ea933e3054f5be3277a1d657280805a3.ppt

- Количество слайдов: 60

2000 Results Appendices 2000 Results 1

2000 Results Appendices 2000 Results 1

Appendices 2000 Results 2

Appendices 2000 Results 2

Group 2000 Results 3 GROUP C&I BK PBAM RETAIL

Group 2000 Results 3 GROUP C&I BK PBAM RETAIL

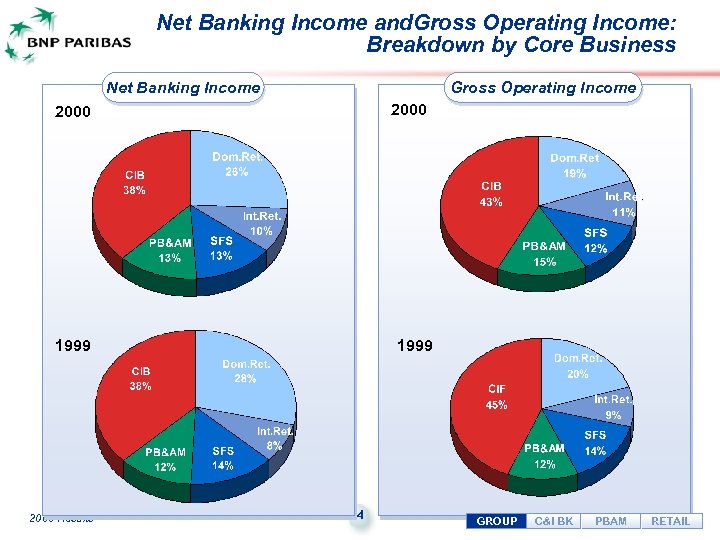

Net Banking Income and. Gross Operating Income: Breakdown by Core Business Net Banking Income Gross Operating Income 2000 1999 2000 Results 1999 4 GROUP C&I BK PBAM RETAIL

Net Banking Income and. Gross Operating Income: Breakdown by Core Business Net Banking Income Gross Operating Income 2000 1999 2000 Results 1999 4 GROUP C&I BK PBAM RETAIL

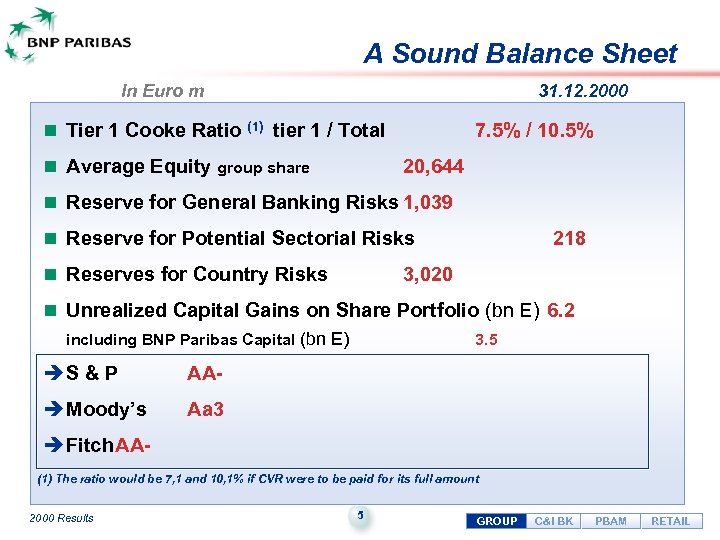

A Sound Balance Sheet In Euro m 31. 12. 2000 n Tier 1 Cooke Ratio (1) tier 1 / Total n Average Equity group share 7. 5% / 10. 5% 20, 644 n Reserve for General Banking Risks 1, 039 n Reserve for Potential Sectorial Risks n Reserves for Country Risks 218 3, 020 n Unrealized Capital Gains on Share Portfolio (bn E) 6. 2 including BNP Paribas Capital (bn E) è S & P AA- è Moody’s 3. 5 Aa 3 è Fitch. AA(1) The ratio would be 7, 1 and 10, 1% if CVR were to be paid for its full amount 2000 Results 5 GROUP C&I BK PBAM RETAIL

A Sound Balance Sheet In Euro m 31. 12. 2000 n Tier 1 Cooke Ratio (1) tier 1 / Total n Average Equity group share 7. 5% / 10. 5% 20, 644 n Reserve for General Banking Risks 1, 039 n Reserve for Potential Sectorial Risks n Reserves for Country Risks 218 3, 020 n Unrealized Capital Gains on Share Portfolio (bn E) 6. 2 including BNP Paribas Capital (bn E) è S & P AA- è Moody’s 3. 5 Aa 3 è Fitch. AA(1) The ratio would be 7, 1 and 10, 1% if CVR were to be paid for its full amount 2000 Results 5 GROUP C&I BK PBAM RETAIL

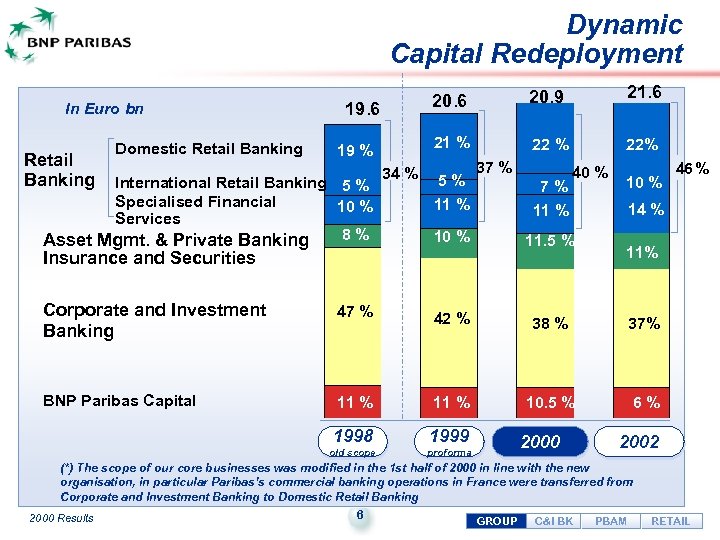

Dynamic Capital Redeployment In Euro bn Retail Banking Domestic Retail Banking 19 % International Retail Banking 5 % Specialised Financial 10 % Services 8 % Asset Mgmt. & Private Banking 34 % 20. 9 21. 6 21 % 19. 6 20. 6 22 % 22% 5 % 37 % 40 % 11 % 7 % 11 % 10 % 11. 5 % Insurance and Securities 10 % 46 % 14 % 11% Corporate and Investment Banking 47 % 42 % 38 % 37% BNP Paribas Capital 11 % 10. 5 % 6 % 1998 1999 old scope proforma 2000 2002 (*) The scope of our core businesses was modified in the 1 st half of 2000 in line with the new organisation, in particular Paribas’s commercial banking operations in France were transferred from Corporate and Investment Banking to Domestic Retail Banking 2000 Results 6 GROUP C&I BK PBAM RETAIL

Dynamic Capital Redeployment In Euro bn Retail Banking Domestic Retail Banking 19 % International Retail Banking 5 % Specialised Financial 10 % Services 8 % Asset Mgmt. & Private Banking 34 % 20. 9 21. 6 21 % 19. 6 20. 6 22 % 22% 5 % 37 % 40 % 11 % 7 % 11 % 10 % 11. 5 % Insurance and Securities 10 % 46 % 14 % 11% Corporate and Investment Banking 47 % 42 % 38 % 37% BNP Paribas Capital 11 % 10. 5 % 6 % 1998 1999 old scope proforma 2000 2002 (*) The scope of our core businesses was modified in the 1 st half of 2000 in line with the new organisation, in particular Paribas’s commercial banking operations in France were transferred from Corporate and Investment Banking to Domestic Retail Banking 2000 Results 6 GROUP C&I BK PBAM RETAIL

The Euro n Starting on 1 January 1999, BNP began providing all its major pricing conditions in Euros n Since the end of 1999, the majority of the branch network’s new contracts signed have been in Euros. l l 90% of Housing Savings Plans (PEL) 85% of personal loans 80% of all savings accounts 60% of mortgages n Group is well prepared but French environment is lagging behing 2000 Results 7 GROUP C&I BK PBAM RETAIL

The Euro n Starting on 1 January 1999, BNP began providing all its major pricing conditions in Euros n Since the end of 1999, the majority of the branch network’s new contracts signed have been in Euros. l l 90% of Housing Savings Plans (PEL) 85% of personal loans 80% of all savings accounts 60% of mortgages n Group is well prepared but French environment is lagging behing 2000 Results 7 GROUP C&I BK PBAM RETAIL

Internet: An Active Yet Selective Investment Strategy n BNPParibas E. CUBE n Active support for group projects n B-to-C: l Le. Site. Immobilier real-estate Web site set up in partnership with the Particulier à Particulier group, leading publisher of real-estate ads in France l Bought an investment stake in company that offers an alternative Person- to-Person payment solution n B-to-B: l l Strategic repositioning of Business Village, focussing on SMEs as a discounted purchasing clearing house offer non specific office supplies l 2000 Results Answork: market place in alliance with Crédit Agricole, SG, Cap Gémini and France Télécom Plans to extend the Business Village model to other sectors 8 GROUP C&I BK PBAM RETAIL

Internet: An Active Yet Selective Investment Strategy n BNPParibas E. CUBE n Active support for group projects n B-to-C: l Le. Site. Immobilier real-estate Web site set up in partnership with the Particulier à Particulier group, leading publisher of real-estate ads in France l Bought an investment stake in company that offers an alternative Person- to-Person payment solution n B-to-B: l l Strategic repositioning of Business Village, focussing on SMEs as a discounted purchasing clearing house offer non specific office supplies l 2000 Results Answork: market place in alliance with Crédit Agricole, SG, Cap Gémini and France Télécom Plans to extend the Business Village model to other sectors 8 GROUP C&I BK PBAM RETAIL

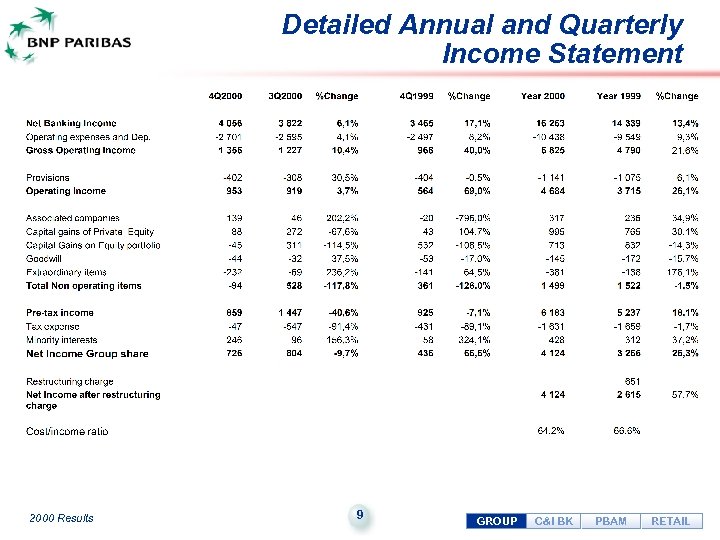

Detailed Annual and Quarterly Income Statement 2000 Results 9 GROUP C&I BK PBAM RETAIL

Detailed Annual and Quarterly Income Statement 2000 Results 9 GROUP C&I BK PBAM RETAIL

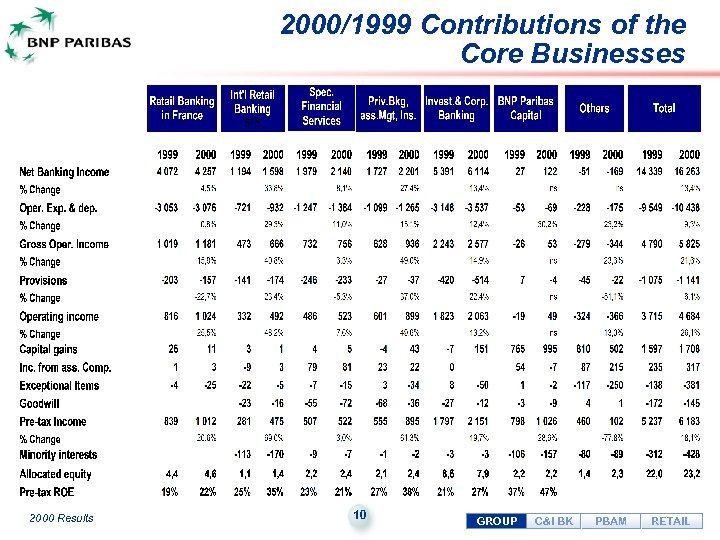

2000/1999 Contributions of the Core Businesses 2000 Results 10 GROUP C&I BK PBAM RETAIL

2000/1999 Contributions of the Core Businesses 2000 Results 10 GROUP C&I BK PBAM RETAIL

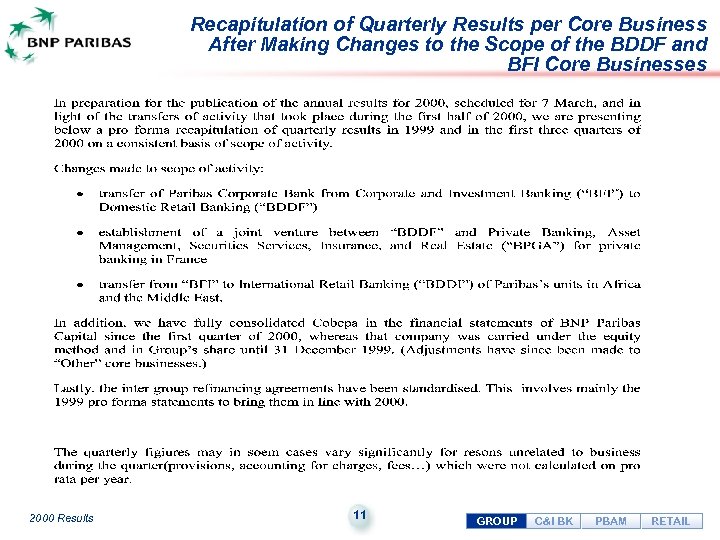

Recapitulation of Quarterly Results per Core Business After Making Changes to the Scope of the BDDF and BFI Core Businesses 2000 Results 11 GROUP C&I BK PBAM RETAIL

