d01e83996d91cbf2c91f128f7e5ab9da.ppt

- Количество слайдов: 58

2009 ---A Right Time for Chinese Enterprises to Go out Mining Overseas and Risk Hedge Thereof Consultant at Chinese Institute of Metallurgical & Mining Enterprises Senior engineer with professor title By Jiao Yushu March 18, 2009 Beijing

2009 ---A Right Time for Chinese Enterprises to Go out Mining Overseas and Risk Hedge Thereof Consultant at Chinese Institute of Metallurgical & Mining Enterprises Senior engineer with professor title By Jiao Yushu March 18, 2009 Beijing

Brief introduction of Mr. Jiao Yushu Mr. Jiao was born in 1933 in Tianjin, university graduate. He is a senior engineer with professor title who is accorded the special governmental allowance by the State Council. Posts that Mr. Jiao currently holds: Consultant at Chinese Institute of Metallurgical & Mining Enterprises Consultant at China Council for the Promotion of International Trade (CCPIT), Metallurgy Sub-council Consultant at China Shougang International Trade & Engineering Corp Consultant at Jianlong Steel Holding Ltd. Editor-in-chief, Mine Engineering magazine Posts that Mr. Jiao once held: President of Anshan Metallurgical Design &Research Institute, Ministry Of Metallurgical Industry Engineering Manager on Chinese Side, Sino-Australian Joint venture Channar Iron Mine, Australia Chief Designer on Chinese Side, Sino-Brazilian Joint venture Carajas Iron Mine, Brazil Chief Designer on Chinese Side, Sino-Brazilian Joint venture kabao·xiafeier Iron Mine, Brazil Deputy Chairman of Chinese Institute of Metallurgical & Mining Enterprises

Brief introduction of Mr. Jiao Yushu Mr. Jiao was born in 1933 in Tianjin, university graduate. He is a senior engineer with professor title who is accorded the special governmental allowance by the State Council. Posts that Mr. Jiao currently holds: Consultant at Chinese Institute of Metallurgical & Mining Enterprises Consultant at China Council for the Promotion of International Trade (CCPIT), Metallurgy Sub-council Consultant at China Shougang International Trade & Engineering Corp Consultant at Jianlong Steel Holding Ltd. Editor-in-chief, Mine Engineering magazine Posts that Mr. Jiao once held: President of Anshan Metallurgical Design &Research Institute, Ministry Of Metallurgical Industry Engineering Manager on Chinese Side, Sino-Australian Joint venture Channar Iron Mine, Australia Chief Designer on Chinese Side, Sino-Brazilian Joint venture Carajas Iron Mine, Brazil Chief Designer on Chinese Side, Sino-Brazilian Joint venture kabao·xiafeier Iron Mine, Brazil Deputy Chairman of Chinese Institute of Metallurgical & Mining Enterprises

2009 ---A Right Time for Chinese Enterprises to Go out Mining Overseas and Risk Hedge Thereof

2009 ---A Right Time for Chinese Enterprises to Go out Mining Overseas and Risk Hedge Thereof

Foreword 1. Why is it a right time for Chinese enterprises to mine overseas in 2009? 1. 1 The birth of , and impact by current financial crisis 1. 1. 1 The birth of the world financial crisis 1. 1. 2 The impact by the world financial crisis 1. 1. 2. 1 The American subprime crisis causes the global financial storm 1. 1. 2. 2 The fast spread of the crisis has effect on international mining enterprises 1. 1. 2. 3 Impact on Chinese markets by the world financial crisis 2. Why is ‘Going Out’ a need for Chinese enterprises? 2. 1 A strategic requirement for China’s national economy to reach a quadruple growth 2. 2 A strategic requirement for China to move forward to form a strong nation of steel from a big nation of steel, and meet its goal of sustainable development

Foreword 1. Why is it a right time for Chinese enterprises to mine overseas in 2009? 1. 1 The birth of , and impact by current financial crisis 1. 1. 1 The birth of the world financial crisis 1. 1. 2 The impact by the world financial crisis 1. 1. 2. 1 The American subprime crisis causes the global financial storm 1. 1. 2. 2 The fast spread of the crisis has effect on international mining enterprises 1. 1. 2. 3 Impact on Chinese markets by the world financial crisis 2. Why is ‘Going Out’ a need for Chinese enterprises? 2. 1 A strategic requirement for China’s national economy to reach a quadruple growth 2. 2 A strategic requirement for China to move forward to form a strong nation of steel from a big nation of steel, and meet its goal of sustainable development

2. 3 Lessons from history: World War II, a war for resources and energy, was caused by the Great Depression in 1930 s, which shows the importance of the controls of mineral resources today 2. 4 China can not afford to lag always behind the struggles foreign resources by multinational groups, to which more attention should be paid. 3. The goals for overseas mining 3. 1 The selection standards for overseas mining projects 3. 2 Other than the economic gain, environmental and social benefits from the overseas mining projects should calculate more. 4. Modes and routes for overseas mining 4. 1 Modes 4. 2. Purchase of a listed shell company and specialized funds 5. Steps to overseas mining 5. 1 Progressive achievement of overseas mining 5. 1. 1 Joint venture projects that are now in practice 5. 1. 2 Projects that are in preparation, prior to construction and under construction.

2. 3 Lessons from history: World War II, a war for resources and energy, was caused by the Great Depression in 1930 s, which shows the importance of the controls of mineral resources today 2. 4 China can not afford to lag always behind the struggles foreign resources by multinational groups, to which more attention should be paid. 3. The goals for overseas mining 3. 1 The selection standards for overseas mining projects 3. 2 Other than the economic gain, environmental and social benefits from the overseas mining projects should calculate more. 4. Modes and routes for overseas mining 4. 1 Modes 4. 2. Purchase of a listed shell company and specialized funds 5. Steps to overseas mining 5. 1 Progressive achievement of overseas mining 5. 1. 1 Joint venture projects that are now in practice 5. 1. 2 Projects that are in preparation, prior to construction and under construction.

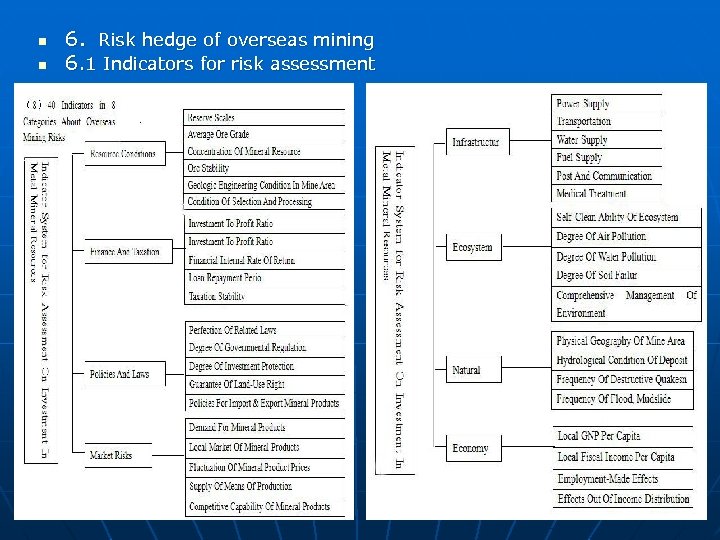

5. 2 Steps to operate the overseas mining 5. 2. 1 Preparatory work and the procedure for production and construction 5. 2. 2 Applications for EPM, MDL and ML 5. 2. 3 Project approval proceedings 5. 2. 4 Laws and regulations related 5. 2. 5 Criterions and standards 6. Risk hedge of overseas mining 6. 1 Indicators for risk assessment 6. 2 Lessons needed to learn 6. 2. 1 Risks of geologic resources 6. 2. 2 Risks of ore processing and minerals logistics 6. 2. 3 Risks of project approvals 6. 2. 4 Risks of labor relation system 6. 2. 5 Risks out of the different law systems 7. Role Model for the 21 st century---CITIC Palma Iron Mine, Western Australia

5. 2 Steps to operate the overseas mining 5. 2. 1 Preparatory work and the procedure for production and construction 5. 2. 2 Applications for EPM, MDL and ML 5. 2. 3 Project approval proceedings 5. 2. 4 Laws and regulations related 5. 2. 5 Criterions and standards 6. Risk hedge of overseas mining 6. 1 Indicators for risk assessment 6. 2 Lessons needed to learn 6. 2. 1 Risks of geologic resources 6. 2. 2 Risks of ore processing and minerals logistics 6. 2. 3 Risks of project approvals 6. 2. 4 Risks of labor relation system 6. 2. 5 Risks out of the different law systems 7. Role Model for the 21 st century---CITIC Palma Iron Mine, Western Australia

2009 ---A Right Time for Chinese Enterprises to Go out Mining Overseas and Risk Hedge Thereof

2009 ---A Right Time for Chinese Enterprises to Go out Mining Overseas and Risk Hedge Thereof

1. Why is it a right time for Chinese enterprises to mine overseas in 2009? 1. 1 The birth of , and impact by current financial crisis 1. 1. 1 The birth of the world financial crisis Subprime problem is the most popular official explanation for this financial crisis while the real cause is the “leverage” used by financial institutes. Behind the financial crisis is Credit Default Swap (CDS), and then what is the relation between subprime, leverage and CDS?

1. Why is it a right time for Chinese enterprises to mine overseas in 2009? 1. 1 The birth of , and impact by current financial crisis 1. 1. 1 The birth of the world financial crisis Subprime problem is the most popular official explanation for this financial crisis while the real cause is the “leverage” used by financial institutes. Behind the financial crisis is Credit Default Swap (CDS), and then what is the relation between subprime, leverage and CDS?

Ⅰ. Leverage. At present, to gain staggering profits, many investment banks have their leverage operations about 20— 30 folds high. Ⅱ. CDS Contract. Due to the huge risks of leverage, banks are not permitted to this risky operation if they follow the rules. So someone made up an approach to insure the investment by leverage, which is CDS. Ⅲ. CDS Market. Ⅳ. Subprime. The U. S. mortgage market comprises of Subprime and Prime markets, and the subprime loan is a mortgage home loan for those who have poor credit standings, no proof of their incomes and repayment capabilities, and some debts. Financial Crisis Subprime Crisis Dollar Crisis

Ⅰ. Leverage. At present, to gain staggering profits, many investment banks have their leverage operations about 20— 30 folds high. Ⅱ. CDS Contract. Due to the huge risks of leverage, banks are not permitted to this risky operation if they follow the rules. So someone made up an approach to insure the investment by leverage, which is CDS. Ⅲ. CDS Market. Ⅳ. Subprime. The U. S. mortgage market comprises of Subprime and Prime markets, and the subprime loan is a mortgage home loan for those who have poor credit standings, no proof of their incomes and repayment capabilities, and some debts. Financial Crisis Subprime Crisis Dollar Crisis

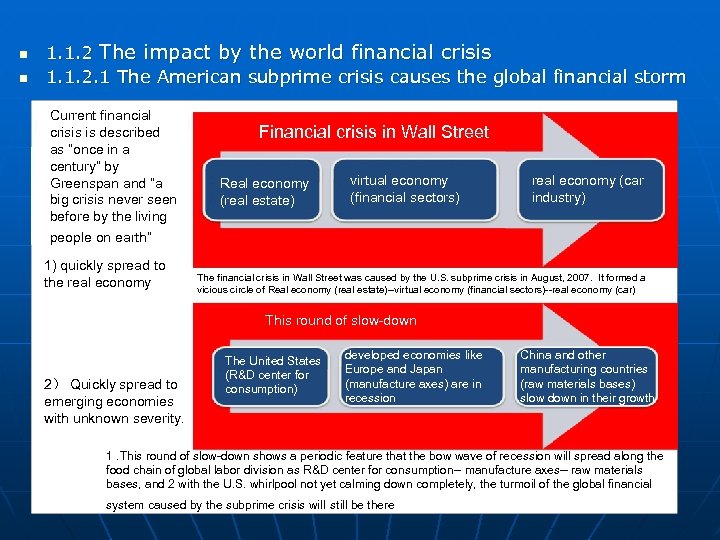

1. 1. 2 The impact by the world financial crisis 1. 1. 2. 1 The American subprime crisis causes the global financial storm Current financial crisis is described as “once in a century” by Greenspan and “a big crisis never seen before by the living people on earth” 1) quickly spread to the real economy Financial crisis in Wall Street Real economy (real estate) virtual economy (financial sectors) real economy (car industry) The financial crisis in Wall Street was caused by the U. S. subprime crisis in August, 2007. It formed a vicious circle of Real economy (real estate)--virtual economy (financial sectors)--real economy (car) This round of slow-down 2) Quickly spread to emerging economies with unknown severity. The United States (R&D center for consumption) developed economies like Europe and Japan (manufacture axes) are in recession China and other manufacturing countries (raw materials bases) slow down in their growth 1. This round of slow-down shows a periodic feature that the bow wave of recession will spread along the food chain of global labor division as R&D center for consumption-- manufacture axes-- raw materials bases, and 2 with the U. S. whirlpool not yet calming down completely, the turmoil of the global financial system caused by the subprime crisis will still be there

1. 1. 2 The impact by the world financial crisis 1. 1. 2. 1 The American subprime crisis causes the global financial storm Current financial crisis is described as “once in a century” by Greenspan and “a big crisis never seen before by the living people on earth” 1) quickly spread to the real economy Financial crisis in Wall Street Real economy (real estate) virtual economy (financial sectors) real economy (car industry) The financial crisis in Wall Street was caused by the U. S. subprime crisis in August, 2007. It formed a vicious circle of Real economy (real estate)--virtual economy (financial sectors)--real economy (car) This round of slow-down 2) Quickly spread to emerging economies with unknown severity. The United States (R&D center for consumption) developed economies like Europe and Japan (manufacture axes) are in recession China and other manufacturing countries (raw materials bases) slow down in their growth 1. This round of slow-down shows a periodic feature that the bow wave of recession will spread along the food chain of global labor division as R&D center for consumption-- manufacture axes-- raw materials bases, and 2 with the U. S. whirlpool not yet calming down completely, the turmoil of the global financial system caused by the subprime crisis will still be there

