952d092bc9ca1eb1a51deff7145a4e19.ppt

- Количество слайдов: 21

15 - 1 Bonds 15 & SF Chapter 15 Mc. Graw-Hill Ryerson©

Bonds 15 Learning Objectives & SF After completing this chapter, you will be able to: Calculate LO 1. … the market price of a bond on any date LO 2. … the yield to maturity of a bond on any Mc. Graw-Hill Ryerson© interest payment date 15 - 2

15 - 3 Bonds 15 & SF … fixed Income investments Mc. Graw-Hill Ryerson©

Bonds 15 & SF 15 - 4 Basic Concepts & Definitions of Main Characteristics Face Value (or denomination) … the principal amount that the issuer is required to pay to the bond holder on the maturity date Coupon … interest rate paid on face value … rate normally fixed for life of bond … paid semiannually Mc. Graw-Hill Ryerson©

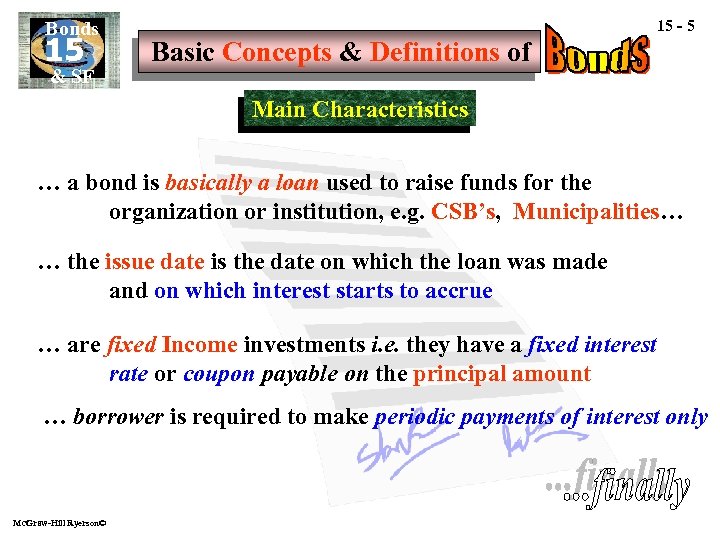

Bonds 15 & SF 15 - 5 Basic Concepts & Definitions of Main Characteristics … a bond is basically a loan used to raise funds for the organization or institution, e. g. CSB’s, Municipalities… … the issue date is the date on which the loan was made and on which interest starts to accrue … are fixed Income investments i. e. they have a fixed interest rate or coupon payable on the principal amount … borrower is required to make periodic payments of interest only Mc. Graw-Hill Ryerson©

Bonds 15 & SF 15 - 6 Basic Concepts & Definitions of Main Characteristics … issued with maturities ranging from 2 … on the maturity to 30 years date of the bond, the full principal amount is repaid along with the final interest payment Mc. Graw-Hill Ryerson©

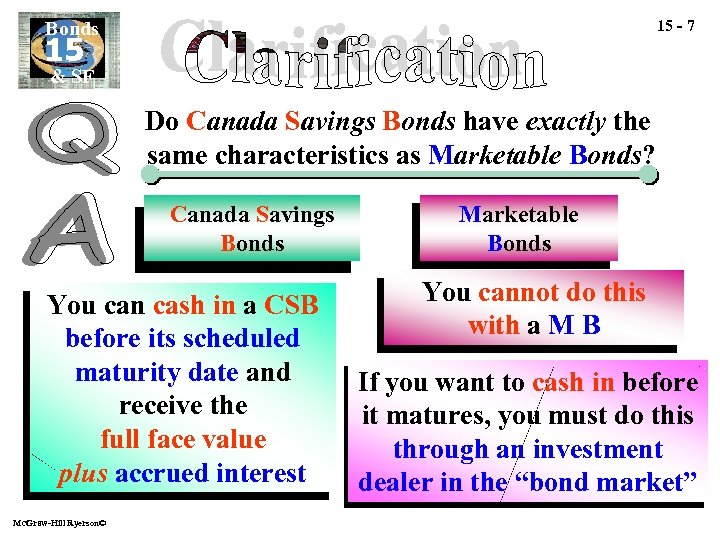

15 - 7 Bonds 15 & SF Do Canada Savings Bonds have exactly the same characteristics as Marketable Bonds? Canada Savings Bonds You can cash in a CSB before its scheduled maturity date and receive the full face value plus accrued interest Mc. Graw-Hill Ryerson© Marketable Bonds You cannot do this with a M B If you want to cash in before it matures, you must do this through an investment dealer in the “bond market”

