03674c211194d4e5bcb50c79fec42e5c.ppt

- Количество слайдов: 122

2007 High School Counselor Drive In Workshop

2007 High School Counselor Drive In Workshop

My College Welcomes You Today’s Presenters: 2

My College Welcomes You Today’s Presenters: 2

Workshop Coordinated By: ■ Wisconsin Association of Student Financial Aid Administrators (WASFAA) ■ Wisconsin Higher Educational Aids Board (HEAB) ■ Wisconsin Department of Public Instruction (DPI) ■ Wisconsin Educational Opportunity Programs (WEOP) ■ Great Lakes 3

Workshop Coordinated By: ■ Wisconsin Association of Student Financial Aid Administrators (WASFAA) ■ Wisconsin Higher Educational Aids Board (HEAB) ■ Wisconsin Department of Public Instruction (DPI) ■ Wisconsin Educational Opportunity Programs (WEOP) ■ Great Lakes 3

Today’s Agenda 8: 00 – 8: 30 Registration 8: 30 – 8: 45 Welcome Review of Agenda and Packet Materials College Goal Sunday 8: 45 – 9: 45 – 10: 00 Break 10: 00 – 10: 30 HEAB Update 10: 30 – 11: 00 DPI Update 11: 00 – 12: 00 4 Financial Aid Fundamentals Special Topics

Today’s Agenda 8: 00 – 8: 30 Registration 8: 30 – 8: 45 Welcome Review of Agenda and Packet Materials College Goal Sunday 8: 45 – 9: 45 – 10: 00 Break 10: 00 – 10: 30 HEAB Update 10: 30 – 11: 00 DPI Update 11: 00 – 12: 00 4 Financial Aid Fundamentals Special Topics

College Goal Sunday February 10, 2008 2: 00 – 4: 00 p. m. ■ College Goal Sunday is a statewide event that will offer free assistance to families in completing the Free Application for Federal Student Aid (FAFSA) ■ Volunteer forms, marketing materials and additional information can be found on the website ■ Scheduled at 20 sites throughout Wisconsin www. Wi. College. Goal. Sunday. org 5

College Goal Sunday February 10, 2008 2: 00 – 4: 00 p. m. ■ College Goal Sunday is a statewide event that will offer free assistance to families in completing the Free Application for Federal Student Aid (FAFSA) ■ Volunteer forms, marketing materials and additional information can be found on the website ■ Scheduled at 20 sites throughout Wisconsin www. Wi. College. Goal. Sunday. org 5

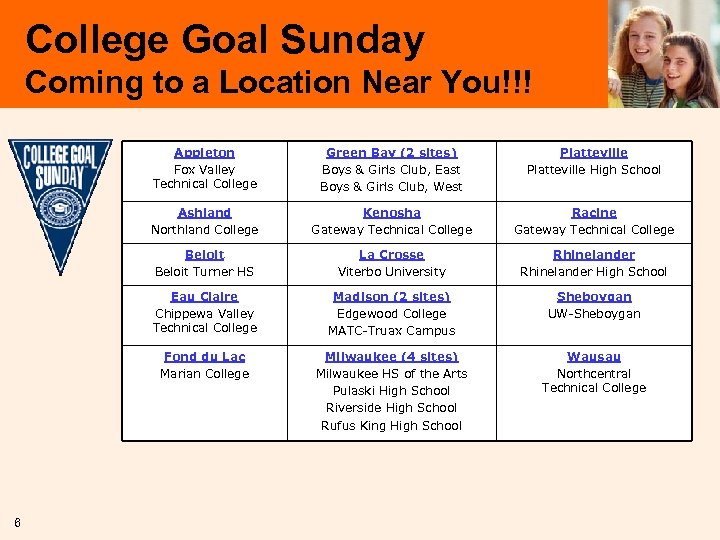

College Goal Sunday Coming to a Location Near You!!! Appleton Fox Valley Technical College Platteville High School Ashland Northland College Kenosha Gateway Technical College Racine Gateway Technical College Beloit Turner HS La Crosse Viterbo University Rhinelander High School Eau Claire Chippewa Valley Technical College Madison (2 sites) Edgewood College MATC-Truax Campus Sheboygan UW-Sheboygan Fond du Lac Marian College 6 Green Bay (2 sites) Boys & Girls Club, East Boys & Girls Club, West Milwaukee (4 sites) Milwaukee HS of the Arts Pulaski High School Riverside High School Rufus King High School Wausau Northcentral Technical College

College Goal Sunday Coming to a Location Near You!!! Appleton Fox Valley Technical College Platteville High School Ashland Northland College Kenosha Gateway Technical College Racine Gateway Technical College Beloit Turner HS La Crosse Viterbo University Rhinelander High School Eau Claire Chippewa Valley Technical College Madison (2 sites) Edgewood College MATC-Truax Campus Sheboygan UW-Sheboygan Fond du Lac Marian College 6 Green Bay (2 sites) Boys & Girls Club, East Boys & Girls Club, West Milwaukee (4 sites) Milwaukee HS of the Arts Pulaski High School Riverside High School Rufus King High School Wausau Northcentral Technical College

FINANCIAL AID FUNDAMENTALS

FINANCIAL AID FUNDAMENTALS

Financing Your Education ■ ■ ■ 8 What is the goal of financial aid? How is financial need determined? How do I apply? What aid is available? What is the role of the financial aid office?

Financing Your Education ■ ■ ■ 8 What is the goal of financial aid? How is financial need determined? How do I apply? What aid is available? What is the role of the financial aid office?

Goal of Financial Aid ■ To assist students in paying for college. ■ To provide opportunity and access to higher education. 9

Goal of Financial Aid ■ To assist students in paying for college. ■ To provide opportunity and access to higher education. 9

Basic Principles of Financial Aid The family has primary responsibility for financing postsecondary education. Financial aid is the BRIDGE. 10

Basic Principles of Financial Aid The family has primary responsibility for financing postsecondary education. Financial aid is the BRIDGE. 10

Principles of Needs Analysis ■ To the extent they are able, parents have primary responsibility to pay for their dependent children’s education. ■ Students also have a responsibility to contribute to their educational costs. ■ Families should be evaluated in their present financial condition. ■ A family’s ability to pay for educational costs must be evaluated in an equitable and consistent manner, recognizing that special circumstances can and do affect a family’s ability to pay. 11

Principles of Needs Analysis ■ To the extent they are able, parents have primary responsibility to pay for their dependent children’s education. ■ Students also have a responsibility to contribute to their educational costs. ■ Families should be evaluated in their present financial condition. ■ A family’s ability to pay for educational costs must be evaluated in an equitable and consistent manner, recognizing that special circumstances can and do affect a family’s ability to pay. 11

Financial Aid Regulations ■ Are determined by federal and state statutes and legislators ■ Establish your eligibility for most types of aid ■ Apply to all schools 12

Financial Aid Regulations ■ Are determined by federal and state statutes and legislators ■ Establish your eligibility for most types of aid ■ Apply to all schools 12

What Are the Costs? + + = 13 Tuition and Fees Room and Board Transportation Books & Supplies Miscellaneous Living Expenses Cost of Attendance (COA)

What Are the Costs? + + = 13 Tuition and Fees Room and Board Transportation Books & Supplies Miscellaneous Living Expenses Cost of Attendance (COA)

Expected Family Contribution (EFC) (Federal Methodology established by U. S. Congress) Determined by filing the FAFSA www. FAFSA. ed. gov 14

Expected Family Contribution (EFC) (Federal Methodology established by U. S. Congress) Determined by filing the FAFSA www. FAFSA. ed. gov 14

Main Determinants of the EFC ■ ■ ■ Income Assets Family size Number in College Age of the older parent Adjustments to EFC may be made due to Verification and/or Special Circumstances that limit ability to pay 15

Main Determinants of the EFC ■ ■ ■ Income Assets Family size Number in College Age of the older parent Adjustments to EFC may be made due to Verification and/or Special Circumstances that limit ability to pay 15

Expected Family Contribution (EFC) ■ Is the sum of four separate calculations: · Contribution from Parental Income · Contribution from Parental Assets · Contribution from Student Income · Contribution from Student Assets 16

Expected Family Contribution (EFC) ■ Is the sum of four separate calculations: · Contribution from Parental Income · Contribution from Parental Assets · Contribution from Student Income · Contribution from Student Assets 16

Financial Need Defined Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need 17

Financial Need Defined Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need 17

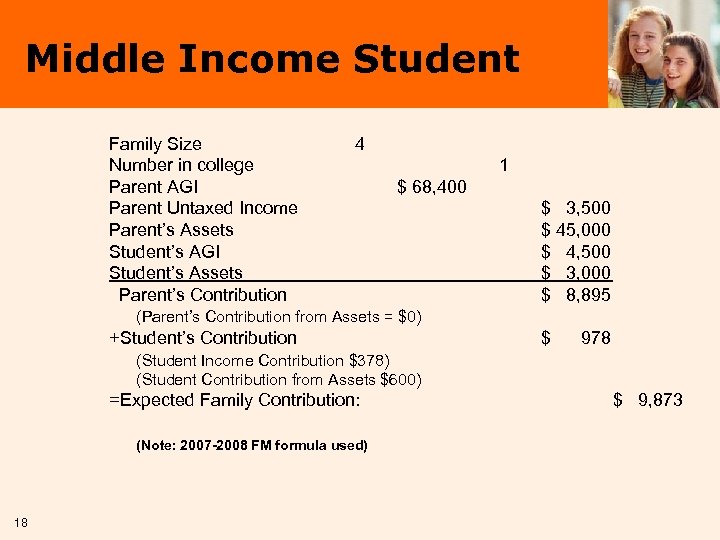

Middle Income Student Family Size Number in college Parent AGI Parent Untaxed Income Parent’s Assets Student’s AGI Student’s Assets Parent’s Contribution 4 1 $ 68, 400 $ 3, 500 $ 45, 000 $ 4, 500 $ 3, 000 $ 8, 895 (Parent’s Contribution from Assets = $0) +Student’s Contribution $ 978 (Student Income Contribution $378) (Student Contribution from Assets $600) =Expected Family Contribution: (Note: 2007 -2008 FM formula used) 18 $ 9, 873

Middle Income Student Family Size Number in college Parent AGI Parent Untaxed Income Parent’s Assets Student’s AGI Student’s Assets Parent’s Contribution 4 1 $ 68, 400 $ 3, 500 $ 45, 000 $ 4, 500 $ 3, 000 $ 8, 895 (Parent’s Contribution from Assets = $0) +Student’s Contribution $ 978 (Student Income Contribution $378) (Student Contribution from Assets $600) =Expected Family Contribution: (Note: 2007 -2008 FM formula used) 18 $ 9, 873

