7110882cefe0406edd7facf42144f3fb.ppt

- Количество слайдов: 38

2004 Stop Loss Rules

2004 Stop Loss Rules

Agenda • Overview § What are Stop Loss rules? § What is their effect? 2004 • Examples • Solutions

Agenda • Overview § What are Stop Loss rules? § What is their effect? 2004 • Examples • Solutions

Stop Loss Rules Income Tax Act ss. 112(3. 2) • What are they? § Rules that impact business and estate planning where… 2004 • Method used is corporate share redemption • Funding is with life insurance

Stop Loss Rules Income Tax Act ss. 112(3. 2) • What are they? § Rules that impact business and estate planning where… 2004 • Method used is corporate share redemption • Funding is with life insurance

Stop loss rules Income Tax Act ss. 112(3. 2) • What’s the effect? § Assuming the rules apply to a share disposition by the estate…. • Double tax exposure • Estate loss reduced by up to 50% of capital dividend • Capital gain taxed on terminal return is increased 2004 § Double taxation occurs because…. • Surviving shareholders receive NO ACB increase • The gain is taxed in hand’s of deceased • The gain is taxed again when surviving shareholder disposes of shares

Stop loss rules Income Tax Act ss. 112(3. 2) • What’s the effect? § Assuming the rules apply to a share disposition by the estate…. • Double tax exposure • Estate loss reduced by up to 50% of capital dividend • Capital gain taxed on terminal return is increased 2004 § Double taxation occurs because…. • Surviving shareholders receive NO ACB increase • The gain is taxed in hand’s of deceased • The gain is taxed again when surviving shareholder disposes of shares

Company Profile • XYZ Inc. • FMV = $2, 000 • Owners § John owns 50% of shares • ACB of John’s shares $10, 000 • PUC of John’s shares $10, 000 2004 § Mary owns 50% of shares • ACB of Mary’s shares $10, 000 • PUC of Mary’s shares $10, 000

Company Profile • XYZ Inc. • FMV = $2, 000 • Owners § John owns 50% of shares • ACB of John’s shares $10, 000 • PUC of John’s shares $10, 000 2004 § Mary owns 50% of shares • ACB of Mary’s shares $10, 000 • PUC of Mary’s shares $10, 000

Company Profile • • Growth rate of company Personal marginal tax rate on income Personal marginal tax rate on dividends Capital gains inclusion rate 2% 50% 33% 50% 2004 • Assume John died last night • Assume Mary sells the business in 10 years

Company Profile • • Growth rate of company Personal marginal tax rate on income Personal marginal tax rate on dividends Capital gains inclusion rate 2% 50% 33% 50% 2004 • Assume John died last night • Assume Mary sells the business in 10 years

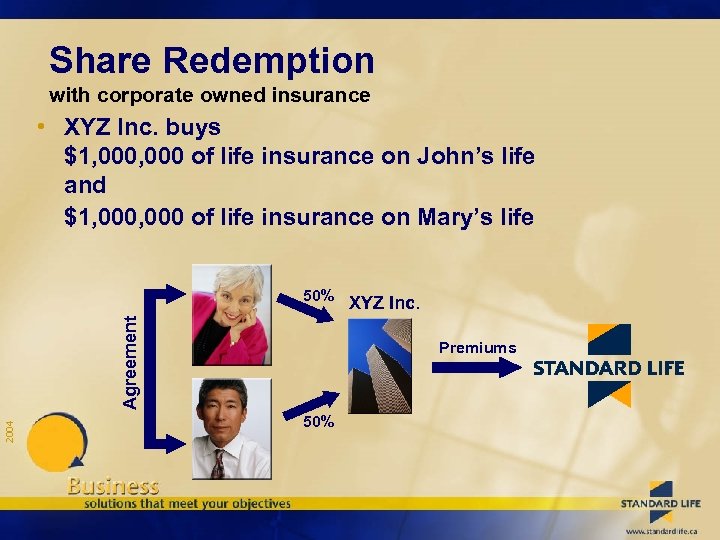

Share Redemption with corporate owned insurance • XYZ Inc. buys $1, 000 of life insurance on John’s life and $1, 000 of life insurance on Mary’s life 2004 Agreement 50% XYZ Inc. Premiums 50%

Share Redemption with corporate owned insurance • XYZ Inc. buys $1, 000 of life insurance on John’s life and $1, 000 of life insurance on Mary’s life 2004 Agreement 50% XYZ Inc. Premiums 50%

