2c8cc88e71d777cce4a1090a35ee3cc6.ppt

- Количество слайдов: 25

178. 307, Markets, Firms and Consumers Lecture 10 - Pricing

178. 307, Markets, Firms and Consumers Lecture 10 - Pricing

Overview l l This topic considers the interaction with the firm and the consumer. We will look at 2 issues: – – Price bundling Bait and Switch advertising. l Readings: – l See references at end of lecture. Administration – – Makeup Test is Friday (19 th) at 12 noon, in QB 7 It is only available to students who got less than 60% in Test 1.

Overview l l This topic considers the interaction with the firm and the consumer. We will look at 2 issues: – – Price bundling Bait and Switch advertising. l Readings: – l See references at end of lecture. Administration – – Makeup Test is Friday (19 th) at 12 noon, in QB 7 It is only available to students who got less than 60% in Test 1.

Basic Definitions l Commodity Bundling – – – Many goods are sold in “packages” Pure bundling- goods only available as a package Mixed bundling- goods available separately (components) or as package l E. g. Fastfood “Special Meals” l Consumer Surplus – l The difference between what a consumer is willing to pay (reservation price) and what they actually pay (market price) Price-discrimination – – Selling identical units of output at different prices. Requires consumers to be separated.

Basic Definitions l Commodity Bundling – – – Many goods are sold in “packages” Pure bundling- goods only available as a package Mixed bundling- goods available separately (components) or as package l E. g. Fastfood “Special Meals” l Consumer Surplus – l The difference between what a consumer is willing to pay (reservation price) and what they actually pay (market price) Price-discrimination – – Selling identical units of output at different prices. Requires consumers to be separated.

Forms of Price Discrimination l First Degree – – l Each consumer is identified and charged their reservation price. All consumer surplus is extracted. Third Degree – – Separate markets are identified and charged different prices (based on elasticities) Arbitrage must not be possible l Second Degree – – – Firm does not separate market Firm sets prices so that consumers ‘separate’ themselves E. g. Two part Tariffs l l – Entry fee to get into amusement park Fee per ride Quantity ‘discounts’.

Forms of Price Discrimination l First Degree – – l Each consumer is identified and charged their reservation price. All consumer surplus is extracted. Third Degree – – Separate markets are identified and charged different prices (based on elasticities) Arbitrage must not be possible l Second Degree – – – Firm does not separate market Firm sets prices so that consumers ‘separate’ themselves E. g. Two part Tariffs l l – Entry fee to get into amusement park Fee per ride Quantity ‘discounts’.

Commodity-Bundling l Why does a “specialmeal” at Mc. Donalds cost less than the components separately? – – Cost savings? Complements in consumption? l Adams/Yellen show it is a form of pricediscrimination – – Firm does not need to know reservation price It’s not illegal (some forms of price discrimination are…)

Commodity-Bundling l Why does a “specialmeal” at Mc. Donalds cost less than the components separately? – – Cost savings? Complements in consumption? l Adams/Yellen show it is a form of pricediscrimination – – Firm does not need to know reservation price It’s not illegal (some forms of price discrimination are…)

Yellen/Adams Model 1 l Technology – l Marginal cost (c 1, c 2) of supply is constant, cost of bundle (c. B) = c 1 + c 2. Indivisibility – l Marginal utility of a second unit of each good = 0. Independence – l Reservation price of bundle (r. B) equals sum of separate reservation price (r 1, r 2) These assumptions exclude cost-savings and complementary consumption as explanations for bundling.

Yellen/Adams Model 1 l Technology – l Marginal cost (c 1, c 2) of supply is constant, cost of bundle (c. B) = c 1 + c 2. Indivisibility – l Marginal utility of a second unit of each good = 0. Independence – l Reservation price of bundle (r. B) equals sum of separate reservation price (r 1, r 2) These assumptions exclude cost-savings and complementary consumption as explanations for bundling.

