4d409b9b8b8a3441f954024cfee91e21.ppt

- Количество слайдов: 56

14 - 1 B 40. 2302 Class #9 w BM 6 chapters 25. 2 -25. 6, 27 25: Leasing è 26: Risk management è 27: International risk management è w Based on slides created by Matthew Will w Modified 11/07/2001 by Jeffrey Wurgler Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Principles of Corporate Finance Brealey and Myers u Sixth Edition Leasing Slides by Matthew Will, Jeffrey Wurgler Irwin/Mc. Graw Hill Chapter 25. 2 -25. 6 ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 3 Topics Covered w Why Lease? w Operating (Short-term) Leases w Financial (Long-term) Leases Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 4 Why Lease? w Sensible (Non-tax) Reasons for Leasing è Short-term leases are convenient è Cancellation options are valuable è Maintenance may be provided è Standardization leads to low transaction costs • (Relative to bond or stock issue) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 5 Why Lease? w Sensible (Tax) Reasons for Leasing è Tax shields can be used • Lessor owns asset, and so deducts its depreciation • If lessor can make better use of tax shield than lessee, then lessor should own equipment and pass on some tax benefits to lessee (in form of lower lease payments) • So direct tax gain to lessor, indirect gain to lessee è Reduces the alternative minimum tax (AMT) • Corporate tax = max{regular tax, AMT} • Leasing (as opposed to buying) reduces lessee’s AMT Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 6 Why Lease? w Dubious Reasons for Leasing è è Leasing avoids internal capital expenditure controls Leasing preserves capital Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 7 Why Lease? w Dubious Reasons for Leasing (contd. ) è Leases may be off-balance-sheet financing • In Germany, all leases are off balance sheet • In US, only operating leases are off balance sheet è Leasing affects book income • Leasing reduces book income bec. lease payments are expensed • Buy-and-borrow alternative reduces book income through both interest and depreciation Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 8 Operating Leases w Review: Suppose you decide to lease a machine for one year Q: What is the rental payment in a competitive leasing industry? A: The lessor’s equivalent annual cost (EAC) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

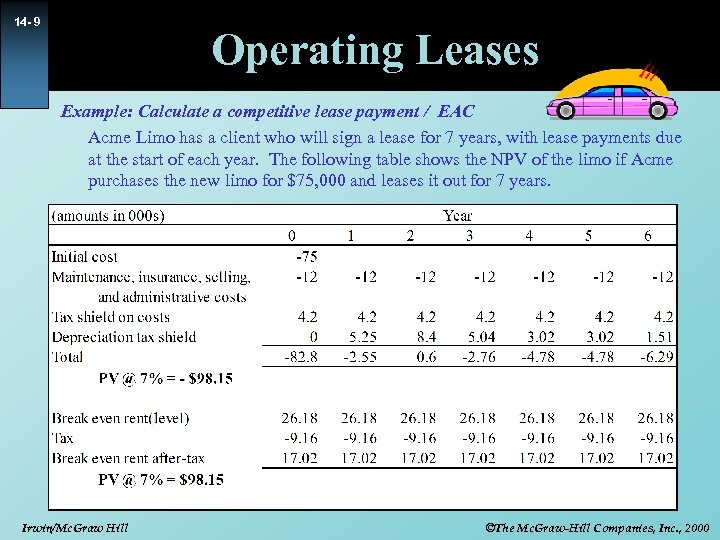

14 - 9 Operating Leases Example: Calculate a competitive lease payment / EAC Acme Limo has a client who will sign a lease for 7 years, with lease payments due at the start of each year. The following table shows the NPV of the limo if Acme purchases the new limo for $75, 000 and leases it out for 7 years. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 10 Operating Leases w Bottom line for lessee: Operating lease or buy? Buy if the lessee’s equivalent annual cost of ownership and operation is less than the best available operating lease rate Otherwise lease w Complication: If operating lease includes option to cancel/abandon, need to factor that in Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 11 Financial Leases Example - cont Greymare Bus Lines is considering a lease. Your operating manager wants to buy a new bus for $100, 000. The bus has an 8 year life. An alternative is to lease the bus for 8 years at $16, 900 per year, but Greymare still assumes all operating and maintenance costs. Should Greymare buy or lease the bus? Cash flow consequences of the financial lease contract: • Greymare saves the $100, 000 cost of the bus. • Loss of depreciation benefit of owning the bus. • $16, 900 lease payment is due at the start of each year. • Lease payments are tax deductible. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

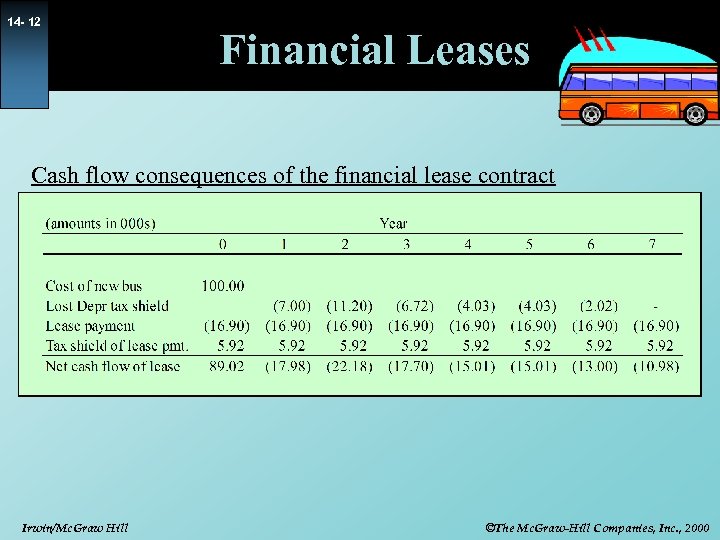

14 - 12 Financial Leases Cash flow consequences of the financial lease contract Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 13 Financial Leases How to discount CFs? Since lessor is essentially lending money to lessee, appropriate rate is the equivalent lending/borrowing rate • Lender pays tax on interest it receives: net return is after-tax interest rate • Borrower deducts interest from taxable income: net cost is aftertax interest rate • Thus, after-tax interest rate is effective rate at which company can transfer debt-equivalent cash flows across time • Suppose Greymare can borrow at 10%. Then the lease payments should be discounted at (1 -. 35)*. 10 =. 065. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