Share redemption with corporate owned insurance 2004 John dies

Share redemption with corporate owned insurance 2004 John dies

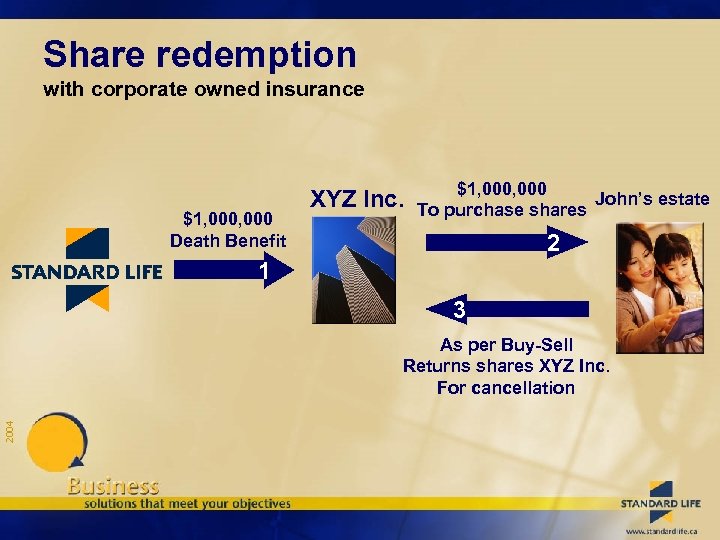

Share redemption with corporate owned insurance $1, 000 Death Benefit XYZ Inc. $1, 000 John’s estate To purchase shares 2 1 3 2004 As per Buy-Sell Returns shares XYZ Inc. For cancellation

Share redemption with corporate owned insurance $1, 000 Death Benefit XYZ Inc. $1, 000 John’s estate To purchase shares 2 1 3 2004 As per Buy-Sell Returns shares XYZ Inc. For cancellation

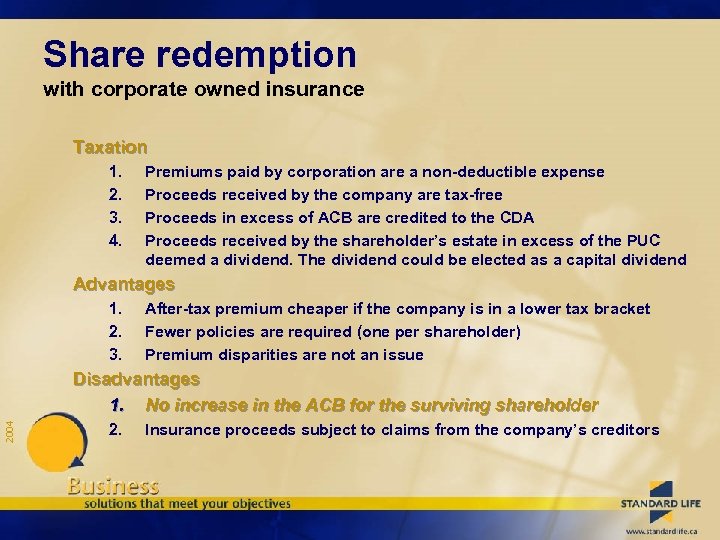

Share redemption with corporate owned insurance Taxation 1. 2. 3. 4. Premiums paid by corporation are a non-deductible expense Proceeds received by the company are tax-free Proceeds in excess of ACB are credited to the CDA Proceeds received by the shareholder’s estate in excess of the PUC deemed a dividend. The dividend could be elected as a capital dividend Advantages 1. 2. 3. After-tax premium cheaper if the company is in a lower tax bracket Fewer policies are required (one per shareholder) Premium disparities are not an issue 2004 Disadvantages 1. No increase in the ACB for the surviving shareholder 2. Insurance proceeds subject to claims from the company’s creditors

Share redemption with corporate owned insurance Taxation 1. 2. 3. 4. Premiums paid by corporation are a non-deductible expense Proceeds received by the company are tax-free Proceeds in excess of ACB are credited to the CDA Proceeds received by the shareholder’s estate in excess of the PUC deemed a dividend. The dividend could be elected as a capital dividend Advantages 1. 2. 3. After-tax premium cheaper if the company is in a lower tax bracket Fewer policies are required (one per shareholder) Premium disparities are not an issue 2004 Disadvantages 1. No increase in the ACB for the surviving shareholder 2. Insurance proceeds subject to claims from the company’s creditors

Share redemption with corporate owned insurance 2004 Mary now owns 100% of XYZ Inc.

Share redemption with corporate owned insurance 2004 Mary now owns 100% of XYZ Inc.

