2fdf0d07dfb75aeb1dbc3802505aa782.ppt

- Количество слайдов: 33

2005 Annual Shareholder Meeting May 13, 2005

2005 Annual Shareholder Meeting May 13, 2005

Opening Remarks Steve Odland Chairman and Chief Executive Officer 2

Opening Remarks Steve Odland Chairman and Chief Executive Officer 2

Board of Directors § Lee A. Ault III (1998) • Chairman of the Board, In-Q-Tel, Inc. § Neil R. Austrian (1998) • Private investor § David W. Bernauer (2004) • Chairman and Chief Executive Officer, Walgreen Co. § Abelardo (Al) E. Bru (2004) • Vice Chairman (retired), Pepsi. Co, Inc. § David I. Fuente (1987) • Former Chairman and Chief Executive Officer, Office Depot, Inc. § Brenda J. Gaines (2002) • North American President (retired), Diners Club International, a Division of Citigroup 3

Board of Directors § Lee A. Ault III (1998) • Chairman of the Board, In-Q-Tel, Inc. § Neil R. Austrian (1998) • Private investor § David W. Bernauer (2004) • Chairman and Chief Executive Officer, Walgreen Co. § Abelardo (Al) E. Bru (2004) • Vice Chairman (retired), Pepsi. Co, Inc. § David I. Fuente (1987) • Former Chairman and Chief Executive Officer, Office Depot, Inc. § Brenda J. Gaines (2002) • North American President (retired), Diners Club International, a Division of Citigroup 3

Board of Directors § Myra M. Hart (2004) • Professor, Entrepreneurial Management, Harvard Business School § W. Scott Hedrick (1991) • General Partner, Inter. West Partners § James L. Heskett (1996) • Baker Foundation Professor, Harvard Business School § Patricia A. Mc. Kay (2004) • Executive Vice President and Chief Financial Officer, Restoration Hardware, Inc. § Michael J. Myers (1987) • Senior Advisory Partner, Sentinel Capital Partners § Steve Odland (2005) • Chairman and Chief Executive Officer, Office Depot, Inc. 4

Board of Directors § Myra M. Hart (2004) • Professor, Entrepreneurial Management, Harvard Business School § W. Scott Hedrick (1991) • General Partner, Inter. West Partners § James L. Heskett (1996) • Baker Foundation Professor, Harvard Business School § Patricia A. Mc. Kay (2004) • Executive Vice President and Chief Financial Officer, Restoration Hardware, Inc. § Michael J. Myers (1987) • Senior Advisory Partner, Sentinel Capital Partners § Steve Odland (2005) • Chairman and Chief Executive Officer, Office Depot, Inc. 4

Executive Committee § Charles Brown – President, Office Depot International and Chief Financial Officer § Cindy Campbell – EVP, North American Business Services § David Fannin – EVP, General Counsel and Corporate Secretary § Mark Holifield – EVP, Supply Chain § Rick Lepley – EVP, North American Retail § Monica Luechtefeld – EVP, Business Development and Information Technology § Chuck Rubin – EVP, Chief Merchandising and Marketing Officer § Frank Scruggs – EVP, Human Resources 5

Executive Committee § Charles Brown – President, Office Depot International and Chief Financial Officer § Cindy Campbell – EVP, North American Business Services § David Fannin – EVP, General Counsel and Corporate Secretary § Mark Holifield – EVP, Supply Chain § Rick Lepley – EVP, North American Retail § Monica Luechtefeld – EVP, Business Development and Information Technology § Chuck Rubin – EVP, Chief Merchandising and Marketing Officer § Frank Scruggs – EVP, Human Resources 5

Additional Introductions § Office Depot Corporate Communications • Brian Levine – Public Relations • Sean Mc. Hugh – Investor Relations § Independent Public Accountants – Deloitte & Touche LLP • Ralph Siegel – Engagement Partner • Tony Giro – Senior Manager 6

Additional Introductions § Office Depot Corporate Communications • Brian Levine – Public Relations • Sean Mc. Hugh – Investor Relations § Independent Public Accountants – Deloitte & Touche LLP • Ralph Siegel – Engagement Partner • Tony Giro – Senior Manager 6

Items of Business § Notice of meeting of shareholders § Final voting § Election of Board of Directors § Ratification of Deloitte & Touche LLP as Independent Accountants § Shareholder proposal #1 § Shareholder proposal #2 7

