d49502625f5560bfe010bceb0da75a8e.ppt

- Количество слайдов: 63

2008 full year results Craig Dunn Chief Executive Officer Paul Leaming Chief Financial Officer 19 February 2009

2008 full year results Craig Dunn Chief Executive Officer Paul Leaming Chief Financial Officer 19 February 2009

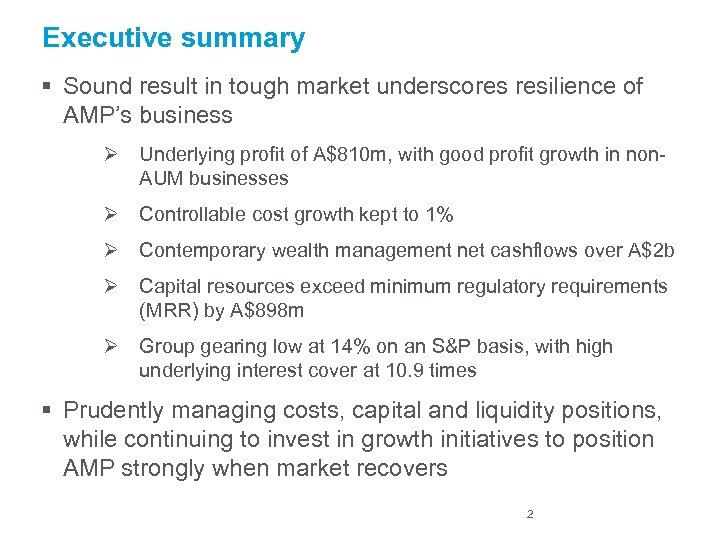

Executive summary § Sound result in tough market underscores resilience of AMP’s business Ø Underlying profit of A$810 m, with good profit growth in non. AUM businesses Ø Controllable cost growth kept to 1% Ø Contemporary wealth management net cashflows over A$2 b Ø Capital resources exceed minimum regulatory requirements (MRR) by A$898 m Ø Group gearing low at 14% on an S&P basis, with high underlying interest cover at 10. 9 times § Prudently managing costs, capital and liquidity positions, while continuing to invest in growth initiatives to position AMP strongly when market recovers 2

Executive summary § Sound result in tough market underscores resilience of AMP’s business Ø Underlying profit of A$810 m, with good profit growth in non. AUM businesses Ø Controllable cost growth kept to 1% Ø Contemporary wealth management net cashflows over A$2 b Ø Capital resources exceed minimum regulatory requirements (MRR) by A$898 m Ø Group gearing low at 14% on an S&P basis, with high underlying interest cover at 10. 9 times § Prudently managing costs, capital and liquidity positions, while continuing to invest in growth initiatives to position AMP strongly when market recovers 2

Outline § Group overview § Business line review § Financial overview § Outlook and strategy § Summary 3

Outline § Group overview § Business line review § Financial overview § Outlook and strategy § Summary 3

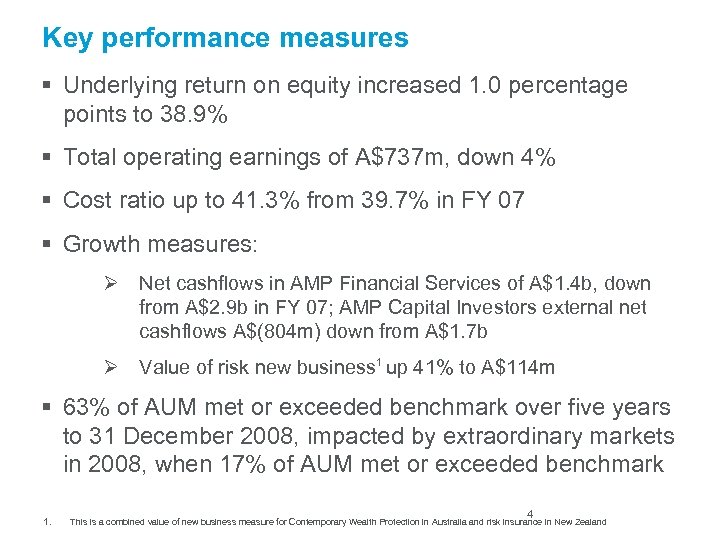

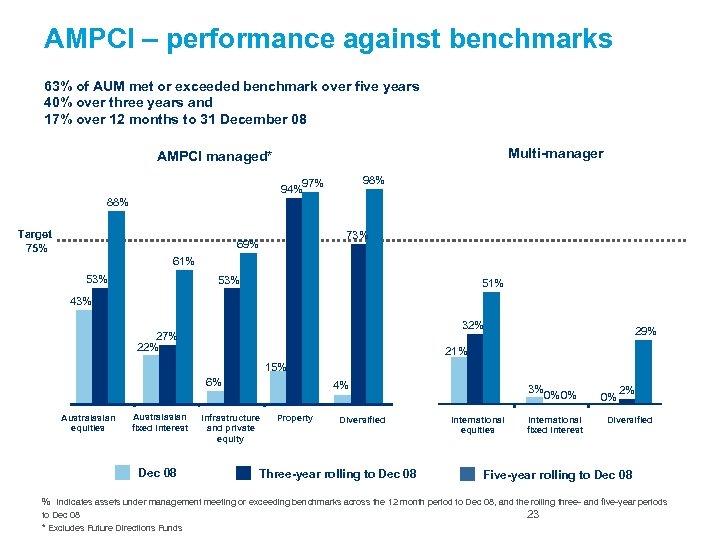

Key performance measures § Underlying return on equity increased 1. 0 percentage points to 38. 9% § Total operating earnings of A$737 m, down 4% § Cost ratio up to 41. 3% from 39. 7% in FY 07 § Growth measures: Ø Net cashflows in AMP Financial Services of A$1. 4 b, down from A$2. 9 b in FY 07; AMP Capital Investors external net cashflows A$(804 m) down from A$1. 7 b Ø Value of risk new business 1 up 41% to A$114 m § 63% of AUM met or exceeded benchmark over five years to 31 December 2008, impacted by extraordinary markets in 2008, when 17% of AUM met or exceeded benchmark 1. 4 This is a combined value of new business measure for Contemporary Wealth Protection in Australia and risk insurance in New Zealand

Key performance measures § Underlying return on equity increased 1. 0 percentage points to 38. 9% § Total operating earnings of A$737 m, down 4% § Cost ratio up to 41. 3% from 39. 7% in FY 07 § Growth measures: Ø Net cashflows in AMP Financial Services of A$1. 4 b, down from A$2. 9 b in FY 07; AMP Capital Investors external net cashflows A$(804 m) down from A$1. 7 b Ø Value of risk new business 1 up 41% to A$114 m § 63% of AUM met or exceeded benchmark over five years to 31 December 2008, impacted by extraordinary markets in 2008, when 17% of AUM met or exceeded benchmark 1. 4 This is a combined value of new business measure for Contemporary Wealth Protection in Australia and risk insurance in New Zealand

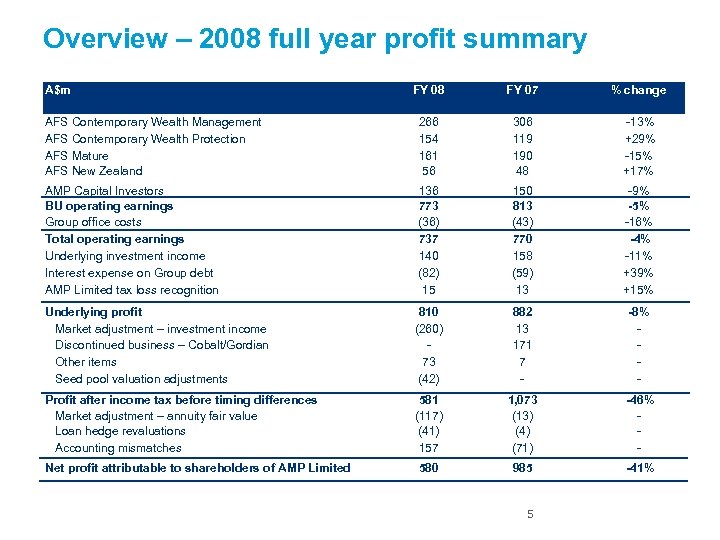

Overview – 2008 full year profit summary A$m FY 08 FY 07 % change AFS Contemporary Wealth Management AFS Contemporary Wealth Protection AFS Mature AFS New Zealand 266 154 161 56 306 119 190 48 -13% +29% -15% +17% AMP Capital Investors BU operating earnings Group office costs Total operating earnings Underlying investment income Interest expense on Group debt AMP Limited tax loss recognition 136 773 (36) 737 140 (82) 15 150 813 (43) 770 158 (59) 13 -9% -5% -16% -4% -11% +39% +15% Underlying profit Market adjustment – investment income Discontinued business – Cobalt/Gordian Other items Seed pool valuation adjustments 810 (260) 73 (42) 882 13 171 7 - -8% - Profit after income tax before timing differences Market adjustment – annuity fair value Loan hedge revaluations Accounting mismatches 581 (117) (41) 157 1, 073 (13) (4) (71) -46% - 580 985 -41% Net profit attributable to shareholders of AMP Limited 5

Overview – 2008 full year profit summary A$m FY 08 FY 07 % change AFS Contemporary Wealth Management AFS Contemporary Wealth Protection AFS Mature AFS New Zealand 266 154 161 56 306 119 190 48 -13% +29% -15% +17% AMP Capital Investors BU operating earnings Group office costs Total operating earnings Underlying investment income Interest expense on Group debt AMP Limited tax loss recognition 136 773 (36) 737 140 (82) 15 150 813 (43) 770 158 (59) 13 -9% -5% -16% -4% -11% +39% +15% Underlying profit Market adjustment – investment income Discontinued business – Cobalt/Gordian Other items Seed pool valuation adjustments 810 (260) 73 (42) 882 13 171 7 - -8% - Profit after income tax before timing differences Market adjustment – annuity fair value Loan hedge revaluations Accounting mismatches 581 (117) (41) 157 1, 073 (13) (4) (71) -46% - 580 985 -41% Net profit attributable to shareholders of AMP Limited 5

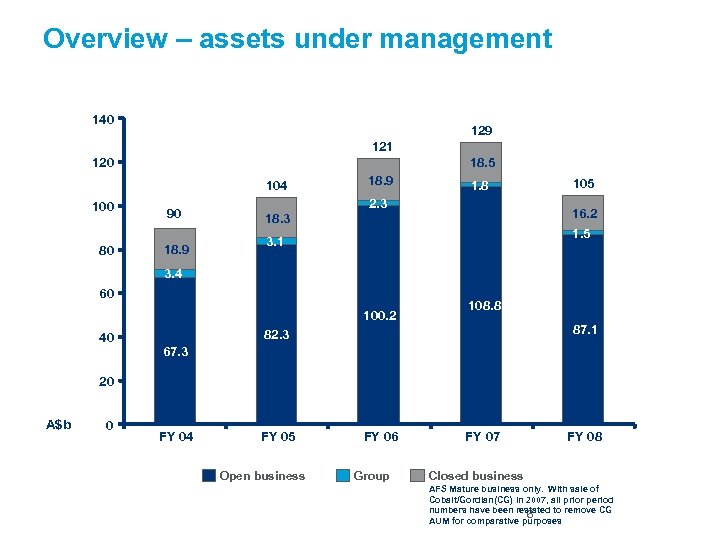

Overview – assets under management 140 129 121 120 18. 5 104 100 80 90 18. 9 1. 8 2. 3 105 16. 2 18. 3 1. 5 3. 1 3. 4 60 100. 2 40 108. 8 87. 1 82. 3 67. 3 20 A$b 0 FY 04 FY 05 Open business FY 06 Group FY 07 FY 08 Closed business AFS Mature business only. With sale of Cobalt/Gordian(CG) in 2007, all prior period numbers have been restated to remove CG 6 AUM for comparative purposes

Overview – assets under management 140 129 121 120 18. 5 104 100 80 90 18. 9 1. 8 2. 3 105 16. 2 18. 3 1. 5 3. 1 3. 4 60 100. 2 40 108. 8 87. 1 82. 3 67. 3 20 A$b 0 FY 04 FY 05 Open business FY 06 Group FY 07 FY 08 Closed business AFS Mature business only. With sale of Cobalt/Gordian(CG) in 2007, all prior period numbers have been restated to remove CG 6 AUM for comparative purposes

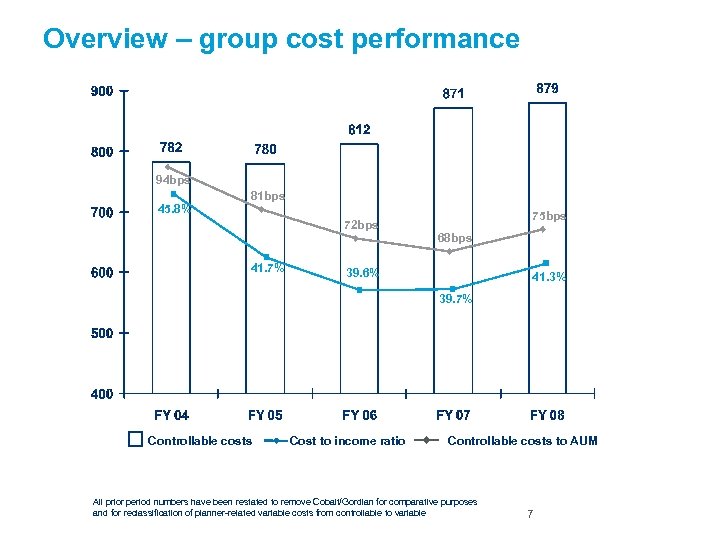

Overview – group cost performance 94 bps 45. 8% 81 bps 72 bps 41. 7% 75 bps 68 bps 39. 6% 41. 3% 39. 7% Controllable costs Cost to income ratio Controllable costs to AUM All prior period numbers have been restated to remove Cobalt/Gordian for comparative purposes and for reclassification of planner-related variable costs from controllable to variable 7

Overview – group cost performance 94 bps 45. 8% 81 bps 72 bps 41. 7% 75 bps 68 bps 39. 6% 41. 3% 39. 7% Controllable costs Cost to income ratio Controllable costs to AUM All prior period numbers have been restated to remove Cobalt/Gordian for comparative purposes and for reclassification of planner-related variable costs from controllable to variable 7

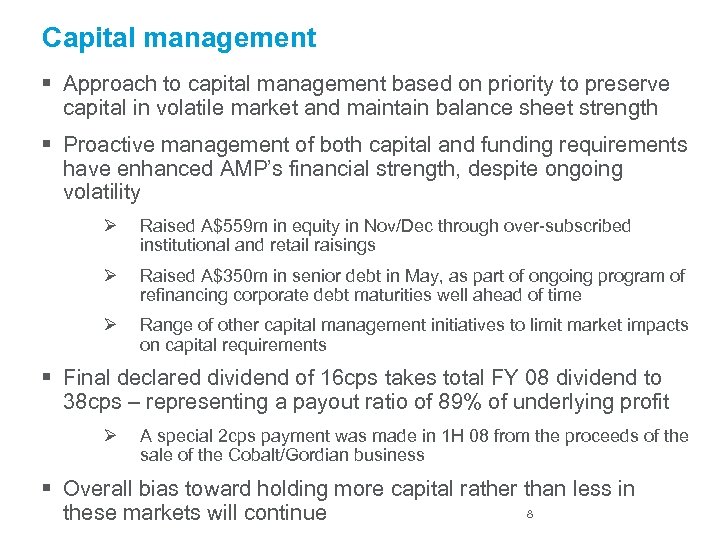

Capital management § Approach to capital management based on priority to preserve capital in volatile market and maintain balance sheet strength § Proactive management of both capital and funding requirements have enhanced AMP’s financial strength, despite ongoing volatility Ø Raised A$559 m in equity in Nov/Dec through over-subscribed institutional and retail raisings Ø Raised A$350 m in senior debt in May, as part of ongoing program of refinancing corporate debt maturities well ahead of time Ø Range of other capital management initiatives to limit market impacts on capital requirements § Final declared dividend of 16 cps takes total FY 08 dividend to 38 cps – representing a payout ratio of 89% of underlying profit Ø A special 2 cps payment was made in 1 H 08 from the proceeds of the sale of the Cobalt/Gordian business § Overall bias toward holding more capital rather than less in 8 these markets will continue

