cf5a741b299c8f2511197249d3db3d6b.ppt

- Количество слайдов: 27

192 Ahmad Block, New Garden Town, Lahore - Pakistan. Ph: (92 -42) 35913096 - 98, Fax: (92 -42) 35913056 Email: info@alhudacibe. com www. alhudacibe. com

Murabahah Abdul Samad Al. Huda CIBE

Presentation Outline n n n This module will highlight the following aspects of Murabaha: Step by Step Murabaha Financing Documentation Profit Calculation Issues Conclusion

Murabaha - Definition /Introduction n In literary terms Ba’y Murabaha means “sale on profit” Murabaha is a particular kind of sale where the seller discloses its cost and profit charged thereon. The price in this sale can be both on spot and deferred

MFI Murabaha n n The product of Murabaha that is being used in MFIing as a mode of finance is something different from the Murabaha used in normal trade. This transaction is concluded with a prior promise to buy, submitted by a person interested in acquiring good through the institution.

MFI Murabaha n n n It is a contract wherein the institution, upon request by the customer, purchases an asset from the third party usually a supplier/vendor and resells the same to the customer either against immediate payment or on a deferred payment basis. It is called Murabaha to the purchase order. It is a bunch of contracts completed in steps and ultimately meet the financial needs of the client.

Scope of Murabaha n n As it is a kind of sale, there must be a seller and buyer and something that is bought and sold. The institution is the seller and the client is buyer. It cannot be used as a substitute for running finance facility, which provides cash for fulfilling various need of the client. It is fixed price sale and normally is done for short term. The transaction can be used in order to meet the working capital requirement however it cannot be used to meet liquidity requirements.

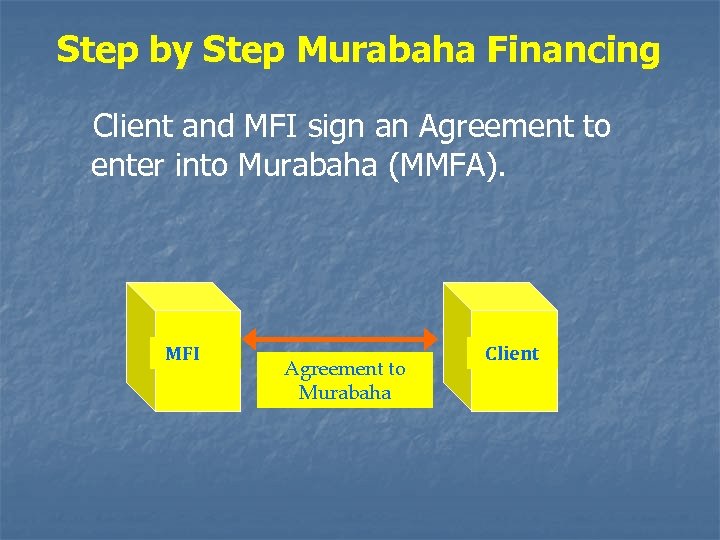

Step by Step Murabaha Financing Client and MFI sign an Agreement to enter into Murabaha (MMFA). MFI Agreement to Murabaha Client

Step by step Murabaha Financing Client appointed as Agent to purchase goods on MFI’s behalf. In this case, the concerned branch Manager will explain the appointment of client as an Agent, which will be checked by the Shariah Advisor. MFI Agency Agreement Client

Step by step Murabaha Financing MFI gives money to agent/supplier for purchase of goods. MFI Client Agreement to Murabaha Agency Agreement Disbursement to the agent or supplier Supplier

