daa44564b01db55f91757c41c9fbe2f0.ppt

- Количество слайдов: 22

2009 Financial Statement Workshops Budget Implications

Topics to be covered: n n n Financial statement implications Budgeting options Budget implications Go Forward Budgeting Provincial legislation update

Financial Statement Implications n n n As of 2009, PSAB requires local governments to use full accrual accounting when preparing their financial statements PSAB does not prescribe a format for completing a local government budget Budgets must be reconciled to the financial statements at the end of the year for the necessary comparatives on the Statement of Operations & Statement of Change in Net Financial Assets, any other corresponding schedules

Budgeting Options n (1) (2) (3) Three options for preparing a local government budget: Cash basis budget Moderate changes to budget Prepare a full accrual budget

Cash Budget n n n Currently the budget format that most municipalities undertake Well understood by both administrators and elected officials Local governments would have to reconcile their budget format to their financial statements at year end

Other budget options n n Modified budget – creation of a cash based budget with the necessary amounts for estimated non-cash items to allow for comparatives on the financial statements Full Accrual budget - adoption of a local government budget that chooses to levy or not levy the necessary taxes to fund the non-cash items

Budget Format Implications Three scenarios for Non-Cash items on a local government budget: n If non-cash items are not budgeted for, a budget to actual variance will exist n If non-cash items are budgeted for and revenues aren’t increased, an unbalanced budget is created n If you budget and levy tax dollars for non-cash items, you are directly funding non-cash items

Other Budget Implications n n 1. 2. 3. Operating expenses may now be considered as part of the capital cost Items to be aware of: Engineering fees Equipment in-service labor costs In house labor costs for constructing various assets

Other Budget Implications n n Long Term Debt now shows up on the cash flow statement only Reserve Funds do not show up on the financial statements at all, as noted in Layne’s presentation, they are now shown under Schedule 08 in the new financial statements

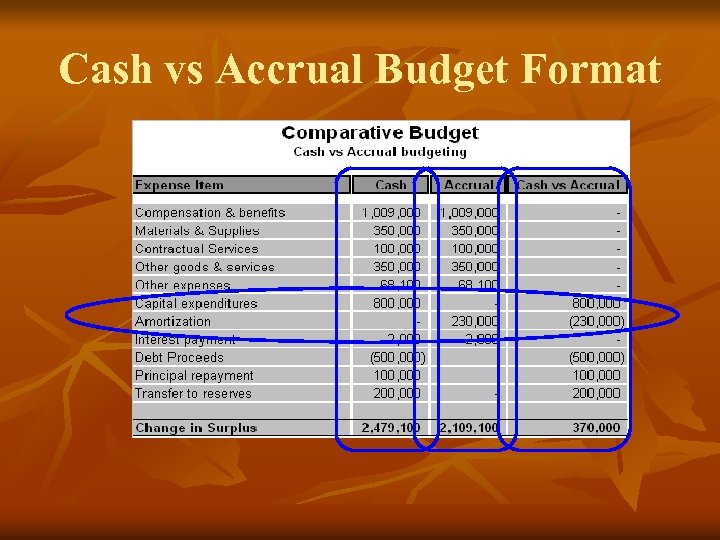

Cash vs Accrual Budget Format

Go Forward Budgeting n Current budgeting model is a cash format: Municipal revenues Less: Annual Expenditures (Incl. Capital Exp) Equals: Change in Net Financial Assets (Pg 04, Line 29)

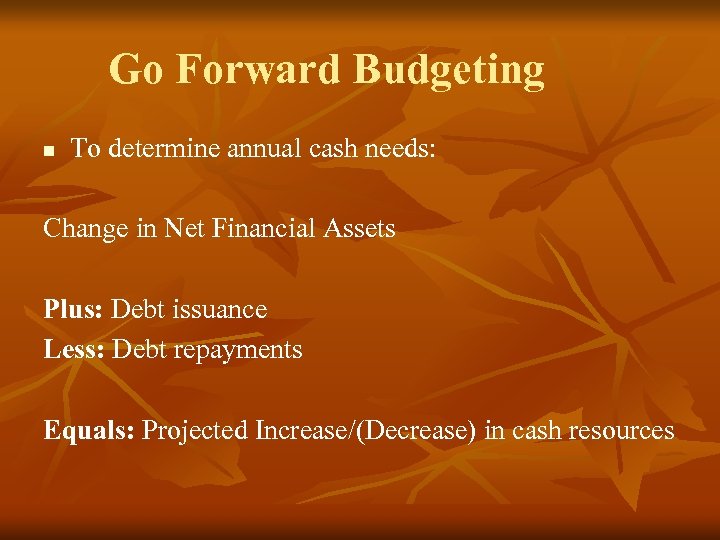

Go Forward Budgeting n To determine annual cash needs: Change in Net Financial Assets Plus: Debt issuance Less: Debt repayments Equals: Projected Increase/(Decrease) in cash resources

