8bf0e6fa69116fcffb0be53cd763c58a.ppt

- Количество слайдов: 36

2001 MICHAEL BAKER CORPORATION Investor Relations Presentation e ngineering and e nergy solutions

2001 Safe Harbor This presentation will contain information related to events which may occur in the future. These forward -looking statements may include future business trends, revenue and earnings forecasts, and acquisition and corporate finance activity. These statements are subject to market, operating and other risks and uncertainties and, as a result, actual results may vary. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

2001 n Summary / Highlights Leader in Professional Services u u n n Oil & Gas Production O&M Transportation and Civil Infrastructure Engineering Positioned to Accelerate Margin Growth, Led by Energy Segment Focused on Two Segments with New Management Team in Place Recognized Expertise in Transportation, Pipeline and Power Generation Markets Under-followed Micro Cap Valued at 4 x EBITDA

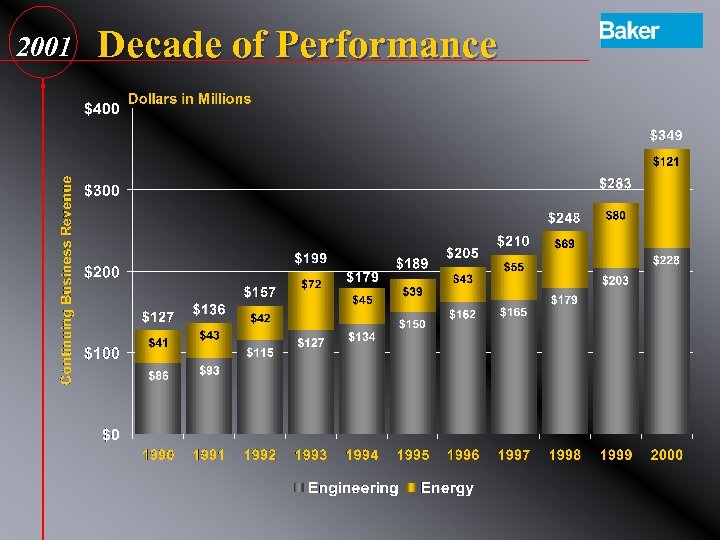

2001 Decade of Performance

2001 n Core Energy Service Offerings Oil & Gas u u n Operations & Maintenance Competency-Based Training Operations Engineering Supply Chain Management Power u u Operations & Maintenance New Equipment Installation Outage Planning/Overhauls Engineering / Start-up Assistance

2001 n Differentiation of Services Energy u u u Integrated Services and Solutions for Global O&G Upstream Production Operations Competency-Based Training and Nationalization Programs OPCOSM

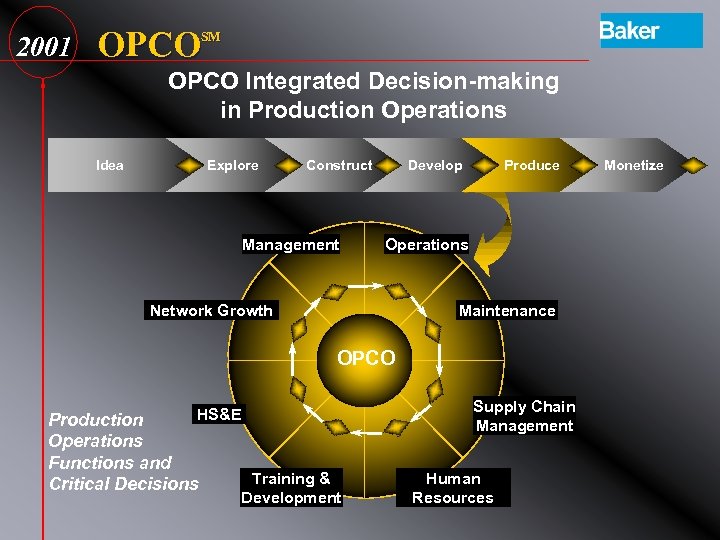

2001 OPCO SM OPCO Integrated Decision-making in Production Operations Idea Explore Construct Management Develop Produce Operations Network Growth Maintenance OPCO Supply Chain Management HS&E Production Operations Functions and Critical Decisions Training & Development Human Resources Monetize