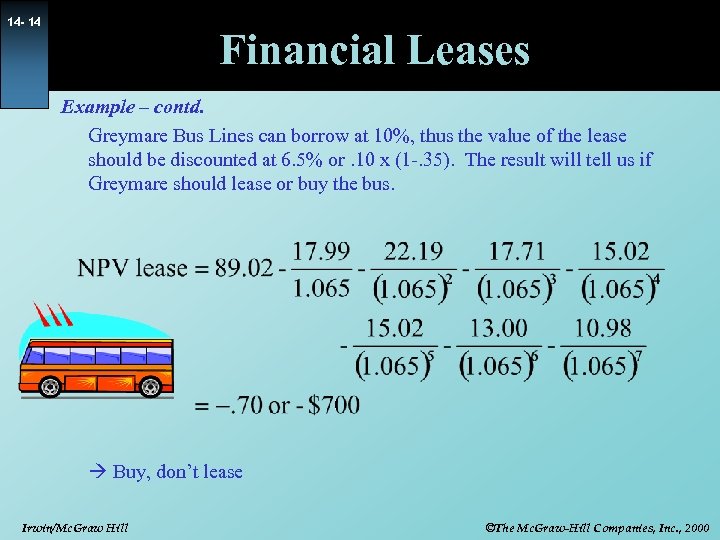

14 - 14 Financial Leases Example – contd. Greymare Bus Lines can borrow at 10%, thus the value of the lease should be discounted at 6. 5% or. 10 x (1 -. 35). The result will tell us if Greymare should lease or buy the bus. Buy, don’t lease Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

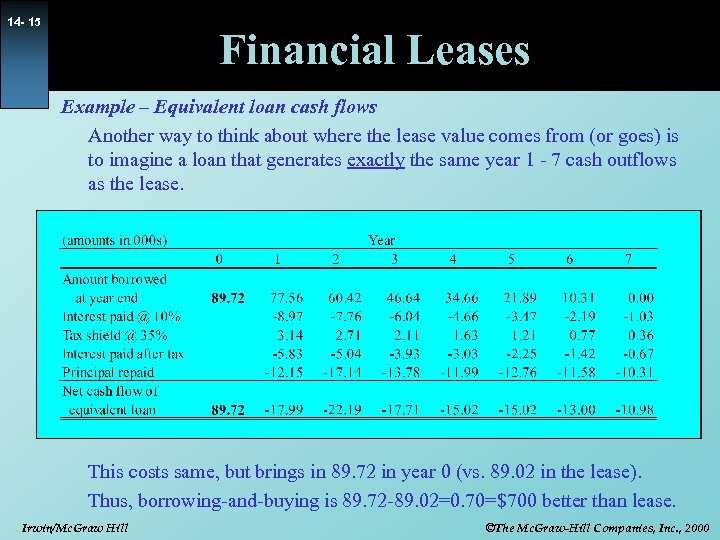

14 - 15 Financial Leases Example – Equivalent loan cash flows Another way to think about where the lease value comes from (or goes) is to imagine a loan that generates exactly the same year 1 - 7 cash outflows as the lease. This costs same, but brings in 89. 72 in year 0 (vs. 89. 02 in the lease). Thus, borrowing-and-buying is 89. 72 -89. 02=0. 70=$700 better than lease. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 16 Financial Leases w Bottom line for lessee: Financial lease or buyand-borrow? Buy-and-borrow if can devise a borrowing plan that gives same cash flow as lease in every future period, but higher immediate cash flow (equivalently, buy-and-borrow if incremental lease cash flows are NPV<0) Otherwise lease Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

