fcc221ce5a93eb8df7947df00b29f561.ppt

- Количество слайдов: 22

2 nd AECSD Conference, Moscow - 5 th October 2005 A Single Protocol for Clearing and Settlement John Falk Securities Market Infrastructures SWIFT AECSD_20051005 Slide 1

2 nd AECSD Conference, Moscow - 5 th October 2005 A Single Protocol for Clearing and Settlement John Falk Securities Market Infrastructures SWIFT AECSD_20051005 Slide 1

Recommendations, Barriers or Regulations What is meant by a Single Protocol for Clearing and Settlement? AECSD_20051005 Slide 2

Recommendations, Barriers or Regulations What is meant by a Single Protocol for Clearing and Settlement? AECSD_20051005 Slide 2

Recommendations, Barriers or Regulations 2001 CPSS-IOSCO Recommendation 16: “Securities Settlement Systems should 16 use or accommodate relevant international communication procedures & standards…” 2003 G 30, Recommendation 2 “Harmonise message standards & communication protocols” 2003 Giovannini, Barrier 1 “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” 2004 ESCB-CESR, Standard 16 (draft) “Entities providing securities clearing and settlement services, and participants in their systems should use or accommodate relevant international communication procedures and messaging and reference data standards………” AECSD_20051005 Slide 3

Recommendations, Barriers or Regulations 2001 CPSS-IOSCO Recommendation 16: “Securities Settlement Systems should 16 use or accommodate relevant international communication procedures & standards…” 2003 G 30, Recommendation 2 “Harmonise message standards & communication protocols” 2003 Giovannini, Barrier 1 “Define EU wide protocol to eliminate national differences in IT & interfaces used by Clearing & Settlement providers” 2004 ESCB-CESR, Standard 16 (draft) “Entities providing securities clearing and settlement services, and participants in their systems should use or accommodate relevant international communication procedures and messaging and reference data standards………” AECSD_20051005 Slide 3

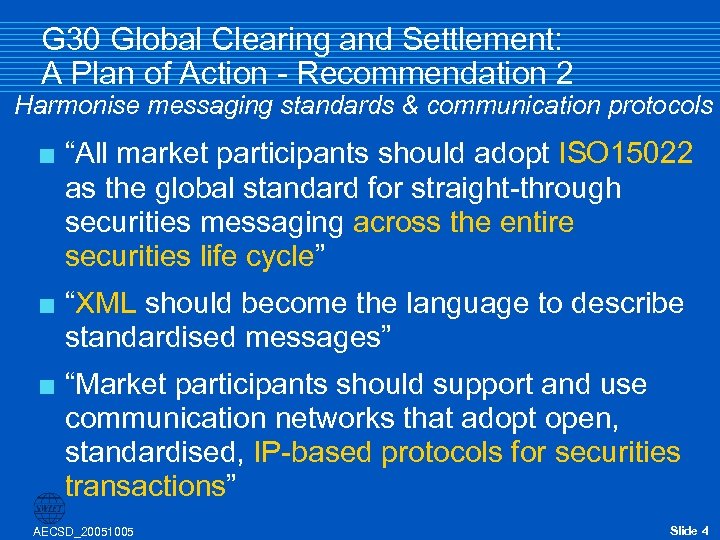

G 30 Global Clearing and Settlement: A Plan of Action - Recommendation 2 Harmonise messaging standards & communication protocols < “All market participants should adopt ISO 15022 as the global standard for straight-through securities messaging across the entire securities life cycle” < “XML should become the language to describe standardised messages” < “Market participants should support and use communication networks that adopt open, standardised, IP-based protocols for securities transactions” AECSD_20051005 Slide 4

G 30 Global Clearing and Settlement: A Plan of Action - Recommendation 2 Harmonise messaging standards & communication protocols < “All market participants should adopt ISO 15022 as the global standard for straight-through securities messaging across the entire securities life cycle” < “XML should become the language to describe standardised messages” < “Market participants should support and use communication networks that adopt open, standardised, IP-based protocols for securities transactions” AECSD_20051005 Slide 4

SWIFT meeting the challenge Present and future < Communication network – SWIFTNet (IP based service) < Market Practice Standards worldwide – Securities Market Practice Group (SMPG) < Data Standards – ISO 15022 – SWIFT ISO XML Standards – UNIFI (ISO 20022 - Standards convergence) AECSD_20051005 Slide 5

SWIFT meeting the challenge Present and future < Communication network – SWIFTNet (IP based service) < Market Practice Standards worldwide – Securities Market Practice Group (SMPG) < Data Standards – ISO 15022 – SWIFT ISO XML Standards – UNIFI (ISO 20022 - Standards convergence) AECSD_20051005 Slide 5

