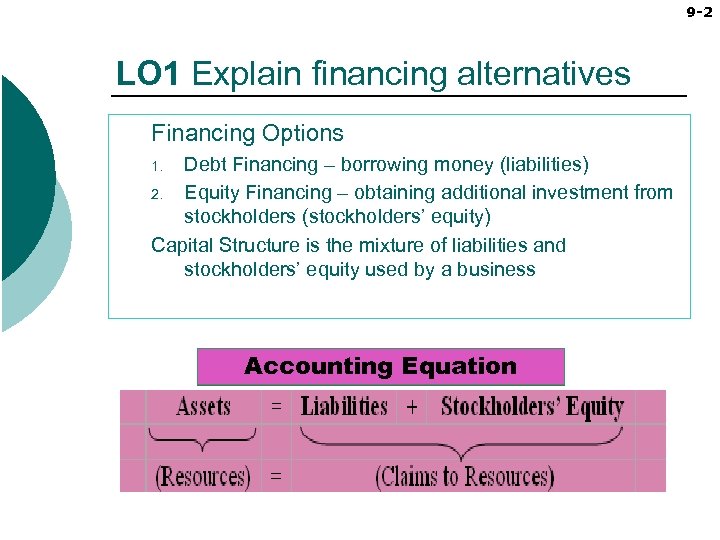

9 -2 LO 1 Explain financing alternatives Financing Options Debt Financing – borrowing money (liabilities) 2. Equity Financing – obtaining additional investment from stockholders (stockholders’ equity) Capital Structure is the mixture of liabilities and stockholders’ equity used by a business 1. Accounting Equation

9 -2 LO 1 Explain financing alternatives Financing Options Debt Financing – borrowing money (liabilities) 2. Equity Financing – obtaining additional investment from stockholders (stockholders’ equity) Capital Structure is the mixture of liabilities and stockholders’ equity used by a business 1. Accounting Equation

© 2009 The Mc. Graw-Hill Companies, Inc. Part A Bonds

© 2009 The Mc. Graw-Hill Companies, Inc. Part A Bonds

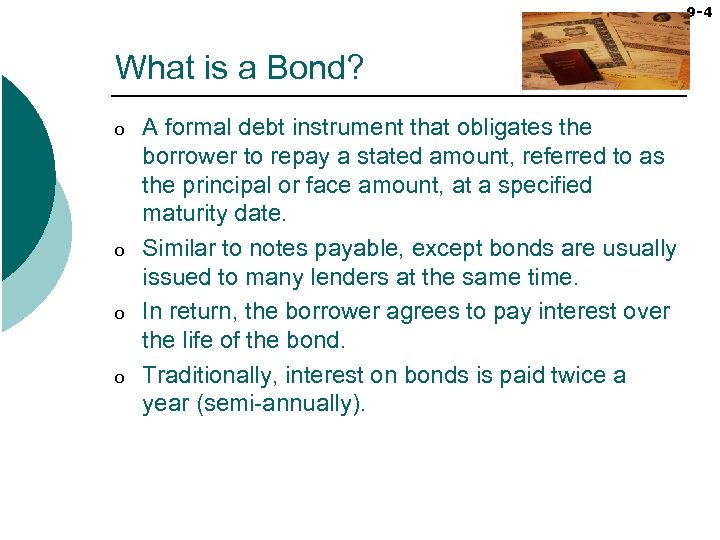

9 -4 What is a Bond? o o A formal debt instrument that obligates the borrower to repay a stated amount, referred to as the principal or face amount, at a specified maturity date. Similar to notes payable, except bonds are usually issued to many lenders at the same time. In return, the borrower agrees to pay interest over the life of the bond. Traditionally, interest on bonds is paid twice a year (semi-annually).

9 -4 What is a Bond? o o A formal debt instrument that obligates the borrower to repay a stated amount, referred to as the principal or face amount, at a specified maturity date. Similar to notes payable, except bonds are usually issued to many lenders at the same time. In return, the borrower agrees to pay interest over the life of the bond. Traditionally, interest on bonds is paid twice a year (semi-annually).

9 -5 Bonds (cont. ) o o o Bonds are sold or underwritten by investment houses like Citigroup, J P Morgan Chase, and Merrill Lynch. The borrower pays a fee for underwriting services. Other costs include legal, accounting, registration, and printing fees. To keep costs down, the issuing company may choose to sell the debt securities directly to a single investor. This is referred to as a Private placement. o Issue costs are lower because privately placed securities are not subject to the costly and lengthy process of registering with the SEC that is required of all public offerings.

9 -5 Bonds (cont. ) o o o Bonds are sold or underwritten by investment houses like Citigroup, J P Morgan Chase, and Merrill Lynch. The borrower pays a fee for underwriting services. Other costs include legal, accounting, registration, and printing fees. To keep costs down, the issuing company may choose to sell the debt securities directly to a single investor. This is referred to as a Private placement. o Issue costs are lower because privately placed securities are not subject to the costly and lengthy process of registering with the SEC that is required of all public offerings.

9 -6 LO 2 Identify the characteristics of bonds o o A bond indenture is a contract between a firm issuing bonds and the corporations or individuals who purchase the bonds as investments. Bonds may be secured or unsecured, term or serial, callable, or convertible.

9 -6 LO 2 Identify the characteristics of bonds o o A bond indenture is a contract between a firm issuing bonds and the corporations or individuals who purchase the bonds as investments. Bonds may be secured or unsecured, term or serial, callable, or convertible.

9 -7 Secured and Unsecured Bonds o Secured Bonds are supported by specific assets the issuer has pledged as collateral. o o o Mortgage bonds are backed by specific real estate assets. If the borrower defaults on the payments, the lender is entitled to the real estate pledged as collateral. Unsecured bonds, also referred to as debentures, are not backed by a specific asset. o Secured only by the “full faith and credit” of the borrower

9 -7 Secured and Unsecured Bonds o Secured Bonds are supported by specific assets the issuer has pledged as collateral. o o o Mortgage bonds are backed by specific real estate assets. If the borrower defaults on the payments, the lender is entitled to the real estate pledged as collateral. Unsecured bonds, also referred to as debentures, are not backed by a specific asset. o Secured only by the “full faith and credit” of the borrower

9 -8 Term and Serial Bonds o Term bonds require payment of the full principal amount of the bond at a single maturity date. o Most bonds have this characteristic. o To ensure that sufficient funds are available to repay the amount at maturity, the borrower sets aside money in a “sinking fund. ” o o A sinking fund is an investment fund used to set aside money to pay the outstanding debt as it comes due. Serial bonds require payments in instalments over a series of years. o It makes it easier for the borrower to meet its bond obligations as they become due.

9 -8 Term and Serial Bonds o Term bonds require payment of the full principal amount of the bond at a single maturity date. o Most bonds have this characteristic. o To ensure that sufficient funds are available to repay the amount at maturity, the borrower sets aside money in a “sinking fund. ” o o A sinking fund is an investment fund used to set aside money to pay the outstanding debt as it comes due. Serial bonds require payments in instalments over a series of years. o It makes it easier for the borrower to meet its bond obligations as they become due.

9 -9 Callable Bonds o o Most corporate bonds are callable, or redeemable. Allows the borrower to repay the bonds before their scheduled maturity date at a specified call price. o o Call price is stated in the bond contract and usually exceeds the bond’s face amount. It helps protect the borrower against future decreases in interest rates. If interest rates decline, the borrower can buy back the highinterest rate bonds at a fixed price and issue new bonds at the new, lower interest rate.

