03d98dfbddef2a41199e59119cb5db3d.ppt

- Количество слайдов: 72

12 © 2010 W. W. Norton & Company, Inc. Uncertainty

12 © 2010 W. W. Norton & Company, Inc. Uncertainty

Uncertainty is Pervasive u What is uncertain in economic systems? – tomorrow’s prices – future wealth – future availability of commodities – present and future actions of other people. © 2010 W. W. Norton & Company, Inc. 2

Uncertainty is Pervasive u What is uncertain in economic systems? – tomorrow’s prices – future wealth – future availability of commodities – present and future actions of other people. © 2010 W. W. Norton & Company, Inc. 2

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 3

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 3

States of Nature u Possible states of Nature: – “car accident” (a) – “no car accident” (na). u Accident occurs with probability a, does not with probability na ; a + na = 1. u Accident causes a loss of $L. © 2010 W. W. Norton & Company, Inc. 4

States of Nature u Possible states of Nature: – “car accident” (a) – “no car accident” (na). u Accident occurs with probability a, does not with probability na ; a + na = 1. u Accident causes a loss of $L. © 2010 W. W. Norton & Company, Inc. 4

Contingencies u. A contract implemented only when a particular state of Nature occurs is state-contingent. u E. g. the insurer pays only if there is an accident. © 2010 W. W. Norton & Company, Inc. 5

Contingencies u. A contract implemented only when a particular state of Nature occurs is state-contingent. u E. g. the insurer pays only if there is an accident. © 2010 W. W. Norton & Company, Inc. 5

Contingencies u. A state-contingent consumption plan is implemented only when a particular state of Nature occurs. u E. g. take a vacation only if there is no accident. © 2010 W. W. Norton & Company, Inc. 6

Contingencies u. A state-contingent consumption plan is implemented only when a particular state of Nature occurs. u E. g. take a vacation only if there is no accident. © 2010 W. W. Norton & Company, Inc. 6

State-Contingent Budget Constraints $1 of accident insurance costs . u Consumer has $m of wealth. u Cna is consumption value in the noaccident state. u Ca is consumption value in the accident state. u Each © 2010 W. W. Norton & Company, Inc. 7

State-Contingent Budget Constraints $1 of accident insurance costs . u Consumer has $m of wealth. u Cna is consumption value in the noaccident state. u Ca is consumption value in the accident state. u Each © 2010 W. W. Norton & Company, Inc. 7

State-Contingent Budget Constraints Cna Ca © 2010 W. W. Norton & Company, Inc. 8

State-Contingent Budget Constraints Cna Ca © 2010 W. W. Norton & Company, Inc. 8

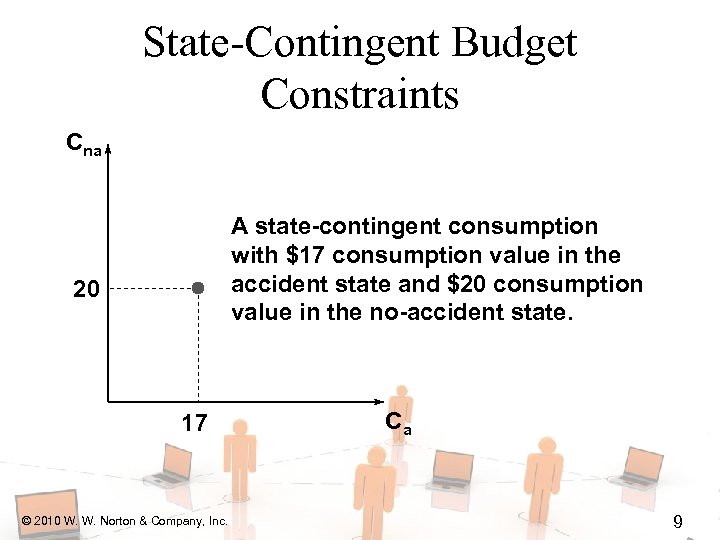

State-Contingent Budget Constraints Cna A state-contingent consumption with $17 consumption value in the accident state and $20 consumption value in the no-accident state. 20 17 © 2010 W. W. Norton & Company, Inc. Ca 9

State-Contingent Budget Constraints Cna A state-contingent consumption with $17 consumption value in the accident state and $20 consumption value in the no-accident state. 20 17 © 2010 W. W. Norton & Company, Inc. Ca 9

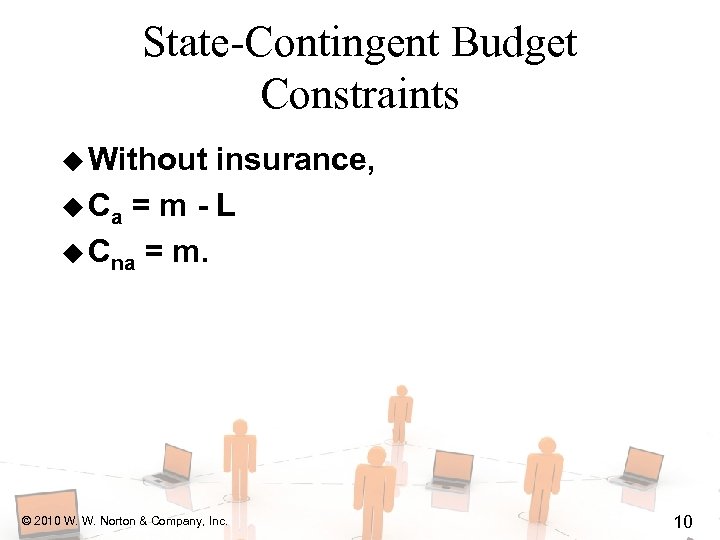

State-Contingent Budget Constraints u Without insurance, u Ca = m - L u Cna = m. © 2010 W. W. Norton & Company, Inc. 10

State-Contingent Budget Constraints u Without insurance, u Ca = m - L u Cna = m. © 2010 W. W. Norton & Company, Inc. 10

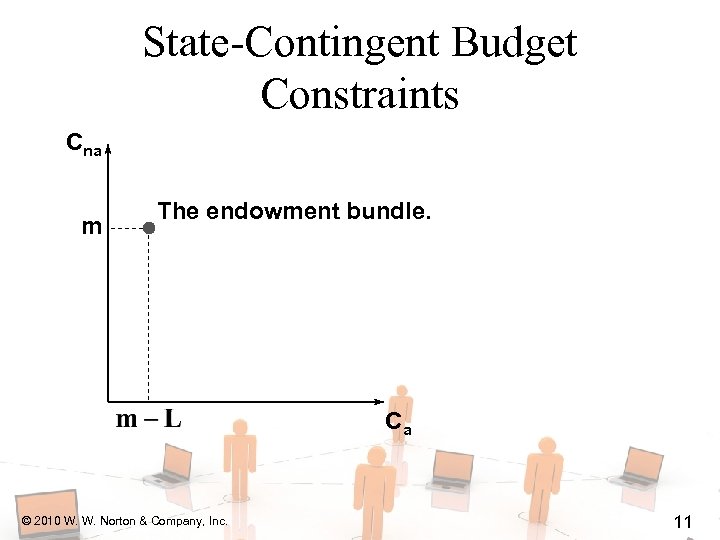

State-Contingent Budget Constraints Cna m The endowment bundle. Ca © 2010 W. W. Norton & Company, Inc. 11

State-Contingent Budget Constraints Cna m The endowment bundle. Ca © 2010 W. W. Norton & Company, Inc. 11

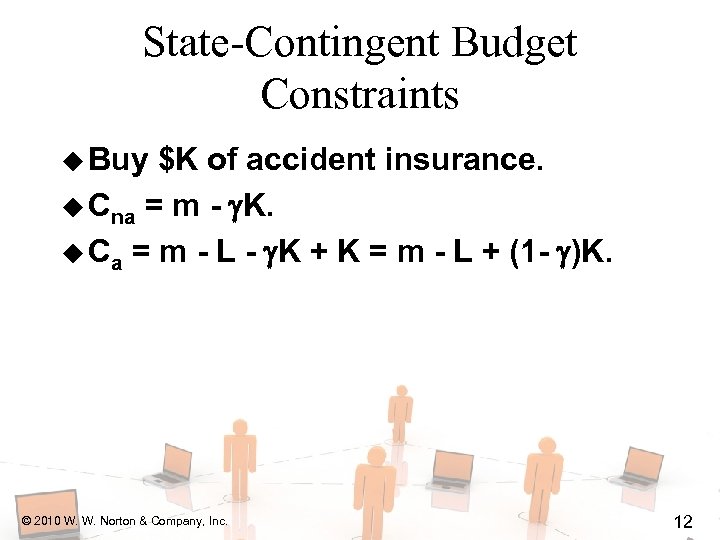

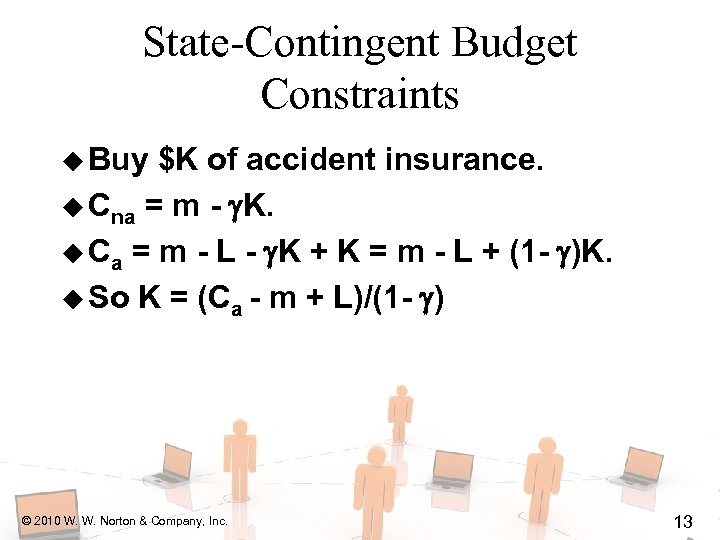

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. © 2010 W. W. Norton & Company, Inc. 12

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. © 2010 W. W. Norton & Company, Inc. 12

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) © 2010 W. W. Norton & Company, Inc. 13

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) © 2010 W. W. Norton & Company, Inc. 13

