51d191ce5a7d4360177180adee6459c3.ppt

- Количество слайдов: 21

2008 IPAA Private Capital Conference Charles Kingswell-Smith, Managing Director January 16, 2008 1

2008 IPAA Private Capital Conference Charles Kingswell-Smith, Managing Director January 16, 2008 1

Upstream Market Environment

Upstream Market Environment

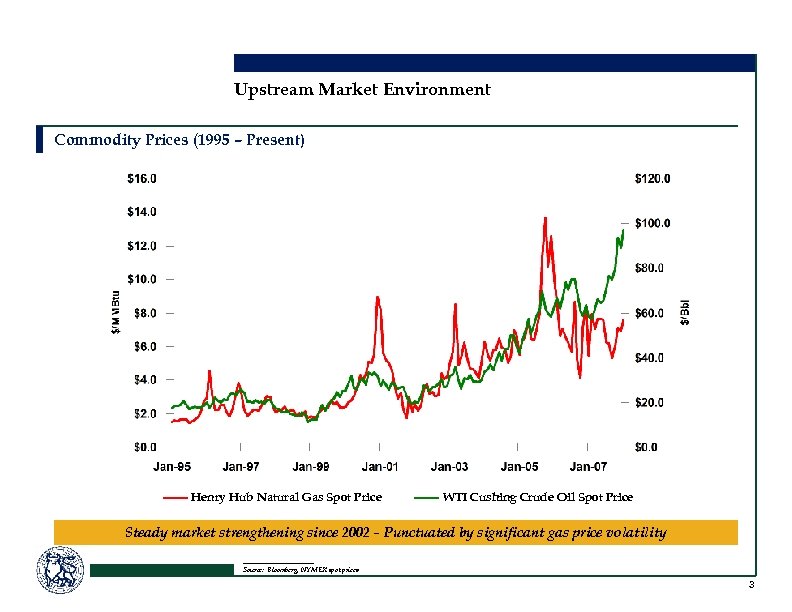

Upstream Market Environment Commodity Prices (1995 – Present) Henry Hub Natural Gas Spot Price WTI Cushing Crude Oil Spot Price Steady market strengthening since 2002 – Punctuated by significant gas price volatility __________ Source: Bloomberg, NYMEX spot prices 3

Upstream Market Environment Commodity Prices (1995 – Present) Henry Hub Natural Gas Spot Price WTI Cushing Crude Oil Spot Price Steady market strengthening since 2002 – Punctuated by significant gas price volatility __________ Source: Bloomberg, NYMEX spot prices 3

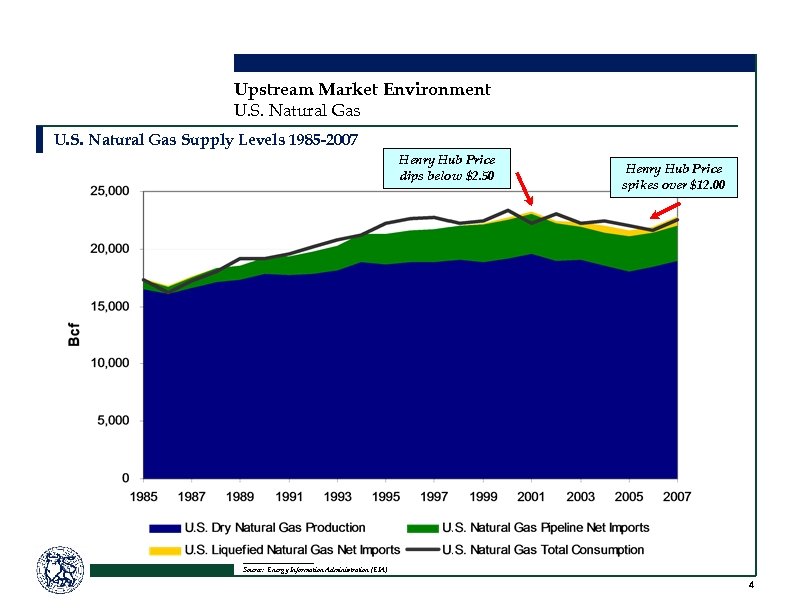

Upstream Market Environment U. S. Natural Gas Supply Levels 1985 -2007 Henry Hub Price dips below $2. 50 Henry Hub Price spikes over $12. 00 __________ Source: Energy Information Administration (EIA) 4

Upstream Market Environment U. S. Natural Gas Supply Levels 1985 -2007 Henry Hub Price dips below $2. 50 Henry Hub Price spikes over $12. 00 __________ Source: Energy Information Administration (EIA) 4

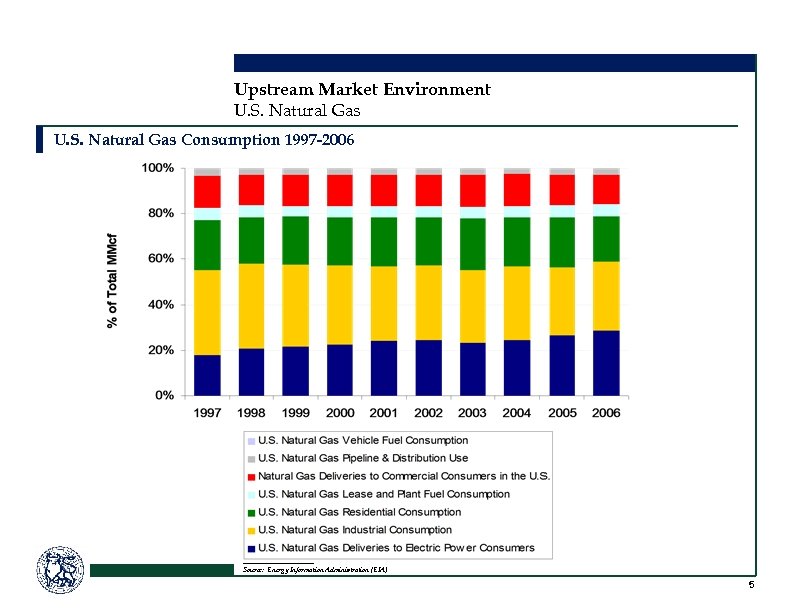

Upstream Market Environment U. S. Natural Gas Consumption 1997 -2006 __________ Source: Energy Information Administration (EIA) 5

Upstream Market Environment U. S. Natural Gas Consumption 1997 -2006 __________ Source: Energy Information Administration (EIA) 5