9 -9 Callable Bonds o o Most corporate bonds are callable, or redeemable. Allows the borrower to repay the bonds before their scheduled maturity date at a specified call price. o o Call price is stated in the bond contract and usually exceeds the bond’s face amount. It helps protect the borrower against future decreases in interest rates. If interest rates decline, the borrower can buy back the highinterest rate bonds at a fixed price and issue new bonds at the new, lower interest rate.

9 -10 Convertible Bonds o o o While callable bonds benefit the borrower, convertible bonds benefit both the borrower and the lender. Convertible bonds allow the lender to convert each bond into a specified number of shares of common stock. For example, A $1, 000 convertible bond can be converted into 20 shares of common stock. The borrower also benefits. Convertible bonds sell at a higher price and require a lower interest rate than bonds without a conversion feature.

9 -10 Convertible Bonds o o o While callable bonds benefit the borrower, convertible bonds benefit both the borrower and the lender. Convertible bonds allow the lender to convert each bond into a specified number of shares of common stock. For example, A $1, 000 convertible bond can be converted into 20 shares of common stock. The borrower also benefits. Convertible bonds sell at a higher price and require a lower interest rate than bonds without a conversion feature.

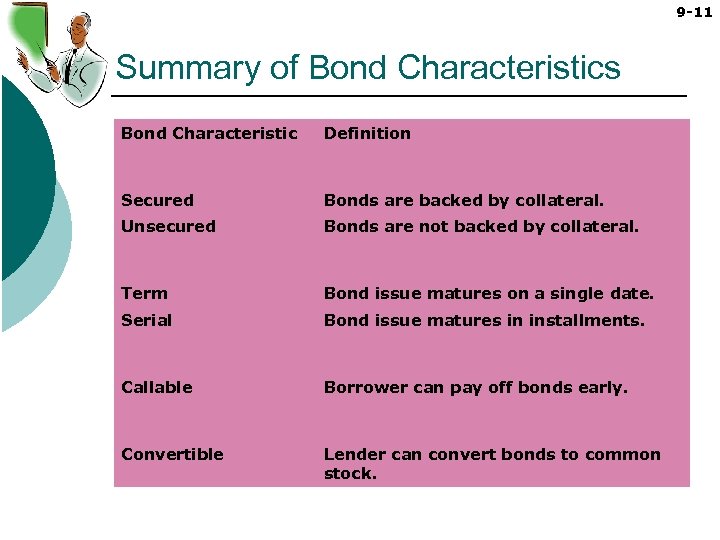

9 -11 Summary of Bond Characteristics Bond Characteristic Definition Secured Bonds are backed by collateral. Unsecured Bonds are not backed by collateral. Term Bond issue matures on a single date. Serial Bond issue matures in installments. Callable Borrower can pay off bonds early. Convertible Lender can convert bonds to common stock.

9 -11 Summary of Bond Characteristics Bond Characteristic Definition Secured Bonds are backed by collateral. Unsecured Bonds are not backed by collateral. Term Bond issue matures on a single date. Serial Bond issue matures in installments. Callable Borrower can pay off bonds early. Convertible Lender can convert bonds to common stock.

© 2009 The Mc. Graw-Hill Companies, Inc. Part B Bond Pricing

© 2009 The Mc. Graw-Hill Companies, Inc. Part B Bond Pricing

9 -13 LO 3 Pricing a Bond o Issue price is calculated as the present value of the face amount plus the present value of the periodic interest payments. o Bonds can be issued at: o o Face amount Below face amount (discount) Above face amount (premium) Ways to determine the issue price of bonds: o o Financial calculator. Calculate the price of the bonds using present value tables.

9 -13 LO 3 Pricing a Bond o Issue price is calculated as the present value of the face amount plus the present value of the periodic interest payments. o Bonds can be issued at: o o Face amount Below face amount (discount) Above face amount (premium) Ways to determine the issue price of bonds: o o Financial calculator. Calculate the price of the bonds using present value tables.

9 -14 Pricing a Bond (cont. ) o Market Interest Rate – true interest rate used by investors to value a company’s bond issue. o o o The higher the market interest rate, the lower the bond issue price will be. Stated Interest Rate – rate quoted in the bond contract used to calculate the cash payments for interest. Periods to Maturity – number of years to maturity multiplied by the number of interest payments per year.

9 -14 Pricing a Bond (cont. ) o Market Interest Rate – true interest rate used by investors to value a company’s bond issue. o o o The higher the market interest rate, the lower the bond issue price will be. Stated Interest Rate – rate quoted in the bond contract used to calculate the cash payments for interest. Periods to Maturity – number of years to maturity multiplied by the number of interest payments per year.

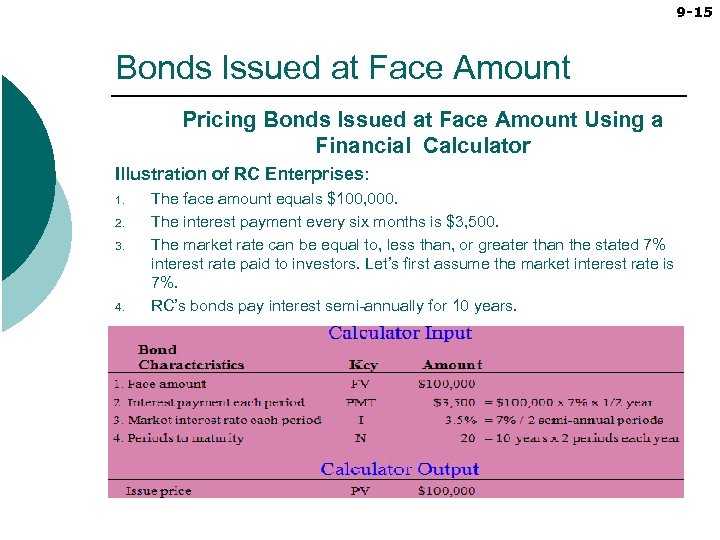

9 -15 Bonds Issued at Face Amount Pricing Bonds Issued at Face Amount Using a Financial Calculator Illustration of RC Enterprises: 1. 2. 3. 4. The face amount equals $100, 000. The interest payment every six months is $3, 500. The market rate can be equal to, less than, or greater than the stated 7% interest rate paid to investors. Let’s first assume the market interest rate is 7%. RC’s bonds pay interest semi-annually for 10 years.

9 -15 Bonds Issued at Face Amount Pricing Bonds Issued at Face Amount Using a Financial Calculator Illustration of RC Enterprises: 1. 2. 3. 4. The face amount equals $100, 000. The interest payment every six months is $3, 500. The market rate can be equal to, less than, or greater than the stated 7% interest rate paid to investors. Let’s first assume the market interest rate is 7%. RC’s bonds pay interest semi-annually for 10 years.

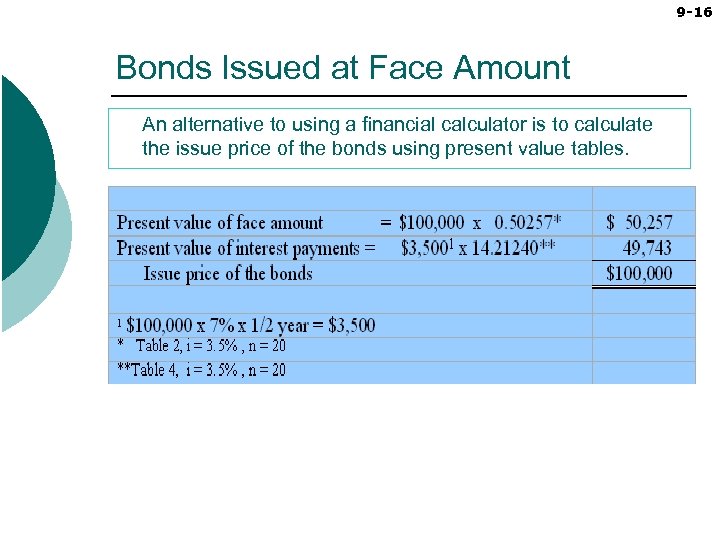

9 -16 Bonds Issued at Face Amount An alternative to using a financial calculator is to calculate the issue price of the bonds using present value tables.

