529a491ea75cb931821549409eaca423.ppt

- Количество слайдов: 39

13 th RCC Meeting Sofia, Bulgaria, 29 th January 2009

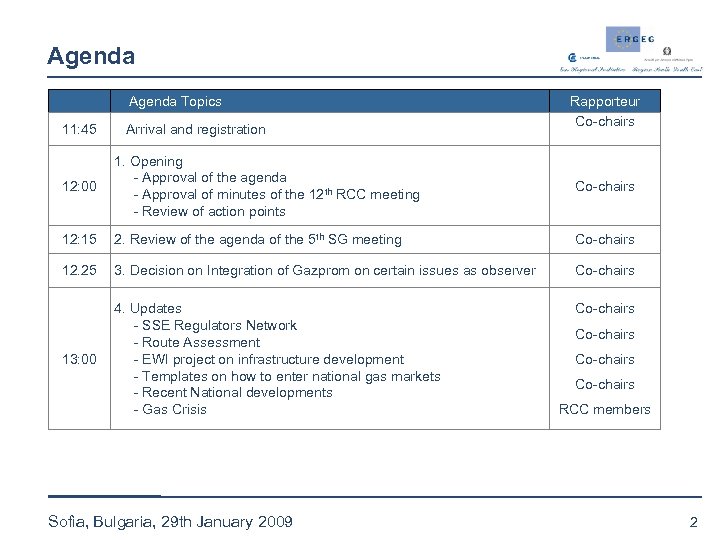

Agenda Topics 11: 45 Arrival and registration Rapporteur Co-chairs 12: 00 1. Opening - Approval of the agenda - Approval of minutes of the 12 th RCC meeting - Review of action points Co-chairs 12: 15 2. Review of the agenda of the 5 th SG meeting Co-chairs 12. 25 3. Decision on Integration of Gazprom on certain issues as observer Co-chairs 13: 00 4. Updates - SSE Regulators Network - Route Assessment - EWI project on infrastructure development - Templates on how to enter national gas markets - Recent National developments - Gas Crisis Sofia, Bulgaria, 29 th January 2009 Co-chairs RCC members 2

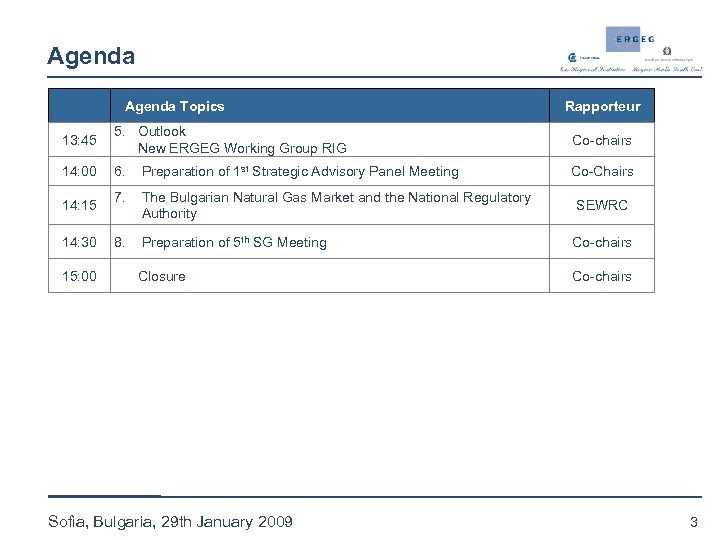

Agenda Topics Rapporteur 13: 45 5. Outlook New ERGEG Working Group RIG Co-chairs 14: 00 6. Preparation of 1 st Strategic Advisory Panel Meeting Co-Chairs 7. The Bulgarian Natural Gas Market and the National Regulatory Authority SEWRC 8. Preparation of 5 th SG Meeting Co-chairs Closure Co-chairs 14: 15 14: 30 15: 00 Sofia, Bulgaria, 29 th January 2009 3