2001 Growth Drivers Outsourcing Trends $4 bil. Total GOM Market $? bil. Total Int’l. Market GOM 10% GOM Outsourced O&M Market International ? % Int’l. Outsourced O&M Market

2001 n Growth Drivers Energy u u Outsourcing and Industry Growth Commitments of Major and Independent Oil and Gas Producers Political and Economic Requirements to Develop Nationalized Workforce u Favorable Environment for Fossil Fuel Sources u Bush Administration Energy Proposal u Deregulation of Electric Power Industry

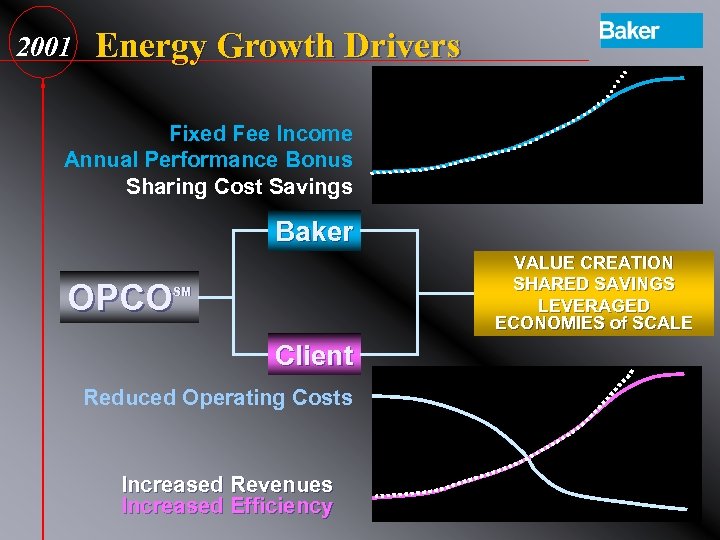

2001 Energy Growth Drivers Fixed Fee Income Annual Performance Bonus Sharing Cost Savings Baker VALUE CREATION SHARED SAVINGS LEVERAGED ECONOMIES of SCALE OPCO SM Client Reduced Operating Costs Increased Revenues Increased Efficiency

