a6e50a2346bb6acf495dd7a488def116.ppt

- Количество слайдов: 73

16 Standard Costing, Variance Analysis and Kaizen Costing Mc. Graw-Hill/Irwin Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

16 Standard Costing, Variance Analysis and Kaizen Costing Mc. Graw-Hill/Irwin Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

2 Learning Objective 1

2 Learning Objective 1

3 Using Standard-Costing Systems for Control based on carefully predetermined amounts. Standard costs are used for planning labor and material requirements. the expected level of performance. benchmarks for measuring performance.

3 Using Standard-Costing Systems for Control based on carefully predetermined amounts. Standard costs are used for planning labor and material requirements. the expected level of performance. benchmarks for measuring performance.

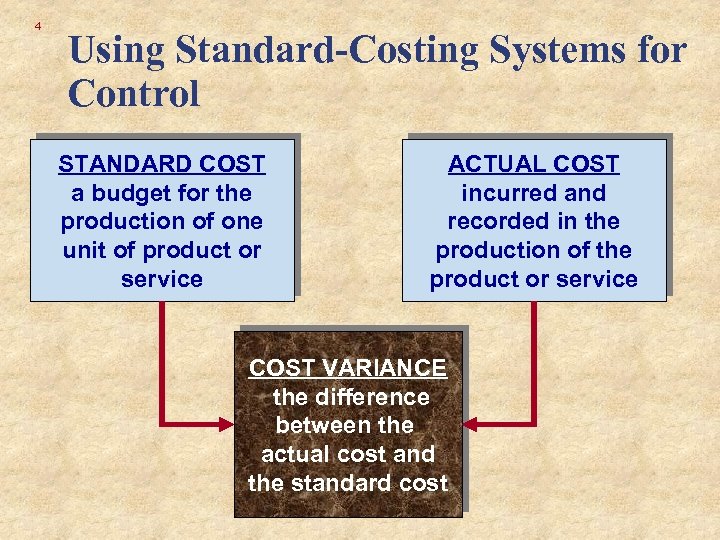

4 Using Standard-Costing Systems for Control STANDARD COST a budget for the production of one unit of product or service ACTUAL COST incurred and recorded in the production of the product or service COST VARIANCE the difference between the actual cost and the standard cost

4 Using Standard-Costing Systems for Control STANDARD COST a budget for the production of one unit of product or service ACTUAL COST incurred and recorded in the production of the product or service COST VARIANCE the difference between the actual cost and the standard cost

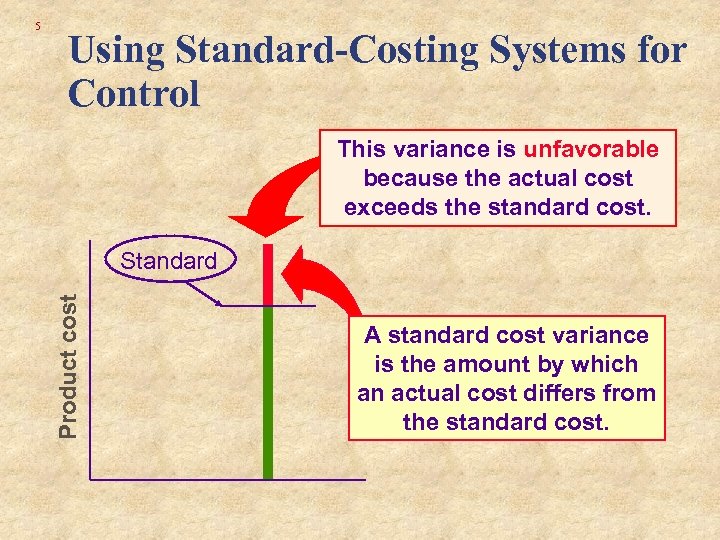

Using Standard-Costing Systems for Control This variance is unfavorable because the actual cost exceeds the standard cost. Standard Product cost 5 A standard cost variance is the amount by which an actual cost differs from the standard cost.

Using Standard-Costing Systems for Control This variance is unfavorable because the actual cost exceeds the standard cost. Standard Product cost 5 A standard cost variance is the amount by which an actual cost differs from the standard cost.

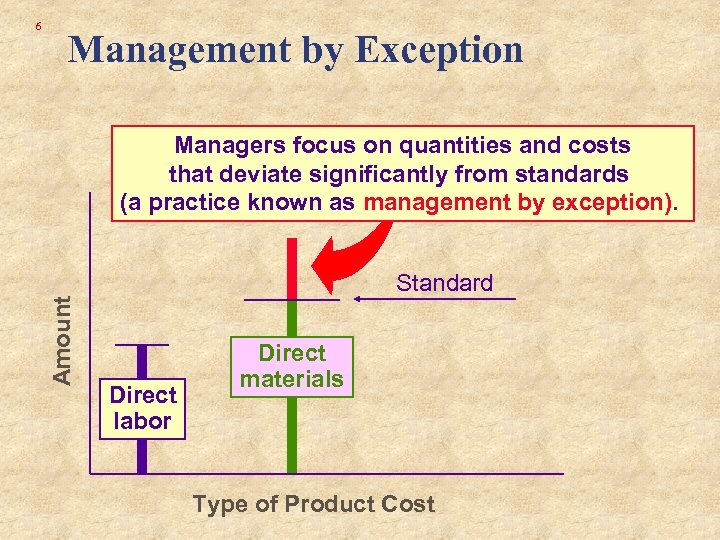

Management by Exception Managers focus on quantities and costs that deviate significantly from standards (a practice known as management by exception). Amount 6 Standard Direct labor Direct materials Type of Product Cost

Management by Exception Managers focus on quantities and costs that deviate significantly from standards (a practice known as management by exception). Amount 6 Standard Direct labor Direct materials Type of Product Cost

7 Management by Exception Take the time to investigate only significant cost variances. What is significant? Depends on the size of the organization Depends on the production process Depends on the type of the organization

7 Management by Exception Take the time to investigate only significant cost variances. What is significant? Depends on the size of the organization Depends on the production process Depends on the type of the organization

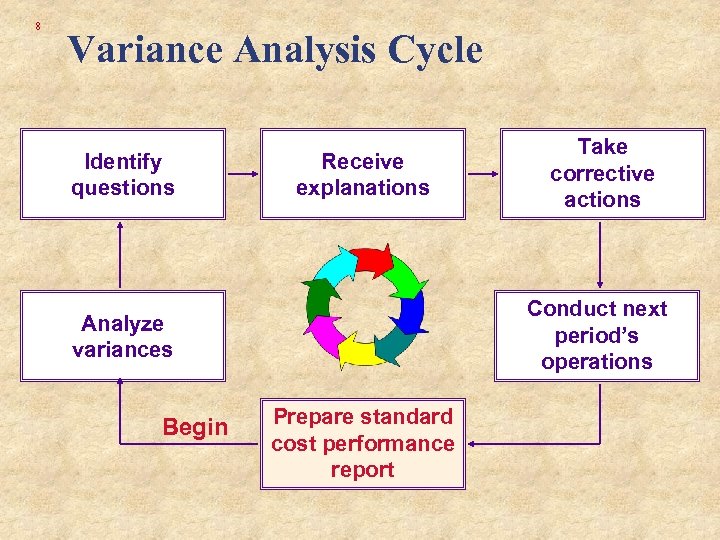

8 Variance Analysis Cycle Identify questions Receive explanations Conduct next period’s operations Analyze variances Begin Take corrective actions Prepare standard cost performance report

8 Variance Analysis Cycle Identify questions Receive explanations Conduct next period’s operations Analyze variances Begin Take corrective actions Prepare standard cost performance report

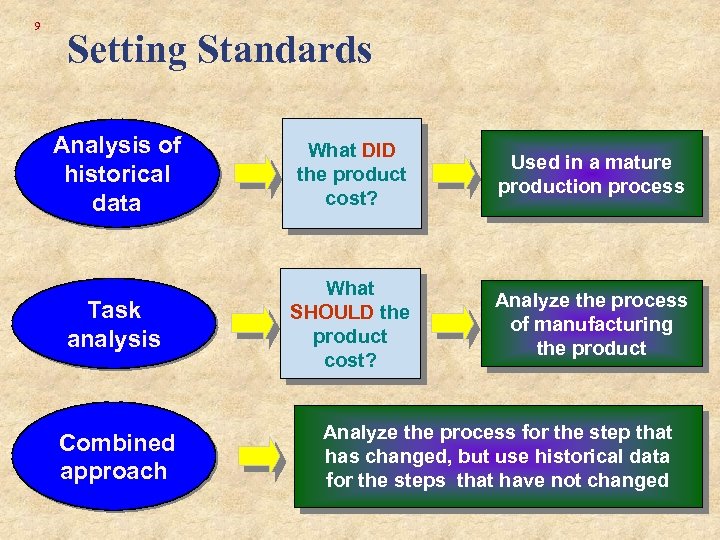

9 Setting Standards Analysis of historical data What DID the product cost? Used in a mature production process Task analysis What SHOULD the product cost? Analyze the process of manufacturing the product Combined approach Analyze the process for the step that has changed, but use historical data for the steps that have not changed

9 Setting Standards Analysis of historical data What DID the product cost? Used in a mature production process Task analysis What SHOULD the product cost? Analyze the process of manufacturing the product Combined approach Analyze the process for the step that has changed, but use historical data for the steps that have not changed

10 Participation in Setting Standards Accountants, engineers, personnel administrators, and production managers combine efforts to set standards based on experience and expectations.

10 Participation in Setting Standards Accountants, engineers, personnel administrators, and production managers combine efforts to set standards based on experience and expectations.