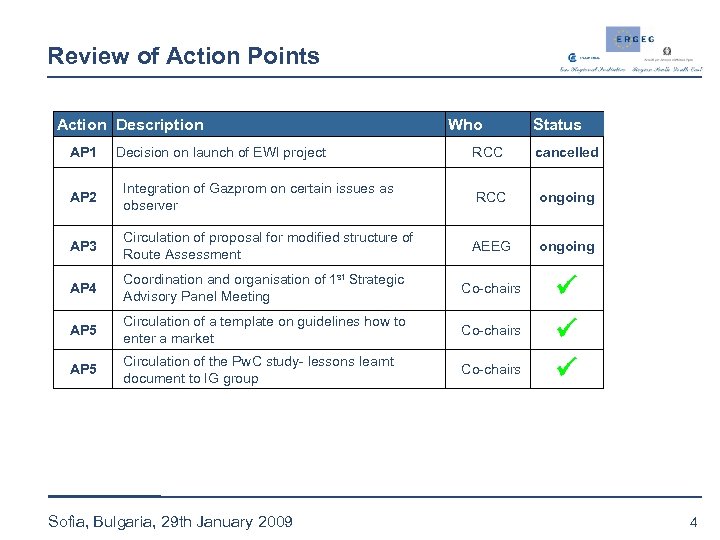

Review of Action Points Action Description AP 1 Decision on launch of EWI project Who RCC cancelled RCC ongoing AEEG ongoing AP 2 Integration of Gazprom on certain issues as observer AP 3 Circulation of proposal for modified structure of Route Assessment AP 4 Coordination and organisation of 1 st Strategic Advisory Panel Meeting Co-chairs AP 5 Circulation of a template on guidelines how to enter a market Co-chairs AP 5 Circulation of the Pw. C study- lessons learnt document to IG group Co-chairs Sofia, Bulgaria, 29 th January 2009 Status 4

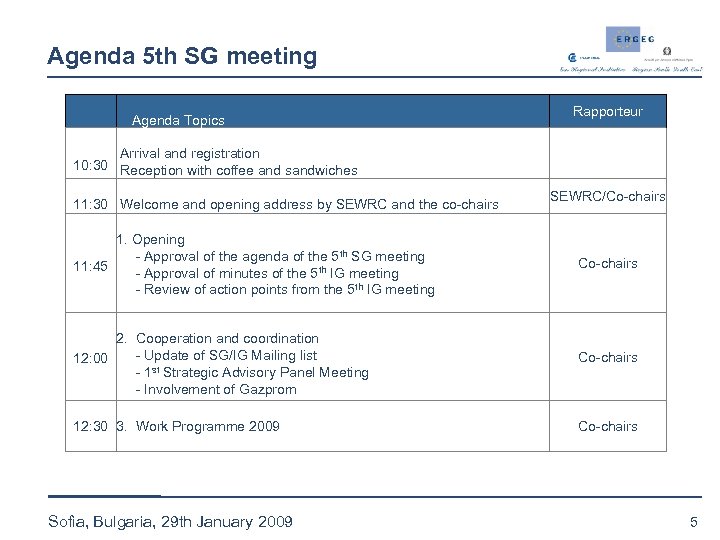

Agenda 5 th SG meeting Agenda Topics Rapporteur Arrival and registration 10: 30 Reception with coffee and sandwiches 11: 30 Welcome and opening address by SEWRC and the co-chairs SEWRC/Co-chairs 1. Opening - Approval of the agenda of the 5 th SG meeting 11: 45 - Approval of minutes of the 5 th IG meeting - Review of action points from the 5 th IG meeting Co-chairs 2. Cooperation and coordination - Update of SG/IG Mailing list 12: 00 - 1 st Strategic Advisory Panel Meeting - Involvement of Gazprom Co-chairs 12: 30 3. Work Programme 2009 Co-chairs Sofia, Bulgaria, 29 th January 2009 5