Capital management § Approach to capital management based on priority to preserve capital in volatile market and maintain balance sheet strength § Proactive management of both capital and funding requirements have enhanced AMP’s financial strength, despite ongoing volatility Ø Raised A$559 m in equity in Nov/Dec through over-subscribed institutional and retail raisings Ø Raised A$350 m in senior debt in May, as part of ongoing program of refinancing corporate debt maturities well ahead of time Ø Range of other capital management initiatives to limit market impacts on capital requirements § Final declared dividend of 16 cps takes total FY 08 dividend to 38 cps – representing a payout ratio of 89% of underlying profit Ø A special 2 cps payment was made in 1 H 08 from the proceeds of the sale of the Cobalt/Gordian business § Overall bias toward holding more capital rather than less in 8 these markets will continue

Business line review 9

Business line review 9

AMP Financial Services – FY 08 highlights § Diversified business delivered solid results in difficult environment, with operating earnings of A$637 m, down 4% on FY 07, despite 19% fall in AUM § Contemporary Wealth Management’s operating earnings down 13% to A$266 m reflecting impact of market turbulence § Contemporary Wealth Protection’s earnings up 29% as a result of strong new business growth and better claims experience § Operating earnings for the New Zealand business up 17% driven by risk growth, improved claims experience, cost control and success in Kiwi. Saver § 35. 4% cost ratio reflects tight cost focus combined with continued long-term investment program 10

AMP Financial Services – FY 08 highlights § Diversified business delivered solid results in difficult environment, with operating earnings of A$637 m, down 4% on FY 07, despite 19% fall in AUM § Contemporary Wealth Management’s operating earnings down 13% to A$266 m reflecting impact of market turbulence § Contemporary Wealth Protection’s earnings up 29% as a result of strong new business growth and better claims experience § Operating earnings for the New Zealand business up 17% driven by risk growth, improved claims experience, cost control and success in Kiwi. Saver § 35. 4% cost ratio reflects tight cost focus combined with continued long-term investment program 10

AFS overview – FY 08 cashflows § Resilient business model and strong mandated super position drove relative outperformance in cashflows, despite fall in member contributions § Total net cashflows of A$1. 4 b compared with A$2. 9 b in FY 07 Ø Retail superannuation and pensions/annuities net cashflows of A$1. 3 b compared to A$2. 4 b in FY 07 Ø Corporate super net cashflows (ex-mandate wins) up 57% to A$554 m, largely driven by solid employer contributions Ø NZ net cashflows increased to A$126 m from A$73 m in FY 07 § Positive net cashflows helped drive market share growth of 0. 5% 1. Source: Plan for Life, 30 Sep 08, based on retail AUM (excludes CMTs) Refer to pages 20 -22 in the FY 08 Investor Report for more information on cashflows 11 1

AFS overview – FY 08 cashflows § Resilient business model and strong mandated super position drove relative outperformance in cashflows, despite fall in member contributions § Total net cashflows of A$1. 4 b compared with A$2. 9 b in FY 07 Ø Retail superannuation and pensions/annuities net cashflows of A$1. 3 b compared to A$2. 4 b in FY 07 Ø Corporate super net cashflows (ex-mandate wins) up 57% to A$554 m, largely driven by solid employer contributions Ø NZ net cashflows increased to A$126 m from A$73 m in FY 07 § Positive net cashflows helped drive market share growth of 0. 5% 1. Source: Plan for Life, 30 Sep 08, based on retail AUM (excludes CMTs) Refer to pages 20 -22 in the FY 08 Investor Report for more information on cashflows 11 1

AFS overview – FY 08 cashflows § Planner channels reflected investor reticence but still had positive cashflows Ø Ø AMP Financial Planning net cashflows of A$863 m compared to A$2 b in FY 07 Hillross net cashflows of A$56 m compared to A$664 m in FY 07 § Persistency¹ strengthened across the board Ø Ø Overall persistency up to 90. 3% from 88. 6% Retail super persistency up to 91. 9% from 89. 3% Corporate super persistency up to 94. 0% from 92. 0% Allocated annuities and pensions persistency up to 86. 8% from 83. 0% § Outflows slowed Ø Ø Ø 1. Outflows overall down 18% to A$13 b from $16 b Outflows from Mature book down 22% on FY 07 64% of corporate super outflows flowed back into other AMP products, up from 61% in FY 07, while 56% of retail super outflows were also retained, down from 62% Persistency ratios relate to external outflows only. They do not include internal flows between AMP products. Refer to pages 20 -22 in the FY 08 Investor Report for more information on cashflows. 12

AFS overview – FY 08 cashflows § Planner channels reflected investor reticence but still had positive cashflows Ø Ø AMP Financial Planning net cashflows of A$863 m compared to A$2 b in FY 07 Hillross net cashflows of A$56 m compared to A$664 m in FY 07 § Persistency¹ strengthened across the board Ø Ø Overall persistency up to 90. 3% from 88. 6% Retail super persistency up to 91. 9% from 89. 3% Corporate super persistency up to 94. 0% from 92. 0% Allocated annuities and pensions persistency up to 86. 8% from 83. 0% § Outflows slowed Ø Ø Ø 1. Outflows overall down 18% to A$13 b from $16 b Outflows from Mature book down 22% on FY 07 64% of corporate super outflows flowed back into other AMP products, up from 61% in FY 07, while 56% of retail super outflows were also retained, down from 62% Persistency ratios relate to external outflows only. They do not include internal flows between AMP products. Refer to pages 20 -22 in the FY 08 Investor Report for more information on cashflows. 12

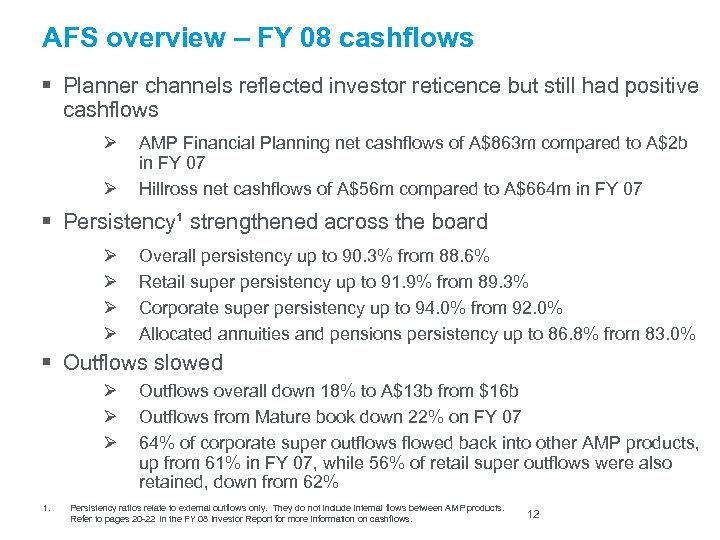

AFS – cost performance 100 bps 87 bps 42. 8% 76 bps 75 bps 69 bps 38. 5% 35. 4% 35. 2% 34. 2% Controllable costs Cost to income ratio Controllable costs to AUM Planner related variable costs previously included in controllable costs have been reclassified to variable costs. 13

AFS – cost performance 100 bps 87 bps 42. 8% 76 bps 75 bps 69 bps 38. 5% 35. 4% 35. 2% 34. 2% Controllable costs Cost to income ratio Controllable costs to AUM Planner related variable costs previously included in controllable costs have been reclassified to variable costs. 13

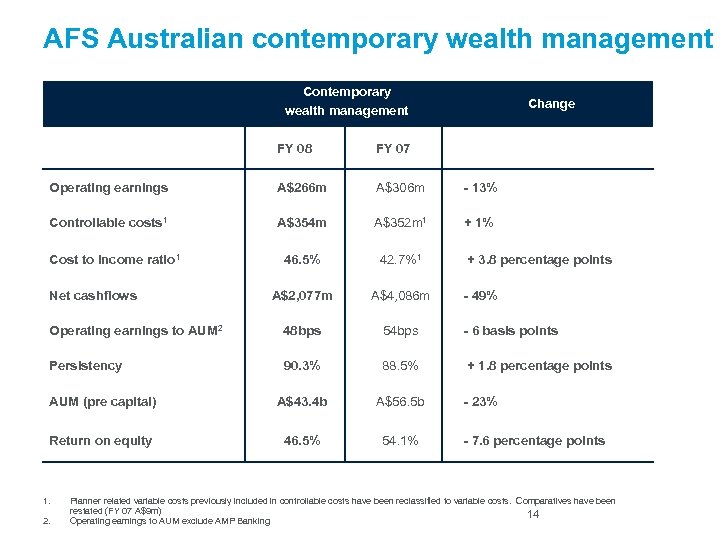

AFS Australian contemporary wealth management Change FY 08 FY 07 Operating earnings A$266 m A$306 m - 13% Controllable costs 1 A$354 m A$352 m 1 + 1% 46. 5% 42. 7%1 A$2, 077 m A$4, 086 m Operating earnings to AUM 2 48 bps 54 bps - 6 basis points Persistency 90. 3% 88. 5% + 1. 8 percentage points AUM (pre capital) A$43. 4 b A$56. 5 b Return on equity 46. 5% 54. 1% Cost to income ratio 1 Net cashflows 1. 2. + 3. 8 percentage points - 49% - 23% - 7. 6 percentage points Planner related variable costs previously included in controllable costs have been reclassified to variable costs. Comparatives have been restated (FY 07 A$9 m) 14 Operating earnings to AUM exclude AMP Banking

AFS Australian contemporary wealth management Change FY 08 FY 07 Operating earnings A$266 m A$306 m - 13% Controllable costs 1 A$354 m A$352 m 1 + 1% 46. 5% 42. 7%1 A$2, 077 m A$4, 086 m Operating earnings to AUM 2 48 bps 54 bps - 6 basis points Persistency 90. 3% 88. 5% + 1. 8 percentage points AUM (pre capital) A$43. 4 b A$56. 5 b Return on equity 46. 5% 54. 1% Cost to income ratio 1 Net cashflows 1. 2. + 3. 8 percentage points - 49% - 23% - 7. 6 percentage points Planner related variable costs previously included in controllable costs have been reclassified to variable costs. Comparatives have been restated (FY 07 A$9 m) 14 Operating earnings to AUM exclude AMP Banking

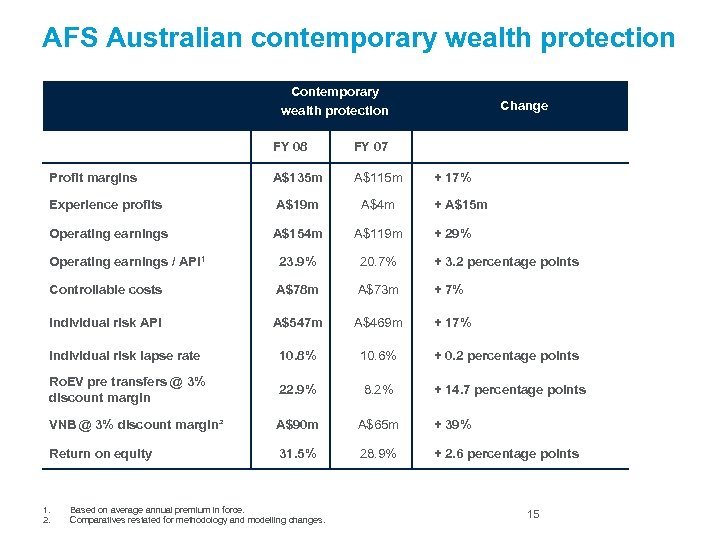

AFS Australian contemporary wealth protection Change FY 08 FY 07 Profit margins A$135 m A$115 m Experience profits A$19 m A$4 m Operating earnings A$154 m A$119 m Operating earnings / API 1 23. 9% 20. 7% + 3. 2 percentage points Controllable costs A$78 m A$73 m + 7% Individual risk API A$547 m A$469 m + 17% Individual risk lapse rate 10. 8% 10. 6% + 0. 2 percentage points Ro. EV pre transfers @ 3% discount margin 22. 9% 8. 2% + 14. 7 percentage points VNB @ 3% discount margin² A$90 m A$65 m + 39% Return on equity 31. 5% 28. 9% + 2. 6 percentage points 1. 2. Based on average annual premium in force. Comparatives restated for methodology and modelling changes. + 17% + A$15 m + 29% 15

AFS Australian contemporary wealth protection Change FY 08 FY 07 Profit margins A$135 m A$115 m Experience profits A$19 m A$4 m Operating earnings A$154 m A$119 m Operating earnings / API 1 23. 9% 20. 7% + 3. 2 percentage points Controllable costs A$78 m A$73 m + 7% Individual risk API A$547 m A$469 m + 17% Individual risk lapse rate 10. 8% 10. 6% + 0. 2 percentage points Ro. EV pre transfers @ 3% discount margin 22. 9% 8. 2% + 14. 7 percentage points VNB @ 3% discount margin² A$90 m A$65 m + 39% Return on equity 31. 5% 28. 9% + 2. 6 percentage points 1. 2. Based on average annual premium in force. Comparatives restated for methodology and modelling changes. + 17% + A$15 m + 29% 15

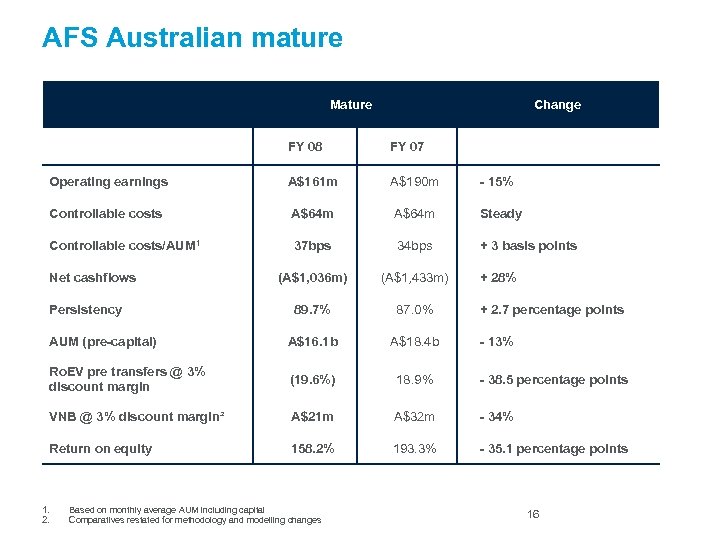

AFS Australian mature Mature Change FY 08 FY 07 Operating earnings A$161 m A$190 m - 15% Controllable costs A$64 m Steady Controllable costs/AUM 1 37 bps 34 bps + 3 basis points (A$1, 036 m) (A$1, 433 m) 89. 7% 87. 0% AUM (pre-capital) A$16. 1 b A$18. 4 b Ro. EV pre transfers @ 3% discount margin (19. 6%) 18. 9% - 38. 5 percentage points VNB @ 3% discount margin² A$21 m A$32 m - 34% Return on equity 158. 2% 193. 3% - 35. 1 percentage points Net cashflows Persistency 1. 2. Based on monthly average AUM including capital Comparatives restated for methodology and modelling changes + 28% + 2. 7 percentage points - 13% 16