Recapitulation of Quarterly Results per Core Business After Making Changes to the Scope of the BDDF and BFI Core Businesses 2000 Results 11 GROUP C&I BK PBAM RETAIL

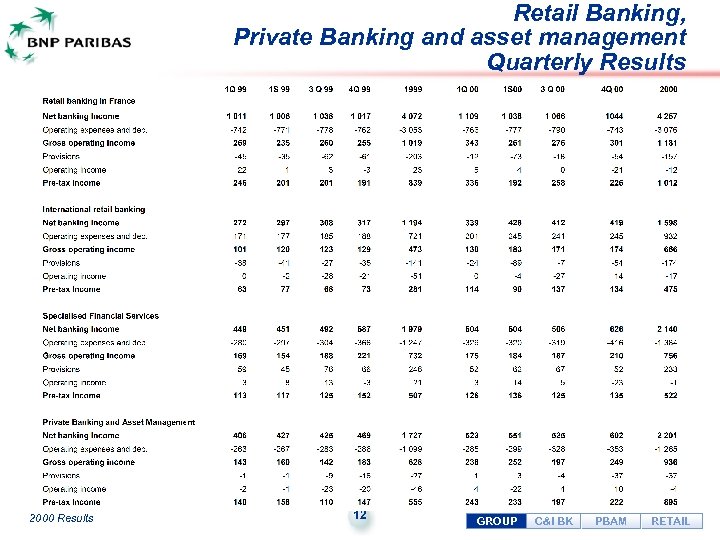

Retail Banking, Private Banking and asset management Quarterly Results 2000 Results 12 GROUP C&I BK PBAM RETAIL

Retail Banking, Private Banking and asset management Quarterly Results 2000 Results 12 GROUP C&I BK PBAM RETAIL

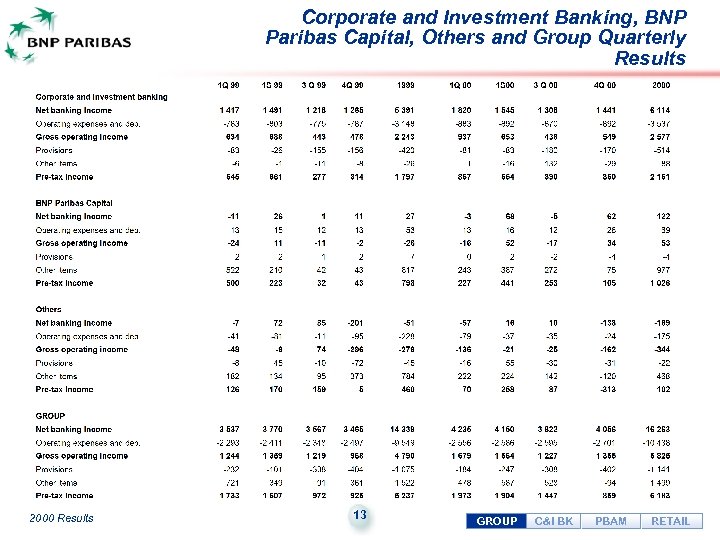

Corporate and Investment Banking, BNP Paribas Capital, Others and Group Quarterly Results 2000 Results 13 GROUP C&I BK PBAM RETAIL

Corporate and Investment Banking, BNP Paribas Capital, Others and Group Quarterly Results 2000 Results 13 GROUP C&I BK PBAM RETAIL

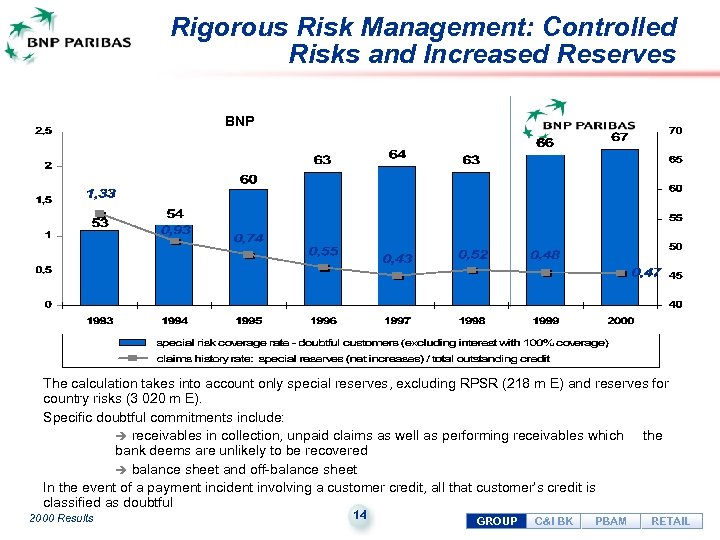

Rigorous Risk Management: Controlled Risks and Increased Reserves BNP The calculation takes into account only special reserves, excluding RPSR (218 m E) and reserves for country risks (3 020 m E). Specific doubtful commitments include: è receivables in collection, unpaid claims as well as performing receivables which the bank deems are unlikely to be recovered è balance sheet and off-balance sheet In the event of a payment incident involving a customer credit, all that customer’s credit is classified as doubtful 2000 Results 14 GROUP C&I BK PBAM RETAIL

Rigorous Risk Management: Controlled Risks and Increased Reserves BNP The calculation takes into account only special reserves, excluding RPSR (218 m E) and reserves for country risks (3 020 m E). Specific doubtful commitments include: è receivables in collection, unpaid claims as well as performing receivables which the bank deems are unlikely to be recovered è balance sheet and off-balance sheet In the event of a payment incident involving a customer credit, all that customer’s credit is classified as doubtful 2000 Results 14 GROUP C&I BK PBAM RETAIL

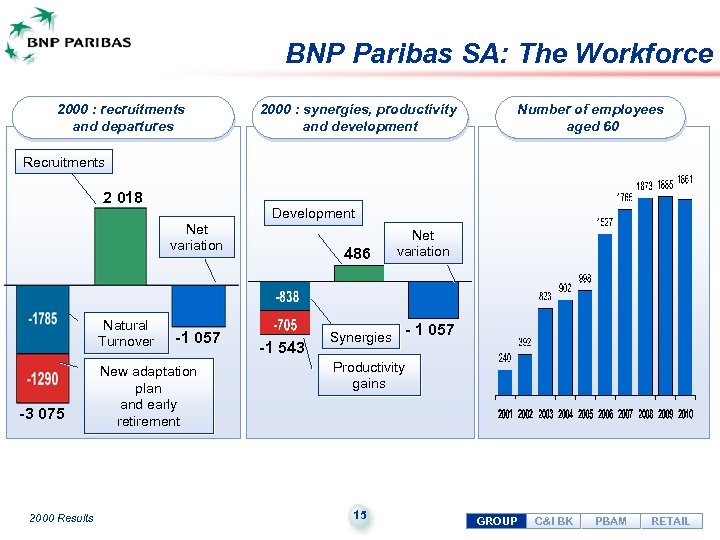

BNP Paribas SA: The Workforce 2000 : recruitments and departures 2000 : synergies, productivity and development Number of employees aged 60 Recruitments 2 018 Net variation Natural Turnover -3 075 2000 Results -1 057 New adaptation plan and early retirement Development 486 -1 543 Net variation Synergies - 1 057 Productivity gains 15 GROUP C&I BK PBAM RETAIL

BNP Paribas SA: The Workforce 2000 : recruitments and departures 2000 : synergies, productivity and development Number of employees aged 60 Recruitments 2 018 Net variation Natural Turnover -3 075 2000 Results -1 057 New adaptation plan and early retirement Development 486 -1 543 Net variation Synergies - 1 057 Productivity gains 15 GROUP C&I BK PBAM RETAIL

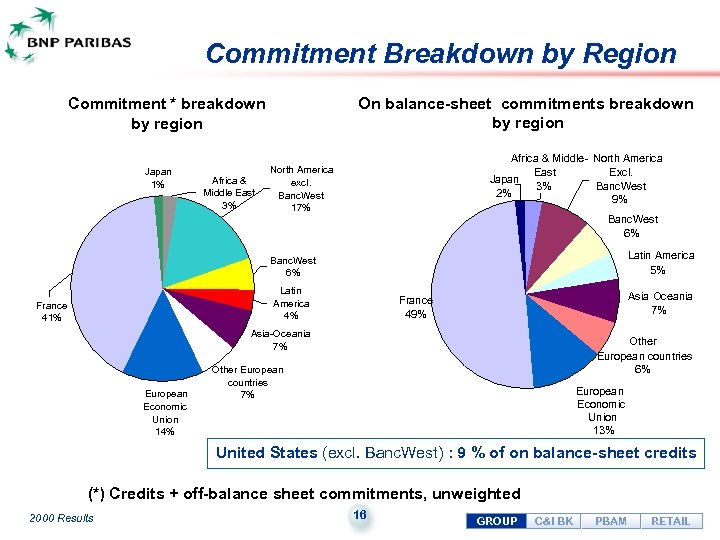

Commitment Breakdown by Region On balance-sheet commitments breakdown by region Commitment * breakdown by region Japan 1% Africa & Middle East 3% Africa & Middle- North America East Excl. Japan 3% Banc. West 2% 9% North America excl. Banc. West 17% Banc. West 6% Latin America 5% Banc. West 6% Latin America 4% France 41% Asia Oceania 7% France 49% Asia-Oceania 7% European Economic Union 14% Other European countries 6% Other European countries 7% European Economic Union 13% United States (excl. Banc. West) : 9 % of on balance-sheet credits (*) Credits + off-balance sheet commitments, unweighted 2000 Results 16 GROUP C&I BK PBAM RETAIL

Commitment Breakdown by Region On balance-sheet commitments breakdown by region Commitment * breakdown by region Japan 1% Africa & Middle East 3% Africa & Middle- North America East Excl. Japan 3% Banc. West 2% 9% North America excl. Banc. West 17% Banc. West 6% Latin America 5% Banc. West 6% Latin America 4% France 41% Asia Oceania 7% France 49% Asia-Oceania 7% European Economic Union 14% Other European countries 6% Other European countries 7% European Economic Union 13% United States (excl. Banc. West) : 9 % of on balance-sheet credits (*) Credits + off-balance sheet commitments, unweighted 2000 Results 16 GROUP C&I BK PBAM RETAIL

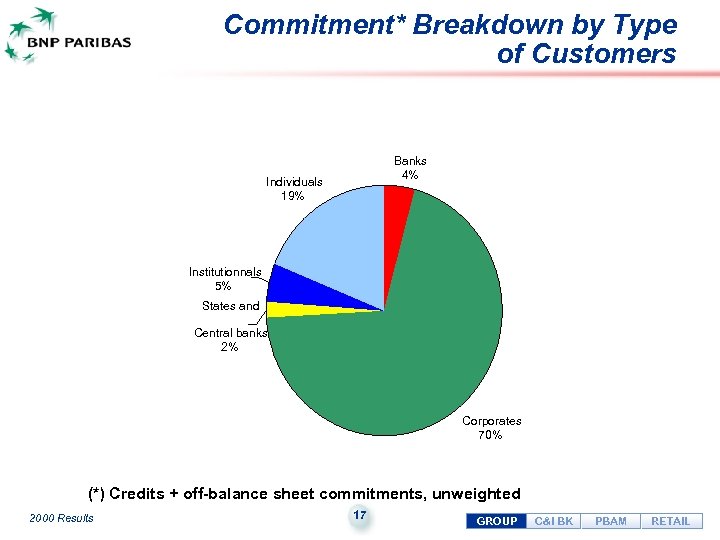

Commitment* Breakdown by Type of Customers Banks 4% Individuals 19% Institutionnals 5% States and Central banks 2% Corporates 70% (*) Credits + off-balance sheet commitments, unweighted 2000 Results 17 GROUP C&I BK PBAM RETAIL

Commitment* Breakdown by Type of Customers Banks 4% Individuals 19% Institutionnals 5% States and Central banks 2% Corporates 70% (*) Credits + off-balance sheet commitments, unweighted 2000 Results 17 GROUP C&I BK PBAM RETAIL

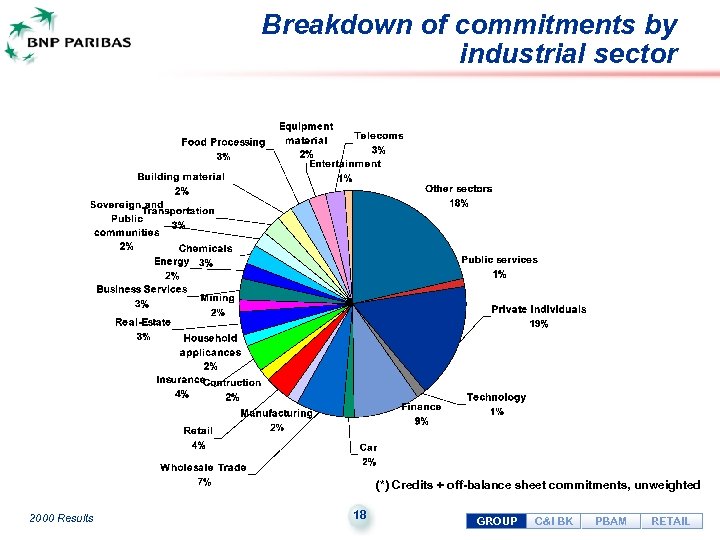

Breakdown of commitments by industrial sector (*) Credits + off-balance sheet commitments, unweighted 2000 Results 18 GROUP C&I BK PBAM RETAIL