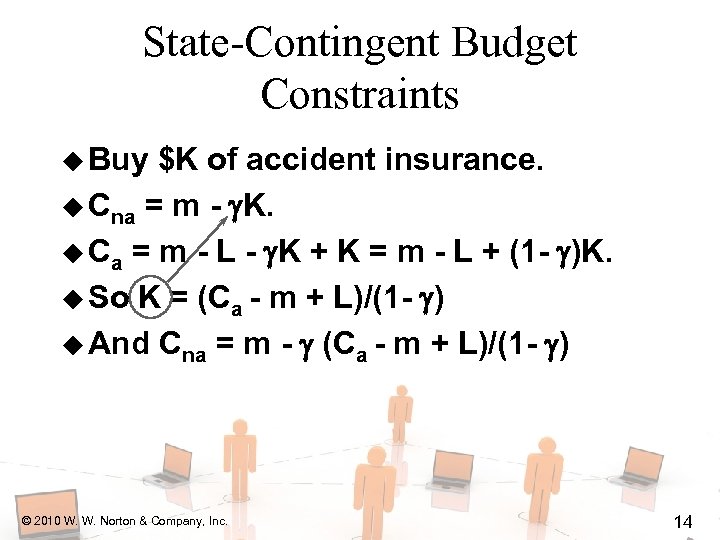

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) u And Cna = m - (Ca - m + L)/(1 - ) © 2010 W. W. Norton & Company, Inc. 14

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) u And Cna = m - (Ca - m + L)/(1 - ) © 2010 W. W. Norton & Company, Inc. 14

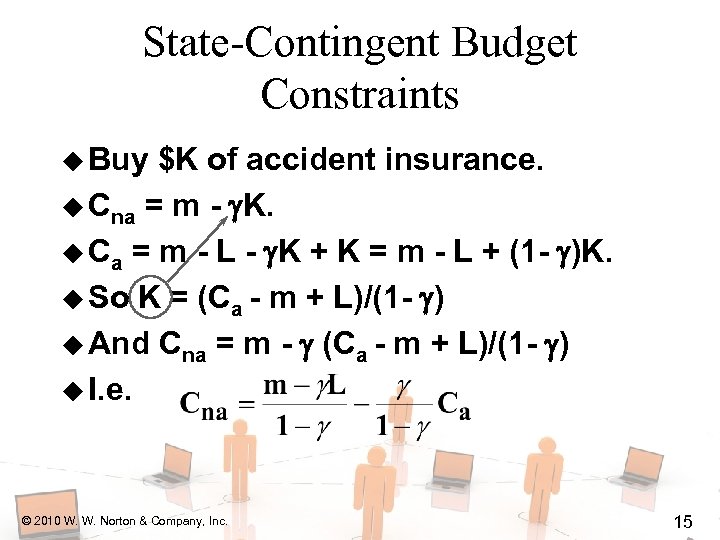

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) u And Cna = m - (Ca - m + L)/(1 - ) u I. e. © 2010 W. W. Norton & Company, Inc. 15

State-Contingent Budget Constraints u Buy $K of accident insurance. u Cna = m - K. u Ca = m - L - K + K = m - L + (1 - )K. u So K = (Ca - m + L)/(1 - ) u And Cna = m - (Ca - m + L)/(1 - ) u I. e. © 2010 W. W. Norton & Company, Inc. 15

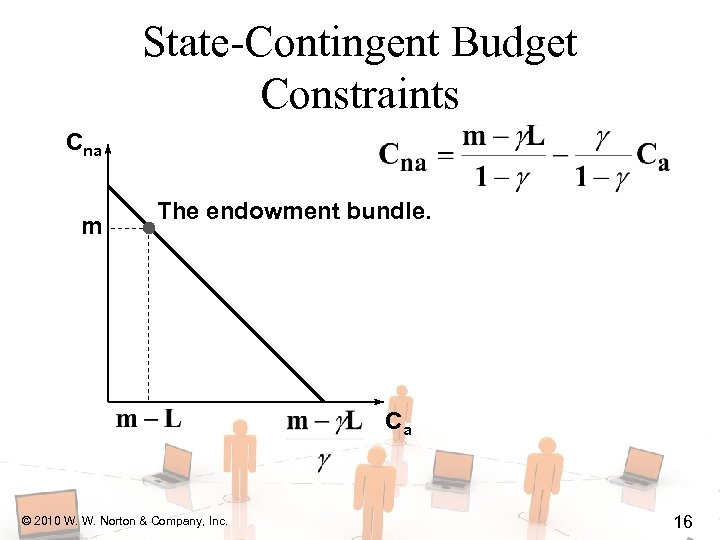

State-Contingent Budget Constraints Cna m The endowment bundle. Ca © 2010 W. W. Norton & Company, Inc. 16

State-Contingent Budget Constraints Cna m The endowment bundle. Ca © 2010 W. W. Norton & Company, Inc. 16

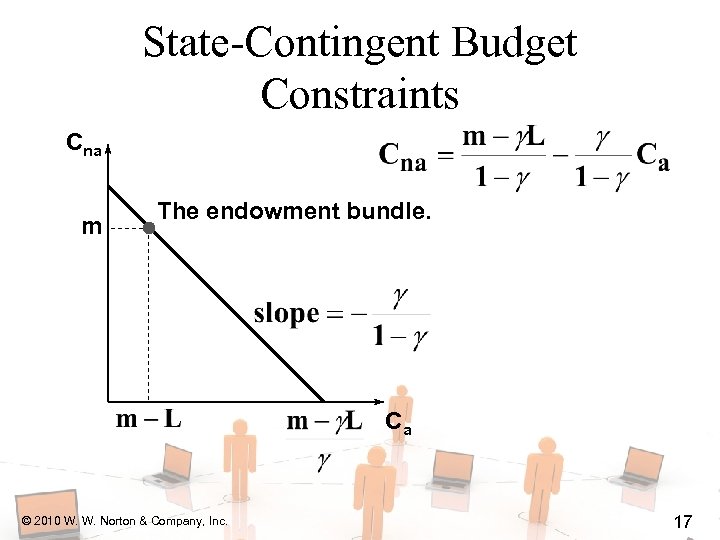

State-Contingent Budget Constraints Cna m The endowment bundle. Ca © 2010 W. W. Norton & Company, Inc. 17

State-Contingent Budget Constraints Cna m The endowment bundle. Ca © 2010 W. W. Norton & Company, Inc. 17

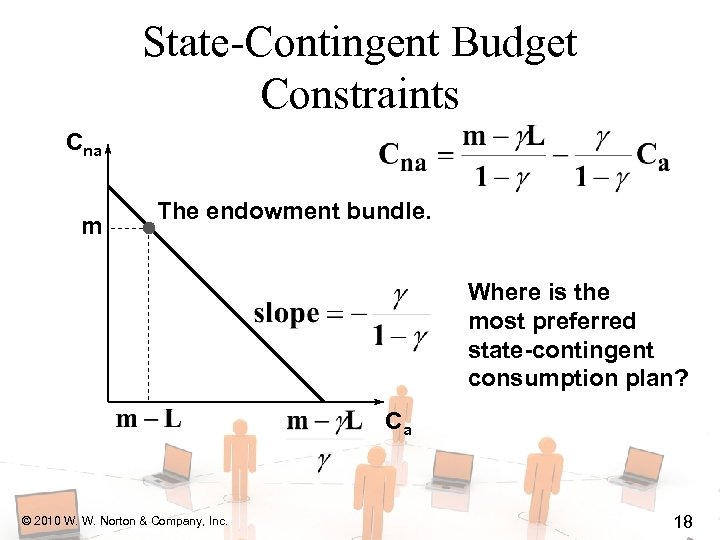

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Ca © 2010 W. W. Norton & Company, Inc. 18

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Ca © 2010 W. W. Norton & Company, Inc. 18

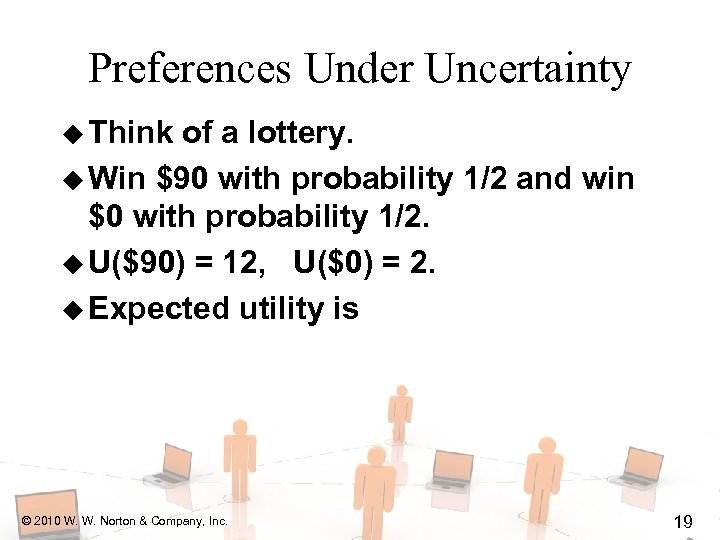

Preferences Under Uncertainty u Think of a lottery. u Win $90 with probability 1/2 and win $0 with probability 1/2. u U($90) = 12, U($0) = 2. u Expected utility is © 2010 W. W. Norton & Company, Inc. 19

Preferences Under Uncertainty u Think of a lottery. u Win $90 with probability 1/2 and win $0 with probability 1/2. u U($90) = 12, U($0) = 2. u Expected utility is © 2010 W. W. Norton & Company, Inc. 19

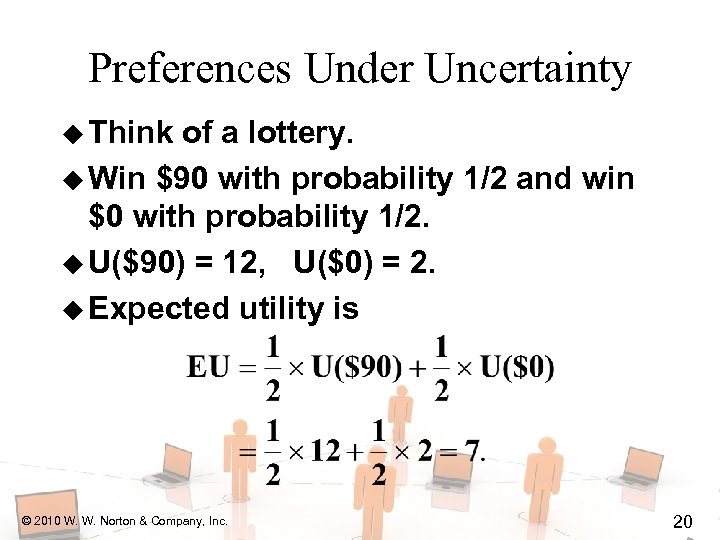

Preferences Under Uncertainty u Think of a lottery. u Win $90 with probability 1/2 and win $0 with probability 1/2. u U($90) = 12, U($0) = 2. u Expected utility is © 2010 W. W. Norton & Company, Inc. 20

