4969071ae4bdbd9c96243bb8f4cfafb0.ppt

- Количество слайдов: 23

20 November 2007 Latam Metals & Mining Felipe Hirai, CFA +1 212 449 -2132 Research Analyst MLPF&S felipe_hirai@ml. com Exploring Opportunities in Latin America British & Colombian Chamber of Commerce Merrill Lynch does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Refer to important disclosures on page 22 -24 Analyst Certification on page 21 10673729 Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 0

Presentation Overview 20 November 2007 1. Merrill Lynch Metals & Mining Research Team 2. Our view on the metals 3. Trends in Latin America 4. Opportunities 5. Challenges 6. Conclusion Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 1

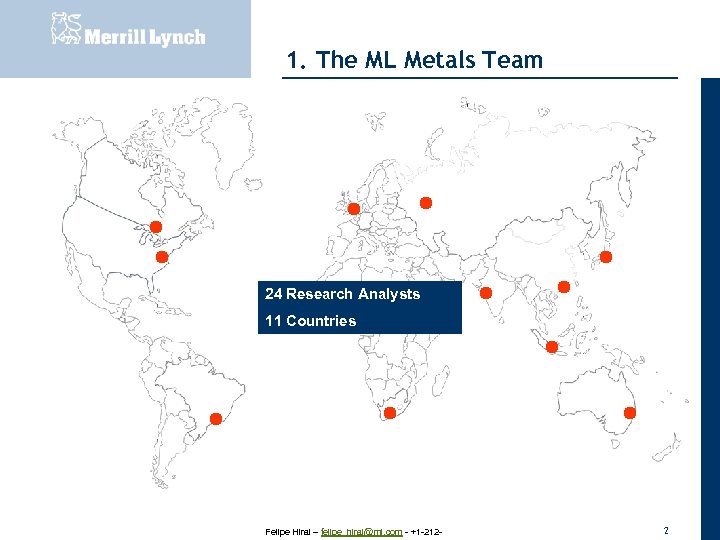

20 November 2007 1. The ML Metals Team 24 Research Analysts 11 Countries Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 2

20 November 2007 2. The ML view on metals Extended metals cycle: higher prices for a longer period Tight S&D balance: China still supporting demand growth Demand potential from other emerging economies Global growth should remain solid, despite a US slowdown (decoupling) Preferred metals: bulks (iron ore/coal) and precious (gold/silver) RISKS: Product substitution Higher costs (equipment / energy) Political stability and environmental challenges Severe recession in the USA Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 3

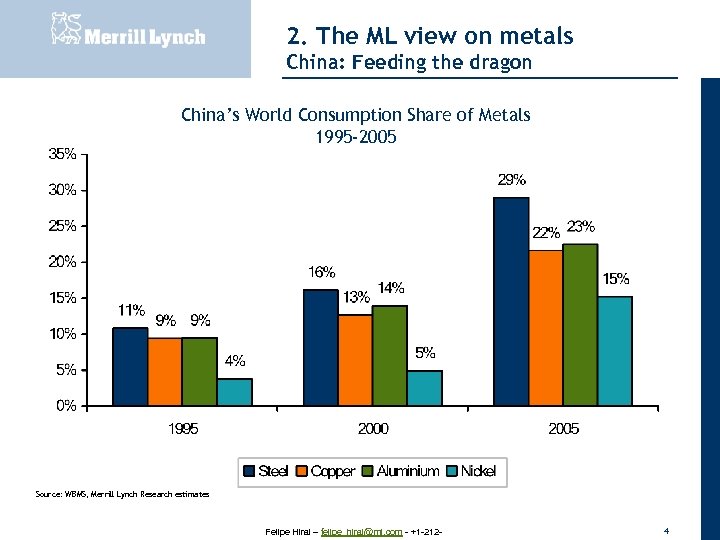

2. The ML view on metals 20 November 2007 China: Feeding the dragon China’s World Consumption Share of Metals 1995 -2005 Source: WBMS, Merrill Lynch Research estimates Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 4