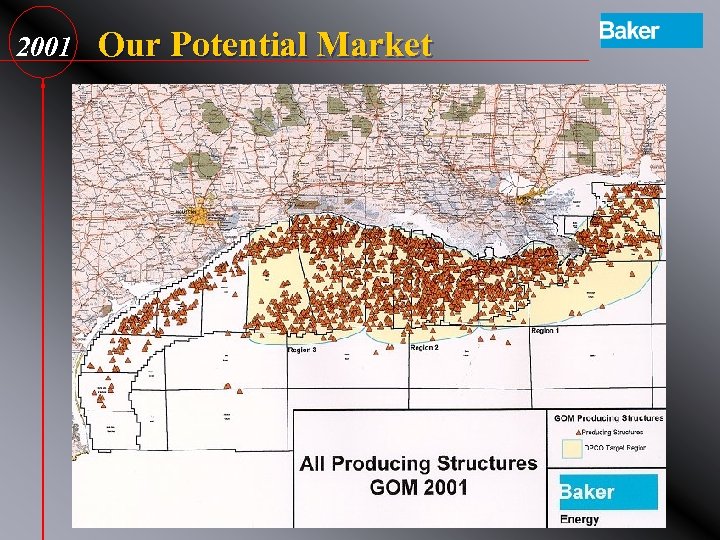

2001 Our Potential Market

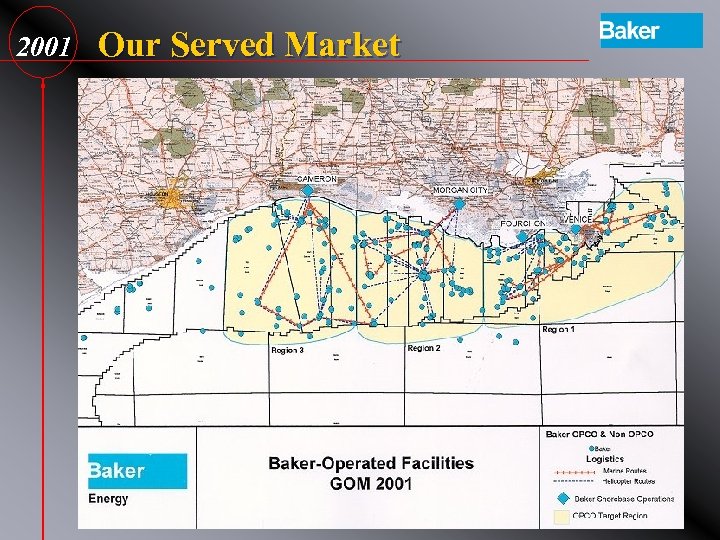

2001 Our Served Market

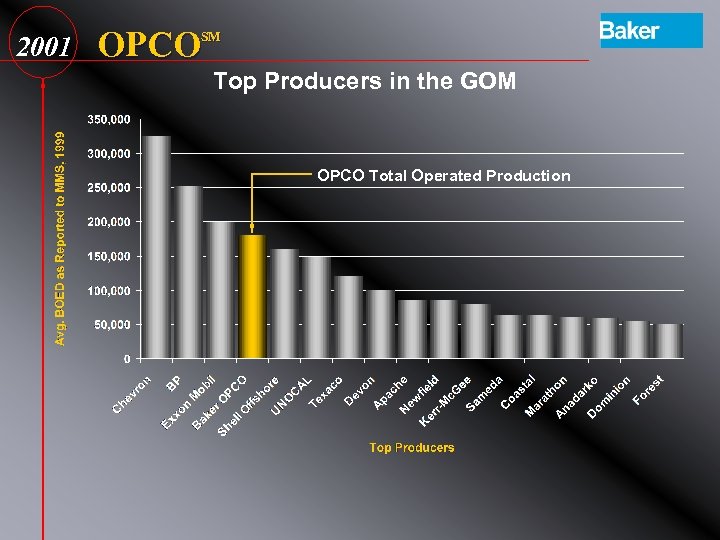

2001 OPCO SM Top Producers in the GOM OPCO Total Operated Production

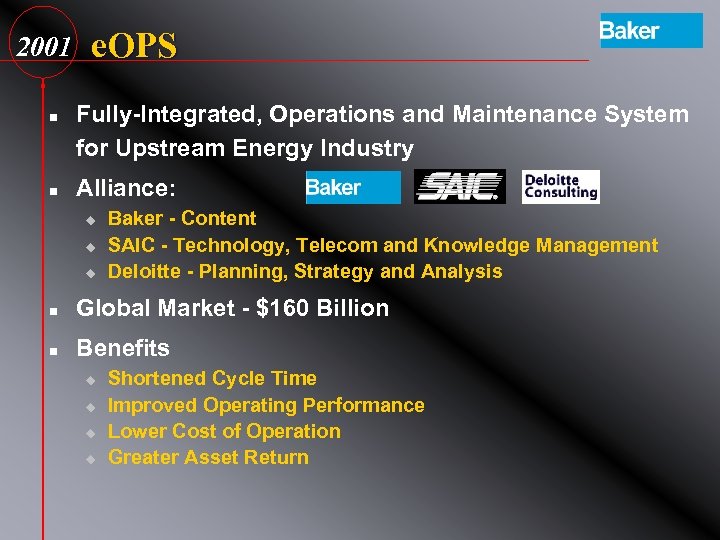

2001 n n e. OPS Fully-Integrated, Operations and Maintenance System for Upstream Energy Industry Alliance: u u u Baker - Content SAIC - Technology, Telecom and Knowledge Management Deloitte - Planning, Strategy and Analysis n Global Market - $160 Billion n Benefits u u Shortened Cycle Time Improved Operating Performance Lower Cost of Operation Greater Asset Return

2001 Energy - Recent Contracts CLIENT INITIAL TERM Chevron (Thailand) Burlington Resources El Paso Production Nigeria LNG Limited BP (Various) Magnum Hunter Panaco Ener. Vest Mitsubishi Heavy Industries Sonatrach 5 YR. 3 YR. INITIAL CV $25 m $60 m $64 m $10 m $5 m >$1 m

