d1f14e3d354207746a80b973fd03448c.ppt

- Количество слайдов: 22

13 e Chapter 07: Inflation Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

13 e Chapter 07: Inflation Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Learning Objectives • 07 -01. Know how inflation is measured. • 07 -02. Know why inflation is a socioeconomic problem. • 07 -03. Know the meaning of “price stability. ” • 07 -04. Know the broad causes of inflation. 7 -2

Learning Objectives • 07 -01. Know how inflation is measured. • 07 -02. Know why inflation is a socioeconomic problem. • 07 -03. Know the meaning of “price stability. ” • 07 -04. Know the broad causes of inflation. 7 -2

What Is Inflation? • Inflation: an increase in the average level of prices, not a change in any specific price of a good. • The prices of specific basket of goods are collected and computed into an average price level for that basket in a year. – A rise in that average price level is inflation. – A decrease in that average price level is deflation. 7 -3

What Is Inflation? • Inflation: an increase in the average level of prices, not a change in any specific price of a good. • The prices of specific basket of goods are collected and computed into an average price level for that basket in a year. – A rise in that average price level is inflation. – A decrease in that average price level is deflation. 7 -3

Relative Prices • The market mechanism causes the prices of individual goods and services to rise or fall – an essential market function. – Relative price: the price of one good compared to the price of other goods. – Buyers switch from one good to another when their relative prices diverge. • Inflation is a rise in the average price of all goods. – It is not a market function. 7 -4

Relative Prices • The market mechanism causes the prices of individual goods and services to rise or fall – an essential market function. – Relative price: the price of one good compared to the price of other goods. – Buyers switch from one good to another when their relative prices diverge. • Inflation is a rise in the average price of all goods. – It is not a market function. 7 -4

Effects of Inflation • Some prices rise and some fall. • Rising prices require you to reallocate your purchasing power to ensure that you get the most satisfaction per dollar spent. – You might reduce buying goods with higher prices and increase buying goods with lower prices. • This can be seen by the difference between nominal income and real income. 7 -5

Effects of Inflation • Some prices rise and some fall. • Rising prices require you to reallocate your purchasing power to ensure that you get the most satisfaction per dollar spent. – You might reduce buying goods with higher prices and increase buying goods with lower prices. • This can be seen by the difference between nominal income and real income. 7 -5

Effects of Inflation • Nominal income: the amount of money income received in a given time period, measured in current dollars. • Real income: income in constant dollars; nominal income adjusted for inflation. • You may get a raise (nominal income increases) – but if it does not rise as fast as inflation, your purchasing power decreases (real income falls). 7 -6

Effects of Inflation • Nominal income: the amount of money income received in a given time period, measured in current dollars. • Real income: income in constant dollars; nominal income adjusted for inflation. • You may get a raise (nominal income increases) – but if it does not rise as fast as inflation, your purchasing power decreases (real income falls). 7 -6

Redistribution of Income and Wealth by Inflation • Price effects. – Those who buy products that are increasing in price the fastest end up worse off. – Those who sell products that are increasing in price the fastest end up better off. – Those who buy products that are increasing in price the slowest end up better off. – Those who sell products that are increasing in price the slowest end up worse off. 7 -7

Redistribution of Income and Wealth by Inflation • Price effects. – Those who buy products that are increasing in price the fastest end up worse off. – Those who sell products that are increasing in price the fastest end up better off. – Those who buy products that are increasing in price the slowest end up better off. – Those who sell products that are increasing in price the slowest end up worse off. 7 -7

Redistribution of Income and Wealth by Inflation • Income effects. – People with nominal incomes rising more slowly than inflation end up worse off. – People with nominal incomes rising faster than inflation end up better off. 7 -8

Redistribution of Income and Wealth by Inflation • Income effects. – People with nominal incomes rising more slowly than inflation end up worse off. – People with nominal incomes rising faster than inflation end up better off. 7 -8

Redistribution of Income and Wealth by Inflation • Wealth effects. – Those who own assets that are declining in real value end up worse off. – Those who own assets that are increasing in real value end up better off. 7 -9

Redistribution of Income and Wealth by Inflation • Wealth effects. – Those who own assets that are declining in real value end up worse off. – Those who own assets that are increasing in real value end up better off. 7 -9

Money Illusion • Money illusion: using nominal dollars rather than real dollars to gauge changes in one’s income or wealth. • Exercise: – In the “good old days” a movie ticket was 50 cents and the minimum wage was $1. 00. – Compare the purchasing power of the minimum wage today to the “good old days. ” – You could buy two movie tickets with one hour’s work before, but now. 7 -10

Money Illusion • Money illusion: using nominal dollars rather than real dollars to gauge changes in one’s income or wealth. • Exercise: – In the “good old days” a movie ticket was 50 cents and the minimum wage was $1. 00. – Compare the purchasing power of the minimum wage today to the “good old days. ” – You could buy two movie tickets with one hour’s work before, but now. 7 -10

