3a3e547683ef6167ee9a21d1fb2ceffc.ppt

- Количество слайдов: 22

2 ND PRACTITIONERS’ SEMINAR, 2017 GOVERNANCE IN COOPERATIVE SOCIETIES FRIDAY, 16 JUNE, 2017

2 ND PRACTITIONERS’ SEMINAR, 2017 GOVERNANCE IN COOPERATIVE SOCIETIES FRIDAY, 16 JUNE, 2017

Contents 1. Looking at Co-operative Societies as businesses. 2. Identify available opportunities for Practitioners.

Contents 1. Looking at Co-operative Societies as businesses. 2. Identify available opportunities for Practitioners.

Preliminaries Vision for Kenya’s financial sector “To become the leading financial centre in Eastern and Southern Africa, in competition with similar centres in the Western Indian Ocean rim” (Medium Term Plan for financial services (2008 -2012) Vision 2030)

Preliminaries Vision for Kenya’s financial sector “To become the leading financial centre in Eastern and Southern Africa, in competition with similar centres in the Western Indian Ocean rim” (Medium Term Plan for financial services (2008 -2012) Vision 2030)

Classification of the Financial sector Formal prudential • Commercial banks • Deposit taking microfinance institutions (DTMs) • Deposit taking Saccos (DTIs) • Capital markets • Insurance providers • Forex bureaux (Source: Fin Access Survey 2013)

Classification of the Financial sector Formal prudential • Commercial banks • Deposit taking microfinance institutions (DTMs) • Deposit taking Saccos (DTIs) • Capital markets • Insurance providers • Forex bureaux (Source: Fin Access Survey 2013)

Classification of the Financial sector Formal non-prudential • Mobile phone financial service providers (MFSP) • Postbank • NSSF • NHIF

Classification of the Financial sector Formal non-prudential • Mobile phone financial service providers (MFSP) • Postbank • NSSF • NHIF

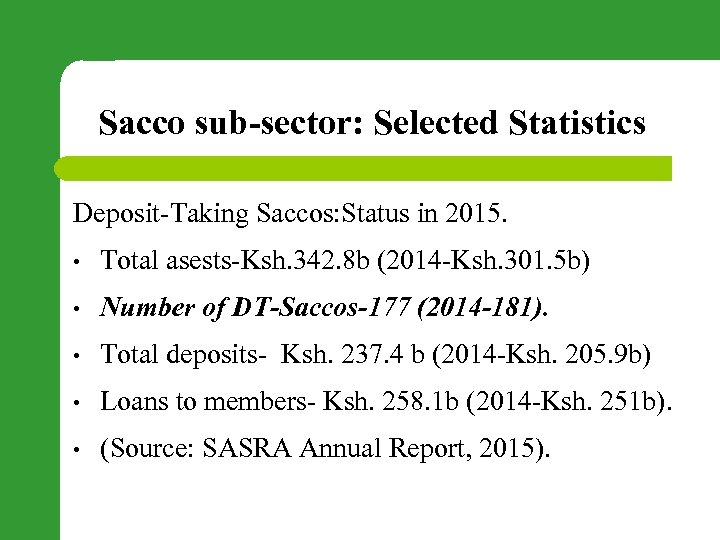

Sacco sub-sector: Selected Statistics Deposit-Taking Saccos: Status in 2015. • Total asests-Ksh. 342. 8 b (2014 -Ksh. 301. 5 b) • Number of DT-Saccos-177 (2014 -181). • Total deposits- Ksh. 237. 4 b (2014 -Ksh. 205. 9 b) • Loans to members- Ksh. 258. 1 b (2014 -Ksh. 251 b). • (Source: SASRA Annual Report, 2015).

Sacco sub-sector: Selected Statistics Deposit-Taking Saccos: Status in 2015. • Total asests-Ksh. 342. 8 b (2014 -Ksh. 301. 5 b) • Number of DT-Saccos-177 (2014 -181). • Total deposits- Ksh. 237. 4 b (2014 -Ksh. 205. 9 b) • Loans to members- Ksh. 258. 1 b (2014 -Ksh. 251 b). • (Source: SASRA Annual Report, 2015).

