46a669fab6739a9b85c1e6c8e3a42243.ppt

- Количество слайдов: 88

2009 Medicare Part D Update and Medicare Advantage in Minnesota: the Other MA Kelli Jo Greiner, MN Board on Aging Jeff Goodmanson, MN DHS Susan Kennedy, MN DHS

2009 Medicare Part D Update and Medicare Advantage in Minnesota: the Other MA Kelli Jo Greiner, MN Board on Aging Jeff Goodmanson, MN DHS Susan Kennedy, MN DHS

Medicare Part D 2009 Update and Medicare Advantage Overview Kelli Jo Greiner Minnesota Board on Aging

Medicare Part D 2009 Update and Medicare Advantage Overview Kelli Jo Greiner Minnesota Board on Aging

2009 Medicare Part D Preview 10/1/08: Mailings and Marketing begin 11/15/08: Open Enrollment begins 12/31/08: Open Enrollment ends 1/1/09: New Plan enrollment effective

2009 Medicare Part D Preview 10/1/08: Mailings and Marketing begin 11/15/08: Open Enrollment begins 12/31/08: Open Enrollment ends 1/1/09: New Plan enrollment effective

Annual Coordinated Election Period (AEP) • People can join, drop, or switch – Prescription drug plans – Medicare Advantage plans with prescription drug coverage

Annual Coordinated Election Period (AEP) • People can join, drop, or switch – Prescription drug plans – Medicare Advantage plans with prescription drug coverage

Minnesota Amounts for 2009 • National Average Part D Basic Premium: $28. 00 • MN Benchmark amount: $33. 19 • MA capitation rate in MN – Ranges from $740. 82 -$874. 60 per month per bene

Minnesota Amounts for 2009 • National Average Part D Basic Premium: $28. 00 • MN Benchmark amount: $33. 19 • MA capitation rate in MN – Ranges from $740. 82 -$874. 60 per month per bene

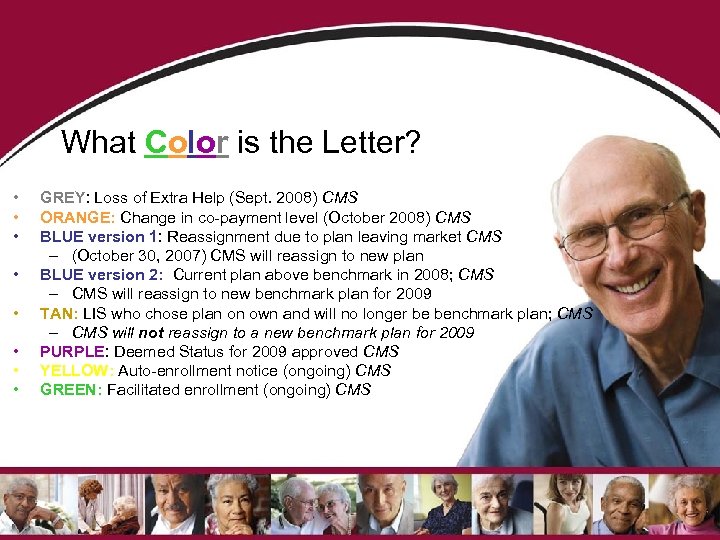

What Color is the Letter? • • GREY: Loss of Extra Help (Sept. 2008) CMS ORANGE: Change in co-payment level (October 2008) CMS BLUE version 1: Reassignment due to plan leaving market CMS – (October 30, 2007) CMS will reassign to new plan BLUE version 2: Current plan above benchmark in 2008; CMS – CMS will reassign to new benchmark plan for 2009 TAN: LIS who chose plan on own and will no longer be benchmark plan; CMS – CMS will not reassign to a new benchmark plan for 2009 PURPLE: Deemed Status for 2009 approved CMS YELLOW: Auto-enrollment notice (ongoing) CMS GREEN: Facilitated enrollment (ongoing) CMS

What Color is the Letter? • • GREY: Loss of Extra Help (Sept. 2008) CMS ORANGE: Change in co-payment level (October 2008) CMS BLUE version 1: Reassignment due to plan leaving market CMS – (October 30, 2007) CMS will reassign to new plan BLUE version 2: Current plan above benchmark in 2008; CMS – CMS will reassign to new benchmark plan for 2009 TAN: LIS who chose plan on own and will no longer be benchmark plan; CMS – CMS will not reassign to a new benchmark plan for 2009 PURPLE: Deemed Status for 2009 approved CMS YELLOW: Auto-enrollment notice (ongoing) CMS GREEN: Facilitated enrollment (ongoing) CMS

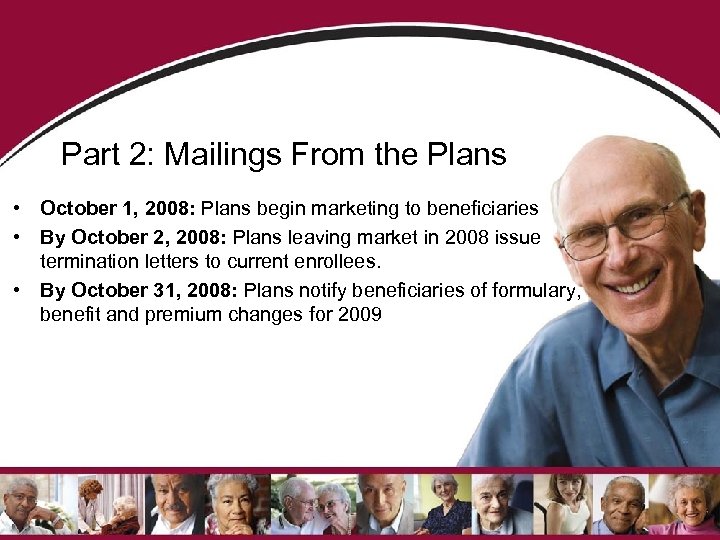

Part 2: Mailings From the Plans • October 1, 2008: Plans begin marketing to beneficiaries • By October 2, 2008: Plans leaving market in 2008 issue termination letters to current enrollees. • By October 31, 2008: Plans notify beneficiaries of formulary, benefit and premium changes for 2009

Part 2: Mailings From the Plans • October 1, 2008: Plans begin marketing to beneficiaries • By October 2, 2008: Plans leaving market in 2008 issue termination letters to current enrollees. • By October 31, 2008: Plans notify beneficiaries of formulary, benefit and premium changes for 2009

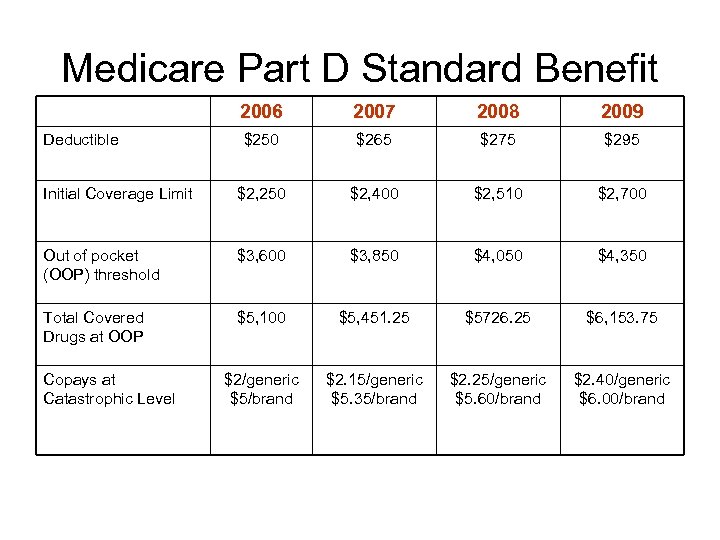

Medicare Part D Standard Benefit 2006 2007 2008 2009 $250 $265 $275 $295 Initial Coverage Limit $2, 250 $2, 400 $2, 510 $2, 700 Out of pocket (OOP) threshold $3, 600 $3, 850 $4, 050 $4, 350 Total Covered Drugs at OOP $5, 100 $5, 451. 25 $5726. 25 $6, 153. 75 $2/generic $5/brand $2. 15/generic $5. 35/brand $2. 25/generic $5. 60/brand $2. 40/generic $6. 00/brand Deductible Copays at Catastrophic Level

Medicare Part D Standard Benefit 2006 2007 2008 2009 $250 $265 $275 $295 Initial Coverage Limit $2, 250 $2, 400 $2, 510 $2, 700 Out of pocket (OOP) threshold $3, 600 $3, 850 $4, 050 $4, 350 Total Covered Drugs at OOP $5, 100 $5, 451. 25 $5726. 25 $6, 153. 75 $2/generic $5/brand $2. 15/generic $5. 35/brand $2. 25/generic $5. 60/brand $2. 40/generic $6. 00/brand Deductible Copays at Catastrophic Level

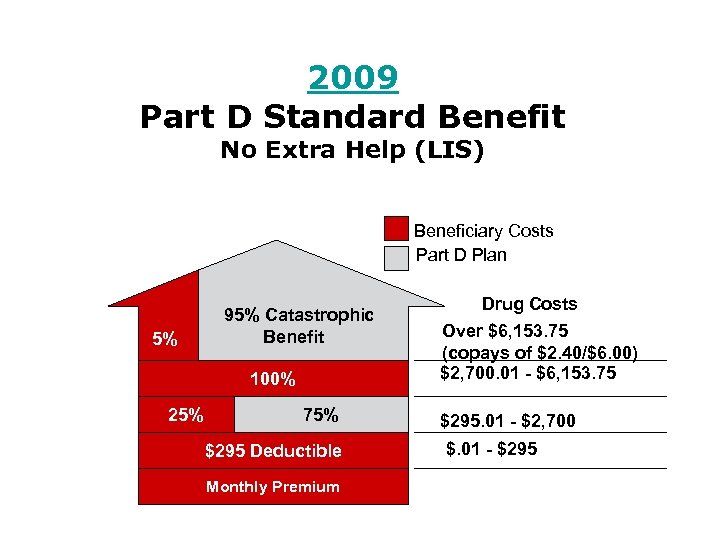

2009 Part D Standard Benefit No Extra Help (LIS) Beneficiary Costs Part D Plan 5% 95% Catastrophic Benefit 100% 25% 75% $295 Deductible Monthly Premium Drug Costs Over $6, 153. 75 (copays of $2. 40/$6. 00) $2, 700. 01 - $6, 153. 75 $295. 01 - $2, 700 $. 01 - $295

2009 Part D Standard Benefit No Extra Help (LIS) Beneficiary Costs Part D Plan 5% 95% Catastrophic Benefit 100% 25% 75% $295 Deductible Monthly Premium Drug Costs Over $6, 153. 75 (copays of $2. 40/$6. 00) $2, 700. 01 - $6, 153. 75 $295. 01 - $2, 700 $. 01 - $295

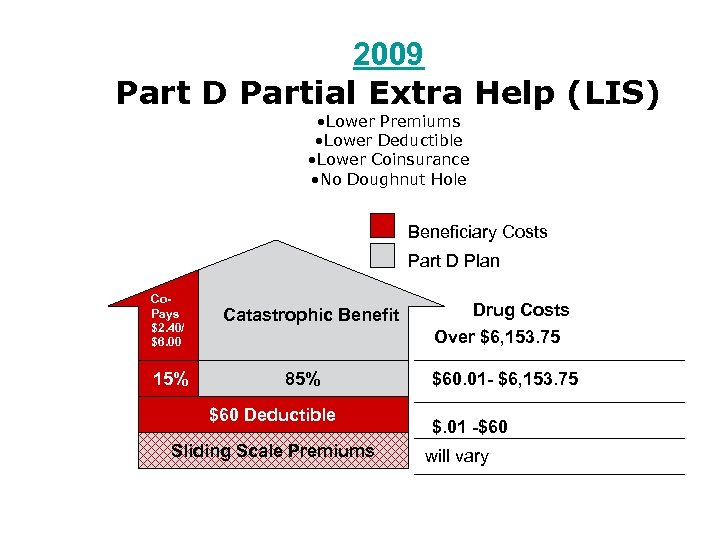

2009 Part D Partial Extra Help (LIS) • Lower Premiums • Lower Deductible • Lower Coinsurance • No Doughnut Hole Beneficiary Costs Part D Plan Co. Pays $2. 40/ $6. 00 15% Catastrophic Benefit 85% $60 Deductible Sliding Scale Premiums Drug Costs Over $6, 153. 75 $60. 01 - $6, 153. 75 $. 01 -$60 will vary

2009 Part D Partial Extra Help (LIS) • Lower Premiums • Lower Deductible • Lower Coinsurance • No Doughnut Hole Beneficiary Costs Part D Plan Co. Pays $2. 40/ $6. 00 15% Catastrophic Benefit 85% $60 Deductible Sliding Scale Premiums Drug Costs Over $6, 153. 75 $60. 01 - $6, 153. 75 $. 01 -$60 will vary

Benchmark • A prescription drug plan with a monthly premium at or below the low income premium subsidy amount. • MN Benchmark amount in 2009 = $33. 19 • Dual eligible premiums for these plans are completely covered by Extra Help – Duals can enroll in non-benchmark plans but will have out of pocket costs for premium

Benchmark • A prescription drug plan with a monthly premium at or below the low income premium subsidy amount. • MN Benchmark amount in 2009 = $33. 19 • Dual eligible premiums for these plans are completely covered by Extra Help – Duals can enroll in non-benchmark plans but will have out of pocket costs for premium

BE AWARE!! • CMS has notified us that the number of dually eligible beneficiaries that will be affected by changes in benchmark plans will be higher in 2009 than 2008.

BE AWARE!! • CMS has notified us that the number of dually eligible beneficiaries that will be affected by changes in benchmark plans will be higher in 2009 than 2008.