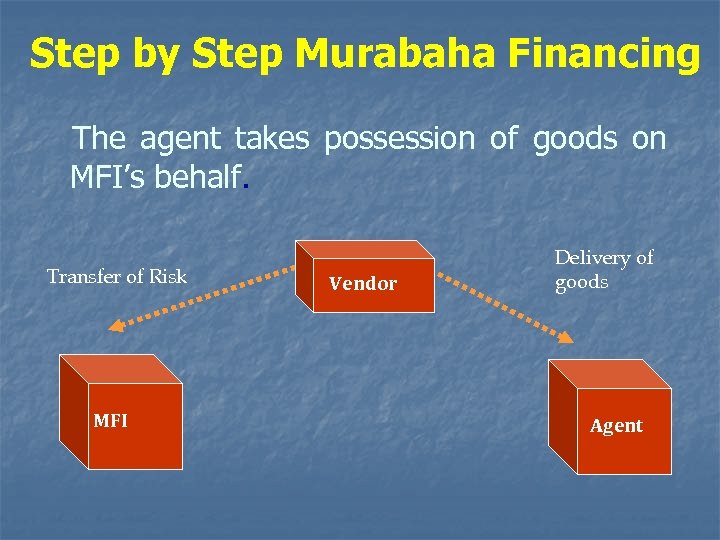

Step by Step Murabaha Financing The agent takes possession of goods on MFI’s behalf. Transfer of Risk MFI Vendor Delivery of goods Agent

Step by Step Murabaha Financing Client makes an offer to purchase the goods from MFI through a declaration. MFI Client Offer to purchase

Step by step Murabaha Financing MFI accepts the offer and sale is concluded. Murabaha Agreement + Transfer of Title MFI Client

Step by step Murabaha Financing Client pays agreed price to MFI according to an agreed schedule. Usually on a deferred payment basis (Bai Muajjal) MFI Payment of Price Client

Steps Of MFI Murabaha MOU Order Form Agency Agreement Purchase Payment of Purchase Price Possession Offer and Acceptance (Declaration) Payment of Murabaha Price

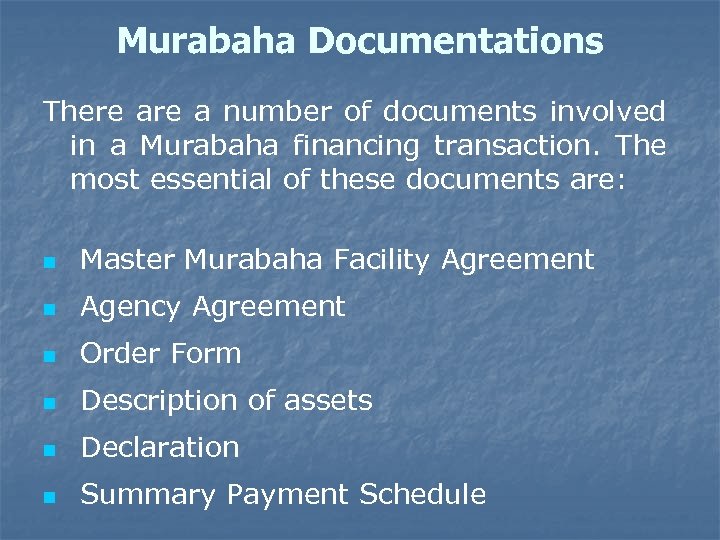

Murabaha Documentations There a number of documents involved in a Murabaha financing transaction. The most essential of these documents are: n Master Murabaha Facility Agreement n Agency Agreement n Order Form n Description of assets n Declaration n Summary Payment Schedule

ISSUES RELATED TO MURABAHA

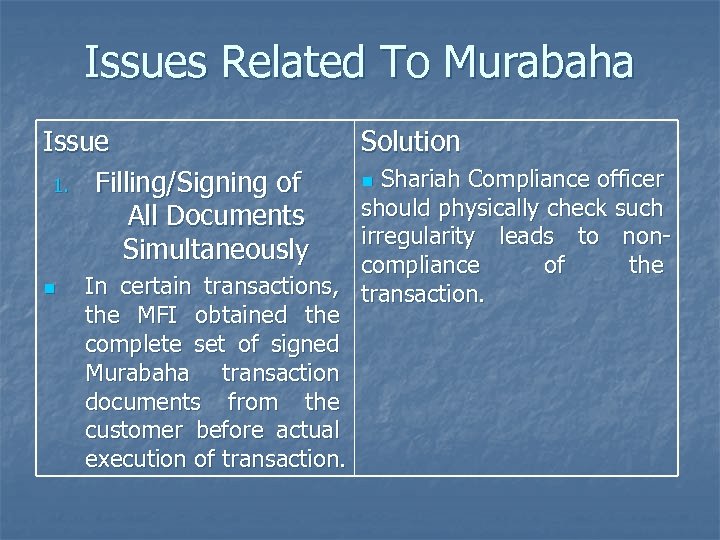

Issues Related To Murabaha Issue 1. Filling/Signing of All Documents Simultaneously n Solution n Shariah Compliance officer should physically check such irregularity leads to noncompliance of the In certain transactions, transaction. the MFI obtained the complete set of signed Murabaha transaction documents from the customer before actual execution of transaction.

