22b9b1fea30d580fdfa749f0e10c4be2.ppt

- Количество слайдов: 41

15 - 1

15 - 1

15 - 2 Definitions

15 - 2 Definitions

15 - 3

15 - 3

15 - 4 How does SKI’s working capital policy compare with the industry?

15 - 4 How does SKI’s working capital policy compare with the industry?

15 - 5 Is SKI inefficient or just conservative?

15 - 5 Is SKI inefficient or just conservative?

15 - 6 Cash Conversion Cycle

15 - 6 Cash Conversion Cycle

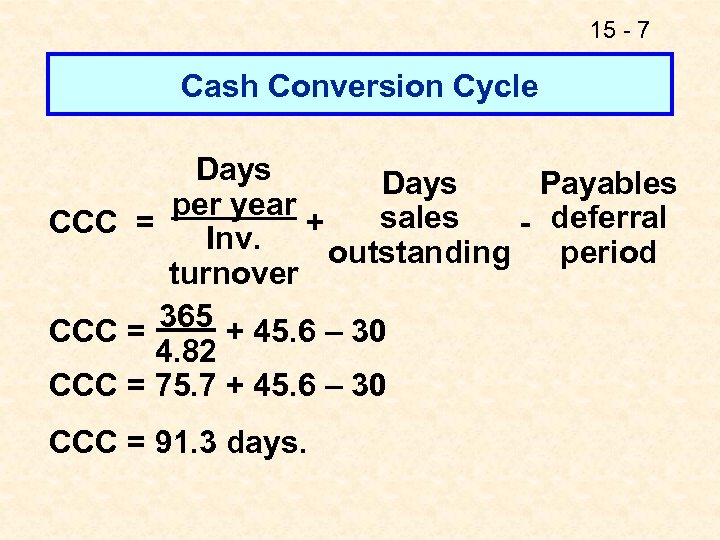

15 - 7 Cash Conversion Cycle Days Payables per year sales CCC = + - deferral Inv. outstanding period turnover 365 + 45. 6 – 30 CCC = 4. 82 CCC = 75. 7 + 45. 6 – 30 CCC = 91. 3 days.

15 - 7 Cash Conversion Cycle Days Payables per year sales CCC = + - deferral Inv. outstanding period turnover 365 + 45. 6 – 30 CCC = 4. 82 CCC = 75. 7 + 45. 6 – 30 CCC = 91. 3 days.

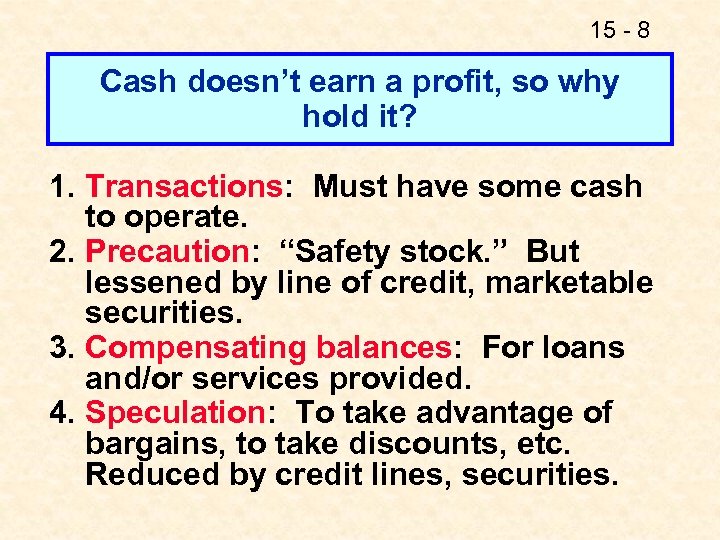

15 - 8 Cash doesn’t earn a profit, so why hold it? 1. Transactions: Must have some cash to operate. 2. Precaution: “Safety stock. ” But lessened by line of credit, marketable securities. 3. Compensating balances: For loans and/or services provided. 4. Speculation: To take advantage of bargains, to take discounts, etc. Reduced by credit lines, securities.

15 - 8 Cash doesn’t earn a profit, so why hold it? 1. Transactions: Must have some cash to operate. 2. Precaution: “Safety stock. ” But lessened by line of credit, marketable securities. 3. Compensating balances: For loans and/or services provided. 4. Speculation: To take advantage of bargains, to take discounts, etc. Reduced by credit lines, securities.

15 - 9 What’s the goal of cash management?