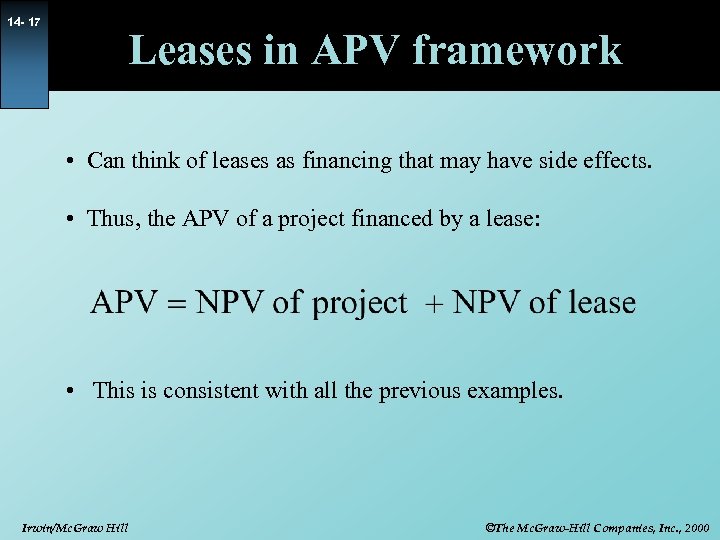

14 - 17 Leases in APV framework • Can think of leases as financing that may have side effects. • Thus, the APV of a project financed by a lease: • This is consistent with all the previous examples. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Principles of Corporate Finance Brealey and Myers u Sixth Edition Managing Risk Slides by Matthew Will, Jeffrey Wurgler Irwin/Mc. Graw Hill Chapter 26 ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 19 Topics Covered w Insurance w Futures contracts w Forward contracts w Swaps w How to set up a hedge Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 20 Insurance w Most businesses insure against fire, theft, environmental liability, vehicle accidents, etc. w Insurance transfers risk from company to insurer w Insurers pool risks The claims on any individual policy are very risky… è … but the claims on a large portfolio of policies may be quite predictable è This gives insurers a risk-bearing advantage è Of course, insurers cannot diversify away macro risks è • In same way that investors can’t diversify away systematic risk Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 21 Insurance Example An offshore oil platform is valued at $1 billion. Expert meteorologist reports indicate that a 1 in 10, 000 chance exists that the platform may be destroyed by a storm over the course of the next year. What is the “fair price” of insurance? Answer: There is no systematic risk; it’s all due to the weather Therefore no systematic risk premium required The expected loss per year is = (1/10, 000)*$1 billion = $100, 000 = “fair price” But for several reasons we’d expect a higher price … Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 22 Insurance w Why would an insurance company probably not offer a policy on this oil platform for $100, 000/yr? Administrative costs è Adverse selection è Moral hazard è w If these costs are large, there may be cheaper ways to protect against risk Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 23 Insurance: British Petroleum w During the 1980 s BP paid out $115 m/year in insurance, recovered $25 m/year in claims w BP has decided to cut down insurance BP felt it was better-placed to assess risk è And insurance was not competitively priced è w So now BP assumes more risk than when it insured BP guesses a big loss of $500 m happens every 30 years è Even so, this is <1% of BP market equity ! è BP can afford not to insure against these risks è Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 24 Hedging Taking on one risk to offset another Some basic tools for hedging Futures è Forwards è Swaps è Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 25 Futures w Futures contract - A contract between two parties for the delivery of an asset, at a negotiated price, on a set future date w Example: è è Wheat farmer expects to have 100, 000 bushels of wheat next Sept. He’s worried that price may decline in the meantime To hedge this risk, he can sell 100, 000 bushels of Sept. wheat futures at a price that is set today Bottom line -- perfect hedge • If price rises, value of his wheat goes up but futures contract value falls • If price falls, value of his wheat falls but futures contract value rises Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 26 Futures are standardized contracts, traded on organized futures exchanges SUGAR Commodity Futures -Sugar -Corn -OJ -Lumber -Wheat -Soybeans -Pork bellies -Oil -Copper -Silver -. . . Financial Futures -Tbills -Japanese govt. bonds -S&P 500 -DJIA index -. . . Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 27 Futures w When you buy a financial future, you end up with the same security that you would have if you bought in the “spot market” (i. e. on-the-spot today) w Except: è è You don’t pay up front, so you earn interest on purchase price You miss out on any dividend or interest in interim w Therefore for a financial future: Futures price/(1+rf)t = Spot price – PV(foregone interest or dividends) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

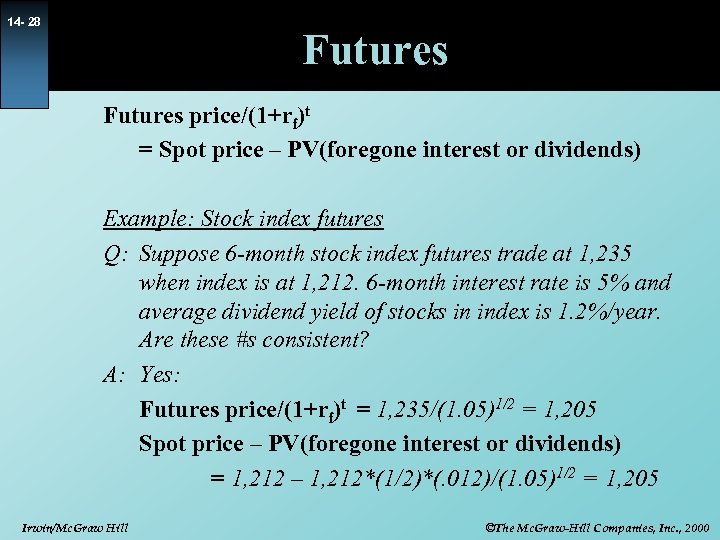

14 - 28 Futures price/(1+rf)t = Spot price – PV(foregone interest or dividends) Example: Stock index futures Q: Suppose 6 -month stock index futures trade at 1, 235 when index is at 1, 212. 6 -month interest rate is 5% and average dividend yield of stocks in index is 1. 2%/year. Are these #s consistent? A: Yes: Futures price/(1+rf)t = 1, 235/(1. 05)1/2 = 1, 205 Spot price – PV(foregone interest or dividends) = 1, 212 – 1, 212*(1/2)*(. 012)/(1. 05)1/2 = 1, 205 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

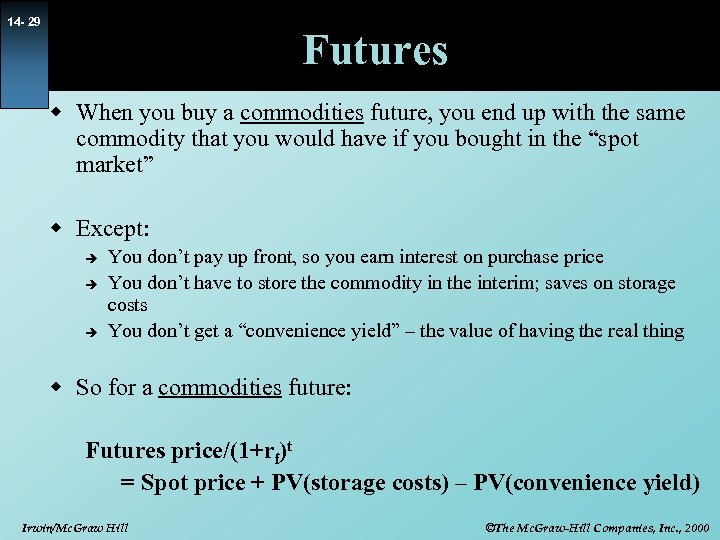

14 - 29 Futures w When you buy a commodities future, you end up with the same commodity that you would have if you bought in the “spot market” w Except: è è è You don’t pay up front, so you earn interest on purchase price You don’t have to store the commodity in the interim; saves on storage costs You don’t get a “convenience yield” – the value of having the real thing w So for a commodities future: Futures price/(1+rf)t = Spot price + PV(storage costs) – PV(convenience yield) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 30 Forwards w Futures contracts are standardized, exchange traded w Forward contracts are tailor-made futures contracts, not exchange traded Main forward market is in foreign currency è Also forward interest-rate contracts è Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