11 Learning Objective 2

11 Learning Objective 2

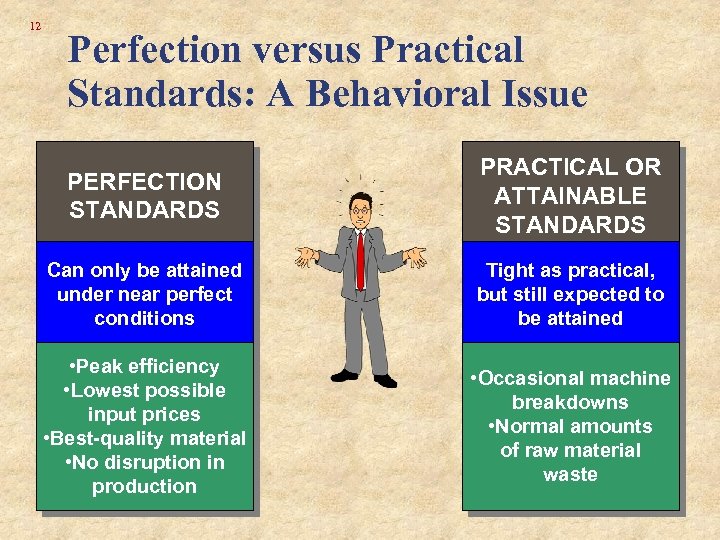

12 Perfection versus Practical Standards: A Behavioral Issue PERFECTION STANDARDS PRACTICAL OR ATTAINABLE STANDARDS Can only be attained under near perfect conditions Tight as practical, but still expected to be attained • Peak efficiency • Lowest possible input prices • Best-quality material • No disruption in production • Occasional machine breakdowns • Normal amounts of raw material waste

12 Perfection versus Practical Standards: A Behavioral Issue PERFECTION STANDARDS PRACTICAL OR ATTAINABLE STANDARDS Can only be attained under near perfect conditions Tight as practical, but still expected to be attained • Peak efficiency • Lowest possible input prices • Best-quality material • No disruption in production • Occasional machine breakdowns • Normal amounts of raw material waste

13 Perfection versus Practical Standards: A Behavioral Issue Should we use practical standards or perfection standards? Practical standards should be set at levels that are currently attainable with reasonable and efficient effort.

13 Perfection versus Practical Standards: A Behavioral Issue Should we use practical standards or perfection standards? Practical standards should be set at levels that are currently attainable with reasonable and efficient effort.

14 Perfection versus Practical Standards: A Behavioral Issue I agree. Perfection standards are unattainable and therefore discouraging to most employees.

14 Perfection versus Practical Standards: A Behavioral Issue I agree. Perfection standards are unattainable and therefore discouraging to most employees.

15 Setting Standards – Direct Materials Price Standards Quantity Standards Use competitive bids for the quality and quantity desired. Use product design specifications.

15 Setting Standards – Direct Materials Price Standards Quantity Standards Use competitive bids for the quality and quantity desired. Use product design specifications.

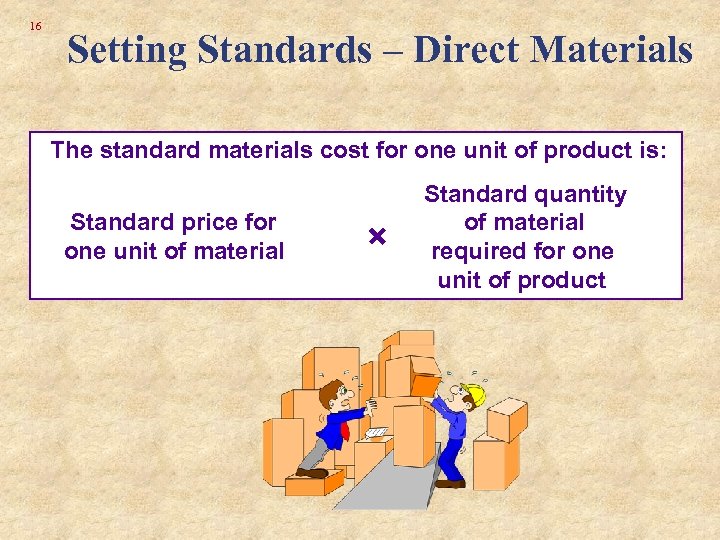

16 Setting Standards – Direct Materials The standard materials cost for one unit of product is: Standard price for one unit of material × Standard quantity of material required for one unit of product

16 Setting Standards – Direct Materials The standard materials cost for one unit of product is: Standard price for one unit of material × Standard quantity of material required for one unit of product

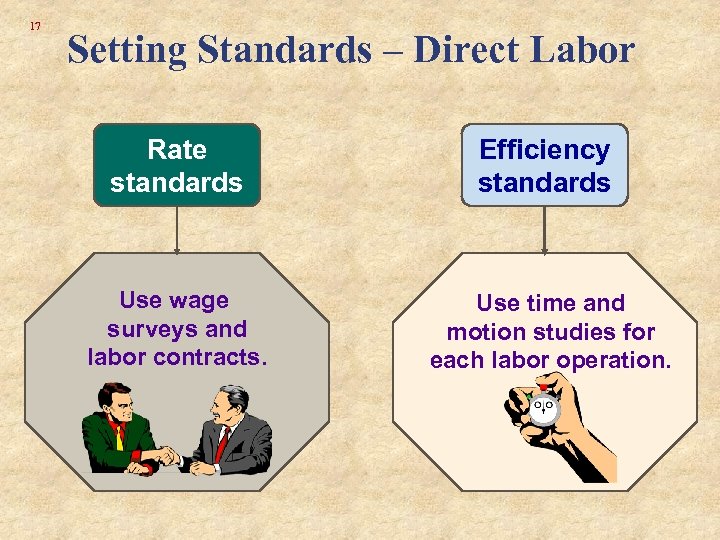

17 Setting Standards – Direct Labor Rate standards Efficiency standards Use wage surveys and labor contracts. Use time and motion studies for each labor operation.

17 Setting Standards – Direct Labor Rate standards Efficiency standards Use wage surveys and labor contracts. Use time and motion studies for each labor operation.

18 Setting Standards – Direct Labor The standard labor cost for one unit of product is: Standard wage rate for one hour × Standard number of labor hours for one unit of product

18 Setting Standards – Direct Labor The standard labor cost for one unit of product is: Standard wage rate for one hour × Standard number of labor hours for one unit of product

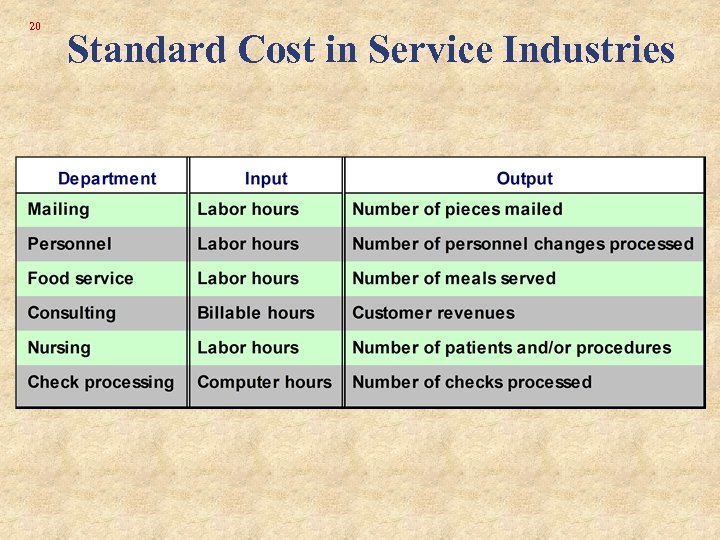

19 Standard Cost in Service Industries l Jobs with repetitive tasks lend themselves to efficiency measures. l Computing nonmanufacturing efficiency variances requires some assumed relationship between input and output activity. Examples

19 Standard Cost in Service Industries l Jobs with repetitive tasks lend themselves to efficiency measures. l Computing nonmanufacturing efficiency variances requires some assumed relationship between input and output activity. Examples

20 Standard Cost in Service Industries

20 Standard Cost in Service Industries

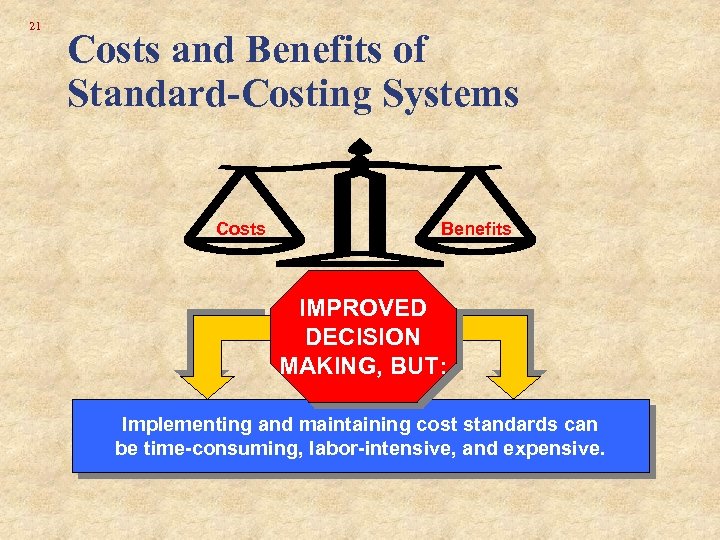

21 Costs and Benefits of Standard-Costing Systems Costs Benefits IMPROVED DECISION MAKING, BUT: Implementing and maintaining cost standards can be time-consuming, labor-intensive, and expensive.

21 Costs and Benefits of Standard-Costing Systems Costs Benefits IMPROVED DECISION MAKING, BUT: Implementing and maintaining cost standards can be time-consuming, labor-intensive, and expensive.