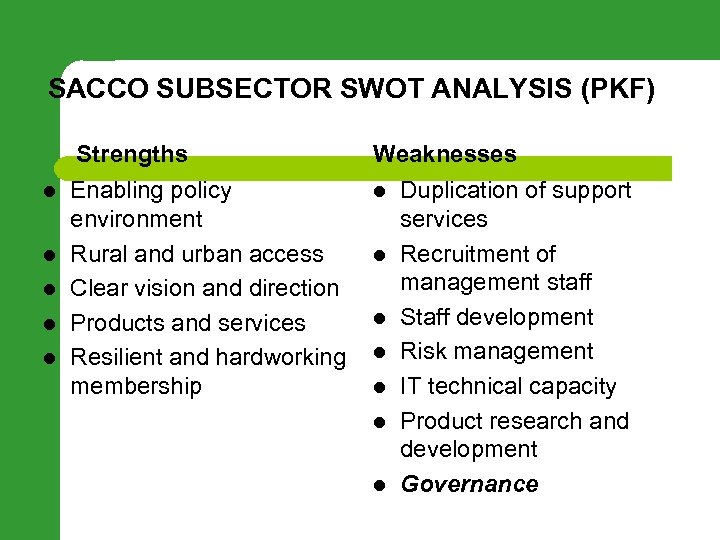

SACCO SUBSECTOR SWOT ANALYSIS (PKF) Strengths l l l Enabling policy environment Rural and urban access Clear vision and direction Products and services Resilient and hardworking membership Weaknesses l l l l Duplication of support services Recruitment of management staff Staff development Risk management IT technical capacity Product research and development Governance

SACCO SUBSECTOR SWOT ANALYSIS (PKF) Strengths l l l Enabling policy environment Rural and urban access Clear vision and direction Products and services Resilient and hardworking membership Weaknesses l l l l Duplication of support services Recruitment of management staff Staff development Risk management IT technical capacity Product research and development Governance

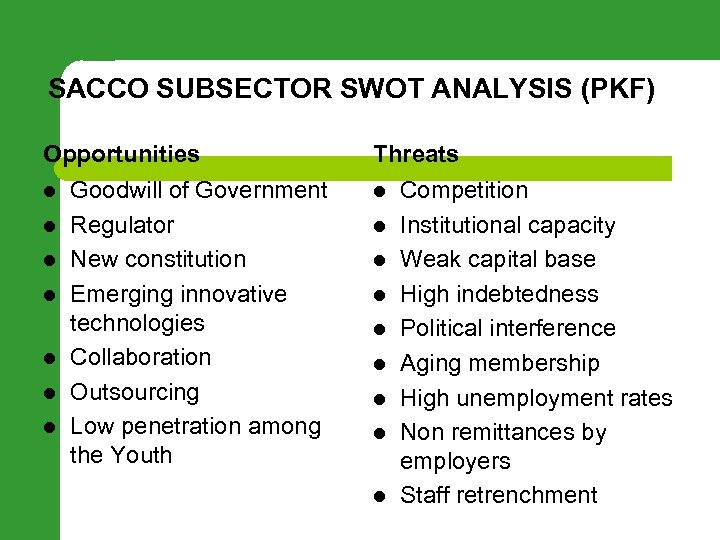

SACCO SUBSECTOR SWOT ANALYSIS (PKF) Opportunities l l l l Goodwill of Government Regulator New constitution Emerging innovative technologies Collaboration Outsourcing Low penetration among the Youth Threats l l l l l Competition Institutional capacity Weak capital base High indebtedness Political interference Aging membership High unemployment rates Non remittances by employers Staff retrenchment