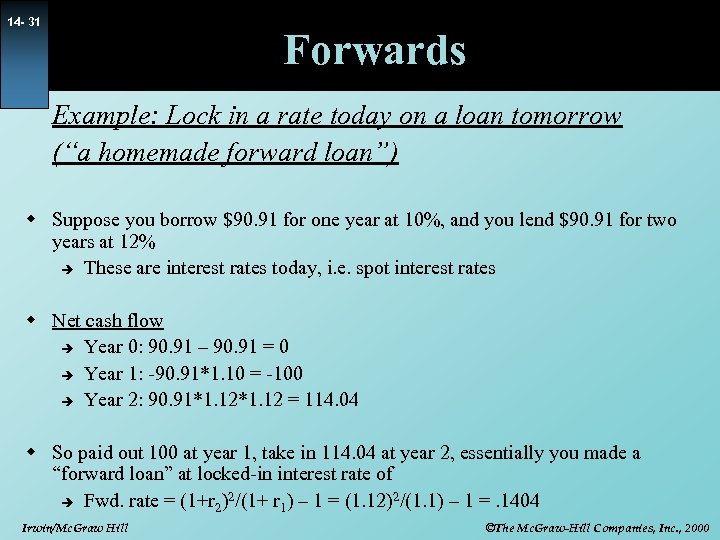

14 - 31 Forwards Example: Lock in a rate today on a loan tomorrow (“a homemade forward loan”) w Suppose you borrow $90. 91 for one year at 10%, and you lend $90. 91 for two years at 12% è These are interest rates today, i. e. spot interest rates w Net cash flow è Year 0: 90. 91 – 90. 91 = 0 è Year 1: -90. 91*1. 10 = -100 è Year 2: 90. 91*1. 12 = 114. 04 w So paid out 100 at year 1, take in 114. 04 at year 2, essentially you made a “forward loan” at locked-in interest rate of è Fwd. rate = (1+r 2)2/(1+ r 1) – 1 = (1. 12)2/(1. 1) – 1 =. 1404 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 32 Swaps Swap contract - An agreement between two parties (“counterparties”) lend to each other on different terms, e. g. in different currencies, or one at fixed rate and the other at a floating rate Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

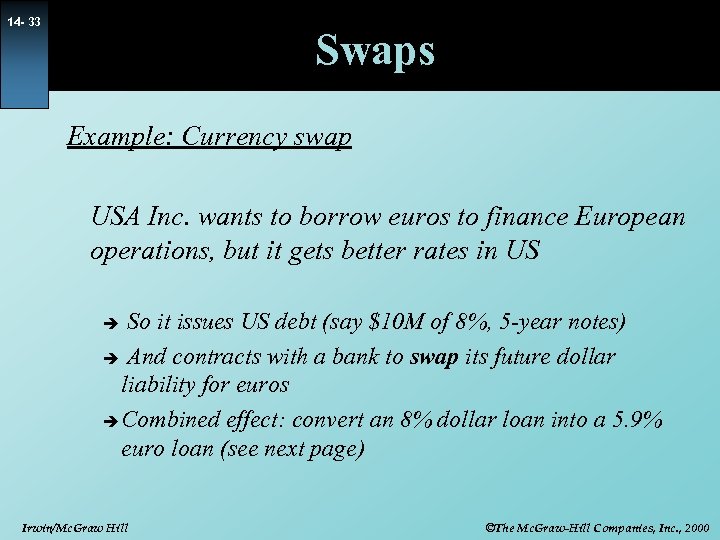

14 - 33 Swaps Example: Currency swap USA Inc. wants to borrow euros to finance European operations, but it gets better rates in US So it issues US debt (say $10 M of 8%, 5 -year notes) è And contracts with a bank to swap its future dollar liability for euros è Combined effect: convert an 8% dollar loan into a 5. 9% euro loan (see next page) è Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

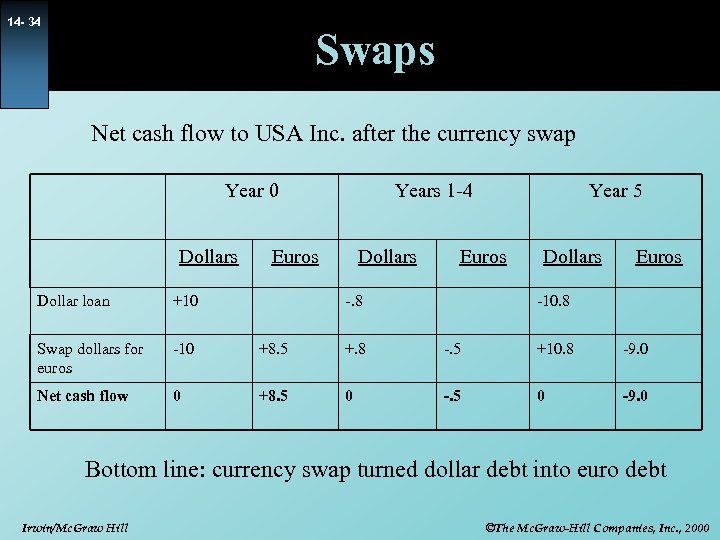

14 - 34 Swaps Net cash flow to USA Inc. after the currency swap Year 0 Dollars Years 1 -4 Euros Dollars Year 5 Euros -. 8 Dollars Euros Dollar loan +10 -10. 8 Swap dollars for euros -10 +8. 5 +. 8 -. 5 +10. 8 -9. 0 Net cash flow 0 +8. 5 0 -9. 0 Bottom line: currency swap turned dollar debt into euro debt Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

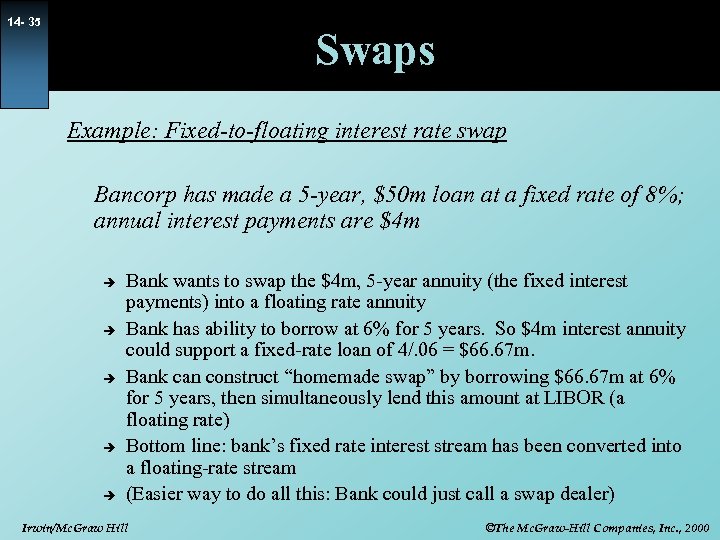

14 - 35 Swaps Example: Fixed-to-floating interest rate swap Bancorp has made a 5 -year, $50 m loan at a fixed rate of 8%; annual interest payments are $4 m è è è Bank wants to swap the $4 m, 5 -year annuity (the fixed interest payments) into a floating rate annuity Bank has ability to borrow at 6% for 5 years. So $4 m interest annuity could support a fixed-rate loan of 4/. 06 = $66. 67 m. Bank can construct “homemade swap” by borrowing $66. 67 m at 6% for 5 years, then simultaneously lend this amount at LIBOR (a floating rate) Bottom line: bank’s fixed rate interest stream has been converted into a floating-rate stream (Easier way to do all this: Bank could just call a swap dealer) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

