24001d0bfd44a65b599e749bdbb75250.ppt

- Количество слайдов: 83

2 -1 Chapter 2 Time Value of Money

2 -1 Chapter 2 Time Value of Money

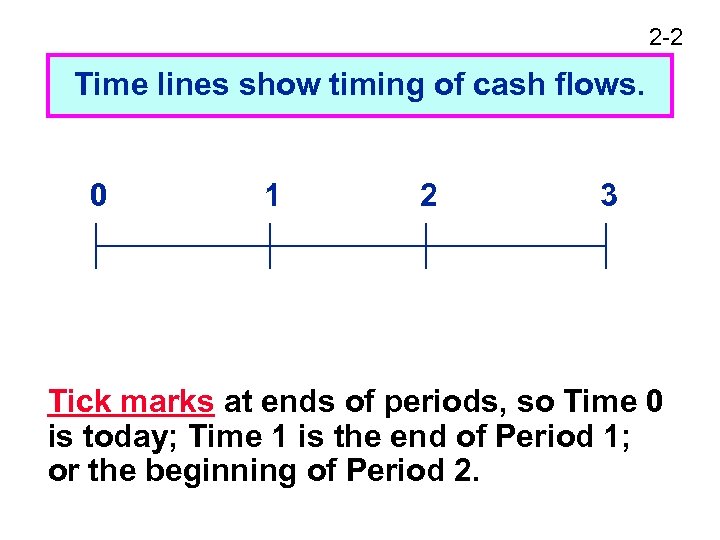

2 -2 Time lines show timing of cash flows. 0 1 2 3 Tick marks at ends of periods, so Time 0 is today; Time 1 is the end of Period 1; or the beginning of Period 2.

2 -2 Time lines show timing of cash flows. 0 1 2 3 Tick marks at ends of periods, so Time 0 is today; Time 1 is the end of Period 1; or the beginning of Period 2.

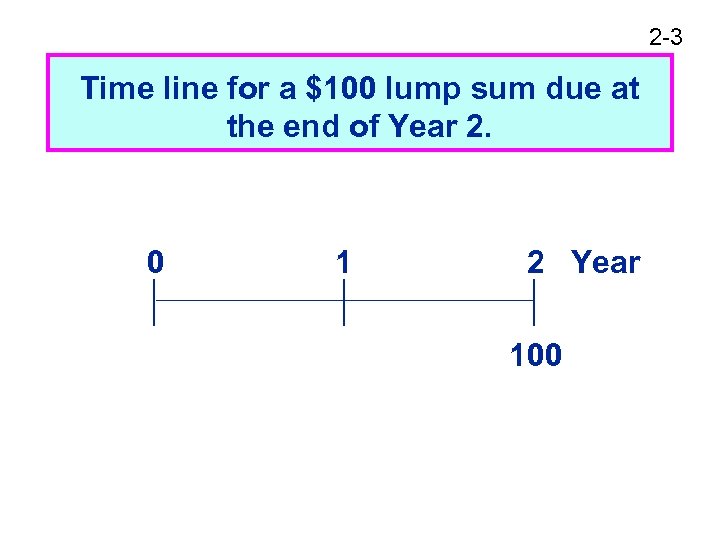

2 -3 Time line for a $100 lump sum due at the end of Year 2. 0 1 2 Year 100

2 -3 Time line for a $100 lump sum due at the end of Year 2. 0 1 2 Year 100

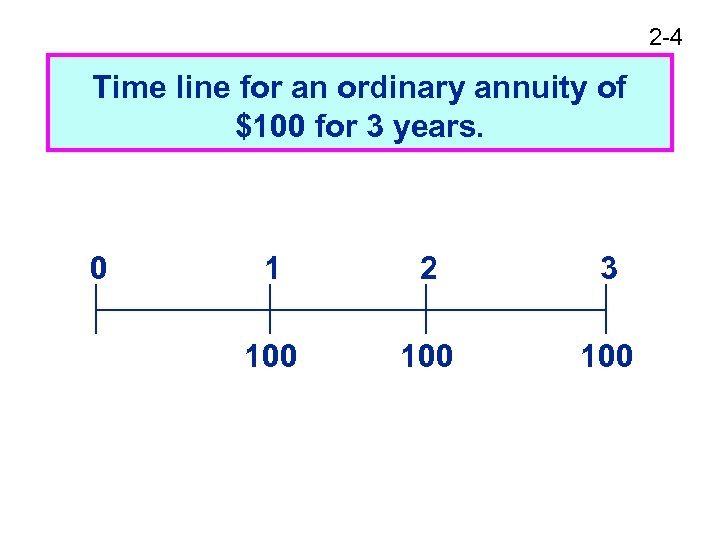

2 -4 Time line for an ordinary annuity of $100 for 3 years. 0 1 2 3 100 100

2 -4 Time line for an ordinary annuity of $100 for 3 years. 0 1 2 3 100 100

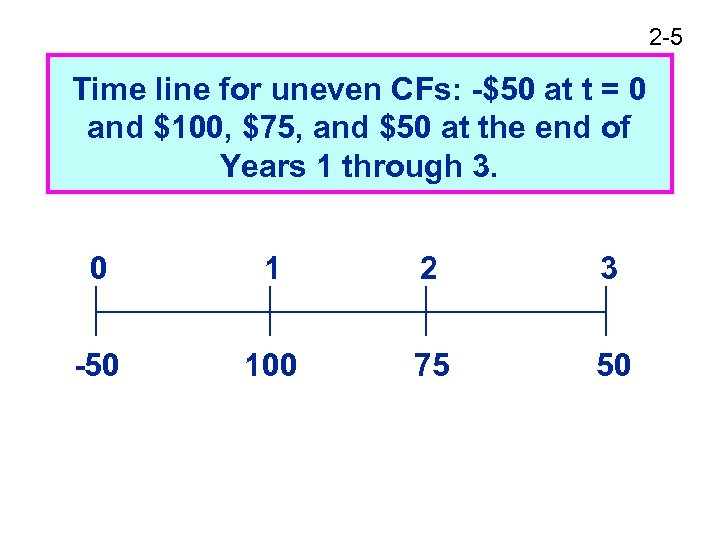

2 -5 Time line for uneven CFs: -$50 at t = 0 and $100, $75, and $50 at the end of Years 1 through 3. 0 1 2 3 -50 100 75 50

2 -5 Time line for uneven CFs: -$50 at t = 0 and $100, $75, and $50 at the end of Years 1 through 3. 0 1 2 3 -50 100 75 50