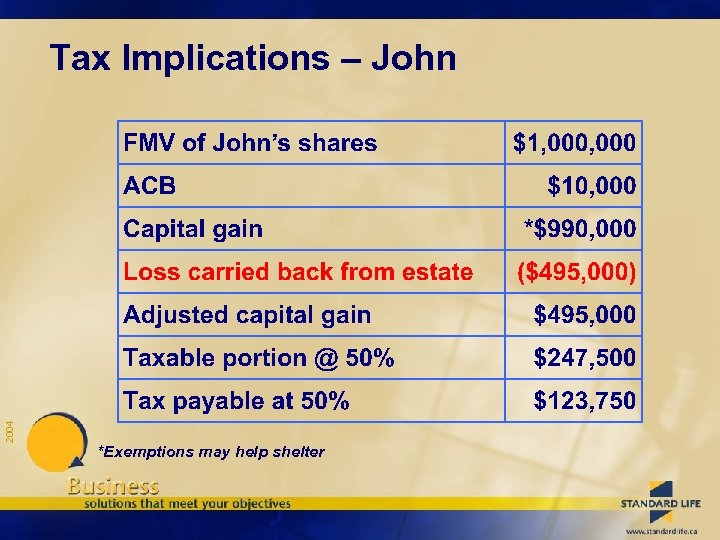

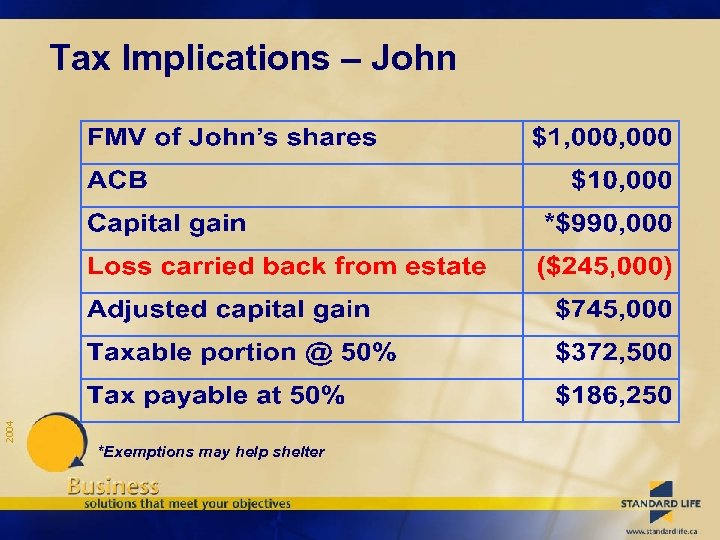

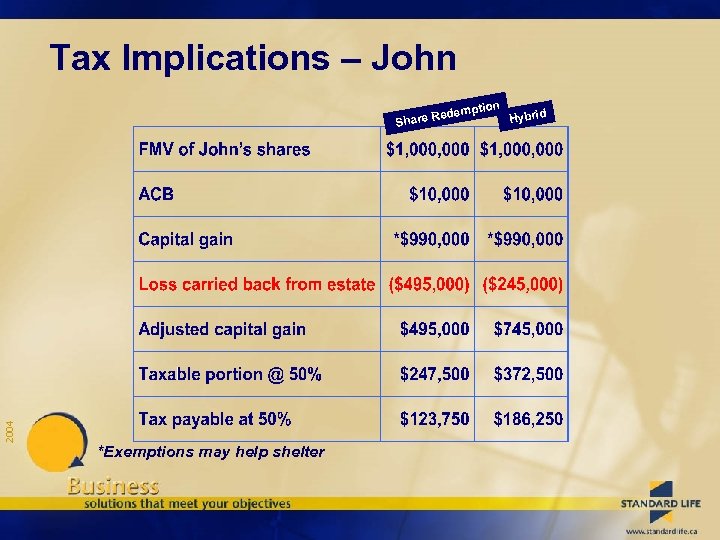

2004 Tax Implications – John *Exemptions may help shelter

2004 Tax Implications – John *Exemptions may help shelter

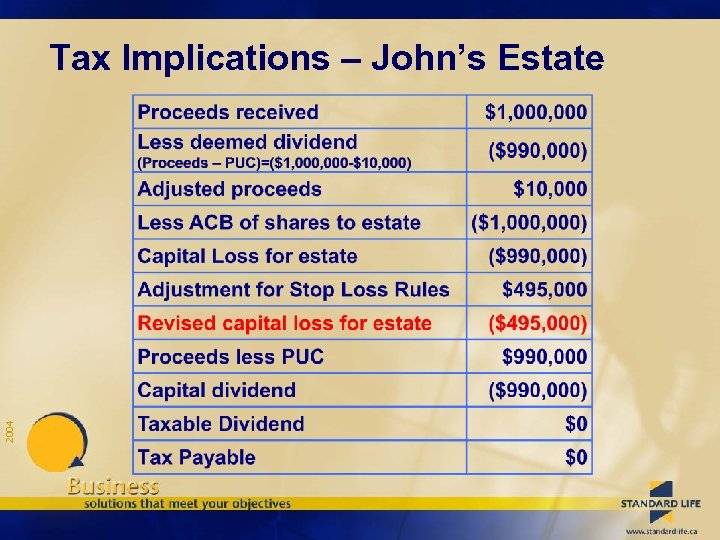

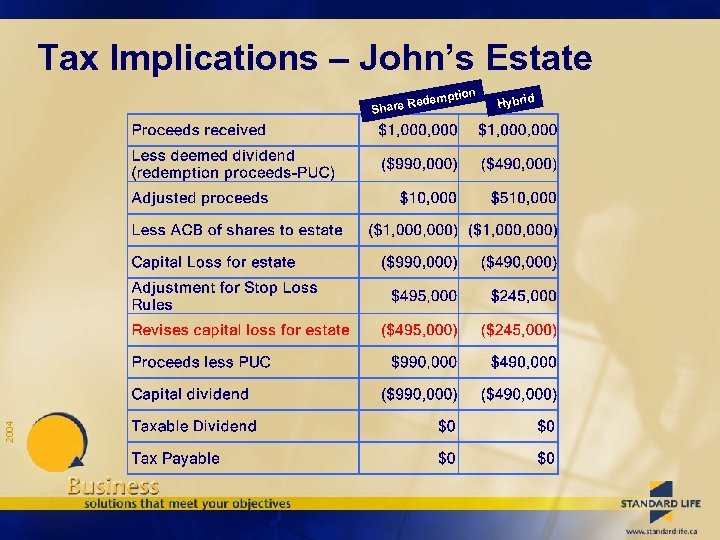

2004 Tax Implications – John’s Estate

2004 Tax Implications – John’s Estate

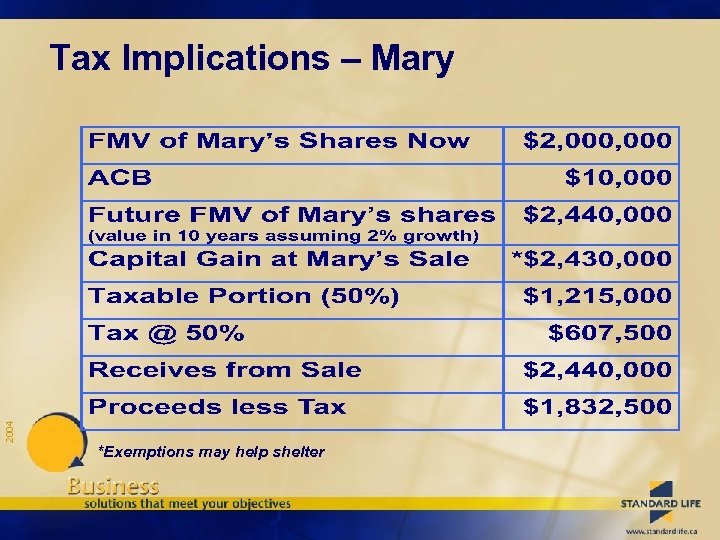

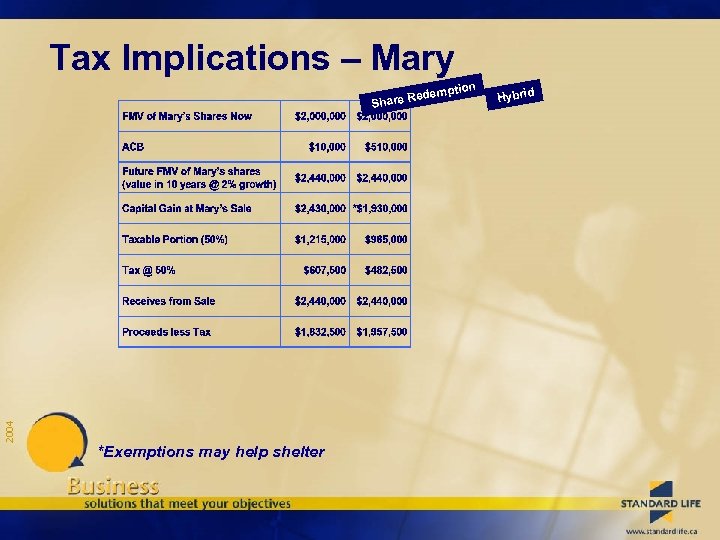

2004 Tax Implications – Mary *Exemptions may help shelter

2004 Tax Implications – Mary *Exemptions may help shelter

Stop Loss Rules 2004 • Prior to the introduction of these rules, it was possible to eliminate all tax on the disposition of shares for a deceased shareholder • The department of finance determined that this was an unwarranted deferral of capital gains tax and introduced the legislation • The Stop Loss rules apply to transactions after April 26, 1995

