f2e0ff1d81a1769274e8329a0be7758f.ppt

- Количество слайдов: 29

2000 General Insurance Convention Making Mergers and Acquisitions Work Peter Copeman 27 October 2000

2000 General Insurance Convention Making Mergers and Acquisitions Work Peter Copeman 27 October 2000

2 Mergers and acquisitions What is driving M&A now? M&A Strategy and Change Management The Future

2 Mergers and acquisitions What is driving M&A now? M&A Strategy and Change Management The Future

3 Key Issues for Non-Life. . . Industry consolidation 36% Excess capital 24% New distribution channels 23%

3 Key Issues for Non-Life. . . Industry consolidation 36% Excess capital 24% New distribution channels 23%

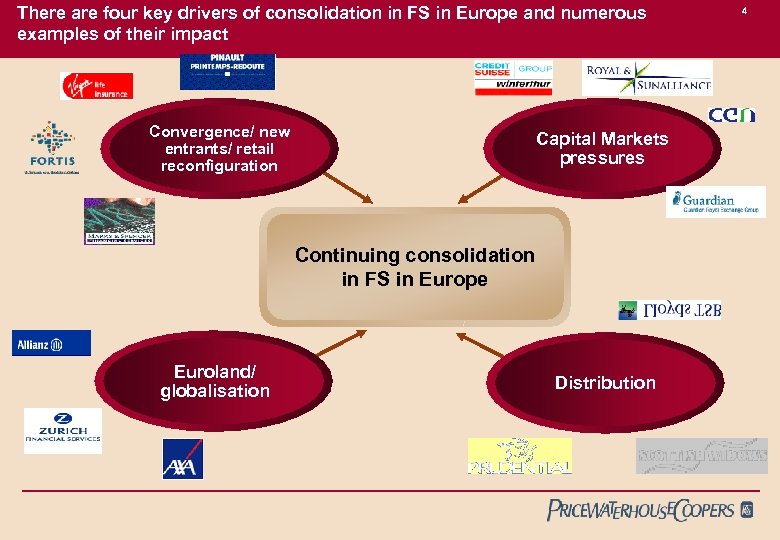

There are four key drivers of consolidation in FS in Europe and numerous examples of their impact Convergence/ new entrants/ retail reconfiguration Capital Markets pressures Continuing consolidation in FS in Europe Euroland/ globalisation Distribution 4

There are four key drivers of consolidation in FS in Europe and numerous examples of their impact Convergence/ new entrants/ retail reconfiguration Capital Markets pressures Continuing consolidation in FS in Europe Euroland/ globalisation Distribution 4

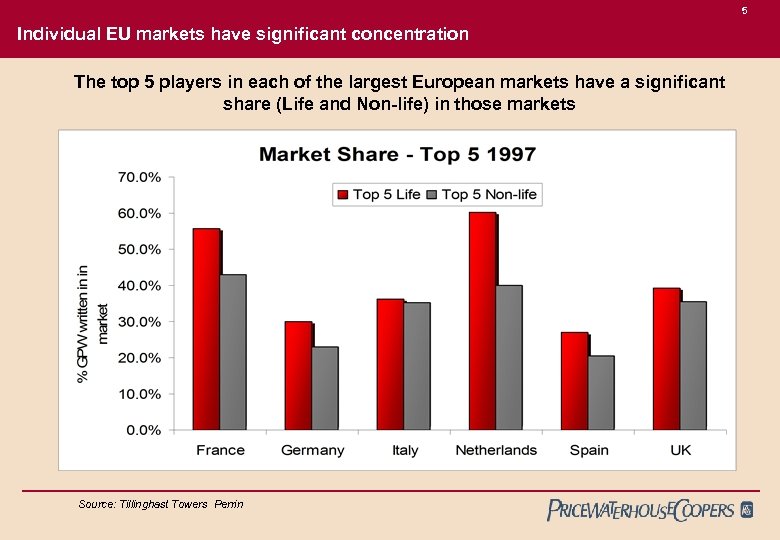

5 Individual EU markets have significant concentration The top 5 players in each of the largest European markets have a significant share (Life and Non-life) in those markets Source: Tillinghast Towers Perrin

5 Individual EU markets have significant concentration The top 5 players in each of the largest European markets have a significant share (Life and Non-life) in those markets Source: Tillinghast Towers Perrin

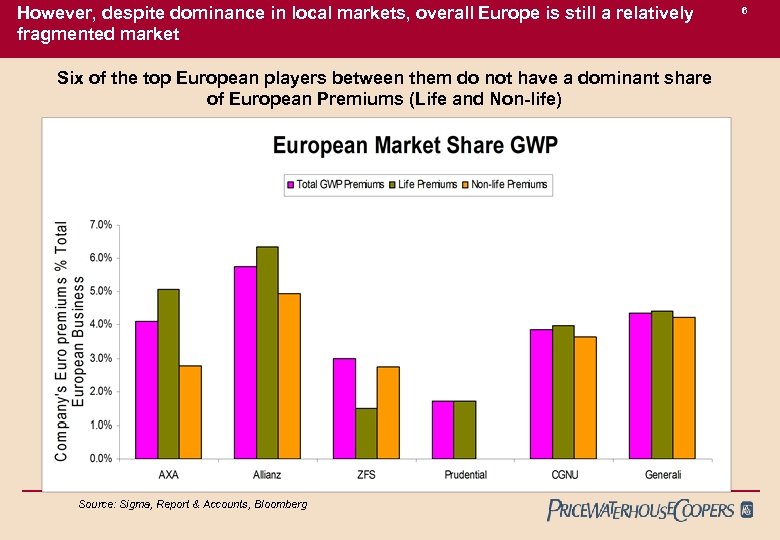

However, despite dominance in local markets, overall Europe is still a relatively fragmented market Six of the top European players between them do not have a dominant share of European Premiums (Life and Non-life) Source: Sigma, Report & Accounts, Bloomberg 6