Preferences Under Uncertainty u Think of a lottery. u Win $90 with probability 1/2 and win $0 with probability 1/2. u U($90) = 12, U($0) = 2. u Expected utility is © 2010 W. W. Norton & Company, Inc. 20

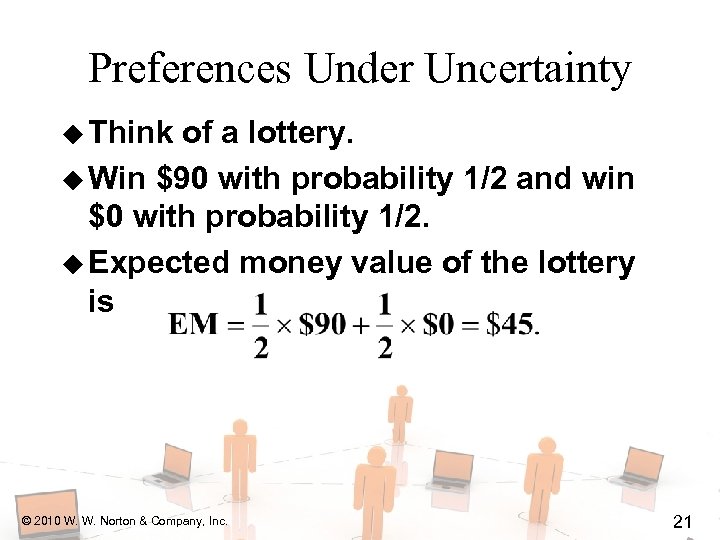

Preferences Under Uncertainty u Think of a lottery. u Win $90 with probability 1/2 and win $0 with probability 1/2. u Expected money value of the lottery is © 2010 W. W. Norton & Company, Inc. 21

Preferences Under Uncertainty u Think of a lottery. u Win $90 with probability 1/2 and win $0 with probability 1/2. u Expected money value of the lottery is © 2010 W. W. Norton & Company, Inc. 21

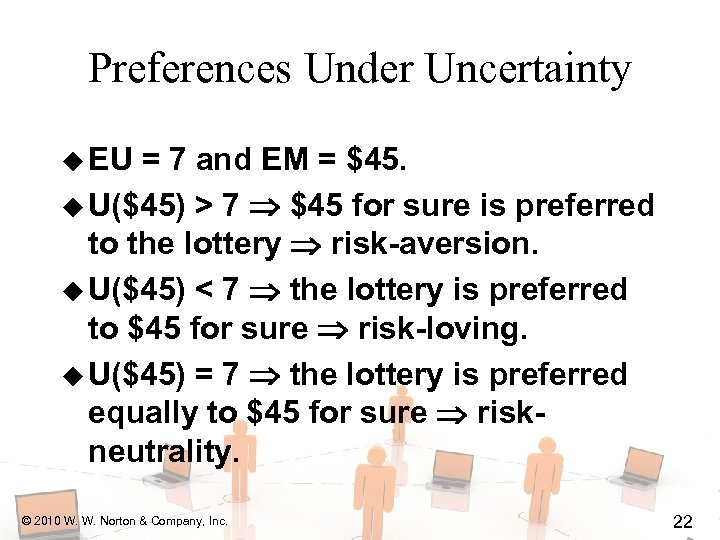

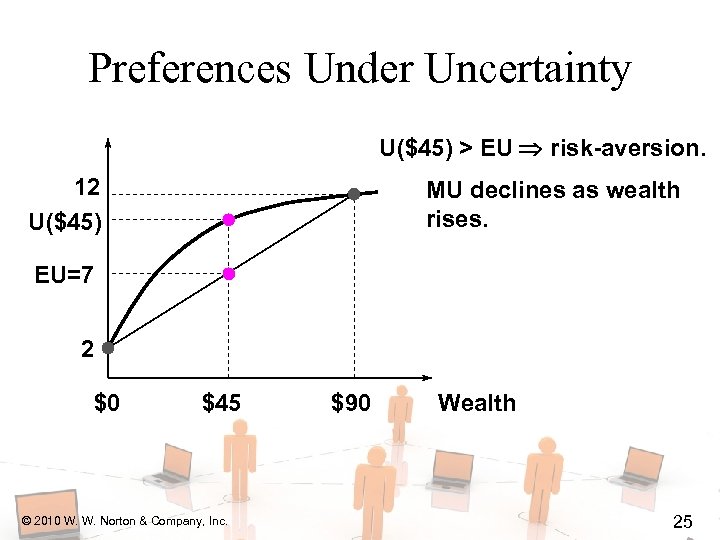

Preferences Under Uncertainty u EU = 7 and EM = $45. u U($45) > 7 $45 for sure is preferred to the lottery risk-aversion. u U($45) < 7 the lottery is preferred to $45 for sure risk-loving. u U($45) = 7 the lottery is preferred equally to $45 for sure riskneutrality. © 2010 W. W. Norton & Company, Inc. 22

Preferences Under Uncertainty u EU = 7 and EM = $45. u U($45) > 7 $45 for sure is preferred to the lottery risk-aversion. u U($45) < 7 the lottery is preferred to $45 for sure risk-loving. u U($45) = 7 the lottery is preferred equally to $45 for sure riskneutrality. © 2010 W. W. Norton & Company, Inc. 22

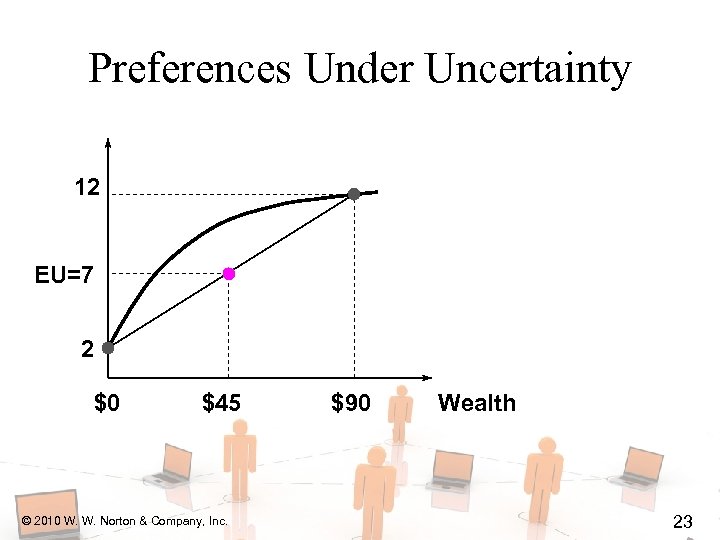

Preferences Under Uncertainty 12 EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 23

Preferences Under Uncertainty 12 EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 23

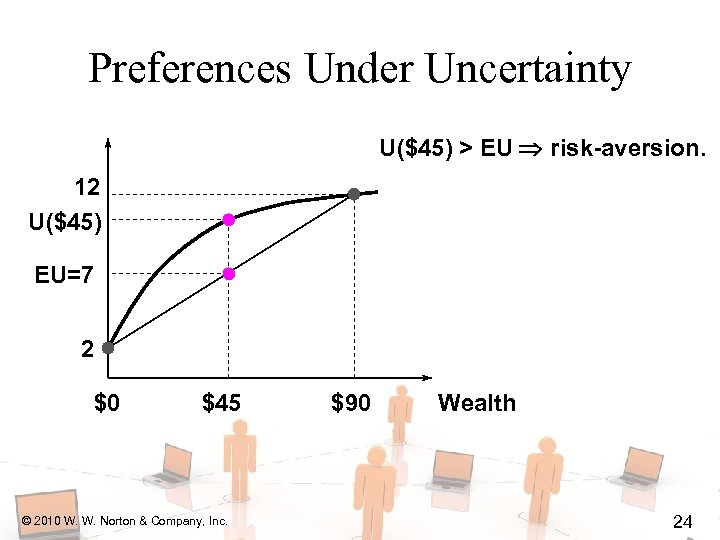

Preferences Under Uncertainty U($45) > EU risk-aversion. 12 U($45) EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 24

Preferences Under Uncertainty U($45) > EU risk-aversion. 12 U($45) EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 24

Preferences Under Uncertainty U($45) > EU risk-aversion. 12 U($45) MU declines as wealth rises. EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 25

Preferences Under Uncertainty U($45) > EU risk-aversion. 12 U($45) MU declines as wealth rises. EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 25

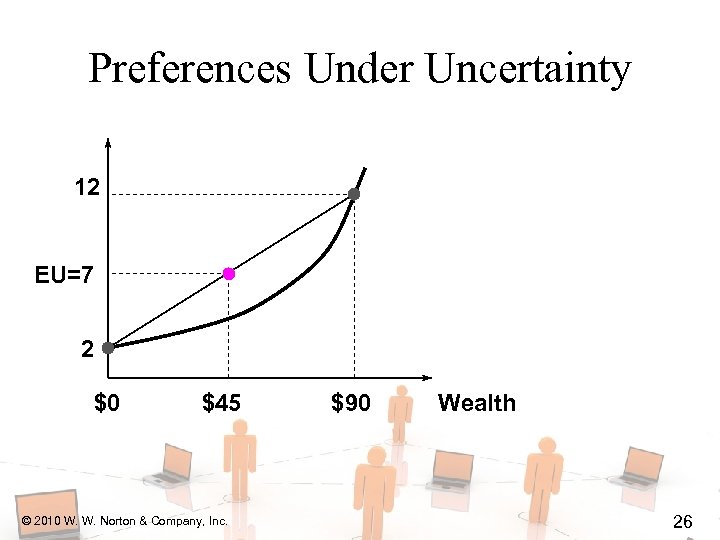

Preferences Under Uncertainty 12 EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 26

Preferences Under Uncertainty 12 EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 26