Stop Loss Rules 2004 • Prior to the introduction of these rules, it was possible to eliminate all tax on the disposition of shares for a deceased shareholder • The department of finance determined that this was an unwarranted deferral of capital gains tax and introduced the legislation • The Stop Loss rules apply to transactions after April 26, 1995

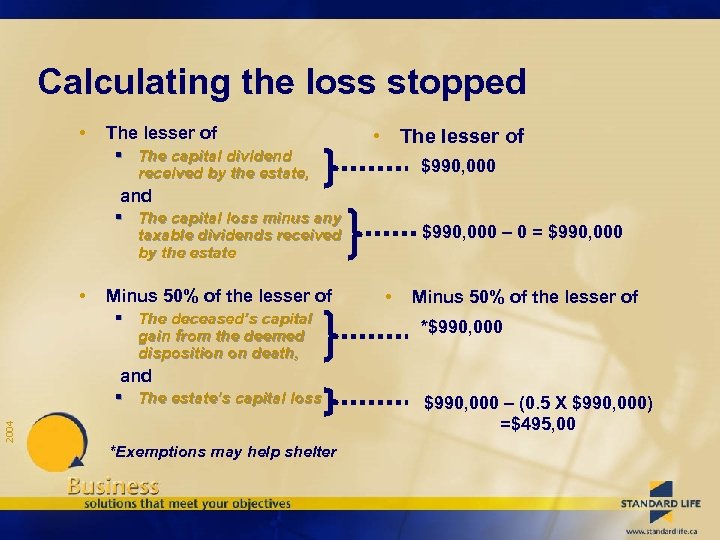

Calculating the loss stopped • The lesser of § The capital dividend received by the estate, • The lesser of $990, 000 and § The capital loss minus any taxable dividends received by the estate • Minus 50% of the lesser of § The deceased’s capital gain from the deemed disposition on death, $990, 000 – 0 = $990, 000 • Minus 50% of the lesser of *$990, 000 and 2004 § The estate’s capital loss *Exemptions may help shelter $990, 000 – (0. 5 X $990, 000) =$495, 00