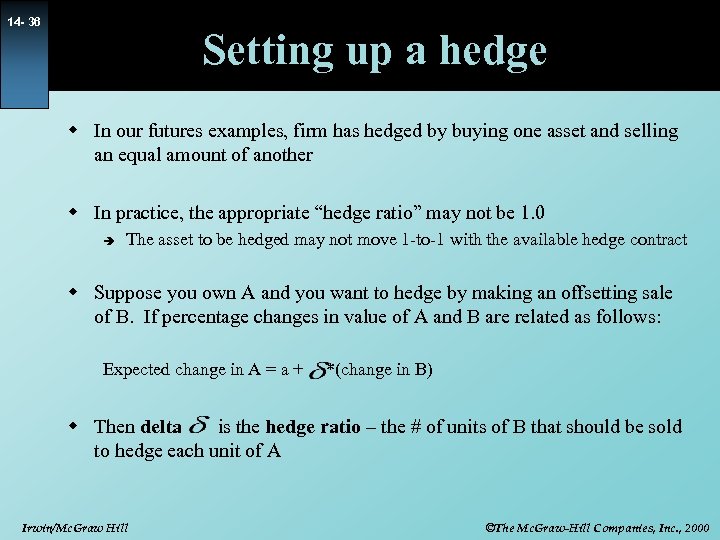

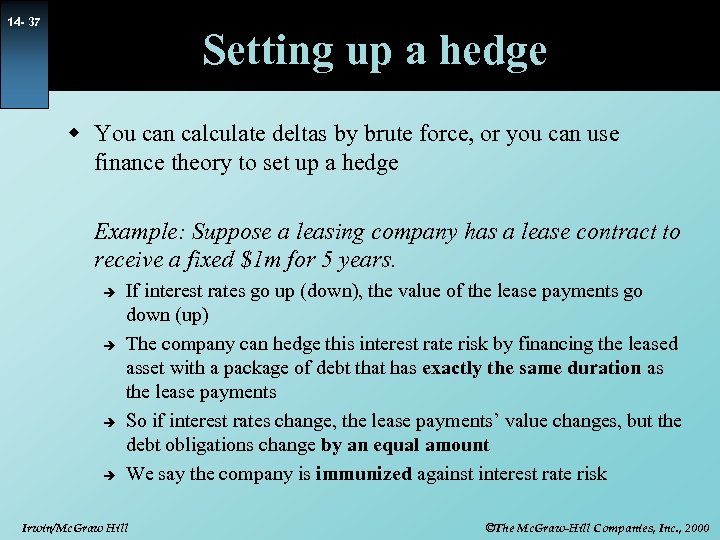

14 - 36 Setting up a hedge w In our futures examples, firm has hedged by buying one asset and selling an equal amount of another w In practice, the appropriate “hedge ratio” may not be 1. 0 è The asset to be hedged may not move 1 -to-1 with the available hedge contract w Suppose you own A and you want to hedge by making an offsetting sale of B. If percentage changes in value of A and B are related as follows: Expected change in A = a + *(change in B) w Then delta is the hedge ratio – the # of units of B that should be sold to hedge each unit of A Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 37 Setting up a hedge w You can calculate deltas by brute force, or you can use finance theory to set up a hedge Example: Suppose a leasing company has a lease contract to receive a fixed $1 m for 5 years. è è If interest rates go up (down), the value of the lease payments go down (up) The company can hedge this interest rate risk by financing the leased asset with a package of debt that has exactly the same duration as the lease payments So if interest rates change, the lease payments’ value changes, but the debt obligations change by an equal amount We say the company is immunized against interest rate risk Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Principles of Corporate Finance Brealey and Myers u Sixth Edition Managing International Risk Slides by Matthew Will, Jeffrey Wurgler Irwin/Mc. Graw Hill Chapter 27 ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 39 Topics Covered w Foreign Exchange Markets w Some Basic Relationships w Hedging Currency Risk w International Capital Budgeting Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 40 Foreign Exchange Markets Exchange Rate - Amount of one currency needed to purchase one unit of another. Spot Exchange Rate – Price of currency for immediate delivery. Forward Exchange Rate – Price for future delivery. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

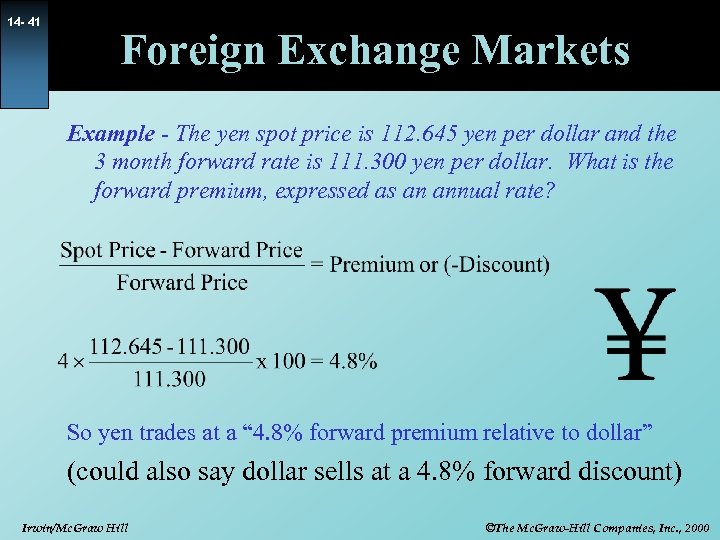

14 - 41 Foreign Exchange Markets Example - The yen spot price is 112. 645 yen per dollar and the 3 month forward rate is 111. 300 yen per dollar. What is the forward premium, expressed as an annual rate? So yen trades at a “ 4. 8% forward premium relative to dollar” (could also say dollar sells at a 4. 8% forward discount) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