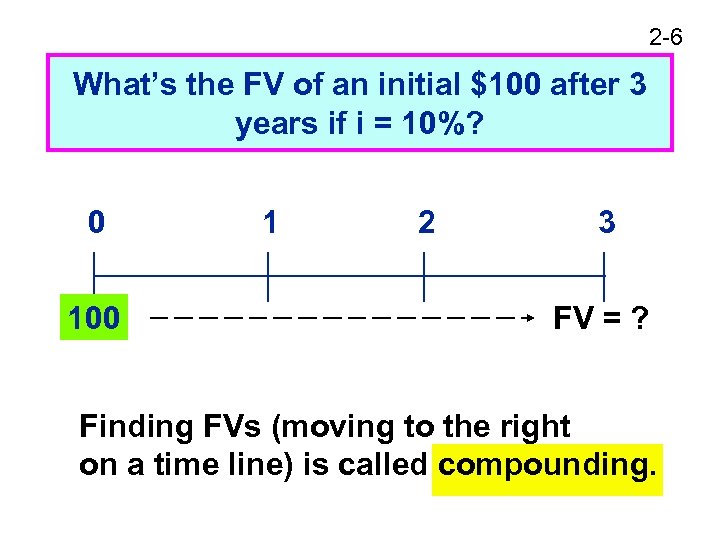

2 -6 What’s the FV of an initial $100 after 3 years if i = 10%? 0 100 1 2 3 FV = ? Finding FVs (moving to the right on a time line) is called compounding.

2 -6 What’s the FV of an initial $100 after 3 years if i = 10%? 0 100 1 2 3 FV = ? Finding FVs (moving to the right on a time line) is called compounding.

2 -7 After 1 year: After 2 years:

2 -7 After 1 year: After 2 years:

2 -8 After 3 years: In general,

2 -8 After 3 years: In general,

2 -9 Three Ways to Find FVs

2 -9 Three Ways to Find FVs

2 -10 Financial calculator: HP 10 BII

2 -10 Financial calculator: HP 10 BII

2 -11 HP 10 BII (Continued)

2 -11 HP 10 BII (Continued)

2 -12 HP 10 BII: Set Time Value Parameters

2 -12 HP 10 BII: Set Time Value Parameters

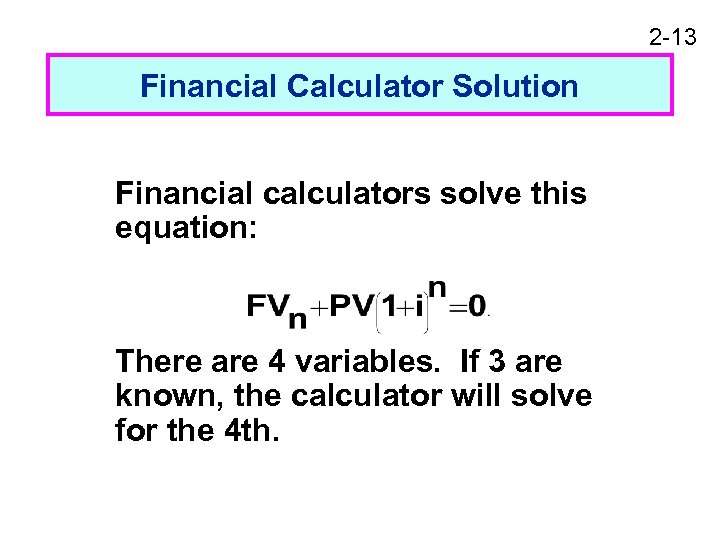

2 -13 Financial Calculator Solution Financial calculators solve this equation: There are 4 variables. If 3 are known, the calculator will solve for the 4 th.

2 -13 Financial Calculator Solution Financial calculators solve this equation: There are 4 variables. If 3 are known, the calculator will solve for the 4 th.

2 -14 Here’s the setup to find FV: Clearing automatically sets everything to 0, but for safety enter PMT = 0. Set: P/YR = 1, END.

2 -14 Here’s the setup to find FV: Clearing automatically sets everything to 0, but for safety enter PMT = 0. Set: P/YR = 1, END.

2 -15 Spreadsheet Solution

2 -15 Spreadsheet Solution

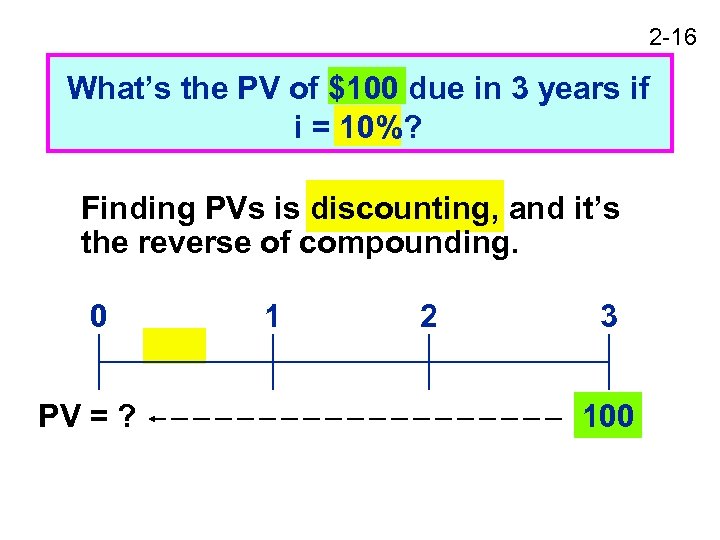

2 -16 What’s the PV of $100 due in 3 years if i = 10%? Finding PVs is discounting, and it’s the reverse of compounding. 0 PV = ? 1 2 3 100

2 -16 What’s the PV of $100 due in 3 years if i = 10%? Finding PVs is discounting, and it’s the reverse of compounding. 0 PV = ? 1 2 3 100

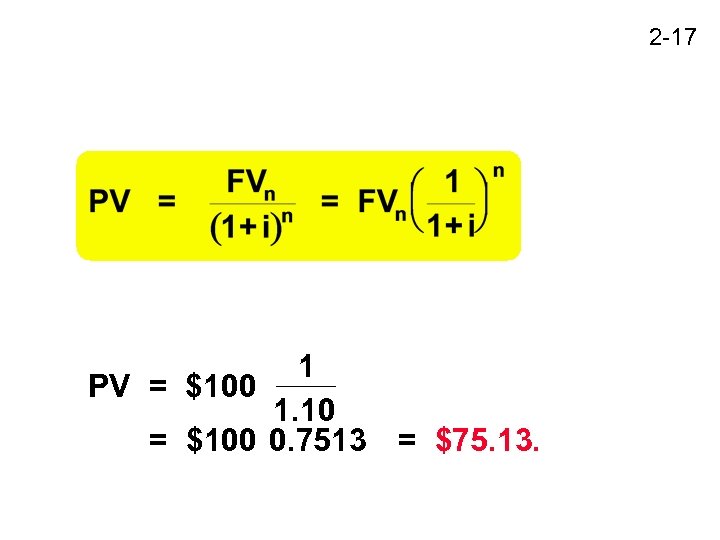

2 -17 1 PV = $100 1. 10 = $100 0. 7513 = $75. 13.