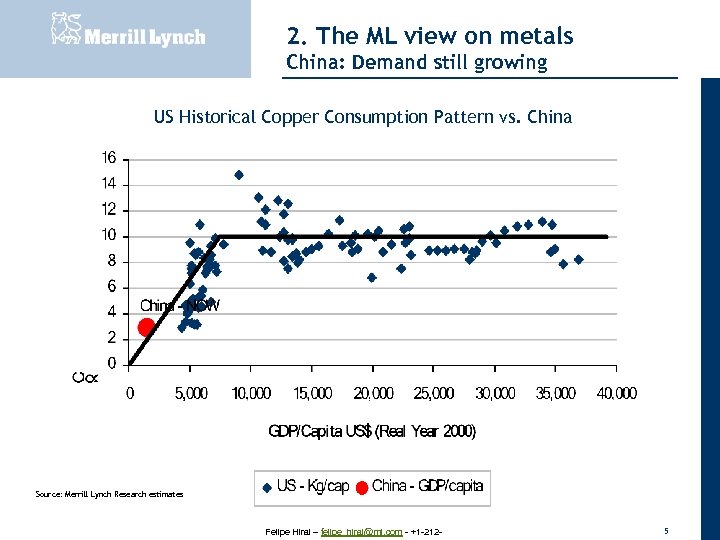

2. The ML view on metals 20 November 2007 China: Demand still growing US Historical Copper Consumption Pattern vs. China Source: Merrill Lynch Research estimates Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 5

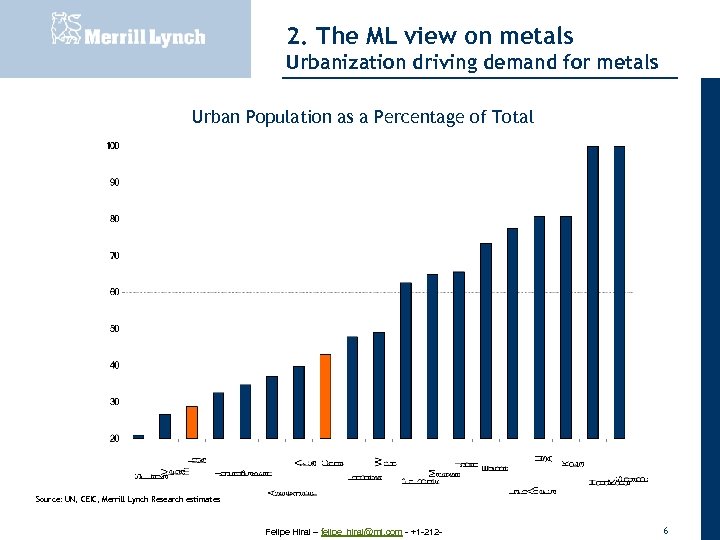

2. The ML view on metals 20 November 2007 Urbanization driving demand for metals Urban Population as a Percentage of Total Source: UN, CEIC, Merrill Lynch Research estimates Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 6

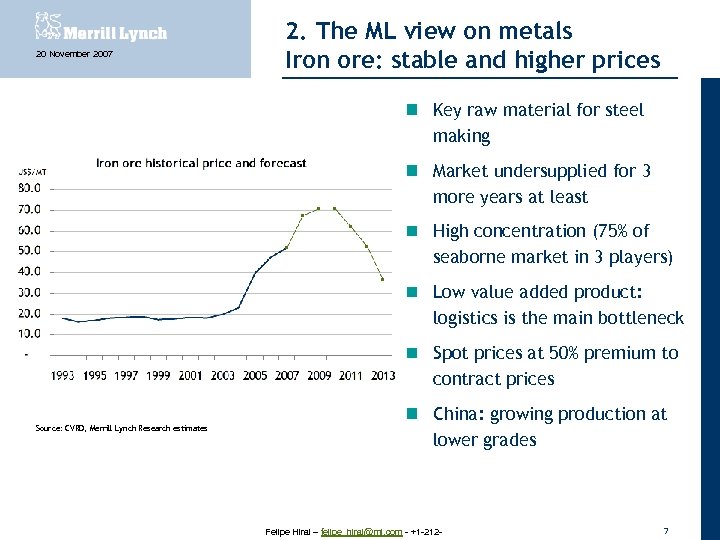

20 November 2007 2. The ML view on metals Iron ore: stable and higher prices Key raw material for steel making Market undersupplied for 3 more years at least High concentration (75% of seaborne market in 3 players) Low value added product: logistics is the main bottleneck Spot prices at 50% premium to contract prices Source: CVRD, Merrill Lynch Research estimates China: growing production at lower grades Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 7