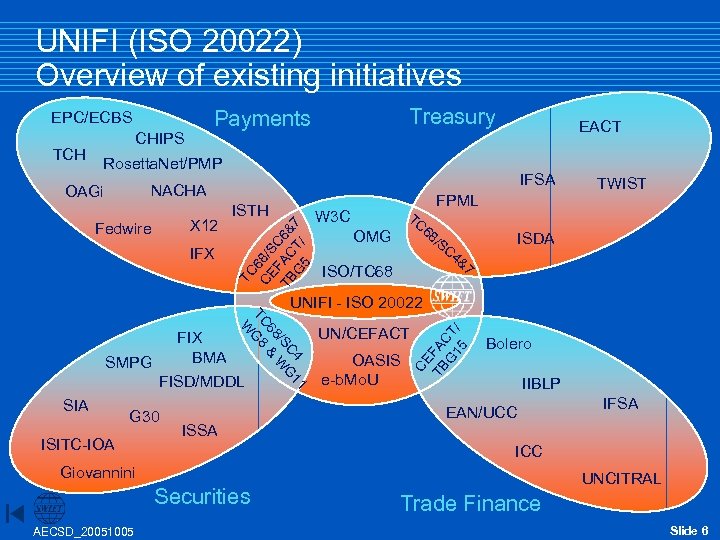

UNIFI (ISO 20022) Overview of existing initiatives CHIPS EACT Rosetta. Net/PMP IFSA NACHA OAGi X 12 Fedwire IFX ISTH TC 6 CE 8/S F C TB AC 6& G T/ 7 5 TCH Treasury Payments EPC/ECBS W 3 C FPML TC 68 /S OMG ISO/TC 68 C 4 &7 TWIST ISDA UNIFI - ISO 20022 G 30 ISITC-IOA 1 SIA UN/CEFACT OASIS e-b. Mo. U CE TB FA G CT 15 / C 4 1 /S WG 68 & TC G 8 W FIX BMA SMPG FISD/MDDL Bolero IIBLP EAN/UCC ISSA ICC Giovannini Securities AECSD_20051005 IFSA UNCITRAL Trade Finance Slide 6

UNIFI (ISO 20022) Overview of existing initiatives CHIPS EACT Rosetta. Net/PMP IFSA NACHA OAGi X 12 Fedwire IFX ISTH TC 6 CE 8/S F C TB AC 6& G T/ 7 5 TCH Treasury Payments EPC/ECBS W 3 C FPML TC 68 /S OMG ISO/TC 68 C 4 &7 TWIST ISDA UNIFI - ISO 20022 G 30 ISITC-IOA 1 SIA UN/CEFACT OASIS e-b. Mo. U CE TB FA G CT 15 / C 4 1 /S WG 68 & TC G 8 W FIX BMA SMPG FISD/MDDL Bolero IIBLP EAN/UCC ISSA ICC Giovannini Securities AECSD_20051005 IFSA UNCITRAL Trade Finance Slide 6

A Single Protocol for Clearing and Settlement What is being proposed? AECSD_20051005 Slide 7

A Single Protocol for Clearing and Settlement What is being proposed? AECSD_20051005 Slide 7

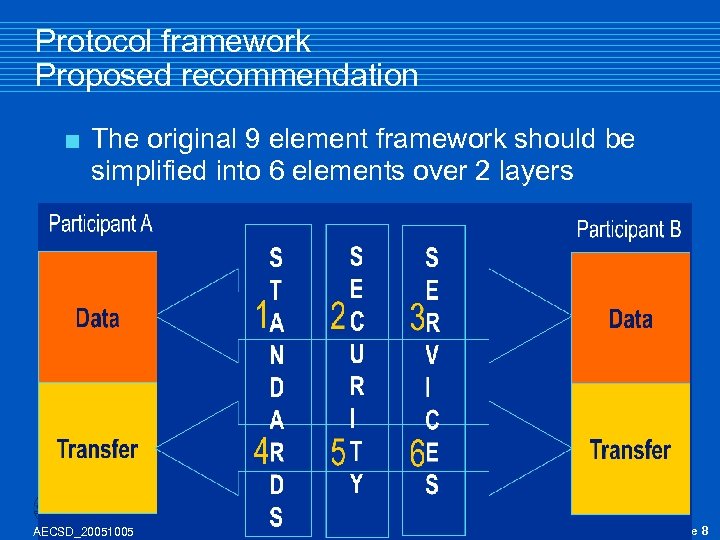

Protocol framework Proposed recommendation < The original 9 element framework should be simplified into 6 elements over 2 layers AECSD_20051005 Slide 8

