e679e4620233969e500e7798d70e6844.ppt

- Количество слайдов: 136

2. 2 AGGREGATE Demand AGGREGATE Supply

2. 2 AGGREGATE Demand AGGREGATE Supply

Macroeconomic Goals • Lots of debate • Not a lot of knowledge among all decision makers. (homework) • General agreement on 5 goals

Macroeconomic Goals • Lots of debate • Not a lot of knowledge among all decision makers. (homework) • General agreement on 5 goals

5 main goals • Full employment – Controversial as to what this exactly is • Price stability – Control inflation • Economic Development – - increase HDI • Economic Growth – Increase in r. GDP • External Equilibrium

5 main goals • Full employment – Controversial as to what this exactly is • Price stability – Control inflation • Economic Development – - increase HDI • Economic Growth – Increase in r. GDP • External Equilibrium

5 main goals • Full employment – Controversial as to what this exactly is • Price stability – Control inflation • Economic Development – - increase HDI • Economic Growth – Increase in RGDP • External Equilibrium

5 main goals • Full employment – Controversial as to what this exactly is • Price stability – Control inflation • Economic Development – - increase HDI • Economic Growth – Increase in RGDP • External Equilibrium

Conflicts among goals • • Full employment vs price stability Growth vs development External vs internal There is lots of debate about which lever to pull first • Let’s start with Economic Growth – Inflation, employment will be later in Sec 2 – External equilibrium is Sec 3 – Economic Development is Sec 4

Conflicts among goals • • Full employment vs price stability Growth vs development External vs internal There is lots of debate about which lever to pull first • Let’s start with Economic Growth – Inflation, employment will be later in Sec 2 – External equilibrium is Sec 3 – Economic Development is Sec 4

Economic Growth • 2 sides to the economy

Economic Growth • 2 sides to the economy

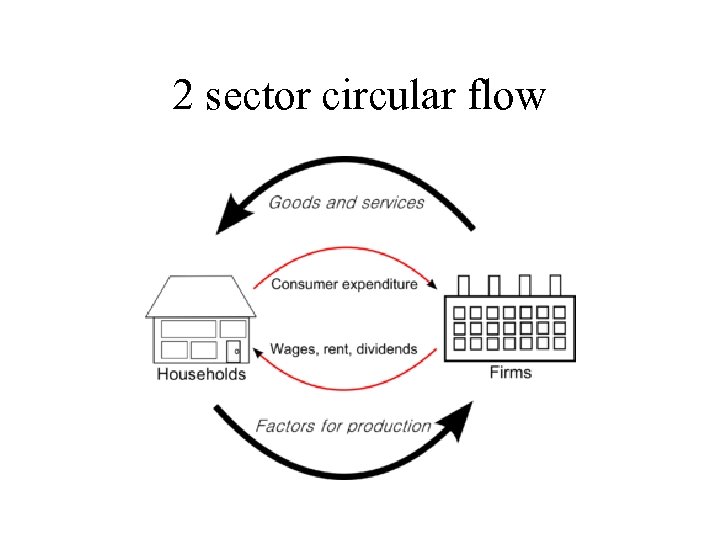

2 sector circular flow

2 sector circular flow

Economic Growth • 2 sides to the economy – Consumption and Production • Consumption is also known as “demand” • Aggregate

Economic Growth • 2 sides to the economy – Consumption and Production • Consumption is also known as “demand” • Aggregate

Aggregate Demand

Aggregate Demand

WAS Largest Mall in Europe

WAS Largest Mall in Europe

Remember? • • • Formula for GDP C + G + I + (X-M) Same formula for Aggregate Demand r= Adjusted for inflation

Remember? • • • Formula for GDP C + G + I + (X-M) Same formula for Aggregate Demand r= Adjusted for inflation

Consumption (C) • Services • Goods – Durable vs non -durable • N. B. Durable goods affected by credit availability

Consumption (C) • Services • Goods – Durable vs non -durable • N. B. Durable goods affected by credit availability

• Gw ill co me l ater …. .

• Gw ill co me l ater …. .

Investment (I) • Replacement investment - maintain • Induced investment - expand

Investment (I) • Replacement investment - maintain • Induced investment - expand

Trade (x-m) • Looking at net figure • AKA Balance of Trade

Trade (x-m) • Looking at net figure • AKA Balance of Trade

Simple rule • • When price goes up Demand falls So…. When general price level is higher…. • r. GDP is lower • (AKA National Income)

Simple rule • • When price goes up Demand falls So…. When general price level is higher…. • r. GDP is lower • (AKA National Income)

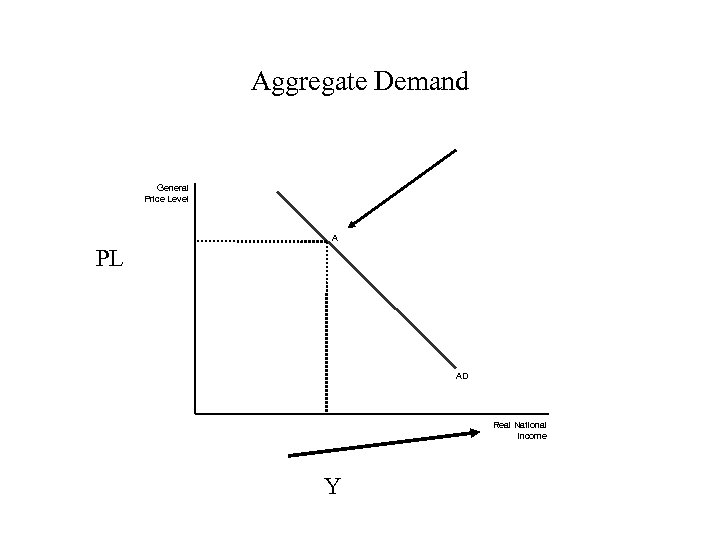

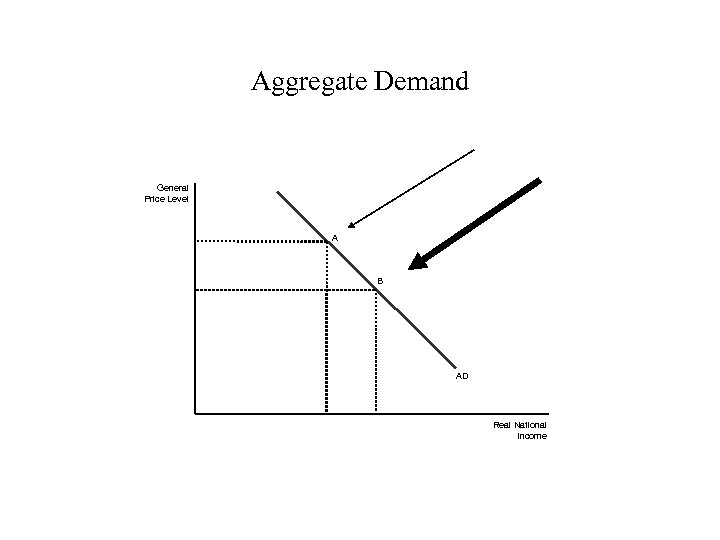

Aggregate Demand General Price Level A PL AD Real National Income Y

Aggregate Demand General Price Level A PL AD Real National Income Y

Aggregate Demand • What about general price level? – Consumer price index (CPI) – Mostly theoretical – And sometimes hypothetical

Aggregate Demand • What about general price level? – Consumer price index (CPI) – Mostly theoretical – And sometimes hypothetical

CHANGE in AD • IF PL (general price level) changes then AD changes inversely • It is downward sloping curve

CHANGE in AD • IF PL (general price level) changes then AD changes inversely • It is downward sloping curve

Aggregate Demand General Price Level A B AD Real National Income

Aggregate Demand General Price Level A B AD Real National Income

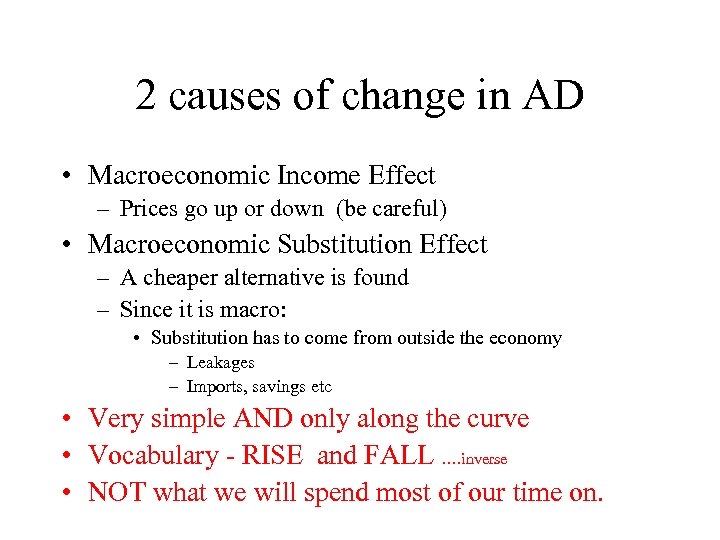

2 causes of change in AD • Macroeconomic Income Effect – Prices go up or down (be careful) • Macroeconomic Substitution Effect – A cheaper alternative is found – Since it is macro: • Substitution has to come from outside the economy – Leakages – Imports, savings etc • Very simple AND only along the curve • Vocabulary - RISE and FALL …. inverse • NOT what we will spend most of our time on.

2 causes of change in AD • Macroeconomic Income Effect – Prices go up or down (be careful) • Macroeconomic Substitution Effect – A cheaper alternative is found – Since it is macro: • Substitution has to come from outside the economy – Leakages – Imports, savings etc • Very simple AND only along the curve • Vocabulary - RISE and FALL …. inverse • NOT what we will spend most of our time on.

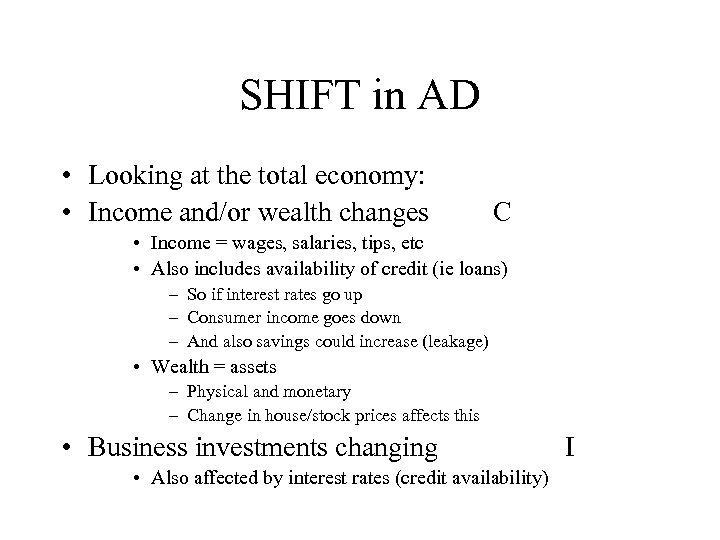

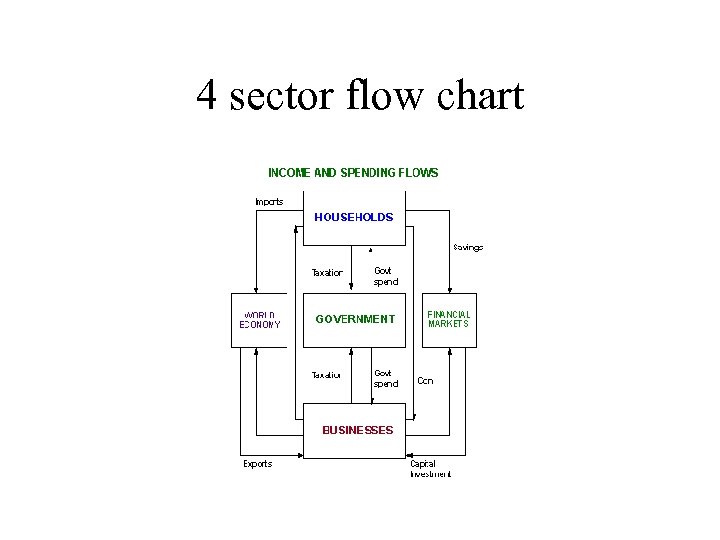

SHIFT in AD • Looking at the total economy: • Income and/or wealth changes C • Income = wages, salaries, tips, etc • Also includes availability of credit (ie loans) – So if interest rates go up – Consumer income goes down – And also savings could increase (leakage) • Wealth = assets – Physical and monetary – Change in house/stock prices affects this • Business investments changing • Also affected by interest rates (credit availability) I

SHIFT in AD • Looking at the total economy: • Income and/or wealth changes C • Income = wages, salaries, tips, etc • Also includes availability of credit (ie loans) – So if interest rates go up – Consumer income goes down – And also savings could increase (leakage) • Wealth = assets – Physical and monetary – Change in house/stock prices affects this • Business investments changing • Also affected by interest rates (credit availability) I

4 sector flow chart

4 sector flow chart

Shift in AD • Government policies changing G • Politically driven • Happen in two areas • Fiscal policy – Direct spending by government » Military, social welfare, increase/reduce taxes • Monetary policy – Control of money supply » Central Banks (ie Federal Reserve, ECB, Bank al Maghreb ) empowered to make money (loans) easy to get (loose) » Or hard to get (tight)

