74faa00be9e39328fe345746a448f010.ppt

- Количество слайдов: 32

#19 Unit 2 Microeconomics

#19 Unit 2 Microeconomics

Unit 2 Warm Ups #20

Unit 2 Warm Ups #20

Key Terms l Sole proprietorship- a business owned by one person l Unlimited liability -when the owner is responsible for the l l l company’s debts Partnership- a business owned by two or more people who share its risks and rewards Corporation- a company that is registered by a state and operates apart from its owners Limited liability- holding a firm’s owners responsible for no more than the capital that they have invested in it Cooperative- an organization that is owned and operated by its members Nonprofit organization- a type of business that focuses on providing service, not on making a profit Franchise- a contractual agreement to use the name and sell the products or services of a company in a designated geographic area

Key Terms l Sole proprietorship- a business owned by one person l Unlimited liability -when the owner is responsible for the l l l company’s debts Partnership- a business owned by two or more people who share its risks and rewards Corporation- a company that is registered by a state and operates apart from its owners Limited liability- holding a firm’s owners responsible for no more than the capital that they have invested in it Cooperative- an organization that is owned and operated by its members Nonprofit organization- a type of business that focuses on providing service, not on making a profit Franchise- a contractual agreement to use the name and sell the products or services of a company in a designated geographic area

Business Organizations #22 l 1. Sole Proprietorship—A business owned and operated by one person. u u Oldest, simplest, most common type Who owns SP’s? (Internet advantages)

Business Organizations #22 l 1. Sole Proprietorship—A business owned and operated by one person. u u Oldest, simplest, most common type Who owns SP’s? (Internet advantages)

Advantages of Sole Proprietorships: 1. Low Cost start up 2. Full control 3. Exclusive right to all profits

Advantages of Sole Proprietorships: 1. Low Cost start up 2. Full control 3. Exclusive right to all profits

Sole Proprietorships l 1. Low Cost Start Up— u Require small amount of money u Involve few legal requirements Ø Zoning Laws—Must observe; not all businesses can operate in certain areas because of zoning restrictions. Ø May have to obtain city/county licenses

Sole Proprietorships l 1. Low Cost Start Up— u Require small amount of money u Involve few legal requirements Ø Zoning Laws—Must observe; not all businesses can operate in certain areas because of zoning restrictions. Ø May have to obtain city/county licenses

Sole Proprietorships l 2. Control—You maintain complete control and can make quick decisions. u Minimal paperwork, meetings, depends on YOU! l 3. Profit—The owner (YOU) keeps all the profits.

Sole Proprietorships l 2. Control—You maintain complete control and can make quick decisions. u Minimal paperwork, meetings, depends on YOU! l 3. Profit—The owner (YOU) keeps all the profits.

Sole Proprietorships l Disadvantages: 1. Unlimited liability 2. Sole responsibility 3. Difficulty Raising Capital 4. Lack of longevity

Sole Proprietorships l Disadvantages: 1. Unlimited liability 2. Sole responsibility 3. Difficulty Raising Capital 4. Lack of longevity

Disadvantages of S. P. l 1. Unlimited Liability—YOU are personally responsible for all business debts. l 2. Sole Responsibility—YOU are responsible for ALL aspects of running your business. l 3. Difficulty Raising Capital— u Collateral—Anything of value you pledge as security for a loan.

Disadvantages of S. P. l 1. Unlimited Liability—YOU are personally responsible for all business debts. l 2. Sole Responsibility—YOU are responsible for ALL aspects of running your business. l 3. Difficulty Raising Capital— u Collateral—Anything of value you pledge as security for a loan.

Disadvantages of SP l 4. Lack of Longevity—The length of a firm’s life or the amount of time the business operates. u Ex. Your health u Ex. You lose interest in the business u Ex. Your competence

Disadvantages of SP l 4. Lack of Longevity—The length of a firm’s life or the amount of time the business operates. u Ex. Your health u Ex. You lose interest in the business u Ex. Your competence

Partnerships l Partnership—A business that is owned and controlled by two or more people. Ex. Small retail stores, construction companies, doctors, lawyers, accountants, etc. Two types of partnerships: 1. General—Partners enjoy equal decision making authority. They also have unlimited liability. 2. Limited—Partners who provide capital($) but do not play an active role in running the company. Liability is also limited. u

Partnerships l Partnership—A business that is owned and controlled by two or more people. Ex. Small retail stores, construction companies, doctors, lawyers, accountants, etc. Two types of partnerships: 1. General—Partners enjoy equal decision making authority. They also have unlimited liability. 2. Limited—Partners who provide capital($) but do not play an active role in running the company. Liability is also limited. u

Advantages of Partnerships l Advantages of Partnerships: 1. Ease of start-up 2. Specialization 3. Shared decision making 4. Shared business losses

Advantages of Partnerships l Advantages of Partnerships: 1. Ease of start-up 2. Specialization 3. Shared decision making 4. Shared business losses