Protocol framework Proposed recommendation < The original 9 element framework should be simplified into 6 elements over 2 layers AECSD_20051005 Slide 8

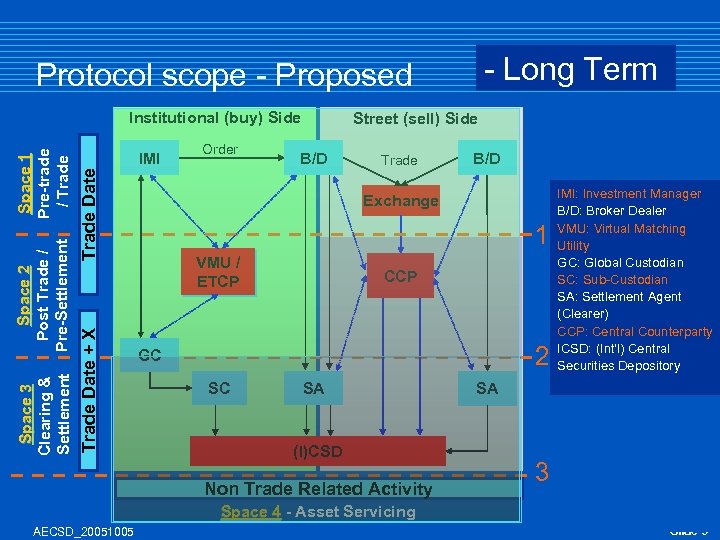

Short Term - Long Term Protocol scope - Proposed Trade Date IMI Trade Date + X Space 3 Clearing & Settlement Space 2 Post Trade / Pre-Settlement Space 1 Pre-trade / Trade Institutional (buy) Side Order Street (sell) Side B/D Trade B/D Exchange 1 VMU / ETCP CCP 2 GC SC SA (I)CSD Non Trade Related Activity IMI: Investment Manager B/D: Broker Dealer VMU: Virtual Matching Utility GC: Global Custodian SC: Sub-Custodian SA: Settlement Agent (Clearer) CCP: Central Counterparty ICSD: (Int‘l) Central Securities Depository SA 3 Space 4 - Asset Servicing AECSD_20051005 Slide 9

Short Term - Long Term Protocol scope - Proposed Trade Date IMI Trade Date + X Space 3 Clearing & Settlement Space 2 Post Trade / Pre-Settlement Space 1 Pre-trade / Trade Institutional (buy) Side Order Street (sell) Side B/D Trade B/D Exchange 1 VMU / ETCP CCP 2 GC SC SA (I)CSD Non Trade Related Activity IMI: Investment Manager B/D: Broker Dealer VMU: Virtual Matching Utility GC: Global Custodian SC: Sub-Custodian SA: Settlement Agent (Clearer) CCP: Central Counterparty ICSD: (Int‘l) Central Securities Depository SA 3 Space 4 - Asset Servicing AECSD_20051005 Slide 9

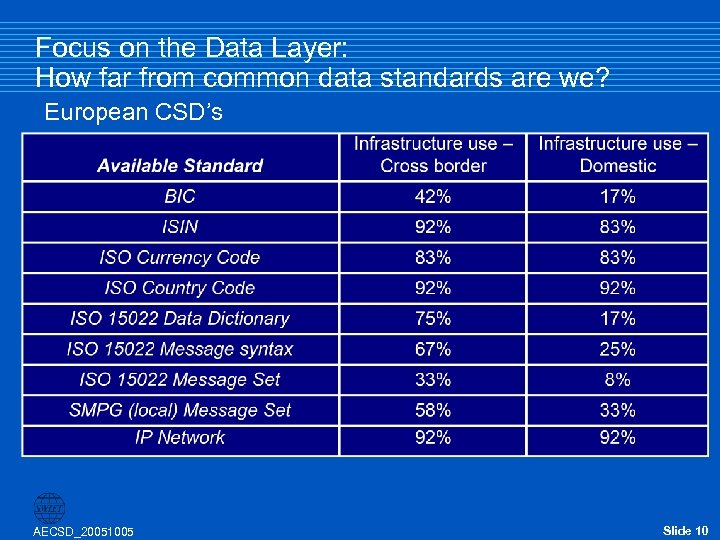

Focus on the Data Layer: How far from common data standards are we? European CSD’s AECSD_20051005 Slide 10

