2 nd TASE-NASDAQ Conference The Tel Aviv Stock Exchange Growth & Opportunity Ester Levanon, CEO November 2007 - 1 -

2 nd TASE-NASDAQ Conference The Tel Aviv Stock Exchange Growth & Opportunity Ester Levanon, CEO November 2007 - 1 -

Tel-Aviv Stock Exchange – Since 1935 • One stop shop: • • Shares, corporate bonds, treasury bills and bonds, index products and derivatives Clearing, settlement and custody services Fully-automated (central order book trading system) Active Index product market Over 200 products, about 17% of daily volume in shares • Global Perception 65 companies cross-listed with foreign exchanges 4 foreign members • Ownership: TASE members - 2 -

Tel-Aviv Stock Exchange – Since 1935 • One stop shop: • • Shares, corporate bonds, treasury bills and bonds, index products and derivatives Clearing, settlement and custody services Fully-automated (central order book trading system) Active Index product market Over 200 products, about 17% of daily volume in shares • Global Perception 65 companies cross-listed with foreign exchanges 4 foreign members • Ownership: TASE members - 2 -

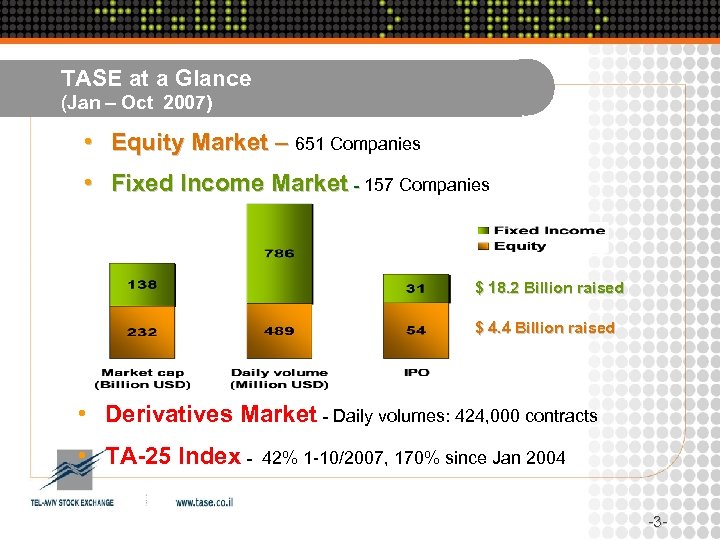

TASE at a Glance (Jan – Oct 2007) • Equity Market – 651 Companies • Fixed Income Market - 157 Companies $ 18. 2 Billion raised $ 4. 4 Billion raised • Derivatives Market - Daily volumes: 424, 000 contracts • TA-25 Index - 42% 1 -10/2007, 170% since Jan 2004 - 3 -

TASE at a Glance (Jan – Oct 2007) • Equity Market – 651 Companies • Fixed Income Market - 157 Companies $ 18. 2 Billion raised $ 4. 4 Billion raised • Derivatives Market - Daily volumes: 424, 000 contracts • TA-25 Index - 42% 1 -10/2007, 170% since Jan 2004 - 3 -

TASE globalization • Foreign investments • • Significant growth of foreign investments - $ 1 billion in 2007 Rules for remote membership Foreign Cooperation & Cross listings • • • 4 Foreign members MOU with LSE & NASDAQ 65 Companies cross-listed with foreign exchanges International clearing & custody services • Custody services for Israeli investors trading abroad • Clearing T+1 (government bonds) - 4 -

TASE globalization • Foreign investments • • Significant growth of foreign investments - $ 1 billion in 2007 Rules for remote membership Foreign Cooperation & Cross listings • • • 4 Foreign members MOU with LSE & NASDAQ 65 Companies cross-listed with foreign exchanges International clearing & custody services • Custody services for Israeli investors trading abroad • Clearing T+1 (government bonds) - 4 -

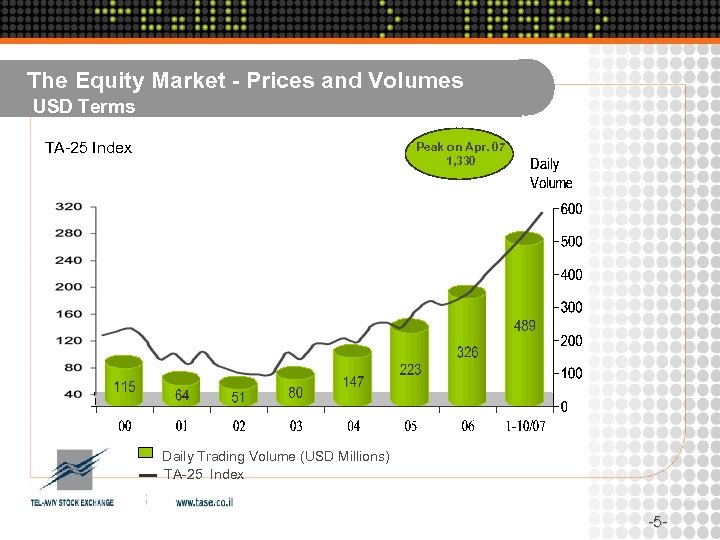

The Equity Market - Prices and Volumes USD Terms TA-25 Index Peak on Apr. 07 1, 330 Daily Trading Volume (USD Millions) TA-25 Index - 5 -