9 -16 Bonds Issued at Face Amount An alternative to using a financial calculator is to calculate the issue price of the bonds using present value tables.

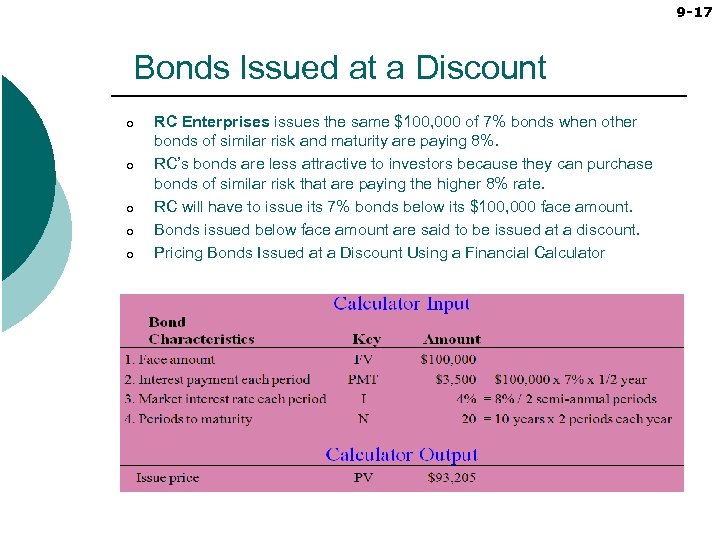

9 -17 Bonds Issued at a Discount o o o RC Enterprises issues the same $100, 000 of 7% bonds when other bonds of similar risk and maturity are paying 8%. RC’s bonds are less attractive to investors because they can purchase bonds of similar risk that are paying the higher 8% rate. RC will have to issue its 7% bonds below its $100, 000 face amount. Bonds issued below face amount are said to be issued at a discount. Pricing Bonds Issued at a Discount Using a Financial Calculator

9 -17 Bonds Issued at a Discount o o o RC Enterprises issues the same $100, 000 of 7% bonds when other bonds of similar risk and maturity are paying 8%. RC’s bonds are less attractive to investors because they can purchase bonds of similar risk that are paying the higher 8% rate. RC will have to issue its 7% bonds below its $100, 000 face amount. Bonds issued below face amount are said to be issued at a discount. Pricing Bonds Issued at a Discount Using a Financial Calculator

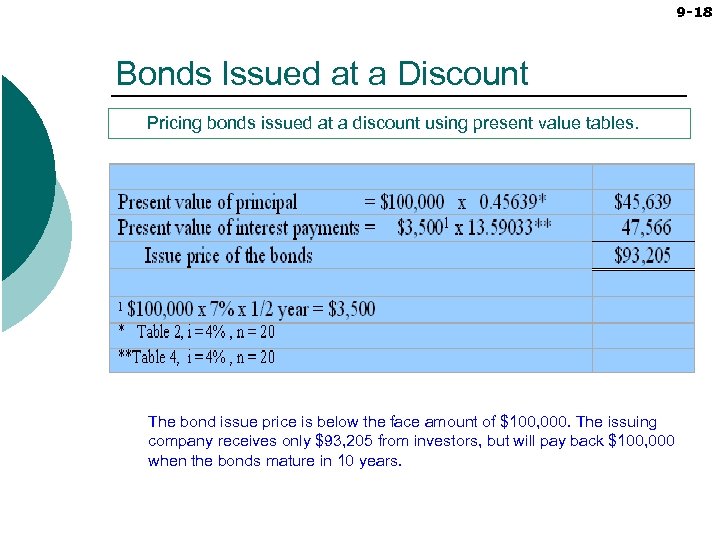

9 -18 Bonds Issued at a Discount Pricing bonds issued at a discount using present value tables. The bond issue price is below the face amount of $100, 000. The issuing company receives only $93, 205 from investors, but will pay back $100, 000 when the bonds mature in 10 years.

9 -18 Bonds Issued at a Discount Pricing bonds issued at a discount using present value tables. The bond issue price is below the face amount of $100, 000. The issuing company receives only $93, 205 from investors, but will pay back $100, 000 when the bonds mature in 10 years.

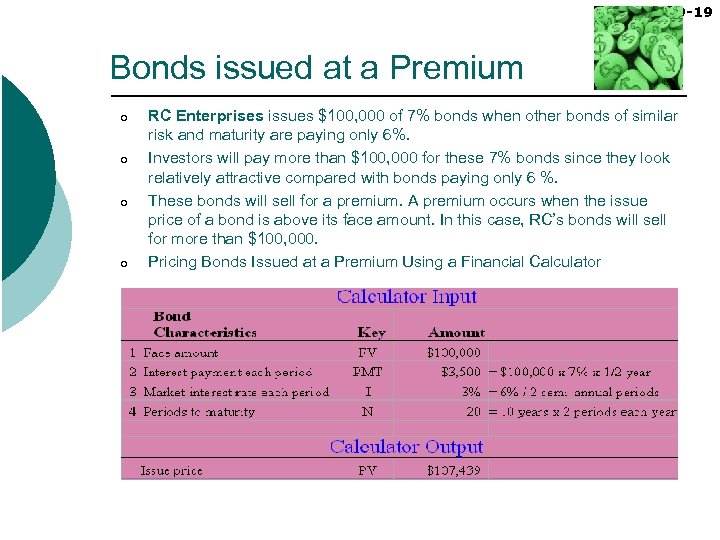

9 -19 Bonds issued at a Premium o o RC Enterprises issues $100, 000 of 7% bonds when other bonds of similar risk and maturity are paying only 6%. Investors will pay more than $100, 000 for these 7% bonds since they look relatively attractive compared with bonds paying only 6 %. These bonds will sell for a premium. A premium occurs when the issue price of a bond is above its face amount. In this case, RC’s bonds will sell for more than $100, 000. Pricing Bonds Issued at a Premium Using a Financial Calculator

9 -19 Bonds issued at a Premium o o RC Enterprises issues $100, 000 of 7% bonds when other bonds of similar risk and maturity are paying only 6%. Investors will pay more than $100, 000 for these 7% bonds since they look relatively attractive compared with bonds paying only 6 %. These bonds will sell for a premium. A premium occurs when the issue price of a bond is above its face amount. In this case, RC’s bonds will sell for more than $100, 000. Pricing Bonds Issued at a Premium Using a Financial Calculator

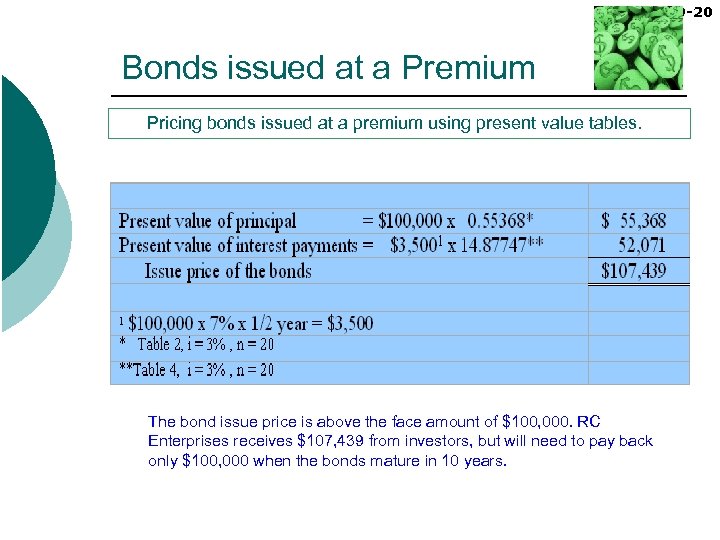

9 -20 Bonds issued at a Premium Pricing bonds issued at a premium using present value tables. The bond issue price is above the face amount of $100, 000. RC Enterprises receives $107, 439 from investors, but will need to pay back only $100, 000 when the bonds mature in 10 years.

