61614034719ea635f73f687353cb3a73.ppt

- Количество слайдов: 23

1991 – 2011: A 20 Year History of Biofuels policy and the impact on the Recreational Marine Industry Biofuels Thom Dammrich, NMMA 1

1991 – 2011: A 20 Year History of Biofuels policy and the impact on the Recreational Marine Industry Biofuels Thom Dammrich, NMMA 1

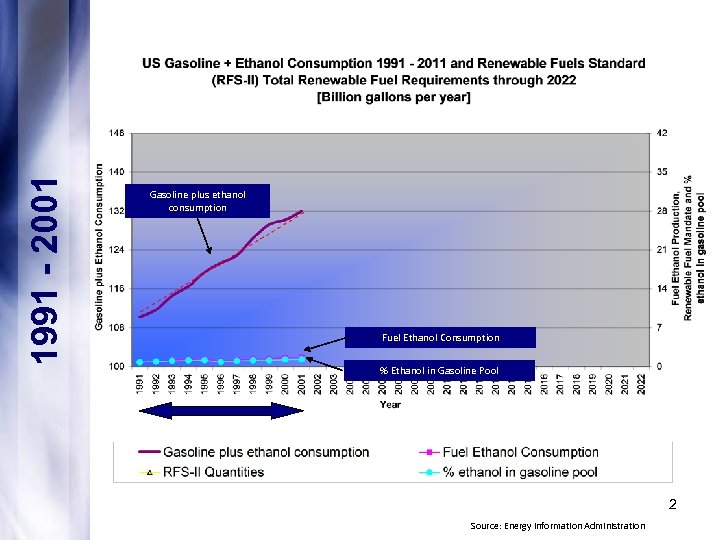

1991 - 2001 Gasoline plus ethanol consumption Fuel Ethanol Consumption % Ethanol in Gasoline Pool 2 Source: Energy Information Administration

1991 - 2001 Gasoline plus ethanol consumption Fuel Ethanol Consumption % Ethanol in Gasoline Pool 2 Source: Energy Information Administration

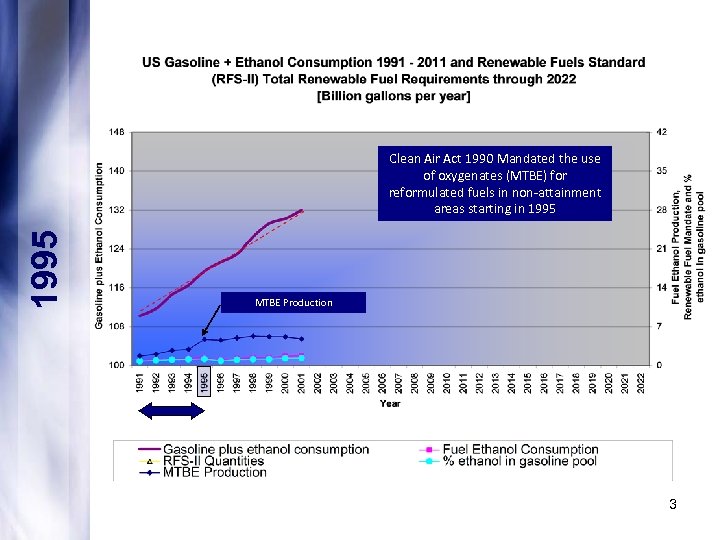

1995 Clean Air Act 1990 Mandated the use of oxygenates (MTBE) for reformulated fuels in non-attainment areas starting in 1995 MTBE Production 3

1995 Clean Air Act 1990 Mandated the use of oxygenates (MTBE) for reformulated fuels in non-attainment areas starting in 1995 MTBE Production 3