Macro Consequences of Inflation • Uncertainty: not knowing the prices of goods in the future makes purchasing and production decision making much more difficult. • Speculation: decisions will shift from standard economic activity to betting on the future prices of goods. • Bracket creep: in a progressive tax system, when nominal incomes rise, the taxpayer gets pushed into a higher tax bracket. 7 -11

Macro Consequences of Inflation • Uncertainty: not knowing the prices of goods in the future makes purchasing and production decision making much more difficult. • Speculation: decisions will shift from standard economic activity to betting on the future prices of goods. • Bracket creep: in a progressive tax system, when nominal incomes rise, the taxpayer gets pushed into a higher tax bracket. 7 -11

Deflation • Deflation: a general decrease in average prices. • This has redistribution effects that are just the opposite of those for inflation. • This has macro consequences also. – Sellers are reluctant to stock inventory. – Buyers are reluctant to buy now. – Businesses are reluctant to borrow funds or invest. – Incomes fall, and asset values decrease. 7 -12

Deflation • Deflation: a general decrease in average prices. • This has redistribution effects that are just the opposite of those for inflation. • This has macro consequences also. – Sellers are reluctant to stock inventory. – Buyers are reluctant to buy now. – Businesses are reluctant to borrow funds or invest. – Incomes fall, and asset values decrease. 7 -12

Consumer Price Index (CPI) • Consumer price index (CPI): a measure (index) of the average price of consumer goods and services. – Used to calculate the inflation rate. • Inflation rate: the annual percentage rate of increase in the average price level. 7 -13

Consumer Price Index (CPI) • Consumer price index (CPI): a measure (index) of the average price of consumer goods and services. – Used to calculate the inflation rate. • Inflation rate: the annual percentage rate of increase in the average price level. 7 -13

Creating a Price Index • Select a “market basket” of goods: a standardized list of goods and services customers usually buy. • Select a base year: the reference year whose dollar value will be used. • Set the price index in the base year always equal to 100. • Measure the prices for the basket of goods in both the current year and in the base year. 7 -14

Creating a Price Index • Select a “market basket” of goods: a standardized list of goods and services customers usually buy. • Select a base year: the reference year whose dollar value will be used. • Set the price index in the base year always equal to 100. • Measure the prices for the basket of goods in both the current year and in the base year. 7 -14

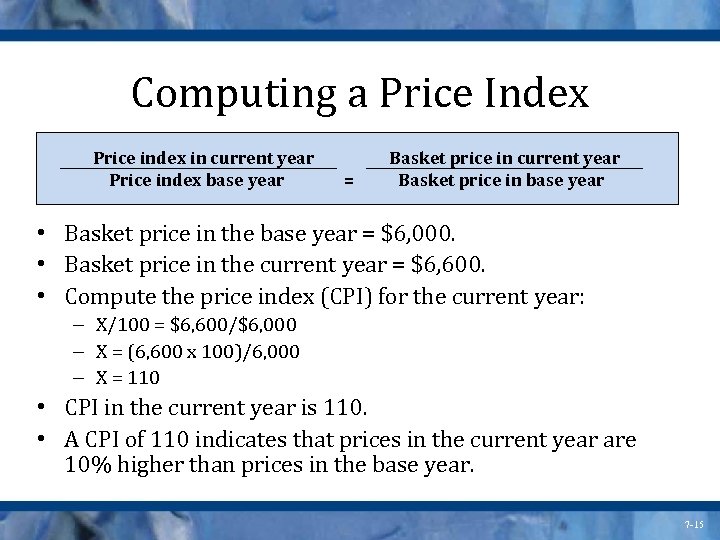

Computing a Price Index Price index in current year Price index base year = Basket price in current year Basket price in base year • Basket price in the base year = $6, 000. • Basket price in the current year = $6, 600. • Compute the price index (CPI) for the current year: – X/100 = $6, 600/$6, 000 – X = (6, 600 x 100)/6, 000 – X = 110 • CPI in the current year is 110. • A CPI of 110 indicates that prices in the current year are 10% higher than prices in the base year. 7 -15

Computing a Price Index Price index in current year Price index base year = Basket price in current year Basket price in base year • Basket price in the base year = $6, 000. • Basket price in the current year = $6, 600. • Compute the price index (CPI) for the current year: – X/100 = $6, 600/$6, 000 – X = (6, 600 x 100)/6, 000 – X = 110 • CPI in the current year is 110. • A CPI of 110 indicates that prices in the current year are 10% higher than prices in the base year. 7 -15

Other Measures of Inflation • Core inflation: changes in CPI, excluding food and energy prices. • Producer price index (PPI): changes in the average prices at intermediate steps of production. • GDP deflator: changes in prices of all goods and services included in GDP. – Used to correct nominal GDP to real GDP. 7 -16