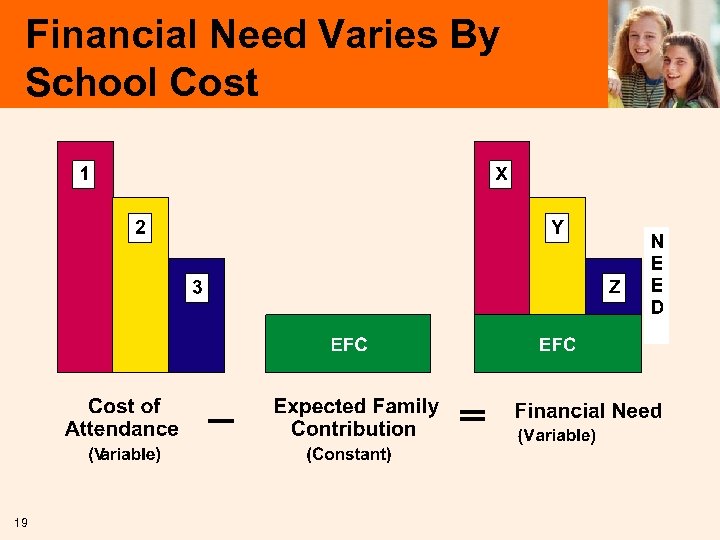

Financial Need Varies By School Cost 19

Financial Need Varies By School Cost 19

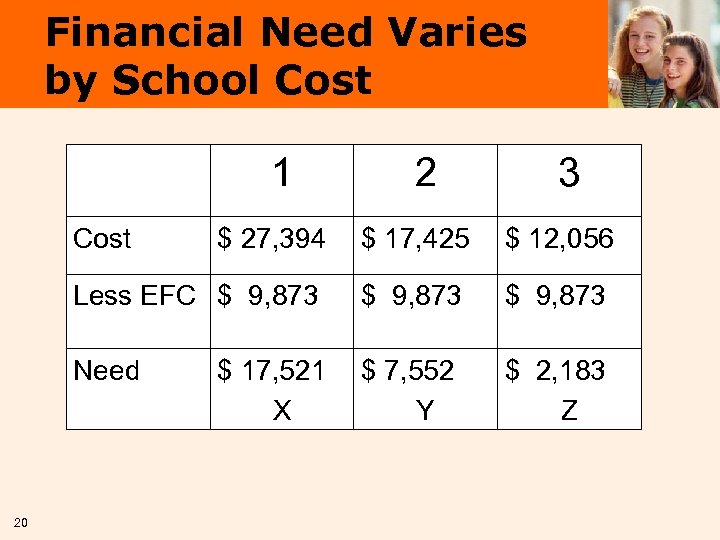

Financial Need Varies by School Cost 1 Cost 2 3 $ 17, 425 $ 12, 056 Less EFC $ 9, 873 Need 20 $ 27, 394 $ 7, 552 Y $ 2, 183 Z $ 17, 521 X

Financial Need Varies by School Cost 1 Cost 2 3 $ 17, 425 $ 12, 056 Less EFC $ 9, 873 Need 20 $ 27, 394 $ 7, 552 Y $ 2, 183 Z $ 17, 521 X

You may be eligible for aid, but…. . YOU MUST APPLY TO FIND OUT! And it’s free! File the FAFSA each year. www. FAFSA. ed. gov 21

You may be eligible for aid, but…. . YOU MUST APPLY TO FIND OUT! And it’s free! File the FAFSA each year. www. FAFSA. ed. gov 21

Application Process ■ Apply for PIN through Department of Education ■ Submit the Free Application for Federal Student Aid (FAFSA) prior to your school’s deadline (paper or electronic) ■ Submit any institutional application materials (if required by your school) ■ Attain admission status ■ Make sure to meet all required deadlines! 22

Application Process ■ Apply for PIN through Department of Education ■ Submit the Free Application for Federal Student Aid (FAFSA) prior to your school’s deadline (paper or electronic) ■ Submit any institutional application materials (if required by your school) ■ Attain admission status ■ Make sure to meet all required deadlines! 22

Free Application for Federal Student Aid ■ Collects family’s personal and financial information used to calculate the EFC ■ May file the FAFSA in one of two ways: · FAFSA on the Web · Paper FAFSA www. FAFSA. ed. gov 23

Free Application for Federal Student Aid ■ Collects family’s personal and financial information used to calculate the EFC ■ May file the FAFSA in one of two ways: · FAFSA on the Web · Paper FAFSA www. FAFSA. ed. gov 23

What is a PIN? www. pin. ed. gov ■ ■ ■ 24 Personal Identification Number Students and parents can get PINs Electronic signature for FAFSA on the Web PIN delivery · Real time online · By regular mail in 7 -10 days Can also be used for: · Renewal on the Web · Corrections on the Web · National Student Loan Database · Signing promissory notes for student/parent loans (Perkins, Stafford, PLUS)

What is a PIN? www. pin. ed. gov ■ ■ ■ 24 Personal Identification Number Students and parents can get PINs Electronic signature for FAFSA on the Web PIN delivery · Real time online · By regular mail in 7 -10 days Can also be used for: · Renewal on the Web · Corrections on the Web · National Student Loan Database · Signing promissory notes for student/parent loans (Perkins, Stafford, PLUS)

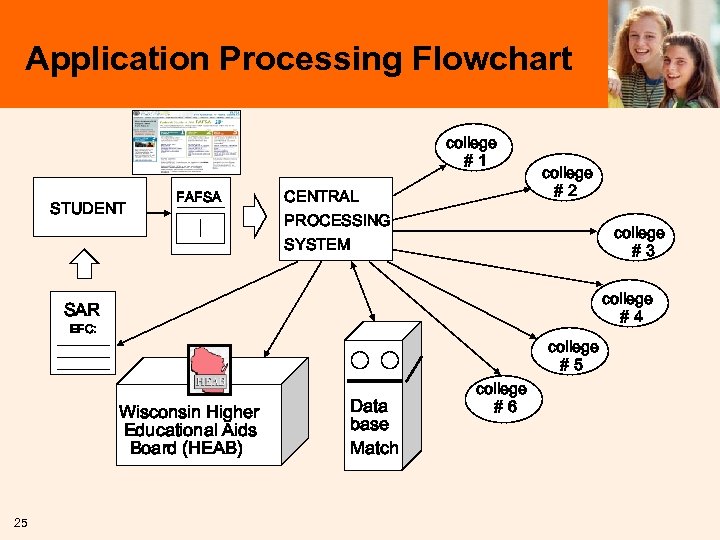

Application Processing Flowchart college #1 STUDENT FAFSA CENTRAL PROCESSING SYSTEM college #2 college #3 college #4 SAR EFC: college #5 Wisconsin Higher Educational Aids Board (HEAB) 25 Data base Match college #6

Application Processing Flowchart college #1 STUDENT FAFSA CENTRAL PROCESSING SYSTEM college #2 college #3 college #4 SAR EFC: college #5 Wisconsin Higher Educational Aids Board (HEAB) 25 Data base Match college #6

CSS /PROFILE (used by some private schools) ■ Collects additional data colleges need ■ Targets non-federal funds · Financial need (ability to pay) vs. federal eligibility (EFC) ■ Supports Institutional Methodology (IM) as well as Federal Methodology (FM) ■ Supports early estimates/early admission 26

CSS /PROFILE (used by some private schools) ■ Collects additional data colleges need ■ Targets non-federal funds · Financial need (ability to pay) vs. federal eligibility (EFC) ■ Supports Institutional Methodology (IM) as well as Federal Methodology (FM) ■ Supports early estimates/early admission 26

Timelines ■ The earliest a student can file the FAFSA for the 2008 -2009 academic year - January 1, 2008. ■ Check with the colleges at which the student plans to apply for institutional deadlines and requirements. ■ Failure to apply early may result in less aid even if eligible. ■ Students must re-apply for aid every year. Renewal notification is sent to students towards the end of each calendar year. 27

Timelines ■ The earliest a student can file the FAFSA for the 2008 -2009 academic year - January 1, 2008. ■ Check with the colleges at which the student plans to apply for institutional deadlines and requirements. ■ Failure to apply early may result in less aid even if eligible. ■ Students must re-apply for aid every year. Renewal notification is sent to students towards the end of each calendar year. 27

What is Financial Aid? ■ ■ 28 Scholarships Grants Loans Employment opportunities

What is Financial Aid? ■ ■ 28 Scholarships Grants Loans Employment opportunities

Three primary sources of funding: ■ US Department of Education · The federal agency that provides college funding in the form of grants, scholarships and loans. ■ State · Most states have agencies that administer state scholarship and grant programs, college savings and prepaid tuition programs, and loans. The Higher Educational Aids Board (HEAB) manages state aid in Wisconsin. ■ Colleges & Universities · Schools may offer their own scholarship, grant, work-study and loan programs, with each college setting its requirements. 29

Three primary sources of funding: ■ US Department of Education · The federal agency that provides college funding in the form of grants, scholarships and loans. ■ State · Most states have agencies that administer state scholarship and grant programs, college savings and prepaid tuition programs, and loans. The Higher Educational Aids Board (HEAB) manages state aid in Wisconsin. ■ Colleges & Universities · Schools may offer their own scholarship, grant, work-study and loan programs, with each college setting its requirements. 29

Gift Aid (FREE $$$) Grants & Scholarships ■ Federal (Administered by schools) · Federal Pell Grant · Federal Supplemental Educational Opportunity Grant (SEOG) · Academic Competitiveness Grant (ACG) · National SMART Grant ■ State (Administered by HEAB, DPI-WEOP & Schools) ■ Institutional (Endowment funds from Schools) ■ Private (Various outside organizations) 30

Gift Aid (FREE $$$) Grants & Scholarships ■ Federal (Administered by schools) · Federal Pell Grant · Federal Supplemental Educational Opportunity Grant (SEOG) · Academic Competitiveness Grant (ACG) · National SMART Grant ■ State (Administered by HEAB, DPI-WEOP & Schools) ■ Institutional (Endowment funds from Schools) ■ Private (Various outside organizations) 30

Academic Competitiveness Grant (ACG) · First year grant is $750 · For students who will be new freshman in 2008 -09 the following criteria are required: § U. S. Citizen AND § Enrolled in a 2 or 4 -year program AND § Pell eligible AND § Full Time AND § Graduated from high school after 1/1/2006 AND § Completed a rigorous high school curriculum as defined by the state · Second year grant is $1300 § Same criteria as above AND § Must have a minimum 3. 0 GPA AND § Graduated from high school after 1/1/2005 31

Academic Competitiveness Grant (ACG) · First year grant is $750 · For students who will be new freshman in 2008 -09 the following criteria are required: § U. S. Citizen AND § Enrolled in a 2 or 4 -year program AND § Pell eligible AND § Full Time AND § Graduated from high school after 1/1/2006 AND § Completed a rigorous high school curriculum as defined by the state · Second year grant is $1300 § Same criteria as above AND § Must have a minimum 3. 0 GPA AND § Graduated from high school after 1/1/2005 31

National Science and Mathematics Access to Retain Talent (SMART) Grant ■ Up to $4000 in 3 rd and 4 th years of undergraduate study ■ Eligibility requires include: · · · U. S. Citizen Pell Eligible Full Time 3. 0 Cumulative G. P. A. Enrolled in an eligible program of study § Computer Science, Engineering, Critical Foreign Languages, Life Sciences, Mathematics, Physical Sciences, Technology, or Multidisciplinary Studies 32

National Science and Mathematics Access to Retain Talent (SMART) Grant ■ Up to $4000 in 3 rd and 4 th years of undergraduate study ■ Eligibility requires include: · · · U. S. Citizen Pell Eligible Full Time 3. 0 Cumulative G. P. A. Enrolled in an eligible program of study § Computer Science, Engineering, Critical Foreign Languages, Life Sciences, Mathematics, Physical Sciences, Technology, or Multidisciplinary Studies 32