Advantages of Partnerships l 1. Easy start up– Few government regulations u Costs tend to be low u Partners usually develop a partnership contract u l 2. Specialization—Specific business duties can be assigned to different partners based on expertise and individual talents. Ø Ex. One good in sales—other good in accounting

Advantages of Partnerships l 1. Easy start up– Few government regulations u Costs tend to be low u Partners usually develop a partnership contract u l 2. Specialization—Specific business duties can be assigned to different partners based on expertise and individual talents. Ø Ex. One good in sales—other good in accounting

Advantages of Partnerships l 3. Shared Decision Making—Partners can minimize mistakes by consulting with each other. u Can pool each others skills l 4. Shared Business Losses—The sharing of losses may enable a partnership to survive a situation that might cause a sole proprietorship to fail. Example: Ø 2 partners: Business loss $20, 000: Each partner loses only $10, 000 each. Sole Prop. =$20, 000

Advantages of Partnerships l 3. Shared Decision Making—Partners can minimize mistakes by consulting with each other. u Can pool each others skills l 4. Shared Business Losses—The sharing of losses may enable a partnership to survive a situation that might cause a sole proprietorship to fail. Example: Ø 2 partners: Business loss $20, 000: Each partner loses only $10, 000 each. Sole Prop. =$20, 000

Disadvantages of Partnerships l 1. Unlimited Liability—Each partner is responsible for debts incurred by the business. If one partner refuses to pay for his share, then the other partners are still liable for the debt. u 2. Potential Conflict—Disagreements or conflicts may arise among partners. u • Different management styles • Personality conflicts

Disadvantages of Partnerships l 1. Unlimited Liability—Each partner is responsible for debts incurred by the business. If one partner refuses to pay for his share, then the other partners are still liable for the debt. u 2. Potential Conflict—Disagreements or conflicts may arise among partners. u • Different management styles • Personality conflicts

Disadvantages of Partnerships l 3. Lack of Longevity—Life of the business is dependent on the willingness and ability of the partners to continue to work together. u One may decide that he/she can no longer work together as partners. u Find a new partner or maybe even close the business.

Disadvantages of Partnerships l 3. Lack of Longevity—Life of the business is dependent on the willingness and ability of the partners to continue to work together. u One may decide that he/she can no longer work together as partners. u Find a new partner or maybe even close the business.

Franchise l a contractual agreement to use the name and sell the products or services of a company in a designated geographic area

Franchise l a contractual agreement to use the name and sell the products or services of a company in a designated geographic area

Advantages of Franchise l 1. Smaller than usual capital investment l 2. Prior public acceptance of product l 3. Better than average profit margins l 4. Management assistance

Advantages of Franchise l 1. Smaller than usual capital investment l 2. Prior public acceptance of product l 3. Better than average profit margins l 4. Management assistance

Disadvantages of Franchise l 1. Possible high franchiser fee l 2. Some loss of independence l 3. Possible difficulties in canceling contract

Disadvantages of Franchise l 1. Possible high franchiser fee l 2. Some loss of independence l 3. Possible difficulties in canceling contract

Corporations l Corporations—Are companies that are formed as legally distinct from their owners and are treated as if they were individuals. u Can: Hire workers, make contracts, pay taxes, sue and be sued, make & sell products.

Corporations l Corporations—Are companies that are formed as legally distinct from their owners and are treated as if they were individuals. u Can: Hire workers, make contracts, pay taxes, sue and be sued, make & sell products.

Forming a Corporation 7. 3 l 1. Must apply for a state license known as the: articles of incorporation. Includes: name and purpose of corp. u Address and headquarters u Amount of $ it expects to raise u Names and addresses of officers u Length of time expected to exist u u License granted is called: corporate charter

Forming a Corporation 7. 3 l 1. Must apply for a state license known as the: articles of incorporation. Includes: name and purpose of corp. u Address and headquarters u Amount of $ it expects to raise u Names and addresses of officers u Length of time expected to exist u u License granted is called: corporate charter

Corporate Structure l Structure: u Owners/Shareholders u Board of Directors u Corporate Officers u Vice Presidents u Department Heads u Employees

Corporate Structure l Structure: u Owners/Shareholders u Board of Directors u Corporate Officers u Vice Presidents u Department Heads u Employees