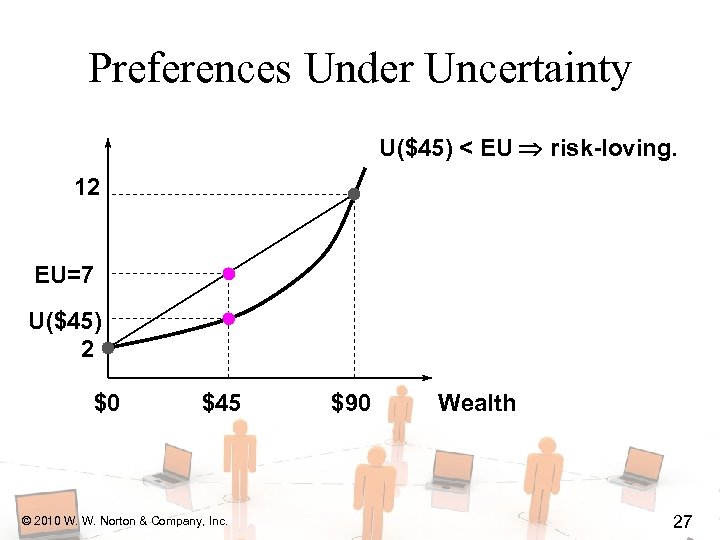

Preferences Under Uncertainty U($45) < EU risk-loving. 12 EU=7 U($45) 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 27

Preferences Under Uncertainty U($45) < EU risk-loving. 12 EU=7 U($45) 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 27

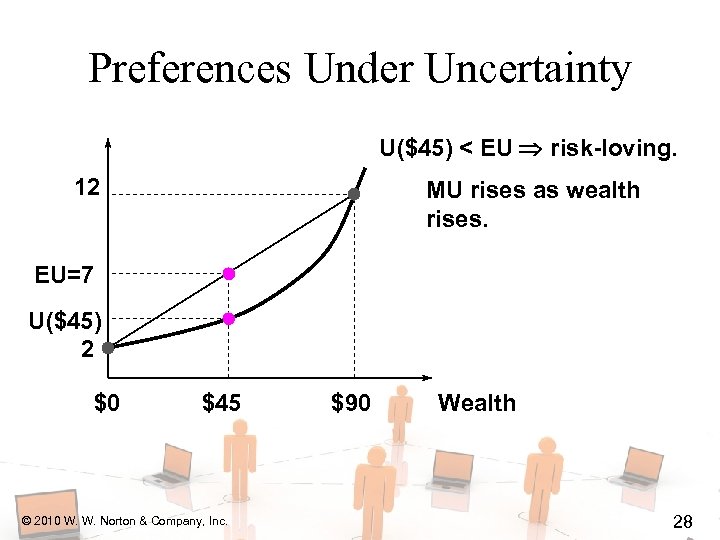

Preferences Under Uncertainty U($45) < EU risk-loving. 12 MU rises as wealth rises. EU=7 U($45) 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 28

Preferences Under Uncertainty U($45) < EU risk-loving. 12 MU rises as wealth rises. EU=7 U($45) 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 28

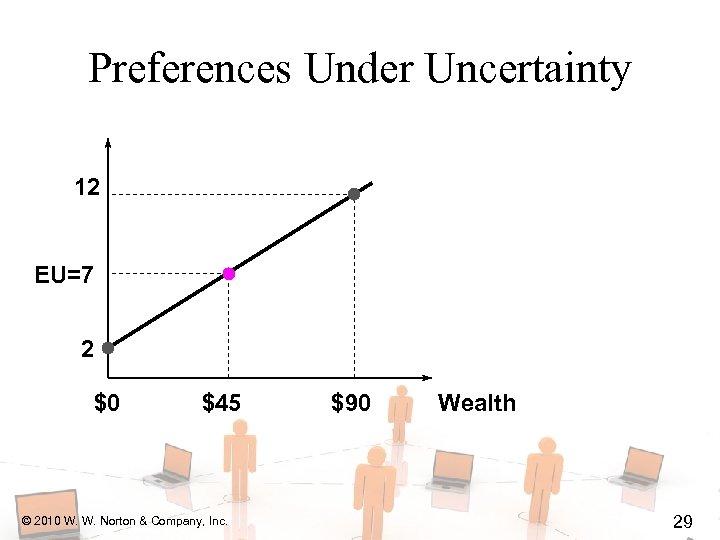

Preferences Under Uncertainty 12 EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 29

Preferences Under Uncertainty 12 EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 29

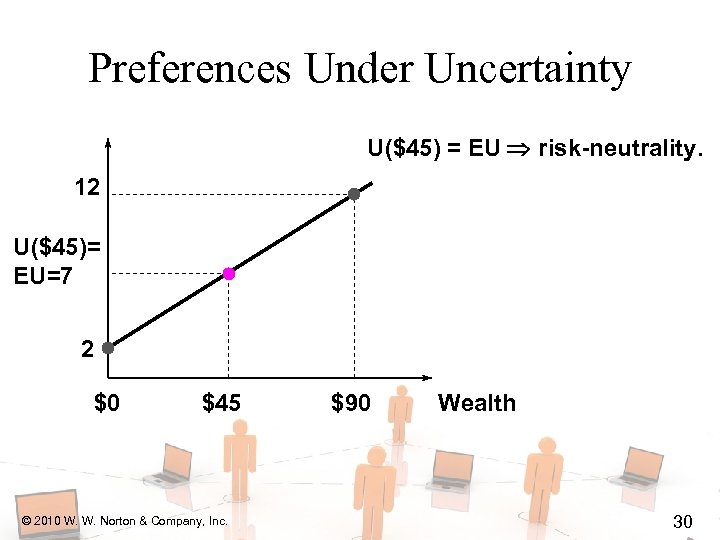

Preferences Under Uncertainty U($45) = EU risk-neutrality. 12 U($45)= EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 30

Preferences Under Uncertainty U($45) = EU risk-neutrality. 12 U($45)= EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 30

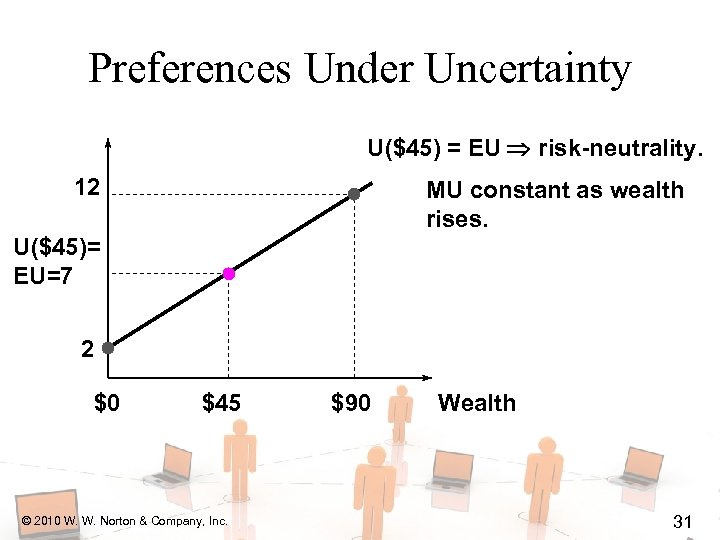

Preferences Under Uncertainty U($45) = EU risk-neutrality. 12 MU constant as wealth rises. U($45)= EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 31

Preferences Under Uncertainty U($45) = EU risk-neutrality. 12 MU constant as wealth rises. U($45)= EU=7 2 $0 $45 © 2010 W. W. Norton & Company, Inc. $90 Wealth 31

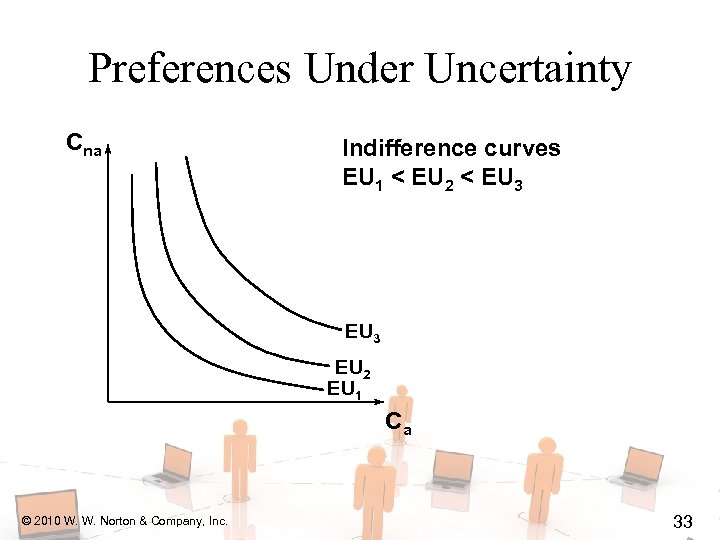

Preferences Under Uncertainty u State-contingent consumption plans that give equal expected utility are equally preferred. © 2010 W. W. Norton & Company, Inc. 32

Preferences Under Uncertainty u State-contingent consumption plans that give equal expected utility are equally preferred. © 2010 W. W. Norton & Company, Inc. 32

Preferences Under Uncertainty Cna Indifference curves EU 1 < EU 2 < EU 3 EU 2 EU 1 Ca © 2010 W. W. Norton & Company, Inc. 33

Preferences Under Uncertainty Cna Indifference curves EU 1 < EU 2 < EU 3 EU 2 EU 1 Ca © 2010 W. W. Norton & Company, Inc. 33