Breakdown of commitments by industrial sector (*) Credits + off-balance sheet commitments, unweighted 2000 Results 18 GROUP C&I BK PBAM RETAIL

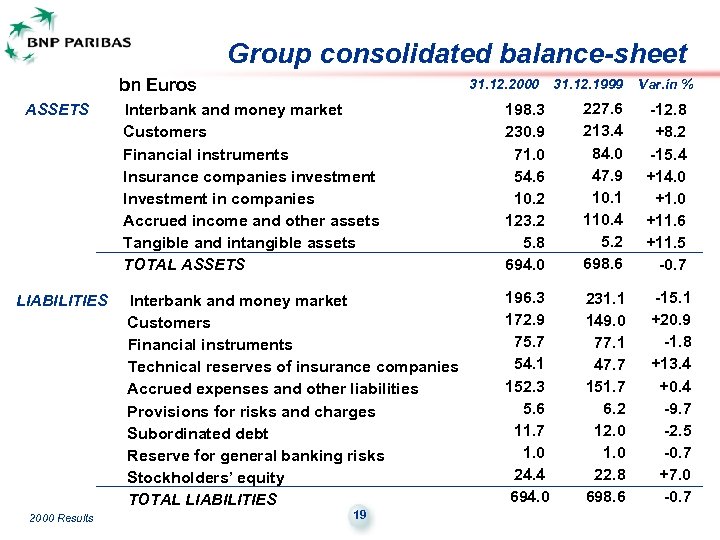

Group consolidated balance-sheet bn Euros ASSETS Interbank and money market Customers Financial instruments Insurance companies investment Investment in companies Accrued income and other assets Tangible and intangible assets TOTAL ASSETS LIABILITIES Interbank and money market Customers Financial instruments Technical reserves of insurance companies Accrued expenses and other liabilities Provisions for risks and charges Subordinated debt Reserve for general banking risks Stockholders’ equity TOTAL LIABILITIES 19 2000 Results 31. 12. 2000 31. 12. 1999 198. 3 230. 9 71. 0 54. 6 10. 2 123. 2 5. 8 694. 0 196. 3 172. 9 75. 7 54. 1 152. 3 5. 6 11. 7 1. 0 24. 4 694. 0 Var. in % 227. 6 -12. 8 213. 4 +8. 2 84. 0 -15. 4 47. 9 +14. 0 10. 1 +1. 0 110. 4 +11. 6 5. 2 +11. 5 698. 6 -0. 7 -15. 1 231. 1 +20. 9 149. 0 77. 1 -1. 8 +13. 4 47. 7 +0. 4 151. 7 -9. 7 6. 2 -2. 5 12. 0 -0. 7 1. 0 +7. 0 22. 8 -0. 7 698. 6

Group consolidated balance-sheet bn Euros ASSETS Interbank and money market Customers Financial instruments Insurance companies investment Investment in companies Accrued income and other assets Tangible and intangible assets TOTAL ASSETS LIABILITIES Interbank and money market Customers Financial instruments Technical reserves of insurance companies Accrued expenses and other liabilities Provisions for risks and charges Subordinated debt Reserve for general banking risks Stockholders’ equity TOTAL LIABILITIES 19 2000 Results 31. 12. 2000 31. 12. 1999 198. 3 230. 9 71. 0 54. 6 10. 2 123. 2 5. 8 694. 0 196. 3 172. 9 75. 7 54. 1 152. 3 5. 6 11. 7 1. 0 24. 4 694. 0 Var. in % 227. 6 -12. 8 213. 4 +8. 2 84. 0 -15. 4 47. 9 +14. 0 10. 1 +1. 0 110. 4 +11. 6 5. 2 +11. 5 698. 6 -0. 7 -15. 1 231. 1 +20. 9 149. 0 77. 1 -1. 8 +13. 4 47. 7 +0. 4 151. 7 -9. 7 6. 2 -2. 5 12. 0 -0. 7 1. 0 +7. 0 22. 8 -0. 7 698. 6

Corporate and Investment Banking 2000 Results 20

Corporate and Investment Banking 2000 Results 20

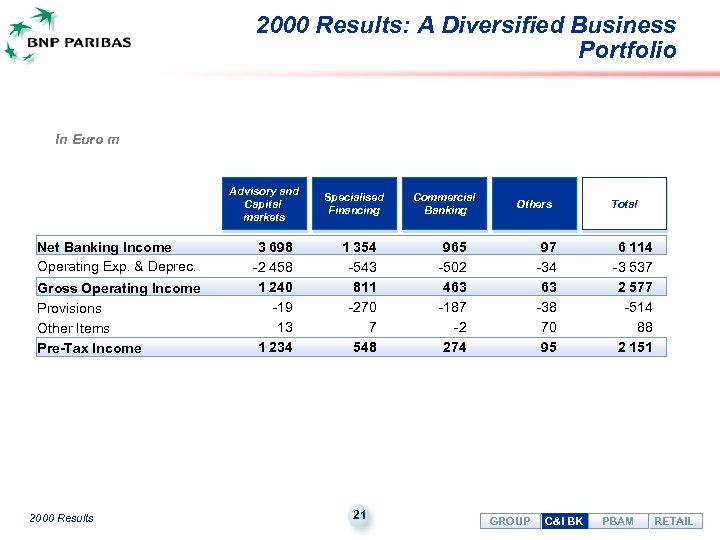

2000 Results: A Diversified Business Portfolio In Euro m Advisory and Capital markets Net Banking Income Operating Exp. & Deprec. Gross Operating Income Provisions Other Items Pre-Tax Income 3 698 -2 458 1 240 -19 13 1 234 Specialised Financing 1 354 -543 811 -270 7 548 Commercial Banking Others 97 -34 63 -38 70 95 965 -502 463 -187 -2 274 Total 6 114 -3 537 2 577 -514 88 2 151 2000 Results 21 GROUP C&I BK PBAM RETAIL

2000 Results: A Diversified Business Portfolio In Euro m Advisory and Capital markets Net Banking Income Operating Exp. & Deprec. Gross Operating Income Provisions Other Items Pre-Tax Income 3 698 -2 458 1 240 -19 13 1 234 Specialised Financing 1 354 -543 811 -270 7 548 Commercial Banking Others 97 -34 63 -38 70 95 965 -502 463 -187 -2 274 Total 6 114 -3 537 2 577 -514 88 2 151 2000 Results 21 GROUP C&I BK PBAM RETAIL

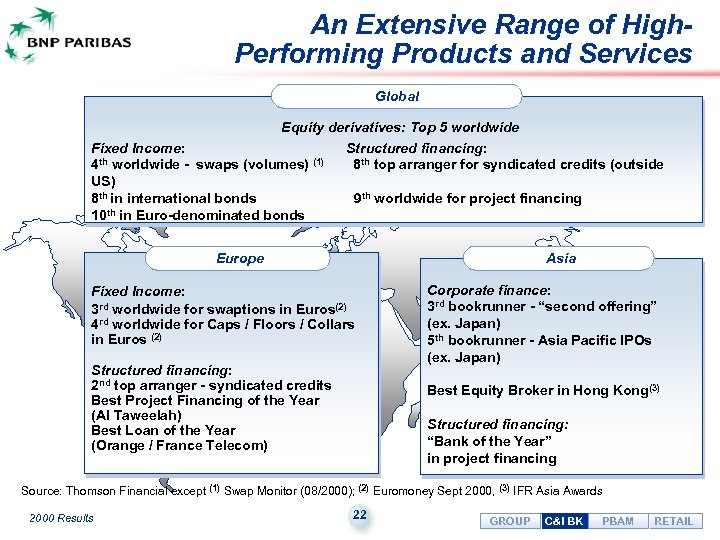

An Extensive Range of High. Performing Products and Services Global Equity derivatives: Top 5 worldwide Fixed Income: Structured financing: th worldwide - swaps (volumes) (1) 8 th top arranger for syndicated credits (outside 4 US) 8 th in international bonds 9 th worldwide for project financing 10 th in Euro-denominated bonds Europe Fixed Income: 3 rd worldwide for swaptions in Euros(2) 4 rd worldwide for Caps / Floors / Collars in Euros (2) Structured financing: 2 nd top arranger - syndicated credits Best Project Financing of the Year (Al Taweelah) Best Loan of the Year (Orange / France Telecom) Asia Corporate finance: 3 rd bookrunner - “second offering” (ex. Japan) 5 th bookrunner - Asia Pacific IPOs (ex. Japan) Best Equity Broker in Hong Kong(3) Structured financing: “Bank of the Year” in project financing Source: Thomson Financial except (1) Swap Monitor (08/2000); (2) Euromoney Sept 2000, (3) IFR Asia Awards 22 2000 Results GROUP C&I BK PBAM RETAIL

An Extensive Range of High. Performing Products and Services Global Equity derivatives: Top 5 worldwide Fixed Income: Structured financing: th worldwide - swaps (volumes) (1) 8 th top arranger for syndicated credits (outside 4 US) 8 th in international bonds 9 th worldwide for project financing 10 th in Euro-denominated bonds Europe Fixed Income: 3 rd worldwide for swaptions in Euros(2) 4 rd worldwide for Caps / Floors / Collars in Euros (2) Structured financing: 2 nd top arranger - syndicated credits Best Project Financing of the Year (Al Taweelah) Best Loan of the Year (Orange / France Telecom) Asia Corporate finance: 3 rd bookrunner - “second offering” (ex. Japan) 5 th bookrunner - Asia Pacific IPOs (ex. Japan) Best Equity Broker in Hong Kong(3) Structured financing: “Bank of the Year” in project financing Source: Thomson Financial except (1) Swap Monitor (08/2000); (2) Euromoney Sept 2000, (3) IFR Asia Awards 22 2000 Results GROUP C&I BK PBAM RETAIL

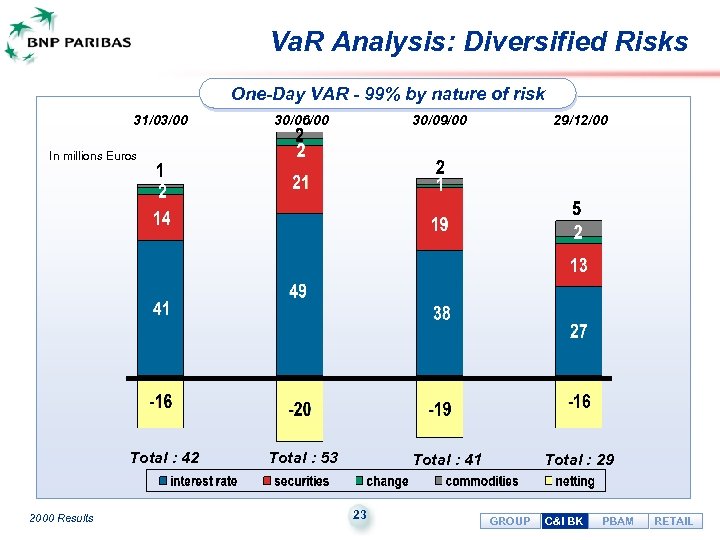

Va. R Analysis: Diversified Risks One-Day VAR - 99% by nature of risk 31/03/00 30/06/00 30/09/00 29/12/00 In millions Euros Total : 42 2000 Results Total : 53 Total : 41 23 Total : 29 GROUP C&I BK PBAM RETAIL

Va. R Analysis: Diversified Risks One-Day VAR - 99% by nature of risk 31/03/00 30/06/00 30/09/00 29/12/00 In millions Euros Total : 42 2000 Results Total : 53 Total : 41 23 Total : 29 GROUP C&I BK PBAM RETAIL

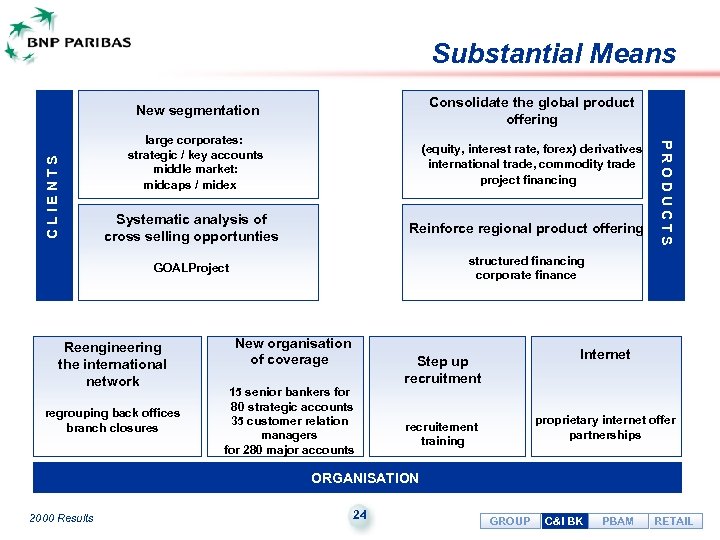

Substantial Means C L I E N T S Consolidate the global product offering large corporates: strategic / key accounts middle market: midcaps / midex (equity, interest rate, forex) derivatives international trade, commodity trade project financing Systematic analysis of cross selling opportunties Reinforce regional product offering GOALProject P R O D U C T S New segmentation structured financing corporate finance Reengineering the international network regrouping back offices branch closures New organisation of coverage 15 senior bankers for 80 strategic accounts 35 customer relation managers for 280 major accounts Internet Step up recruitment proprietary internet offer partnerships recruitement training ORGANISATION 2000 Results 24 GROUP C&I BK PBAM RETAIL