15 - 9 What’s the goal of cash management?

15 - 10 Reducing Cash and Securities without Harming Operations Securities could be sold off and combined with existing cash used to reduce debt, to buy back stock, or to invest in operating assets.

15 - 10 Reducing Cash and Securities without Harming Operations Securities could be sold off and combined with existing cash used to reduce debt, to buy back stock, or to invest in operating assets.

15 - 11 Cash Budget: The Primary Cash Management Tool

15 - 11 Cash Budget: The Primary Cash Management Tool

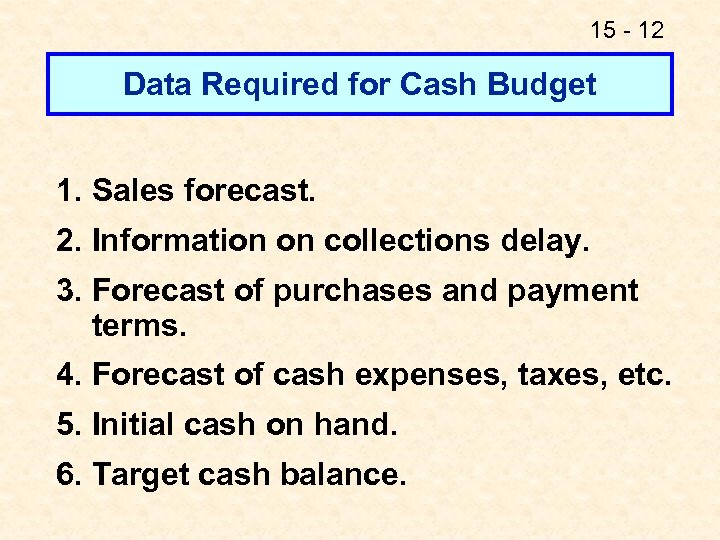

15 - 12 Data Required for Cash Budget 1. Sales forecast. 2. Information on collections delay. 3. Forecast of purchases and payment terms. 4. Forecast of cash expenses, taxes, etc. 5. Initial cash on hand. 6. Target cash balance.

15 - 12 Data Required for Cash Budget 1. Sales forecast. 2. Information on collections delay. 3. Forecast of purchases and payment terms. 4. Forecast of cash expenses, taxes, etc. 5. Initial cash on hand. 6. Target cash balance.

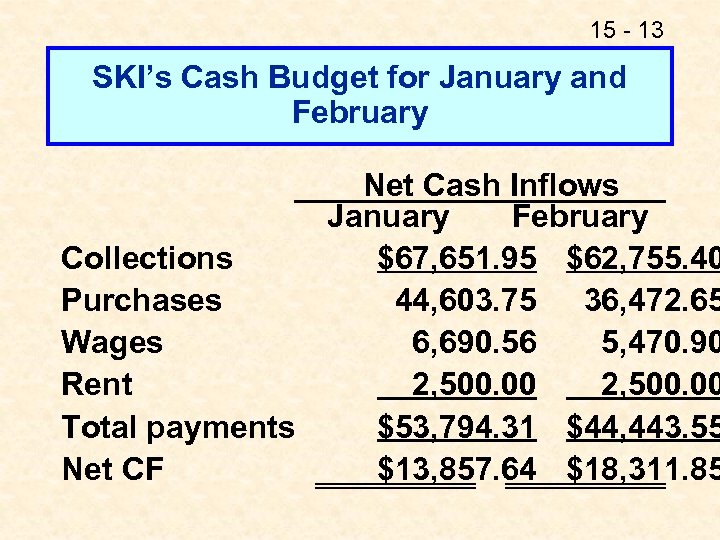

15 - 13 SKI’s Cash Budget for January and February Net Cash Inflows January February Collections $67, 651. 95 $62, 755. 40 Purchases 44, 603. 75 36, 472. 65 Wages 6, 690. 56 5, 470. 90 Rent 2, 500. 00 Total payments $53, 794. 31 $44, 443. 55 Net CF $13, 857. 64 $18, 311. 85

15 - 13 SKI’s Cash Budget for January and February Net Cash Inflows January February Collections $67, 651. 95 $62, 755. 40 Purchases 44, 603. 75 36, 472. 65 Wages 6, 690. 56 5, 470. 90 Rent 2, 500. 00 Total payments $53, 794. 31 $44, 443. 55 Net CF $13, 857. 64 $18, 311. 85