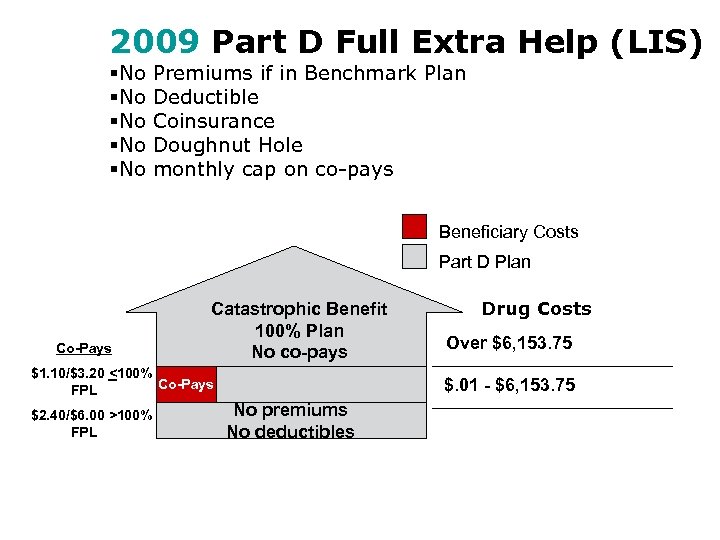

2009 Part D Full Extra Help (LIS) §No §No §No Premiums if in Benchmark Plan Deductible Coinsurance Doughnut Hole monthly cap on co-pays Beneficiary Costs Part D Plan Co-Pays Catastrophic Benefit 100% Plan No co-pays $1. 10/$3. 20 <100% Co-Pays FPL $2. 40/$6. 00 >100% FPL Drug Costs Over $6, 153. 75 $. 01 - $6, 153. 75 No premiums No deductibles

2009 Part D Full Extra Help (LIS) §No §No §No Premiums if in Benchmark Plan Deductible Coinsurance Doughnut Hole monthly cap on co-pays Beneficiary Costs Part D Plan Co-Pays Catastrophic Benefit 100% Plan No co-pays $1. 10/$3. 20 <100% Co-Pays FPL $2. 40/$6. 00 >100% FPL Drug Costs Over $6, 153. 75 $. 01 - $6, 153. 75 No premiums No deductibles

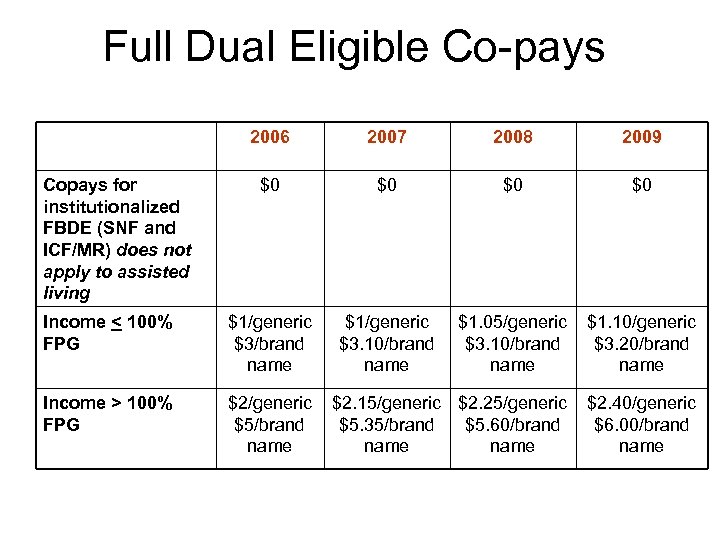

Full Dual Eligible Co-pays 2006 2007 2008 2009 $0 $0 Income < 100% FPG $1/generic $3/brand name $1/generic $3. 10/brand name $1. 05/generic $3. 10/brand name $1. 10/generic $3. 20/brand name Income > 100% FPG $2/generic $5/brand name $2. 15/generic $2. 25/generic $5. 35/brand $5. 60/brand name $2. 40/generic $6. 00/brand name Copays for institutionalized FBDE (SNF and ICF/MR) does not apply to assisted living

Full Dual Eligible Co-pays 2006 2007 2008 2009 $0 $0 Income < 100% FPG $1/generic $3/brand name $1/generic $3. 10/brand name $1. 05/generic $3. 10/brand name $1. 10/generic $3. 20/brand name Income > 100% FPG $2/generic $5/brand name $2. 15/generic $2. 25/generic $5. 35/brand $5. 60/brand name $2. 40/generic $6. 00/brand name Copays for institutionalized FBDE (SNF and ICF/MR) does not apply to assisted living

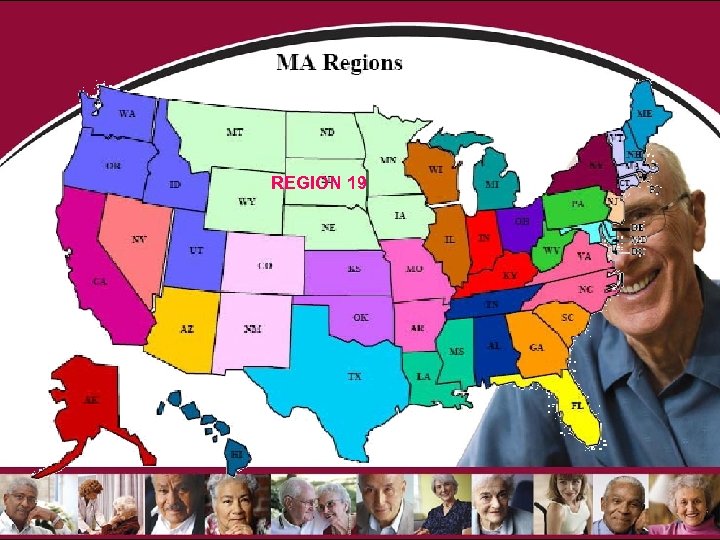

REGION 19

REGION 19

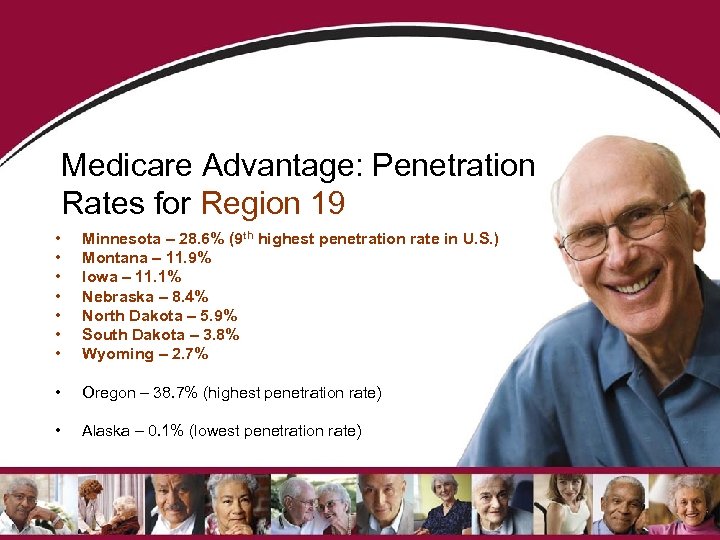

Medicare Advantage: Penetration Rates for Region 19 • • Minnesota – 28. 6% (9 th highest penetration rate in U. S. ) Montana – 11. 9% Iowa – 11. 1% Nebraska – 8. 4% North Dakota – 5. 9% South Dakota – 3. 8% Wyoming – 2. 7% • Oregon – 38. 7% (highest penetration rate) • Alaska – 0. 1% (lowest penetration rate)

Medicare Advantage: Penetration Rates for Region 19 • • Minnesota – 28. 6% (9 th highest penetration rate in U. S. ) Montana – 11. 9% Iowa – 11. 1% Nebraska – 8. 4% North Dakota – 5. 9% South Dakota – 3. 8% Wyoming – 2. 7% • Oregon – 38. 7% (highest penetration rate) • Alaska – 0. 1% (lowest penetration rate)

Medicare Advantage in MN • • • Coordinated Care Plans (Local HMOs and PPO) Cost Based Plans with Part D Regional Preferred Provider Organizations Private Fee-for-Service Special Needs Plans Medicare Medical Savings Accounts

Medicare Advantage in MN • • • Coordinated Care Plans (Local HMOs and PPO) Cost Based Plans with Part D Regional Preferred Provider Organizations Private Fee-for-Service Special Needs Plans Medicare Medical Savings Accounts

Medicare Advantage Option 1 in Minnesota (Medicare A, B and D benefits) • • These plans provide: – Medicare A benefits – Medicare B benefits – Medicare Part D benefits Option 1 includes: – Medicare Advantage HMO/Point of Service – Cost plans – Medicare Advantage Private-Fee-For. Service – Medicare Advantage Regional Preferred Provider Organization

Medicare Advantage Option 1 in Minnesota (Medicare A, B and D benefits) • • These plans provide: – Medicare A benefits – Medicare B benefits – Medicare Part D benefits Option 1 includes: – Medicare Advantage HMO/Point of Service – Cost plans – Medicare Advantage Private-Fee-For. Service – Medicare Advantage Regional Preferred Provider Organization

Medicare Advantage Option 2 in Minnesota (Medicare A and B benefits) • These plans provide – Medicare A – Medicare B – No part D • • May enroll in a stand alone PDP only under Cost plan and PFFS Option 2 includes: – Medicare Advantage HMO/Point of Service – Cost plans – Medicare Advantage Private-Fee-For Service

Medicare Advantage Option 2 in Minnesota (Medicare A and B benefits) • These plans provide – Medicare A – Medicare B – No part D • • May enroll in a stand alone PDP only under Cost plan and PFFS Option 2 includes: – Medicare Advantage HMO/Point of Service – Cost plans – Medicare Advantage Private-Fee-For Service

Medicare Advantage Option 3 in Minnesota (Medicare A, B, D and all Medicaid) • These plans provide all – Medicare A benefits – Medicare B benefits – Medicare Part D benefits – Most Medicaid benefits • Option 3 includes: – Medicare Advantage Special Needs Plans (MA-SNP: MSHO and Mn. DHO)

Medicare Advantage Option 3 in Minnesota (Medicare A, B, D and all Medicaid) • These plans provide all – Medicare A benefits – Medicare B benefits – Medicare Part D benefits – Most Medicaid benefits • Option 3 includes: – Medicare Advantage Special Needs Plans (MA-SNP: MSHO and Mn. DHO)

Medicare Advantage Option 4 in Minnesota • These plans provide all – – • Medicare A benefits Medicare B benefits Medicare Part D benefits Some Medicaid benefits • Only available to beneficiaries age 1864 Option 4 includes – Medicare Advantage Special Needs Basic Care Plans (MA-SNBC)

Medicare Advantage Option 4 in Minnesota • These plans provide all – – • Medicare A benefits Medicare B benefits Medicare Part D benefits Some Medicaid benefits • Only available to beneficiaries age 1864 Option 4 includes – Medicare Advantage Special Needs Basic Care Plans (MA-SNBC)

Medicare Advantage Option 5 in Minnesota (Medicare A and B, deductible must be paid first) • These plans will pay for Medicare A and B services once a high annual deductible is met – Deductible amount varies from plan – Once deductible is reached , the MSA plan will cover most costs of Part A and B services – No Part D coverage • Option 5 includes – Medicare Advantage Medical Savings Accounts (MA-MSA)

Medicare Advantage Option 5 in Minnesota (Medicare A and B, deductible must be paid first) • These plans will pay for Medicare A and B services once a high annual deductible is met – Deductible amount varies from plan – Once deductible is reached , the MSA plan will cover most costs of Part A and B services – No Part D coverage • Option 5 includes – Medicare Advantage Medical Savings Accounts (MA-MSA)

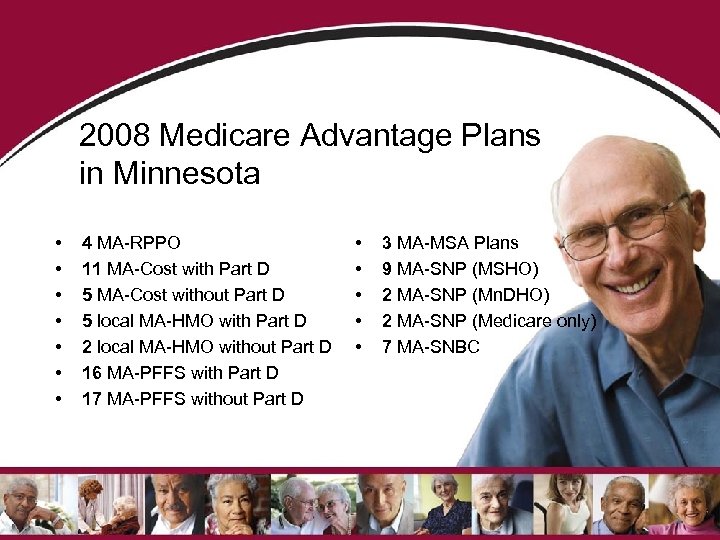

2008 Medicare Advantage Plans in Minnesota • • 4 MA-RPPO 11 MA-Cost with Part D 5 MA-Cost without Part D 5 local MA-HMO with Part D 2 local MA-HMO without Part D 16 MA-PFFS with Part D 17 MA-PFFS without Part D • • • 3 MA-MSA Plans 9 MA-SNP (MSHO) 2 MA-SNP (Mn. DHO) 2 MA-SNP (Medicare only) 7 MA-SNBC

2008 Medicare Advantage Plans in Minnesota • • 4 MA-RPPO 11 MA-Cost with Part D 5 MA-Cost without Part D 5 local MA-HMO with Part D 2 local MA-HMO without Part D 16 MA-PFFS with Part D 17 MA-PFFS without Part D • • • 3 MA-MSA Plans 9 MA-SNP (MSHO) 2 MA-SNP (Mn. DHO) 2 MA-SNP (Medicare only) 7 MA-SNBC

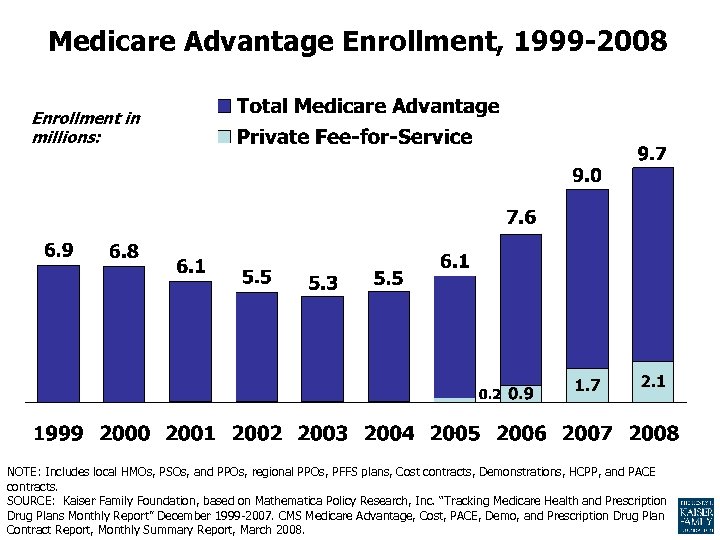

Medicare Advantage Enrollment, 1999 -2008 Enrollment in millions: NOTE: Includes local HMOs, PSOs, and PPOs, regional PPOs, PFFS plans, Cost contracts, Demonstrations, HCPP, and PACE contracts. SOURCE: Kaiser Family Foundation, based on Mathematica Policy Research, Inc. “Tracking Medicare Health and Prescription Drug Plans Monthly Report” December 1999 -2007. CMS Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report, Monthly Summary Report, March 2008.