Items of Business § Notice of meeting of shareholders § Final voting § Election of Board of Directors § Ratification of Deloitte & Touche LLP as Independent Accountants § Shareholder proposal #1 § Shareholder proposal #2 7

Safe Harbor Statement Certain statements made during this presentation are ‘forward-looking’ statements under the Private Securities Litigation Reform Act. Except for historical financial and business performance information, comments made during this presentation should be considered ‘forward-looking. ’ Actual future results may differ materially from those discussed at this meeting because of risks and uncertainties, both foreseen and unforeseen. Certain risks and uncertainties are described in detail in our Report on Form 10 -K, filed with the SEC on March 10, 2005, and in our 10 -Q and 8 -K filings made from time to time. During portions of today’s presentation, Office Depot executives may refer to the results of fiscal year 2004 and first quarter fiscal year 2005 which are not GAAP numbers. A reconciliation of non-GAAP numbers to GAAP results is available on our website at www. officedepot. com. 8

Safe Harbor Statement Certain statements made during this presentation are ‘forward-looking’ statements under the Private Securities Litigation Reform Act. Except for historical financial and business performance information, comments made during this presentation should be considered ‘forward-looking. ’ Actual future results may differ materially from those discussed at this meeting because of risks and uncertainties, both foreseen and unforeseen. Certain risks and uncertainties are described in detail in our Report on Form 10 -K, filed with the SEC on March 10, 2005, and in our 10 -Q and 8 -K filings made from time to time. During portions of today’s presentation, Office Depot executives may refer to the results of fiscal year 2004 and first quarter fiscal year 2005 which are not GAAP numbers. A reconciliation of non-GAAP numbers to GAAP results is available on our website at www. officedepot. com. 8

Company Overview § Founded in 1986 § Office Depot is a leading global provider of office products and services § NYSE listed since 1991 § S&P 500 member since 1999 § Annual sales $13. 6 billion § Operations in 23 countries § Multi-channel – stores, catalog, Internet and contract § Three divisions: • North American Retail • North American Business Services • International 9

Company Overview § Founded in 1986 § Office Depot is a leading global provider of office products and services § NYSE listed since 1991 § S&P 500 member since 1999 § Annual sales $13. 6 billion § Operations in 23 countries § Multi-channel – stores, catalog, Internet and contract § Three divisions: • North American Retail • North American Business Services • International 9

Company Overview § Provide office products and related services* • Supplies – 55% of sales • Technology – 25% of sales • Furniture – 20% of sales § Use multi-channel capabilities to serve business customers of any size, from small office / home office to Fortune 500 accounts • North American Retail – 995 stores in U. S. and Canada • North American Business Services – catalog, contract and e-commerce • International – catalog, contract, e-commerce, and retail • World’s #3 internet retailer – $3. 1 billion in sales Note: *2004 total Company sales mix by product category. “Furniture” refers to “Furniture, low tech, and other” as more fully described in our 2004 annual report on Form 10 -K. 10

Company Overview § Provide office products and related services* • Supplies – 55% of sales • Technology – 25% of sales • Furniture – 20% of sales § Use multi-channel capabilities to serve business customers of any size, from small office / home office to Fortune 500 accounts • North American Retail – 995 stores in U. S. and Canada • North American Business Services – catalog, contract and e-commerce • International – catalog, contract, e-commerce, and retail • World’s #3 internet retailer – $3. 1 billion in sales Note: *2004 total Company sales mix by product category. “Furniture” refers to “Furniture, low tech, and other” as more fully described in our 2004 annual report on Form 10 -K. 10