However, despite dominance in local markets, overall Europe is still a relatively fragmented market Six of the top European players between them do not have a dominant share of European Premiums (Life and Non-life) Source: Sigma, Report & Accounts, Bloomberg 6

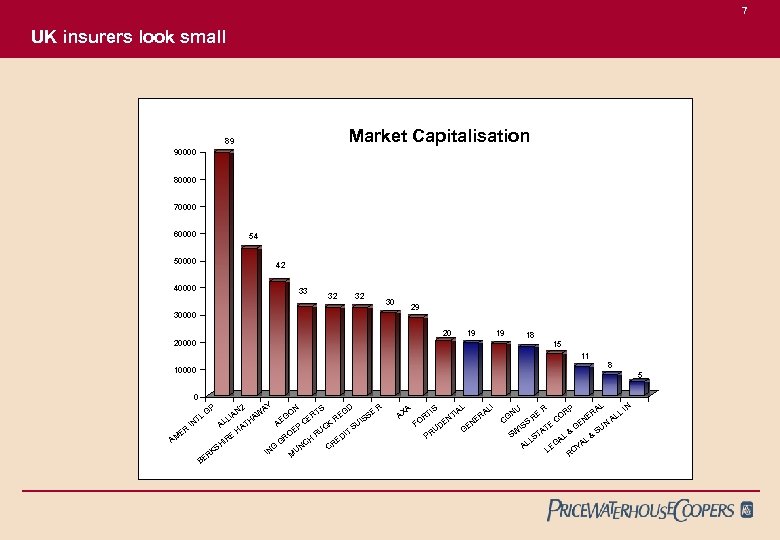

7 UK insurers look small Market Capitalisation 89 90000 80000 70000 60000 54 50000 42 40000 33 32 32 30 29 30000 20 19 19 18 20000 15 11 8 10000 5 0 R D. S. AY N NZ W EG RT SE IA GO E L. R IS E HA C K A T AL P SU HA UC T OE E. R DI R E GR CH HI G CR UN KS IN R M. P. G TL . IN ER AM BE A AX I RT FO P S D RU E I NT LI AL GE N A ER U GN C S IS SW RE A ST L AL . RP CO R TE LE G AL & . AL R NE GE AL Y RO & SU . IN N L AL

7 UK insurers look small Market Capitalisation 89 90000 80000 70000 60000 54 50000 42 40000 33 32 32 30 29 30000 20 19 19 18 20000 15 11 8 10000 5 0 R D. S. AY N NZ W EG RT SE IA GO E L. R IS E HA C K A T AL P SU HA UC T OE E. R DI R E GR CH HI G CR UN KS IN R M. P. G TL . IN ER AM BE A AX I RT FO P S D RU E I NT LI AL GE N A ER U GN C S IS SW RE A ST L AL . RP CO R TE LE G AL & . AL R NE GE AL Y RO & SU . IN N L AL

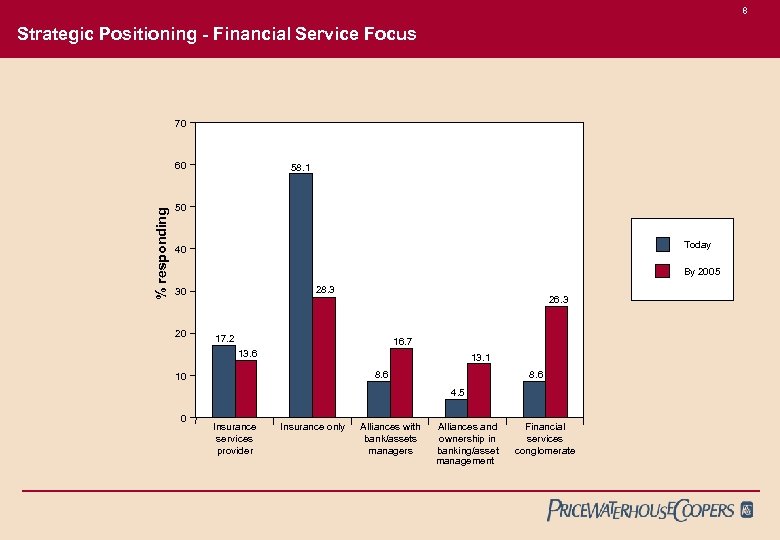

8 Strategic Positioning - Financial Service Focus 70 % responding 60 58. 1 50 Today 40 By 2005 28. 3 30 20 26. 3 17. 2 16. 7 13. 6 13. 1 8. 6 10 8. 6 4. 5 0 Insurance services provider Insurance only Alliances with bank/assets managers Alliances and ownership in banking/asset management Financial services conglomerate

8 Strategic Positioning - Financial Service Focus 70 % responding 60 58. 1 50 Today 40 By 2005 28. 3 30 20 26. 3 17. 2 16. 7 13. 6 13. 1 8. 6 10 8. 6 4. 5 0 Insurance services provider Insurance only Alliances with bank/assets managers Alliances and ownership in banking/asset management Financial services conglomerate