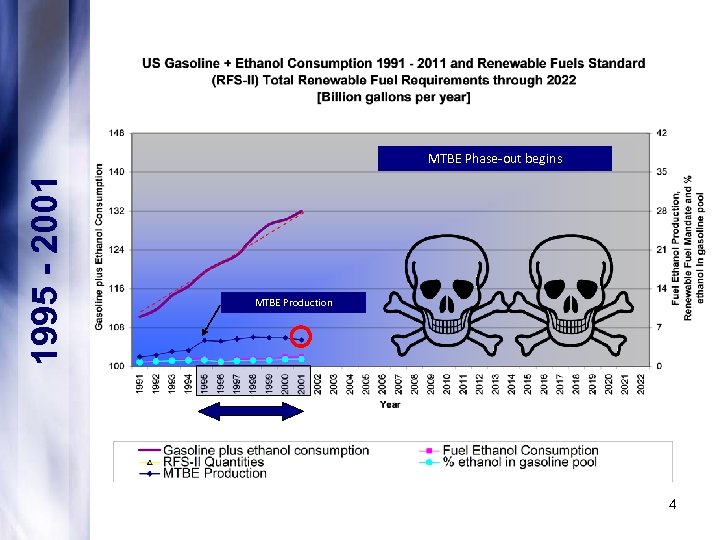

1995 - 2001 MTBE Phase-out begins MTBE Production 4

1995 - 2001 MTBE Phase-out begins MTBE Production 4

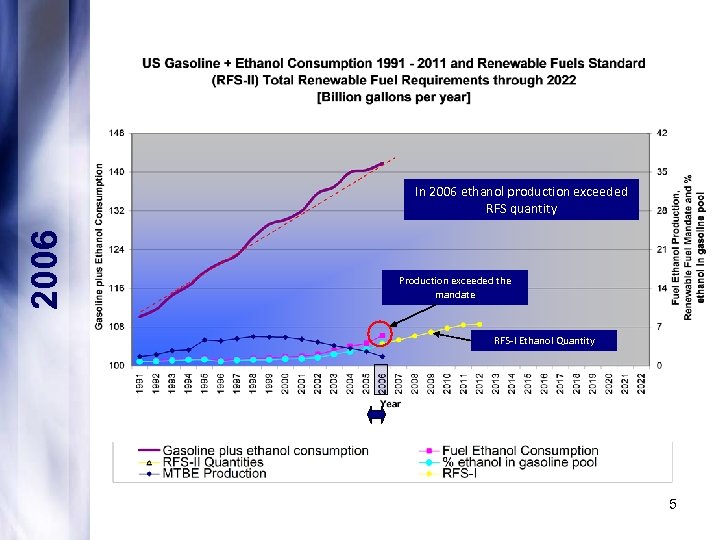

2006 In 2006 ethanol production exceeded RFS quantity Production exceeded the mandate RFS-I Ethanol Quantity 5

2006 In 2006 ethanol production exceeded RFS quantity Production exceeded the mandate RFS-I Ethanol Quantity 5

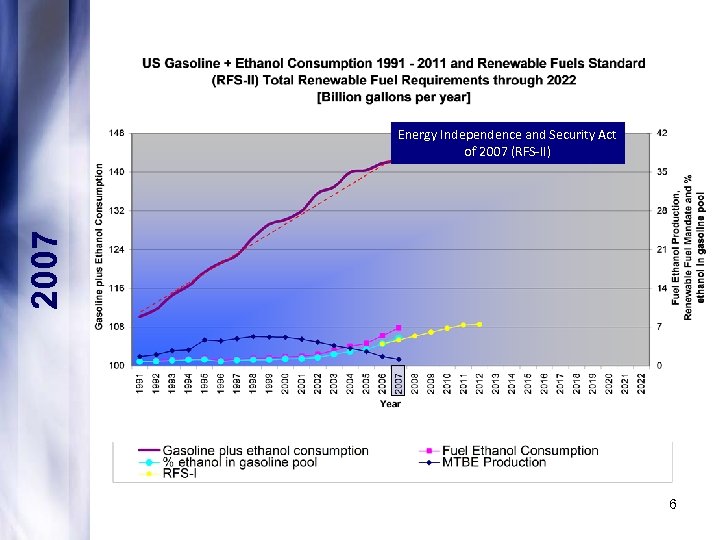

2007 Energy Independence and Security Act of 2007 (RFS-II) 6

2007 Energy Independence and Security Act of 2007 (RFS-II) 6

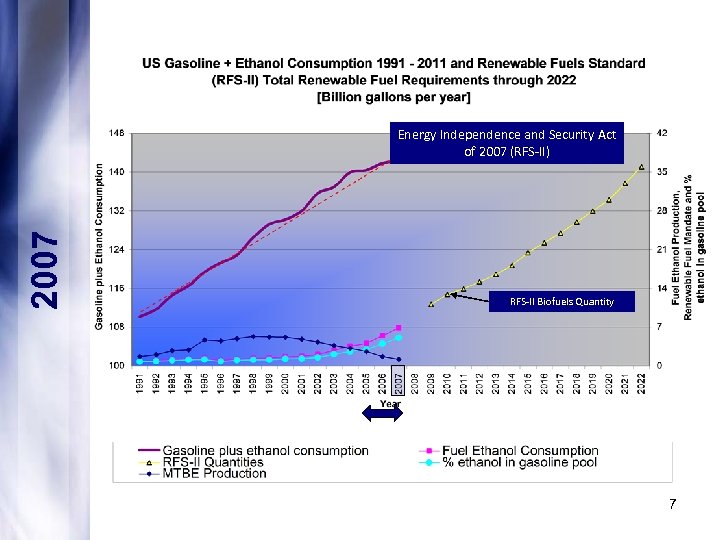

2007 Energy Independence and Security Act of 2007 (RFS-II) RFS-II Biofuels Quantity 7

2007 Energy Independence and Security Act of 2007 (RFS-II) RFS-II Biofuels Quantity 7

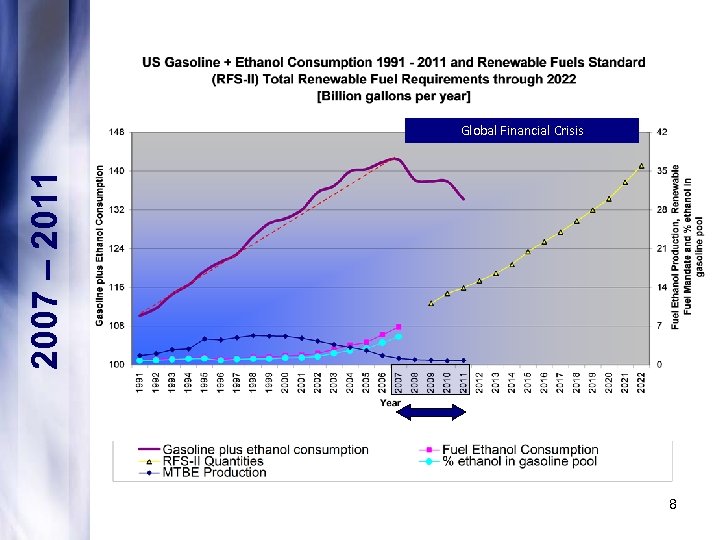

2007 – 2011 Global Financial Crisis 8

2007 – 2011 Global Financial Crisis 8

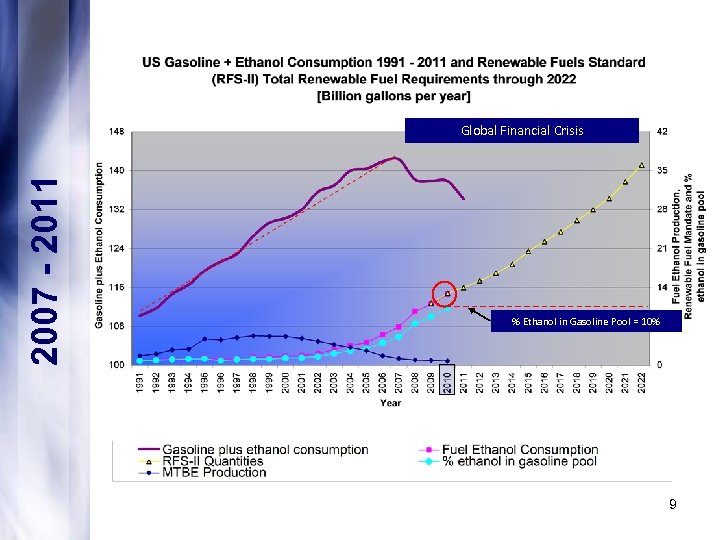

2007 - 2011 Global Financial Crisis % Ethanol in Gasoline Pool = 10% 9

2007 - 2011 Global Financial Crisis % Ethanol in Gasoline Pool = 10% 9

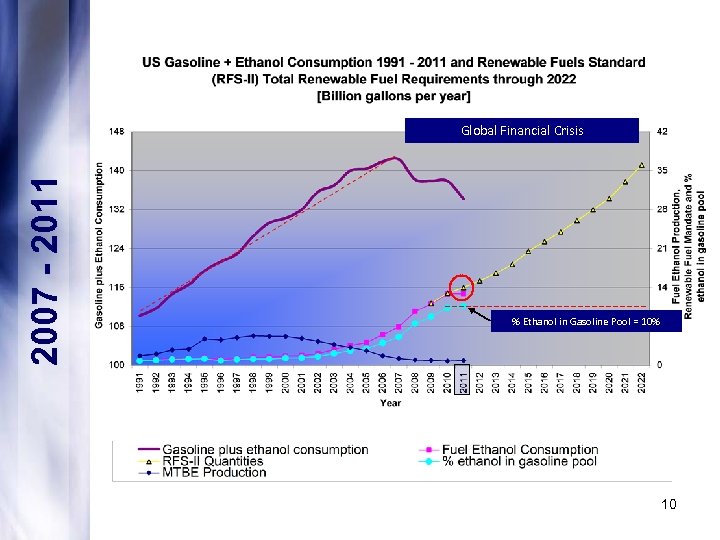

2007 - 2011 Global Financial Crisis % Ethanol in Gasoline Pool = 10% 10

2007 - 2011 Global Financial Crisis % Ethanol in Gasoline Pool = 10% 10