Calculating the loss stopped • The lesser of § The capital dividend received by the estate, • The lesser of $990, 000 and § The capital loss minus any taxable dividends received by the estate • Minus 50% of the lesser of § The deceased’s capital gain from the deemed disposition on death, $990, 000 – 0 = $990, 000 • Minus 50% of the lesser of *$990, 000 and 2004 § The estate’s capital loss *Exemptions may help shelter $990, 000 – (0. 5 X $990, 000) =$495, 00

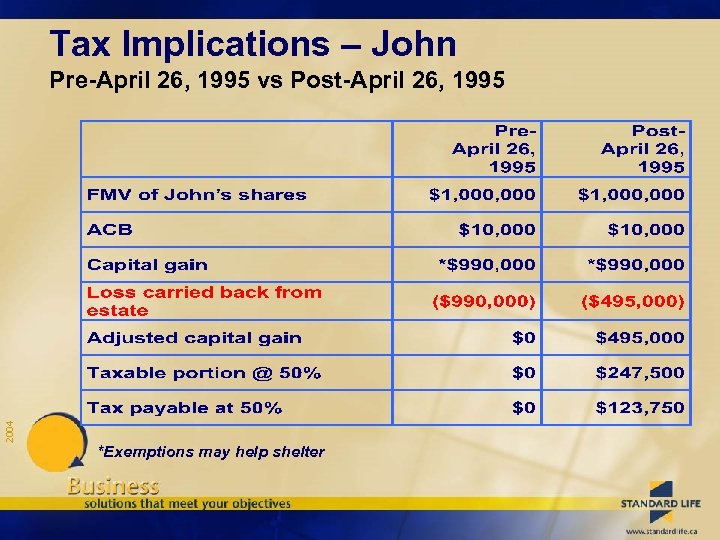

Tax Implications – John 2004 Pre-April 26, 1995 vs Post-April 26, 1995 *Exemptions may help shelter

Tax Implications – John 2004 Pre-April 26, 1995 vs Post-April 26, 1995 *Exemptions may help shelter

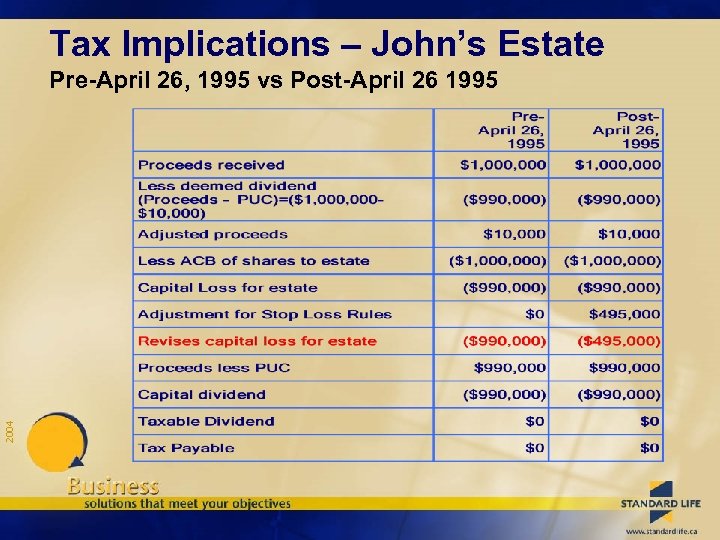

Tax Implications – John’s Estate 2004 Pre-April 26, 1995 vs Post-April 26 1995

Tax Implications – John’s Estate 2004 Pre-April 26, 1995 vs Post-April 26 1995

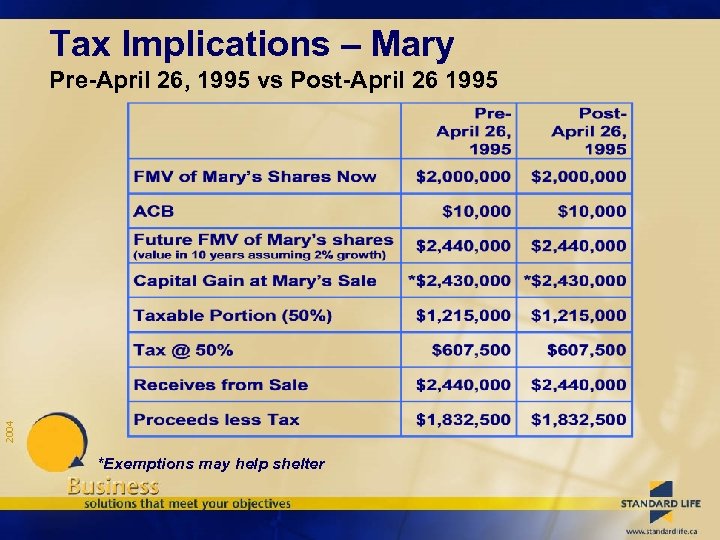

Tax Implications – Mary 2004 Pre-April 26, 1995 vs Post-April 26 1995 *Exemptions may help shelter

Tax Implications – Mary 2004 Pre-April 26, 1995 vs Post-April 26 1995 *Exemptions may help shelter