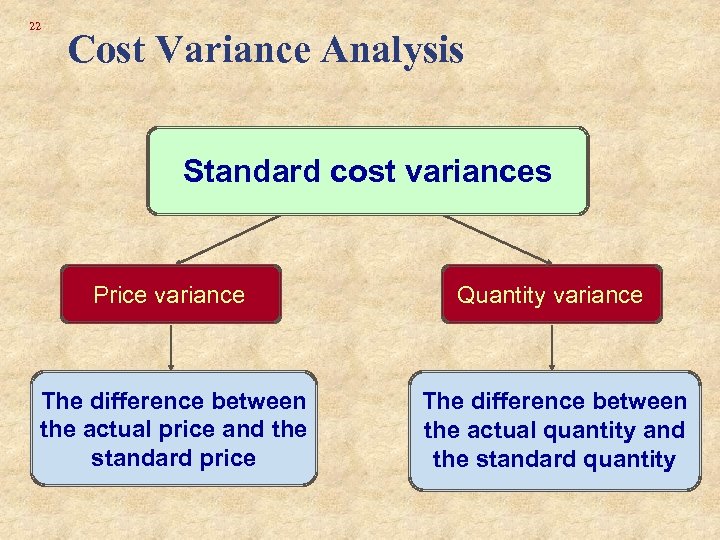

22 Cost Variance Analysis Standard cost variances Price variance Quantity variance The difference between the actual price and the standard price The difference between the actual quantity and the standard quantity

22 Cost Variance Analysis Standard cost variances Price variance Quantity variance The difference between the actual price and the standard price The difference between the actual quantity and the standard quantity

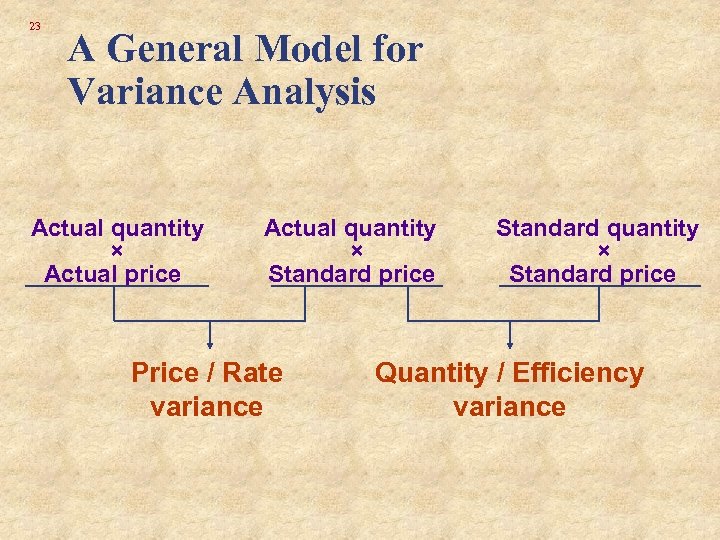

23 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Standard quantity × Standard price Quantity / Efficiency variance

23 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Standard quantity × Standard price Quantity / Efficiency variance

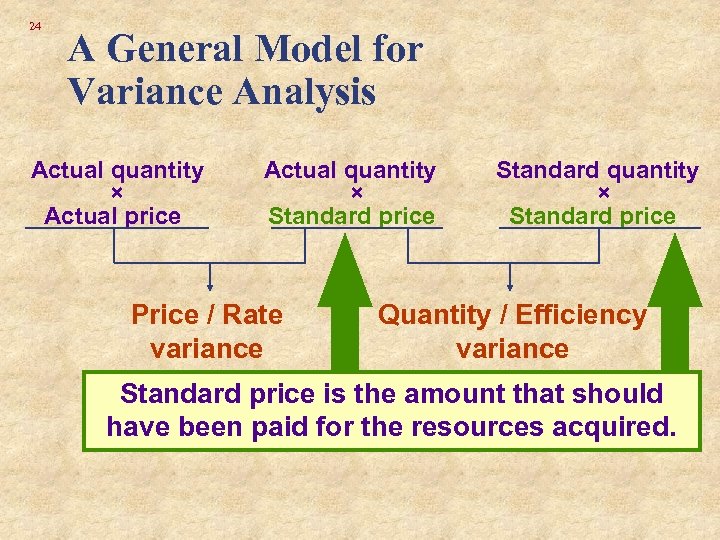

24 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Standard quantity × Standard price Quantity / Efficiency variance Standard price is the amount that should have been paid for the resources acquired.

24 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Standard quantity × Standard price Quantity / Efficiency variance Standard price is the amount that should have been paid for the resources acquired.

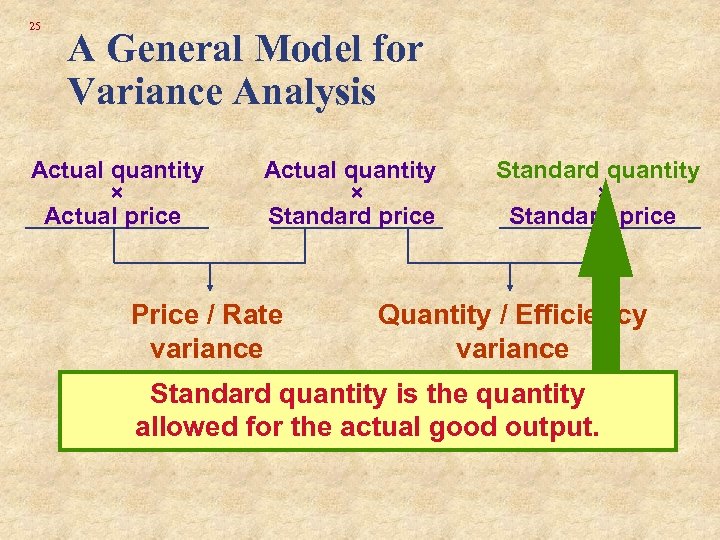

25 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Standard quantity × Standard price Quantity / Efficiency variance Standard quantity is the quantity allowed for the actual good output.

25 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Standard quantity × Standard price Quantity / Efficiency variance Standard quantity is the quantity allowed for the actual good output.

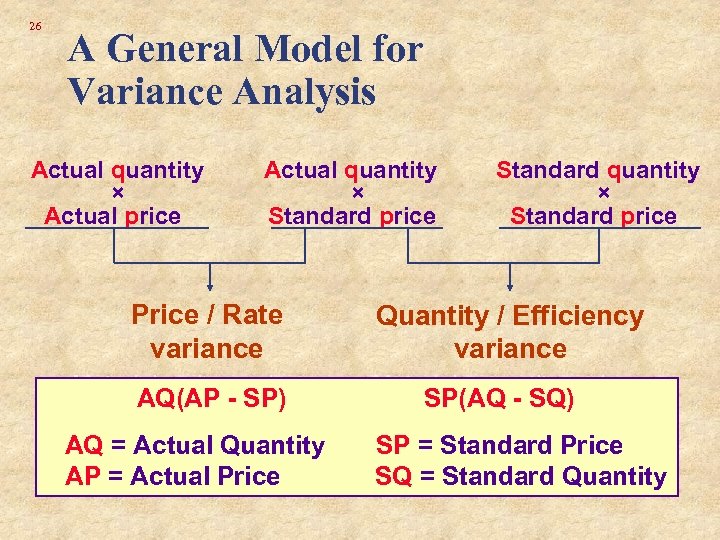

26 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Materials price variance AQ(AP - SP) Labor rate variance AQVariable overhead = Actual Quantity APspending variance = Actual Price Standard quantity × Standard price Quantity / Efficiency variance Materials quantity variance SP(AQ - SQ) Labor efficiency variance SP Variable overhead = Standard Price SQefficiency variance = Standard Quantity

26 A General Model for Variance Analysis Actual quantity × Actual price Actual quantity × Standard price Price / Rate variance Materials price variance AQ(AP - SP) Labor rate variance AQVariable overhead = Actual Quantity APspending variance = Actual Price Standard quantity × Standard price Quantity / Efficiency variance Materials quantity variance SP(AQ - SQ) Labor efficiency variance SP Variable overhead = Standard Price SQefficiency variance = Standard Quantity

27 Standard Costs Let’s use the concepts of the general model to calculate standard cost variances, starting with direct materials.

27 Standard Costs Let’s use the concepts of the general model to calculate standard cost variances, starting with direct materials.

28 Learning Objective 3

28 Learning Objective 3

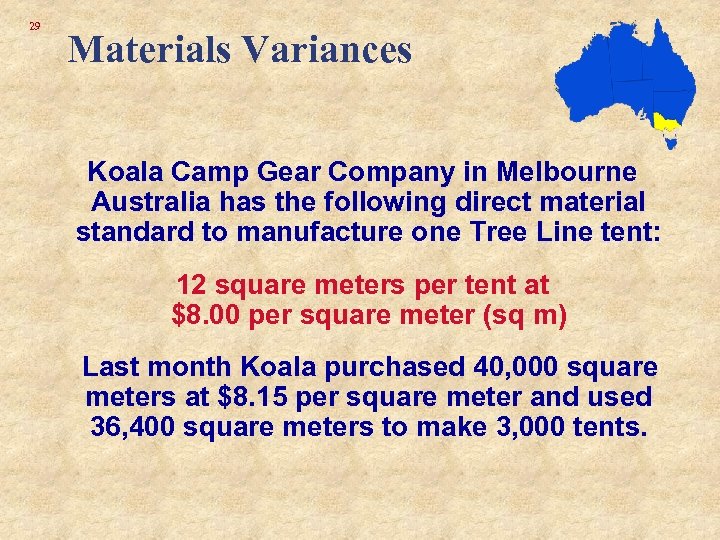

29 Materials Variances Koala Camp Gear Company in Melbourne Australia has the following direct material standard to manufacture one Tree Line tent: 12 square meters per tent at $8. 00 per square meter (sq m) Last month Koala purchased 40, 000 square meters at $8. 15 per square meter and used 36, 400 square meters to make 3, 000 tents.

29 Materials Variances Koala Camp Gear Company in Melbourne Australia has the following direct material standard to manufacture one Tree Line tent: 12 square meters per tent at $8. 00 per square meter (sq m) Last month Koala purchased 40, 000 square meters at $8. 15 per square meter and used 36, 400 square meters to make 3, 000 tents.