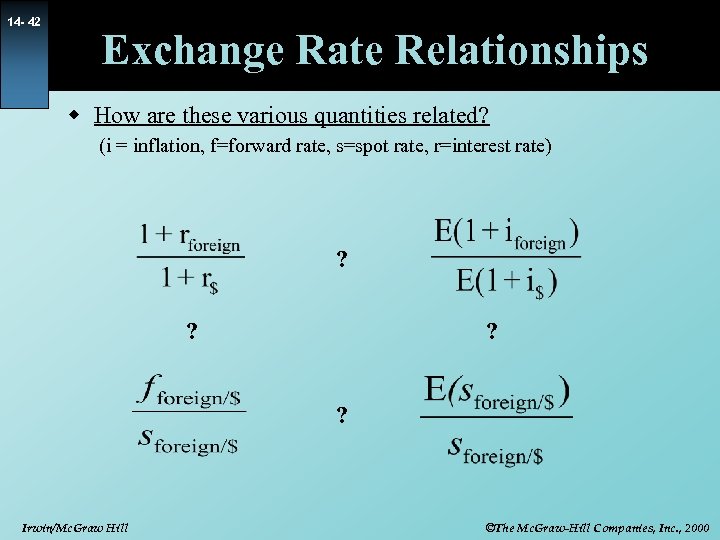

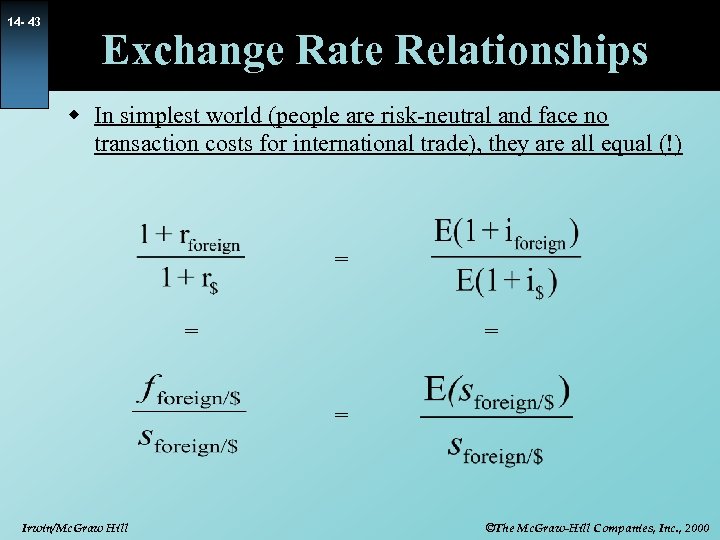

14 - 42 Exchange Rate Relationships w How are these various quantities related? (i = inflation, f=forward rate, s=spot rate, r=interest rate) ? ? Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 43 Exchange Rate Relationships w In simplest world (people are risk-neutral and face no transaction costs for international trade), they are all equal (!) = = Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

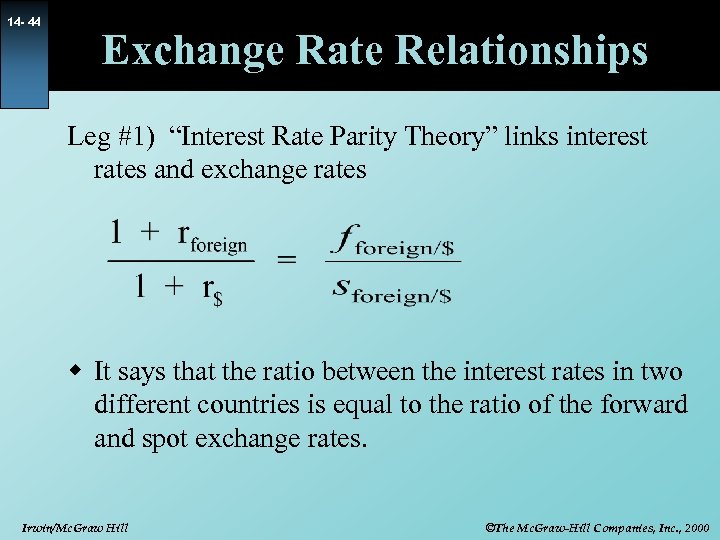

14 - 44 Exchange Rate Relationships Leg #1) “Interest Rate Parity Theory” links interest rates and exchange rates w It says that the ratio between the interest rates in two different countries is equal to the ratio of the forward and spot exchange rates. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

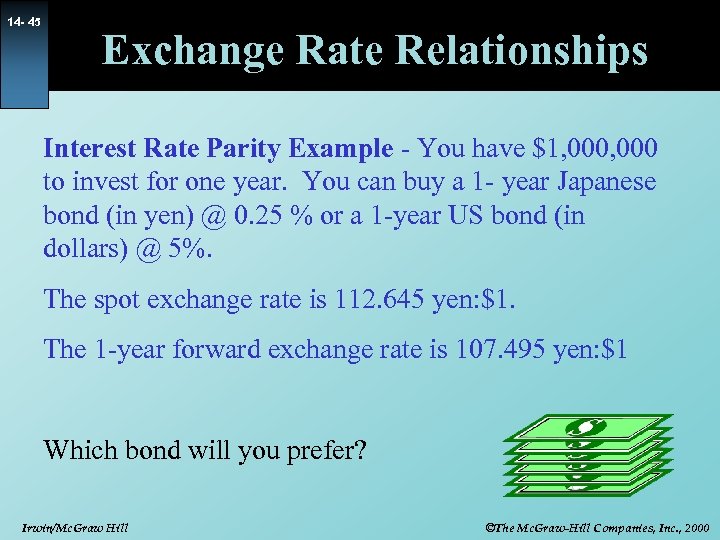

14 - 45 Exchange Rate Relationships Interest Rate Parity Example - You have $1, 000 to invest for one year. You can buy a 1 - year Japanese bond (in yen) @ 0. 25 % or a 1 -year US bond (in dollars) @ 5%. The spot exchange rate is 112. 645 yen: $1. The 1 -year forward exchange rate is 107. 495 yen: $1 Which bond will you prefer? Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