Focus on the Data Layer: How far from common data standards are we? European CSD’s AECSD_20051005 Slide 10

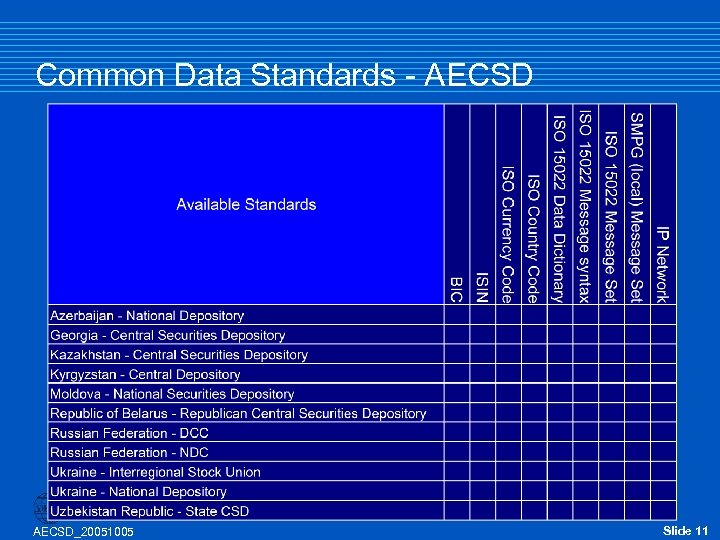

Common Data Standards - AECSD_20051005 Slide 11

Common Data Standards - AECSD_20051005 Slide 11

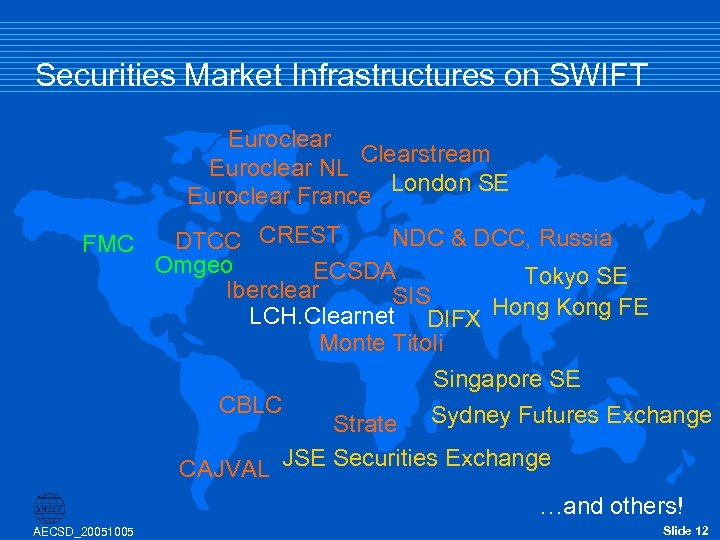

Securities Market Infrastructures on SWIFT Euroclear Clearstream Euroclear NL London SE Euroclear France FMC NDC & DCC, Russia DTCC CREST Omgeo ECSDA Tokyo SE Iberclear SIS LCH. Clearnet DIFX Hong Kong FE Monte Titoli Singapore SE CBLC Strate Sydney Futures Exchange CAJVAL JSE Securities Exchange …and others! AECSD_20051005 Slide 12

Securities Market Infrastructures on SWIFT Euroclear Clearstream Euroclear NL London SE Euroclear France FMC NDC & DCC, Russia DTCC CREST Omgeo ECSDA Tokyo SE Iberclear SIS LCH. Clearnet DIFX Hong Kong FE Monte Titoli Singapore SE CBLC Strate Sydney Futures Exchange CAJVAL JSE Securities Exchange …and others! AECSD_20051005 Slide 12