2001 Core Engineering Service Offerings n Transportation Engineering Services u u u n Highways Bridges (Structures) Airports Civil Infrastructure Services u u u Cold Region Pipelines Water/Waste Water Power / Utilities

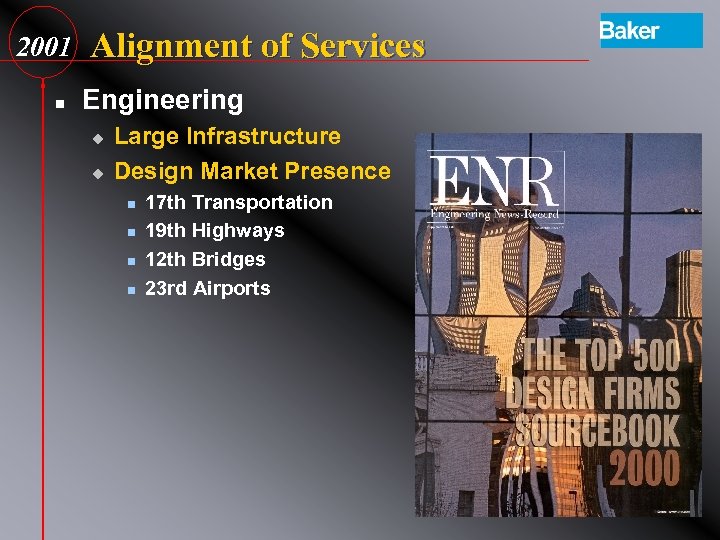

2001 n Alignment of Services Engineering u u Large Infrastructure Design Market Presence n n 17 th Transportation 19 th Highways 12 th Bridges 23 rd Airports

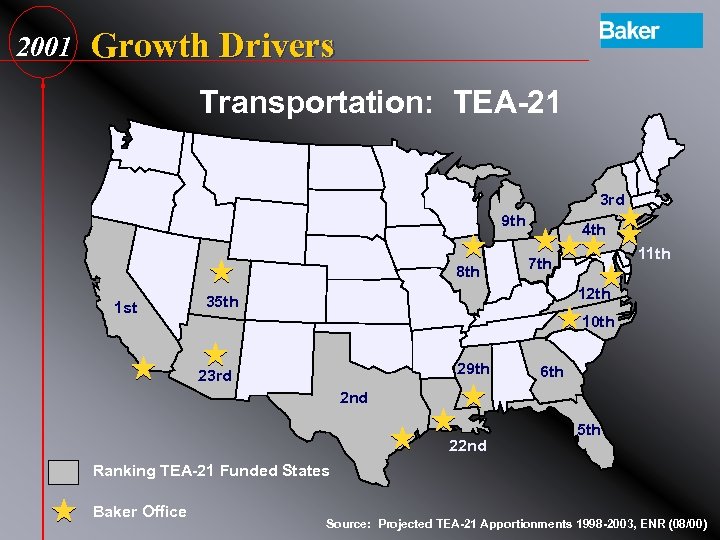

2001 Growth Drivers Transportation: TEA-21 3 rd 9 th 8 th 1 st 4 th 11 th 7 th 12 th 35 th 10 th 29 th 23 rd 6 th 2 nd 22 nd 5 th Ranking TEA-21 Funded States Baker Office Source: Projected TEA-21 Apportionments 1998 -2003, ENR (08/00)

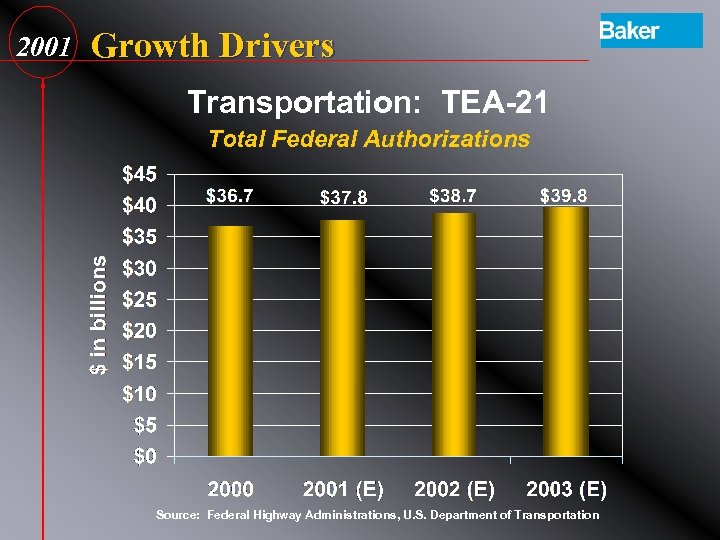

2001 Growth Drivers Transportation: TEA-21 Total Federal Authorizations Source: Federal Highway Administrations, U. S. Department of Transportation