ACG/SMART Grant Information Academic Competitiveness Grant (ACG) http: //www. fsa 4 counselors. ed. gov/clcf/Academic. Grants. html National Science and Mathematics Access to Retain Talent (SMART) Grant http: //www. fsa 4 counselors. ed. gov/clcf/Smart. Grants. html 33

ACG/SMART Grant Information Academic Competitiveness Grant (ACG) http: //www. fsa 4 counselors. ed. gov/clcf/Academic. Grants. html National Science and Mathematics Access to Retain Talent (SMART) Grant http: //www. fsa 4 counselors. ed. gov/clcf/Smart. Grants. html 33

Wisconsin Covenant ■ Goal: Make sure that every Wisconsin 8 th grader knows that higher education is an option if they are willing to work hard during high school. ■ Students pledge to graduate, maintain at least a “B” average, take classes that prepare them for higher education, and be good citizens. ■ Students who fulfill the pledge are guaranteed a place in a Wisconsin college or university and a financial aid package based on the family’s financial need that helps make college more affordable. ■ Students in the Class of 2011 were the first to sign the Wisconsin Covenant Pledge. ■ Wisconsin Covenant Students will apply for financial aid in the same way that other students do. 34

Wisconsin Covenant ■ Goal: Make sure that every Wisconsin 8 th grader knows that higher education is an option if they are willing to work hard during high school. ■ Students pledge to graduate, maintain at least a “B” average, take classes that prepare them for higher education, and be good citizens. ■ Students who fulfill the pledge are guaranteed a place in a Wisconsin college or university and a financial aid package based on the family’s financial need that helps make college more affordable. ■ Students in the Class of 2011 were the first to sign the Wisconsin Covenant Pledge. ■ Wisconsin Covenant Students will apply for financial aid in the same way that other students do. 34

Wisconsin Covenant For more information: www. Wisconsin. Covenant. wi. gov Contact: Office of the Wisconsin Covenant PO Box 7869 Madison, WI 53707 608 -267 -9389 Wisconsin. Covenant@wi. gov 35

Wisconsin Covenant For more information: www. Wisconsin. Covenant. wi. gov Contact: Office of the Wisconsin Covenant PO Box 7869 Madison, WI 53707 608 -267 -9389 Wisconsin. Covenant@wi. gov 35

Self-Help Aid Employment (must be earned as wages) ■ Federal Work-Study ■ Institutional Work-Study Programs ■ Off Campus employment Loans (must be repaid with interest) ■ Federal Perkins Loan ■ Federal Stafford Loans (school determines the loan program) · Federal Family Education Loan (FFEL) Program · William D. Ford Federal Direct Loan Program ■ Federal PLUS Loan (Parents) ■ State Loans ■ Institutional Loans ■ Private-Alternative Loans 36

Self-Help Aid Employment (must be earned as wages) ■ Federal Work-Study ■ Institutional Work-Study Programs ■ Off Campus employment Loans (must be repaid with interest) ■ Federal Perkins Loan ■ Federal Stafford Loans (school determines the loan program) · Federal Family Education Loan (FFEL) Program · William D. Ford Federal Direct Loan Program ■ Federal PLUS Loan (Parents) ■ State Loans ■ Institutional Loans ■ Private-Alternative Loans 36

Why Get A Federal Student Loan? ■ You don’t have to repay until you leave school ■ Lower interest rates than private loans or credit cards ■ Credit record is not needed ■ Cosigner is not required 37

Why Get A Federal Student Loan? ■ You don’t have to repay until you leave school ■ Lower interest rates than private loans or credit cards ■ Credit record is not needed ■ Cosigner is not required 37

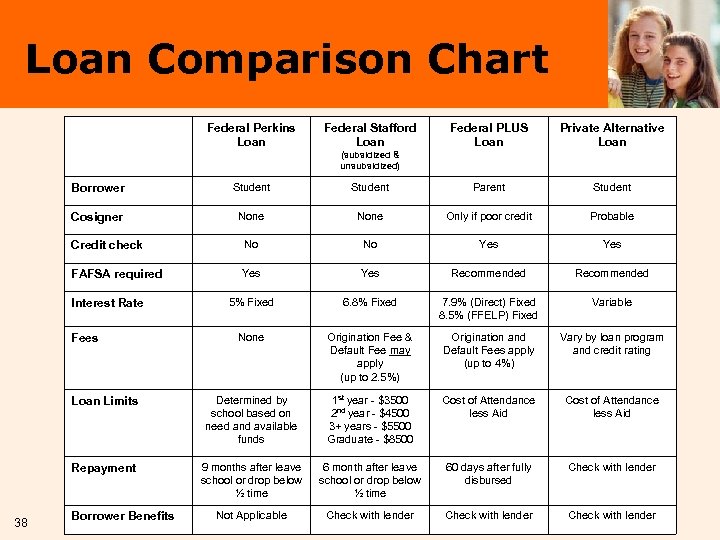

Loan Comparison Chart Federal Perkins Loan Federal Stafford Loan Federal PLUS Loan Private Alternative Loan (subsidized & unsubsidized) Borrower Student Parent Student Cosigner None Only if poor credit Probable Credit check No No Yes FAFSA required Yes Recommended 5% Fixed 6. 8% Fixed 7. 9% (Direct) Fixed 8. 5% (FFELP) Fixed Variable None Origination Fee & Default Fee may apply (up to 2. 5%) Origination and Default Fees apply (up to 4%) Vary by loan program and credit rating Loan Limits Determined by school based on need and available funds 1 st year - $3500 2 nd year - $4500 3+ years - $5500 Graduate - $8500 Cost of Attendance less Aid Repayment 9 months after leave school or drop below ½ time 6 month after leave school or drop below ½ time 60 days after fully disbursed Check with lender Not Applicable Check with lender Interest Rate Fees 38 Borrower Benefits

Loan Comparison Chart Federal Perkins Loan Federal Stafford Loan Federal PLUS Loan Private Alternative Loan (subsidized & unsubsidized) Borrower Student Parent Student Cosigner None Only if poor credit Probable Credit check No No Yes FAFSA required Yes Recommended 5% Fixed 6. 8% Fixed 7. 9% (Direct) Fixed 8. 5% (FFELP) Fixed Variable None Origination Fee & Default Fee may apply (up to 2. 5%) Origination and Default Fees apply (up to 4%) Vary by loan program and credit rating Loan Limits Determined by school based on need and available funds 1 st year - $3500 2 nd year - $4500 3+ years - $5500 Graduate - $8500 Cost of Attendance less Aid Repayment 9 months after leave school or drop below ½ time 6 month after leave school or drop below ½ time 60 days after fully disbursed Check with lender Not Applicable Check with lender Interest Rate Fees 38 Borrower Benefits

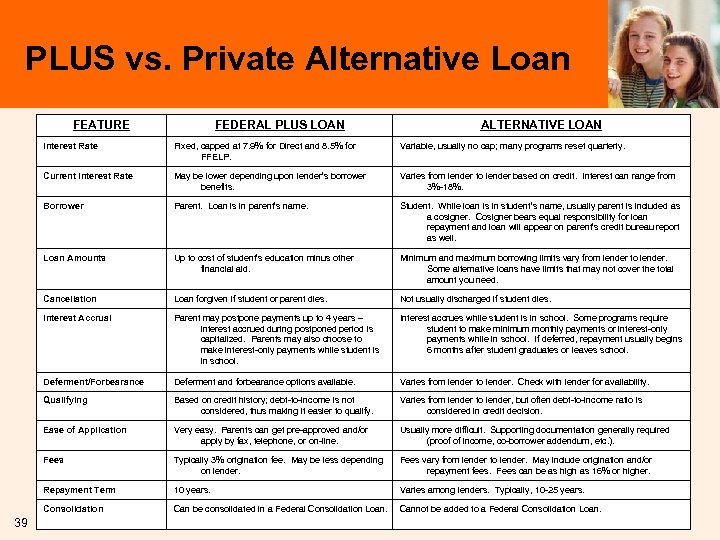

PLUS vs. Private Alternative Loan FEATURE FEDERAL PLUS LOAN ALTERNATIVE LOAN Interest Rate Variable, usually no cap; many programs reset quarterly. Current Interest Rate May be lower depending upon lender’s borrower benefits. Varies from lender to lender based on credit. Interest can range from 3%-18%. Borrower Parent. Loan is in parent’s name. Student. While loan is in student’s name, usually parent is included as a cosigner. Cosigner bears equal responsibility for loan repayment and loan will appear on parent’s credit bureau report as well. Loan Amounts Up to cost of student’s education minus other financial aid. Minimum and maximum borrowing limits vary from lender to lender. Some alternative loans have limits that may not cover the total amount you need. Cancellation Loan forgiven if student or parent dies. Not usually discharged if student dies. Interest Accrual Parent may postpone payments up to 4 years – interest accrued during postponed period is capitalized. Parents may also choose to make interest-only payments while student is in school. Interest accrues while student is in school. Some programs require student to make minimum monthly payments or interest-only payments while in school. If deferred, repayment usually begins 6 months after student graduates or leaves school. Deferment/Forbearance Deferment and forbearance options available. Varies from lender to lender. Check with lender for availability. Qualifying Based on credit history; debt-to-income is not considered, thus making it easier to qualify. Varies from lender to lender, but often debt-to-income ratio is considered in credit decision. Ease of Application Very easy. Parents can get pre-approved and/or apply by fax, telephone, or on-line. Usually more difficult. Supporting documentation generally required (proof of income, co-borrower addendum, etc. ). Fees Typically 3% origination fee. May be less depending on lender. Fees vary from lender to lender. May include origination and/or repayment fees. Fees can be as high as 16% or higher. Repayment Term 10 years. Varies among lenders. Typically, 10 -25 years. Consolidation 39 Fixed, capped at 7. 9% for Direct and 8. 5% for FFELP. Can be consolidated in a Federal Consolidation Loan. Cannot be added to a Federal Consolidation Loan.

PLUS vs. Private Alternative Loan FEATURE FEDERAL PLUS LOAN ALTERNATIVE LOAN Interest Rate Variable, usually no cap; many programs reset quarterly. Current Interest Rate May be lower depending upon lender’s borrower benefits. Varies from lender to lender based on credit. Interest can range from 3%-18%. Borrower Parent. Loan is in parent’s name. Student. While loan is in student’s name, usually parent is included as a cosigner. Cosigner bears equal responsibility for loan repayment and loan will appear on parent’s credit bureau report as well. Loan Amounts Up to cost of student’s education minus other financial aid. Minimum and maximum borrowing limits vary from lender to lender. Some alternative loans have limits that may not cover the total amount you need. Cancellation Loan forgiven if student or parent dies. Not usually discharged if student dies. Interest Accrual Parent may postpone payments up to 4 years – interest accrued during postponed period is capitalized. Parents may also choose to make interest-only payments while student is in school. Interest accrues while student is in school. Some programs require student to make minimum monthly payments or interest-only payments while in school. If deferred, repayment usually begins 6 months after student graduates or leaves school. Deferment/Forbearance Deferment and forbearance options available. Varies from lender to lender. Check with lender for availability. Qualifying Based on credit history; debt-to-income is not considered, thus making it easier to qualify. Varies from lender to lender, but often debt-to-income ratio is considered in credit decision. Ease of Application Very easy. Parents can get pre-approved and/or apply by fax, telephone, or on-line. Usually more difficult. Supporting documentation generally required (proof of income, co-borrower addendum, etc. ). Fees Typically 3% origination fee. May be less depending on lender. Fees vary from lender to lender. May include origination and/or repayment fees. Fees can be as high as 16% or higher. Repayment Term 10 years. Varies among lenders. Typically, 10 -25 years. Consolidation 39 Fixed, capped at 7. 9% for Direct and 8. 5% for FFELP. Can be consolidated in a Federal Consolidation Loan. Cannot be added to a Federal Consolidation Loan.