A DOE Funded Mercury Marine and Volvo Penta study of the effects of running 15% ethanol concentration in current production 4 -stroke engines and “legacy” 2 -stroke engines – Verado 300 hp Outboard – Mercury Marine – 9. 9 hp four stroke outboard- Mercury Marine – 200 HP EFI 2. 5 L 2 Stroke- Mercury Marine – 4. 3 Liter Volvo Penta Inboard Engine

A DOE Funded Mercury Marine and Volvo Penta study of the effects of running 15% ethanol concentration in current production 4 -stroke engines and “legacy” 2 -stroke engines – Verado 300 hp Outboard – Mercury Marine – 9. 9 hp four stroke outboard- Mercury Marine – 200 HP EFI 2. 5 L 2 Stroke- Mercury Marine – 4. 3 Liter Volvo Penta Inboard Engine

Cylinder 3 Top Valve Cylinder 6 Top Valve

Cylinder 3 Top Valve Cylinder 6 Top Valve

Remaining Pieces from Cylinder 3 Rod Bearing Cage Undamaged Bearing Undamaged Rod from Cyl 3

Remaining Pieces from Cylinder 3 Rod Bearing Cage Undamaged Bearing Undamaged Rod from Cyl 3

5. Solutions The US Market was saturated with ethanol in 2010. The industry cannot continue to grow beyond that of exports. – Solutions: • Quickly start consuming more gasoline (ridiculous) • Realign the RFS to match the new fuel demand reality (unlikely - does nothing to address the growth of the ethanol industry) • Raise the amount of ethanol allowed in gasoline (E 15 waiver request granted – source of much debate, will cause issues) • Explore other alternative fuels that can better satisfy the RFS volumes without affecting millions of existing engines 14