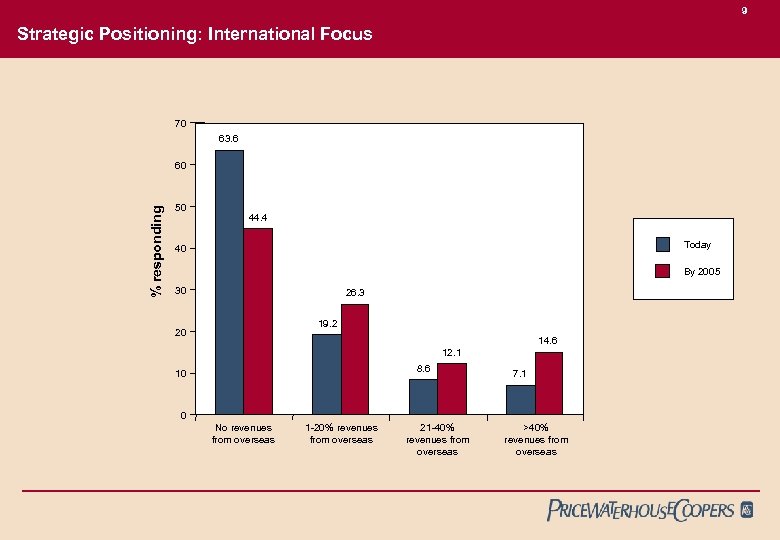

9 Strategic Positioning: International Focus 70 63. 6 % responding 60 50 44. 4 Today 40 By 2005 30 26. 3 19. 2 20 14. 6 12. 1 8. 6 10 7. 1 0 No revenues from overseas 1 -20% revenues from overseas 21 -40% revenues from overseas >40% revenues from overseas

9 Strategic Positioning: International Focus 70 63. 6 % responding 60 50 44. 4 Today 40 By 2005 30 26. 3 19. 2 20 14. 6 12. 1 8. 6 10 7. 1 0 No revenues from overseas 1 -20% revenues from overseas 21 -40% revenues from overseas >40% revenues from overseas

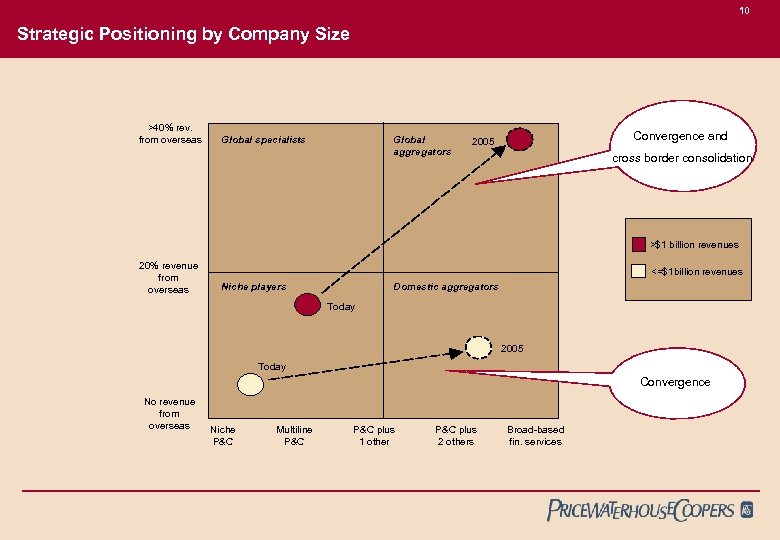

10 Strategic Positioning by Company Size >40% rev. from overseas Global aggregators Global specialists Convergence and 2005 cross border consolidation >$1 billion revenues 20% revenue from overseas <=$1 billion revenues Niche players Domestic aggregators Today 2005 Today Convergence No revenue from overseas Niche P&C Multiline P&C plus 1 other P&C plus 2 others Broad-based fin. services

10 Strategic Positioning by Company Size >40% rev. from overseas Global aggregators Global specialists Convergence and 2005 cross border consolidation >$1 billion revenues 20% revenue from overseas <=$1 billion revenues Niche players Domestic aggregators Today 2005 Today Convergence No revenue from overseas Niche P&C Multiline P&C plus 1 other P&C plus 2 others Broad-based fin. services

11 Mergers and acquisitions What is driving M&A now? M&A Strategy and Change Management The Future

11 Mergers and acquisitions What is driving M&A now? M&A Strategy and Change Management The Future

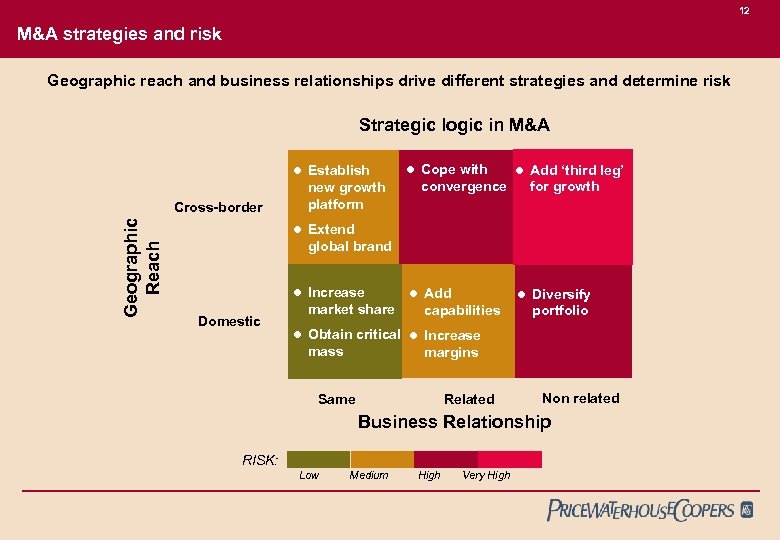

12 M&A strategies and risk Geographic reach and business relationships drive different strategies and determine risk Strategic logic in M&A l Establish Geographic Reach Cross-border new growth platform l Cope with convergence l Add ‘third leg’ for growth l Extend global brand l Increase Domestic market share l Add l Diversify capabilities portfolio l Obtain critical l Increase mass margins Same Related Non related Business Relationship RISK: Low Medium High Very High

12 M&A strategies and risk Geographic reach and business relationships drive different strategies and determine risk Strategic logic in M&A l Establish Geographic Reach Cross-border new growth platform l Cope with convergence l Add ‘third leg’ for growth l Extend global brand l Increase Domestic market share l Add l Diversify capabilities portfolio l Obtain critical l Increase mass margins Same Related Non related Business Relationship RISK: Low Medium High Very High