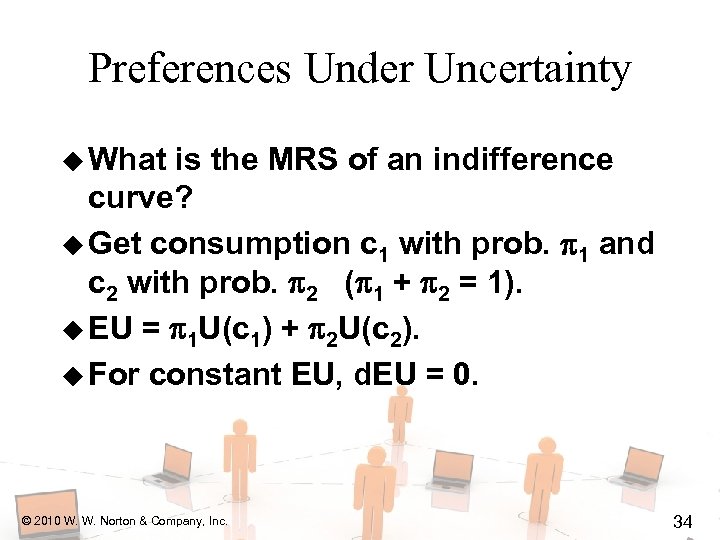

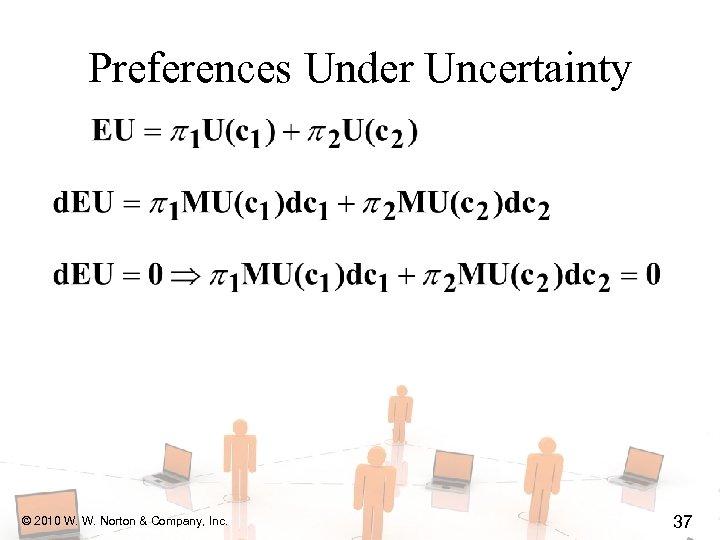

Preferences Under Uncertainty u What is the MRS of an indifference curve? u Get consumption c 1 with prob. 1 and c 2 with prob. 2 ( 1 + 2 = 1). u EU = 1 U(c 1) + 2 U(c 2). u For constant EU, d. EU = 0. © 2010 W. W. Norton & Company, Inc. 34

Preferences Under Uncertainty u What is the MRS of an indifference curve? u Get consumption c 1 with prob. 1 and c 2 with prob. 2 ( 1 + 2 = 1). u EU = 1 U(c 1) + 2 U(c 2). u For constant EU, d. EU = 0. © 2010 W. W. Norton & Company, Inc. 34

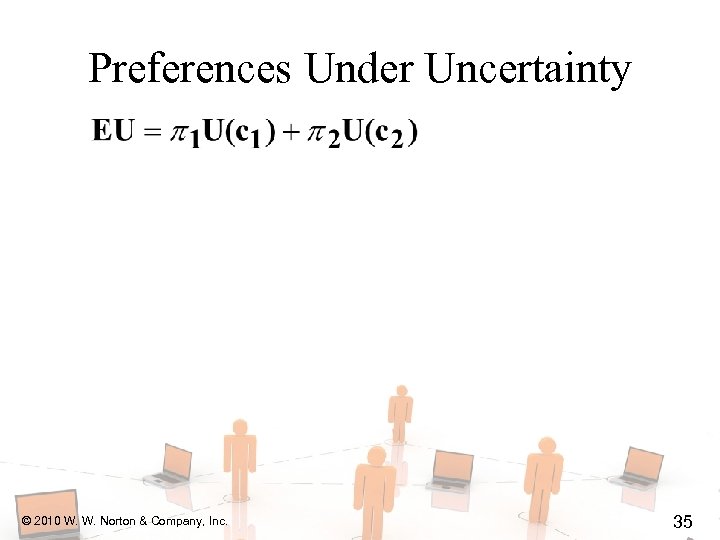

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 35

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 35

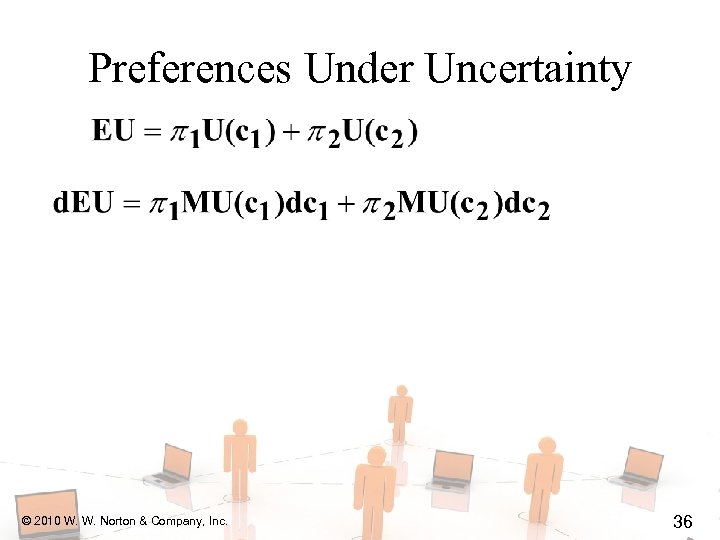

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 36

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 36

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 37

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 37

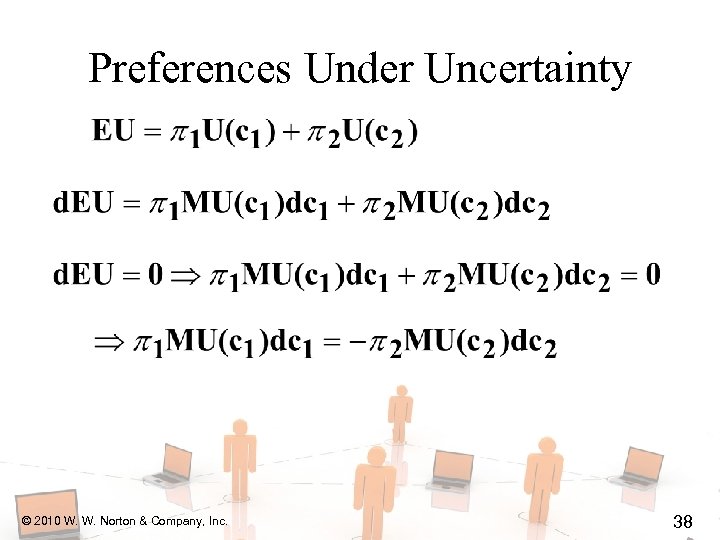

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 38

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 38

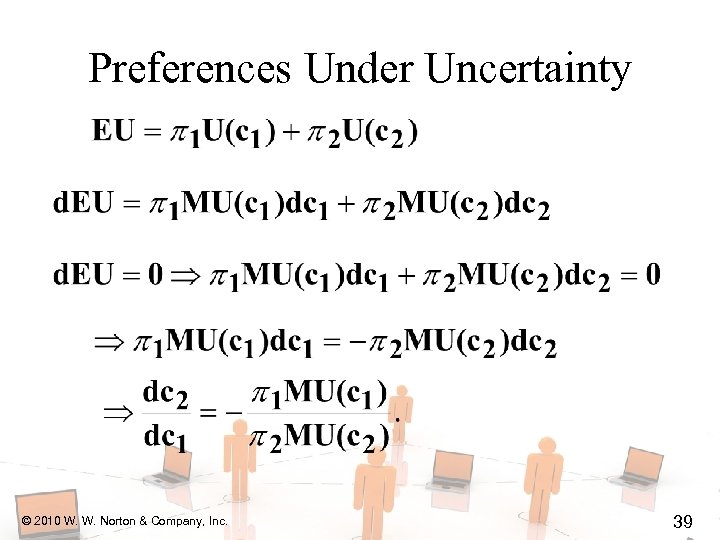

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 39

Preferences Under Uncertainty © 2010 W. W. Norton & Company, Inc. 39

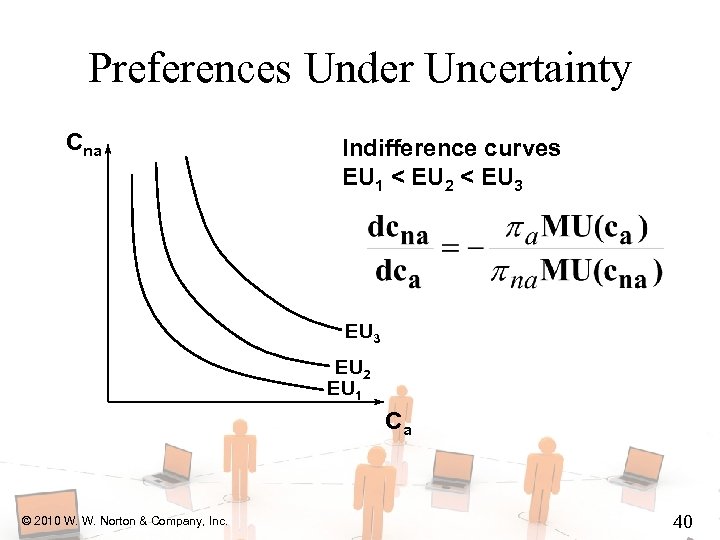

Preferences Under Uncertainty Cna Indifference curves EU 1 < EU 2 < EU 3 EU 2 EU 1 Ca © 2010 W. W. Norton & Company, Inc. 40

Preferences Under Uncertainty Cna Indifference curves EU 1 < EU 2 < EU 3 EU 2 EU 1 Ca © 2010 W. W. Norton & Company, Inc. 40

Choice Under Uncertainty u Q: How is a rational choice made under uncertainty? u A: Choose the most preferred affordable state-contingent consumption plan. © 2010 W. W. Norton & Company, Inc. 41

Choice Under Uncertainty u Q: How is a rational choice made under uncertainty? u A: Choose the most preferred affordable state-contingent consumption plan. © 2010 W. W. Norton & Company, Inc. 41

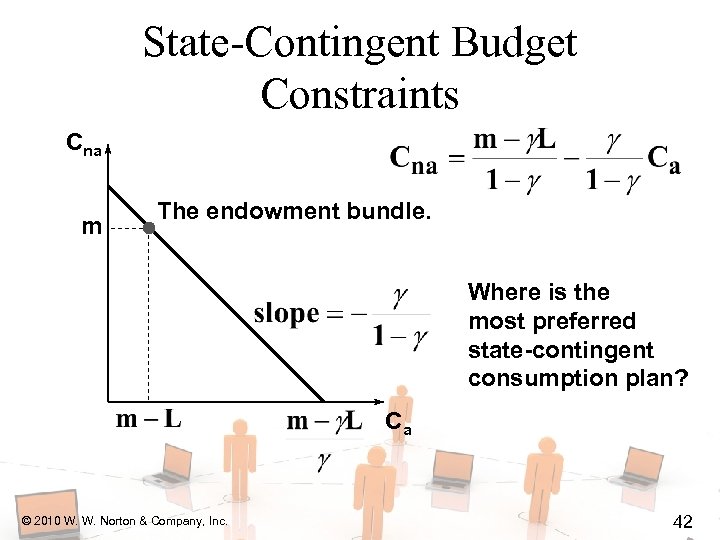

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Ca © 2010 W. W. Norton & Company, Inc. 42