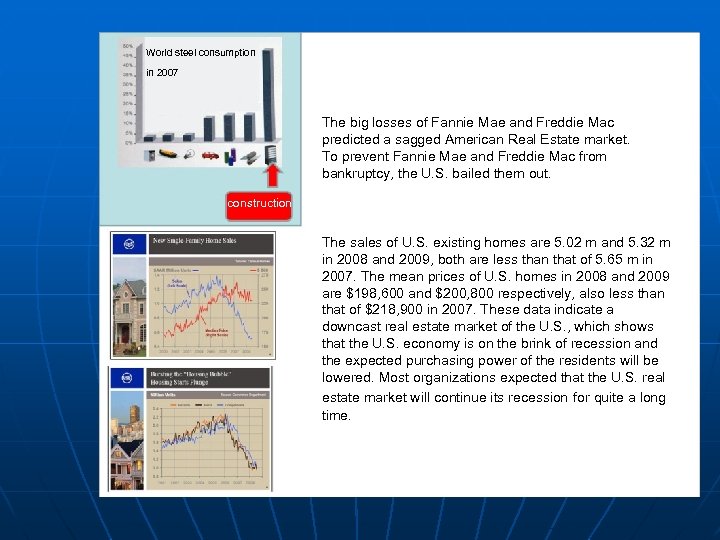

World steel consumption in 2007 The big losses of Fannie Mae and Freddie Mac predicted a sagged American Real Estate market. To prevent Fannie Mae and Freddie Mac from bankruptcy, the U. S. bailed them out. construction The sales of U. S. existing homes are 5. 02 m and 5. 32 m in 2008 and 2009, both are less than that of 5. 65 m in 2007. The mean prices of U. S. homes in 2008 and 2009 are $198, 600 and $200, 800 respectively, also less than that of $218, 900 in 2007. These data indicate a downcast real estate market of the U. S. , which shows that the U. S. economy is on the brink of recession and the expected purchasing power of the residents will be lowered. Most organizations expected that the U. S. real estate market will continue its recession for quite a long time.

World steel consumption in 2007 The big losses of Fannie Mae and Freddie Mac predicted a sagged American Real Estate market. To prevent Fannie Mae and Freddie Mac from bankruptcy, the U. S. bailed them out. construction The sales of U. S. existing homes are 5. 02 m and 5. 32 m in 2008 and 2009, both are less than that of 5. 65 m in 2007. The mean prices of U. S. homes in 2008 and 2009 are $198, 600 and $200, 800 respectively, also less than that of $218, 900 in 2007. These data indicate a downcast real estate market of the U. S. , which shows that the U. S. economy is on the brink of recession and the expected purchasing power of the residents will be lowered. Most organizations expected that the U. S. real estate market will continue its recession for quite a long time.

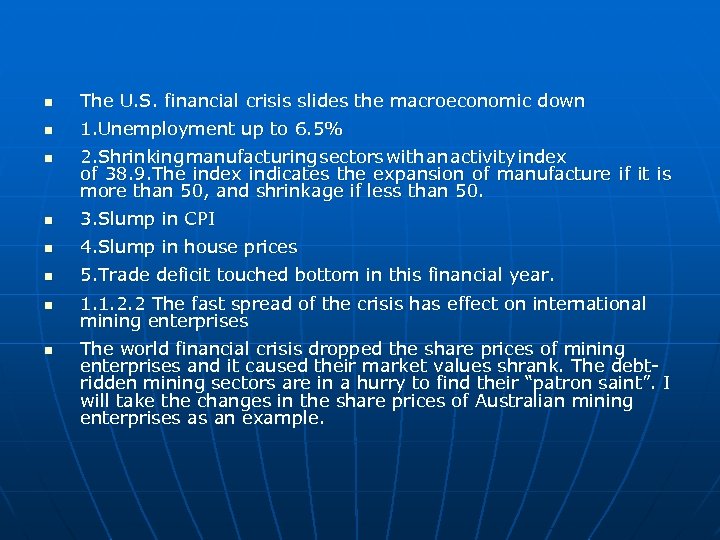

The U. S. financial crisis slides the macroeconomic down 1. Unemployment up to 6. 5% 2. Shrinking manufacturing sectors with an activity index of 38. 9. The index indicates the expansion of manufacture if it is more than 50, and shrinkage if less than 50. 3. Slump in CPI 4. Slump in house prices 5. Trade deficit touched bottom in this financial year. 1. 1. 2. 2 The fast spread of the crisis has effect on international mining enterprises The world financial crisis dropped the share prices of mining enterprises and it caused their market values shrank. The debtridden mining sectors are in a hurry to find their “patron saint”. I will take the changes in the share prices of Australian mining enterprises as an example.

The U. S. financial crisis slides the macroeconomic down 1. Unemployment up to 6. 5% 2. Shrinking manufacturing sectors with an activity index of 38. 9. The index indicates the expansion of manufacture if it is more than 50, and shrinkage if less than 50. 3. Slump in CPI 4. Slump in house prices 5. Trade deficit touched bottom in this financial year. 1. 1. 2. 2 The fast spread of the crisis has effect on international mining enterprises The world financial crisis dropped the share prices of mining enterprises and it caused their market values shrank. The debtridden mining sectors are in a hurry to find their “patron saint”. I will take the changes in the share prices of Australian mining enterprises as an example.

Australian Stock Market ASX falls from 6747. 6 on Oct. 26, 2007 to current low point of 3052. 5. (1))BHP. B from $50 on May 16, 2008 to$20 on Oct. 21, 2008; Oct. 21, 2008 (2)Rio tinto from $157. 45 on May 16, 2008 to$29. 91 on Dec. 25, 2008; (3)One steel from $7. 88 on June 20, 2008 to$1. 53 on Mar. 6, 2009 (4)Fortescue metals Ltd from $13. 15 on June 27, 2008 to$1. 16 on Nov. 24, 2008 (5)Grange Resources from $3. 0 on Aug. 17, 2007 to$0. 325 on Jan. 2, 2009 (6)Gindalbie metals Ltd from $1. 98 on Sep. 7, 2007 to$0. 32 on (7)Atlas Iron from $4. 37 on May 6, 2008 to$0. 405 on Oct. 20, 2008 Oct. 10, 2008 (8)Golden west Resonces from $3. 35 on Dec. 18, 2006 to$0. 21 on Dec. 19, 2008 (9) Cape Cambert Iron from $0. 92 on July 25, 2008 to$0. 155 on Nov. 21, 2008

Australian Stock Market ASX falls from 6747. 6 on Oct. 26, 2007 to current low point of 3052. 5. (1))BHP. B from $50 on May 16, 2008 to$20 on Oct. 21, 2008; Oct. 21, 2008 (2)Rio tinto from $157. 45 on May 16, 2008 to$29. 91 on Dec. 25, 2008; (3)One steel from $7. 88 on June 20, 2008 to$1. 53 on Mar. 6, 2009 (4)Fortescue metals Ltd from $13. 15 on June 27, 2008 to$1. 16 on Nov. 24, 2008 (5)Grange Resources from $3. 0 on Aug. 17, 2007 to$0. 325 on Jan. 2, 2009 (6)Gindalbie metals Ltd from $1. 98 on Sep. 7, 2007 to$0. 32 on (7)Atlas Iron from $4. 37 on May 6, 2008 to$0. 405 on Oct. 20, 2008 Oct. 10, 2008 (8)Golden west Resonces from $3. 35 on Dec. 18, 2006 to$0. 21 on Dec. 19, 2008 (9) Cape Cambert Iron from $0. 92 on July 25, 2008 to$0. 155 on Nov. 21, 2008