SACCO SUBSECTOR SWOT ANALYSIS (PKF) Opportunities l l l l Goodwill of Government Regulator New constitution Emerging innovative technologies Collaboration Outsourcing Low penetration among the Youth Threats l l l l l Competition Institutional capacity Weak capital base High indebtedness Political interference Aging membership High unemployment rates Non remittances by employers Staff retrenchment

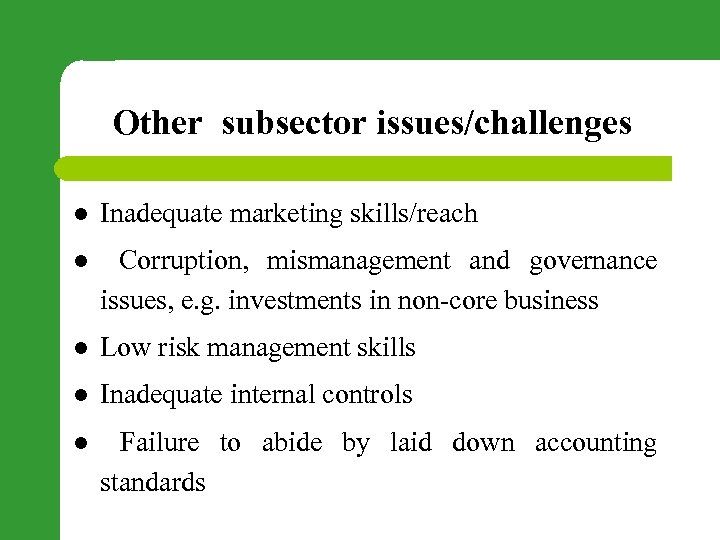

Other subsector issues/challenges l Inadequate marketing skills/reach l Corruption, mismanagement and governance issues, e. g. investments in non-core business l Low risk management skills l Inadequate internal controls l Failure to abide by laid down accounting standards

Other subsector issues/challenges l Inadequate marketing skills/reach l Corruption, mismanagement and governance issues, e. g. investments in non-core business l Low risk management skills l Inadequate internal controls l Failure to abide by laid down accounting standards

Sacco Competitive advantages l Fair, reasonable and steady interest rates l Member loyalty through democratic governance l Member ownership/management l Transparency in terms of lending

Sacco Competitive advantages l Fair, reasonable and steady interest rates l Member loyalty through democratic governance l Member ownership/management l Transparency in terms of lending

Exercise One • Watu Sacco has over 18, 000 members spread across three counties. • In the last AGM, up to 3, 000 members attended and the meeting lasted from 9. 00 am to 6. 00 pm. • In subsequent Board meeting following the AGM, the Board meeting lasted 8 hours. Identify issues requiring attention and in what context.

Exercise One • Watu Sacco has over 18, 000 members spread across three counties. • In the last AGM, up to 3, 000 members attended and the meeting lasted from 9. 00 am to 6. 00 pm. • In subsequent Board meeting following the AGM, the Board meeting lasted 8 hours. Identify issues requiring attention and in what context.

Areas of Opportunities for CSs l As a financial institution, compliance is critical. Ø Guidelines issued by the Regulator (SASRA): ü Prudential guidelines-concerned with financial soundness of the Sacco ü Reporting guidelines ü Role of the Board.

Areas of Opportunities for CSs l As a financial institution, compliance is critical. Ø Guidelines issued by the Regulator (SASRA): ü Prudential guidelines-concerned with financial soundness of the Sacco ü Reporting guidelines ü Role of the Board.

Areas of Opportunities for CSs-Cont’d l Responsibilities/rights of members. l Development of Code of Best Practice. l Management of Meetings. l Board Composition/Structure/Succession Plan. l Interpretation of financial statements. l Development of Board Charter & Strategic Plan.

Areas of Opportunities for CSs-Cont’d l Responsibilities/rights of members. l Development of Code of Best Practice. l Management of Meetings. l Board Composition/Structure/Succession Plan. l Interpretation of financial statements. l Development of Board Charter & Strategic Plan.