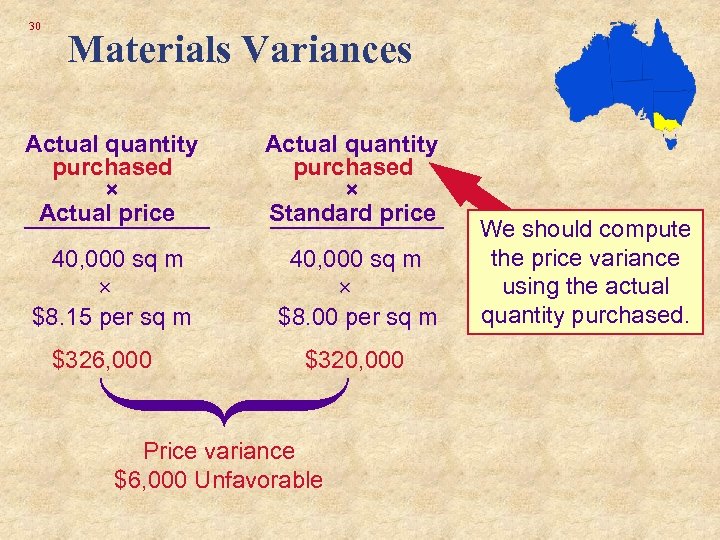

30 Materials Variances Actual quantity purchased × Actual price Actual quantity purchased × Standard price 40, 000 sq m × $8. 15 per sq m 40, 000 sq m × $8. 00 per sq m $326, 000 $320, 000 Price variance $6, 000 Unfavorable We should compute the price variance using the actual quantity purchased.

30 Materials Variances Actual quantity purchased × Actual price Actual quantity purchased × Standard price 40, 000 sq m × $8. 15 per sq m 40, 000 sq m × $8. 00 per sq m $326, 000 $320, 000 Price variance $6, 000 Unfavorable We should compute the price variance using the actual quantity purchased.

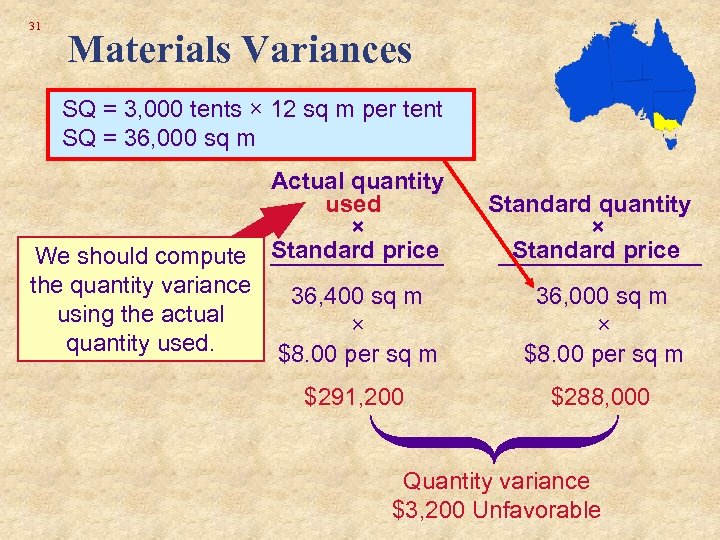

31 Materials Variances SQ = 3, 000 tents × 12 sq m per tent SQ = 36, 000 sq m We should compute the quantity variance using the actual quantity used. Actual quantity used × Standard price Standard quantity × Standard price 36, 400 sq m × $8. 00 per sq m 36, 000 sq m × $8. 00 per sq m $291, 200 $288, 000 Quantity variance $3, 200 Unfavorable

31 Materials Variances SQ = 3, 000 tents × 12 sq m per tent SQ = 36, 000 sq m We should compute the quantity variance using the actual quantity used. Actual quantity used × Standard price Standard quantity × Standard price 36, 400 sq m × $8. 00 per sq m 36, 000 sq m × $8. 00 per sq m $291, 200 $288, 000 Quantity variance $3, 200 Unfavorable

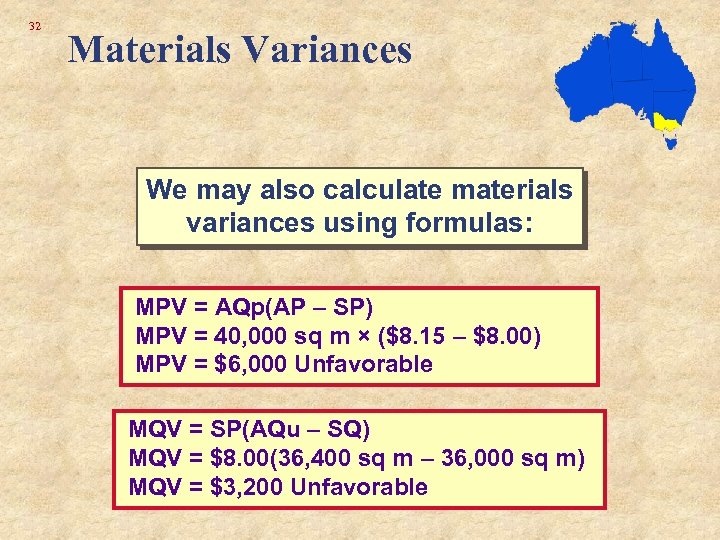

32 Materials Variances We may also calculate materials variances using formulas: MPV = AQp(AP – SP) MPV = 40, 000 sq m × ($8. 15 – $8. 00) MPV = $6, 000 Unfavorable MQV = SP(AQu – SQ) MQV = $8. 00(36, 400 sq m – 36, 000 sq m) MQV = $3, 200 Unfavorable

32 Materials Variances We may also calculate materials variances using formulas: MPV = AQp(AP – SP) MPV = 40, 000 sq m × ($8. 15 – $8. 00) MPV = $6, 000 Unfavorable MQV = SP(AQu – SQ) MQV = $8. 00(36, 400 sq m – 36, 000 sq m) MQV = $3, 200 Unfavorable

33 Reporting Materials Variances I need the variances as soon as possible so that I can better identify problems and control costs. You accountants just don’t understand the problems we production managers have. Okay. I’ll compute the price variance when materials are purchased, and the usage variance as soon as material is used.

33 Reporting Materials Variances I need the variances as soon as possible so that I can better identify problems and control costs. You accountants just don’t understand the problems we production managers have. Okay. I’ll compute the price variance when materials are purchased, and the usage variance as soon as material is used.

34 Responsibility for Materials Variances I am not responsible for this unfavorable materials usage variance. You bought poor quality materials, so my people had to use more of it. Your poorly trained workers and poorly maintained equipment caused the problems. Also, your poor scheduling requires rush orders of materials at higher prices, causing unfavorable price variances.

34 Responsibility for Materials Variances I am not responsible for this unfavorable materials usage variance. You bought poor quality materials, so my people had to use more of it. Your poorly trained workers and poorly maintained equipment caused the problems. Also, your poor scheduling requires rush orders of materials at higher prices, causing unfavorable price variances.

35 Standard Costs Now let’s calculate standard cost variances for direct labor.

35 Standard Costs Now let’s calculate standard cost variances for direct labor.

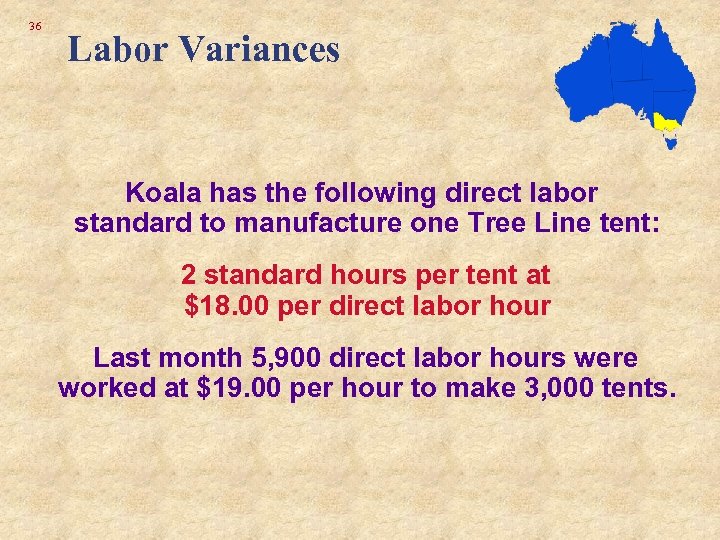

36 Labor Variances Koala has the following direct labor standard to manufacture one Tree Line tent: 2 standard hours per tent at $18. 00 per direct labor hour Last month 5, 900 direct labor hours were worked at $19. 00 per hour to make 3, 000 tents.

36 Labor Variances Koala has the following direct labor standard to manufacture one Tree Line tent: 2 standard hours per tent at $18. 00 per direct labor hour Last month 5, 900 direct labor hours were worked at $19. 00 per hour to make 3, 000 tents.