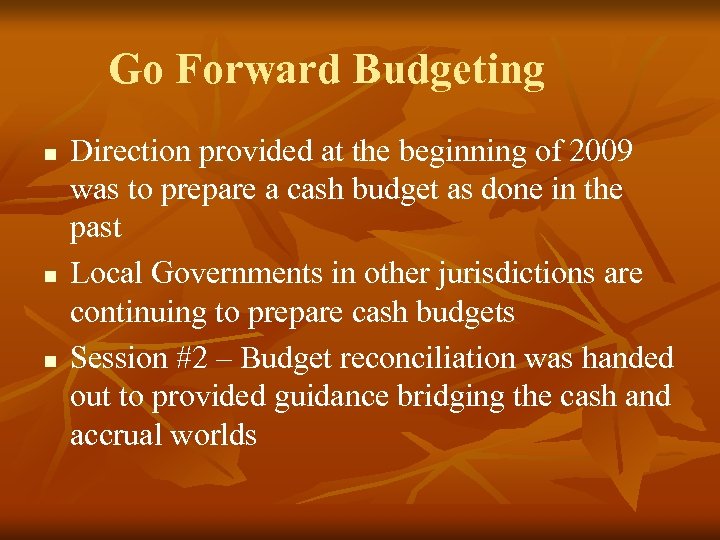

Go Forward Budgeting n n n Direction provided at the beginning of 2009 was to prepare a cash budget as done in the past Local Governments in other jurisdictions are continuing to prepare cash budgets Session #2 – Budget reconciliation was handed out to provided guidance bridging the cash and accrual worlds

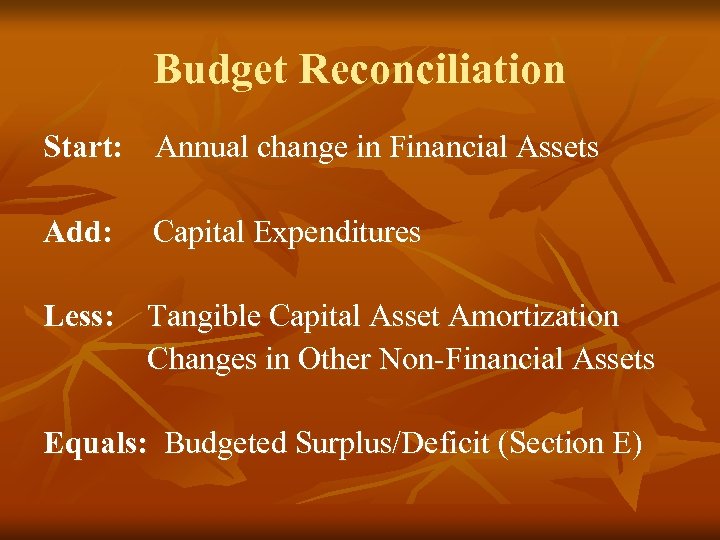

Budget Reconciliation Start: Annual change in Financial Assets Add: Capital Expenditures Less: Tangible Capital Asset Amortization Changes in Other Non-Financial Assets Equals: Budgeted Surplus/Deficit (Section E)

Provincial Legislation n n Topics to be covered: Ontario legislation update Alberta legislation update Manitoba legislation update Current Provincial legislation

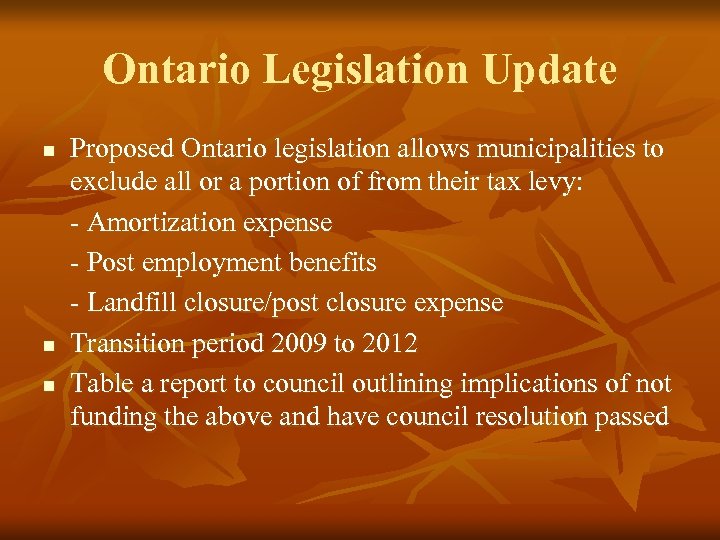

Ontario Legislation Update n n n Proposed Ontario legislation allows municipalities to exclude all or a portion of from their tax levy: - Amortization expense - Post employment benefits - Landfill closure/post closure expense Transition period 2009 to 2012 Table a report to council outlining implications of not funding the above and have council resolution passed

Alberta Legislation Update n n n Alberta has changed the regulations to allow municipalities to choose to not fund most of their amortization expense Municipalities must also ensure that they maintain a positive reserves balance. The formula is accumulated surplus less net investment in tangible capital assets must be greater than or equal to zero For example, on the session 3 handout, $7, 723, 296 less $6, 514, 845(Line 29) is equal to $1, 208, 451.

Manitoba Legislation Update n n No changes are being planned Taking a wait and see approach as to how the financial statements look once municipalities start reporting in 2010

Current Provincial Legislation n n Municipal legislation states that any deficit incurred by a municipality must be incorporated into the following year’s budget A number of options have been looked at to change the current legislation surrounding the balanced budget requirement A proposal will be made to the provincial Cabinet to create an interim period that would exclude tangible capital asset amortization from the expenditures definition in municipal legislation This will allow time for a long term solution to be developed and consultations to be held

Municipal Legislation Consultation n n The ministry will be consulting with the municipal sector in both the short term and beyond regarding the current balanced budget legislation The initial consultation period will close on October 31, 2009 Municipalities can send their comments to legislation@sasktca. ca by October 31, 2009 Details regarding consultations beyond October 31, 2009 will be provided in the future

Questions?

daa44564b01db55f91757c41c9fbe2f0.ppt