2 -17 1 PV = $100 1. 10 = $100 0. 7513 = $75. 13.

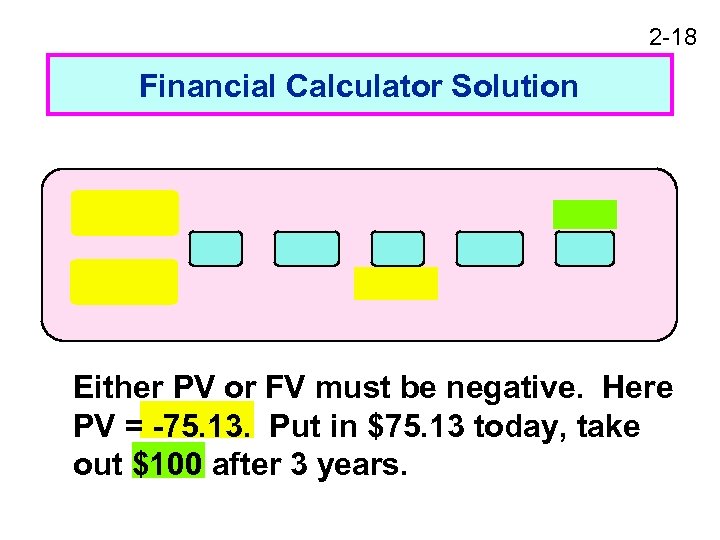

2 -18 Financial Calculator Solution Either PV or FV must be negative. Here PV = -75. 13. Put in $75. 13 today, take out $100 after 3 years.

2 -18 Financial Calculator Solution Either PV or FV must be negative. Here PV = -75. 13. Put in $75. 13 today, take out $100 after 3 years.

2 -19 Spreadsheet Solution

2 -19 Spreadsheet Solution

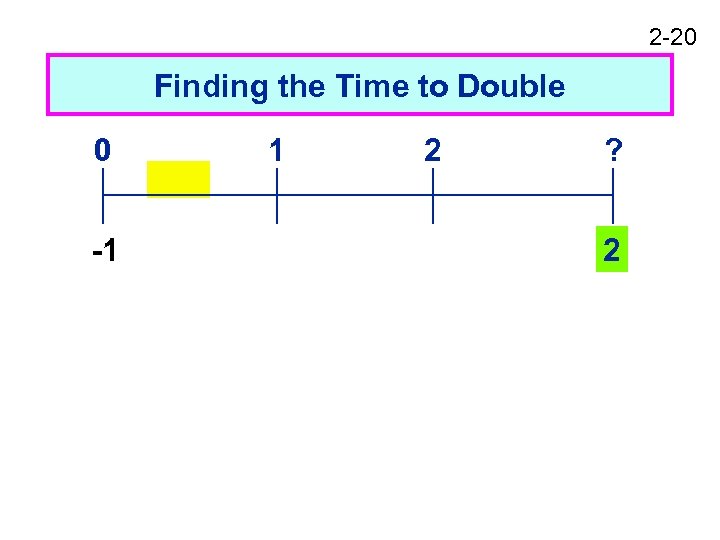

2 -20 Finding the Time to Double 0 -1 1 2 ? 2

2 -20 Finding the Time to Double 0 -1 1 2 ? 2

2 -21 Financial Calculator

2 -21 Financial Calculator

2 -22 Spreadsheet Solution

2 -22 Spreadsheet Solution

2 -23 Finding the Interest Rate 0 -1 1 2 3 2

2 -23 Finding the Interest Rate 0 -1 1 2 3 2

2 -24 Financial Calculator

2 -24 Financial Calculator

2 -25 Spreadsheet Solution

2 -25 Spreadsheet Solution

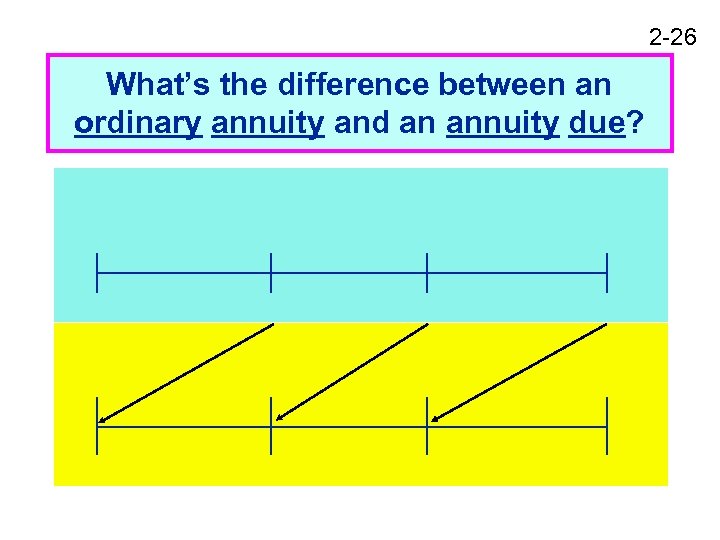

2 -26 What’s the difference between an ordinary annuity and an annuity due?

2 -26 What’s the difference between an ordinary annuity and an annuity due?

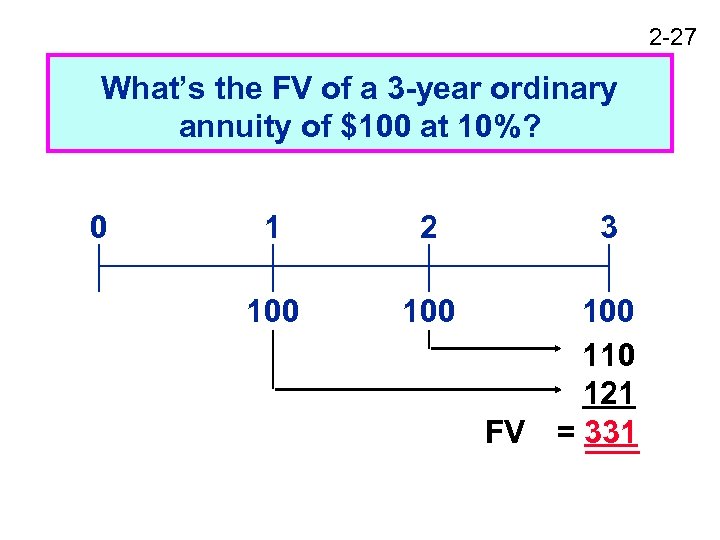

2 -27 What’s the FV of a 3 -year ordinary annuity of $100 at 10%? 0 1 2 100 3 100 110 121 FV = 331