AFS Australian mature Mature Change FY 08 FY 07 Operating earnings A$161 m A$190 m - 15% Controllable costs A$64 m Steady Controllable costs/AUM 1 37 bps 34 bps + 3 basis points (A$1, 036 m) (A$1, 433 m) 89. 7% 87. 0% AUM (pre-capital) A$16. 1 b A$18. 4 b Ro. EV pre transfers @ 3% discount margin (19. 6%) 18. 9% - 38. 5 percentage points VNB @ 3% discount margin² A$21 m A$32 m - 34% Return on equity 158. 2% 193. 3% - 35. 1 percentage points Net cashflows Persistency 1. 2. Based on monthly average AUM including capital Comparatives restated for methodology and modelling changes + 28% + 2. 7 percentage points - 13% 16

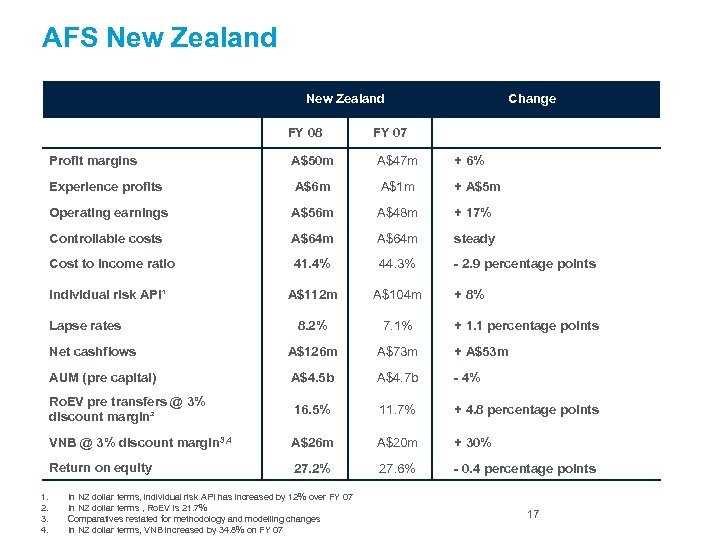

AFS New Zealand FY 08 Change FY 07 Profit margins A$50 m A$47 m + 6% Experience profits A$6 m A$1 m + A$5 m Operating earnings A$56 m A$48 m + 17% Controllable costs A$64 m steady Cost to income ratio 41. 4% 44. 3% - 2. 9 percentage points A$112 m A$104 m 8. 2% 7. 1% Net cashflows A$126 m A$73 m + A$53 m AUM (pre capital) A$4. 5 b A$4. 7 b - 4% Ro. EV pre transfers @ 3% discount margin² 16. 5% 11. 7% + 4. 8 percentage points VNB @ 3% discount margin 3, 4 A$26 m A$20 m + 30% Return on equity 27. 2% 27. 6% - 0. 4 percentage points Individual risk API¹ Lapse rates 1. 2. 3. 4. In NZ dollar terms, individual risk API has increased by 12% over FY 07 In NZ dollar terms , Ro. EV is 21. 7% Comparatives restated for methodology and modelling changes In NZ dollar terms, VNB increased by 34. 8% on FY 07 + 8% + 1. 1 percentage points 17

AFS New Zealand FY 08 Change FY 07 Profit margins A$50 m A$47 m + 6% Experience profits A$6 m A$1 m + A$5 m Operating earnings A$56 m A$48 m + 17% Controllable costs A$64 m steady Cost to income ratio 41. 4% 44. 3% - 2. 9 percentage points A$112 m A$104 m 8. 2% 7. 1% Net cashflows A$126 m A$73 m + A$53 m AUM (pre capital) A$4. 5 b A$4. 7 b - 4% Ro. EV pre transfers @ 3% discount margin² 16. 5% 11. 7% + 4. 8 percentage points VNB @ 3% discount margin 3, 4 A$26 m A$20 m + 30% Return on equity 27. 2% 27. 6% - 0. 4 percentage points Individual risk API¹ Lapse rates 1. 2. 3. 4. In NZ dollar terms, individual risk API has increased by 12% over FY 07 In NZ dollar terms , Ro. EV is 21. 7% Comparatives restated for methodology and modelling changes In NZ dollar terms, VNB increased by 34. 8% on FY 07 + 8% + 1. 1 percentage points 17

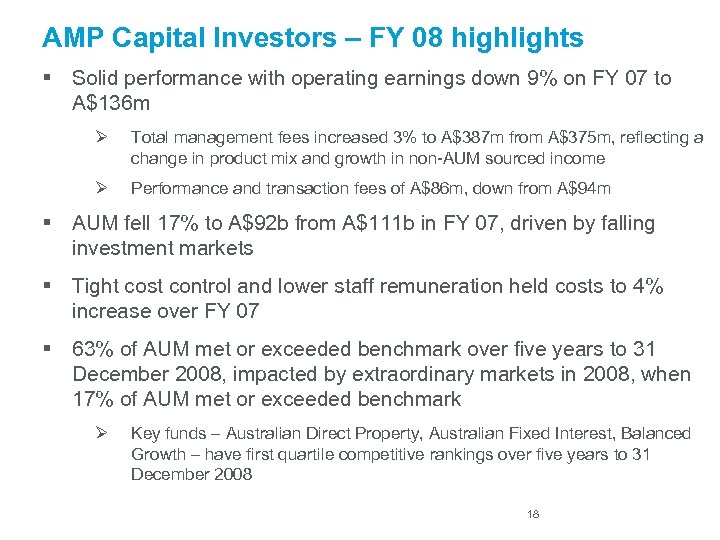

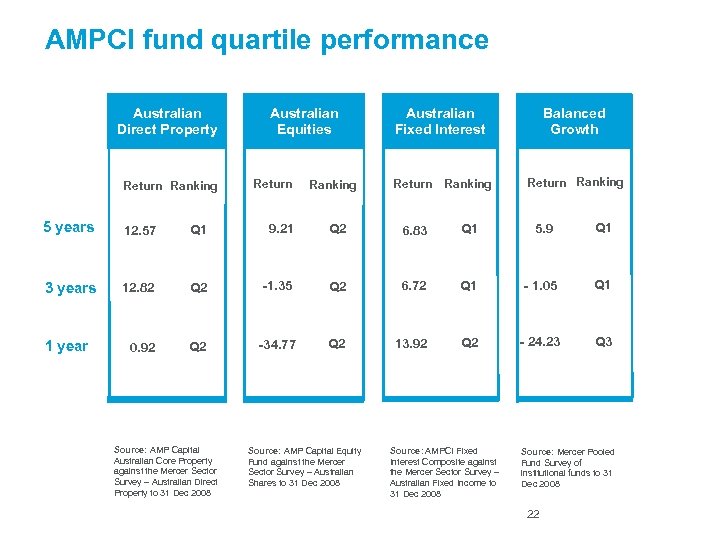

AMP Capital Investors – FY 08 highlights § Solid performance with operating earnings down 9% on FY 07 to A$136 m Ø Total management fees increased 3% to A$387 m from A$375 m, reflecting a change in product mix and growth in non-AUM sourced income Ø Performance and transaction fees of A$86 m, down from A$94 m § AUM fell 17% to A$92 b from A$111 b in FY 07, driven by falling investment markets § Tight cost control and lower staff remuneration held costs to 4% increase over FY 07 § 63% of AUM met or exceeded benchmark over five years to 31 December 2008, impacted by extraordinary markets in 2008, when 17% of AUM met or exceeded benchmark Ø Key funds – Australian Direct Property, Australian Fixed Interest, Balanced Growth – have first quartile competitive rankings over five years to 31 December 2008 18

AMP Capital Investors – FY 08 highlights § Solid performance with operating earnings down 9% on FY 07 to A$136 m Ø Total management fees increased 3% to A$387 m from A$375 m, reflecting a change in product mix and growth in non-AUM sourced income Ø Performance and transaction fees of A$86 m, down from A$94 m § AUM fell 17% to A$92 b from A$111 b in FY 07, driven by falling investment markets § Tight cost control and lower staff remuneration held costs to 4% increase over FY 07 § 63% of AUM met or exceeded benchmark over five years to 31 December 2008, impacted by extraordinary markets in 2008, when 17% of AUM met or exceeded benchmark Ø Key funds – Australian Direct Property, Australian Fixed Interest, Balanced Growth – have first quartile competitive rankings over five years to 31 December 2008 18

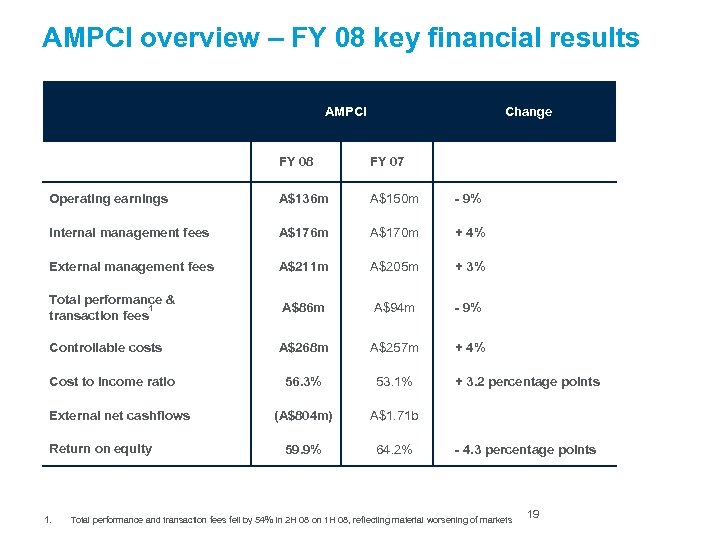

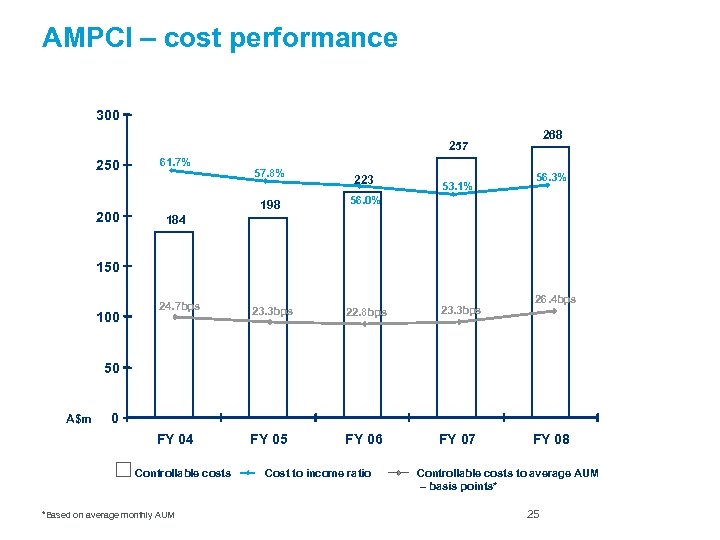

AMPCI overview – FY 08 key financial results AMPCI Change FY 08 FY 07 Operating earnings A$136 m A$150 m - 9% Internal management fees A$176 m A$170 m + 4% External management fees A$211 m A$205 m + 3% Total performance & 1 transaction fees A$86 m A$94 m - 9% Controllable costs A$268 m A$257 m + 4% 56. 3% 53. 1% (A$804 m) A$1. 71 b 59. 9% 64. 2% Cost to income ratio External net cashflows Return on equity 1. + 3. 2 percentage points - 4. 3 percentage points Total performance and transaction fees fell by 54% in 2 H 08 on 1 H 08, reflecting material worsening of markets 19

AMPCI overview – FY 08 key financial results AMPCI Change FY 08 FY 07 Operating earnings A$136 m A$150 m - 9% Internal management fees A$176 m A$170 m + 4% External management fees A$211 m A$205 m + 3% Total performance & 1 transaction fees A$86 m A$94 m - 9% Controllable costs A$268 m A$257 m + 4% 56. 3% 53. 1% (A$804 m) A$1. 71 b 59. 9% 64. 2% Cost to income ratio External net cashflows Return on equity 1. + 3. 2 percentage points - 4. 3 percentage points Total performance and transaction fees fell by 54% in 2 H 08 on 1 H 08, reflecting material worsening of markets 19

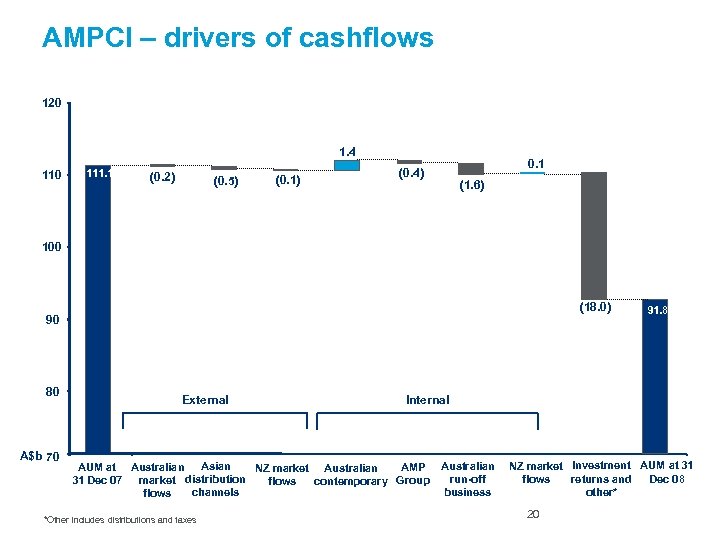

AMPCI – drivers of cashflows 120 1. 4 110 111. 1 (0. 2) (0. 5) (0. 1) 0. 1 (0. 4) (1. 6) 100 (18. 0) 90 80 A$b 70 External Internal AMP AUM at Australian Asian NZ market Australian Group market distribution 31 Dec 07 flows contemporary channels flows *Other includes distributions and taxes 91. 8 Australian run-off business NZ market Investment AUM at 31 returns and Dec 08 flows other* 20

AMPCI – drivers of cashflows 120 1. 4 110 111. 1 (0. 2) (0. 5) (0. 1) 0. 1 (0. 4) (1. 6) 100 (18. 0) 90 80 A$b 70 External Internal AMP AUM at Australian Asian NZ market Australian Group market distribution 31 Dec 07 flows contemporary channels flows *Other includes distributions and taxes 91. 8 Australian run-off business NZ market Investment AUM at 31 returns and Dec 08 flows other* 20

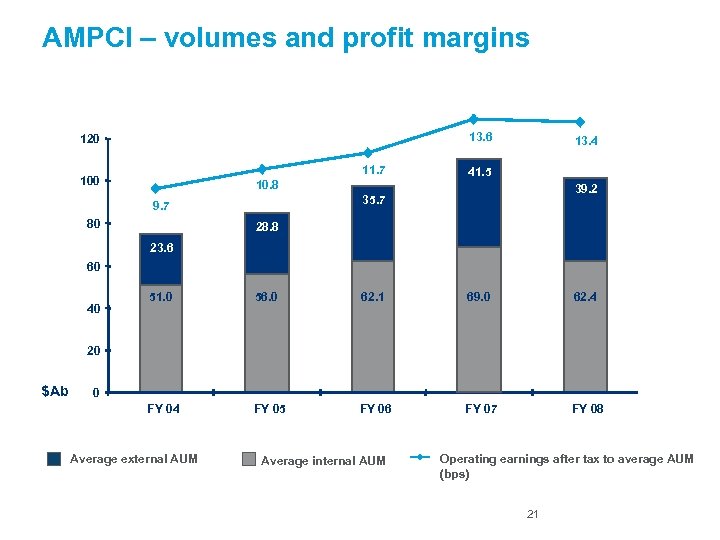

AMPCI – volumes and profit margins 13. 6 120 11. 7 100 10. 8 41. 5 39. 2 35. 7 9. 7 80 13. 4 28. 8 23. 6 60 51. 0 56. 0 62. 1 69. 0 62. 4 FY 04 40 FY 05 FY 06 FY 07 FY 08 20 $Ab 0 Average external AUM Average internal AUM Operating earnings after tax to average AUM (bps) 21