Medicare Advantage Enrollment, 1999 -2008 Enrollment in millions: NOTE: Includes local HMOs, PSOs, and PPOs, regional PPOs, PFFS plans, Cost contracts, Demonstrations, HCPP, and PACE contracts. SOURCE: Kaiser Family Foundation, based on Mathematica Policy Research, Inc. “Tracking Medicare Health and Prescription Drug Plans Monthly Report” December 1999 -2007. CMS Medicare Advantage, Cost, PACE, Demo, and Prescription Drug Plan Contract Report, Monthly Summary Report, March 2008.

Need Assistance with Solving Problems related to Part D? • • Call the Senior Link. Age Line® at 1 -800 -333 -2433 MBA has data sharing agreement with DHS – Access to CMS monthly return file SLL is the SHIP for MN – Plans have designated specific staff for Senior Link. Age Line® to work with to resolve problems – Designated staff at CMS to work at resolving problems for SHIP – CMS has designated specific contacts for SHIPs to use at 1 -800 -333 -2433. This is not available to the general public. Senior Linkage Line® is here to help you and your clients!

Need Assistance with Solving Problems related to Part D? • • Call the Senior Link. Age Line® at 1 -800 -333 -2433 MBA has data sharing agreement with DHS – Access to CMS monthly return file SLL is the SHIP for MN – Plans have designated specific staff for Senior Link. Age Line® to work with to resolve problems – Designated staff at CMS to work at resolving problems for SHIP – CMS has designated specific contacts for SHIPs to use at 1 -800 -333 -2433. This is not available to the general public. Senior Linkage Line® is here to help you and your clients!

Need more Information, Answers or Help? • • Senior Link. Age Line® 1 -800 -333 -2433 Disability Linkage Line ® 1 -866 -333 -2466 Veterans Linkage Line 1 -888 -546 -5838 (Link. Vet) www. cms. hhs. gov www. Medicare. gov 1 -800 -MEDICARE www. socialsecurity. gov 1 -800 -772 -1213 www. Minnesota. Help. info 27

Need more Information, Answers or Help? • • Senior Link. Age Line® 1 -800 -333 -2433 Disability Linkage Line ® 1 -866 -333 -2466 Veterans Linkage Line 1 -888 -546 -5838 (Link. Vet) www. cms. hhs. gov www. Medicare. gov 1 -800 -MEDICARE www. socialsecurity. gov 1 -800 -772 -1213 www. Minnesota. Help. info 27

CONTACT INFORMATION • CONTACT INFORMATION – Kelli Jo Greiner – 651 -431 -2581 – Kellijo. greiner@state. mn. us

CONTACT INFORMATION • CONTACT INFORMATION – Kelli Jo Greiner – 651 -431 -2581 – Kellijo. greiner@state. mn. us

Minnesota Senior Health Options Jeff Goodmanson 651 -431 -2530 jeff. goodmanson@state. mn. us

Minnesota Senior Health Options Jeff Goodmanson 651 -431 -2530 jeff. goodmanson@state. mn. us

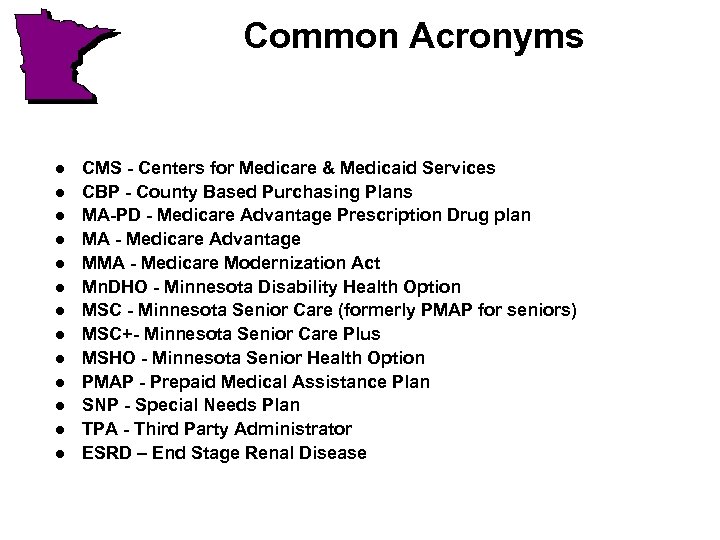

Common Acronyms l l l l CMS - Centers for Medicare & Medicaid Services CBP - County Based Purchasing Plans MA-PD - Medicare Advantage Prescription Drug plan MA - Medicare Advantage MMA - Medicare Modernization Act Mn. DHO - Minnesota Disability Health Option MSC - Minnesota Senior Care (formerly PMAP for seniors) MSC+- Minnesota Senior Care Plus MSHO - Minnesota Senior Health Option PMAP - Prepaid Medical Assistance Plan SNP - Special Needs Plan TPA - Third Party Administrator ESRD – End Stage Renal Disease

Common Acronyms l l l l CMS - Centers for Medicare & Medicaid Services CBP - County Based Purchasing Plans MA-PD - Medicare Advantage Prescription Drug plan MA - Medicare Advantage MMA - Medicare Modernization Act Mn. DHO - Minnesota Disability Health Option MSC - Minnesota Senior Care (formerly PMAP for seniors) MSC+- Minnesota Senior Care Plus MSHO - Minnesota Senior Health Option PMAP - Prepaid Medical Assistance Plan SNP - Special Needs Plan TPA - Third Party Administrator ESRD – End Stage Renal Disease

Managed Care Options For Seniors l MSC - Minnesota Senior Care l MSC+ - Minnesota Senior Care Plus l MSHO – Minnesota Senior Health Options

Managed Care Options For Seniors l MSC - Minnesota Senior Care l MSC+ - Minnesota Senior Care Plus l MSHO – Minnesota Senior Health Options

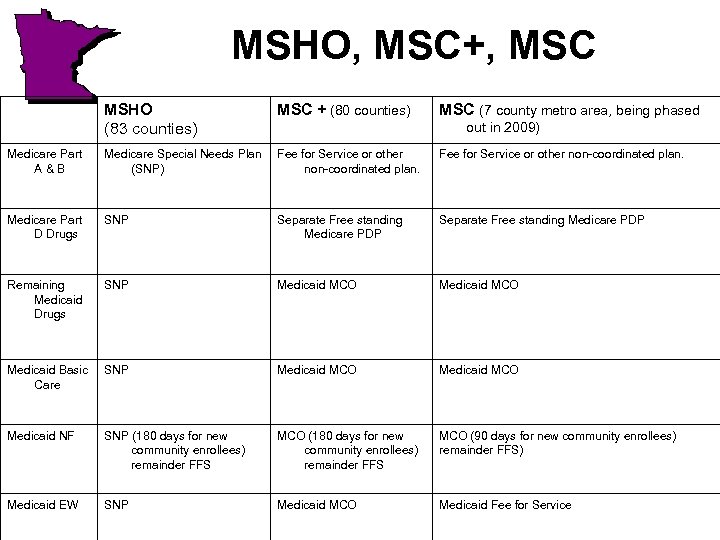

MSHO, MSC+, MSC MSHO (83 counties) MSC + (80 counties) MSC (7 county metro area, being phased Medicare Part A&B Medicare Special Needs Plan (SNP) Fee for Service or other non-coordinated plan. Medicare Part D Drugs SNP Separate Free standing Medicare PDP Remaining Medicaid Drugs SNP Medicaid MCO Medicaid Basic Care SNP Medicaid MCO Medicaid NF SNP (180 days for new community enrollees) remainder FFS MCO (90 days for new community enrollees) remainder FFS) Medicaid EW SNP Medicaid MCO Medicaid Fee for Service out in 2009)

MSHO, MSC+, MSC MSHO (83 counties) MSC + (80 counties) MSC (7 county metro area, being phased Medicare Part A&B Medicare Special Needs Plan (SNP) Fee for Service or other non-coordinated plan. Medicare Part D Drugs SNP Separate Free standing Medicare PDP Remaining Medicaid Drugs SNP Medicaid MCO Medicaid Basic Care SNP Medicaid MCO Medicaid NF SNP (180 days for new community enrollees) remainder FFS MCO (90 days for new community enrollees) remainder FFS) Medicaid EW SNP Medicaid MCO Medicaid Fee for Service out in 2009)

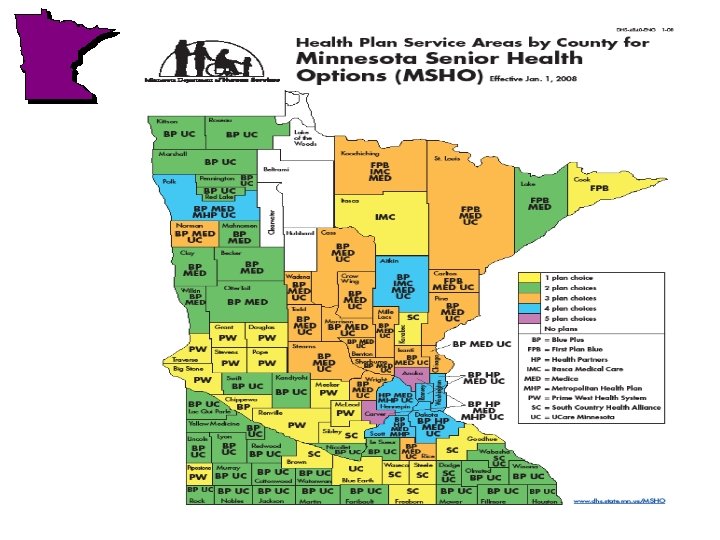

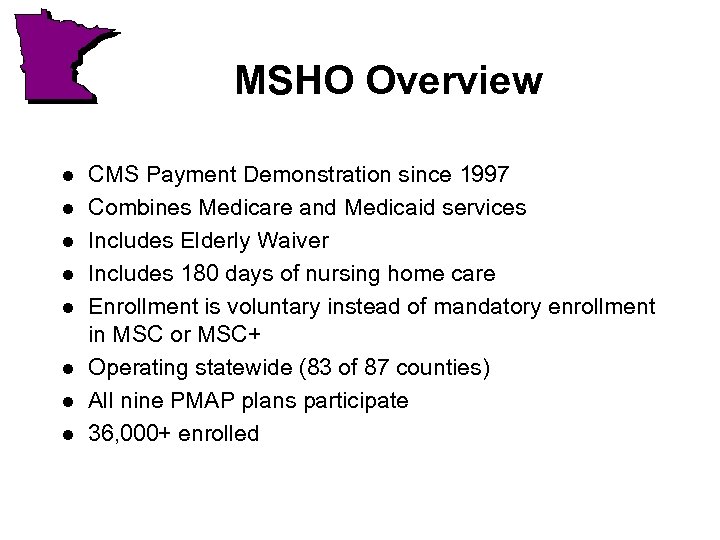

MSHO Overview l l l l CMS Payment Demonstration since 1997 Combines Medicare and Medicaid services Includes Elderly Waiver Includes 180 days of nursing home care Enrollment is voluntary instead of mandatory enrollment in MSC or MSC+ Operating statewide (83 of 87 counties) All nine PMAP plans participate 36, 000+ enrolled

MSHO Overview l l l l CMS Payment Demonstration since 1997 Combines Medicare and Medicaid services Includes Elderly Waiver Includes 180 days of nursing home care Enrollment is voluntary instead of mandatory enrollment in MSC or MSC+ Operating statewide (83 of 87 counties) All nine PMAP plans participate 36, 000+ enrolled

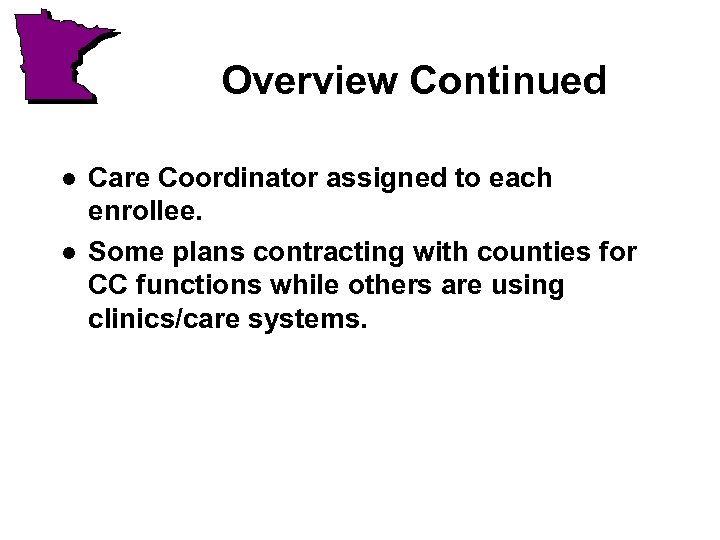

Overview Continued l l Care Coordinator assigned to each enrollee. Some plans contracting with counties for CC functions while others are using clinics/care systems.

Overview Continued l l Care Coordinator assigned to each enrollee. Some plans contracting with counties for CC functions while others are using clinics/care systems.