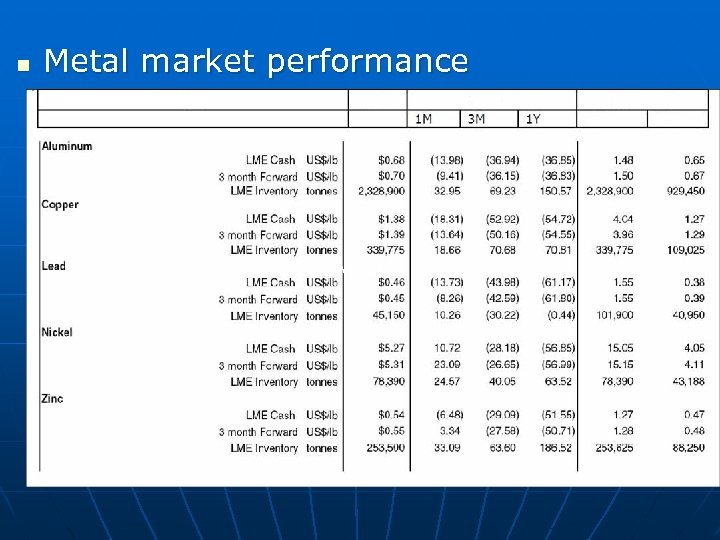

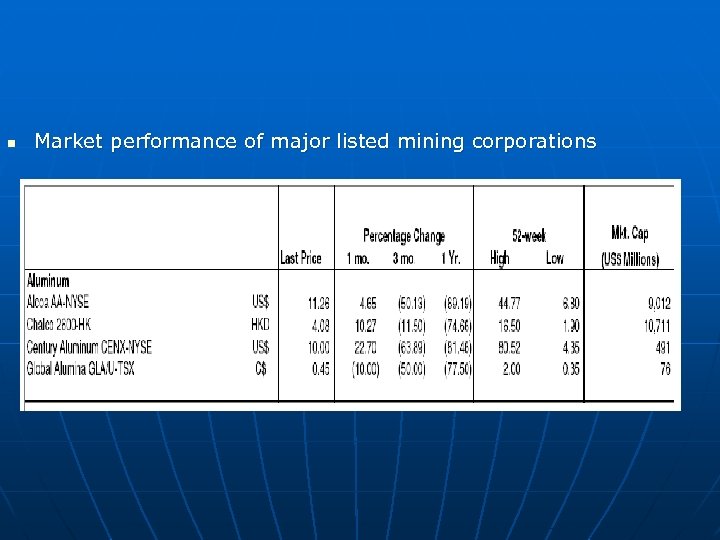

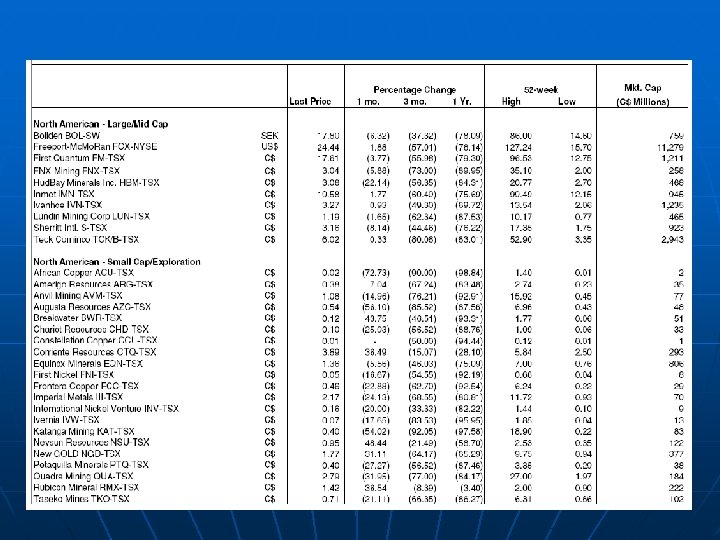

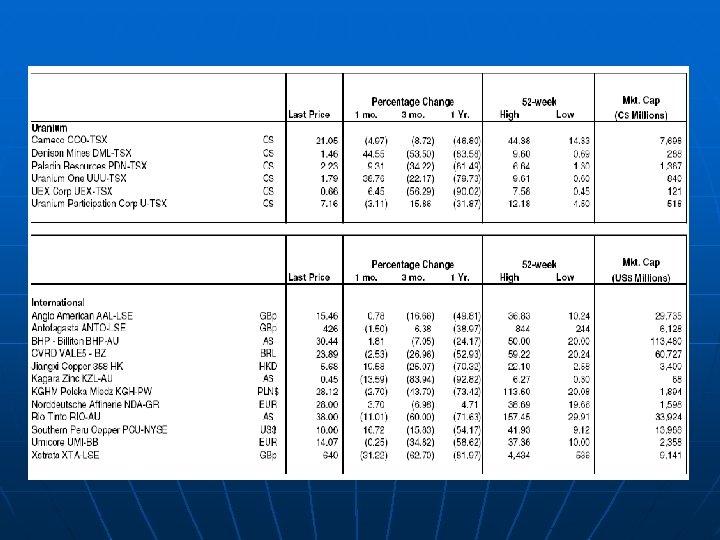

Metal market performance Metal

Metal market performance Metal

Market performance of major listed mining corporations

Market performance of major listed mining corporations

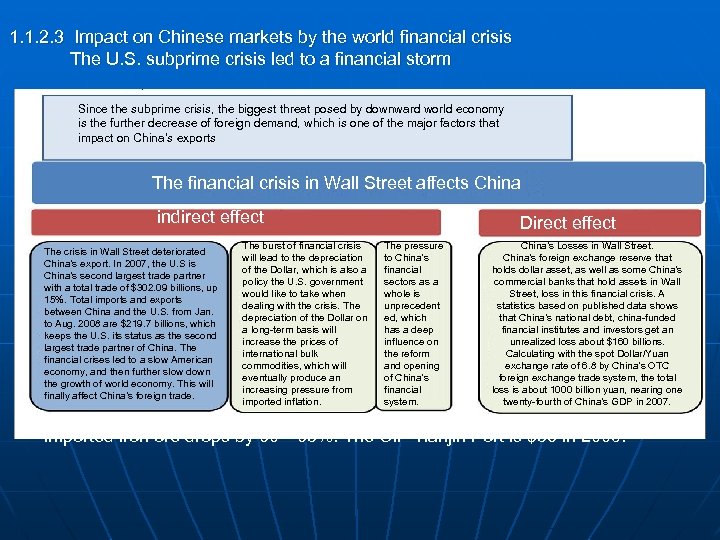

1. 1. 2. 3 Impact on Chinese markets by the world financial crisis The U. S. subprime crisis led to a financial storm Since the subprime crisis, the biggest threat posed by downward world economy is the further decrease of foreign demand, which is one of the major factors that impact on China’s exports The financial crisis in Wall Street affects China indirect effect The crisis in Wall Street deteriorated China’s export. In 2007, the U. S is China’s second largest trade partner with a total trade of $302. 09 billions, up 15%. Total imports and exports between China and the U. S. from Jan. to Aug. 2008 are $219. 7 billions, which keeps the U. S. its status as the second largest trade partner of China. The financial crises led to a slow American economy, and then further slow down the growth of world economy. This will finally affect China’s foreign trade. The burst of financial crisis will lead to the depreciation of the Dollar, which is also a policy the U. S. government would like to take when dealing with the crisis. The depreciation of the Dollar on a long-term basis will increase the prices of international bulk commodities, which will eventually produce an increasing pressure from imported inflation. Direct effect The pressure to China’s financial sectors as a whole is unprecedent ed, which has a deep influence on the reform and opening of China’s financial system. China’s Losses in Wall Street. China’s foreign exchange reserve that holds dollar asset, as well as some China’s commercial banks that hold assets in Wall Street, loss in this financial crisis. A statistics based on published data shows that China’s national debt, china-funded financial institutes and investors get an unrealized loss about $160 billions. Calculating with the spot Dollar/Yuan exchange rate of 6. 8 by China’s OTC foreign exchange trade system, the total loss is about 1000 billion yuan, nearing one twenty-fourth of China’s GDP in 2007. Under the influence of slowing world economy, China’s steel and iron ore markets slump and the prices of steel and iron ore fall sharply. The spot price of imported iron ore drops by 60— 65%. The CIF Tianjin Port is $58 in 2009.

1. 1. 2. 3 Impact on Chinese markets by the world financial crisis The U. S. subprime crisis led to a financial storm Since the subprime crisis, the biggest threat posed by downward world economy is the further decrease of foreign demand, which is one of the major factors that impact on China’s exports The financial crisis in Wall Street affects China indirect effect The crisis in Wall Street deteriorated China’s export. In 2007, the U. S is China’s second largest trade partner with a total trade of $302. 09 billions, up 15%. Total imports and exports between China and the U. S. from Jan. to Aug. 2008 are $219. 7 billions, which keeps the U. S. its status as the second largest trade partner of China. The financial crises led to a slow American economy, and then further slow down the growth of world economy. This will finally affect China’s foreign trade. The burst of financial crisis will lead to the depreciation of the Dollar, which is also a policy the U. S. government would like to take when dealing with the crisis. The depreciation of the Dollar on a long-term basis will increase the prices of international bulk commodities, which will eventually produce an increasing pressure from imported inflation. Direct effect The pressure to China’s financial sectors as a whole is unprecedent ed, which has a deep influence on the reform and opening of China’s financial system. China’s Losses in Wall Street. China’s foreign exchange reserve that holds dollar asset, as well as some China’s commercial banks that hold assets in Wall Street, loss in this financial crisis. A statistics based on published data shows that China’s national debt, china-funded financial institutes and investors get an unrealized loss about $160 billions. Calculating with the spot Dollar/Yuan exchange rate of 6. 8 by China’s OTC foreign exchange trade system, the total loss is about 1000 billion yuan, nearing one twenty-fourth of China’s GDP in 2007. Under the influence of slowing world economy, China’s steel and iron ore markets slump and the prices of steel and iron ore fall sharply. The spot price of imported iron ore drops by 60— 65%. The CIF Tianjin Port is $58 in 2009.

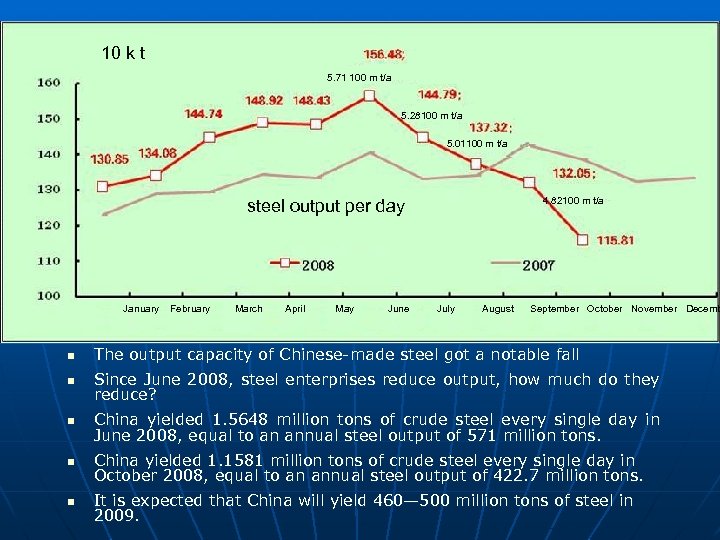

10 k t 5. 71 100 m t/a 5. 28100 m t/a 5. 01100 m t/a 4. 82100 m t/a steel output per day January February March April May June July August September October November Decemb The output capacity of Chinese-made steel got a notable fall Since June 2008, steel enterprises reduce output, how much do they reduce? China yielded 1. 5648 million tons of crude steel every single day in June 2008, equal to an annual steel output of 571 million tons. China yielded 1. 1581 million tons of crude steel every single day in October 2008, equal to an annual steel output of 422. 7 million tons. It is expected that China will yield 460— 500 million tons of steel in 2009.

10 k t 5. 71 100 m t/a 5. 28100 m t/a 5. 01100 m t/a 4. 82100 m t/a steel output per day January February March April May June July August September October November Decemb The output capacity of Chinese-made steel got a notable fall Since June 2008, steel enterprises reduce output, how much do they reduce? China yielded 1. 5648 million tons of crude steel every single day in June 2008, equal to an annual steel output of 571 million tons. China yielded 1. 1581 million tons of crude steel every single day in October 2008, equal to an annual steel output of 422. 7 million tons. It is expected that China will yield 460— 500 million tons of steel in 2009.

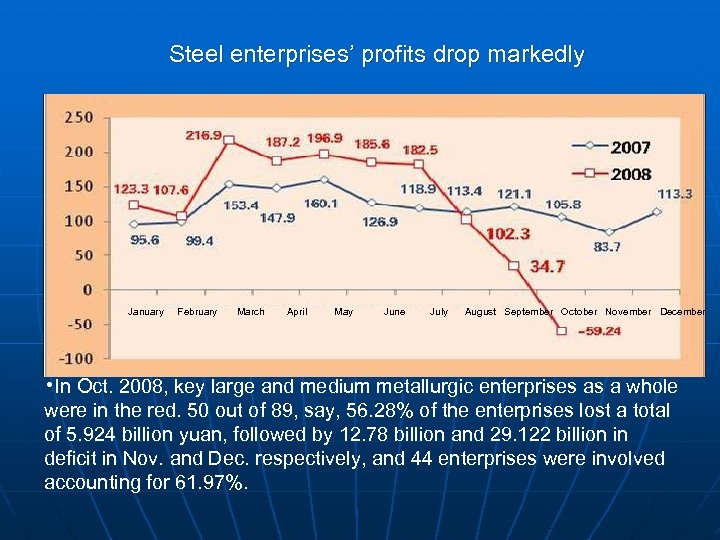

Steel enterprises’ profits drop markedly January February March April May June July August September October November December • In Oct. 2008, key large and medium metallurgic enterprises as a whole were in the red. 50 out of 89, say, 56. 28% of the enterprises lost a total of 5. 924 billion yuan, followed by 12. 78 billion and 29. 122 billion in deficit in Nov. and Dec. respectively, and 44 enterprises were involved accounting for 61. 97%.

Steel enterprises’ profits drop markedly January February March April May June July August September October November December • In Oct. 2008, key large and medium metallurgic enterprises as a whole were in the red. 50 out of 89, say, 56. 28% of the enterprises lost a total of 5. 924 billion yuan, followed by 12. 78 billion and 29. 122 billion in deficit in Nov. and Dec. respectively, and 44 enterprises were involved accounting for 61. 97%.

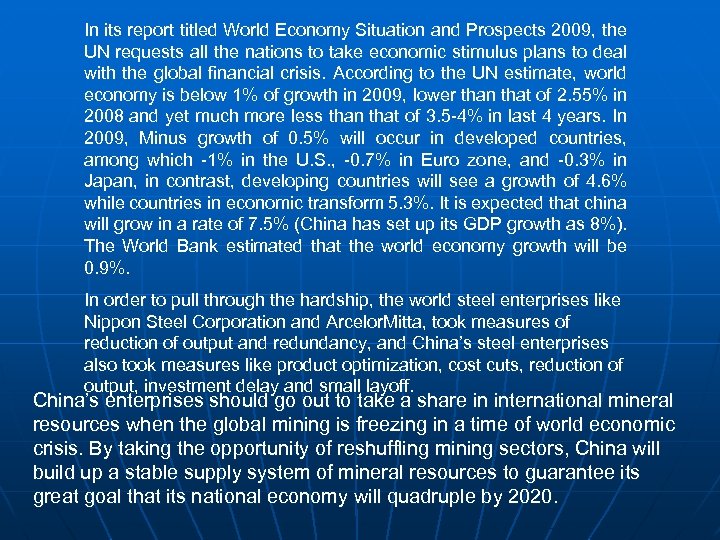

In its report titled World Economy Situation and Prospects 2009, the UN requests all the nations to take economic stimulus plans to deal with the global financial crisis. According to the UN estimate, world economy is below 1% of growth in 2009, lower than that of 2. 55% in 2008 and yet much more less than that of 3. 5 -4% in last 4 years. In 2009, Minus growth of 0. 5% will occur in developed countries, among which -1% in the U. S. , -0. 7% in Euro zone, and -0. 3% in Japan, in contrast, developing countries will see a growth of 4. 6% while countries in economic transform 5. 3%. It is expected that china will grow in a rate of 7. 5% (China has set up its GDP growth as 8%). The World Bank estimated that the world economy growth will be 0. 9%. In order to pull through the hardship, the world steel enterprises like Nippon Steel Corporation and Arcelor. Mitta, took measures of reduction of output and redundancy, and China’s steel enterprises also took measures like product optimization, cost cuts, reduction of output, investment delay and small layoff. China’s enterprises should go out to take a share in international mineral resources when the global mining is freezing in a time of world economic crisis. By taking the opportunity of reshuffling mining sectors, China will build up a stable supply system of mineral resources to guarantee its great goal that its national economy will quadruple by 2020.

In its report titled World Economy Situation and Prospects 2009, the UN requests all the nations to take economic stimulus plans to deal with the global financial crisis. According to the UN estimate, world economy is below 1% of growth in 2009, lower than that of 2. 55% in 2008 and yet much more less than that of 3. 5 -4% in last 4 years. In 2009, Minus growth of 0. 5% will occur in developed countries, among which -1% in the U. S. , -0. 7% in Euro zone, and -0. 3% in Japan, in contrast, developing countries will see a growth of 4. 6% while countries in economic transform 5. 3%. It is expected that china will grow in a rate of 7. 5% (China has set up its GDP growth as 8%). The World Bank estimated that the world economy growth will be 0. 9%. In order to pull through the hardship, the world steel enterprises like Nippon Steel Corporation and Arcelor. Mitta, took measures of reduction of output and redundancy, and China’s steel enterprises also took measures like product optimization, cost cuts, reduction of output, investment delay and small layoff. China’s enterprises should go out to take a share in international mineral resources when the global mining is freezing in a time of world economic crisis. By taking the opportunity of reshuffling mining sectors, China will build up a stable supply system of mineral resources to guarantee its great goal that its national economy will quadruple by 2020.