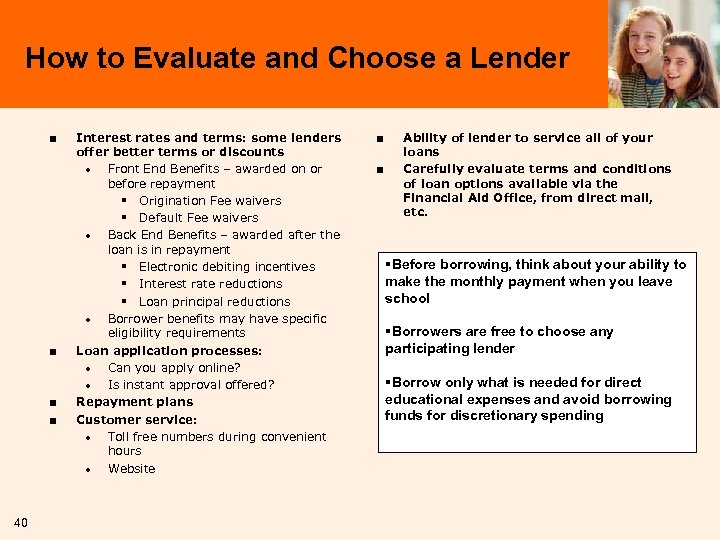

How to Evaluate and Choose a Lender ■ ■ 40 Interest rates and terms: some lenders offer better terms or discounts · Front End Benefits – awarded on or before repayment § Origination Fee waivers § Default Fee waivers · Back End Benefits – awarded after the loan is in repayment § Electronic debiting incentives § Interest rate reductions § Loan principal reductions · Borrower benefits may have specific eligibility requirements Loan application processes: · Can you apply online? · Is instant approval offered? Repayment plans Customer service: · Toll free numbers during convenient hours · Website ■ ■ Ability of lender to service all of your loans Carefully evaluate terms and conditions of loan options available via the Financial Aid Office, from direct mail, etc. §Before borrowing, think about your ability to make the monthly payment when you leave school §Borrowers are free to choose any participating lender §Borrow only what is needed for direct educational expenses and avoid borrowing funds for discretionary spending

How to Evaluate and Choose a Lender ■ ■ 40 Interest rates and terms: some lenders offer better terms or discounts · Front End Benefits – awarded on or before repayment § Origination Fee waivers § Default Fee waivers · Back End Benefits – awarded after the loan is in repayment § Electronic debiting incentives § Interest rate reductions § Loan principal reductions · Borrower benefits may have specific eligibility requirements Loan application processes: · Can you apply online? · Is instant approval offered? Repayment plans Customer service: · Toll free numbers during convenient hours · Website ■ ■ Ability of lender to service all of your loans Carefully evaluate terms and conditions of loan options available via the Financial Aid Office, from direct mail, etc. §Before borrowing, think about your ability to make the monthly payment when you leave school §Borrowers are free to choose any participating lender §Borrow only what is needed for direct educational expenses and avoid borrowing funds for discretionary spending

How to Compare College Financial Aid Offers ■ ■ ■ 41 Start with tuition, fees, room and board Subtract grant and scholarship offers only The difference is your “net cost” Always compare net cost Do not subtract Federal Work Study as a lump sum disbursement as students are paid for hours worked

How to Compare College Financial Aid Offers ■ ■ ■ 41 Start with tuition, fees, room and board Subtract grant and scholarship offers only The difference is your “net cost” Always compare net cost Do not subtract Federal Work Study as a lump sum disbursement as students are paid for hours worked

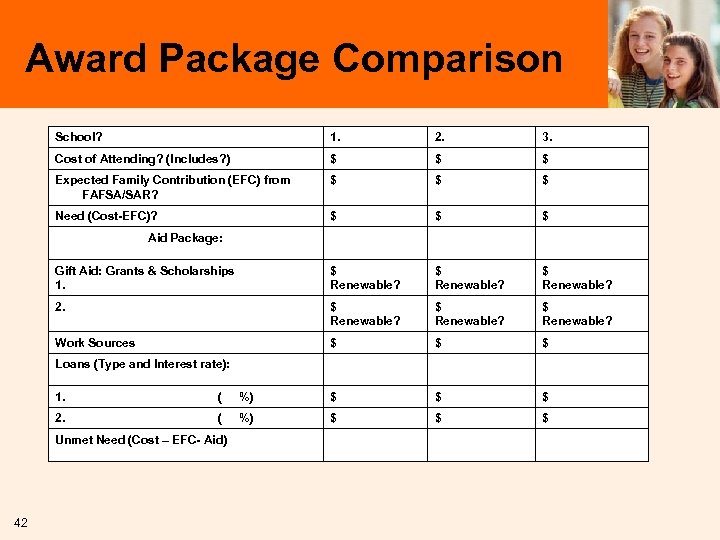

Award Package Comparison School? 1. 2. 3. Cost of Attending? (Includes? ) $ $ $ Expected Family Contribution (EFC) from FAFSA/SAR? $ $ $ Need (Cost-EFC)? $ $ $ Gift Aid: Grants & Scholarships 1. $ Renewable? 2. $ Renewable? Work Sources $ $ $ Aid Package: Loans (Type and Interest rate): 1. ( %) $ $ $ 2. ( %) $ $ $ Unmet Need (Cost – EFC- Aid) 42

Award Package Comparison School? 1. 2. 3. Cost of Attending? (Includes? ) $ $ $ Expected Family Contribution (EFC) from FAFSA/SAR? $ $ $ Need (Cost-EFC)? $ $ $ Gift Aid: Grants & Scholarships 1. $ Renewable? 2. $ Renewable? Work Sources $ $ $ Aid Package: Loans (Type and Interest rate): 1. ( %) $ $ $ 2. ( %) $ $ $ Unmet Need (Cost – EFC- Aid) 42

Other Financing Options ■ School Payment Plans (spread over several months) ■ Home Equity Loans (longer repayment, tax deductible) ■ Life Insurance Policy Loans ■ Pension Plan Loans ■ 529 Plan withdrawals ■ Wisconsin Tuition Remission for Vets 43

Other Financing Options ■ School Payment Plans (spread over several months) ■ Home Equity Loans (longer repayment, tax deductible) ■ Life Insurance Policy Loans ■ Pension Plan Loans ■ 529 Plan withdrawals ■ Wisconsin Tuition Remission for Vets 43

Need versus Merit Aid ■ Aid based on financial need · · Most government grants Subsidized student loans Perkins loans Federal Work-Study ■ Aid based on merit · Academic and athletic scholarships · Some government grants ■ Some scholarships require merit and need 44

Need versus Merit Aid ■ Aid based on financial need · · Most government grants Subsidized student loans Perkins loans Federal Work-Study ■ Aid based on merit · Academic and athletic scholarships · Some government grants ■ Some scholarships require merit and need 44

Government Resources ■ ■ ■ Corporation for National and Community Service Veteran’s benefits and tuition waivers ROTC Scholarships and/or stipends Bureau of Indian Affairs (BIA) Grants State Divisions of Vocational Rehabilitation (DVR) ■ Health and Human Services Loan and Scholarship Programs 45

Government Resources ■ ■ ■ Corporation for National and Community Service Veteran’s benefits and tuition waivers ROTC Scholarships and/or stipends Bureau of Indian Affairs (BIA) Grants State Divisions of Vocational Rehabilitation (DVR) ■ Health and Human Services Loan and Scholarship Programs 45

Other Sources of Funds ■ Parental Affiliations · Employers & Labor Unions · Religious and Community Organizations · Clubs and Civic groups ■ Civic organization scholarships · High School · Local Public Library ■ Private business scholarships 46

Other Sources of Funds ■ Parental Affiliations · Employers & Labor Unions · Religious and Community Organizations · Clubs and Civic groups ■ Civic organization scholarships · High School · Local Public Library ■ Private business scholarships 46

FREE Scholarship Services 47

FREE Scholarship Services 47

Role of the Financial Aid Office ■ Answers your questions · FERPA restrictions ■ Determines financial need eligibility for various types of financial aid ■ Verifies applicant data when required ■ Develops policy and procedures to distribute aid ■ Packages aid from all available sources ■ Sends award notification letters/e-mails with information on: · · 48 Costs Amount awarded from each aid program How and when aid will be disbursed Terms and conditions of student’s award

Role of the Financial Aid Office ■ Answers your questions · FERPA restrictions ■ Determines financial need eligibility for various types of financial aid ■ Verifies applicant data when required ■ Develops policy and procedures to distribute aid ■ Packages aid from all available sources ■ Sends award notification letters/e-mails with information on: · · 48 Costs Amount awarded from each aid program How and when aid will be disbursed Terms and conditions of student’s award

Role of the Business Office ■ ■ ■ ■ Calculates tuition, meals and other fees Sends billing statements Credits financial aid to the student’s account Sets up payment plans, if available Processes student checks Returns financial aid funds that are unearned Collects payments for charges on student’s account ■ Sends out 1098 T for tax purposes 49

Role of the Business Office ■ ■ ■ ■ Calculates tuition, meals and other fees Sends billing statements Credits financial aid to the student’s account Sets up payment plans, if available Processes student checks Returns financial aid funds that are unearned Collects payments for charges on student’s account ■ Sends out 1098 T for tax purposes 49

Sample Questions for the Financial Aid Office 1) What is the average cost for the first year? Estimates for future years? 2) 3) What type of aid does the school have? Need-based or Merit? 4) What applications, besides the FAFSA, are needed to apply for aid? 5) What is the priority deadline date for all types of financial aid? 6) When will I be notified about a financial aid award? 7) How does the aid package normally change from year to year? 8) What are the conditions of the aid package? 9) Is there an opportunity to appeal if the package isn’t enough? 10) 50 Does applying for aid affect the admission decision? How does the college bill for tuition, fees, etc. ? If you have any other questions or concern about the financial aid process, contact the financial aid office at your school. Your Financial Aid Administrator is there to help.

Sample Questions for the Financial Aid Office 1) What is the average cost for the first year? Estimates for future years? 2) 3) What type of aid does the school have? Need-based or Merit? 4) What applications, besides the FAFSA, are needed to apply for aid? 5) What is the priority deadline date for all types of financial aid? 6) When will I be notified about a financial aid award? 7) How does the aid package normally change from year to year? 8) What are the conditions of the aid package? 9) Is there an opportunity to appeal if the package isn’t enough? 10) 50 Does applying for aid affect the admission decision? How does the college bill for tuition, fees, etc. ? If you have any other questions or concern about the financial aid process, contact the financial aid office at your school. Your Financial Aid Administrator is there to help.