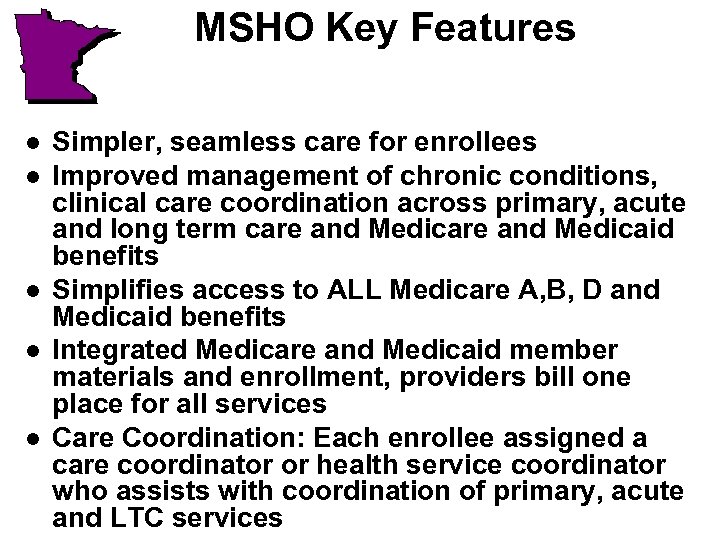

MSHO Key Features l l l Simpler, seamless care for enrollees Improved management of chronic conditions, clinical care coordination across primary, acute and long term care and Medicaid benefits Simplifies access to ALL Medicare A, B, D and Medicaid benefits Integrated Medicare and Medicaid member materials and enrollment, providers bill one place for all services Care Coordination: Each enrollee assigned a care coordinator or health service coordinator who assists with coordination of primary, acute and LTC services

MSHO Key Features l l l Simpler, seamless care for enrollees Improved management of chronic conditions, clinical care coordination across primary, acute and long term care and Medicaid benefits Simplifies access to ALL Medicare A, B, D and Medicaid benefits Integrated Medicare and Medicaid member materials and enrollment, providers bill one place for all services Care Coordination: Each enrollee assigned a care coordinator or health service coordinator who assists with coordination of primary, acute and LTC services

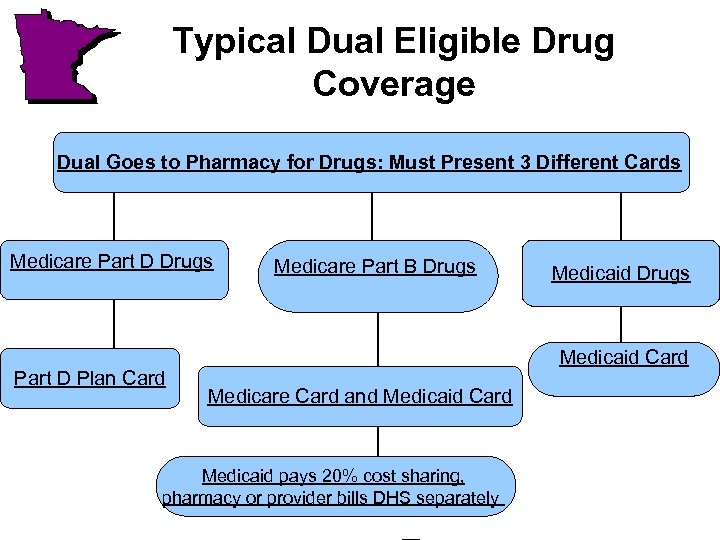

Typical Dual Eligible Drug Coverage Dual Goes to Pharmacy for Drugs: Must Present 3 Different Cards Medicare Part D Drugs Part D Plan Card Medicare Part B Drugs Medicaid Card Medicare Card and Medicaid Card Medicaid pays 20% cost sharing, pharmacy or provider bills DHS separately

Typical Dual Eligible Drug Coverage Dual Goes to Pharmacy for Drugs: Must Present 3 Different Cards Medicare Part D Drugs Part D Plan Card Medicare Part B Drugs Medicaid Card Medicare Card and Medicaid Card Medicaid pays 20% cost sharing, pharmacy or provider bills DHS separately

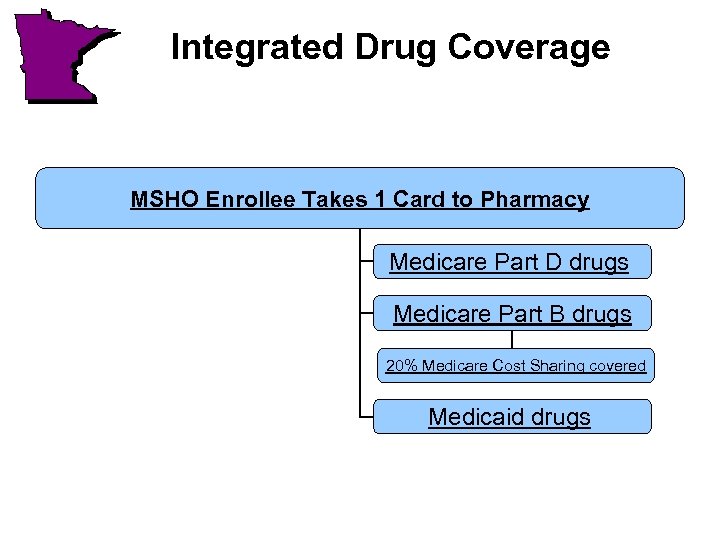

Integrated Drug Coverage MSHO Enrollee Takes 1 Card to Pharmacy Medicare Part D drugs Medicare Part B drugs 20% Medicare Cost Sharing covered Medicaid drugs

Integrated Drug Coverage MSHO Enrollee Takes 1 Card to Pharmacy Medicare Part D drugs Medicare Part B drugs 20% Medicare Cost Sharing covered Medicaid drugs

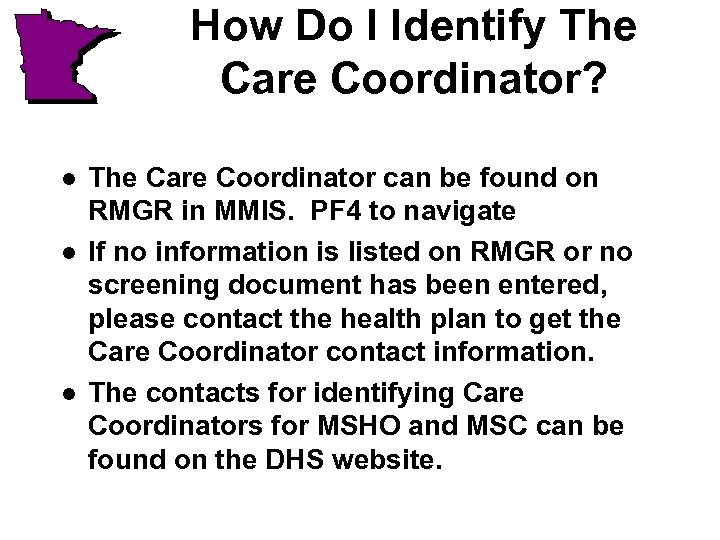

How Do I Identify The Care Coordinator? l l l The Care Coordinator can be found on RMGR in MMIS. PF 4 to navigate If no information is listed on RMGR or no screening document has been entered, please contact the health plan to get the Care Coordinator contact information. The contacts for identifying Care Coordinators for MSHO and MSC can be found on the DHS website.

How Do I Identify The Care Coordinator? l l l The Care Coordinator can be found on RMGR in MMIS. PF 4 to navigate If no information is listed on RMGR or no screening document has been entered, please contact the health plan to get the Care Coordinator contact information. The contacts for identifying Care Coordinators for MSHO and MSC can be found on the DHS website.

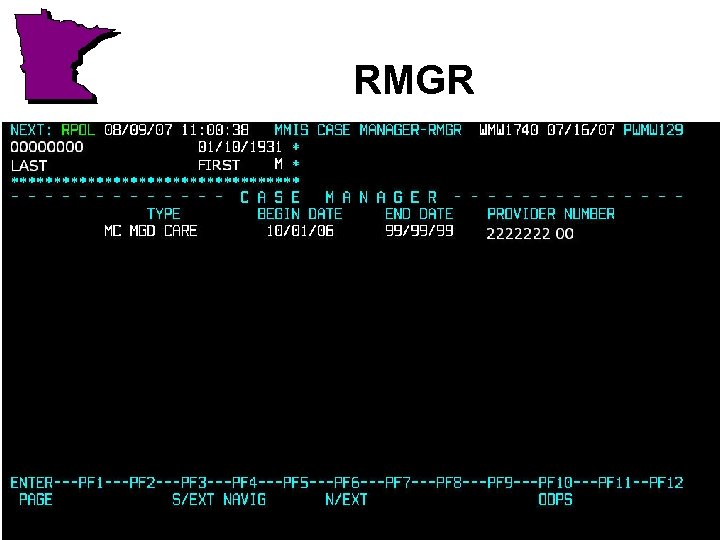

RMGR

RMGR

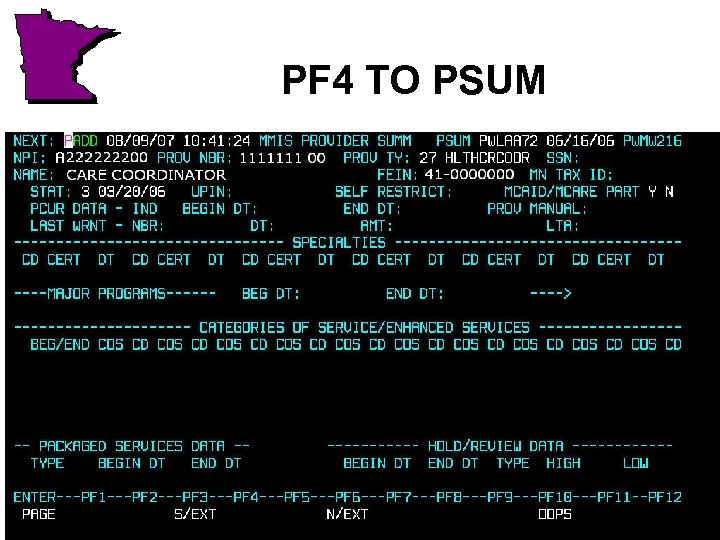

PF 4 TO PSUM

PF 4 TO PSUM

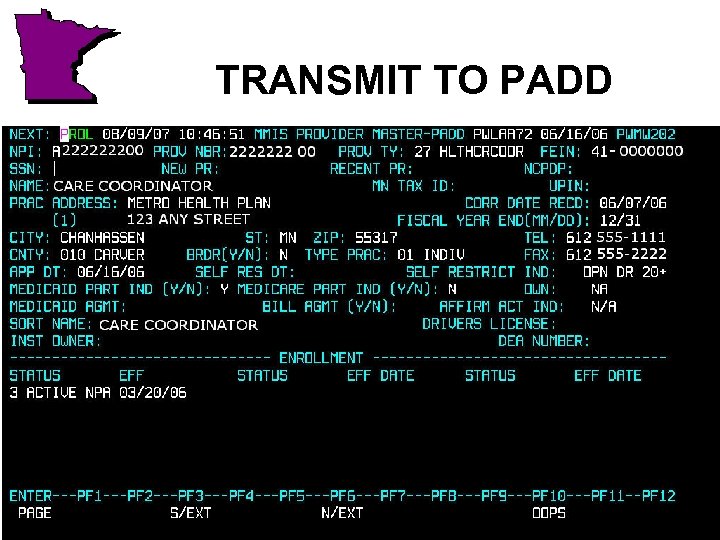

TRANSMIT TO PADD

TRANSMIT TO PADD

Communication Form l l l DHS developed a new communication form that will be used by counties, managed care plans (Care Coordinators), and DHS to help improve communication. The new communication form was developed in a workgroup that included DHS, Counties, and Managed Care staff. Please see bulletin 07 -21 -09 for additional information.

Communication Form l l l DHS developed a new communication form that will be used by counties, managed care plans (Care Coordinators), and DHS to help improve communication. The new communication form was developed in a workgroup that included DHS, Counties, and Managed Care staff. Please see bulletin 07 -21 -09 for additional information.

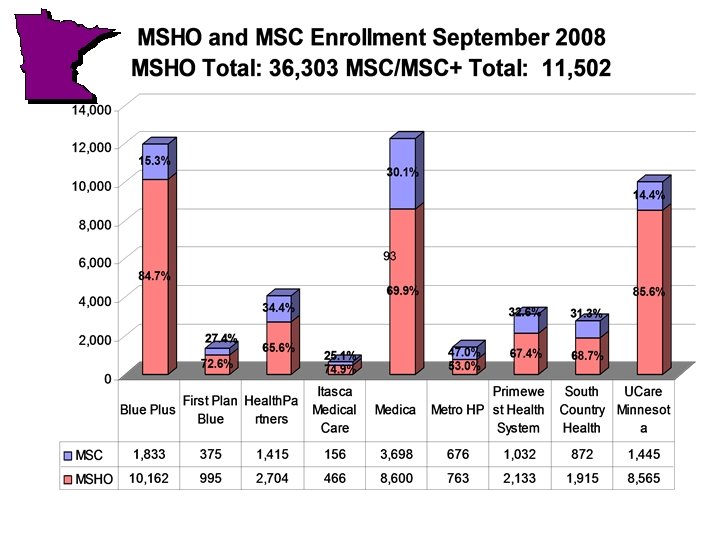

Participating MSHO SNPs and MSC/MSC+ Health Plans for Seniors l l l l l Blue Plus First Plan Health Partners Itasca Medical Care ** Medica * Metropolitan Health Plan * Prime West ** South Country Health Alliance ** UCare Minnesota * * Original MSHO plans ** Current MSC+ plans

Participating MSHO SNPs and MSC/MSC+ Health Plans for Seniors l l l l l Blue Plus First Plan Health Partners Itasca Medical Care ** Medica * Metropolitan Health Plan * Prime West ** South Country Health Alliance ** UCare Minnesota * * Original MSHO plans ** Current MSC+ plans

Who can Enroll into MSHO? l l l People 65 or over, and Are eligible for Medicare Part A and B or who do not have Medicare, and Live in a participating MSHO county, and Are eligible for MA without a medical spenddown, or Are Eligible for SIS EW with a waiver obligation. Effective 6/1/05 applicants with a medical spenddown are not eligible to enroll. People who acquire a medical spenddown after MSHO enrollment are allowed to continue MSHO enrollment if the spenddown is paid directly to DHS.

Who can Enroll into MSHO? l l l People 65 or over, and Are eligible for Medicare Part A and B or who do not have Medicare, and Live in a participating MSHO county, and Are eligible for MA without a medical spenddown, or Are Eligible for SIS EW with a waiver obligation. Effective 6/1/05 applicants with a medical spenddown are not eligible to enroll. People who acquire a medical spenddown after MSHO enrollment are allowed to continue MSHO enrollment if the spenddown is paid directly to DHS.