9 -20 Bonds issued at a Premium Pricing bonds issued at a premium using present value tables. The bond issue price is above the face amount of $100, 000. RC Enterprises receives $107, 439 from investors, but will need to pay back only $100, 000 when the bonds mature in 10 years.

© 2009 The Mc. Graw-Hill Companies, Inc. Part C Recording Bonds Payable

© 2009 The Mc. Graw-Hill Companies, Inc. Part C Recording Bonds Payable

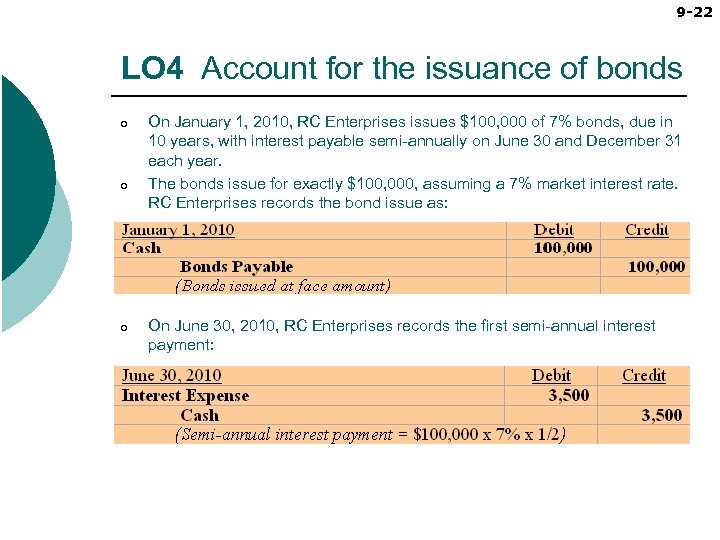

9 -22 LO 4 Account for the issuance of bonds o o o On January 1, 2010, RC Enterprises issues $100, 000 of 7% bonds, due in 10 years, with interest payable semi-annually on June 30 and December 31 each year. The bonds issue for exactly $100, 000, assuming a 7% market interest rate. RC Enterprises records the bond issue as: On June 30, 2010, RC Enterprises records the first semi-annual interest payment:

9 -22 LO 4 Account for the issuance of bonds o o o On January 1, 2010, RC Enterprises issues $100, 000 of 7% bonds, due in 10 years, with interest payable semi-annually on June 30 and December 31 each year. The bonds issue for exactly $100, 000, assuming a 7% market interest rate. RC Enterprises records the bond issue as: On June 30, 2010, RC Enterprises records the first semi-annual interest payment:

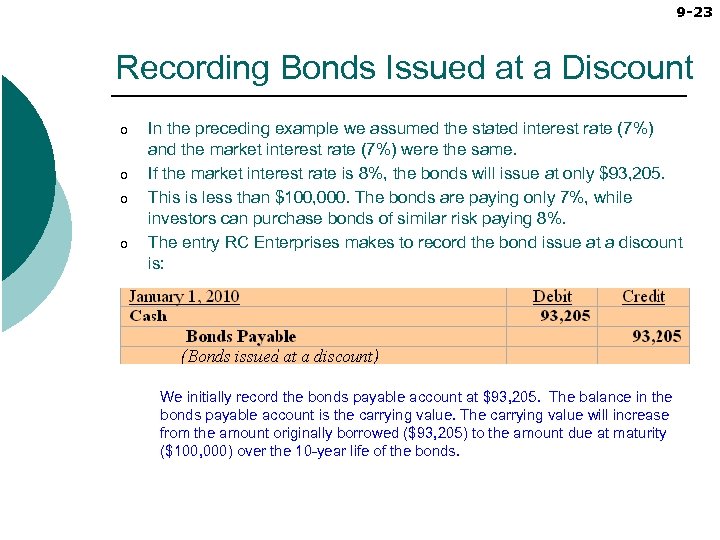

9 -23 Recording Bonds Issued at a Discount o o In the preceding example we assumed the stated interest rate (7%) and the market interest rate (7%) were the same. If the market interest rate is 8%, the bonds will issue at only $93, 205. This is less than $100, 000. The bonds are paying only 7%, while investors can purchase bonds of similar risk paying 8%. The entry RC Enterprises makes to record the bond issue at a discount is: We initially record the bonds payable account at $93, 205. The balance in the bonds payable account is the carrying value. The carrying value will increase from the amount originally borrowed ($93, 205) to the amount due at maturity ($100, 000) over the 10 -year life of the bonds.

9 -23 Recording Bonds Issued at a Discount o o In the preceding example we assumed the stated interest rate (7%) and the market interest rate (7%) were the same. If the market interest rate is 8%, the bonds will issue at only $93, 205. This is less than $100, 000. The bonds are paying only 7%, while investors can purchase bonds of similar risk paying 8%. The entry RC Enterprises makes to record the bond issue at a discount is: We initially record the bonds payable account at $93, 205. The balance in the bonds payable account is the carrying value. The carrying value will increase from the amount originally borrowed ($93, 205) to the amount due at maturity ($100, 000) over the 10 -year life of the bonds.

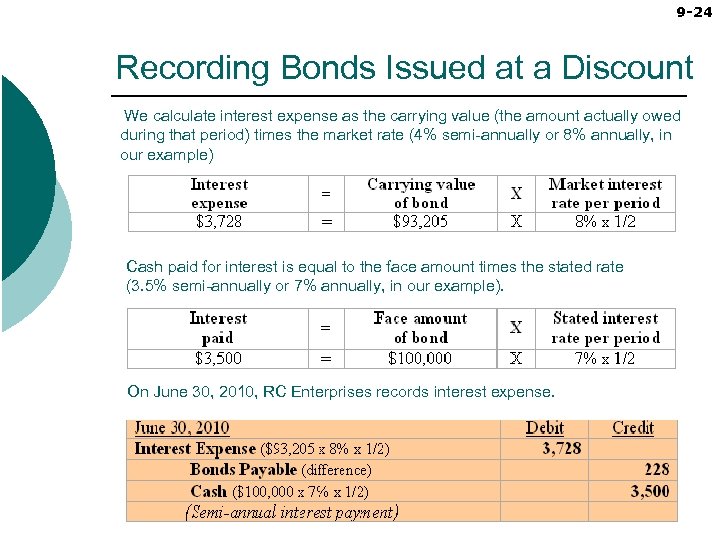

9 -24 Recording Bonds Issued at a Discount We calculate interest expense as the carrying value (the amount actually owed during that period) times the market rate (4% semi-annually or 8% annually, in our example) Cash paid for interest is equal to the face amount times the stated rate (3. 5% semi-annually or 7% annually, in our example). On June 30, 2010, RC Enterprises records interest expense.