5. Solutions The US Market was saturated with ethanol in 2010. The industry cannot continue to grow beyond that of exports. – Solutions: • Quickly start consuming more gasoline (ridiculous) • Realign the RFS to match the new fuel demand reality (unlikely - does nothing to address the growth of the ethanol industry) • Raise the amount of ethanol allowed in gasoline (E 15 waiver request granted – source of much debate, will cause issues) • Explore other alternative fuels that can better satisfy the RFS volumes without affecting millions of existing engines 14

What is Butanol? • A four carbon alcohol (C 4 H 9 OH), colorless, neutral liquid of medium volatility with a characteristic banana-like odor. • Traditionally petrochemical derived Generally used to make other chemicals, or used as a solvent or an ingredient in formulated products such as cosmetics. 15

What is Butanol? • A four carbon alcohol (C 4 H 9 OH), colorless, neutral liquid of medium volatility with a characteristic banana-like odor. • Traditionally petrochemical derived Generally used to make other chemicals, or used as a solvent or an ingredient in formulated products such as cosmetics. 15

Butanol Properties: • Butanol 99, 800 BTU/gallon • Gasoline 116, 000 BTU/gallon • Approximately 86% of the energy content of gasoline • Ethanol 76, 300 BTU/gallon (68% of the energy content of gasoline) 16