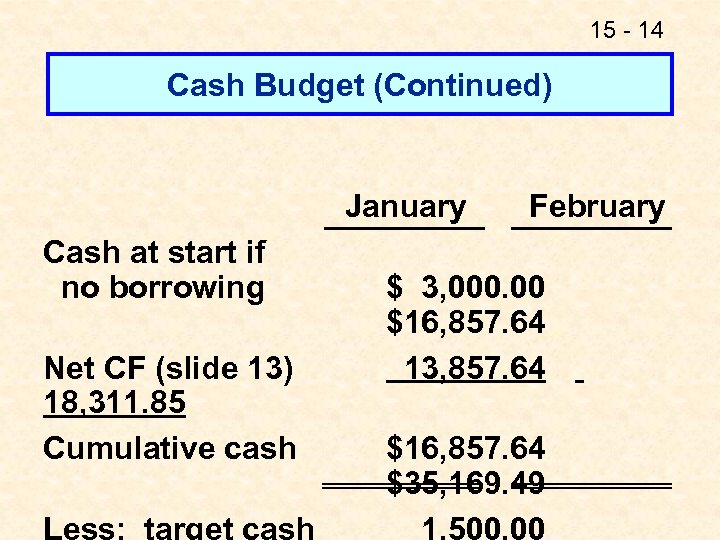

15 - 14 Cash Budget (Continued) January Cash at start if no borrowing Net CF (slide 13) 18, 311. 85 Cumulative cash Less: target cash February $ 3, 000. 00 $16, 857. 64 13, 857. 64 $16, 857. 64 $35, 169. 49 1, 500. 00

15 - 14 Cash Budget (Continued) January Cash at start if no borrowing Net CF (slide 13) 18, 311. 85 Cumulative cash Less: target cash February $ 3, 000. 00 $16, 857. 64 13, 857. 64 $16, 857. 64 $35, 169. 49 1, 500. 00

15 - 15 Should depreciation be explicitly included in the cash budget?

15 - 15 Should depreciation be explicitly included in the cash budget?

15 - 16 What are some other potential cash inflows besides collections?

15 - 16 What are some other potential cash inflows besides collections?

15 - 17 How could bad debts be worked into the cash budget?

15 - 17 How could bad debts be worked into the cash budget?

15 - 18 SKI’s forecasted cash budget indicates that the company’s cash holdings will exceed the targeted cash balance every month, except for October and November.

15 - 18 SKI’s forecasted cash budget indicates that the company’s cash holdings will exceed the targeted cash balance every month, except for October and November.

15 - 19 What reasons might SKI have for maintaining a relatively high amount of cash?

15 - 19 What reasons might SKI have for maintaining a relatively high amount of cash?

15 - 20 Categories of Inventory Costs

15 - 20 Categories of Inventory Costs

15 - 21 Reducing the average amount of inventory generally reduces carrying costs, increases ordering costs, and may increase the costs of running short.

15 - 21 Reducing the average amount of inventory generally reduces carrying costs, increases ordering costs, and may increase the costs of running short.

15 - 22 Is SKI holding too much inventory?

15 - 22 Is SKI holding too much inventory?

15 - 23 If SKI reduces its inventory, without adversely affecting sales, what effect will this have on its cash position?

15 - 23 If SKI reduces its inventory, without adversely affecting sales, what effect will this have on its cash position?

15 - 24 Do SKI’s customers pay more or less promptly than those of its competitors?

15 - 24 Do SKI’s customers pay more or less promptly than those of its competitors?

15 - 25 Elements of Credit Policy

15 - 25 Elements of Credit Policy

15 - 26 Does SKI face any risk if it tightens its credit policy? YES! A tighter credit policy may discourage sales. Some customers may choose to go elsewhere if they are pressured to pay their bills sooner.

15 - 26 Does SKI face any risk if it tightens its credit policy? YES! A tighter credit policy may discourage sales. Some customers may choose to go elsewhere if they are pressured to pay their bills sooner.

15 - 27 If SKI succeeds in reducing DSO without adversely affecting sales, what effect would this have on its cash position?

15 - 27 If SKI succeeds in reducing DSO without adversely affecting sales, what effect would this have on its cash position?