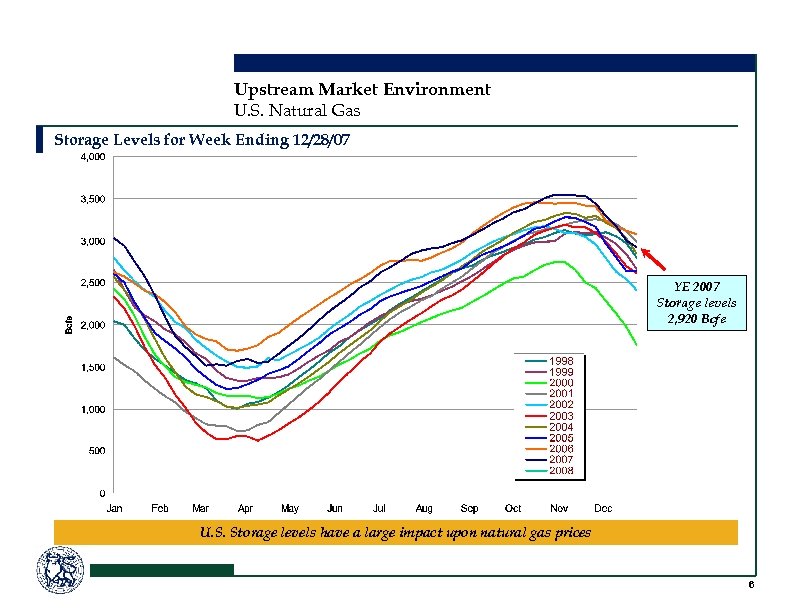

Upstream Market Environment U. S. Natural Gas Storage Levels for Week Ending 12/28/07 YE 2007 Storage levels 2, 920 Bcfe U. S. Storage levels have a large impact upon natural gas prices 6

Upstream Market Environment U. S. Natural Gas Storage Levels for Week Ending 12/28/07 YE 2007 Storage levels 2, 920 Bcfe U. S. Storage levels have a large impact upon natural gas prices 6

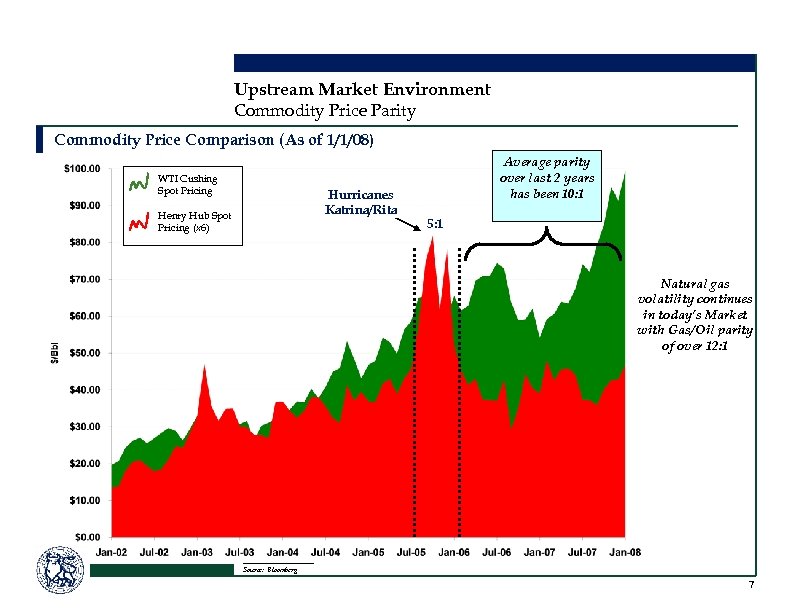

Upstream Market Environment Commodity Price Parity Commodity Price Comparison (As of 1/1/08) WTI Cushing Spot Pricing Hurricanes Katrina/Rita Henry Hub Spot Pricing (x 6) Average parity over last 2 years has been 10: 1 5: 1 Natural gas volatility continues in today’s Market with Gas/Oil parity of over 12: 1 __________ Source: Bloomberg 7

Upstream Market Environment Commodity Price Parity Commodity Price Comparison (As of 1/1/08) WTI Cushing Spot Pricing Hurricanes Katrina/Rita Henry Hub Spot Pricing (x 6) Average parity over last 2 years has been 10: 1 5: 1 Natural gas volatility continues in today’s Market with Gas/Oil parity of over 12: 1 __________ Source: Bloomberg 7

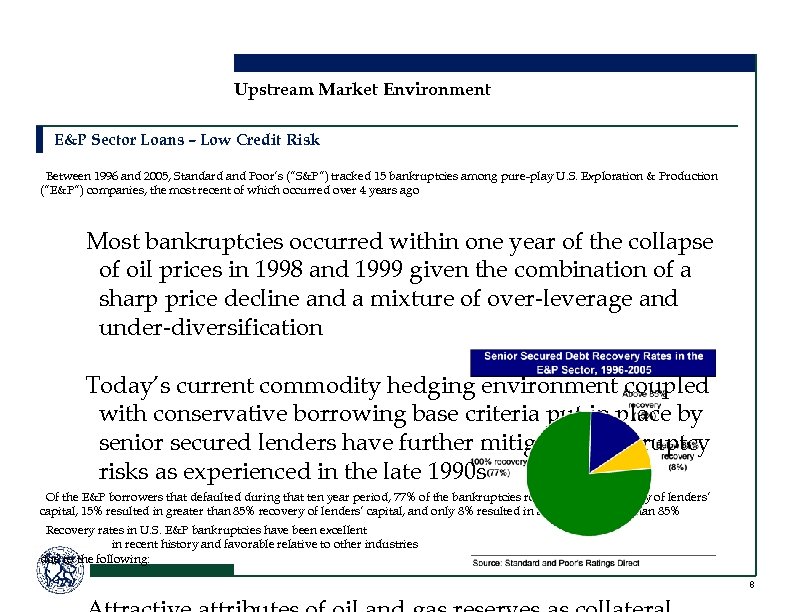

Upstream Market Environment E&P Sector Loans – Low Credit Risk §Between 1996 and 2005, Standard and Poor’s (“S&P”) tracked 15 bankruptcies among pure-play U. S. Exploration & Production (“E&P”) companies, the most recent of which occurred over 4 years ago Most bankruptcies occurred within one year of the collapse of oil prices in 1998 and 1999 given the combination of a sharp price decline and a mixture of over-leverage and under-diversification Today’s current commodity hedging environment coupled with conservative borrowing base criteria put in place by senior secured lenders have further mitigated bankruptcy risks as experienced in the late 1990 s §Of the E&P borrowers that defaulted during that ten year period, 77% of the bankruptcies resulted in full recovery of lenders’ capital, 15% resulted in greater than 85% recovery of lenders’ capital, and only 8% resulted in a recovery of less than 85% §Recovery rates in U. S. E&P bankruptcies have been excellent in recent history and favorable relative to other industries due to the following: 8