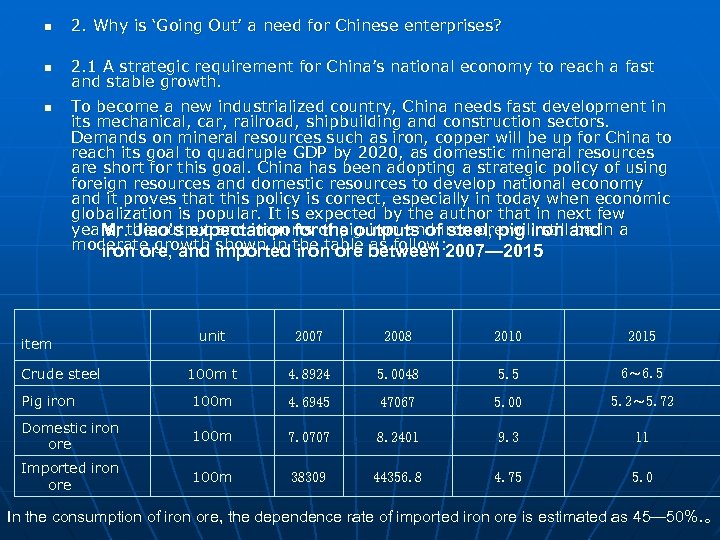

2. Why is ‘Going Out’ a need for Chinese enterprises? 2. 1 A strategic requirement for China’s national economy to reach a fast and stable growth. To become a new industrialized country, China needs fast development in its mechanical, car, railroad, shipbuilding and construction sectors. Demands on mineral resources such as iron, copper will be up for China to reach its goal to quadruple GDP by 2020, as domestic mineral resources are short for this goal. China has been adopting a strategic policy of using foreign resources and domestic resources to develop national economy and it proves that this policy is correct, especially in today when economic globalization is popular. It is expected by the author that in next few years, the output and imports of pig iron and iron ore will still andin a Mr. Jiao’s expectation for the outputs of steel, pig iron be moderate growth imported the table between 2007— 2015 iron ore, and shown in iron ore as follow: unit 2007 2008 2010 2015 100 m t 4. 8924 5. 0048 5. 5 6~ 6. 5 Pig iron 100 m 4. 6945 47067 5. 00 5. 2~ 5. 72 Domestic iron ore 100 m 7. 0707 8. 2401 9. 3 11 Imported iron ore 100 m 38309 44356. 8 4. 75 5. 0 item Crude steel In the consumption of iron ore, the dependence rate of imported iron ore is estimated as 45— 50%. 。

2. Why is ‘Going Out’ a need for Chinese enterprises? 2. 1 A strategic requirement for China’s national economy to reach a fast and stable growth. To become a new industrialized country, China needs fast development in its mechanical, car, railroad, shipbuilding and construction sectors. Demands on mineral resources such as iron, copper will be up for China to reach its goal to quadruple GDP by 2020, as domestic mineral resources are short for this goal. China has been adopting a strategic policy of using foreign resources and domestic resources to develop national economy and it proves that this policy is correct, especially in today when economic globalization is popular. It is expected by the author that in next few years, the output and imports of pig iron and iron ore will still andin a Mr. Jiao’s expectation for the outputs of steel, pig iron be moderate growth imported the table between 2007— 2015 iron ore, and shown in iron ore as follow: unit 2007 2008 2010 2015 100 m t 4. 8924 5. 0048 5. 5 6~ 6. 5 Pig iron 100 m 4. 6945 47067 5. 00 5. 2~ 5. 72 Domestic iron ore 100 m 7. 0707 8. 2401 9. 3 11 Imported iron ore 100 m 38309 44356. 8 4. 75 5. 0 item Crude steel In the consumption of iron ore, the dependence rate of imported iron ore is estimated as 45— 50%. 。

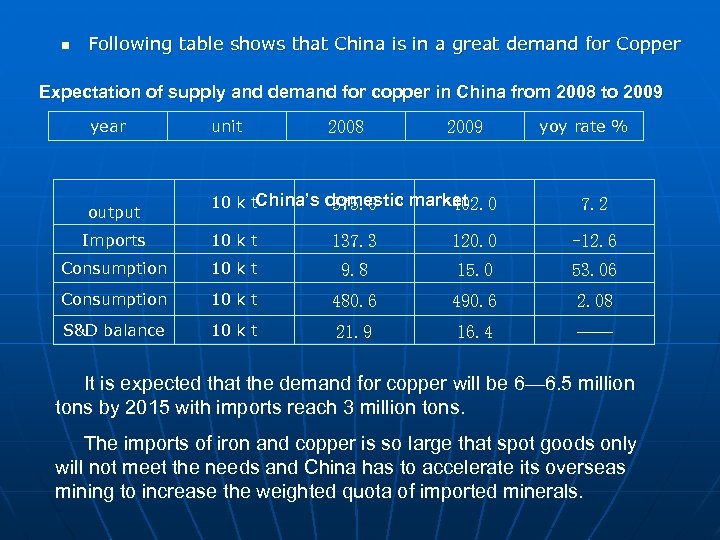

Following table shows that China is in a great demand for Copper Expectation of supply and demand for copper in China from 2008 to 2009 year output unit 2008 2009 10 k t. China’s domestic market 375. 0 402. 0 yoy rate % 7. 2 Imports 10 k t 137. 3 120. 0 -12. 6 Consumption 10 k t 9. 8 15. 0 53. 06 Consumption 10 k t 480. 6 490. 6 2. 08 S&D balance 10 k t 21. 9 16. 4 —— It is expected that the demand for copper will be 6— 6. 5 million tons by 2015 with imports reach 3 million tons. The imports of iron and copper is so large that spot goods only will not meet the needs and China has to accelerate its overseas mining to increase the weighted quota of imported minerals.

Following table shows that China is in a great demand for Copper Expectation of supply and demand for copper in China from 2008 to 2009 year output unit 2008 2009 10 k t. China’s domestic market 375. 0 402. 0 yoy rate % 7. 2 Imports 10 k t 137. 3 120. 0 -12. 6 Consumption 10 k t 9. 8 15. 0 53. 06 Consumption 10 k t 480. 6 490. 6 2. 08 S&D balance 10 k t 21. 9 16. 4 —— It is expected that the demand for copper will be 6— 6. 5 million tons by 2015 with imports reach 3 million tons. The imports of iron and copper is so large that spot goods only will not meet the needs and China has to accelerate its overseas mining to increase the weighted quota of imported minerals.

2. 2 A strategic requirement for China to meet its goal of sustainable development in steel industry. Scaling up the mining overseas to increase the weighted quota of imports and decrease spot goods trading, this is an important way to cut the costs of imported minerals. It might reach 500 million tons imports in next few years. The major obstacle is the high cost of the imports. In comparison with Japan’s expenditure, it is about $10 billions higher, shown as follow: Comparison of CIFs between China and Japan on imported iron ore Figure 14 2005 2006 year 2007 Mean CIF China($/t) 61. 09 66. 77 64. 12 88. 2 Mean CIF Japan($/t) 29. 61 42. 0 53. 28 63. 85 CIF difference($/t) 31. 48 24. 77 10. 84 24. 35 China’s imports (10 k t) 20808. 86 27526. 05 32630. 33 38309 66. 255 68. 18 35. 37 93. 28 China’s Excessive payment comparing to CIF Japan ($100 m)

2. 2 A strategic requirement for China to meet its goal of sustainable development in steel industry. Scaling up the mining overseas to increase the weighted quota of imports and decrease spot goods trading, this is an important way to cut the costs of imported minerals. It might reach 500 million tons imports in next few years. The major obstacle is the high cost of the imports. In comparison with Japan’s expenditure, it is about $10 billions higher, shown as follow: Comparison of CIFs between China and Japan on imported iron ore Figure 14 2005 2006 year 2007 Mean CIF China($/t) 61. 09 66. 77 64. 12 88. 2 Mean CIF Japan($/t) 29. 61 42. 0 53. 28 63. 85 CIF difference($/t) 31. 48 24. 77 10. 84 24. 35 China’s imports (10 k t) 20808. 86 27526. 05 32630. 33 38309 66. 255 68. 18 35. 37 93. 28 China’s Excessive payment comparing to CIF Japan ($100 m)

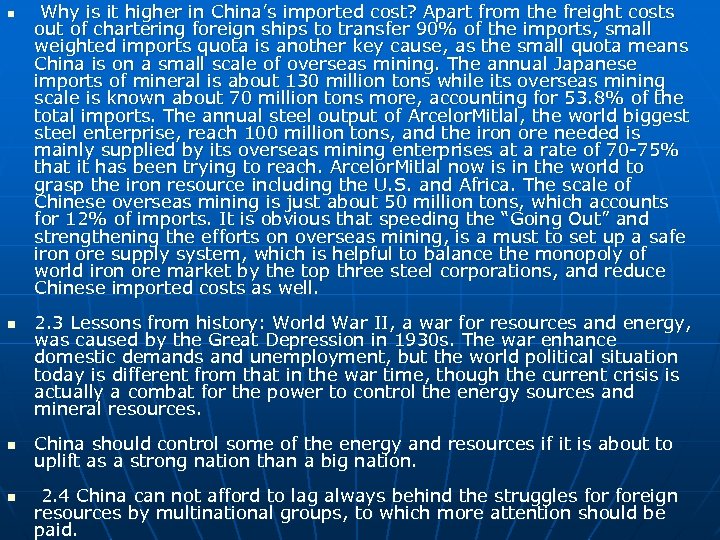

Why is it higher in China’s imported cost? Apart from the freight costs out of chartering foreign ships to transfer 90% of the imports, small weighted imports quota is another key cause, as the small quota means China is on a small scale of overseas mining. The annual Japanese imports of mineral is about 130 million tons while its overseas mining scale is known about 70 million tons more, accounting for 53. 8% of the total imports. The annual steel output of Arcelor. Mitlal, the world biggest steel enterprise, reach 100 million tons, and the iron ore needed is mainly supplied by its overseas mining enterprises at a rate of 70 -75% that it has been trying to reach. Arcelor. Mitlal now is in the world to grasp the iron resource including the U. S. and Africa. The scale of Chinese overseas mining is just about 50 million tons, which accounts for 12% of imports. It is obvious that speeding the “Going Out” and strengthening the efforts on overseas mining, is a must to set up a safe iron ore supply system, which is helpful to balance the monopoly of world iron ore market by the top three steel corporations, and reduce Chinese imported costs as well. 2. 3 Lessons from history: World War II, a war for resources and energy, was caused by the Great Depression in 1930 s. The war enhance domestic demands and unemployment, but the world political situation today is different from that in the war time, though the current crisis is actually a combat for the power to control the energy sources and mineral resources. China should control some of the energy and resources if it is about to uplift as a strong nation than a big nation. 2. 4 China can not afford to lag always behind the struggles foreign resources by multinational groups, to which more attention should be paid.

Why is it higher in China’s imported cost? Apart from the freight costs out of chartering foreign ships to transfer 90% of the imports, small weighted imports quota is another key cause, as the small quota means China is on a small scale of overseas mining. The annual Japanese imports of mineral is about 130 million tons while its overseas mining scale is known about 70 million tons more, accounting for 53. 8% of the total imports. The annual steel output of Arcelor. Mitlal, the world biggest steel enterprise, reach 100 million tons, and the iron ore needed is mainly supplied by its overseas mining enterprises at a rate of 70 -75% that it has been trying to reach. Arcelor. Mitlal now is in the world to grasp the iron resource including the U. S. and Africa. The scale of Chinese overseas mining is just about 50 million tons, which accounts for 12% of imports. It is obvious that speeding the “Going Out” and strengthening the efforts on overseas mining, is a must to set up a safe iron ore supply system, which is helpful to balance the monopoly of world iron ore market by the top three steel corporations, and reduce Chinese imported costs as well. 2. 3 Lessons from history: World War II, a war for resources and energy, was caused by the Great Depression in 1930 s. The war enhance domestic demands and unemployment, but the world political situation today is different from that in the war time, though the current crisis is actually a combat for the power to control the energy sources and mineral resources. China should control some of the energy and resources if it is about to uplift as a strong nation than a big nation. 2. 4 China can not afford to lag always behind the struggles foreign resources by multinational groups, to which more attention should be paid.

A grave situation by Multinationals in their efforts to control iron ore (1)The annual import of iron ore by Japan reaches 130 million tons with 70 million tons of mining quota according to an incomplete statistics. Mines under Control Percentage in Statistics of Foreign Iron mine controlled by Major Japanese enterprises corporation control percentage imports Mitsui Iron Ore Development 4563. 9 65. 08 37. 22 Nippon Steel Corporation 870 12. 41 7. 10 JFE 1261 17. 98 10. 29 Sumitomo Metal Mining Co 270 3. 85 2. 20 Kobelco Steel Group 28 0. 39 0. 23 Nippon 20 0. 29 0. 16 total 7012. 9 100 57. 00

A grave situation by Multinationals in their efforts to control iron ore (1)The annual import of iron ore by Japan reaches 130 million tons with 70 million tons of mining quota according to an incomplete statistics. Mines under Control Percentage in Statistics of Foreign Iron mine controlled by Major Japanese enterprises corporation control percentage imports Mitsui Iron Ore Development 4563. 9 65. 08 37. 22 Nippon Steel Corporation 870 12. 41 7. 10 JFE 1261 17. 98 10. 29 Sumitomo Metal Mining Co 270 3. 85 2. 20 Kobelco Steel Group 28 0. 39 0. 23 Nippon 20 0. 29 0. 16 total 7012. 9 100 57. 00

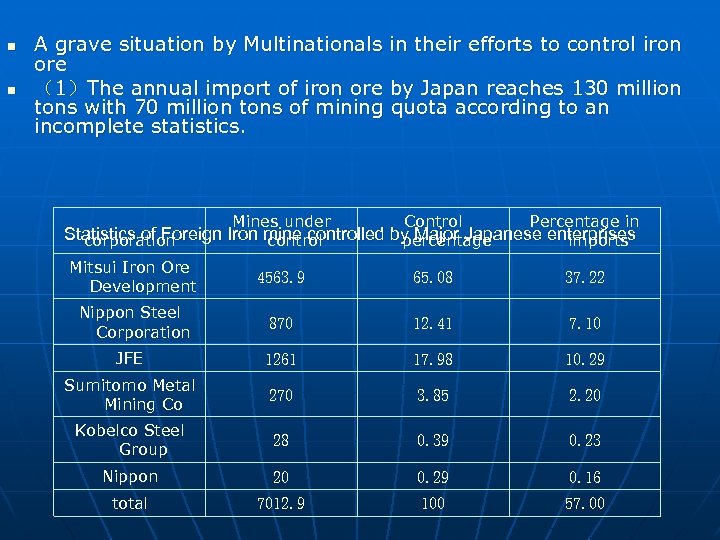

(2)iron resources under control by Arcelor. Mitlal Nation Company Capacity (10 k t/a) Share percentage% Quota America Empire Iron Works 480 21 100. 8 America Xibin 850 62. 3 529. 55 Brazil Belgo Mineira 150 100 150 Liberia Western Mine 1500 $900 m of investment 1500 Senegal Faleme Mine 1500 -2500 $2. 2 b of investment 1500 -2500 Kazakhstan Atasusky unknown Algeria Mittal Steel Tebessa Ukraine Mittal Steel Kryvyi Rih 1170 South Africa Mittal South Africa 300 Canada QCM 700 Canada Wabush 490 developing Bou Khadra mine area 1170 developing Thabazimbi mine area 700 28 137 (3)Indian Tata Steel Cooperating with state-owned Sodemi corp. in the Republic of Ivory Coast to develop Mount Nimban Mine, Tata invested $1. 5 billion and expect to yield in 2 -3 years. Indian Jindal Steel & Power Ltd. (JINDALL) Ltd. ( JINDALL) In a bid of $2. 3 billion (in place in 8 years) in June 2006 to get a long-term management right to develop 20 billion tons in the western part of El Mutún iron mine area. It is expected that in five years it will reach an output of 10. 5 million tons of concentrate ore, 9. 5 million tons of pellet ore, 6 million tons of directly reduced iron and 1. 6 million tons of long products. If China is going to move forward to form a strong nation of steel from a big nation of steel, it needs to take a part in the competition with multinationals and make a great progress in overseas mining.