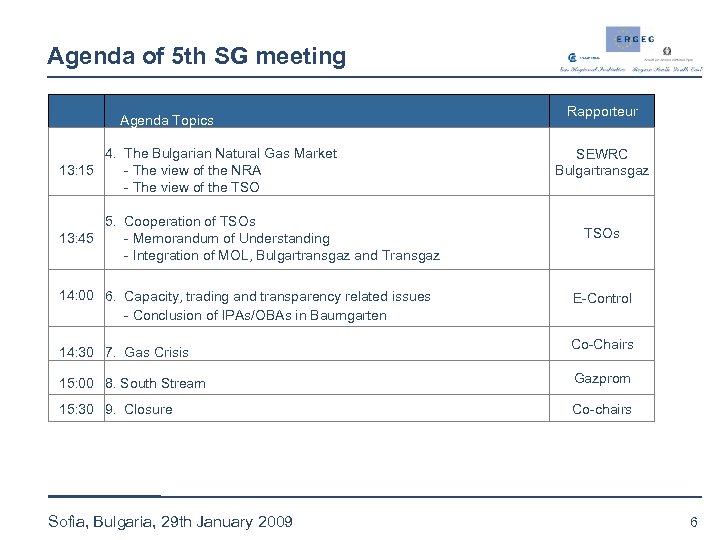

Agenda of 5 th SG meeting Agenda Topics 4. The Bulgarian Natural Gas Market 13: 15 - The view of the NRA - The view of the TSO 5. Cooperation of TSOs 13: 45 - Memorandum of Understanding - Integration of MOL, Bulgartransgaz and Transgaz 14: 00 6. Capacity, trading and transparency related issues - Conclusion of IPAs/OBAs in Baumgarten 14: 30 7. Gas Crisis Rapporteur SEWRC Bulgartransgaz TSOs E-Control Co-Chairs 15: 00 8. South Stream Gazprom 15: 30 9. Closure Co-chairs Sofia, Bulgaria, 29 th January 2009 6

3. Integration of Gazprom Export • Decision on invitation of Gazprom Export as observer on certain issues. • • E. g. on South Stream Participation during 5 th SG meeting planned on the issue „South Stream“ and „Gas Crisis“. Sofia, Bulgaria, 29 th January 2009 7

4. Update on SSE Regulators Network Send all your input to Konstantin Heiller Konstantin. heiller@e-control. at, 0043124724810 Sofia, Bulgaria, 29 th January 2009 8

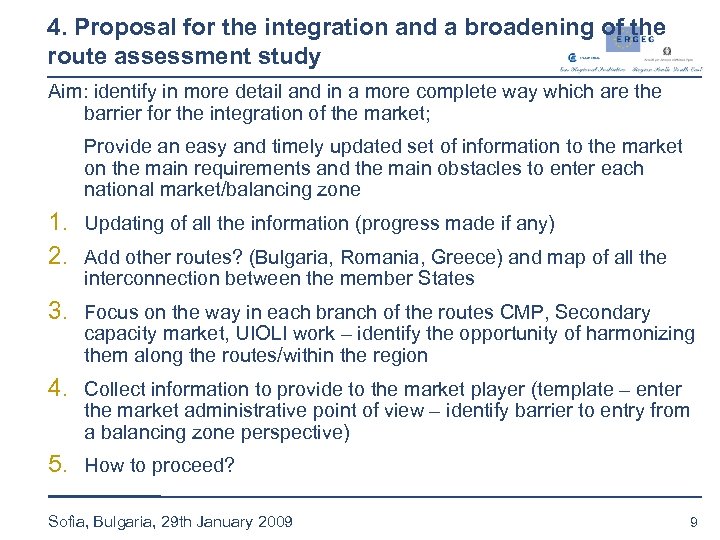

4. Proposal for the integration and a broadening of the route assessment study Aim: identify in more detail and in a more complete way which are the barrier for the integration of the market; Provide an easy and timely updated set of information to the market on the main requirements and the main obstacles to enter each national market/balancing zone 1. Updating of all the information (progress made if any) 2. Add other routes? (Bulgaria, Romania, Greece) and map of all the interconnection between the member States 3. Focus on the way in each branch of the routes CMP, Secondary capacity market, UIOLI work – identify the opportunity of harmonizing them along the routes/within the region 4. Collect information to provide to the market player (template – enter the market administrative point of view – identify barrier to entry from a balancing zone perspective) 5. How to proceed? Sofia, Bulgaria, 29 th January 2009 9