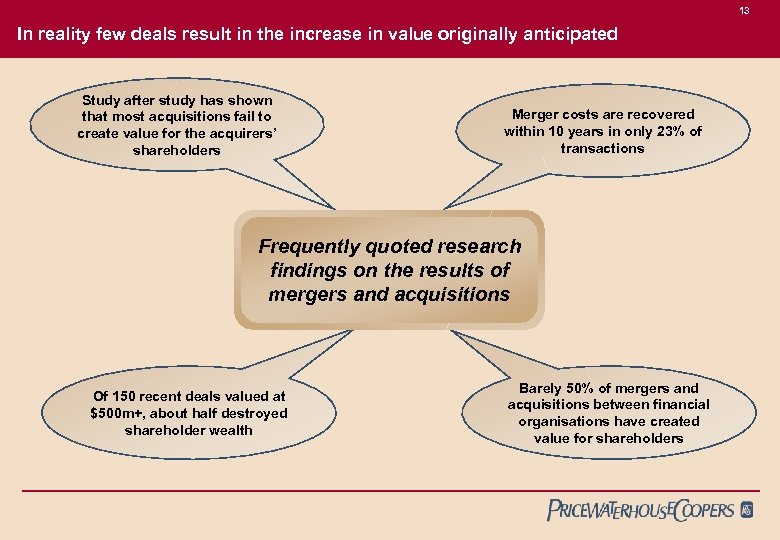

13 In reality few deals result in the increase in value originally anticipated Study after study has shown that most acquisitions fail to create value for the acquirers’ shareholders Merger costs are recovered within 10 years in only 23% of transactions Frequently quoted research findings on the results of mergers and acquisitions Of 150 recent deals valued at $500 m+, about half destroyed shareholder wealth Barely 50% of mergers and acquisitions between financial organisations have created value for shareholders

13 In reality few deals result in the increase in value originally anticipated Study after study has shown that most acquisitions fail to create value for the acquirers’ shareholders Merger costs are recovered within 10 years in only 23% of transactions Frequently quoted research findings on the results of mergers and acquisitions Of 150 recent deals valued at $500 m+, about half destroyed shareholder wealth Barely 50% of mergers and acquisitions between financial organisations have created value for shareholders

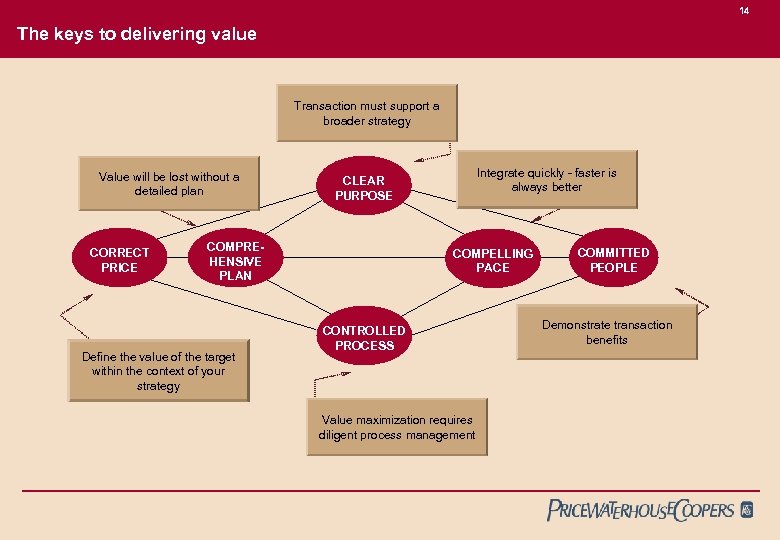

14 The keys to delivering value Transaction must support a broader strategy Value will be lost without a detailed plan CORRECT PRICE COMPREHENSIVE PLAN Define the value of the target within the context of your strategy Integrate quickly - faster is always better CLEAR PURPOSE COMPELLING PACE CONTROLLED PROCESS Value maximization requires diligent process management COMMITTED PEOPLE Demonstrate transaction benefits

14 The keys to delivering value Transaction must support a broader strategy Value will be lost without a detailed plan CORRECT PRICE COMPREHENSIVE PLAN Define the value of the target within the context of your strategy Integrate quickly - faster is always better CLEAR PURPOSE COMPELLING PACE CONTROLLED PROCESS Value maximization requires diligent process management COMMITTED PEOPLE Demonstrate transaction benefits

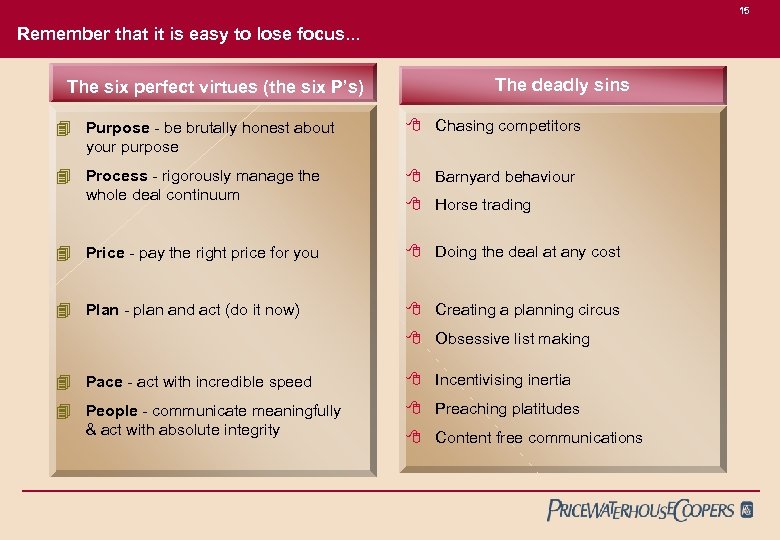

15 Remember that it is easy to lose focus. . . The six perfect virtues (the six P’s) The deadly sins 4 Purpose - be brutally honest about your purpose 8 Chasing competitors 4 Process - rigorously manage the whole deal continuum 8 Barnyard behaviour 4 Price - pay the right price for you 8 Doing the deal at any cost 4 Plan - plan and act (do it now) 8 Creating a planning circus 8 Horse trading 8 Obsessive list making 4 Pace - act with incredible speed 8 Incentivising inertia 4 People - communicate meaningfully & act with absolute integrity 8 Preaching platitudes 8 Content free communications