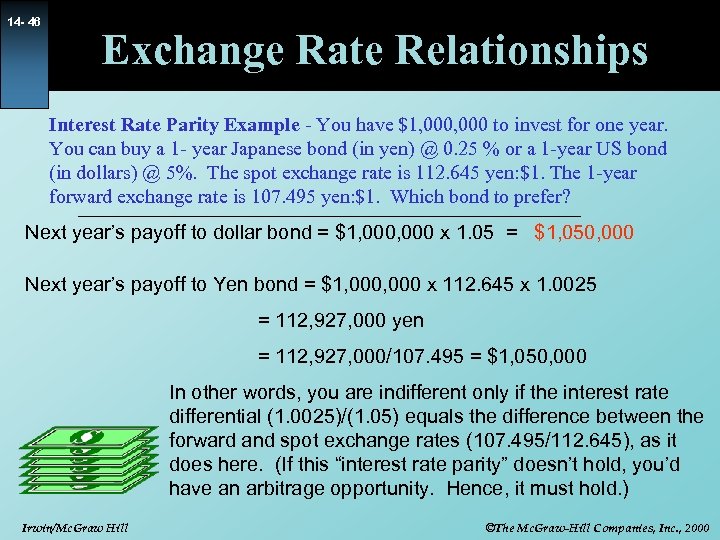

14 - 46 Exchange Rate Relationships Interest Rate Parity Example - You have $1, 000 to invest for one year. You can buy a 1 - year Japanese bond (in yen) @ 0. 25 % or a 1 -year US bond (in dollars) @ 5%. The spot exchange rate is 112. 645 yen: $1. The 1 -year forward exchange rate is 107. 495 yen: $1. Which bond to prefer? Next year’s payoff to dollar bond = $1, 000 x 1. 05 = $1, 050, 000 Next year’s payoff to Yen bond = $1, 000 x 112. 645 x 1. 0025 = 112, 927, 000 yen = 112, 927, 000/107. 495 = $1, 050, 000 In other words, you are indifferent only if the interest rate differential (1. 0025)/(1. 05) equals the difference between the forward and spot exchange rates (107. 495/112. 645), as it does here. (If this “interest rate parity” doesn’t hold, you’d have an arbitrage opportunity. Hence, it must hold. ) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

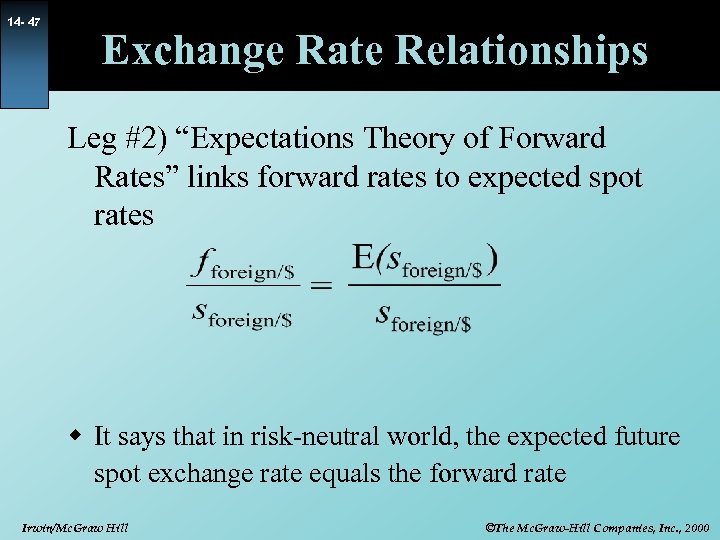

14 - 47 Exchange Rate Relationships Leg #2) “Expectations Theory of Forward Rates” links forward rates to expected spot rates w It says that in risk-neutral world, the expected future spot exchange rate equals the forward rate Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 48 Exchange Rate Relationships Expectations theory logic Suppose one-year forward rate on yen is 107. 495 But that traders expect the future spot rate to be 120. Then no trader would be willing to buy yen forward, since would get more yen by waiting and buying spot. Thus the forward rate will have to rise until the two rates are equal Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

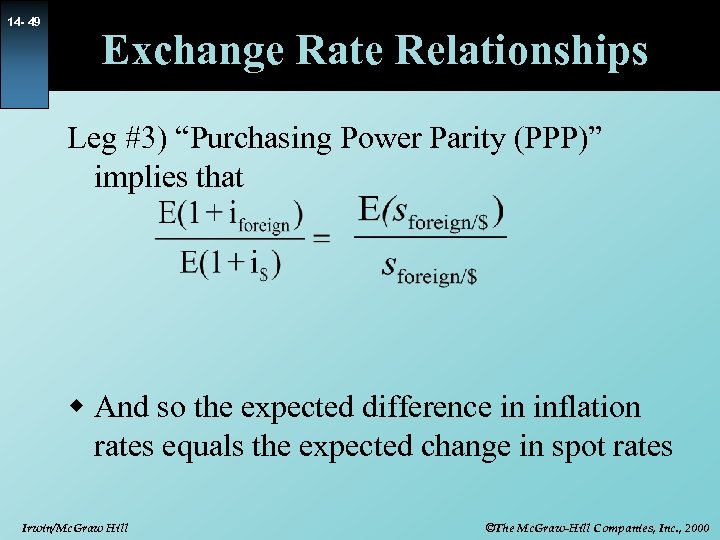

14 - 49 Exchange Rate Relationships Leg #3) “Purchasing Power Parity (PPP)” implies that w And so the expected difference in inflation rates equals the expected change in spot rates Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 50 Exchange Rate Relationships PPP intuition If $1 buys a Mc. Donald’s hamburger in the USA, it also buys (after currency conversion) a hamburger in Japan So spot exchange rates should be set such that $1 has the same “purchasing power” around the world – else, there would be import/export arbitrage – buy goods where $1 buys a lot, sell them where $1 doesn’t buy much. And if this relationship is to hold tomorrow as well, then the expected change in the spot rate must reflect relative inflation. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