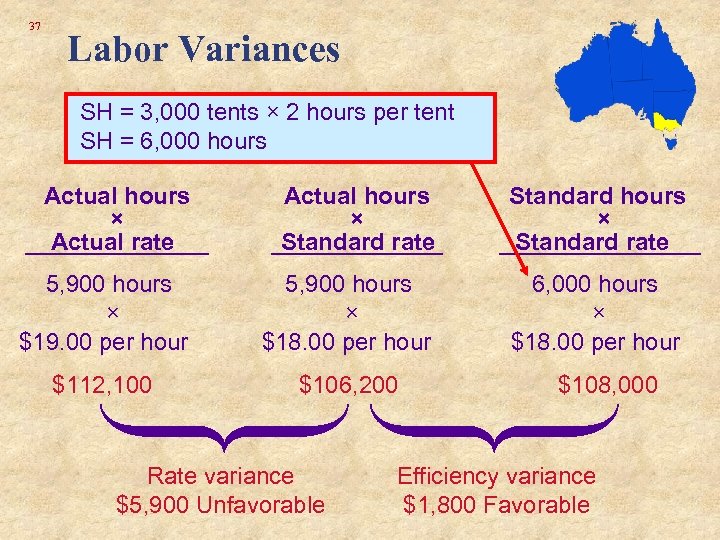

37 Labor Variances SH = 3, 000 tents × 2 hours per tent SH = 6, 000 hours Actual hours × Actual rate Actual hours × Standard rate Standard hours × Standard rate 5, 900 hours × $19. 00 per hour 5, 900 hours × $18. 00 per hour 6, 000 hours × $18. 00 per hour $112, 100 $106, 200 Rate variance $5, 900 Unfavorable $108, 000 Efficiency variance $1, 800 Favorable

37 Labor Variances SH = 3, 000 tents × 2 hours per tent SH = 6, 000 hours Actual hours × Actual rate Actual hours × Standard rate Standard hours × Standard rate 5, 900 hours × $19. 00 per hour 5, 900 hours × $18. 00 per hour 6, 000 hours × $18. 00 per hour $112, 100 $106, 200 Rate variance $5, 900 Unfavorable $108, 000 Efficiency variance $1, 800 Favorable

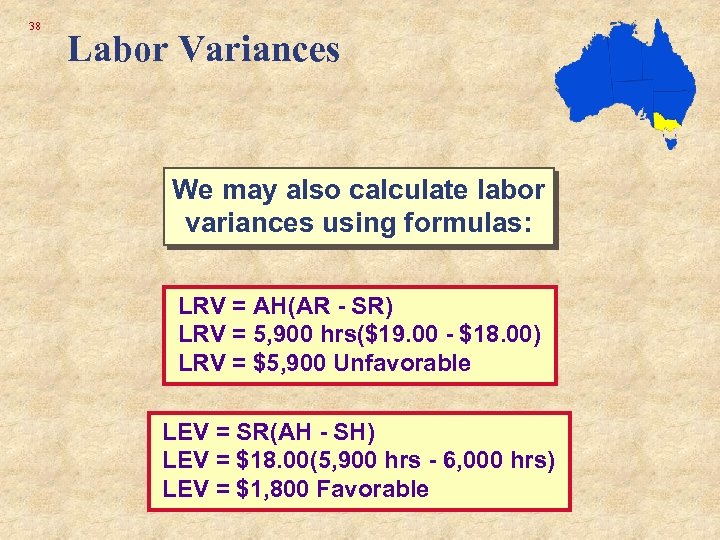

38 Labor Variances We may also calculate labor variances using formulas: LRV = AH(AR - SR) LRV = 5, 900 hrs($19. 00 - $18. 00) LRV = $5, 900 Unfavorable LEV = SR(AH - SH) LEV = $18. 00(5, 900 hrs - 6, 000 hrs) LEV = $1, 800 Favorable

38 Labor Variances We may also calculate labor variances using formulas: LRV = AH(AR - SR) LRV = 5, 900 hrs($19. 00 - $18. 00) LRV = $5, 900 Unfavorable LEV = SR(AH - SH) LEV = $18. 00(5, 900 hrs - 6, 000 hrs) LEV = $1, 800 Favorable

39 Labor Rate Variance – A Closer Look Using highly paid skilled workers to perform unskilled tasks results in an unfavorable price variance. High skill, high rate Low skill, low rate Production managers who make work assignments are generally responsible for price variances.

39 Labor Rate Variance – A Closer Look Using highly paid skilled workers to perform unskilled tasks results in an unfavorable price variance. High skill, high rate Low skill, low rate Production managers who make work assignments are generally responsible for price variances.

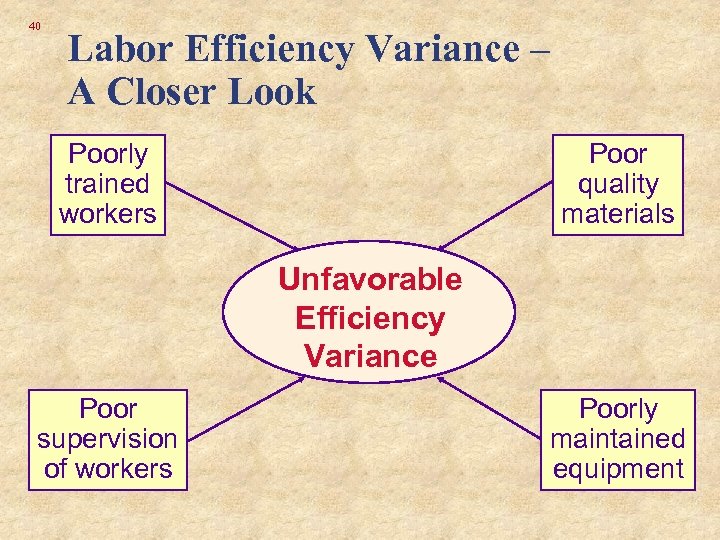

40 Labor Efficiency Variance – A Closer Look Poorly trained workers Poor quality materials Unfavorable Efficiency Variance Poor supervision of workers Poorly maintained equipment

40 Labor Efficiency Variance – A Closer Look Poorly trained workers Poor quality materials Unfavorable Efficiency Variance Poor supervision of workers Poorly maintained equipment

41 Responsibility for Labor Variances I am not responsible for the unfavorable labor efficiency variance! You bought poor quality materials, so my people took more time to process them. You used too much time because of poorly trained workers and poor supervision.

41 Responsibility for Labor Variances I am not responsible for the unfavorable labor efficiency variance! You bought poor quality materials, so my people took more time to process them. You used too much time because of poorly trained workers and poor supervision.

42 Responsibility for Labor Variances Maybe I can attribute the labor and materials variances to personnel for hiring the wrong people and training them poorly.

42 Responsibility for Labor Variances Maybe I can attribute the labor and materials variances to personnel for hiring the wrong people and training them poorly.

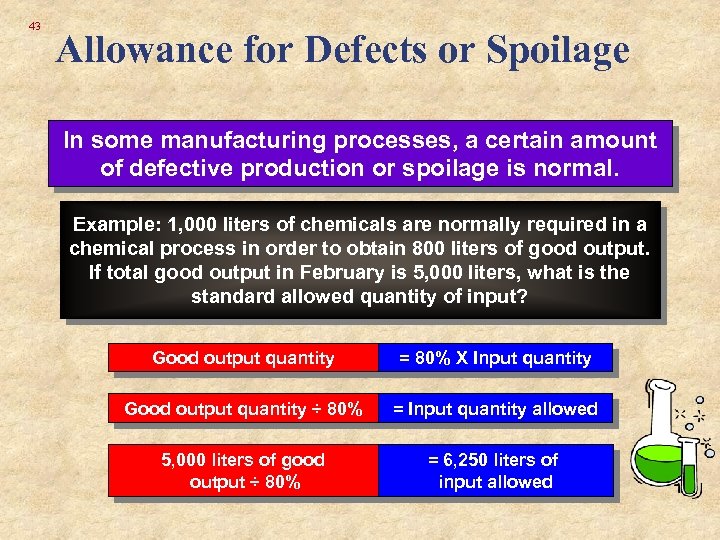

43 Allowance for Defects or Spoilage In some manufacturing processes, a certain amount of defective production or spoilage is normal. Example: 1, 000 liters of chemicals are normally required in a chemical process in order to obtain 800 liters of good output. If total good output in February is 5, 000 liters, what is the standard allowed quantity of input? Good output quantity = 80% X Input quantity Good output quantity ÷ 80% = Input quantity allowed 5, 000 liters of good output ÷ 80% = 6, 250 liters of input allowed

43 Allowance for Defects or Spoilage In some manufacturing processes, a certain amount of defective production or spoilage is normal. Example: 1, 000 liters of chemicals are normally required in a chemical process in order to obtain 800 liters of good output. If total good output in February is 5, 000 liters, what is the standard allowed quantity of input? Good output quantity = 80% X Input quantity Good output quantity ÷ 80% = Input quantity allowed 5, 000 liters of good output ÷ 80% = 6, 250 liters of input allowed

44 Learning Objective 4

44 Learning Objective 4

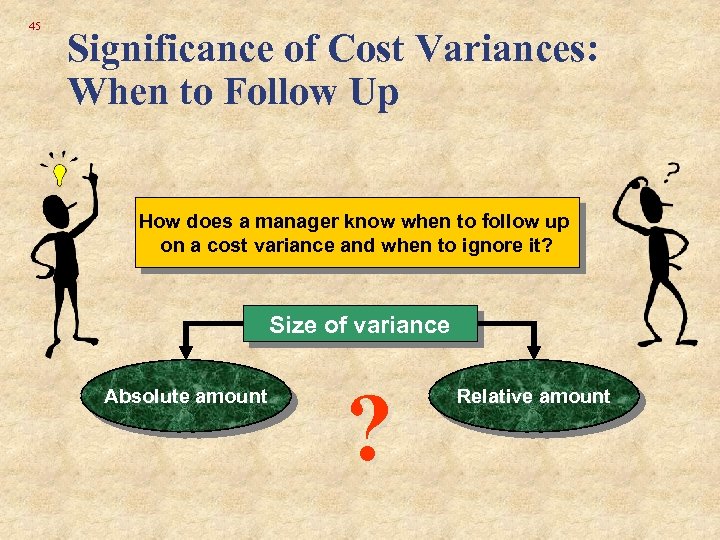

45 Significance of Cost Variances: When to Follow Up How does a manager know when to follow up on a cost variance and when to ignore it? Size of variance Absolute amount ? Relative amount

45 Significance of Cost Variances: When to Follow Up How does a manager know when to follow up on a cost variance and when to ignore it? Size of variance Absolute amount ? Relative amount

46 Significance of Cost Variances l Size of variance l l l What clues help me to determine the variances that I should investigate? l Dollar amount Percentage of standard Recurring variances Trends Controllability Favorable variances Costs and benefits of investigation

46 Significance of Cost Variances l Size of variance l l l What clues help me to determine the variances that I should investigate? l Dollar amount Percentage of standard Recurring variances Trends Controllability Favorable variances Costs and benefits of investigation

47 Significance of Cost Variances: When to Follow Up How do I know which variances to investigate? Larger variances, in dollar amount or as a percentage of the standard, are investigated first. We could use a rule of thumb such as: investigate all variances that are over $10, 000 or over 10 percent of the standard cost.