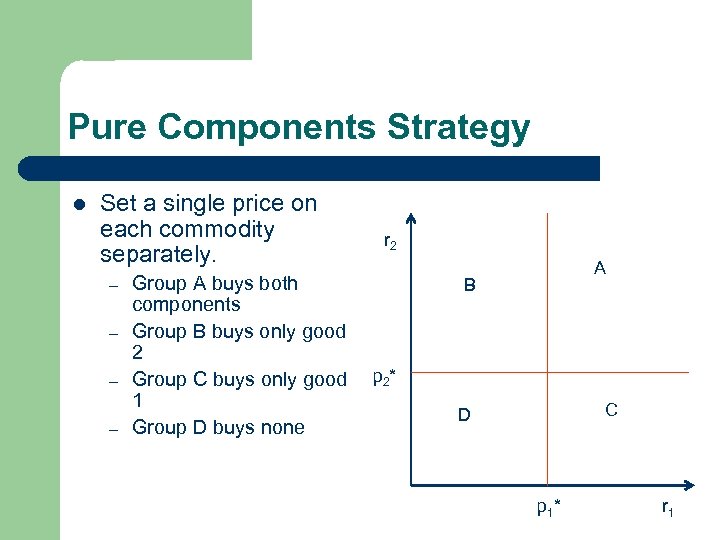

Pure Components Strategy l Set a single price on each commodity separately. – – Group A buys both components Group B buys only good 2 Group C buys only good 1 Group D buys none r 2 A B p 2 * C D p 1 * r 1

Pure Components Strategy l Set a single price on each commodity separately. – – Group A buys both components Group B buys only good 2 Group C buys only good 1 Group D buys none r 2 A B p 2 * C D p 1 * r 1

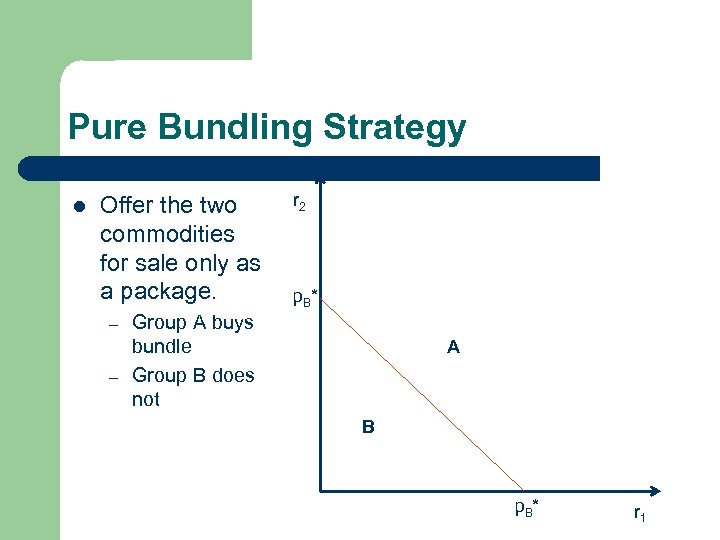

Pure Bundling Strategy l Offer the two commodities for sale only as a package. – – r 2 p. B* Group A buys bundle Group B does not A B p. B* r 1

Pure Bundling Strategy l Offer the two commodities for sale only as a package. – – r 2 p. B* Group A buys bundle Group B does not A B p. B* r 1

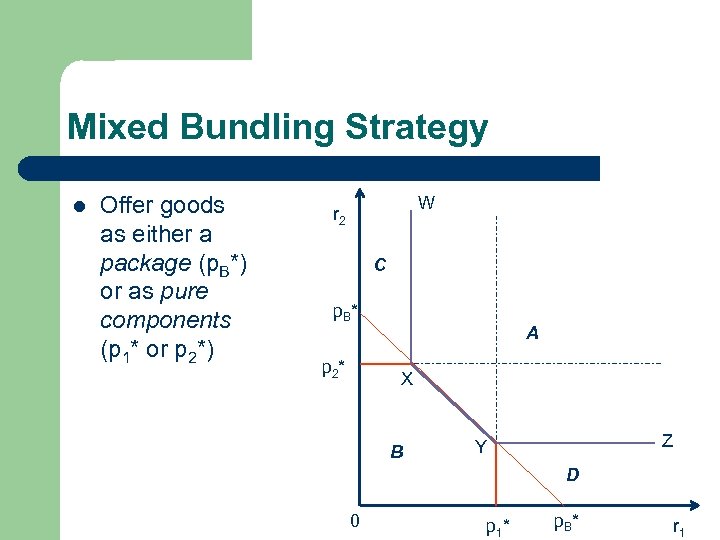

Mixed Bundling Strategy l Offer goods as either a package (p. B*) or as pure components (p 1* or p 2*) W r 2 C p. B* p 2 * A X B Z Y D 0 p 1 * p. B* r 1

Mixed Bundling Strategy l Offer goods as either a package (p. B*) or as pure components (p 1* or p 2*) W r 2 C p. B* p 2 * A X B Z Y D 0 p 1 * p. B* r 1

Consumption Behaviour l l Group B- reservation price is below both components and bundled-price Group A- only buy the bundle Group C- only buy good 2 Group D- only buy good 1 l l Each strategy has advantages and disadvantages for the firm. We establish a bench-mark (pure price discrimination).

