ac08d23e11a9c44f5402cd798827afe0.ppt

- Количество слайдов: 21

14 th Annual SBCCOG General Assembly February 22, 2013 Economic Development Without Redevelopment Changes in Retail and Tax Strategies and How Cities Can Respond Contact: Larry Kosmont, CRE President and CEO Kosmont Companies

THE SCRIPT • Retail as Economic Development in California • Retail Trends Today • Case Studies • Techniques to survive and thrive

“Show Me The Money” Development Without Redevelopment

California’s Retail – A Lead Role In Our Economy • $43 billion in sales and use tax revenue annually • 164, 200 unique stores; 650, 000 retail outlets • 500 recognized market areas • $571 billion in sales annually • 2, 776, 000 employees (nearly one fifth of California’s total employment)

The “Fiscalization” of Land Use • The lure of sales tax dollars has encouraged general plans and zoning ordinances to be drafted that favor retail • Sometimes resulted in “spot zoning” that created “islands of retail” amid other, often incompatible uses • Retail proliferated at freeway exit ramps & City boundaries • Over three decades, sales tax policy has greatly influenced legitimate land use decisions and distribution of land uses • Competition between cities for the same retailers resulted in incentive wars for major retailers to locate • Ultimately legislation (SB 114) stopped cities from using incentives to poach more sales tax revenue

Retail Trends – The Elephant in the Living Room 1. Online Retailing • • Brick & Mortar electronic retailers increasingly vulnerable Borders gone, B&N closing 20 stores per year for a decade Fulfillment Centers expanding Increase in fulfillment centers may lead to more retail located in industrial areas as well as “B” and “C” locations 2. “Showrooming” – Browsing at stores then buying online 3. “Geofencing” – offering promotions via mobiles in or near store 4. “Omni-channel” Shopping – integration of all market pathways 5. Non-discount Brick & Mortars must offer a unique shopping experience and entertaining environment to thrive

Internet Sales Tax Collection • National Level – Congress divided: • Proposed Main Street Fairness Act would set guidelines for how states should collect taxes from online retailers, but. . . • Federal legislation also introduced to stop states from trying to collect internet taxes on out of state retailers • In California: • Out of state retailers now required to collect sales taxes on internet purchases. • Amazon fought law, but then settled. • Amazon building large distribution centers in CA with goal of same day delivery

Internet Sales Tax Collection • Who captures the sales tax? 1. Where the purchaser is located? 2. Where the seller has a physical presence? • Lockbox • • Items purchased are delivered to secure local location Purchaser given code to unlock and take package Permits delivery of items en mass Lowers shipping fees & helps mitigate cost of sales tax Ultimately cities & states will capture sales tax revenue. The question is…. How?

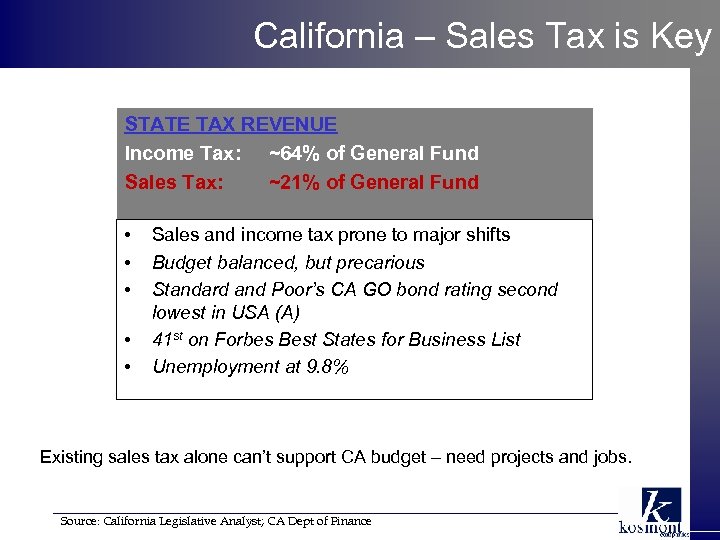

California – Sales Tax is Key STATE TAX REVENUE Income Tax: ~64% of General Fund Sales Tax: ~21% of General Fund • Sales and income tax prone to major shifts • Budget balanced, but precarious • Standard and Poor’s CA GO bond rating second • • lowest in USA (A) 41 st on Forbes Best States for Business List Unemployment at 9. 8% Existing sales tax alone can’t support CA budget – need projects and jobs. Source: California Legislative Analyst; CA Dept of Finance