47 Significance of Cost Variances: When to Follow Up How do I know which variances to investigate? Larger variances, in dollar amount or as a percentage of the standard, are investigated first. We could use a rule of thumb such as: investigate all variances that are over $10, 000 or over 10 percent of the standard cost.

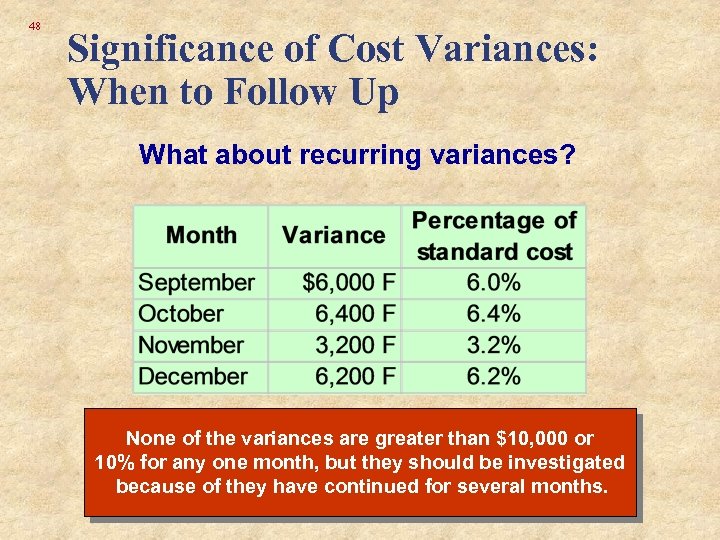

48 Significance of Cost Variances: When to Follow Up What about recurring variances? None of the variances are greater than $10, 000 or 10% for any one month, but they should be investigated because of they have continued for several months.

48 Significance of Cost Variances: When to Follow Up What about recurring variances? None of the variances are greater than $10, 000 or 10% for any one month, but they should be investigated because of they have continued for several months.

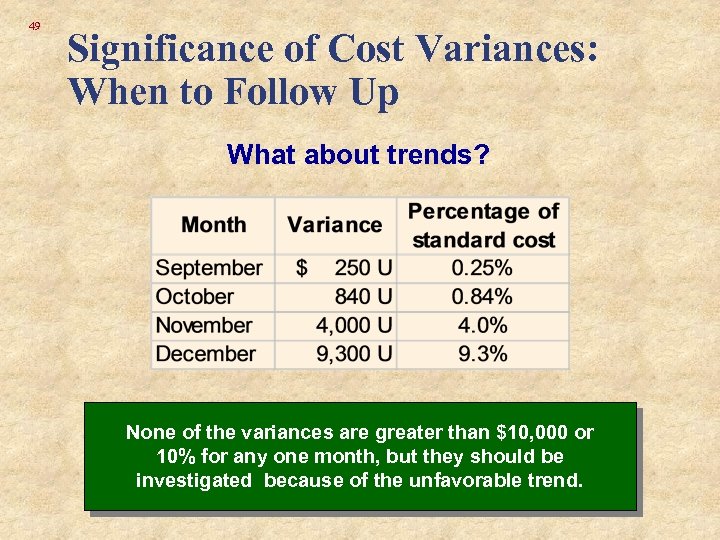

49 Significance of Cost Variances: When to Follow Up What about trends? None of the variances are greater than $10, 000 or 10% for any one month, but they should be investigated because of the unfavorable trend.

49 Significance of Cost Variances: When to Follow Up What about trends? None of the variances are greater than $10, 000 or 10% for any one month, but they should be investigated because of the unfavorable trend.

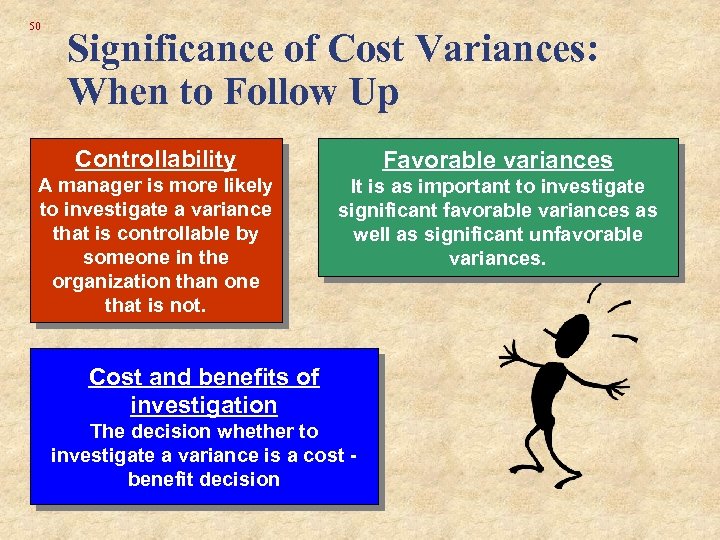

50 Significance of Cost Variances: When to Follow Up Controllability Favorable variances A manager is more likely to investigate a variance that is controllable by someone in the organization than one that is not. It is as important to investigate significant favorable variances as well as significant unfavorable variances. Cost and benefits of investigation The decision whether to investigate a variance is a cost benefit decision

50 Significance of Cost Variances: When to Follow Up Controllability Favorable variances A manager is more likely to investigate a variance that is controllable by someone in the organization than one that is not. It is as important to investigate significant favorable variances as well as significant unfavorable variances. Cost and benefits of investigation The decision whether to investigate a variance is a cost benefit decision

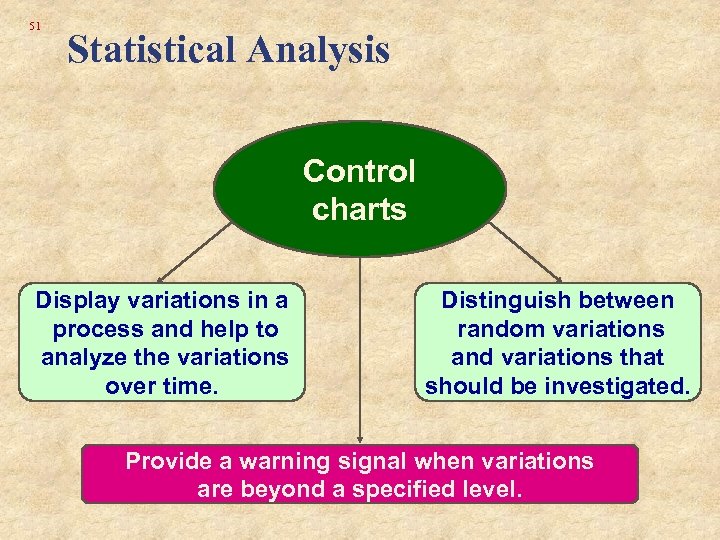

51 Statistical Analysis Control charts Display variations in a process and help to analyze the variations over time. Distinguish between random variations and variations that should be investigated. Provide a warning signal when variations are beyond a specified level.

51 Statistical Analysis Control charts Display variations in a process and help to analyze the variations over time. Distinguish between random variations and variations that should be investigated. Provide a warning signal when variations are beyond a specified level.

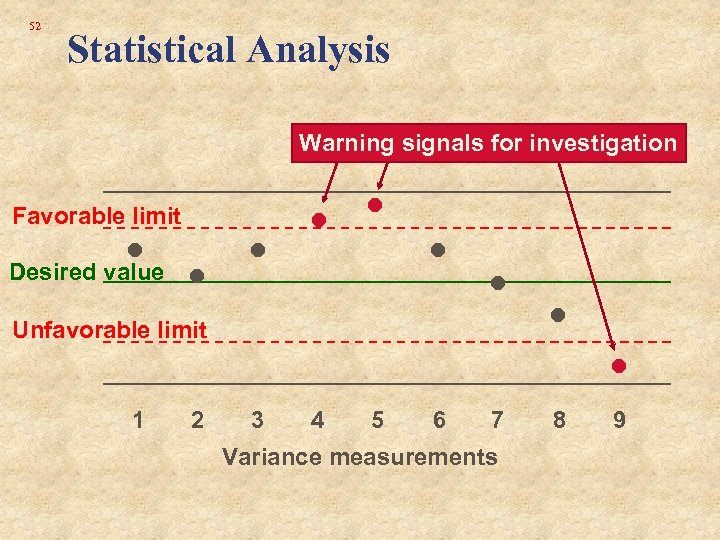

52 Statistical Analysis Warning signals for investigation Favorable limit • Desired value • • • Unfavorable limit 1 2 3 4 5 6 7 Variance measurements • 8 • 9

52 Statistical Analysis Warning signals for investigation Favorable limit • Desired value • • • Unfavorable limit 1 2 3 4 5 6 7 Variance measurements • 8 • 9

53 Learning Objective 5

53 Learning Objective 5

54 Behavioral Effects of Standard Costing Standard costs, budgets and variances are used to evaluate the performance of individuals and departments They can profoundly influence behavior when they are used to determine salary increases, bonuses and promotions

54 Behavioral Effects of Standard Costing Standard costs, budgets and variances are used to evaluate the performance of individuals and departments They can profoundly influence behavior when they are used to determine salary increases, bonuses and promotions