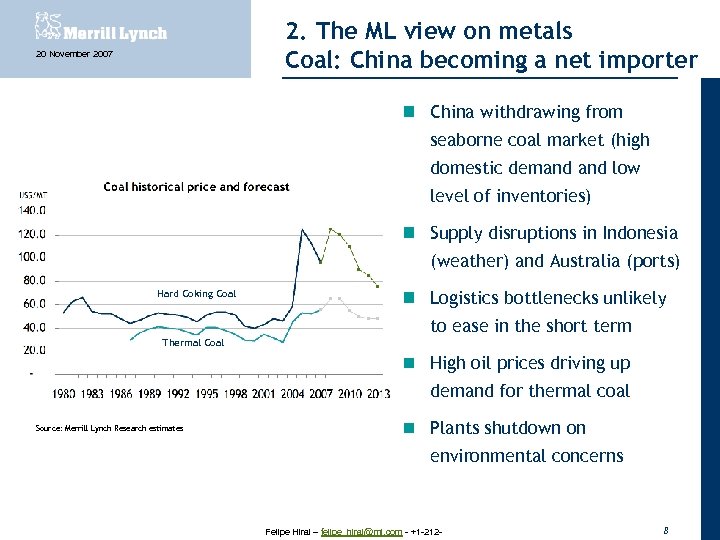

2. The ML view on metals Coal: China becoming a net importer 20 November 2007 China withdrawing from seaborne coal market (high domestic demand low level of inventories) Supply disruptions in Indonesia (weather) and Australia (ports) Hard Coking Coal Logistics bottlenecks unlikely to ease in the short term Thermal Coal High oil prices driving up demand for thermal coal Source: Merrill Lynch Research estimates Plants shutdown on environmental concerns Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 8

20 November 2007 2. The ML view on metals Gold: Positive in the medium term Higher gold prices in the medium term Tight supply x demand for the bullion market Mine output declining from 2011 onwards USD weakness on financial crisis and lower interest rates Inflationary pressures from higher energy prices Source: Merrill Lynch Research estimates High jewellery demand on global economic growth Marginal cost at US$550/oz Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 9

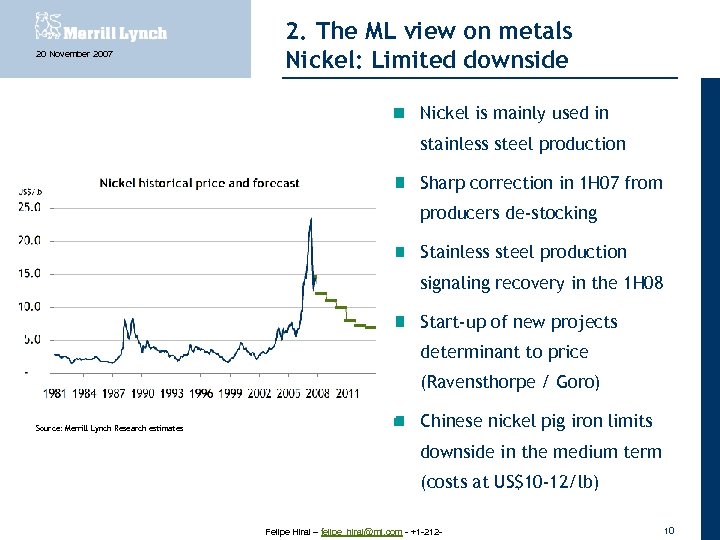

20 November 2007 2. The ML view on metals Nickel: Limited downside Nickel is mainly used in stainless steel production Sharp correction in 1 H 07 from producers de-stocking Stainless steel production signaling recovery in the 1 H 08 Start-up of new projects determinant to price (Ravensthorpe / Goro) Source: Merrill Lynch Research estimates Chinese nickel pig iron limits downside in the medium term (costs at US$10 -12/lb) Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 10