15 Remember that it is easy to lose focus. . . The six perfect virtues (the six P’s) The deadly sins 4 Purpose - be brutally honest about your purpose 8 Chasing competitors 4 Process - rigorously manage the whole deal continuum 8 Barnyard behaviour 4 Price - pay the right price for you 8 Doing the deal at any cost 4 Plan - plan and act (do it now) 8 Creating a planning circus 8 Horse trading 8 Obsessive list making 4 Pace - act with incredible speed 8 Incentivising inertia 4 People - communicate meaningfully & act with absolute integrity 8 Preaching platitudes 8 Content free communications

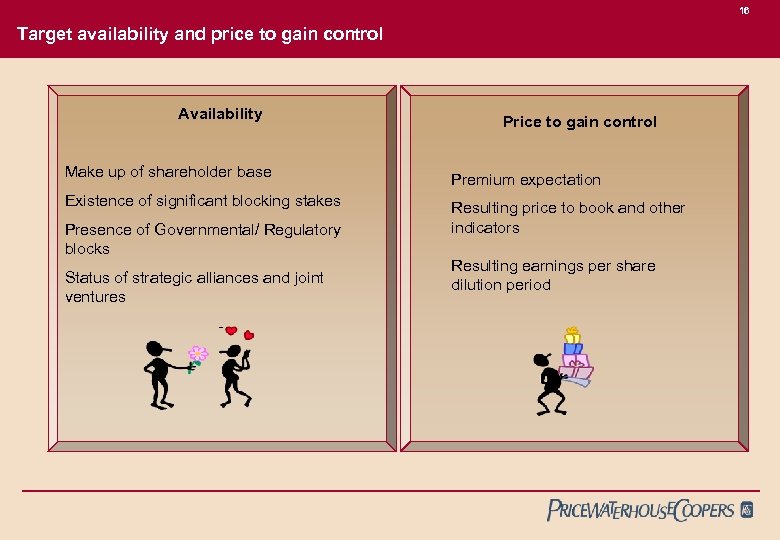

16 Target availability and price to gain control Availability Price to gain control Make up of shareholder base Premium expectation Existence of significant blocking stakes Resulting price to book and other indicators Presence of Governmental/ Regulatory blocks Status of strategic alliances and joint ventures - Resulting earnings per share dilution period

16 Target availability and price to gain control Availability Price to gain control Make up of shareholder base Premium expectation Existence of significant blocking stakes Resulting price to book and other indicators Presence of Governmental/ Regulatory blocks Status of strategic alliances and joint ventures - Resulting earnings per share dilution period

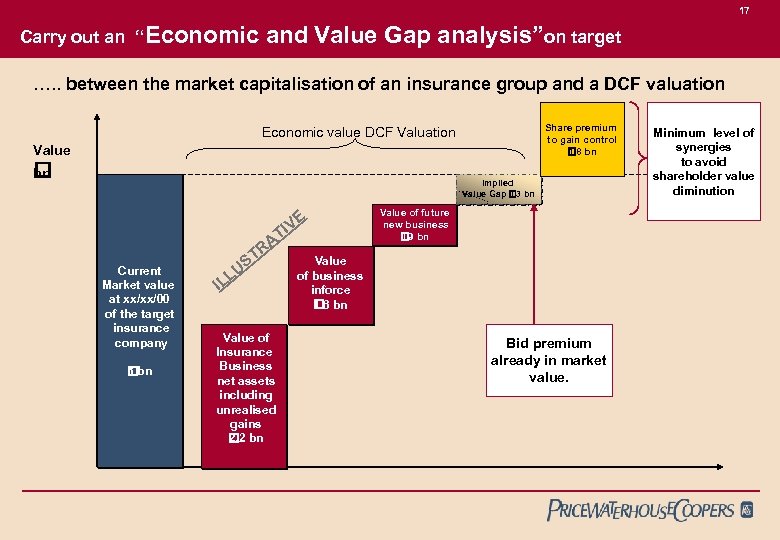

17 Carry out an “Economic and Value Gap analysis”on target …. . between the market capitalisation of an insurance group and a DCF valuation Share premium to gain control 1. 8 bn Economic value DCF Valuation Value bn Implied Value Gap bn 0. 3 E IV Current Market value at xx/xx/00 of the target insurance company 5 bn S LU T RA T IL Value of Insurance Business net assets including unrealised gains 2. 2 bn Value of future new business 0. 9 bn Value of business inforce 1. 6 bn Bid premium already in market value. Minimum level of synergies to avoid shareholder value diminution

17 Carry out an “Economic and Value Gap analysis”on target …. . between the market capitalisation of an insurance group and a DCF valuation Share premium to gain control 1. 8 bn Economic value DCF Valuation Value bn Implied Value Gap bn 0. 3 E IV Current Market value at xx/xx/00 of the target insurance company 5 bn S LU T RA T IL Value of Insurance Business net assets including unrealised gains 2. 2 bn Value of future new business 0. 9 bn Value of business inforce 1. 6 bn Bid premium already in market value. Minimum level of synergies to avoid shareholder value diminution