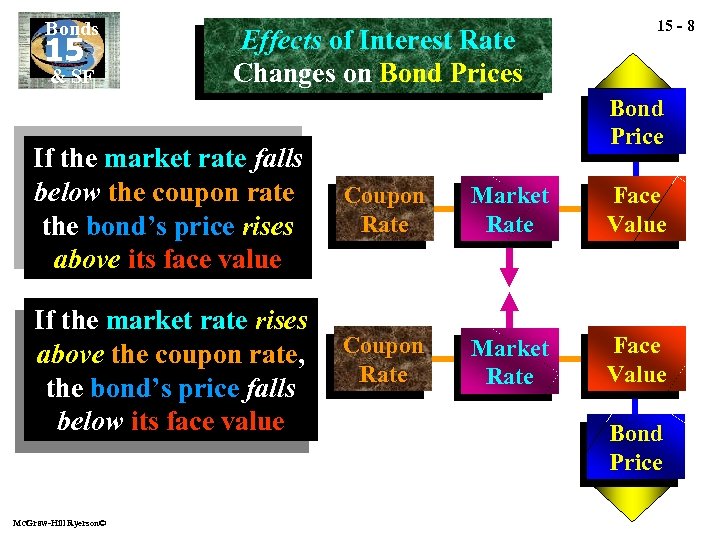

Bonds 15 & SF Effects of Interest Rate Changes on Bond Prices 15 - 8 Bond Price If the market rate falls below the coupon rate, the bond’s price rises above its face value Coupon Rate Market Rate Face Value If the market rate rises above the coupon rate, the bond’s price falls below its face value Coupon Rate Market Rate Face Value Mc. Graw-Hill Ryerson© Bond Price

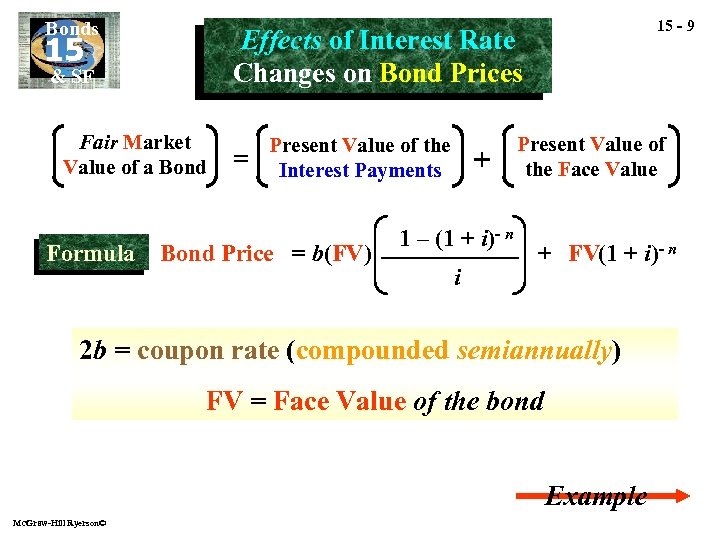

Bonds Effects of Interest Rate Changes on Bond Prices 15 & SF Fair Market Value of a Bond Formula 15 - 9 = Present Value of the Interest Payments Bond Price = b(FV) + 1 – (1 + i)- n i Present Value of the Face Value + FV(1 + i)- n 2 b = coupon rate (compounded semiannually) FV = Face Value of the bond Example Mc. Graw-Hill Ryerson©