Upstream Market Environment E&P Sector Loans – Low Credit Risk §Between 1996 and 2005, Standard and Poor’s (“S&P”) tracked 15 bankruptcies among pure-play U. S. Exploration & Production (“E&P”) companies, the most recent of which occurred over 4 years ago Most bankruptcies occurred within one year of the collapse of oil prices in 1998 and 1999 given the combination of a sharp price decline and a mixture of over-leverage and under-diversification Today’s current commodity hedging environment coupled with conservative borrowing base criteria put in place by senior secured lenders have further mitigated bankruptcy risks as experienced in the late 1990 s §Of the E&P borrowers that defaulted during that ten year period, 77% of the bankruptcies resulted in full recovery of lenders’ capital, 15% resulted in greater than 85% recovery of lenders’ capital, and only 8% resulted in a recovery of less than 85% §Recovery rates in U. S. E&P bankruptcies have been excellent in recent history and favorable relative to other industries due to the following: 8

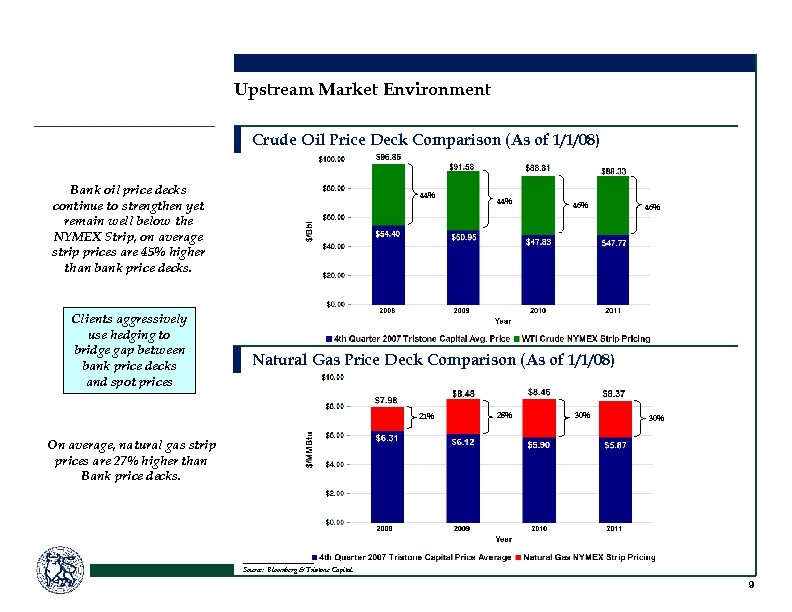

Upstream Market Environment Crude Oil Price Deck Comparison (As of 1/1/08) Bank oil price decks continue to strengthen yet remain well below the NYMEX Strip, on average strip prices are 45% higher than bank price decks. Clients aggressively use hedging to bridge gap between bank price decks and spot prices 44% 46% Natural Gas Price Deck Comparison (As of 1/1/08) 21% 28% 30% On average, natural gas strip prices are 27% higher than Bank price decks. __________ Source: Bloomberg & Tristone Capital. 9

Upstream Market Environment Crude Oil Price Deck Comparison (As of 1/1/08) Bank oil price decks continue to strengthen yet remain well below the NYMEX Strip, on average strip prices are 45% higher than bank price decks. Clients aggressively use hedging to bridge gap between bank price decks and spot prices 44% 46% Natural Gas Price Deck Comparison (As of 1/1/08) 21% 28% 30% On average, natural gas strip prices are 27% higher than Bank price decks. __________ Source: Bloomberg & Tristone Capital. 9

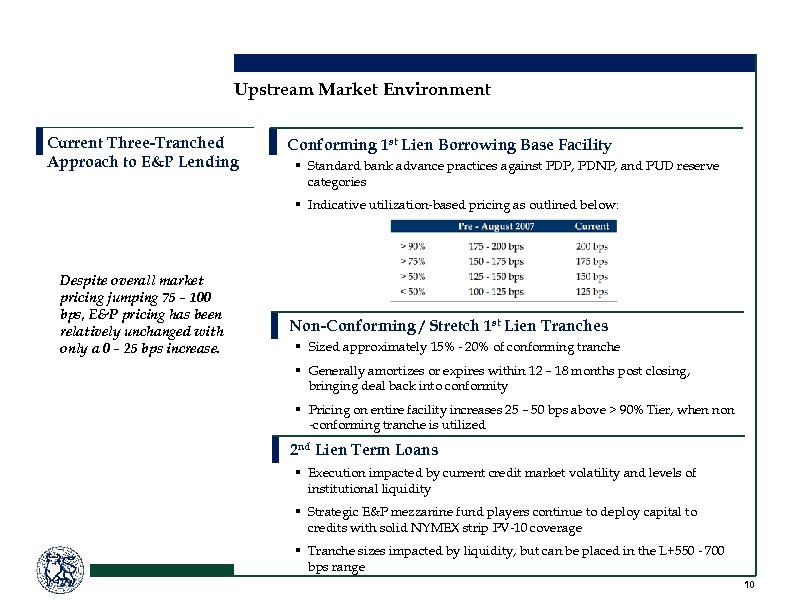

Upstream Market Environment Current Three-Tranched Approach to E&P Lending Conforming 1 st Lien Borrowing Base Facility § Standard bank advance practices against PDP, PDNP, and PUD reserve categories § Indicative utilization-based pricing as outlined below: Despite overall market pricing jumping 75 – 100 bps, E&P pricing has been relatively unchanged with only a 0 – 25 bps increase. Non-Conforming / Stretch 1 st Lien Tranches § Sized approximately 15% - 20% of conforming tranche § Generally amortizes or expires within 12 – 18 months post closing, bringing deal back into conformity § Pricing on entire facility increases 25 – 50 bps above > 90% Tier, when non -conforming tranche is utilized 2 nd Lien Term Loans § Execution impacted by current credit market volatility and levels of institutional liquidity § Strategic E&P mezzanine fund players continue to deploy capital to credits with solid NYMEX strip PV-10 coverage § Tranche sizes impacted by liquidity, but can be placed in the L+550 - 700 bps range 10