2 -27 What’s the FV of a 3 -year ordinary annuity of $100 at 10%? 0 1 2 100 3 100 110 121 FV = 331

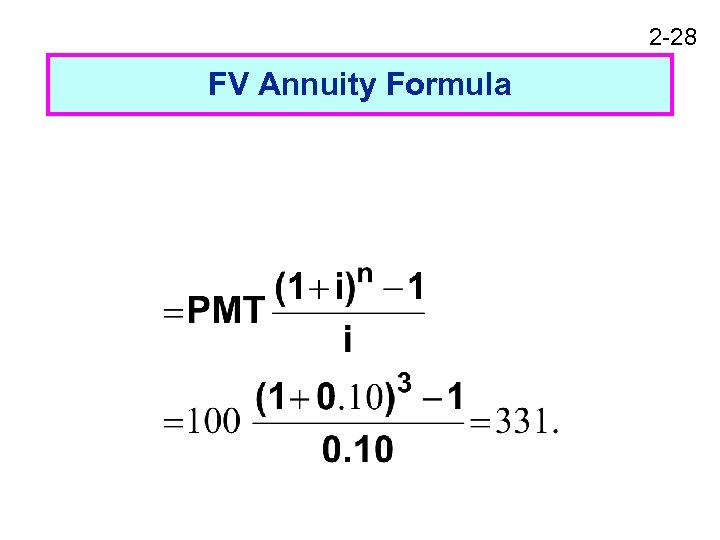

2 -28 FV Annuity Formula

2 -28 FV Annuity Formula

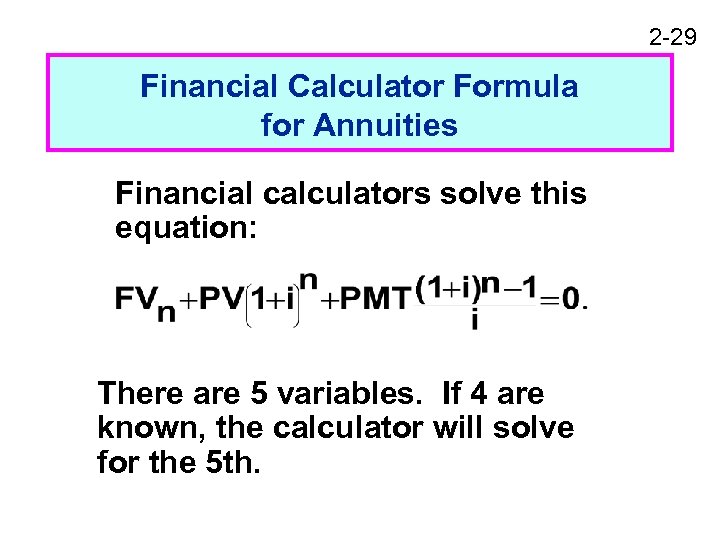

2 -29 Financial Calculator Formula for Annuities Financial calculators solve this equation: There are 5 variables. If 4 are known, the calculator will solve for the 5 th.

2 -29 Financial Calculator Formula for Annuities Financial calculators solve this equation: There are 5 variables. If 4 are known, the calculator will solve for the 5 th.

2 -30 Financial Calculator Solution Have payments but no lump sum PV, so enter 0 for present value.

2 -30 Financial Calculator Solution Have payments but no lump sum PV, so enter 0 for present value.

2 -31 Spreadsheet Solution

2 -31 Spreadsheet Solution

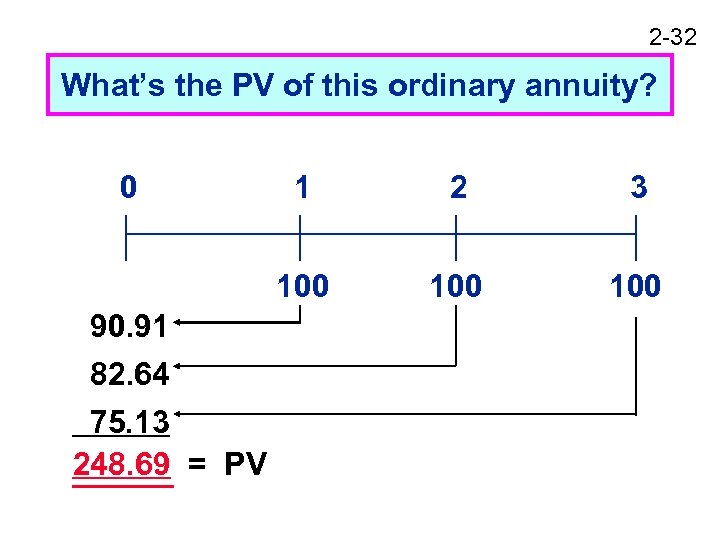

2 -32 What’s the PV of this ordinary annuity? 0 2 3 100 90. 91 82. 64 75. 13 248. 69 = PV 1 100

2 -32 What’s the PV of this ordinary annuity? 0 2 3 100 90. 91 82. 64 75. 13 248. 69 = PV 1 100

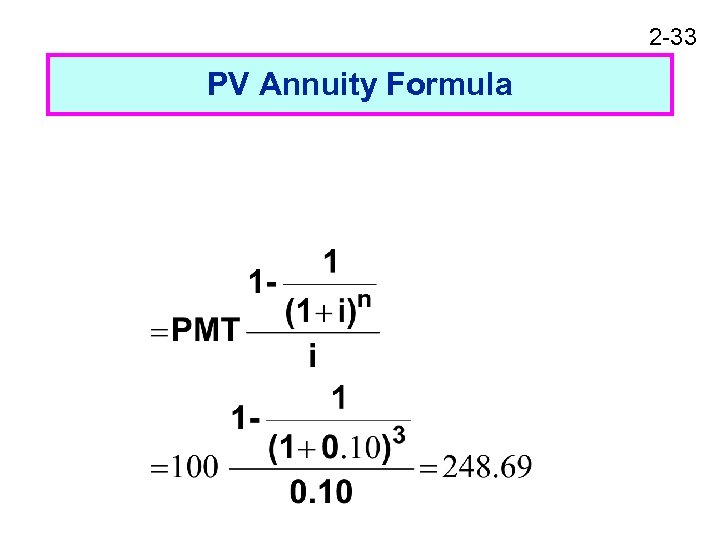

2 -33 PV Annuity Formula

2 -33 PV Annuity Formula

2 -34 Financial Calculator Solution Have payments but no lump sum FV, so enter 0 for future value.

2 -34 Financial Calculator Solution Have payments but no lump sum FV, so enter 0 for future value.