The Equity Market - Prices and Volumes USD Terms TA-25 Index Peak on Apr. 07 1, 330 Daily Trading Volume (USD Millions) TA-25 Index - 5 -

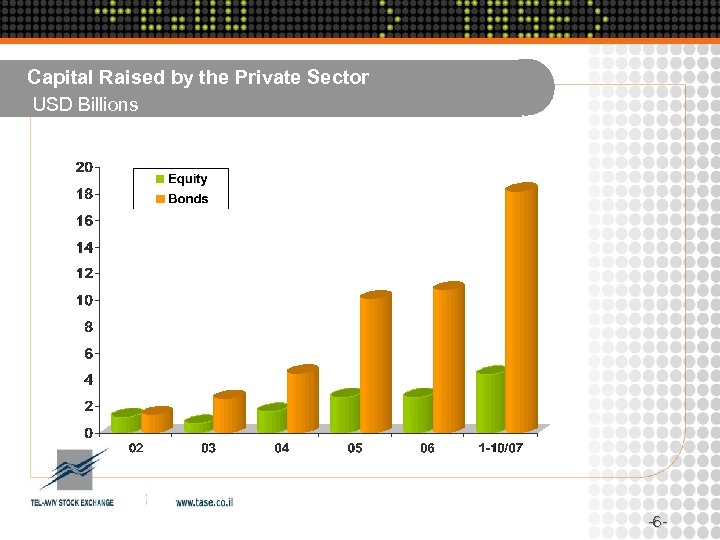

Capital Raised by the Private Sector USD Billions - 6 -

Capital Raised by the Private Sector USD Billions - 6 -

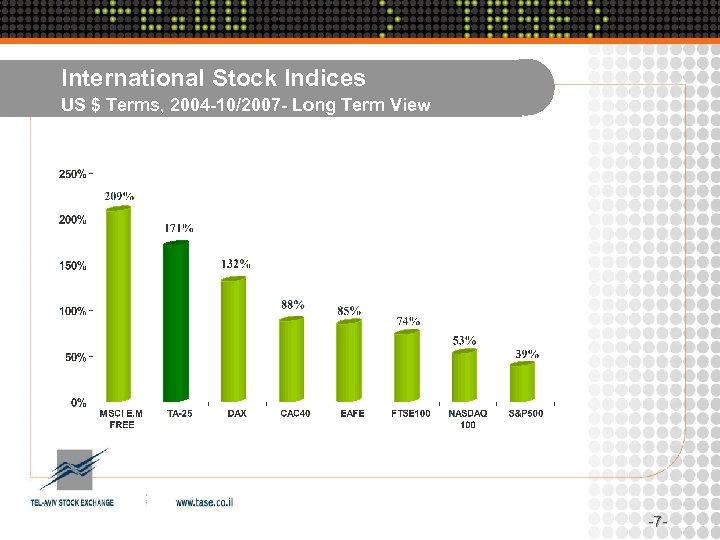

International Stock Indices US $ Terms, 2004 -10/2007 - Long Term View - 7 -

International Stock Indices US $ Terms, 2004 -10/2007 - Long Term View - 7 -

Investor Protection • • • Advanced regulatory framework - U. S based legislation Effective securities regulator (ISA) Focus on corporate governance Designated offshore securities market - by the U. S. SEC High disclosure standards. Reporting requirements – International accounting standards 2008 - IFRS compliant – European standards - 8 -

Investor Protection • • • Advanced regulatory framework - U. S based legislation Effective securities regulator (ISA) Focus on corporate governance Designated offshore securities market - by the U. S. SEC High disclosure standards. Reporting requirements – International accounting standards 2008 - IFRS compliant – European standards - 8 -

Summary • Companies with high growth potential Including high-tech & bio-tech companies • Privatization of government companies continues • Steady growth with low volatility • Modern and sophisticated market infrastructure • High level of investor protection - 9 -

Summary • Companies with high growth potential Including high-tech & bio-tech companies • Privatization of government companies continues • Steady growth with low volatility • Modern and sophisticated market infrastructure • High level of investor protection - 9 -

Thank You Nothing contained in this presentation should be construed as investment advice, either on behalf of particular securities or overall investment strategies, and nothing contained in this presentation shall be deemed to constitute an offer, or solicitation of an offer, to buy or sell any securities. While the information contained in this presentation was obtained from sources believed to be accurate and reliable, the TASE does not represent that such information is accurate or complete, and is not responsible for any errors or omissions. -10 -

Thank You Nothing contained in this presentation should be construed as investment advice, either on behalf of particular securities or overall investment strategies, and nothing contained in this presentation shall be deemed to constitute an offer, or solicitation of an offer, to buy or sell any securities. While the information contained in this presentation was obtained from sources believed to be accurate and reliable, the TASE does not represent that such information is accurate or complete, and is not responsible for any errors or omissions. -10 -