Shift in AD • Government policies changing G • Politically driven • Happen in two areas • Fiscal policy – Direct spending by government » Military, social welfare, increase/reduce taxes • Monetary policy – Control of money supply » Central Banks (ie Federal Reserve, ECB, Bank al Maghreb ) empowered to make money (loans) easy to get (loose) » Or hard to get (tight)

Fiscal Policy • Expansionary • Contractionary

Fiscal Policy • Expansionary • Contractionary

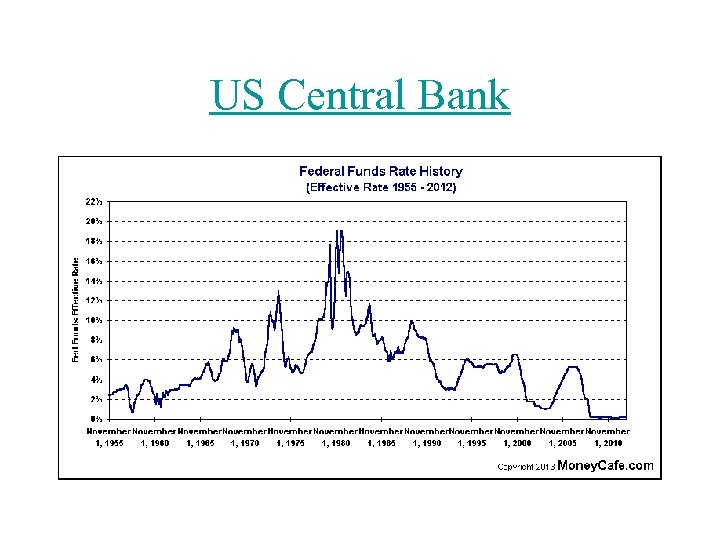

Monetary Policy • We will deal with this much more in “inflation” but for now…. . • Banks are regulated by a Central Bank (Federal Reserve, ECB, Bank al Maghreb) • Central Bank loans money - Base Rate or Discount Rate • Banks then loan to consumers/business/each other. • Big businesses get Prime Rate • Central Bank can also affect “required reserve”

Monetary Policy • We will deal with this much more in “inflation” but for now…. . • Banks are regulated by a Central Bank (Federal Reserve, ECB, Bank al Maghreb) • Central Bank loans money - Base Rate or Discount Rate • Banks then loan to consumers/business/each other. • Big businesses get Prime Rate • Central Bank can also affect “required reserve”

US Central Bank

US Central Bank

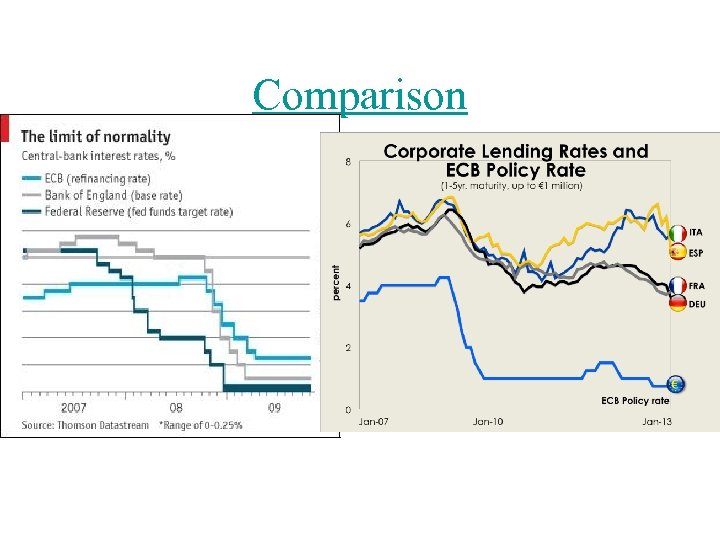

Comparison

Comparison

Monetary Policy • Expansionary (Loose) • Contractionary (Tight)

Monetary Policy • Expansionary (Loose) • Contractionary (Tight)

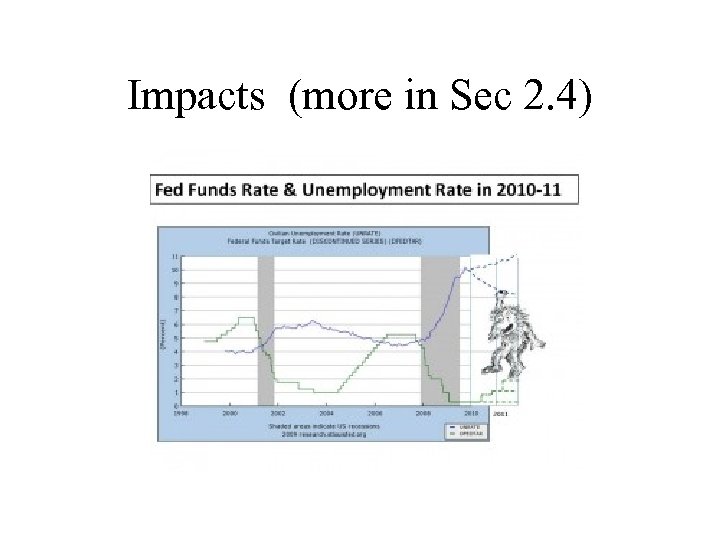

Impacts (more in Sec 2. 4)

Impacts (more in Sec 2. 4)

Balance of Trade • • If you export more… increase r. GDP due to increase in I More jobs= more spending (affects C) Also, you are selling more overseas so affects____ • If you import more…. . Tertiary vs Primary/Secondary ? ? ? • Why demand for imports? (increased C)

Balance of Trade • • If you export more… increase r. GDP due to increase in I More jobs= more spending (affects C) Also, you are selling more overseas so affects____ • If you import more…. . Tertiary vs Primary/Secondary ? ? ? • Why demand for imports? (increased C)

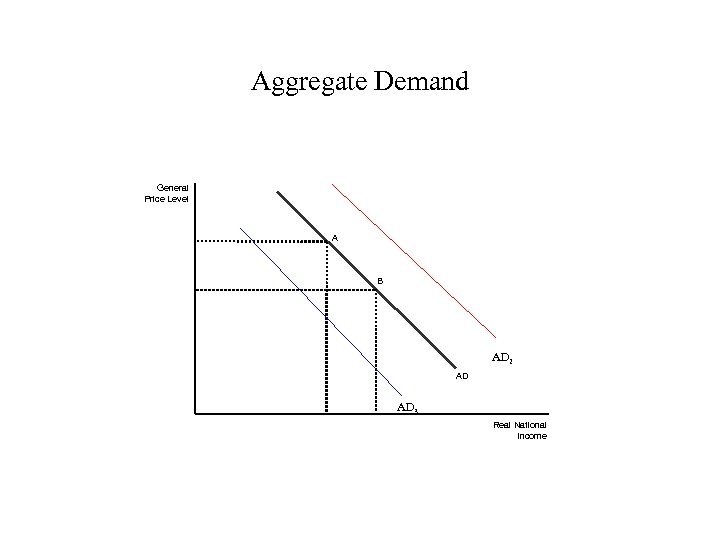

Aggregate Demand General Price Level A B AD 2 AD AD 3 Real National Income

Aggregate Demand General Price Level A B AD 2 AD AD 3 Real National Income

Demand Side Shock • Temporary event • AD increases (shifts right) or decreases (shifts left) • Due to political, natural events • After shock, AD returns to normal

Demand Side Shock • Temporary event • AD increases (shifts right) or decreases (shifts left) • Due to political, natural events • After shock, AD returns to normal

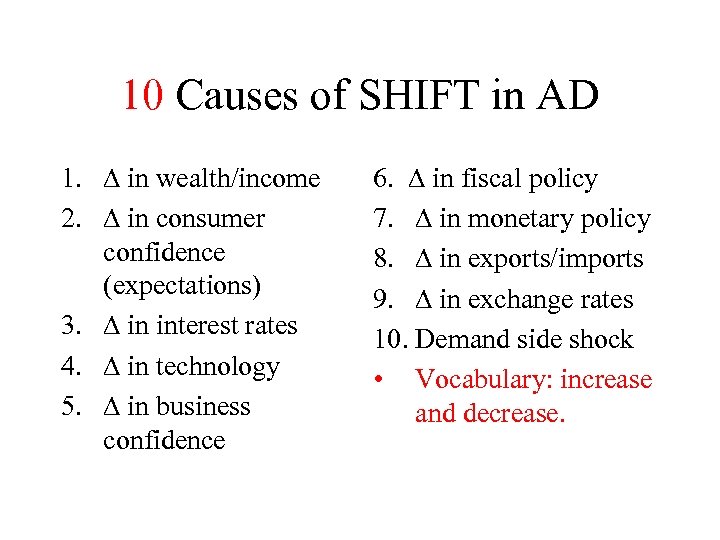

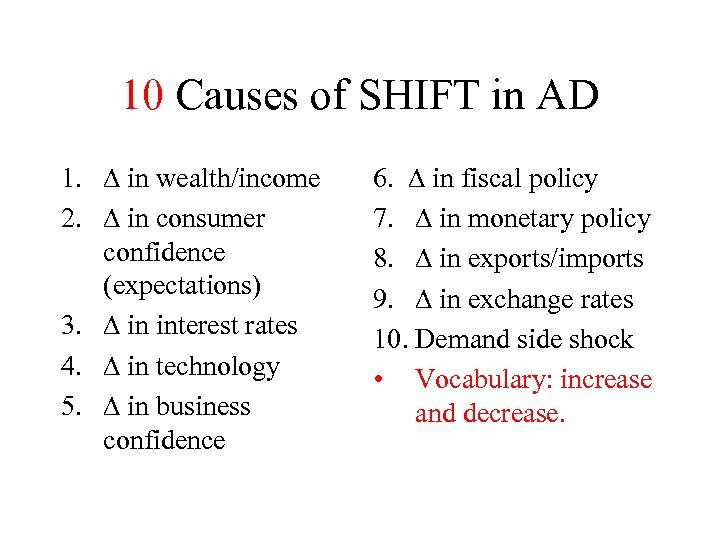

10 Causes of SHIFT in AD 1. ∆ in wealth/income 2. ∆ in consumer confidence (expectations) 3. ∆ in interest rates 4. ∆ in technology 5. ∆ in business confidence 6. ∆ in fiscal policy 7. ∆ in monetary policy 8. ∆ in exports/imports 9. ∆ in exchange rates 10. Demand side shock • Vocabulary: increase and decrease.

10 Causes of SHIFT in AD 1. ∆ in wealth/income 2. ∆ in consumer confidence (expectations) 3. ∆ in interest rates 4. ∆ in technology 5. ∆ in business confidence 6. ∆ in fiscal policy 7. ∆ in monetary policy 8. ∆ in exports/imports 9. ∆ in exchange rates 10. Demand side shock • Vocabulary: increase and decrease.

III. Aggregate Supply • Same idea as AD - total amount of goods/services available • But reverse holds true: • When PL is up, AS (aka Y) is up • Parallel relationship • Upward sloping curve

III. Aggregate Supply • Same idea as AD - total amount of goods/services available • But reverse holds true: • When PL is up, AS (aka Y) is up • Parallel relationship • Upward sloping curve

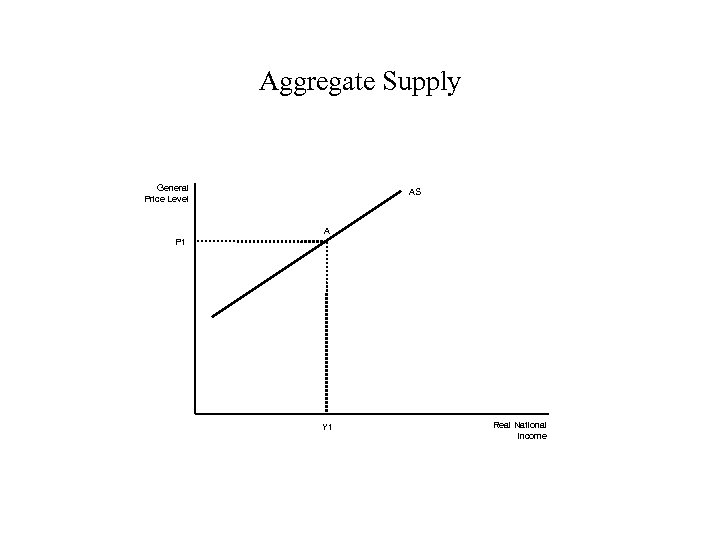

Aggregate Supply General Price Level AS A P 1 Y 1 Real National Income

Aggregate Supply General Price Level AS A P 1 Y 1 Real National Income

III. Aggregate Supply • Same idea as AD - total amount of goods/services available – But reverse holds true: • When PL is up, AS is up • Parrallel relationship • Upward sloping curve • Simple rule - when demand meets supply the economy is in harmony (equilibrium)

III. Aggregate Supply • Same idea as AD - total amount of goods/services available – But reverse holds true: • When PL is up, AS is up • Parrallel relationship • Upward sloping curve • Simple rule - when demand meets supply the economy is in harmony (equilibrium)