(2)iron resources under control by Arcelor. Mitlal Nation Company Capacity (10 k t/a) Share percentage% Quota America Empire Iron Works 480 21 100. 8 America Xibin 850 62. 3 529. 55 Brazil Belgo Mineira 150 100 150 Liberia Western Mine 1500 $900 m of investment 1500 Senegal Faleme Mine 1500 -2500 $2. 2 b of investment 1500 -2500 Kazakhstan Atasusky unknown Algeria Mittal Steel Tebessa Ukraine Mittal Steel Kryvyi Rih 1170 South Africa Mittal South Africa 300 Canada QCM 700 Canada Wabush 490 developing Bou Khadra mine area 1170 developing Thabazimbi mine area 700 28 137 (3)Indian Tata Steel Cooperating with state-owned Sodemi corp. in the Republic of Ivory Coast to develop Mount Nimban Mine, Tata invested $1. 5 billion and expect to yield in 2 -3 years. Indian Jindal Steel & Power Ltd. (JINDALL) Ltd. ( JINDALL) In a bid of $2. 3 billion (in place in 8 years) in June 2006 to get a long-term management right to develop 20 billion tons in the western part of El Mutún iron mine area. It is expected that in five years it will reach an output of 10. 5 million tons of concentrate ore, 9. 5 million tons of pellet ore, 6 million tons of directly reduced iron and 1. 6 million tons of long products. If China is going to move forward to form a strong nation of steel from a big nation of steel, it needs to take a part in the competition with multinationals and make a great progress in overseas mining.

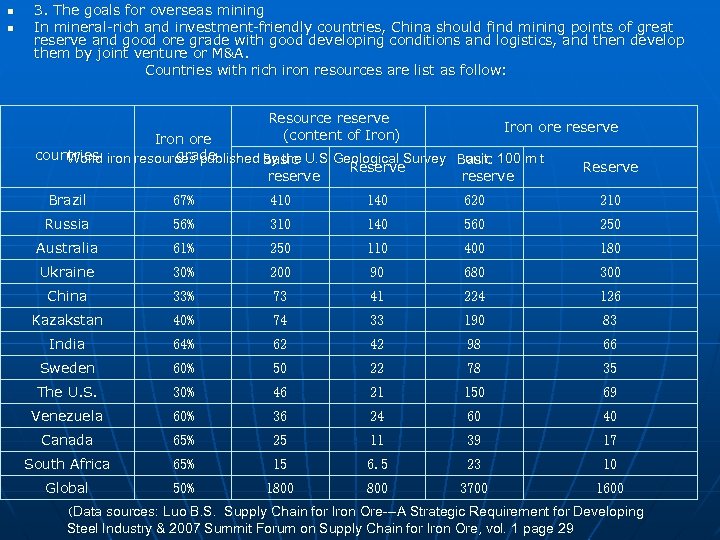

3. The goals for overseas mining In mineral-rich and investment-friendly countries, China should find mining points of great reserve and good ore grade with good developing conditions and logistics, and then develop them by joint venture or M&A. Countries with rich iron resources are list as follow: Resource reserve (content of Iron) Iron ore reserve Iron ore countries iron resources published Basic U. S Geological Survey Basic 100 m t grade World by the unit: Reserve reserve Brazil 67% 410 140 620 210 Russia 56% 310 140 560 250 Australia 61% 250 110 400 180 Ukraine 30% 200 90 680 300 China 33% 73 41 224 126 Kazakstan 40% 74 33 190 83 India 64% 62 42 98 66 Sweden 60% 50 22 78 35 The U. S. 30% 46 21 150 69 Venezuela 60% 36 24 60 40 Canada 65% 25 11 39 17 South Africa 65% 15 6. 5 23 10 Global 50% 1800 3700 1600 (Data sources: Luo B. S. Supply Chain for Iron Ore---A Strategic Requirement for Developing Steel Industry & 2007 Summit Forum on Supply Chain for Iron Ore, vol. 1 page 29

3. The goals for overseas mining In mineral-rich and investment-friendly countries, China should find mining points of great reserve and good ore grade with good developing conditions and logistics, and then develop them by joint venture or M&A. Countries with rich iron resources are list as follow: Resource reserve (content of Iron) Iron ore reserve Iron ore countries iron resources published Basic U. S Geological Survey Basic 100 m t grade World by the unit: Reserve reserve Brazil 67% 410 140 620 210 Russia 56% 310 140 560 250 Australia 61% 250 110 400 180 Ukraine 30% 200 90 680 300 China 33% 73 41 224 126 Kazakstan 40% 74 33 190 83 India 64% 62 42 98 66 Sweden 60% 50 22 78 35 The U. S. 30% 46 21 150 69 Venezuela 60% 36 24 60 40 Canada 65% 25 11 39 17 South Africa 65% 15 6. 5 23 10 Global 50% 1800 3700 1600 (Data sources: Luo B. S. Supply Chain for Iron Ore---A Strategic Requirement for Developing Steel Industry & 2007 Summit Forum on Supply Chain for Iron Ore, vol. 1 page 29

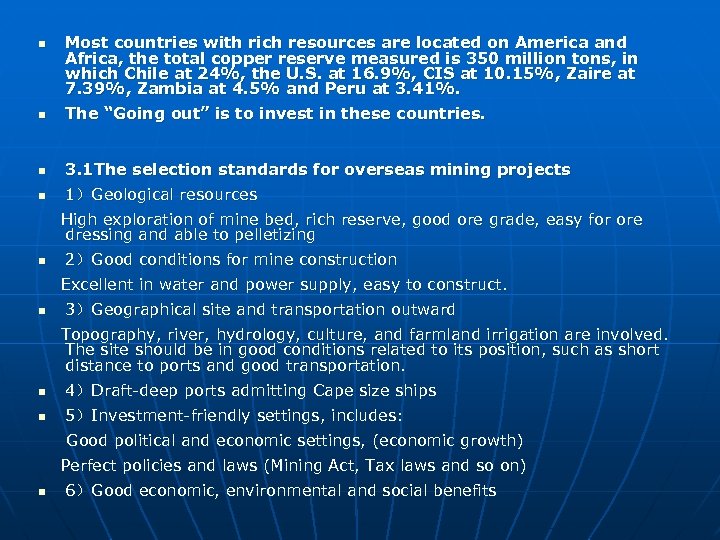

Most countries with rich resources are located on America and Africa, the total copper reserve measured is 350 million tons, in which Chile at 24%, the U. S. at 16. 9%, CIS at 10. 15%, Zaire at 7. 39%, Zambia at 4. 5% and Peru at 3. 41%. The “Going out” is to invest in these countries. 3. 1 The selection standards for overseas mining projects 1)Geological resources High exploration of mine bed, rich reserve, good ore grade, easy for ore dressing and able to pelletizing 2)Good conditions for mine construction Excellent in water and power supply, easy to construct. 3)Geographical site and transportation outward Topography, river, hydrology, culture, and farmland irrigation are involved. The site should be in good conditions related to its position, such as short distance to ports and good transportation. 4)Draft-deep ports admitting Cape size ships 5)Investment-friendly settings, includes: Good political and economic settings, (economic growth) Perfect policies and laws (Mining Act, Tax laws and so on) 6)Good economic, environmental and social benefits

Most countries with rich resources are located on America and Africa, the total copper reserve measured is 350 million tons, in which Chile at 24%, the U. S. at 16. 9%, CIS at 10. 15%, Zaire at 7. 39%, Zambia at 4. 5% and Peru at 3. 41%. The “Going out” is to invest in these countries. 3. 1 The selection standards for overseas mining projects 1)Geological resources High exploration of mine bed, rich reserve, good ore grade, easy for ore dressing and able to pelletizing 2)Good conditions for mine construction Excellent in water and power supply, easy to construct. 3)Geographical site and transportation outward Topography, river, hydrology, culture, and farmland irrigation are involved. The site should be in good conditions related to its position, such as short distance to ports and good transportation. 4)Draft-deep ports admitting Cape size ships 5)Investment-friendly settings, includes: Good political and economic settings, (economic growth) Perfect policies and laws (Mining Act, Tax laws and so on) 6)Good economic, environmental and social benefits

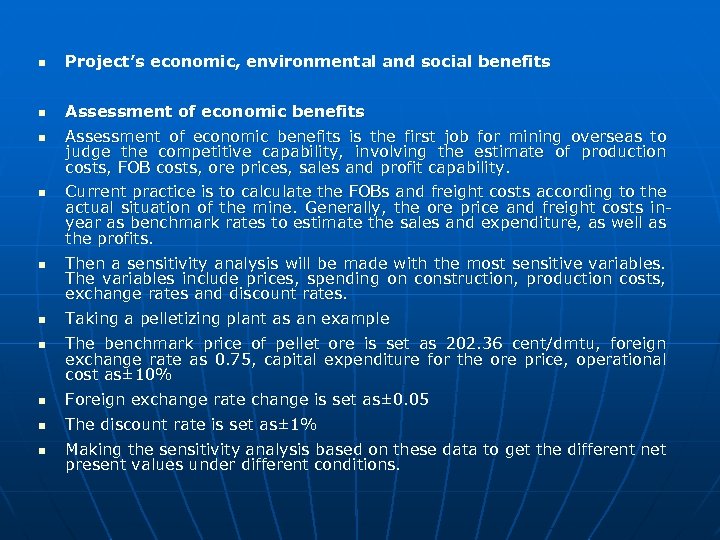

Project’s economic, environmental and social benefits Assessment of economic benefits Assessment of economic benefits is the first job for mining overseas to judge the competitive capability, involving the estimate of production costs, FOB costs, ore prices, sales and profit capability. Current practice is to calculate the FOBs and freight costs according to the actual situation of the mine. Generally, the ore price and freight costs inyear as benchmark rates to estimate the sales and expenditure, as well as the profits. Then a sensitivity analysis will be made with the most sensitive variables. The variables include prices, spending on construction, production costs, exchange rates and discount rates. Taking a pelletizing plant as an example The benchmark price of pellet ore is set as 202. 36 cent/dmtu, foreign exchange rate as 0. 75, capital expenditure for the ore price, operational cost as± 10% Foreign exchange rate change is set as± 0. 05 The discount rate is set as± 1% Making the sensitivity analysis based on these data to get the different net present values under different conditions.

Project’s economic, environmental and social benefits Assessment of economic benefits Assessment of economic benefits is the first job for mining overseas to judge the competitive capability, involving the estimate of production costs, FOB costs, ore prices, sales and profit capability. Current practice is to calculate the FOBs and freight costs according to the actual situation of the mine. Generally, the ore price and freight costs inyear as benchmark rates to estimate the sales and expenditure, as well as the profits. Then a sensitivity analysis will be made with the most sensitive variables. The variables include prices, spending on construction, production costs, exchange rates and discount rates. Taking a pelletizing plant as an example The benchmark price of pellet ore is set as 202. 36 cent/dmtu, foreign exchange rate as 0. 75, capital expenditure for the ore price, operational cost as± 10% Foreign exchange rate change is set as± 0. 05 The discount rate is set as± 1% Making the sensitivity analysis based on these data to get the different net present values under different conditions.