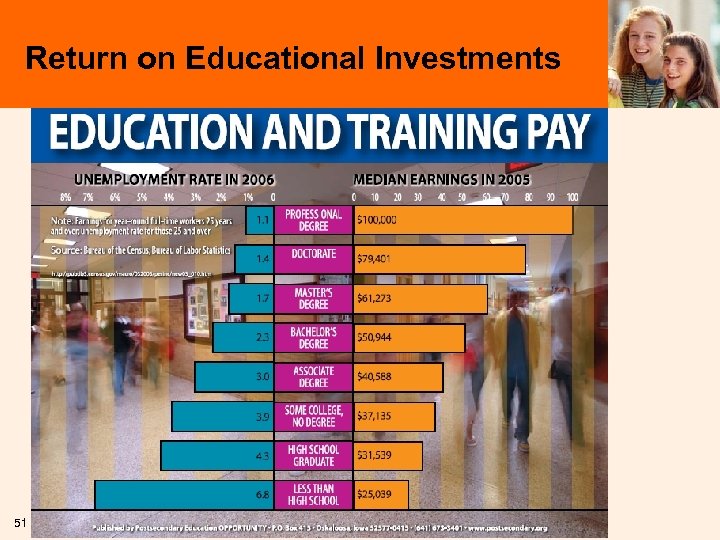

Return on Educational Investments 51

Return on Educational Investments 51

Questions? ? ? 52

Questions? ? ? 52

53

53

State of Wisconsin Higher Educational Aids Board

State of Wisconsin Higher Educational Aids Board

Financial Aid is a… …Shared Responsibility ■ ■ 55 Students Parents State and Federal Governments Private Sources

Financial Aid is a… …Shared Responsibility ■ ■ 55 Students Parents State and Federal Governments Private Sources

Goals of State Financial Aid ■ Eliminate financial barriers and ensure educational opportunity for all Wisconsin citizens consistent with their individual abilities, interests, and ambitions. ■ Support educational diversity by allowing students freedom to choose among the various educational offerings. 56

Goals of State Financial Aid ■ Eliminate financial barriers and ensure educational opportunity for all Wisconsin citizens consistent with their individual abilities, interests, and ambitions. ■ Support educational diversity by allowing students freedom to choose among the various educational offerings. 56

Who May Receive State Aid? State financial aid is available to residents of the State of Wisconsin enrolled at non-profit colleges and universities based in Wisconsin: ■ University of Wisconsin System ■ Wisconsin Technical Colleges ■ Independent Colleges & Universities ■ Tribal Colleges 57

Who May Receive State Aid? State financial aid is available to residents of the State of Wisconsin enrolled at non-profit colleges and universities based in Wisconsin: ■ University of Wisconsin System ■ Wisconsin Technical Colleges ■ Independent Colleges & Universities ■ Tribal Colleges 57

Who May Not Receive State Aid? State statutes prohibit students from receiving state financial aid who are: ■ ■ Not registered with Selective Service Listed on the Dept. of Workforce Development’s statewide Child Support Lien Docket · Students on the Lien Docket may still receive state loans 58

Who May Not Receive State Aid? State statutes prohibit students from receiving state financial aid who are: ■ ■ Not registered with Selective Service Listed on the Dept. of Workforce Development’s statewide Child Support Lien Docket · Students on the Lien Docket may still receive state loans 58

Applying for State Aid Free Application for Federal Student Aid ■ ■ HEAB receives FAFSA data for all Wisconsin residents. The FAFSA is the only application for Wisconsin's 2 major grant programs: · Wisconsin Higher Education Grant (UW, Technical Colleges, Tribal Colleges) · Wisconsin Tuition Grant (Independent Colleges & Universities) 59

Applying for State Aid Free Application for Federal Student Aid ■ ■ HEAB receives FAFSA data for all Wisconsin residents. The FAFSA is the only application for Wisconsin's 2 major grant programs: · Wisconsin Higher Education Grant (UW, Technical Colleges, Tribal Colleges) · Wisconsin Tuition Grant (Independent Colleges & Universities) 59

State Financial Aid Programs for Students with Financial Need Student must file the Free Application for Federal Student Aid (FAFSA) Wisconsin Higher Education Grant Wisconsin Tuition Grant Programs for Students with Financial Need who must also meet Additional Requirements - FAFSA and additional Application or Nomination Hearing & Visually Handicapped Student Grant Indian Student Assistance Grant Minority Undergraduate Retention Grant Nursing Student Loan Talent Incentive Program Grant Programs Not Based on Financial Need - Do not require the FAFSA Academic Excellence Scholarship Minnesota-Wisconsin Tuition Reciprocity Program Minority Teacher Loan Teacher of the Visually Impaired Loan 60

State Financial Aid Programs for Students with Financial Need Student must file the Free Application for Federal Student Aid (FAFSA) Wisconsin Higher Education Grant Wisconsin Tuition Grant Programs for Students with Financial Need who must also meet Additional Requirements - FAFSA and additional Application or Nomination Hearing & Visually Handicapped Student Grant Indian Student Assistance Grant Minority Undergraduate Retention Grant Nursing Student Loan Talent Incentive Program Grant Programs Not Based on Financial Need - Do not require the FAFSA Academic Excellence Scholarship Minnesota-Wisconsin Tuition Reciprocity Program Minority Teacher Loan Teacher of the Visually Impaired Loan 60

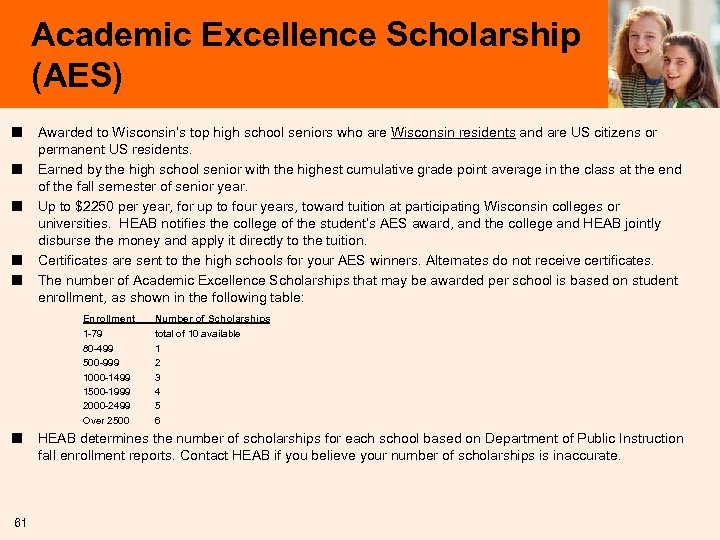

Academic Excellence Scholarship (AES) ■ ■ ■ Awarded to Wisconsin’s top high school seniors who are Wisconsin residents and are US citizens or permanent US residents. Earned by the high school senior with the highest cumulative grade point average in the class at the end of the fall semester of senior year. Up to $2250 per year, for up to four years, toward tuition at participating Wisconsin colleges or universities. HEAB notifies the college of the student’s AES award, and the college and HEAB jointly disburse the money and apply it directly to the tuition. Certificates are sent to the high schools for your AES winners. Alternates do not receive certificates. The number of Academic Excellence Scholarships that may be awarded per school is based on student enrollment, as shown in the following table: Enrollment ■ 61 Number of Scholarships 1 -79 80 -499 500 -999 1000 -1499 1500 -1999 2000 -2499 Over 2500 total of 10 available 1 2 3 4 5 6 HEAB determines the number of scholarships for each school based on Department of Public Instruction fall enrollment reports. Contact HEAB if you believe your number of scholarships is inaccurate.

Academic Excellence Scholarship (AES) ■ ■ ■ Awarded to Wisconsin’s top high school seniors who are Wisconsin residents and are US citizens or permanent US residents. Earned by the high school senior with the highest cumulative grade point average in the class at the end of the fall semester of senior year. Up to $2250 per year, for up to four years, toward tuition at participating Wisconsin colleges or universities. HEAB notifies the college of the student’s AES award, and the college and HEAB jointly disburse the money and apply it directly to the tuition. Certificates are sent to the high schools for your AES winners. Alternates do not receive certificates. The number of Academic Excellence Scholarships that may be awarded per school is based on student enrollment, as shown in the following table: Enrollment ■ 61 Number of Scholarships 1 -79 80 -499 500 -999 1000 -1499 1500 -1999 2000 -2499 Over 2500 total of 10 available 1 2 3 4 5 6 HEAB determines the number of scholarships for each school based on Department of Public Instruction fall enrollment reports. Contact HEAB if you believe your number of scholarships is inaccurate.

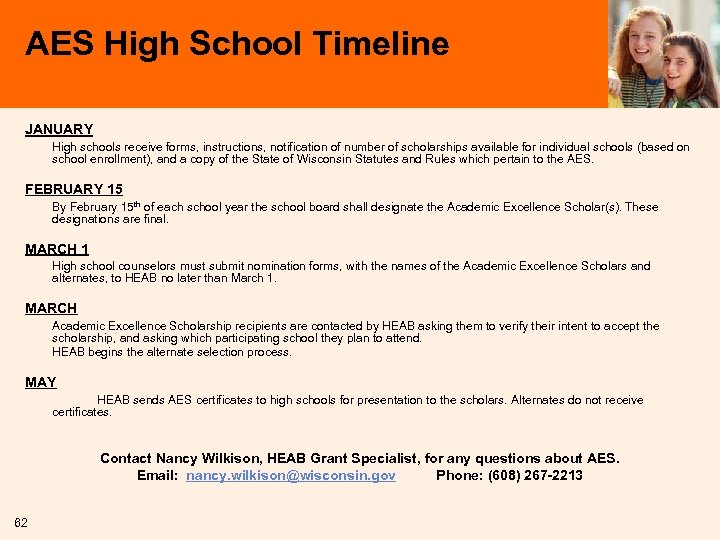

AES High School Timeline JANUARY High schools receive forms, instructions, notification of number of scholarships available for individual schools (based on school enrollment), and a copy of the State of Wisconsin Statutes and Rules which pertain to the AES. FEBRUARY 15 By February 15 th of each school year the school board shall designate the Academic Excellence Scholar(s). These designations are final. MARCH 1 High school counselors must submit nomination forms, with the names of the Academic Excellence Scholars and alternates, to HEAB no later than March 1. MARCH Academic Excellence Scholarship recipients are contacted by HEAB asking them to verify their intent to accept the scholarship, and asking which participating school they plan to attend. HEAB begins the alternate selection process. MAY HEAB sends AES certificates to high schools for presentation to the scholars. Alternates do not receive certificates. Contact Nancy Wilkison, HEAB Grant Specialist, for any questions about AES. Email: nancy. wilkison@wisconsin. gov Phone: (608) 267 -2213 62