AMPCI – volumes and profit margins 13. 6 120 11. 7 100 10. 8 41. 5 39. 2 35. 7 9. 7 80 13. 4 28. 8 23. 6 60 51. 0 56. 0 62. 1 69. 0 62. 4 FY 04 40 FY 05 FY 06 FY 07 FY 08 20 $Ab 0 Average external AUM Average internal AUM Operating earnings after tax to average AUM (bps) 21

AMPCI fund quartile performance Australian Direct Property Return Ranking Australian Equities Return Ranking Australian Fixed Interest Return Ranking Balanced Growth Return Ranking 5 years 12. 57 Q 1 9. 21 Q 2 6. 83 Q 1 5. 9 Q 1 3 years 12. 82 Q 2 -1. 35 Q 2 6. 72 Q 1 - 1. 05 Q 1 0. 92 Q 2 -34. 77 Q 2 13. 92 Q 2 - 24. 23 Q 3 1 year Source: AMP Capital Australian Core Property against the Mercer Sector Survey – Australian Direct Property to 31 Dec 2008 Source: AMP Capital Equity Fund against the Mercer Sector Survey – Australian Shares to 31 Dec 2008 Source: AMPCI Fixed Interest Composite against the Mercer Sector Survey – Australian Fixed Income to 31 Dec 2008 Source: Mercer Pooled Fund Survey of institutional funds to 31 Dec 2008 22

AMPCI fund quartile performance Australian Direct Property Return Ranking Australian Equities Return Ranking Australian Fixed Interest Return Ranking Balanced Growth Return Ranking 5 years 12. 57 Q 1 9. 21 Q 2 6. 83 Q 1 5. 9 Q 1 3 years 12. 82 Q 2 -1. 35 Q 2 6. 72 Q 1 - 1. 05 Q 1 0. 92 Q 2 -34. 77 Q 2 13. 92 Q 2 - 24. 23 Q 3 1 year Source: AMP Capital Australian Core Property against the Mercer Sector Survey – Australian Direct Property to 31 Dec 2008 Source: AMP Capital Equity Fund against the Mercer Sector Survey – Australian Shares to 31 Dec 2008 Source: AMPCI Fixed Interest Composite against the Mercer Sector Survey – Australian Fixed Income to 31 Dec 2008 Source: Mercer Pooled Fund Survey of institutional funds to 31 Dec 2008 22

AMPCI – performance against benchmarks 63% of AUM met or exceeded benchmark over five years 40% over three years and 17% over 12 months to 31 December 08 Multi-manager AMPCI managed* 98% 97% 94% 88% Target 75% 73% 69% 61% 53% 51% 43% 32% 27% 22% 29% 21% 15% 6% Australasian equities Australasian fixed interest Dec 08 4% Infrastructure and private equity Property Diversified Three-year rolling to Dec 08 3% International equities 0% 0% International fixed interest 0% 2% Diversified Five-year rolling to Dec 08 % indicates assets under management meeting or exceeding benchmarks across the 12 month period to Dec 08, and the rolling three- and five-year periods to Dec 08 23 * Excludes Future Directions Funds

AMPCI – performance against benchmarks 63% of AUM met or exceeded benchmark over five years 40% over three years and 17% over 12 months to 31 December 08 Multi-manager AMPCI managed* 98% 97% 94% 88% Target 75% 73% 69% 61% 53% 51% 43% 32% 27% 22% 29% 21% 15% 6% Australasian equities Australasian fixed interest Dec 08 4% Infrastructure and private equity Property Diversified Three-year rolling to Dec 08 3% International equities 0% 0% International fixed interest 0% 2% Diversified Five-year rolling to Dec 08 % indicates assets under management meeting or exceeding benchmarks across the 12 month period to Dec 08, and the rolling three- and five-year periods to Dec 08 23 * Excludes Future Directions Funds

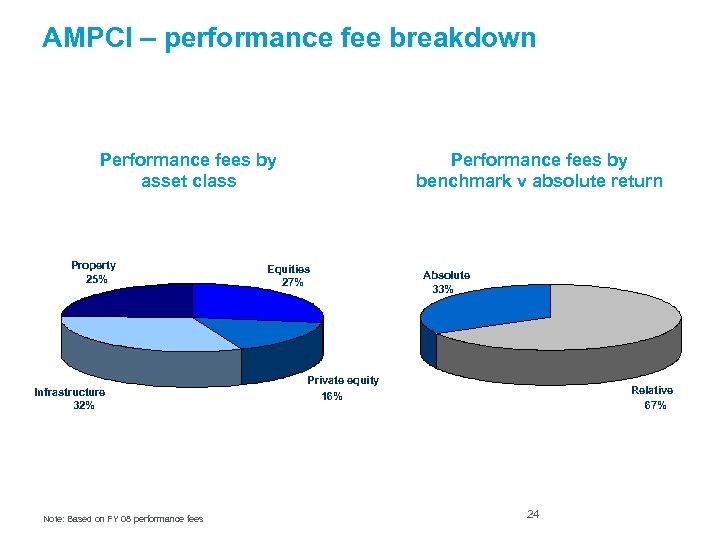

AMPCI – performance fee breakdown Performance fees by asset class Property 25% Infrastructure 32% Note: Based on FY 08 performance fees Performance fees by benchmark v absolute return Equities 27% Absolute 33% Private equity 16% Relative 67% 24

AMPCI – performance fee breakdown Performance fees by asset class Property 25% Infrastructure 32% Note: Based on FY 08 performance fees Performance fees by benchmark v absolute return Equities 27% Absolute 33% Private equity 16% Relative 67% 24

AMPCI – cost performance 300 268 257 250 61. 7% 57. 8% 223 53. 1% 56. 0% 24. 7 bps 23. 3 bps 22. 8 bps 23. 3 bps FY 04 200 198 FY 05 FY 06 FY 07 56. 3% 184 150 100 26. 4 bps 50 A$m 0 Controllable costs *Based on average monthly AUM Cost to income ratio FY 08 Controllable costs to average AUM – basis points* 25

AMPCI – cost performance 300 268 257 250 61. 7% 57. 8% 223 53. 1% 56. 0% 24. 7 bps 23. 3 bps 22. 8 bps 23. 3 bps FY 04 200 198 FY 05 FY 06 FY 07 56. 3% 184 150 100 26. 4 bps 50 A$m 0 Controllable costs *Based on average monthly AUM Cost to income ratio FY 08 Controllable costs to average AUM – basis points* 25

Financial overview Paul Leaming Chief Financial Officer 26

Financial overview Paul Leaming Chief Financial Officer 26

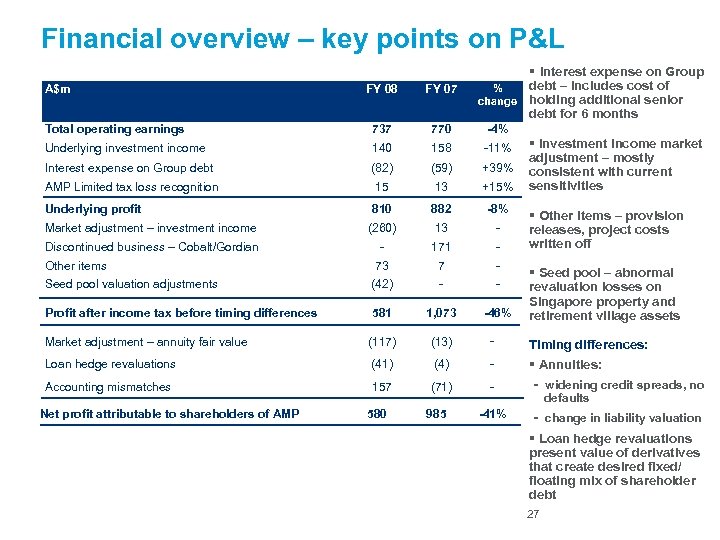

Financial overview – key points on P&L § Interest expense on Group FY 08 FY 07 % change Total operating earnings 737 770 Underlying investment income 140 158 -11% Interest expense on Group debt (82) (59) +39% AMP Limited tax loss recognition 15 13 +15% Underlying profit 810 882 -8% debt – includes cost of holding additional senior debt for 6 months -4% A$m § Investment income market adjustment – mostly consistent with current sensitivities § Other items – provision releases, project costs written off Market adjustment – investment income (260) 13 - Discontinued business – Cobalt/Gordian - 171 - 73 7 - Seed pool valuation adjustments (42) - - Profit after income tax before timing differences 581 1, 073 -46% Market adjustment – annuity fair value (117) (13) - Timing differences: Loan hedge revaluations (41) (4) - § Annuities: Accounting mismatches 157 (71) - - widening credit spreads, no defaults -41% - change in liability valuation Other items Net profit attributable to shareholders of AMP 580 985 § Seed pool – abnormal revaluation losses on Singapore property and retirement village assets § Loan hedge revaluations present value of derivatives that create desired fixed/ floating mix of shareholder debt 27

Financial overview – key points on P&L § Interest expense on Group FY 08 FY 07 % change Total operating earnings 737 770 Underlying investment income 140 158 -11% Interest expense on Group debt (82) (59) +39% AMP Limited tax loss recognition 15 13 +15% Underlying profit 810 882 -8% debt – includes cost of holding additional senior debt for 6 months -4% A$m § Investment income market adjustment – mostly consistent with current sensitivities § Other items – provision releases, project costs written off Market adjustment – investment income (260) 13 - Discontinued business – Cobalt/Gordian - 171 - 73 7 - Seed pool valuation adjustments (42) - - Profit after income tax before timing differences 581 1, 073 -46% Market adjustment – annuity fair value (117) (13) - Timing differences: Loan hedge revaluations (41) (4) - § Annuities: Accounting mismatches 157 (71) - - widening credit spreads, no defaults -41% - change in liability valuation Other items Net profit attributable to shareholders of AMP 580 985 § Seed pool – abnormal revaluation losses on Singapore property and retirement village assets § Loan hedge revaluations present value of derivatives that create desired fixed/ floating mix of shareholder debt 27

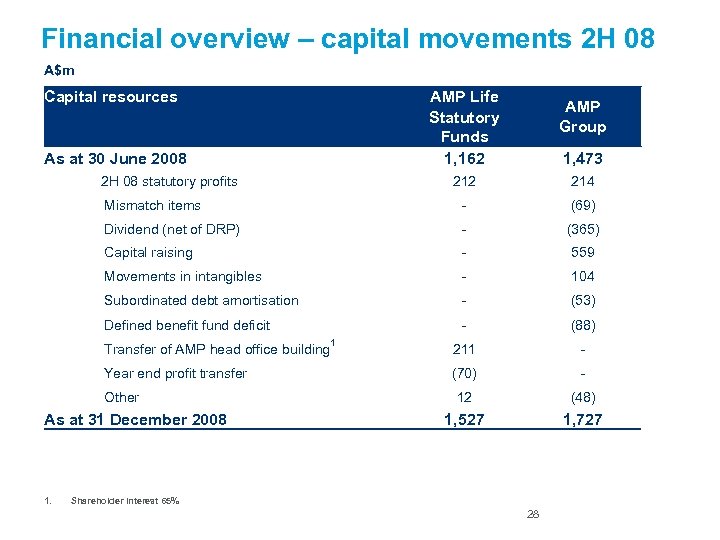

Financial overview – capital movements 2 H 08 A$m Capital resources AMP Life Statutory Funds 1, 162 As at 30 June 2008 2 H 08 statutory profits AMP Group 1, 473 212 214 Mismatch items - (69) Dividend (net of DRP) - (365) Capital raising - 559 Movements in intangibles - 104 Subordinated debt amortisation - (53) Defined benefit fund deficit - (88) 211 - (70) - 12 (48) 1, 527 1, 727 Transfer of AMP head office building Year end profit transfer Other As at 31 December 2008 1. 1 Shareholder interest 65% 28

Financial overview – capital movements 2 H 08 A$m Capital resources AMP Life Statutory Funds 1, 162 As at 30 June 2008 2 H 08 statutory profits AMP Group 1, 473 212 214 Mismatch items - (69) Dividend (net of DRP) - (365) Capital raising - 559 Movements in intangibles - 104 Subordinated debt amortisation - (53) Defined benefit fund deficit - (88) 211 - (70) - 12 (48) 1, 527 1, 727 Transfer of AMP head office building Year end profit transfer Other As at 31 December 2008 1. 1 Shareholder interest 65% 28

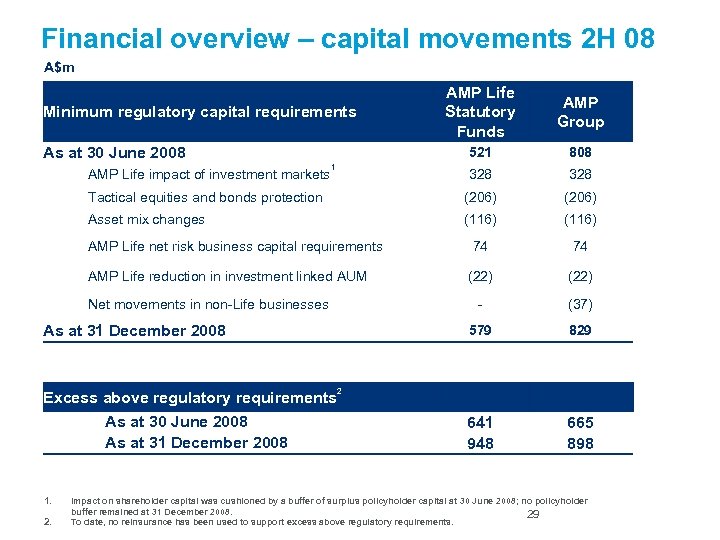

Financial overview – capital movements 2 H 08 A$m AMP Life Statutory Funds AMP Group 521 808 328 Tactical equities and bonds protection (206) Asset mix changes (116) 74 74 (22) - (37) 579 829 641 948 665 898 Minimum regulatory capital requirements As at 30 June 2008 AMP Life impact of investment markets 1 AMP Life net risk business capital requirements AMP Life reduction in investment linked AUM Net movements in non-Life businesses As at 31 December 2008 Excess above regulatory requirements As at 30 June 2008 As at 31 December 2008 1. 2. 2 Impact on shareholder capital was cushioned by a buffer of surplus policyholder capital at 30 June 2008; no policyholder buffer remained at 31 December 2008. 29 To date, no reinsurance has been used to support excess above regulatory requirements.

Financial overview – capital movements 2 H 08 A$m AMP Life Statutory Funds AMP Group 521 808 328 Tactical equities and bonds protection (206) Asset mix changes (116) 74 74 (22) - (37) 579 829 641 948 665 898 Minimum regulatory capital requirements As at 30 June 2008 AMP Life impact of investment markets 1 AMP Life net risk business capital requirements AMP Life reduction in investment linked AUM Net movements in non-Life businesses As at 31 December 2008 Excess above regulatory requirements As at 30 June 2008 As at 31 December 2008 1. 2. 2 Impact on shareholder capital was cushioned by a buffer of surplus policyholder capital at 30 June 2008; no policyholder buffer remained at 31 December 2008. 29 To date, no reinsurance has been used to support excess above regulatory requirements.