2 -35 Spreadsheet Solution

2 -35 Spreadsheet Solution

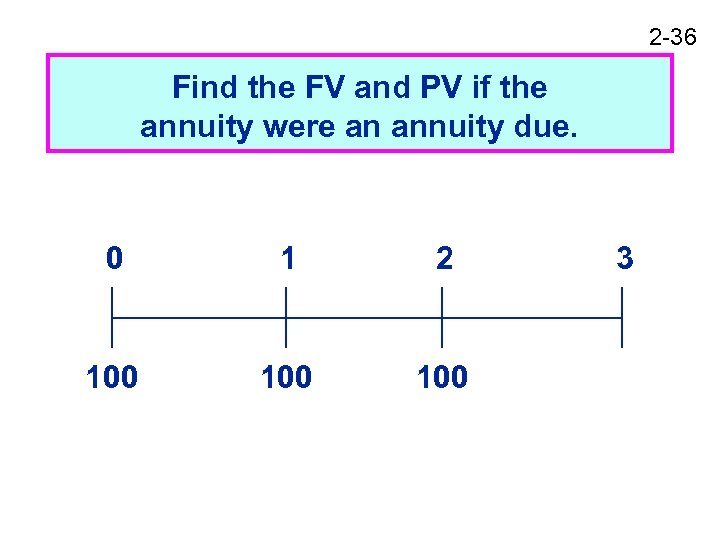

2 -36 Find the FV and PV if the annuity were an annuity due. 0 1 2 100 100 3

2 -36 Find the FV and PV if the annuity were an annuity due. 0 1 2 100 100 3

2 -37 PV and FV of Annuity Due vs. Ordinary Annuity

2 -37 PV and FV of Annuity Due vs. Ordinary Annuity

2 -38 Then enter PV = 0 and press FV to find FV = $364. 10.

2 -38 Then enter PV = 0 and press FV to find FV = $364. 10.

2 -39 Excel Function for Annuities Due

2 -39 Excel Function for Annuities Due

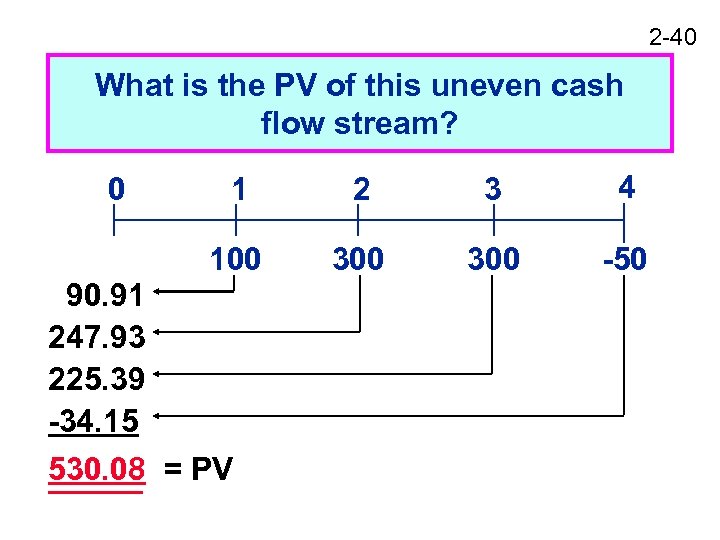

2 -40 What is the PV of this uneven cash flow stream? 1 2 3 4 100 0 300 -50 90. 91 247. 93 225. 39 -34. 15 530. 08 = PV

2 -40 What is the PV of this uneven cash flow stream? 1 2 3 4 100 0 300 -50 90. 91 247. 93 225. 39 -34. 15 530. 08 = PV

2 -41 Financial calculator: HP 10 BII

2 -41 Financial calculator: HP 10 BII

2 -42 Financial calculator: HP 10 BII (more)

2 -42 Financial calculator: HP 10 BII (more)

2 -43

2 -43

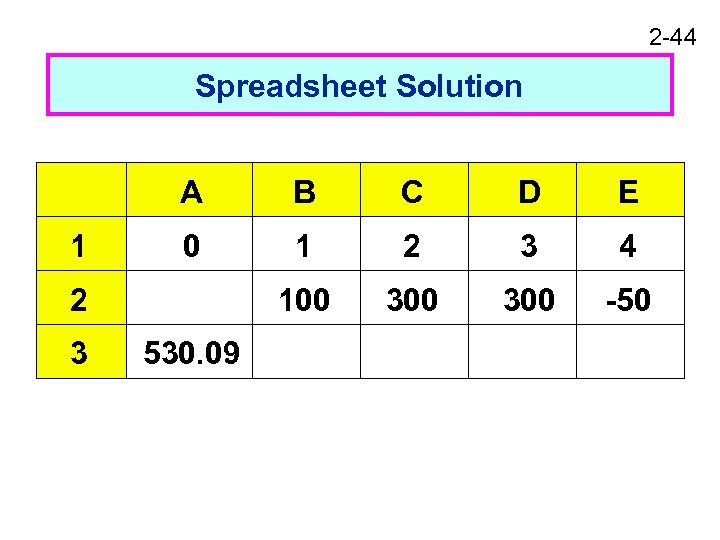

2 -44 Spreadsheet Solution A 1 B C D E 0 1 2 3 4 100 300 -50 2 3 530. 09

2 -44 Spreadsheet Solution A 1 B C D E 0 1 2 3 4 100 300 -50 2 3 530. 09

2 -45

2 -45

2 -46

2 -46

2 -47 Will the FV of a lump sum be larger or smaller if we compound more often, holding the stated I% constant? Why? LARGER! If compounding is more frequent than once a year--for example, semiannually, quarterly, or daily--interest is earned on interest more often.

2 -47 Will the FV of a lump sum be larger or smaller if we compound more often, holding the stated I% constant? Why? LARGER! If compounding is more frequent than once a year--for example, semiannually, quarterly, or daily--interest is earned on interest more often.

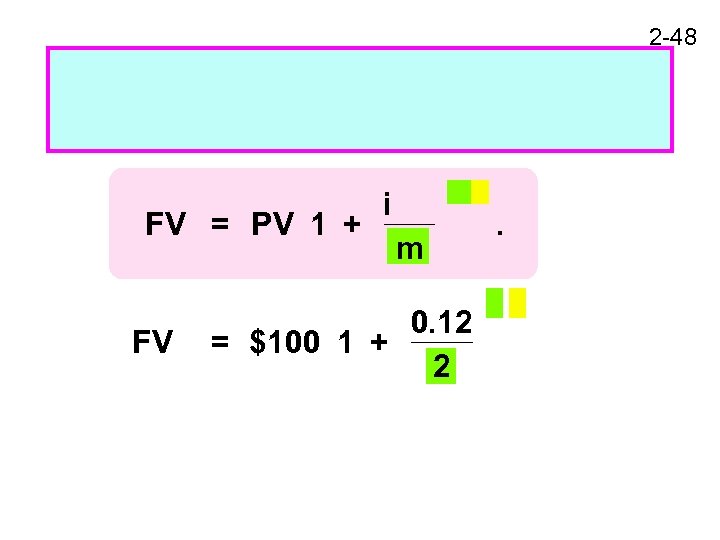

2 -48 FV = PV 1 + FV i m 0. 12 = $100 1 + 2 .

