d4fb5f8750335b40f2b0f6359cf1990c.ppt

- Количество слайдов: 21

16 th Bled Electronic Commerce Conference June 9 -11, 2003 INTRODUCTION TO THE ONLINE MUSIC MARKET June 11 th, 2003

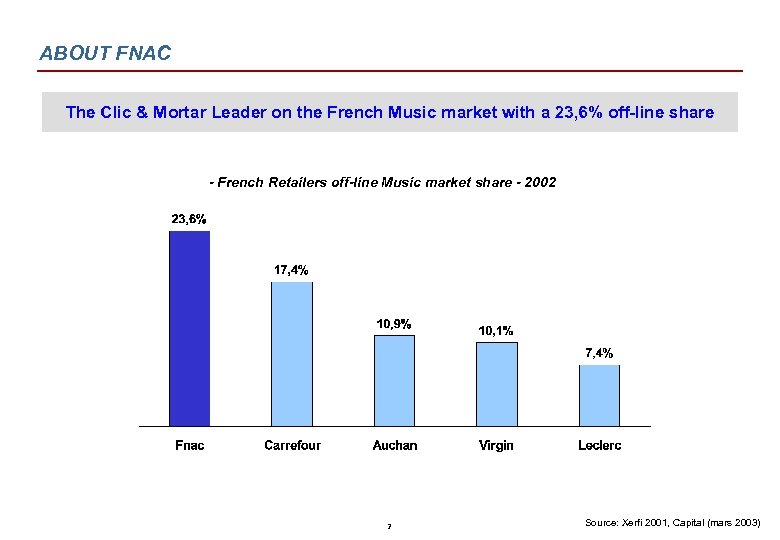

ABOUT FNAC The Clic & Mortar Leader on the French Music market with a 23, 6% off-line share - French Retailers off-line Music market share - 2002 2 Source: Xerfi 2001, Capital (mars 2003)

INSIGHTS This presentation is a digest of the latest short and middle term foresights we share about the On-Line Music Market *. Looking backwards a few years ago about the « Promise Land » all actors are now very careful whenever talking about Eldorados to come and « possible » break-evens. Indeed, the « Old Economy » rules are well-alive and shareholders are more than ever requiring Business Models with profitable customers and low costs as a premium source of value creation. Existing or Upcoming actors are all preparing for the next years’ fights and no unique model has emerged yet. * May, 2003 3

Summary 1 – Internet & Music, consumer behavior 2 – Typology of the Online Music Market 3 – Consumer uptake 4

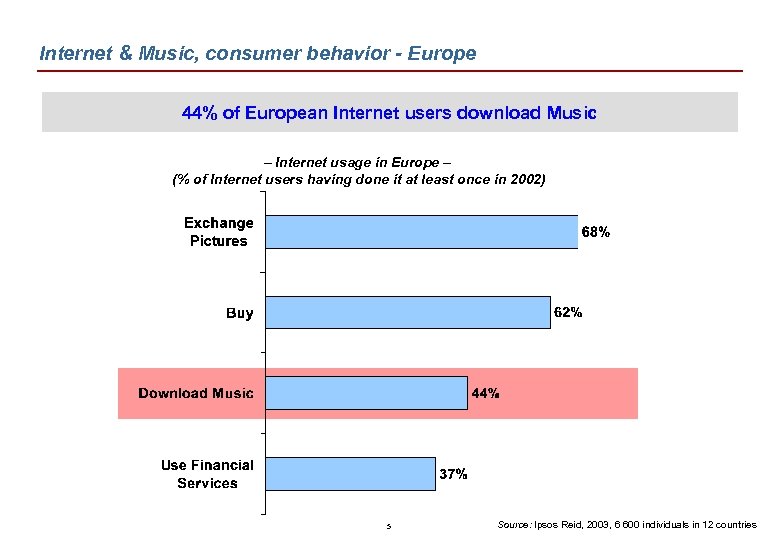

Internet & Music, consumer behavior - Europe 44% of European Internet users download Music – Internet usage in Europe – (% of Internet users having done it at least once in 2002) 5 Source: Ipsos Reid, 2003, 6 600 individuals in 12 countries