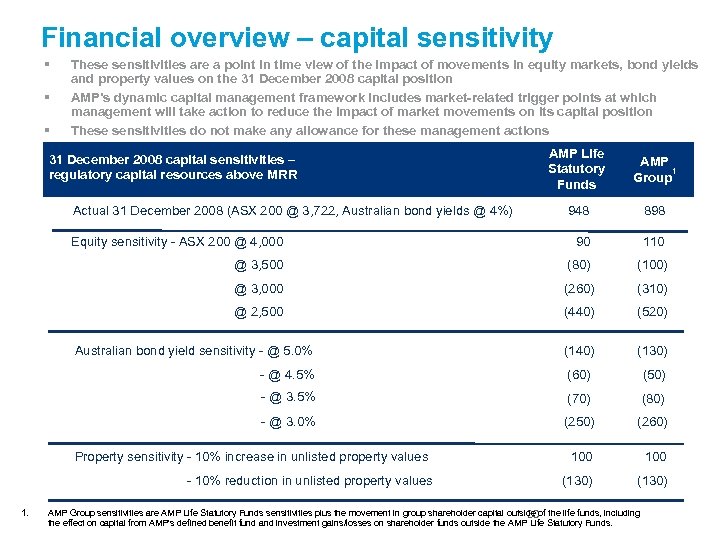

Financial overview – capital sensitivity § § § These sensitivities are a point in time view of the impact of movements in equity markets, bond yields and property values on the 31 December 2008 capital position AMP’s dynamic capital management framework includes market-related trigger points at which management will take action to reduce the impact of market movements on its capital position These sensitivities do not make any allowance for these management actions AMP Life Statutory Funds AMP 1 Group 948 898 Equity sensitivity - ASX 200 @ 4, 000 90 110 @ 3, 500 (80) (100) @ 3, 000 (260) (310) @ 2, 500 (440) (520) (140) (130) - @ 4. 5% (60) (50) - @ 3. 5% (70) (80) - @ 3. 0% (250) (260) 100 (130) 31 December 2008 capital sensitivities – regulatory capital resources above MRR Actual 31 December 2008 (ASX 200 @ 3, 722, Australian bond yields @ 4%) Australian bond yield sensitivity - @ 5. 0% Property sensitivity - 10% increase in unlisted property values - 10% reduction in unlisted property values 1. AMP Group sensitivities are AMP Life Statutory Funds sensitivities plus the movement in group shareholder capital outside of the life funds, including 30 the effect on capital from AMP's defined benefit fund and investment gains/losses on shareholder funds outside the AMP Life Statutory Funds.

Financial overview – capital sensitivity § § § These sensitivities are a point in time view of the impact of movements in equity markets, bond yields and property values on the 31 December 2008 capital position AMP’s dynamic capital management framework includes market-related trigger points at which management will take action to reduce the impact of market movements on its capital position These sensitivities do not make any allowance for these management actions AMP Life Statutory Funds AMP 1 Group 948 898 Equity sensitivity - ASX 200 @ 4, 000 90 110 @ 3, 500 (80) (100) @ 3, 000 (260) (310) @ 2, 500 (440) (520) (140) (130) - @ 4. 5% (60) (50) - @ 3. 5% (70) (80) - @ 3. 0% (250) (260) 100 (130) 31 December 2008 capital sensitivities – regulatory capital resources above MRR Actual 31 December 2008 (ASX 200 @ 3, 722, Australian bond yields @ 4%) Australian bond yield sensitivity - @ 5. 0% Property sensitivity - 10% increase in unlisted property values - 10% reduction in unlisted property values 1. AMP Group sensitivities are AMP Life Statutory Funds sensitivities plus the movement in group shareholder capital outside of the life funds, including 30 the effect on capital from AMP's defined benefit fund and investment gains/losses on shareholder funds outside the AMP Life Statutory Funds.

Financial overview – capital management strategy § AMP remains strongly capitalised, with A$898 m in surplus capital above MRR, reflecting disciplined and dynamic capital management approach § Capital management strategy aims to deliver: Ø strong balance sheet in a challenging market, with focus on capital preservation Ø business flexibility for growth Ø optimised capital mix, subject to market conditions § Capacity to raise up to A$660 m additional Tier 2 capital Ø Intend to replace maturing A$267 m in subordinated debt with like instrument before 2 H 09, provided market conditions are supportive 31

Financial overview – capital management strategy § AMP remains strongly capitalised, with A$898 m in surplus capital above MRR, reflecting disciplined and dynamic capital management approach § Capital management strategy aims to deliver: Ø strong balance sheet in a challenging market, with focus on capital preservation Ø business flexibility for growth Ø optimised capital mix, subject to market conditions § Capacity to raise up to A$660 m additional Tier 2 capital Ø Intend to replace maturing A$267 m in subordinated debt with like instrument before 2 H 09, provided market conditions are supportive 31

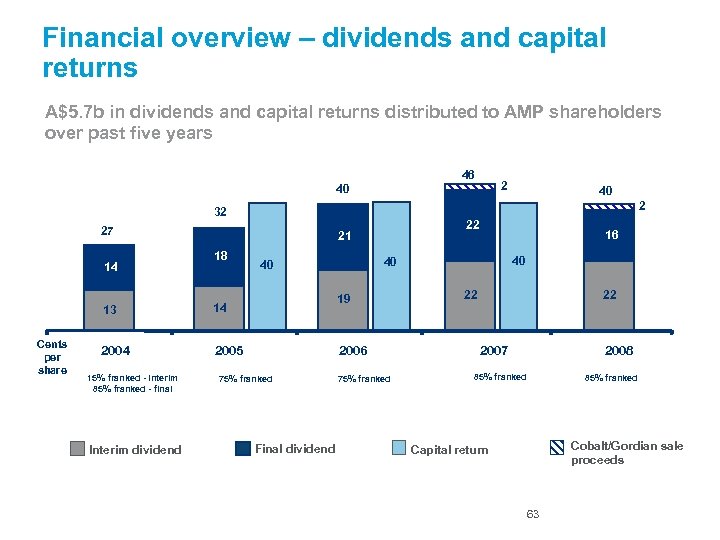

Financial overview – dividend § Final dividend of 16 cps, franked to 85%, takes FY 08 dividend to 38 cps¹ – a payout ratio of 89% of underlying profit. § Dividend decision driven by: Ø Ø Ø current cash earnings expected future underlying profits (1 -2 years) preservation of capital and balance sheet strength § Prudent decision consistent with overall capital strategy of maintaining strong balance sheet in a challenging market, particularly given material worsening of market since 1 H 08 § Target payout ratio likely to be in range of 75%-85% of underlying profits going forward § DRP (uncapped, issued not bought) will be offered at a 2. 5% discount Ø 1. Discount expected to raise DRP participation to 30%, supported by partial underwrite to that level Excludes special 2 cps dividend payment from proceeds of Cobalt/Gordian sale in 1 H 08. 32

Financial overview – dividend § Final dividend of 16 cps, franked to 85%, takes FY 08 dividend to 38 cps¹ – a payout ratio of 89% of underlying profit. § Dividend decision driven by: Ø Ø Ø current cash earnings expected future underlying profits (1 -2 years) preservation of capital and balance sheet strength § Prudent decision consistent with overall capital strategy of maintaining strong balance sheet in a challenging market, particularly given material worsening of market since 1 H 08 § Target payout ratio likely to be in range of 75%-85% of underlying profits going forward § DRP (uncapped, issued not bought) will be offered at a 2. 5% discount Ø 1. Discount expected to raise DRP participation to 30%, supported by partial underwrite to that level Excludes special 2 cps dividend payment from proceeds of Cobalt/Gordian sale in 1 H 08. 32

Financial overview – franking § Sufficient franking credits to frank final dividend to 85% § Tax payable in 2 H 08 significantly down on prior periods due to impact of markets § Supply of franking credits reduced as a result of interim dividend being greater than earnings § 85% franking ratio remains appropriate target provided investment markets stabilise 33

Financial overview – franking § Sufficient franking credits to frank final dividend to 85% § Tax payable in 2 H 08 significantly down on prior periods due to impact of markets § Supply of franking credits reduced as a result of interim dividend being greater than earnings § 85% franking ratio remains appropriate target provided investment markets stabilise 33

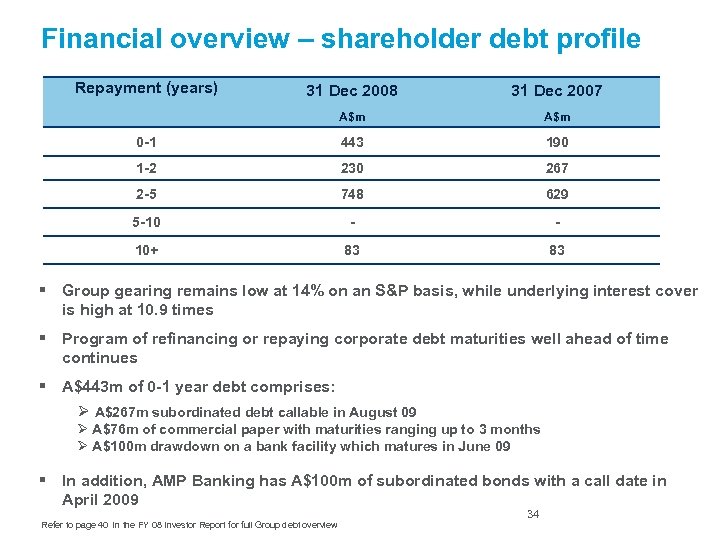

Financial overview – shareholder debt profile Repayment (years) 31 Dec 2008 31 Dec 2007 A$m 0 -1 443 190 1 -2 230 267 2 -5 748 629 5 -10 - - 10+ 83 83 § Group gearing remains low at 14% on an S&P basis, while underlying interest cover is high at 10. 9 times § Program of refinancing or repaying corporate debt maturities well ahead of time continues § A$443 m of 0 -1 year debt comprises: Ø A$267 m subordinated debt callable in August 09 Ø A$76 m of commercial paper with maturities ranging up to 3 months Ø A$100 m drawdown on a bank facility which matures in June 09 § In addition, AMP Banking has A$100 m of subordinated bonds with a call date in April 2009 Refer to page 40 in the FY 08 Investor Report for full Group debt overview 34

Financial overview – shareholder debt profile Repayment (years) 31 Dec 2008 31 Dec 2007 A$m 0 -1 443 190 1 -2 230 267 2 -5 748 629 5 -10 - - 10+ 83 83 § Group gearing remains low at 14% on an S&P basis, while underlying interest cover is high at 10. 9 times § Program of refinancing or repaying corporate debt maturities well ahead of time continues § A$443 m of 0 -1 year debt comprises: Ø A$267 m subordinated debt callable in August 09 Ø A$76 m of commercial paper with maturities ranging up to 3 months Ø A$100 m drawdown on a bank facility which matures in June 09 § In addition, AMP Banking has A$100 m of subordinated bonds with a call date in April 2009 Refer to page 40 in the FY 08 Investor Report for full Group debt overview 34

Financial overview – summary § Proactive management of capital resources has strengthened AMP’s capital position despite continuing market turbulence § Significant flexibility remains for management to take action to preserve capital against further market downturn § Future dividend payout likely to be in the range of 75% to 85% of underlying profit, targeting 85% franking § Strong bias remains toward having more capital rather than less in the current environment § Balance sheet strength key to maintaining investment in growth initiatives 35

Financial overview – summary § Proactive management of capital resources has strengthened AMP’s capital position despite continuing market turbulence § Significant flexibility remains for management to take action to preserve capital against further market downturn § Future dividend payout likely to be in the range of 75% to 85% of underlying profit, targeting 85% franking § Strong bias remains toward having more capital rather than less in the current environment § Balance sheet strength key to maintaining investment in growth initiatives 35

Outlook & strategy Craig Dunn Chief Executive Officer 36

Outlook & strategy Craig Dunn Chief Executive Officer 36

Market outlook – short term § Continued market volatility through 2009 Ø Full consequences of credit crunch still working way through economy § Subdued investor sentiment Ø Flight to safety and quality Ø ‘Deleveraging’ of households Ø Returns favouring liquid investors § Rapidly changing competitive environment § New opportunities for strong, well-capitalised industry participants 37

Market outlook – short term § Continued market volatility through 2009 Ø Full consequences of credit crunch still working way through economy § Subdued investor sentiment Ø Flight to safety and quality Ø ‘Deleveraging’ of households Ø Returns favouring liquid investors § Rapidly changing competitive environment § New opportunities for strong, well-capitalised industry participants 37

Short-term priorities § Prudently managing costs, liquidity and capital to protect our financial position in the short term § Ongoing focus on risk management, as risks heightened in volatile and uncertain environment § Acting on opportunities to sustain and improve revenues in current market, by Ø Growing revenues in non AUM-based businesses - eg banking and risk insurance Ø Improving investment performance Ø Focusing strongly on customer retention Ø Continuing investment to increase scale and productivity of our distribution footprint Ø Renewing core superannuation product to improve tailoring opportunities for customers and cost efficiencies - New modular offering to suit all customer profiles, from simple, low-cost needs to complex, sophisticated needs, with appropriate pricing 38

Short-term priorities § Prudently managing costs, liquidity and capital to protect our financial position in the short term § Ongoing focus on risk management, as risks heightened in volatile and uncertain environment § Acting on opportunities to sustain and improve revenues in current market, by Ø Growing revenues in non AUM-based businesses - eg banking and risk insurance Ø Improving investment performance Ø Focusing strongly on customer retention Ø Continuing investment to increase scale and productivity of our distribution footprint Ø Renewing core superannuation product to improve tailoring opportunities for customers and cost efficiencies - New modular offering to suit all customer profiles, from simple, low-cost needs to complex, sophisticated needs, with appropriate pricing 38

Outlook – costs § Total controllable costs moderated in 2 H 08 (down 3% on 2 H 07), reflecting actions to reduce cost base, including lower staff numbers § AFS costs expected to be around 3% lower in FY 09 on FY 08, as continued investment in growth initiatives is offset by cost efficiencies § AMPCI costs will be managed closely, contingent on market opportunities and conditions, and variables such as staff remuneration and increased technology spend § Group office costs expected to remain flat 39

Outlook – costs § Total controllable costs moderated in 2 H 08 (down 3% on 2 H 07), reflecting actions to reduce cost base, including lower staff numbers § AFS costs expected to be around 3% lower in FY 09 on FY 08, as continued investment in growth initiatives is offset by cost efficiencies § AMPCI costs will be managed closely, contingent on market opportunities and conditions, and variables such as staff remuneration and increased technology spend § Group office costs expected to remain flat 39

Market outlook – medium to long term § Robust growth outlook for wealth management sectors in Australia, New Zealand selected Asian markets, underpinned by: Ø Ageing demographics Ø Bi-partisan party support for mandatory superannuation regime in Australia – super now tax free after age 60 Ø Kiwi. Saver and PIE initiatives in New Zealand Ø Economic, social and political development in selected Asian markets, opening up new sources of funds and assets § Long-term outlook for key geographic markets remains attractive 40

Market outlook – medium to long term § Robust growth outlook for wealth management sectors in Australia, New Zealand selected Asian markets, underpinned by: Ø Ageing demographics Ø Bi-partisan party support for mandatory superannuation regime in Australia – super now tax free after age 60 Ø Kiwi. Saver and PIE initiatives in New Zealand Ø Economic, social and political development in selected Asian markets, opening up new sources of funds and assets § Long-term outlook for key geographic markets remains attractive 40

Outlook – growth goal § Over-arching goal to deliver top quartile TSR performance to shareholders Ø Aim to be in top 25% of the top 50 listed Australian industrials in terms of total shareholder returns over every five-year cycle Ø Strong alignment between shareholder goal and long term incentive (LTI) for executives § Requires prudent and pragmatic management of costs, capital and liquidity in current market, while maintaining investment in critical growth initiatives for medium to long term (and as markets recover) 41

Outlook – growth goal § Over-arching goal to deliver top quartile TSR performance to shareholders Ø Aim to be in top 25% of the top 50 listed Australian industrials in terms of total shareholder returns over every five-year cycle Ø Strong alignment between shareholder goal and long term incentive (LTI) for executives § Requires prudent and pragmatic management of costs, capital and liquidity in current market, while maintaining investment in critical growth initiatives for medium to long term (and as markets recover) 41