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Ca © 2010 W. W. Norton & Company, Inc. 42

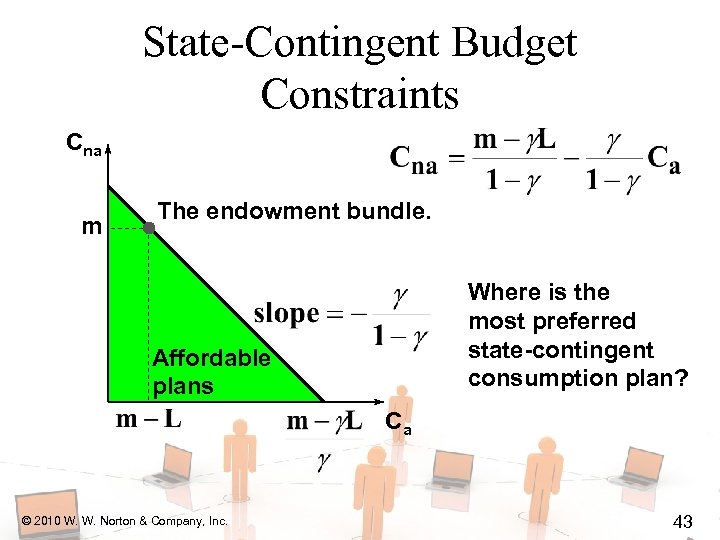

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Affordable plans Ca © 2010 W. W. Norton & Company, Inc. 43

State-Contingent Budget Constraints Cna m The endowment bundle. Where is the most preferred state-contingent consumption plan? Affordable plans Ca © 2010 W. W. Norton & Company, Inc. 43

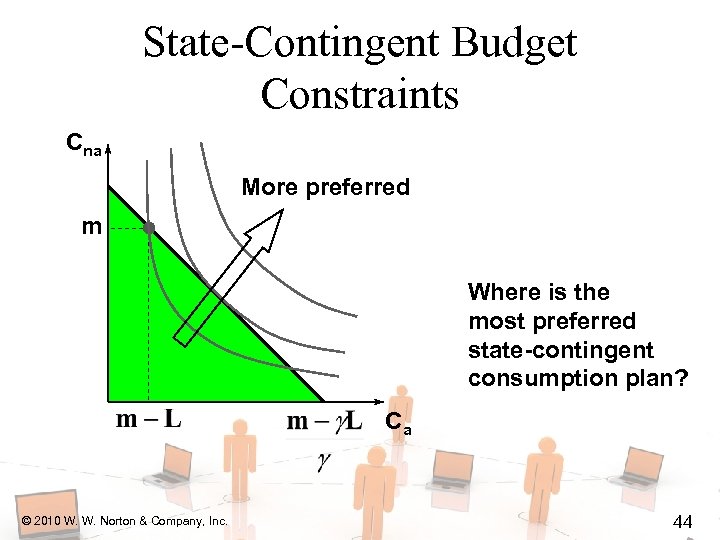

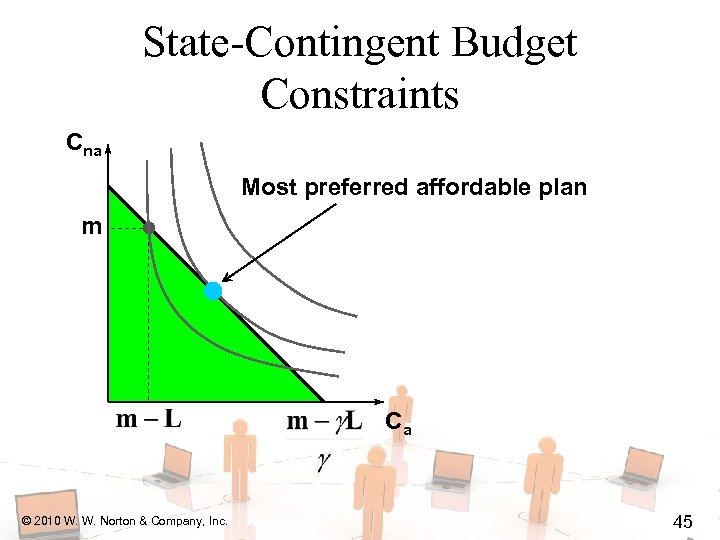

State-Contingent Budget Constraints Cna More preferred m Where is the most preferred state-contingent consumption plan? Ca © 2010 W. W. Norton & Company, Inc. 44

State-Contingent Budget Constraints Cna More preferred m Where is the most preferred state-contingent consumption plan? Ca © 2010 W. W. Norton & Company, Inc. 44

State-Contingent Budget Constraints Cna Most preferred affordable plan m Ca © 2010 W. W. Norton & Company, Inc. 45

State-Contingent Budget Constraints Cna Most preferred affordable plan m Ca © 2010 W. W. Norton & Company, Inc. 45

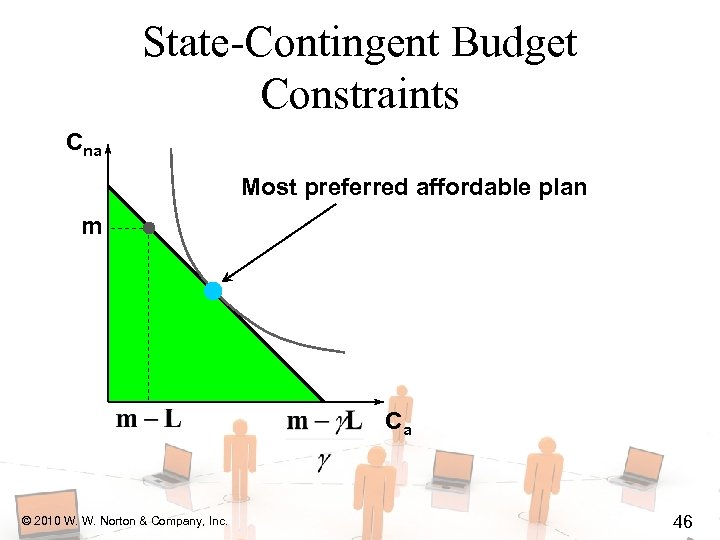

State-Contingent Budget Constraints Cna Most preferred affordable plan m Ca © 2010 W. W. Norton & Company, Inc. 46

State-Contingent Budget Constraints Cna Most preferred affordable plan m Ca © 2010 W. W. Norton & Company, Inc. 46

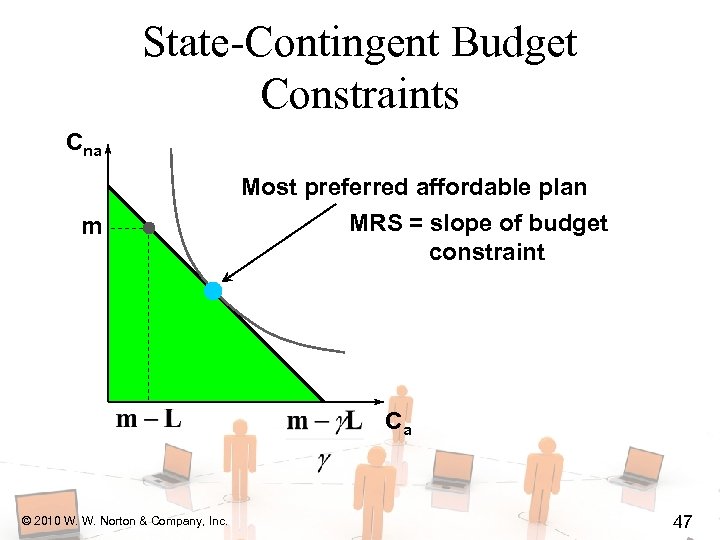

State-Contingent Budget Constraints Cna m Most preferred affordable plan MRS = slope of budget constraint Ca © 2010 W. W. Norton & Company, Inc. 47

State-Contingent Budget Constraints Cna m Most preferred affordable plan MRS = slope of budget constraint Ca © 2010 W. W. Norton & Company, Inc. 47

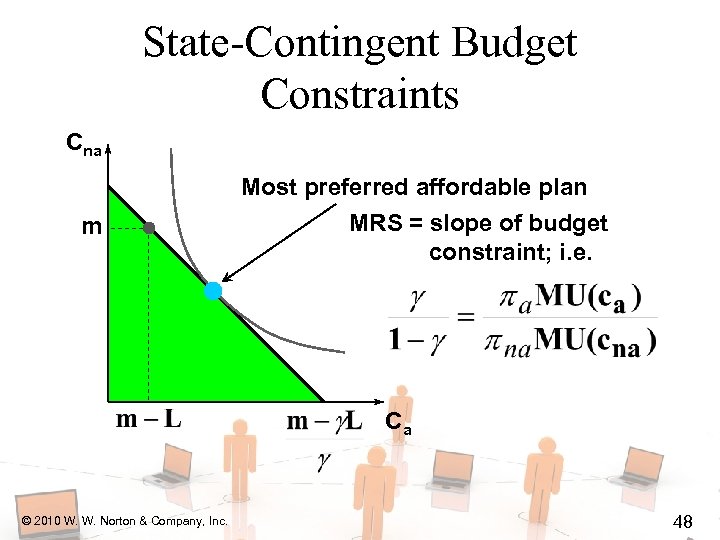

State-Contingent Budget Constraints Cna m Most preferred affordable plan MRS = slope of budget constraint; i. e. Ca © 2010 W. W. Norton & Company, Inc. 48

State-Contingent Budget Constraints Cna m Most preferred affordable plan MRS = slope of budget constraint; i. e. Ca © 2010 W. W. Norton & Company, Inc. 48