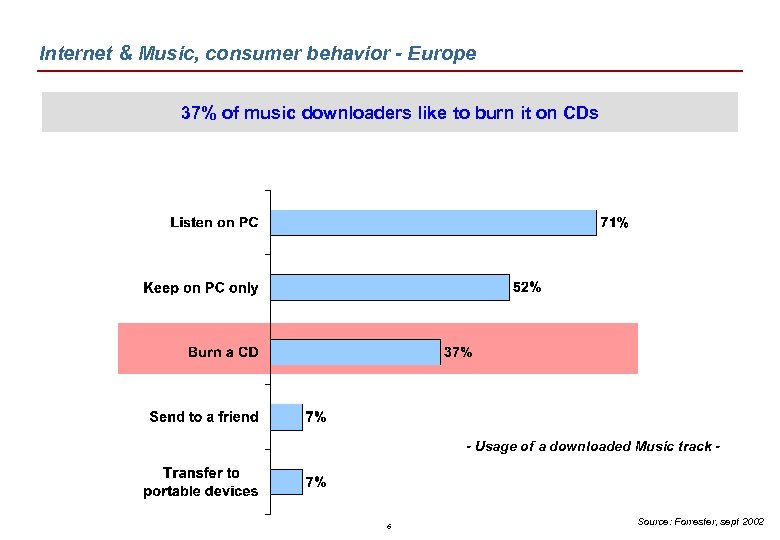

Internet & Music, consumer behavior - Europe 37% of music downloaders like to burn it on CDs - Usage of a downloaded Music track - 6 Source: Forrester, sept 2002

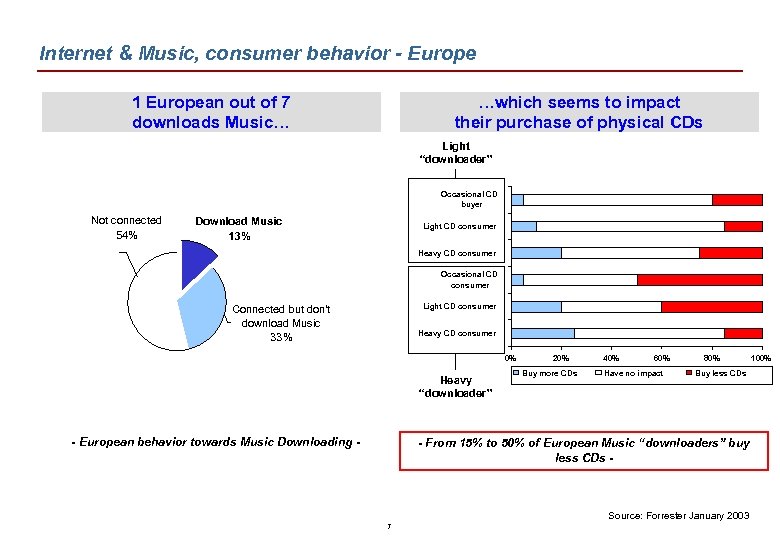

Internet & Music, consumer behavior - Europe 1 European out of 7 downloads Music… …which seems to impact their purchase of physical CDs Light “downloader” Occasional CD buyer Not connected 54% Download Music 13% Light CD consumer Heavy CD consumer Occasional CD consumer Light CD consumer Connected but don't download Music 33% Heavy CD consumer 0% Heavy “downloader” - European behavior towards Music Downloading - 20% Buy more CDs 40% 60% Have no impact 80% 100% Buy less CDs - From 15% to 50% of European Music “downloaders” buy less CDs - Source: Forrester January 2003 7