Substantial Means C L I E N T S Consolidate the global product offering large corporates: strategic / key accounts middle market: midcaps / midex (equity, interest rate, forex) derivatives international trade, commodity trade project financing Systematic analysis of cross selling opportunties Reinforce regional product offering GOALProject P R O D U C T S New segmentation structured financing corporate finance Reengineering the international network regrouping back offices branch closures New organisation of coverage 15 senior bankers for 80 strategic accounts 35 customer relation managers for 280 major accounts Internet Step up recruitment proprietary internet offer partnerships recruitement training ORGANISATION 2000 Results 24 GROUP C&I BK PBAM RETAIL

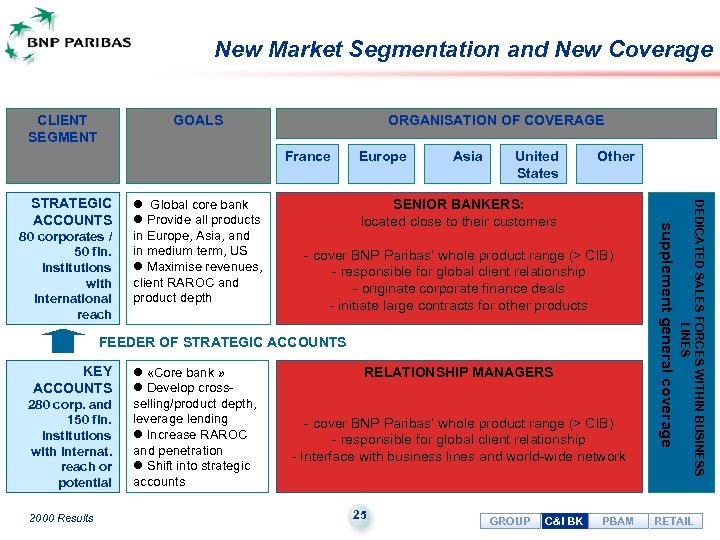

New Market Segmentation and New Coverage CLIENT SEGMENT GOALS ORGANISATION OF COVERAGE France United States Other SENIOR BANKERS: located close to their customers - cover BNP Paribas’ whole product range (> CIB) - responsible for global client relationship - originate corporate finance deals - initiate large contracts for other products FEEDER OF STRATEGIC ACCOUNTS KEY ACCOUNTS 280 corp. and 150 fin. institutions with internat. reach or potential 2000 Results l «Core bank » l Develop crossselling/product depth, leverage lending l Increase RAROC and penetration l Shift into strategic accounts RELATIONSHIP MANAGERS - cover BNP Paribas’ whole product range (> CIB) - responsible for global client relationship - Interface with business lines and world-wide network 25 GROUP C&I BK PBAM DEDICATED SALES FORCES WITHIN BUSINESS LINES 80 corporates / 50 fin. institutions with international reach l Global core bank l Provide all products in Europe, Asia, and in medium term, US l Maximise revenues, client RAROC and product depth Asia supplement general coverage STRATEGIC ACCOUNTS Europe RETAIL

New Market Segmentation and New Coverage CLIENT SEGMENT GOALS ORGANISATION OF COVERAGE France United States Other SENIOR BANKERS: located close to their customers - cover BNP Paribas’ whole product range (> CIB) - responsible for global client relationship - originate corporate finance deals - initiate large contracts for other products FEEDER OF STRATEGIC ACCOUNTS KEY ACCOUNTS 280 corp. and 150 fin. institutions with internat. reach or potential 2000 Results l «Core bank » l Develop crossselling/product depth, leverage lending l Increase RAROC and penetration l Shift into strategic accounts RELATIONSHIP MANAGERS - cover BNP Paribas’ whole product range (> CIB) - responsible for global client relationship - Interface with business lines and world-wide network 25 GROUP C&I BK PBAM DEDICATED SALES FORCES WITHIN BUSINESS LINES 80 corporates / 50 fin. institutions with international reach l Global core bank l Provide all products in Europe, Asia, and in medium term, US l Maximise revenues, client RAROC and product depth Asia supplement general coverage STRATEGIC ACCOUNTS Europe RETAIL

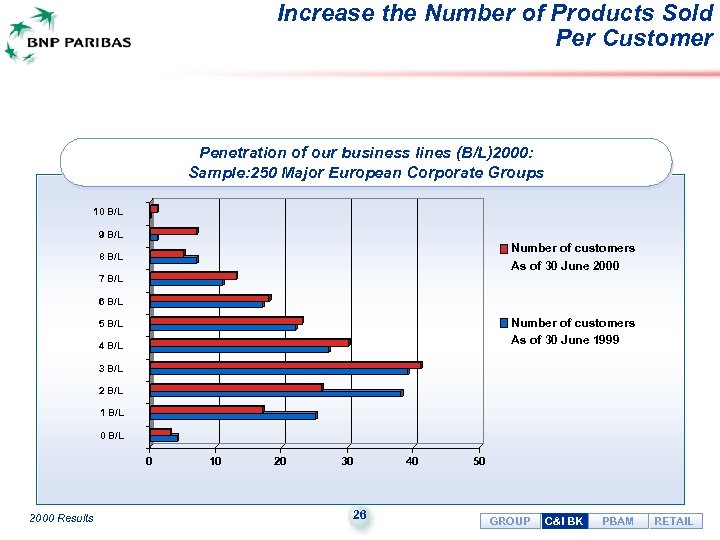

Increase the Number of Products Sold Per Customer Penetration of our business lines (B/L)2000: Sample: 250 Major European Corporate Groups 10 B/L 9 B/L Number of customers As of 30 June 2000 8 B/L 7 B/L 6 B/L Number of customers As of 30 June 1999 5 B/L 4 B/L 3 B/L 2 B/L 1 B/L 0 2000 Results 10 20 30 40 26 50 GROUP C&I BK PBAM RETAIL

Increase the Number of Products Sold Per Customer Penetration of our business lines (B/L)2000: Sample: 250 Major European Corporate Groups 10 B/L 9 B/L Number of customers As of 30 June 2000 8 B/L 7 B/L 6 B/L Number of customers As of 30 June 1999 5 B/L 4 B/L 3 B/L 2 B/L 1 B/L 0 2000 Results 10 20 30 40 26 50 GROUP C&I BK PBAM RETAIL

Private Banking & Asset Management, Insurance and Securities services 2000 Results 27

Private Banking & Asset Management, Insurance and Securities services 2000 Results 27

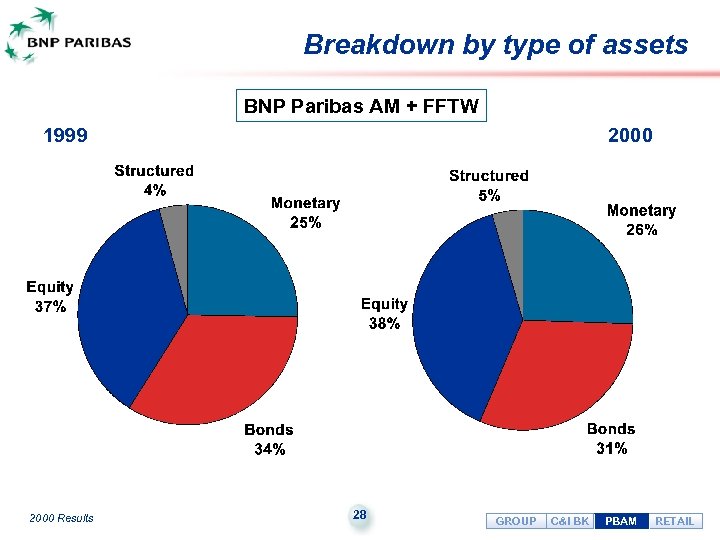

Breakdown by type of assets BNP Paribas AM + FFTW 1999 2000 Results 2000 28 GROUP C&I BK PBAM RETAIL

Breakdown by type of assets BNP Paribas AM + FFTW 1999 2000 Results 2000 28 GROUP C&I BK PBAM RETAIL

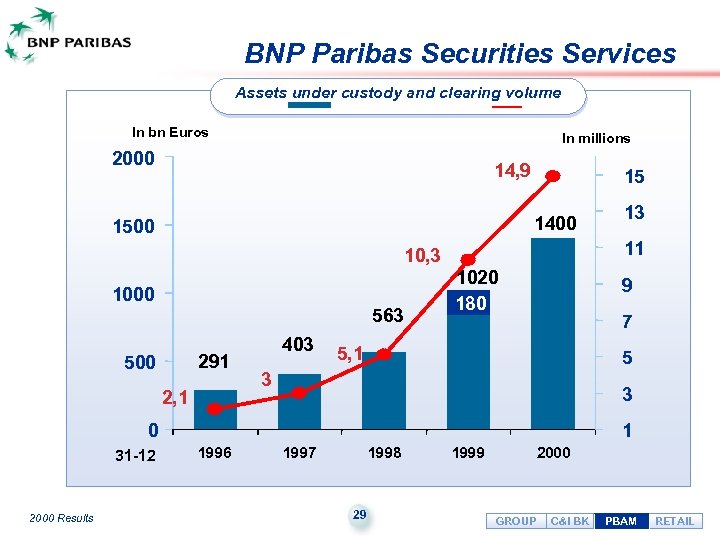

BNP Paribas Securities Services Assets under custody and clearing volume In bn Euros In millions 2000 14, 9 15 1400 1500 11 10, 3 1000 563 291 500 2, 1 403 1020 180 9 7 5, 1 5 3 3 0 31 -12 2000 Results 13 1 1996 1997 1998 29 1999 2000 GROUP C&I BK PBAM RETAIL

BNP Paribas Securities Services Assets under custody and clearing volume In bn Euros In millions 2000 14, 9 15 1400 1500 11 10, 3 1000 563 291 500 2, 1 403 1020 180 9 7 5, 1 5 3 3 0 31 -12 2000 Results 13 1 1996 1997 1998 29 1999 2000 GROUP C&I BK PBAM RETAIL

Real-Estate n BNP PARIBAS has a presence in real-estate : l Development-marketing è l Real estate ownership è l Klépierre (2 nd largest owner of commercial malls in France) Real estate linked services è è 2000 Results Meunier/ Sinvim (3 rd largest real-estate development company in France) Third-party property management: Office Building: Comadim (subsidiary of Meunier) (20% market share) Shopping Centres: Ségécé (subsidiary of Klépierre) 1 st manager in France Real-estate expertise with Coextim 30 GROUP C&I BK PBAM RETAIL

Real-Estate n BNP PARIBAS has a presence in real-estate : l Development-marketing è l Real estate ownership è l Klépierre (2 nd largest owner of commercial malls in France) Real estate linked services è è 2000 Results Meunier/ Sinvim (3 rd largest real-estate development company in France) Third-party property management: Office Building: Comadim (subsidiary of Meunier) (20% market share) Shopping Centres: Ségécé (subsidiary of Klépierre) 1 st manager in France Real-estate expertise with Coextim 30 GROUP C&I BK PBAM RETAIL

BNP Paribas Capital 2000 Results 31

BNP Paribas Capital 2000 Results 31

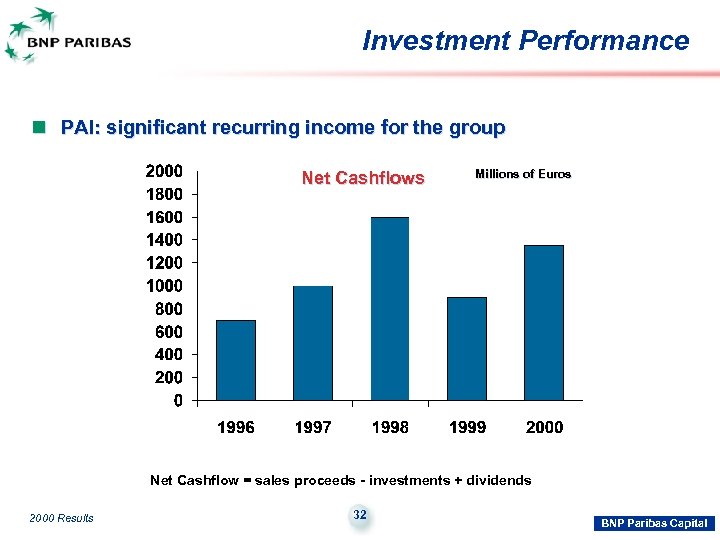

Investment Performance n PAI: significant recurring income for the group Net Cashflows Millions of Euros Net Cashflow = sales proceeds - investments + dividends 2000 Results 32 BNP Paribas Capital

Investment Performance n PAI: significant recurring income for the group Net Cashflows Millions of Euros Net Cashflow = sales proceeds - investments + dividends 2000 Results 32 BNP Paribas Capital