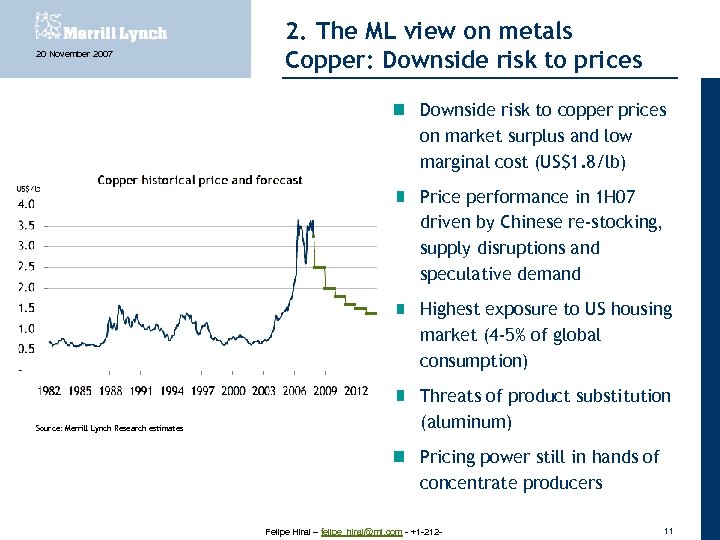

20 November 2007 2. The ML view on metals Copper: Downside risk to prices Downside risk to copper prices on market surplus and low marginal cost (US$1. 8/lb) Price performance in 1 H 07 driven by Chinese re-stocking, supply disruptions and speculative demand Highest exposure to US housing market (4 -5% of global consumption) Source: Merrill Lynch Research estimates Threats of product substitution (aluminum) Pricing power still in hands of concentrate producers Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 11

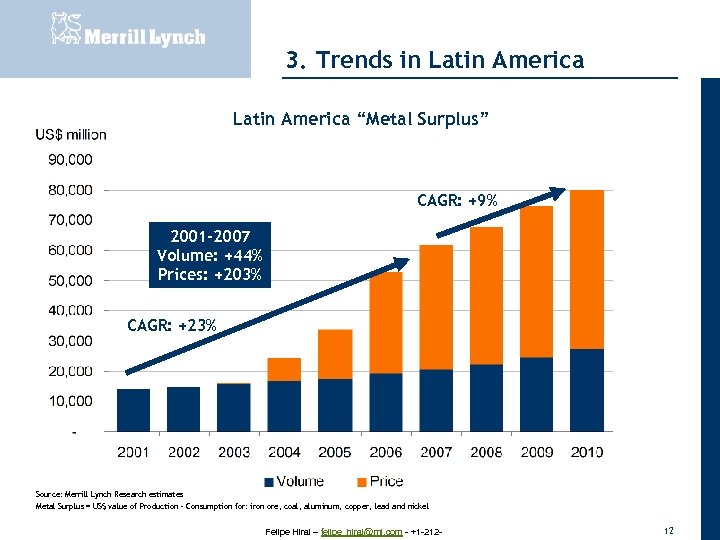

3. Trends in Latin America 20 November 2007 Latin America “Metal Surplus” CAGR: +9% 2001 -2007 Volume: +44% Prices: +203% CAGR: +23% Source: Merrill Lynch Research estimates Metal Surplus = US$ value of Production – Consumption for: iron ore, coal, aluminum, copper, lead and nickel Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 12

20 November 2007 4. Opportunities China and other emerging economies to sustain global economic growth (and higher metal prices) High quality of reserves and technology Position in the lower quartiles of cash cost in the industry Focus on exploration to create a sustainable growth platform Consolidation: creation of strong & global metals companies, with headquarters in Latin America Diversification: development of new metals (coal in Colombia) Access to capital: abundant liquidity in the market Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 13

20 November 2007 5. Challenges Political stability: support from Government Infra-structure still a bottleneck in the region Lack of qualified personnel Increase in costs and in lead time in the industry Stricter regulation from environmental agencies Currencies appreciating against the USD Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 14