Upstream Market Environment Current Three-Tranched Approach to E&P Lending Conforming 1 st Lien Borrowing Base Facility § Standard bank advance practices against PDP, PDNP, and PUD reserve categories § Indicative utilization-based pricing as outlined below: Despite overall market pricing jumping 75 – 100 bps, E&P pricing has been relatively unchanged with only a 0 – 25 bps increase. Non-Conforming / Stretch 1 st Lien Tranches § Sized approximately 15% - 20% of conforming tranche § Generally amortizes or expires within 12 – 18 months post closing, bringing deal back into conformity § Pricing on entire facility increases 25 – 50 bps above > 90% Tier, when non -conforming tranche is utilized 2 nd Lien Term Loans § Execution impacted by current credit market volatility and levels of institutional liquidity § Strategic E&P mezzanine fund players continue to deploy capital to credits with solid NYMEX strip PV-10 coverage § Tranche sizes impacted by liquidity, but can be placed in the L+550 - 700 bps range 10

Merrill Lynch Capital Energy Finance

Merrill Lynch Capital Energy Finance

Merrill Lynch Capital Energy Finance Introduction § MLC’s Energy Finance team, established in November 2006, is dedicated to providing senior debt financing to the North American oil and gas and natural resources industry Leading provider of Debt Capital Markets products to middle market upstream and midstream businesses Seasoned team of professionals with extensive experience arranging, underwriting, and syndicating senior debt financings § MLC Energy Finance distinguishes itself from its competitors through: Strong, long-standing relationships with management teams and equity sponsors Experience and market knowledge, delivering client focused results Consistent and disciplined lending practices A dedicated balance sheet driven approach Ability to provide significant and timely capital commitments to clients (ranging from approximately $10 MM - $2 BN) 12

Merrill Lynch Capital Energy Finance Introduction § MLC’s Energy Finance team, established in November 2006, is dedicated to providing senior debt financing to the North American oil and gas and natural resources industry Leading provider of Debt Capital Markets products to middle market upstream and midstream businesses Seasoned team of professionals with extensive experience arranging, underwriting, and syndicating senior debt financings § MLC Energy Finance distinguishes itself from its competitors through: Strong, long-standing relationships with management teams and equity sponsors Experience and market knowledge, delivering client focused results Consistent and disciplined lending practices A dedicated balance sheet driven approach Ability to provide significant and timely capital commitments to clients (ranging from approximately $10 MM - $2 BN) 12

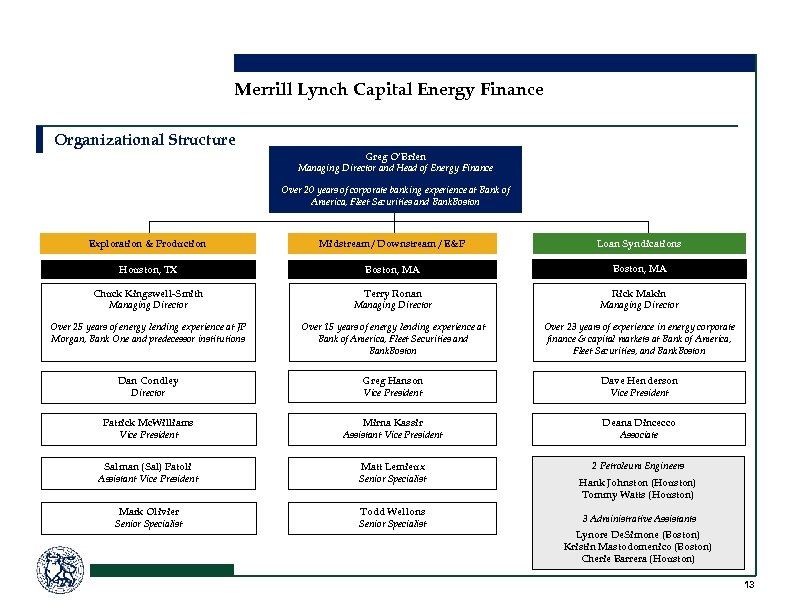

Merrill Lynch Capital Energy Finance Organizational Structure Greg O’Brien Managing Director and Head of Energy Finance Over 20 years of corporate banking experience at Bank of America, Fleet Securities and Bank. Boston Exploration & Production Midstream / Downstream / E&P Loan Syndications Houston, TX Boston, MA Chuck Kingswell-Smith Managing Director Terry Ronan Managing Director Rick Makin Managing Director Over 25 years of energy lending experience at JP Morgan, Bank One and predecessor institutions Over 15 years of energy lending experience at Bank of America, Fleet Securities and Bank. Boston Over 23 years of experience in energy corporate finance & capital markets at Bank of America, Fleet Securities, and Bank. Boston Dan Condley Director Greg Hanson Vice President Dave Henderson Vice President Patrick Mc. Williams Vice President Mirna Kassir Assistant Vice President Deana Dincecco Associate Salman (Sal) Patoli Assistant Vice President Matt Lemieux Senior Specialist 2 Petroleum Engineers Mark Olivier Senior Specialist Todd Wellons Senior Specialist Hank Johnston (Houston) Tommy Watts (Houston) 3 Administrative Assistants Lynore De. Simone (Boston) Kristin Mastodomenico (Boston) Cherie Barrera (Houston) 13

Merrill Lynch Capital Energy Finance Organizational Structure Greg O’Brien Managing Director and Head of Energy Finance Over 20 years of corporate banking experience at Bank of America, Fleet Securities and Bank. Boston Exploration & Production Midstream / Downstream / E&P Loan Syndications Houston, TX Boston, MA Chuck Kingswell-Smith Managing Director Terry Ronan Managing Director Rick Makin Managing Director Over 25 years of energy lending experience at JP Morgan, Bank One and predecessor institutions Over 15 years of energy lending experience at Bank of America, Fleet Securities and Bank. Boston Over 23 years of experience in energy corporate finance & capital markets at Bank of America, Fleet Securities, and Bank. Boston Dan Condley Director Greg Hanson Vice President Dave Henderson Vice President Patrick Mc. Williams Vice President Mirna Kassir Assistant Vice President Deana Dincecco Associate Salman (Sal) Patoli Assistant Vice President Matt Lemieux Senior Specialist 2 Petroleum Engineers Mark Olivier Senior Specialist Todd Wellons Senior Specialist Hank Johnston (Houston) Tommy Watts (Houston) 3 Administrative Assistants Lynore De. Simone (Boston) Kristin Mastodomenico (Boston) Cherie Barrera (Houston) 13