15 - 28 Working Capital Financing Policies

15 - 28 Working Capital Financing Policies

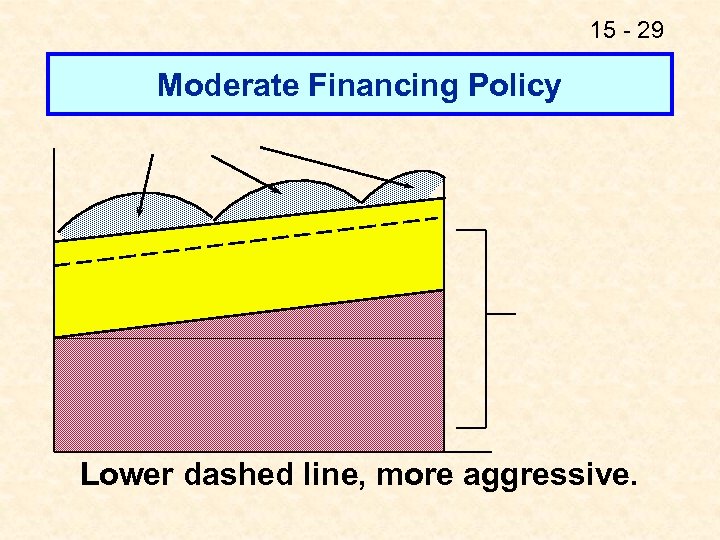

15 - 29 Moderate Financing Policy Lower dashed line, more aggressive.

15 - 29 Moderate Financing Policy Lower dashed line, more aggressive.

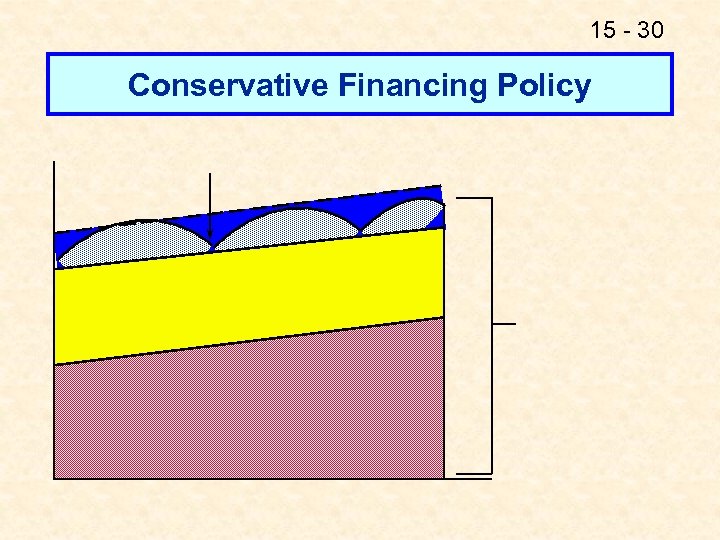

15 - 30 Conservative Financing Policy

15 - 30 Conservative Financing Policy

15 - 31 What is short-term credit, and what are the major sources?

15 - 31 What is short-term credit, and what are the major sources?

15 - 32

15 - 32

15 - 33 Is there a cost to accruals? Do firms have much control over amount of accruals?

15 - 33 Is there a cost to accruals? Do firms have much control over amount of accruals?

15 - 34 What is trade credit?

15 - 34 What is trade credit?

15 - 35 B&B buys $512, 106 gross, or $506, 985 net, on terms of 1/10, net 30, and pays on Day 40. How much free and costly trade credit, and what’s the cost of costly trade credit? Net daily purchases = $506, 985/365 = $1, 389.

15 - 35 B&B buys $512, 106 gross, or $506, 985 net, on terms of 1/10, net 30, and pays on Day 40. How much free and costly trade credit, and what’s the cost of costly trade credit? Net daily purchases = $506, 985/365 = $1, 389.