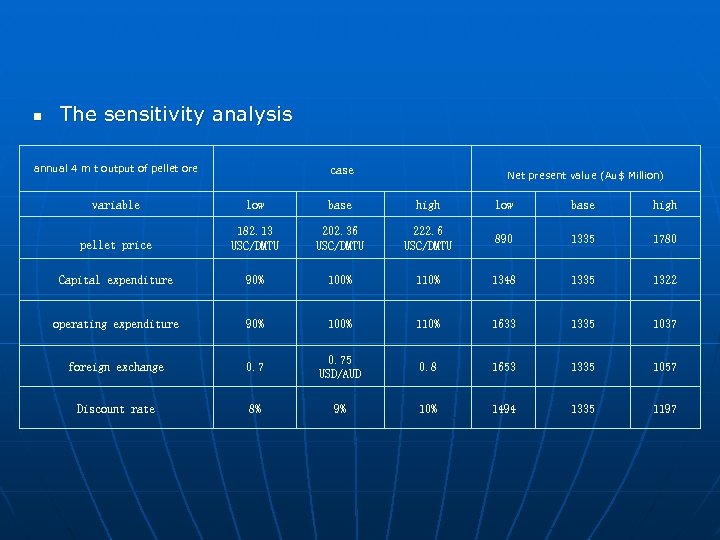

The sensitivity analysis annual 4 m t output of pellet ore case Net present value (Au$ Million) variable low base high pellet price 182. 13 USC/DMTU 202. 36 USC/DMTU 222. 6 USC/DMTU 890 1335 1780 Capital expenditure 90% 100% 110% 1348 1335 1322 operating expenditure 90% 100% 110% 1633 1335 1037 foreign exchange 0. 75 USD/AUD 0. 8 1653 1335 1057 Discount rate 8% 9% 10% 1494 1335 1197

The sensitivity analysis annual 4 m t output of pellet ore case Net present value (Au$ Million) variable low base high pellet price 182. 13 USC/DMTU 202. 36 USC/DMTU 222. 6 USC/DMTU 890 1335 1780 Capital expenditure 90% 100% 110% 1348 1335 1322 operating expenditure 90% 100% 110% 1633 1335 1037 foreign exchange 0. 75 USD/AUD 0. 8 1653 1335 1057 Discount rate 8% 9% 10% 1494 1335 1197

At present, China and other countries use this method to calculate the economic benefit. Mean value is another way available. The average production cost and average sales can be concluded during the mining period, along with the mean freight fee, they can be put in comparison with the floating costs relative to the mine’s competitive capability and the floating prices, if the floating rates are under the mean values, then the competitive capability is there. But the prices related to production factors are floating in years and so do the ore prices that they are unpredictable, so the mean values is difficult to be precise ones. In 1984, Australia Harmersley Iron joint hands with China Metallurgy Import &Export to put forward flexibility study on Channar Iron mine. They calculated the production costs and sale prices for the years within the lifespan of the mine, referring to inflation rates (imaginary values actually) that were estimated in those years. But it proves that the calculation is meaningless to the actual situation that has changed too much. Despite the complexity, a principle that overseas mining must be profitable must be followed. The operation should be in line with the principle of cash flow mining.

At present, China and other countries use this method to calculate the economic benefit. Mean value is another way available. The average production cost and average sales can be concluded during the mining period, along with the mean freight fee, they can be put in comparison with the floating costs relative to the mine’s competitive capability and the floating prices, if the floating rates are under the mean values, then the competitive capability is there. But the prices related to production factors are floating in years and so do the ore prices that they are unpredictable, so the mean values is difficult to be precise ones. In 1984, Australia Harmersley Iron joint hands with China Metallurgy Import &Export to put forward flexibility study on Channar Iron mine. They calculated the production costs and sale prices for the years within the lifespan of the mine, referring to inflation rates (imaginary values actually) that were estimated in those years. But it proves that the calculation is meaningless to the actual situation that has changed too much. Despite the complexity, a principle that overseas mining must be profitable must be followed. The operation should be in line with the principle of cash flow mining.

3. 2 Other than the economic gain, environmental and social benefits from the overseas mining projects should be calculated too. The assessment of social benefits for previous overseas mining was ignored, especially the practices in south America and Africa where local resident’s living and local economic growth were somewhat overlooked when attentions were put upon the hold of mineral resources. With this, western media attacked us, saying that China only cared about the resources. In this respect, Marcona Peru Iron Mine Iron mine that was M&A by Shougang Group in 1992, are still in some management trouble. Now it is time to change the concept. One Chinese enterprise agreed that it will help build an agricultural display garden, a high school, a prime school, a kindergarten, a hospital, a mining lab and some other facilities when it was in a negotiation of mining project with foreign partner. Though the costs are increasing, but it is necessary for a harmonious world.

3. 2 Other than the economic gain, environmental and social benefits from the overseas mining projects should be calculated too. The assessment of social benefits for previous overseas mining was ignored, especially the practices in south America and Africa where local resident’s living and local economic growth were somewhat overlooked when attentions were put upon the hold of mineral resources. With this, western media attacked us, saying that China only cared about the resources. In this respect, Marcona Peru Iron Mine Iron mine that was M&A by Shougang Group in 1992, are still in some management trouble. Now it is time to change the concept. One Chinese enterprise agreed that it will help build an agricultural display garden, a high school, a prime school, a kindergarten, a hospital, a mining lab and some other facilities when it was in a negotiation of mining project with foreign partner. Though the costs are increasing, but it is necessary for a harmonious world.

4.Modes and routes for overseas mining 4. 1 Modes The man purpose for overseas mining is to stably hold and fairly make use of foreign mineral resources with flexible modes conforming to local situations. (1)Risk exploration Geological exploration, according to international practice, comprises of four stages: pre-survey, detailed survey and exploration. Pre-survey: under regional geology or geophysical and geochemical anomaly, combine field observation with a little engineering test to survey and produce some results that will afterward be compared with some known mine beds having similar geology to the survey area. By doing so, a potential mineralization area is predicted. If there is enough information, then the amount of mineral resource might be estimated as a potential mineral resource. Survey: do the outcrop check, geological mapping, small sample takings and geophysical and geochemical prospecting to generally ascertain the form, the occurrence texture and quality property of the orebody, and then decide whether the mine area is worthy of detailed survey or sketch out the area for detailed survey. Risk exploration: do the detailed survey and exploration jobs on the base of the results from pre-survey and survey. There are some risks in it, so it is name risk exploration. At present, some countries like those in South-eastern Asia are generally in this situation. With basic pre-survey information, the risk exploration is the first stem to hold mineral resource. Japan encourages its enterprises to go overseas to run risk exploration of copper by offering governmental subsidy. From 1955 to 2001, the budget for mineral seeking reached 82. 4 billion yen. As for the exploration spending, 50% of it is from loan that will be returned within 15 years. All these show the national supports for overseas development of resources. China should assume some selective risk exploration. I recommend that Chinese government provide financial supports to those enterprises in risk exploration work.

4.Modes and routes for overseas mining 4. 1 Modes The man purpose for overseas mining is to stably hold and fairly make use of foreign mineral resources with flexible modes conforming to local situations. (1)Risk exploration Geological exploration, according to international practice, comprises of four stages: pre-survey, detailed survey and exploration. Pre-survey: under regional geology or geophysical and geochemical anomaly, combine field observation with a little engineering test to survey and produce some results that will afterward be compared with some known mine beds having similar geology to the survey area. By doing so, a potential mineralization area is predicted. If there is enough information, then the amount of mineral resource might be estimated as a potential mineral resource. Survey: do the outcrop check, geological mapping, small sample takings and geophysical and geochemical prospecting to generally ascertain the form, the occurrence texture and quality property of the orebody, and then decide whether the mine area is worthy of detailed survey or sketch out the area for detailed survey. Risk exploration: do the detailed survey and exploration jobs on the base of the results from pre-survey and survey. There are some risks in it, so it is name risk exploration. At present, some countries like those in South-eastern Asia are generally in this situation. With basic pre-survey information, the risk exploration is the first stem to hold mineral resource. Japan encourages its enterprises to go overseas to run risk exploration of copper by offering governmental subsidy. From 1955 to 2001, the budget for mineral seeking reached 82. 4 billion yen. As for the exploration spending, 50% of it is from loan that will be returned within 15 years. All these show the national supports for overseas development of resources. China should assume some selective risk exploration. I recommend that Chinese government provide financial supports to those enterprises in risk exploration work.

(2) Joint venture mining refers to developing new mining site. The mining sites selected should be those with rich reserve, good conditions for ore processing and mine construction, good transportation and water & power supply system, as well as investment-friendly settings. Exclusive investment and joint venture are two kinds of modes of joint venture mining. Generally, exclusive investment is not recommended for overseas mining. Shougang Group’s Peru Iron mine project is an exclusive investment project held by Chinese with 98. 4% of share holding. But there are lots of problems in years that can not be solved perfectly. Joint venture is recommended for overseas mining projects and Chinese could hold 50% of less than 50% of stocks. As joint venture enterprises are easy to manage, especially when there are problems related to labor relation, environmental protection and subsidy for resource usage happen. After all, local staff is more helpful when dealing with these problems. Sino-Australia joint venture Channar Iron Mine is a good example. There are two ways of management in a joint venture mining enterprises where Chinese hold some share, one is to have Chinese representatives in the team, while one is without but the foreign side has authority on Chinese side, and the Chinese just regularly attend the directorate meetings. Baosteel group takes 46% share in Sino-Australia joint venture Bao. HI Ranges and 50% share in Sino-Brazil joint venture Baovale mineracao, but Baosteel has no representative in the management team. Sinosteel Corporation holds 40% share in Sino-Australia joint venture Channar Iron Mine, all the time in last 20 years, there are Chinese representatives in management team. Practice has shown that sending representatives to take a part in management for joint venture enterprises is useful in two ways, with Chinese staff in planning, sales, financial and QC departments, Chinese side can take hold of the operations, and for Chinese staff, management participation is also a training or learning. The joint venture projects mean normally a new development project, whose process takes a long period from site selection, site construction to production.

(2) Joint venture mining refers to developing new mining site. The mining sites selected should be those with rich reserve, good conditions for ore processing and mine construction, good transportation and water & power supply system, as well as investment-friendly settings. Exclusive investment and joint venture are two kinds of modes of joint venture mining. Generally, exclusive investment is not recommended for overseas mining. Shougang Group’s Peru Iron mine project is an exclusive investment project held by Chinese with 98. 4% of share holding. But there are lots of problems in years that can not be solved perfectly. Joint venture is recommended for overseas mining projects and Chinese could hold 50% of less than 50% of stocks. As joint venture enterprises are easy to manage, especially when there are problems related to labor relation, environmental protection and subsidy for resource usage happen. After all, local staff is more helpful when dealing with these problems. Sino-Australia joint venture Channar Iron Mine is a good example. There are two ways of management in a joint venture mining enterprises where Chinese hold some share, one is to have Chinese representatives in the team, while one is without but the foreign side has authority on Chinese side, and the Chinese just regularly attend the directorate meetings. Baosteel group takes 46% share in Sino-Australia joint venture Bao. HI Ranges and 50% share in Sino-Brazil joint venture Baovale mineracao, but Baosteel has no representative in the management team. Sinosteel Corporation holds 40% share in Sino-Australia joint venture Channar Iron Mine, all the time in last 20 years, there are Chinese representatives in management team. Practice has shown that sending representatives to take a part in management for joint venture enterprises is useful in two ways, with Chinese staff in planning, sales, financial and QC departments, Chinese side can take hold of the operations, and for Chinese staff, management participation is also a training or learning. The joint venture projects mean normally a new development project, whose process takes a long period from site selection, site construction to production.

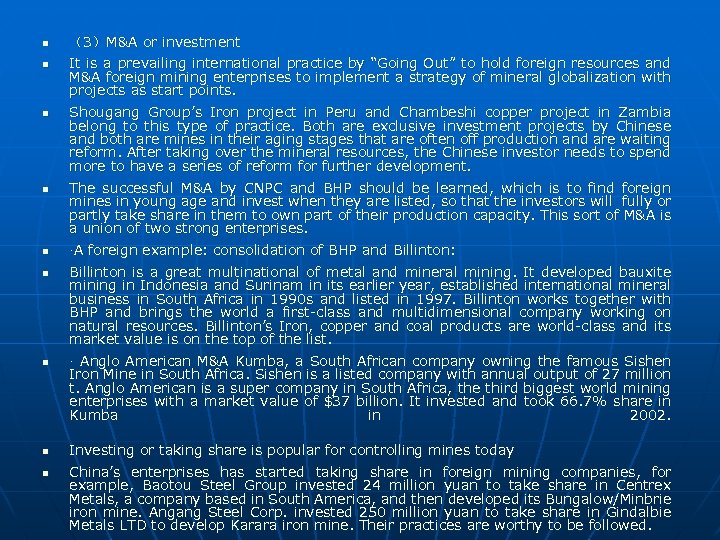

(3)M&A or investment It is a prevailing international practice by “Going Out” to hold foreign resources and M&A foreign mining enterprises to implement a strategy of mineral globalization with projects as start points. Shougang Group’s Iron project in Peru and Chambeshi copper project in Zambia belong to this type of practice. Both are exclusive investment projects by Chinese and both are mines in their aging stages that are often off production and are waiting reform. After taking over the mineral resources, the Chinese investor needs to spend more to have a series of reform for further development. The successful M&A by CNPC and BHP should be learned, which is to find foreign mines in young age and invest when they are listed, so that the investors will fully or partly take share in them to own part of their production capacity. This sort of M&A is a union of two strong enterprises. ·A foreign example: consolidation of BHP and Billinton: Billinton is a great multinational of metal and mineral mining. It developed bauxite mining in Indonesia and Surinam in its earlier year, established international mineral business in South Africa in 1990 s and listed in 1997. Billinton works together with BHP and brings the world a first-class and multidimensional company working on natural resources. Billinton’s Iron, copper and coal products are world-class and its market value is on the top of the list. · Anglo American M&A Kumba, a South African company owning the famous Sishen Iron Mine in South Africa. Sishen is a listed company with annual output of 27 million t. Anglo American is a super company in South Africa, the third biggest world mining enterprises with a market value of $37 billion. It invested and took 66. 7% share in Kumba in 2002. Investing or taking share is popular for controlling mines today China’s enterprises has started taking share in foreign mining companies, for example, Baotou Steel Group invested 24 million yuan to take share in Centrex Metals, a company based in South America, and then developed its Bungalow/Minbrie iron mine. Angang Steel Corp. invested 250 million yuan to take share in Gindalbie Metals LTD to develop Karara iron mine. Their practices are worthy to be followed.