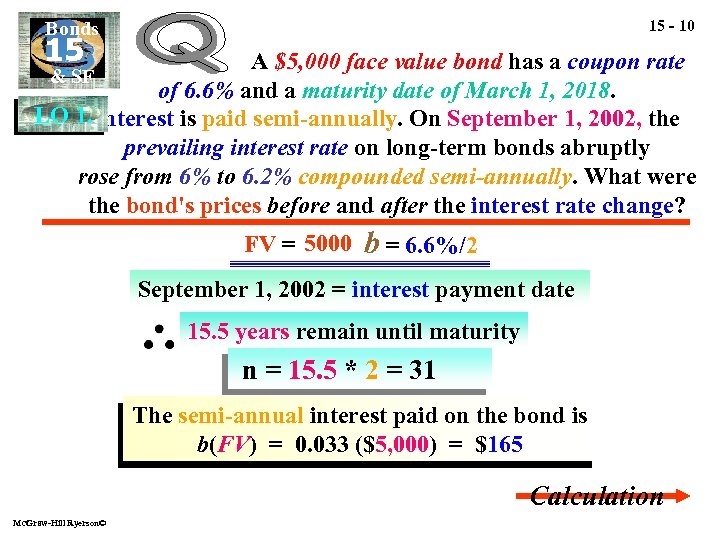

15 - 10 Bonds 15 A $5, 000 face value bond has a coupon rate of 6. 6% and a maturity date of March 1, 2018. LO 1. Interest is paid semi-annually. On September 1, 2002, the prevailing interest rate on long-term bonds abruptly rose from 6% to 6. 2% compounded semi-annually. What were the bond's prices before and after the interest rate change? & SF FV = 5000 b = 6. 6%/2 September 1, 2002 = interest payment date 15. 5 years remain until maturity n = 15. 5 * 2 = 31 The semi-annual interest paid on the bond is b(FV) = 0. 033 ($5, 000) = $165 Calculation Mc. Graw-Hill Ryerson©

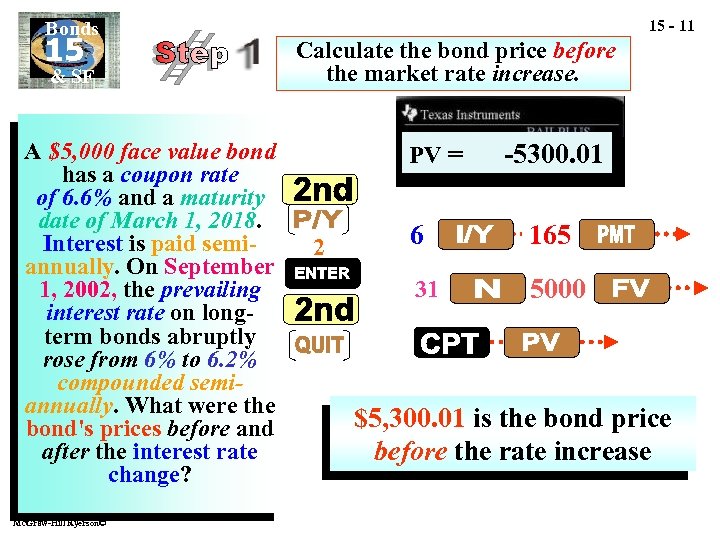

Bonds 15 & SF A $5, 000 face value bond has a coupon rate of 6. 6% and a maturity date of March 1, 2018. Interest is paid semiannually. On September 1, 2002, the prevailing interest rate on longterm bonds abruptly rose from 6% to 6. 2% compounded semiannually. What were the bond's prices before and after the interest rate change? Mc. Graw-Hill Ryerson© 15 - 11 Calculate the bond price before the market rate increase. PV = 2 -5300. 01 6 165 31 5000 $5, 300. 01 is the bond price before the rate increase

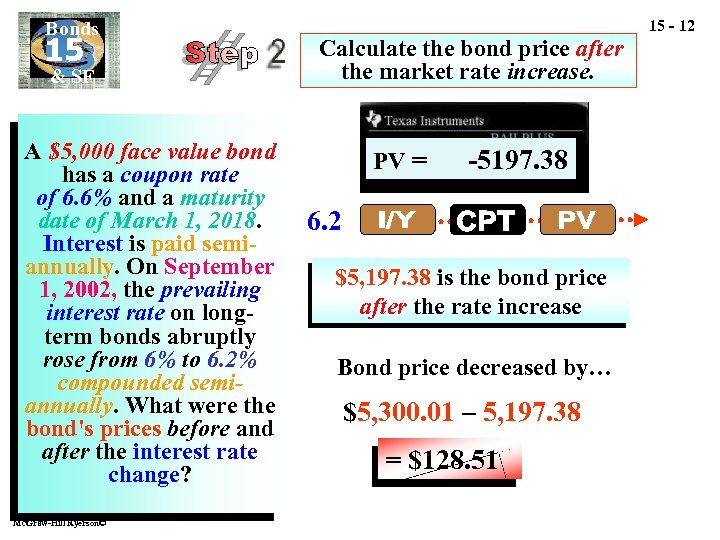

Bonds 15 & SF A $5, 000 face value bond has a coupon rate of 6. 6% and a maturity date of March 1, 2018. Interest is paid semiannually. On September 1, 2002, the prevailing interest rate on longterm bonds abruptly rose from 6% to 6. 2% compounded semiannually. What were the bond's prices before and after the interest rate change? Mc. Graw-Hill Ryerson© 15 - 12 Calculate the bond price after the market rate increase. PV = -5197. 38 6. 2 $5, 197. 38 is the bond price after the rate increase Bond price decreased by… $5, 300. 01 – 5, 197. 38 = $128. 51