20 November 2007 6. Conclusion Extended metals cycle: higher prices for a longer period Other emerging economies should increase demand for metals “Metal surplus” for Latin America should continue to grow Companies should focus in exploration, taking advantage of high quality of reserves and low cost operations Governments need to be pro-active towards the mining industry Logistics infra-structure and qualified personnel are the main bottlenecks in the industry Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 15

20 November 2007 Merrill Lynch Disclaimers Analyst Certification I, Felipe Hirai, hereby certify that the views expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report. Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 16

20 November 2007 Merrill Lynch Disclaimers Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 17

20 November 2007 Merrill Lynch Disclaimers Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 18

20 November 2007 Analyst Certification I, Felipe Hirai, CFA, hereby certify that the views expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or view expressed in this research report. Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 19

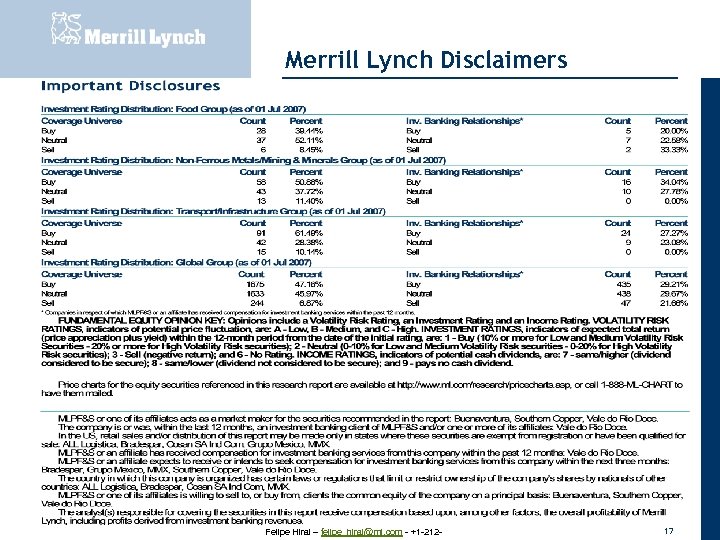

20 November 2007 Important Disclosures FUNDAMENTAL EQUITY OPINION KEY: Opinions include a Volatility Risk Rating, an Investment Rating and an Income Rating. VOLATILITY RISK RATINGS, indicators of potential price fluctuation, are: A - Low, B - Medium, and C - High. INVESTMENT RATINGS, indicators of expected total return (price appreciation plus yield) within the 12 -month period from the date of the initial rating, are: 1 - Buy (10% or more for Low and Medium Volatility Risk Securities - 20% or more for High Volatility Risk securities); 2 - Neutral (0 -10% for Low and Medium Volatility Risk securities - 0 -20% for High Volatility Risk securities); 3 - Sell (negative return); and 6 - No Rating. INCOME RATINGS, indicators of potential cash dividends, are: 7 - same/higher (dividend considered to be secure); 8 - same/lower (dividend not considered to be secure); and 9 - pays no cash dividend. Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 20

20 November 2007 Important Disclosures The analyst(s) responsible for covering the securities in this report receive compensation based upon, among other factors, the overall profitability of Merrill Lynch, including profits derived from investment banking revenues. Felipe Hirai – felipe_hirai@ml. com - +1 -212 - 21