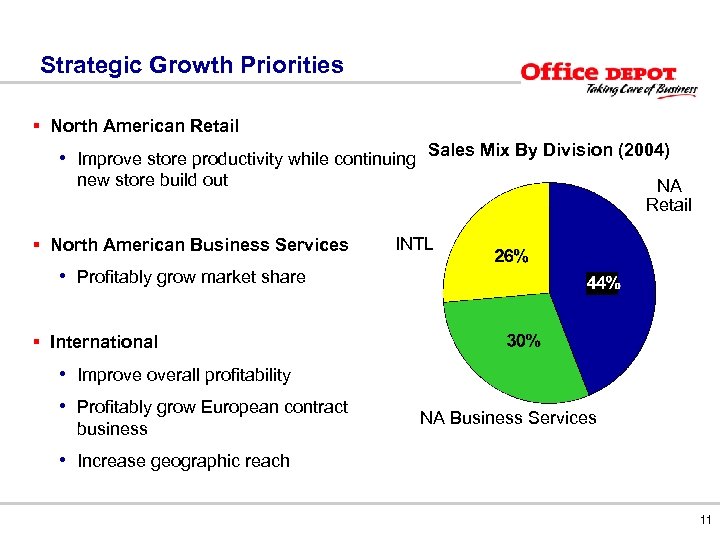

Strategic Growth Priorities § North American Retail • Improve store productivity while continuing Sales Mix By Division (2004) new store build out § North American Business Services NA Retail INTL • Profitably grow market share § International • Improve overall profitability • Profitably grow European contract business NA Business Services • Increase geographic reach 11

Strategic Growth Priorities § North American Retail • Improve store productivity while continuing Sales Mix By Division (2004) new store build out § North American Business Services NA Retail INTL • Profitably grow market share § International • Improve overall profitability • Profitably grow European contract business NA Business Services • Increase geographic reach 11

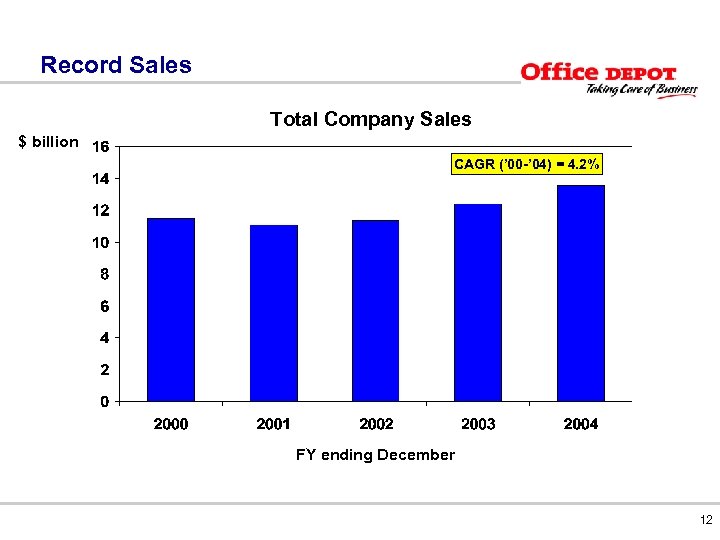

Record Sales Total Company Sales $ billion CAGR (’ 00 -’ 04) = 4. 2% FY ending December 12

Record Sales Total Company Sales $ billion CAGR (’ 00 -’ 04) = 4. 2% FY ending December 12

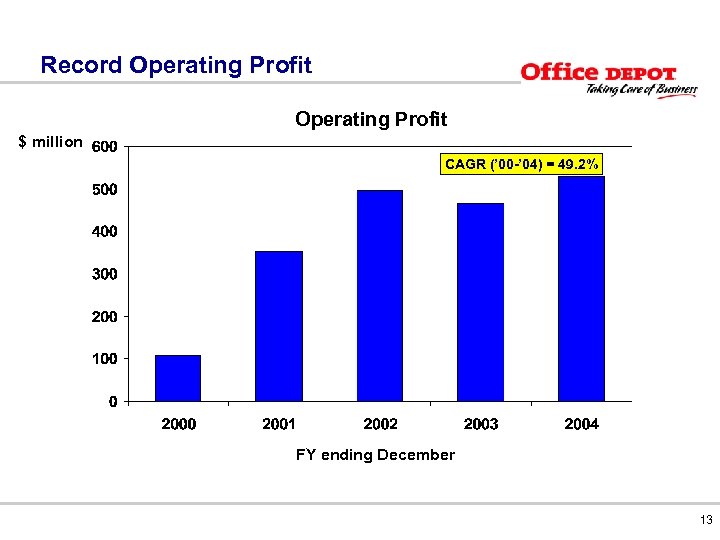

Record Operating Profit $ million CAGR (’ 00 -’ 04) = 49. 2% FY ending December 13

Record Operating Profit $ million CAGR (’ 00 -’ 04) = 49. 2% FY ending December 13