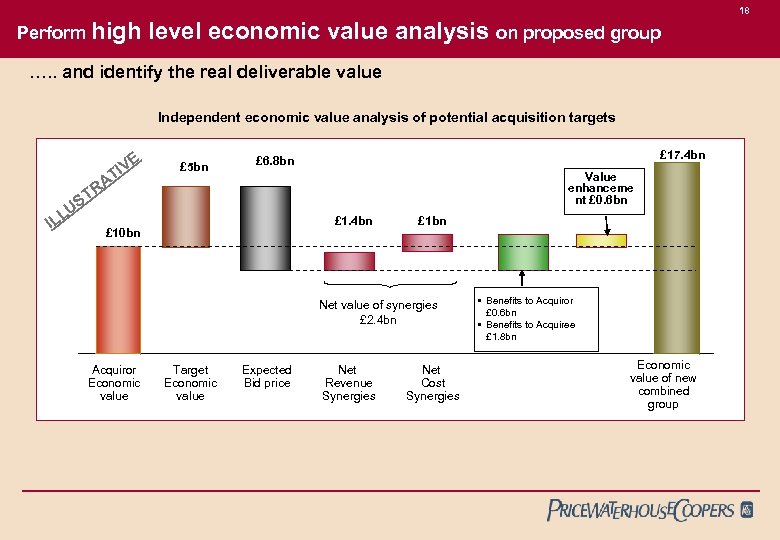

18 Perform high level economic value analysis on proposed group …. . and identify the real deliverable value Independent economic value analysis of potential acquisition targets I AT R T US L IL VE £ 5 bn £ 17. 4 bn £ 6. 8 bn Value enhanceme nt £ 0. 6 bn £ 1. 4 bn £ 10 bn £ 1 bn Net value of synergies £ 2. 4 bn Acquiror Economic value Target Economic value Expected Bid price Net Revenue Synergies Net Cost Synergies • Benefits to Acquiror £ 0. 6 bn • Benefits to Acquiree £ 1. 8 bn Economic value of new combined group

18 Perform high level economic value analysis on proposed group …. . and identify the real deliverable value Independent economic value analysis of potential acquisition targets I AT R T US L IL VE £ 5 bn £ 17. 4 bn £ 6. 8 bn Value enhanceme nt £ 0. 6 bn £ 1. 4 bn £ 10 bn £ 1 bn Net value of synergies £ 2. 4 bn Acquiror Economic value Target Economic value Expected Bid price Net Revenue Synergies Net Cost Synergies • Benefits to Acquiror £ 0. 6 bn • Benefits to Acquiree £ 1. 8 bn Economic value of new combined group

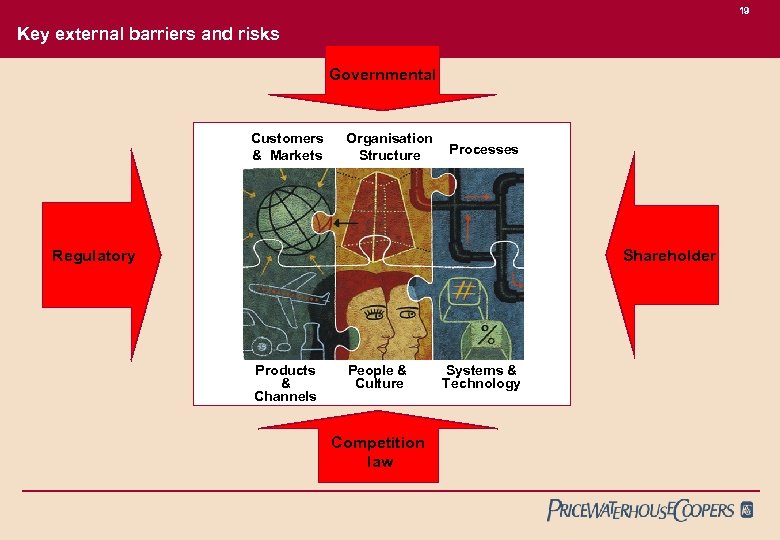

19 Key external barriers and risks Governmental Customers & Markets Organisation Structure Processes Regulatory Shareholder Products & Channels People & Culture Competition law Systems & Technology

19 Key external barriers and risks Governmental Customers & Markets Organisation Structure Processes Regulatory Shareholder Products & Channels People & Culture Competition law Systems & Technology

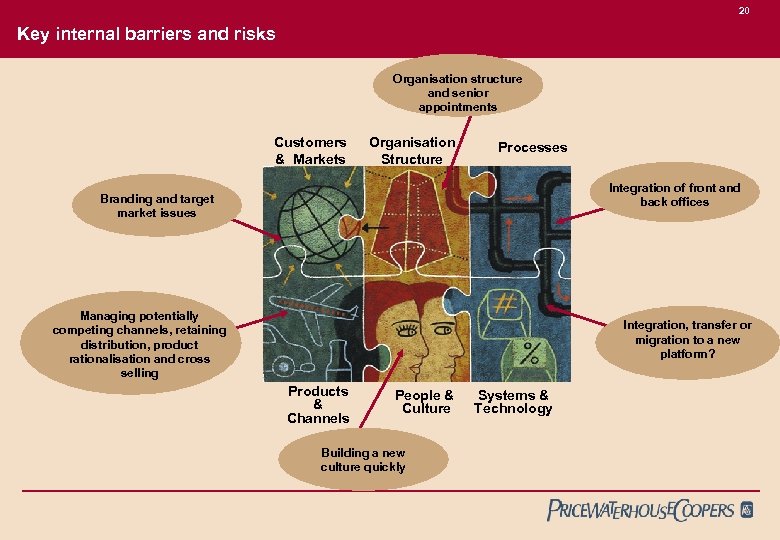

20 Key internal barriers and risks Organisation structure and senior appointments Customers & Markets Organisation Structure Processes Integration of front and back offices Branding and target market issues Managing potentially competing channels, retaining distribution, product rationalisation and cross selling Integration, transfer or migration to a new platform? Products & Channels People & Culture Building a new culture quickly Systems & Technology