Cities Focused on Real Estate & Taxes Cities need private partners for projects that generate taxes & jobs • Retail – sales tax & jobs (entry level) • Rooms – hotel transient occupancy tax (TOT) • Relocation/Expansion – business tax & jobs • Real Estate Development – property taxes & jobs Cities need Tax Increment to induce projects that generate sales tax.

Redevelopment “Cancelled” TIF California now only one of 2 states w/o tax increment, THE most powerful tool for economic development • Based upon property tax which is a stable funding source • RDA Tax-Increment Financing (TIF) model allowed local agencies access to significant & long-term source of funds • Tax increment grows for decades beyond a flat base year, capturing significant leverageable value over time Redevelopment was a Tax-Increment Financing power tool: So what’s left after Redevelopment?

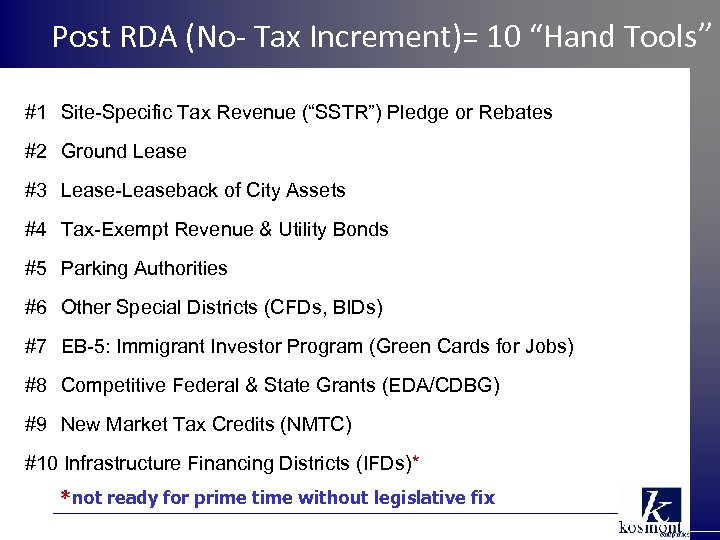

Post RDA (No- Tax Increment)= 10 “Hand Tools” #1 Site-Specific Tax Revenue (“SSTR”) Pledge or Rebates #2 Ground Lease #3 Lease-Leaseback of City Assets #4 Tax-Exempt Revenue & Utility Bonds #5 Parking Authorities #6 Other Special Districts (CFDs, BIDs) #7 EB-5: Immigrant Investor Program (Green Cards for Jobs) #8 Competitive Federal & State Grants (EDA/CDBG) #9 New Market Tax Credits (NMTC) #10 Infrastructure Financing Districts (IFDs)* *not ready for prime time without legislative fix

How to Survive in 2013? P 3’s are the Keys Three P’s required of public & private sectors for Public Private Partnerships to work: 1. Participation • Financial • Transactional • Operational 2. Public Purpose • Public benefits 3. Political Will • Where there’s a will there’s a way

“Deal or No Deal” Pick a number, any number

City of Redondo Beach Waterfront Revitalization (Project In Process) Hand Tools: • Lease-Leaseback Financing • Option Agreement • RFQ • Site Specific Tax Revenues (? ) • Parking District (? ) “Economic Development Without Redevelopment”