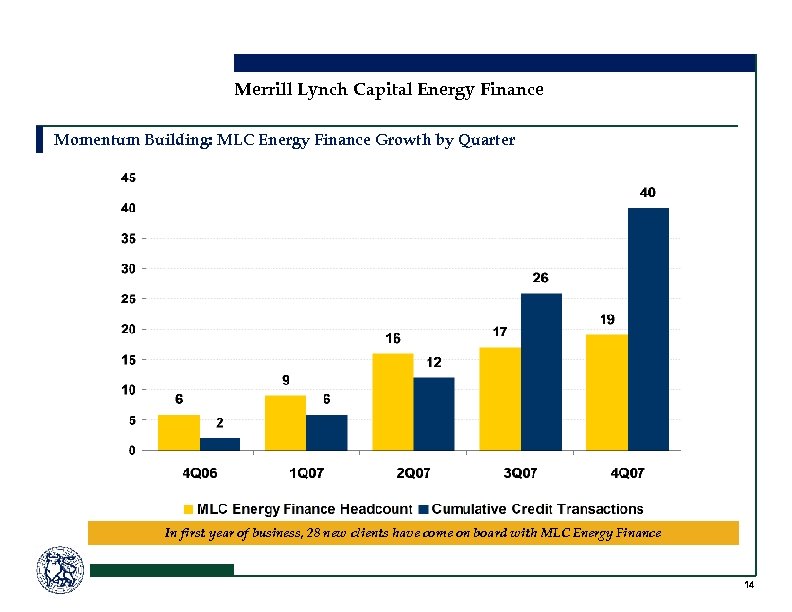

Merrill Lynch Capital Energy Finance Momentum Building: MLC Energy Finance Growth by Quarter In first year of business, 28 new clients have come on board with MLC Energy Finance 14

Merrill Lynch Capital Energy Finance Momentum Building: MLC Energy Finance Growth by Quarter In first year of business, 28 new clients have come on board with MLC Energy Finance 14

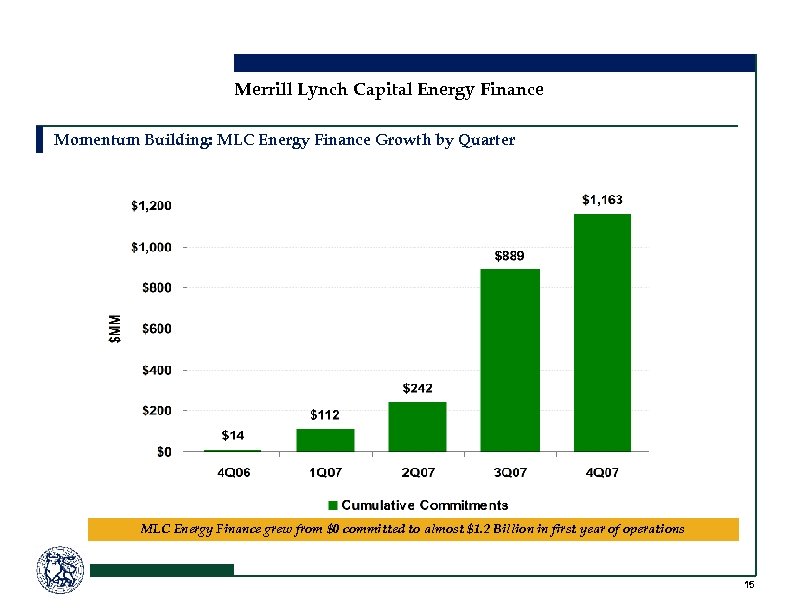

Merrill Lynch Capital Energy Finance Momentum Building: MLC Energy Finance Growth by Quarter MLC Energy Finance grew from $0 committed to almost $1. 2 Billion in first year of operations 15

Merrill Lynch Capital Energy Finance Momentum Building: MLC Energy Finance Growth by Quarter MLC Energy Finance grew from $0 committed to almost $1. 2 Billion in first year of operations 15

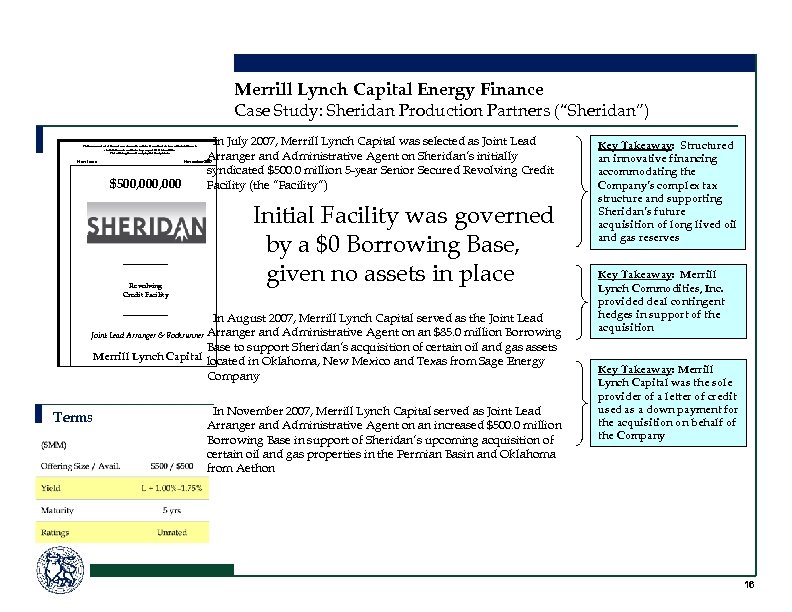

Merrill Lynch Capital Energy Finance Case Study: Sheridan Production Partners (“Sheridan”) This announcement is under no circumstances to be construed as an offer to sell or as a solicitation of an offer to buy any of these securities. The offering is made only by the Prospectus. New Issue §In July 2007, Merrill Lynch Capital was selected as Joint Lead Arranger and Administrative Agent on Sheridan’s initially syndicated $500. 0 million 5 -year Senior Secured Revolving Credit Facility (the “Facility”) November 2007 $500, 000 Revolving Credit Facility Initial Facility was governed by a $0 Borrowing Base, given no assets in place §In August 2007, Merrill Lynch Capital served as the Joint Lead Arranger & Bookrunner Arranger and Administrative Agent on an $85. 0 million Borrowing Base to support Sheridan’s acquisition of certain oil and gas assets Merrill Lynch Capital located in Oklahoma, New Mexico and Texas from Sage Energy Company Terms §In November 2007, Merrill Lynch Capital served as Joint Lead Arranger and Administrative Agent on an increased $500. 0 million Borrowing Base in support of Sheridan’s upcoming acquisition of certain oil and gas properties in the Permian Basin and Oklahoma from Aethon Key Takeaway: Structured an innovative financing accommodating the Company’s complex tax structure and supporting Sheridan’s future acquisition of long lived oil and gas reserves Key Takeaway: Merrill Lynch Commodities, Inc. provided deal contingent hedges in support of the acquisition Key Takeaway: Merrill Lynch Capital was the sole provider of a letter of credit used as a down payment for the acquisition on behalf of the Company 16