Butanol Properties: • Butanol 99, 800 BTU/gallon • Gasoline 116, 000 BTU/gallon • Approximately 86% of the energy content of gasoline • Ethanol 76, 300 BTU/gallon (68% of the energy content of gasoline) 16

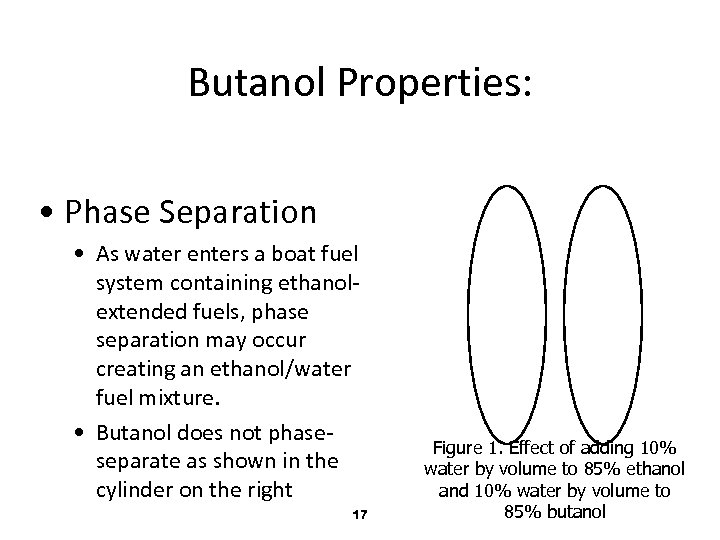

Butanol Properties: • Phase Separation • As water enters a boat fuel system containing ethanolextended fuels, phase separation may occur creating an ethanol/water fuel mixture. • Butanol does not phaseseparate as shown in the cylinder on the right 17 Figure 1. Effect of adding 10% water by volume to 85% ethanol and 10% water by volume to 85% butanol

Butanol Properties: • Phase Separation • As water enters a boat fuel system containing ethanolextended fuels, phase separation may occur creating an ethanol/water fuel mixture. • Butanol does not phaseseparate as shown in the cylinder on the right 17 Figure 1. Effect of adding 10% water by volume to 85% ethanol and 10% water by volume to 85% butanol

Butanol Introduction: • Less susceptible to phase separation means butanol could be successfully delivered in existing pipelines • Eliminates need for splash-blending • Least corrosive of alcohols • Higher energy content – can be blended into gasoline at higher percentages than ethanol 18

Butanol Introduction: • Less susceptible to phase separation means butanol could be successfully delivered in existing pipelines • Eliminates need for splash-blending • Least corrosive of alcohols • Higher energy content – can be blended into gasoline at higher percentages than ethanol 18

Purpose of Testing: • To evaluate the effect of butanol-extended fuels in a harsh marine environment and to see if there is a better alternative to ethanolextended fuels 19

Purpose of Testing: • To evaluate the effect of butanol-extended fuels in a harsh marine environment and to see if there is a better alternative to ethanolextended fuels 19

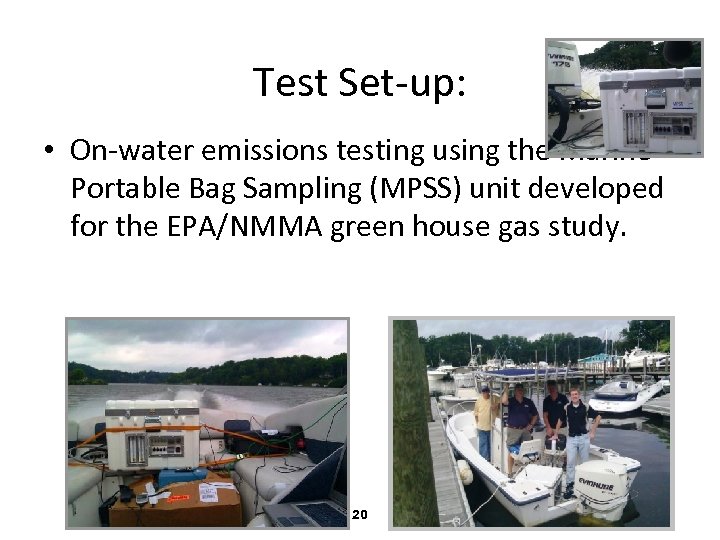

Test Set-up: • On-water emissions testing using the Marine Portable Bag Sampling (MPSS) unit developed for the EPA/NMMA green house gas study. 20