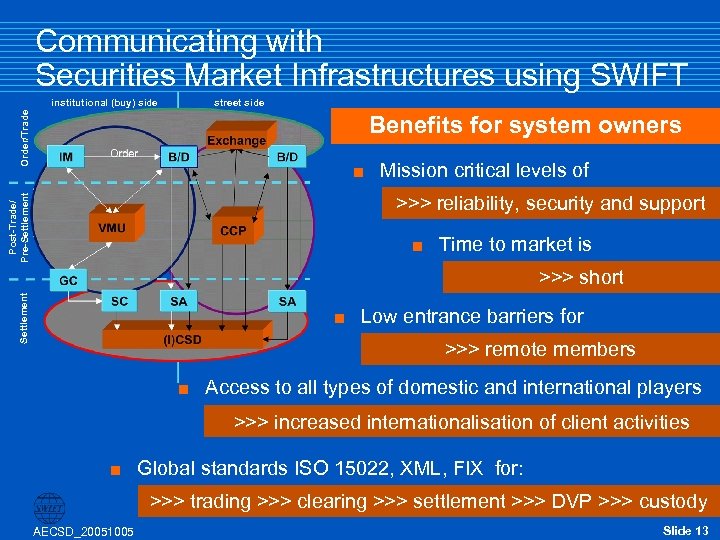

Communicating with Securities Market Infrastructures using SWIFT street side Order/Trade institutional (buy) side Benefits for system owners < Mission critical levels of Post-Trade/ Pre-Settlement >>> reliability, security and support < Time to market is Settlement >>> short < Low entrance barriers for >>> remote members < Access to all types of domestic and international players >>> increased internationalisation of client activities < Global standards ISO 15022, XML, FIX for: >>> trading >>> clearing >>> settlement >>> DVP >>> custody AECSD_20051005 Slide 13

Communicating with Securities Market Infrastructures using SWIFT street side Order/Trade institutional (buy) side Benefits for system owners < Mission critical levels of Post-Trade/ Pre-Settlement >>> reliability, security and support < Time to market is Settlement >>> short < Low entrance barriers for >>> remote members < Access to all types of domestic and international players >>> increased internationalisation of client activities < Global standards ISO 15022, XML, FIX for: >>> trading >>> clearing >>> settlement >>> DVP >>> custody AECSD_20051005 Slide 13

uestions & A AECSD_20051005 nswers Slide 14

uestions & A AECSD_20051005 nswers Slide 14

2 nd AECSD Conference, Moscow - 5 th October 2005 A Single Protocol for Clearing and Settlement? John Falk Securities Market Infrastructures SWIFT AECSD_20051005 Slide 15

2 nd AECSD Conference, Moscow - 5 th October 2005 A Single Protocol for Clearing and Settlement? John Falk Securities Market Infrastructures SWIFT AECSD_20051005 Slide 15

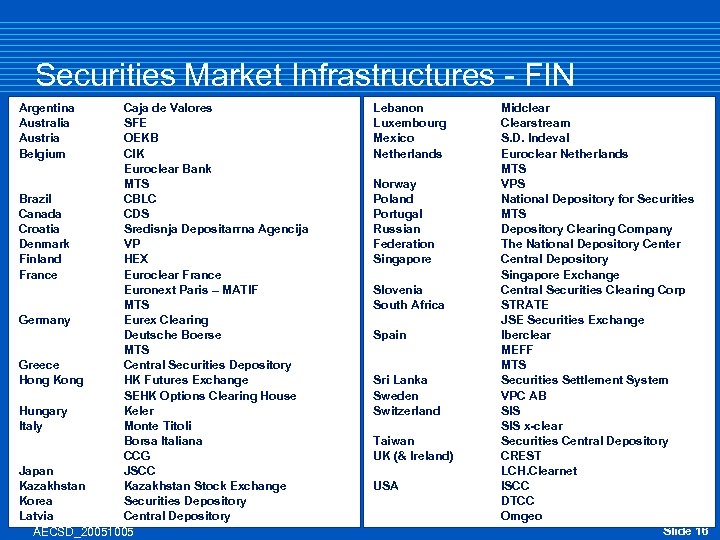

Securities Market Infrastructures - FIN Argentina Australia Austria Belgium Caja de Valores SFE OEKB CIK Euroclear Bank MTS Brazil CBLC Canada CDS Croatia Sredisnja Depositarrna Agencija Denmark VP Finland HEX France Euroclear France Euronext Paris – MATIF MTS Germany Eurex Clearing Deutsche Boerse MTS Greece Central Securities Depository Hong Kong HK Futures Exchange SEHK Options Clearing House Hungary Keler Italy Monte Titoli Borsa Italiana CCG Japan JSCC Kazakhstan Stock Exchange Korea Securities Depository Latvia Central Depository AECSD_20051005 Lebanon Luxembourg Mexico Netherlands Norway Poland Portugal Russian Federation Singapore Slovenia South Africa Spain Sri Lanka Sweden Switzerland Taiwan UK (& Ireland) USA Midclear Clearstream S. D. Indeval Euroclear Netherlands MTS VPS National Depository for Securities MTS Depository Clearing Company The National Depository Center Central Depository Singapore Exchange Central Securities Clearing Corp STRATE JSE Securities Exchange Iberclear MEFF MTS Securities Settlement System VPC AB SIS x-clear Securities Central Depository CREST LCH. Clearnet ISCC DTCC Omgeo Slide 16