9 -24 Recording Bonds Issued at a Discount We calculate interest expense as the carrying value (the amount actually owed during that period) times the market rate (4% semi-annually or 8% annually, in our example) Cash paid for interest is equal to the face amount times the stated rate (3. 5% semi-annually or 7% annually, in our example). On June 30, 2010, RC Enterprises records interest expense.

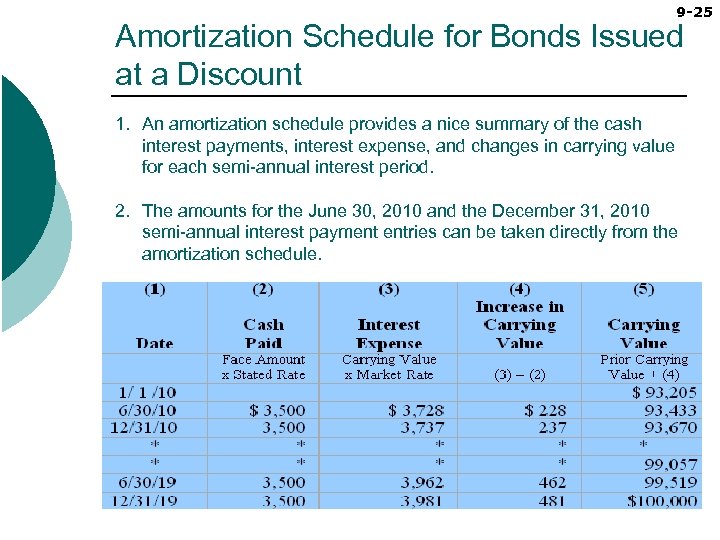

9 -25 Amortization Schedule for Bonds Issued at a Discount 1. An amortization schedule provides a nice summary of the cash interest payments, interest expense, and changes in carrying value for each semi-annual interest period. 2. The amounts for the June 30, 2010 and the December 31, 2010 semi-annual interest payment entries can be taken directly from the amortization schedule.

9 -25 Amortization Schedule for Bonds Issued at a Discount 1. An amortization schedule provides a nice summary of the cash interest payments, interest expense, and changes in carrying value for each semi-annual interest period. 2. The amounts for the June 30, 2010 and the December 31, 2010 semi-annual interest payment entries can be taken directly from the amortization schedule.

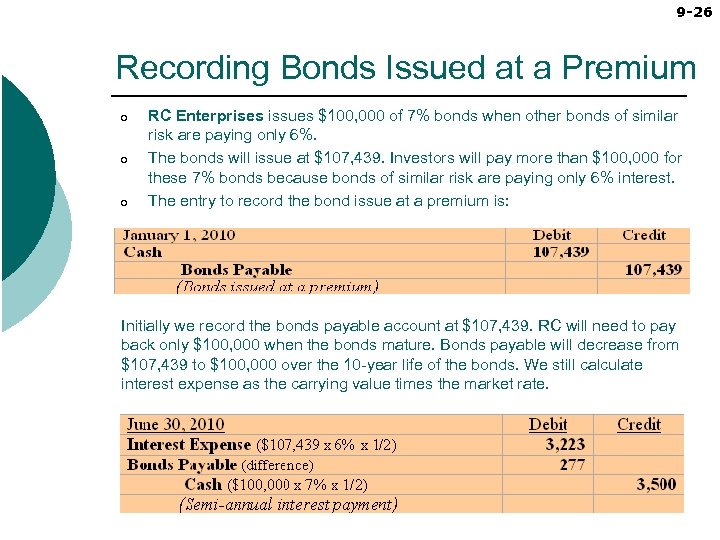

9 -26 Recording Bonds Issued at a Premium o o o RC Enterprises issues $100, 000 of 7% bonds when other bonds of similar risk are paying only 6%. The bonds will issue at $107, 439. Investors will pay more than $100, 000 for these 7% bonds because bonds of similar risk are paying only 6% interest. The entry to record the bond issue at a premium is: Initially we record the bonds payable account at $107, 439. RC will need to pay back only $100, 000 when the bonds mature. Bonds payable will decrease from $107, 439 to $100, 000 over the 10 -year life of the bonds. We still calculate interest expense as the carrying value times the market rate.

9 -26 Recording Bonds Issued at a Premium o o o RC Enterprises issues $100, 000 of 7% bonds when other bonds of similar risk are paying only 6%. The bonds will issue at $107, 439. Investors will pay more than $100, 000 for these 7% bonds because bonds of similar risk are paying only 6% interest. The entry to record the bond issue at a premium is: Initially we record the bonds payable account at $107, 439. RC will need to pay back only $100, 000 when the bonds mature. Bonds payable will decrease from $107, 439 to $100, 000 over the 10 -year life of the bonds. We still calculate interest expense as the carrying value times the market rate.

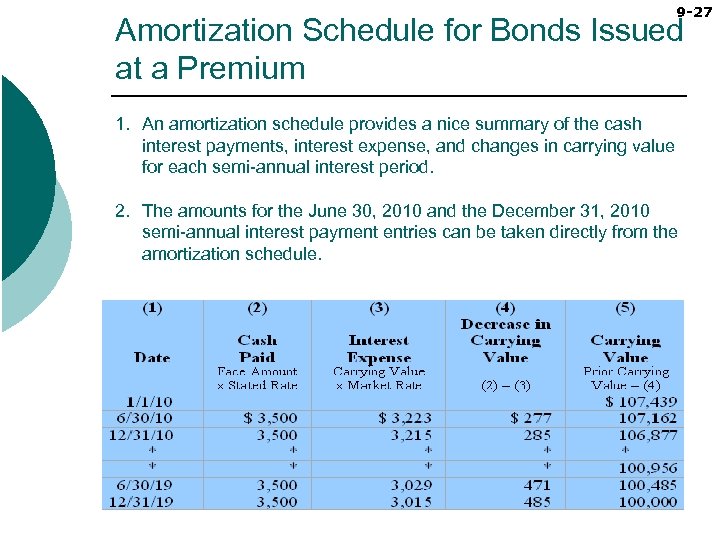

9 -27 Amortization Schedule for Bonds Issued at a Premium 1. An amortization schedule provides a nice summary of the cash interest payments, interest expense, and changes in carrying value for each semi-annual interest period. 2. The amounts for the June 30, 2010 and the December 31, 2010 semi-annual interest payment entries can be taken directly from the amortization schedule.

9 -27 Amortization Schedule for Bonds Issued at a Premium 1. An amortization schedule provides a nice summary of the cash interest payments, interest expense, and changes in carrying value for each semi-annual interest period. 2. The amounts for the June 30, 2010 and the December 31, 2010 semi-annual interest payment entries can be taken directly from the amortization schedule.