AES High School Timeline JANUARY High schools receive forms, instructions, notification of number of scholarships available for individual schools (based on school enrollment), and a copy of the State of Wisconsin Statutes and Rules which pertain to the AES. FEBRUARY 15 By February 15 th of each school year the school board shall designate the Academic Excellence Scholar(s). These designations are final. MARCH 1 High school counselors must submit nomination forms, with the names of the Academic Excellence Scholars and alternates, to HEAB no later than March 1. MARCH Academic Excellence Scholarship recipients are contacted by HEAB asking them to verify their intent to accept the scholarship, and asking which participating school they plan to attend. HEAB begins the alternate selection process. MAY HEAB sends AES certificates to high schools for presentation to the scholars. Alternates do not receive certificates. Contact Nancy Wilkison, HEAB Grant Specialist, for any questions about AES. Email: nancy. wilkison@wisconsin. gov Phone: (608) 267 -2213 62

AES Tips for Guidance Counselors § The scholarship recipient(s) you list should be the student(s) with the highest cumulative GPAs at the end of the fall semester of senior year, regardless of whether or not they plan to accept the Academic Excellence Scholarship. § Your districts are required to have a tie-breaking strategy in place in the event that more than one student shares the highest cumulative GPA. § The required number of semesters of enrollment for a student to be eligible for the AES is determined by each school district as part of your Board Policy. § § § If you have an un-weighted, or traditional, grading system, alternates for the AES must have the very same GPA as the winner of the AES. If you have a weighted grading system, alternates are listed in order of the next highest GPAs. The cumulative GPA for each student should be reported exactly as it is shown on your official high school transcript. § Student names should be written exactly as the student wishes it to appear on the certificate. § Schools should inform all recipients and alternates of their AES status as early as possible. § Please encourage recipients to return their paperwork to HEAB as soon as possible. Those who will not be attending a participating school should be reminded that alternates may be waiting in the wings! 63

AES Tips for Guidance Counselors § The scholarship recipient(s) you list should be the student(s) with the highest cumulative GPAs at the end of the fall semester of senior year, regardless of whether or not they plan to accept the Academic Excellence Scholarship. § Your districts are required to have a tie-breaking strategy in place in the event that more than one student shares the highest cumulative GPA. § The required number of semesters of enrollment for a student to be eligible for the AES is determined by each school district as part of your Board Policy. § § § If you have an un-weighted, or traditional, grading system, alternates for the AES must have the very same GPA as the winner of the AES. If you have a weighted grading system, alternates are listed in order of the next highest GPAs. The cumulative GPA for each student should be reported exactly as it is shown on your official high school transcript. § Student names should be written exactly as the student wishes it to appear on the certificate. § Schools should inform all recipients and alternates of their AES status as early as possible. § Please encourage recipients to return their paperwork to HEAB as soon as possible. Those who will not be attending a participating school should be reminded that alternates may be waiting in the wings! 63

Receiving State Financial Aid ■ HEAB notifies the college or university financial aid offices of each student’s eligibility for state financial aid. ■ The financial aid offices include the state aid in the student’s financial aid package. 64

Receiving State Financial Aid ■ HEAB notifies the college or university financial aid offices of each student’s eligibility for state financial aid. ■ The financial aid offices include the state aid in the student’s financial aid package. 64

Contacting HEAB State of Wisconsin Higher Educational Aids Board P. O. Box 7885 Madison, WI 53707 -7885 (608) 267 -2206 Fax: (608) 267 -2808 E-Mail: HEABmail@heab. state. wi. us Web Page: heab. wi. gov 65

Contacting HEAB State of Wisconsin Higher Educational Aids Board P. O. Box 7885 Madison, WI 53707 -7885 (608) 267 -2206 Fax: (608) 267 -2808 E-Mail: HEABmail@heab. state. wi. us Web Page: heab. wi. gov 65

Wisconsin Department of Public Instruction Wisconsin Educational Opportunity Programs

Wisconsin Department of Public Instruction Wisconsin Educational Opportunity Programs

WEOP Offices Ashland 715 -682 -7975 Eau-Claire 715 -836 -3171 Green Bay 920 -492 -5745 Madison 608 -267 -1058 Milwaukee 414 -227 -4466 Racine 262 -638 -7370 Wausau 715 -842 -0871 www. dpi. state. wi. us 67

WEOP Offices Ashland 715 -682 -7975 Eau-Claire 715 -836 -3171 Green Bay 920 -492 -5745 Madison 608 -267 -1058 Milwaukee 414 -227 -4466 Racine 262 -638 -7370 Wausau 715 -842 -0871 www. dpi. state. wi. us 67

What is WEOP? WEOP is a component of the Department of Public Instruction. Our purpose is to help educationally and economically disadvantaged students continue their education through select statewide programs. 68

What is WEOP? WEOP is a component of the Department of Public Instruction. Our purpose is to help educationally and economically disadvantaged students continue their education through select statewide programs. 68

WEOP Programs ■ ■ ■ State Talent Search Program Talent Incentive Program (TIP) Pre. College Scholarship Program Early Identification Program (EIP) Federal GEAR UP Program (GU) Federal Upward Bound Program · (Wausau Office only) ■ Federal Talent Search Program · (Ashland, Eau Claire, Green Bay, and Wausau offices only) 69

WEOP Programs ■ ■ ■ State Talent Search Program Talent Incentive Program (TIP) Pre. College Scholarship Program Early Identification Program (EIP) Federal GEAR UP Program (GU) Federal Upward Bound Program · (Wausau Office only) ■ Federal Talent Search Program · (Ashland, Eau Claire, Green Bay, and Wausau offices only) 69

State Talent Search Program ■ Individual advising regarding financial aid, admissions and careers ■ Assist with the college and financial aid application process ■ Identify and recommend students for the TIP Grant ■ Recommend students for the GEAR UP scholarship ■ Assist students in identifying scholarship sources ■ Make financial aid presentations to parents, students, and community groups 70

State Talent Search Program ■ Individual advising regarding financial aid, admissions and careers ■ Assist with the college and financial aid application process ■ Identify and recommend students for the TIP Grant ■ Recommend students for the GEAR UP scholarship ■ Assist students in identifying scholarship sources ■ Make financial aid presentations to parents, students, and community groups 70

Talent Incentive Program (TIP) TIP Grant Purpose: Assist disadvantaged, low-income students with limited financial resources 71

Talent Incentive Program (TIP) TIP Grant Purpose: Assist disadvantaged, low-income students with limited financial resources 71

Benefits of the TIP Grant ■ Grant ranges from $600 -$1800 per year ■ Automatically renewable if student applies for financial aid and is continuously enrolled ■ Available for 10 consecutive semesters 72

Benefits of the TIP Grant ■ Grant ranges from $600 -$1800 per year ■ Automatically renewable if student applies for financial aid and is continuously enrolled ■ Available for 10 consecutive semesters 72

TIP Guidelines ■ Must be a WI resident ■ Attend a HEAB approved post-secondary institution (WI technical, public or private college/university) ■ Be a first time college freshman (A student who has been enrolled in a post-secondary institution for less than two semesters at half time or greater status since attending high school. ) ■ Must meet the following criteria: 73

TIP Guidelines ■ Must be a WI resident ■ Attend a HEAB approved post-secondary institution (WI technical, public or private college/university) ■ Be a first time college freshman (A student who has been enrolled in a post-secondary institution for less than two semesters at half time or greater status since attending high school. ) ■ Must meet the following criteria: 73

TIP Criteria ■ A student must meet one criteria from Group A and one from Group B · Group A is based on financial need · Group B is based on other factors ■ The criteria is based on dependent or independent status for financial aid purposes 74

TIP Criteria ■ A student must meet one criteria from Group A and one from Group B · Group A is based on financial need · Group B is based on other factors ■ The criteria is based on dependent or independent status for financial aid purposes 74

Group A Dependent Student 1. Parent contribution at or below $200 2. Family receives TANF benefits 3. Parents unemployed and have no current income from employment 75

Group A Dependent Student 1. Parent contribution at or below $200 2. Family receives TANF benefits 3. Parents unemployed and have no current income from employment 75

Group A Independent Student 1. A student contribution at or below $200 2. A student receives TANF benefits 3. A student is unemployed and receives no income from employment 76

Group A Independent Student 1. A student contribution at or below $200 2. A student receives TANF benefits 3. A student is unemployed and receives no income from employment 76

Group B A student must meet one of these criteria: ■ Be a member of a minority group ■ Be enrolled in a special academic support program at college ■ Be a first generation (neither parent graduated from a 4 -year college) ■ Be a DVR Client ■ Be formerly incarcerated ■ Have special family circumstances that may deter the student from pursuing a post-secondary education 77

Group B A student must meet one of these criteria: ■ Be a member of a minority group ■ Be enrolled in a special academic support program at college ■ Be a first generation (neither parent graduated from a 4 -year college) ■ Be a DVR Client ■ Be formerly incarcerated ■ Have special family circumstances that may deter the student from pursuing a post-secondary education 77

Required Documentation ■ ■ ■ 78 College Letter of Acceptance or Class Schedule Student Aid Report (SAR) Prior Year Tax Forms Verification of untaxed income Financial Aid Award Letter

Required Documentation ■ ■ ■ 78 College Letter of Acceptance or Class Schedule Student Aid Report (SAR) Prior Year Tax Forms Verification of untaxed income Financial Aid Award Letter

How to apply? ■ Contact your nearest WEOP office ■ Download the application at: www. dpi. state. wi. us/weop/index. html 79

How to apply? ■ Contact your nearest WEOP office ■ Download the application at: www. dpi. state. wi. us/weop/index. html 79

Pre. College Scholarship Program ■ Available to Wisconsin students in grades 6 -12 who are eligible for free or reduced lunch. ■ Must be attending a Wisconsin academic pre-college program ■ Must have a 2. 0 or better GPA to receive a scholarship ■ Covers tuition, books, supplies, room and board ■ Application must be signed by guidance counselor, teacher, principal or WEOP counselor and a parent or legal guardian The application is available at: www. dpi. state. wi. us/weop/index. html 80

Pre. College Scholarship Program ■ Available to Wisconsin students in grades 6 -12 who are eligible for free or reduced lunch. ■ Must be attending a Wisconsin academic pre-college program ■ Must have a 2. 0 or better GPA to receive a scholarship ■ Covers tuition, books, supplies, room and board ■ Application must be signed by guidance counselor, teacher, principal or WEOP counselor and a parent or legal guardian The application is available at: www. dpi. state. wi. us/weop/index. html 80

EIP, FTS, UB, GU Guidelines ■ Grades 6 -12 ■ Programs emphasize: · · · Academic Achievement Tutoring Mentoring Parent Involvement College Visits Early Awareness ■ Programs are provided to: · Targeted School Districts · Students who meet federal income guidelines 81

EIP, FTS, UB, GU Guidelines ■ Grades 6 -12 ■ Programs emphasize: · · · Academic Achievement Tutoring Mentoring Parent Involvement College Visits Early Awareness ■ Programs are provided to: · Targeted School Districts · Students who meet federal income guidelines 81

GEAR UP Scholarship Eligible participants: ■ Are GEAR UP, EIP or Federal Trio students who are eligible for the TIP grant ■ Must be nominated by a WEOP Counselor ■ Must attend a public, private, or technical college in Wisconsin ■ Can receive this renewable scholarship for 10 consecutive semesters of attendance 82

GEAR UP Scholarship Eligible participants: ■ Are GEAR UP, EIP or Federal Trio students who are eligible for the TIP grant ■ Must be nominated by a WEOP Counselor ■ Must attend a public, private, or technical college in Wisconsin ■ Can receive this renewable scholarship for 10 consecutive semesters of attendance 82