20 Key internal barriers and risks Organisation structure and senior appointments Customers & Markets Organisation Structure Processes Integration of front and back offices Branding and target market issues Managing potentially competing channels, retaining distribution, product rationalisation and cross selling Integration, transfer or migration to a new platform? Products & Channels People & Culture Building a new culture quickly Systems & Technology

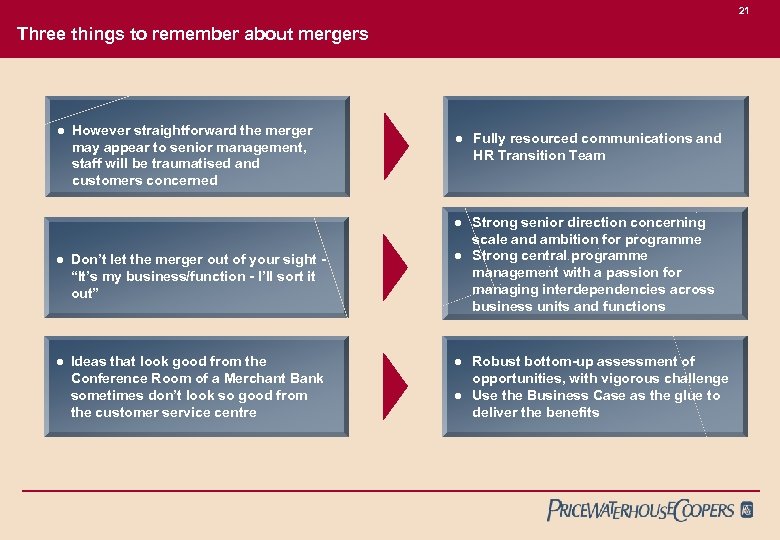

21 Three things to remember about mergers l However straightforward the merger may appear to senior management, staff will be traumatised and customers concerned l Fully resourced communications and HR Transition Team l Strong senior direction concerning scale and ambition for programme Strong central programme management with a passion for managing interdependencies across business units and functions l Don’t let the merger out of your sight “It’s my business/function - I’ll sort it out” l l Ideas that look good from the Conference Room of a Merchant Bank sometimes don’t look so good from the customer service centre l l Robust bottom-up assessment of opportunities, with vigorous challenge Use the Business Case as the glue to deliver the benefits

21 Three things to remember about mergers l However straightforward the merger may appear to senior management, staff will be traumatised and customers concerned l Fully resourced communications and HR Transition Team l Strong senior direction concerning scale and ambition for programme Strong central programme management with a passion for managing interdependencies across business units and functions l Don’t let the merger out of your sight “It’s my business/function - I’ll sort it out” l l Ideas that look good from the Conference Room of a Merchant Bank sometimes don’t look so good from the customer service centre l l Robust bottom-up assessment of opportunities, with vigorous challenge Use the Business Case as the glue to deliver the benefits

22 Mergers and acquisitions What is driving M&A now? M&A Strategy and Change Management The Future

22 Mergers and acquisitions What is driving M&A now? M&A Strategy and Change Management The Future

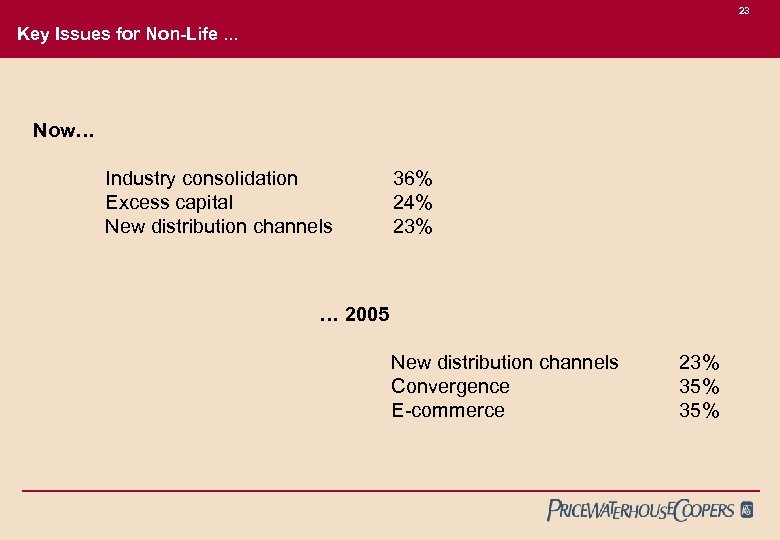

23 Key Issues for Non-Life. . . Now… Industry consolidation Excess capital New distribution channels 36% 24% 23% … 2005 New distribution channels Convergence E-commerce 23% 35%

23 Key Issues for Non-Life. . . Now… Industry consolidation Excess capital New distribution channels 36% 24% 23% … 2005 New distribution channels Convergence E-commerce 23% 35%

24 Financial Times Extract

24 Financial Times Extract

25 Kaj Ahlmann, Chairman and Chief Executive of Employers Re Corporation says. . . “I believe people who have access will transfer blocks of business to people who have strong balance sheets. Everywhere someone is in touch with a group of people, a block of insurance business can be created and transferred to a balance sheet. When you lease a car you can put insurance with it, when you sell a mortgage you can put insurance in it. We could see a primary insurance company as something that could be disintermediated. ”

25 Kaj Ahlmann, Chairman and Chief Executive of Employers Re Corporation says. . . “I believe people who have access will transfer blocks of business to people who have strong balance sheets. Everywhere someone is in touch with a group of people, a block of insurance business can be created and transferred to a balance sheet. When you lease a car you can put insurance with it, when you sell a mortgage you can put insurance in it. We could see a primary insurance company as something that could be disintermediated. ”