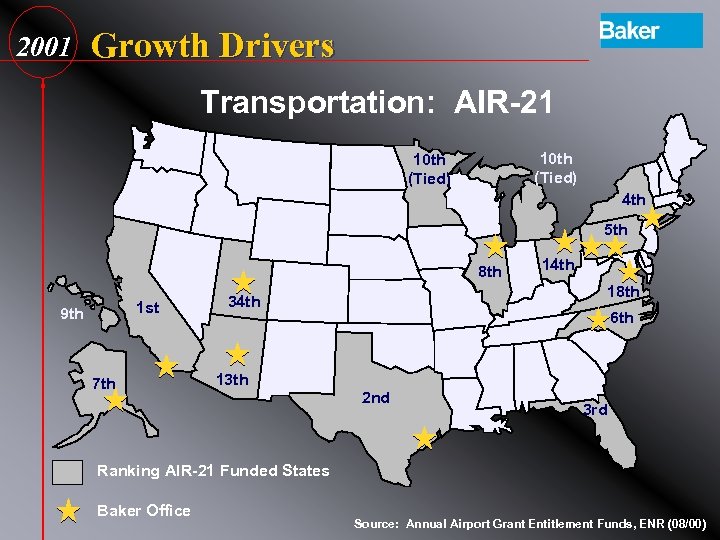

2001 Growth Drivers Transportation: AIR-21 10 th (Tied) 4 th 5 th 8 th 1 st 9 th 7 th 14 th 18 th 34 th 6 th 13 th 2 nd 3 rd Ranking AIR-21 Funded States Baker Office Source: Annual Airport Grant Entitlement Funds, ENR (08/00)

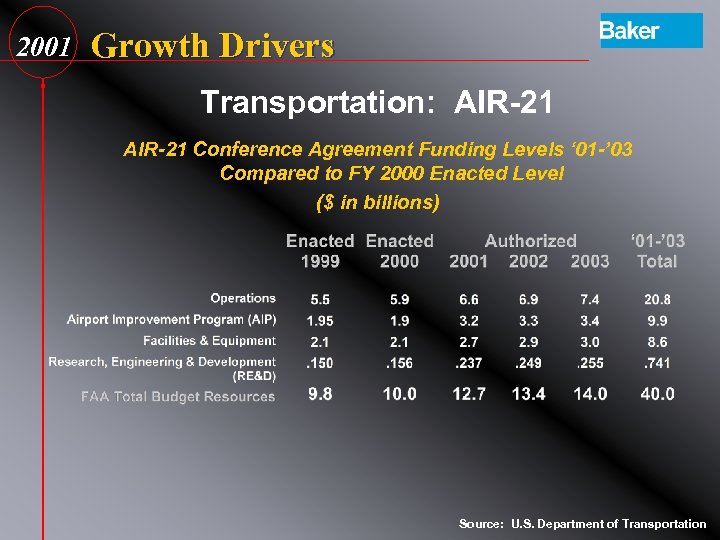

2001 Growth Drivers Transportation: AIR-21 Conference Agreement Funding Levels ‘ 01 -’ 03 Compared to FY 2000 Enacted Level ($ in billions) Source: U. S. Department of Transportation

2001 n Growth Drivers Oil & Gas Pipelines Cold Regions Expertise Trans-Alaska Pipeline u Alpine Extension - Colville River u Sakhalin Island u Alas-Can Project u

2001 n Competitive Barriers to Entry Energy Customer Relationships u Content and Information Delivery Systems u Implementation/Delivery Capability u OPCO Network u n Engineering Alignment of Services to Meet Customer Needs u Long-Term Relationships u