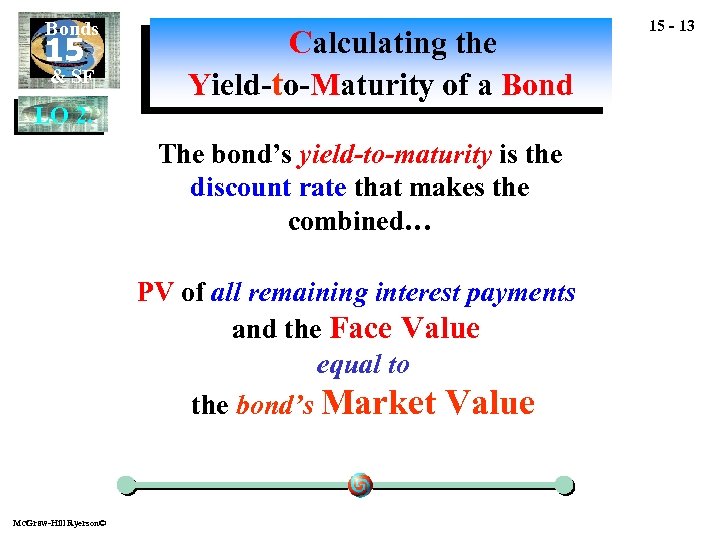

Bonds 15 & SF LO 2. Calculating the Yield-to-Maturity of a Bond The bond’s yield-to-maturity is the discount rate that makes the combined… PV of all remaining interest payments and the Face Value equal to the bond’s Market Value Mc. Graw-Hill Ryerson© 15 - 13

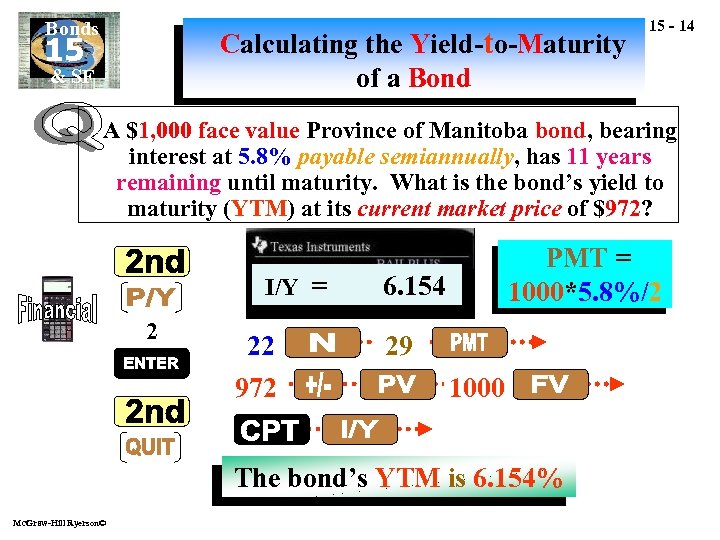

Bonds Calculating the Yield-to-Maturity of a Bond 15 & SF 15 - 14 A $1, 000 face value Province of Manitoba bond, bearing interest at 5. 8% payable semiannually, has 11 years remaining until maturity. What is the bond’s yield to maturity (YTM) at its current market price of $972? I/Y = P/Y = 2 22 972 6. 154 2 PMT = 1000*5. 8%/2 29 1000 The bond’s YTM is 6. 154% Mc. Graw-Hill Ryerson©