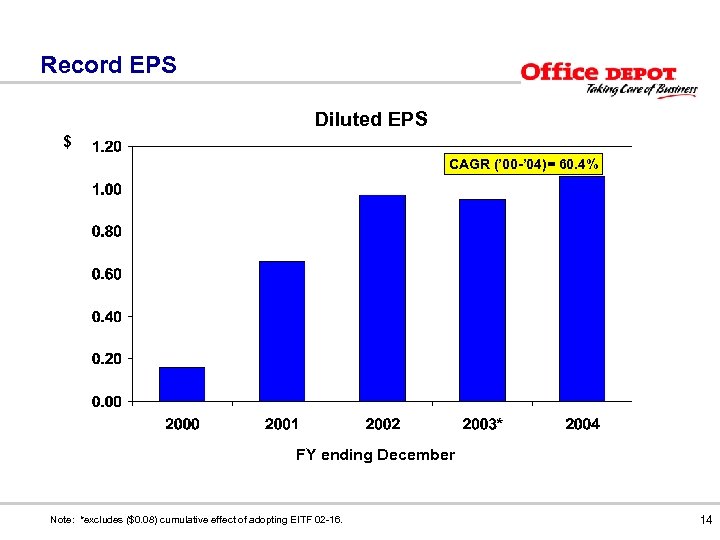

Record EPS Diluted EPS $ CAGR (’ 00 -’ 04)= 60. 4% FY ending December Note: *excludes ($0. 08) cumulative effect of adopting EITF 02 -16. 14

Record EPS Diluted EPS $ CAGR (’ 00 -’ 04)= 60. 4% FY ending December Note: *excludes ($0. 08) cumulative effect of adopting EITF 02 -16. 14