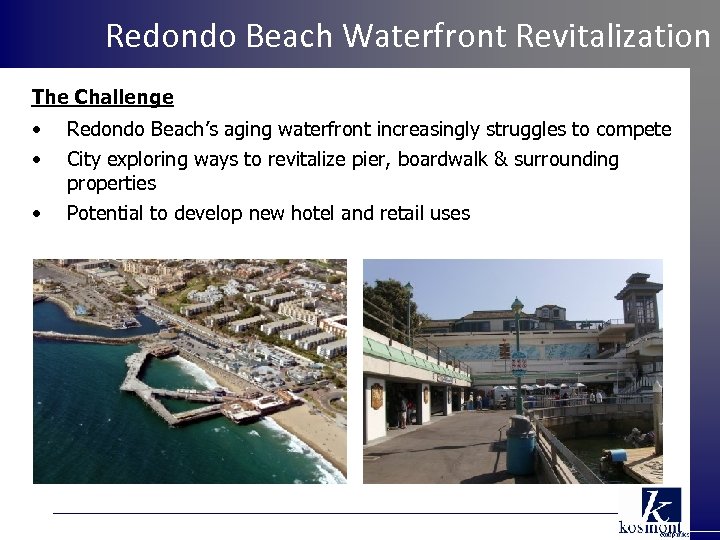

Redondo Beach Waterfront Revitalization The Challenge • • • Redondo Beach’s aging waterfront increasingly struggles to compete City exploring ways to revitalize pier, boardwalk & surrounding properties Potential to develop new hotel and retail uses

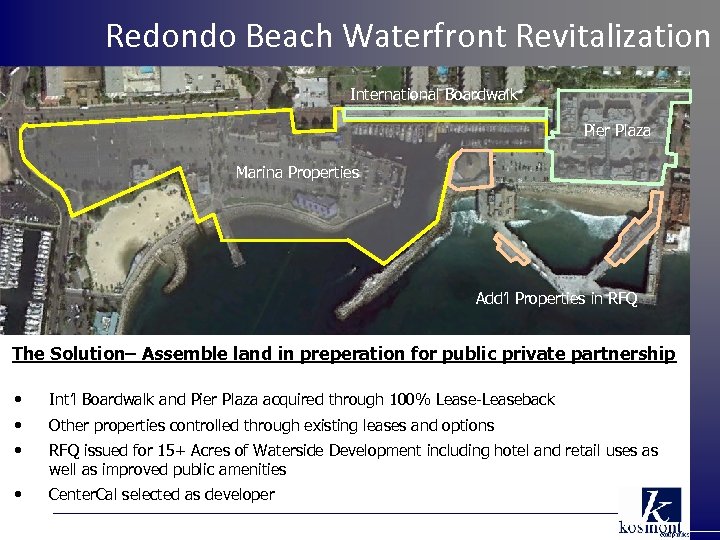

Redondo Beach Waterfront Revitalization International Boardwalk Pier Plaza Marina Properties Add’l Properties in RFQ The Solution– Assemble land in preperation for public private partnership • Int’l Boardwalk and Pier Plaza acquired through 100% Lease-Leaseback • Other properties controlled through existing leases and options • RFQ issued for 15+ Acres of Waterside Development including hotel and retail uses as well as improved public amenities • Center. Cal selected as developer

City of Redondo Beach Marine Ave. Hotels (Project In Process) Hand Tools: • Ground Lease • Lease-Leaseback • Site-Specific Tax Revenue Pledge (prop & TOT) • Mezzanine Reserve Fund “Economic Development Without Redevelopment”

Redondo Beach Marine Avenue Hotel Project The Challenge • • wants to better utilize area near Metro station that has yet to attract City transit-oriented development. Odd lot size & shape; multiple ownership; and vacant condition has deterred private development. The Project: (Escrow scheduled to close and break ground Feb. 2013) • 147 room Hilton Garden Inn & a 172 -room Marriott Residence Inn located adjacent to a Metro station • Community use of meeting rooms, Fwy. Billboard use for City

And That’s a Wrap 1. Retail real estate is about 3 things : Urban location, location. 2. Internet retailing rising fast, but still market for “bricks”, especially in underserved and urban markets 3. California’s budget structure still favors retail, but land use decisions may shift as online retail changes “points of sale” 4. How will cities and states capture sales tax? 5. Public-private deals need to be incentivized on a local level to maintain and pay for quality of life and services 6. There a variety of financing tools in the wake of redevelopment; but none are as effective as Tax Increment. 7. California needs an long term funding solution for economic development projects 8. Ultimately, the public sector and private sector need a heavy dose of each other to thrive. Let’s do lunch!

This presentation is available online www. kosmont. com

ac08d23e11a9c44f5402cd798827afe0.ppt