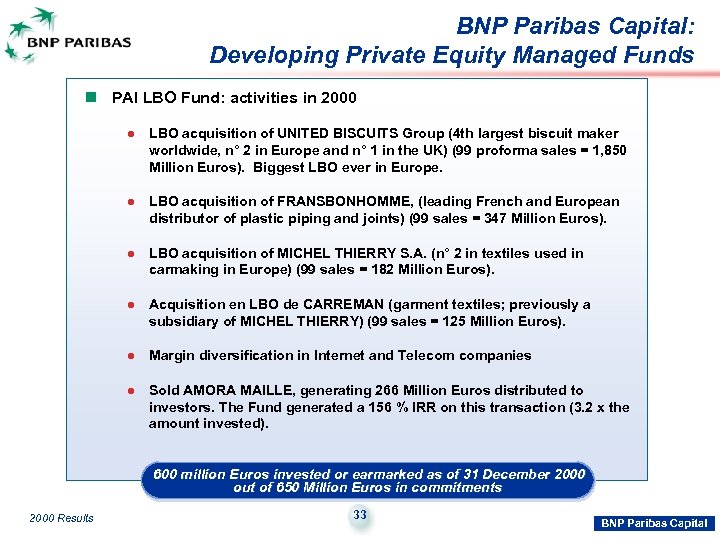

BNP Paribas Capital: Developing Private Equity Managed Funds n PAI LBO Fund: activities in 2000 l LBO acquisition of UNITED BISCUITS Group (4 th largest biscuit maker worldwide, n° 2 in Europe and n° 1 in the UK) (99 proforma sales = 1, 850 Million Euros). Biggest LBO ever in Europe. l LBO acquisition of FRANSBONHOMME, (leading French and European distributor of plastic piping and joints) (99 sales = 347 Million Euros). l LBO acquisition of MICHEL THIERRY S. A. (n° 2 in textiles used in carmaking in Europe) (99 sales = 182 Million Euros). l Acquisition en LBO de CARREMAN (garment textiles; previously a subsidiary of MICHEL THIERRY) (99 sales = 125 Million Euros). l Margin diversification in Internet and Telecom companies l Sold AMORA MAILLE, generating 266 Million Euros distributed to investors. The Fund generated a 156 % IRR on this transaction (3. 2 x the amount invested). 600 million Euros invested or earmarked as of 31 December 2000 out of 650 Million Euros in commitments 2000 Results 33 BNP Paribas Capital

BNP Paribas Capital: Developing Private Equity Managed Funds n PAI LBO Fund: activities in 2000 l LBO acquisition of UNITED BISCUITS Group (4 th largest biscuit maker worldwide, n° 2 in Europe and n° 1 in the UK) (99 proforma sales = 1, 850 Million Euros). Biggest LBO ever in Europe. l LBO acquisition of FRANSBONHOMME, (leading French and European distributor of plastic piping and joints) (99 sales = 347 Million Euros). l LBO acquisition of MICHEL THIERRY S. A. (n° 2 in textiles used in carmaking in Europe) (99 sales = 182 Million Euros). l Acquisition en LBO de CARREMAN (garment textiles; previously a subsidiary of MICHEL THIERRY) (99 sales = 125 Million Euros). l Margin diversification in Internet and Telecom companies l Sold AMORA MAILLE, generating 266 Million Euros distributed to investors. The Fund generated a 156 % IRR on this transaction (3. 2 x the amount invested). 600 million Euros invested or earmarked as of 31 December 2000 out of 650 Million Euros in commitments 2000 Results 33 BNP Paribas Capital

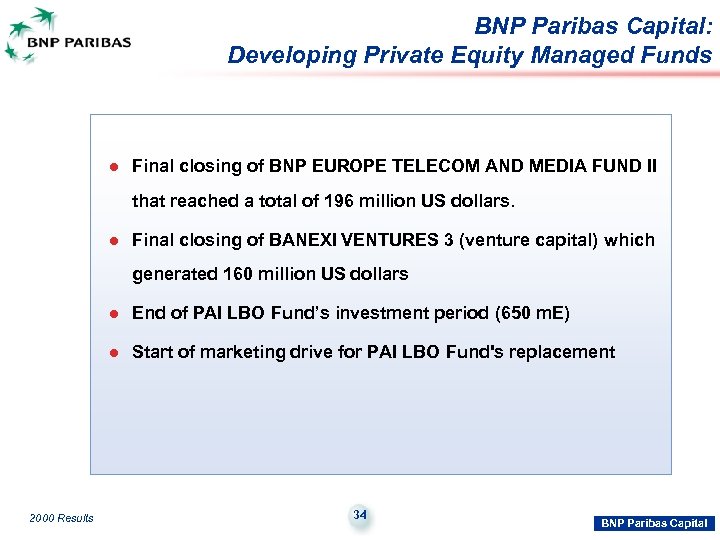

BNP Paribas Capital: Developing Private Equity Managed Funds l Final closing of BNP EUROPE TELECOM AND MEDIA FUND II that reached a total of 196 million US dollars. l Final closing of BANEXI VENTURES 3 (venture capital) which generated 160 million US dollars l l 2000 Results End of PAI LBO Fund’s investment period (650 m. E) Start of marketing drive for PAI LBO Fund's replacement 34 BNP Paribas Capital

BNP Paribas Capital: Developing Private Equity Managed Funds l Final closing of BNP EUROPE TELECOM AND MEDIA FUND II that reached a total of 196 million US dollars. l Final closing of BANEXI VENTURES 3 (venture capital) which generated 160 million US dollars l l 2000 Results End of PAI LBO Fund’s investment period (650 m. E) Start of marketing drive for PAI LBO Fund's replacement 34 BNP Paribas Capital

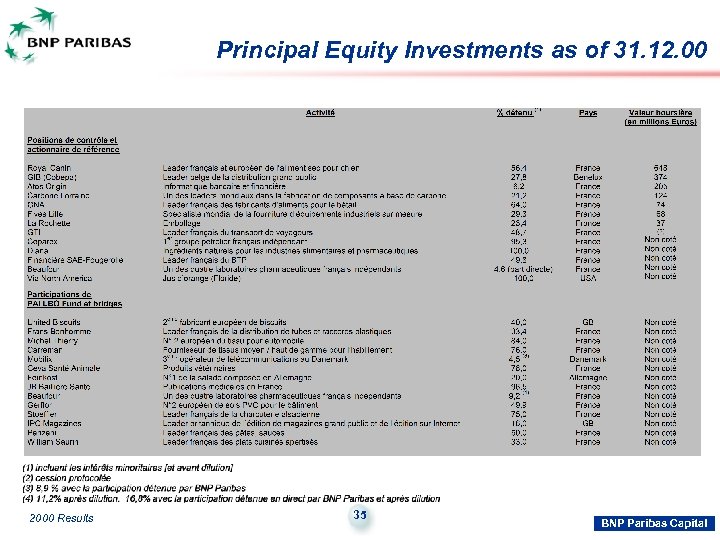

Principal Equity Investments as of 31. 12. 00 2000 Results 35 BNP Paribas Capital

Principal Equity Investments as of 31. 12. 00 2000 Results 35 BNP Paribas Capital

Principal Equity Investments as of 31. 12. 00 2000 Results 36 BNP Paribas Capital

Principal Equity Investments as of 31. 12. 00 2000 Results 36 BNP Paribas Capital

Specialised Financial Services 2000 Results 37

Specialised Financial Services 2000 Results 37

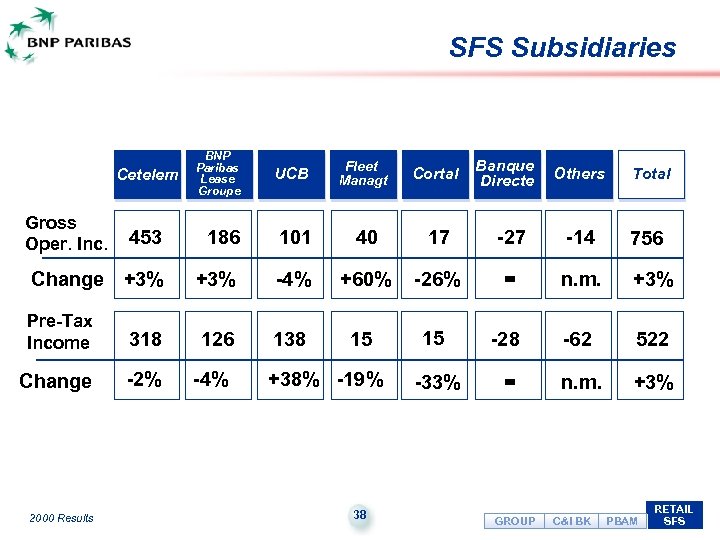

SFS Subsidiaries Cetelem Gross Oper. Inc. BNP Paribas Lease Groupe UCB Fleet Managt Cortal Banque Directe Others Total 453 186 101 40 17 -27 -14 756 Change +3% -4% +60% -26% = n. m. +3% Pre-Tax Income 318 126 138 15 15 -28 -62 522 -2% -4% -33% = n. m. +3% Change 2000 Results +38% -19% 38 GROUP C&I BK PBAM RETAIL SFS

SFS Subsidiaries Cetelem Gross Oper. Inc. BNP Paribas Lease Groupe UCB Fleet Managt Cortal Banque Directe Others Total 453 186 101 40 17 -27 -14 756 Change +3% -4% +60% -26% = n. m. +3% Pre-Tax Income 318 126 138 15 15 -28 -62 522 -2% -4% -33% = n. m. +3% Change 2000 Results +38% -19% 38 GROUP C&I BK PBAM RETAIL SFS

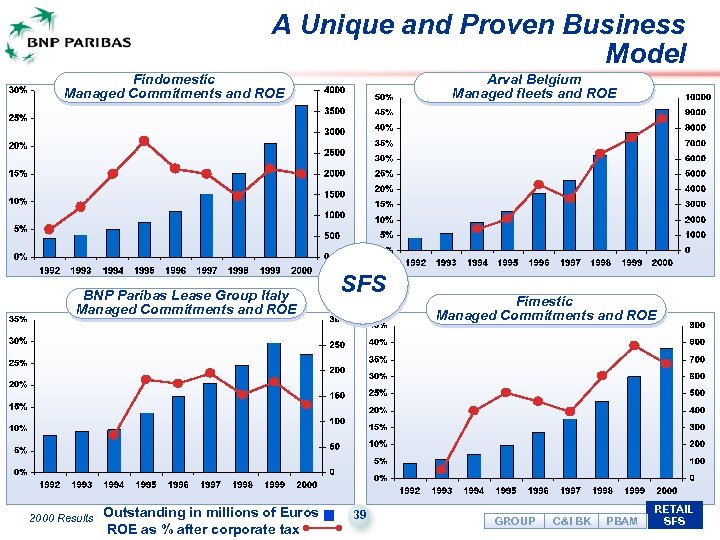

A Unique and Proven Business Model Findomestic Managed Commitments and ROE BNP Paribas Lease Group Italy Managed Commitments and ROE 2000 Results Arval Belgium Managed fleets and ROE SFS Outstanding in millions of Euros 39 ROE as % after corporate tax Fimestic Managed Commitments and ROE GROUP C&I BK PBAM RETAIL SFS

A Unique and Proven Business Model Findomestic Managed Commitments and ROE BNP Paribas Lease Group Italy Managed Commitments and ROE 2000 Results Arval Belgium Managed fleets and ROE SFS Outstanding in millions of Euros 39 ROE as % after corporate tax Fimestic Managed Commitments and ROE GROUP C&I BK PBAM RETAIL SFS

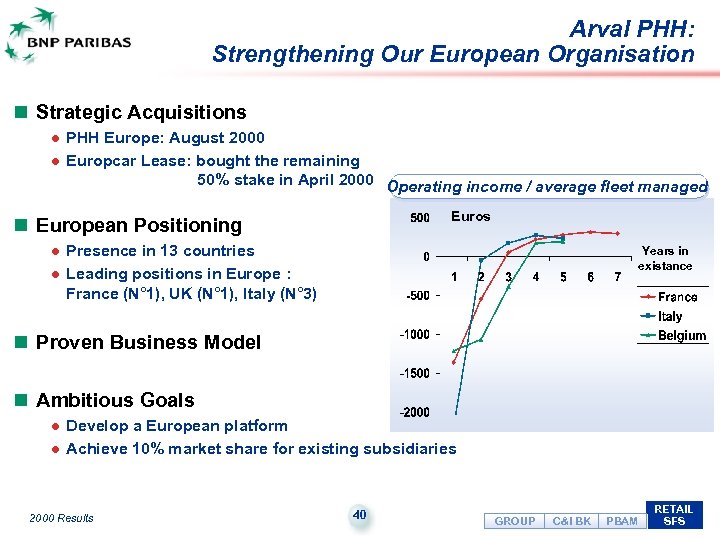

Arval PHH: Strengthening Our European Organisation n Strategic Acquisitions PHH Europe: August 2000 l Europcar Lease: bought the remaining 50% stake in April 2000 Operating income / average fleet managed l Euros n European Positioning Presence in 13 countries l Leading positions in Europe : France (N° 1), UK (N° 1), Italy (N° 3) Years in existance l n Proven Business Model n Ambitious Goals l l Develop a European platform Achieve 10% market share for existing subsidiaries 2000 Results 40 GROUP C&I BK PBAM RETAIL SFS

Arval PHH: Strengthening Our European Organisation n Strategic Acquisitions PHH Europe: August 2000 l Europcar Lease: bought the remaining 50% stake in April 2000 Operating income / average fleet managed l Euros n European Positioning Presence in 13 countries l Leading positions in Europe : France (N° 1), UK (N° 1), Italy (N° 3) Years in existance l n Proven Business Model n Ambitious Goals l l Develop a European platform Achieve 10% market share for existing subsidiaries 2000 Results 40 GROUP C&I BK PBAM RETAIL SFS