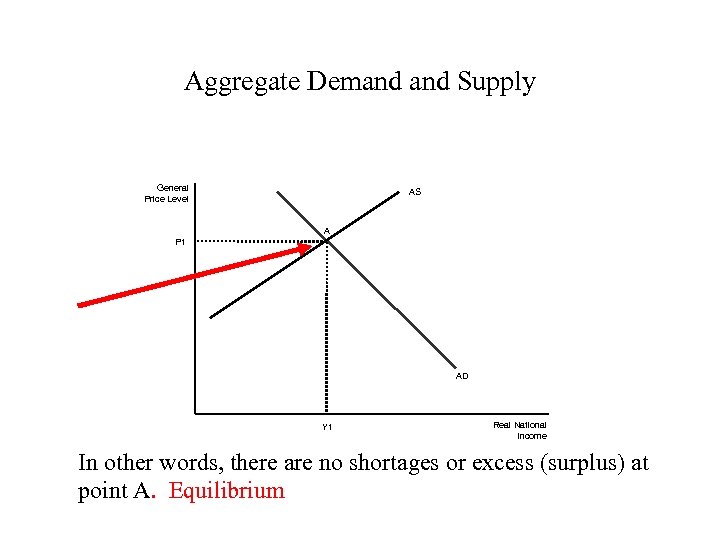

Aggregate Demand Supply General Price Level AS A P 1 AD Y 1 Real National Income In other words, there are no shortages or excess (surplus) at point A. Equilibrium

Aggregate Demand Supply General Price Level AS A P 1 AD Y 1 Real National Income In other words, there are no shortages or excess (surplus) at point A. Equilibrium

Why is this important? • Key to understanding: – Unemployment – Inflation – And government policy towards economy • • Goal: Moving the equilibrium point…AKA r. GDP = that spot of intersection AKA:

Why is this important? • Key to understanding: – Unemployment – Inflation – And government policy towards economy • • Goal: Moving the equilibrium point…AKA r. GDP = that spot of intersection AKA:

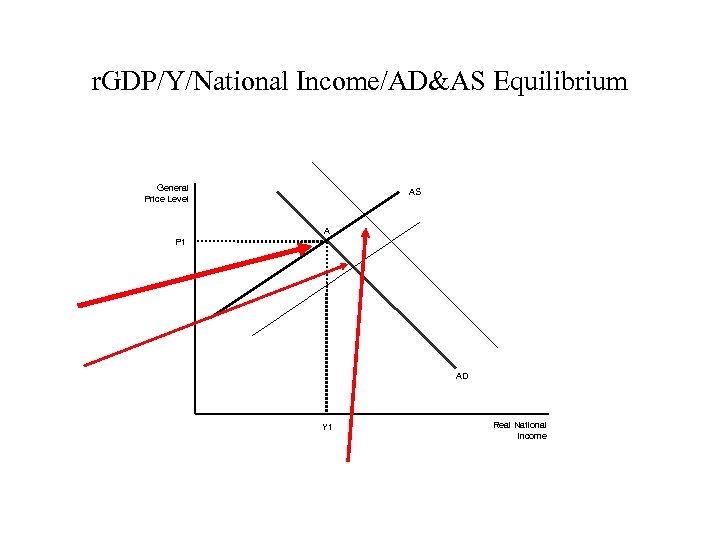

r. GDP/Y/National Income/AD&AS Equilibrium General Price Level AS A P 1 AD Y 1 Real National Income

r. GDP/Y/National Income/AD&AS Equilibrium General Price Level AS A P 1 AD Y 1 Real National Income

III. Aggregate Supply • Same as demand - total amount of goods/services available. • Simple rule - when demand meets supply the economy is in harmony (equilibrium) • UNFORTUNATELY there are two types of aggregate supply (AS) – Short Run (SRAS) – Long Run (LRAS)

III. Aggregate Supply • Same as demand - total amount of goods/services available. • Simple rule - when demand meets supply the economy is in harmony (equilibrium) • UNFORTUNATELY there are two types of aggregate supply (AS) – Short Run (SRAS) – Long Run (LRAS)

Short Run AS • Producers can change labor input to increase/decrease production • BUT don’t have to build new factories etc • Ex: Holiday shopping season, tourism season. increase/decrease • They are not necessarily responding to current prices. • Labour costs ∆

Short Run AS • Producers can change labor input to increase/decrease production • BUT don’t have to build new factories etc • Ex: Holiday shopping season, tourism season. increase/decrease • They are not necessarily responding to current prices. • Labour costs ∆

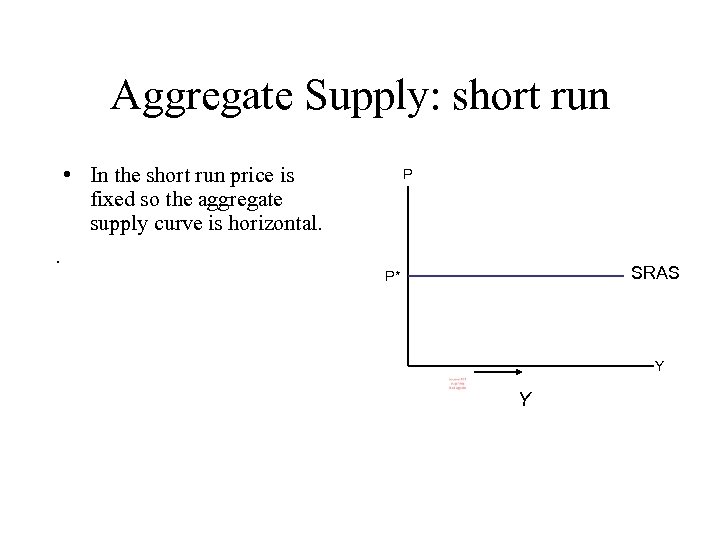

Aggregate Supply: short run • In the short run price is fixed so the aggregate supply curve is horizontal. P . SRAS P* Y Y

Aggregate Supply: short run • In the short run price is fixed so the aggregate supply curve is horizontal. P . SRAS P* Y Y

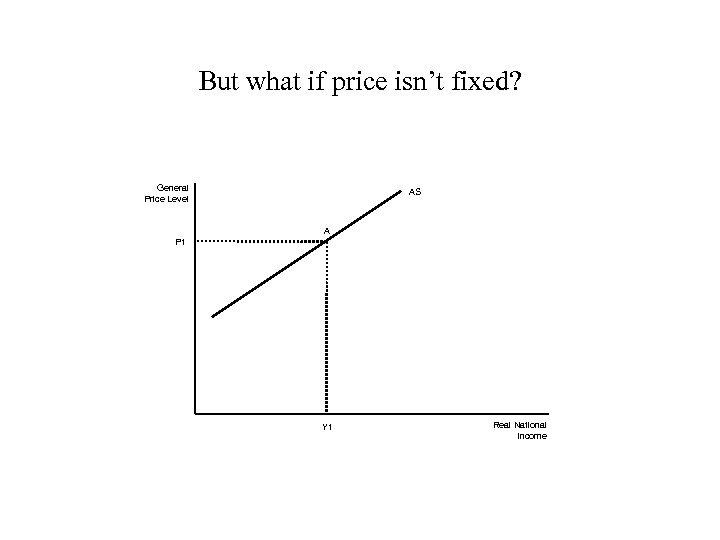

But what if price isn’t fixed? General Price Level AS A P 1 Y 1 Real National Income

But what if price isn’t fixed? General Price Level AS A P 1 Y 1 Real National Income

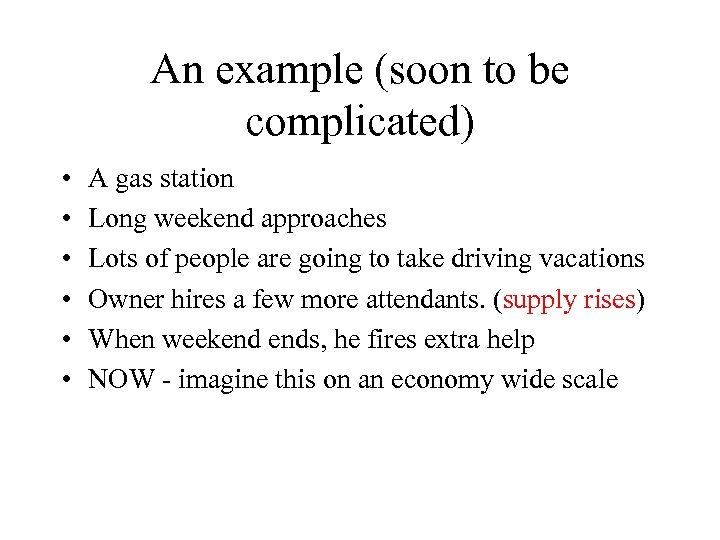

An example (soon to be complicated) • • • A gas station Long weekend approaches Lots of people are going to take driving vacations Owner hires a few more attendants. (supply rises) When weekend ends, he fires extra help NOW - imagine this on an economy wide scale

An example (soon to be complicated) • • • A gas station Long weekend approaches Lots of people are going to take driving vacations Owner hires a few more attendants. (supply rises) When weekend ends, he fires extra help NOW - imagine this on an economy wide scale

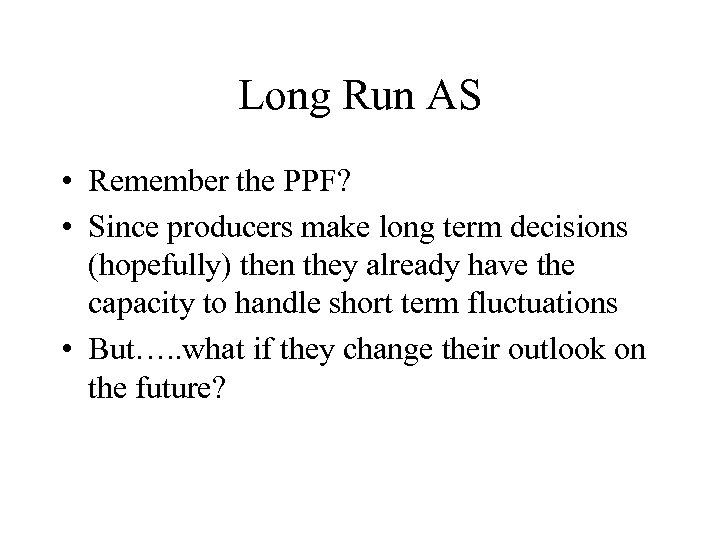

Long Run AS • Remember the PPF? • Since producers make long term decisions (hopefully) then they already have the capacity to handle short term fluctuations • But…. . what if they change their outlook on the future?

Long Run AS • Remember the PPF? • Since producers make long term decisions (hopefully) then they already have the capacity to handle short term fluctuations • But…. . what if they change their outlook on the future?

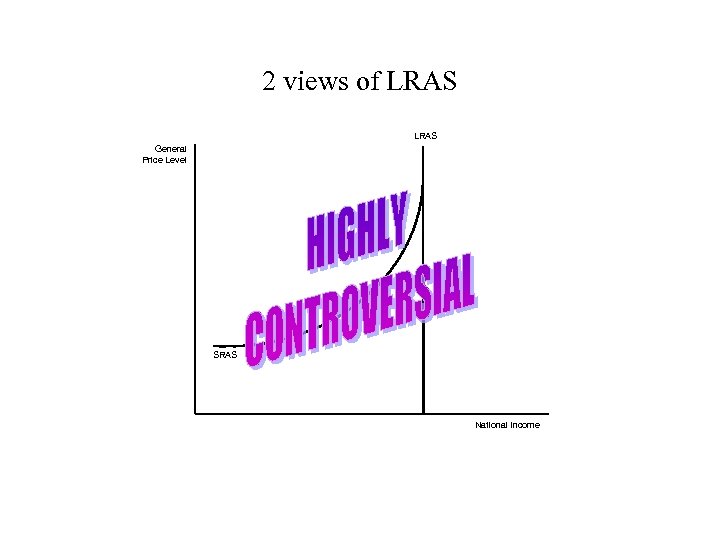

2 views of LRAS General Price Level SRAS National Income

2 views of LRAS General Price Level SRAS National Income

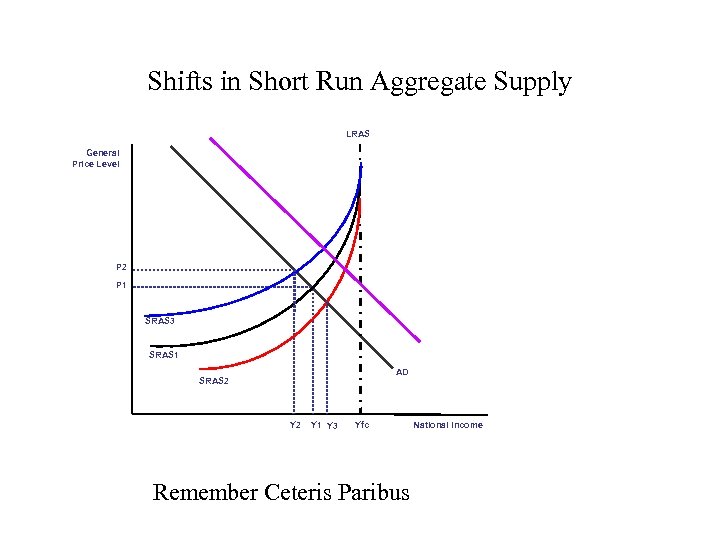

Shifts in Short Run Aggregate Supply LRAS General Price Level P 2 P 1 SRAS 3 SRAS 1 AD SRAS 2 Y 1 Y 3 Yfc Remember Ceteris Paribus National Income