Securities Market Infrastructures - FIN Argentina Australia Austria Belgium Caja de Valores SFE OEKB CIK Euroclear Bank MTS Brazil CBLC Canada CDS Croatia Sredisnja Depositarrna Agencija Denmark VP Finland HEX France Euroclear France Euronext Paris – MATIF MTS Germany Eurex Clearing Deutsche Boerse MTS Greece Central Securities Depository Hong Kong HK Futures Exchange SEHK Options Clearing House Hungary Keler Italy Monte Titoli Borsa Italiana CCG Japan JSCC Kazakhstan Stock Exchange Korea Securities Depository Latvia Central Depository AECSD_20051005 Lebanon Luxembourg Mexico Netherlands Norway Poland Portugal Russian Federation Singapore Slovenia South Africa Spain Sri Lanka Sweden Switzerland Taiwan UK (& Ireland) USA Midclear Clearstream S. D. Indeval Euroclear Netherlands MTS VPS National Depository for Securities MTS Depository Clearing Company The National Depository Center Central Depository Singapore Exchange Central Securities Clearing Corp STRATE JSE Securities Exchange Iberclear MEFF MTS Securities Settlement System VPC AB SIS x-clear Securities Central Depository CREST LCH. Clearnet ISCC DTCC Omgeo Slide 16

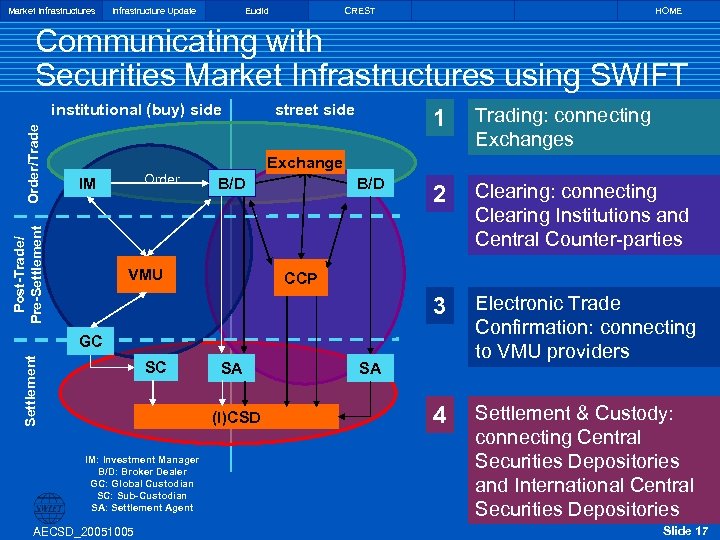

Market Infrastructures Infrastructure Update Euclid CREST HOME Communicating with Securities Market Infrastructures using SWIFT street side 1 Trading: connecting Exchanges 2 Clearing: connecting Clearing Institutions and Central Counter-parties 3 Electronic Trade Confirmation: connecting to VMU providers 4 Settlement & Custody: connecting Central Securities Depositories and International Central Securities Depositories Exchange Order IM Post-Trade/ Pre-Settlement Order/Trade institutional (buy) side B/D VMU B/D CCP Settlement GC SC SA (I)CSD IM: Investment Manager B/D: Broker Dealer GC: Global Custodian SC: Sub-Custodian SA: Settlement Agent AECSD_20051005 SA Slide 17

Market Infrastructures Infrastructure Update Euclid CREST HOME Communicating with Securities Market Infrastructures using SWIFT street side 1 Trading: connecting Exchanges 2 Clearing: connecting Clearing Institutions and Central Counter-parties 3 Electronic Trade Confirmation: connecting to VMU providers 4 Settlement & Custody: connecting Central Securities Depositories and International Central Securities Depositories Exchange Order IM Post-Trade/ Pre-Settlement Order/Trade institutional (buy) side B/D VMU B/D CCP Settlement GC SC SA (I)CSD IM: Investment Manager B/D: Broker Dealer GC: Global Custodian SC: Sub-Custodian SA: Settlement Agent AECSD_20051005 SA Slide 17