2001 n Key Customer Relationships Energy n Engineering

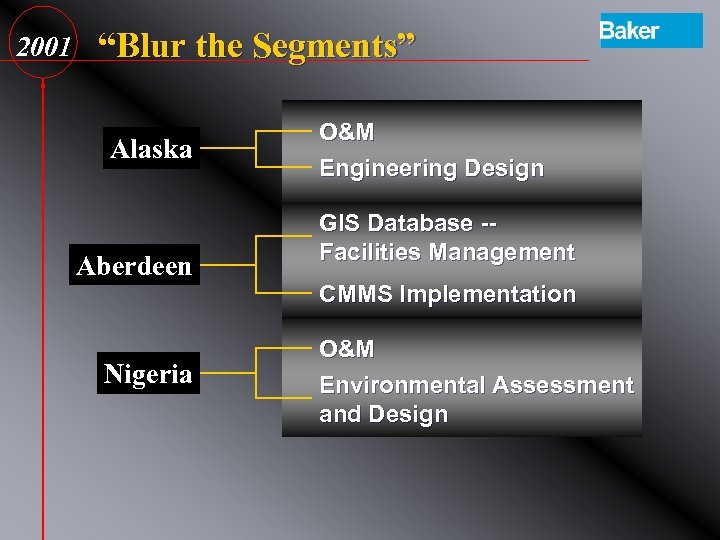

2001 “Blur the Segments” Alaska Aberdeen Nigeria O&M Engineering Design GIS Database -Facilities Management CMMS Implementation O&M Environmental Assessment and Design

2001 Acquisition Growth Opportunities n Geographic and Capacity Expansion Energy Opportunities u Engineering Opportunities u n Additional Capabilities u Energy Training Program Development n Maintenance Management Systems n u Engineering Power n Water/Wastewater n Asset Management n