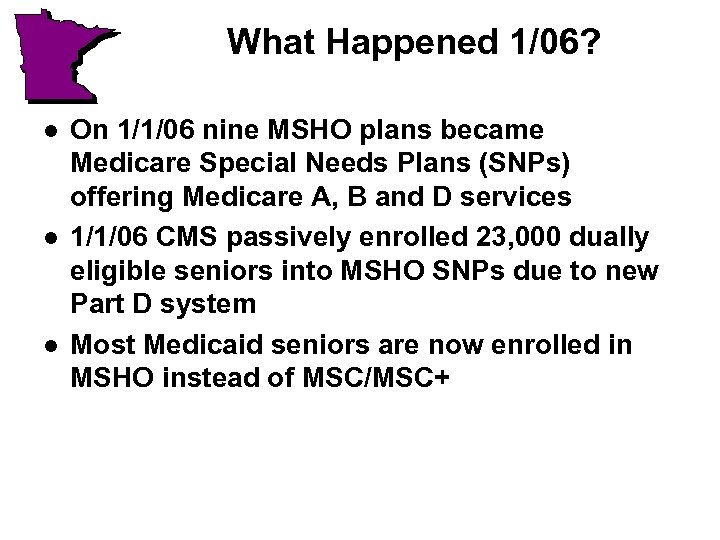

What Happened 1/06? l l l On 1/1/06 nine MSHO plans became Medicare Special Needs Plans (SNPs) offering Medicare A, B and D services 1/1/06 CMS passively enrolled 23, 000 dually eligible seniors into MSHO SNPs due to new Part D system Most Medicaid seniors are now enrolled in MSHO instead of MSC/MSC+

What Happened 1/06? l l l On 1/1/06 nine MSHO plans became Medicare Special Needs Plans (SNPs) offering Medicare A, B and D services 1/1/06 CMS passively enrolled 23, 000 dually eligible seniors into MSHO SNPs due to new Part D system Most Medicaid seniors are now enrolled in MSHO instead of MSC/MSC+

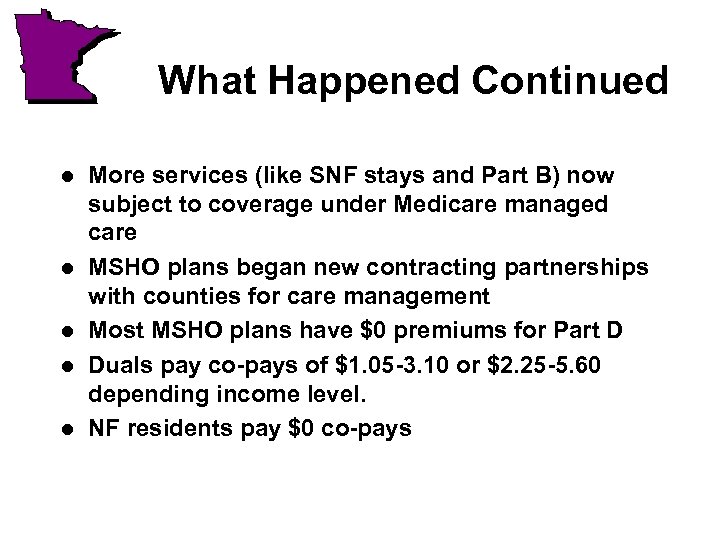

What Happened Continued l l l More services (like SNF stays and Part B) now subject to coverage under Medicare managed care MSHO plans began new contracting partnerships with counties for care management Most MSHO plans have $0 premiums for Part D Duals pay co-pays of $1. 05 -3. 10 or $2. 25 -5. 60 depending income level. NF residents pay $0 co-pays

What Happened Continued l l l More services (like SNF stays and Part B) now subject to coverage under Medicare managed care MSHO plans began new contracting partnerships with counties for care management Most MSHO plans have $0 premiums for Part D Duals pay co-pays of $1. 05 -3. 10 or $2. 25 -5. 60 depending income level. NF residents pay $0 co-pays

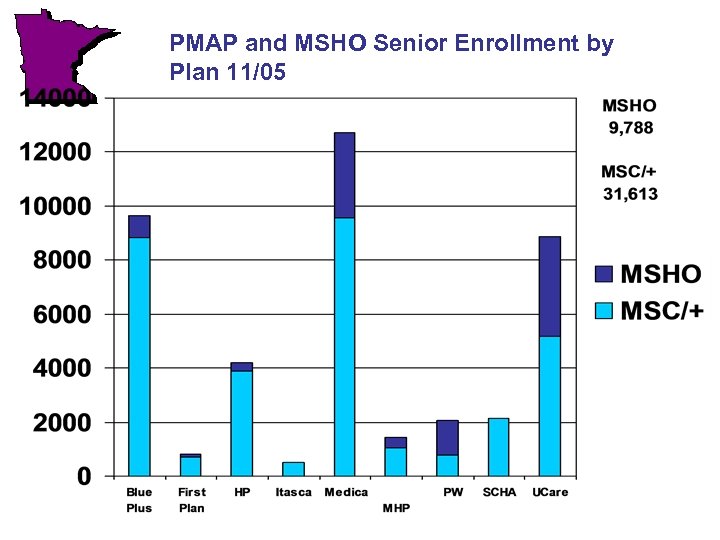

PMAP and MSHO Senior Enrollment by Plan 11/05

PMAP and MSHO Senior Enrollment by Plan 11/05

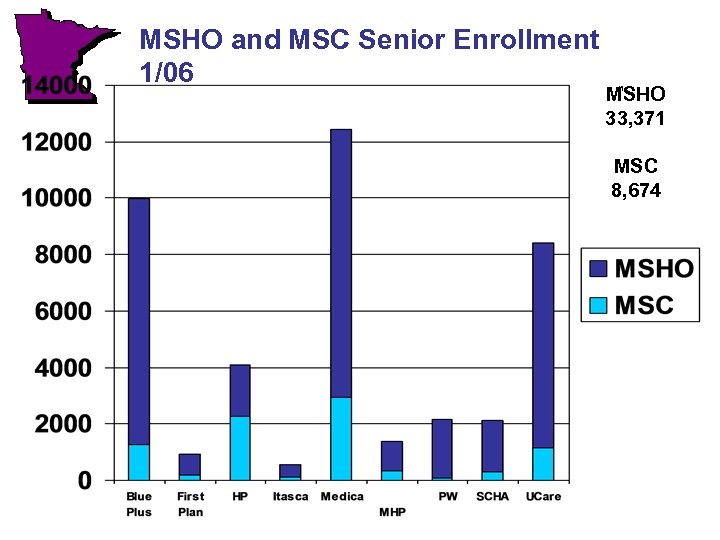

MSHO and MSC Senior Enrollment 1/06 MSHO 33, 371 MSC 8, 674

MSHO and MSC Senior Enrollment 1/06 MSHO 33, 371 MSC 8, 674

Living Arrangement Impact on Part D Co-Pays l l l DHS provides NF information to CMS for dual eligibles on a monthly file based on what is listed in MMIS for the living arrangement It is important that the NF submit the 1503 to the county timely The county must update the living arrangement immediately so the correct information gets sent to CMS Once the living arrangement is updated, the NF information is submitted to CMS on the next monthly file CMS processes the DHS file and then tells the health plan how much to charge for the co-pay The amount of time it takes for all actions to occur may result in delays in the resident getting charged the correct co-pay.

Living Arrangement Impact on Part D Co-Pays l l l DHS provides NF information to CMS for dual eligibles on a monthly file based on what is listed in MMIS for the living arrangement It is important that the NF submit the 1503 to the county timely The county must update the living arrangement immediately so the correct information gets sent to CMS Once the living arrangement is updated, the NF information is submitted to CMS on the next monthly file CMS processes the DHS file and then tells the health plan how much to charge for the co-pay The amount of time it takes for all actions to occur may result in delays in the resident getting charged the correct co-pay.

More About Part D Co-Pays l l It is important that all providers bill timely If the enrollee has a spenddown, the enrollee is not considered a dual eligible until the spenddown has been reached once in the calendar year for Medicare Part D purposes DHS will not submit the enrollee for dual status until the spenddown has been reached even if the enrollee is a NF resident Timely billing is a key factor in the enrollee getting changed the correct co-pay level

More About Part D Co-Pays l l It is important that all providers bill timely If the enrollee has a spenddown, the enrollee is not considered a dual eligible until the spenddown has been reached once in the calendar year for Medicare Part D purposes DHS will not submit the enrollee for dual status until the spenddown has been reached even if the enrollee is a NF resident Timely billing is a key factor in the enrollee getting changed the correct co-pay level

Medical Spenddowns l l l People who acquire a medical spenddown after MSHO enrollment has started are allowed to remain enrolled in MSHO only if they pay the full spenddown amount directly to DHS (SRU) bills the enrollee each month Enrollees with AMM’s should only remain enrolled if medical expenses are routinely more then the amount of the spenddown.

Medical Spenddowns l l l People who acquire a medical spenddown after MSHO enrollment has started are allowed to remain enrolled in MSHO only if they pay the full spenddown amount directly to DHS (SRU) bills the enrollee each month Enrollees with AMM’s should only remain enrolled if medical expenses are routinely more then the amount of the spenddown.

Waiver Obligations l l l Enrollees with waiver obligations are allowed to enroll in MSHO Waiver obligations are paid directly to the provider similar to fee-for-service Providers bill the health plan for EW services MSHO health plans pay the provider after deducting the waiver obligation amount DHS informs the health plan of the waiver obligation amount monthly

Waiver Obligations l l l Enrollees with waiver obligations are allowed to enroll in MSHO Waiver obligations are paid directly to the provider similar to fee-for-service Providers bill the health plan for EW services MSHO health plans pay the provider after deducting the waiver obligation amount DHS informs the health plan of the waiver obligation amount monthly

Institutional Spenddown l l Institutional spenddowns for people enrolled in MSHO are collected by the provider just like all other Medicaid enrollees See Bulletin 06 -21 -05 for more information about institutional spenddowns for people on MSHO

Institutional Spenddown l l Institutional spenddowns for people enrolled in MSHO are collected by the provider just like all other Medicaid enrollees See Bulletin 06 -21 -05 for more information about institutional spenddowns for people on MSHO

Designated Providers l l l Designated provider numbers should not be used for waiver obligations and medical spenddowns for MSHO Exception: People who are in a nursing home and elect hospice should be coded as AMM with the hospice provider as the designated provider. (See MMIS User Manual) Designated Providers should be used for institutional spenddowns.

Designated Providers l l l Designated provider numbers should not be used for waiver obligations and medical spenddowns for MSHO Exception: People who are in a nursing home and elect hospice should be coded as AMM with the hospice provider as the designated provider. (See MMIS User Manual) Designated Providers should be used for institutional spenddowns.

Why can’t we use a designated provider for waiver obligations and medical spenddowns? l l The health plans do not use our designated provider data DHS is paying a cap to the health plan to pay claims DHS bills the client directly for the medical spenddown amount because claims are being paid by the health plan in full The health plans can only deduct the waiver obligation amounts based on DHS provided information but they do not use our designated provider data

Why can’t we use a designated provider for waiver obligations and medical spenddowns? l l The health plans do not use our designated provider data DHS is paying a cap to the health plan to pay claims DHS bills the client directly for the medical spenddown amount because claims are being paid by the health plan in full The health plans can only deduct the waiver obligation amounts based on DHS provided information but they do not use our designated provider data

Why can we have designated providers for Institutional and Hospice Spenddowns? l l When the health plan has the NF liability for an MSHO enrollee, the plan pays the facility the full charges for the 180 days. DHS will deduct the amount of the AIM spenddown from the provider on the remittance advice DHS pays to the provider Once the 180 liability ends, the claims are submitted to DHS fee-for-service and the amount is reduced on the submitted claims Hospice room and board charges are submitted to DHS fee-for-service so DHS can reduce the spenddown amount when the claim is submitted

Why can we have designated providers for Institutional and Hospice Spenddowns? l l When the health plan has the NF liability for an MSHO enrollee, the plan pays the facility the full charges for the 180 days. DHS will deduct the amount of the AIM spenddown from the provider on the remittance advice DHS pays to the provider Once the 180 liability ends, the claims are submitted to DHS fee-for-service and the amount is reduced on the submitted claims Hospice room and board charges are submitted to DHS fee-for-service so DHS can reduce the spenddown amount when the claim is submitted

Enrollment Hassles l l l MSHO enrollments may come in either through the counties, health plans, or through changes that CMS makes directly with notification to the plan/State Dual eligibles can change plans or disenroll each month per CMS policy Signing an enrollment in a freestanding Prescription Drug Plan or another type of Medicare plan (Medicare Private FFS Plan) automatically terminates an MSHO SNP enrollment per CMS policy

Enrollment Hassles l l l MSHO enrollments may come in either through the counties, health plans, or through changes that CMS makes directly with notification to the plan/State Dual eligibles can change plans or disenroll each month per CMS policy Signing an enrollment in a freestanding Prescription Drug Plan or another type of Medicare plan (Medicare Private FFS Plan) automatically terminates an MSHO SNP enrollment per CMS policy

Enrollment Hassles l l Loss of Medicaid eligibility also may change enrollment Counties DO NOT control MSHO enrollment The State tracks the MSHO Medicare SNP enrollments because we coordinate the Medicare and Medicaid enrollment to the best extent possible SOME enrollment changes MUST be made retroactively due to CMS SNP rules

Enrollment Hassles l l Loss of Medicaid eligibility also may change enrollment Counties DO NOT control MSHO enrollment The State tracks the MSHO Medicare SNP enrollments because we coordinate the Medicare and Medicaid enrollment to the best extent possible SOME enrollment changes MUST be made retroactively due to CMS SNP rules

Minnesota Disability Health Options (Mn. DHO) Special Needs Basic. Care (SNBC) Special Needs Purchasing Susan Kennedy – Project Coordinator

Minnesota Disability Health Options (Mn. DHO) Special Needs Basic. Care (SNBC) Special Needs Purchasing Susan Kennedy – Project Coordinator

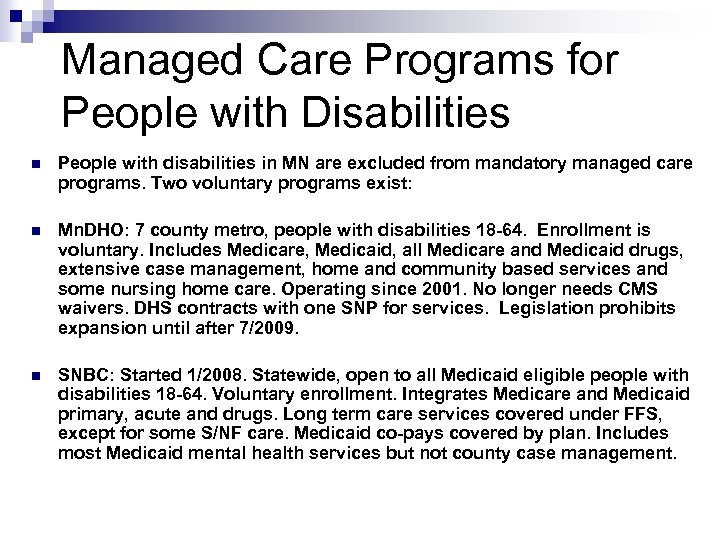

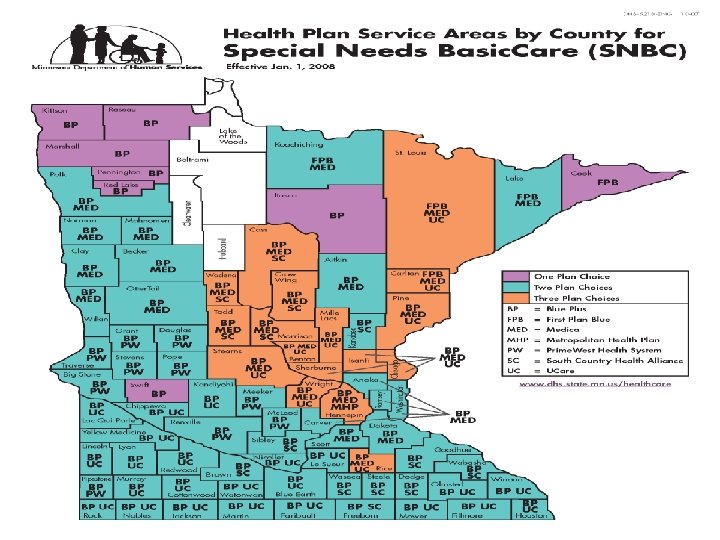

Managed Care Programs for People with Disabilities n People with disabilities in MN are excluded from mandatory managed care programs. Two voluntary programs exist: n Mn. DHO: 7 county metro, people with disabilities 18 -64. Enrollment is voluntary. Includes Medicare, Medicaid, all Medicare and Medicaid drugs, extensive case management, home and community based services and some nursing home care. Operating since 2001. No longer needs CMS waivers. DHS contracts with one SNP for services. Legislation prohibits expansion until after 7/2009. n SNBC: Started 1/2008. Statewide, open to all Medicaid eligible people with disabilities 18 -64. Voluntary enrollment. Integrates Medicare and Medicaid primary, acute and drugs. Long term care services covered under FFS, except for some S/NF care. Medicaid co-pays covered by plan. Includes most Medicaid mental health services but not county case management.