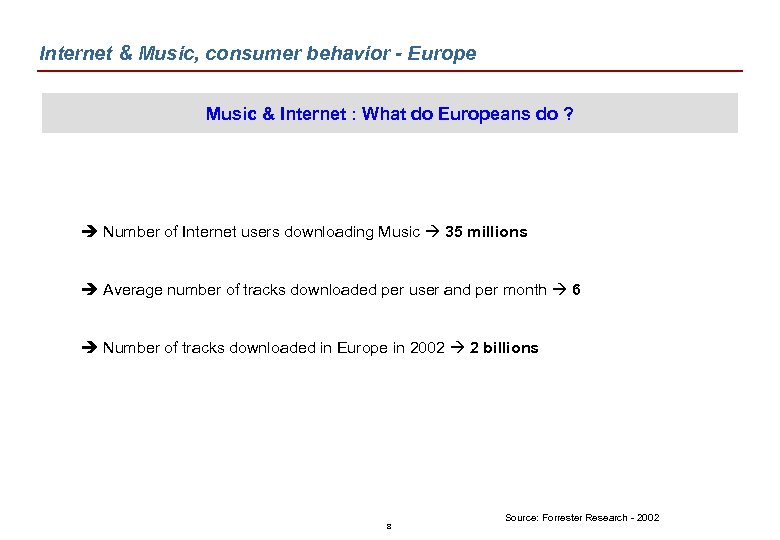

Internet & Music, consumer behavior - Europe Music & Internet : What do Europeans do ? è Number of Internet users downloading Music 35 millions è Average number of tracks downloaded per user and per month 6 è Number of tracks downloaded in Europe in 2002 2 billions 8 Source: Forrester Research - 2002

Summary 1 – Internet & Music, consumer behavior 2 – Structure of the Online Music Market 3 – Consumer uptake 9

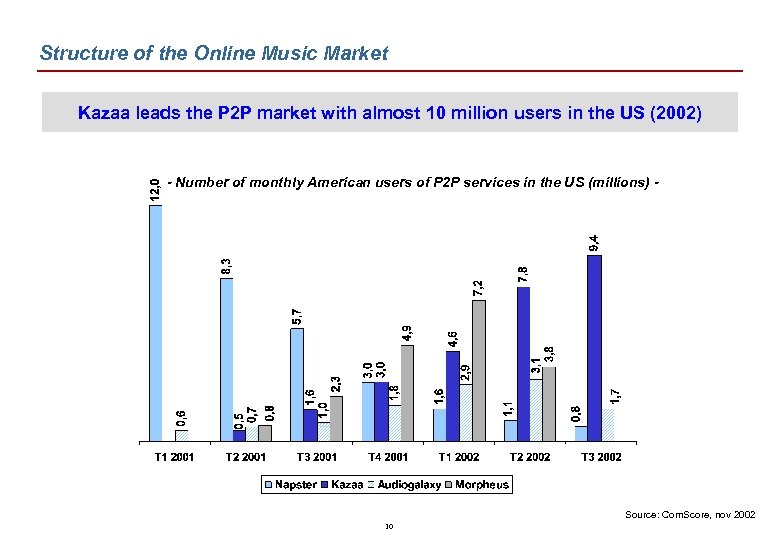

Structure of the Online Music Market Kazaa leads the P 2 P market with almost 10 million users in the US (2002) - Number of monthly American users of P 2 P services in the US (millions) - Source: Com. Score, nov 2002 10

Structure of the Online Music Market Typology of online Music Actors : everybody’s trying to enter / lead the game è Record labels ( Music. Net, E-Compil, …) è DSPs (OD 2, …) è Pure Players (Amazon) è Clic & Mortar Retailers (Fnac, Virgin Ent. , Tower, …) è Hardware manufacturers (Apple, …) è Software companies (Roxio, …) è Specialists and portals (Vitaminic, MSN, …) è ISPs (Tiscali, Wanadoo, …) 11

Structure of the Online Music Market Legal online Music – An American driven market * è Rhapsody the online music service from SF Start-up Listen. com has been bought by Real. Networks for 36 millions $ and starts selling tracks for 79 cents è Roxio, the CD burning software specialist, has acquired Pressplay for 39. 5 millions $ and plans to rebrand service thru NAPSTER è Musicnet has raised an additional 10 $m from founders è Apple has launched i. Tunes Music Store and sold 2 millions tracks during the first 2 weeks è A consortium of seven US retailers including Best Buy, Tower Records and Virgin have created Echo, a digital music distribution platform * Updated May 2003 12

Structure of the Online Music Market Legal online Music – The European market * A complex legal environment, high VAT rate and reluctance from Record Labels to widely open their catalogue result in a very slow take-off. è In April, EMI has launched a major online program and cleared over 140, 000 tracks for digital distribution è OD 2 has established itself as the leading independent European DSP, distributing digital music through a wide range of portals, ISPs and commerce sites including Fnac. com è Universal Music France testes online music distribution via E-Compil, its fully owned subsidiary and distributes over 30, 000 tracks each month * Updated May 2003 13