Merrill Lynch Capital Energy Finance Case Study: Sheridan Production Partners (“Sheridan”) This announcement is under no circumstances to be construed as an offer to sell or as a solicitation of an offer to buy any of these securities. The offering is made only by the Prospectus. New Issue §In July 2007, Merrill Lynch Capital was selected as Joint Lead Arranger and Administrative Agent on Sheridan’s initially syndicated $500. 0 million 5 -year Senior Secured Revolving Credit Facility (the “Facility”) November 2007 $500, 000 Revolving Credit Facility Initial Facility was governed by a $0 Borrowing Base, given no assets in place §In August 2007, Merrill Lynch Capital served as the Joint Lead Arranger & Bookrunner Arranger and Administrative Agent on an $85. 0 million Borrowing Base to support Sheridan’s acquisition of certain oil and gas assets Merrill Lynch Capital located in Oklahoma, New Mexico and Texas from Sage Energy Company Terms §In November 2007, Merrill Lynch Capital served as Joint Lead Arranger and Administrative Agent on an increased $500. 0 million Borrowing Base in support of Sheridan’s upcoming acquisition of certain oil and gas properties in the Permian Basin and Oklahoma from Aethon Key Takeaway: Structured an innovative financing accommodating the Company’s complex tax structure and supporting Sheridan’s future acquisition of long lived oil and gas reserves Key Takeaway: Merrill Lynch Commodities, Inc. provided deal contingent hedges in support of the acquisition Key Takeaway: Merrill Lynch Capital was the sole provider of a letter of credit used as a down payment for the acquisition on behalf of the Company 16

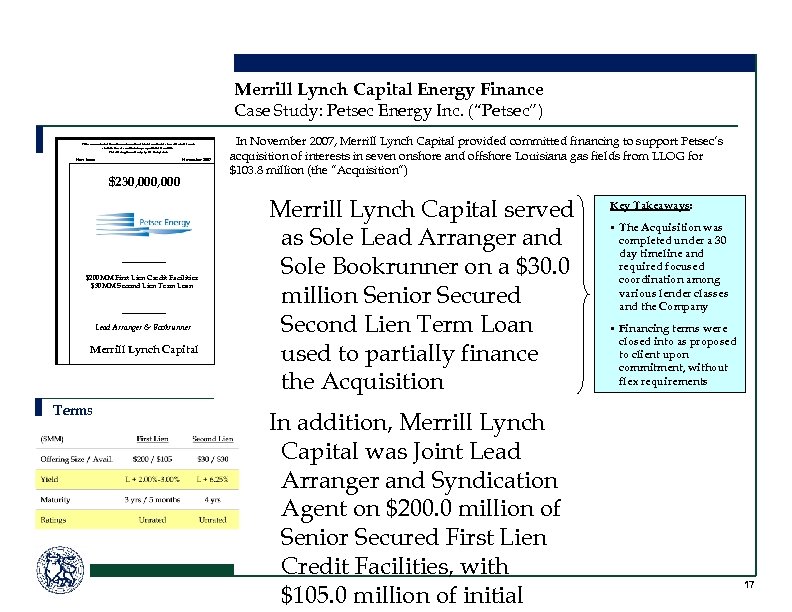

Merrill Lynch Capital Energy Finance Case Study: Petsec Energy Inc. (“Petsec”) This announcement is under no circumstances to be construed as an offer to sell or as a solicitation of an offer to buy any of these securities. The offering is made only by the Prospectus. New Issue November 2007 $230, 000 $200 MM First Lien Credit Facilities $30 MM Second Lien Term Loan Lead Arranger & Bookrunner Merrill Lynch Capital Terms §In November 2007, Merrill Lynch Capital provided committed financing to support Petsec’s acquisition of interests in seven onshore and offshore Louisiana gas fields from LLOG for $103. 8 million (the “Acquisition”) Merrill Lynch Capital served as Sole Lead Arranger and Sole Bookrunner on a $30. 0 million Senior Secured Second Lien Term Loan used to partially finance the Acquisition In addition, Merrill Lynch Capital was Joint Lead Arranger and Syndication Agent on $200. 0 million of Senior Secured First Lien Credit Facilities, with $105. 0 million of initial Key Takeaways: § The Acquisition was completed under a 30 day timeline and required focused coordination among various lender classes and the Company § Financing terms were closed into as proposed to client upon commitment, without flex requirements 17

Merrill Lynch Capital Energy Finance Case Study: Petsec Energy Inc. (“Petsec”) This announcement is under no circumstances to be construed as an offer to sell or as a solicitation of an offer to buy any of these securities. The offering is made only by the Prospectus. New Issue November 2007 $230, 000 $200 MM First Lien Credit Facilities $30 MM Second Lien Term Loan Lead Arranger & Bookrunner Merrill Lynch Capital Terms §In November 2007, Merrill Lynch Capital provided committed financing to support Petsec’s acquisition of interests in seven onshore and offshore Louisiana gas fields from LLOG for $103. 8 million (the “Acquisition”) Merrill Lynch Capital served as Sole Lead Arranger and Sole Bookrunner on a $30. 0 million Senior Secured Second Lien Term Loan used to partially finance the Acquisition In addition, Merrill Lynch Capital was Joint Lead Arranger and Syndication Agent on $200. 0 million of Senior Secured First Lien Credit Facilities, with $105. 0 million of initial Key Takeaways: § The Acquisition was completed under a 30 day timeline and required focused coordination among various lender classes and the Company § Financing terms were closed into as proposed to client upon commitment, without flex requirements 17