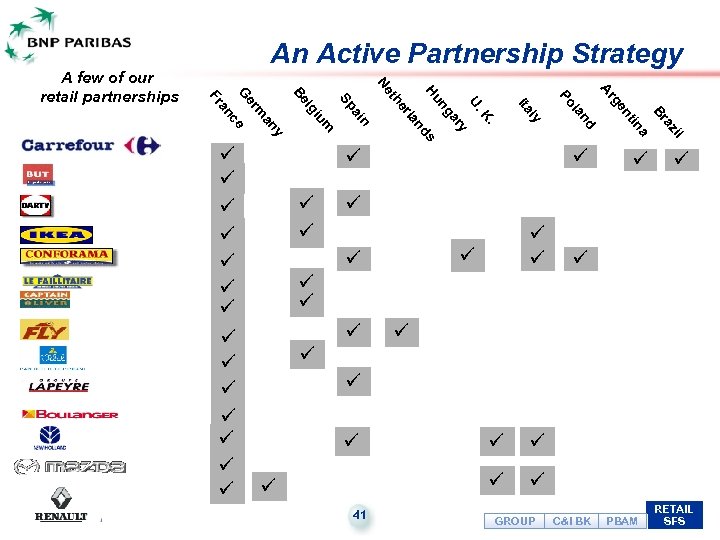

nt il a ü az in nd Br ge la s ü ü ü Ar Po ly . y nd ar la n K I ta U. er ng th Hu Ne ai m y 2000 Results iu an ce m lg er an ü ü ü ü Sp Be G Fr A few of our retail partnerships An Active Partnership Strategy ü ü ü ü ü ü ü ü 41 GROUP C&I BK PBAM RETAIL SFS

nt il a ü az in nd Br ge la s ü ü ü Ar Po ly . y nd ar la n K I ta U. er ng th Hu Ne ai m y 2000 Results iu an ce m lg er an ü ü ü ü Sp Be G Fr A few of our retail partnerships An Active Partnership Strategy ü ü ü ü ü ü ü ü 41 GROUP C&I BK PBAM RETAIL SFS

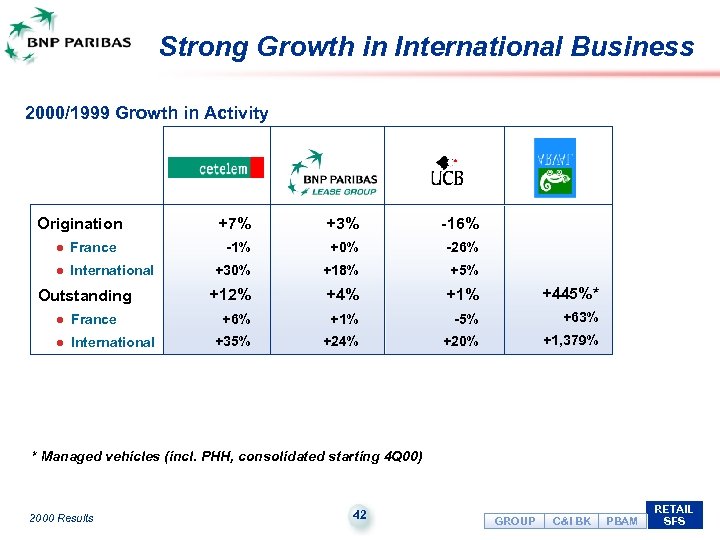

Strong Growth in International Business 2000/1999 Growth in Activity Origination l France l International Outstanding l France l International +7% +3% -16% -1% +0% -26% +30% +18% +5% +12% +4% +1% +445%* +6% +1% -5% +63% +35% +24% +20% +1, 379% * Managed vehicles (incl. PHH, consolidated starting 4 Q 00) 2000 Results 42 GROUP C&I BK PBAM RETAIL SFS

Strong Growth in International Business 2000/1999 Growth in Activity Origination l France l International Outstanding l France l International +7% +3% -16% -1% +0% -26% +30% +18% +5% +12% +4% +1% +445%* +6% +1% -5% +63% +35% +24% +20% +1, 379% * Managed vehicles (incl. PHH, consolidated starting 4 Q 00) 2000 Results 42 GROUP C&I BK PBAM RETAIL SFS

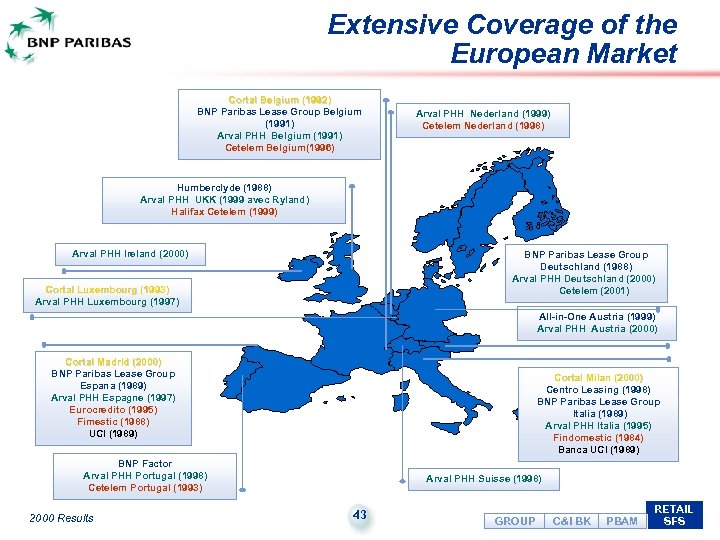

Extensive Coverage of the European Market Cortal Belgium (1992) BNP Paribas Lease Group Belgium (1991) Arval PHH Belgium (1991) Cetelem Belgium(1996) Arval PHH Nederland (1999) Cetelem Nederland (1998) Humberclyde (1988) Arval PHH UKK (1999 avec Ryland) Halifax Cetelem (1999) Arval PHH Ireland (2000) BNP Paribas Lease Group Deutschland (1988) Arval PHH Deutschland (2000) Cetelem (2001) Cortal Luxembourg (1993) Arval PHH Luxembourg (1997) All-in-One Austria (1999) Arval PHH Austria (2000) Cortal Madrid (2000) BNP Paribas Lease Group Espana (1989) Arval PHH Espagne (1997) Eurocredito (1995) Fimestic (1988) UCI (1989) Cortal Milan (2000) Centro Leasing (1998) BNP Paribas Lease Group Italia (1989) Arval PHH Italia (1995) Findomestic (1984) Banca UCI (1989) BNP Factor Arval PHH Portugal (1998) Cetelem Portugal (1993) 2000 Results Arval PHH Suisse (1998) 43 GROUP C&I BK PBAM RETAIL SFS

Extensive Coverage of the European Market Cortal Belgium (1992) BNP Paribas Lease Group Belgium (1991) Arval PHH Belgium (1991) Cetelem Belgium(1996) Arval PHH Nederland (1999) Cetelem Nederland (1998) Humberclyde (1988) Arval PHH UKK (1999 avec Ryland) Halifax Cetelem (1999) Arval PHH Ireland (2000) BNP Paribas Lease Group Deutschland (1988) Arval PHH Deutschland (2000) Cetelem (2001) Cortal Luxembourg (1993) Arval PHH Luxembourg (1997) All-in-One Austria (1999) Arval PHH Austria (2000) Cortal Madrid (2000) BNP Paribas Lease Group Espana (1989) Arval PHH Espagne (1997) Eurocredito (1995) Fimestic (1988) UCI (1989) Cortal Milan (2000) Centro Leasing (1998) BNP Paribas Lease Group Italia (1989) Arval PHH Italia (1995) Findomestic (1984) Banca UCI (1989) BNP Factor Arval PHH Portugal (1998) Cetelem Portugal (1993) 2000 Results Arval PHH Suisse (1998) 43 GROUP C&I BK PBAM RETAIL SFS

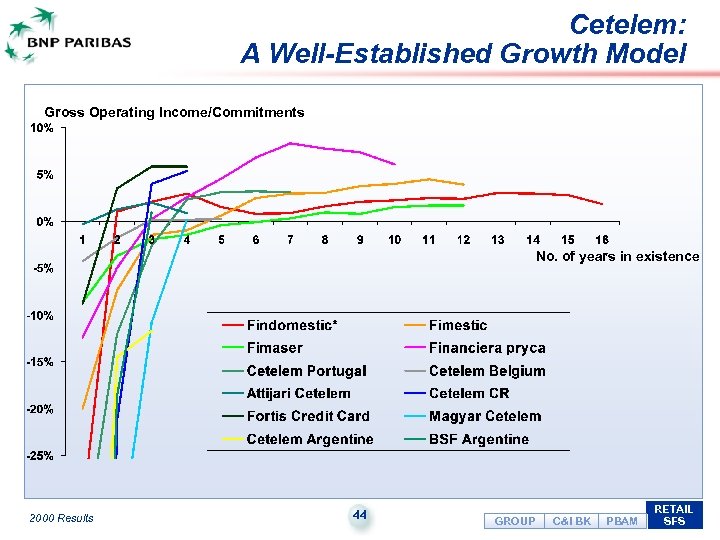

Cetelem: A Well-Established Growth Model Gross Operating Income/Commitments No. of years in existence 2000 Results 44 GROUP C&I BK PBAM RETAIL SFS

Cetelem: A Well-Established Growth Model Gross Operating Income/Commitments No. of years in existence 2000 Results 44 GROUP C&I BK PBAM RETAIL SFS

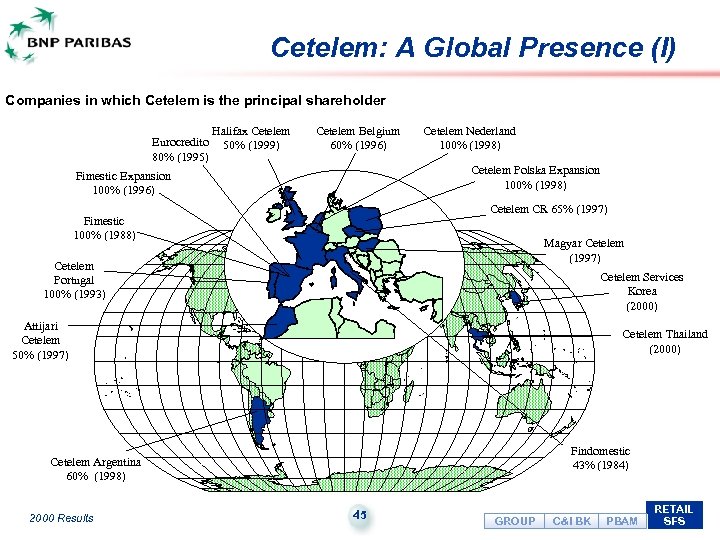

Cetelem: A Global Presence (I) Companies in which Cetelem is the principal shareholder Eurocredito 80% (1995) Halifax Cetelem 50% (1999) Cetelem Belgium 60% (1996) Cetelem Nederland 100% (1998) Cetelem Polska Expansion 100% (1998) Fimestic Expansion 100% (1996) Cetelem CR 65% (1997) Fimestic 100% (1988) Magyar Cetelem (1997) Cetelem Portugal 100% (1993) Cetelem Services Korea (2000) Attijari Cetelem 50% (1997) Cetelem Thailand (2000) depuis 1950 Findomestic 43% (1984) Cetelem Argentina 60% (1998) 2000 Results 45 GROUP C&I BK PBAM RETAIL SFS

Cetelem: A Global Presence (I) Companies in which Cetelem is the principal shareholder Eurocredito 80% (1995) Halifax Cetelem 50% (1999) Cetelem Belgium 60% (1996) Cetelem Nederland 100% (1998) Cetelem Polska Expansion 100% (1998) Fimestic Expansion 100% (1996) Cetelem CR 65% (1997) Fimestic 100% (1988) Magyar Cetelem (1997) Cetelem Portugal 100% (1993) Cetelem Services Korea (2000) Attijari Cetelem 50% (1997) Cetelem Thailand (2000) depuis 1950 Findomestic 43% (1984) Cetelem Argentina 60% (1998) 2000 Results 45 GROUP C&I BK PBAM RETAIL SFS

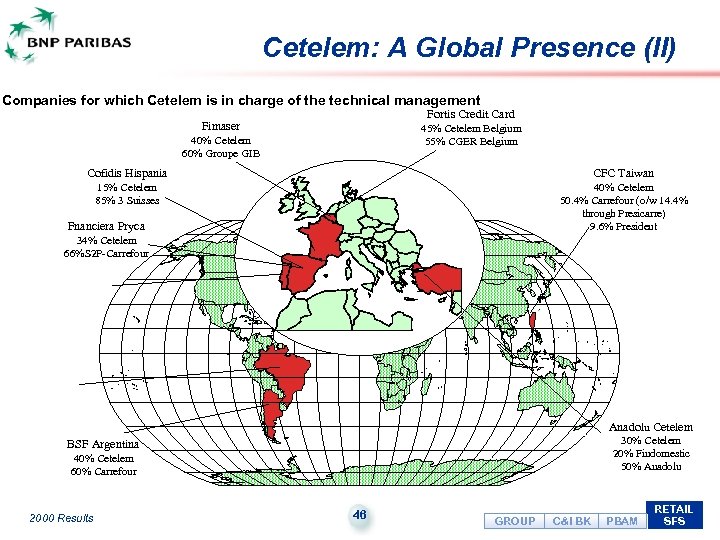

Cetelem: A Global Presence (II) Companies for which Cetelem is in charge of the technical management Fortis Credit Card Fimaser 45% Cetelem Belgium 55% CGER Belgium 40% Cetelem 60% Groupe GIB Cofidis Hispania CFC Taiwan 15% Cetelem 85% 3 Suisses 40% Cetelem 50. 4% Carrefour (o/w 14. 4% through Presicarre) 9. 6% President Fnanciera Pryca 34% Cetelem 66%S 2 P-Carrefour Anadolu Cetelem 30% Cetelem 20% Findomestic 50% Anadolu BSF Argentina 40% Cetelem 60% Carrefour 2000 Results 46 GROUP C&I BK PBAM RETAIL SFS

Cetelem: A Global Presence (II) Companies for which Cetelem is in charge of the technical management Fortis Credit Card Fimaser 45% Cetelem Belgium 55% CGER Belgium 40% Cetelem 60% Groupe GIB Cofidis Hispania CFC Taiwan 15% Cetelem 85% 3 Suisses 40% Cetelem 50. 4% Carrefour (o/w 14. 4% through Presicarre) 9. 6% President Fnanciera Pryca 34% Cetelem 66%S 2 P-Carrefour Anadolu Cetelem 30% Cetelem 20% Findomestic 50% Anadolu BSF Argentina 40% Cetelem 60% Carrefour 2000 Results 46 GROUP C&I BK PBAM RETAIL SFS