2 -48 FV = PV 1 + FV i m 0. 12 = $100 1 + 2 .

2 -49 FV of $100 at a 12% nominal rate for 5 years with different compounding

2 -49 FV of $100 at a 12% nominal rate for 5 years with different compounding

2 -50 Effective Annual Rate (EAR = EFF%)

2 -50 Effective Annual Rate (EAR = EFF%)

2 -51

2 -51

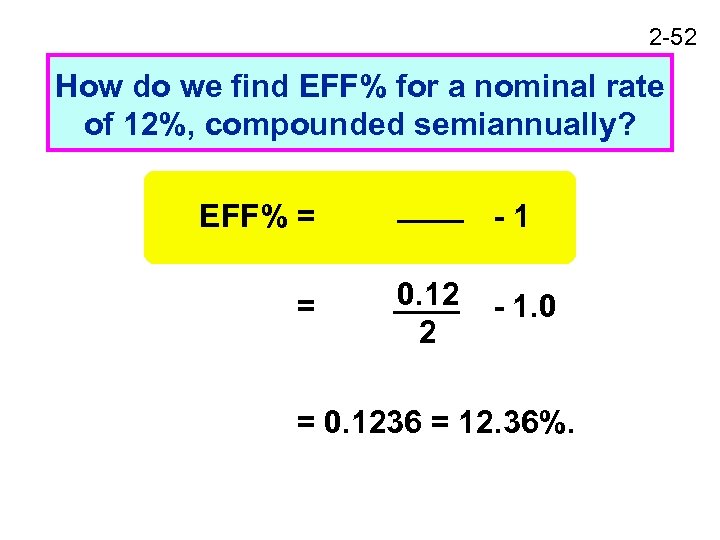

2 -52 How do we find EFF% for a nominal rate of 12%, compounded semiannually? EFF% = = -1 0. 12 2 - 1. 0 = 0. 1236 = 12. 36%.

2 -52 How do we find EFF% for a nominal rate of 12%, compounded semiannually? EFF% = = -1 0. 12 2 - 1. 0 = 0. 1236 = 12. 36%.

2 -53 Finding EFF with HP 10 BII

2 -53 Finding EFF with HP 10 BII

2 -54 EAR (or EFF%) for a Nominal Rate of of 12%

2 -54 EAR (or EFF%) for a Nominal Rate of of 12%

2 -55 Can the effective rate ever be equal to the nominal rate?

2 -55 Can the effective rate ever be equal to the nominal rate?

2 -56 When is each rate used? Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines.

2 -56 When is each rate used? Written into contracts, quoted by banks and brokers. Not used in calculations or shown on time lines.

2 -57 Used in calculations, shown on time lines.

2 -57 Used in calculations, shown on time lines.

2 -58 EAR = EFF%: Used to compare returns on investments with different payments per year. (Used for calculations if and only if dealing with annuities where payments don’t match interest compounding periods. )

2 -58 EAR = EFF%: Used to compare returns on investments with different payments per year. (Used for calculations if and only if dealing with annuities where payments don’t match interest compounding periods. )

2 -59 Amortization Construct an amortization schedule for a $1, 000, 10% annual rate loan with 3 equal payments.

2 -59 Amortization Construct an amortization schedule for a $1, 000, 10% annual rate loan with 3 equal payments.

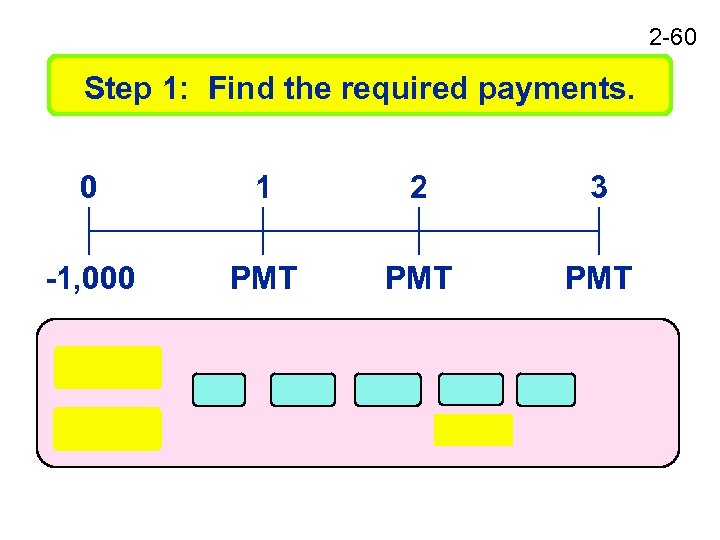

2 -60 Step 1: Find the required payments. 0 1 2 3 -1, 000 PMT PMT

2 -60 Step 1: Find the required payments. 0 1 2 3 -1, 000 PMT PMT

2 -61 Step 2: Find interest charge for Year 1. Step 3: Find repayment of principal in Year 1. Repmt = PMT - INT = $402. 11 - $100 = $302. 11.

2 -61 Step 2: Find interest charge for Year 1. Step 3: Find repayment of principal in Year 1. Repmt = PMT - INT = $402. 11 - $100 = $302. 11.

2 -62 Step 4: Find ending balance after Year 1. End bal = Beg bal - Repmt = $1, 000 - $302. 11 = $697. 89. Repeat these steps for Years 2 and 3 to complete the amortization table.

2 -62 Step 4: Find ending balance after Year 1. End bal = Beg bal - Repmt = $1, 000 - $302. 11 = $697. 89. Repeat these steps for Years 2 and 3 to complete the amortization table.