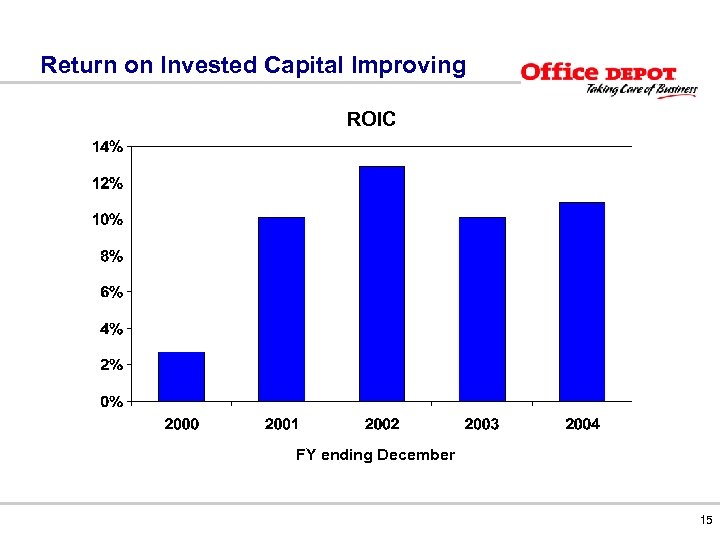

Return on Invested Capital Improving ROIC FY ending December 15

Return on Invested Capital Improving ROIC FY ending December 15

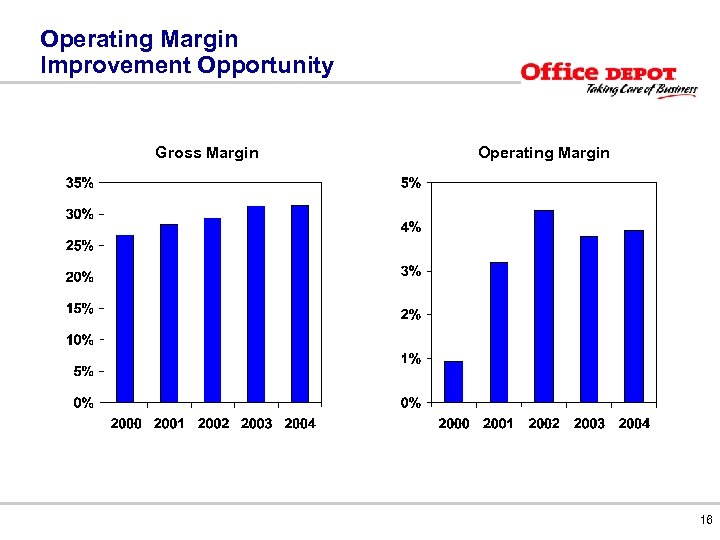

Operating Margin Improvement Opportunity Gross Margin Operating Margin 16

Operating Margin Improvement Opportunity Gross Margin Operating Margin 16

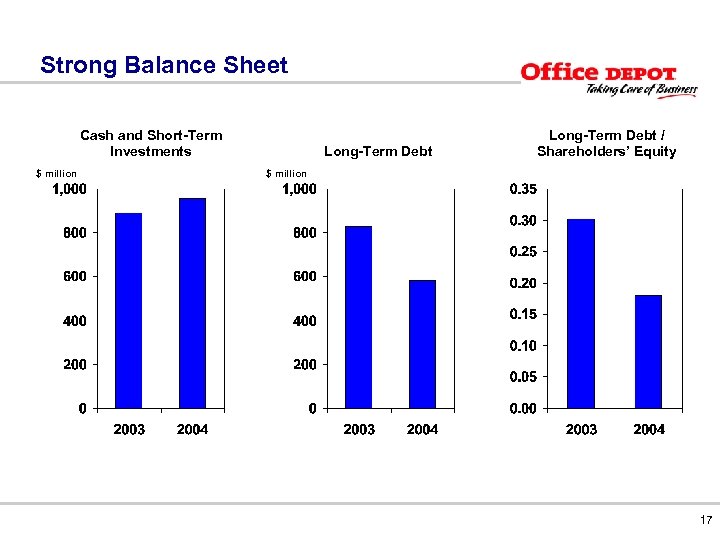

Strong Balance Sheet Cash and Short-Term Investments $ million Long-Term Debt / Shareholders’ Equity $ million 17

Strong Balance Sheet Cash and Short-Term Investments $ million Long-Term Debt / Shareholders’ Equity $ million 17

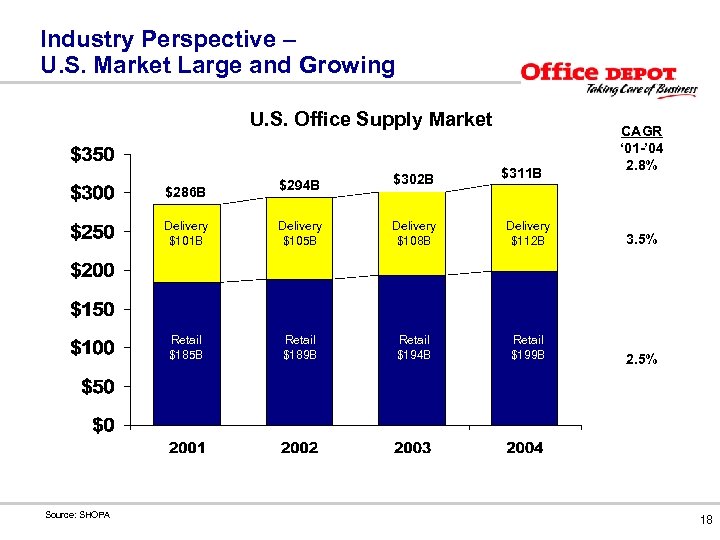

Industry Perspective – U. S. Market Large and Growing U. S. Office Supply Market $311 B CAGR ‘ 01 -’ 04 2. 8% $294 B $302 B Delivery $101 B Delivery $105 B Delivery $108 B Delivery $112 B 3. 5% Retail $185 B Retail $189 B Retail $194 B Retail $199 B 2. 5% $286 B Source: SHOPA 18

Industry Perspective – U. S. Market Large and Growing U. S. Office Supply Market $311 B CAGR ‘ 01 -’ 04 2. 8% $294 B $302 B Delivery $101 B Delivery $105 B Delivery $108 B Delivery $112 B 3. 5% Retail $185 B Retail $189 B Retail $194 B Retail $199 B 2. 5% $286 B Source: SHOPA 18