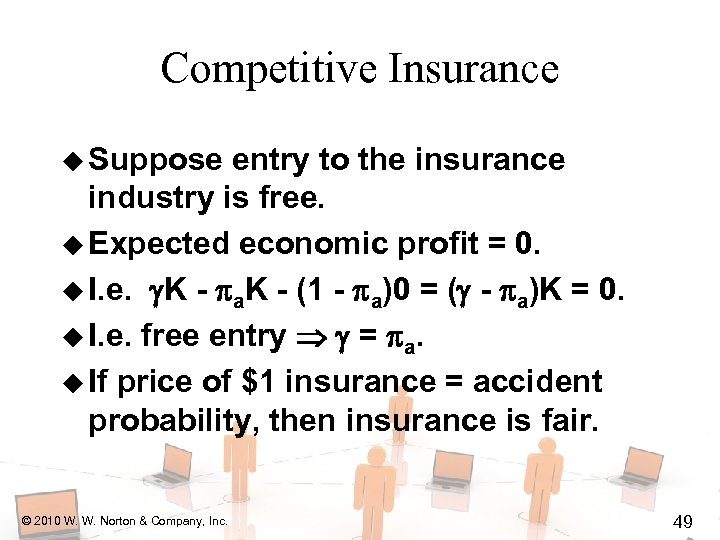

Competitive Insurance u Suppose entry to the insurance industry is free. u Expected economic profit = 0. u I. e. K - a. K - (1 - a)0 = ( - a)K = 0. u I. e. free entry = a. u If price of $1 insurance = accident probability, then insurance is fair. © 2010 W. W. Norton & Company, Inc. 49

Competitive Insurance u Suppose entry to the insurance industry is free. u Expected economic profit = 0. u I. e. K - a. K - (1 - a)0 = ( - a)K = 0. u I. e. free entry = a. u If price of $1 insurance = accident probability, then insurance is fair. © 2010 W. W. Norton & Company, Inc. 49

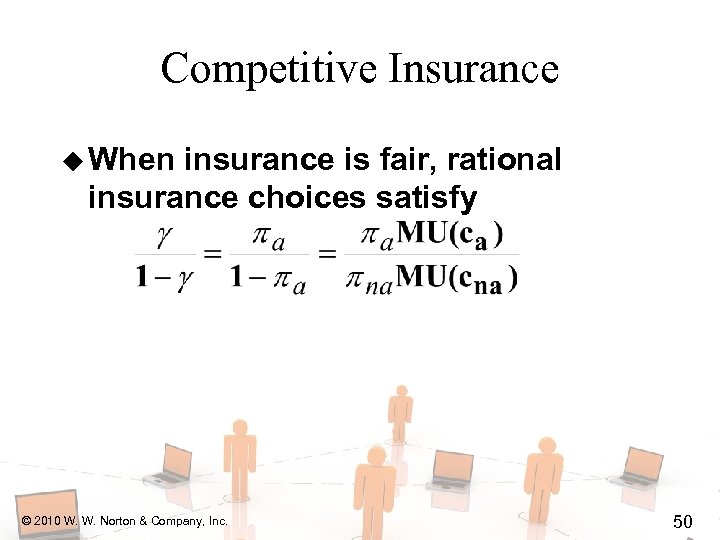

Competitive Insurance u When insurance is fair, rational insurance choices satisfy © 2010 W. W. Norton & Company, Inc. 50

Competitive Insurance u When insurance is fair, rational insurance choices satisfy © 2010 W. W. Norton & Company, Inc. 50

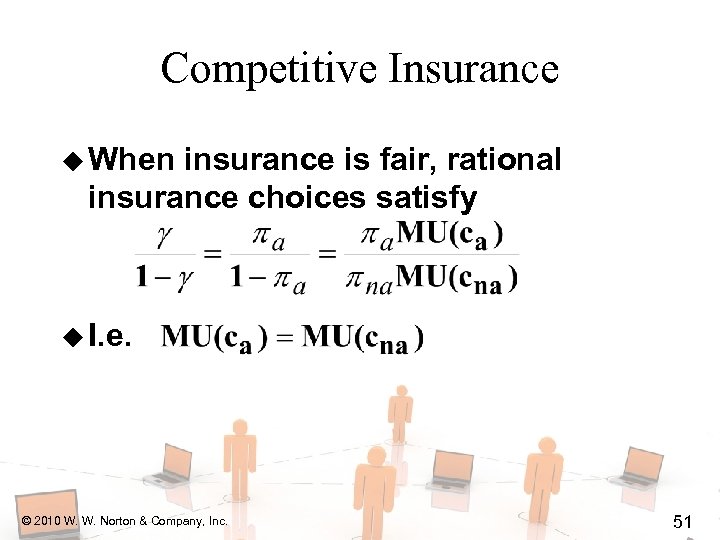

Competitive Insurance u When insurance is fair, rational insurance choices satisfy u I. e. © 2010 W. W. Norton & Company, Inc. 51

Competitive Insurance u When insurance is fair, rational insurance choices satisfy u I. e. © 2010 W. W. Norton & Company, Inc. 51

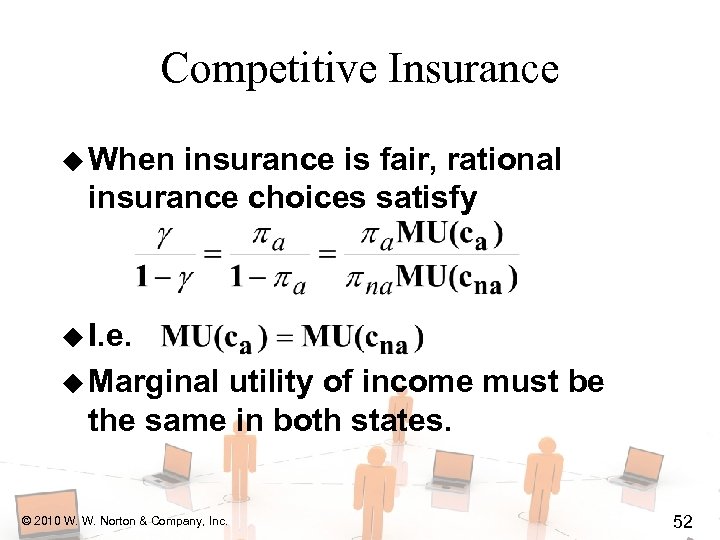

Competitive Insurance u When insurance is fair, rational insurance choices satisfy u I. e. u Marginal utility of income must be the same in both states. © 2010 W. W. Norton & Company, Inc. 52

Competitive Insurance u When insurance is fair, rational insurance choices satisfy u I. e. u Marginal utility of income must be the same in both states. © 2010 W. W. Norton & Company, Inc. 52

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? © 2010 W. W. Norton & Company, Inc. 53

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? © 2010 W. W. Norton & Company, Inc. 53

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion © 2010 W. W. Norton & Company, Inc. MU(c) as c . 54

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion © 2010 W. W. Norton & Company, Inc. MU(c) as c . 54

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion MU(c) as c . u Hence © 2010 W. W. Norton & Company, Inc. 55

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion MU(c) as c . u Hence © 2010 W. W. Norton & Company, Inc. 55

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion MU(c) as c . u Hence u I. e. full-insurance. © 2010 W. W. Norton & Company, Inc. 56

Competitive Insurance u How much fair insurance does a riskaverse consumer buy? u Risk-aversion MU(c) as c . u Hence u I. e. full-insurance. © 2010 W. W. Norton & Company, Inc. 56

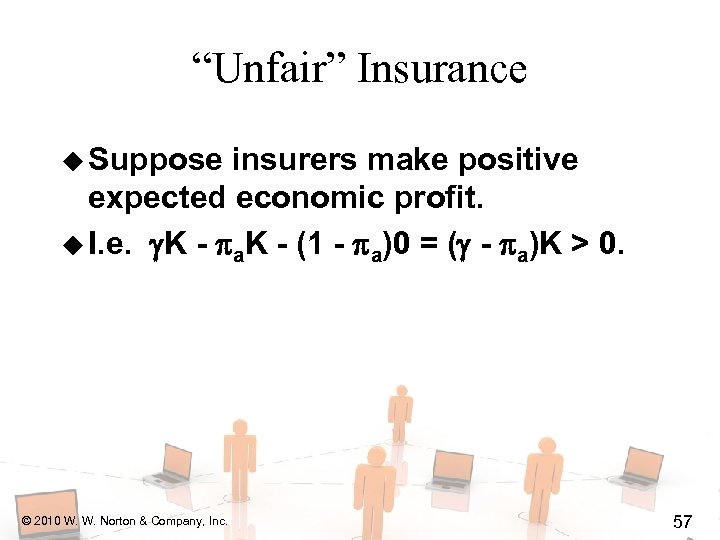

“Unfair” Insurance u Suppose insurers make positive expected economic profit. u I. e. K - a. K - (1 - a)0 = ( - a)K > 0. © 2010 W. W. Norton & Company, Inc. 57

“Unfair” Insurance u Suppose insurers make positive expected economic profit. u I. e. K - a. K - (1 - a)0 = ( - a)K > 0. © 2010 W. W. Norton & Company, Inc. 57

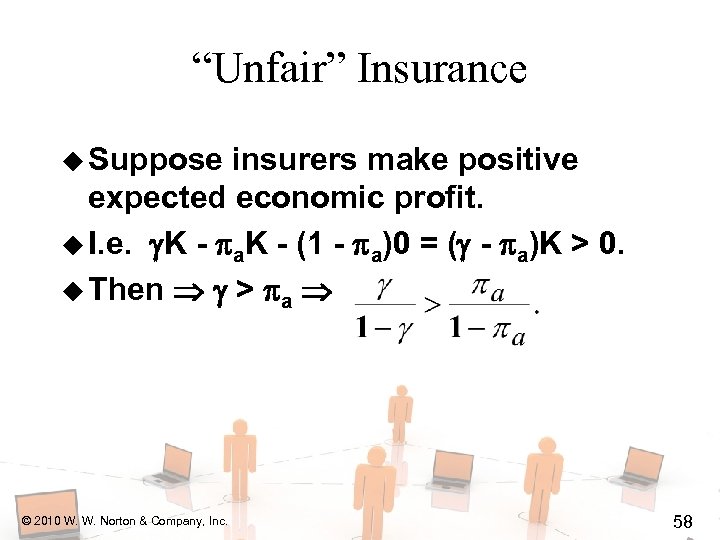

“Unfair” Insurance u Suppose insurers make positive expected economic profit. u I. e. K - a. K - (1 - a)0 = ( - a)K > 0. u Then > a © 2010 W. W. Norton & Company, Inc. 58