Consumption Behaviour l l Group B- reservation price is below both components and bundled-price Group A- only buy the bundle Group C- only buy good 2 Group D- only buy good 1 l l Each strategy has advantages and disadvantages for the firm. We establish a bench-mark (pure price discrimination).

Benchmark l Complete Extraction – l No consumer realises any consumer surplus on their purchases. Exclusion – l Inclusion – Any individual whose reservation price exceeds its cost, consumes the good. No consumer consumes a good (i) if ci > ri. Note: the symbol r or R is used to denote reservation prices

Benchmark l Complete Extraction – l No consumer realises any consumer surplus on their purchases. Exclusion – l Inclusion – Any individual whose reservation price exceeds its cost, consumes the good. No consumer consumes a good (i) if ci > ri. Note: the symbol r or R is used to denote reservation prices

Dilemmas l Pure Components – – l Achieves exclusion Cannot achieve both inclusion and extraction. Pure bundling – Problem is with exclusion l Mixed Bundling – Is always more profitable than pure bundling when l – Exclusion is violated woth pure bundling Mixed bundling adds more sorting categories.

Dilemmas l Pure Components – – l Achieves exclusion Cannot achieve both inclusion and extraction. Pure bundling – Problem is with exclusion l Mixed Bundling – Is always more profitable than pure bundling when l – Exclusion is violated woth pure bundling Mixed bundling adds more sorting categories.

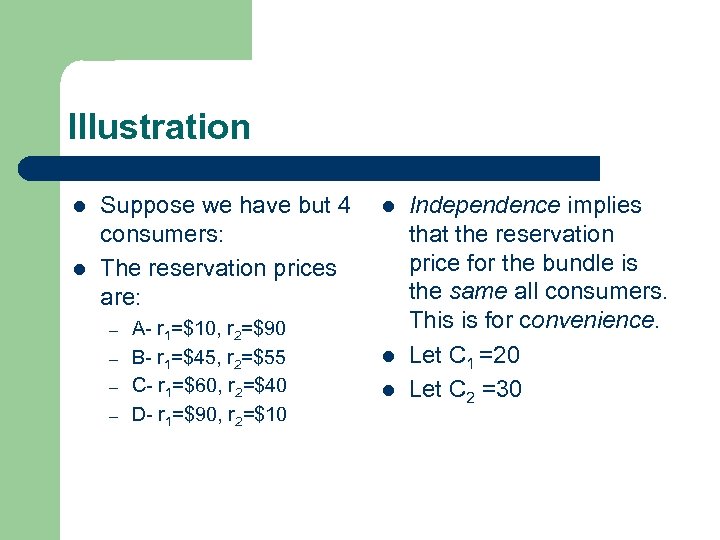

Illustration l l Suppose we have but 4 consumers: The reservation prices are: – – A- r 1=$10, r 2=$90 B- r 1=$45, r 2=$55 C- r 1=$60, r 2=$40 D- r 1=$90, r 2=$10 l l l Independence implies that the reservation price for the bundle is the same all consumers. This is for convenience. Let C 1 =20 Let C 2 =30

Illustration l l Suppose we have but 4 consumers: The reservation prices are: – – A- r 1=$10, r 2=$90 B- r 1=$45, r 2=$55 C- r 1=$60, r 2=$40 D- r 1=$90, r 2=$10 l l l Independence implies that the reservation price for the bundle is the same all consumers. This is for convenience. Let C 1 =20 Let C 2 =30