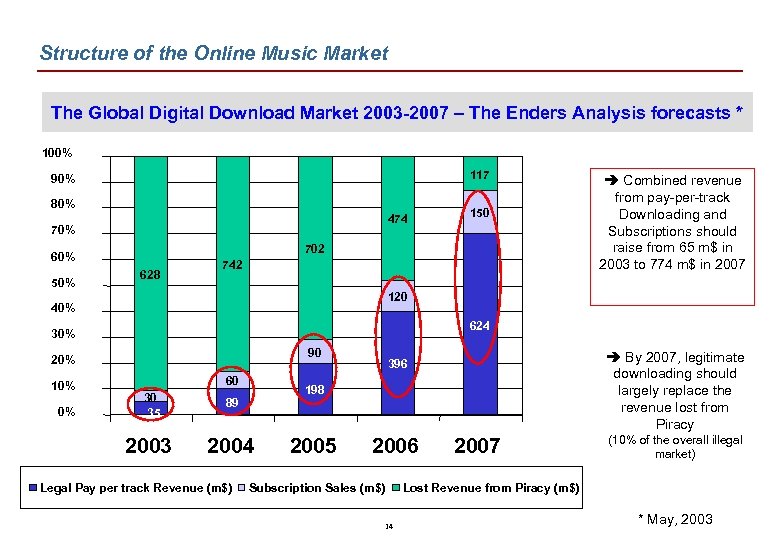

Structure of the Online Music Market The Global Digital Download Market 2003 -2007 – The Enders Analysis forecasts * 100% 117 90% 80% 474 70% 702 60% 50% 628 742 120 40% 624 30% 90 20% 10% 60 89 2004 Legal Pay per track Revenue (m$) è By 2007, legitimate downloading should largely replace the revenue lost from Piracy 396 198 30 35 2003 0% 150 è Combined revenue from pay-per-track Downloading and Subscriptions should raise from 65 m$ in 2003 to 774 m$ in 2007 2005 2006 Subscription Sales (m$) 14 2007 (10% of the overall illegal market) Lost Revenue from Piracy (m$) * May, 2003

Summary 1 – Internet & Music, consumer behavior 2 – Typology of the Online Music Market 3 – Factors of market development and consumer uptake 15

Factors of market development and consumer uptake An endless stream of creativity : new plateforms/multiple actors è Record Labels might choose to intensify the licensing of their catalogues to third parties rather than pursue their efforts to distribute directly their content (global cost estimate : $ 2 billions) è Hardware manufacturers and software companies start investing heavily (Apple, Roxio, Microsoft? ) è Traditional Retailers and especially Clic & Mortars such as Fnac will leverage their Music distribution expertise to package new digital content for their existing customers è ISPs might push the subscription model to raise their ARPU è DSPs will help other actors with turnkey solutions 16

Factors of market development and consumer uptake Time to market Pricing & appropriate formats…. …combined with the launching of new Portable Digital Devices è Digital Music will have to be more affordable (less than 1€ / 0, 5 € per track ? ) è High and cheap storage capacity è Easy and fun to buy (micropayment, …) and download… è Multi-functional devices (Mobile phones, PDAs, car stereos…) è Compatibility with most formats è … in a secured transactional environment è Easy to transfer to multiple devices 17

Factors of market development and consumer uptake Attractive marketing offers from Editors and Retailers è More Pre-releases (the Madonna experience) Enable to start making revenue before a record hits the stores, also great marketing tool è Original Bundles with hardware or physical CDs (such as digital Bonus track) è Unreleased tracks and re-editions sold via digital downloads exclusivity è… 18

Factors of market development and consumer uptake Fight against illegal services, consumer education Lawsuits against P 2 P services (tough to implement, see recent US court ruling in favor of Grokster and Morpheus because of the fact that they don’t operate centralized services) ISPs vs file sharers themselves (possible breach of customers’ privacy rights) Spoofing Intensification of P 2 P networks pollution with poor quality/trapped tracks Education Making piracy less attractive as an option by creative negative association with the activity combined with a time-to-market pricing 19

CONCLUSION A new Eldorado, when…. • Majors widely open their catalogues to any DSP • Pricing is adapted to mass digital diffusion • Piracy containment is efficient • Telcoms harvest a tax on MP 3 • Broadband Access becomes really cheap and then widely adopted • Powerful and cheap Mobile Players are massively adopted by consumers • Copyright matters are solved (eg private copy in France) • E-retailers can bundle digital content and On-demand CD/DVD burning • Taxes are lowered (VAT) 20

THANK YOU FOR YOUR ATTENTION 21

d4fb5f8750335b40f2b0f6359cf1990c.ppt