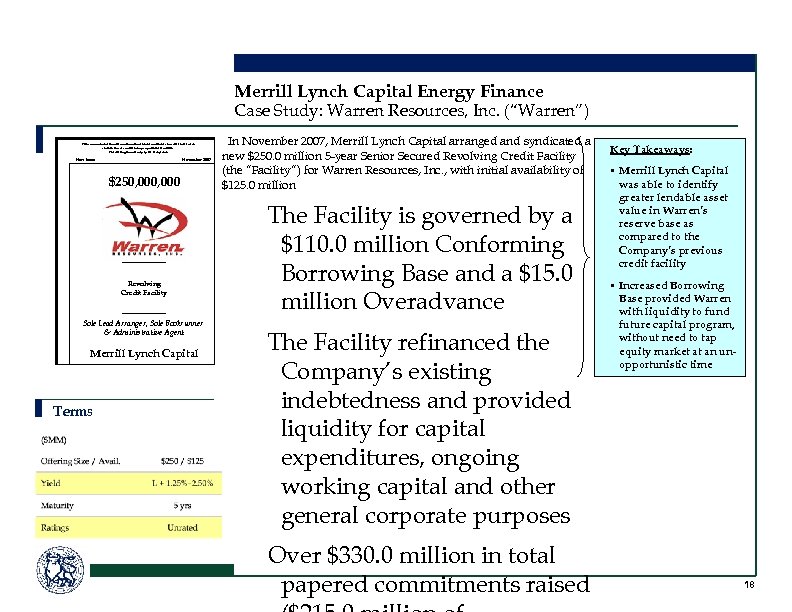

Merrill Lynch Capital Energy Finance Case Study: Warren Resources, Inc. (“Warren”) This announcement is under no circumstances to be construed as an offer to sell or as a solicitation of an offer to buy any of these securities. The offering is made only by the Prospectus. New Issue November 2007 $250, 000 Revolving Credit Facility Sole Lead Arranger, Sole Bookrunner & Administrative Agent Merrill Lynch Capital Terms §In November 2007, Merrill Lynch Capital arranged and syndicated a new $250. 0 million 5 -year Senior Secured Revolving Credit Facility (the “Facility”) for Warren Resources, Inc. , with initial availability of $125. 0 million The Facility is governed by a $110. 0 million Conforming Borrowing Base and a $15. 0 million Overadvance The Facility refinanced the Company’s existing indebtedness and provided liquidity for capital expenditures, ongoing working capital and other general corporate purposes Over $330. 0 million in total papered commitments raised Key Takeaways: § Merrill Lynch Capital was able to identify greater lendable asset value in Warren’s reserve base as compared to the Company’s previous credit facility § Increased Borrowing Base provided Warren with liquidity to fund future capital program, without need to tap equity market at an unopportunistic time 18

Merrill Lynch Capital Energy Finance Case Study: Warren Resources, Inc. (“Warren”) This announcement is under no circumstances to be construed as an offer to sell or as a solicitation of an offer to buy any of these securities. The offering is made only by the Prospectus. New Issue November 2007 $250, 000 Revolving Credit Facility Sole Lead Arranger, Sole Bookrunner & Administrative Agent Merrill Lynch Capital Terms §In November 2007, Merrill Lynch Capital arranged and syndicated a new $250. 0 million 5 -year Senior Secured Revolving Credit Facility (the “Facility”) for Warren Resources, Inc. , with initial availability of $125. 0 million The Facility is governed by a $110. 0 million Conforming Borrowing Base and a $15. 0 million Overadvance The Facility refinanced the Company’s existing indebtedness and provided liquidity for capital expenditures, ongoing working capital and other general corporate purposes Over $330. 0 million in total papered commitments raised Key Takeaways: § Merrill Lynch Capital was able to identify greater lendable asset value in Warren’s reserve base as compared to the Company’s previous credit facility § Increased Borrowing Base provided Warren with liquidity to fund future capital program, without need to tap equity market at an unopportunistic time 18

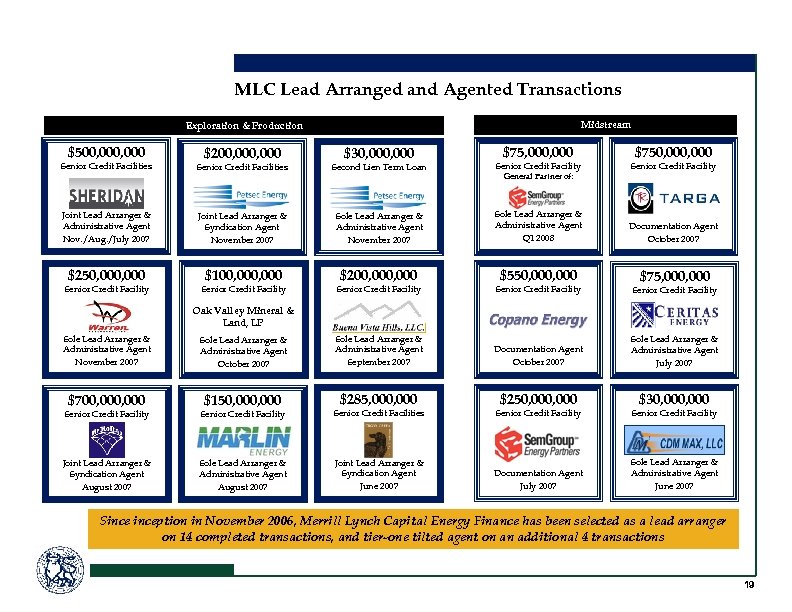

MLC Lead Arranged and Agented Transactions Midstream Exploration & Production $500, 000 Senior Credit Facilities Joint Lead Arranger & Administrative Agent Nov. /Aug. /July 2007 $250, 000 Senior Credit Facility $200, 000 $30, 000 $75, 000 $750, 000 Senior Credit Facilities Second Lien Term Loan Senior Credit Facility Joint Lead Arranger & Syndication Agent November 2007 Sole Lead Arranger & Administrative Agent Q 1 2008 Documentation Agent October 2007 $100, 000 Senior Credit Facility $200, 000 General Partner of: $550, 000 $75, 000 Senior Credit Facility Documentation Agent October 2007 Sole Lead Arranger & Administrative Agent July 2007 Oak Valley Mineral & Land, LP Sole Lead Arranger & Administrative Agent November 2007 Sole Lead Arranger & Administrative Agent October 2007 Sole Lead Arranger & Administrative Agent September 2007 $700, 000 $150, 000 $285, 000 $250, 000 Senior Credit Facility Senior Credit Facilities Senior Credit Facility Joint Lead Arranger & Syndication Agent August 2007 Sole Lead Arranger & Administrative Agent August 2007 Joint Lead Arranger & Syndication Agent June 2007 Documentation Agent July 2007 $30, 000 Senior Credit Facility Sole Lead Arranger & Administrative Agent June 2007 Sinception in November 2006, Merrill Lynch Capital Energy Finance has been selected as a lead arranger on 14 completed transactions, and tier-one tilted agent on an additional 4 transactions 19