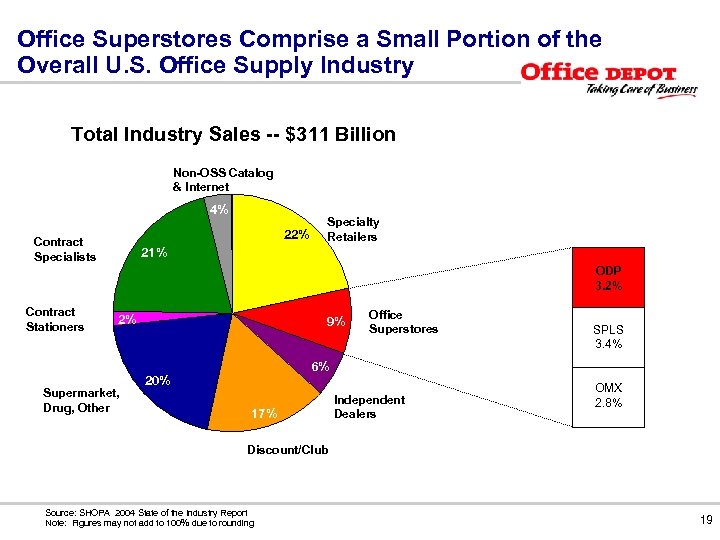

Office Superstores Comprise a Small Portion of the Overall U. S. Office Supply Industry Total Industry Sales -- $311 Billion Non-OSS Catalog & Internet 4% 22% Contract Specialists Specialty Retailers 21% ODP 3. 2% Contract Stationers 2% 9% Office Superstores SPLS 3. 4% 6% Supermarket, Drug, Other 20% 17% Independent Dealers OMX 2. 8% Discount/Club Source: SHOPA 2004 State of the Industry Report Note: Figures may not add to 100% due to rounding 19

Office Superstores Comprise a Small Portion of the Overall U. S. Office Supply Industry Total Industry Sales -- $311 Billion Non-OSS Catalog & Internet 4% 22% Contract Specialists Specialty Retailers 21% ODP 3. 2% Contract Stationers 2% 9% Office Superstores SPLS 3. 4% 6% Supermarket, Drug, Other 20% 17% Independent Dealers OMX 2. 8% Discount/Club Source: SHOPA 2004 State of the Industry Report Note: Figures may not add to 100% due to rounding 19

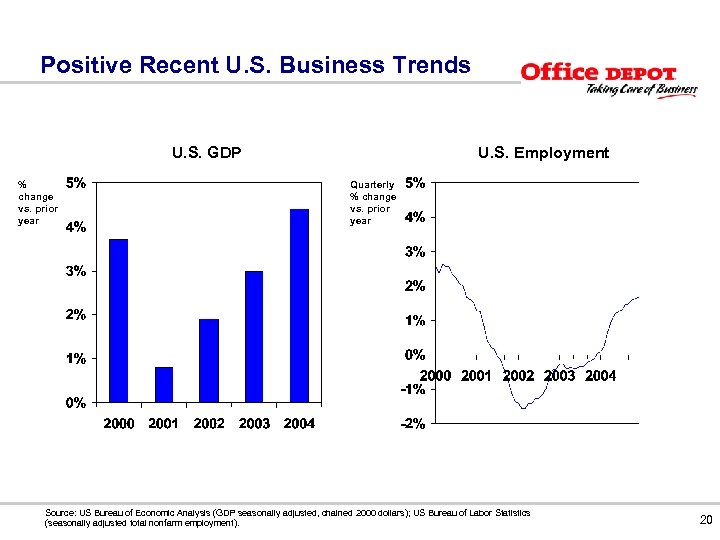

Positive Recent U. S. Business Trends U. S. GDP % change vs. prior year U. S. Employment Quarterly % change vs. prior year Source: US Bureau of Economic Analysis (GDP seasonally adjusted, chained 2000 dollars); US Bureau of Labor Statistics (seasonally adjusted total nonfarm employment). 20

Positive Recent U. S. Business Trends U. S. GDP % change vs. prior year U. S. Employment Quarterly % change vs. prior year Source: US Bureau of Economic Analysis (GDP seasonally adjusted, chained 2000 dollars); US Bureau of Labor Statistics (seasonally adjusted total nonfarm employment). 20

Grow North American Retail and Business Services – Taking Care of Business Campaign 21

Grow North American Retail and Business Services – Taking Care of Business Campaign 21