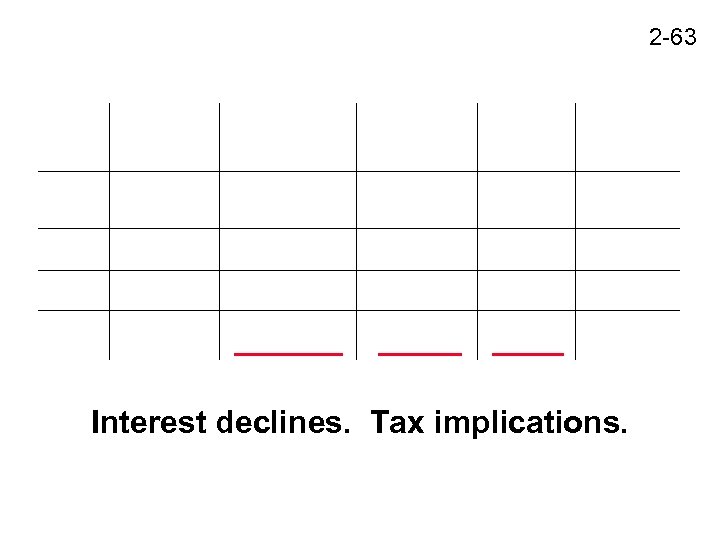

2 -63 Interest declines. Tax implications.

2 -63 Interest declines. Tax implications.

2 -64

2 -64

2 -65

2 -65

2 -66 On January 1 you deposit $100 in an account that pays a nominal interest rate of 11. 33463%, with daily compounding (365 days). How much will you have on October 1, or after 9 months (273 days)? (Days given. )

2 -66 On January 1 you deposit $100 in an account that pays a nominal interest rate of 11. 33463%, with daily compounding (365 days). How much will you have on October 1, or after 9 months (273 days)? (Days given. )

2 -67 FV = $100 1. 00031054 = $100 1. 08846 = $108. 85.

2 -67 FV = $100 1. 00031054 = $100 1. 08846 = $108. 85.

2 -68 Enter i in one step. Leave data in calculator.

2 -68 Enter i in one step. Leave data in calculator.

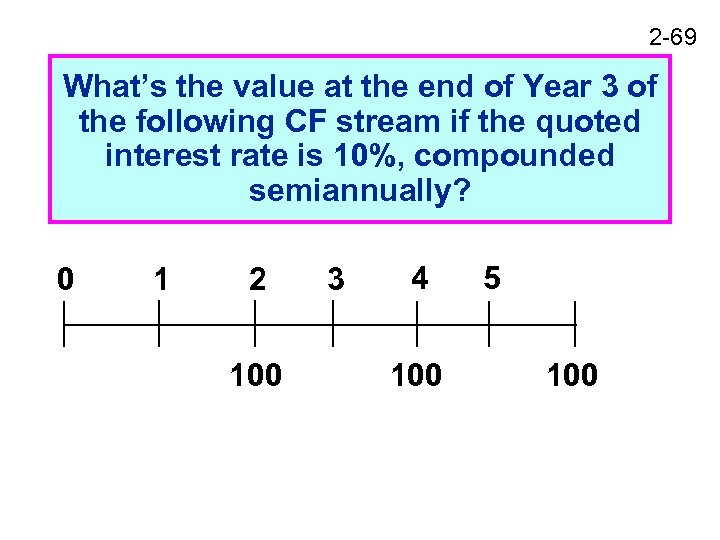

2 -69 What’s the value at the end of Year 3 of the following CF stream if the quoted interest rate is 10%, compounded semiannually? 0 1 2 100 3 4 100 5 100

2 -69 What’s the value at the end of Year 3 of the following CF stream if the quoted interest rate is 10%, compounded semiannually? 0 1 2 100 3 4 100 5 100

2 -70

2 -70

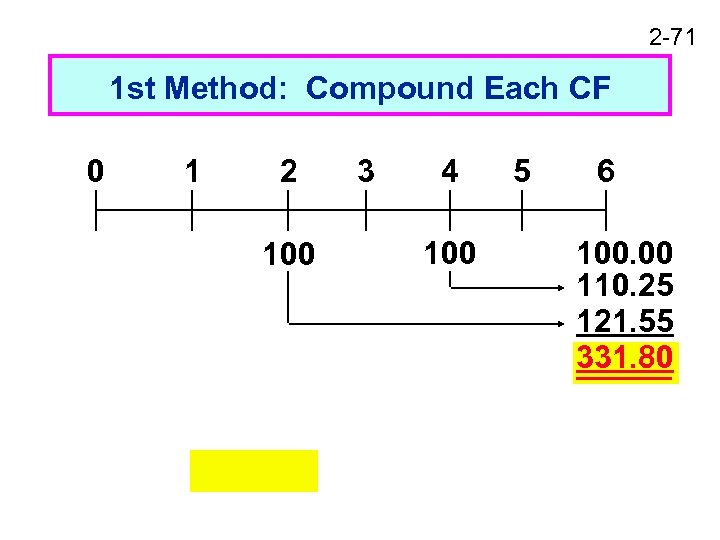

2 -71 1 st Method: Compound Each CF 0 1 2 100 3 4 100 5 6 100. 00 110. 25 121. 55 331. 80

2 -71 1 st Method: Compound Each CF 0 1 2 100 3 4 100 5 6 100. 00 110. 25 121. 55 331. 80

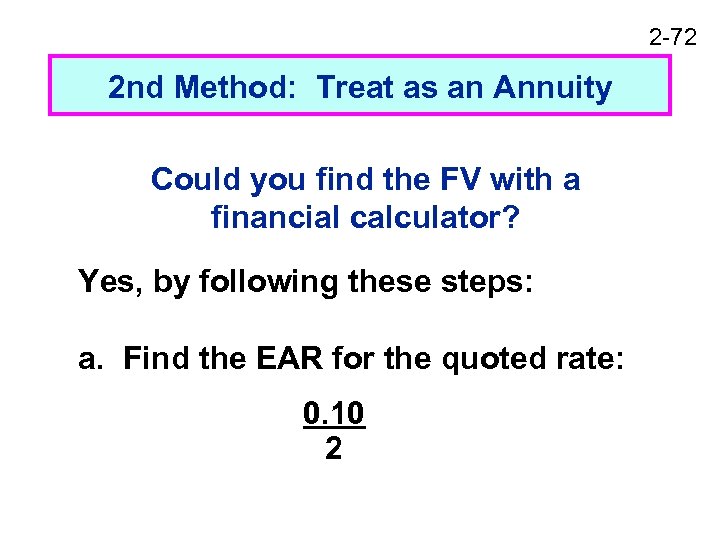

2 -72 2 nd Method: Treat as an Annuity Could you find the FV with a financial calculator? Yes, by following these steps: a. Find the EAR for the quoted rate: 0. 10 2

2 -72 2 nd Method: Treat as an Annuity Could you find the FV with a financial calculator? Yes, by following these steps: a. Find the EAR for the quoted rate: 0. 10 2