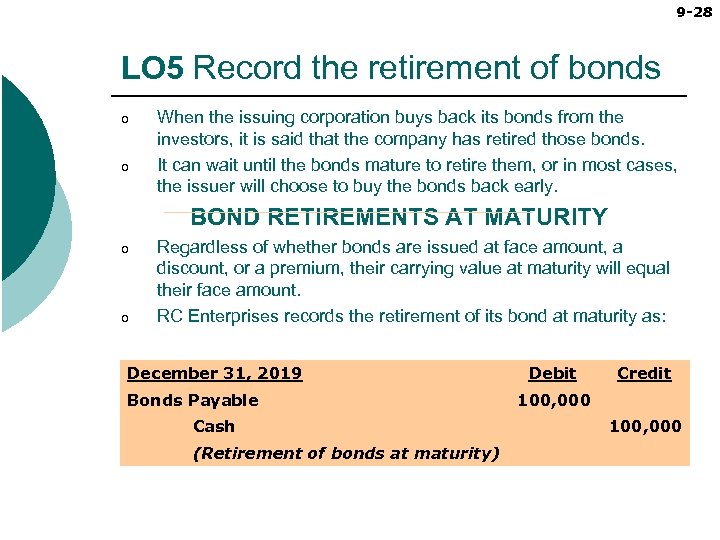

9 -28 LO 5 Record the retirement of bonds o o When the issuing corporation buys back its bonds from the investors, it is said that the company has retired those bonds. It can wait until the bonds mature to retire them, or in most cases, the issuer will choose to buy the bonds back early. BOND RETIREMENTS AT MATURITY o o Regardless of whether bonds are issued at face amount, a discount, or a premium, their carrying value at maturity will equal their face amount. RC Enterprises records the retirement of its bond at maturity as: December 31, 2019 Bonds Payable Cash (Retirement of bonds at maturity) Debit Credit 100, 000

9 -28 LO 5 Record the retirement of bonds o o When the issuing corporation buys back its bonds from the investors, it is said that the company has retired those bonds. It can wait until the bonds mature to retire them, or in most cases, the issuer will choose to buy the bonds back early. BOND RETIREMENTS AT MATURITY o o Regardless of whether bonds are issued at face amount, a discount, or a premium, their carrying value at maturity will equal their face amount. RC Enterprises records the retirement of its bond at maturity as: December 31, 2019 Bonds Payable Cash (Retirement of bonds at maturity) Debit Credit 100, 000

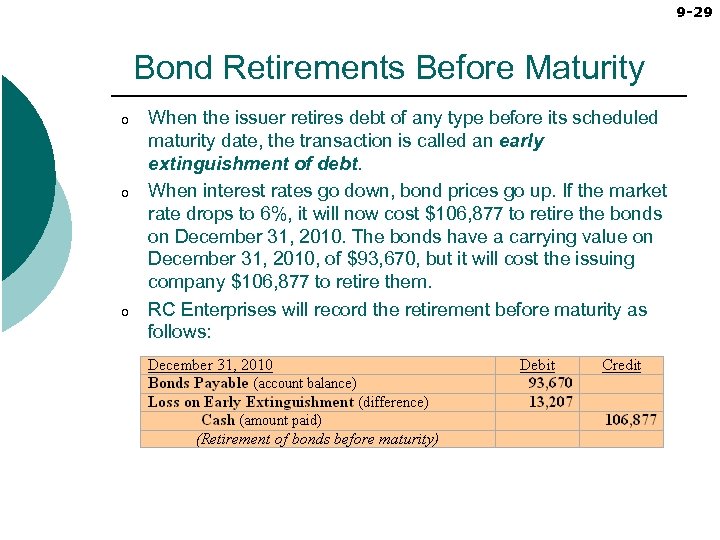

9 -29 Bond Retirements Before Maturity o o o When the issuer retires debt of any type before its scheduled maturity date, the transaction is called an early extinguishment of debt. When interest rates go down, bond prices go up. If the market rate drops to 6%, it will now cost $106, 877 to retire the bonds on December 31, 2010. The bonds have a carrying value on December 31, 2010, of $93, 670, but it will cost the issuing company $106, 877 to retire them. RC Enterprises will record the retirement before maturity as follows:

9 -29 Bond Retirements Before Maturity o o o When the issuer retires debt of any type before its scheduled maturity date, the transaction is called an early extinguishment of debt. When interest rates go down, bond prices go up. If the market rate drops to 6%, it will now cost $106, 877 to retire the bonds on December 31, 2010. The bonds have a carrying value on December 31, 2010, of $93, 670, but it will cost the issuing company $106, 877 to retire them. RC Enterprises will record the retirement before maturity as follows:

© 2009 The Mc. Graw-Hill Companies, Inc. Part D Other Long-Term Liabilities and Debt Analysis

© 2009 The Mc. Graw-Hill Companies, Inc. Part D Other Long-Term Liabilities and Debt Analysis

LO 6 Identify other major long-term liabilities Three common long-term liabilities other than bonds payable are: 1. 2. 3. Long-Term Notes Payable Leases Deferred Taxes 9 -31

LO 6 Identify other major long-term liabilities Three common long-term liabilities other than bonds payable are: 1. 2. 3. Long-Term Notes Payable Leases Deferred Taxes 9 -31

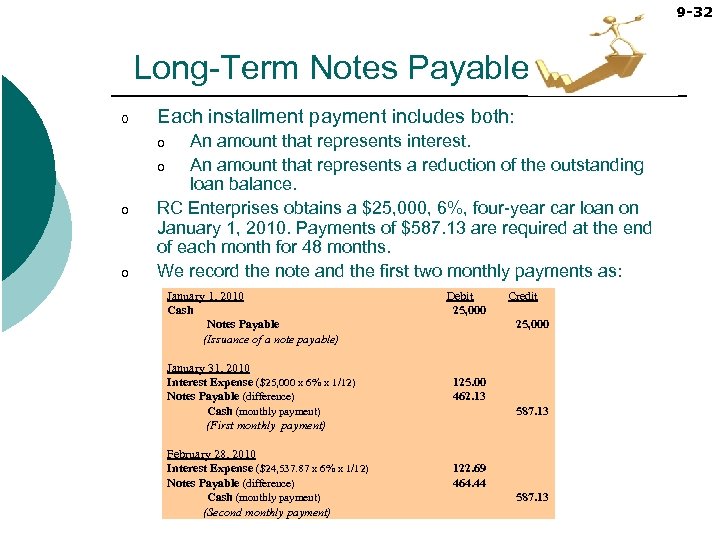

9 -32 Long-Term Notes Payable o Each installment payment includes both: An amount that represents interest. o An amount that represents a reduction of the outstanding loan balance. RC Enterprises obtains a $25, 000, 6%, four-year car loan on January 1, 2010. Payments of $587. 13 are required at the end of each month for 48 months. We record the note and the first two monthly payments as: o o o January 1, 2010 Cash Notes Payable (Issuance of a note payable) January 31, 2010 Interest Expense ($25, 000 x 6% x 1/12) Notes Payable (difference) Cash (monthly payment) (First monthly payment) February 28, 2010 Interest Expense ($24, 537. 87 x 6% x 1/12) Notes Payable (difference) Cash (monthly payment) (Second monthly payment) Debit 25, 000 Credit 25, 000 125. 00 462. 13 587. 13 122. 69 464. 44 587. 13

9 -32 Long-Term Notes Payable o Each installment payment includes both: An amount that represents interest. o An amount that represents a reduction of the outstanding loan balance. RC Enterprises obtains a $25, 000, 6%, four-year car loan on January 1, 2010. Payments of $587. 13 are required at the end of each month for 48 months. We record the note and the first two monthly payments as: o o o January 1, 2010 Cash Notes Payable (Issuance of a note payable) January 31, 2010 Interest Expense ($25, 000 x 6% x 1/12) Notes Payable (difference) Cash (monthly payment) (First monthly payment) February 28, 2010 Interest Expense ($24, 537. 87 x 6% x 1/12) Notes Payable (difference) Cash (monthly payment) (Second monthly payment) Debit 25, 000 Credit 25, 000 125. 00 462. 13 587. 13 122. 69 464. 44 587. 13

9 -33 Leases o o o A lease is a contractual agreement by which the lessor (owner) provides the lessee (user) the right to use an asset for a specific period of time. Approximately one-third of all corporate financing in the United States is through leasing. For accounting purposes, we have two basic types of leases: operating leases and capital leases o o Operating Leases: This type of a lease is similar to a rental. Example: Car rentals and short-term apartment leases. Capital Leases: Occurs when a lessee buys an asset and borrows the money through a lease to pay for the asset. Example: A borrower signs a four-year lease for a car that automatically transfers ownership at the end of the lease term.