Grow North American Retail and Business Services – NASCAR and Roush Racing 22

Grow North American Retail and Business Services – NASCAR and Roush Racing 22

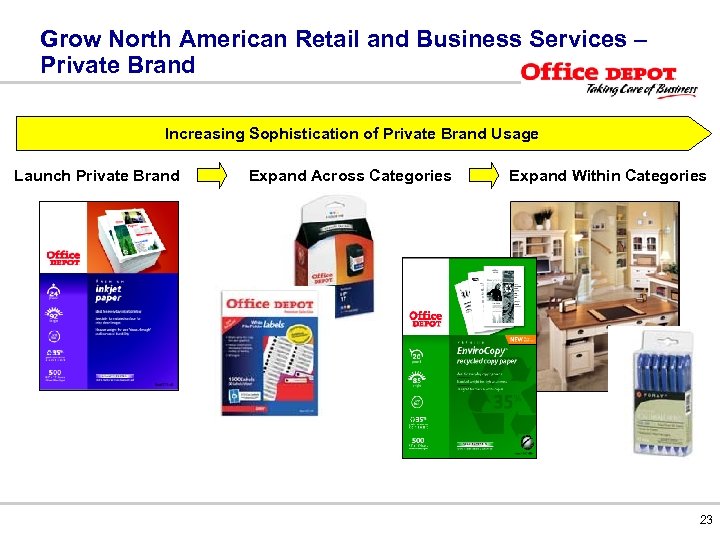

Grow North American Retail and Business Services – Private Brand Increasing Sophistication of Private Brand Usage Launch Private Brand Expand Across Categories Expand Within Categories 23

Grow North American Retail and Business Services – Private Brand Increasing Sophistication of Private Brand Usage Launch Private Brand Expand Across Categories Expand Within Categories 23

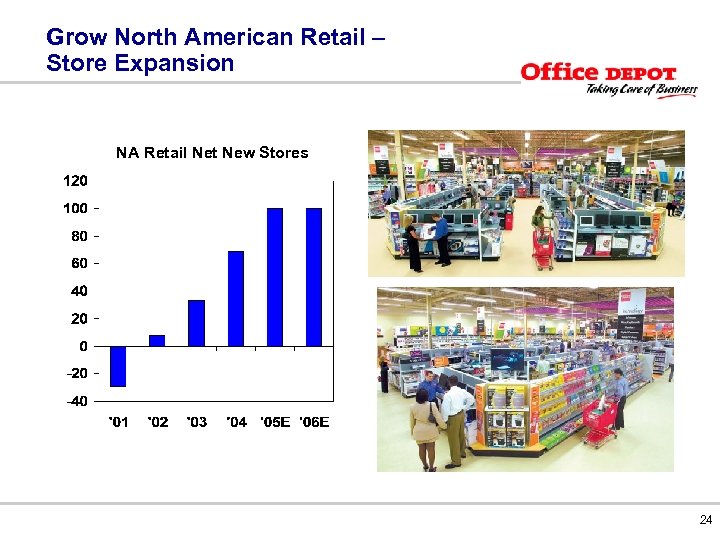

Grow North American Retail – Store Expansion NA Retail Net New Stores 24

Grow North American Retail – Store Expansion NA Retail Net New Stores 24

North American Retail and Business Services -Additional Profitable Growth Initiatives 25

North American Retail and Business Services -Additional Profitable Growth Initiatives 25

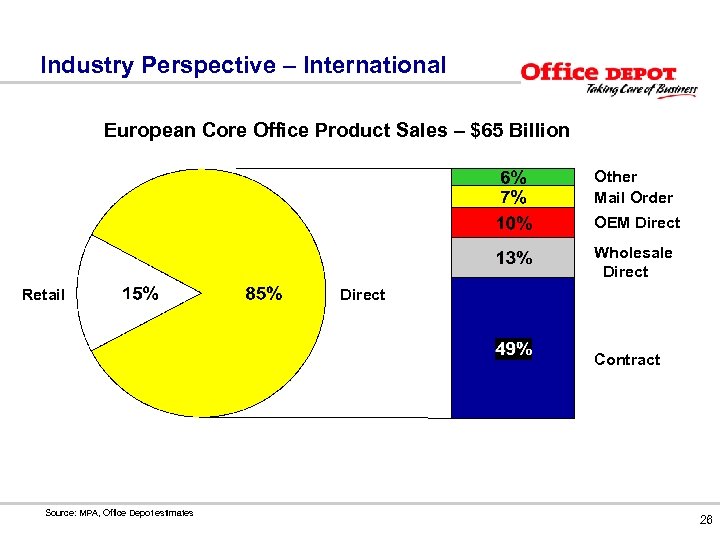

Industry Perspective – International European Core Office Product Sales – $65 Billion Other Mail Order OEM Direct Wholesale Direct Retail Direct Contract Source: MPA, Office Depot estimates 26

Industry Perspective – International European Core Office Product Sales – $65 Billion Other Mail Order OEM Direct Wholesale Direct Retail Direct Contract Source: MPA, Office Depot estimates 26

