0b4b78d9fa217fd9dcf7d38ad930a6cd.ppt

- Количество слайдов: 21

2. 13. 1. G 1 Double the Salary An employee starting a new job has the option to choose how he is paid for the first twenty days of work. He works five days a week, for four full weeks. Make the best choice for the new employee after comparing the two options. Payment Option 1: For the first twenty days of work, the new employee will be paid $500 a day. Payment Option 2: The pay will be $0. 01 for the first day. Each day the pay will double. So, it will be $0. 02 the second day, $0. 04 the third day, $0. 08 the fourth day, etc. By the end of twenty days, how much money will the employee have made? © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Double the Salary Payment Option 1: Payment Option 2: $500. 00 a day * 20 days = $10, 000 Day 1 $ 0. 01 Day 11 10. 24 Day 2 . 02 Day 12 20. 48 Day 3 . 04 Day 13 40. 96 Day 4 . 08 Day 14 81. 92 Day 5 . 16 Day 15 163. 84 Day 6 . 32 Day 16 327. 68 Day 7 . 64 Day 17 655. 36 Day 8 1. 28 Day 18 1310. 72 Day 9 2. 56 Day 19 2621. 44 Day 10 5. 12 Day 20 5242. 88 Total: $10, 485. 75 © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Solution Payment Option 1: $500. 00 a day * 20 days = $10, 000. 00 Payment Option 2: This is a better choice for the new employee as he will be making $10, 485. 75 This is $485. 75 more than if he would have chosen Payment Option 1 © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Family Economics & Financial Education Planet Paycheck An Earthlings Guide to Understanding Paychecks © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Planet Paycheck Navigation Welcome to Planet Paycheck! While visiting Planet Paycheck the vast world of paychecks will be explored! © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 First Job! • Miss Patty Paycheck has just received her first paycheck from her new job! – But, the paycheck amount seems a little lower than she had figured. How could that be? • Taxes – Required charges of citizens by local, state, and federal governments – Taxes are deducted from all employees paychecks – Used to provide public goods and services • Roads, police, schools, governmental agencies, fire and emergency services © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Starting a New Job To receive a paycheck, an employee must: Complete a Form W-4 • Employee’s Withholding Allowance Certificate • Determines the amount of money withheld for taxes © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Starting a New Job Complete a Form I-9 • Used to prove the identity of people and avoid hiring non United States citizens • Must provide at least 2 of the following – passport – driver’s license – U. S. military card – Social Security card – birth certificate © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Starting A New Job Form W-2 (Wage and Tax Statement) • States the amount of money earned and taxes paid throughout the previous year • Used to file income taxes by April 15 th • Individuals may be exempt from filing federal withholdings if they make less than a certain amount per year © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Methods for Paying Employees 1. 2. 3. Paycheck • Paper check with stub • Least secure payment method because the employee is responsible for handling the paycheck Direct Deposit • Employers directly deposit employee’s paycheck into the authorized employee’s bank account Payroll Card • A payroll card electronically carries the balance of the employee’s net pay © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Payment Method Pros and Cons • Paycheck • Payroll card – Pros: • Employee controls when the check is deposited – Cons: • Least secure, employee responsible for getting it to the bank – Pros: • Wages automatically loaded onto a card – Cons • May charge fees for use of the card • Direct Deposit – Pros: • No direct handling of check • Employee knows exactly when he/she will be paid © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Reading A Paycheck Stub Items on a paycheck stub include: • Personal Information -The employee’s full name, address, and social security number • Pay Period -The length of time for which an employee’s wages are calculated – Most businesses pay employees either weekly, bi-weekly, or monthly © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Reading A Paycheck Stub Gross Pay – The total amount of money earned before payroll withholdings • If a person earns an hourly wage, gross pay is calculated by multiplying the number of hours worked by the wage © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 What is the Gross Pay? If Miss Patty Paycheck worked at Terrific Tacos for $6. 00/hour for 15 hours a week what will her gross pay be? # hours worked x wage = gross pay 15 hours x $6. 00/hr = $90. 00/week What is Miss Patty Paycheck’s gross pay for a two week pay period? 30 hours x $6. 00/hr = $180. 00 for 2 weeks © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Reading A Paycheck Stub • Payroll Withholdings – The amount of money subtracted from the gross pay for taxes. Typically about 30% of your paycheck! – Withholding Tax – The amount required by law for employers to withhold from earned wages to pay taxes – FICA-Federal Insurance Contribution Act • Fed OASDI/EE (Federal Old Age Survivors Disability Insurance Employee Employment Tax) or Social Security - helps provide retirement income for the elderly and pays disability benefits • Fed MED/EE (Federal Medicare Employee Employment Tax) or Medicare - health care program for the elderly and disabled © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Reading A Paycheck Stub • Net Pay – The amount left after all payroll deductions have been taken from the gross pay – Net pay is also referred to as “take home” pay © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