(3)M&A or investment It is a prevailing international practice by “Going Out” to hold foreign resources and M&A foreign mining enterprises to implement a strategy of mineral globalization with projects as start points. Shougang Group’s Iron project in Peru and Chambeshi copper project in Zambia belong to this type of practice. Both are exclusive investment projects by Chinese and both are mines in their aging stages that are often off production and are waiting reform. After taking over the mineral resources, the Chinese investor needs to spend more to have a series of reform for further development. The successful M&A by CNPC and BHP should be learned, which is to find foreign mines in young age and invest when they are listed, so that the investors will fully or partly take share in them to own part of their production capacity. This sort of M&A is a union of two strong enterprises. ·A foreign example: consolidation of BHP and Billinton: Billinton is a great multinational of metal and mineral mining. It developed bauxite mining in Indonesia and Surinam in its earlier year, established international mineral business in South Africa in 1990 s and listed in 1997. Billinton works together with BHP and brings the world a first-class and multidimensional company working on natural resources. Billinton’s Iron, copper and coal products are world-class and its market value is on the top of the list. · Anglo American M&A Kumba, a South African company owning the famous Sishen Iron Mine in South Africa. Sishen is a listed company with annual output of 27 million t. Anglo American is a super company in South Africa, the third biggest world mining enterprises with a market value of $37 billion. It invested and took 66. 7% share in Kumba in 2002. Investing or taking share is popular for controlling mines today China’s enterprises has started taking share in foreign mining companies, for example, Baotou Steel Group invested 24 million yuan to take share in Centrex Metals, a company based in South America, and then developed its Bungalow/Minbrie iron mine. Angang Steel Corp. invested 250 million yuan to take share in Gindalbie Metals LTD to develop Karara iron mine. Their practices are worthy to be followed.

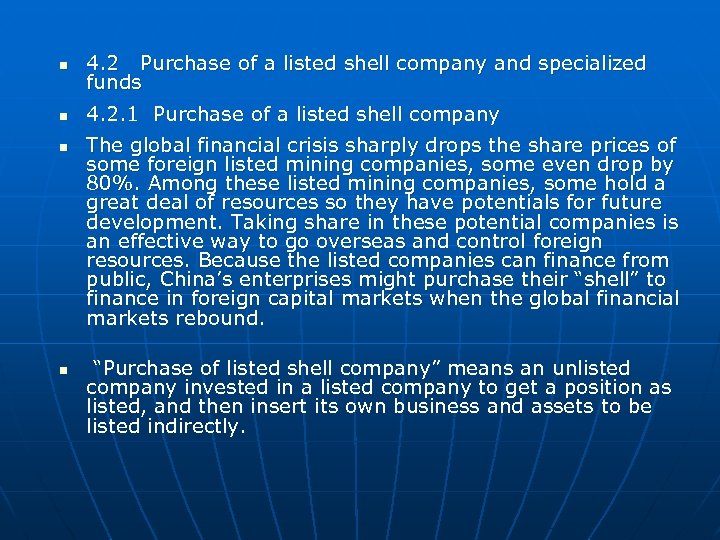

4. 2 Purchase of a listed shell company and specialized funds 4. 2. 1 Purchase of a listed shell company The global financial crisis sharply drops the share prices of some foreign listed mining companies, some even drop by 80%. Among these listed mining companies, some hold a great deal of resources so they have potentials for future development. Taking share in these potential companies is an effective way to go overseas and control foreign resources. Because the listed companies can finance from public, China’s enterprises might purchase their “shell” to finance in foreign capital markets when the global financial markets rebound. “Purchase of listed shell company” means an unlisted company invested in a listed company to get a position as listed, and then insert its own business and assets to be listed indirectly.

4. 2 Purchase of a listed shell company and specialized funds 4. 2. 1 Purchase of a listed shell company The global financial crisis sharply drops the share prices of some foreign listed mining companies, some even drop by 80%. Among these listed mining companies, some hold a great deal of resources so they have potentials for future development. Taking share in these potential companies is an effective way to go overseas and control foreign resources. Because the listed companies can finance from public, China’s enterprises might purchase their “shell” to finance in foreign capital markets when the global financial markets rebound. “Purchase of listed shell company” means an unlisted company invested in a listed company to get a position as listed, and then insert its own business and assets to be listed indirectly.

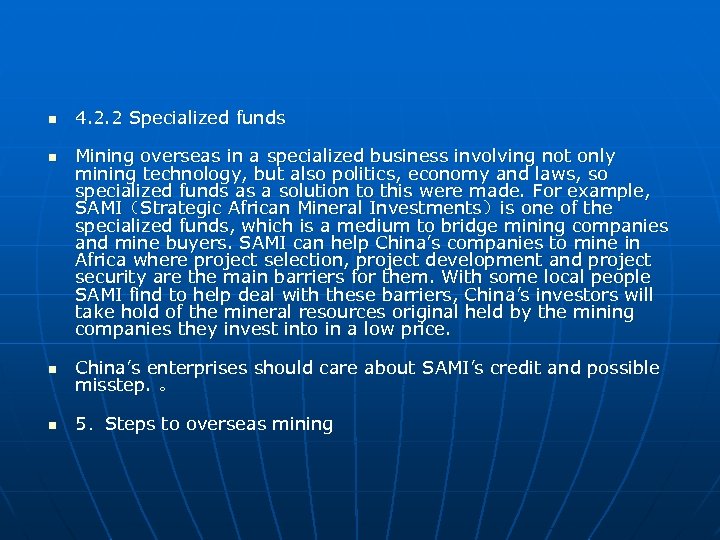

4. 2. 2 Specialized funds Mining overseas in a specialized business involving not only mining technology, but also politics, economy and laws, so specialized funds as a solution to this were made. For example, SAMI(Strategic African Mineral Investments)is one of the specialized funds, which is a medium to bridge mining companies and mine buyers. SAMI can help China’s companies to mine in Africa where project selection, project development and project security are the main barriers for them. With some local people SAMI find to help deal with these barriers, China’s investors will take hold of the mineral resources original held by the mining companies they invest into in a low price. China’s enterprises should care about SAMI’s credit and possible misstep. 。 5.Steps to overseas mining

4. 2. 2 Specialized funds Mining overseas in a specialized business involving not only mining technology, but also politics, economy and laws, so specialized funds as a solution to this were made. For example, SAMI(Strategic African Mineral Investments)is one of the specialized funds, which is a medium to bridge mining companies and mine buyers. SAMI can help China’s companies to mine in Africa where project selection, project development and project security are the main barriers for them. With some local people SAMI find to help deal with these barriers, China’s investors will take hold of the mineral resources original held by the mining companies they invest into in a low price. China’s enterprises should care about SAMI’s credit and possible misstep. 。 5.Steps to overseas mining

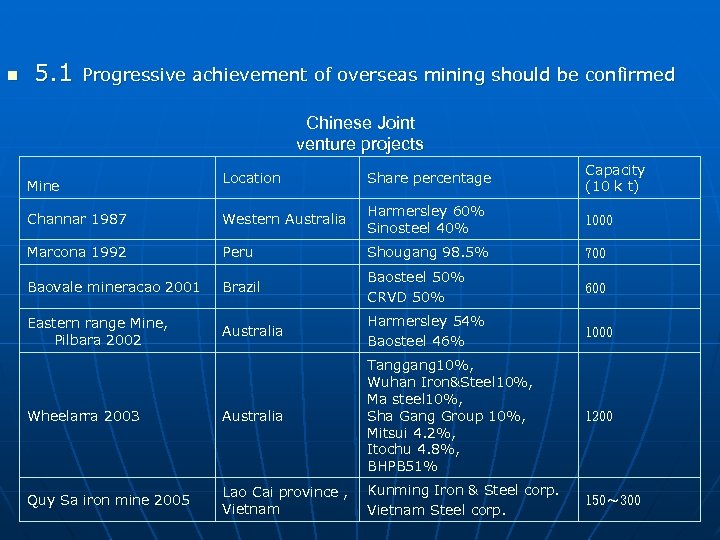

5. 1 Progressive achievement of overseas mining should be confirmed Chinese Joint venture projects Location Share percentage Capacity (10 k t) Channar 1987 Western Australia Harmersley 60% Sinosteel 40% 1000 Marcona 1992 Peru Shougang 98. 5% 700 Baovale mineracao 2001 Brazil Baosteel 50% CRVD 50% 600 Eastern range Mine, Pilbara 2002 Australia Harmersley 54% Baosteel 46% 1000 Wheelarra 2003 Australia Tanggang 10%, Wuhan Iron&Steel 10%, Ma steel 10%, Sha Gang Group 10%, Mitsui 4. 2%, Itochu 4. 8%, BHPB 51% 1200 Quy Sa iron mine 2005 Lao Cai province , Vietnam Kunming Iron & Steel corp. Vietnam Steel corp. 150~ 300 Mine

5. 1 Progressive achievement of overseas mining should be confirmed Chinese Joint venture projects Location Share percentage Capacity (10 k t) Channar 1987 Western Australia Harmersley 60% Sinosteel 40% 1000 Marcona 1992 Peru Shougang 98. 5% 700 Baovale mineracao 2001 Brazil Baosteel 50% CRVD 50% 600 Eastern range Mine, Pilbara 2002 Australia Harmersley 54% Baosteel 46% 1000 Wheelarra 2003 Australia Tanggang 10%, Wuhan Iron&Steel 10%, Ma steel 10%, Sha Gang Group 10%, Mitsui 4. 2%, Itochu 4. 8%, BHPB 51% 1200 Quy Sa iron mine 2005 Lao Cai province , Vietnam Kunming Iron & Steel corp. Vietnam Steel corp. 150~ 300 Mine

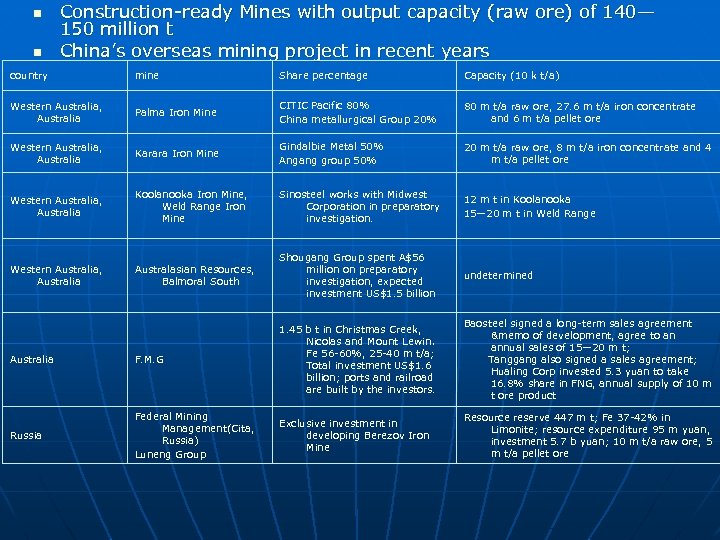

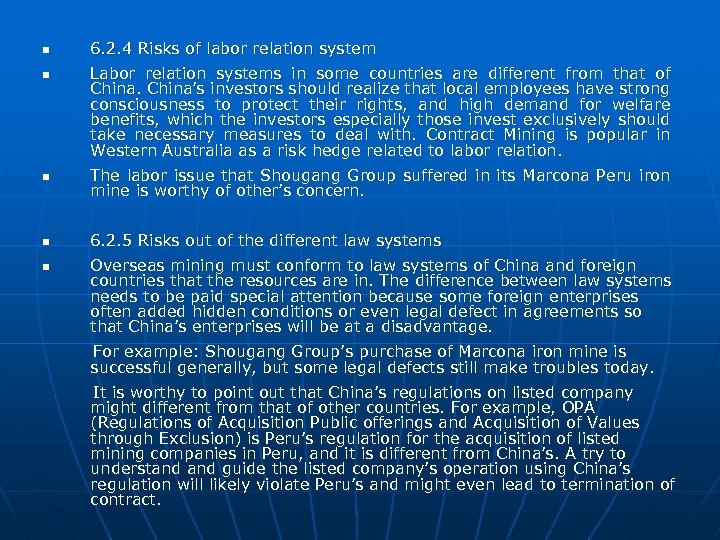

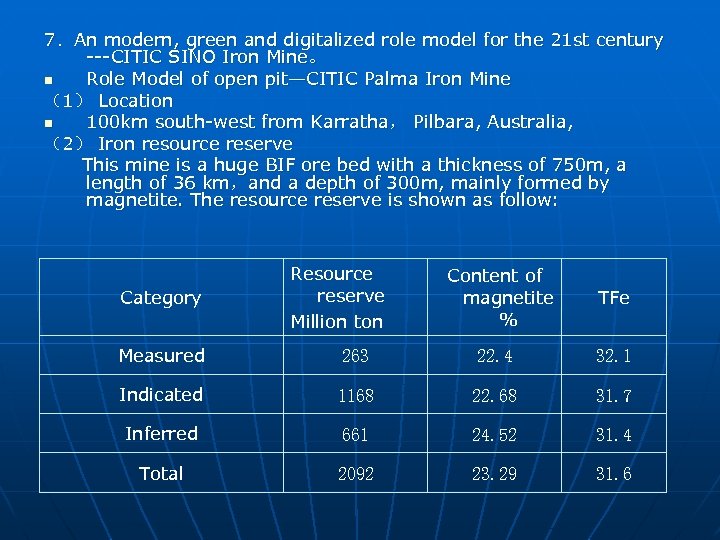

Construction-ready Mines with output capacity (raw ore) of 140— 150 million t China’s overseas mining project in recent years country mine Share percentage Capacity (10 k t/a) Western Australia, Australia Palma Iron Mine CITIC Pacific 80% China metallurgical Group 20% 80 m t/a raw ore, 27. 6 m t/a iron concentrate and 6 m t/a pellet ore Western Australia, Australia Karara Iron Mine Gindalbie Metal 50% Angang group 50% 20 m t/a raw ore, 8 m t/a iron concentrate and 4 m t/a pellet ore Western Australia, Australia Koolanooka Iron Mine, Weld Range Iron Mine Sinosteel works with Midwest Corporation in preparatory investigation. 12 m t in Koolanooka 15— 20 m t in Weld Range Western Australia, Australia Australasian Resources, Balmoral South Shougang Group spent A$56 million on preparatory investigation, expected investment US$1. 5 billion undetermined Australia F. M. G 1. 45 b t in Christmas Creek, Nicolas and Mount Lewin, Fe 56 -60%, 25 -40 m t/a; Total investment US$1. 6 billion; ports and railroad are built by the investors. Baosteel signed a long-term sales agreement &memo of development, agree to an annual sales of 15— 20 m t; Tanggang also signed a sales agreement; Hualing Corp invested 5. 3 yuan to take 16. 8% share in FNG, annual supply of 10 m t ore product Russia Federal Mining Management(Cita, Russia) Luneng Group Exclusive investment in developing Berezov Iron Mine Resource reserve 447 m t; Fe 37 -42% in Limonite; resource expenditure 95 m yuan, investment 5. 7 b yuan; 10 m t/a raw ore, 5 m t/a pellet ore