9 -33 Leases o o o A lease is a contractual agreement by which the lessor (owner) provides the lessee (user) the right to use an asset for a specific period of time. Approximately one-third of all corporate financing in the United States is through leasing. For accounting purposes, we have two basic types of leases: operating leases and capital leases o o Operating Leases: This type of a lease is similar to a rental. Example: Car rentals and short-term apartment leases. Capital Leases: Occurs when a lessee buys an asset and borrows the money through a lease to pay for the asset. Example: A borrower signs a four-year lease for a car that automatically transfers ownership at the end of the lease term.

9 -34 Deferred Taxes o o Net income in the income statement is not the same amount as taxable income reported to the Internal Revenue Service (IRS). Net income is based on financial accounting rules, while taxable income in the corporate tax return is based on tax accounting rules. There are many differences between financial accounting rules and tax accounting rules. Differences between financial accounting and tax accounting result in a company being permitted to defer paying some of its income tax expense, in which case it will report a deferred tax liability. Or the company may be required to defer a tax benefit, in which case it will report a deferred tax asset.

9 -34 Deferred Taxes o o Net income in the income statement is not the same amount as taxable income reported to the Internal Revenue Service (IRS). Net income is based on financial accounting rules, while taxable income in the corporate tax return is based on tax accounting rules. There are many differences between financial accounting rules and tax accounting rules. Differences between financial accounting and tax accounting result in a company being permitted to defer paying some of its income tax expense, in which case it will report a deferred tax liability. Or the company may be required to defer a tax benefit, in which case it will report a deferred tax asset.

9 -35 LO 7 Make financial decisions using longterm liability ratios Debt Analysis o o o Business decisions include risk. Failure to properly consider risk in those decisions is one of the most costly, yet most common, mistakes investors and creditors make. Long-term debt is one of the first places decision makers should look when trying to manage risk. To measure a company’s risk, we calculate the debt to equity ratio and the times interest earned ratio.

9 -35 LO 7 Make financial decisions using longterm liability ratios Debt Analysis o o o Business decisions include risk. Failure to properly consider risk in those decisions is one of the most costly, yet most common, mistakes investors and creditors make. Long-term debt is one of the first places decision makers should look when trying to manage risk. To measure a company’s risk, we calculate the debt to equity ratio and the times interest earned ratio.

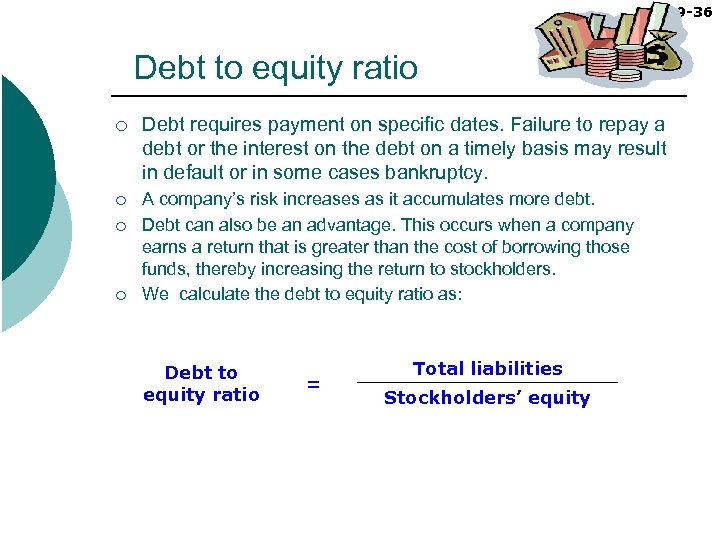

9 -36 Debt to equity ratio ¡ Debt requires payment on specific dates. Failure to repay a debt or the interest on the debt on a timely basis may result in default or in some cases bankruptcy. ¡ A company’s risk increases as it accumulates more debt. Debt can also be an advantage. This occurs when a company earns a return that is greater than the cost of borrowing those funds, thereby increasing the return to stockholders. We calculate the debt to equity ratio as: ¡ ¡ Debt to equity ratio = Total liabilities Stockholders’ equity

9 -36 Debt to equity ratio ¡ Debt requires payment on specific dates. Failure to repay a debt or the interest on the debt on a timely basis may result in default or in some cases bankruptcy. ¡ A company’s risk increases as it accumulates more debt. Debt can also be an advantage. This occurs when a company earns a return that is greater than the cost of borrowing those funds, thereby increasing the return to stockholders. We calculate the debt to equity ratio as: ¡ ¡ Debt to equity ratio = Total liabilities Stockholders’ equity

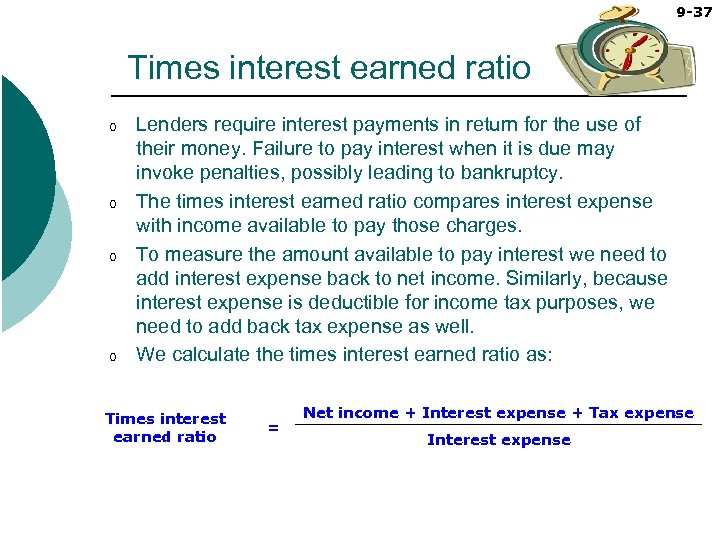

9 -37 Times interest earned ratio o o Lenders require interest payments in return for the use of their money. Failure to pay interest when it is due may invoke penalties, possibly leading to bankruptcy. The times interest earned ratio compares interest expense with income available to pay those charges. To measure the amount available to pay interest we need to add interest expense back to net income. Similarly, because interest expense is deductible for income tax purposes, we need to add back tax expense as well. We calculate the times interest earned ratio as: Times interest earned ratio = Net income + Interest expense + Tax expense Interest expense

9 -37 Times interest earned ratio o o Lenders require interest payments in return for the use of their money. Failure to pay interest when it is due may invoke penalties, possibly leading to bankruptcy. The times interest earned ratio compares interest expense with income available to pay those charges. To measure the amount available to pay interest we need to add interest expense back to net income. Similarly, because interest expense is deductible for income tax purposes, we need to add back tax expense as well. We calculate the times interest earned ratio as: Times interest earned ratio = Net income + Interest expense + Tax expense Interest expense