4. Update on EWI project • • Project cancelled. Similar project will probably be done by GWG. Sofia, Bulgaria, 29 th January 2009 10

4. How to enter national gas markets Structure of the Guidelines for importing & supplying natural gas to customers: 1. National Authority & Legal Basis 2. Requirements 3. Procedure & Timetable 4. Costs 5. Additional Information • E. g. Links to further web pages Responses received from Slovenia and Czech Republic up to now Sofia, Bulgaria, 29 th January 2009 11

mag. Aleš Osrajnik Energy Agency of the Republic of Slovenia Guidelines for importing supplying natural gas to customers for Slovenia Sofia, 29. January 2009

Transmission level network What I need if I want to supply to a supplier already active on the Slovenian market? • An access contract to have a right to access to transmission network • Supply contract at the entry point on Slovenian border • Balancing contract with the transmission system operator (balancing group) 13 29. January 2009 Guidelines for importing supplying natural gas to customers for Slovenia

Distribution level network What I need if I want to supply (sell) natural gas to a customer on Slovenian natural gas market? • An access contract to have a right to access to distribution and/or transmission network • Supply contract with the customer • Balancing contract with the Balance group leader • Licensee for supplying 14 29. January 2009 Guidelines for importing supplying natural gas to customers for Slovenia

Transit What I need if I want to transit natural gas through Slovenia? • 15 An access contract to have a right to access to transmission network 29. January 2009 Guidelines for importing supplying natural gas to customers for Slovenia

Procedures & Timetable • • 16 Energy act, Ordinance on natural gas market operations & General conditions for the supply and consumption of natural gas have to be obeyed Procedure for acquisition of licensees is prescribed by special law TSO require financial insurance for transmission of natural gas There are no other special financial barriers to start with import and supply of natural gas 29. January 2009 Guidelines for importing supplying natural gas to customers for Slovenia

Thank you for your attention! mag. Aleš Osrajnik ales. osrajnik@agen-rs. si Telefon: +386 22 34 03 00 Faks: +386 22 34 03 20 17 29. January 2009 Guidelines for importing supplying natural gas to customers for Slovenia

Guidelines for importing & supplying natural gas to customers in the Czech natural gas market Karel Havlicek, ERO Energetický regulační úřad

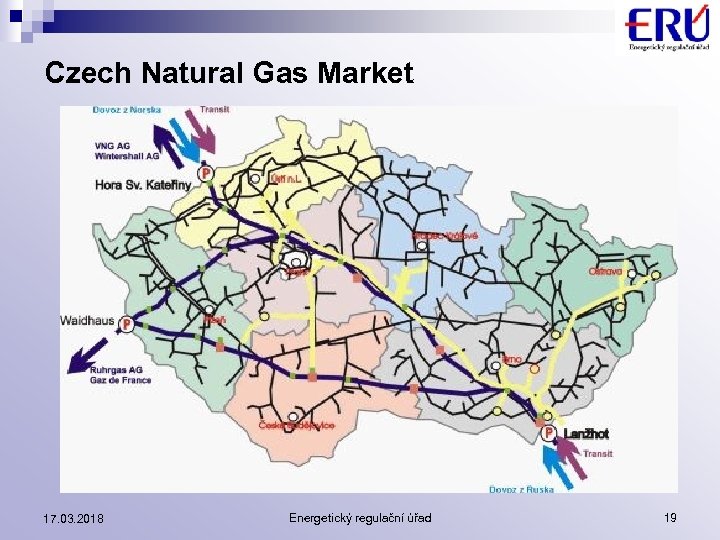

Czech Natural Gas Market 17. 03. 2018 Energetický regulační úřad 19

Legal Basis & Procedure & Costs • • • Legal Basis – Energy Act and ERO Decrees - rules for the organisation of the gas market + details of awarding licences for business in the energy industries Licences for gas trading from Energy Regulatory Office are granted for a period of 5 years The fee for issuing the license for trading is 100 000, - CZK (approx. 4000 EUR) Start of the commercial activity can be estimated on several weeks More information – www. eru. cz 17. 03. 2018 Energetický regulační úřad 20