Strategic response Continuing to invest today in improving distribution and enhancing products and services to drive strong value growth over the longer term by: 1. Growing planner capacity and broadening distribution 2. Expanding to Asia through AMP Capital Investors 3. Growing customers in high-value segments 4. Reshaping AMP Capital Investors into a high value-add investment manager 5. Building our capacity for profitable growth 42

Strategic response Continuing to invest today in improving distribution and enhancing products and services to drive strong value growth over the longer term by: 1. Growing planner capacity and broadening distribution 2. Expanding to Asia through AMP Capital Investors 3. Growing customers in high-value segments 4. Reshaping AMP Capital Investors into a high value-add investment manager 5. Building our capacity for profitable growth 42

1. Growing planner capacity and broadening distribution Goal: Strengthen core planner franchise, while building new channels to reach more customers in high-value segments by: increasing planner numbers and improving their productivity in the short term Ø Planner numbers up by 63 planners or 3% to 2, 095; 27 new AMPFP planner practices and 7 new Hillross practices added to AFS network Ø Continued strong interest in planner academy, with over 3, 600 total applications to date Ø New planner software to improve productivity now rolled out to 212 practices Ø Paraplanning services extended to 175 practices Ø Increased take-up of low-touch program, with almost 130, 000 clients now being serviced developing broader, complementary distribution channels in both AFS and AMPCI over the medium term Ø AMPCI capabilities now represented on 38 of the top 50 Australian retail platforms, with the Core Property, the Small Companies, Responsible Investment Leaders and Sustainable funds recently added to leading external platforms Ø 32% increase in insurance new business distributed through third party and mortgage broker market Ø 18% increase in mortgage book; retail and AMP Super Cash deposits up 70% to A$3. 4 b Ø Continued rollout of Kiwi. Saver in NZ; captured 15% of market Ø Organic growth of corporate super in Australia (A$500 m of mandate wins) 43

1. Growing planner capacity and broadening distribution Goal: Strengthen core planner franchise, while building new channels to reach more customers in high-value segments by: increasing planner numbers and improving their productivity in the short term Ø Planner numbers up by 63 planners or 3% to 2, 095; 27 new AMPFP planner practices and 7 new Hillross practices added to AFS network Ø Continued strong interest in planner academy, with over 3, 600 total applications to date Ø New planner software to improve productivity now rolled out to 212 practices Ø Paraplanning services extended to 175 practices Ø Increased take-up of low-touch program, with almost 130, 000 clients now being serviced developing broader, complementary distribution channels in both AFS and AMPCI over the medium term Ø AMPCI capabilities now represented on 38 of the top 50 Australian retail platforms, with the Core Property, the Small Companies, Responsible Investment Leaders and Sustainable funds recently added to leading external platforms Ø 32% increase in insurance new business distributed through third party and mortgage broker market Ø 18% increase in mortgage book; retail and AMP Super Cash deposits up 70% to A$3. 4 b Ø Continued rollout of Kiwi. Saver in NZ; captured 15% of market Ø Organic growth of corporate super in Australia (A$500 m of mandate wins) 43

2. Expanding to Asia through AMP Capital Investors Goal: Establish AMPCI as strong competitor in select investment capabilities in targeted Asian funds management markets by: expanding Asian distribution channels and alliances to market existing Australian and global products in the short term Ø AMPCI products now distributed in Japan, Singapore, Malaysia, Korea Ø Strengthened distribution team, appointing Head of Institutional Business in Japan Ø Won mandates from Japan’s T&D Asset Management for European and Asia Pacific infrastructure funds establishing investment capabilities in Asia to manage Asian assets over the medium term Ø Appointed a Head of Asia Pacific Equities; Head of Private Debt Asia; Co-head of Infrastructure Asia Ø Won 2 nd China Qualified Foreign Institutional Investor (QFII) mandate of US$100 m - the only Australian investment manager to have received two QFII mandates Ø Established investment advisory office in Beijing and signed Memorandum of Understanding with China Life Asset Management Company, China’s largest asset management company, for infrastructure Ø Building external recognition for Asian investment capabilities • Nikko Global REIT fund awarded first place in the Global REIT category of the 2008 Rating and Investment Inc (Japan’s leading rating house) awards 44

2. Expanding to Asia through AMP Capital Investors Goal: Establish AMPCI as strong competitor in select investment capabilities in targeted Asian funds management markets by: expanding Asian distribution channels and alliances to market existing Australian and global products in the short term Ø AMPCI products now distributed in Japan, Singapore, Malaysia, Korea Ø Strengthened distribution team, appointing Head of Institutional Business in Japan Ø Won mandates from Japan’s T&D Asset Management for European and Asia Pacific infrastructure funds establishing investment capabilities in Asia to manage Asian assets over the medium term Ø Appointed a Head of Asia Pacific Equities; Head of Private Debt Asia; Co-head of Infrastructure Asia Ø Won 2 nd China Qualified Foreign Institutional Investor (QFII) mandate of US$100 m - the only Australian investment manager to have received two QFII mandates Ø Established investment advisory office in Beijing and signed Memorandum of Understanding with China Life Asset Management Company, China’s largest asset management company, for infrastructure Ø Building external recognition for Asian investment capabilities • Nikko Global REIT fund awarded first place in the Global REIT category of the 2008 Rating and Investment Inc (Japan’s leading rating house) awards 44

3. Growing customers in high-value segments Goal: Attract new customers and develop stronger relationships with existing customers in high-value segments with new offers based on customer needs by: developing and rolling out improved product and service offerings, and extending relationships with customers over the medium term Ø In 2008 AFS rolled out: • The insurance offering Loan Cover, along with several risk enhancements • AMP Super Cash – a deposit product with AMP Banking that provides low risk investment returns in a superannuation environment – to Corporate Superannuation customers • AMP Banking’s First Home Saver Account • Term deposits on super and pension investment menus • The AMP Growth Bond Ø Customer Value pilots reached more than 8, 000 customers in two tests in ’ 08; ramping up to reach over 36, 000 customers in ’ 09 with targeted offers Ø AMPCI focusing on customers in high-value markets in Asia and Europe; new mandates from: • Middle Eastern sovereign wealth fund for development property deal • Global institution for global REIT • Dutch pension fund for European infrastructure product 45

3. Growing customers in high-value segments Goal: Attract new customers and develop stronger relationships with existing customers in high-value segments with new offers based on customer needs by: developing and rolling out improved product and service offerings, and extending relationships with customers over the medium term Ø In 2008 AFS rolled out: • The insurance offering Loan Cover, along with several risk enhancements • AMP Super Cash – a deposit product with AMP Banking that provides low risk investment returns in a superannuation environment – to Corporate Superannuation customers • AMP Banking’s First Home Saver Account • Term deposits on super and pension investment menus • The AMP Growth Bond Ø Customer Value pilots reached more than 8, 000 customers in two tests in ’ 08; ramping up to reach over 36, 000 customers in ’ 09 with targeted offers Ø AMPCI focusing on customers in high-value markets in Asia and Europe; new mandates from: • Middle Eastern sovereign wealth fund for development property deal • Global institution for global REIT • Dutch pension fund for European infrastructure product 45

4. Reshaping AMP Capital Investors into a high value-add investment manager Goal: Drive margin growth in higher value business and market segments, by delivering superior value to clients by: refreshing investment platforms and research capabilities in short term Ø Continued investment in technology platforms to underpin growth initiatives in Asia and new investment capabilities expanding investment capabilities in higher value segments which are more specialised and attract higher margins Ø Continued to attract higher management fees externally than internally Ø Launched Asian Giants Infrastructure Fund, raising A$145 m and intends its initial investment to be a minority stake in an Indian infrastructure company Ø Continued shopping centre investment program; portfolio 41 centres strong Ø Made two new infrastructure acquisitions in Europe totalling £ 300 m Ø Continuing to build strong external recognition of investment capabilities 46

4. Reshaping AMP Capital Investors into a high value-add investment manager Goal: Drive margin growth in higher value business and market segments, by delivering superior value to clients by: refreshing investment platforms and research capabilities in short term Ø Continued investment in technology platforms to underpin growth initiatives in Asia and new investment capabilities expanding investment capabilities in higher value segments which are more specialised and attract higher margins Ø Continued to attract higher management fees externally than internally Ø Launched Asian Giants Infrastructure Fund, raising A$145 m and intends its initial investment to be a minority stake in an Indian infrastructure company Ø Continued shopping centre investment program; portfolio 41 centres strong Ø Made two new infrastructure acquisitions in Europe totalling £ 300 m Ø Continuing to build strong external recognition of investment capabilities 46

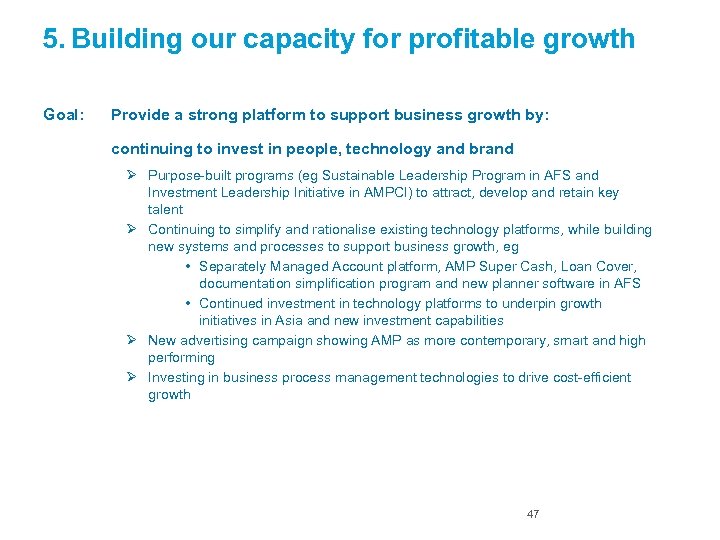

5. Building our capacity for profitable growth Goal: Provide a strong platform to support business growth by: continuing to invest in people, technology and brand Ø Purpose-built programs (eg Sustainable Leadership Program in AFS and Investment Leadership Initiative in AMPCI) to attract, develop and retain key talent Ø Continuing to simplify and rationalise existing technology platforms, while building new systems and processes to support business growth, eg • Separately Managed Account platform, AMP Super Cash, Loan Cover, documentation simplification program and new planner software in AFS • Continued investment in technology platforms to underpin growth initiatives in Asia and new investment capabilities Ø New advertising campaign showing AMP as more contemporary, smart and high performing Ø Investing in business process management technologies to drive cost-efficient growth 47

5. Building our capacity for profitable growth Goal: Provide a strong platform to support business growth by: continuing to invest in people, technology and brand Ø Purpose-built programs (eg Sustainable Leadership Program in AFS and Investment Leadership Initiative in AMPCI) to attract, develop and retain key talent Ø Continuing to simplify and rationalise existing technology platforms, while building new systems and processes to support business growth, eg • Separately Managed Account platform, AMP Super Cash, Loan Cover, documentation simplification program and new planner software in AFS • Continued investment in technology platforms to underpin growth initiatives in Asia and new investment capabilities Ø New advertising campaign showing AMP as more contemporary, smart and high performing Ø Investing in business process management technologies to drive cost-efficient growth 47

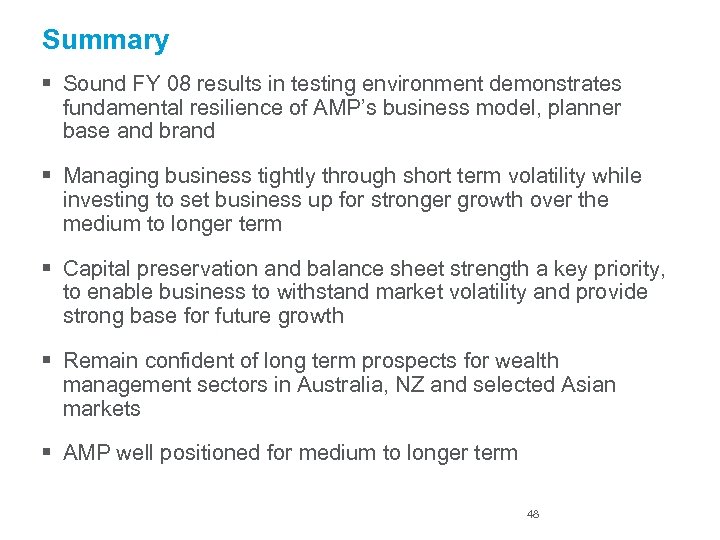

Summary § Sound FY 08 results in testing environment demonstrates fundamental resilience of AMP’s business model, planner base and brand § Managing business tightly through short term volatility while investing to set business up for stronger growth over the medium to longer term § Capital preservation and balance sheet strength a key priority, to enable business to withstand market volatility and provide strong base for future growth § Remain confident of long term prospects for wealth management sectors in Australia, NZ and selected Asian markets § AMP well positioned for medium to longer term 48

Summary § Sound FY 08 results in testing environment demonstrates fundamental resilience of AMP’s business model, planner base and brand § Managing business tightly through short term volatility while investing to set business up for stronger growth over the medium to longer term § Capital preservation and balance sheet strength a key priority, to enable business to withstand market volatility and provide strong base for future growth § Remain confident of long term prospects for wealth management sectors in Australia, NZ and selected Asian markets § AMP well positioned for medium to longer term 48