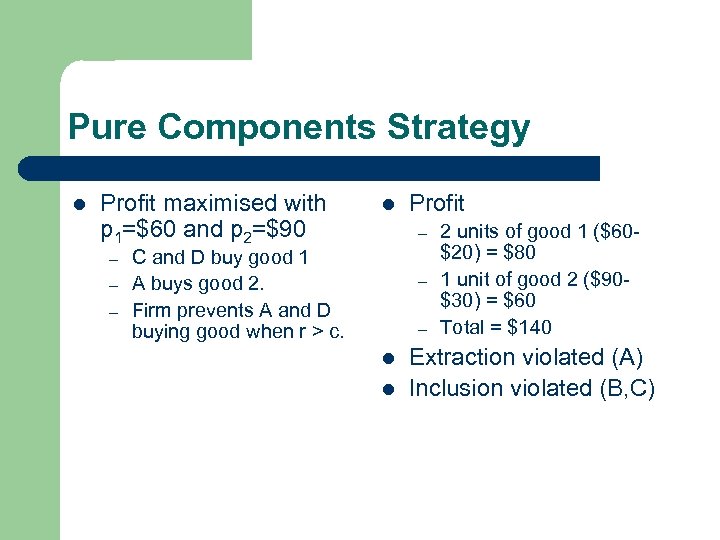

Pure Components Strategy l Profit maximised with p 1=$60 and p 2=$90 – – – l Profit – C and D buy good 1 A buys good 2. Firm prevents A and D buying good when r > c. – – l l 2 units of good 1 ($60$20) = $80 1 unit of good 2 ($90$30) = $60 Total = $140 Extraction violated (A) Inclusion violated (B, C)

Pure Components Strategy l Profit maximised with p 1=$60 and p 2=$90 – – – l Profit – C and D buy good 1 A buys good 2. Firm prevents A and D buying good when r > c. – – l l 2 units of good 1 ($60$20) = $80 1 unit of good 2 ($90$30) = $60 Total = $140 Extraction violated (A) Inclusion violated (B, C)

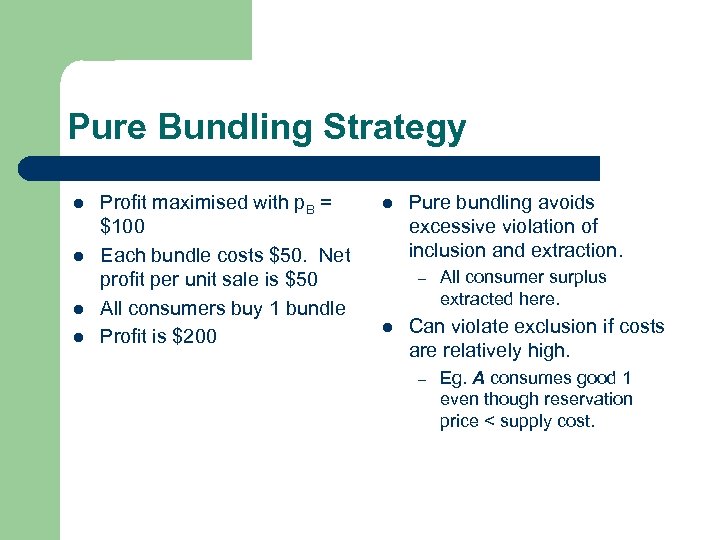

Pure Bundling Strategy l l Profit maximised with p. B = $100 Each bundle costs $50. Net profit per unit sale is $50 All consumers buy 1 bundle Profit is $200 l Pure bundling avoids excessive violation of inclusion and extraction. – l All consumer surplus extracted here. Can violate exclusion if costs are relatively high. – Eg. A consumes good 1 even though reservation price < supply cost.

Pure Bundling Strategy l l Profit maximised with p. B = $100 Each bundle costs $50. Net profit per unit sale is $50 All consumers buy 1 bundle Profit is $200 l Pure bundling avoids excessive violation of inclusion and extraction. – l All consumer surplus extracted here. Can violate exclusion if costs are relatively high. – Eg. A consumes good 1 even though reservation price < supply cost.