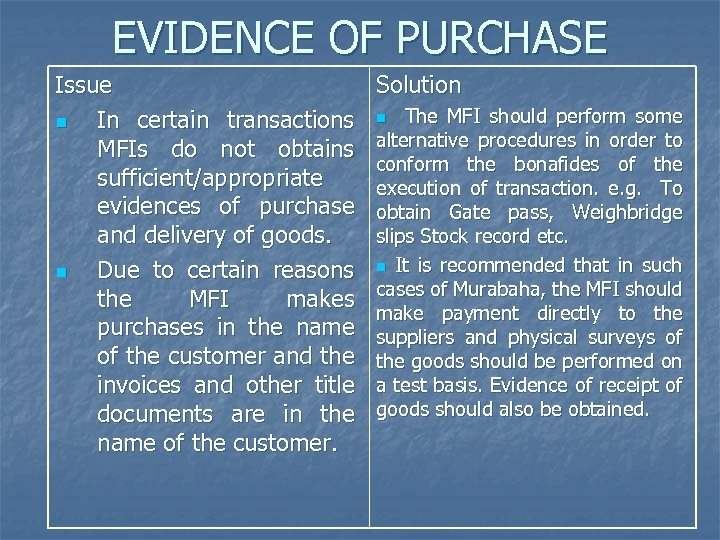

EVIDENCE OF PURCHASE Issue n In certain transactions MFIs do not obtains sufficient/appropriate evidences of purchase and delivery of goods. n Due to certain reasons the MFI makes purchases in the name of the customer and the invoices and other title documents are in the name of the customer. Solution n The MFI should perform some alternative procedures in order to conform the bonafides of the execution of transaction. e. g. To obtain Gate pass, Weighbridge slips Stock record etc. n It is recommended that in such cases of Murabaha, the MFI should make payment directly to the suppliers and physical surveys of the goods should be performed on a test basis. Evidence of receipt of goods should also be obtained.

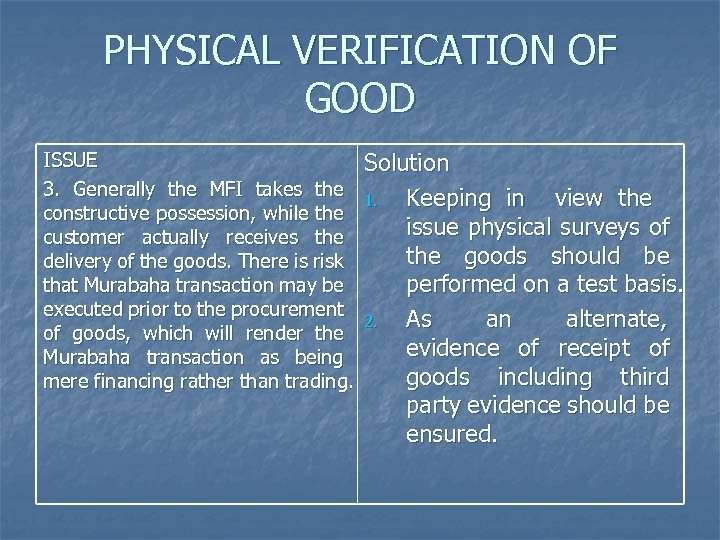

PHYSICAL VERIFICATION OF GOOD ISSUE Solution 3. Generally the MFI takes the 1. Keeping in view the constructive possession, while the issue physical surveys of customer actually receives the goods should be delivery of the goods. There is risk that Murabaha transaction may be performed on a test basis. executed prior to the procurement 2. As an alternate, of goods, which will render the evidence of receipt of Murabaha transaction as being goods including third mere financing rather than trading. party evidence should be ensured.