Shifts in Short Run Aggregate Supply LRAS General Price Level P 2 P 1 SRAS 3 SRAS 1 AD SRAS 2 Y 1 Y 3 Yfc Remember Ceteris Paribus National Income

What makes supply? • Land – materials • Labor – Skills • Capital – Technology – Machines • Entrepreneurship/risk • FACTORS OF PRODUCTION

What makes supply? • Land – materials • Labor – Skills • Capital – Technology – Machines • Entrepreneurship/risk • FACTORS OF PRODUCTION

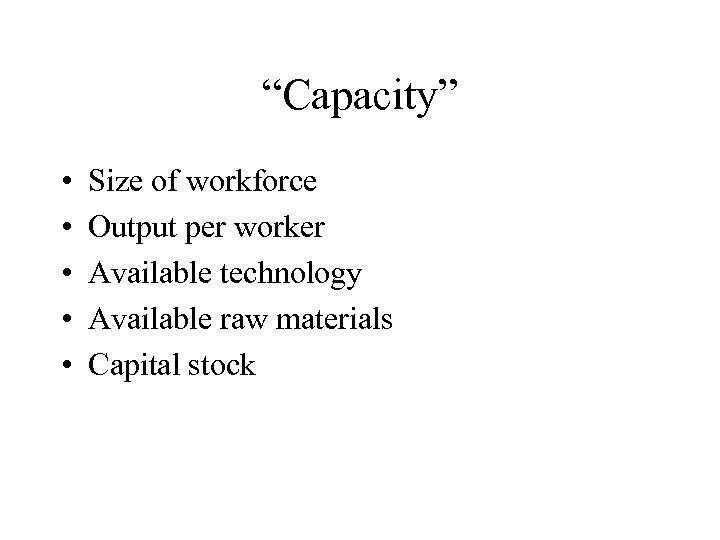

So we have a conflict • Based on the issue of “full employment” and “capacity” • When is economy able to fully provide enough supply to meet demand? • Is it now? Or do we need to manipulate it?

So we have a conflict • Based on the issue of “full employment” and “capacity” • When is economy able to fully provide enough supply to meet demand? • Is it now? Or do we need to manipulate it?

Scenerio: 2 sides • Team 1 • Brainstorm all the possible things we currently make with Gold or Gold parts. • Team 2 • Brainstorm all the possible things that you could make with Gold THAT DO NOT ALREADY EXIST.

Scenerio: 2 sides • Team 1 • Brainstorm all the possible things we currently make with Gold or Gold parts. • Team 2 • Brainstorm all the possible things that you could make with Gold THAT DO NOT ALREADY EXIST.

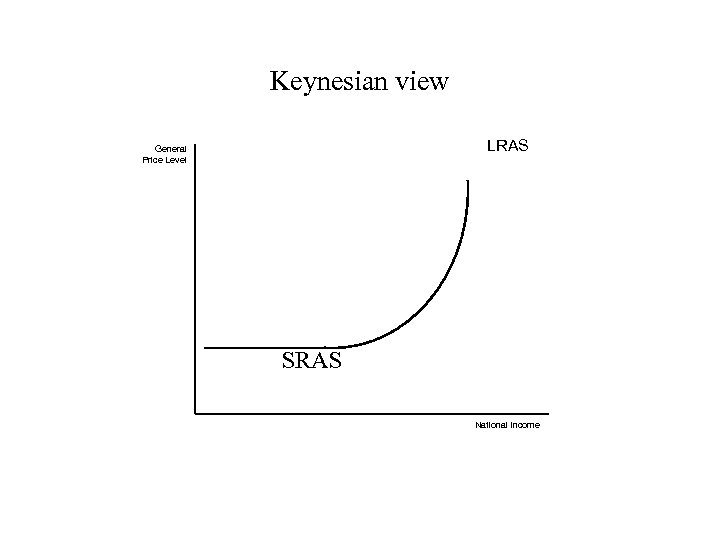

Keynesian view LRAS General Price Level SRAS National Income

Keynesian view LRAS General Price Level SRAS National Income

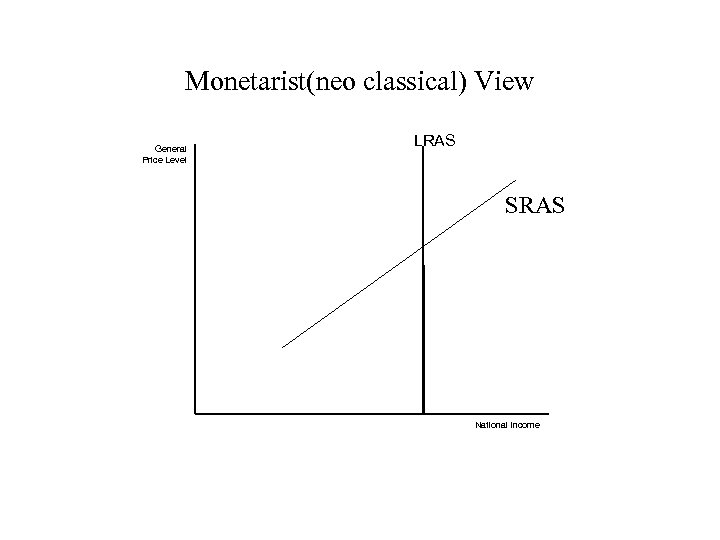

Monetarist(neo classical) View General Price Level LRAS SRAS National Income

Monetarist(neo classical) View General Price Level LRAS SRAS National Income

“Capacity” • • • Size of workforce Output per worker Available technology Available raw materials Capital stock

“Capacity” • • • Size of workforce Output per worker Available technology Available raw materials Capital stock

So… • Is economy using all materials/labor/capital available? • Are we on the PPF curve or at “I” ? • And what is the determination of full employment? • Ceteris Paribus » QUIZ NEXT CLASS » Homework AS worksheet, pg 1 & 2

So… • Is economy using all materials/labor/capital available? • Are we on the PPF curve or at “I” ? • And what is the determination of full employment? • Ceteris Paribus » QUIZ NEXT CLASS » Homework AS worksheet, pg 1 & 2

Two main schools of thought • Keynesian • Monetarist (neo -classical)

Two main schools of thought • Keynesian • Monetarist (neo -classical)

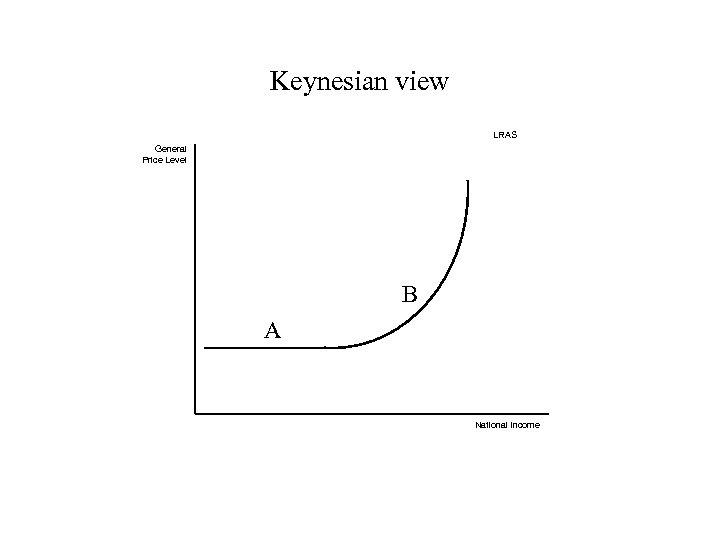

Keynesian • John Maynard Keynes (1883 -1946) • British • Lots of assumptions to challenge. • For now: full employment is never reached w/o government intervention. • LRAS has three phases AND is dependent on PL

Keynesian • John Maynard Keynes (1883 -1946) • British • Lots of assumptions to challenge. • For now: full employment is never reached w/o government intervention. • LRAS has three phases AND is dependent on PL

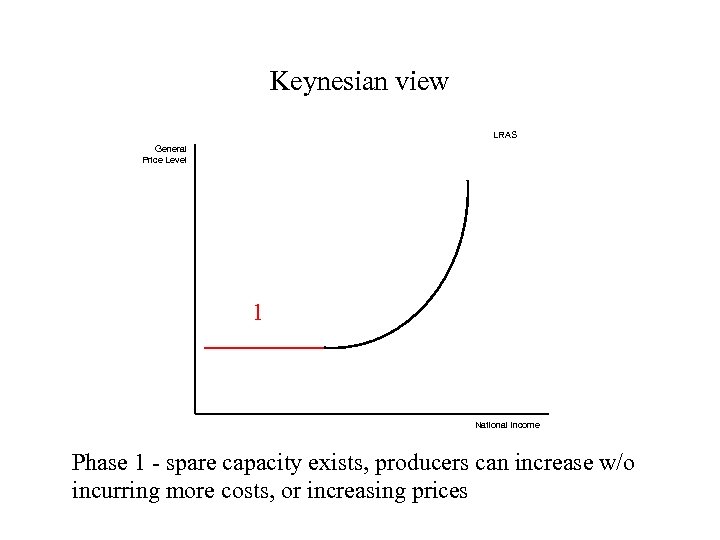

Keynesian view LRAS General Price Level 1 National Income Phase 1 - spare capacity exists, producers can increase w/o incurring more costs, or increasing prices

Keynesian view LRAS General Price Level 1 National Income Phase 1 - spare capacity exists, producers can increase w/o incurring more costs, or increasing prices

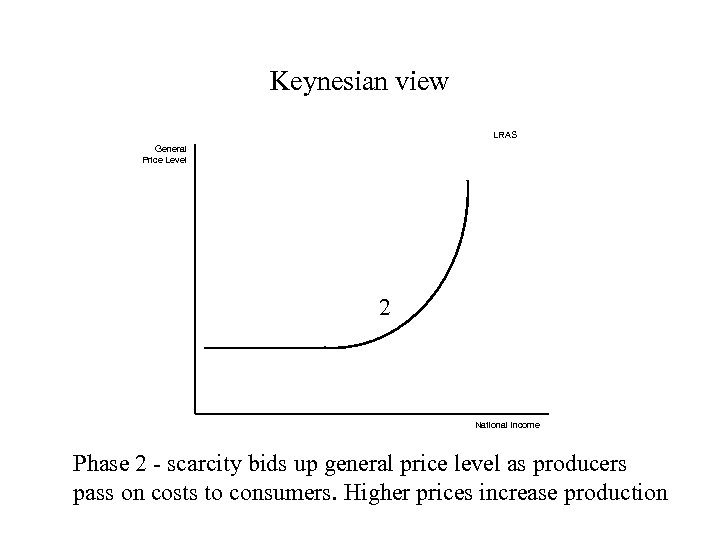

Keynesian view LRAS General Price Level 2 National Income Phase 2 - scarcity bids up general price level as producers pass on costs to consumers. Higher prices increase production

Keynesian view LRAS General Price Level 2 National Income Phase 2 - scarcity bids up general price level as producers pass on costs to consumers. Higher prices increase production

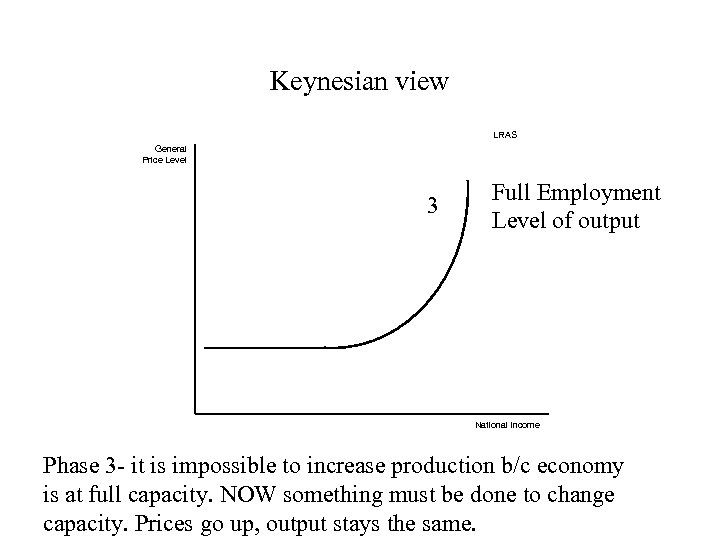

Keynesian view LRAS General Price Level 3 Full Employment Level of output National Income Phase 3 - it is impossible to increase production b/c economy is at full capacity. NOW something must be done to change capacity. Prices go up, output stays the same.

Keynesian view LRAS General Price Level 3 Full Employment Level of output National Income Phase 3 - it is impossible to increase production b/c economy is at full capacity. NOW something must be done to change capacity. Prices go up, output stays the same.