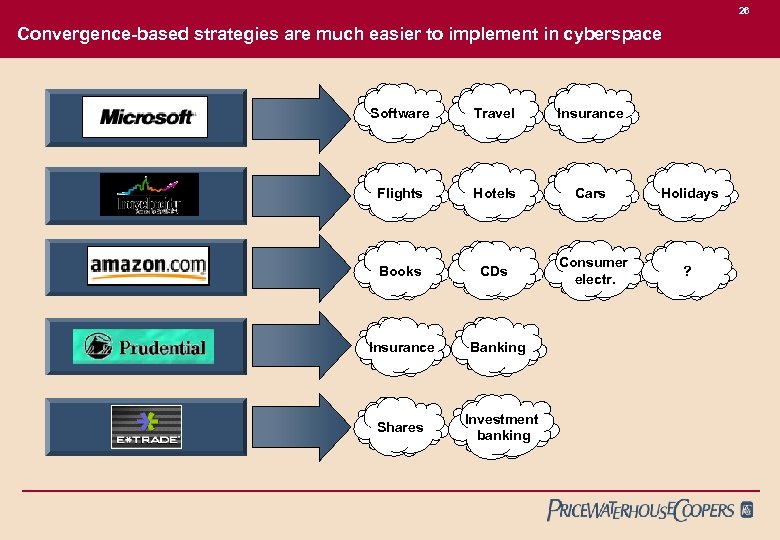

26 Convergence-based strategies are much easier to implement in cyberspace Software Travel Insurance Flights Hotels Cars Holidays Books CDs Consumer electr. ? Insurance Banking Shares Investment banking

26 Convergence-based strategies are much easier to implement in cyberspace Software Travel Insurance Flights Hotels Cars Holidays Books CDs Consumer electr. ? Insurance Banking Shares Investment banking

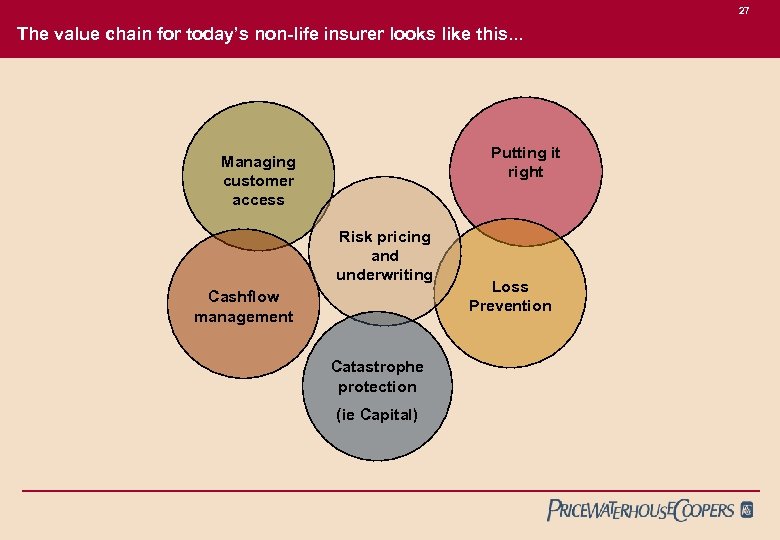

27 The value chain for today’s non-life insurer looks like this. . . Putting it right Managing customer access Risk pricing and underwriting Cashflow management Catastrophe protection (ie Capital) Loss Prevention

27 The value chain for today’s non-life insurer looks like this. . . Putting it right Managing customer access Risk pricing and underwriting Cashflow management Catastrophe protection (ie Capital) Loss Prevention

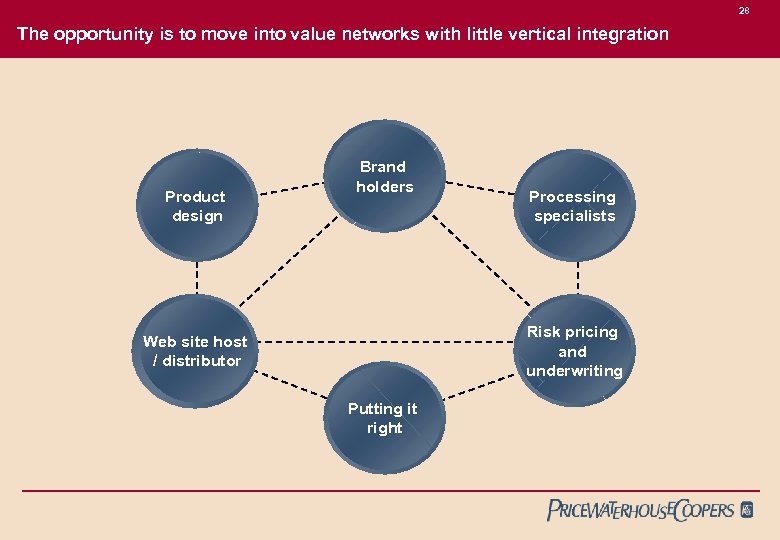

28 The opportunity is to move into value networks with little vertical integration Product design Brand holders Processing specialists Risk pricing and underwriting Web site host / distributor Putting it right

28 The opportunity is to move into value networks with little vertical integration Product design Brand holders Processing specialists Risk pricing and underwriting Web site host / distributor Putting it right

29 Conclusions • Cross border M&A will continue as dominant pan-European players emerge • Shareholders will demand clarity on value before …… …. and after the deal • Convergence and e-commerce will increasingly drive acquisition behaviour over the next five years

29 Conclusions • Cross border M&A will continue as dominant pan-European players emerge • Shareholders will demand clarity on value before …… …. and after the deal • Convergence and e-commerce will increasingly drive acquisition behaviour over the next five years