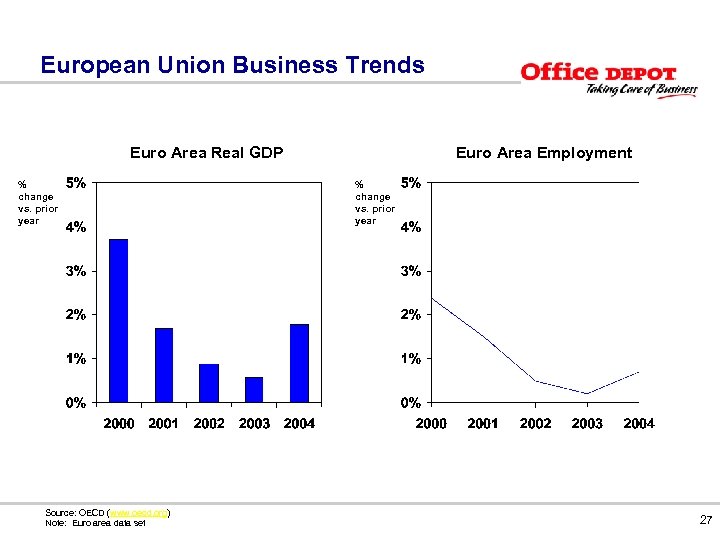

European Union Business Trends Euro Area Real GDP % change vs. prior year Source: OECD (www. oecd. org) Note: Euro area data set Euro Area Employment % change vs. prior year 27

European Union Business Trends Euro Area Real GDP % change vs. prior year Source: OECD (www. oecd. org) Note: Euro area data set Euro Area Employment % change vs. prior year 27

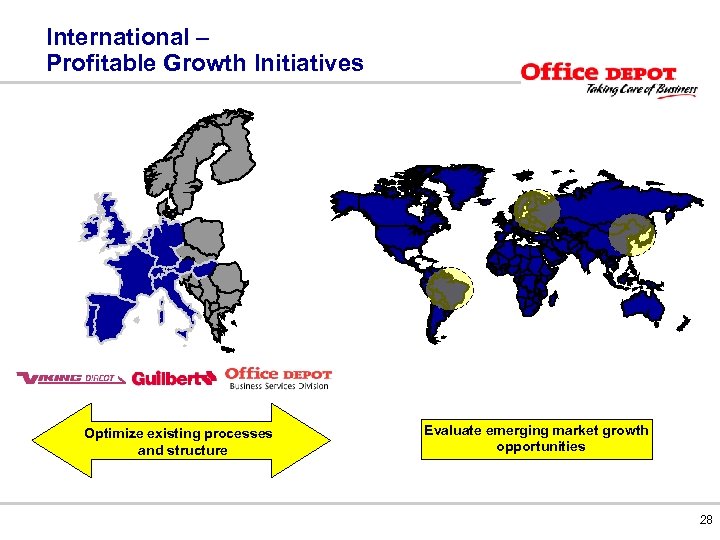

International – Profitable Growth Initiatives Optimize existing processes and structure Evaluate emerging market growth opportunities 28

International – Profitable Growth Initiatives Optimize existing processes and structure Evaluate emerging market growth opportunities 28

Corporate Governance Recognition § Institutional Shareholder Services* • Industry percentile – 94. 7 • S&P 500 percentile – 74. 4 § Governance. Metrics International** • 9. 0 / 10. 0 – top 7% Note: *as of 05/01/05; **as of 01/14/05 29

Corporate Governance Recognition § Institutional Shareholder Services* • Industry percentile – 94. 7 • S&P 500 percentile – 74. 4 § Governance. Metrics International** • 9. 0 / 10. 0 – top 7% Note: *as of 05/01/05; **as of 01/14/05 29

Outlook § Strategic growth priorities: • North American Retail • North American Business Services • International § Use cash flow to profitably grow our business: • Opening new stores / new geographic markets • Making necessary investments in the core business • Acquiring assets or businesses in our key priority areas • Repurchasing shares 30

Outlook § Strategic growth priorities: • North American Retail • North American Business Services • International § Use cash flow to profitably grow our business: • Opening new stores / new geographic markets • Making necessary investments in the core business • Acquiring assets or businesses in our key priority areas • Repurchasing shares 30

Question & Answer Session 31

Question & Answer Session 31

Proxy Vote Results 32

Proxy Vote Results 32

2005 Annual Shareholder Meeting May 13, 2005

2005 Annual Shareholder Meeting May 13, 2005