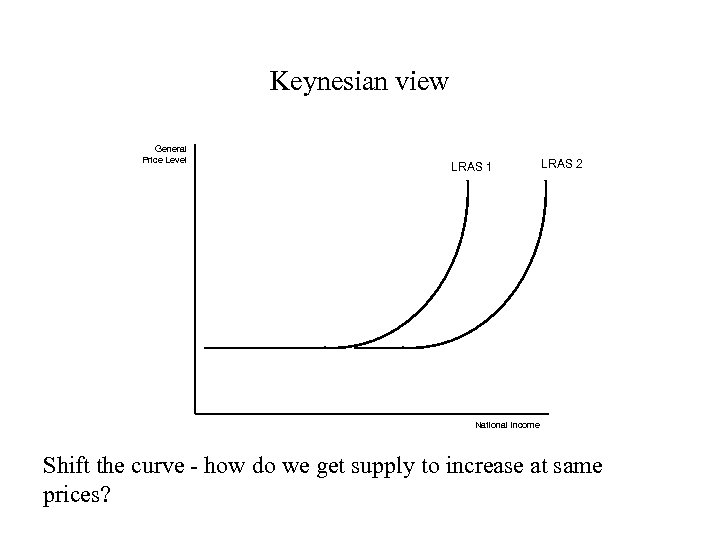

Keynesian view General Price Level LRAS 1 LRAS 2 National Income Shift the curve - how do we get supply to increase at same prices?

Keynesian view General Price Level LRAS 1 LRAS 2 National Income Shift the curve - how do we get supply to increase at same prices?

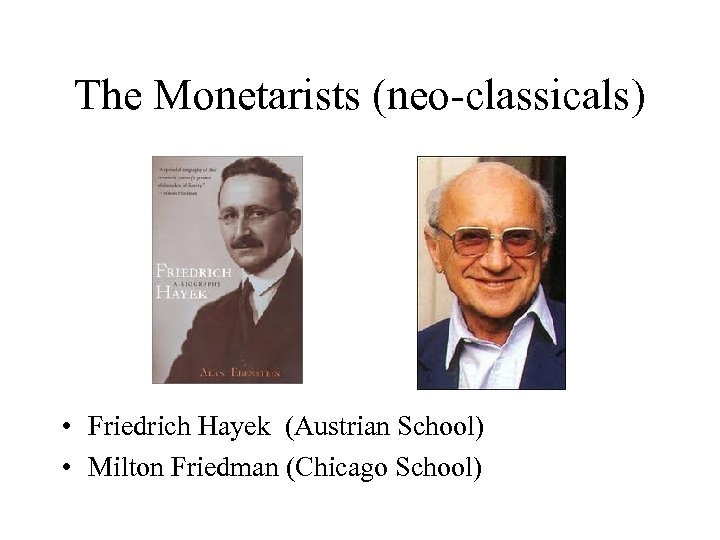

The Monetarists (neo-classicals) • Friedrich Hayek (Austrian School) • Milton Friedman (Chicago School)

The Monetarists (neo-classicals) • Friedrich Hayek (Austrian School) • Milton Friedman (Chicago School)

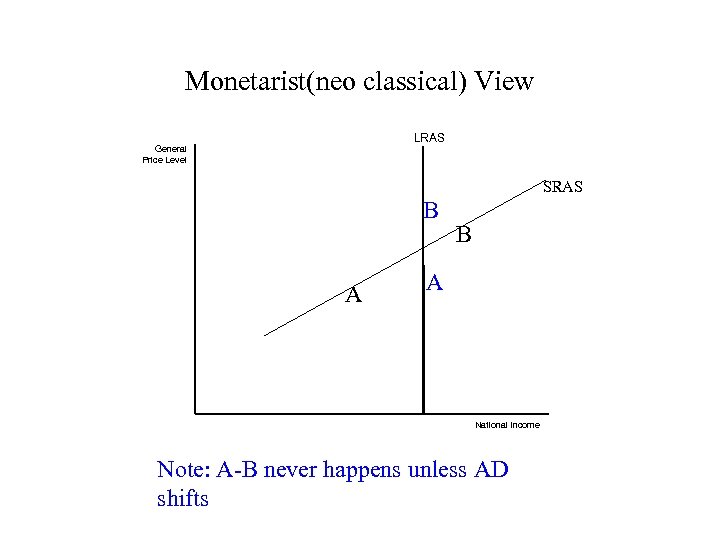

Monetarist (neo-classical) view • There is no build up to capacity • Economy already exists at capacity • Potential output is dependent on QUALITY and QUANTITY of factors of production • Suppliers need incentives to shift supply curve. • If you give consumers more money, it will only raise prices.

Monetarist (neo-classical) view • There is no build up to capacity • Economy already exists at capacity • Potential output is dependent on QUALITY and QUANTITY of factors of production • Suppliers need incentives to shift supply curve. • If you give consumers more money, it will only raise prices.

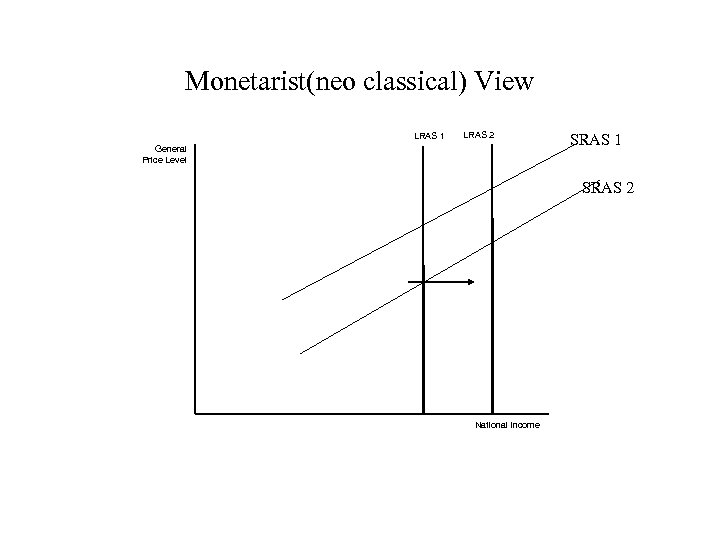

Monetarist(neo classical) View LRAS 1 LRAS 2 General Price Level SRAS 1 SRAS 2 National Income

Monetarist(neo classical) View LRAS 1 LRAS 2 General Price Level SRAS 1 SRAS 2 National Income

In simple English • Keynesian view is that suppliers will respond if more money is injected at consumer level and/or prices rise. • Monetarist view is that suppliers will only respond to incentives (market or forced)

In simple English • Keynesian view is that suppliers will respond if more money is injected at consumer level and/or prices rise. • Monetarist view is that suppliers will only respond to incentives (market or forced)

Stickiness • Wage – Contracts – resistance • Price – Information speed – Other factors

Stickiness • Wage – Contracts – resistance • Price – Information speed – Other factors

Fantasy land • For Monetarist to work: • No unions • No minimum wage laws • No price guarantees • For Keynesian to work • Huge government debts • Huge tax increases on wealthy • Huge risk of inflation

Fantasy land • For Monetarist to work: • No unions • No minimum wage laws • No price guarantees • For Keynesian to work • Huge government debts • Huge tax increases on wealthy • Huge risk of inflation

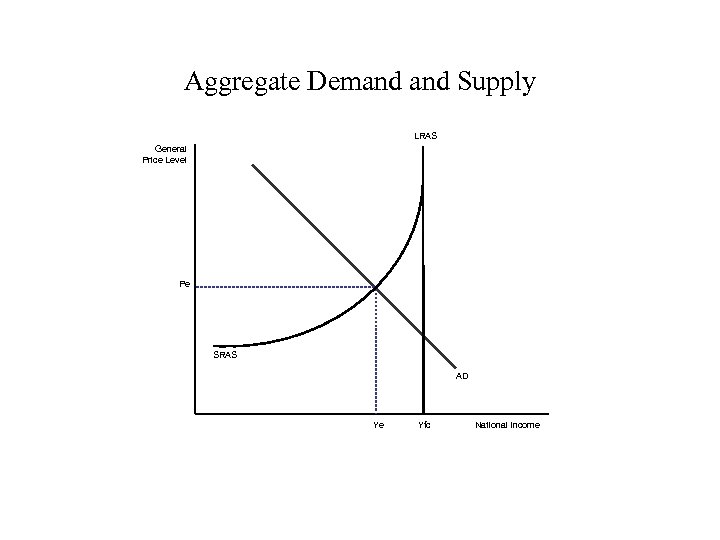

Aggregate Demand Supply LRAS General Price Level Pe SRAS AD Ye Yfc National Income

Aggregate Demand Supply LRAS General Price Level Pe SRAS AD Ye Yfc National Income

Inflationary and Deflationary gaps • Anytime the AD curve is on the AS curve BELOW full employment level of output • We have a Deflationary Gap (aka output gap)

Inflationary and Deflationary gaps • Anytime the AD curve is on the AS curve BELOW full employment level of output • We have a Deflationary Gap (aka output gap)

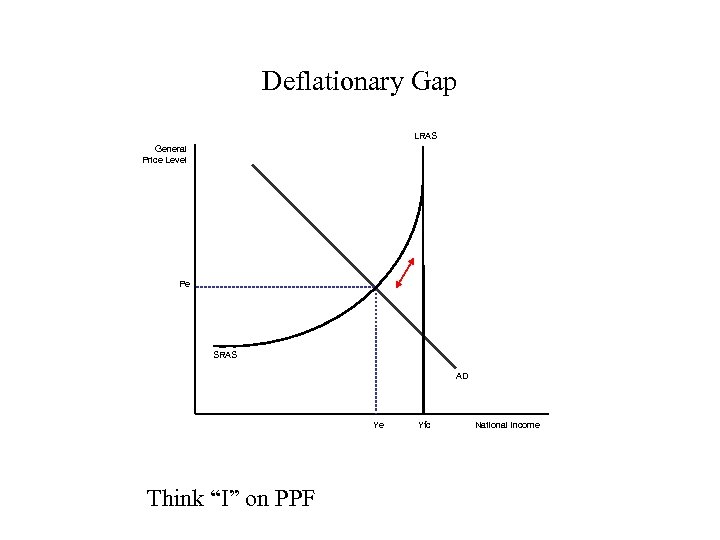

Deflationary Gap LRAS General Price Level Pe SRAS AD Ye Think “I” on PPF Yfc National Income

Deflationary Gap LRAS General Price Level Pe SRAS AD Ye Think “I” on PPF Yfc National Income

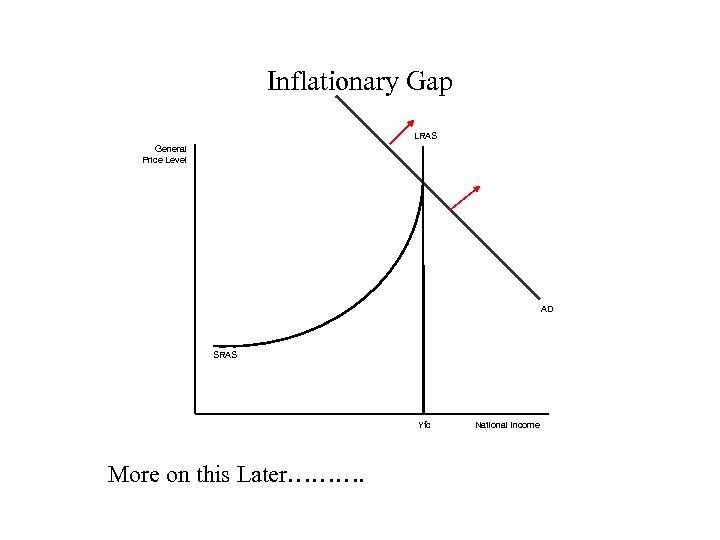

Inflationary and Deflationary gaps • Anytime the AD curve is on the AS curve BELOW full employment level of output • We have a Deflationary Gap (aka output gap) • Conversely, Inflationary Gap is when

Inflationary and Deflationary gaps • Anytime the AD curve is on the AS curve BELOW full employment level of output • We have a Deflationary Gap (aka output gap) • Conversely, Inflationary Gap is when

Inflationary Gap LRAS General Price Level AD SRAS Yfc More on this Later………. National Income

Inflationary Gap LRAS General Price Level AD SRAS Yfc More on this Later………. National Income

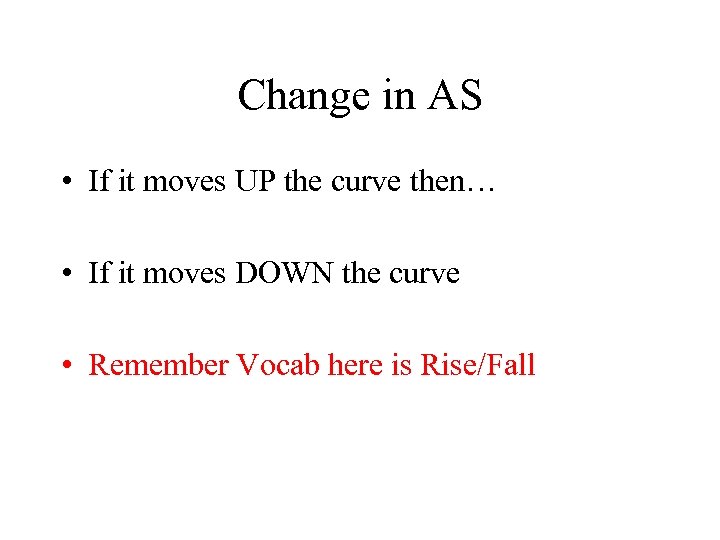

Causes of Change in AS • There is only 1 thing that will cause a change (or movement along) the AS curve