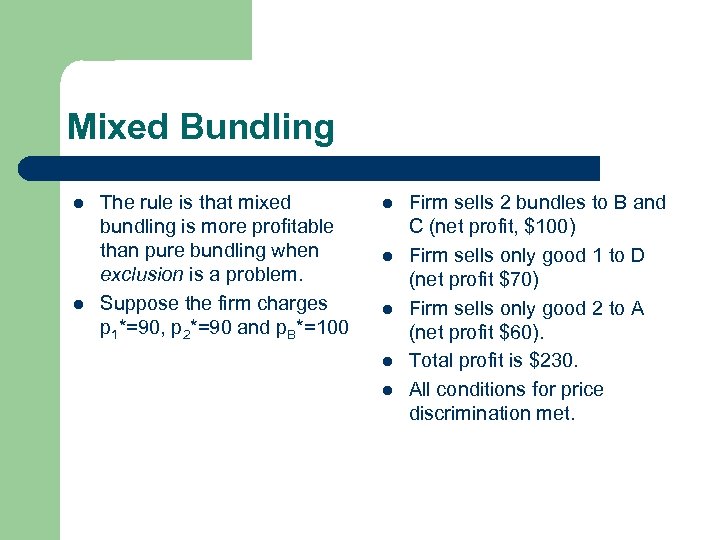

Mixed Bundling l l The rule is that mixed bundling is more profitable than pure bundling when exclusion is a problem. Suppose the firm charges p 1*=90, p 2*=90 and p. B*=100 l l l Firm sells 2 bundles to B and C (net profit, $100) Firm sells only good 1 to D (net profit $70) Firm sells only good 2 to A (net profit $60). Total profit is $230. All conditions for price discrimination met.

Mixed Bundling l l The rule is that mixed bundling is more profitable than pure bundling when exclusion is a problem. Suppose the firm charges p 1*=90, p 2*=90 and p. B*=100 l l l Firm sells 2 bundles to B and C (net profit, $100) Firm sells only good 1 to D (net profit $70) Firm sells only good 2 to A (net profit $60). Total profit is $230. All conditions for price discrimination met.

Bait and Switch l Form of False-Advertising – – Low-piced good is advertised Replaced by different good in show-room l l l Surprising because false-advertising discourages appropriate buyers Firms bait and switch to draw a greater number of shoppers What are conditions that make it profitable?

Bait and Switch l Form of False-Advertising – – Low-piced good is advertised Replaced by different good in show-room l l l Surprising because false-advertising discourages appropriate buyers Firms bait and switch to draw a greater number of shoppers What are conditions that make it profitable?

Simplify the problem l l l There are two types of commodities (A, B) Consumers have wealth W, and face prices PA and PB. Let search costs be k.

Simplify the problem l l l There are two types of commodities (A, B) Consumers have wealth W, and face prices PA and PB. Let search costs be k.

Utilities l l If A consumed, M(W - PA - k) If B consumed, N(W - PB - k) R(W) if neither A nor B is consumed; no search occurs R(W-k) if neither A nor B is consumed; search occurs

Utilities l l If A consumed, M(W - PA - k) If B consumed, N(W - PB - k) R(W) if neither A nor B is consumed; no search occurs R(W-k) if neither A nor B is consumed; search occurs

Firms l l Let γ firms produce A and (1 - γ) firms produce B. A potential customer gets a message from one (and only one) seller The message identifies location of store and commodity available for sale. After message, the consumer can decide to shop, or not shop.

Firms l l Let γ firms produce A and (1 - γ) firms produce B. A potential customer gets a message from one (and only one) seller The message identifies location of store and commodity available for sale. After message, the consumer can decide to shop, or not shop.

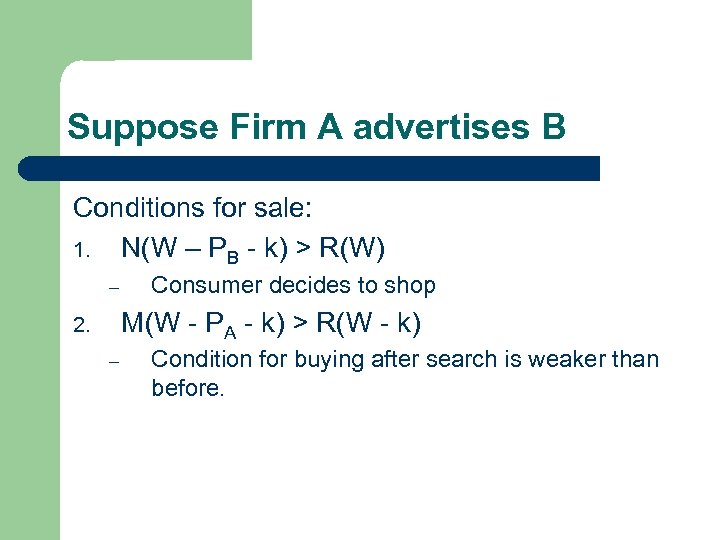

Suppose Firm A advertises B Conditions for sale: 1. N(W – PB - k) > R(W) – Consumer decides to shop M(W - PA - k) > R(W - k) 2. – Condition for buying after search is weaker than before.