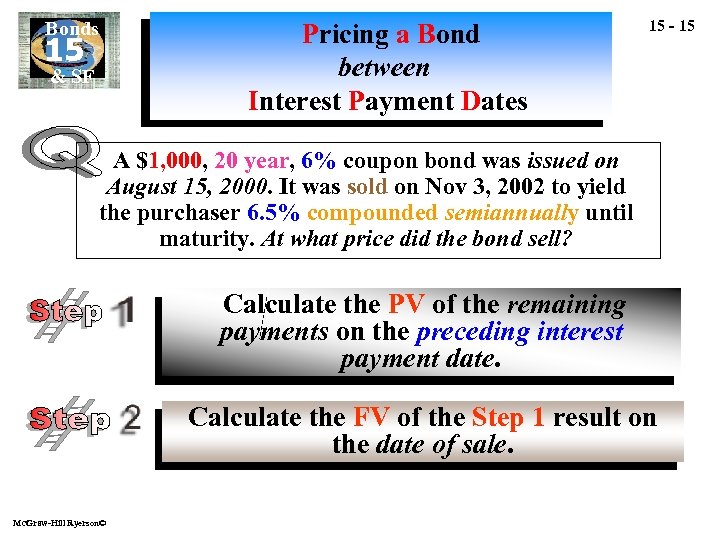

Bonds 15 & SF Pricing a Bond between Interest Payment Dates 15 - 15 A $1, 000, 20 year, 6% coupon bond was issued on August 15, 2000. It was sold on Nov 3, 2002 to yield the purchaser 6. 5% compounded semiannually until maturity. At what price did the bond sell? Calculate the PV of the remaining payments on the preceding interest payment date. Calculate the FV of the Step 1 result on the date of sale. Mc. Graw-Hill Ryerson©

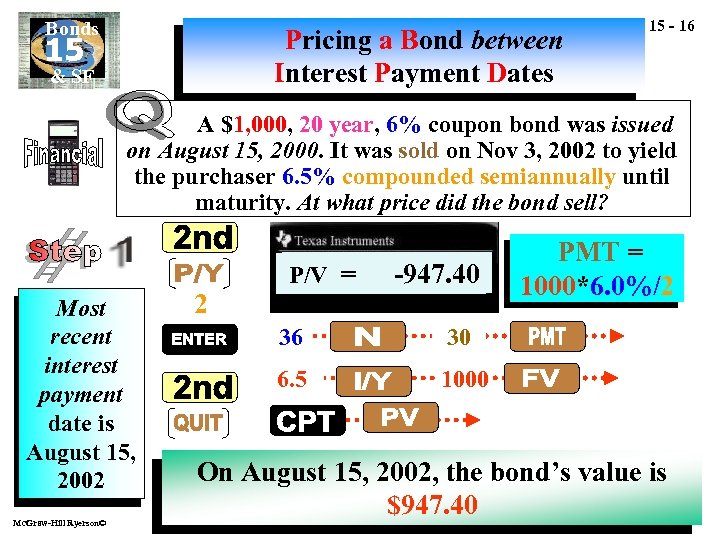

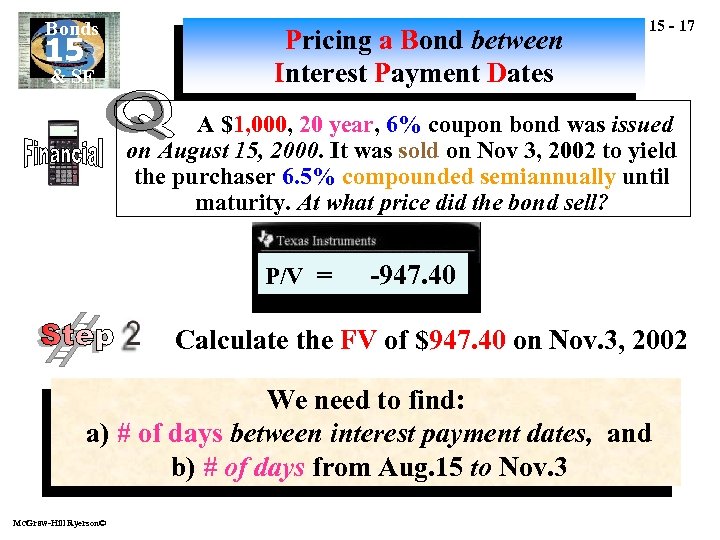

Bonds Pricing a Bond between Interest Payment Dates 15 & SF 15 - 16 A $1, 000, 20 year, 6% coupon bond was issued on August 15, 2000. It was sold on Nov 3, 2002 to yield the purchaser 6. 5% compounded semiannually until maturity. At what price did the bond sell? Most recent interest payment date is August 15, 2002 Mc. Graw-Hill Ryerson© 2 P/V = P/Y = -947. 40 2 36 30 6. 5 PMT = 1000*6. 0%/2 1000 On August 15, 2002, the bond’s value is $947. 40