WEOP Offices 620 Beaser Avenue Ashland, WI 54806 (715)682 -7975 125 South Webster Street, Room 309 Madison, WI 53707 (608)267 -1058 204 E. Grand Avenue, 5 th Floor Eau Claire, WI 54701 (715)836 -3171 2113 N. Wisconsin Racine, WI 53402 (262)638 -7370 2140 Holmgren Way Green Bay, WI 54304 (920)492 -5745 133 River Drive Wausau, WI 54403 (715)842 -0871 101 W. Pleasant Street, Suite 204 Milwaukee, WI 53212 (414)227 -4466 83

WEOP Offices 620 Beaser Avenue Ashland, WI 54806 (715)682 -7975 125 South Webster Street, Room 309 Madison, WI 53707 (608)267 -1058 204 E. Grand Avenue, 5 th Floor Eau Claire, WI 54701 (715)836 -3171 2113 N. Wisconsin Racine, WI 53402 (262)638 -7370 2140 Holmgren Way Green Bay, WI 54304 (920)492 -5745 133 River Drive Wausau, WI 54403 (715)842 -0871 101 W. Pleasant Street, Suite 204 Milwaukee, WI 53212 (414)227 -4466 83

Thanks Questions or Comments? 84

Thanks Questions or Comments? 84

Special Topics in Financial Aid

Special Topics in Financial Aid

Special Topics in Financial Aid ■ ■ ■ 86 Don’t Get Scammed Common Errors Special Circumstances Processing Tool Kit Internet Resources

Special Topics in Financial Aid ■ ■ ■ 86 Don’t Get Scammed Common Errors Special Circumstances Processing Tool Kit Internet Resources

Don’t Get Scammed on Your Way to College Consumer complaints are mainly about business practices: ■ College prep/financial aid advice services ■ FAFSA for a fee Be aware of tactics used to convince students to buy services: ■ “If you use our services, you’re guaranteed to get at least $2000 in student aid for college, or we’ll give your money back. ” ■ “Applying for aid is complicated. We’re the only ones who can help you through the process and find all the aid for which you’re eligible. ” ■ “I’d like to offer you a scholarship (or grant). All I need is your bank account information so the money can be deposited and a processing fee charged. ” Contact your nearest college financial aid office if you have questions regarding the legitimacy of any questionable offer 87

Don’t Get Scammed on Your Way to College Consumer complaints are mainly about business practices: ■ College prep/financial aid advice services ■ FAFSA for a fee Be aware of tactics used to convince students to buy services: ■ “If you use our services, you’re guaranteed to get at least $2000 in student aid for college, or we’ll give your money back. ” ■ “Applying for aid is complicated. We’re the only ones who can help you through the process and find all the aid for which you’re eligible. ” ■ “I’d like to offer you a scholarship (or grant). All I need is your bank account information so the money can be deposited and a processing fee charged. ” Contact your nearest college financial aid office if you have questions regarding the legitimacy of any questionable offer 87

Proceed with Caution! ■ Avoid being charged a fee to file the FAFSA · Processes of completing and processing the FAFSA are FREE · If filing FAFSA on the Web, make sure you go directly to: www. fafsa. ed. gov (not www. fafsa. com) · Contact the financial aid office if you need help in completing the FAFSA 88

Proceed with Caution! ■ Avoid being charged a fee to file the FAFSA · Processes of completing and processing the FAFSA are FREE · If filing FAFSA on the Web, make sure you go directly to: www. fafsa. ed. gov (not www. fafsa. com) · Contact the financial aid office if you need help in completing the FAFSA 88

Frequent FAFSA Errors ■ ■ ■ 89 Missing Signatures/PIN Wrong Social Security Number Divorced/remarried parent information Income earned by parents/stepparents Untaxed income U. S. income taxes paid Household size Number in postsecondary education Real estate and investment net worth Not using real name NOT APPLYING AT ALL

Frequent FAFSA Errors ■ ■ ■ 89 Missing Signatures/PIN Wrong Social Security Number Divorced/remarried parent information Income earned by parents/stepparents Untaxed income U. S. income taxes paid Household size Number in postsecondary education Real estate and investment net worth Not using real name NOT APPLYING AT ALL

Dependency Status ■ ■ ■ At least 24 years old; Graduate or professional student; Married; Has child for whom student provides more than half support; Has dependent other than child or spouse who lives with student and for whom provides more than half support; ■ Orphan or ward of the court; ■ Veteran of the U. S. Armed Forces or currently serving active duty for other than training purposes in the U. S. Armed forces; or ■ Determined to be independent by the financial aid administrator (Parents refusal to provide support or financial data is insufficient to make a student independent regardless of tax filing status) 90

Dependency Status ■ ■ ■ At least 24 years old; Graduate or professional student; Married; Has child for whom student provides more than half support; Has dependent other than child or spouse who lives with student and for whom provides more than half support; ■ Orphan or ward of the court; ■ Veteran of the U. S. Armed Forces or currently serving active duty for other than training purposes in the U. S. Armed forces; or ■ Determined to be independent by the financial aid administrator (Parents refusal to provide support or financial data is insufficient to make a student independent regardless of tax filing status) 90

For Federal Methodology Who is a Parent? ■ ■ ■ 91 Two biological parents married to each other Divorced or separated parents Stepparent Widowed parent Legal adoptive parent

For Federal Methodology Who is a Parent? ■ ■ ■ 91 Two biological parents married to each other Divorced or separated parents Stepparent Widowed parent Legal adoptive parent

Divorced/Separated Issues ■ FAFSA is to be completed by parent with whom the student is living, regardless of who claims student on taxes or what divorce decree states. ■ If parent has remarried, stepparent information must be included on the FAFSA. ■ Some higher-cost schools will ask for a Divorced/Separated Supplement to be completed on other parent to determine eligibility for college programs. 92

Divorced/Separated Issues ■ FAFSA is to be completed by parent with whom the student is living, regardless of who claims student on taxes or what divorce decree states. ■ If parent has remarried, stepparent information must be included on the FAFSA. ■ Some higher-cost schools will ask for a Divorced/Separated Supplement to be completed on other parent to determine eligibility for college programs. 92

After you file the FAFSA 93 ■ Results are sent electronically to the college(s) the student selected. ■ Students & Parents will receive the results of their FAFSA by e-mail (or regular mail) - Student Aid Report (SAR). ■ Students may be required to verify the information submitted on the FAFSA (submit tax forms). ■ Contact the college with any Special Circumstances. ■ After the student is admitted to a college, a financial aid package will be prepared.

After you file the FAFSA 93 ■ Results are sent electronically to the college(s) the student selected. ■ Students & Parents will receive the results of their FAFSA by e-mail (or regular mail) - Student Aid Report (SAR). ■ Students may be required to verify the information submitted on the FAFSA (submit tax forms). ■ Contact the college with any Special Circumstances. ■ After the student is admitted to a college, a financial aid package will be prepared.

Special Circumstances? Call the Financial Aid Office ■ ■ ■ Divorce/Separation Loss of income or benefits One-time income Death or Disability of student or parent Medical/Dental expenses not covered by insurance ■ Elementary or secondary school tuition ■ Dependency override (Note: Professional Judgement is at the sole discretion of each institution. ) 94

Special Circumstances? Call the Financial Aid Office ■ ■ ■ Divorce/Separation Loss of income or benefits One-time income Death or Disability of student or parent Medical/Dental expenses not covered by insurance ■ Elementary or secondary school tuition ■ Dependency override (Note: Professional Judgement is at the sole discretion of each institution. ) 94

Professional Judgment by Financial Aid Administrators ■ Adjustments are determined by each institution on a case by case basis. ■ Another institution cannot automatically accept a professional judgment made by another institution. ■ The decision must recognize the unique situation of the student and must be documented. 95

Professional Judgment by Financial Aid Administrators ■ Adjustments are determined by each institution on a case by case basis. ■ Another institution cannot automatically accept a professional judgment made by another institution. ■ The decision must recognize the unique situation of the student and must be documented. 95

FAFSA on the Web and Renewal FAFSA on the Web ■ Parents with multiple children in college can continue to transfer information to additional applications ■ Link on confirmation page to “Begin a new application with parent data already filled in? ” will display only for – · Dependent students · Independent students who provided parent data on the application 96

FAFSA on the Web and Renewal FAFSA on the Web ■ Parents with multiple children in college can continue to transfer information to additional applications ■ Link on confirmation page to “Begin a new application with parent data already filled in? ” will display only for – · Dependent students · Independent students who provided parent data on the application 96

E-Mail Correspondence ■ When e-mails with links to SAR information on the Web are returned as undeliverable, a paper SAR or SAR Acknowledgement will be generated and mailed to student ■ Spanish e-mail notifications will be sent to students and parents who submitted Spanishlanguage applications and provided valid e-mail addresses 97

E-Mail Correspondence ■ When e-mails with links to SAR information on the Web are returned as undeliverable, a paper SAR or SAR Acknowledgement will be generated and mailed to student ■ Spanish e-mail notifications will be sent to students and parents who submitted Spanishlanguage applications and provided valid e-mail addresses 97

What’s So Great About Doing the FAFSA Online? You should use FAFSA on the Web instead of paper because: ■ It’s quick… · · ■ It’s easy… · · · ■ Automatically edits data as you enter it and detects errors for correction before submission Due to edits and online help, less likely to de delayed by the need for corrections It’s safe… · 98 Detailed help screens for every question Live, private online help is available Skip logic: asks only what you must answer – skips questions that don’t apply Access from anywhere Electronic signature using PIN English or Spanish versions It’s accurate… · · ■ Results back up to three weeks faster Speed may be important for schools awarding limited resources Instant access to EFC estimate Electronic Student Aid Report (SAR) sent to email provided FASFA on the Web uses encryption to protect confidentiality of data

What’s So Great About Doing the FAFSA Online? You should use FAFSA on the Web instead of paper because: ■ It’s quick… · · ■ It’s easy… · · · ■ Automatically edits data as you enter it and detects errors for correction before submission Due to edits and online help, less likely to de delayed by the need for corrections It’s safe… · 98 Detailed help screens for every question Live, private online help is available Skip logic: asks only what you must answer – skips questions that don’t apply Access from anywhere Electronic signature using PIN English or Spanish versions It’s accurate… · · ■ Results back up to three weeks faster Speed may be important for schools awarding limited resources Instant access to EFC estimate Electronic Student Aid Report (SAR) sent to email provided FASFA on the Web uses encryption to protect confidentiality of data