Suppose Firm A advertises B Conditions for sale: 1. N(W – PB - k) > R(W) – Consumer decides to shop M(W - PA - k) > R(W - k) 2. – Condition for buying after search is weaker than before.

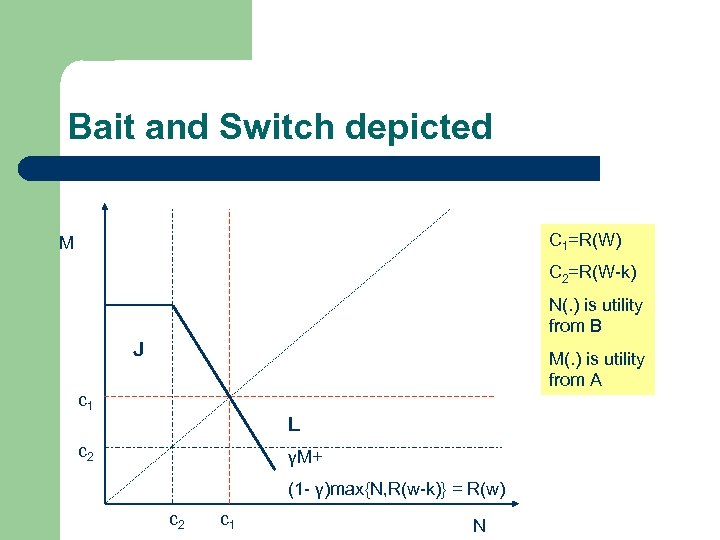

Bait and Switch depicted C 1=R(W) M C 2=R(W-k) N(. ) is utility from B J M(. ) is utility from A c 1 L c 2 γM+ (1 - γ)max{N, R(w-k)} = R(w) c 2 c 1 N

Bait and Switch depicted C 1=R(W) M C 2=R(W-k) N(. ) is utility from B J M(. ) is utility from A c 1 L c 2 γM+ (1 - γ)max{N, R(w-k)} = R(w) c 2 c 1 N

Conclusions l l Sellers of A will use bait -and-switch so long as individuals in Zone L exceeds individuals in Zone J. Most likely when market is ‘dense’ at one end. l l Bait and switch requires that A and B be close substitutes. Search costs crucial – – – l R(W-k) < M(W-PA-k) < R(W) Can only hold if k>0.

Conclusions l l Sellers of A will use bait -and-switch so long as individuals in Zone L exceeds individuals in Zone J. Most likely when market is ‘dense’ at one end. l l Bait and switch requires that A and B be close substitutes. Search costs crucial – – – l R(W-k) < M(W-PA-k) < R(W) Can only hold if k>0.

Summary l Bait and switch occurs because – – – Sellers gain shoppers by lying Once search costs are paid, marginal cost of buying commodity falls Firm loses customers who would genuinely desire good. l Only occurs when – – l l Many shoppers prefer a good to the other Hence false adverstising increases number of shoppers Must involve close substitutes or costly search Less likely if there are costs of showing good.

Summary l Bait and switch occurs because – – – Sellers gain shoppers by lying Once search costs are paid, marginal cost of buying commodity falls Firm loses customers who would genuinely desire good. l Only occurs when – – l l Many shoppers prefer a good to the other Hence false adverstising increases number of shoppers Must involve close substitutes or costly search Less likely if there are costs of showing good.

References l l Adams/Yellen (1976). Commodity Bundling & the Burden of Monopoly. Quarterly Journal of Economics 90(3): 475 -498. Lazear, E. (1995). Bait and Switch. Journal of Political Economy 103(4): 813 -829.

References l l Adams/Yellen (1976). Commodity Bundling & the Burden of Monopoly. Quarterly Journal of Economics 90(3): 475 -498. Lazear, E. (1995). Bait and Switch. Journal of Political Economy 103(4): 813 -829.