Appendices 49

Appendices 49

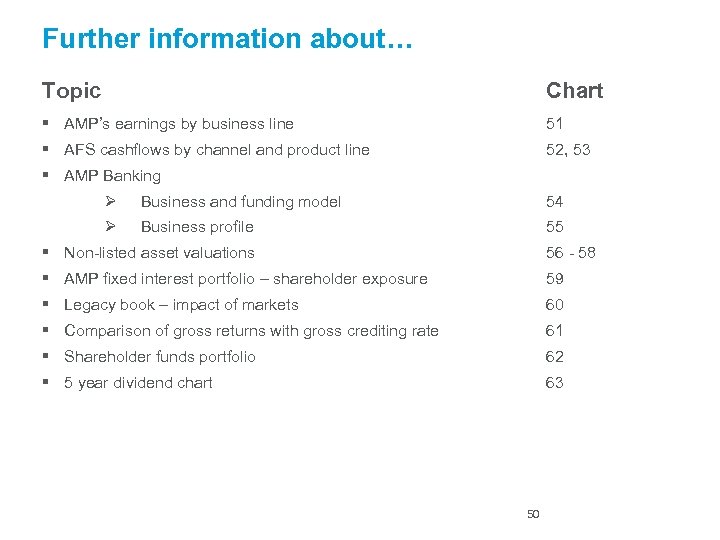

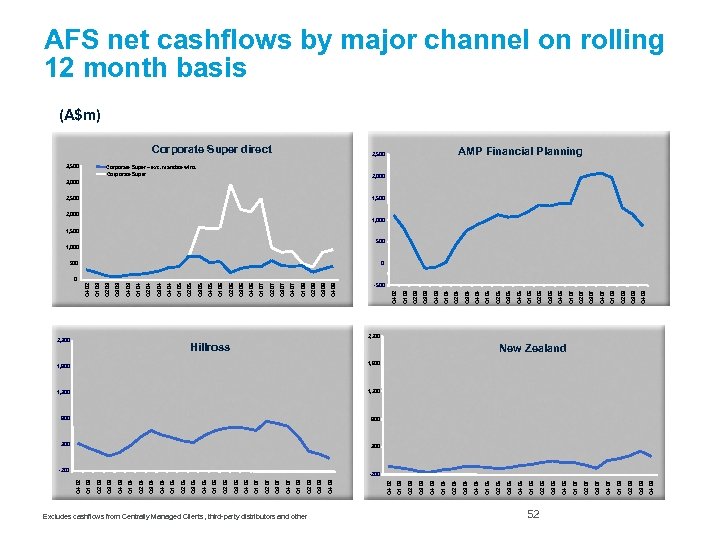

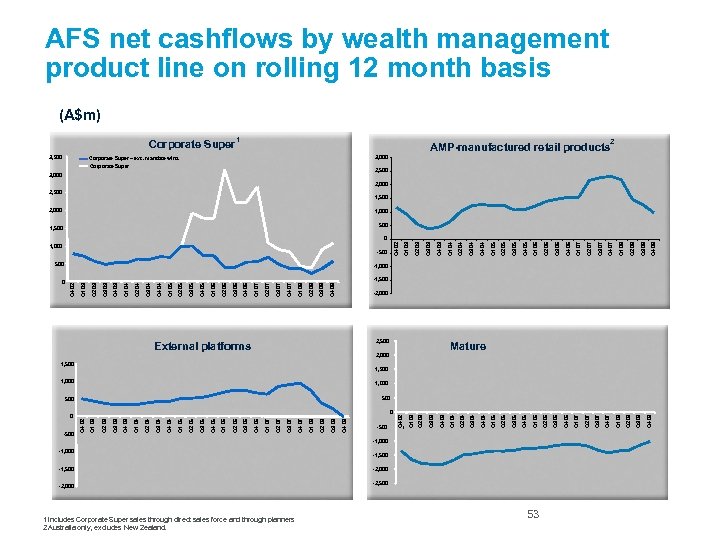

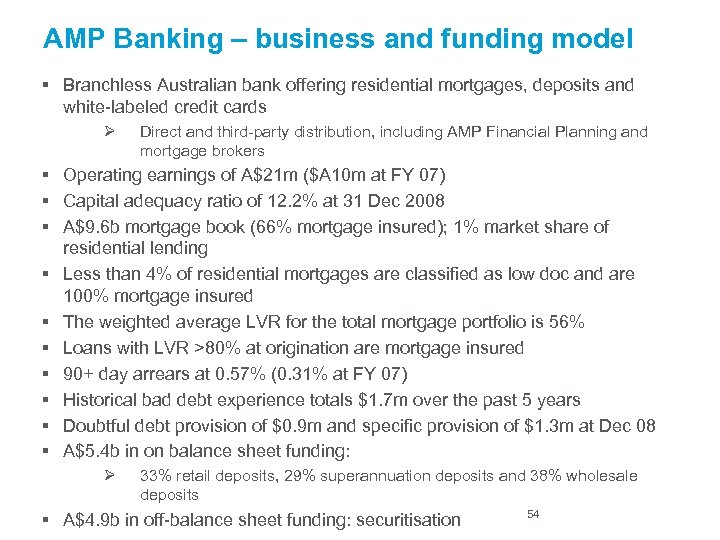

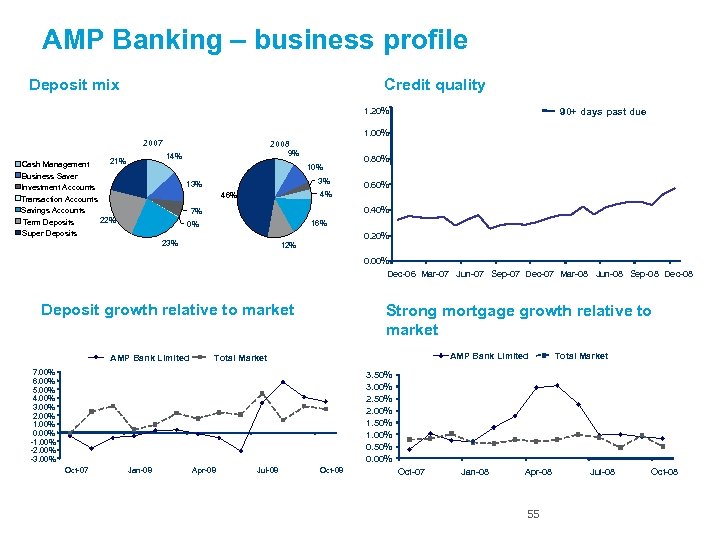

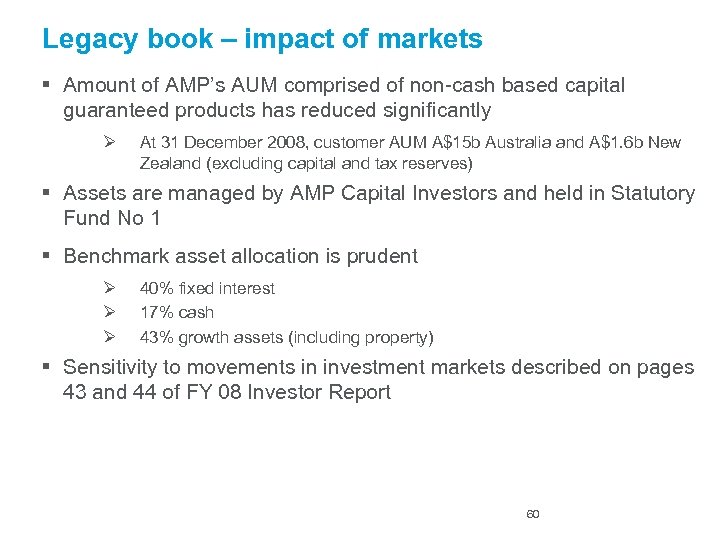

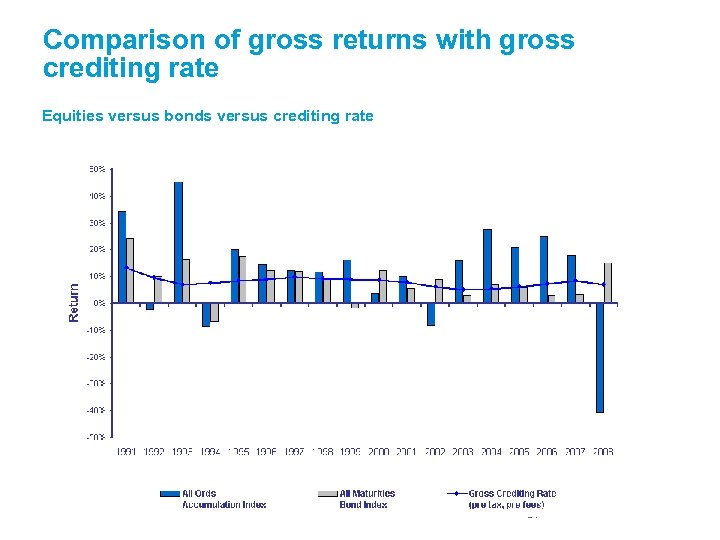

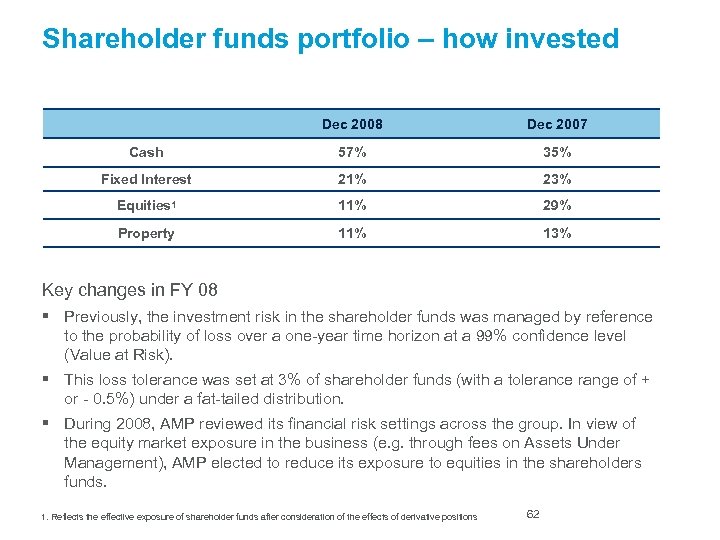

Further information about… Topic Chart § AMP’s earnings by business line 51 § AFS cashflows by channel and product line 52, 53 § AMP Banking Ø Business and funding model 54 Ø Business profile 55 § Non-listed asset valuations 56 - 58 § AMP fixed interest portfolio – shareholder exposure 59 § Legacy book – impact of markets 60 § Comparison of gross returns with gross crediting rate 61 § Shareholder funds portfolio 62 § 5 year dividend chart 63 50

Further information about… Topic Chart § AMP’s earnings by business line 51 § AFS cashflows by channel and product line 52, 53 § AMP Banking Ø Business and funding model 54 Ø Business profile 55 § Non-listed asset valuations 56 - 58 § AMP fixed interest portfolio – shareholder exposure 59 § Legacy book – impact of markets 60 § Comparison of gross returns with gross crediting rate 61 § Shareholder funds portfolio 62 § 5 year dividend chart 63 50

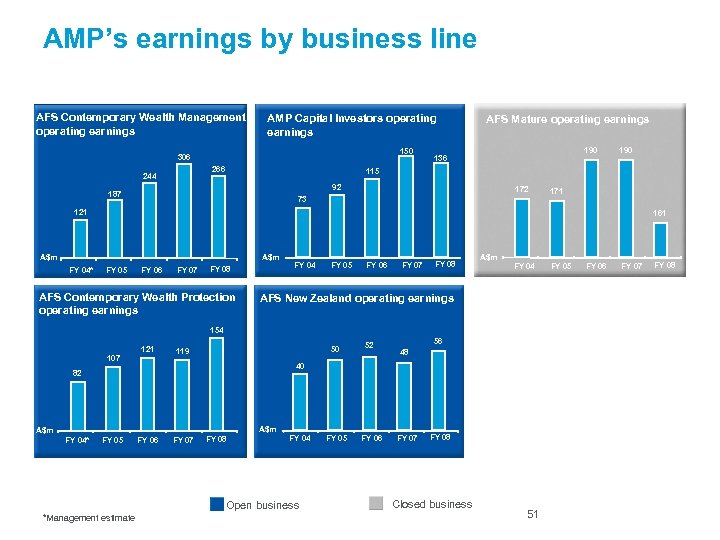

AMP’s earnings by business line AFS Contemporary Wealth Management operating earnings AMP Capital Investors operating earnings 150 306 266 244 AFS Mature operating earnings 190 136 190 115 92 187 172 73 171 121 161 A$m FY 04* FY 05 FY 06 FY 07 FY 08 AFS Contemporary Wealth Protection operating earnings FY 04 FY 05 FY 06 FY 07 FY 08 A$m FY 04 AFS New Zealand operating earnings 154 107 121 50 119 A$m FY 05 FY 06 FY 07 FY 08 FY 04 Open business *Management estimate 56 48 40 82 FY 04* 52 FY 05 FY 06 FY 07 FY 08 Closed business 51 FY 05 FY 06 FY 07 FY 08

AMP’s earnings by business line AFS Contemporary Wealth Management operating earnings AMP Capital Investors operating earnings 150 306 266 244 AFS Mature operating earnings 190 136 190 115 92 187 172 73 171 121 161 A$m FY 04* FY 05 FY 06 FY 07 FY 08 AFS Contemporary Wealth Protection operating earnings FY 04 FY 05 FY 06 FY 07 FY 08 A$m FY 04 AFS New Zealand operating earnings 154 107 121 50 119 A$m FY 05 FY 06 FY 07 FY 08 FY 04 Open business *Management estimate 56 48 40 82 FY 04* 52 FY 05 FY 06 FY 07 FY 08 Closed business 51 FY 05 FY 06 FY 07 FY 08

Excludes cashflows from Centrally Managed Clients, third-party distributors and other 52 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 2, 300 Q 1 05 -200 Q 4 04 800 300 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 2, 500 Q 3 04 1, 300 800 Q 2 04 1, 300 Q 1 04 1, 800 Q 4 03 Hillross Q 3 03 500 Q 1 03 2, 000 Q 2 03 2, 500 Q 4 02 Corporate Super – exc. mandate wins Corporate Super Q 1 03 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 Corporate Super direct Q 4 02 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 2, 300 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 1 03 Q 4 02 3, 500 Q 3 03 Q 2 03 Q 1 03 Q 4 02 AFS net cashflows by major channel on rolling 12 month basis (A$m) AMP Financial Planning 3, 000 2, 000 1, 500 1, 000 500 0 0 -500 New Zealand 1, 800 300 -200

Excludes cashflows from Centrally Managed Clients, third-party distributors and other 52 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 2, 300 Q 1 05 -200 Q 4 04 800 300 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 2, 500 Q 3 04 1, 300 800 Q 2 04 1, 300 Q 1 04 1, 800 Q 4 03 Hillross Q 3 03 500 Q 1 03 2, 000 Q 2 03 2, 500 Q 4 02 Corporate Super – exc. mandate wins Corporate Super Q 1 03 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 Corporate Super direct Q 4 02 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 2, 300 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 1 03 Q 4 02 3, 500 Q 3 03 Q 2 03 Q 1 03 Q 4 02 AFS net cashflows by major channel on rolling 12 month basis (A$m) AMP Financial Planning 3, 000 2, 000 1, 500 1, 000 500 0 0 -500 New Zealand 1, 800 300 -200

0 -500 -1, 000 -1, 500 -2, 000 1 Includes Corporate Super sales through direct sales force and through planners 2 Australia only, excludes New Zealand. Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 1, 500 1, 000 500 0 -500 -1, 000 -1, 500 -2, 000 -2, 500 53 Q 3 06 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 2 06 Q 3 06 Q 4 06 Q 1 06 Q 2 06 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 4 05 500 Q 1 06 1, 000 Q 3 05 1, 500 Q 4 05 Mature Q 2 05 2, 000 Q 3 05 -2, 000 Q 1 05 -1, 500 Q 2 05 -1, 000 Q 1 05 Q 4 04 2, 500 Q 3 04 External platforms Q 2 04 500 Q 1 04 -500 Q 4 03 1 Q 3 03 1, 000 Q 2 03 1, 500 Q 1 03 2, 000 Q 2 03 2, 500 Q 1 03 3, 000 Q 4 02 Corporate Super – exc. mandate wins Corporate Super Q 4 02 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 Corporate Super Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 Q 1 03 3, 500 Q 1 03 Q 4 02 0 Q 4 02 AFS net cashflows by wealth management product line on rolling 12 month basis (A$m) AMP-manufactured retail products 2 3, 000 2, 500 2, 000 1, 500 1, 000 500 0

0 -500 -1, 000 -1, 500 -2, 000 1 Includes Corporate Super sales through direct sales force and through planners 2 Australia only, excludes New Zealand. Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 1, 500 1, 000 500 0 -500 -1, 000 -1, 500 -2, 000 -2, 500 53 Q 3 06 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 2 06 Q 3 06 Q 4 06 Q 1 06 Q 2 06 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 4 05 500 Q 1 06 1, 000 Q 3 05 1, 500 Q 4 05 Mature Q 2 05 2, 000 Q 3 05 -2, 000 Q 1 05 -1, 500 Q 2 05 -1, 000 Q 1 05 Q 4 04 2, 500 Q 3 04 External platforms Q 2 04 500 Q 1 04 -500 Q 4 03 1 Q 3 03 1, 000 Q 2 03 1, 500 Q 1 03 2, 000 Q 2 03 2, 500 Q 1 03 3, 000 Q 4 02 Corporate Super – exc. mandate wins Corporate Super Q 4 02 Q 4 08 Q 3 08 Q 2 08 Q 1 08 Q 4 07 Q 3 07 Q 2 07 Q 1 07 Q 4 06 Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 Corporate Super Q 3 06 Q 2 06 Q 1 06 Q 4 05 Q 3 05 Q 2 05 Q 1 05 Q 4 04 Q 3 04 Q 2 04 Q 1 04 Q 4 03 Q 3 03 Q 2 03 Q 1 03 3, 500 Q 1 03 Q 4 02 0 Q 4 02 AFS net cashflows by wealth management product line on rolling 12 month basis (A$m) AMP-manufactured retail products 2 3, 000 2, 500 2, 000 1, 500 1, 000 500 0