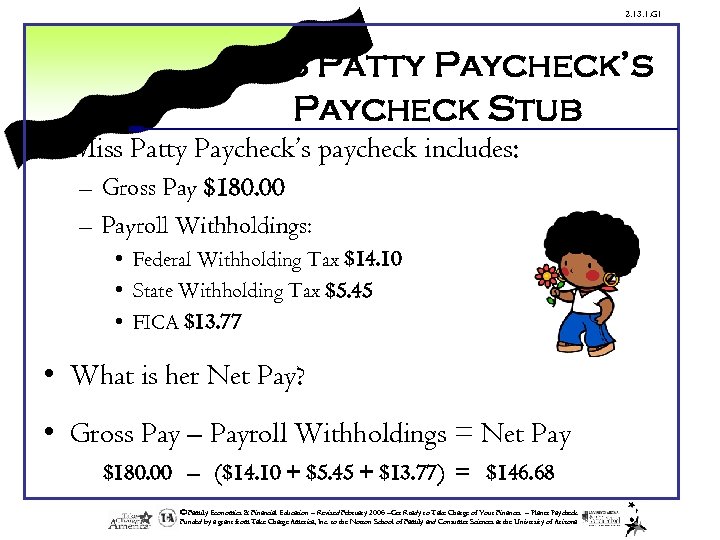

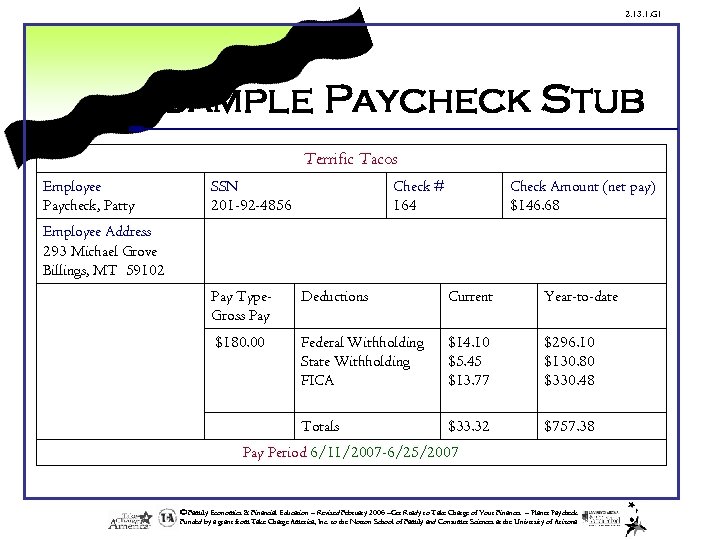

2. 13. 1. G 1 Miss Patty Paycheck’s Paycheck Stub • Miss Patty Paycheck’s paycheck includes: – Gross Pay $180. 00 – Payroll Withholdings: • Federal Withholding Tax $14. 10 • State Withholding Tax $5. 45 • FICA $13. 77 • What is her Net Pay? • Gross Pay – Payroll Withholdings = Net Pay $180. 00 – ($14. 10 + $5. 45 + $13. 77) = $146. 68 © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Reading A Paycheck Stub • Year-to-Date- Totals all of the deductions which have been withheld from an individual’s paycheck from January 1 to the last day of the pay period indicated on the paycheck stub © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Sample Paycheck Stub Terrific Tacos Employee Paycheck, Patty SSN 201 -92 -4856 Check # 164 Check Amount (net pay) $146. 68 Employee Address 293 Michael Grove Billings, MT 59102 Pay Type. Gross Pay Deductions Current Year-to-date $180. 00 Federal Withholding State Withholding FICA $14. 10 $5. 45 $13. 77 $296. 10 $130. 80 $330. 48 Totals $33. 32 $757. 38 Pay Period 6/11/2007 -6/25/2007 © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Remember to Review • It is important to review each paycheck stub to identify any possible mistakes! – If a mistake is found, contact the employer for clarification © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

2. 13. 1. G 1 Thanks for Visiting Thank you for visiting planet paycheck. Good luck with all of your future paycheck journeys! © Family Economics & Financial Education – Revised February 2006 –Get Ready to Take Charge of Your Finances – Planet Paycheck Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences at the University of Arizona

0b4b78d9fa217fd9dcf7d38ad930a6cd.ppt