20 November 2007 Other Important Disclosures UK readers: MLPF&S or an affiliate is a liquidity provider for the securities discussed in this report. Information relating to Non-U. S. affiliates of Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S): MLPF&S distributes research reports of the following non-US affiliates in the US (short name: legal name): Merrill Lynch (France): Merrill Lynch Capital Markets (France) SAS; Merrill Lynch (Frankfurt): Merrill Lynch International Bank Ltd, Frankfurt Branch; Merrill Lynch (South Africa): Merrill Lynch South Africa (Pty) Ltd; Merrill Lynch (Milan): Merrill Lynch International Bank Limited; MLPF&S (UK): Merrill Lynch, Pierce, Fenner & Smith Limited; Merrill Lynch (Australia): Merrill Lynch Equities (Australia) Limited; Merrill Lynch (Hong Kong): Merrill Lynch (Asia Pacific) Limited; Merrill Lynch (Singapore): Merrill Lynch (Singapore) Pte Ltd; Merrill Lynch (Canada): Merrill Lynch Canada Inc; Merrill Lynch (Mexico): Merrill Lynch Mexico, SA de CV, Casa de Bolsa; Merrill Lynch (Argentina): Merrill Lynch Argentina SA; Merrill Lynch (Japan): Merrill Lynch Japan Securities Co, Ltd; Merrill Lynch (Seoul): Merrill Lynch International Incorporated (Seoul Branch); Merrill Lynch (Taiwan): Merrill Lynch Global (Taiwan) Limited; DSP Merrill Lynch (India): DSP Merrill Lynch Limited; PT Merrill Lynch (Indonesia): PT Merrill Lynch Indonesia; Merrill Lynch (KL) Sdn. Bhd. : Merrill Lynch (Malaysia); Merrill Lynch (Israel): Merrill Lynch Israel Limited; Merrill Lynch (Russia): Merrill Lynch CIS Limited, Moscow; Merrill Lynch (Turkey): Merrill Lynch Yatirim Bankasi A. S. ; Merrill Lynch (Dubai): Merrill Lynch International Bank Ltd, Dubai Branch. This research report has been prepared and issued by MLPF&S and/or one or more of its non-U. S. affiliates. MLPF&S is the distributor of this research report in the U. S. and accepts full responsibility for research reports of its non-U. S. affiliates distributed in the U. S. Any U. S. person receiving this research report and wishing to effect any transaction in any security discussed in the report should do so through MLPF&S and not such foreign affiliates. This research report has been approved for publication in the United Kingdom by Merrill Lynch, Pierce, Fenner & Smith Limited, which is authorized and regulated by the Financial Services Authority; has been considered and distributed in Japan by Merrill Lynch Japan Securities Co, Ltd, a registered securities dealer under the Securities and Exchange Law in Japan; is distributed in Hong Kong by Merrill Lynch (Asia Pacific) Limited, which is regulated by the Hong Kong SFC; is issued and distributed in Taiwan by Merrill Lynch Global (Taiwan) Ltd or Merrill Lynch, Pierce, Fenner & Smith Limited (Taiwan Branch); is issued and distributed in Malaysia by Merrill Lynch (KL) Sdn. Bhd. , a licensed investment adviser regulated by the Malaysian Securities Commission; is issued and distributed in India by DSP Merrill Lynch Limited; and is issued and distributed in Singapore by Merrill Lynch International Bank Limited (Merchant Bank) and Merrill Lynch (Singapore) Pte Ltd (Company Registration No. ’s F 06872 E and 198602883 D respectively). Merrill Lynch International Bank Limited (Merchant Bank) and Merrill Lynch (Singapore) Pte Ltd. are regulated by the Monetary Authority of Singapore. Merrill Lynch Equities (Australia) Limited, (ABN 65 006 276 795), AFS License 235132, provides this report in Australia. No approval is required for publication or distribution of this report in Brazil. Merrill Lynch (Frankfurt) distributes this report in Germany. Merrill Lynch (Frankfurt) is regulated by Ba. Fin. Copyright, User Agreement and other general information related to this report: Copyright 2007 Merrill Lynch, Pierce, Fenner & Smith Incorporated. All rights reserved. This research report is prepared for the use of Merrill Lynch clients and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Merrill Lynch research reports are distributed simultaneously to internal and client websites eligible to receive such research prior to any public dissemination by Merrill Lynch of the research report or information or opinion contained therein. Any unauthorized use or disclosure is prohibited. Receipt and review of this research report constitutes your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information contained in this report (including any investment recommendations, estimates or price targets) prior to Merrill Lynch's public disclosure of such information. The information herein (other than disclosure information relating to Merrill Lynch and its affiliates) was obtained from various sources and we do not guarantee its accuracy. Merrill Lynch makes no representations or warranties whatsoever as to the data and information provided in any third party referenced website and shall have no liability or responsibility arising out of or in connection with any such referenced website. 22 Felipe Hirai – felipe_hirai@ml. com - +1 -212 -

4969071ae4bdbd9c96243bb8f4cfafb0.ppt