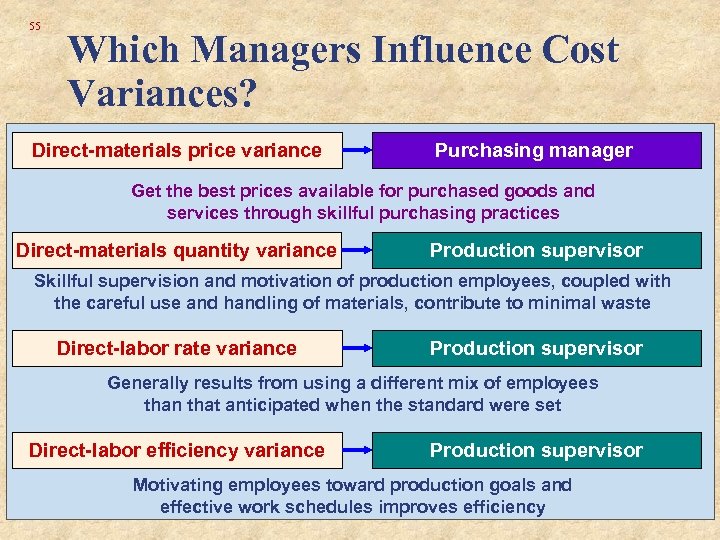

55 Which Managers Influence Cost Variances? Direct-materials price variance Purchasing manager Get the best prices available for purchased goods and services through skillful purchasing practices Direct-materials quantity variance Production supervisor Skillful supervision and motivation of production employees, coupled with the careful use and handling of materials, contribute to minimal waste Direct-labor rate variance Production supervisor Generally results from using a different mix of employees than that anticipated when the standard were set Direct-labor efficiency variance Production supervisor Motivating employees toward production goals and effective work schedules improves efficiency

55 Which Managers Influence Cost Variances? Direct-materials price variance Purchasing manager Get the best prices available for purchased goods and services through skillful purchasing practices Direct-materials quantity variance Production supervisor Skillful supervision and motivation of production employees, coupled with the careful use and handling of materials, contribute to minimal waste Direct-labor rate variance Production supervisor Generally results from using a different mix of employees than that anticipated when the standard were set Direct-labor efficiency variance Production supervisor Motivating employees toward production goals and effective work schedules improves efficiency

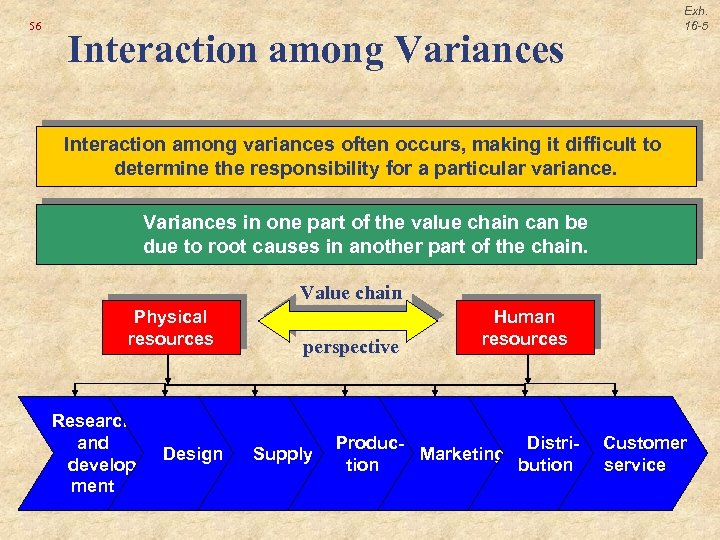

56 Exh. 16 -5 Interaction among Variances Interaction among variances often occurs, making it difficult to determine the responsibility for a particular variance. Variances in one part of the value chain can be due to root causes in another part of the chain. Value chain Physical resources Research and development Design perspective Supply Human resources Produc. Distri. Marketing tion bution Customer service

56 Exh. 16 -5 Interaction among Variances Interaction among variances often occurs, making it difficult to determine the responsibility for a particular variance. Variances in one part of the value chain can be due to root causes in another part of the chain. Value chain Physical resources Research and development Design perspective Supply Human resources Produc. Distri. Marketing tion bution Customer service

57 Learning Objective 6

57 Learning Objective 6

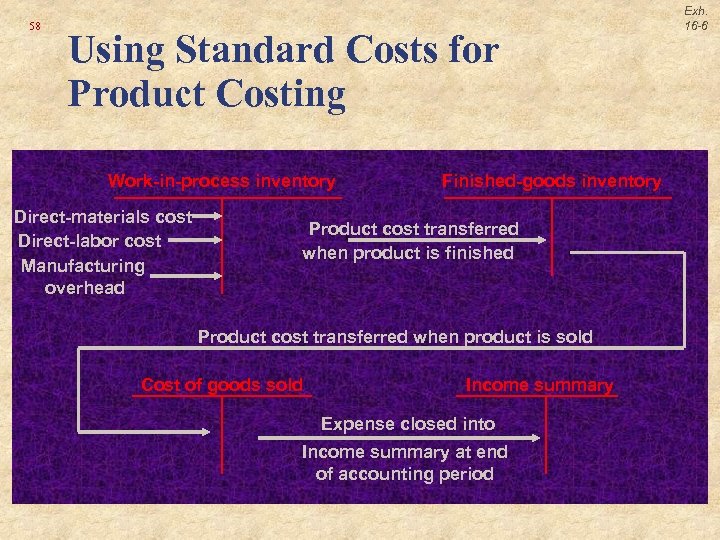

58 Using Standard Costs for Product Costing Work-in-process inventory Direct-materials cost Direct-labor cost Manufacturing overhead Finished-goods inventory Product cost transferred when product is finished Product cost transferred when product is sold Cost of goods sold Income summary Expense closed into Income summary at end of accounting period Exh. 16 -6

58 Using Standard Costs for Product Costing Work-in-process inventory Direct-materials cost Direct-labor cost Manufacturing overhead Finished-goods inventory Product cost transferred when product is finished Product cost transferred when product is sold Cost of goods sold Income summary Expense closed into Income summary at end of accounting period Exh. 16 -6

59 l l Standard Cost Journal Entries Inventories are recorded at standard cost. Variances are recorded as follows: l l l Favorable variances are credits, representing savings in production costs. Unfavorable variances are debits, representing excess production costs. Standard cost variances are usually closed to cost of goods sold. l l Favorable variances decrease cost of goods sold. Unfavorable variances increase cost of goods sold.

59 l l Standard Cost Journal Entries Inventories are recorded at standard cost. Variances are recorded as follows: l l l Favorable variances are credits, representing savings in production costs. Unfavorable variances are debits, representing excess production costs. Standard cost variances are usually closed to cost of goods sold. l l Favorable variances decrease cost of goods sold. Unfavorable variances increase cost of goods sold.

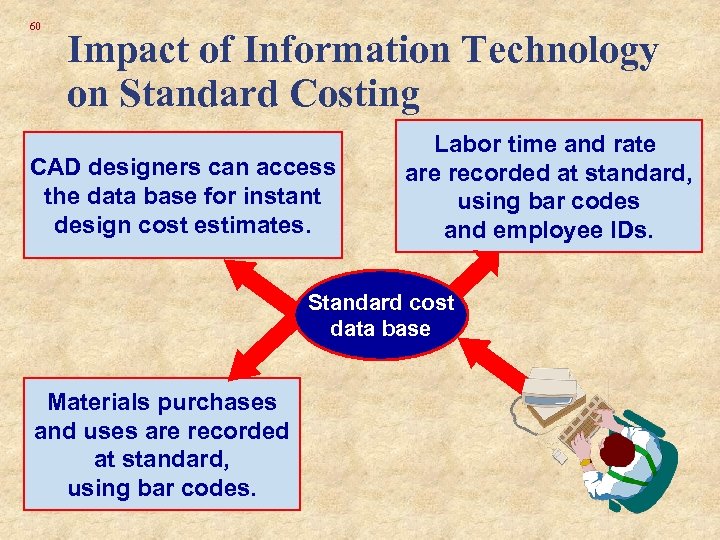

60 Impact of Information Technology on Standard Costing CAD designers can access the data base for instant design cost estimates. Labor time and rate are recorded at standard, using bar codes and employee IDs. Standard cost data base Materials purchases and uses are recorded at standard, using bar codes.

60 Impact of Information Technology on Standard Costing CAD designers can access the data base for instant design cost estimates. Labor time and rate are recorded at standard, using bar codes and employee IDs. Standard cost data base Materials purchases and uses are recorded at standard, using bar codes.

61 Learning Objective 7

61 Learning Objective 7

62 Standard Costing: Its Traditional Advantages Sensible cost comparisons Performance evaluation Management by exception Advantages More stable product costs Employee motivation Less expensive than actual- or normalcosting systems

62 Standard Costing: Its Traditional Advantages Sensible cost comparisons Performance evaluation Management by exception Advantages More stable product costs Employee motivation Less expensive than actual- or normalcosting systems

63 Learning Objective 8

63 Learning Objective 8

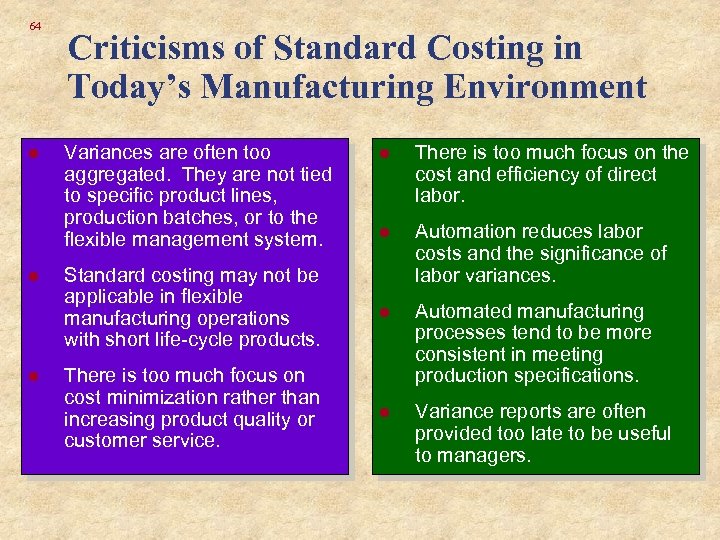

64 l l l Criticisms of Standard Costing in Today’s Manufacturing Environment l There is too much focus on the cost and efficiency of direct labor. l Standard costing may not be applicable in flexible manufacturing operations with short life-cycle products. Automation reduces labor costs and the significance of labor variances. l There is too much focus on cost minimization rather than increasing product quality or customer service. Automated manufacturing processes tend to be more consistent in meeting production specifications. l Variance reports are often provided too late to be useful to managers. Variances are often too aggregated. They are not tied to specific product lines, production batches, or to the flexible management system.