Grandfathering Opportunities 2004 • Where a corporation was the beneficiary of a life insurance policy on the life of a taxpayer, on or before April 26, 1995, where the main purpose of the insurance was to redeem shares held by the taxpayer grandfathering will be available § Applies even if coverage is increased § Policy is converted or replaced § Policy lapses and is reinstated

Grandfathering Opportunities 2004 • Where a corporation was the beneficiary of a life insurance policy on the life of a taxpayer, on or before April 26, 1995, where the main purpose of the insurance was to redeem shares held by the taxpayer grandfathering will be available § Applies even if coverage is increased § Policy is converted or replaced § Policy lapses and is reinstated

Grandfathering Opportunities 2004 • It is up to the taxpayer to provide CCRA with ample documentation to prove that the main purpose of the life policy was to redeem shares

Grandfathering Opportunities 2004 • It is up to the taxpayer to provide CCRA with ample documentation to prove that the main purpose of the life policy was to redeem shares

Grandfathering Opportunities • Grandfathering will also be available for agreements that were in place prior to April 27, 1995 2004 § As long as the agreements are not modified in any way

Grandfathering Opportunities • Grandfathering will also be available for agreements that were in place prior to April 27, 1995 2004 § As long as the agreements are not modified in any way

One way to reduce the effects of the Stop Loss Rules is to use the 2004 Hybrid Method

One way to reduce the effects of the Stop Loss Rules is to use the 2004 Hybrid Method

Hybrid Method with corporate owned insurance • The insurance would be corporately owned but the agreement would allow flexibility in determining at death how many shares would be purchased by the surviving shareholders and how many shares will be 2004 redeemed by the corporation.

Hybrid Method with corporate owned insurance • The insurance would be corporately owned but the agreement would allow flexibility in determining at death how many shares would be purchased by the surviving shareholders and how many shares will be 2004 redeemed by the corporation.

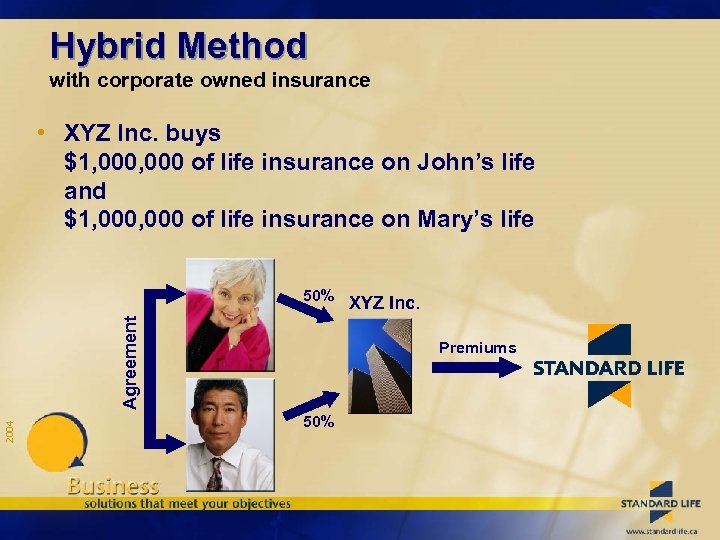

Hybrid Method with corporate owned insurance • XYZ Inc. buys $1, 000 of life insurance on John’s life and $1, 000 of life insurance on Mary’s life 2004 Agreement 50% XYZ Inc. Premiums 50%

Hybrid Method with corporate owned insurance • XYZ Inc. buys $1, 000 of life insurance on John’s life and $1, 000 of life insurance on Mary’s life 2004 Agreement 50% XYZ Inc. Premiums 50%

Hybrid Method with corporate owned insurance 2004 John dies

Hybrid Method with corporate owned insurance 2004 John dies

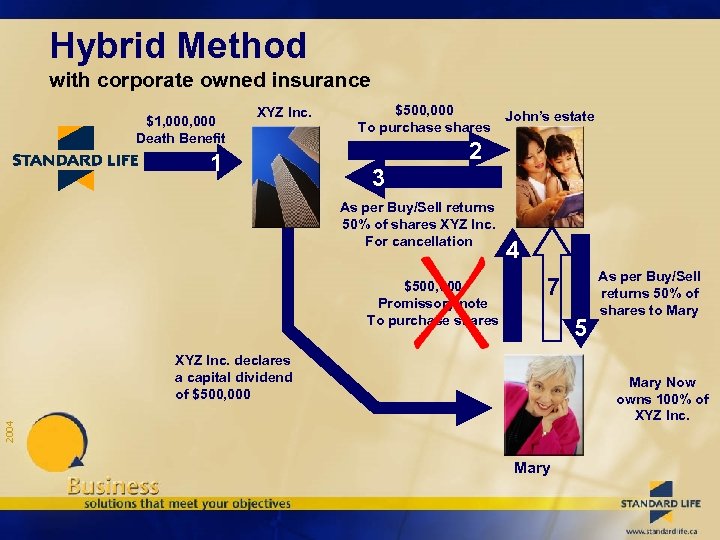

Hybrid Method with corporate owned insurance $1, 000 Death Benefit XYZ Inc. 1 $500, 000 To purchase shares John’s estate 2 3 As per Buy/Sell returns 50% of shares XYZ Inc. For cancellation $500, 000 Promissory note To purchase shares 4 7 5 XYZ Inc. declares a capital dividend of $500, 000 As per Buy/Sell returns 50% of shares to Mary 2004 Mary Now owns 100% of XYZ Inc. Mary