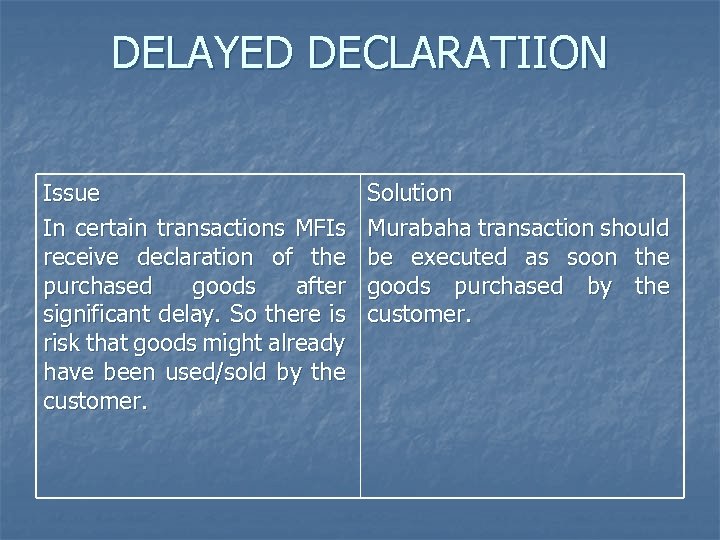

DELAYED DECLARATIION Issue In certain transactions MFIs receive declaration of the purchased goods after significant delay. So there is risk that goods might already have been used/sold by the customer. Solution Murabaha transaction should be executed as soon the goods purchased by the customer.

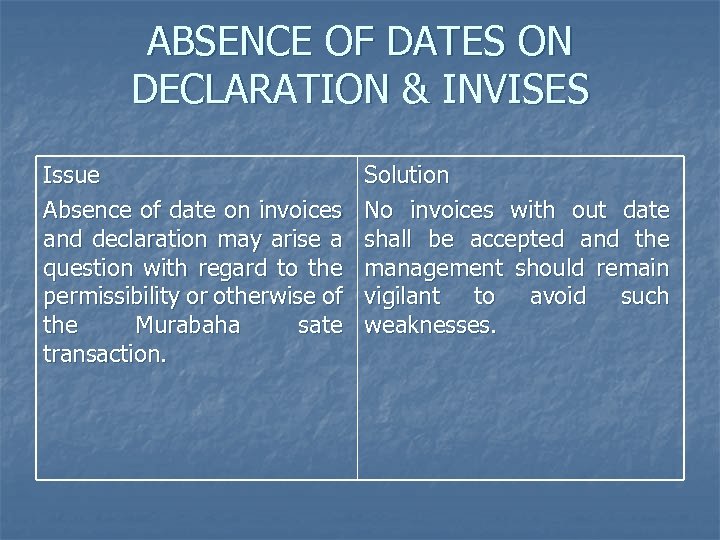

ABSENCE OF DATES ON DECLARATION & INVISES Issue Absence of date on invoices and declaration may arise a question with regard to the permissibility or otherwise of the Murabaha sate transaction. Solution No invoices with out date shall be accepted and the management should remain vigilant to avoid such weaknesses.

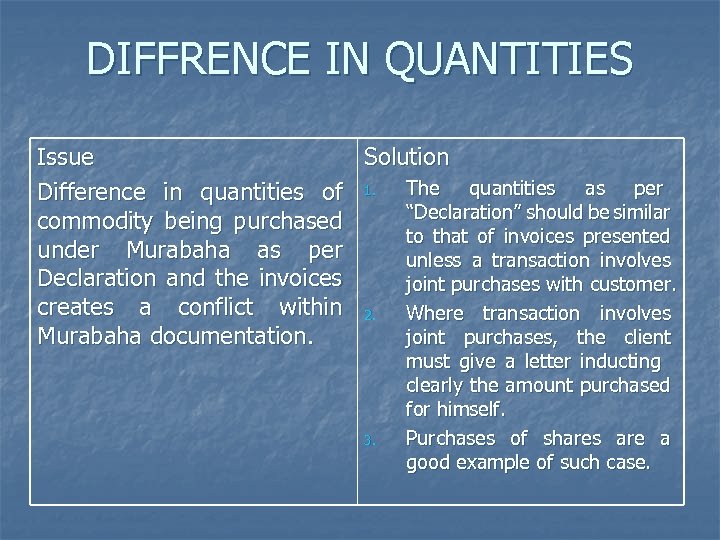

DIFFRENCE IN QUANTITIES Issue Solution Difference in quantities of 1. The quantities as per “Declaration” should be similar commodity being purchased to that of invoices presented under Murabaha as per unless a transaction involves Declaration and the invoices joint purchases with customer. creates a conflict within 2. Where transaction involves joint purchases, the client Murabaha documentation. 3. must give a letter inducting clearly the amount purchased for himself. Purchases of shares are a good example of such case.