Managed Care Programs for People with Disabilities n People with disabilities in MN are excluded from mandatory managed care programs. Two voluntary programs exist: n Mn. DHO: 7 county metro, people with disabilities 18 -64. Enrollment is voluntary. Includes Medicare, Medicaid, all Medicare and Medicaid drugs, extensive case management, home and community based services and some nursing home care. Operating since 2001. No longer needs CMS waivers. DHS contracts with one SNP for services. Legislation prohibits expansion until after 7/2009. n SNBC: Started 1/2008. Statewide, open to all Medicaid eligible people with disabilities 18 -64. Voluntary enrollment. Integrates Medicare and Medicaid primary, acute and drugs. Long term care services covered under FFS, except for some S/NF care. Medicaid co-pays covered by plan. Includes most Medicaid mental health services but not county case management.

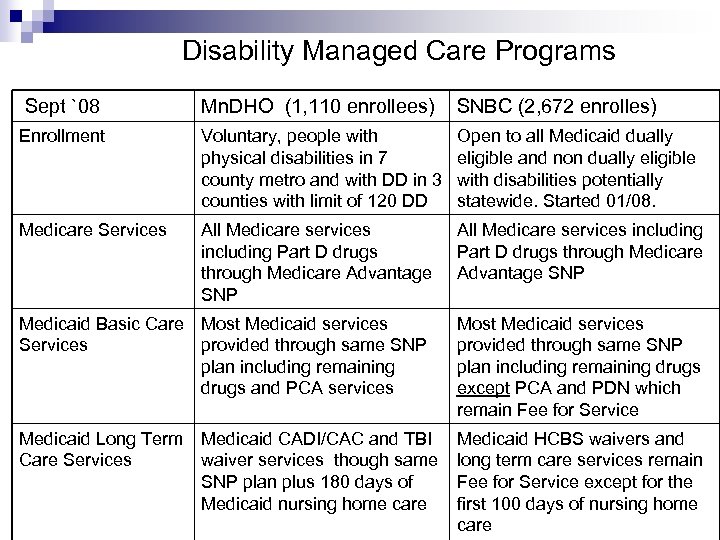

Disability Managed Care Programs Sept `08 Mn. DHO (1, 110 enrollees) SNBC (2, 672 enrolles) Enrollment Voluntary, people with physical disabilities in 7 county metro and with DD in 3 counties with limit of 120 DD Open to all Medicaid dually eligible and non dually eligible with disabilities potentially statewide. Started 01/08. Medicare Services All Medicare services including Part D drugs through Medicare Advantage SNP Medicaid Basic Care Most Medicaid services Services provided through same SNP plan including remaining drugs and PCA services Most Medicaid services provided through same SNP plan including remaining drugs except PCA and PDN which remain Fee for Service Medicaid Long Term Care Services Medicaid HCBS waivers and long term care services remain Fee for Service except for the first 100 days of nursing home care Medicaid CADI/CAC and TBI waiver services though same SNP plan plus 180 days of Medicaid nursing home care

Disability Managed Care Programs Sept `08 Mn. DHO (1, 110 enrollees) SNBC (2, 672 enrolles) Enrollment Voluntary, people with physical disabilities in 7 county metro and with DD in 3 counties with limit of 120 DD Open to all Medicaid dually eligible and non dually eligible with disabilities potentially statewide. Started 01/08. Medicare Services All Medicare services including Part D drugs through Medicare Advantage SNP Medicaid Basic Care Most Medicaid services Services provided through same SNP plan including remaining drugs and PCA services Most Medicaid services provided through same SNP plan including remaining drugs except PCA and PDN which remain Fee for Service Medicaid Long Term Care Services Medicaid HCBS waivers and long term care services remain Fee for Service except for the first 100 days of nursing home care Medicaid CADI/CAC and TBI waiver services though same SNP plan plus 180 days of Medicaid nursing home care

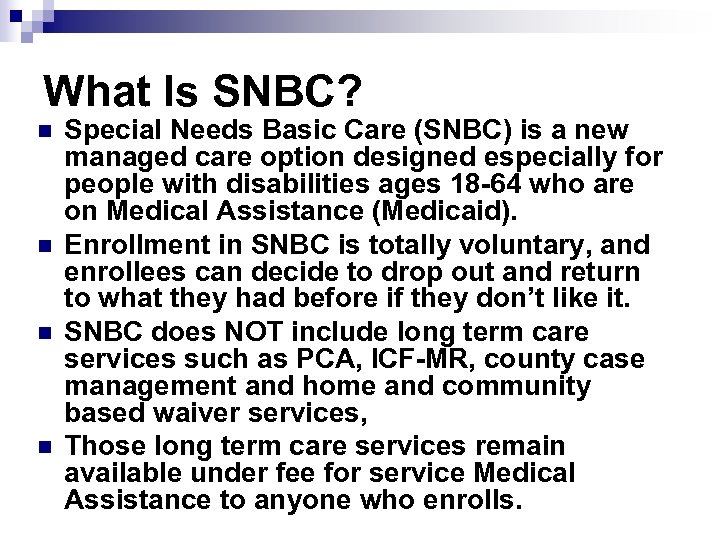

What Is SNBC? n n Special Needs Basic Care (SNBC) is a new managed care option designed especially for people with disabilities ages 18 -64 who are on Medical Assistance (Medicaid). Enrollment in SNBC is totally voluntary, and enrollees can decide to drop out and return to what they had before if they don’t like it. SNBC does NOT include long term care services such as PCA, ICF-MR, county case management and home and community based waiver services, Those long term care services remain available under fee for service Medical Assistance to anyone who enrolls.

What Is SNBC? n n Special Needs Basic Care (SNBC) is a new managed care option designed especially for people with disabilities ages 18 -64 who are on Medical Assistance (Medicaid). Enrollment in SNBC is totally voluntary, and enrollees can decide to drop out and return to what they had before if they don’t like it. SNBC does NOT include long term care services such as PCA, ICF-MR, county case management and home and community based waiver services, Those long term care services remain available under fee for service Medical Assistance to anyone who enrolls.

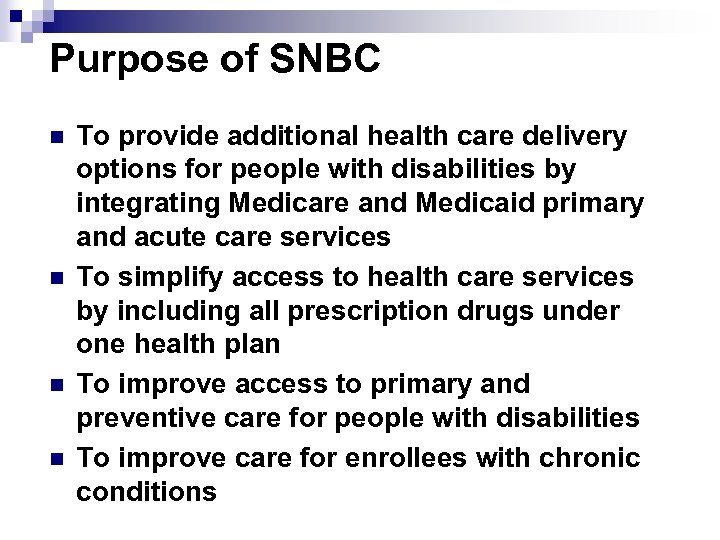

Purpose of SNBC n n To provide additional health care delivery options for people with disabilities by integrating Medicare and Medicaid primary and acute care services To simplify access to health care services by including all prescription drugs under one health plan To improve access to primary and preventive care for people with disabilities To improve care for enrollees with chronic conditions

Purpose of SNBC n n To provide additional health care delivery options for people with disabilities by integrating Medicare and Medicaid primary and acute care services To simplify access to health care services by including all prescription drugs under one health plan To improve access to primary and preventive care for people with disabilities To improve care for enrollees with chronic conditions

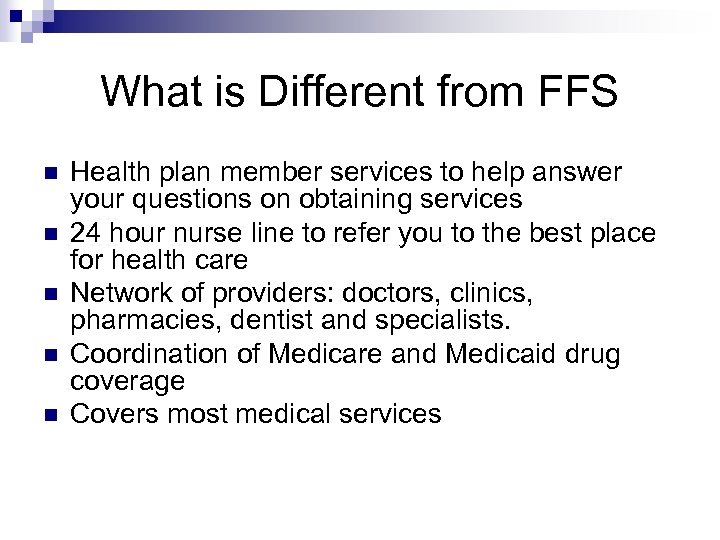

What is Different from FFS n n n Health plan member services to help answer your questions on obtaining services 24 hour nurse line to refer you to the best place for health care Network of providers: doctors, clinics, pharmacies, dentist and specialists. Coordination of Medicare and Medicaid drug coverage Covers most medical services

What is Different from FFS n n n Health plan member services to help answer your questions on obtaining services 24 hour nurse line to refer you to the best place for health care Network of providers: doctors, clinics, pharmacies, dentist and specialists. Coordination of Medicare and Medicaid drug coverage Covers most medical services

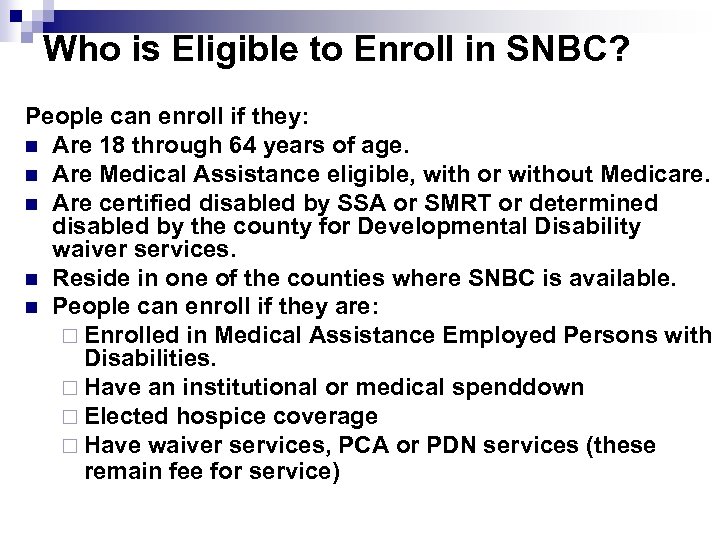

Who is Eligible to Enroll in SNBC? People can enroll if they: n Are 18 through 64 years of age. n Are Medical Assistance eligible, with or without Medicare. n Are certified disabled by SSA or SMRT or determined disabled by the county for Developmental Disability waiver services. n Reside in one of the counties where SNBC is available. n People can enroll if they are: ¨ Enrolled in Medical Assistance Employed Persons with Disabilities. ¨ Have an institutional or medical spenddown ¨ Elected hospice coverage ¨ Have waiver services, PCA or PDN services (these remain fee for service)

Who is Eligible to Enroll in SNBC? People can enroll if they: n Are 18 through 64 years of age. n Are Medical Assistance eligible, with or without Medicare. n Are certified disabled by SSA or SMRT or determined disabled by the county for Developmental Disability waiver services. n Reside in one of the counties where SNBC is available. n People can enroll if they are: ¨ Enrolled in Medical Assistance Employed Persons with Disabilities. ¨ Have an institutional or medical spenddown ¨ Elected hospice coverage ¨ Have waiver services, PCA or PDN services (these remain fee for service)