AMP Banking – business and funding model § Branchless Australian bank offering residential mortgages, deposits and white-labeled credit cards Ø Direct and third-party distribution, including AMP Financial Planning and mortgage brokers § Operating earnings of A$21 m ($A 10 m at FY 07) § Capital adequacy ratio of 12. 2% at 31 Dec 2008 § A$9. 6 b mortgage book (66% mortgage insured); 1% market share of residential lending § Less than 4% of residential mortgages are classified as low doc and are 100% mortgage insured § The weighted average LVR for the total mortgage portfolio is 56% § Loans with LVR >80% at origination are mortgage insured § 90+ day arrears at 0. 57% (0. 31% at FY 07) § Historical bad debt experience totals $1. 7 m over the past 5 years § Doubtful debt provision of $0. 9 m and specific provision of $1. 3 m at Dec 08 § A$5. 4 b in on balance sheet funding: Ø 33% retail deposits, 29% superannuation deposits and 38% wholesale deposits § A$4. 9 b in off-balance sheet funding: securitisation 54

AMP Banking – business and funding model § Branchless Australian bank offering residential mortgages, deposits and white-labeled credit cards Ø Direct and third-party distribution, including AMP Financial Planning and mortgage brokers § Operating earnings of A$21 m ($A 10 m at FY 07) § Capital adequacy ratio of 12. 2% at 31 Dec 2008 § A$9. 6 b mortgage book (66% mortgage insured); 1% market share of residential lending § Less than 4% of residential mortgages are classified as low doc and are 100% mortgage insured § The weighted average LVR for the total mortgage portfolio is 56% § Loans with LVR >80% at origination are mortgage insured § 90+ day arrears at 0. 57% (0. 31% at FY 07) § Historical bad debt experience totals $1. 7 m over the past 5 years § Doubtful debt provision of $0. 9 m and specific provision of $1. 3 m at Dec 08 § A$5. 4 b in on balance sheet funding: Ø 33% retail deposits, 29% superannuation deposits and 38% wholesale deposits § A$4. 9 b in off-balance sheet funding: securitisation 54

AMP Banking – business profile Deposit mix Credit quality 1. 20% 90+ days past due 1. 00% 2007 2008 9% 14% 21% Cash Management Business Saver Investment Accounts Transaction Accounts Savings Accounts 22% Term Deposits Super Deposits 10% 3% 13% 0. 80% 0. 60% 4% 46% 0. 40% 7% 16% 0% 0. 20% 23% 12% 0. 00% Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Deposit growth relative to market AMP Bank Limited Strong mortgage growth relative to market AMP Bank Limited Total Market 7. 00% 6. 00% 5. 00% 4. 00% 3. 00% 2. 00% 1. 00% 0. 00% -1. 00% -2. 00% -3. 00% Total Market 3. 50% 3. 00% 2. 50% 2. 00% 1. 50% 1. 00% 0. 50% 0. 00% Oct-07 Jan-08 Apr-08 Jul-08 Oct-07 Jan-08 Apr-08 55 Jul-08 Oct-08

AMP Banking – business profile Deposit mix Credit quality 1. 20% 90+ days past due 1. 00% 2007 2008 9% 14% 21% Cash Management Business Saver Investment Accounts Transaction Accounts Savings Accounts 22% Term Deposits Super Deposits 10% 3% 13% 0. 80% 0. 60% 4% 46% 0. 40% 7% 16% 0% 0. 20% 23% 12% 0. 00% Dec-06 Mar-07 Jun-07 Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Deposit growth relative to market AMP Bank Limited Strong mortgage growth relative to market AMP Bank Limited Total Market 7. 00% 6. 00% 5. 00% 4. 00% 3. 00% 2. 00% 1. 00% 0. 00% -1. 00% -2. 00% -3. 00% Total Market 3. 50% 3. 00% 2. 50% 2. 00% 1. 50% 1. 00% 0. 50% 0. 00% Oct-07 Jan-08 Apr-08 Jul-08 Oct-07 Jan-08 Apr-08 55 Jul-08 Oct-08

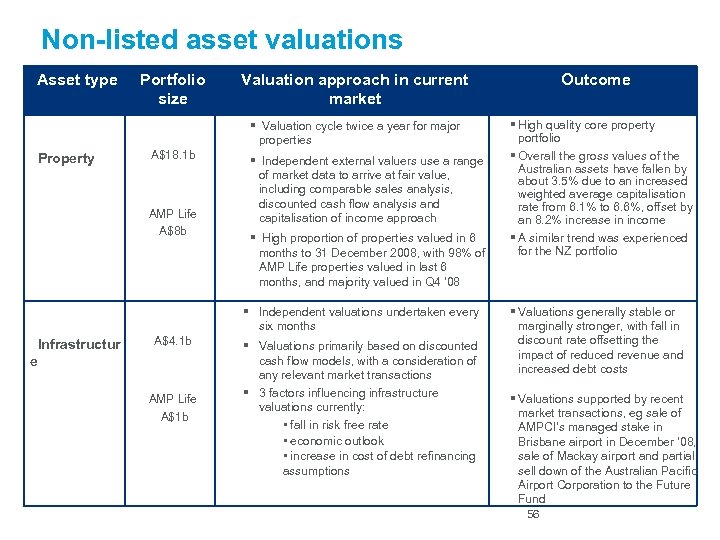

Non-listed asset valuations Asset type Portfolio size Valuation approach in current market § Valuation cycle twice a year for major properties Property A$18. 1 b AMP Life A$8 b § Independent external valuers use a range of market data to arrive at fair value, including comparable sales analysis, discounted cash flow analysis and capitalisation of income approach § High proportion of properties valued in 6 months to 31 December 2008, with 98% of AMP Life properties valued in last 6 months, and majority valued in Q 4 ‘ 08 § Independent valuations undertaken every six months Infrastructur e A$4. 1 b AMP Life A$1 b § Valuations primarily based on discounted cash flow models, with a consideration of any relevant market transactions § 3 factors influencing infrastructure valuations currently: • fall in risk free rate • economic outlook • increase in cost of debt refinancing assumptions Outcome § High quality core property portfolio § Overall the gross values of the Australian assets have fallen by about 3. 5% due to an increased weighted average capitalisation rate from 6. 1% to 6. 6%, offset by an 8. 2% increase in income § A similar trend was experienced for the NZ portfolio § Valuations generally stable or marginally stronger, with fall in discount rate offsetting the impact of reduced revenue and increased debt costs § Valuations supported by recent market transactions, eg sale of AMPCI’s managed stake in Brisbane airport in December ’ 08, sale of Mackay airport and partial sell down of the Australian Pacific Airport Corporation to the Future Fund 56

Non-listed asset valuations Asset type Portfolio size Valuation approach in current market § Valuation cycle twice a year for major properties Property A$18. 1 b AMP Life A$8 b § Independent external valuers use a range of market data to arrive at fair value, including comparable sales analysis, discounted cash flow analysis and capitalisation of income approach § High proportion of properties valued in 6 months to 31 December 2008, with 98% of AMP Life properties valued in last 6 months, and majority valued in Q 4 ‘ 08 § Independent valuations undertaken every six months Infrastructur e A$4. 1 b AMP Life A$1 b § Valuations primarily based on discounted cash flow models, with a consideration of any relevant market transactions § 3 factors influencing infrastructure valuations currently: • fall in risk free rate • economic outlook • increase in cost of debt refinancing assumptions Outcome § High quality core property portfolio § Overall the gross values of the Australian assets have fallen by about 3. 5% due to an increased weighted average capitalisation rate from 6. 1% to 6. 6%, offset by an 8. 2% increase in income § A similar trend was experienced for the NZ portfolio § Valuations generally stable or marginally stronger, with fall in discount rate offsetting the impact of reduced revenue and increased debt costs § Valuations supported by recent market transactions, eg sale of AMPCI’s managed stake in Brisbane airport in December ’ 08, sale of Mackay airport and partial sell down of the Australian Pacific Airport Corporation to the Future Fund 56

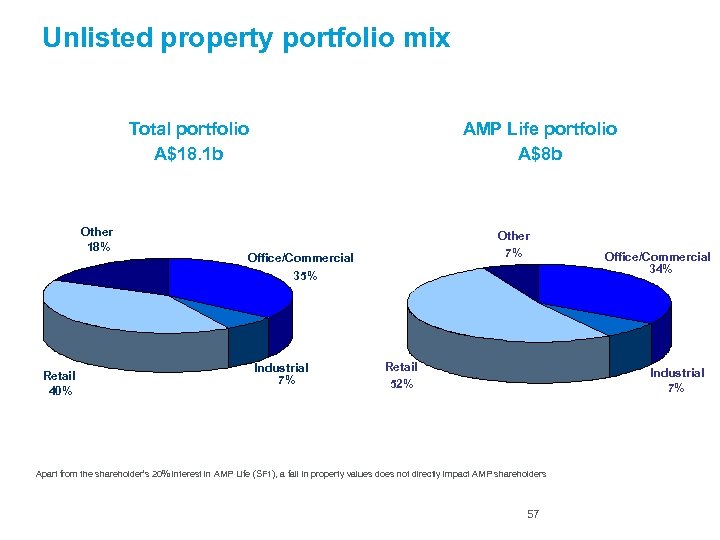

Unlisted property portfolio mix Total portfolio A$18. 1 b Other 18% Retail 40% AMP Life portfolio A$8 b Other 7% Office/Commercial 35% Industrial 7% Retail 52% Office/Commercial 34% Industrial 7% Apart from the shareholder’s 20% interest in AMP Life (SF 1), a fall in property values does not directly impact AMP shareholders 57

Unlisted property portfolio mix Total portfolio A$18. 1 b Other 18% Retail 40% AMP Life portfolio A$8 b Other 7% Office/Commercial 35% Industrial 7% Retail 52% Office/Commercial 34% Industrial 7% Apart from the shareholder’s 20% interest in AMP Life (SF 1), a fall in property values does not directly impact AMP shareholders 57

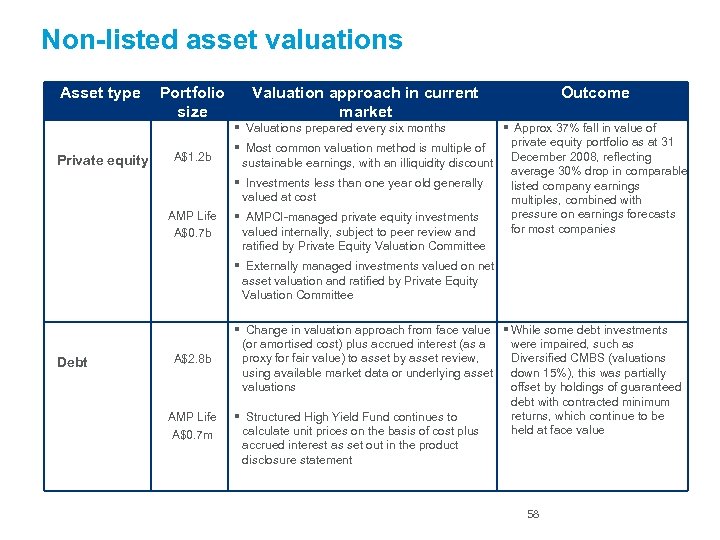

Non-listed asset valuations Asset type Portfolio size Valuation approach in current market Outcome § Valuations prepared every six months Private equity A$1. 2 b AMP Life A$0. 7 b § Approx 37% fall in value of private equity portfolio as at 31 § Most common valuation method is multiple of sustainable earnings, with an illiquidity discount December 2008, reflecting average 30% drop in comparable § Investments less than one year old generally listed company earnings valued at cost multiples, combined with pressure on earnings forecasts § AMPCI-managed private equity investments for most companies valued internally, subject to peer review and ratified by Private Equity Valuation Committee § Externally managed investments valued on net asset valuation and ratified by Private Equity Valuation Committee Debt A$2. 8 b AMP Life A$0. 7 m § Change in valuation approach from face value § While some debt investments (or amortised cost) plus accrued interest (as a were impaired, such as proxy for fair value) to asset by asset review, Diversified CMBS (valuations using available market data or underlying asset down 15%), this was partially valuations offset by holdings of guaranteed debt with contracted minimum returns, which continue to be § Structured High Yield Fund continues to held at face value calculate unit prices on the basis of cost plus accrued interest as set out in the product disclosure statement 58

Non-listed asset valuations Asset type Portfolio size Valuation approach in current market Outcome § Valuations prepared every six months Private equity A$1. 2 b AMP Life A$0. 7 b § Approx 37% fall in value of private equity portfolio as at 31 § Most common valuation method is multiple of sustainable earnings, with an illiquidity discount December 2008, reflecting average 30% drop in comparable § Investments less than one year old generally listed company earnings valued at cost multiples, combined with pressure on earnings forecasts § AMPCI-managed private equity investments for most companies valued internally, subject to peer review and ratified by Private Equity Valuation Committee § Externally managed investments valued on net asset valuation and ratified by Private Equity Valuation Committee Debt A$2. 8 b AMP Life A$0. 7 m § Change in valuation approach from face value § While some debt investments (or amortised cost) plus accrued interest (as a were impaired, such as proxy for fair value) to asset by asset review, Diversified CMBS (valuations using available market data or underlying asset down 15%), this was partially valuations offset by holdings of guaranteed debt with contracted minimum returns, which continue to be § Structured High Yield Fund continues to held at face value calculate unit prices on the basis of cost plus accrued interest as set out in the product disclosure statement 58

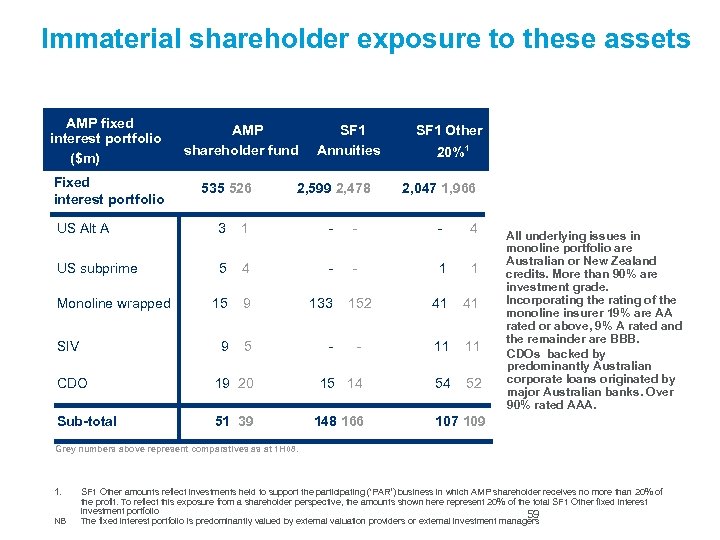

Immaterial shareholder exposure to these assets AMP fixed interest portfolio ($m) Fixed interest portfolio AMP shareholder fund 535 526 SF 1 Annuities SF 1 Other 20%1 2, 599 2, 478 2, 047 1, 966 US Alt A 3 1 - - - 4 US subprime 5 4 - - 1 1 15 9 133 152 41 41 9 5 - - 11 11 54 52 Monoline wrapped SIV CDO 19 20 15 14 Sub-total 51 39 148 166 All underlying issues in monoline portfolio are Australian or New Zealand credits. More than 90% are investment grade. Incorporating the rating of the monoline insurer 19% are AA rated or above, 9% A rated and the remainder are BBB. CDOs backed by predominantly Australian corporate loans originated by major Australian banks. Over 90% rated AAA. 107 109 Grey numbers above represent comparatives as at 1 H 08. 1. NB SF 1 Other amounts reflect investments held to support the participating (‘PAR’) business in which AMP shareholder receives no more than 20% of the profit. To reflect this exposure from a shareholder perspective, the amounts shown here represent 20% of the total SF 1 Other fixed interest investment portfolio 59 The fixed interest portfolio is predominantly valued by external valuation providers or external investment managers