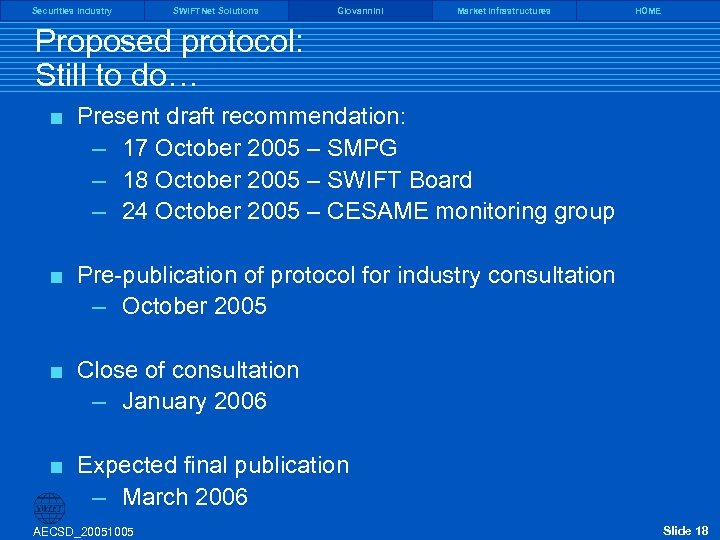

Securities Industry SWIFTNet Solutions Giovannini Market Infrastructures HOME Proposed protocol: Still to do… < Present draft recommendation: – 17 October 2005 – SMPG – 18 October 2005 – SWIFT Board – 24 October 2005 – CESAME monitoring group < Pre-publication of protocol for industry consultation – October 2005 < Close of consultation – January 2006 < Expected final publication – March 2006 AECSD_20051005 Slide 18

Securities Industry SWIFTNet Solutions Giovannini Market Infrastructures HOME Proposed protocol: Still to do… < Present draft recommendation: – 17 October 2005 – SMPG – 18 October 2005 – SWIFT Board – 24 October 2005 – CESAME monitoring group < Pre-publication of protocol for industry consultation – October 2005 < Close of consultation – January 2006 < Expected final publication – March 2006 AECSD_20051005 Slide 18

What Can and Does SWIFT bring to the Securities Markets? < Standards < Security, Reliability and Risk Resilience < Co-Operation < Services < Provides < SWIFT AECSD_20051005 VALUE to the whole market has done it before Slide 19

What Can and Does SWIFT bring to the Securities Markets? < Standards < Security, Reliability and Risk Resilience < Co-Operation < Services < Provides < SWIFT AECSD_20051005 VALUE to the whole market has done it before Slide 19

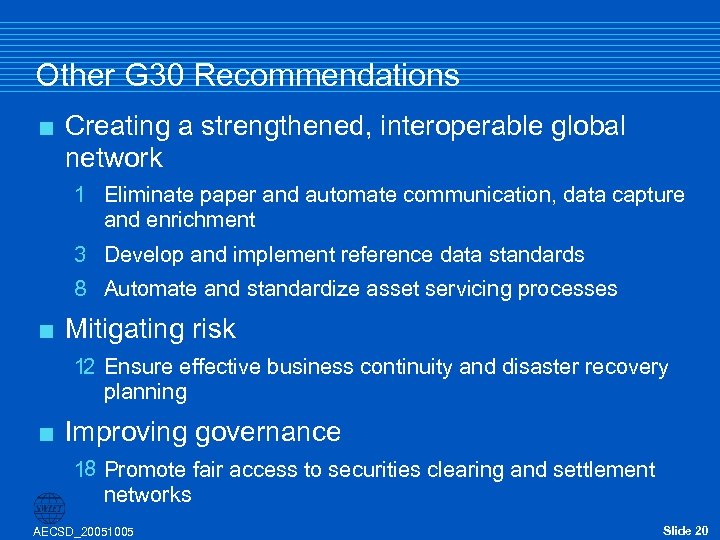

Other G 30 Recommendations < Creating a strengthened, interoperable global network 1 Eliminate paper and automate communication, data capture and enrichment 3 Develop and implement reference data standards 8 Automate and standardize asset servicing processes < Mitigating risk 12 Ensure effective business continuity and disaster recovery planning < Improving governance 18 Promote fair access to securities clearing and settlement networks AECSD_20051005 Slide 20

Other G 30 Recommendations < Creating a strengthened, interoperable global network 1 Eliminate paper and automate communication, data capture and enrichment 3 Develop and implement reference data standards 8 Automate and standardize asset servicing processes < Mitigating risk 12 Ensure effective business continuity and disaster recovery planning < Improving governance 18 Promote fair access to securities clearing and settlement networks AECSD_20051005 Slide 20