Construction-ready Mines with output capacity (raw ore) of 140— 150 million t China’s overseas mining project in recent years country mine Share percentage Capacity (10 k t/a) Western Australia, Australia Palma Iron Mine CITIC Pacific 80% China metallurgical Group 20% 80 m t/a raw ore, 27. 6 m t/a iron concentrate and 6 m t/a pellet ore Western Australia, Australia Karara Iron Mine Gindalbie Metal 50% Angang group 50% 20 m t/a raw ore, 8 m t/a iron concentrate and 4 m t/a pellet ore Western Australia, Australia Koolanooka Iron Mine, Weld Range Iron Mine Sinosteel works with Midwest Corporation in preparatory investigation. 12 m t in Koolanooka 15— 20 m t in Weld Range Western Australia, Australia Australasian Resources, Balmoral South Shougang Group spent A$56 million on preparatory investigation, expected investment US$1. 5 billion undetermined Australia F. M. G 1. 45 b t in Christmas Creek, Nicolas and Mount Lewin, Fe 56 -60%, 25 -40 m t/a; Total investment US$1. 6 billion; ports and railroad are built by the investors. Baosteel signed a long-term sales agreement &memo of development, agree to an annual sales of 15— 20 m t; Tanggang also signed a sales agreement; Hualing Corp invested 5. 3 yuan to take 16. 8% share in FNG, annual supply of 10 m t ore product Russia Federal Mining Management(Cita, Russia) Luneng Group Exclusive investment in developing Berezov Iron Mine Resource reserve 447 m t; Fe 37 -42% in Limonite; resource expenditure 95 m yuan, investment 5. 7 b yuan; 10 m t/a raw ore, 5 m t/a pellet ore

Baotou Steel Group invested A$40 million to take 10. 1% share in Centrex Metals Ltd(CXM. AU) Baotou Steel Group agreed with CXM. AU that it will invest less than A$40 m on geological exploration and bank flexibility study on CXM. AU ‘s Bunglow Iron Mine Tonghua Iron &Steel Corp invested 90 m yuan in South Australia to take 9. 99% share in IMX will develop a new iron mine and the raw ore will be delivered to China for processing. Sha Steel Corp. purchased from British Stemcor Corp. the Savage Ravier Mine under ABM, an Australian company. The annual output of the mine is 2 million tons. ·China Metallurgical Group works together with Cape Lambert. ·China Metallurgical Group takes 70% share in Argentinean MSG Iron Mine (3. 5 m t/a). Wuhan Iron & Steel Corp. agreed with Centrex Metals Ltd to invest $127 million to acquire 1 billion tons of iron resource. . Hualing Group invested 5. 3 billion yuan to take 16. 48% share in FMG and is authorized to purchase 10 m t of finished ore. Aluminum Corporation of China Limited invested US$14 billion in Jan. 2008 to take 12% share in Rio Tinto (Britain). It invested again US$19. 5 billion on Feb. 21, 2009 on Rio Tinto, with $7. 2 billion on Rio Tinto bond. Now the company increases its share from 12% to 19% in Rio Tinto (Britain), and takes 14. 9% share in Rio Tinto (Australia).

Baotou Steel Group invested A$40 million to take 10. 1% share in Centrex Metals Ltd(CXM. AU) Baotou Steel Group agreed with CXM. AU that it will invest less than A$40 m on geological exploration and bank flexibility study on CXM. AU ‘s Bunglow Iron Mine Tonghua Iron &Steel Corp invested 90 m yuan in South Australia to take 9. 99% share in IMX will develop a new iron mine and the raw ore will be delivered to China for processing. Sha Steel Corp. purchased from British Stemcor Corp. the Savage Ravier Mine under ABM, an Australian company. The annual output of the mine is 2 million tons. ·China Metallurgical Group works together with Cape Lambert. ·China Metallurgical Group takes 70% share in Argentinean MSG Iron Mine (3. 5 m t/a). Wuhan Iron & Steel Corp. agreed with Centrex Metals Ltd to invest $127 million to acquire 1 billion tons of iron resource. . Hualing Group invested 5. 3 billion yuan to take 16. 48% share in FMG and is authorized to purchase 10 m t of finished ore. Aluminum Corporation of China Limited invested US$14 billion in Jan. 2008 to take 12% share in Rio Tinto (Britain). It invested again US$19. 5 billion on Feb. 21, 2009 on Rio Tinto, with $7. 2 billion on Rio Tinto bond. Now the company increases its share from 12% to 19% in Rio Tinto (Britain), and takes 14. 9% share in Rio Tinto (Australia).

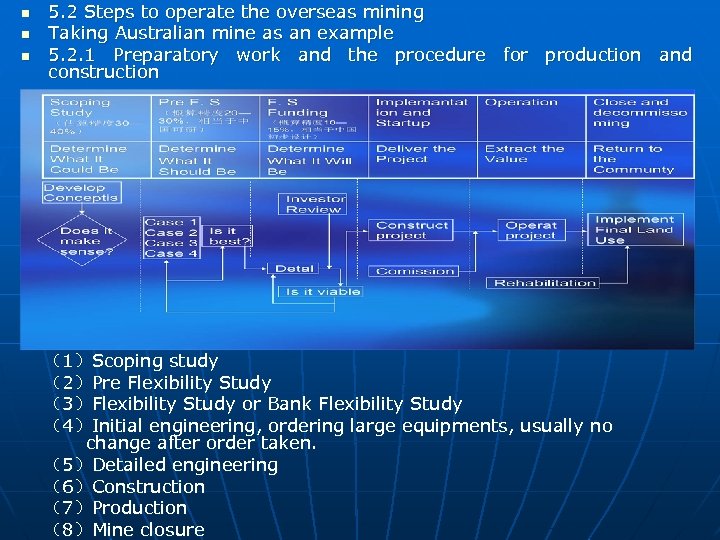

5. 2 Steps to operate the overseas mining Taking Australian mine as an example 5. 2. 1 Preparatory work and the procedure for production and construction (1)Scoping study (2)Pre Flexibility Study (3)Flexibility Study or Bank Flexibility Study (4)Initial engineering, ordering large equipments, usually no change after order taken. (5)Detailed engineering (6)Construction (7)Production (8)Mine closure

5. 2 Steps to operate the overseas mining Taking Australian mine as an example 5. 2. 1 Preparatory work and the procedure for production and construction (1)Scoping study (2)Pre Flexibility Study (3)Flexibility Study or Bank Flexibility Study (4)Initial engineering, ordering large equipments, usually no change after order taken. (5)Detailed engineering (6)Construction (7)Production (8)Mine closure

5. 2. 2 Applications for EPM, MDL and ML Environmental assessment must be submitted for ML Procedures and laws related to overseas mining (Western Australia as an example) Three steps to mining in Australia : 1. EPM; 2. MDL; 3. ML, apply with environmental assessment a requisite

5. 2. 2 Applications for EPM, MDL and ML Environmental assessment must be submitted for ML Procedures and laws related to overseas mining (Western Australia as an example) Three steps to mining in Australia : 1. EPM; 2. MDL; 3. ML, apply with environmental assessment a requisite

Environmental assessment Content of environmental assessment Flora Fauna Surface water Noise Ground water European and Aboriginal Cultural Heritage Air Quality Geochemical Characterization of mined materials Soil Pipeline Burst Consequences and Management Visual Amenity

Environmental assessment Content of environmental assessment Flora Fauna Surface water Noise Ground water European and Aboriginal Cultural Heritage Air Quality Geochemical Characterization of mined materials Soil Pipeline Burst Consequences and Management Visual Amenity

Tenure 5. 2. 3 Project approval proceedings Commonwealth of Australia Foreign Investment Review Board Export Licenses Environmental Approval Import Duty Concessions Tax Rulings

Tenure 5. 2. 3 Project approval proceedings Commonwealth of Australia Foreign Investment Review Board Export Licenses Environmental Approval Import Duty Concessions Tax Rulings

State Government of West Australia Mining Act Environmental Approval Heritage Approval Construction Approval Operating Licenses Royalties Water Extraction Licenses Explosives and Dangerous goods Act Municipal Government Road Permits Building Permits Sewerage Installation Approval

State Government of West Australia Mining Act Environmental Approval Heritage Approval Construction Approval Operating Licenses Royalties Water Extraction Licenses Explosives and Dangerous goods Act Municipal Government Road Permits Building Permits Sewerage Installation Approval

5. 2. 4 Australian Laws and regulations related (1)Legislation Laws relevant to mining in Australia 1. Legislation(based on English Laws) Land access Mineral rights Free hold Native title rights Multiple use rights (grazing、water、mining) Nature conservation rights (2)General Legislation 2. General Legislation Environment and Heritage Health and safety Employment Immigration Foreign Investment Taxation and royalties

5. 2. 4 Australian Laws and regulations related (1)Legislation Laws relevant to mining in Australia 1. Legislation(based on English Laws) Land access Mineral rights Free hold Native title rights Multiple use rights (grazing、water、mining) Nature conservation rights (2)General Legislation 2. General Legislation Environment and Heritage Health and safety Employment Immigration Foreign Investment Taxation and royalties

(3)Environmental Protection Act(Ep Act) Note: there is a request of environmental assessment for project and operating licenses. DEC(Department of Environment and Conservation)is the governmental body to take operating license application, no construction permitted before the license is issued. (4)Mining Act (5)Tenure Location Mining and land Tenure

(3)Environmental Protection Act(Ep Act) Note: there is a request of environmental assessment for project and operating licenses. DEC(Department of Environment and Conservation)is the governmental body to take operating license application, no construction permitted before the license is issued. (4)Mining Act (5)Tenure Location Mining and land Tenure

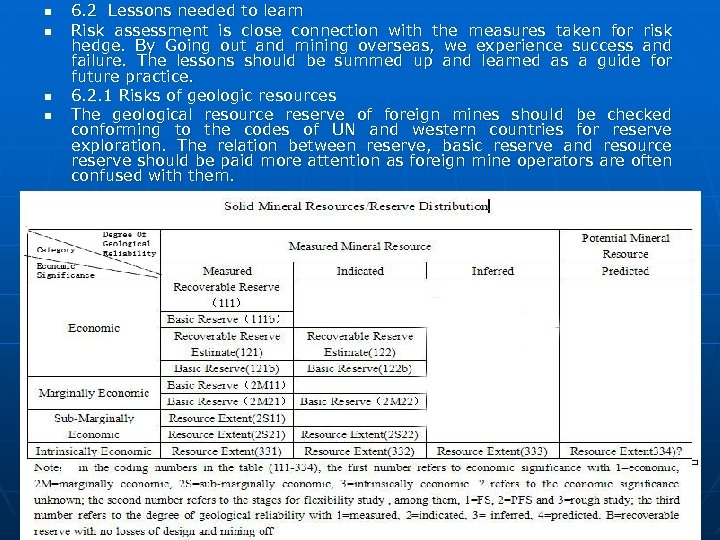

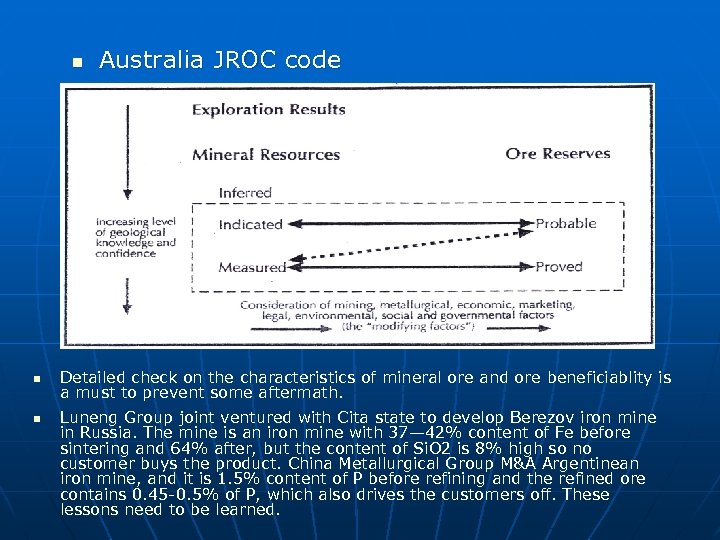

5. 2. 5 Codes and standards ·Joint Ore Reserves Committee (JORC) Code of Mineral Resources and Ore Reserves Occupational Safety and Health Act (OSHA) Mining Acts and Mining Planning Code of Building & Construction Authority (BCA) Code for Electric power engineering and installation Communication, instrument and control Code for mechanical engineering Code for civil engineering Design basis for processing item