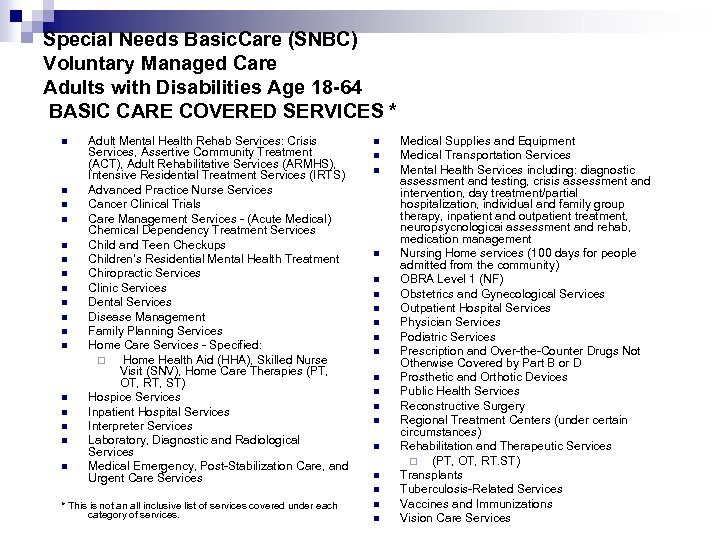

Special Needs Basic. Care (SNBC) Voluntary Managed Care Adults with Disabilities Age 18 -64 BASIC CARE COVERED SERVICES * n n n n n Adult Mental Health Rehab Services: Crisis Services, Assertive Community Treatment (ACT), Adult Rehabilitative Services (ARMHS), Intensive Residential Treatment Services (IRTS) Advanced Practice Nurse Services Cancer Clinical Trials Care Management Services - (Acute Medical) Chemical Dependency Treatment Services Child and Teen Checkups Children’s Residential Mental Health Treatment Chiropractic Services Clinic Services Dental Services Disease Management Family Planning Services Home Care Services - Specified: ¨ Home Health Aid (HHA), Skilled Nurse Visit (SNV), Home Care Therapies (PT, OT, RT, ST) Hospice Services Inpatient Hospital Services Interpreter Services Laboratory, Diagnostic and Radiological Services Medical Emergency, Post-Stabilization Care, and Urgent Care Services n n n n n * This is not an all inclusive list of services covered under each category of services. n n Medical Supplies and Equipment Medical Transportation Services Mental Health Services including: diagnostic assessment and testing, crisis assessment and intervention, day treatment/partial hospitalization, individual and family group therapy, inpatient and outpatient treatment, neuropsycnologicai assessment and rehab, medication management Nursing Home services (100 days for people admitted from the community) OBRA Level 1 (NF) Obstetrics and Gynecological Services Outpatient Hospital Services Physician Services Podiatric Services Prescription and Over-the-Counter Drugs Not Otherwise Covered by Part B or D Prosthetic and Orthotic Devices Public Health Services Reconstructive Surgery Regional Treatment Centers (under certain circumstances) Rehabilitation and Therapeutic Services ¨ (PT, OT, RT. ST) Transplants Tuberculosis-Related Services Vaccines and Immunizations Vision Care Services

Special Needs Basic. Care (SNBC) Voluntary Managed Care Adults with Disabilities Age 18 -64 BASIC CARE COVERED SERVICES * n n n n n Adult Mental Health Rehab Services: Crisis Services, Assertive Community Treatment (ACT), Adult Rehabilitative Services (ARMHS), Intensive Residential Treatment Services (IRTS) Advanced Practice Nurse Services Cancer Clinical Trials Care Management Services - (Acute Medical) Chemical Dependency Treatment Services Child and Teen Checkups Children’s Residential Mental Health Treatment Chiropractic Services Clinic Services Dental Services Disease Management Family Planning Services Home Care Services - Specified: ¨ Home Health Aid (HHA), Skilled Nurse Visit (SNV), Home Care Therapies (PT, OT, RT, ST) Hospice Services Inpatient Hospital Services Interpreter Services Laboratory, Diagnostic and Radiological Services Medical Emergency, Post-Stabilization Care, and Urgent Care Services n n n n n * This is not an all inclusive list of services covered under each category of services. n n Medical Supplies and Equipment Medical Transportation Services Mental Health Services including: diagnostic assessment and testing, crisis assessment and intervention, day treatment/partial hospitalization, individual and family group therapy, inpatient and outpatient treatment, neuropsycnologicai assessment and rehab, medication management Nursing Home services (100 days for people admitted from the community) OBRA Level 1 (NF) Obstetrics and Gynecological Services Outpatient Hospital Services Physician Services Podiatric Services Prescription and Over-the-Counter Drugs Not Otherwise Covered by Part B or D Prosthetic and Orthotic Devices Public Health Services Reconstructive Surgery Regional Treatment Centers (under certain circumstances) Rehabilitation and Therapeutic Services ¨ (PT, OT, RT. ST) Transplants Tuberculosis-Related Services Vaccines and Immunizations Vision Care Services

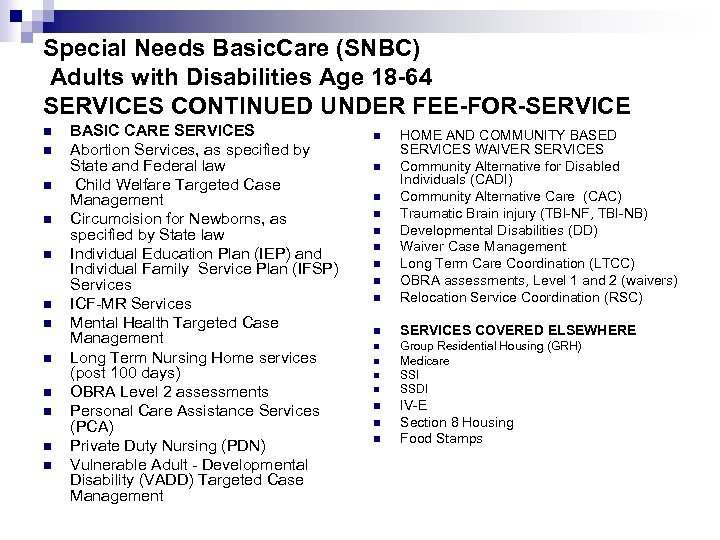

Special Needs Basic. Care (SNBC) Adults with Disabilities Age 18 -64 SERVICES CONTINUED UNDER FEE-FOR-SERVICE n n n BASIC CARE SERVICES Abortion Services, as specified by State and Federal law Child Welfare Targeted Case Management Circumcision for Newborns, as specified by State law Individual Education Plan (IEP) and Individual Family Service Plan (IFSP) Services ICF-MR Services Mental Health Targeted Case Management Long Term Nursing Home services (post 100 days) OBRA Level 2 assessments Personal Care Assistance Services (PCA) Private Duty Nursing (PDN) Vulnerable Adult - Developmental Disability (VADD) Targeted Case Management n HOME AND COMMUNITY BASED SERVICES WAIVER SERVICES Community Alternative for Disabled Individuals (CADI) Community Alternative Care (CAC) Traumatic Brain injury (TBI-NF, TBI-NB) Developmental Disabilities (DD) Waiver Case Management Long Term Care Coordination (LTCC) OBRA assessments, Level 1 and 2 (waivers) Relocation Service Coordination (RSC) n SERVICES COVERED ELSEWHERE n Group Residential Housing (GRH) Medicare SSI SSDI n n n n IV-E Section 8 Housing Food Stamps

Special Needs Basic. Care (SNBC) Adults with Disabilities Age 18 -64 SERVICES CONTINUED UNDER FEE-FOR-SERVICE n n n BASIC CARE SERVICES Abortion Services, as specified by State and Federal law Child Welfare Targeted Case Management Circumcision for Newborns, as specified by State law Individual Education Plan (IEP) and Individual Family Service Plan (IFSP) Services ICF-MR Services Mental Health Targeted Case Management Long Term Nursing Home services (post 100 days) OBRA Level 2 assessments Personal Care Assistance Services (PCA) Private Duty Nursing (PDN) Vulnerable Adult - Developmental Disability (VADD) Targeted Case Management n HOME AND COMMUNITY BASED SERVICES WAIVER SERVICES Community Alternative for Disabled Individuals (CADI) Community Alternative Care (CAC) Traumatic Brain injury (TBI-NF, TBI-NB) Developmental Disabilities (DD) Waiver Case Management Long Term Care Coordination (LTCC) OBRA assessments, Level 1 and 2 (waivers) Relocation Service Coordination (RSC) n SERVICES COVERED ELSEWHERE n Group Residential Housing (GRH) Medicare SSI SSDI n n n n IV-E Section 8 Housing Food Stamps

Medical Spenddowns n n People with Medical Spenddowns will be allowed to enroll PCA/Waiver providers will collect the spend down if they are listed as the designated provider in MMIS Cost of waivered or PCA services must exceed the spend down amount If the enrollee has a designated provider listed in MMIS and is not meeting the spenddown. The enrollee will be dis-enrolled from the SNBC health plan and returned to fee-for-service

Medical Spenddowns n n People with Medical Spenddowns will be allowed to enroll PCA/Waiver providers will collect the spend down if they are listed as the designated provider in MMIS Cost of waivered or PCA services must exceed the spend down amount If the enrollee has a designated provider listed in MMIS and is not meeting the spenddown. The enrollee will be dis-enrolled from the SNBC health plan and returned to fee-for-service

Medical Spenddown – No Designated Provider If no designated provider is listed in MMIS, the enrollee will be billed monthly by DHS Special Recovery Unit n Enrollee will be responsible for paying DHS directly each month n Spenddowns are to be paid in advance n Enrollees will be dis-enrolled from the SNBC plan if the medical spenddown is not paid in full for 3 consecutive months n

Medical Spenddown – No Designated Provider If no designated provider is listed in MMIS, the enrollee will be billed monthly by DHS Special Recovery Unit n Enrollee will be responsible for paying DHS directly each month n Spenddowns are to be paid in advance n Enrollees will be dis-enrolled from the SNBC plan if the medical spenddown is not paid in full for 3 consecutive months n

Institutional Spenddowns n n n Institutional spend downs are collected by the NF provider just like all other Medicaid recipients. When the health plan has the NF liability for an SNBC enrollee, the plan pays the facility the full charges for 100 days. DHS will deduct the amount of the AIM spend down from the provider on the remittance advice DHS pays to the provider Once the 100 day liability ends, the claims are submitted to DHS fee-for-service and the amount is reduced on the submitted claims NF provider will be listed as the designated provider in MMIS

Institutional Spenddowns n n n Institutional spend downs are collected by the NF provider just like all other Medicaid recipients. When the health plan has the NF liability for an SNBC enrollee, the plan pays the facility the full charges for 100 days. DHS will deduct the amount of the AIM spend down from the provider on the remittance advice DHS pays to the provider Once the 100 day liability ends, the claims are submitted to DHS fee-for-service and the amount is reduced on the submitted claims NF provider will be listed as the designated provider in MMIS

What happens at age 65? Enrollee may remain in the SNBC plan when they turn 65, unless; They lose MA eligibility for a period of time and a new enrollment needs to be sent the CMS to restart the Medicare coverage. ¨ They choose to become a participant in the Elder Waiver (EW) program and receive Home and Community Based Services through EW. ¨ Things to consider: SIS-EW budget allows the recipient to retain more of their income. ¨ EW may not have all the services provided through CAC, CADI, DD or TBI waivers. ¨ The SNBC service area is not the same as the MSC+ or MSHO service area. The same health plan may not be available. ¨

What happens at age 65? Enrollee may remain in the SNBC plan when they turn 65, unless; They lose MA eligibility for a period of time and a new enrollment needs to be sent the CMS to restart the Medicare coverage. ¨ They choose to become a participant in the Elder Waiver (EW) program and receive Home and Community Based Services through EW. ¨ Things to consider: SIS-EW budget allows the recipient to retain more of their income. ¨ EW may not have all the services provided through CAC, CADI, DD or TBI waivers. ¨ The SNBC service area is not the same as the MSC+ or MSHO service area. The same health plan may not be available. ¨

Enrollee Rights n Enrollee of SNBC have access to the same rights to appeal as they do under fee for service. n For Medicare covered services, enrollee may file an appeal with the health plan. n For Medicaid covered services, enrollee may appeal directly to DHS for a State Fair Hearing.

Enrollee Rights n Enrollee of SNBC have access to the same rights to appeal as they do under fee for service. n For Medicare covered services, enrollee may file an appeal with the health plan. n For Medicaid covered services, enrollee may appeal directly to DHS for a State Fair Hearing.

Ombudsman Contacts Assistance is available: n DHS Ombudsman for Managed Care n 1 -800 -657 -3729 n Ombudsman for Mental Health and Developmental Disabilities n 1 -800 -657 -3506

Ombudsman Contacts Assistance is available: n DHS Ombudsman for Managed Care n 1 -800 -657 -3729 n Ombudsman for Mental Health and Developmental Disabilities n 1 -800 -657 -3506

The Formulary Can Change n Health Plans can: ¨ Add or remove drugs from the formulary ¨ Add prior authorizations, quantity limits, and/or step-therapy restrictions on a drug. ¨ Move a drug to a higher or lower cost-sharing tier

The Formulary Can Change n Health Plans can: ¨ Add or remove drugs from the formulary ¨ Add prior authorizations, quantity limits, and/or step-therapy restrictions on a drug. ¨ Move a drug to a higher or lower cost-sharing tier

What if your prescription is not on your copy of the formulary n n Confirm the health plan does not cover the drug ¨ Call your care coordinator/care guide ¨ Call member services If the prescription is not covered ¨ Ask your doctor if you can switch to another drug that is covered by the health plan ¨ You or your doctor ask to make an exception to cover your drug ¨ If you recently joined the health plan you may be able to get a temporary supply of a drug you were taking when you joined the health plan. Work with member services or your care coordinator on the transition.

What if your prescription is not on your copy of the formulary n n Confirm the health plan does not cover the drug ¨ Call your care coordinator/care guide ¨ Call member services If the prescription is not covered ¨ Ask your doctor if you can switch to another drug that is covered by the health plan ¨ You or your doctor ask to make an exception to cover your drug ¨ If you recently joined the health plan you may be able to get a temporary supply of a drug you were taking when you joined the health plan. Work with member services or your care coordinator on the transition.