Requirements for new gas traders (entrants on the Czech Gas Market) – part 1 • General conditions : • • Sufficient capacity for transmission • Entry / exit system • • Virtual Trading Point Domestic and international transmission is separated Import and delivery at the Virtual Trading Point o o Gas Transmission Agreement with TSO (balancing is a part of the agreement) Booked transmission capacity for cross-border entry point 17. 03. 2018 21

Requirements for new gas traders (entrants on the Czech Gas Market) – part 2 • Selling natural gas to a customer in the Czech Republic o o o • Gas Transmission Agreement with TSO Acquirement of new customers respecting the „Switching a supplier“ rules Gas distribution Agreement with relevant Distribution System Operator Transit through the Czech Republic • • No ERO license is needed Gas Transmission Agreement with TSO, which is responsible for domestic and international transmission Energetický regulační úřad

Thank you for your attention Energetický regulační úřad

4. Updates on Recent National developments • • Changes in legislation? • What individual measures (short term and long term) were taken in your country to tackle the gas supply shortage? Changes in regulation? Gas crisis? Any other business? Sofia, Bulgaria, 29 th January 2009 24

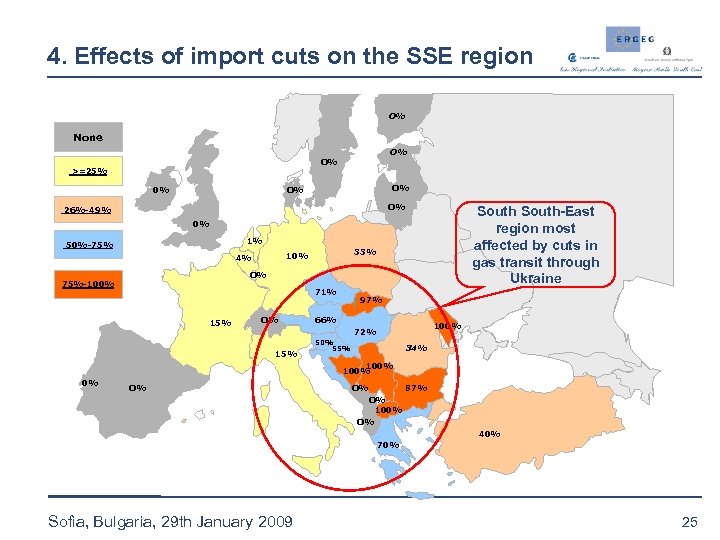

4. Effects of import cuts on the SSE region O% None O% O% >=25% 0% O% O% O% 26%-49% South-East region most affected by cuts in gas transit through Ukraine 0% 1% 50%-75% 33% 10% 4% O% 75%-100% 71% 15% O% 97% 66% 100% 72% 15% 50% 55% 34% 100% 0% O% O% 87% O% 100% O% 40% 70% Sofia, Bulgaria, 29 th January 2009 25