Hybrid Method with corporate owned insurance $1, 000 Death Benefit XYZ Inc. 1 $500, 000 To purchase shares John’s estate 2 3 As per Buy/Sell returns 50% of shares XYZ Inc. For cancellation $500, 000 Promissory note To purchase shares 4 7 5 XYZ Inc. declares a capital dividend of $500, 000 As per Buy/Sell returns 50% of shares to Mary 2004 Mary Now owns 100% of XYZ Inc. Mary

2004 Tax Implications – John *Exemptions may help shelter

2004 Tax Implications – John *Exemptions may help shelter

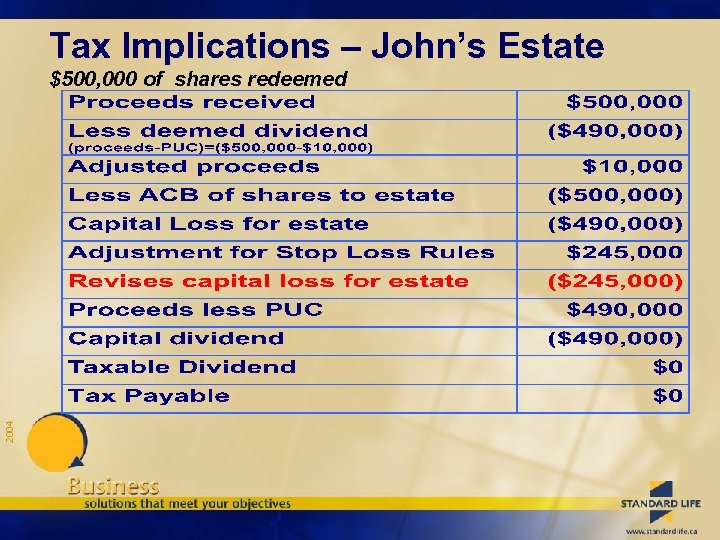

Tax Implications – John’s Estate 2004 $500, 000 of shares redeemed

Tax Implications – John’s Estate 2004 $500, 000 of shares redeemed

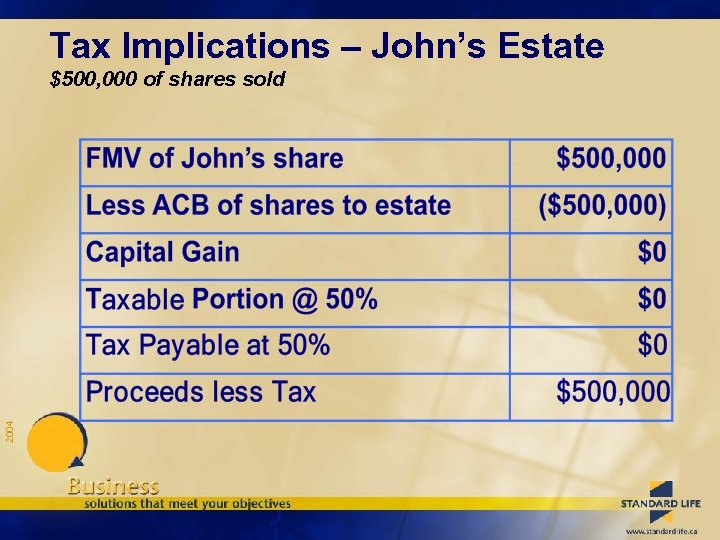

Tax Implications – John’s Estate 2004 $500, 000 of shares sold

Tax Implications – John’s Estate 2004 $500, 000 of shares sold

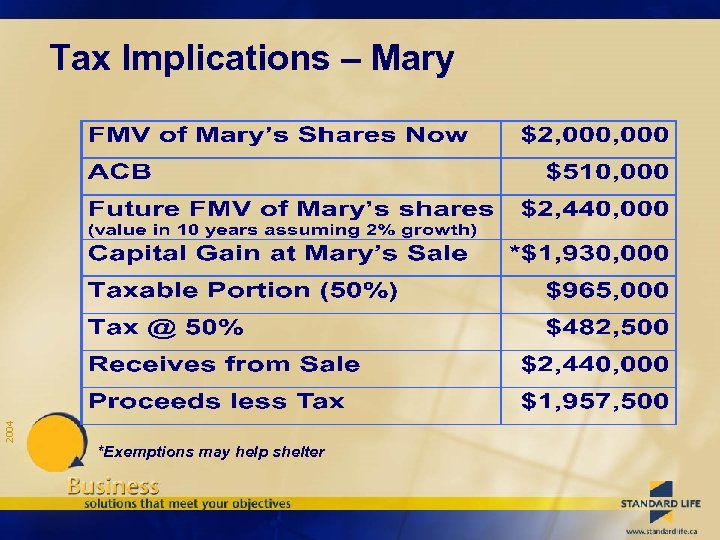

2004 Tax Implications – Mary *Exemptions may help shelter

2004 Tax Implications – Mary *Exemptions may help shelter

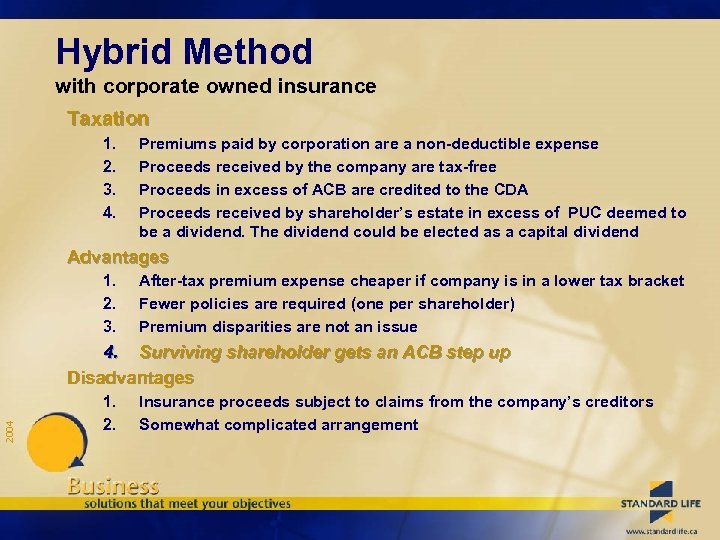

Hybrid Method with corporate owned insurance Taxation 1. 2. 3. 4. Premiums paid by corporation are a non-deductible expense Proceeds received by the company are tax-free Proceeds in excess of ACB are credited to the CDA Proceeds received by shareholder’s estate in excess of PUC deemed to be a dividend. The dividend could be elected as a capital dividend Advantages 1. 2. 3. After-tax premium expense cheaper if company is in a lower tax bracket Fewer policies are required (one per shareholder) Premium disparities are not an issue 2004 4. Surviving shareholder gets an ACB step up Disadvantages 1. 2. Insurance proceeds subject to claims from the company’s creditors Somewhat complicated arrangement