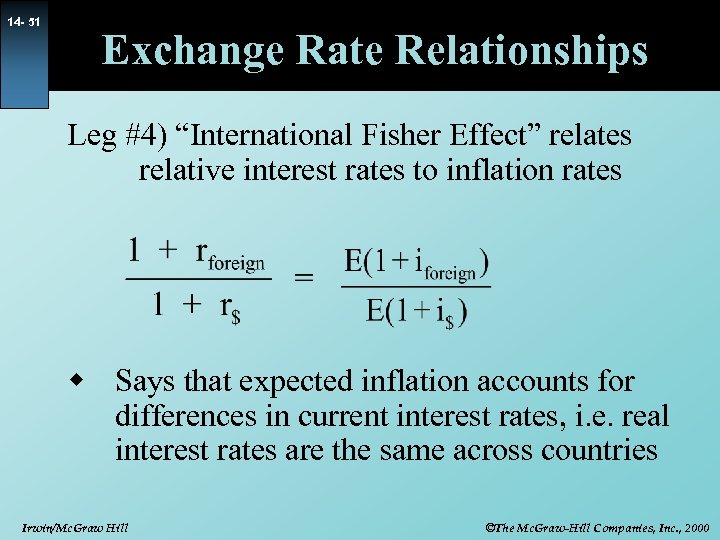

14 - 51 Exchange Rate Relationships Leg #4) “International Fisher Effect” relates relative interest rates to inflation rates w Says that expected inflation accounts for differences in current interest rates, i. e. real interest rates are the same across countries Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

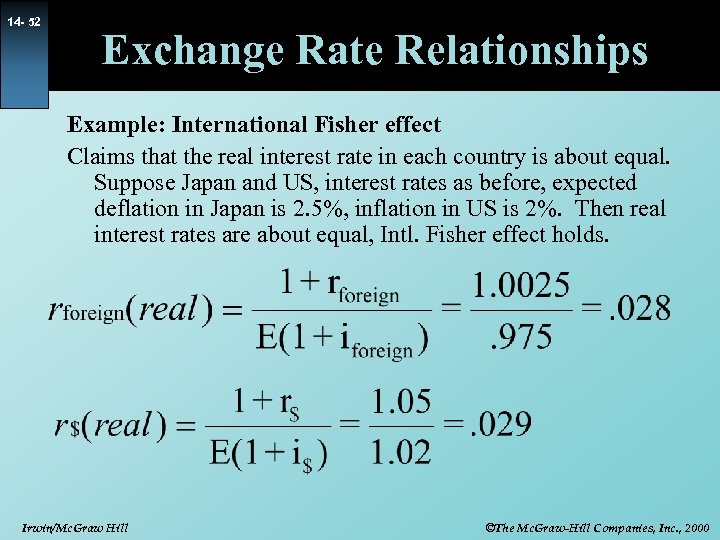

14 - 52 Exchange Rate Relationships Example: International Fisher effect Claims that the real interest rate in each country is about equal. Suppose Japan and US, interest rates as before, expected deflation in Japan is 2. 5%, inflation in US is 2%. Then real interest rates are about equal, Intl. Fisher effect holds. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 53 Hedging Currency Risk Outland Steel: Current situation è Has profitable export business è Contracts involve substantial payment delays è è Company invoices in $, so it is naturally protected against exchange rates But wonders if it’s losing sales to firms that are willing to accept foreign currencies… Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 54 Hedging Currency Risk Outland Steel: Proposal #1 è Accept foreign currency payments… • But if value of that currency declines before payment is made, company may suffer a big loss in dollar terms è … and hedge by selling the currency forward • If contract is to receive X yen next year, then sell X yen forward today. Lock in dollar rate today. è Cost of this “insurance” is the difference between the forward rate and the expected spot rate next year • Cost =0 if these are equal, as in expectations theory (“leg #2”) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

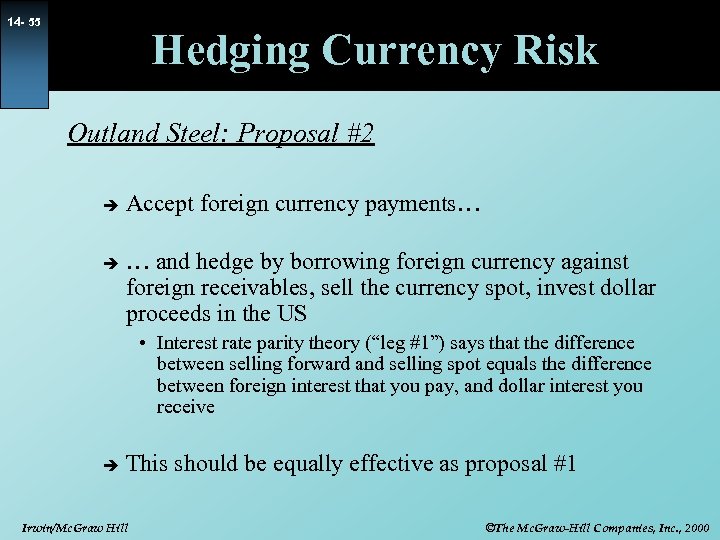

14 - 55 Hedging Currency Risk Outland Steel: Proposal #2 è è Accept foreign currency payments… … and hedge by borrowing foreign currency against foreign receivables, sell the currency spot, invest dollar proceeds in the US • Interest rate parity theory (“leg #1”) says that the difference between selling forward and selling spot equals the difference between foreign interest that you pay, and dollar interest you receive è This should be equally effective as proposal #1 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

14 - 56 International Capital Budgeting Equivalent Intl. Capital Budgeting Techniques 1) (Easy) Discount foreign CFs at foreign cost of capital. (Can then convert this present value to $ using spot exchange rate. ) 2) (Hard) Convert to $ assuming all currency risk was hedged (use forward exchange rates), and then discount with $ cost of capital. These techniques are equivalent (verify BM 6 p. 806 -807) Thus, hedging allows you to separate the investment decision from decision to take on currency risk Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

4d409b9b8b8a3441f954024cfee91e21.ppt