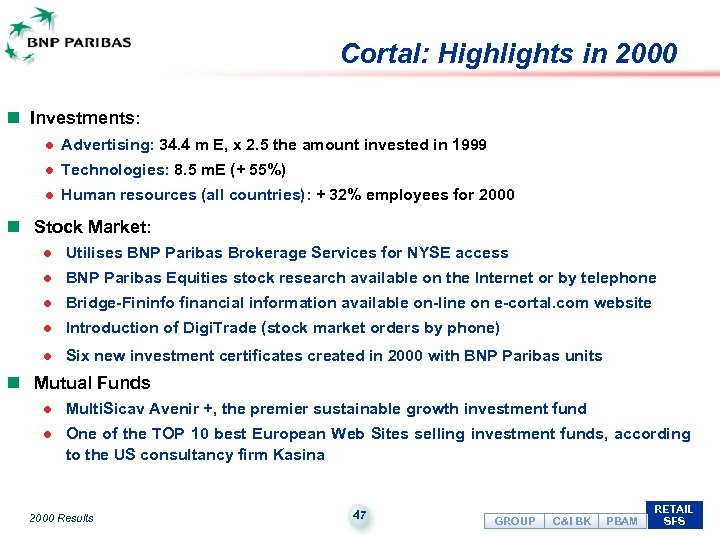

Cortal: Highlights in 2000 n Investments: l Advertising: 34. 4 m E, x 2. 5 the amount invested in 1999 l Technologies: 8. 5 m. E (+ 55%) l Human resources (all countries): + 32% employees for 2000 n Stock Market: l Utilises BNP Paribas Brokerage Services for NYSE access l BNP Paribas Equities stock research available on the Internet or by telephone l Bridge-Fininfo financial information available on-line on e-cortal. com website l Introduction of Digi. Trade (stock market orders by phone) l Six new investment certificates created in 2000 with BNP Paribas units n Mutual Funds l Multi. Sicav Avenir +, the premier sustainable growth investment fund l One of the TOP 10 best European Web Sites selling investment funds, according to the US consultancy firm Kasina 2000 Results 47 GROUP C&I BK PBAM RETAIL SFS

Cortal: Highlights in 2000 n Investments: l Advertising: 34. 4 m E, x 2. 5 the amount invested in 1999 l Technologies: 8. 5 m. E (+ 55%) l Human resources (all countries): + 32% employees for 2000 n Stock Market: l Utilises BNP Paribas Brokerage Services for NYSE access l BNP Paribas Equities stock research available on the Internet or by telephone l Bridge-Fininfo financial information available on-line on e-cortal. com website l Introduction of Digi. Trade (stock market orders by phone) l Six new investment certificates created in 2000 with BNP Paribas units n Mutual Funds l Multi. Sicav Avenir +, the premier sustainable growth investment fund l One of the TOP 10 best European Web Sites selling investment funds, according to the US consultancy firm Kasina 2000 Results 47 GROUP C&I BK PBAM RETAIL SFS

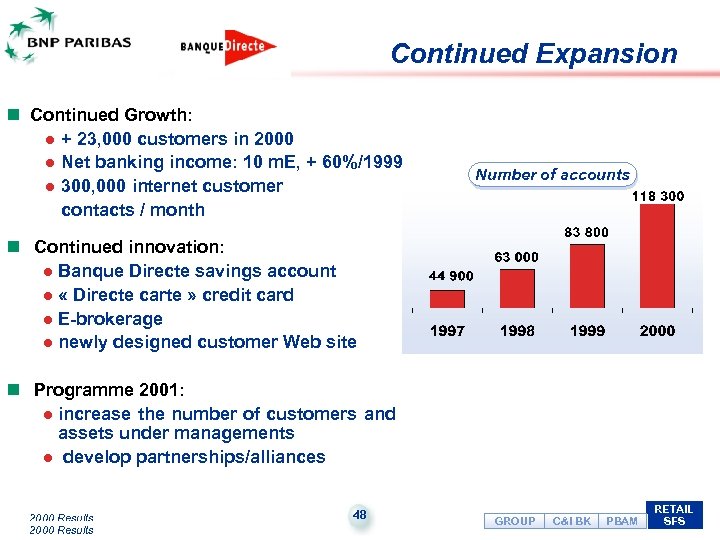

Continued Expansion n Continued Growth: l + 23, 000 customers in 2000 l Net banking income: 10 m. E, + 60%/1999 l 300, 000 internet customer contacts / month Number of accounts n Continued innovation: l Banque Directe savings account l « Directe carte » credit card l E-brokerage l newly designed customer Web site n Programme 2001: l increase the number of customers and assets under managements l develop partnerships/alliances 2000 Results 48 GROUP C&I BK PBAM RETAIL SFS

Continued Expansion n Continued Growth: l + 23, 000 customers in 2000 l Net banking income: 10 m. E, + 60%/1999 l 300, 000 internet customer contacts / month Number of accounts n Continued innovation: l Banque Directe savings account l « Directe carte » credit card l E-brokerage l newly designed customer Web site n Programme 2001: l increase the number of customers and assets under managements l develop partnerships/alliances 2000 Results 48 GROUP C&I BK PBAM RETAIL SFS

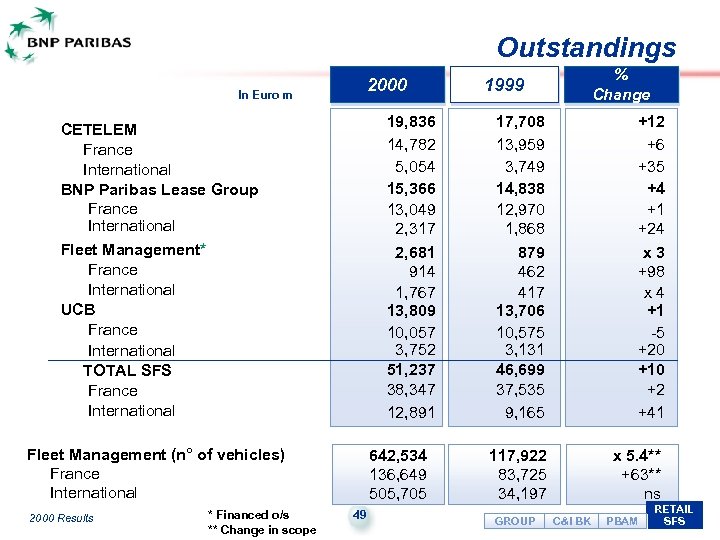

Outstandings 2000 In Euro m 19, 836 14, 782 5, 054 15, 366 13, 049 2, 317 2, 681 914 1, 767 13, 809 10, 057 3, 752 51, 237 38, 347 12, 891 CETELEM France International BNP Paribas Lease Group France International Fleet Management* France International UCB France International TOTAL SFS France International Fleet Management (n° of vehicles) France International 2000 Results * Financed o/s ** Change in scope 642, 534 136, 649 505, 705 49 % Change 1999 17, 708 13, 959 3, 749 14, 838 12, 970 1, 868 879 462 417 13, 706 10, 575 3, 131 46, 699 37, 535 9, 165 117, 922 83, 725 34, 197 GROUP +12 +6 +35 +4 +1 +24 x 3 +98 x 4 +1 -5 +20 +10 +2 +41 x 5. 4** +63** ns C&I BK PBAM RETAIL SFS

Outstandings 2000 In Euro m 19, 836 14, 782 5, 054 15, 366 13, 049 2, 317 2, 681 914 1, 767 13, 809 10, 057 3, 752 51, 237 38, 347 12, 891 CETELEM France International BNP Paribas Lease Group France International Fleet Management* France International UCB France International TOTAL SFS France International Fleet Management (n° of vehicles) France International 2000 Results * Financed o/s ** Change in scope 642, 534 136, 649 505, 705 49 % Change 1999 17, 708 13, 959 3, 749 14, 838 12, 970 1, 868 879 462 417 13, 706 10, 575 3, 131 46, 699 37, 535 9, 165 117, 922 83, 725 34, 197 GROUP +12 +6 +35 +4 +1 +24 x 3 +98 x 4 +1 -5 +20 +10 +2 +41 x 5. 4** +63** ns C&I BK PBAM RETAIL SFS

Domestic Retail Banking 2000 Results 50

Domestic Retail Banking 2000 Results 50

Corporate customers: Efforts Focussing on Selling Services n N° 1 bank for SMEs in France l 7, 000 new corporate customers: +17% compared to 1999 n Growth in lending to companies with better risk profile by using a RAROC approach for SMEs (implemented in 2000) n Sales of services: l Cash management: fees: +10% l BNP Net for Corporate Customers: 20% of corporate customers subscribe 18 months after launch l Substantial growth in Trade Finance business: 8 dedicated Trade Centres opened In 2000, è fees: +13% è 2000 Results 51 GROUP C&I BK PBAM RETAIL DOM

Corporate customers: Efforts Focussing on Selling Services n N° 1 bank for SMEs in France l 7, 000 new corporate customers: +17% compared to 1999 n Growth in lending to companies with better risk profile by using a RAROC approach for SMEs (implemented in 2000) n Sales of services: l Cash management: fees: +10% l BNP Net for Corporate Customers: 20% of corporate customers subscribe 18 months after launch l Substantial growth in Trade Finance business: 8 dedicated Trade Centres opened In 2000, è fees: +13% è 2000 Results 51 GROUP C&I BK PBAM RETAIL DOM

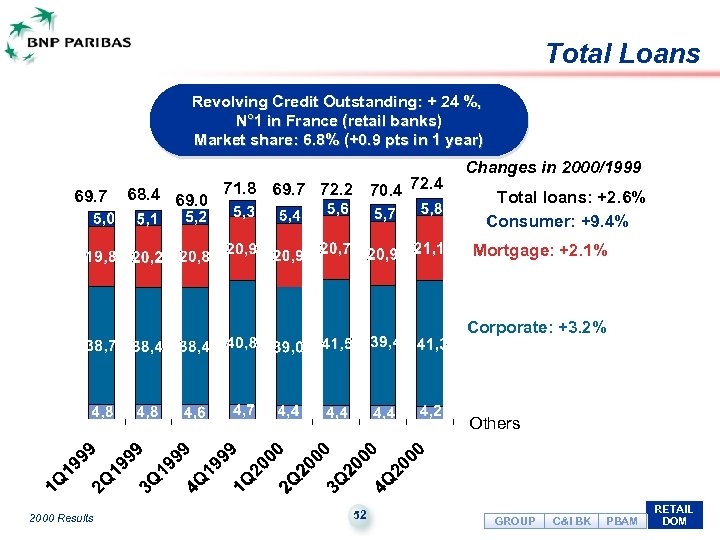

Total Loans Revolving Credit Outstanding: + 24 %, N° 1 in France (retail banks) Market share: 6. 8% (+0. 9 pts in 1 year) 69. 7 72. 4 68. 4 69. 0 71. 8 69. 7 72. 2 70. 4 Changes in 2000/1999 Total loans: +2. 6% Consumer: +9. 4% Mortgage: +2. 1% Corporate: +3. 2% Others 2000 Results 52 GROUP C&I BK PBAM RETAIL DOM

Total Loans Revolving Credit Outstanding: + 24 %, N° 1 in France (retail banks) Market share: 6. 8% (+0. 9 pts in 1 year) 69. 7 72. 4 68. 4 69. 0 71. 8 69. 7 72. 2 70. 4 Changes in 2000/1999 Total loans: +2. 6% Consumer: +9. 4% Mortgage: +2. 1% Corporate: +3. 2% Others 2000 Results 52 GROUP C&I BK PBAM RETAIL DOM

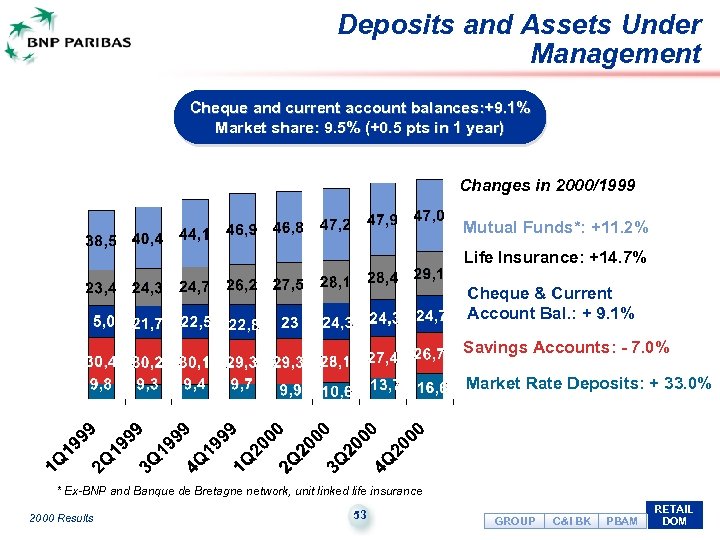

Deposits and Assets Under Management Cheque and current account balances: +9. 1% Market share: 9. 5% (+0. 5 pts in 1 year) Changes in 2000/1999 Mutual Funds*: +11. 2% Life Insurance: +14. 7% Cheque & Current Account Bal. : + 9. 1% Savings Accounts: - 7. 0% Market Rate Deposits: + 33. 0% * Ex-BNP and Banque de Bretagne network, unit linked life insurance 2000 Results 53 GROUP C&I BK PBAM RETAIL DOM

Deposits and Assets Under Management Cheque and current account balances: +9. 1% Market share: 9. 5% (+0. 5 pts in 1 year) Changes in 2000/1999 Mutual Funds*: +11. 2% Life Insurance: +14. 7% Cheque & Current Account Bal. : + 9. 1% Savings Accounts: - 7. 0% Market Rate Deposits: + 33. 0% * Ex-BNP and Banque de Bretagne network, unit linked life insurance 2000 Results 53 GROUP C&I BK PBAM RETAIL DOM