Hybrid Method with corporate owned insurance Taxation 1. 2. 3. 4. Premiums paid by corporation are a non-deductible expense Proceeds received by the company are tax-free Proceeds in excess of ACB are credited to the CDA Proceeds received by shareholder’s estate in excess of PUC deemed to be a dividend. The dividend could be elected as a capital dividend Advantages 1. 2. 3. After-tax premium expense cheaper if company is in a lower tax bracket Fewer policies are required (one per shareholder) Premium disparities are not an issue 2004 4. Surviving shareholder gets an ACB step up Disadvantages 1. 2. Insurance proceeds subject to claims from the company’s creditors Somewhat complicated arrangement

Comparing the Strategies 2004 • Results for each of the relevant parties

Comparing the Strategies 2004 • Results for each of the relevant parties

Tax Implications – John 2004 Red Share *Exemptions may help shelter n emptio Hybrid

Tax Implications – John 2004 Red Share *Exemptions may help shelter n emptio Hybrid

Tax Implications – John’s Estate ion dempt 2004 Re Share Hybrid

Tax Implications – John’s Estate ion dempt 2004 Re Share Hybrid

Tax Implications – Mary mption 2004 Rede Share *Exemptions may help shelter Hybrid

Tax Implications – Mary mption 2004 Rede Share *Exemptions may help shelter Hybrid

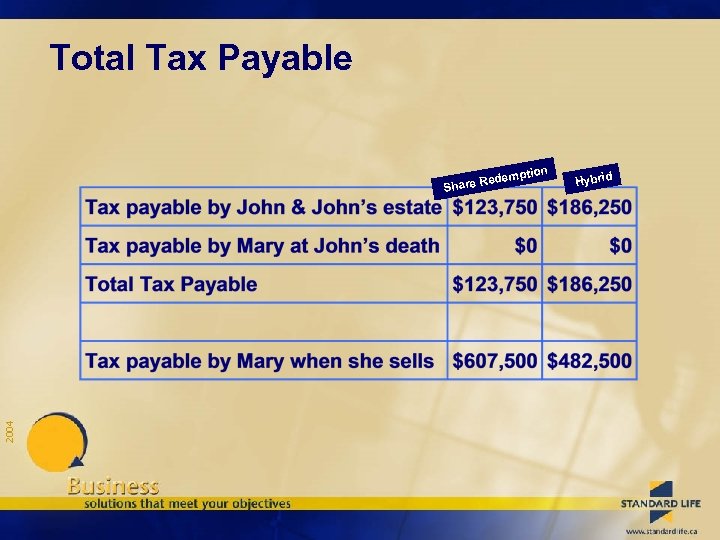

Total Tax Payable mption 2004 Rede Share Hybrid

Total Tax Payable mption 2004 Rede Share Hybrid

Summary 2004 • Both strategies have their pros and cons • Corporate redemption is better from John’s perspective • Hybrid from Mary’s • The best strategy § see if the client can benefit from grandfathering

Summary 2004 • Both strategies have their pros and cons • Corporate redemption is better from John’s perspective • Hybrid from Mary’s • The best strategy § see if the client can benefit from grandfathering