Other Measures of Inflation • Core inflation: changes in CPI, excluding food and energy prices. • Producer price index (PPI): changes in the average prices at intermediate steps of production. • GDP deflator: changes in prices of all goods and services included in GDP. – Used to correct nominal GDP to real GDP. 7 -16

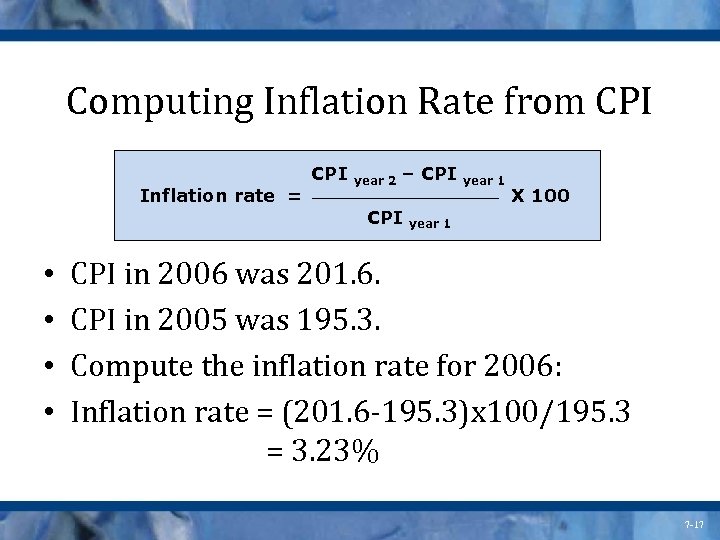

Computing Inflation Rate from CPI Inflation rate = • • CPI year 2 – CPI year 1 X 100 year 1 CPI in 2006 was 201. 6. CPI in 2005 was 195. 3. Compute the inflation rate for 2006: Inflation rate = (201. 6 -195. 3)x 100/195. 3 = 3. 23% 7 -17

Computing Inflation Rate from CPI Inflation rate = • • CPI year 2 – CPI year 1 X 100 year 1 CPI in 2006 was 201. 6. CPI in 2005 was 195. 3. Compute the inflation rate for 2006: Inflation rate = (201. 6 -195. 3)x 100/195. 3 = 3. 23% 7 -17

The Goal: Price Stability • Price stability: the absence of significant changes in the average price level. – Officially defined as a rate of inflation of less than 3 percent. – Established by Full Employment and Balanced Growth Act of 1978. 7 -18

The Goal: Price Stability • Price stability: the absence of significant changes in the average price level. – Officially defined as a rate of inflation of less than 3 percent. – Established by Full Employment and Balanced Growth Act of 1978. 7 -18

The Goal: Price Stability • Measurement concerns. – We are seeking price stability at the lowest rate of unemployment. – From year to year, there are quality improvements in the basket of goods. – New products change the content of the basket of goods we buy. 7 -19

The Goal: Price Stability • Measurement concerns. – We are seeking price stability at the lowest rate of unemployment. – From year to year, there are quality improvements in the basket of goods. – New products change the content of the basket of goods we buy. 7 -19

Causes of Inflation • Demand-pull inflation: results from excessive pressure to buy on the demand side of the economy. – A booming economy creates shortages. – Too much money pumped into the economy by the Federal Reserve. • Cost-push inflation: due to higher production costs putting pressure on suppliers to push up prices. 7 -20

Causes of Inflation • Demand-pull inflation: results from excessive pressure to buy on the demand side of the economy. – A booming economy creates shortages. – Too much money pumped into the economy by the Federal Reserve. • Cost-push inflation: due to higher production costs putting pressure on suppliers to push up prices. 7 -20

Protective Mechanisms • Cost of living allowances (COLA): nominal incomes are indexed to automatically rise at the same rate as inflation. • Adjustable-rate mortgage (ARM): interest rate on a mortgage rises along with inflation so that lenders do not lose money. 7 -21

Protective Mechanisms • Cost of living allowances (COLA): nominal incomes are indexed to automatically rise at the same rate as inflation. • Adjustable-rate mortgage (ARM): interest rate on a mortgage rises along with inflation so that lenders do not lose money. 7 -21

The Real Interest Rate • Real interest rate: the nominal interest rate minus the anticipated inflation rate. – The borrower pays the nominal rate. – The inflation-adjusted (real) rate of interest: Real interest rate = Nominal interest rate – Anticipated rate of inflation – Protects the lenders. Hurts the borrowers. – Borrowers will pay back loan using more lowervalued dollars, but lenders receive the same purchasing power. 7 -22

The Real Interest Rate • Real interest rate: the nominal interest rate minus the anticipated inflation rate. – The borrower pays the nominal rate. – The inflation-adjusted (real) rate of interest: Real interest rate = Nominal interest rate – Anticipated rate of inflation – Protects the lenders. Hurts the borrowers. – Borrowers will pay back loan using more lowervalued dollars, but lenders receive the same purchasing power. 7 -22