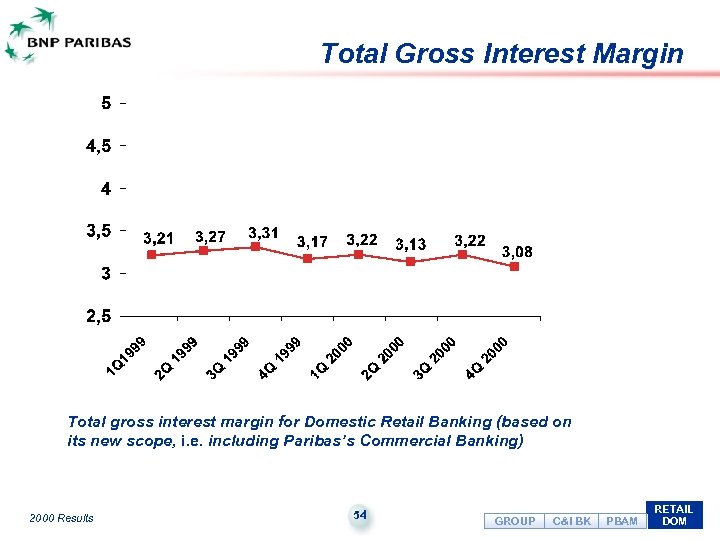

Total Gross Interest Margin Total gross interest margin for Domestic Retail Banking (based on its new scope, i. e. including Paribas’s Commercial Banking) 2000 Results 54 GROUP C&I BK PBAM RETAIL DOM

Total Gross Interest Margin Total gross interest margin for Domestic Retail Banking (based on its new scope, i. e. including Paribas’s Commercial Banking) 2000 Results 54 GROUP C&I BK PBAM RETAIL DOM

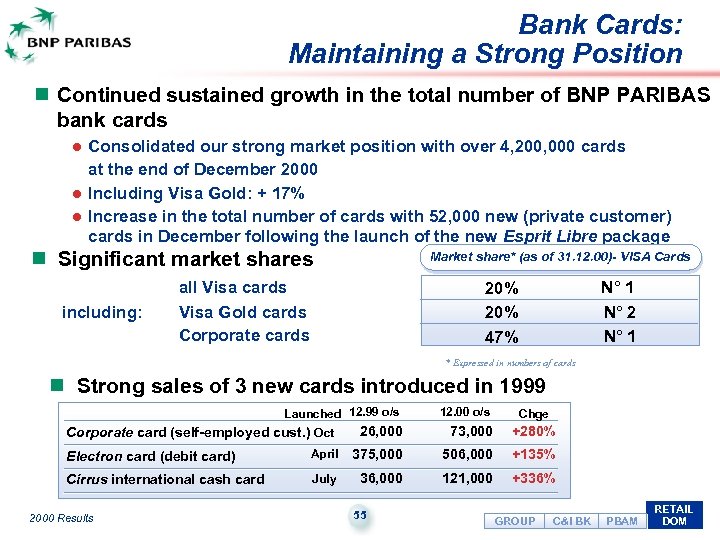

Bank Cards: Maintaining a Strong Position n Continued sustained growth in the total number of BNP PARIBAS bank cards l l l Consolidated our strong market position with over 4, 200, 000 cards at the end of December 2000 Including Visa Gold: + 17% Increase in the total number of cards with 52, 000 new (private customer) cards in December following the launch of the new Esprit Libre package n Significant market shares including: Market share* (as of 31. 12. 00)- VISA Cards all Visa cards 20% 47% Visa Gold cards Corporate cards * Expressed in numbers of cards N° 1 N° 2 N° 1 n Strong sales of 3 new cards introduced in 1999 Launched 12. 99 o/s 12. 00 o/s Chge 26, 000 73, 000 +280% Corporate card (self-employed cust. ) Oct Electron card (debit card) April 375, 000 506, 000 +135% Cirrus international cash card July 36, 000 121, 000 +336% 2000 Results 55 GROUP C&I BK PBAM RETAIL DOM

Bank Cards: Maintaining a Strong Position n Continued sustained growth in the total number of BNP PARIBAS bank cards l l l Consolidated our strong market position with over 4, 200, 000 cards at the end of December 2000 Including Visa Gold: + 17% Increase in the total number of cards with 52, 000 new (private customer) cards in December following the launch of the new Esprit Libre package n Significant market shares including: Market share* (as of 31. 12. 00)- VISA Cards all Visa cards 20% 47% Visa Gold cards Corporate cards * Expressed in numbers of cards N° 1 N° 2 N° 1 n Strong sales of 3 new cards introduced in 1999 Launched 12. 99 o/s 12. 00 o/s Chge 26, 000 73, 000 +280% Corporate card (self-employed cust. ) Oct Electron card (debit card) April 375, 000 506, 000 +135% Cirrus international cash card July 36, 000 121, 000 +336% 2000 Results 55 GROUP C&I BK PBAM RETAIL DOM

International Retail Banking 2000 Results 56

International Retail Banking 2000 Results 56

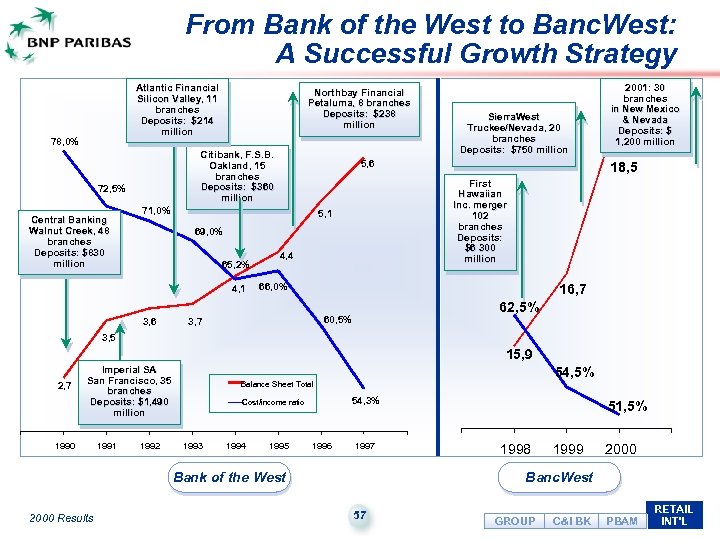

From Bank of the West to Banc. West: A Successful Growth Strategy Atlantic Financial Silicon Valley, 11 branches Deposits: $214 million 78, 0% Citibank, F. S. B. Oakland, 15 branches Deposits: $360 million 72, 5% Central Banking Walnut Creek, 48 branches Deposits: $830 million Northbay Financial Petaluma, 8 branches Deposits: $238 million 5, 6 71, 0% 69, 0% 4, 1 3, 6 18, 5 First Hawaiian Inc. merger 102 branches Deposits: $6 300 million 5, 1 65, 2% Sierra. West Truckee/Nevada, 20 branches Deposits: $750 million 2001: 30 branches in New Mexico & Nevada Deposits: $ 1, 200 million 4, 4 66, 0% 16, 7 62, 5% 60, 5% 3, 7 3, 5 15, 9 2, 7 Imperial SA San Francisco, 35 branches Deposits: $1, 490 million 1990 1991 1992 54, 5% Balance Sheet Total 54, 3% Cost/income ratio 1993 1994 1995 1996 1997 Bank of the West 2000 Results 51, 5% 1998 1999 2000 Banc. West 57 GROUP C&I BK PBAM RETAIL INT’L

From Bank of the West to Banc. West: A Successful Growth Strategy Atlantic Financial Silicon Valley, 11 branches Deposits: $214 million 78, 0% Citibank, F. S. B. Oakland, 15 branches Deposits: $360 million 72, 5% Central Banking Walnut Creek, 48 branches Deposits: $830 million Northbay Financial Petaluma, 8 branches Deposits: $238 million 5, 6 71, 0% 69, 0% 4, 1 3, 6 18, 5 First Hawaiian Inc. merger 102 branches Deposits: $6 300 million 5, 1 65, 2% Sierra. West Truckee/Nevada, 20 branches Deposits: $750 million 2001: 30 branches in New Mexico & Nevada Deposits: $ 1, 200 million 4, 4 66, 0% 16, 7 62, 5% 60, 5% 3, 7 3, 5 15, 9 2, 7 Imperial SA San Francisco, 35 branches Deposits: $1, 490 million 1990 1991 1992 54, 5% Balance Sheet Total 54, 3% Cost/income ratio 1993 1994 1995 1996 1997 Bank of the West 2000 Results 51, 5% 1998 1999 2000 Banc. West 57 GROUP C&I BK PBAM RETAIL INT’L

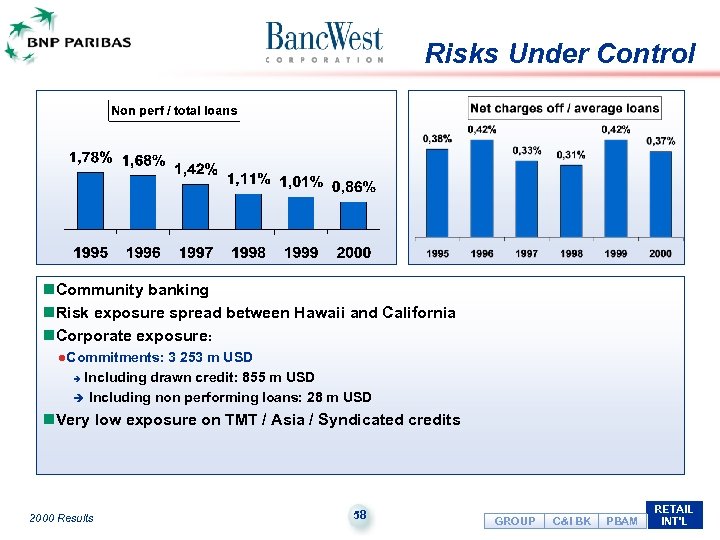

Risks Under Control n. Community banking n. Risk exposure spread between Hawaii and California n. Corporate exposure: l. Commitments: 3 253 m USD Including drawn credit: 855 m USD è Including non performing loans: 28 m USD è n. Very low exposure on TMT / Asia / Syndicated credits 2000 Results 58 GROUP C&I BK PBAM RETAIL INT’L

Risks Under Control n. Community banking n. Risk exposure spread between Hawaii and California n. Corporate exposure: l. Commitments: 3 253 m USD Including drawn credit: 855 m USD è Including non performing loans: 28 m USD è n. Very low exposure on TMT / Asia / Syndicated credits 2000 Results 58 GROUP C&I BK PBAM RETAIL INT’L

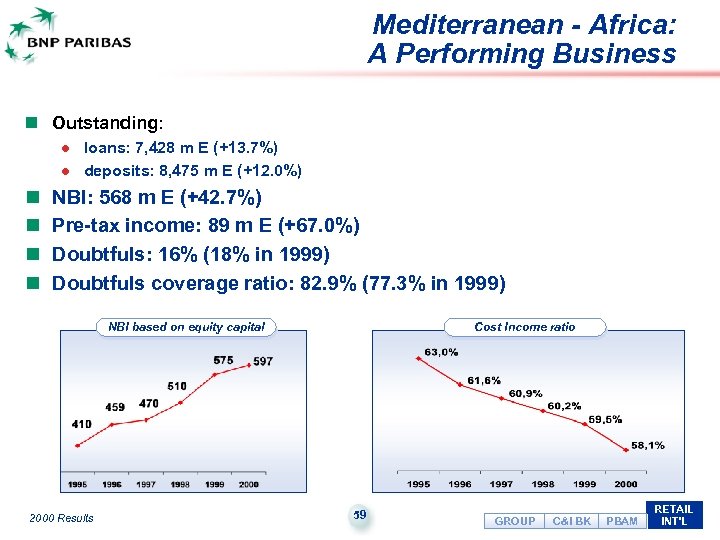

Mediterranean - Africa: A Performing Business n Outstanding: l l n n loans: 7, 428 m E (+13. 7%) deposits: 8, 475 m E (+12. 0%) NBI: 568 m E (+42. 7%) Pre-tax income: 89 m E (+67. 0%) Doubtfuls: 16% (18% in 1999) Doubtfuls coverage ratio: 82. 9% (77. 3% in 1999) NBI based on equity capital 2000 Results Cost Income ratio 59 GROUP C&I BK PBAM RETAIL INT’L

Mediterranean - Africa: A Performing Business n Outstanding: l l n n loans: 7, 428 m E (+13. 7%) deposits: 8, 475 m E (+12. 0%) NBI: 568 m E (+42. 7%) Pre-tax income: 89 m E (+67. 0%) Doubtfuls: 16% (18% in 1999) Doubtfuls coverage ratio: 82. 9% (77. 3% in 1999) NBI based on equity capital 2000 Results Cost Income ratio 59 GROUP C&I BK PBAM RETAIL INT’L

To contact us : Investor Relations & Financial Information Claude Haberer : 33 1 40 14 63 58 Laurent Degabriel : 33 1 42 98 23 40 Irène Chesnais : 33 1 42 98 46 45 Fax : 33 1 42 98 21 22 IR Web Site http: //invest. bnpparibas. com e-mail : investor. relations@bnpparibas. com 2000 Results 60

To contact us : Investor Relations & Financial Information Claude Haberer : 33 1 40 14 63 58 Laurent Degabriel : 33 1 42 98 23 40 Irène Chesnais : 33 1 42 98 46 45 Fax : 33 1 42 98 21 22 IR Web Site http: //invest. bnpparibas. com e-mail : investor. relations@bnpparibas. com 2000 Results 60