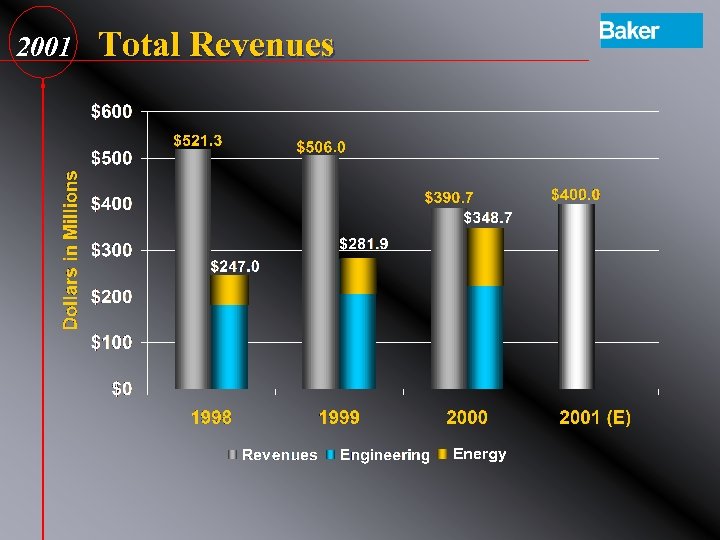

2001 Total Revenues Energy

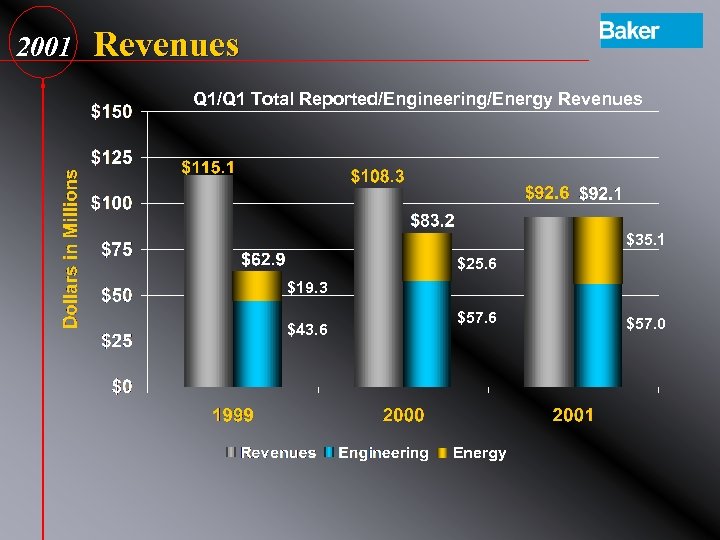

2001 Revenues Q 1/Q 1 Total Reported/Engineering/Energy Revenues $35. 1 $25. 6 $19. 3 $43. 6 $57. 6 Energy $57. 0

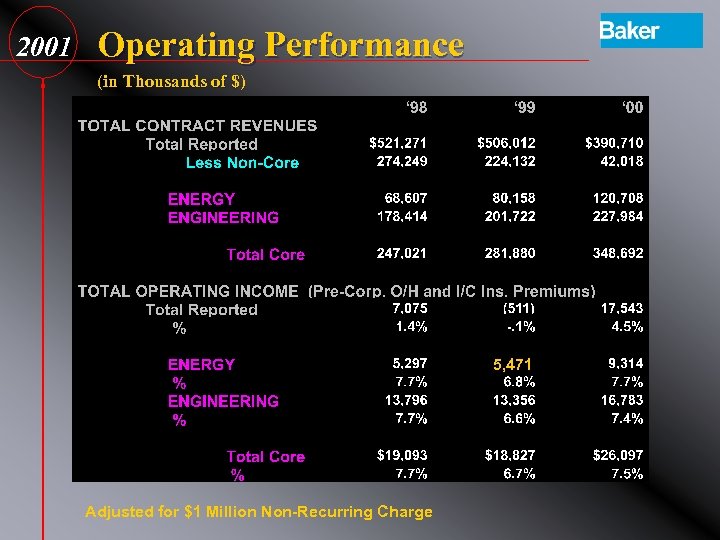

2001 Operating Performance (in Thousands of $) 5, 471 Adjusted for $1 Million Non-Recurring Charge

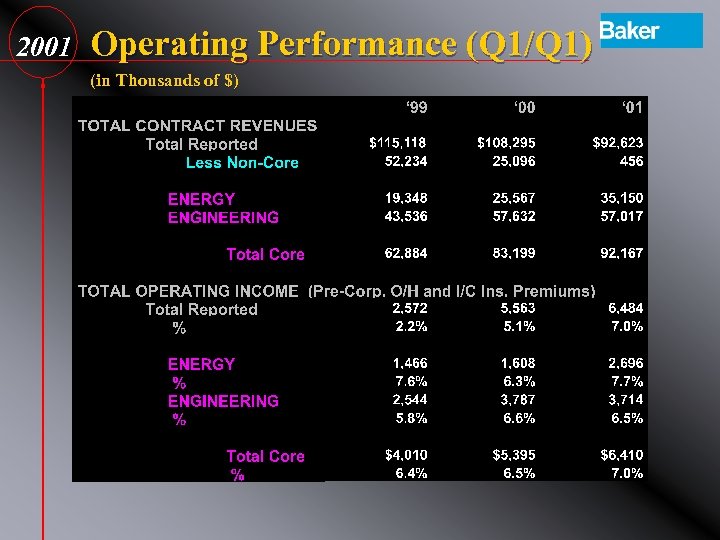

2001 Operating Performance (Q 1/Q 1) (in Thousands of $)

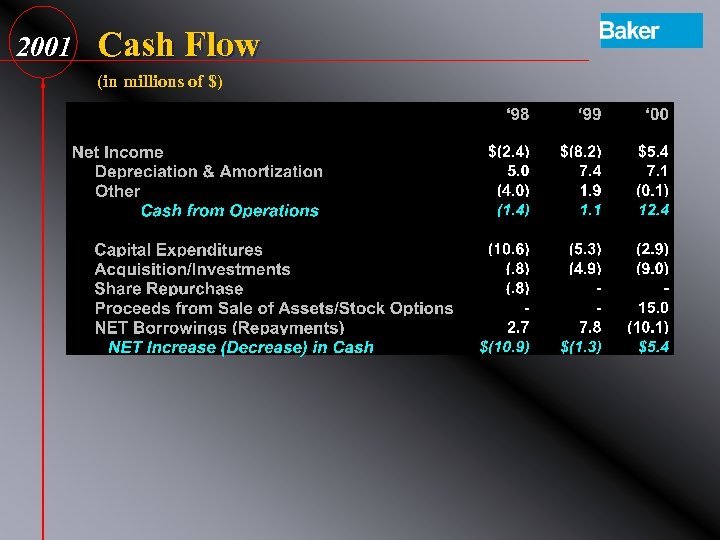

2001 Cash Flow (in millions of $)

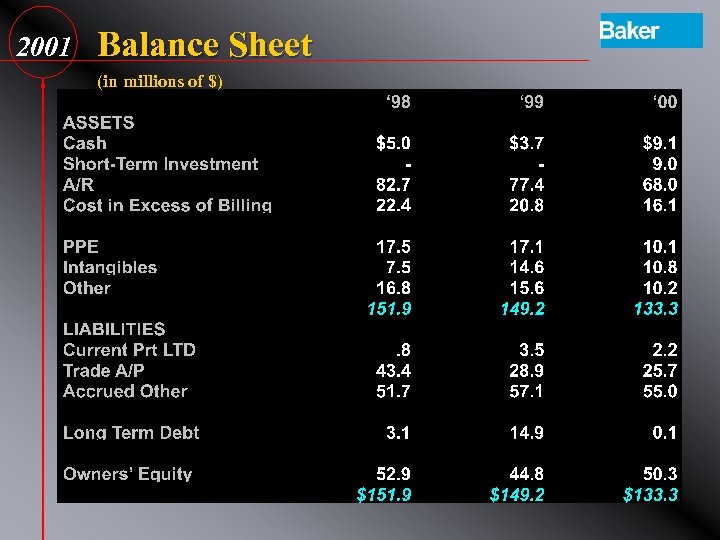

2001 Balance Sheet (in millions of $)

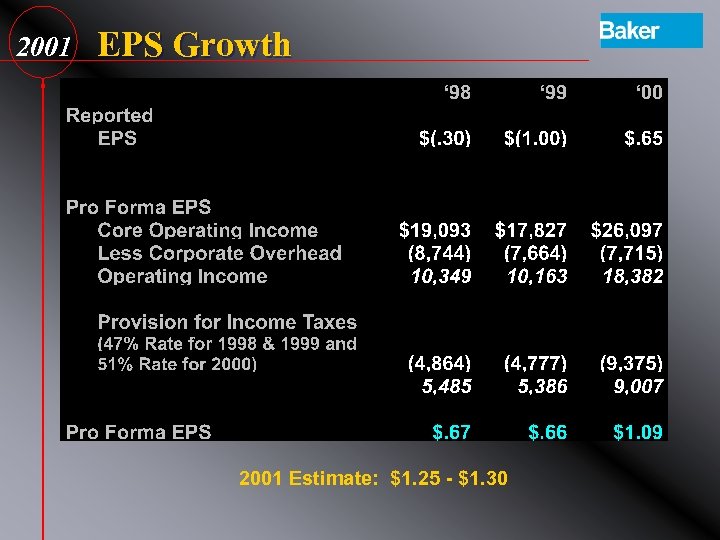

2001 EPS Growth 2001 Estimate: $1. 25 - $1. 30

2001 Ownership Holders Shares Baker ESOP 3, 420, 821 Goldman Sachs Asset Management 720, 900 Lord, Abbett & Co. 525, 200 Dimensional Fund Advisors Inc. 478, 214 Seacor Smit, Inc. 340, 000 Management/Insiders 296, 445 Pennsylvania Public School ERS 236, 400 Corbyn Investment Management 141, 600

2001 n Conclusion Leader in: u u n n Oil & Gas Production O&M Transportation and Civil Infrastructure Engineering Energy Market Conditions Catalyst for Significant Growth Investment in Transportation Infrastructure Providing Substantial Opportunity Debt-free, Leverageable Balance Sheet Under-followed Micro Cap Valued at 4 x EBITDA

2001 MICHAEL BAKER CORPORATION Investor Relations Presentation e ngineering and e nergy solutions

8bf0e6fa69116fcffb0be53cd763c58a.ppt