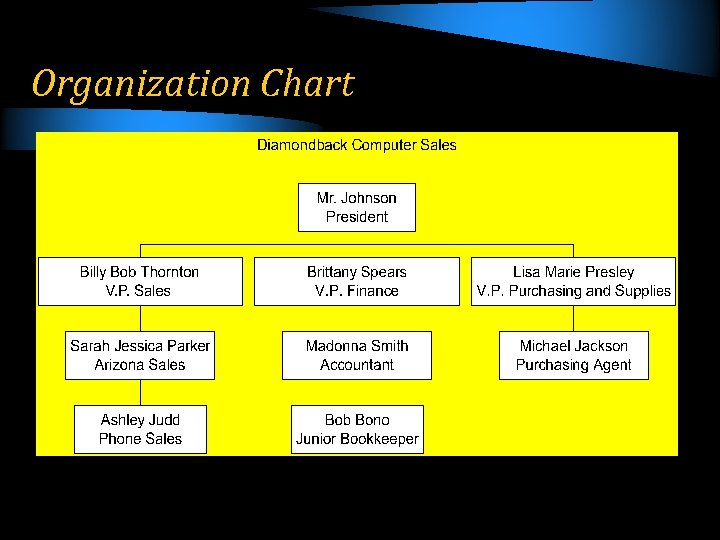

Organization Chart

Organization Chart

Corporate Finances 7. 3 l Stock—Shares that represent ownership of the firm. l Shares—Portions(certificates) issued. l Dividends—Profits paid to shareholders. l Common Stock—Allowed to vote l Preferred Stock—Guaranteed dividends; paid before common stock. No vote.

Corporate Finances 7. 3 l Stock—Shares that represent ownership of the firm. l Shares—Portions(certificates) issued. l Dividends—Profits paid to shareholders. l Common Stock—Allowed to vote l Preferred Stock—Guaranteed dividends; paid before common stock. No vote.

Corporate Finances 7. 3 l Corporate Bond—Certificate issued by a corporation in exchange for money borrowed. l Principal—The actual amount of money borrowed. Ex. Buy $10, 000 @5% interest Principal=$10, 000 X 5%= $500 per year income Interest—Amount borrower must pay for the use of the principal. u

Corporate Finances 7. 3 l Corporate Bond—Certificate issued by a corporation in exchange for money borrowed. l Principal—The actual amount of money borrowed. Ex. Buy $10, 000 @5% interest Principal=$10, 000 X 5%= $500 per year income Interest—Amount borrower must pay for the use of the principal. u

Advantages of Corporations Benefits to stockholders— l 1. Limited Liability 2. Can sell their shares at any time – – l Benefits for Corporations: u u 1. Limited liability 2. Separation of ownership from management. 3. Capital can be raised easily 4. Longevity

Advantages of Corporations Benefits to stockholders— l 1. Limited Liability 2. Can sell their shares at any time – – l Benefits for Corporations: u u 1. Limited liability 2. Separation of ownership from management. 3. Capital can be raised easily 4. Longevity

Disadvantages of Corporations l 1. Corporate charter can be expensive and difficult to obtain. l 2. Government regulation l 3. Slow decision making process l 4. For stockholders—Stockholders can earn a profit, without working for corp. l 5. Corporate profits are taxed twice.

Disadvantages of Corporations l 1. Corporate charter can be expensive and difficult to obtain. l 2. Government regulation l 3. Slow decision making process l 4. For stockholders—Stockholders can earn a profit, without working for corp. l 5. Corporate profits are taxed twice.

The Securities Language l Market cap = market capitalization (price per share X number of shares outstanding). l Ticker symbol = letters assigned to a particular stock. Ex. Microsoft = MSFT l Stock broker = work for firms that specialize in the buying and selling of stock. u Earn a profit by collecting commission and fees for each transaction. l IPO = Initial Public Offering – when a stock first goes public. • Google’s was $85 in 2004 • As of 2009? $490

The Securities Language l Market cap = market capitalization (price per share X number of shares outstanding). l Ticker symbol = letters assigned to a particular stock. Ex. Microsoft = MSFT l Stock broker = work for firms that specialize in the buying and selling of stock. u Earn a profit by collecting commission and fees for each transaction. l IPO = Initial Public Offering – when a stock first goes public. • Google’s was $85 in 2004 • As of 2009? $490

Market Capitalization l Price per share X the number of outstanding shares. (Ex. $10/share X 1, 000 shares=$10 million market capitalization. l Large cap. u Greater than 10 billion dollars in market cap. l Mid cap. u Between 1 billion and 5 billion dollars market cap. l Small cap. u 1 billion dollars or less in market cap.

Market Capitalization l Price per share X the number of outstanding shares. (Ex. $10/share X 1, 000 shares=$10 million market capitalization. l Large cap. u Greater than 10 billion dollars in market cap. l Mid cap. u Between 1 billion and 5 billion dollars market cap. l Small cap. u 1 billion dollars or less in market cap.

A Few Exchange Facts l NYSE Started in 1792 with 24 brokers u First stock was Bank of New York u To be listed: company minimum worth of $60 m and $2 m earned per year for last 2 years u

A Few Exchange Facts l NYSE Started in 1792 with 24 brokers u First stock was Bank of New York u To be listed: company minimum worth of $60 m and $2 m earned per year for last 2 years u

Ticker Symbols l Letters assigned to a particular stock. l NYSE - generally 1 to 3 letters. l NASDAQ - generally 4 letters. l Examples: u T = AT&T. u INTC = Intel. u TXN = Texas instruments. u IBM = IBM.

Ticker Symbols l Letters assigned to a particular stock. l NYSE - generally 1 to 3 letters. l NASDAQ - generally 4 letters. l Examples: u T = AT&T. u INTC = Intel. u TXN = Texas instruments. u IBM = IBM.