64 l l l Criticisms of Standard Costing in Today’s Manufacturing Environment l There is too much focus on the cost and efficiency of direct labor. l Standard costing may not be applicable in flexible manufacturing operations with short life-cycle products. Automation reduces labor costs and the significance of labor variances. l There is too much focus on cost minimization rather than increasing product quality or customer service. Automated manufacturing processes tend to be more consistent in meeting production specifications. l Variance reports are often provided too late to be useful to managers. Variances are often too aggregated. They are not tied to specific product lines, production batches, or to the flexible management system.

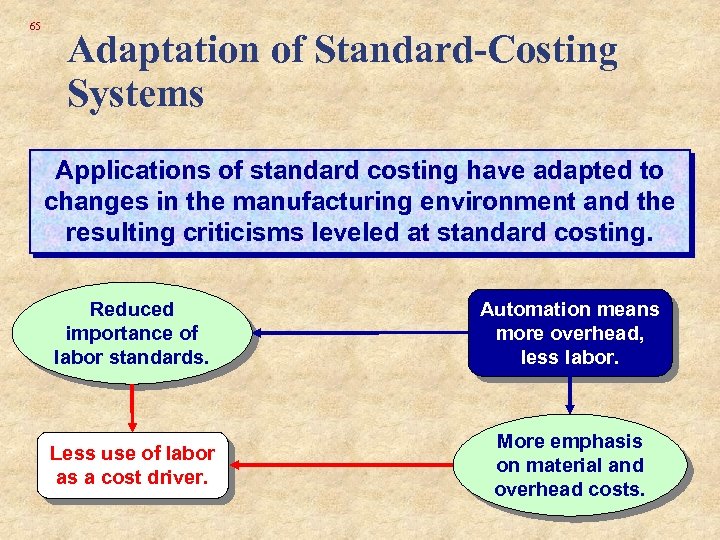

65 Adaptation of Standard-Costing Systems Applications of standard costing have adapted to changes in the manufacturing environment and the resulting criticisms leveled at standard costing. Reduced importance of labor standards. Automation means more overhead, less labor. Less use of labor as a cost driver. More emphasis on material and overhead costs.

65 Adaptation of Standard-Costing Systems Applications of standard costing have adapted to changes in the manufacturing environment and the resulting criticisms leveled at standard costing. Reduced importance of labor standards. Automation means more overhead, less labor. Less use of labor as a cost driver. More emphasis on material and overhead costs.

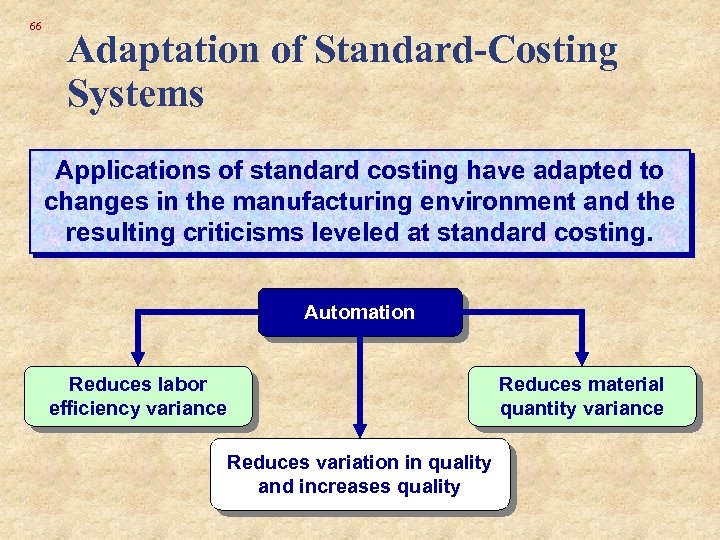

66 Adaptation of Standard-Costing Systems Applications of standard costing have adapted to changes in the manufacturing environment and the resulting criticisms leveled at standard costing. Automation Reduces labor efficiency variance Reduces variation in quality and increases quality Reduces material quantity variance

66 Adaptation of Standard-Costing Systems Applications of standard costing have adapted to changes in the manufacturing environment and the resulting criticisms leveled at standard costing. Automation Reduces labor efficiency variance Reduces variation in quality and increases quality Reduces material quantity variance

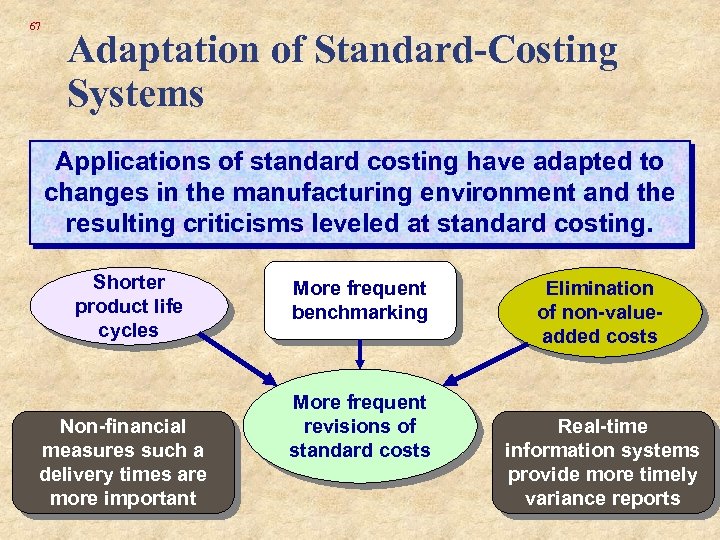

67 Adaptation of Standard-Costing Systems Applications of standard costing have adapted to changes in the manufacturing environment and the resulting criticisms leveled at standard costing. Shorter product life cycles Non-financial measures such a delivery times are more important More frequent benchmarking More frequent revisions of standard costs Elimination of non-valueadded costs Real-time information systems provide more timely variance reports

67 Adaptation of Standard-Costing Systems Applications of standard costing have adapted to changes in the manufacturing environment and the resulting criticisms leveled at standard costing. Shorter product life cycles Non-financial measures such a delivery times are more important More frequent benchmarking More frequent revisions of standard costs Elimination of non-valueadded costs Real-time information systems provide more timely variance reports

68 Learning Objective 9

68 Learning Objective 9

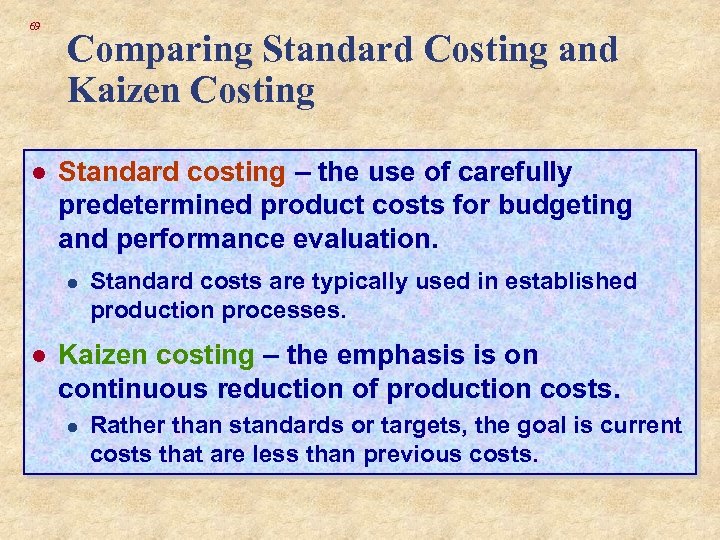

69 l Comparing Standard Costing and Kaizen Costing Standard costing – the use of carefully predetermined product costs for budgeting and performance evaluation. l l Standard costs are typically used in established production processes. Kaizen costing – the emphasis is on continuous reduction of production costs. l Rather than standards or targets, the goal is current costs that are less than previous costs.

69 l Comparing Standard Costing and Kaizen Costing Standard costing – the use of carefully predetermined product costs for budgeting and performance evaluation. l l Standard costs are typically used in established production processes. Kaizen costing – the emphasis is on continuous reduction of production costs. l Rather than standards or targets, the goal is current costs that are less than previous costs.

Kaizen Costing Current year cost base Cost per product unit 70 Exh. 16 -7 Kaizen goal: cost reduction rate Kaizen goal: cost reduction amount Actual cost reduction achieved Actual cost performance of the current year 12/31/x 0 Cost base for next year 12/31/x 1 Time

Kaizen Costing Current year cost base Cost per product unit 70 Exh. 16 -7 Kaizen goal: cost reduction rate Kaizen goal: cost reduction amount Actual cost reduction achieved Actual cost performance of the current year 12/31/x 0 Cost base for next year 12/31/x 1 Time

71 Learning Objective 10

71 Learning Objective 10

72 Production Mix and Yield Variances l l l Nearly all production processes require multiple materials and labor inputs. A summary quantity variance for materials and labor would hide the individual effects of these inputs. The quantity variances can be analyzed into two further variances: l l l Mix (the difference between actual and standard input proportions) Yield (the difference between actual and standard input used) The analysis assumes, of course, that the inputs can be substituted for each other.

72 Production Mix and Yield Variances l l l Nearly all production processes require multiple materials and labor inputs. A summary quantity variance for materials and labor would hide the individual effects of these inputs. The quantity variances can be analyzed into two further variances: l l l Mix (the difference between actual and standard input proportions) Yield (the difference between actual and standard input used) The analysis assumes, of course, that the inputs can be substituted for each other.

73 End of Chapter 16

73 End of Chapter 16