© 2009 The Mc. Graw-Hill Companies, Inc. Appendix Bond Investments

© 2009 The Mc. Graw-Hill Companies, Inc. Appendix Bond Investments

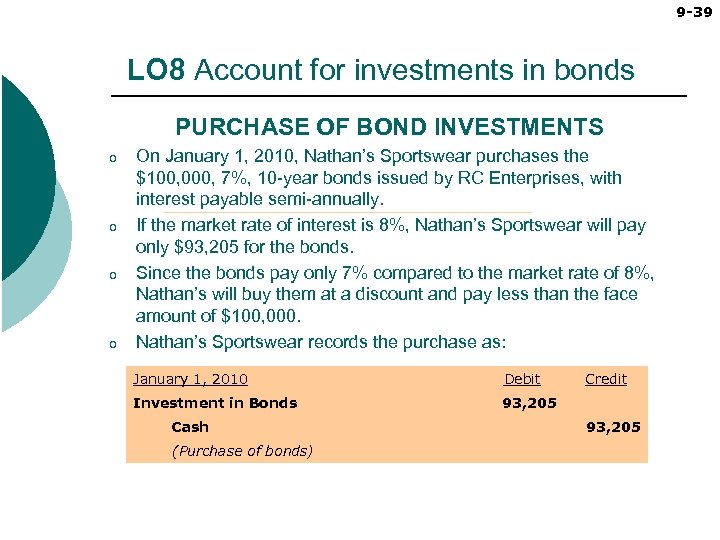

9 -39 LO 8 Account for investments in bonds PURCHASE OF BOND INVESTMENTS o o On January 1, 2010, Nathan’s Sportswear purchases the $100, 000, 7%, 10 -year bonds issued by RC Enterprises, with interest payable semi-annually. If the market rate of interest is 8%, Nathan’s Sportswear will pay only $93, 205 for the bonds. Since the bonds pay only 7% compared to the market rate of 8%, Nathan’s will buy them at a discount and pay less than the face amount of $100, 000. Nathan’s Sportswear records the purchase as: January 1, 2010 Debit Investment in Bonds 93, 205 Cash (Purchase of bonds) Credit 93, 205

9 -39 LO 8 Account for investments in bonds PURCHASE OF BOND INVESTMENTS o o On January 1, 2010, Nathan’s Sportswear purchases the $100, 000, 7%, 10 -year bonds issued by RC Enterprises, with interest payable semi-annually. If the market rate of interest is 8%, Nathan’s Sportswear will pay only $93, 205 for the bonds. Since the bonds pay only 7% compared to the market rate of 8%, Nathan’s will buy them at a discount and pay less than the face amount of $100, 000. Nathan’s Sportswear records the purchase as: January 1, 2010 Debit Investment in Bonds 93, 205 Cash (Purchase of bonds) Credit 93, 205

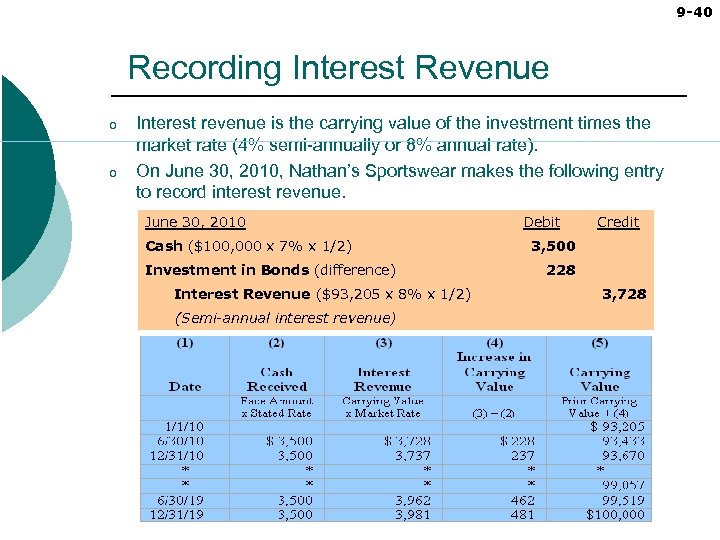

9 -40 Recording Interest Revenue o o Interest revenue is the carrying value of the investment times the market rate (4% semi-annually or 8% annual rate). On June 30, 2010, Nathan’s Sportswear makes the following entry to record interest revenue. June 30, 2010 Cash ($100, 000 x 7% x 1/2) Investment in Bonds (difference) Interest Revenue ($93, 205 x 8% x 1/2) (Semi-annual interest revenue) Debit Credit 3, 500 228 3, 728

9 -40 Recording Interest Revenue o o Interest revenue is the carrying value of the investment times the market rate (4% semi-annually or 8% annual rate). On June 30, 2010, Nathan’s Sportswear makes the following entry to record interest revenue. June 30, 2010 Cash ($100, 000 x 7% x 1/2) Investment in Bonds (difference) Interest Revenue ($93, 205 x 8% x 1/2) (Semi-annual interest revenue) Debit Credit 3, 500 228 3, 728

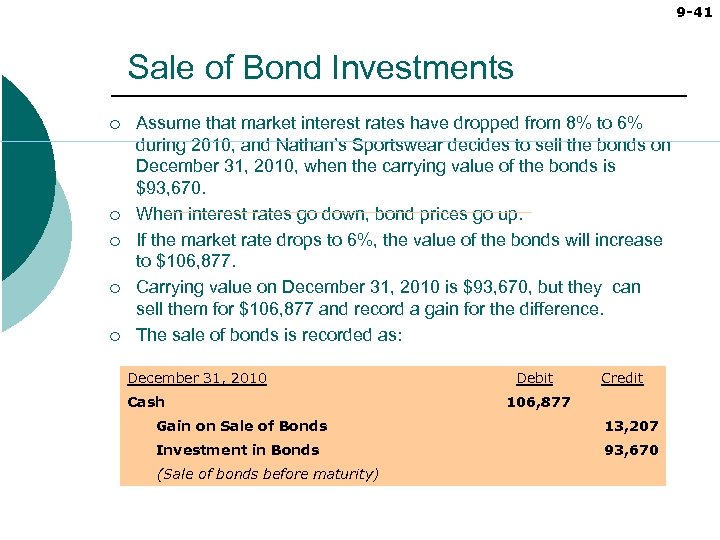

9 -41 Sale of Bond Investments ¡ ¡ ¡ Assume that market interest rates have dropped from 8% to 6% during 2010, and Nathan’s Sportswear decides to sell the bonds on December 31, 2010, when the carrying value of the bonds is $93, 670. When interest rates go down, bond prices go up. If the market rate drops to 6%, the value of the bonds will increase to $106, 877. Carrying value on December 31, 2010 is $93, 670, but they can sell them for $106, 877 and record a gain for the difference. The sale of bonds is recorded as: December 31, 2010 Cash Debit Credit 106, 877 Gain on Sale of Bonds 13, 207 Investment in Bonds 93, 670 (Sale of bonds before maturity)

9 -41 Sale of Bond Investments ¡ ¡ ¡ Assume that market interest rates have dropped from 8% to 6% during 2010, and Nathan’s Sportswear decides to sell the bonds on December 31, 2010, when the carrying value of the bonds is $93, 670. When interest rates go down, bond prices go up. If the market rate drops to 6%, the value of the bonds will increase to $106, 877. Carrying value on December 31, 2010 is $93, 670, but they can sell them for $106, 877 and record a gain for the difference. The sale of bonds is recorded as: December 31, 2010 Cash Debit Credit 106, 877 Gain on Sale of Bonds 13, 207 Investment in Bonds 93, 670 (Sale of bonds before maturity)

© 2009 The Mc. Graw-Hill Companies, Inc. End of chapter 9

© 2009 The Mc. Graw-Hill Companies, Inc. End of chapter 9