Areas of Opportunities for CSs-Cont’d l Board Evaluation as a tool to measure and improve performance. l Enterprise Risk Management (ERM). l Training-Board induction and continuing professional development, including governance issues. l Human capital issues.

Areas of Opportunities for CSs-Cont’d l Board Evaluation as a tool to measure and improve performance. l Enterprise Risk Management (ERM). l Training-Board induction and continuing professional development, including governance issues. l Human capital issues.

Take a Moment…. l What are some of the issues that are likely to be included in the prudential guidelines, taking into account that the guidelines are concerned with the financial soundness of the Sacco?

Take a Moment…. l What are some of the issues that are likely to be included in the prudential guidelines, taking into account that the guidelines are concerned with the financial soundness of the Sacco?

Some Elements of Prudential Guidelines l Capital adequacy, including minimal capital requirements. l Credit Risk-Sacco will need a credit policy. l Delinquent loans-provisioning policy. l Liquidity & funding risk- eg maintenance of liquid assets, branch expansion. l Loans-Sacco must have a loan policy.

Some Elements of Prudential Guidelines l Capital adequacy, including minimal capital requirements. l Credit Risk-Sacco will need a credit policy. l Delinquent loans-provisioning policy. l Liquidity & funding risk- eg maintenance of liquid assets, branch expansion. l Loans-Sacco must have a loan policy.

Some Elements of Prudential Guidelines-Cont’d l Investment – Sacco must have an investment policy. l Prohibition of conflict of interest and related party exposure, eg handling loans to directors/staff. l Internal and external audit requirements. l Divided to be paid at the rate recommended by the Board and approved by the AGM.

Some Elements of Prudential Guidelines-Cont’d l Investment – Sacco must have an investment policy. l Prohibition of conflict of interest and related party exposure, eg handling loans to directors/staff. l Internal and external audit requirements. l Divided to be paid at the rate recommended by the Board and approved by the AGM.

The Modern Sacco l Most urban Saccos are led by very well informed persons, including the general membership. l However, the general membership is politicized and sometimes, polarized. l Most members start savings with their first earnings. This is good. l Board members earn reasonable allowance.

The Modern Sacco l Most urban Saccos are led by very well informed persons, including the general membership. l However, the general membership is politicized and sometimes, polarized. l Most members start savings with their first earnings. This is good. l Board members earn reasonable allowance.

The Modern Sacco-Cont’d l Leadership has a fairly free hand to manage the business of the Sacco. l The modernization is however work-in-progress. There is still a lot of work to be done.

The Modern Sacco-Cont’d l Leadership has a fairly free hand to manage the business of the Sacco. l The modernization is however work-in-progress. There is still a lot of work to be done.

What is expected of CSs? l Develop a wider understanding of the Sacco subsector and related aspects: ü The Cooperative Societies Act 2004 (CSA)-applies to all (Sacco )matters that are not specifically provided for by the SSA (S. 67 SSA) ü The Sacco Societies Act 2008 (SSA) ü The Sacco Societies ( Deposit –Taking Businesses) Regulations 2010 (SSR) ü The Sacco By-laws ü Other relevant statutes (employment, taxation, safety, public procurement, public ethics etc) ü The Common Law on directors duties and liabilities.

What is expected of CSs? l Develop a wider understanding of the Sacco subsector and related aspects: ü The Cooperative Societies Act 2004 (CSA)-applies to all (Sacco )matters that are not specifically provided for by the SSA (S. 67 SSA) ü The Sacco Societies Act 2008 (SSA) ü The Sacco Societies ( Deposit –Taking Businesses) Regulations 2010 (SSR) ü The Sacco By-laws ü Other relevant statutes (employment, taxation, safety, public procurement, public ethics etc) ü The Common Law on directors duties and liabilities.

In conclusion l The purpose of this discussion was to bring to your attention potential areas of opportunities for CSs. l Therefore………. .

In conclusion l The purpose of this discussion was to bring to your attention potential areas of opportunities for CSs. l Therefore………. .

THANK YOU

THANK YOU