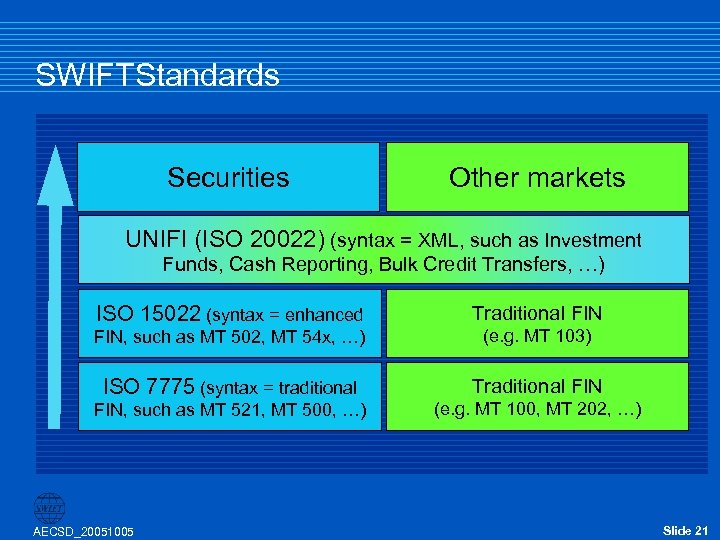

SWIFTStandards Securities Other markets UNIFI (ISO 20022) (syntax = XML, such as Investment Funds, Cash Reporting, Bulk Credit Transfers, …) ISO 15022 (syntax = enhanced Traditional FIN, such as MT 502, MT 54 x, …) (e. g. MT 103) ISO 7775 (syntax = traditional Traditional FIN, such as MT 521, MT 500, …) (e. g. MT 100, MT 202, …) AECSD_20051005 Slide 21

SWIFTStandards Securities Other markets UNIFI (ISO 20022) (syntax = XML, such as Investment Funds, Cash Reporting, Bulk Credit Transfers, …) ISO 15022 (syntax = enhanced Traditional FIN, such as MT 502, MT 54 x, …) (e. g. MT 103) ISO 7775 (syntax = traditional Traditional FIN, such as MT 521, MT 500, …) (e. g. MT 100, MT 202, …) AECSD_20051005 Slide 21

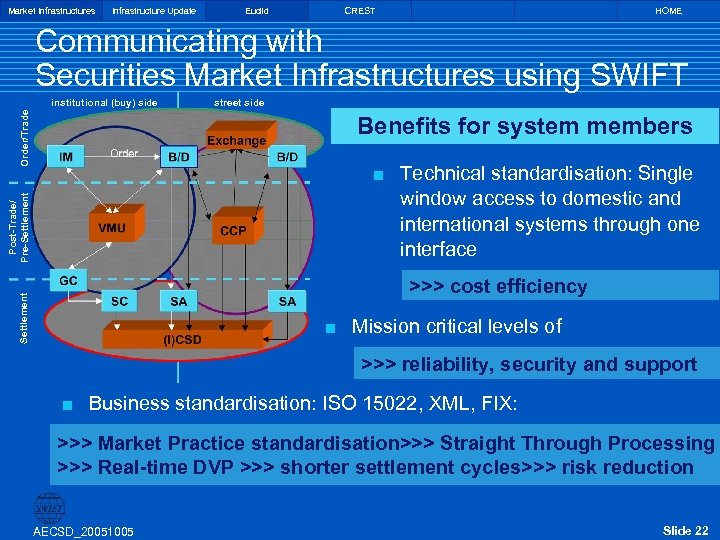

Market Infrastructures Infrastructure Update Euclid CREST HOME Communicating with Securities Market Infrastructures using SWIFT street side Order/Trade institutional (buy) side Benefits for system members Post-Trade/ Pre-Settlement < Technical standardisation: Single window access to domestic and international systems through one interface Settlement >>> cost efficiency < Mission critical levels of >>> reliability, security and support < Business standardisation: ISO 15022, XML, FIX: >>> Market Practice standardisation>>> Straight Through Processing >>> Real-time DVP >>> shorter settlement cycles>>> risk reduction AECSD_20051005 Slide 22

Market Infrastructures Infrastructure Update Euclid CREST HOME Communicating with Securities Market Infrastructures using SWIFT street side Order/Trade institutional (buy) side Benefits for system members Post-Trade/ Pre-Settlement < Technical standardisation: Single window access to domestic and international systems through one interface Settlement >>> cost efficiency < Mission critical levels of >>> reliability, security and support < Business standardisation: ISO 15022, XML, FIX: >>> Market Practice standardisation>>> Straight Through Processing >>> Real-time DVP >>> shorter settlement cycles>>> risk reduction AECSD_20051005 Slide 22