15 - 36 Gross/Net Breakdown

15 - 36 Gross/Net Breakdown

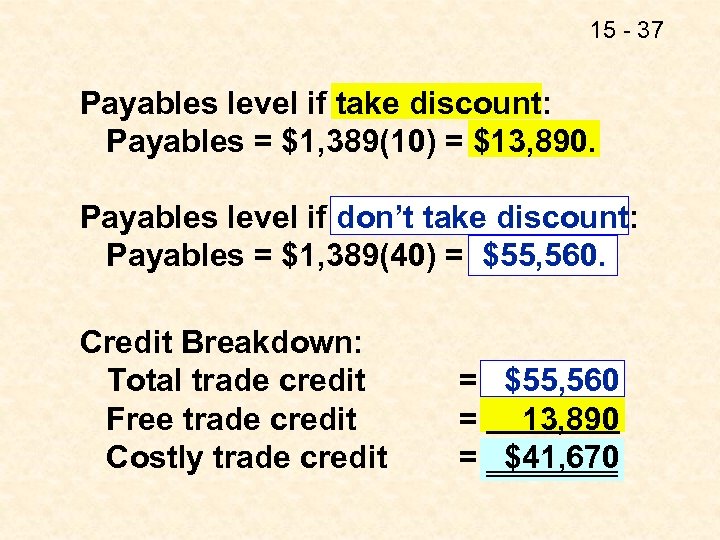

15 - 37 Payables level if take discount: Payables = $1, 389(10) = $13, 890. Payables level if don’t take discount: Payables = $1, 389(40) = $55, 560. Credit Breakdown: Total trade credit Free trade credit Costly trade credit = $55, 560 = 13, 890 = $41, 670

15 - 37 Payables level if take discount: Payables = $1, 389(10) = $13, 890. Payables level if don’t take discount: Payables = $1, 389(40) = $55, 560. Credit Breakdown: Total trade credit Free trade credit Costly trade credit = $55, 560 = 13, 890 = $41, 670

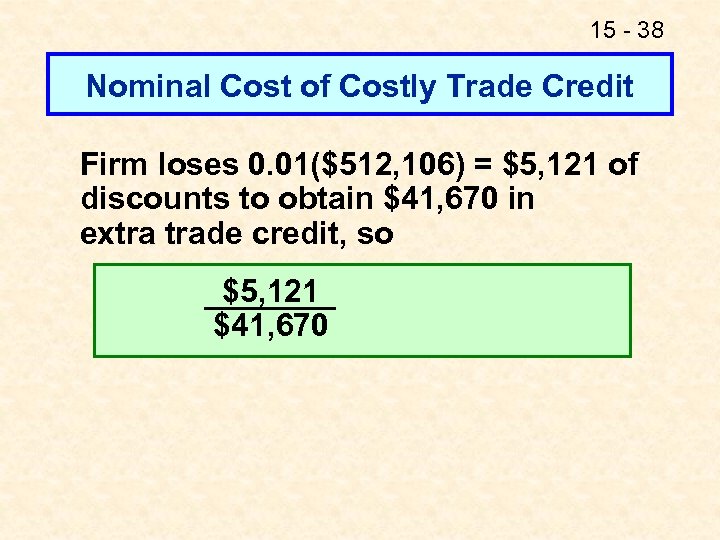

15 - 38 Nominal Cost of Costly Trade Credit Firm loses 0. 01($512, 106) = $5, 121 of discounts to obtain $41, 670 in extra trade credit, so $5, 121 $41, 670

15 - 38 Nominal Cost of Costly Trade Credit Firm loses 0. 01($512, 106) = $5, 121 of discounts to obtain $41, 670 in extra trade credit, so $5, 121 $41, 670

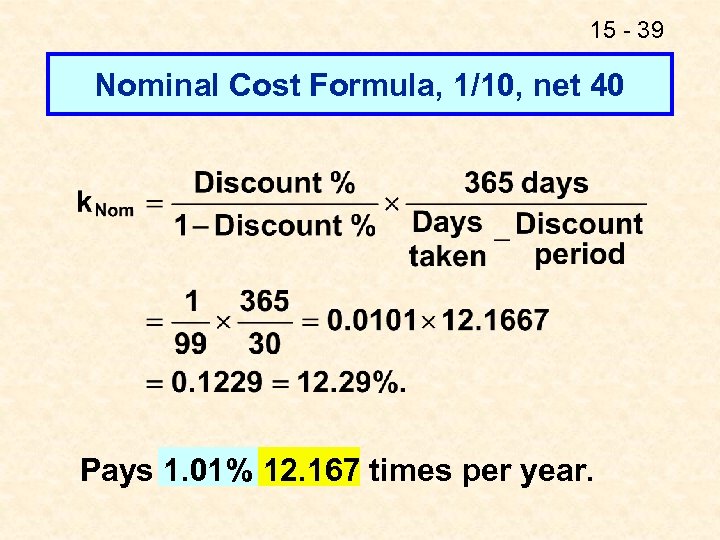

15 - 39 Nominal Cost Formula, 1/10, net 40 Pays 1. 01% 12. 167 times per year.

15 - 39 Nominal Cost Formula, 1/10, net 40 Pays 1. 01% 12. 167 times per year.

15 - 40 Effective Annual Rate, 1/10, net 40

15 - 40 Effective Annual Rate, 1/10, net 40

15 - 41 Commercial Paper (CP)

15 - 41 Commercial Paper (CP)