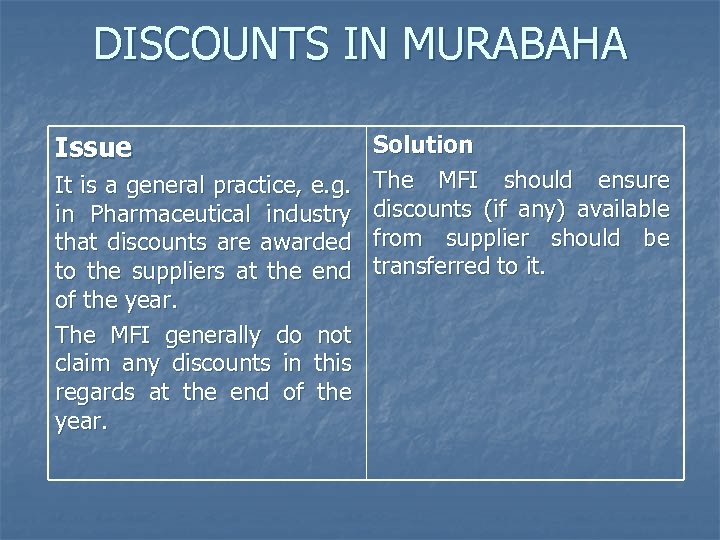

DISCOUNTS IN MURABAHA Issue It is a general practice, e. g. in Pharmaceutical industry that discounts are awarded to the suppliers at the end of the year. The MFI generally do not claim any discounts in this regards at the end of the year. Solution The MFI should ensure discounts (if any) available from supplier should be transferred to it.

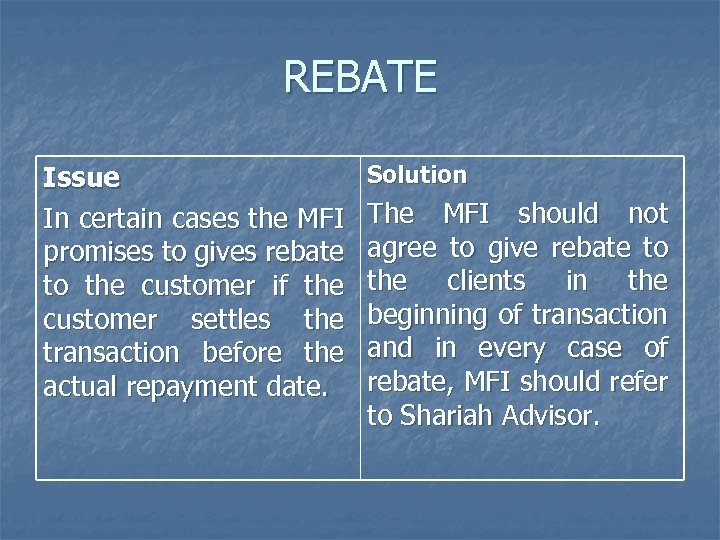

REBATE Issue In certain cases the MFI promises to gives rebate to the customer if the customer settles the transaction before the actual repayment date. Solution The MFI should not agree to give rebate to the clients in the beginning of transaction and in every case of rebate, MFI should refer to Shariah Advisor.

PRICING IN MURABAHA Issue In most of the cases of import Murabaha, the MFIs do not consider custom duty, LC charges etc in their pricing mechanism and the customer borne all these charges. Solution These charges related to the ownership of the asset and should be borne by the MFI instead of the customer. The MFI may add these charges in the cost of Murabaha asset.

192 Ahmad Block, New Garden Town, Lahore - Pakistan. Ph: (92 -42) 35913096 - 98, Fax: (92 -42) 35913056 Email: info@alhudacibe. com www. alhudacibe. com

cf5a741b299c8f2511197249d3db3d6b.ppt