Test Set-up: • On-water emissions testing using the Marine Portable Bag Sampling (MPSS) unit developed for the EPA/NMMA green house gas study. 20

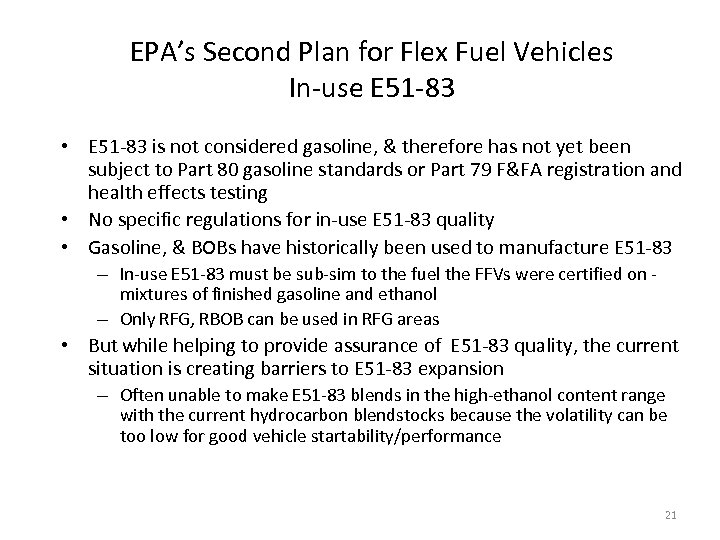

EPA’s Second Plan for Flex Fuel Vehicles In-use E 51 -83 • E 51 -83 is not considered gasoline, & therefore has not yet been subject to Part 80 gasoline standards or Part 79 F&FA registration and health effects testing • No specific regulations for in-use E 51 -83 quality • Gasoline, & BOBs have historically been used to manufacture E 51 -83 – In-use E 51 -83 must be sub-sim to the fuel the FFVs were certified on mixtures of finished gasoline and ethanol – Only RFG, RBOB can be used in RFG areas • But while helping to provide assurance of E 51 -83 quality, the current situation is creating barriers to E 51 -83 expansion – Often unable to make E 51 -83 blends in the high-ethanol content range with the current hydrocarbon blendstocks because the volatility can be too low for good vehicle startability/performance 21

EPA’s Second Plan for Flex Fuel Vehicles In-use E 51 -83 • E 51 -83 is not considered gasoline, & therefore has not yet been subject to Part 80 gasoline standards or Part 79 F&FA registration and health effects testing • No specific regulations for in-use E 51 -83 quality • Gasoline, & BOBs have historically been used to manufacture E 51 -83 – In-use E 51 -83 must be sub-sim to the fuel the FFVs were certified on mixtures of finished gasoline and ethanol – Only RFG, RBOB can be used in RFG areas • But while helping to provide assurance of E 51 -83 quality, the current situation is creating barriers to E 51 -83 expansion – Often unable to make E 51 -83 blends in the high-ethanol content range with the current hydrocarbon blendstocks because the volatility can be too low for good vehicle startability/performance 21