Causes of Change in AS • There is only 1 thing that will cause a change (or movement along) the AS curve

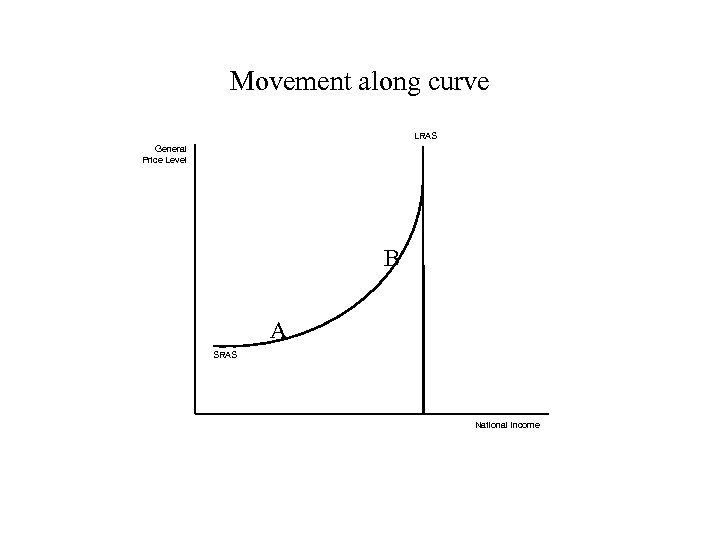

Movement along curve LRAS General Price Level B A SRAS National Income

Movement along curve LRAS General Price Level B A SRAS National Income

Keynesian view LRAS General Price Level B A National Income

Keynesian view LRAS General Price Level B A National Income

Monetarist(neo classical) View LRAS General Price Level SRAS B A National Income Note: A-B never happens unless AD shifts

Monetarist(neo classical) View LRAS General Price Level SRAS B A National Income Note: A-B never happens unless AD shifts

Change in AS • If it moves UP the curve then… • If it moves DOWN the curve • Remember Vocab here is Rise/Fall

Change in AS • If it moves UP the curve then… • If it moves DOWN the curve • Remember Vocab here is Rise/Fall

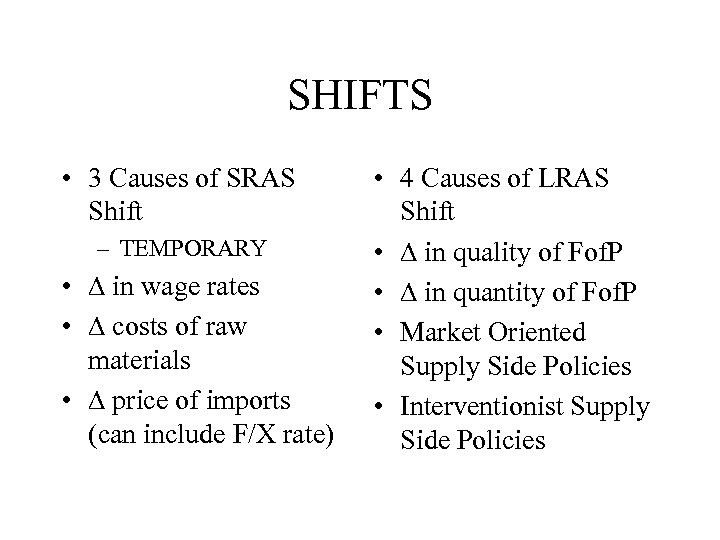

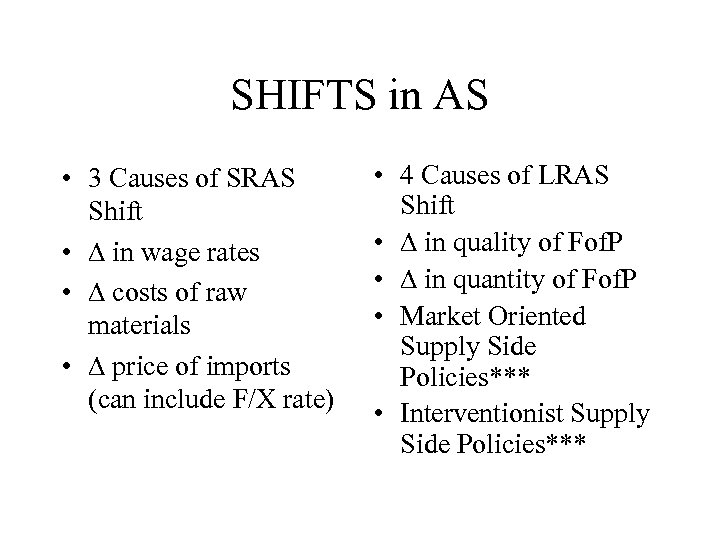

SHIFTS • 3 Causes of SRAS Shift – TEMPORARY • ∆ in wage rates • ∆ costs of raw materials • ∆ price of imports (can include F/X rate) • 4 Causes of LRAS Shift • ∆ in quality of Fof. P • ∆ in quantity of Fof. P • Market Oriented Supply Side Policies • Interventionist Supply Side Policies

SHIFTS • 3 Causes of SRAS Shift – TEMPORARY • ∆ in wage rates • ∆ costs of raw materials • ∆ price of imports (can include F/X rate) • 4 Causes of LRAS Shift • ∆ in quality of Fof. P • ∆ in quantity of Fof. P • Market Oriented Supply Side Policies • Interventionist Supply Side Policies

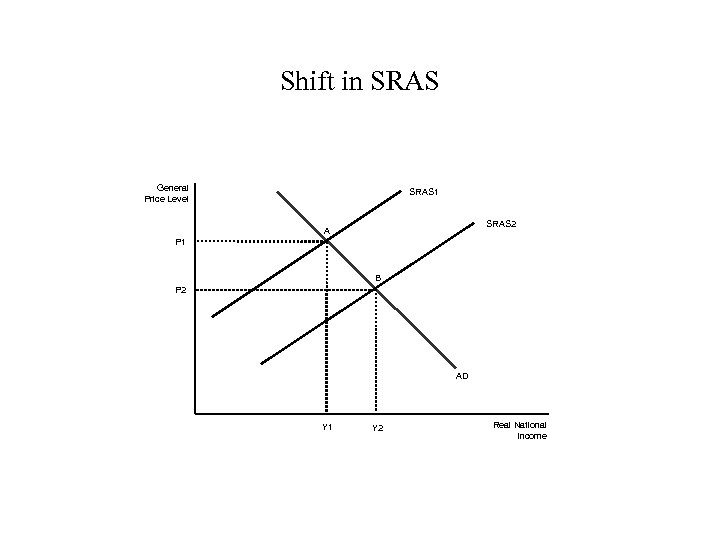

Shift in SRAS General Price Level SRAS 1 SRAS 2 A P 1 B P 2 AD Y 1 Y 2 Real National Income

Shift in SRAS General Price Level SRAS 1 SRAS 2 A P 1 B P 2 AD Y 1 Y 2 Real National Income

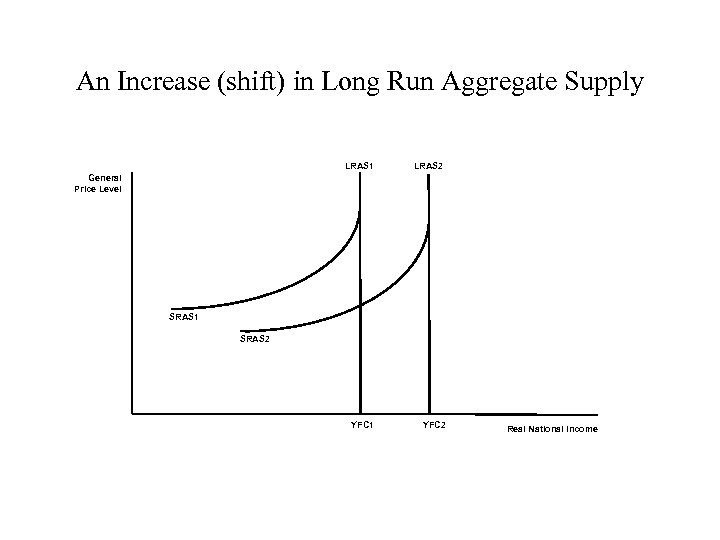

An Increase (shift) in Long Run Aggregate Supply LRAS 1 LRAS 2 YFC 1 YFC 2 General Price Level SRAS 1 SRAS 2 Real National Income

An Increase (shift) in Long Run Aggregate Supply LRAS 1 LRAS 2 YFC 1 YFC 2 General Price Level SRAS 1 SRAS 2 Real National Income

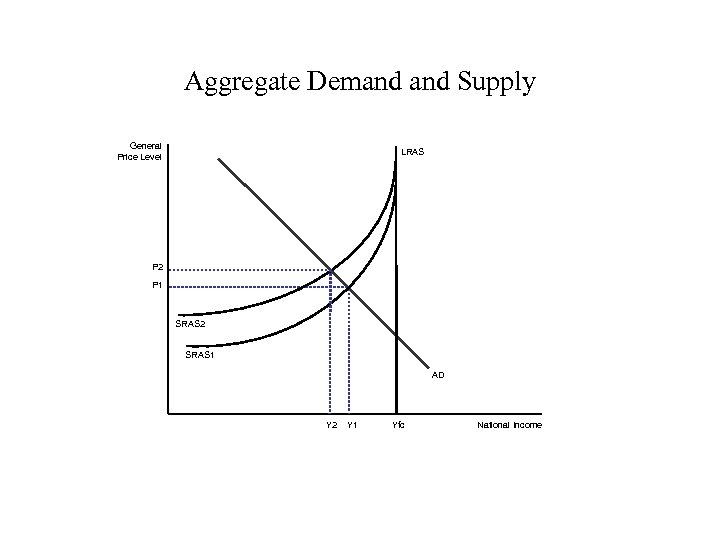

Aggregate Demand Supply General Price Level LRAS P 2 P 1 SRAS 2 SRAS 1 AD Y 2 Y 1 Yfc National Income

Aggregate Demand Supply General Price Level LRAS P 2 P 1 SRAS 2 SRAS 1 AD Y 2 Y 1 Yfc National Income

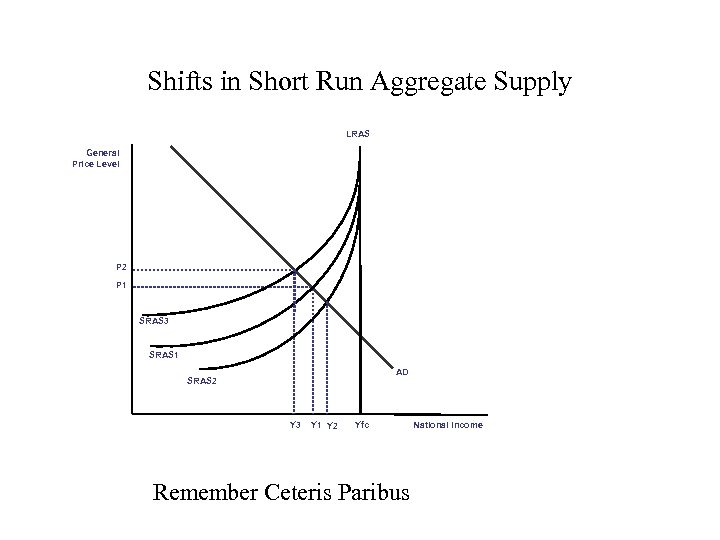

Shifts in Short Run Aggregate Supply LRAS General Price Level P 2 P 1 SRAS 3 SRAS 1 AD SRAS 2 Y 3 Y 1 Y 2 Yfc Remember Ceteris Paribus National Income

Shifts in Short Run Aggregate Supply LRAS General Price Level P 2 P 1 SRAS 3 SRAS 1 AD SRAS 2 Y 3 Y 1 Y 2 Yfc Remember Ceteris Paribus National Income

Out of the Abstract • 2 lines • AS & AD • Red construction paper is the Equilibrium Price • For our purposes, two people will hold it.

Out of the Abstract • 2 lines • AS & AD • Red construction paper is the Equilibrium Price • For our purposes, two people will hold it.

Back to Basics • What does r. GDP measure? • How is the general price level obtained? • What effect do prices have on demand (includes, consumers, gov’t and business investment)? • What effect do prices have on suppliers? • What are factor costs? …. . • What is the difference between short run and long run for suppliers?

Back to Basics • What does r. GDP measure? • How is the general price level obtained? • What effect do prices have on demand (includes, consumers, gov’t and business investment)? • What effect do prices have on suppliers? • What are factor costs? …. . • What is the difference between short run and long run for suppliers?

Cabbage Patch Kids

Cabbage Patch Kids

Tickle Me Elmo

Tickle Me Elmo

Furby

Furby

Beanie Babies

Beanie Babies

XBox

XBox

Sing-a-ma-jigs Past 100 years Top Ten Crazes

Sing-a-ma-jigs Past 100 years Top Ten Crazes

IV. Demand Side vs Supply Side • Viewpoint differs on concept of capacity. • No argument that capacity is eventually reached. • Argument on when. (ferris clip)

IV. Demand Side vs Supply Side • Viewpoint differs on concept of capacity. • No argument that capacity is eventually reached. • Argument on when. (ferris clip)

Back to the gas station model • During holiday rush weekend, owner hires a few more pump attendants. • Then fires them when demand goes back down. • Apply this concept to the whole economy. • What would make gas station owner open up more gas stations?