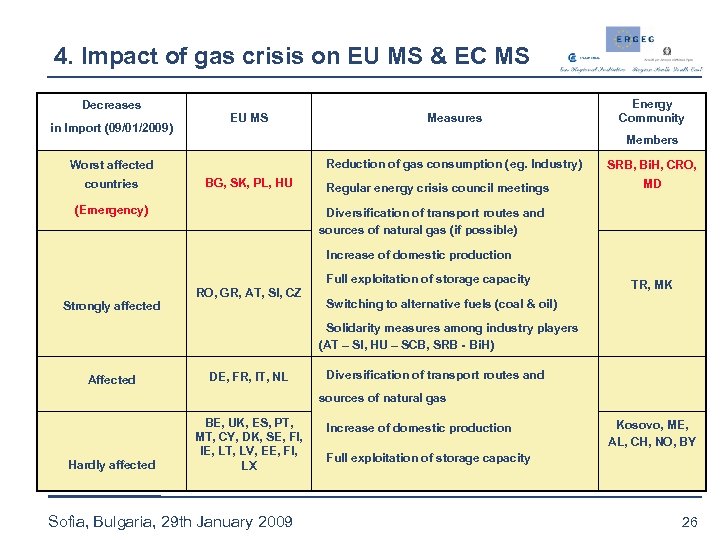

4. Impact of gas crisis on EU MS & EC MS Decreases in Import (09/01/2009) EU MS Members Reduction of gas consumption (eg. Industry) Worst affected countries Measures Energy Community BG, SK, PL, HU (Emergency) Regular energy crisis council meetings SRB, Bi. H, CRO, MD Diversification of transport routes and sources of natural gas (if possible) Increase of domestic production Full exploitation of storage capacity Strongly affected RO, GR, AT, SI, CZ TR, MK Switching to alternative fuels (coal & oil) Solidarity measures among industry players (AT – Sl, HU – SCB, SRB - Bi. H) Affected DE, FR, IT, NL Diversification of transport routes and sources of natural gas Hardly affected BE, UK, ES, PT, MT, CY, DK, SE, FI, IE, LT, LV, EE, FI, LX Sofia, Bulgaria, 29 th January 2009 Increase of domestic production Kosovo, ME, AL, CH, NO, BY Full exploitation of storage capacity 26

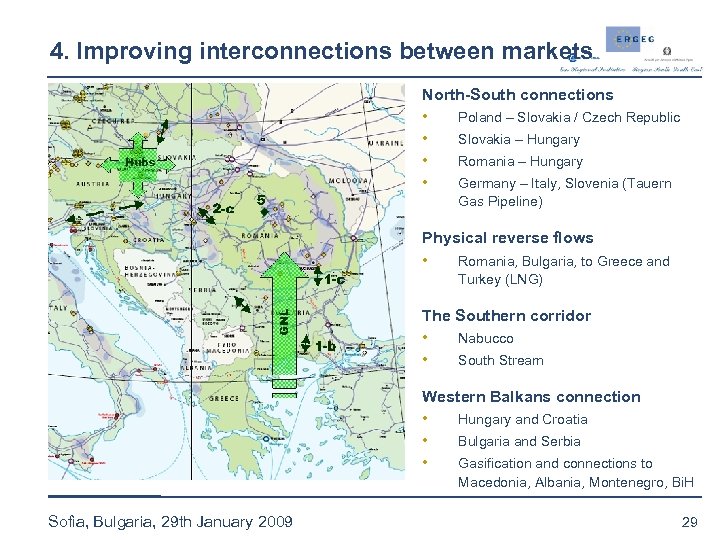

4. Gas crisis – lessons learnt – 1 In general: Liberalized markets tend to cope better with supply disruptions • If the markets are allowed to function, even in emergency situations, the systems are capable to adapt more quickly • Transparent markets automatically increase security of supply as higher short term prices in a given area automatically attract different gas providers to that area Improving interconnections between markets • • North-South connections Interconnectors need to allow bidirectional gas flows Southern corridor Western Balkans connection Sofia, Bulgaria, 29 th January 2009 27

4. Gas crisis – lessons learnt – 2 Coordination between TSOs • Better coordinated Gas Dispatching between TSOs would enable faster reaction to disruptions • Regional, coordinated infrastructure planning and better regional market integration would make the system much more resilient • Regional planning of infrastructure and modeling of “emergency” situations and their effects on the grid would help to identify high priority investment projects Developing storage capacities in line with market requirements • Access to storage must be provided through transparent and nondiscriminatory capacity allocation mechanisms and congestion management procedures European TSOs to supervise gas transit via Ukraine Sofia, Bulgaria, 29 th January 2009 28