MLC Lead Arranged and Agented Transactions Midstream Exploration & Production $500, 000 Senior Credit Facilities Joint Lead Arranger & Administrative Agent Nov. /Aug. /July 2007 $250, 000 Senior Credit Facility $200, 000 $30, 000 $75, 000 $750, 000 Senior Credit Facilities Second Lien Term Loan Senior Credit Facility Joint Lead Arranger & Syndication Agent November 2007 Sole Lead Arranger & Administrative Agent Q 1 2008 Documentation Agent October 2007 $100, 000 Senior Credit Facility $200, 000 General Partner of: $550, 000 $75, 000 Senior Credit Facility Documentation Agent October 2007 Sole Lead Arranger & Administrative Agent July 2007 Oak Valley Mineral & Land, LP Sole Lead Arranger & Administrative Agent November 2007 Sole Lead Arranger & Administrative Agent October 2007 Sole Lead Arranger & Administrative Agent September 2007 $700, 000 $150, 000 $285, 000 $250, 000 Senior Credit Facility Senior Credit Facilities Senior Credit Facility Joint Lead Arranger & Syndication Agent August 2007 Sole Lead Arranger & Administrative Agent August 2007 Joint Lead Arranger & Syndication Agent June 2007 Documentation Agent July 2007 $30, 000 Senior Credit Facility Sole Lead Arranger & Administrative Agent June 2007 Sinception in November 2006, Merrill Lynch Capital Energy Finance has been selected as a lead arranger on 14 completed transactions, and tier-one tilted agent on an additional 4 transactions 19

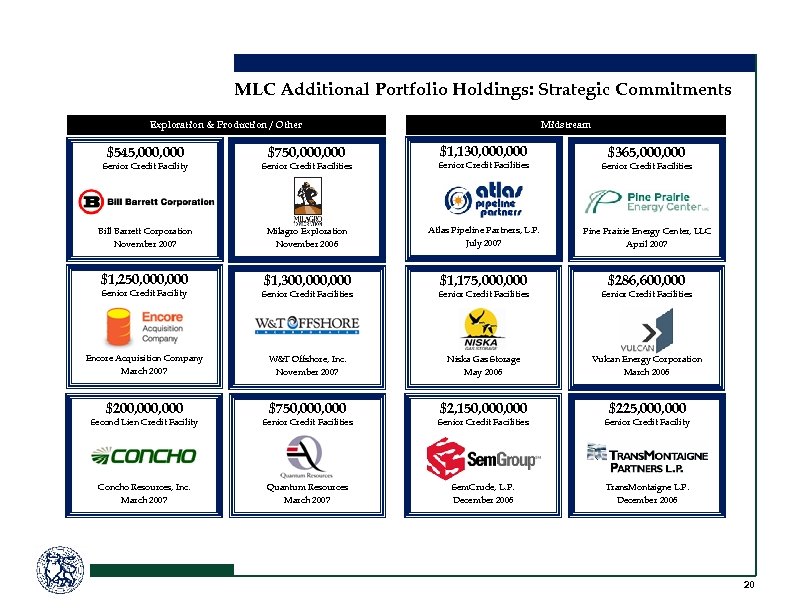

MLC Additional Portfolio Holdings: Strategic Commitments Exploration & Production / Other $545, 000 $750, 000 Midstream $1, 130, 000 $365, 000 Senior Credit Facility Senior Credit Facilities Bill Barrett Corporation November 2007 Milagro Exploration November 2006 Atlas Pipeline Partners, L. P. July 2007 Pine Prairie Energy Center, LLC April 2007 $1, 250, 000 $1, 300, 000 $1, 175, 000 $286, 600, 000 Senior Credit Facility Senior Credit Facilities Encore Acquisition Company March 2007 W&T Offshore, Inc. November 2007 Niska Gas Storage May 2006 Vulcan Energy Corporation March 2006 $200, 000 $750, 000 $2, 150, 000 $225, 000 Second Lien Credit Facility Senior Credit Facilities Senior Credit Facility Concho Resources, Inc. March 2007 Quantum Resources March 2007 Sem. Crude, L. P. December 2006 Trans. Montaigne L. P. December 2006 20

MLC Additional Portfolio Holdings: Strategic Commitments Exploration & Production / Other $545, 000 $750, 000 Midstream $1, 130, 000 $365, 000 Senior Credit Facility Senior Credit Facilities Bill Barrett Corporation November 2007 Milagro Exploration November 2006 Atlas Pipeline Partners, L. P. July 2007 Pine Prairie Energy Center, LLC April 2007 $1, 250, 000 $1, 300, 000 $1, 175, 000 $286, 600, 000 Senior Credit Facility Senior Credit Facilities Encore Acquisition Company March 2007 W&T Offshore, Inc. November 2007 Niska Gas Storage May 2006 Vulcan Energy Corporation March 2006 $200, 000 $750, 000 $2, 150, 000 $225, 000 Second Lien Credit Facility Senior Credit Facilities Senior Credit Facility Concho Resources, Inc. March 2007 Quantum Resources March 2007 Sem. Crude, L. P. December 2006 Trans. Montaigne L. P. December 2006 20

Disclaimers Merrill Lynch prohibits (a) employees from, directly or indirectly, offering a favorable research rating or specific price target, or offering to change such rating or price target, as consideration or inducement for the receipt of business or for compensation, and (b) Research Analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investor clients. This proposal is confidential, for your private use only, and may not be shared with others (other than your advisors) without Merrill Lynch's written permission, except that you (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the proposal and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and tax structure. For purposes of the preceding sentence, tax refers to U. S. federal and state tax. This proposal is for discussion purposes only. Merrill Lynch is not an expert on, and does not render opinions regarding, legal, accounting, regulatory or tax matters. You should consult with your advisors concerning these matters before undertaking the proposed transaction. 21

Disclaimers Merrill Lynch prohibits (a) employees from, directly or indirectly, offering a favorable research rating or specific price target, or offering to change such rating or price target, as consideration or inducement for the receipt of business or for compensation, and (b) Research Analysts from being compensated for involvement in investment banking transactions except to the extent that such participation is intended to benefit investor clients. This proposal is confidential, for your private use only, and may not be shared with others (other than your advisors) without Merrill Lynch's written permission, except that you (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the proposal and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and tax structure. For purposes of the preceding sentence, tax refers to U. S. federal and state tax. This proposal is for discussion purposes only. Merrill Lynch is not an expert on, and does not render opinions regarding, legal, accounting, regulatory or tax matters. You should consult with your advisors concerning these matters before undertaking the proposed transaction. 21