Back to the gas station model • During holiday rush weekend, owner hires a few more pump attendants. • Then fires them when demand goes back down. • Apply this concept to the whole economy. • What would make gas station owner open up more gas stations?

• Keynesians say: if more people are going to be consistently buying gas then owner will make long range plans. • Monetarists say it will only work if the cost or quality of the new gas stations is made cheaper/better. • Short run - easy to increase supply. Long run - much more expensive and risky

• Keynesians say: if more people are going to be consistently buying gas then owner will make long range plans. • Monetarists say it will only work if the cost or quality of the new gas stations is made cheaper/better. • Short run - easy to increase supply. Long run - much more expensive and risky

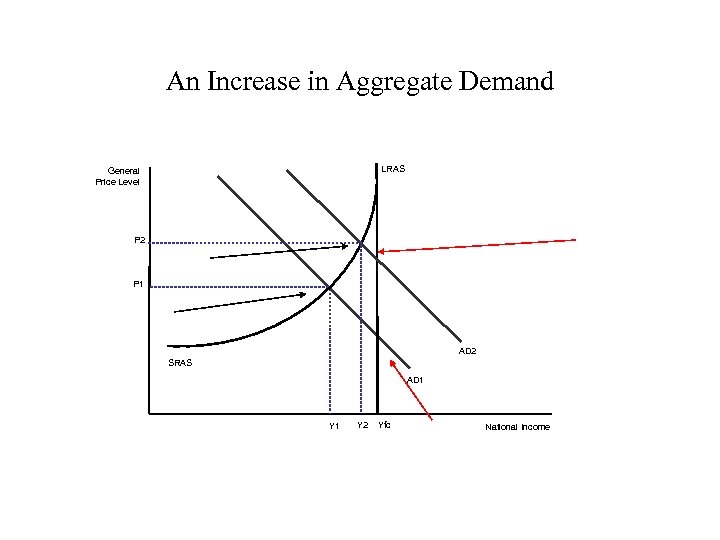

An Increase in Aggregate Demand LRAS General Price Level P 2 P 1 AD 2 SRAS AD 1 Y 2 Yfc National Income

An Increase in Aggregate Demand LRAS General Price Level P 2 P 1 AD 2 SRAS AD 1 Y 2 Yfc National Income

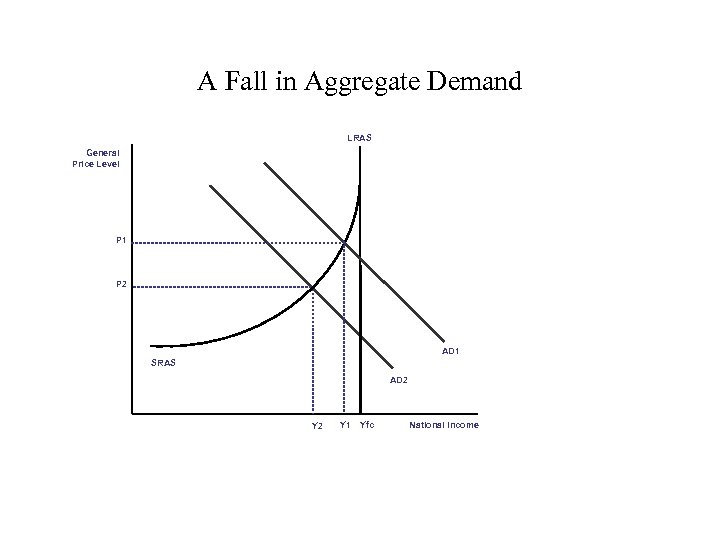

A Fall in Aggregate Demand LRAS General Price Level P 1 P 2 AD 1 SRAS AD 2 Y 1 Yfc National Income

A Fall in Aggregate Demand LRAS General Price Level P 1 P 2 AD 1 SRAS AD 2 Y 1 Yfc National Income

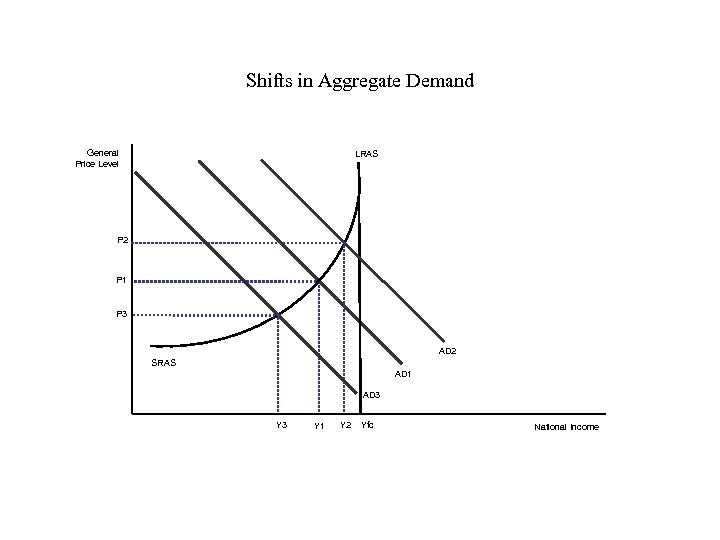

Shifts in Aggregate Demand General Price Level LRAS P 2 P 1 P 3 AD 2 SRAS AD 1 AD 3 Y 1 Y 2 Yfc National Income

Shifts in Aggregate Demand General Price Level LRAS P 2 P 1 P 3 AD 2 SRAS AD 1 AD 3 Y 1 Y 2 Yfc National Income

• Monetarist says in the long run you need to shift the whole curve to avoid price increases.

• Monetarist says in the long run you need to shift the whole curve to avoid price increases.

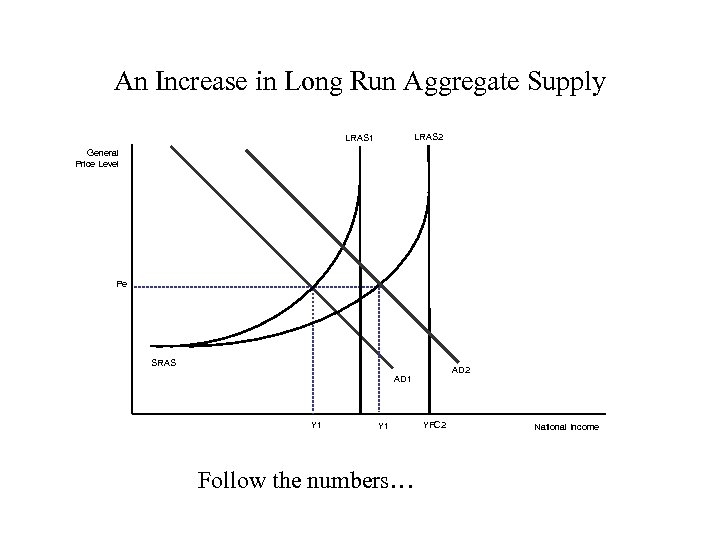

An Increase in Long Run Aggregate Supply LRAS 2 LRAS 1 General Price Level Pe SRAS AD 2 AD 1 Y 1 Follow the numbers… YFC 2 National Income

An Increase in Long Run Aggregate Supply LRAS 2 LRAS 1 General Price Level Pe SRAS AD 2 AD 1 Y 1 Follow the numbers… YFC 2 National Income

So let’s put this in the real world • Economy is experiencing a recession: • Keynesian vs Monetarists

So let’s put this in the real world • Economy is experiencing a recession: • Keynesian vs Monetarists

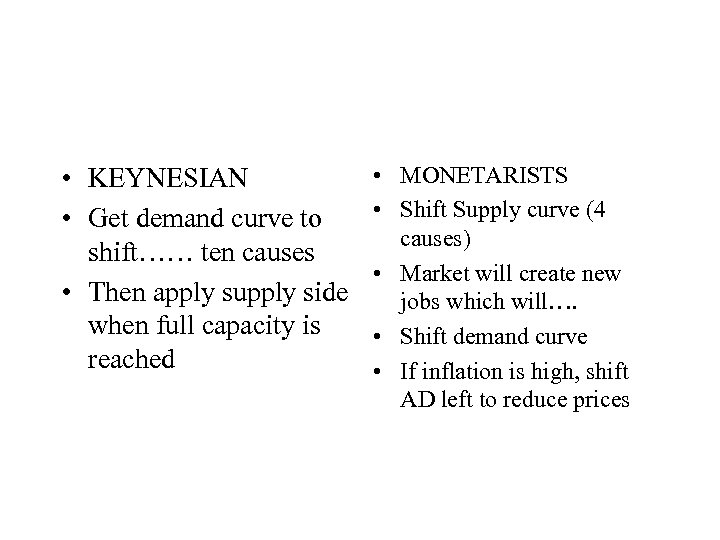

• KEYNESIAN • Get demand curve to shift…… ten causes • Then apply supply side when full capacity is reached • MONETARISTS • Shift Supply curve (4 causes) • Market will create new jobs which will…. • Shift demand curve • If inflation is high, shift AD left to reduce prices

• KEYNESIAN • Get demand curve to shift…… ten causes • Then apply supply side when full capacity is reached • MONETARISTS • Shift Supply curve (4 causes) • Market will create new jobs which will…. • Shift demand curve • If inflation is high, shift AD left to reduce prices

10 Causes of SHIFT in AD 1. ∆ in wealth/income 2. ∆ in consumer confidence (expectations) 3. ∆ in interest rates 4. ∆ in technology 5. ∆ in business confidence 6. ∆ in fiscal policy 7. ∆ in monetary policy 8. ∆ in exports/imports 9. ∆ in exchange rates 10. Demand side shock • Vocabulary: increase and decrease.

10 Causes of SHIFT in AD 1. ∆ in wealth/income 2. ∆ in consumer confidence (expectations) 3. ∆ in interest rates 4. ∆ in technology 5. ∆ in business confidence 6. ∆ in fiscal policy 7. ∆ in monetary policy 8. ∆ in exports/imports 9. ∆ in exchange rates 10. Demand side shock • Vocabulary: increase and decrease.

SHIFTS in AS • 3 Causes of SRAS Shift • ∆ in wage rates • ∆ costs of raw materials • ∆ price of imports (can include F/X rate) • 4 Causes of LRAS Shift • ∆ in quality of Fof. P • ∆ in quantity of Fof. P • Market Oriented Supply Side Policies*** • Interventionist Supply Side Policies***

SHIFTS in AS • 3 Causes of SRAS Shift • ∆ in wage rates • ∆ costs of raw materials • ∆ price of imports (can include F/X rate) • 4 Causes of LRAS Shift • ∆ in quality of Fof. P • ∆ in quantity of Fof. P • Market Oriented Supply Side Policies*** • Interventionist Supply Side Policies***

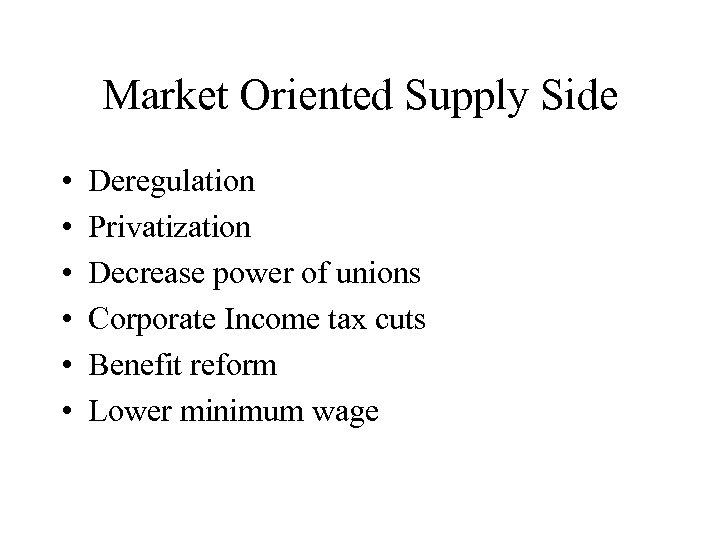

Market Oriented Supply Side • • • Deregulation Privatization Decrease power of unions Corporate Income tax cuts Benefit reform Lower minimum wage

Market Oriented Supply Side • • • Deregulation Privatization Decrease power of unions Corporate Income tax cuts Benefit reform Lower minimum wage

Interventionist Supply Side • • Research and development Education and training Welfare to work programs Assistance with foreign trade

Interventionist Supply Side • • Research and development Education and training Welfare to work programs Assistance with foreign trade

Now…. Let’s Play • http: //www. whitenova. com/think. Economics/adas. html • Go to LMC, grab website from my moodle • NO SHARING. EVERYONE ON THEIR OWN. • For each one, write down what happens to price level • Homework… • Next class. . Quiz and simulation

Now…. Let’s Play • http: //www. whitenova. com/think. Economics/adas. html • Go to LMC, grab website from my moodle • NO SHARING. EVERYONE ON THEIR OWN. • For each one, write down what happens to price level • Homework… • Next class. . Quiz and simulation

Simulation • • 2 groups. Keynesians and Monetarists React to scenerios given. Class debate on pros/cons…. must demonstrate answer with model on board.