Bonds 15 & SF Pricing a Bond between Interest Payment Dates 15 - 17 A $1, 000, 20 year, 6% coupon bond was issued on August 15, 2000. It was sold on Nov 3, 2002 to yield the purchaser 6. 5% compounded semiannually until maturity. At what price did the bond sell? P/V = P/Y = -947. 40 2 Calculate the FV of $947. 40 on Nov. 3, 2002 We need to find: a) # of days between interest payment dates, and b) # of days from Aug. 15 to Nov. 3 Mc. Graw-Hill Ryerson©

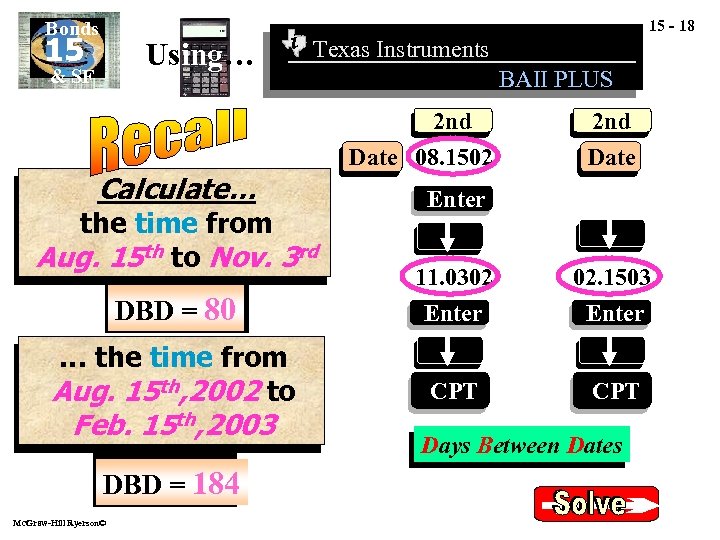

Bonds 15 Using… & SF i 15 - 18 Texas Instruments BAII PLUS 2 nd Calculate… the time from Aug. 15 th to Nov. 3 rd Date 08. 1502 2 nd Date Enter DBD = 80 11. 0302 Enter 02. 1503 Enter … the time from Aug. 15 th, 2002 to CPT Feb. 15 th, 2003 DBD = 184 Mc. Graw-Hill Ryerson© Days Between Dates

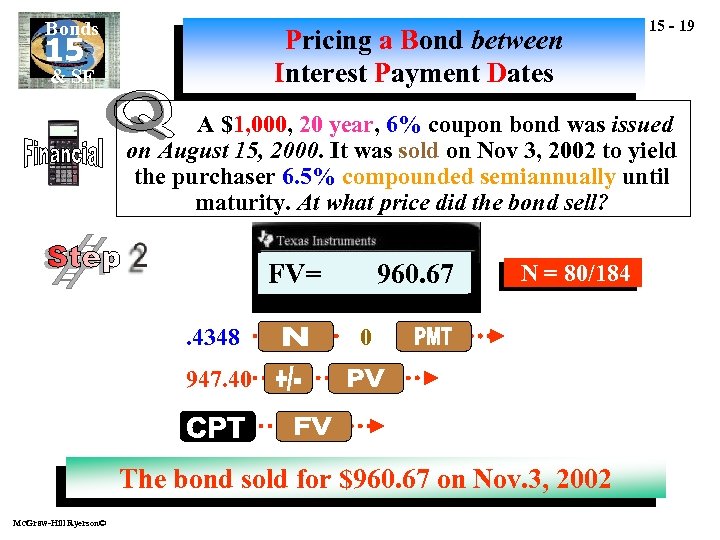

Bonds Pricing a Bond between Interest Payment Dates 15 & SF 15 - 19 A $1, 000, 20 year, 6% coupon bond was issued on August 15, 2000. It was sold on Nov 3, 2002 to yield the purchaser 6. 5% compounded semiannually until maturity. At what price did the bond sell? FV= = P/Y. 4348 960. 67. 4348 2 N = 80/184 0 947. 40 The bond sold for $960. 67 on Nov. 3, 2002 Mc. Graw-Hill Ryerson©

Bonds 15 15 - 20 & SF Click here: http: //www. finpipe. com/fixed. htm This site provides complete details on how bonds function. Just click on the areas that the site provides for information. Mc. Graw-Hill Ryerson©

Bonds 15 15 - 21 & SF This completes Chapter 15 Mc. Graw-Hill Ryerson©

952d092bc9ca1eb1a51deff7145a4e19.ppt