4. Improving interconnections between markets North-South connections • • Poland – Slovakia / Czech Republic Slovakia – Hungary Romania – Hungary Germany – Italy, Slovenia (Tauern Gas Pipeline) Physical reverse flows • Romania, Bulgaria, to Greece and Turkey (LNG) The Southern corridor • • Nabucco South Stream Western Balkans connection • • • Sofia, Bulgaria, 29 th January 2009 Hungary and Croatia Bulgaria and Serbia Gasification and connections to Macedonia, Albania, Montenegro, Bi. H 29

5. Outlook • New ERGEG Working Group RIG • • • GRI TF: D. Jamme (France) / C. Martinez (UK) No part of Gas Working Group any longer • • Chair: Josè Sierra (Spain) GWG representative in RIG Ad hoc TF (within GWG) on Security of Supply issues Sofia, Bulgaria, 29 th January 2009 30

3. GRI SSE Work Programme 2009 Main outcome of regional consultation: 1. Congestion Management • • • Application of UILOI mechanisms. Establishment/Improvement of secondary capacity markets. Involvement of all TSO’s in increasing transparency of price transfer details of secondary capacity. Harmonisation of nomination procedures. Abolish known and track hidden system bottlenecks in gas transfers. Benchmark with GRI NW. 2. Improved TSO Cooperation • • Settlement of OBAs/IPAs between all TSOs and SSOs. Harmonisation of legal and operational procedures among all operators (TSOs, SSOs, LSOs) (including transparent TPA). Harmonisation of regulatory framework to support TSO cooperation. Regional TSO cooperation (R_ISO). Sofia, Bulgaria, 29 th January 2009 31

7. 1 st Strategic Advisory Panel Meeting 3. Transparent, market oriented and regional balancing • • Monitoring of implementation of ERGEG Guidelines. • • Development of a “regional infrastructure” in the SSE area. • Market oriented balancing market. Creation of a regional regulator to promote market development in the region. Analysis aimed at identifying the optimal size of balancing areas & appropriate balancing regimes. 4. Easy and transparent access to storage facilities • Market oriented and transparent storage instead of strategic storage. Sofia, Bulgaria, 29 th January 2009 32

7. 1 st Strategic Advisory Panel Meeting 5. Price transparency at hubs • Foster Development of hubs and other regional trading mechanisms such as exchanges. 6. Market entry barriers • Roadmaps to trading and transiting gas through each country. 7. Transparency requirements for TSOs • Cooperation with TSOs to make all the data available network users consider necessary to perform their activity. Sofia, Bulgaria, 29 th January 2009 33

3. GRI SSE Work Programme 2009 Priorities for Work Program 2009: 1. Security of Supply (due to recent developments) • • • Infrastructure planning /emergency scenarios Diversification of transport routes and gas supply sources Regional coordination 2. Congestion Management • Secondary market 3. Access to Storage 4. Improved transparency by TSOs 5. Improved TSO cooperation • • OBAs/IPAs Information exchange 6. Market entry barriers Sofia, Bulgaria, 29 th January 2009 34

Any other Business Sofia, Bulgaria, 29 th January 2009 35

Next Meetings • Proposal: April • Venue? • Budapest? • Other proposals Sofia, Bulgaria, 29 th January 2009 36

Contact Konstantin Heiller Gas Department Konstantin. heiller@e-control. at +43 1 24 7 24 810 +43 664 966 7239 www. e-control. at Sofia, Bulgaria, 29 th January 2009 37

Dinner Restaurant “Pri Yafata” 28 “Solunska” Str. , Sofia www. pri-yafata. com Meeting point: 18: 15 at lobby of Radisson SAS Hotel Sofia, Bulgaria, 29 th January 2009 38

Thank You ! Further information is available at www. energy-regulators. eu Sofia, Bulgaria, 29 th January 2009 39

529a491ea75cb931821549409eaca423.ppt