“Unfair” Insurance u Suppose insurers make positive expected economic profit. u I. e. K - a. K - (1 - a)0 = ( - a)K > 0. u Then > a © 2010 W. W. Norton & Company, Inc. 58

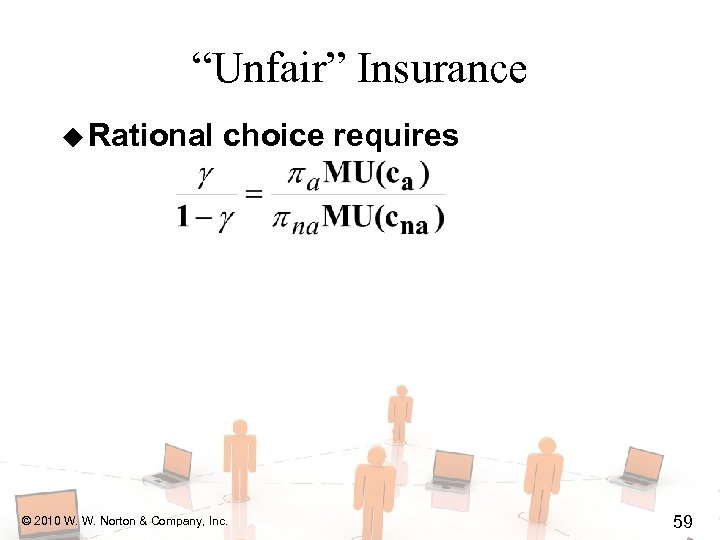

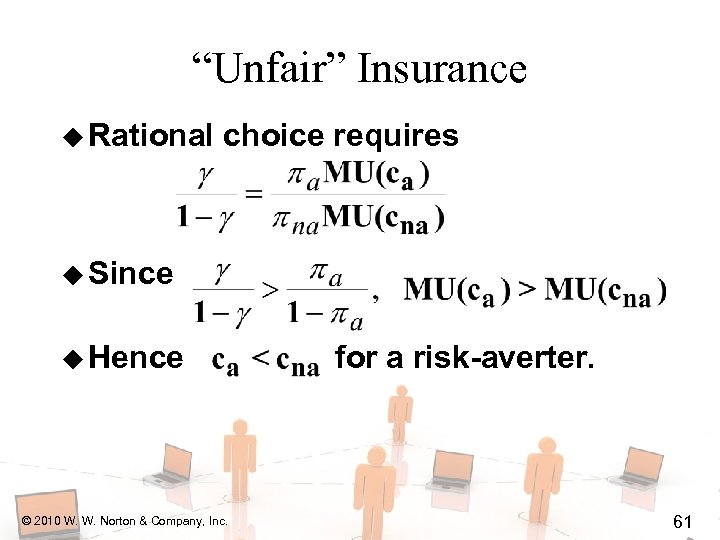

“Unfair” Insurance u Rational choice requires © 2010 W. W. Norton & Company, Inc. 59

“Unfair” Insurance u Rational choice requires © 2010 W. W. Norton & Company, Inc. 59

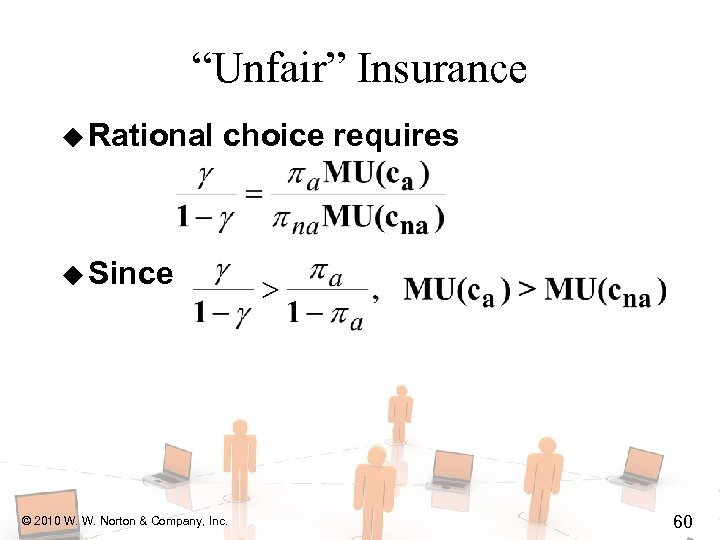

“Unfair” Insurance u Rational choice requires u Since © 2010 W. W. Norton & Company, Inc. 60

“Unfair” Insurance u Rational choice requires u Since © 2010 W. W. Norton & Company, Inc. 60

“Unfair” Insurance u Rational choice requires u Since u Hence © 2010 W. W. Norton & Company, Inc. for a risk-averter. 61

“Unfair” Insurance u Rational choice requires u Since u Hence © 2010 W. W. Norton & Company, Inc. for a risk-averter. 61

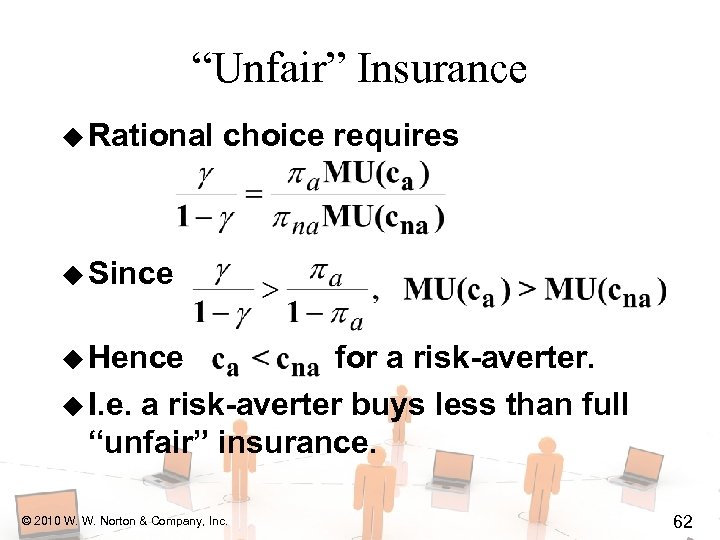

“Unfair” Insurance u Rational choice requires u Since u Hence for a risk-averter. u I. e. a risk-averter buys less than full “unfair” insurance. © 2010 W. W. Norton & Company, Inc. 62

“Unfair” Insurance u Rational choice requires u Since u Hence for a risk-averter. u I. e. a risk-averter buys less than full “unfair” insurance. © 2010 W. W. Norton & Company, Inc. 62

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 63

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 63

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 64

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 64

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) ? – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 65

Uncertainty is Pervasive u What are rational responses to uncertainty? – buying insurance (health, life, auto) ? – a portfolio of contingent consumption goods. © 2010 W. W. Norton & Company, Inc. 65

Diversification u Two firms, A and B. Shares cost $10. u With prob. 1/2 A’s profit is $100 and B’s profit is $20. u With prob. 1/2 A’s profit is $20 and B’s profit is $100. u You have $100 to invest. How? © 2010 W. W. Norton & Company, Inc. 66

Diversification u Two firms, A and B. Shares cost $10. u With prob. 1/2 A’s profit is $100 and B’s profit is $20. u With prob. 1/2 A’s profit is $20 and B’s profit is $100. u You have $100 to invest. How? © 2010 W. W. Norton & Company, Inc. 66

Diversification u Buy only firm A’s stock? u $100/10 = 10 shares. u You earn $1000 with prob. 1/2 and $200 with prob. 1/2. u Expected earning: $500 + $100 = $600 © 2010 W. W. Norton & Company, Inc. 67

Diversification u Buy only firm A’s stock? u $100/10 = 10 shares. u You earn $1000 with prob. 1/2 and $200 with prob. 1/2. u Expected earning: $500 + $100 = $600 © 2010 W. W. Norton & Company, Inc. 67

Diversification u Buy only firm B’s stock? u $100/10 = 10 shares. u You earn $1000 with prob. 1/2 and $200 with prob. 1/2. u Expected earning: $500 + $100 = $600 © 2010 W. W. Norton & Company, Inc. 68

Diversification u Buy only firm B’s stock? u $100/10 = 10 shares. u You earn $1000 with prob. 1/2 and $200 with prob. 1/2. u Expected earning: $500 + $100 = $600 © 2010 W. W. Norton & Company, Inc. 68

Diversification u Buy 5 shares in each firm? u You earn $600 for sure. u Diversification has maintained expected earning and lowered risk. © 2010 W. W. Norton & Company, Inc. 69

Diversification u Buy 5 shares in each firm? u You earn $600 for sure. u Diversification has maintained expected earning and lowered risk. © 2010 W. W. Norton & Company, Inc. 69

Diversification u Buy 5 shares in each firm? u You earn $600 for sure. u Diversification has maintained expected earning and lowered risk. u Typically, diversification lowers expected earnings in exchange for lowered risk. © 2010 W. W. Norton & Company, Inc. 70

Diversification u Buy 5 shares in each firm? u You earn $600 for sure. u Diversification has maintained expected earning and lowered risk. u Typically, diversification lowers expected earnings in exchange for lowered risk. © 2010 W. W. Norton & Company, Inc. 70

Risk Spreading/Mutual Insurance u 100 risk-neutral persons each independently risk a $10, 000 loss. u Loss probability = 0. 01. u Initial wealth is $40, 000. u No insurance: expected wealth is © 2010 W. W. Norton & Company, Inc. 71

Risk Spreading/Mutual Insurance u 100 risk-neutral persons each independently risk a $10, 000 loss. u Loss probability = 0. 01. u Initial wealth is $40, 000. u No insurance: expected wealth is © 2010 W. W. Norton & Company, Inc. 71

Risk Spreading/Mutual Insurance u Mutual insurance: Expected loss is u Each of the 100 persons pays $1 into a mutual insurance fund. u Mutual insurance: expected wealth is u Risk-spreading © 2010 W. W. Norton & Company, Inc. benefits everyone. 72

Risk Spreading/Mutual Insurance u Mutual insurance: Expected loss is u Each of the 100 persons pays $1 into a mutual insurance fund. u Mutual insurance: expected wealth is u Risk-spreading © 2010 W. W. Norton & Company, Inc. benefits everyone. 72