Simulation • • 2 groups. Keynesians and Monetarists React to scenerios given. Class debate on pros/cons…. must demonstrate answer with model on board.

problems

problems

Evaluation • • Assumptions Short term/Long term Best pro/best con Stakeholders

Evaluation • • Assumptions Short term/Long term Best pro/best con Stakeholders

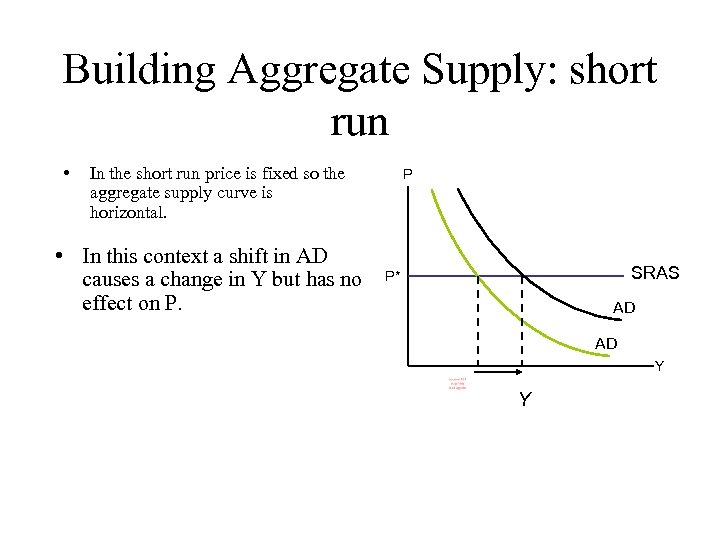

Building Aggregate Supply: short run • In the short run price is fixed so the aggregate supply curve is horizontal. • In this context a shift in AD causes a change in Y but has no effect on P. P SRAS P* AD AD Y Y

Building Aggregate Supply: short run • In the short run price is fixed so the aggregate supply curve is horizontal. • In this context a shift in AD causes a change in Y but has no effect on P. P SRAS P* AD AD Y Y

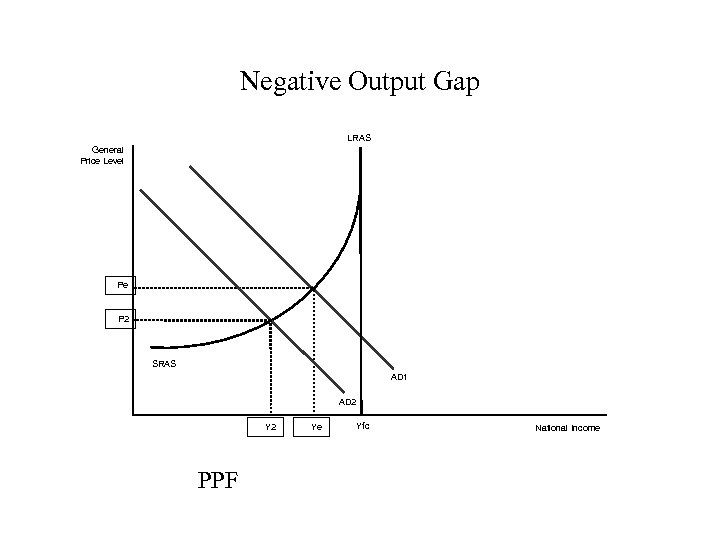

Negative Output Gap LRAS General Price Level Pe P 2 SRAS AD 1 AD 2 Y 2 PPF Ye Yfc National Income

Negative Output Gap LRAS General Price Level Pe P 2 SRAS AD 1 AD 2 Y 2 PPF Ye Yfc National Income

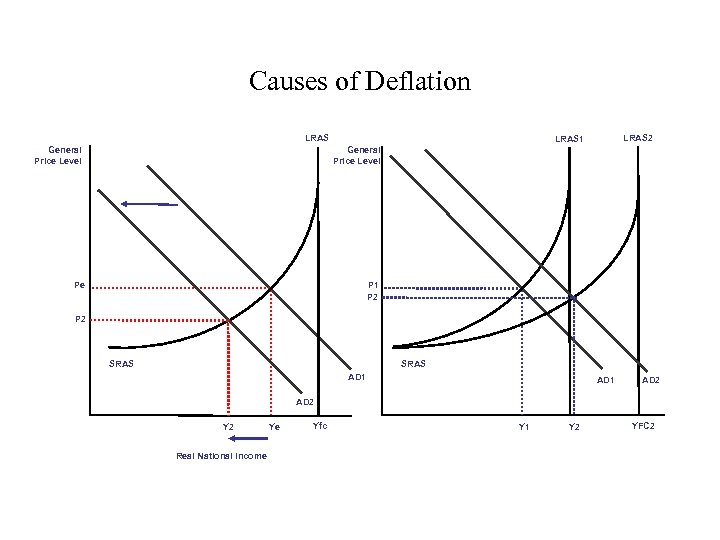

Causes of Deflation LRAS General Price Level LRAS 2 LRAS 1 General Price Level Pe P 1 P 2 SRAS AD 1 AD 2 Y 2 Real National Income Ye Yfc Y 1 Y 2 YFC 2

Causes of Deflation LRAS General Price Level LRAS 2 LRAS 1 General Price Level Pe P 1 P 2 SRAS AD 1 AD 2 Y 2 Real National Income Ye Yfc Y 1 Y 2 YFC 2

• http: //www. whitenova. com/think. Economics/adas. html

• http: //www. whitenova. com/think. Economics/adas. html

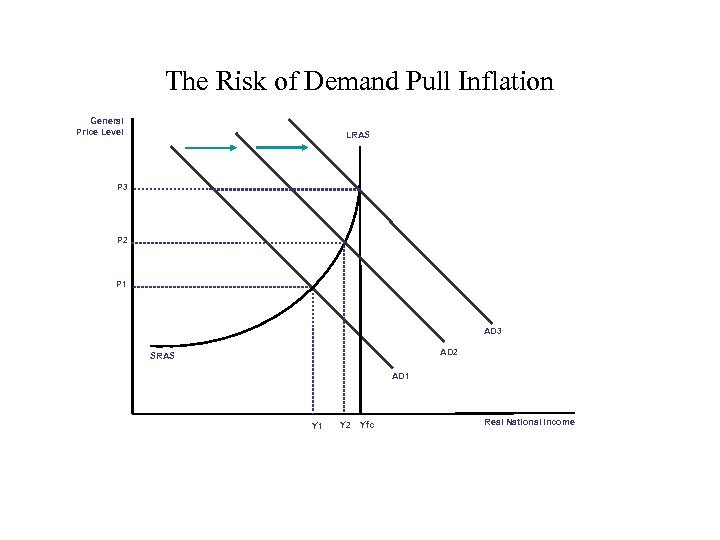

The Risk of Demand Pull Inflation General Price Level LRAS P 3 P 2 P 1 AD 3 AD 2 SRAS AD 1 Y 2 Yfc Real National Income

The Risk of Demand Pull Inflation General Price Level LRAS P 3 P 2 P 1 AD 3 AD 2 SRAS AD 1 Y 2 Yfc Real National Income

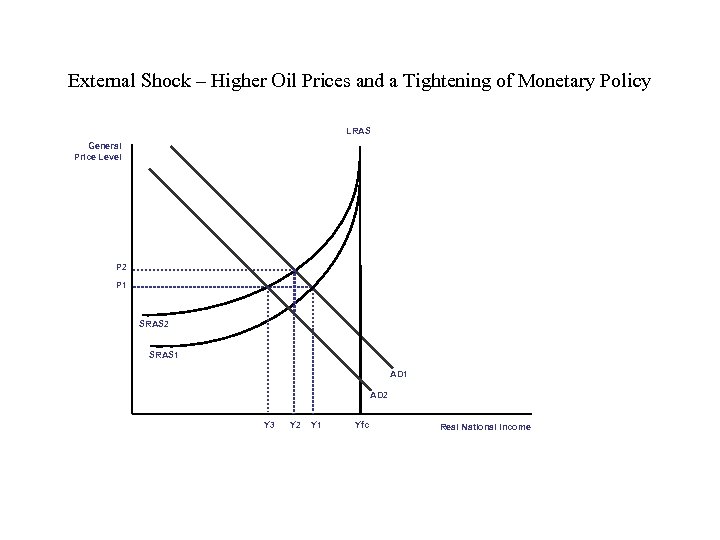

External Shock – Higher Oil Prices and a Tightening of Monetary Policy LRAS General Price Level P 2 P 1 SRAS 2 SRAS 1 AD 2 Y 3 Y 2 Y 1 Yfc Real National Income

External Shock – Higher Oil Prices and a Tightening of Monetary Policy LRAS General Price Level P 2 P 1 SRAS 2 SRAS 1 AD 2 Y 3 Y 2 Y 1 Yfc Real National Income

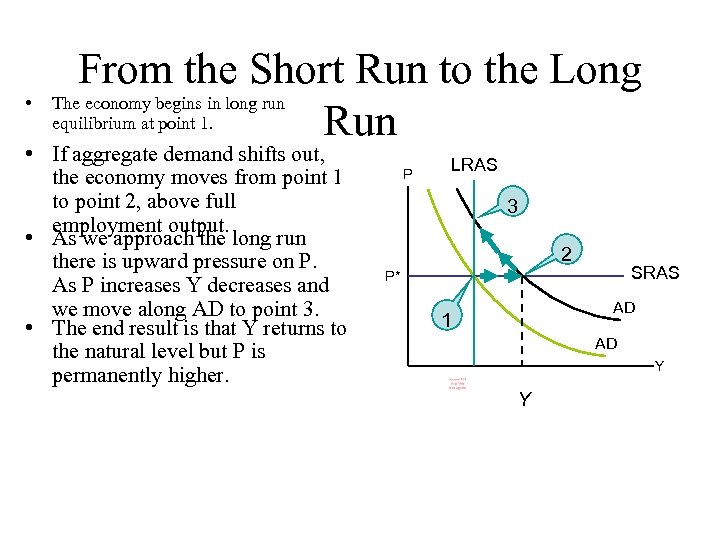

• From the Short Run to the Long The economy begins in long run equilibrium at point 1. Run • If aggregate demand shifts out, the economy moves from point 1 to point 2, above full employment output. • As we approach the long run there is upward pressure on P. As P increases Y decreases and we move along AD to point 3. • The end result is that Y returns to the natural level but P is permanently higher. P LRAS 3 2 SRAS P* AD 1 AD Y Y

• From the Short Run to the Long The economy begins in long run equilibrium at point 1. Run • If aggregate demand shifts out, the economy moves from point 1 to point 2, above full employment output. • As we approach the long run there is upward pressure on P. As P increases Y decreases and we move along AD to point 3. • The end result is that Y returns to the natural level but P is permanently higher. P LRAS 3 2 SRAS P* AD 1 AD Y Y

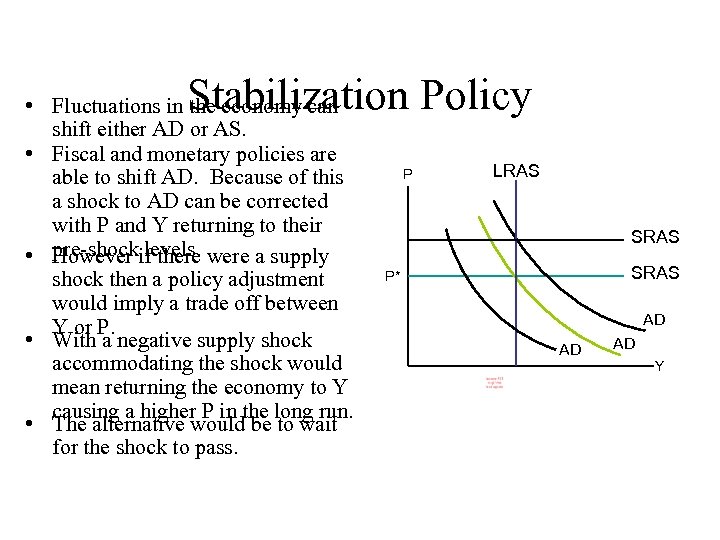

Stabilization Policy • Fluctuations in the economy can shift either AD or AS. • Fiscal and monetary policies are able to shift AD. Because of this a shock to AD can be corrected with P and Y returning to their • pre-shockif there were a supply However levels. shock then a policy adjustment would imply a trade off between Y or P. • With a negative supply shock accommodating the shock would mean returning the economy to Y causing a higher P in the long run. • The alternative would be to wait for the shock to pass. P LRAS SRAS P* AD AD AD Y

Stabilization Policy • Fluctuations in the economy can shift either AD or AS. • Fiscal and monetary policies are able to shift AD. Because of this a shock to AD can be corrected with P and Y returning to their • pre-shockif there were a supply However levels. shock then a policy adjustment would imply a trade off between Y or P. • With a negative supply shock accommodating the shock would mean returning the economy to Y causing a higher P in the long run. • The alternative would be to wait for the shock to pass. P LRAS SRAS P* AD AD AD Y