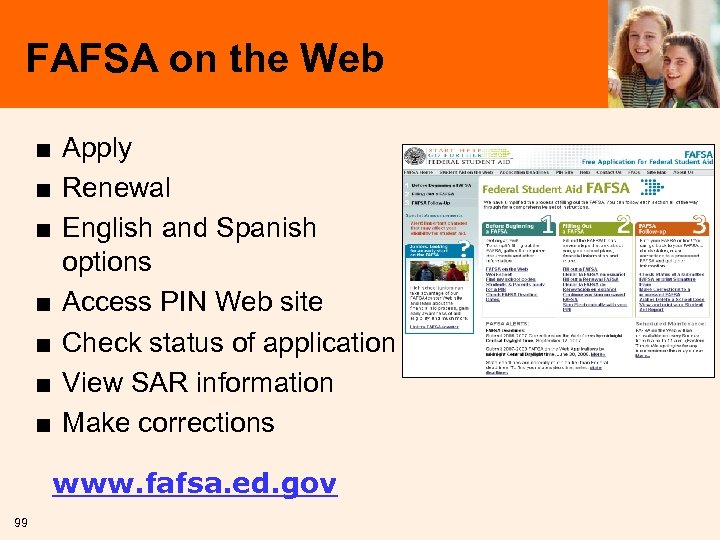

FAFSA on the Web ■ Apply ■ Renewal ■ English and Spanish options ■ Access PIN Web site ■ Check status of application ■ View SAR information ■ Make corrections www. fafsa. ed. gov 99

FAFSA on the Web ■ Apply ■ Renewal ■ English and Spanish options ■ Access PIN Web site ■ Check status of application ■ View SAR information ■ Make corrections www. fafsa. ed. gov 99

There is always the 2008 -2009 Paper FAFSA ■ 2008 -2009 · Orange for students · Purple for parents ■ FAFSA will include · Insert 100

There is always the 2008 -2009 Paper FAFSA ■ 2008 -2009 · Orange for students · Purple for parents ■ FAFSA will include · Insert 100

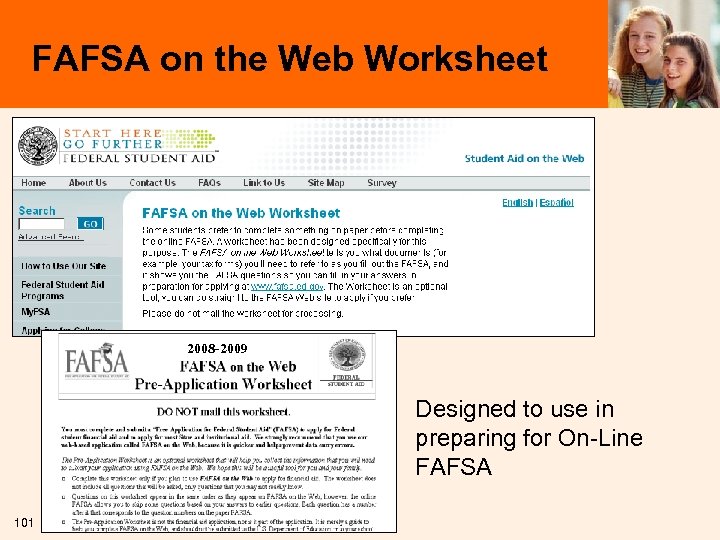

FAFSA on the Web Worksheet 2008 -2009 Designed to use in preparing for On-Line FAFSA 101

FAFSA on the Web Worksheet 2008 -2009 Designed to use in preparing for On-Line FAFSA 101

Student Aid Communications ■ ■ 102 FAFSA on the Web Student Aid Report (SAR) E-mail Notifications Paper FAFSA

Student Aid Communications ■ ■ 102 FAFSA on the Web Student Aid Report (SAR) E-mail Notifications Paper FAFSA

2008 -2009 FAFSA ■ FAFSA Questions · Question order remains the same · No new questions added · No questions deleted 103

2008 -2009 FAFSA ■ FAFSA Questions · Question order remains the same · No new questions added · No questions deleted 103

2008 -2009 Changes ■ Real-Time PIN · Issued upon request (FOTW or PIN Site) · Valid for FAFSA unless subsequent SSA match fails ■ Number of School Choices · Increased to ten on FOTW · Remains four on paper ■ Non-Filers with income “above” IRS filing amount · Questioned on FOTW · Reject if submitted · FAA can override 104

2008 -2009 Changes ■ Real-Time PIN · Issued upon request (FOTW or PIN Site) · Valid for FAFSA unless subsequent SSA match fails ■ Number of School Choices · Increased to ten on FOTW · Remains four on paper ■ Non-Filers with income “above” IRS filing amount · Questioned on FOTW · Reject if submitted · FAA can override 104

2008 -09 Renewal Application Process ■ Renewal Reminders sent in early January 2008 · Students with a valid e-mail address will receive e-mail reminders · If no e-mail address or e-mail is undeliverable, paper reminder letter will be sent to applicant 105

2008 -09 Renewal Application Process ■ Renewal Reminders sent in early January 2008 · Students with a valid e-mail address will receive e-mail reminders · If no e-mail address or e-mail is undeliverable, paper reminder letter will be sent to applicant 105

FAFSA on the Web Toolkits Mailed in October to – · Postsecondary schools · High schools · State agencies · Libraries · PTAs · TRIO Centers · Gear Up · NCAN 106 Toolkits will include – · FOTW Brochure · PIN Brochure · Poster · Tips Card · Web-Link Graphics Flyer · FAA Access Flyer

FAFSA on the Web Toolkits Mailed in October to – · Postsecondary schools · High schools · State agencies · Libraries · PTAs · TRIO Centers · Gear Up · NCAN 106 Toolkits will include – · FOTW Brochure · PIN Brochure · Poster · Tips Card · Web-Link Graphics Flyer · FAA Access Flyer

FAFSA 4 caster ■ FAFSA 4 Caster was developed to: · Foster early awareness with the financial aid application process and form · Serve as an early analysis tool informing college affordability · Reduce the time required to submit the “official” financial aid application in the student's senior year of high school 107

FAFSA 4 caster ■ FAFSA 4 Caster was developed to: · Foster early awareness with the financial aid application process and form · Serve as an early analysis tool informing college affordability · Reduce the time required to submit the “official” financial aid application in the student's senior year of high school 107

FAFSA 4 caster ■ FAFSA 4 caster will: · Automatically generate a Federal Student Aid PIN for use when signing the FAFSA · Instantly calculate eligibility for federal student aid · Generate a FAFSA – a FAFSA populated with student FAFSA 4 caster data will be available when the student is ready to file the official FAFSA 108

FAFSA 4 caster ■ FAFSA 4 caster will: · Automatically generate a Federal Student Aid PIN for use when signing the FAFSA · Instantly calculate eligibility for federal student aid · Generate a FAFSA – a FAFSA populated with student FAFSA 4 caster data will be available when the student is ready to file the official FAFSA 108

www. fafsa 4 caster. ed. gov 109

www. fafsa 4 caster. ed. gov 109

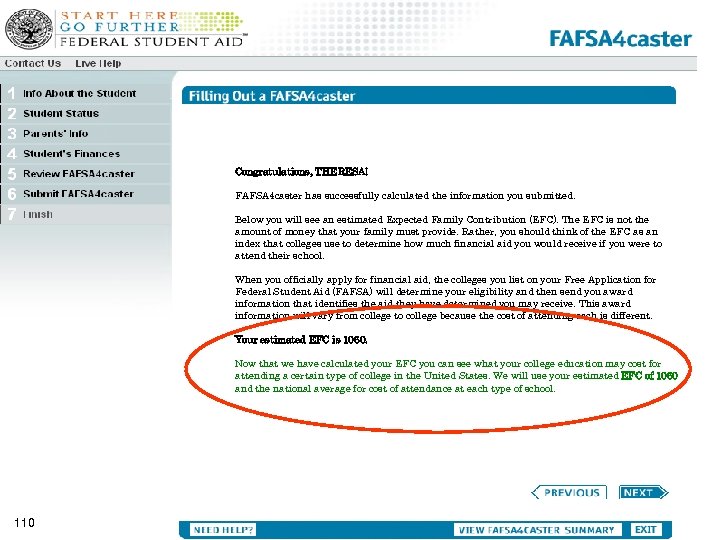

Congratulations, THERESA! FAFSA 4 caster has successfully calculated the information you submitted. Below you will see an estimated Expected Family Contribution (EFC). The EFC is not the amount of money that your family must provide. Rather, you should think of the EFC as an index that colleges use to determine how much financial aid you would receive if you were to attend their school. When you officially apply for financial aid, the colleges you list on your Free Application for Federal Student Aid (FAFSA) will determine your eligibility and then send you award information that identifies the aid they have determined you may receive. This award information will vary from college to college because the cost of attending each is different. Your estimated EFC is 1060. Now that we have calculated your EFC you can see what your college education may cost for attending a certain type of college in the United States. We will use your estimated EFC of 1060 and the national average for cost of attendance at each type of school. 110

Congratulations, THERESA! FAFSA 4 caster has successfully calculated the information you submitted. Below you will see an estimated Expected Family Contribution (EFC). The EFC is not the amount of money that your family must provide. Rather, you should think of the EFC as an index that colleges use to determine how much financial aid you would receive if you were to attend their school. When you officially apply for financial aid, the colleges you list on your Free Application for Federal Student Aid (FAFSA) will determine your eligibility and then send you award information that identifies the aid they have determined you may receive. This award information will vary from college to college because the cost of attending each is different. Your estimated EFC is 1060. Now that we have calculated your EFC you can see what your college education may cost for attending a certain type of college in the United States. We will use your estimated EFC of 1060 and the national average for cost of attendance at each type of school. 110

FAFSA on the Web Demo Site 111

FAFSA on the Web Demo Site 111

www. fsa 4 counselors. ed. gov 112

www. fsa 4 counselors. ed. gov 112

www. studentaid. ed. gov 113

www. studentaid. ed. gov 113

www. students. gov 114

www. students. gov 114

www. Going 2 College. org 115

www. Going 2 College. org 115

www. Know. How 2 GO. org 116

www. Know. How 2 GO. org 116

www. heab. wi. gov 117

www. heab. wi. gov 117

www. wasfaa. net 118

www. wasfaa. net 118

www. finaid. org 119

www. finaid. org 119

Questions? How can we help you? What challenges do you have? Do you need assistance with your financial aid night? 120 Comments?

Questions? How can we help you? What challenges do you have? Do you need assistance with your financial aid night? 120 Comments?

THANK YOU ALL FOR ATTENDING!!! Please complete the evaluation. 121

THANK YOU ALL FOR ATTENDING!!! Please complete the evaluation. 121

Pre-Collegiate School Relations Committee Objective: To educate students, parents, teachers, and school counselors about the availability of financial aid and the aid application process. Committee Members: Lisa Albers Paul Baldridge Triena Bodart Linda Brumm Maureen Crump-Phillips Donna Dahlvang Susan Fischer Bill Henderson Michelle Hermes Sara Beth Holmen Sharon Hunter 122 Connie Hutchison Marilyn Krump Jane Lemke Heather Mc. Gee Leone Pierce Amy Schrader Steve Schuetz Susan Teerink Bill Trippett Kelly Vander Wyst Margaret Zitzer Christine Zollicoffer

Pre-Collegiate School Relations Committee Objective: To educate students, parents, teachers, and school counselors about the availability of financial aid and the aid application process. Committee Members: Lisa Albers Paul Baldridge Triena Bodart Linda Brumm Maureen Crump-Phillips Donna Dahlvang Susan Fischer Bill Henderson Michelle Hermes Sara Beth Holmen Sharon Hunter 122 Connie Hutchison Marilyn Krump Jane Lemke Heather Mc. Gee Leone Pierce Amy Schrader Steve Schuetz Susan Teerink Bill Trippett Kelly Vander Wyst Margaret Zitzer Christine Zollicoffer