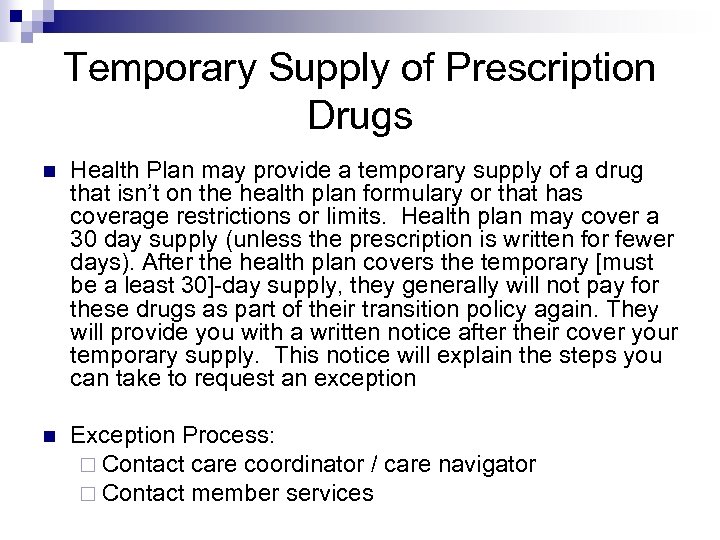

Temporary Supply of Prescription Drugs n Health Plan may provide a temporary supply of a drug that isn’t on the health plan formulary or that has coverage restrictions or limits. Health plan may cover a 30 day supply (unless the prescription is written for fewer days). After the health plan covers the temporary [must be a least 30]-day supply, they generally will not pay for these drugs as part of their transition policy again. They will provide you with a written notice after their cover your temporary supply. This notice will explain the steps you can take to request an exception n Exception Process: ¨ Contact care coordinator / care navigator ¨ Contact member services

Temporary Supply of Prescription Drugs n Health Plan may provide a temporary supply of a drug that isn’t on the health plan formulary or that has coverage restrictions or limits. Health plan may cover a 30 day supply (unless the prescription is written for fewer days). After the health plan covers the temporary [must be a least 30]-day supply, they generally will not pay for these drugs as part of their transition policy again. They will provide you with a written notice after their cover your temporary supply. This notice will explain the steps you can take to request an exception n Exception Process: ¨ Contact care coordinator / care navigator ¨ Contact member services

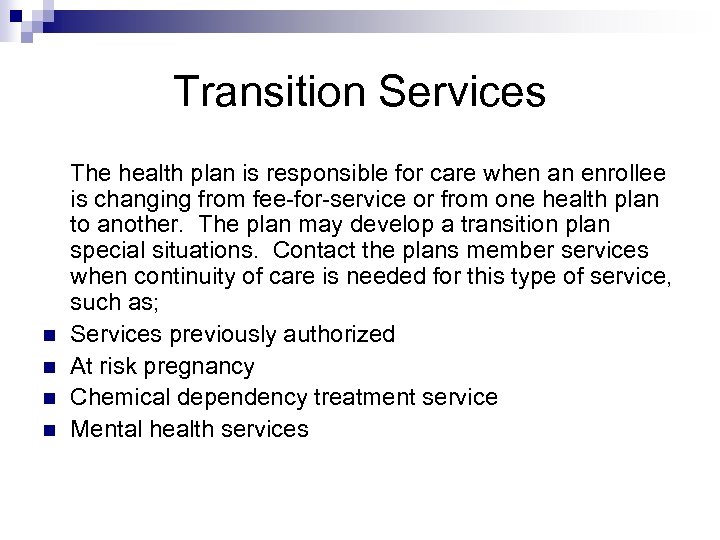

Transition Services n n The health plan is responsible for care when an enrollee is changing from fee-for-service or from one health plan to another. The plan may develop a transition plan special situations. Contact the plans member services when continuity of care is needed for this type of service, such as; Services previously authorized At risk pregnancy Chemical dependency treatment service Mental health services

Transition Services n n The health plan is responsible for care when an enrollee is changing from fee-for-service or from one health plan to another. The plan may develop a transition plan special situations. Contact the plans member services when continuity of care is needed for this type of service, such as; Services previously authorized At risk pregnancy Chemical dependency treatment service Mental health services

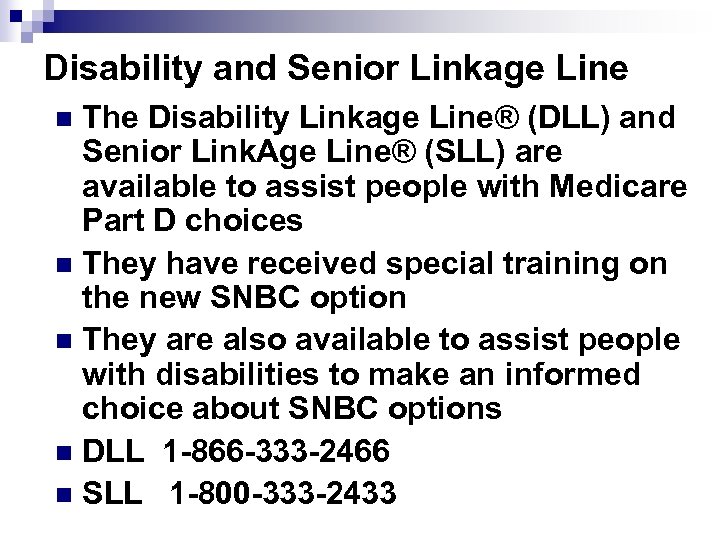

Disability and Senior Linkage Line The Disability Linkage Line® (DLL) and Senior Link. Age Line® (SLL) are available to assist people with Medicare Part D choices n They have received special training on the new SNBC option n They are also available to assist people with disabilities to make an informed choice about SNBC options n DLL 1 -866 -333 -2466 n SLL 1 -800 -333 -2433 n

Disability and Senior Linkage Line The Disability Linkage Line® (DLL) and Senior Link. Age Line® (SLL) are available to assist people with Medicare Part D choices n They have received special training on the new SNBC option n They are also available to assist people with disabilities to make an informed choice about SNBC options n DLL 1 -866 -333 -2466 n SLL 1 -800 -333 -2433 n

Miscellaneous

Miscellaneous

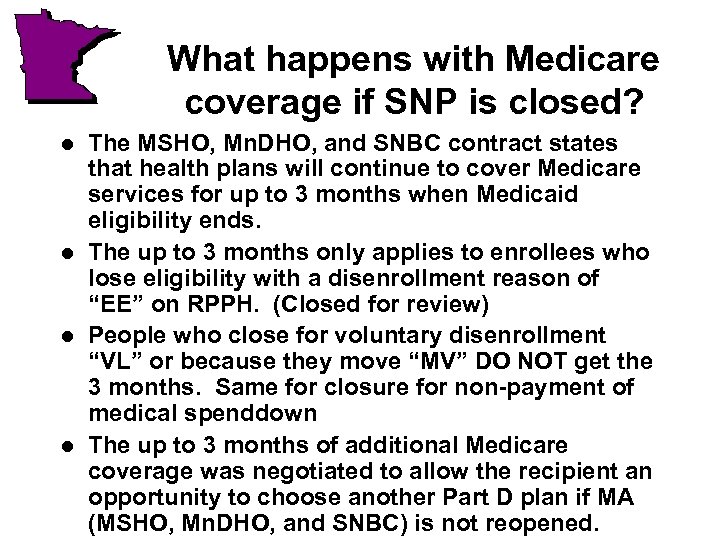

What happens with Medicare coverage if SNP is closed? l l The MSHO, Mn. DHO, and SNBC contract states that health plans will continue to cover Medicare services for up to 3 months when Medicaid eligibility ends. The up to 3 months only applies to enrollees who lose eligibility with a disenrollment reason of “EE” on RPPH. (Closed for review) People who close for voluntary disenrollment “VL” or because they move “MV” DO NOT get the 3 months. Same for closure for non-payment of medical spenddown The up to 3 months of additional Medicare coverage was negotiated to allow the recipient an opportunity to choose another Part D plan if MA (MSHO, Mn. DHO, and SNBC) is not reopened.

What happens with Medicare coverage if SNP is closed? l l The MSHO, Mn. DHO, and SNBC contract states that health plans will continue to cover Medicare services for up to 3 months when Medicaid eligibility ends. The up to 3 months only applies to enrollees who lose eligibility with a disenrollment reason of “EE” on RPPH. (Closed for review) People who close for voluntary disenrollment “VL” or because they move “MV” DO NOT get the 3 months. Same for closure for non-payment of medical spenddown The up to 3 months of additional Medicare coverage was negotiated to allow the recipient an opportunity to choose another Part D plan if MA (MSHO, Mn. DHO, and SNBC) is not reopened.

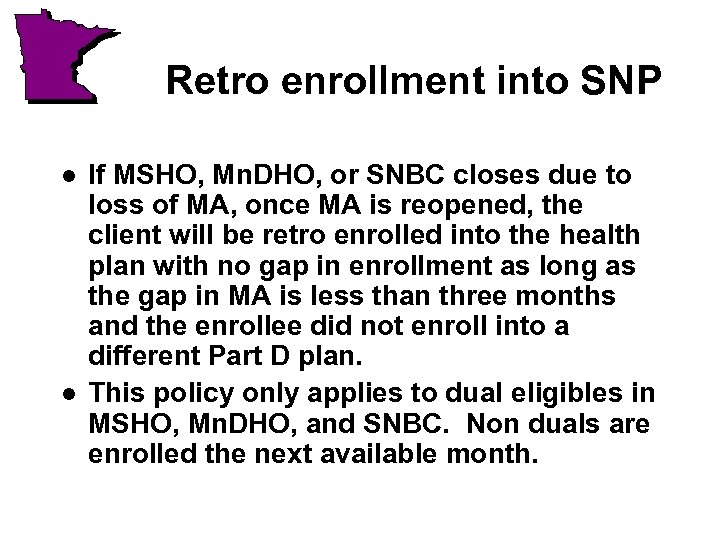

Retro enrollment into SNP l l If MSHO, Mn. DHO, or SNBC closes due to loss of MA, once MA is reopened, the client will be retro enrolled into the health plan with no gap in enrollment as long as the gap in MA is less than three months and the enrollee did not enroll into a different Part D plan. This policy only applies to dual eligibles in MSHO, Mn. DHO, and SNBC. Non duals are enrolled the next available month.

Retro enrollment into SNP l l If MSHO, Mn. DHO, or SNBC closes due to loss of MA, once MA is reopened, the client will be retro enrolled into the health plan with no gap in enrollment as long as the gap in MA is less than three months and the enrollee did not enroll into a different Part D plan. This policy only applies to dual eligibles in MSHO, Mn. DHO, and SNBC. Non duals are enrolled the next available month.

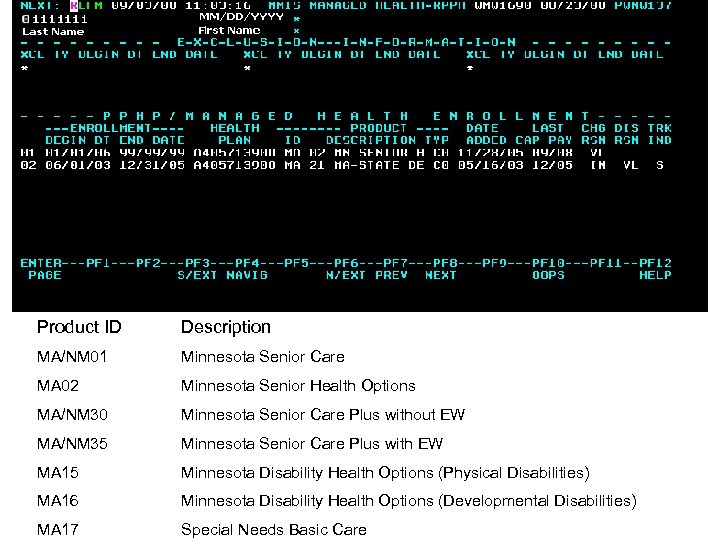

Product ID Description MA/NM 01 Minnesota Senior Care MA 02 Minnesota Senior Health Options MA/NM 30 Minnesota Senior Care Plus without EW MA/NM 35 Minnesota Senior Care Plus with EW MA 15 Minnesota Disability Health Options (Physical Disabilities) MA 16 Minnesota Disability Health Options (Developmental Disabilities) MA 17 Special Needs Basic Care

Product ID Description MA/NM 01 Minnesota Senior Care MA 02 Minnesota Senior Health Options MA/NM 30 Minnesota Senior Care Plus without EW MA/NM 35 Minnesota Senior Care Plus with EW MA 15 Minnesota Disability Health Options (Physical Disabilities) MA 16 Minnesota Disability Health Options (Developmental Disabilities) MA 17 Special Needs Basic Care

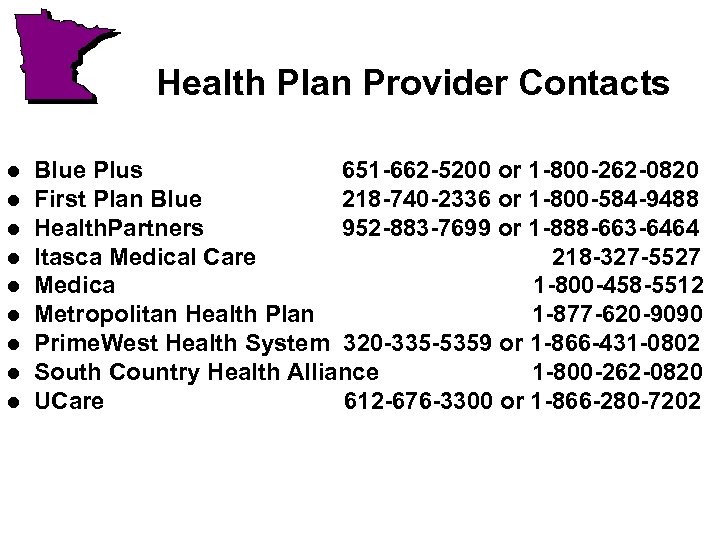

Health Plan Provider Contacts l l l l l Blue Plus 651 -662 -5200 or 1 -800 -262 -0820 First Plan Blue 218 -740 -2336 or 1 -800 -584 -9488 Health. Partners 952 -883 -7699 or 1 -888 -663 -6464 Itasca Medical Care 218 -327 -5527 Medica 1 -800 -458 -5512 Metropolitan Health Plan 1 -877 -620 -9090 Prime. West Health System 320 -335 -5359 or 1 -866 -431 -0802 South Country Health Alliance 1 -800 -262 -0820 UCare 612 -676 -3300 or 1 -866 -280 -7202

Health Plan Provider Contacts l l l l l Blue Plus 651 -662 -5200 or 1 -800 -262 -0820 First Plan Blue 218 -740 -2336 or 1 -800 -584 -9488 Health. Partners 952 -883 -7699 or 1 -888 -663 -6464 Itasca Medical Care 218 -327 -5527 Medica 1 -800 -458 -5512 Metropolitan Health Plan 1 -877 -620 -9090 Prime. West Health System 320 -335 -5359 or 1 -866 -431 -0802 South Country Health Alliance 1 -800 -262 -0820 UCare 612 -676 -3300 or 1 -866 -280 -7202

General Q and A? l Kelli Jo Greiner Jeff Goodmanson Susan Kennedy l THANK YOU! l l

General Q and A? l Kelli Jo Greiner Jeff Goodmanson Susan Kennedy l THANK YOU! l l