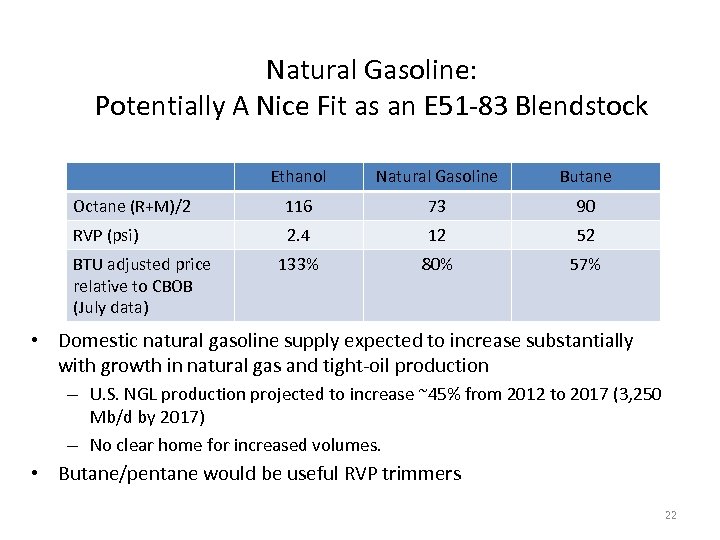

Natural Gasoline: Potentially A Nice Fit as an E 51 -83 Blendstock Ethanol Natural Gasoline Butane Octane (R+M)/2 116 73 90 RVP (psi) 2. 4 12 52 133% 80% 57% BTU adjusted price relative to CBOB (July data) • Domestic natural gasoline supply expected to increase substantially with growth in natural gas and tight-oil production – U. S. NGL production projected to increase ~45% from 2012 to 2017 (3, 250 Mb/d by 2017) – No clear home for increased volumes. • Butane/pentane would be useful RVP trimmers 22

Natural Gasoline: Potentially A Nice Fit as an E 51 -83 Blendstock Ethanol Natural Gasoline Butane Octane (R+M)/2 116 73 90 RVP (psi) 2. 4 12 52 133% 80% 57% BTU adjusted price relative to CBOB (July data) • Domestic natural gasoline supply expected to increase substantially with growth in natural gas and tight-oil production – U. S. NGL production projected to increase ~45% from 2012 to 2017 (3, 250 Mb/d by 2017) – No clear home for increased volumes. • Butane/pentane would be useful RVP trimmers 22

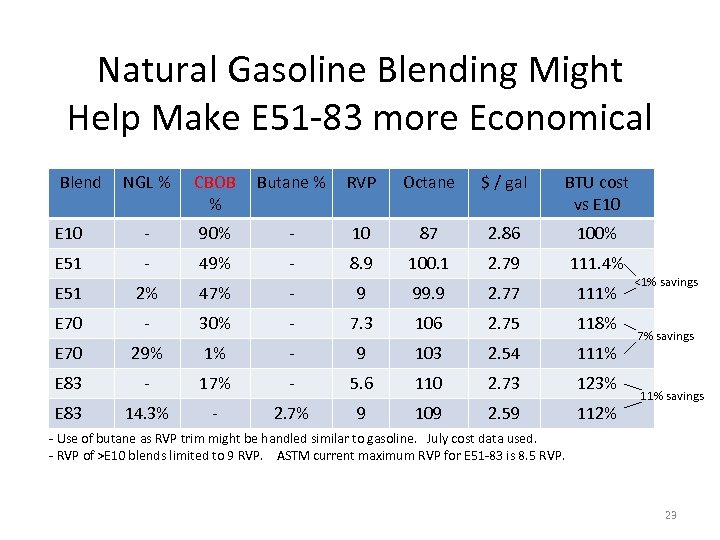

Natural Gasoline Blending Might Help Make E 51 -83 more Economical Blend NGL % CBOB % Butane % RVP Octane $ / gal BTU cost vs E 10 - 90% - 10 87 2. 86 100% E 51 - 49% - 8. 9 100. 1 2. 79 111. 4% E 51 2% 47% - 9 99. 9 2. 77 111% E 70 - 30% - 7. 3 106 2. 75 118% E 70 29% 1% - 9 103 2. 54 111% E 83 - 17% - 5. 6 110 2. 73 123% E 83 14. 3% - 2. 7% 9 109 2. 59 112% <1% savings 7% savings 11% savings - Use of butane as RVP trim might be handled similar to gasoline. July cost data used. - RVP of >E 10 blends limited to 9 RVP. ASTM current maximum RVP for E 51 -83 is 8. 5 RVP. 23

Natural Gasoline Blending Might Help Make E 51 -83 more Economical Blend NGL % CBOB % Butane % RVP Octane $ / gal BTU cost vs E 10 - 90% - 10 87 2. 86 100% E 51 - 49% - 8. 9 100. 1 2. 79 111. 4% E 51 2% 47% - 9 99. 9 2. 77 111% E 70 - 30% - 7. 3 106 2. 75 118% E 70 29% 1% - 9 103 2. 54 111% E 83 - 17% - 5. 6 110 2. 73 123% E 83 14. 3% - 2. 7% 9 109 2. 59 112% <1% savings 7% savings 11% savings - Use of butane as RVP trim might be handled similar to gasoline. July cost data used. - RVP of >E 10 blends limited to 9 RVP. ASTM current maximum RVP for E 51 -83 is 8. 5 RVP. 23