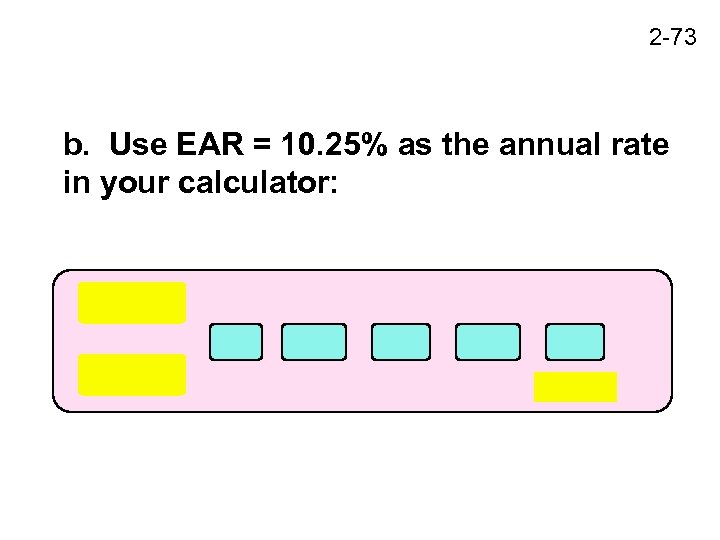

2 -73 b. Use EAR = 10. 25% as the annual rate in your calculator:

2 -73 b. Use EAR = 10. 25% as the annual rate in your calculator:

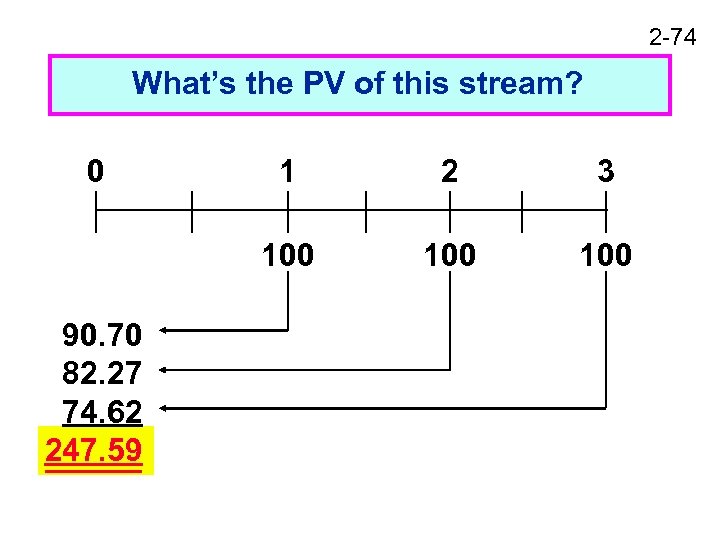

2 -74 What’s the PV of this stream? 0 2 3 100 90. 70 82. 27 74. 62 247. 59 1 100

2 -74 What’s the PV of this stream? 0 2 3 100 90. 70 82. 27 74. 62 247. 59 1 100

2 -75 You are offered a note which pays $1, 000 in 15 months (or 456 days) for $850. You have $850 in a bank which pays a 6. 76649% nominal rate, with 365 daily compounding, which is a daily rate of 0. 018538% and an EAR of 7. 0%. You plan to leave the money in the bank if you don’t buy the note. The note is riskless. Should you buy it?

2 -75 You are offered a note which pays $1, 000 in 15 months (or 456 days) for $850. You have $850 in a bank which pays a 6. 76649% nominal rate, with 365 daily compounding, which is a daily rate of 0. 018538% and an EAR of 7. 0%. You plan to leave the money in the bank if you don’t buy the note. The note is riskless. Should you buy it?

2 -76 3 Ways to Solve: 1. Greatest future wealth: FV 2. Greatest wealth today: PV 3. Highest rate of return: Highest EFF%

2 -76 3 Ways to Solve: 1. Greatest future wealth: FV 2. Greatest wealth today: PV 3. Highest rate of return: Highest EFF%

2 -77 1. Greatest Future Wealth Find FV of $850 left in bank for 15 months and compare with note’s FV = $1, 000. Buy the note: $1, 000 > $924. 97.

2 -77 1. Greatest Future Wealth Find FV of $850 left in bank for 15 months and compare with note’s FV = $1, 000. Buy the note: $1, 000 > $924. 97.

2 -78 Calculator Solution to FV:

2 -78 Calculator Solution to FV:

2 -79 2. Greatest Present Wealth Find PV of note, and compare with its $850 cost:

2 -79 2. Greatest Present Wealth Find PV of note, and compare with its $850 cost:

2 -80 PV of note is greater than its $850 cost, so buy the note. Raises your wealth.

2 -80 PV of note is greater than its $850 cost, so buy the note. Raises your wealth.

2 -81 3. Rate of Return Find the EFF% on note and compare with 7. 0% bank pays, which is your opportunity cost of capital: Now we must solve for i.

2 -81 3. Rate of Return Find the EFF% on note and compare with 7. 0% bank pays, which is your opportunity cost of capital: Now we must solve for i.

2 -82 Convert % to decimal: Decimal = 0. 035646/100 = 0. 00035646.

2 -82 Convert % to decimal: Decimal = 0. 035646/100 = 0. 00035646.

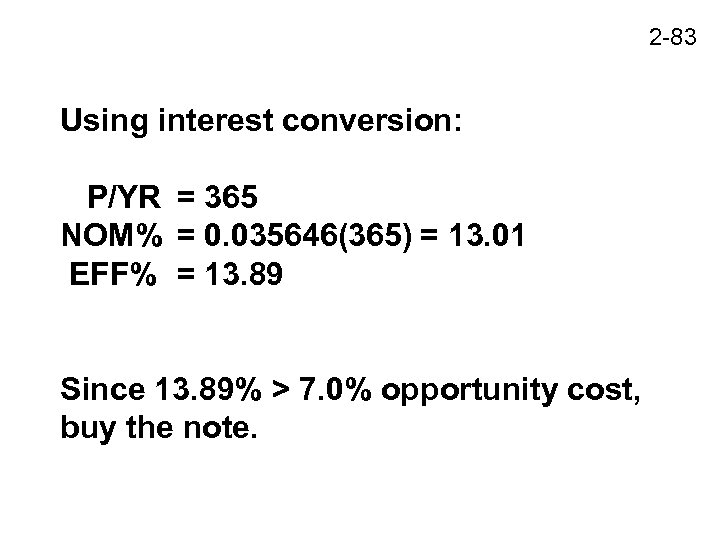

2 -83 Using interest conversion: P/YR = 365 NOM% = 0. 035646(365) = 13. 01 EFF% = 13. 89 Since 13. 89% > 7. 0% opportunity cost, buy the note.

2 -83 Using interest conversion: P/YR = 365 NOM% = 0. 035646(365) = 13. 01 EFF% = 13. 89 Since 13. 89% > 7. 0% opportunity cost, buy the note.